The Scale Logic of Government Debt for Overall Development and Security—From the Perspective of Dual Scale Economy of Explicit and Implicit Debt

Abstract

1. Introduction

2. Data Sources and Methods

2.1. Data

2.2. Methodology

2.2.1. Identification of the Relationship Between Government Explicit and Implicit Debt Scale and High-Quality Economic Development

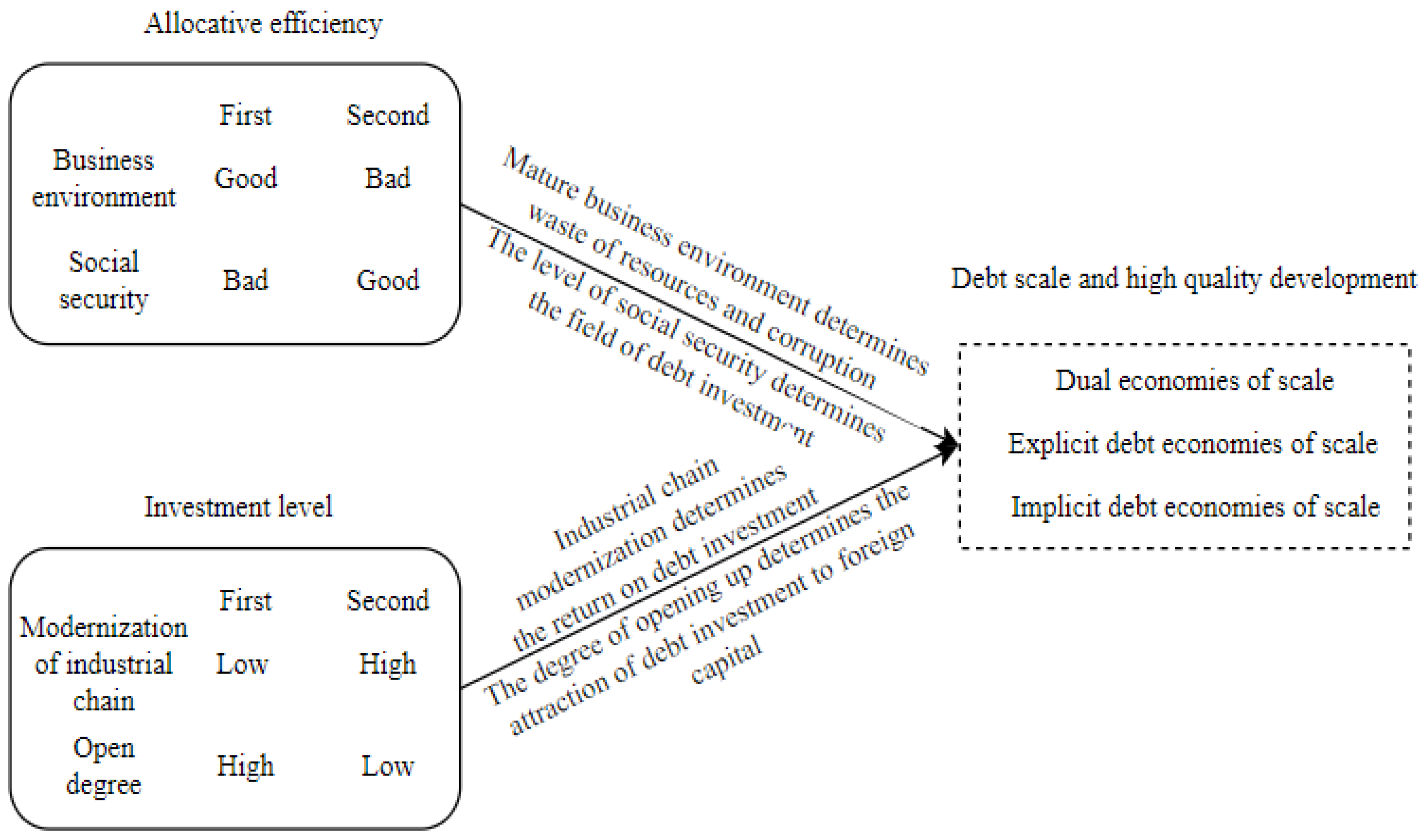

2.2.2. A Model of the Impact of Debt Scale on Resource Allocation Efficiency and Investment Level

2.2.3. An Extended Model of the Relationship Between Government Explicit and Implicit Debt Scale and High-Quality Economic Development

3. Results and Discussion

3.1. Descriptive Statistics of Variables

3.2. Systematic GMM Regression of Two Kinds of Government Debt Economies of Scale

3.3. An Empirical Analysis of the Relationship Between Two Kinds of Government Debt Scale and Resource Allocation Efficiency, Investment Level

3.4. Empirical Analysis of the Influence of Resource Allocation Efficiency and Investment Level on Two Kinds of Government Debt Scale—High-Quality Economic Development

3.5. Robustness Test

4. Conclusions and Recommendation

4.1. Conclusions

- There was an obvious inverted U-shaped trend between the scale of local government debt and high-quality economic development. The difference lay in the significant inverted U-shaped relationship between the scale of implicit debt and high-quality economic development.

- The efficiency of resource allocation and the level of investment significantly affect the government’s explicit and implicit debt economies of scale with high-quality economic development, and both inhibit high-quality economic development.

- Local government debt is currently in the stage of scale economy, where there is still a significant borrowing space for economic development. Furthermore, the borrowing space for implicit debt is significantly larger than that for explicit debt.

- Debt-driven economies of scale exhibit significant regional heterogeneity. In coastal areas, these effects are more sustainable, whereas in inland areas it is relatively weak.

4.2. Recommendations

- Give proper play to the nonlinear effect of government debt on high-quality economic development. Government borrowing to promote high-quality economic development has become an inevitable trend for a long time now and in the future. Under the security constraints of preventing and resolving systemic financial risks, from the perspective of scale, scientifically assess and set debt limits to avoid excessive borrowing. Structure-wise, we should set up the debt maturity and capital use structure in a way that makes sense. This will help avoid the risk of maturity mismatch and direct capital flow to areas that will have positive externalities and long-term economic growth drivers. From the perspective of cost, we should use the fluctuation of interest rates and other financial markets to choose the right time to borrow, and diversify financing channels to reduce the comprehensive financing cost.

- Optimize the resource allocation mechanism and improve the quality and efficiency of investment. Further clarify the boundaries of government functions, focus on providing public services, maintaining market order, ensuring fair competition and other promising areas of government macro-control, and reduce direct government intervention in resource allocation; give full play to the decisive role of effective markets in the flow and allocation of resources, and guide the concentration of resources in areas with high efficiency and high added value by accelerating the process of national unified markets and the reform of price mechanisms. Optimize the investment structure, pay attention to strategic emerging industries, and use the factor endowment structure to rationalize the regional investment layout, so as to promote the transformation of comparative advantage into competitive advantage; In addition, according to the project investment paradigm of market research—seeing the essence through the phenomenon of qualitative change caused by quantitative change, the comprehensive factors of market demand, technical feasibility, economic rationality and impact on the social environment are integrated to ensure that the project conforms to the market development direction and has the most value potential.

- Clarify the division of powers and responsibilities between the central and local governments. Given that implicit debt has both issuance potential and potential damage characteristics, while liberalizing the right of local governments to borrow money, we should reasonably divide the financial powers and responsibilities between the central and local governments through such financial system reforms as clarifying the principles of division of powers (legal, efficiency, benefit and financial matching principles), optimizing the distribution of fiscal revenue (adjusting the proportion of tax distribution and improving the transfer payment system), clearly pointing out responsibilities (central and local expenditure responsibilities), and establishing incentive and constraint mechanisms (performance evaluation, hard budget constraints). Give reasonable tax autonomy to local governments, promote the steady localization of consumption tax, innovate tax design and fee tax reform related to resources and environment, steadily promote the creation of taxes in water resources, real estate and new business forms, and further improve the scope of local management authority.

- A regionally differentiated collaborative strategy is needed for coordinating debt, investment, and resource allocation. Coastal regions should leverage their relatively mild negative investment effects by channeling debt funds into high-tech and high value-added sectors to improve investment quality. At the same time, they should enhance capital allocation efficiency through market-oriented reforms, enabling debt expansion to synergize with efficient investment and optimized resource allocation. In contrast, inland regions should prioritize improving capital allocation efficiency and strictly limit the scale of low-quality investments to mitigate their negative impact. Investment effectiveness can be strengthened through industrial upgrading and institutional innovation, thereby promoting a more adaptive debt-driven development model and achieving dual improvements in both investment quality and allocation efficiency.

Author Contributions

Funding

Data Availability Statement

Conflicts of Interest

References

- Barro, R. J. (1979). On the determination of the public debt. Journal of Political Economy, 87(5), 940–971. [Google Scholar] [CrossRef]

- Blanchard, O. J. (1984). Current and anticipated deficits, interest rates and economic activity. European Economic Review, 25(1), 7–27. [Google Scholar] [CrossRef][Green Version]

- Brixi, H. P. (1998). Contingent government liabilities: A hidden risk for fiscal stabilities. World Bank policy research working paper. World Bank Group. [Google Scholar]

- Cai, F. (2013). Understanding the past, present, and future of China’s economic development: Based on a unified framework of growth theories. Economic Research Journal, 48(11), 4–16+55. [Google Scholar][Green Version]

- Chai, Z. X. (2013). Utilizing foreign investment, environmental constraint and TFP growth of China’s industry: Comparative research based on Malmquist index and Malmquist-Luenberger index. Journal of Technology Economics, 32(1), 64–70. [Google Scholar][Green Version]

- Chen, X. L., Tan, H. Y., & Liu, Z. X. (2020). Re-examination of the impact of transfer payments on local government debt. Research on Financial and Economic Issues, (10), 64–73. [Google Scholar] [CrossRef]

- Cui, X. Y., Lu, G. J., & Zhai, Y. J. (2024). Promoting employment and stabilizing growth: A perspective of pension insurance contribution rates in China. Economic Research Journal, 59(1), 148–167. [Google Scholar][Green Version]

- Demirci, I., Huang, J., & Sialm, C. (2019). Government debt and corporate leverage: International evidence. Journal of Financial Economics, 133(2), 337–356. [Google Scholar] [CrossRef]

- Feng, M. Y., & Liu, L. F. (2025). An examination of the investment mechanism of local government debt affecting economic growth. New Horizons from Tianfu, (2), 119–135+159–160. [Google Scholar]

- Huang, Y., Pagano, T., & Panizza, U. (2020). Local crowding-out in China. Journal of Finance, 75(6), 2855–2898. [Google Scholar] [CrossRef]

- Ji, Y. Y., Mao, J., & Wen, X. T. (2021). Local public debt and return on capital: Evidence from new debt data and the triple mechanism test. Journal of Financial Research, 492(6), 1–20. [Google Scholar]

- Li, G. J., Tian, Z. B., & Song, Y. Q. (2023). The impact of local government debt on urban economic high-quality development. Journal of Central University of Finance & Economics, 0(1), 3–14. [Google Scholar]

- Li, S. J., & Tian, G. Q. (2022). Local government debt expansion and bank risk-taking: Theoretical simulation and empirical evidence. Economic Research Journal, 57(5), 34–50. [Google Scholar]

- Li, Z. X., & Chen, X. G. (2019). Financial decentralization under China’s opening to the outside world—An empirical study based on provincial panel data in China. Studies of International Finance, (10), 9–18. [Google Scholar] [CrossRef]

- Liu, L., & Wang, H. (2025). Estimation of local fiscal expenditure multipliers in China. Journal of Financial Research, 537(3), 188–206. [Google Scholar]

- Liu, W. J., & Wang, H. B. (2018). Analysis of the impact of local debt on high quality development of economy. Journal of Yunnan University of Finance and Economics, 34(10), 73–85. [Google Scholar]

- Lucio, M., Matilde, B., Alessandro, Z., & Alessia, F. (2024). Measuring the impact of the 2008 and 2011 financial crises and the 2015 recovery on the unemployment rate in Italy. Socio-Economic Planning Sciences, 95, 102032. [Google Scholar] [CrossRef]

- Mao, J., & Ma, G. R. (2022). Scale of government debt and fiscal sustainability: A literature review. Fiscal Science, 11, 10–41. [Google Scholar]

- Mao, J., & Ren, Z. S. (2024). Local government debt and the improvement of non-farm employment. Public Finance Research, 2, 71–84. [Google Scholar]

- Owusu-Nantwi, V., & Erickson, C. (2016). Public debt and economic growth in Ghana. African Development Review, 28(1), 116–126. [Google Scholar] [CrossRef]

- Sana, S., Anis, O., & Abdessalem, A. (2024). International capital flows and sustainable development goals: The role of governance and ICT diffusion. Socio-Economic Planning Sciences, 93, 101882. [Google Scholar] [CrossRef]

- Sun, M., & Tai, H. (2019). Fiscal decentralization and economic growth: Theoretical analysis and empirical evidence. Economic Review, (5), 3–21. [Google Scholar] [CrossRef]

- U.S. Department of the Treasury. (2023, January 19). Secretary of the treasury Janet L. Yellen sends letter to congressional leadership on the debt limit. Available online: https://home.treasury.gov/news/press-releases/jy1196 (accessed on 1 June 2024).

- Wang, C. L., Lin, G. S., & Huang, S. X. (2025). Research on regional disparities in the impact of population aging on local government debt. Price: Theory & Practice, (4), 169–174. [Google Scholar] [CrossRef]

- Wang, T., & Gao, K. (2019). Research on the implicit debt risk and countermeasures of local governments in China. Southwest Finance, (11), 3–12. [Google Scholar]

- Woo, J., & Kumar, M. (2015). Public debt and growth. Economica, 82(328), 705–739. [Google Scholar] [CrossRef]

- Wu, H. F., Sun, C. J., & Xiang, H. J. (2023). Research on the impact of local debt on the high quality development of regional economy. Academic Research, (3), 101–108. [Google Scholar]

- Xie, S. X., Chu, H., & Liu, J. D. (2024). Local public debt and corporate investment in housing: Effect and mechanism. Economic Research Journal, 59(4), 43–59. [Google Scholar]

- Xu, L., Hou, L. Q., & Cheng, G. B. (2022). Fiscal decentralization, promotion incentives and local government debt risks. Statistics & Decision, 38(12), 141–145. [Google Scholar]

- Xu, Z. G., Zhang, D., & Cheng, B. D. (2024). The logic of large-scale farming for ensuring China’s food security: Based on the perspectives of scale economies of household and plot. Journal of Management World, 40(5), 106–122. [Google Scholar]

- Yang, R. F., & Wei, Q. Q. (2021). Research on the impact of business environment on urban innovation ability—An empirical test based on intermediary effect. The World of Survey and Research, (10), 35–43. [Google Scholar] [CrossRef]

- Yang, Y. Y., & Jia, P. F. (2025). Local government debt accumulation, default risk measurement, and risk prevention. Financial Economics Research, 40(3), 140–156. [Google Scholar]

- Yi, B., Lu, Y. J., Ouyang, S. Y., & Ma, S. R. (2022). Statistical Accounting and cause analysis of the scale of local implicit debt. The Theory and Practice of Finance and Economics, 43(1), 95–103. [Google Scholar]

- Yu, S. M., Kang, W., Liu, W. J., Wang, D. L., Zheng, J. Y., & Dong, B. Y. (2024). The crowding out effect of local government debt expansion: Insights from commercial credit financing. Economic Analysis and Policy, 83, 858–872. [Google Scholar] [CrossRef]

- Zhan, X. Y., & Liang, L. X. (2024). How does the chain leader policy “Chain” enterprise technological innovation. China Industrial Economics, (11), 137–155. [Google Scholar]

- Zhang, H., Zhang, Y., & Han, A. H. (2022). Research on the measurement of modernization of industrial chains in China. Statistical Research, 39(11), 3–18. [Google Scholar]

- Zhang, Y. X., & Zhao, W. J. (2023). Local government explicit debt, implicit debt and high quality economic development—An Empirical Test Based on nonlinear and long term effects. Statistics & Decision, 39(18), 149–153. [Google Scholar]

- Zhang, Z. L., & Fang, N. (2021). The threshold effect test and social network analysis of the impact of local government debt on High-quality economic development. Studies of International Finance, (10), 14–25. [Google Scholar]

- Zhao, R., & He, P. L. (2024). Government spending efficiency, fiscal decentralization and regional innovation capability: Evidence from China. Economic Analysis and Policy, 84, 693–706. [Google Scholar] [CrossRef]

- Zhu, J., & Xu, H. K. (2023). Research on the impact of local public debt on local financial development. Financial Supervision, (1), 24–30. [Google Scholar]

- Zhu, Y. L., Lu, X. Y., & Yin, L. (2024). A study on the contagion effect of China’s inter provincial government debt risk under multiple correlations. Journal of Statistics and Information, 39(6), 60–73. [Google Scholar]

| Overall Goal | Criterion Layer | First-Level Indicator | Secondary Indicators |

|---|---|---|---|

| High-quality economic development | Innovative | GDP Growth Rate | Regional GDP Growth Rate |

| Intensity of R&D Investment | R&D expenditure of industrial enterprises above designated size/regional GDP | ||

| Investment Efficiency | Incremental Capital Output Ratio (ICOR) = Investment rate/regional GDP growth rate | ||

| Technical Trading Activity | Technology transaction volume/regional GDP | ||

| Coordination | Demand Structure | Total retail sales of consumer goods/regional GDP | |

| Urban-Rural Structure | Urbanization rate | ||

| Industrial Structure | The increase in the proportion of the tertiary industry in regional GDP | ||

| Government Debt Burden | Government debt balance/regional GDP | ||

| Green | Energy Consumption Elasticity Coefficient | Energy consumption growth rate/regional GDP growth rate | |

| Wastewater Output Per Unit | Total wastewater discharge/regional GDP | ||

| Waste Gas Output Per Unit | Sulfur oxide emissions/regional GDP | ||

| Open | Degree of Dependence on Foreign Trade | Total import and export volume/Region GDP | |

| Proportion of Foreign Investment | Actual utilization of foreign investment/regional GDP | ||

| Degree of Marketization | Regional marketization index | ||

| Share | Proportion of Labor Remuneration | Labor remuneration/regional GDP | |

| The Elasticity of Residents’ Income Growth | The growth rate of per capita disposable income of residents/the growth rate of regional GDP | ||

| The Consumption Gap between Urban and Rural Areas | Per capita consumption expenditure of urban residents/Per capita consumption expenditure of rural residents | ||

| The Proportion of Fiscal Expenditure related to People’s Livelihood | The proportion of local fiscal expenditures on education, medical and health care, housing security, social disability and employment in local fiscal budget expenditures |

| Variable | Symbol | First Rectification | Second Rectification | ||||

|---|---|---|---|---|---|---|---|

| Average | Standard Deviation | Observation | Average | Standard Deviation | Observation | ||

| Economy High-Quality | Y | 0.23 | 0.10 | 150 | 0.26 | 0.10 | 150 |

| Explicit Debt | Do_debt | 1925.49 | 2360.84 | 150 | 8622.75 | 4682.91 | 150 |

| Explicit Debt2 | Do_debt2 | 9,281,078.19 | 18,282,458.11 | 150 | 96,281,436.89 | 105,976,484.01 | 150 |

| Implicit Debt | Re_debt | 1719.87 | 1715.80 | 150 | 3708.92 | 4780.69 | 150 |

| Implicit Debt2 | Re_debt2 | 5,901,922.37 | 18,056,719.97 | 150 | 36,611,087.79 | 120,555,117.53 | 150 |

| Economy | Economic | 24,422.98 | 18,466.49 | 150 | 34,955.10 | 27,315.12 | 150 |

| Population | Human Scale | 4592.73 | 2814.80 | 150 | 4682.42 | 2943.69 | 150 |

| Central Transfer Payment | Transpay | 18,657,995.33 | 8,702,635.60 | 150 | 25,242,108.67 | 12,179,495.77 | 150 |

| FDI | FDI | 5,472,101.33 | 5,042,822.21 | 150 | 4,990,053.48 | 5,506,194.71 | 150 |

| Business Environment | BUSINESSENV | 0.16 | 0.09 | 150 | 0.157 | 0.08 | 150 |

| Social Security Level | SOCIALSECURITY | 0.13 | 0.03 | 150 | 0.15 | 0.04 | 150 |

| Modernization of Industrial Chain | INDUSTRYMODERN | 0.20 | 0.06 | 150 | 0.23 | 0.08 | 150 |

| Opening up Degree | OPENLEVEL | 2.72 | 2.80 | 150 | 2.46 | 2.29 | 150 |

| Capital Allocation Efficiency | CAPITALEFFI | 0.66 | 0.38 | 150 | 0.61 | 0.49 | 150 |

| Investment level | INVESTLEVEL | 18,220.88 | 11,870.15 | 150 | 24,769.84 | 17,374.95 | 150 |

| Variable | Full Sample Period | First Rectification (2013–2017) | Second Rectification (2018–2022) | |

|---|---|---|---|---|

| Core Explanatory Variable | Do_debt | 6.88 × 10−6 * | 5.04 × 10−6 | 1.68 × 10−5 ** |

| Do_debt2 | −2.39 × 10−10 * | −6.85 × 10−10 | −5.96 × 10−10 *** | |

| Re_debt | 7.80 × 10−6 ** | 2.80 × 10−5 *** | 4.95 × 10−6 | |

| Re_debt2 | −5.29 × 10−10 *** | −2.73 × 10−9 *** | −4.18 × 10−10 *** | |

| Control Variable | Economy | 2.60 × 10−6 *** | 2.35 × 10−6 * | 3.48 × 10−6 *** |

| Humanscale | −3.07 × 10−5 *** | −2.23 × 10−5 *** | −3.60 × 10−5 *** | |

| Transpay | −1.63 × 10−9 * | −3.03 × 10−9 ** | −1.78 × 10−9 | |

| FDI | 1.09 × 10−8 *** | 9.87 × 10−9 *** | 7.80 × 10−9 ** | |

| Constant | 2.50 × 10−1 *** | 2.42 × 10−1 *** | 2.18 × 10−1 *** | |

| Do_debt turning Point | 1.44 × 104 | 1.41 × 104 | ||

| Re_debt Turning Point | 7.37 × 103 | 5.13 × 103 | ||

| Observation | 240 | 120 | 120 | |

| Goodness of Fit | 0.58 | 0.71 | 0.55 | |

| Theoretical Consistency | Yes | yes | yes |

| Time | First Rectification (2013–2017) | Second Rectification (2018–2022) | |||

|---|---|---|---|---|---|

| Dependent Variable | CAPITALEFFI | INVESTLEVEL | CAPITALEFFI | INVESTLEVEL | |

| Core Explanatory Variable | Do_debt | −1.64 × 10−5 | 3.16 × 10−1 | 1.27 × 10−5 | 3.16 × 10−1 |

| Re_debt | 8.38 × 10−5 *** | 3.93 × 10−1 * | 2.87 × 10−5 ** | 6.96 × 10−1 *** | |

| BUSINESSENV | −1.07 ** | −2.68 × 104 *** | −1.58 *** | −3.86 × 104 *** | |

| SOCIALSECURITY | 1.42 | −4.63 × 104 *** | 1.96 ** | −5.35 × 104 *** | |

| INDUSTRYMODERN | −2.42 * | −3.00 × 104 * | −1.24 | −3.82 × 104 | |

| OPENLEVEL | −7.98 × 10−2 *** | −1.94 × 103 *** | −2.03 × 10−1 *** | −6.08 × 102 | |

| Control Variable | Economic | 4.29 × 10−6 | 4.04 × 10−1 *** | −3.29 × 10−6 | −2.06 × 10−2 |

| Humanscale | 1.91 × 10−5 | 8.52 × 10−2 | 8.12 × 10−5 * | 2.67 *** | |

| Transpay | −1.03 × 10−8 | 9.95 × 10−5 | −2.41 × 10−8 *** | 1.91 × 10−4 * | |

| FDI | −1.45 × 10−8 | 7.43 × 10−4 *** | −8.33 × 10−9 | 9.97 × 10−4 *** | |

| Constant | 1.30 *** | 2.25 × 104 *** | 1.50 × 10+00 *** | 2.31 × 104 *** | |

| Observation | 120 | 120 | 120 | 120 | |

| Goodness of Fit | 0.55 | 0.94 | 0.57 | 0.92 | |

| Theoretical Consistency | yes | yes | yes | yes | |

| Variable | First Rectification (2013–2017) | Second Rectification (2018–2022) | ||||

|---|---|---|---|---|---|---|

| (1) | (2) | (3) | (4) | (5) | (6) | |

| Do_debt | 1.46 × 10−5 ** | 2.61 × 10−7 | 2.35 × 10−5 *** | 2.04 × 10−5 *** | ||

| Do_debt2 | −1.58 × 10−9 * | −3.14 × 10−10 | −7.32 × 10−10 *** | −7.07 × 10−10 *** | ||

| Re_debt | 4.32 × 10−5 *** | 4.56 × 10−5 *** | 2.08 × 10−5 *** | 1.81 × 10−5 *** | ||

| Re_debt2 | −3.50 × 10−9 *** | −3.56 × 10−9 *** | −6.84 × 10−10 *** | −6.05 × 10−10 *** | ||

| CAPITALEFFI | 1.51 × 10−2 | −8.97 × 10−3 | −1.15 × 10−2 | −5.49 × 10−2 *** | −5.89 × 10−2 *** | −5.47 × 10−2 *** |

| INVESTLEVEL | −5.40 × 10−6 ** | −7.47 × 10−6 *** | −7.75 × 10−6 *** | −1.65 × 10−6 | −2.57 × 10−6 | −5.32 × 10−6 *** |

| INVESTLEVEL2 | −5.60 × 10−13 | 3.95 × 10−11 | 4.56 × 10−11 | −1.68 × 10−11 | −2.43 × 10−11 | 2.38 × 10−11 |

| Control Variable | Controlled | Controlled | Controlled | Controlled | Controlled | Controlled |

| Constant | 2.40 × 10−1 *** | 2.45 × 10−1 *** | 1.24 *** | 2.25 × 10−1 *** | 2.66 × 10−1 *** | 1.23 *** |

| Do_debt turning point | 4.62 × 103 | 1.61 × 104 | 1.44 × 104 | |||

| Re_debt Turning point | 6.17 × | 6.41 × | 1.52 × | 1.50 × 104 | ||

| Observation | 120 | 120 | 120 | 120 | 120 | 120 |

| Goodness of Fit | 0.74 | 0.78 | 0.78 | 0.60 | 0.63 | 0.66 |

| Theoretical Consistency | Yes | Yes | Yes | Yes | Yes | Yes |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2025 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Yuan, Y.; Yang, X.; Umer, M. The Scale Logic of Government Debt for Overall Development and Security—From the Perspective of Dual Scale Economy of Explicit and Implicit Debt. Economies 2025, 13, 245. https://doi.org/10.3390/economies13080245

Yuan Y, Yang X, Umer M. The Scale Logic of Government Debt for Overall Development and Security—From the Perspective of Dual Scale Economy of Explicit and Implicit Debt. Economies. 2025; 13(8):245. https://doi.org/10.3390/economies13080245

Chicago/Turabian StyleYuan, Yunxiao, Xiaoyu Yang, and Muhammad Umer. 2025. "The Scale Logic of Government Debt for Overall Development and Security—From the Perspective of Dual Scale Economy of Explicit and Implicit Debt" Economies 13, no. 8: 245. https://doi.org/10.3390/economies13080245

APA StyleYuan, Y., Yang, X., & Umer, M. (2025). The Scale Logic of Government Debt for Overall Development and Security—From the Perspective of Dual Scale Economy of Explicit and Implicit Debt. Economies, 13(8), 245. https://doi.org/10.3390/economies13080245