Abstract

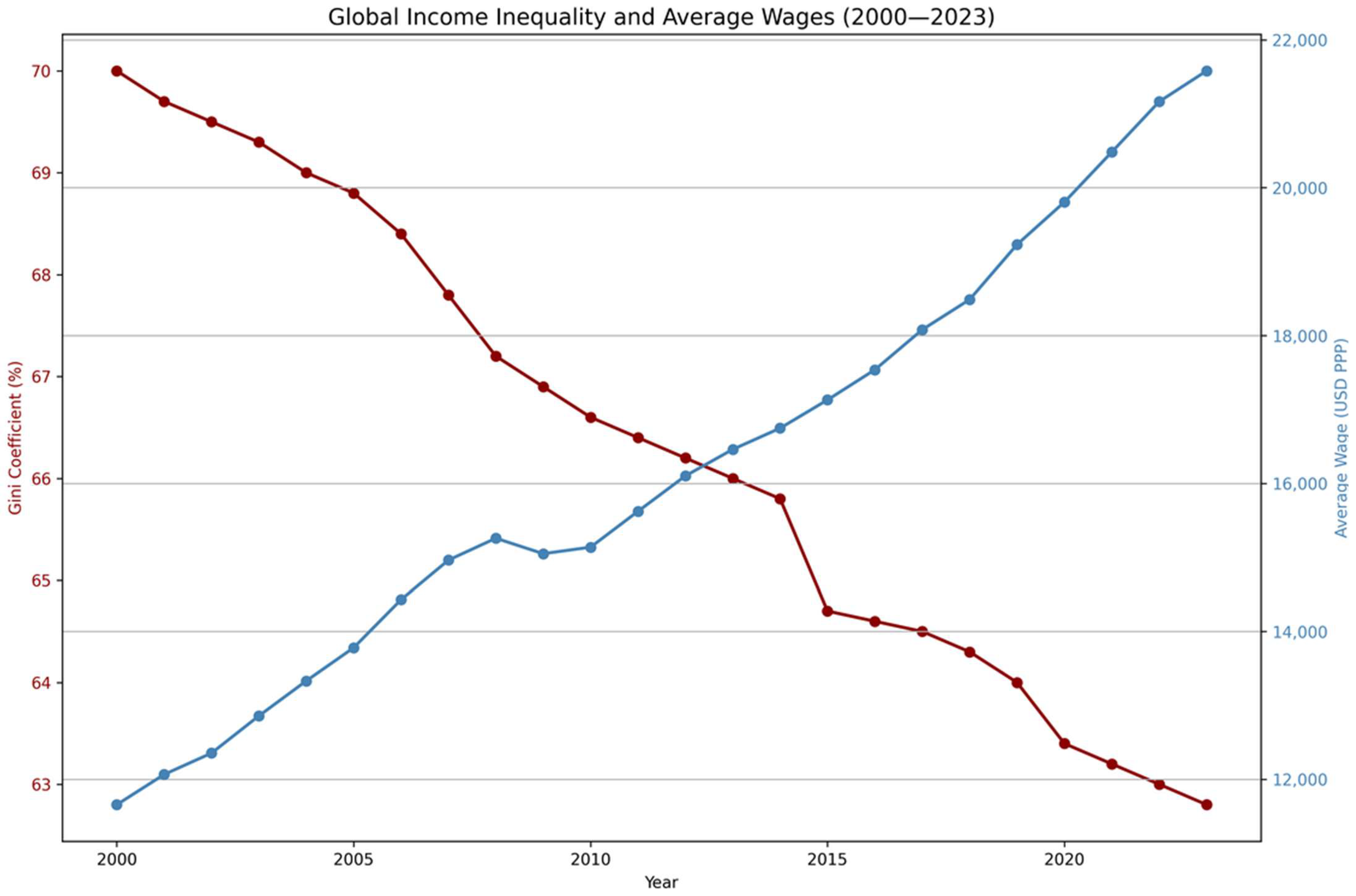

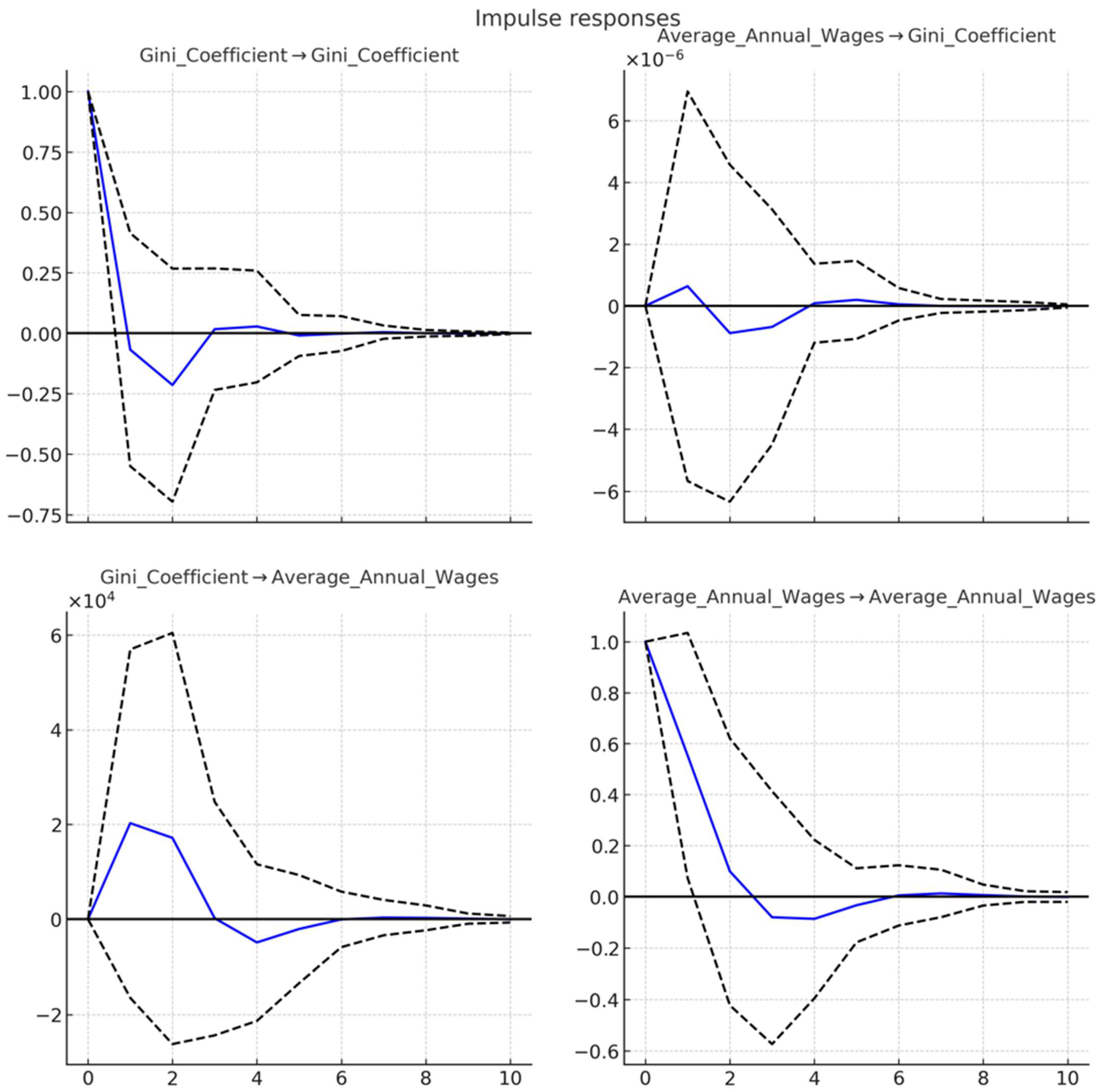

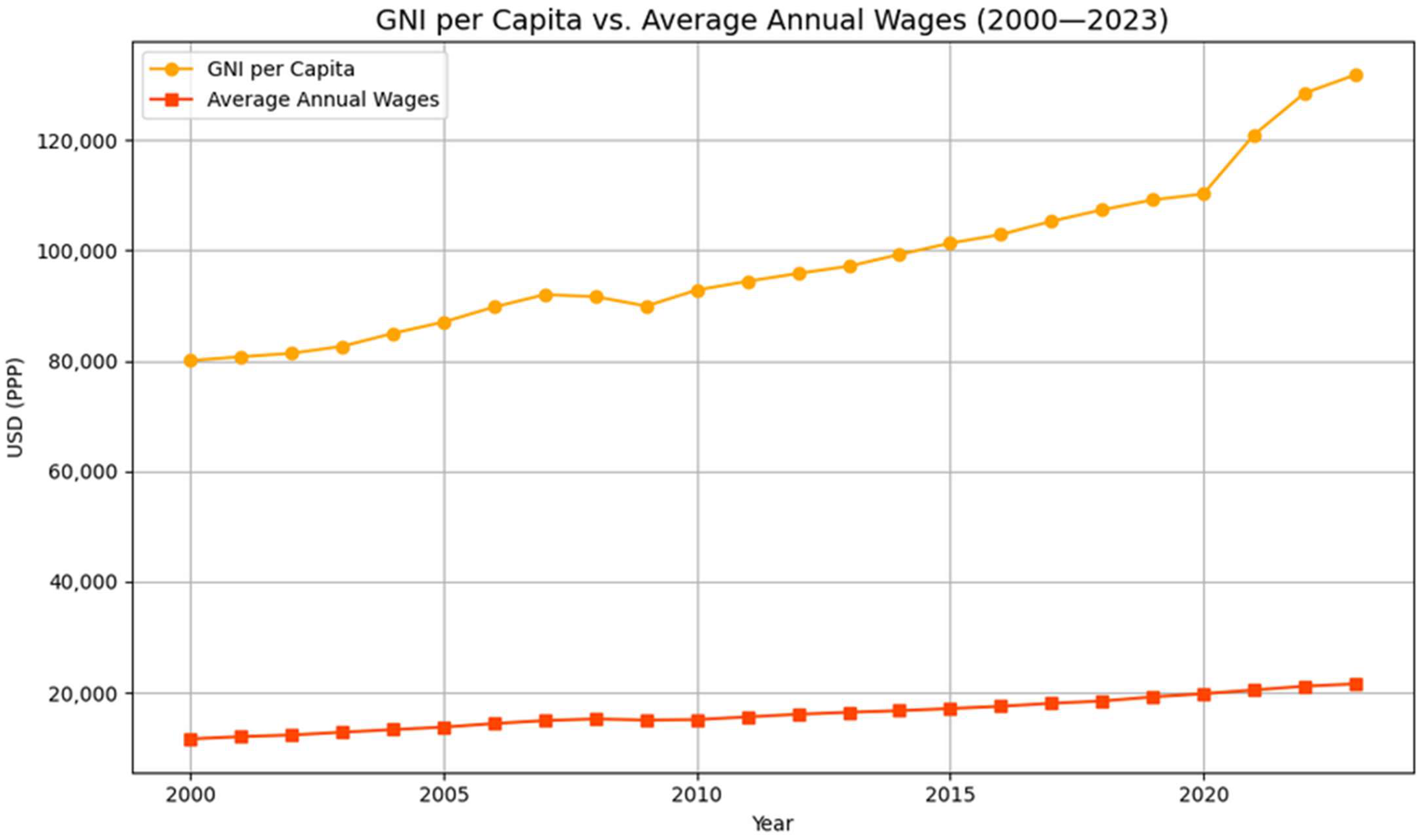

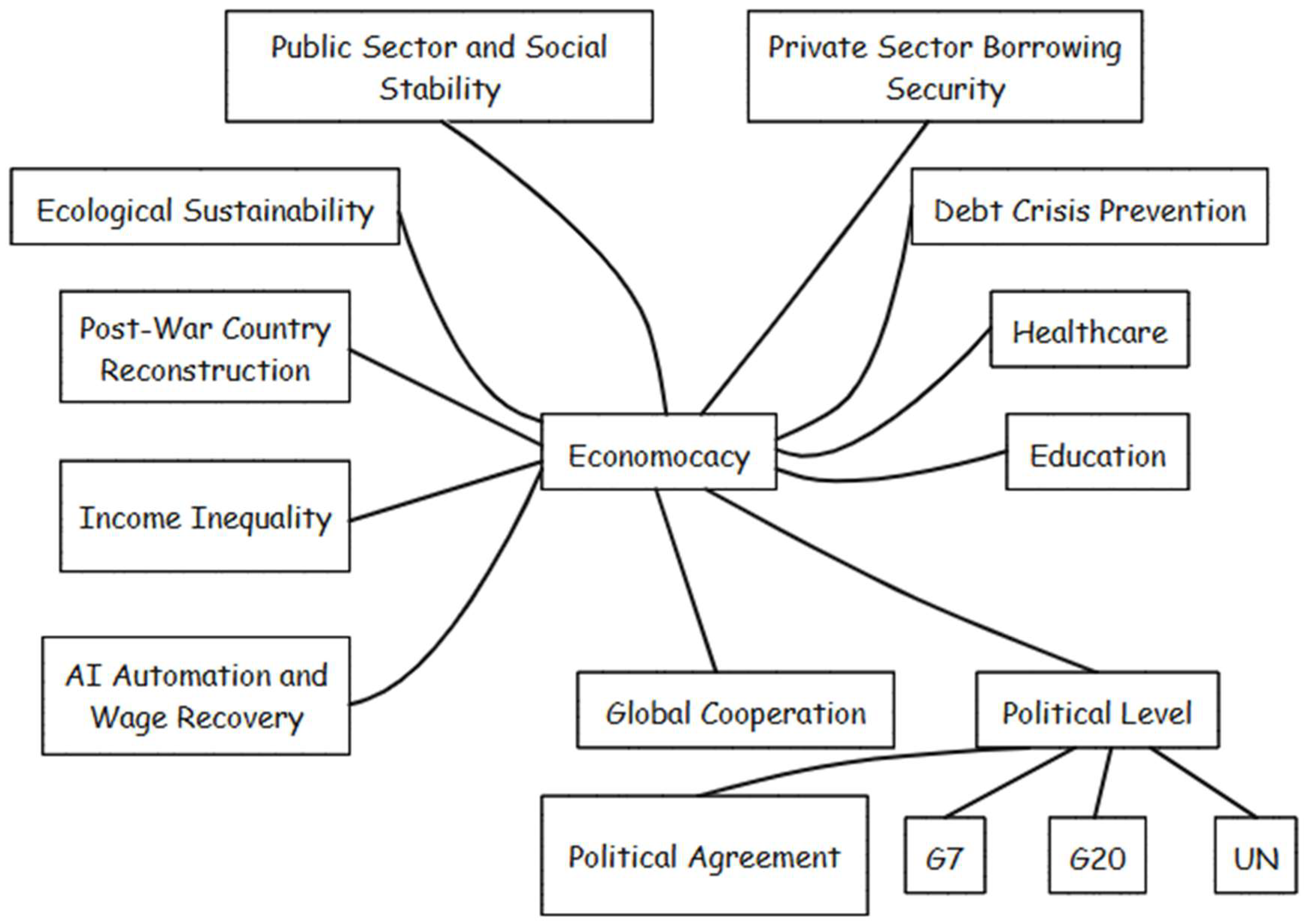

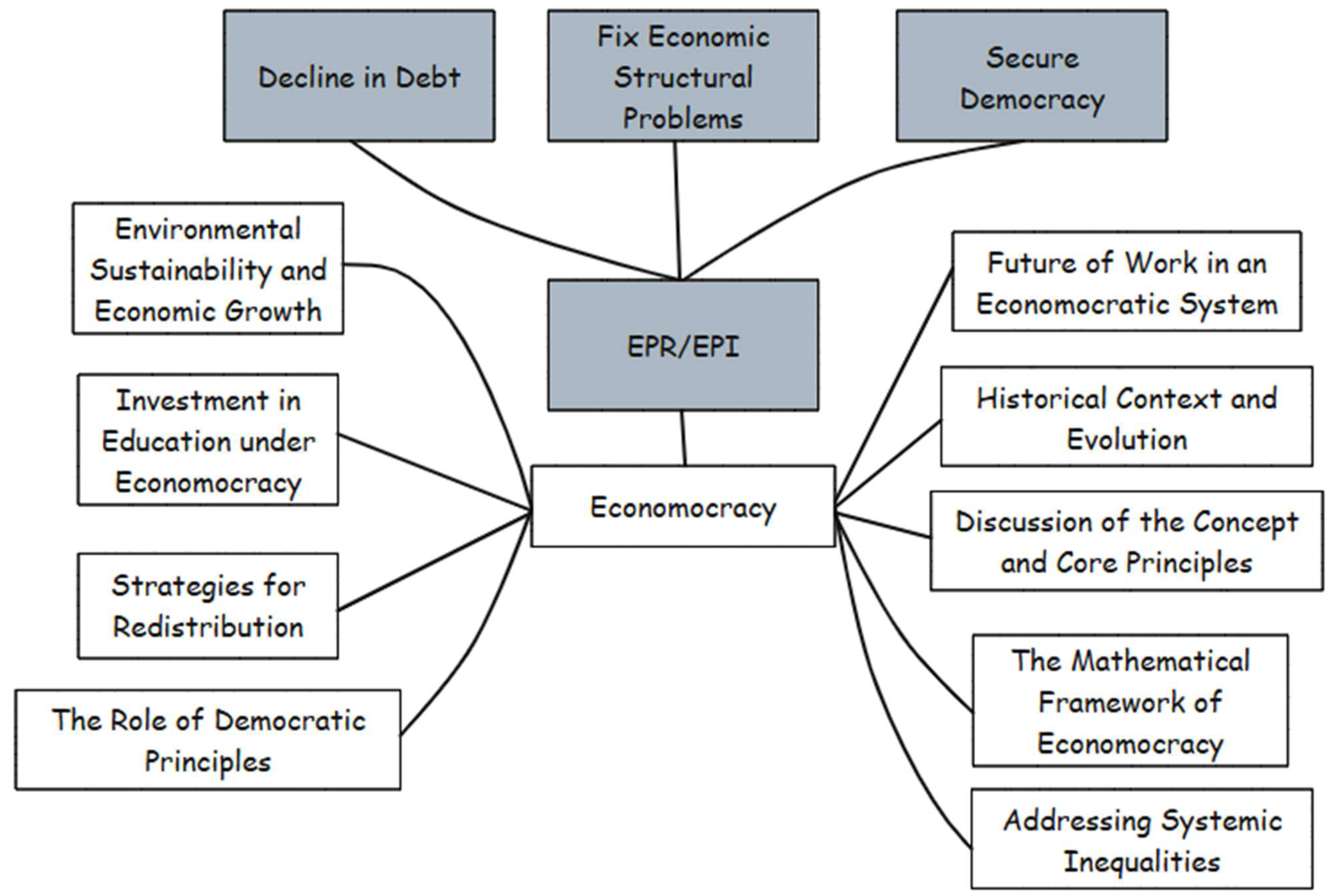

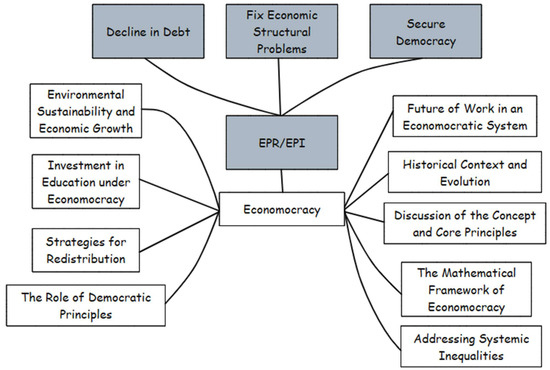

Economic systems face critical challenges, including widening income inequality, unemployment driven by automation, mounting public debt, and environmental degradation. This study introduces Economocracy as a transformative framework aimed at addressing these systemic issues by integrating democratic principles into economic decision-making to achieve social equity, economic efficiency, and environmental sustainability. The research focuses on two core mechanisms: Economic Productive Resets (EPRs) and Economic Periodic Injections (EPIs). EPRs facilitate proportional redistribution of resources to reduce income disparities, while EPIs target investments to stimulate job creation, mitigate automion-related job displacement, and support sustainable development. The study employs a theoretical and analytical methodology, developing mathematical models to quantify the impact of EPRs and EPIs on key economic indicators, including the Gini coefficient for inequality, unemployment rates, average wages, and job displacement due to automation. Hypothetical scenarios simulate baseline conditions, EPR implementation, and the combined application of EPRs and EPIs. The methodology is threefold: (1) a mathematical–theoretical validation of the Cycle of Money framework, establishing internal consistency; (2) an econometric analysis using global historical data (2000–2023) to evaluate the correlation between GNI per capita, Gini coefficient, and average wages; and (3) scenario simulations and Difference-in-Differences (DiD) estimates to test the systemic impact of implementing EPR/EPI policies on inequality and labor outcomes. The models are further strengthened through tools such as OLS regression, and Impulse results to assess causality and dynamic interactions. Empirical results confirm that EPR/EPI can substantially reduce income inequality and unemployment, while increasing wage levels, findings supported by both the theoretical architecture and data-driven outcomes. Results demonstrate that Economocracy can significantly lower income inequality, reduce unemployment, increase wages, and mitigate automation’s effects on the labor market. These findings highlight Economocracy’s potential as a viable alternative to traditional economic systems, offering a sustainable pathway that harmonizes growth, social justice, and environmental stewardship in the global economy. Economocracy demonstrates potential to reduce debt per capita by increasing the efficiency of public resource allocation and enhancing average income levels. As EPIs stimulate employment and productivity while EPRs moderate inequality, the resulting economic growth expands the tax base and alleviates fiscal pressures. These dynamics lead to lower per capita debt burdens over time. The analysis is situated within the broader discourse of institutional economics to demonstrate that Economocracy is not merely a policy correction but a new economic system akin to democracy in political life.

1. Introduction

The concept of Economocracy describes a transformative approach to economic governance, aiming to integrate democratic values within the intricate workings of the global economy. This framework proposes a system where economic decisions are not merely dictated by market laws but are influenced by collective input and accountability. By weaving in the ideals of equality and sustainability, Economocracy offers a tantalizing glimpse of how economic structures might evolve to better serve society as a whole. By examining the historical context and theoretical foundations of this system, it is plausible to uncover the motivations and philosophies that underpin this ambitious model.

While extensive literature exists on the ideological and structural critiques of capitalism, socialism, and democracy, this study does not aim to repeat those debates. Instead, it builds upon those foundations to offer a concrete and analytically rigorous solution: Economocracy, a system that mathematically restructures economic flows to eliminate systemic debt, reduce inequality, and democratize monetary control. Unlike previous conceptual frameworks, Economocracy operationalizes its principles through computable mechanisms such as Economic Productive Resets (EPRs) and Economic Periodic Injections (EPIs). These tools are not philosophical abstractions but functionally testable instruments supported by simulation and validated logic. Thus, this paper departs from ideological discourse and enters the domain of structural economic design.

This study addresses a critical gap in economic governance models: the absence of a mathematically grounded and democratically accountable system that mitigates automation-induced job loss, public debt accumulation, and rising inequality. The existing literature fails to reconcile the structural flaws of capitalism and the inefficiencies of socialism within a unified framework. The objective of this study is to introduce and validate the concept of Economocracy through mathematical modeling and simulation, demonstrating its ability to reduce inequality, unemployment, and automation risk, while preserving fiscal sustainability and social justice. Despite decades of economic evolution, neither traditional capitalism nor socialism has resolved the structural issues underpinning modern global crises, including public debt accumulation, wealth inequality, and automation-driven unemployment. A significant research gap exists in proposing a mathematically grounded and democratically accountable alternative system that can address these systemic weaknesses. Most of the current literature either focuses on monetary reform without structural alternatives to interest-based debt or emphasizes redistribution without tackling the underlying mechanics of value creation and circulation. No economic model to date integrates both a solution to systemic debt and a redistribution framework linked to democratic legitimacy.

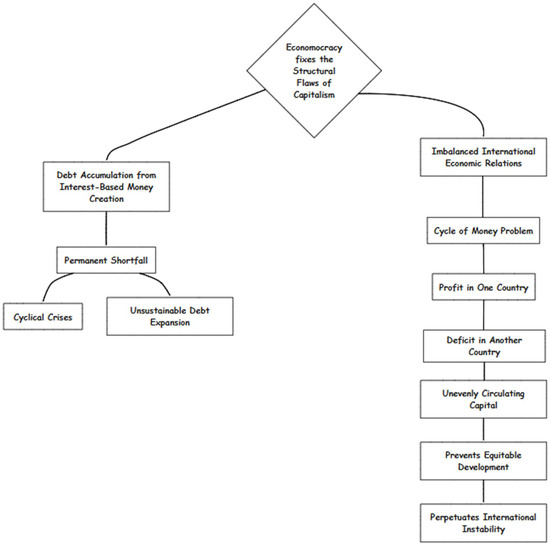

Capitalism suffers from two core structural and mathematical flaws:

- 1.

- Debt Accumulation from Interest-Based Money Creation:Under current monetary systems, money is primarily created through bank loans that must be repaid with interest. However, the interest itself is not created within the system, resulting in a permanent shortfall that structurally generates public and private debt. This flaw leads to cyclical crises and unsustainable debt expansion.

- 2.

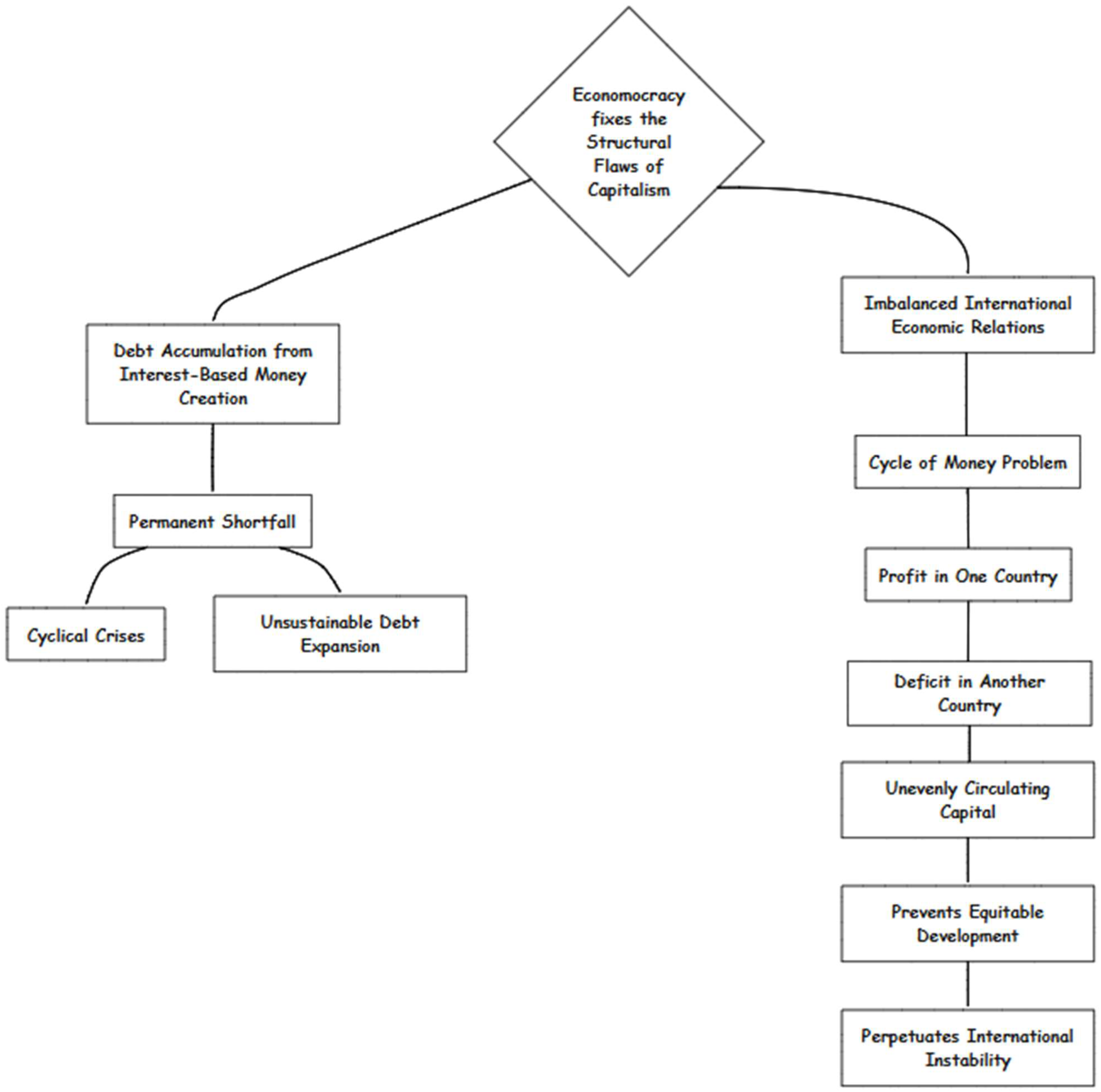

- Imbalanced International Economic Relations (Cycle of Money Problem):According to the Theory of the Cycle of Money, any profit or surplus generated in one country mathematically implies a deficit in another, due to the finite and unevenly circulating nature of global capital. This zero-sum condition structurally prevents equitable global development and perpetuates international instability (see Figure 1).

Figure 1. Methodology of Q.E. reverse engineering method (Author’s scheme, Appendix B and Appendix C).

Figure 1. Methodology of Q.E. reverse engineering method (Author’s scheme, Appendix B and Appendix C).

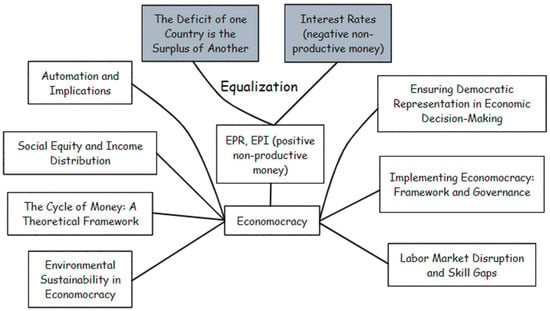

This paper analyzes Economocracy as a new mathematically consistent economic system designed to overcome the aforementioned failures of capitalism. The study’s objectives are to theoretically develop and mathematically model the mechanisms of EPR and EPI as tools to replace debt-based money with positive non-productive money, to simulate baseline and intervention scenarios to evaluate the effects of Economocracy on key indicators (inequality, unemployment, wages, automation impact), and to demonstrate that Economocracy can simultaneously achieve economic efficiency, social equity, and sustainability through a system grounded in democratic values and fiscal balance.

Between the mid-20th century and early 21st century, the world witnessed significant changes influenced by various economic ideologies. The rise of automation and globalization, coupled with environmental degradation, prompted economists and theorists to reassess traditional capitalism’s shortcomings. This was a period marked by increasing inequality and the alarming effects of climate change, leading to the search for alternatives that could bridge the gulf between economic growth and social welfare. During this time, the seeds of Economocracy began to take root, addressing the pressing need for a more equitable system of resource distribution (Braudel, 1982; Braudel et al., 1981; Haskel & Westlake, 2021; Lenin, 1916; Szabó, 2022).

Ending an era dominated by unchecked capitalist expansion, the emergence of Economocracy reflects a convergence of ideas from multiple disciplines, including economics, political theory, and environmental science. Influenced by the growing concern over sustainability and the moral imperative to reduce inequalities, the framework proposed by Economocracy resonates more socially responsible approach to economic behavior. This blending of ideas gave rise to new mechanisms aimed at alleviating public debt and redistributing wealth, significant shifts that resonate across the global stage today (Challoumis, 2024e). The main research question is whether Economocracy can effectively resolve the structural mathematical flaws of capitalism, such as the unsustainable nature of debt accumulation and the imbalance caused by non-productive money (e.g., interest rates), as identified by the Theory of the Cycle of Money. Of course, there are more issues that serve at the compliance of the economic system to democratic principles, including AI aspects, unemployment, inequality, the transition of debts between generations, the funding of healthcare systems, the step-up of space foundation programs, and many others that have been discussed in previous papers on Economocracy (Challoumis, 2022a, 2024a, 2024d, 2024e).

2. Literature Review

By framing itself as an alternative to both capitalism and socialism, Economocracy embodies a synthesis of pragmatic and ideological responses to contemporary economic and social challenges. It does not merely seek to correct the deficiencies of existing systems; instead, it endeavors to reconstruct economic interactions at every level. Exploring the underpinnings of Economocracy, it is plausible to discover how its historical emergence draws on the lessons learned from the failures and successes of past economic models. What follows is based on the terms developed in the papers “Economocracy versus Capitalism” (Challoumis, 2024d) and “The Index of the Cycle of Money: The Case of Switzerland” (Challoumis, 2024g).

Fundamental aspects: Economocracy is the only economic system built upon an appropriate mathematical structure, addressing two fundamental mathematical problems inherent in capitalism (Challoumis, 2022a, 2024a, 2024d, 2024e). Firstly, it resolves the issue of continually increasing debts, caused by interest rates, through the introduction of positive non-productive money. Secondly, according to the Theory of the Cycle of Money, even the smallest profit gained by one country directly corresponds to a deficit experienced by another. By addressing these interconnected issues, Economocracy rectifies the fundamental mathematical flaw present in capitalism, as articulated by the Cycle of Money and the principles underlying Economocracy itself. Furthermore, Economocracy aligns economic operations with democratic values by effectively tackling challenges related to inequality, healthcare, education, war, environmental sustainability, and space exploration programs (Challoumis, 2022a, 2024a, 2024d, 2024e).

The Cycle of Money: The theory of the Cycle of Money centers on the distinction between enforcement savings and escape savings, a differentiation that critically influences economic performance. Enforcement savings are retained within the local banking system, supporting investment in manufacturing and specialized sectors by major corporations while still allowing space for small businesses to thrive. Real-world case scenarios support the applicability of the Cycle of Money theory, particularly through the analysis of enforcement mechanisms and escaped savings, as observed in multiple countries such as Switzerland, Greece, Canada, the United Kingdom, Poland, and Costa Rica (Challoumis, 2021a, 2021b, 2021c, 2021d, 2021e, 2021f, 2021g, 2021h, 2021i, 2022b, 2022c, 2023a, 2023b, 2023c, 2023d, 2024c, 2024g). The theory is further validated through its consistent patterns across multiple national contexts and in a global overview (Challoumis, 2024h). This circulation of funds boosts economic momentum and promotes self-sustaining growth. When enforcement savings exceed escape savings, the economy reaches optimal performance, with each economic agent contributing productively to a resilient system. In contrast, escape savings, funds that exit the local economy, disrupt this flow, weakening the cycle of reinvestment and slowing overall growth (Challoumis, 2021c, 2021f, 2022c, 2023b, 2023c). The theory suggests that regulatory tools, such as higher taxes on corporations that displace smaller enterprises and subsidies for capital-intensive projects, can strengthen enforcement savings. Likewise, low taxation on productive activities and strategic investment in areas like healthcare and education enhance economic efficiency (Challoumis, 2024g).

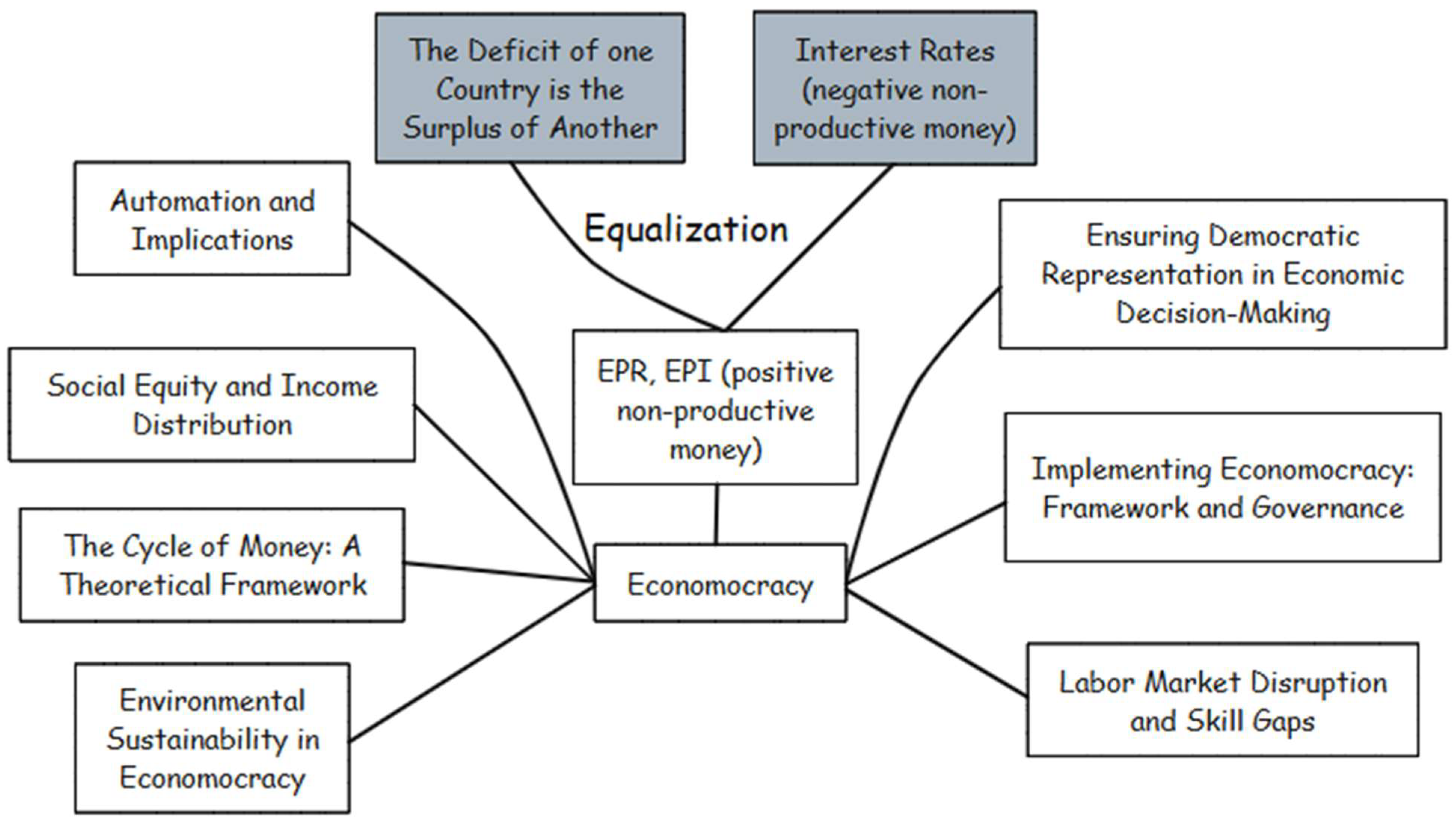

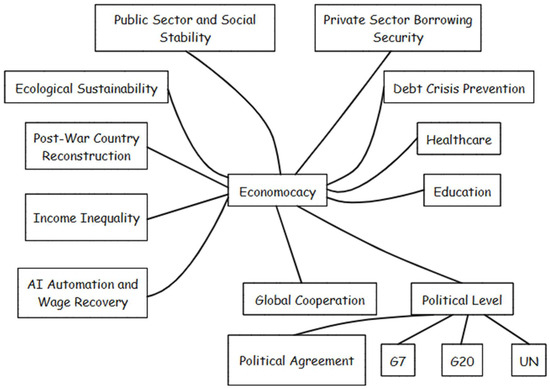

2.1. Economocracy

A system developed by Constantinos Challoumis, builds upon this theory to address critical global issues, including escalating public debt and the challenges posed by central bank interest rates. Interest rates are requested money that must be returned, considered as negative non-productive money (Challoumis, 2022a). This problem could be only addressed by the positive non-productive money that the economic system of Economocracy offers through EPRs and EPIs. EPRs aim more at debt and EPIs more to social aspects e.g., healthcare system, reconstruction of countries after wars, space programs, education, etc. EPRs and EPIs depend on the GDP of each country, a valid measure to use for the proportional decline of debts (Challoumis, 2022b). The term is not random; it is based on the proportional terms of democracy, meaning “holding the economy by people” (economy + state, “οικονομία + κράτος”). The term should not be confused with the term of Econocracy (Karpf et al., 2024; Munck, 2016). Historically, the term democracy also had the same problem, as it had negative meaning, and the prior term was politeia. Democracy was the bad case of politeia. The term politeia has been replaced by the term of democracy. Then, the etymology historically was more important for the meaning of the aspect. One of its core insights is the structural mismatch between the amount of circulating money and the levels of debt incurred through borrowing, a disparity that generates financial instability (Crick, 2007; Friede, 2020; Lovett & Zuehl, 2022; Westheimer & Kahne, 2004). Economocracy also acknowledges the interconnected nature of global economies, where one nation’s surplus GDP often translates into another’s deficit, highlighting the need for mechanisms that facilitate fair wealth redistribution. By applying the principles of the Cycle of Money, Economocracy advocates for policies that promote the continuous and equitable reuse of money within and across economies. It calls for a rethinking of traditional monetary and fiscal frameworks, proposing reforms that reduce dependence on excessive borrowing and correct imbalances in economic outcomes (see Figure 2). Through regulatory strategies, such as lower taxes on productive endeavors and targeted public investment, Economocracy aims to create a more balanced sustainable global economy, where prosperity is more evenly shared. There could be some instances where authoritarian states have good economic performances, but economies without democratic values do not have personal and social progress (Challoumis, 2022a, 2024e). Moreover, it should be mentioned that interest rates are considered as non-productive money, and Economocracy fixes this issue with positive non-productive money (based on Economic Productive Resets and Economic Periodic Injections) (Chu et al., 2024; Daniels, 2021; Przeworski, 2024). While the etymological construction of the term Economocracy draws from classical Greek roots to mean “rule through economic equilibrium,” this paper does not dwell on the linguistic evolution of the term. The focus lies not in terminology, but in substance: Economocracy presents a structured and computable alternative to current economic systems, grounded in redistributive tools that correct the failures of interest-based debt and structural global imbalances. Economocracy is not an abstract philosophy or ideological label; it is a system of mathematically governed instruments that can be translated into real policy.

Figure 2.

Economic Productive Resets (EPRs) and Economic Periodic Injections (EPIs) (Author’s scheme).

The two core tools, EPRs and EPIs, enable governments to cancel unsustainable debts and fund social infrastructure without resorting to inflation or austerity. These mechanisms are not theoretical ideals; they are modeled, computable, and suitable for simulation, national piloting, or even coordinated international implementation through G7/G20 policy agreements. Although the term Econocracy has been used in the prior literature to describe the rise of economic technocracy and elite-driven policymaking, Economocracy is fundamentally different. This model does not critique technocracy alone; it replaces the entire macroeconomic operating framework with a system based on democratic oversight, proportional redistribution, and monetary sustainability. The distinction is not semantic; it is structural and institutional.

EPRs (Economic Productive Resets): The core principle of Economocracy must be applied to critical global challenges, and this can be achieved through the mechanism known as EPR, Economic Productive Reset. EPRs enable the transformation of adverse economic outcomes into financial stability and help address austerity measures by supporting necessary changes. Their implementation can smooth out economic fluctuations, contribute to the gradual elimination of global debt with only minimal impact on prices, and preserve exchange rate stability. However, the effectiveness of this strategy depends on a political consensus among nations, potentially formalized through an agreement within the G20. Debt restructuring under EPRs should be aligned with each country’s GDP and credit rating. In cases where the restructured amount exceeds a country’s outstanding debt, that nation should receive additional funds, on the condition that such resources are not allocated to military expenditures. An EPR is one of the two fundamental mechanisms, the other being an EPI, that introduce non-productive money into the economy to address the issue of globally increasing debts. This process occurs fairly, as it is based on GDP (or alternatively, GDP per capita, depending on the terms agreed upon) (Challoumis, 2022a).

EPIs (Economic Periodic Injections): Economic support across all nations can be maintained through the use of EPIs—Economic Periodic Injections. This mechanism involves the regular allocation of agreed-upon capital to strengthen essential social sectors, such as education and healthcare. By doing so, countries can mitigate persistent issues stemming from inadequate infrastructure or the impact of conflict. In this framework, developed nations may repurpose EPR-related funds for non-military uses. Since the injected amounts are relatively modest when compared to average GDPs, they can be provided as fixed sums; however, if the amounts are larger, they should instead be adjusted in proportion to each country’s GDP. This approach ensures exchange rate stability while maintaining equitable economic support (Challoumis, 2022a).

Democracy: The term democracy means he control of the political affairs by people (people + state, “δήμος + κράτος”) The origins of democracy are often attributed to ancient Greece, particularly the city of Athens in the 5th century BC, although earlier forms of basic democratic practices likely existed elsewhere. At a time when autocracies and oligarchies dominated, the Athenian system stood out for its unique structure. Unlike modern democracies, it operated as a direct democracy, where citizens themselves gathered to debate and decide on policies rather than electing officials to represent them. In the present day, democracy takes many diverse forms, with each democratic nation adopting its own version (Holston, 2022; Plattner, 2015; Zagrebina, 2020). There is no universal template: some democracies are presidential, others parliamentary; some are federal, others unitary; and voting systems range from proportional to majoritarian. Some democracies even coexist with monarchies, demonstrating the broad spectrum of democratic governance in the modern world (Challoumis, 2022a).

Theoretical Foundations: Before we probe the core tenets of Economocracy, it is crucial to understand the theoretical foundations that inform its design. These foundations blend concepts from classical economics with emerging insights on sustainability and equity. At its essence, Economocracy addresses the structural issues inherent within contemporary financial systems, particularly how they perpetuate cycles of debt and inequality. In doing so, it seeks to provide a coherent integrated approach that reflects the interconnected nature of global economies, where one nation’s prosperity often rests on the deficits of another (Carfora et al., 2021; Diallo et al., 2021; dos Santos Benso Maciel et al., 2020; Marques, 2019; Nash et al., 2017; Spiel et al., 2018; J. Wu et al., 2019).

Foundations of Economocracy are rooted in its innovative mathematical concepts, such as the Cycle of Money theory, which distinguishes between enforcement savings and escape savings. This differentiation elucidates how money circulates within a local economy, advocating for regulations that enhance enforcement savings by incentivizing local investment and minimizing capital flight. Such insights are imperative for understanding how wealth distribution can be optimized to benefit society at large as opposed to a select few. An optimal distribution of wealth is defined on the theory of Cycle of Money, where economic activity is boosted by the enhancement of enforcement savings and the decline of escaped savings (Challoumis, 2024g). The focus on equitable resource allocation informs the design of Economocracy, making it a pertinent response to the challenges posed by automation, environmental crises, and rampant inequality (Camiña et al., 2020; Ghobakhloo et al., 2023; Kraske, 2008).

Key Principles Governing Economocracy: Above all, the principles governing Economocracy emphasize sustainability, equity, and democratic engagement, positioning itself as a contemporary answer to age-old economic debates. Thus, this statement echoes the principles of a welfare state with a market economy (Challoumis, 2022a, 2024a, 2024d, 2024e). By reinstating the importance of proportional distribution, Economocracy ensures a fair allocation of resources based on economic productive outputs, ultimately supporting weaker economies and promoting global equity. The introduction of mechanisms like EPRs and EPIs illustrates how the system seeks to realign financial resources with societal needs. These principles challenge the long-standing notions of unregulated markets and their inclination towards exacerbating inequality and environmental neglect (AICPA, 2017; Hasselman & Stoker, 2017).

Navigating through the key principles that underlie Economocracy, it is plausible to discover how they intertwine with everyday economic interactions. By fostering an environment where investments in education, healthcare, and green initiatives are prioritized, Economocracy paves the way for a more cohesive global community. Understanding these principles is not merely an academic exercise; where economic decision-making is conducted with the intent of promoting human welfare, environmental resilience, and global cooperation. By embracing these principles, people will be empowered to contribute to the evolution of an economic system that truly values individuals and the planet alike (Abdelkafi, 2018; Campos et al., 2019).

2.2. Automation and Implications

While it may seem like a distant concern, the rise of automation is dramatically reshaping the global economy, influencing the fabric of how societies function and individuals earn a living. As technology advances, automated systems are increasingly performing tasks once reserved for human workers, resulting in profound changes in productivity and efficiency. This shift is not merely a trend but a fundamental alteration in the way economic systems operate (Coombs et al., 2020; Limkar & Tamboli, 2024; Milakis et al., 2017; Prettner, 2017; Shevchenko et al., 2025). The implications of this automation surge must be considered—not only for economies but for its own potential career paths and financial stability. By understanding these shifts, one can be better equipped for the future landscape of work and wealth distribution.

Along with the rapid pace of technological advancement, industries across all sectors are integrating automated solutions to streamline operations and maximize profit margins. This trend, once confined to manufacturing, has expanded to realms such as services, logistics, and even creative fields. Technology could replace jobs, in a way that paints a compelling picture of the future labor landscape. Automation-driven efficiency may contribute to economic growth, but the resulting displacement of workers poses significant challenges. The question lies in how societies will adapt and what safety nets will be put in place to support those affected (Danaher, 2022; Lindgren, 2024; Touseef et al., 2023).

The impact of automation extends beyond individual sectors; it reshapes economic structures fundamentally. As businesses automate processes, the reliance on human labor diminishes, leading to a reallocation of resources towards fewer skilled job roles. This shift has created a dual economy where technology enhances productivity and profitability in certain sectors, while leaving others vulnerable and under-resourced. One should consider that while some may thrive in this new context, others might find themselves disenfranchised. The continuous integration of AI and machine learning into routine activities illustrates the urgency of addressing these imbalances (S. D. Baker et al., 2020; Cho, 2020; Moreno-Jiménez et al., 2014; Stoica & Ilas, 2013; Varlamova, 2019).

Furthermore, these changes are not uniform across regions and demographics. Developed countries often see a quicker embrace of automation, while emerging economies face a more stringent adaptation period. As a global citizen, it is imperative to understand the implications for international labor markets, as jobs that move toward automation in wealthier nations may stagnate or vanish in less affluent regions. The wealth and opportunity gaps exacerbate the existing inequalities, necessitating an urgent call for frameworks that can redistribute wealth and protect the marginalized (Chestnut, 1965; Doran et al., 2025; Eden & Gaggl, 2015; Fang et al., 2023; Gasteiger & Prettner, 2020).

2.3. Labor Market Disruption and Skill Gaps

An outcome of this automation wave is the significant disruption it brings to the labor market, leading to increasingly apparent skill gaps. As traditional roles fade, the demand for advanced skills in technology and digital literacy rises. There could be in a paradox where jobs requiring high-level skills face shortages, while many lower-skill positions are vanishing. The need for reskilling and lifelong learning becomes paramount in this ever-evolving landscape. To remain competitive and viable in this professional journey, one needs to actively seek opportunities to upskill and reskill, adapting to the changing needs of the job market (Codoceo-Contreras et al., 2024; Klarin & Xiao, 2023). Moreover, this disruption is not just a challenge; it opens a dialogue about training and education systems. Many current educational frameworks fall short in preparing individuals for the realities of an automated workforce. One should advocate for reform in education that focuses on critical thinking, problem-solving, and digital skills, allowing future generations to thrive. Additionally, social and governmental institutions must collaborate to create innovative solutions that bridge the skills gap, ensuring that the workforce is equipped to meet the challenges posed by automation (Adams et al., 1987). Further, there is an intergenerational aspect to these shifts; younger workers generally adapt more readily to technology, whereas older employees may struggle to transition to new digitized roles. This divide can lead to increased tension within the labor market. One needs to acknowledge the importance of fostering inclusive retraining programs that cater to diverse age groups and backgrounds. Only through comprehensive targeted efforts can societies begin to mitigate the impact of automation on employment (Adeyeri, 2024; Ardakani & Saenz, 2023; Taleghani & Sola, 2024).

Behind the scenes of automation lies the pressing need for effective mechanisms of income redistribution to counterbalance the socioeconomic disparities created by this technology-driven landscape. As automation increases productivity in select sectors, the wealth generated often concentrates among a limited group of stakeholders: those who have access to capital and technical expertise. To ensure equitable distribution, one should support the integration of policies that promote fairness and access to wealth (Challoumis, 2024d). Approaches such as EPR and EPI are designed to redistribute resources and empower communities adversely affected by automation (Badmus, 2023). These mechanisms operate alongside a broader framework that includes tax regulations targeting the wealth generated by technology. There could be a world where revenue from highly automated industries contributes to social programs designed to uplift those whose jobs have been displaced (Hai, 2016). Global attention is required to construct a supportive policy environment around these initiatives. The challenge is not merely financial but also moral; the implications of ignoring those left behind in the wake of technological advancement should be recognized. By advocating for mechanisms that prioritize equitable resource distribution, one contributes to a resilient global economy that values sustainability and social equity (Bourdin & Nadou, 2018; Fabrègue & Bogoni, 2023; Farah, 2011; Hai, 2016; Islam et al., 2020; Moreno-Jiménez et al., 2014).

2.4. Environmental Sustainability in Economocracy

For a world increasingly challenged by environmental degradation and climate change, the integration of sustainable practices within economic frameworks represents a profound shift in how, as a global citizen, it would be plausible to participate in and influence the future. Economocracy, as a reformed economic system, aims to create a delicate balance between economic growth and environmental stewardship. It recognizes that traditional capitalism often prioritizes profit over ecological health, adversely affecting the very foundation of life on Earth. In this new paradigm, the principles of fairness and sustainability are woven into the fabric of economic decision-making, thereby fostering an environment where both human prosperity and nature can coexist harmoniously (Cuenca-Soto et al., 2023; Saiful & Setyorini, 2022; Yadav, 2025). Stewardship of our planet demands innovative thinking and redefined values that reject the short-term gains characteristic of conventional economic models. Within the framework of Economocracy, the emphasis shifts toward long-term sustainability, where policymakers and business leaders alike are encouraged to prioritize ecological well-being alongside economic progress. By aligning financial incentives with environmental responsibility, it is plausible to cultivate a culture where sustainable practices are not merely an afterthought but are fundamentally integrated into the core strategies of both markets and governments. This holistic approach to economic management acknowledges that the health of the planet directly impacts economic viability, fostering a cycle of positive reinforcement (Symons & Karlsson, 2018; Challoumis, 2022a).

Moreover, in the engagement with these new economic constructs, the relationship between environmental stewardship and economic growth is not just one of sacrifice but rather one that presents opportunities for innovation and creativity. Economocracy promotes the development of green technologies and renewable energy solutions that can drive employment and economic dynamism. In sectors greatly affected by automation and other economic upheavals, the potential for job creation lies in investing in cleaner and more sustainable industries. Such investments not only have the power to mitigate the environmental crises can be faced today, but they also equip future generations to thrive in a world that values balance between human achievement and ecological preservation (Biondi, 2023; Dodel & Mesch, 2020; Leung et al., 2018). Under Economocracy, the everyday choices—whether that is supporting eco-friendly products or investing in green initiatives—become vital elements of a collective effort that challenges the status quo. It is plausible to have the power to shape a future where economic vitality and a healthy planet are not seen as opposing forces but as complementary aspects of a thriving society (Curtis, 2003; Pontius & McIntosh, 2019). Along with this journey toward sustainability, Economocracy introduces innovative approaches to green financing that challenge conventional funding mechanisms and promote environmental accountability. By redistributing financial resources through methods such as EPRs and EPIs, the system harnesses GDP-linked funds to support projects with a sustainable focus. These initiatives are geared toward funding renewable energy, sustainable agriculture, and environmentally friendly infrastructure, ensuring that many investments yield both financial returns and ecological benefits (Biswas et al., 2022; Diamantina & Yulida, 2023). Even more interesting is the way Economocracy paves new pathways for collaboration between governments, private sectors, and non-governmental organizations. By integrating environmental goals with economic strategies, it is plausible to benefit from the cumulative expertise and resources that diverse stakeholders bring to the table. The focus is on fostering an ecosystem of investment where businesses can flourish while simultaneously addressing critical environmental issues. Such innovative financing mechanisms create a robust framework that limits the reliance on traditional debt models, often fraught with high-interest obligations, which can stifle the ability to invest in sustainable initiatives (Ahmed et al., 2021; Cuenca-Soto et al., 2023; Symons & Karlsson, 2018; Challoumis, 2022b).

The essence of our collective survival in the face of climate change lies in global cooperation. Under Economocracy, the imperative for international collaboration is underscored as nations work together to tackle environmental challenges that transcend borders. A unified approach not only amplifies the efficacy of local initiatives but also harnesses the potential of shared knowledge and resources to address widespread ecological issues. In this interconnected global landscape, cooperative efforts pave the way for comprehensive environmental strategies that benefit all stakeholders (Ahmed et al., 2021; Biswas et al., 2022; Diamantina & Yulida, 2023). Due to the interconnected nature of today’s global economy, the consequences of environmental negligence in one area reverberate across the world. The principle of proportional distributions in Economocracy fosters an environment of accountability, where wealthier nations are encouraged to support those with fewer resources, creating a collaborative effort towards global environmental protection. This means that this role in advocating for such cooperation can help bridge the divide, ensuring that no country is left behind in the quest for sustainability. In engaging with these efforts, it is plausible to contribute to a collective undertaking that prioritizes not just survival but the flourishing of the entire planet (Curtis, 2003; Kopnina et al., 2021; Pontius & McIntosh, 2019; Symons & Karlsson, 2018).

2.5. Social Equity and Income Distribution

Despite the growing consensus on the detrimental effects of income inequality, traditional economic systems often struggle to provide constructive solutions. By exploring the landscape of global income disparities, it becomes evident that existing frameworks frequently exacerbate the divides, leaving countless individuals and communities in precarious positions. Economocracy offers a refreshing departure from these antiquated paradigms, advocating for a system that prioritizes fairness, accountability, and inclusive growth (Gödöllei & Beck, 2023; Howcroft & Taylor, 2022). By addressing income loss resulting from automation and reallocating resources efficiently, Economocracy presents a pathway toward creating a more equitable society. This approach not only benefits the marginalized but also enhances societal cohesion and economic resilience (Fabbri, 2010; McClellan, 2018; Ribaj & Mexhuani, 2021). Across the globe, automation and technological advancement are reshaping labor markets, leading to significant job displacement and a widening wealth gap. It is vital to recognize the implications of persistent income inequality on stability and sustainability. The traditional capitalist model has often prioritized profit over social equity, relegating many to the margins of economic opportunity. However, Economocracy shows a restructured system that actively combats inequality through mechanisms such as EPRs and EPIs. These strategies are designed to cushion the impacts of automation while fostering inclusive growth across sectors and society (Borry & Getha-Taylor, 2018; Camiña et al., 2020; Ghobakhloo et al., 2023; Kraske, 2008; Lowenberg-DeBoer et al., 2019). Implementing EPRs enables funds to be distributed on a global scale, proportionate to GDP, empowering regions that have suffered from job losses to stimulate new employment opportunities in emerging industries. This is not merely a redistribution of resources; it reflects an understanding of the interconnectedness of economies and the need for collaborative efforts to tackle widespread issues. By engaging in these practices, it is plausible to find that a more equitable approach to income distribution fosters social stability, reduces unrest, and encourages innovative problem-solving among diverse communities (Arabyan, 2016; Franko et al., 2013; Prati, 2023; Swanstrom et al., 2002). Furthermore, the Economic Periodic Injections ensure that ongoing capital infusions support vital social infrastructure improvements, such as education and healthcare, which are critical for adapting to technological changes. This approach reinforces the idea that social equity and economic growth are not mutually exclusive; rather, they coalesce to create robust and resilient societies. By implementing these mechanisms, Economocracy provides a framework where individuals can reclaim their agency, contributing to an economic future that honors both their potential and aspirations (Cuenca-Soto et al., 2023; Lupinacci et al., 2023; Ober & Manville, 2024).

Besides addressing income disparities, Economocracy emphasizes the importance of implementing proportional resource allocation mechanisms. This framework promotes equitable distribution of resources, ensuring that financial support is directed to those who need it most, irrespective of geographic location or economic standing. By utilizing GDP-linked funding approaches, Economocracy advocates for a conscious rebalancing of economic power and resources, creating a more inclusive financial ecosystem that aligns with the principles of fairness and social justice. It is vital to understand that proportional resource allocation moves beyond mere economic redistributions. These mechanisms encourage continuous investment in regions previously left behind, fostering a more sustainable and diverse economy. By allowing for equitable access to financial resources, Economocracy aims to uplift communities, channeling collective efforts toward innovations that benefit everyone. This conscious effort to distribute resources equitably equips societies with the tools to break free from cycles of poverty and despair. By researching the concept of proportional resource allocation more deeply, it is plausible to begin to see how it cultivates an environment of reciprocity and communal responsibility. Instead of creating dependency, these measures empower individuals and communities to engage actively in their economic destiny, facilitating a more organic and sustained growth trajectory. By fostering collaboration among local and national stakeholders, Economocracy aspires to enhance societal well-being, reinforcing the interconnectedness of individual success and community welfare (Cuenca-Soto et al., 2023; Challoumis, 2022a). Equitable growth hinges on the effective integration of education as a fundamental pillar. By navigating the complexities of socioeconomic challenges, it becomes clear that education serves as both a catalyst for change and a means of empowerment. Economocracy emphasizes the need to invest heavily in educational systems that adapt to the needs of a rapidly changing workforce and prioritize access for all. By providing quality education and skill-development opportunities, it is plausible to enable individuals to thrive in an increasingly automated world, where adaptability becomes key to survival and success (Cuenca-Soto et al., 2023; Lupinacci et al., 2023; Ober & Manville, 2024). The transformative power of education extends beyond the individual; it fosters community resilience and enhances overall economic productivity. The multifaceted relationship between education and social equity unveils a landscape of potential where empowered individuals contribute meaningfully to society. Investing in educational reforms and lifelong learning initiatives not only helps address income inequality but inspires a forward-thinking mindset that places value on diverse skills and experiences. Global perspectives show that nations that prioritize equitable access to education tend to experience more sustainable economic growth and social harmony. This commitment to inclusive education aligns seamlessly with Economocracy’s vision of creating systems that recognize and celebrate human capital’s potential. By valuing education as a fundamental driver of progress, it is plausible to play an active role in shaping a future where opportunities are accessible to all, driving a collective agenda for prosperity and shared success (Crick, 2007; Cuenca-Soto et al., 2023; Parker, 1997).

2.6. The Cycle of Money: A Theoretical Framework

Not all financial systems are created equal, especially when it comes to understanding the intricacies of their operational mechanics. One of the more profound insights offered by the theory of the Cycle of Money is the dichotomy between enforcement and escape savings. This differentiation is paramount for grasping how money flows within economies and affects their productivity. Enforcement savings are those that remain within local banking systems, playing a vital role in fueling investments and economic activities. Conversely, escape savings are money that is diverted from these local networks, leading to diminished economic circulation and weakened growth (Amaral & Quintin, 2010; Sacher, 2021). On a deeper level, understanding enforcement savings leads to conceptualizing how a community can maximize its economic potential. When enforcement savings dominate, significant capital is retained for investments in manufacturing or innovation, ultimately fostering industrial vitality without overshadowing smaller enterprises that may struggle to compete in increasingly capital-intensive sectors. This dynamic is not merely an abstract concept; it can directly influence employment opportunities locally. When savings are channeled effectively, they accelerate economic activity and establishe a self-organizing structure where each economic agent can contribute to a thriving ecosystem. Local businesses emerge under advantageous conditions created by these savings, demonstrating the practical impact of this theoretical distinction (Gallemore & Jacob, 2020; Lambert, 2019). Additionally, this theory provides a framework for evaluating the risks associated with escape savings. As this type of saving siphons off liquidity from a local economy, it directly contributes to a cycle of scarcity that stifles growth and innovation. With less money available for reinvestment and local spending, economic activities slow down, leading to a cascade of financial problems. Small businesses, which are often the backbone of a community, may find it increasingly challenging to obtain the resources needed to thrive. By being aware of these dynamics, the role of local banks and financial institutions should be appreciated in cultivating a sound economic environment that promotes sustainable growth and community resilience (Chiteji, 2002; Delis et al., 2017). On examining the implications of enforcement and escape savings for economic stability and growth, it is plausible to uncover a nuanced relationship between the two. When a community effectively enhances enforcement savings, it fosters an environment ripe for growth by ensuring that money is recirculated within the local economy. This promotes higher employment rates, innovation, and the overall well-being of society. In contrast, when escape savings disproportionately prevail, the economy may face stagnation. This stagnant condition leads to increased public debts, which rise in tandem with reliance on borrowed funds. The equilibrium between these types of savings thus not only shapes short-term economic conditions but also has substantial long-term implications. On a broader scale, the Cycle of Money framework encourages citizens to advocate for policies that optimize these savings types for collective benefit. A society that relies heavily on enforcement savings is likely to exhibit greater financial resilience in the face of global economic shifts and crises. If a local economy can retain and reinvest its financial resources effectively, it is plausible to contribute to a self-sustaining cycle that elevates standards of living and cultivates social equity. Understanding this connection enables asking pertinent questions about fiscal and monetary policies that might impact any community’s prosperity in a tangible way (Chiteji, 2002; Slemrod, 2019; Wanzala & Obokoh, 2024; Zhang et al., 2024). Indeed, the insights derived from the Cycle of Money imply that people must consider how the architecture of local financial systems might either support or hinder economic stability. A balanced approach to addressing escape savings can reveal pathways toward minimizing their detrimental effects while enhancing the vibrancy of enforcement savings. Such awareness may inspire most people to invest in issues such as interest rate policies and government spending strategies, cognizant of their far-reaching implications for both local and global economic health (Adamiak, 2006). Stability in economic systems is often viewed through the lens of effective regulatory policies, which ought to aim at optimizing both enforcement and escape savings within the Cycle of Money framework. By establishing low taxes on productive activities and strategically investing in vital sectors like healthcare and education, these regulations can directly influence how money flows within the economy. When fiscal policies favor sustainable investment, it is plausible to help the creation of a robust economic cycle where success breeds further success, ultimately allowing a community to thrive in less uncertain environments (Ribaj & Mexhuani, 2021; Slemrod, 2019).

Moreover, addressing the balance between these two savings types provides additional avenues for policy intervention. For instance, targeted subsidies for local businesses can encourage the retention of funds within local systems while disincentivizing practices that might lead to escaped savings. The participation in discussions around these policies advocates for measures that favor local economic interests and contribute to a resilient financial landscape. Recognizing that it is plausible to have both power and agency within these financial limitations creates a pathway toward improved living conditions and equitable resource allocation (Fabbri, 2010; McClellan, 2018). Due to the interconnected nature of global economies, it becomes increasingly important for anyone to remain informed about how regulatory activities influence broader financial systems. The cycle of enforcement and escape savings mandates a rethinking of traditional economic frameworks, compelling as a proactive citizen to push for reforms that are in line with the principles of Economocracy. Ultimately, by recognizing a role in these dynamics, it is plausible to contribute to a more equitable and sustainable future for all (Lousley, 2020; Macklin, 2022; Yadav, 2025).

2.7. Implementing Economocracy: Framework and Governance

After recognizing the myriad ways in which current systems have failed to address pressing global issues, one may begin to see the potential within Economocracy. The effective implementation of Economocracy hinges on establishing a centralized global economic authority—an entity that coordinates the distribution of resources and oversees adherence to equitable economic principles. This authority serves as the linchpin for enacting policies that can significantly reduce the income disparities fueled by automation and environmental degradation. By synthesizing the fiscal needs of various nations with their productive capacities, such an authority can ensure that economic resources are allocated where they are most needed, thus fostering global stability (Biondi, 2023; Dodel & Mesch, 2020; Ghobakhloo et al., 2023; Leung et al., 2018). More than just an administrative body, this centralized authority represents a paradigm shift in governance where economic decision-making aligns with democratic values (Asher et al., 2022; Council of Europe, 2022; Greenleaf, 2014; Rodriguez, 2011; Svärd, 2019; Swanstrom et al., 2002). The model shows a global board composed of representatives from each participating nation, tasked with the responsibility of managing EPRs and EPIs. Such a governance structure not only amplifies accountability but also ensures that voices from various socioeconomic backgrounds are included. It strives for a fine balance between regulatory oversight and the encouragement of local entrepreneurship, ensuring that emerging sectors are bolstered without undermining smaller businesses. The establishment of a centralized global economic authority requires the active engagement of nations across sectors, as well as commitment to worldwide cooperation. By integrating financial mechanisms with democratic processes, this entity addresses the dual challenge of technological disruption and environmental challenges (Marcet & Marimon, 1992; Sacher, 2021; Wanzala & Obokoh, 2024). Aside from the establishment of a centralized authority, effective coordination of fiscal and monetary policies is necessary for the successful implementation of Economocracy (Challoumis, 2022a, 2024a, 2024d, 2024e, 2024f). One needs to show a harmonized approach that transcends borders, where countries can collaboratively align their budgetary and monetary strategies to foster shared economic growth. This synchronization minimizes the risks associated with erratic financial practices, providing a more stable foundation for addressing issues such as public debt and income inequality. By streamlining these policies, Economocracy ensures that economic resources are allocated more efficiently, thereby enhancing overall productivity (Braudel, 1982; Braudel et al., 1981; Haskel & Westlake, 2021; Lenin, 1916; Szabó, 2022).

The need for coordinated fiscal and monetary policies cannot be overstated; without them, the global economy risks falling prey to the pitfalls of disjointed approaches that often hinder progress. The dynamics of how production surpluses in one nation can create deficits in another potentially destabilizes the global economic structure. By working within a framework of unified policies, nations can mitigate these imbalances, fostering a system that benefits all participants rather than just the few. Economocracy’s innovative principles advocate for a redistribution of wealth that acknowledges current disparities while encouraging sustainable growth (McClellan, 2018; Ribaj & Mexhuani, 2021). To further enhance the coordination of fiscal and monetary policies, it is necessary that technological tools and data analytics are leveraged. These resources enable real-time assessments of economic conditions globally, allowing for swift adjustments as needed. This approach not only promotes responsiveness but also leads to more informed decision-making processes, wherein countries can collectively address shared challenges, such as environmental sustainability and workforce adaptation in the face of automation (Camiña et al., 2020; Kraske, 2008; Lowenberg-DeBoer et al., 2019).

2.8. Ensuring Democratic Representation in Economic Decision-Making

Decision-making becomes an integral aspect of Economocracy, as it prioritizes democratic representation in all economic decision-making processes. It is necessary for policies to reflect the will of the people while navigating complex economic landscapes. In a system that integrates democratic values, representatives from a diverse range of backgrounds, including marginalized communities, play a vital role in shaping economic governance. This system seeks not only to listen but also to act upon the concerns of the populace, ensuring equitable policies that address the realities faced by individuals in various socioeconomic segments (McIsaac & Riley, 2020; Nguyen et al., 2020; H. Wu & Xu, 2021). The democratic representation in economic decision-making fosters transparency and accountability. It might be found that this inclusion leads to more effective governance, as diverse perspectives contribute to a richer understanding of economic challenges. With such a multitude of experiences at the table, policies can be tailored to suit the needs of different populations, ensuring that no group is left behind. The governance of Economocracy, thus, becomes a collaborative endeavor, where every voice matters in shaping the future of both local and global economies (Baviskar & Malone, 2004; Bhagwati, 2008; Fadele et al., 2023; Holston, 2022; Parker, 1997; Plattner, 2015; Zagrebina, 2020). Ensuring that all groups have access to economic decision-making processes is fundamental to the ethos of Economocracy. Such representation encourages an ongoing dialogue where decisions are made collectively, thus reinforcing societal trust in economic governance and promoting the stability necessary for sustainable growth (Chu et al., 2024; Daniels, 2021). The landscape of employment in the U.S. and China is undergoing radical transformations due to automation. In the U.S., the widespread adoption of AI and robotics in industries like manufacturing and service sectors is reshaping job availability, as machines increasingly take over tasks traditionally performed by humans. This shift is not merely a matter of replacing workers but rather involves a fundamental change in the economic fabric. This transition could leave millions facing job displacement as sectors struggle to adapt. Economocracy provides a solution through mechanisms such as EPRs, which would allocate funds proportionate to GDP to facilitate retraining and job creation in sectors heavily impacted by automation. China is similarly navigating the complexities of automation, with the government actively promoting AI advancements as part of its economic strategy. Forecasts predict that up to 60 million jobs could be displaced in the next decade due to automation in various industries. However, China is also seizing the opportunity to innovate and reskill its workforce, establishing robust retraining programs backed by substantial state investments. By employing the principles of Economocracy, the Chinese government could implement EPIs, ensuring that funds flow into educational initiatives that prepare future workers for emerging technological landscapes. The goal is not only to address immediate job losses but also to set the stage for sustainable economic recovery. Through these targeted actions, the U.S. and China can create a more resilient workforce capable of adapting to rapid technological change. By prioritizing human capital, Economocracy aligns economic growth with social well-being (Biondi, 2023; Borry & Getha-Taylor, 2018; Camiña et al., 2020; Dodel & Mesch, 2020; Ghobakhloo et al., 2023; Howcroft & Taylor, 2022; Kraske, 2008; Leung et al., 2018; Lowenberg-DeBoer et al., 2019). The integration of democratic values into this economic restructuring offers a path to mitigate the adverse effects of automation, promoting greater equity and inclusivity in the labor market (Challoumis, 2024g).

Automation is reshaping the economies of developed nations, but Europe stands at the forefront of sustainability initiatives. The European Union’s commitment to invest over EUR 1 trillion in green initiatives by 2030 serves as a powerful case study demonstrating how Economocracy can foster environmental sustainability (European Commission, 2020). By re-allocating resources toward renewable energy projects, enhancing public transportation systems, and implementing green technologies, European nations are striving to meet their ambitious climate goals. This proactive approach not only addresses the pressing issue of climate change but also sets the stage for sustainable economic growth. The ongoing struggle to combat climate change in Europe highlights the need for a more equitable approach to resource distribution. It could be found that the investments channeled into sustainability not only aim to reduce greenhouse gas emissions but also serve as catalysts for job creation across the continent. Renewable energy sectors, such as wind and solar power, are projected to generate millions of jobs by 2030, providing ample opportunities for displaced workers as traditional energy sectors decline. By implementing the principles of Economocracy, European nations can ensure that funds allocated to green initiatives are distributed fairly, promoting social equity while addressing environmental challenges. Moreover, it is imperative to acknowledge that Denmark, as a leading example, has demonstrated significant strides toward achieving carbon neutrality by 2050. The nation has embraced a holistic model that incorporates both government-led initiatives and public engagement, emphasizing the importance of collective action in driving sustainability. As people explore these initiatives, the European experience in integrating democratic principles with economic policies provides a roadmap for sustainable development that emphasizes equity and cooperation. Economocracy can support green initiatives without relying on traditional investment methods, as it utilizes positive productive money (Ahmed et al., 2021; Biswas et al., 2022; Curtis, 2003; Diamantina & Yulida, 2023; Pontius & McIntosh, 2019; Symons & Karlsson, 2018; Challoumis, 2022a). China’s ascent as an economic powerhouse offers valuable insights into the principles of Economocracy, particularly in the context of emerging markets. The nation has made substantial investments in infrastructure, education, and technology, laying the foundation for long-term economic resilience. By embracing the tenets of Economocracy, China has sought to address systemic inequities both regionally and globally. The implementation of EPRs could be a game-changer, channeling resources where they are needed most and ensuring that growth is inclusive and sustainable. Many emerging economies face similar challenges, with rising public debts and limited resources constraining their ability to invest in critical sectors. By adopting the principles of Economocracy, countries such as India and Brazil can work towards relieving these financial burdens while fostering sustainable growth. For instance, targeted investments in healthcare and education not only address immediate needs but also position these nations for future success. EPI mechanisms could infuse regular capital into imperative infrastructure, strengthening the overall economic framework and enhancing resilience against global shocks (D’Orazio et al., 2024; Da Silva et al., 2025; De Souza et al., 2017; Flórez-Jiménez et al., 2024; Khater & Faik, 2024; Korhonen & Seager, 2008; Rosário & Boechat, 2025; Sarma & Sharma, 2024; Shen et al., 2024; Suriyankietkaew et al., 2022; Waqar et al., 2024; Wei et al., 2024; Yin & Zhao, 2024; Zavala-Alcívar et al., 2020; Zeng et al., 2022). But it is imperative to recognize that economic resilience in emerging markets relies heavily on their ability to harmonize with global economic conditions. Addressing wealth disparities through equitable resource allocation can aid these nations in developing the necessary infrastructure to enhance productivity. By creating an interconnected system that emphasizes collaboration and support, the principles of Economocracy can serve as a beacon of hope, inspiring emerging markets to thrive in the global economy while ensuring that their citizens benefit from progress (Jackson et al., 2014; Lule et al., 2020).

3. Materials and Methods

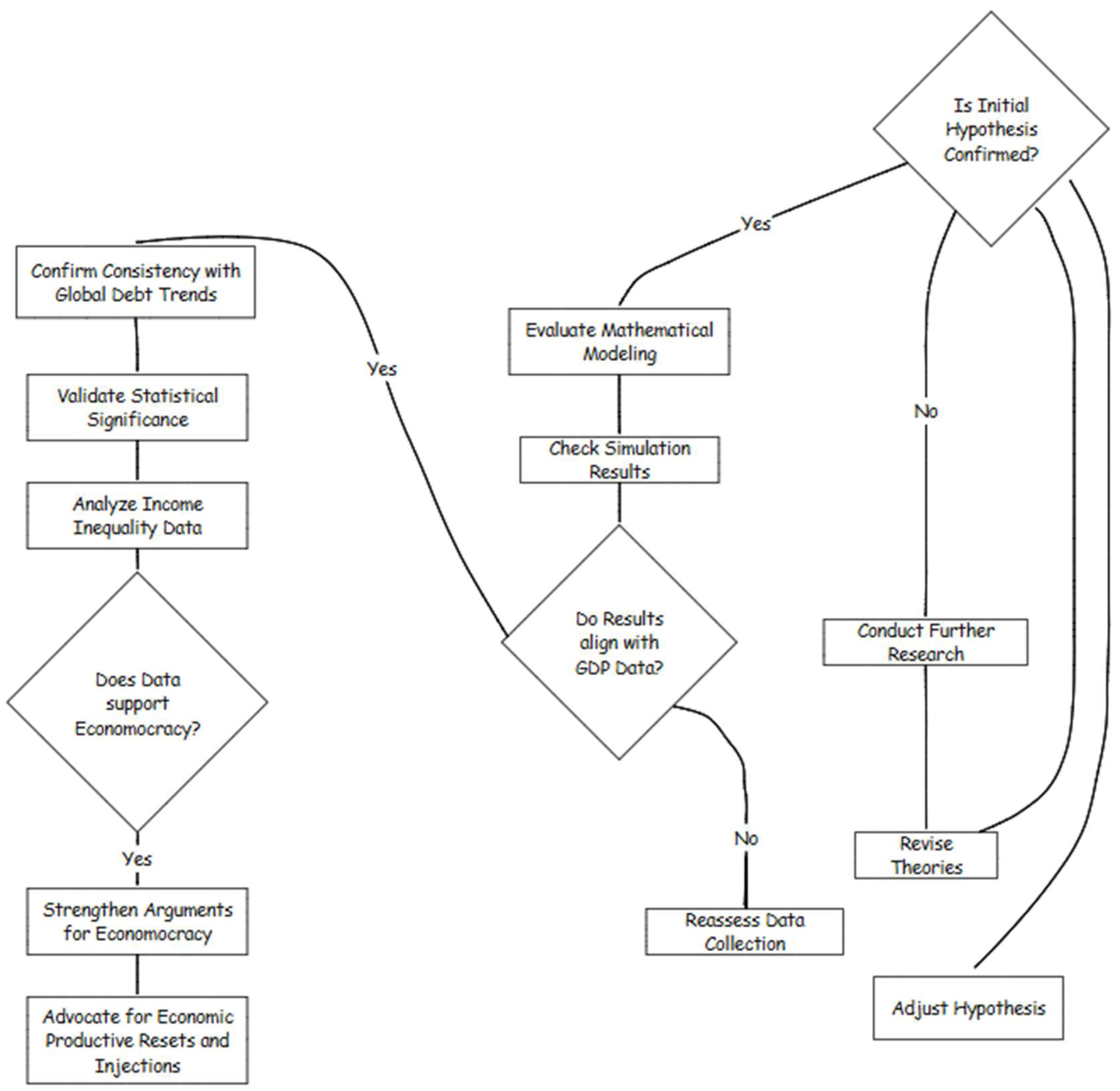

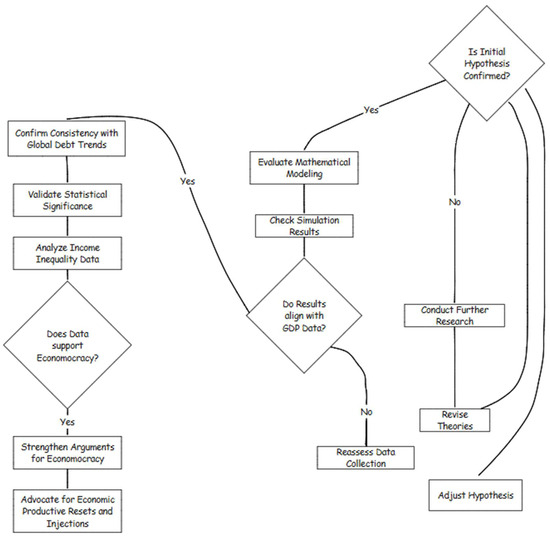

The methodology has three steps: the first step is based on simulation and the second one on real data. The applied method is based on the Q.E. method, and the application in the current paper is based on Python language. This is a method of transforming quality data into quantitative data analysis, based on theoretical and mathematical aspects (Challoumis, 2024i). After analyzing the pros and cons of capitalism and socialism, it is plausible to find that Economocracy emerges as a promising hybrid model. The Q.E. method is based on quantitative analysis of quality data, so if the initial hypothesis is not confirmed, then the model is automatically remodified until the adequate model that complies with the mathematical and theoretical aspects is determined (Challoumis, 2024g). What sets Economocracy apart is its commitment to integrating democratic values within economic governance. While it seeks to achieve social equity and resource distribution akin to socialism, it simultaneously embraces the innovation and efficiency associated with capitalist systems. This unique blend aims to create an environment where both individual and collective interests harmoniously coexist.

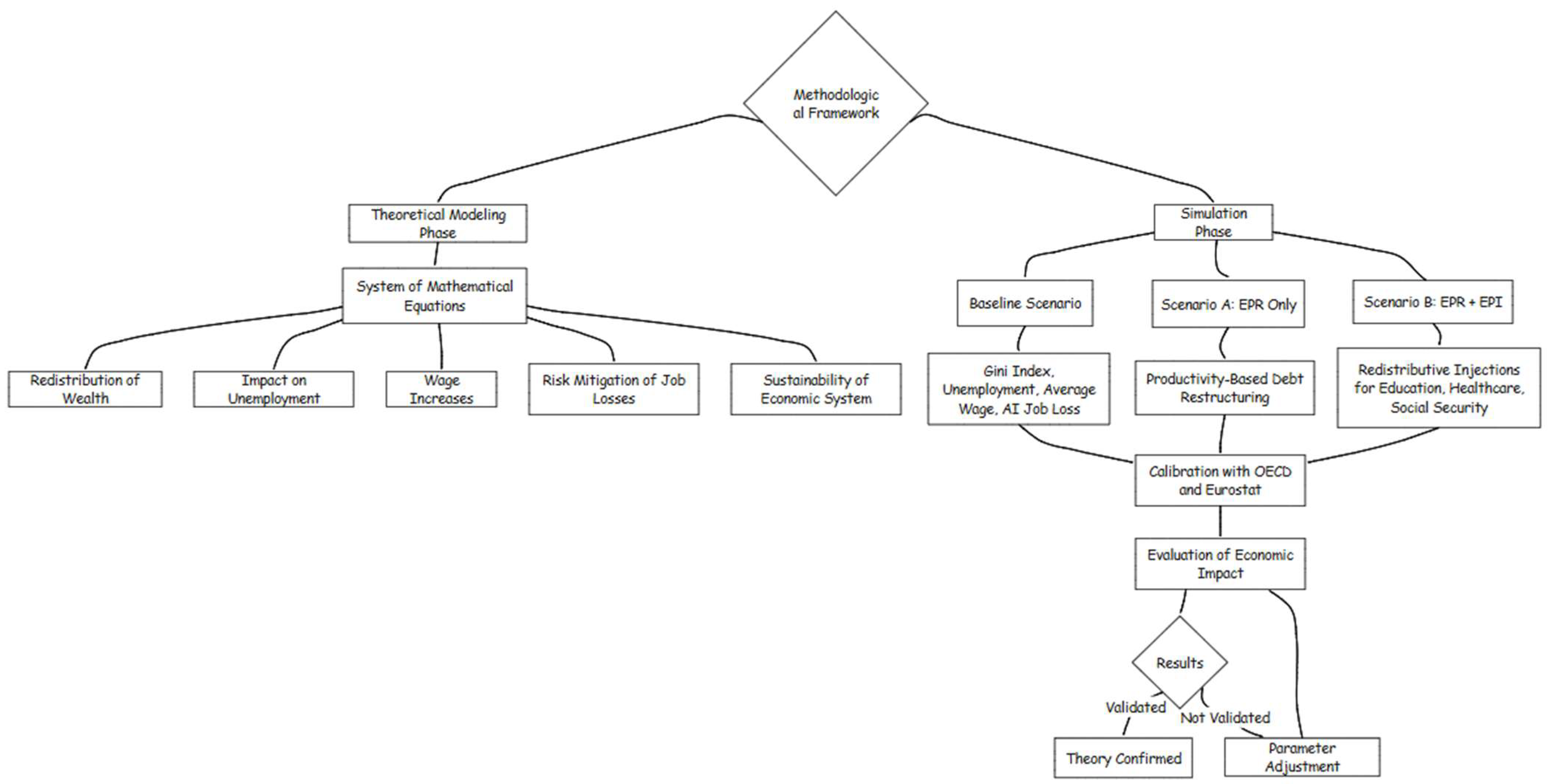

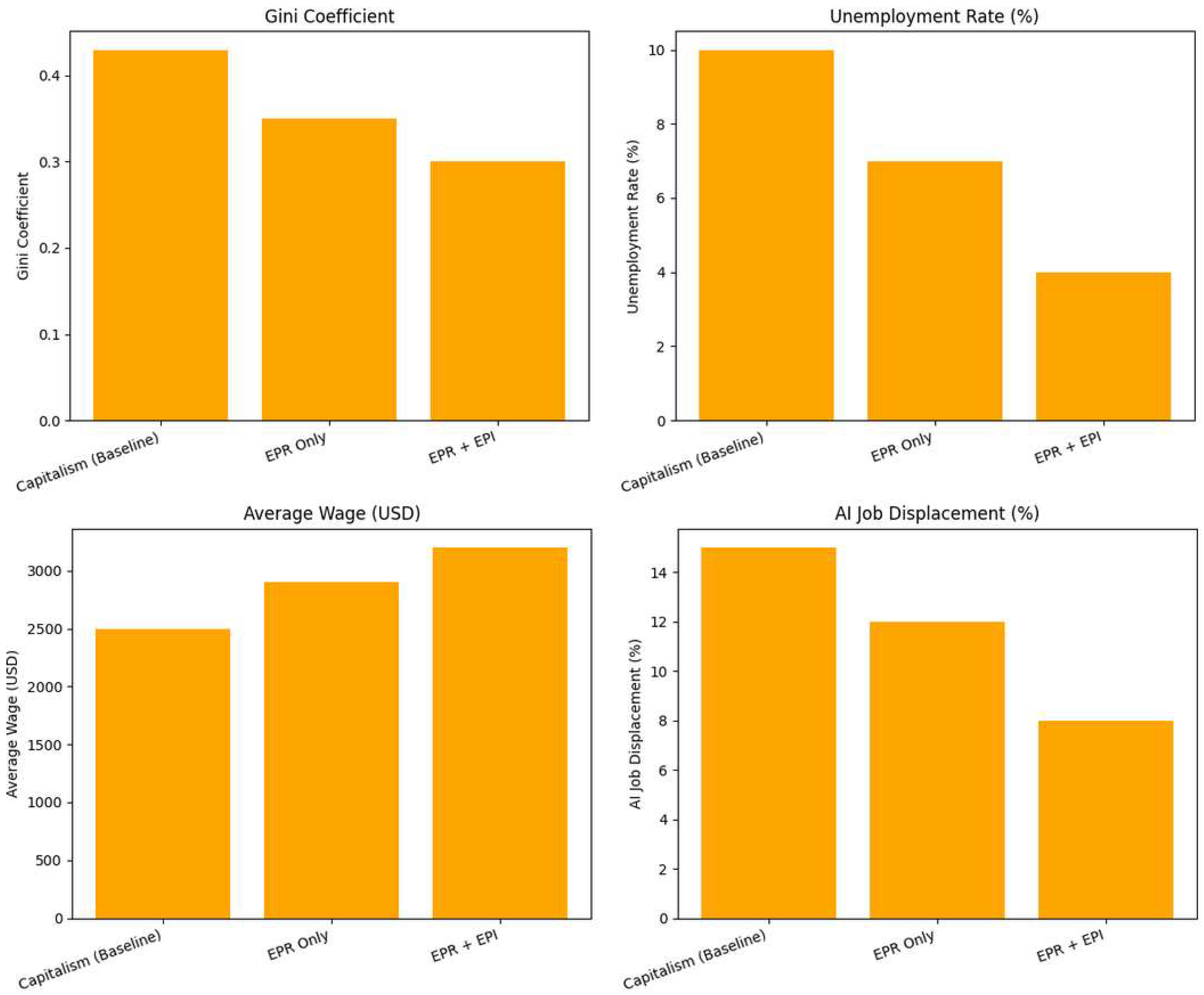

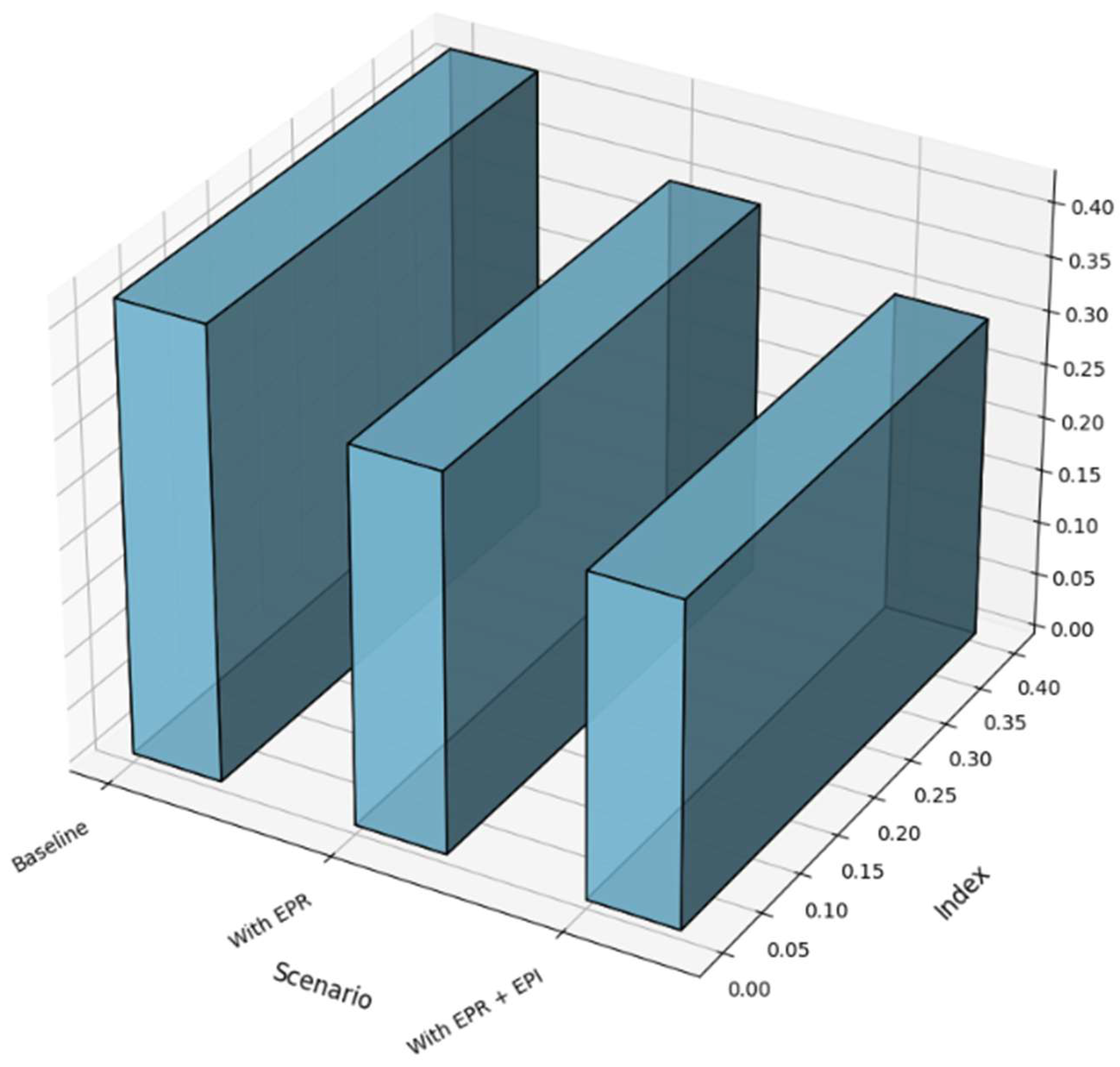

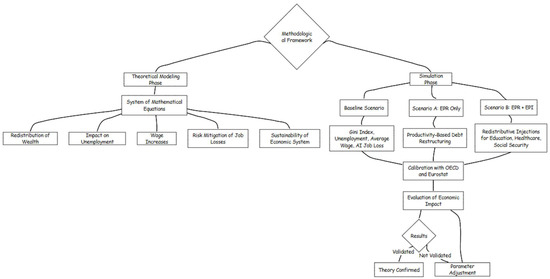

This study employs a two-phase methodological framework grounded in the Quantification of Everything (Q.E.) method (see Table 1). The approach combines theoretical mathematical modeling and simulation-based evaluation of key macroeconomic indicators under a proposed system of Economocracy. The methodology is designed to assess how the mechanisms of Economocracy, particularly EPRs and EPIs, impact income inequality, unemployment, wage levels, and automation-induced job loss.

Table 1.

Methodological procedure (Author’s table).

The theoretical modeling phase develops a system of mathematical equations that describe the internal logic and dynamics of Economocracy. These include equations for the redistribution of income and the Gini coefficient, the reduction in unemployment through periodic resets, increases in average wages via redistributed productivity gains, and reductions in AI-driven job displacement through public investment injections. These equations are derived from the theory of the Cycle of Money and are structured to address the systemic limitations of capitalism, particularly those arising from interest-based debt accumulation and imbalances in international monetary circulation.

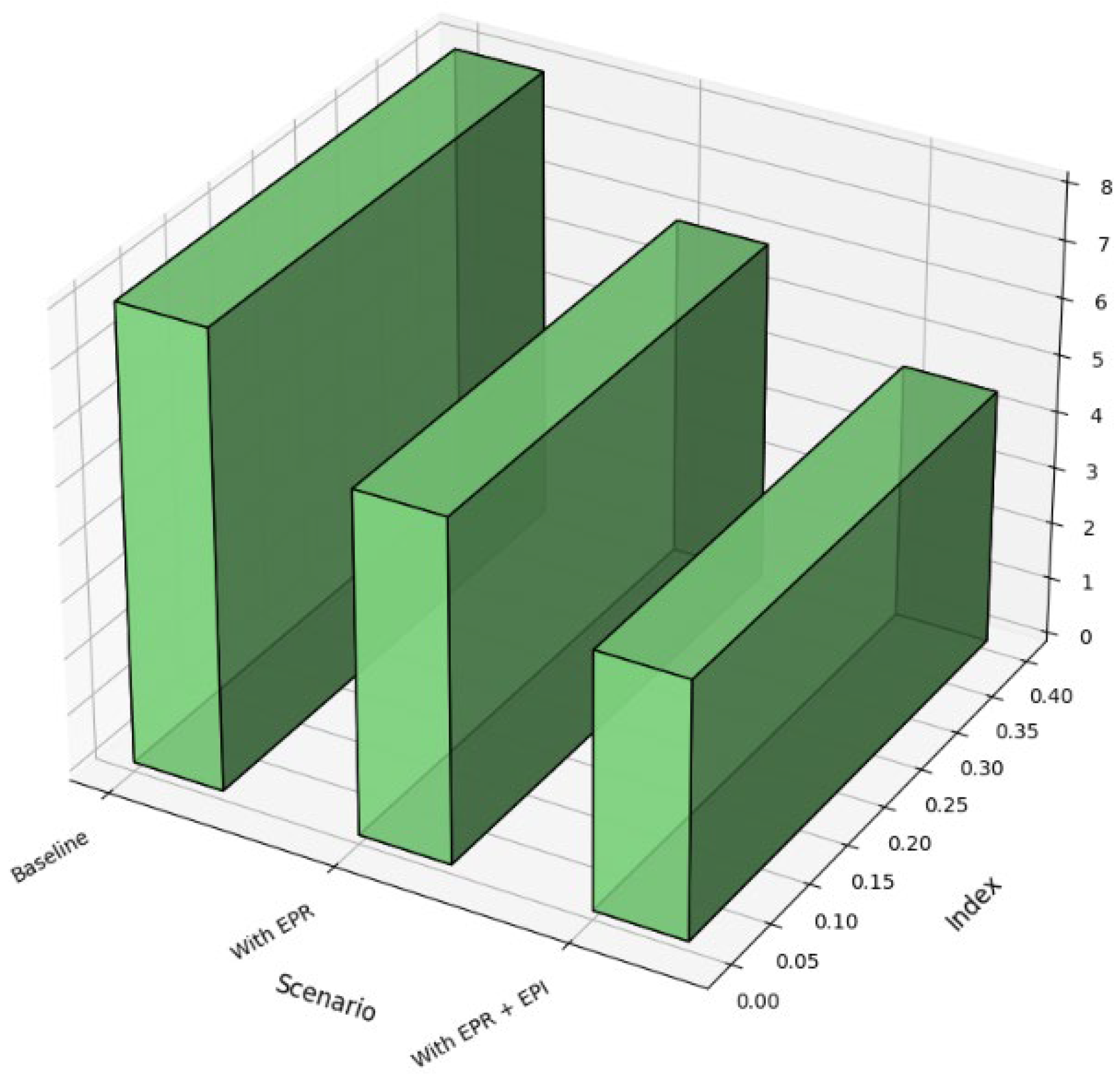

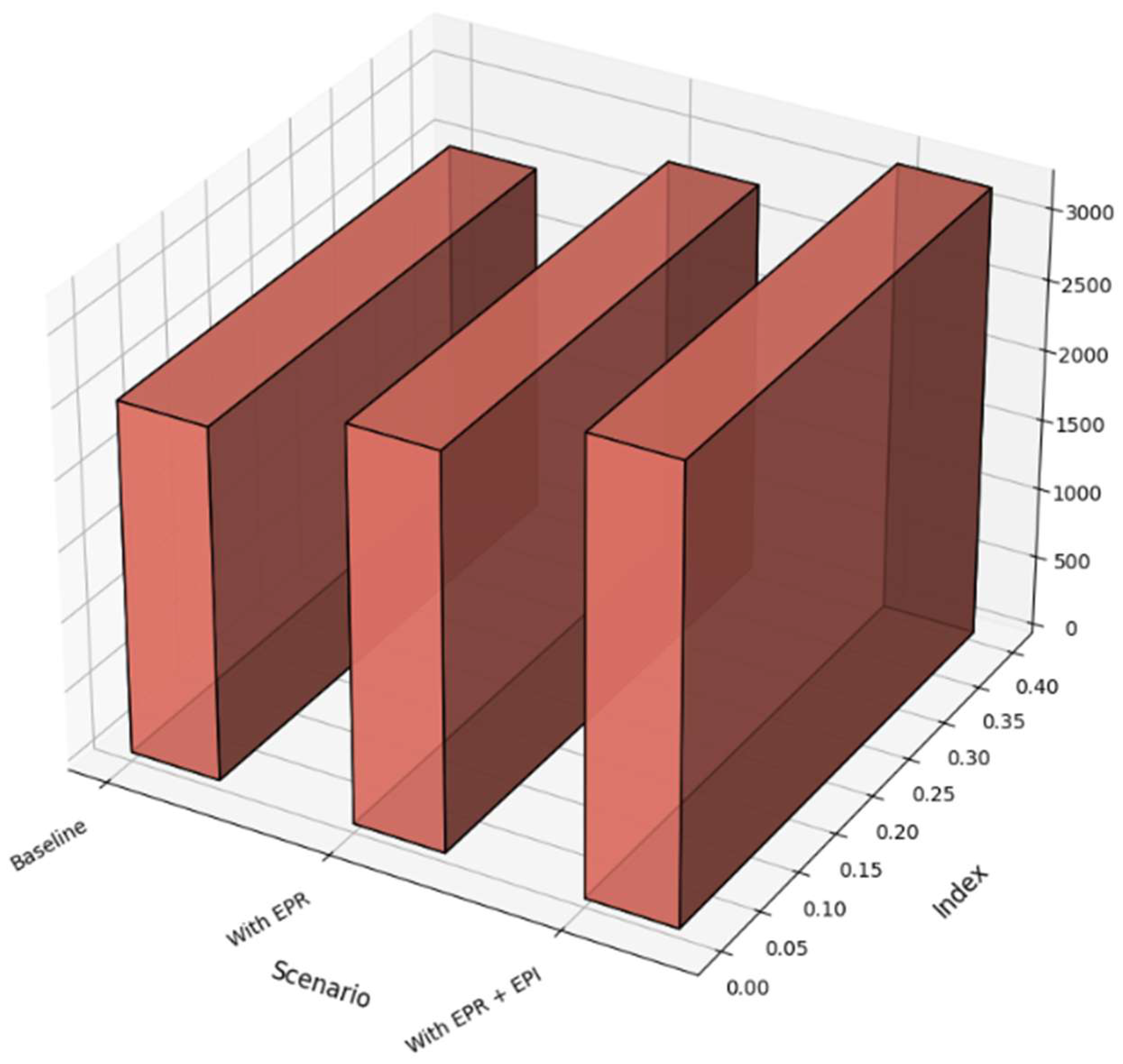

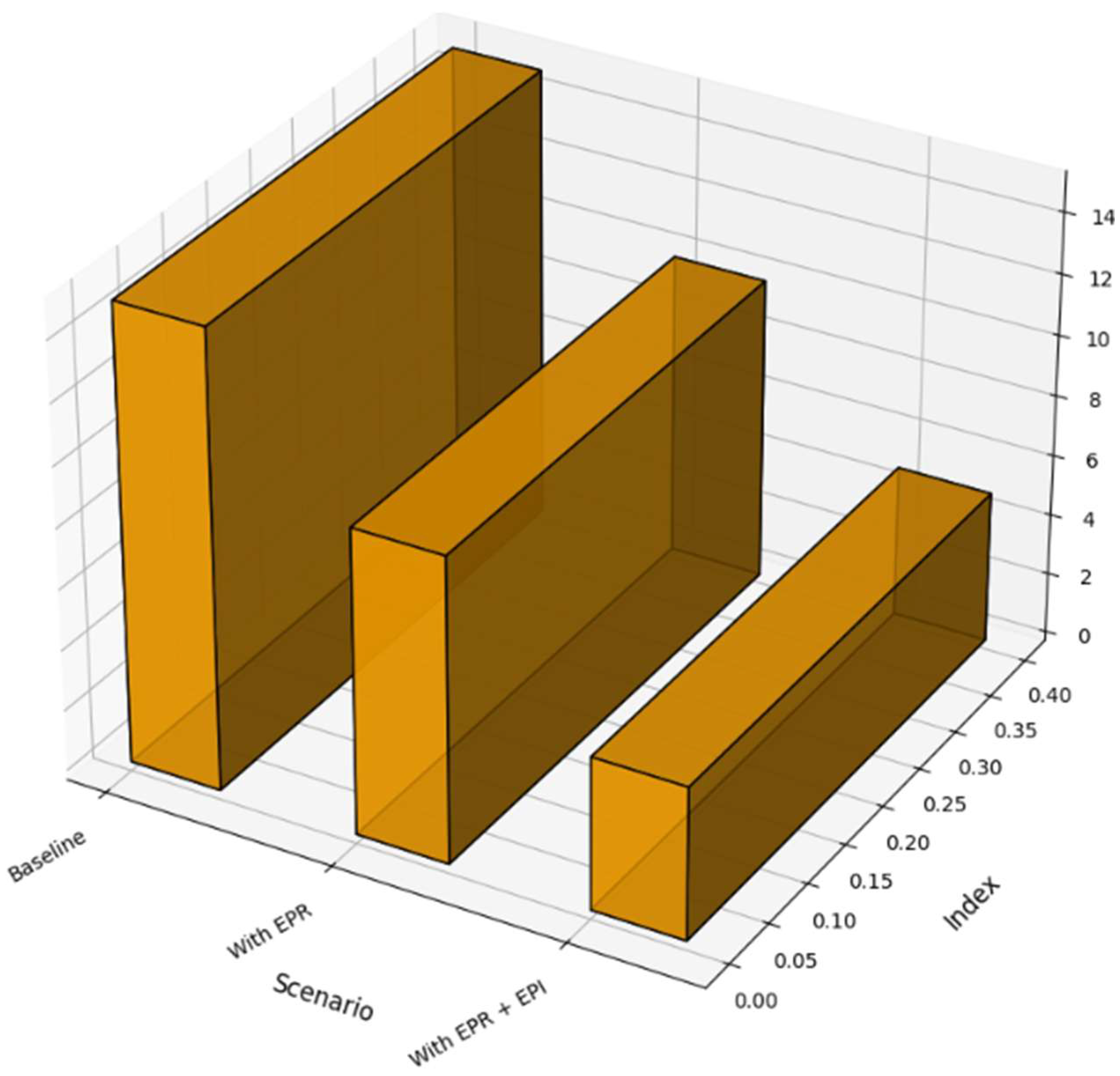

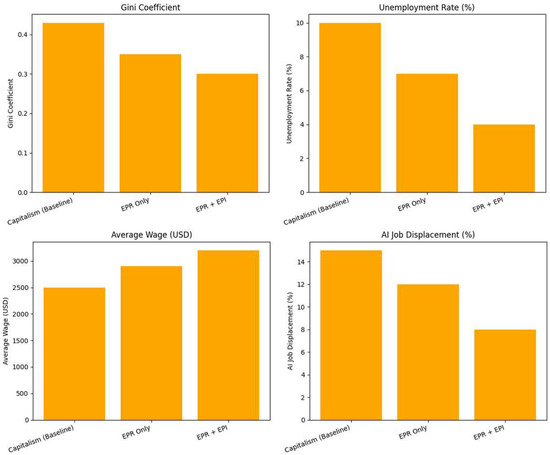

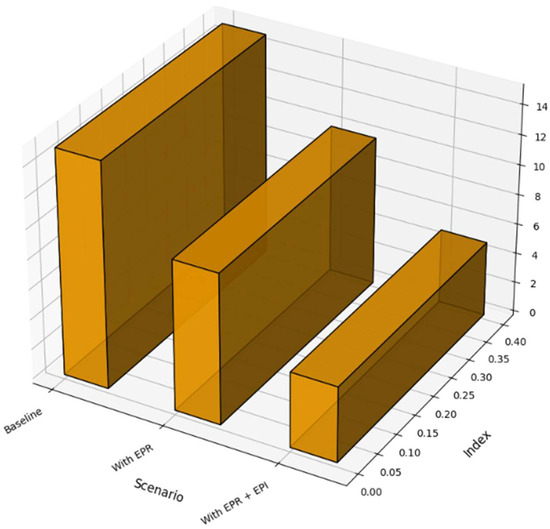

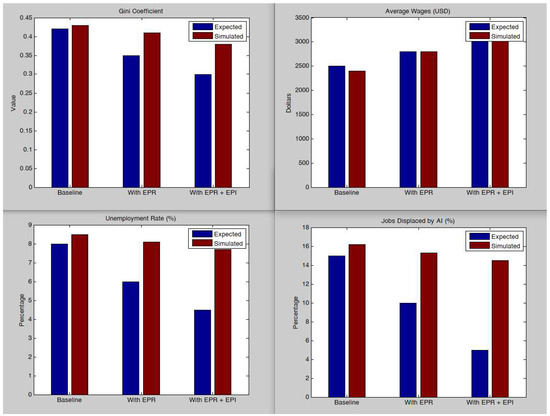

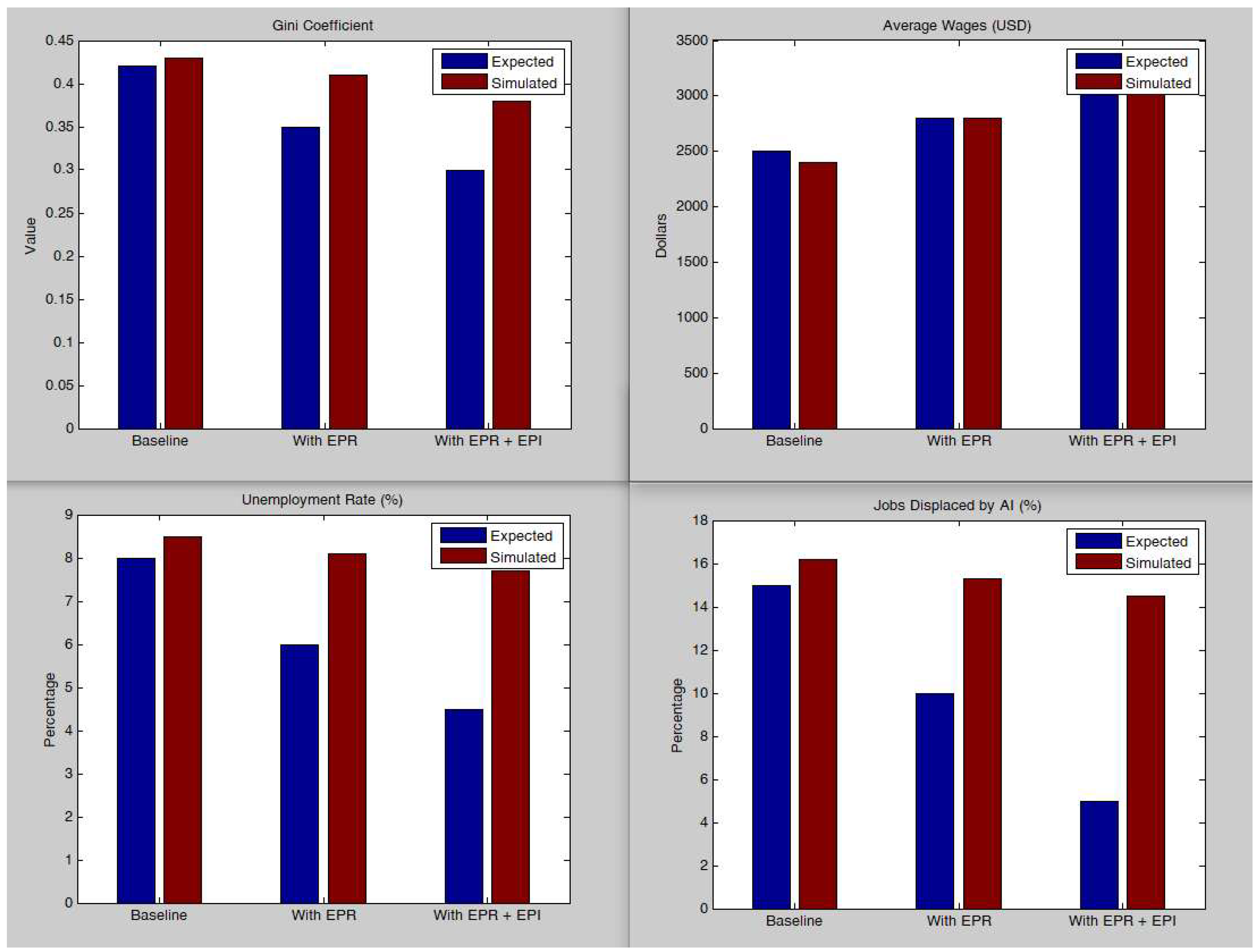

The simulation phase tests three macroeconomic scenarios. The first is a baseline representing the current capitalist system, with input parameters reflecting average values: a Gini index, unemployment, average wages, and AI-induced job loss. The second scenario introduces EPR mechanisms alone, and the third combines EPR with EPI tools, targeting investments in education, healthcare, and social protection. These simulations are calibrated using empirical data from OECD and Eurostat databases, ensuring plausibility in parameter settings and results.

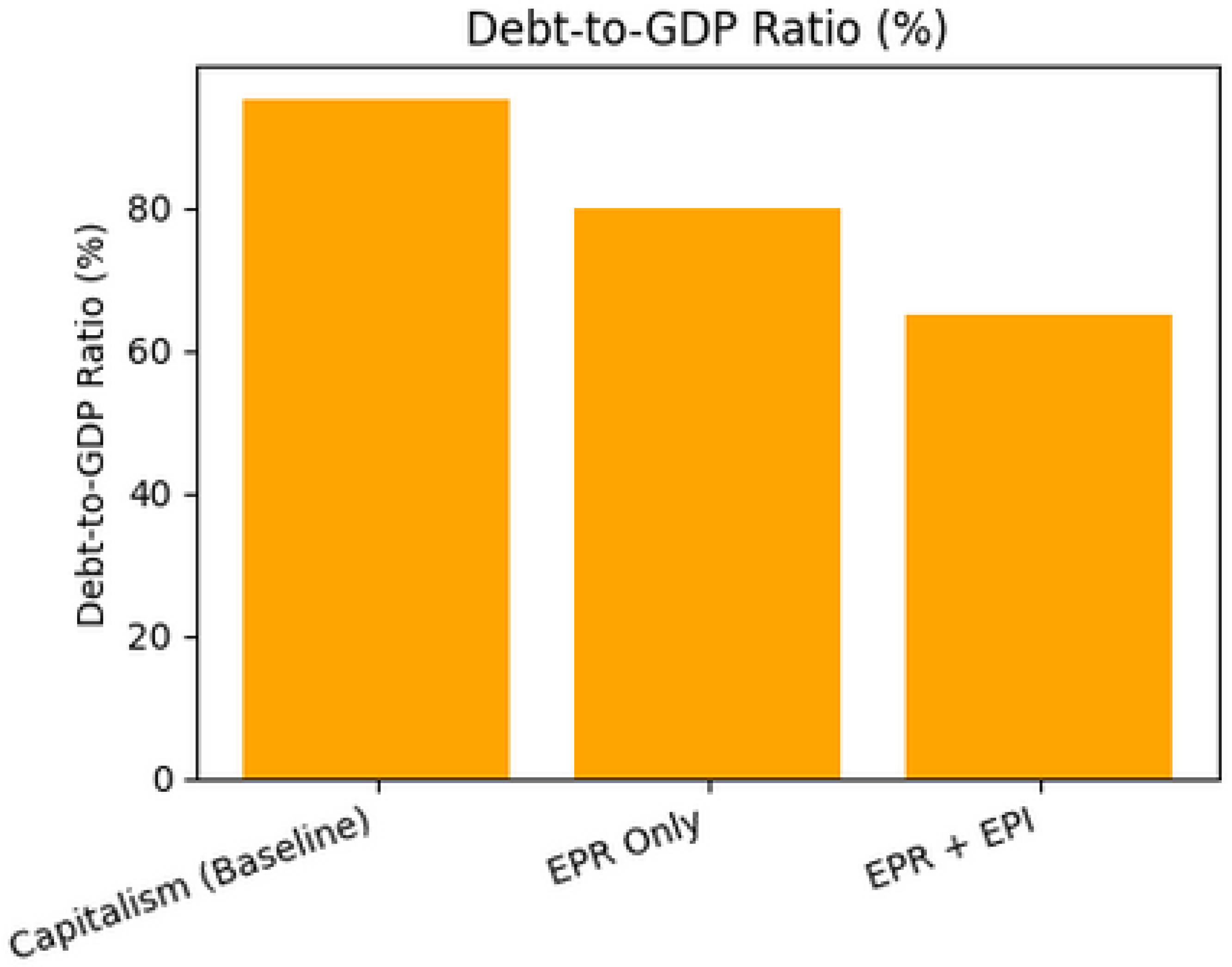

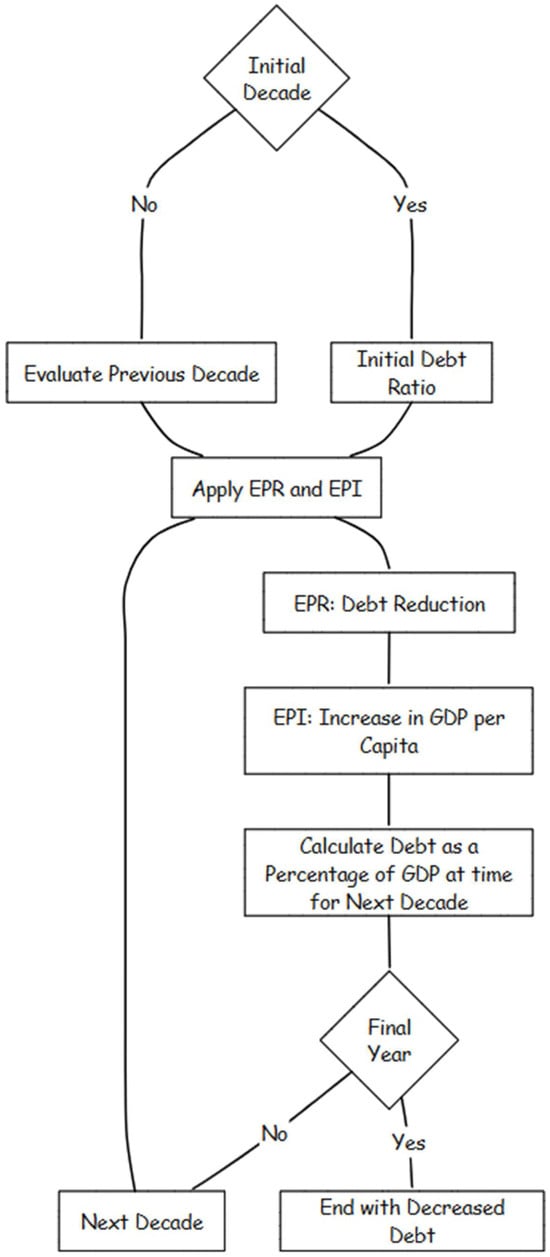

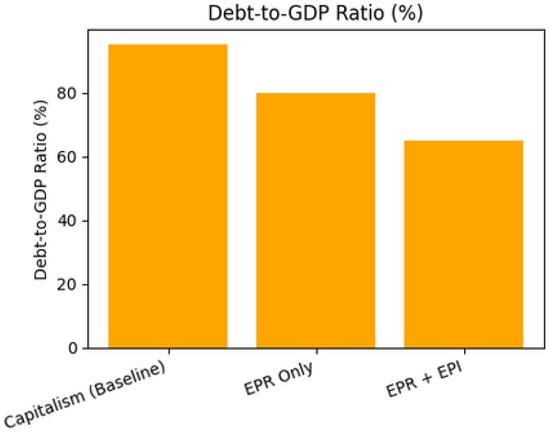

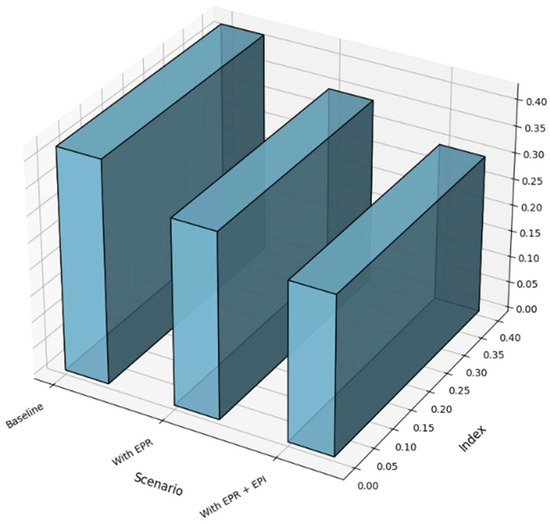

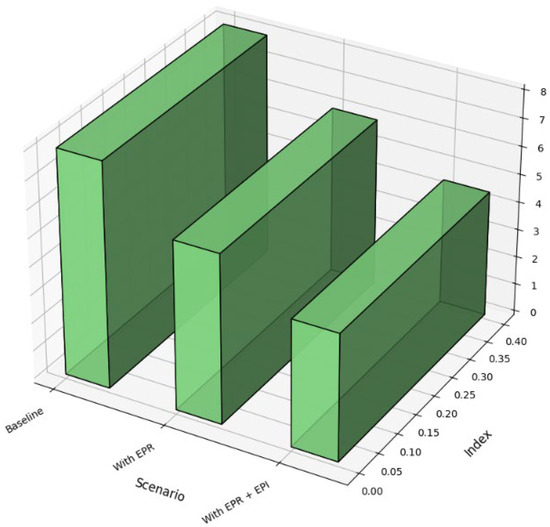

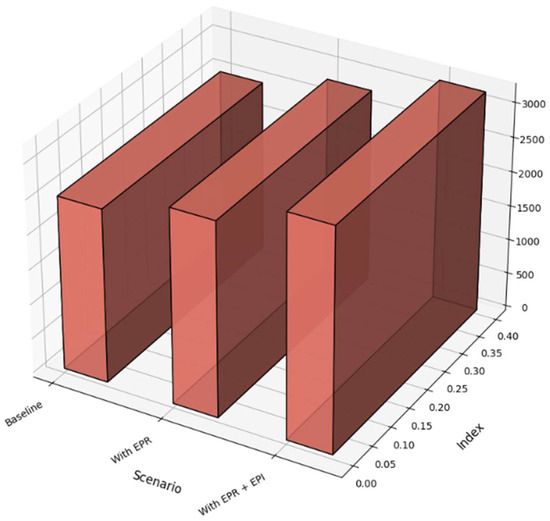

Although Economocracy is a theoretical construct, the model is anchored in real-world data for validation. The Cycle of Money Index has been tested using statistical data from Switzerland, confirming the logical consistency of the redistribution mechanics. Variables such as unemployment, average wages, and the Gini index are aligned with international benchmarks from IMF, World Bank, and national statistical services, which serve as the basis for simulation input ranges. All simulations are implemented using Python, enabling efficient iteration of the system of equations until stable equilibrium values are reached for each policy scenario. The Q.E. method allows the researcher to revise assumptions dynamically, ensuring that the simulated results conform to the expected theoretical outcomes. When the results diverge from theoretical expectations, parameters and relational weights are adjusted until the desired convergence is achieved across all core indicators. Key variables examined in the model include the Gini coefficient (to measure inequality), unemployment rate (to measure labor market conditions), average wage level (as a proxy for productivity distribution), AI job displacement percentage (to reflect technological risk), and the debt-to-GDP ratio (as a measure of macroeconomic sustainability). The redistributive tools of Economocracy, EPRs and EPIs, serve as the primary policy instruments tested. The methodology as a whole ensures that the theoretical premises of Economocracy are both internally coherent and externally benchmarked, allowing for robust evaluation of the system’s potential economic impact.

This study employs a two-phase methodological framework grounded in the Quantification of Everything (Q.E.) method. The approach combines theoretical mathematical modeling and simulation-based evaluation of key macroeconomic indicators under a proposed system of Economocracy.

The foundation of the analysis is a formal system of equations that describes the internal logic of Economocracy. These include equations governing:

- Redistribution of wealth and inequality levels (via Gini index),

- Impact on unemployment from Economic Productive Resets (EPRs),

- Wage increases under redistributed productivity,

- Risk mitigation of automation-related job losses through targeted EPIs,

- Sustainability of the economic system under a non-debt-based monetary framework.

Simulations are conducted to examine the effects of the Economocracy model across three comparative scenarios:

- Capitalist Baseline: parameters set with Gini index, unemployment, average wage, and AI-induced job loss.

- Scenario A (EPR only): incorporates productivity-based debt restructuring mechanisms.

- Scenario B (EPR + EPI): adds periodic redistributive injections directed to education, healthcare, and social security.

The simulation parameters are calibrated to reflect average conditions in developed and developing economies, drawing on OECD and Eurostat data. These scenarios allow testing of the system’s capacity to improve socioeconomic outcomes while maintaining fiscal equilibrium. Although Economocracy has not yet been implemented in practice, the model is validated against historical and empirical benchmarks. Variables such as unemployment rates, average wages, and Gini coefficients are benchmarked using statistical data from IMF, World Bank, and national statistical agencies.

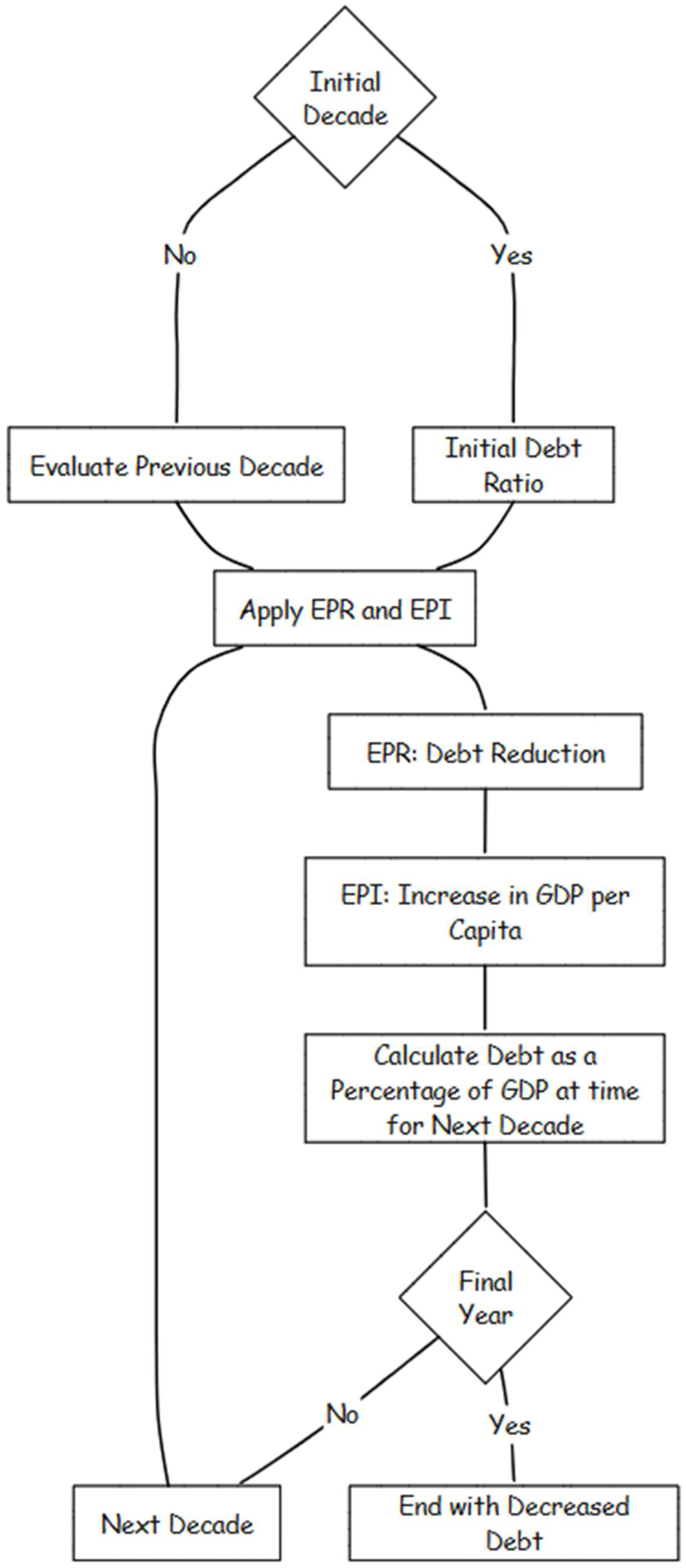

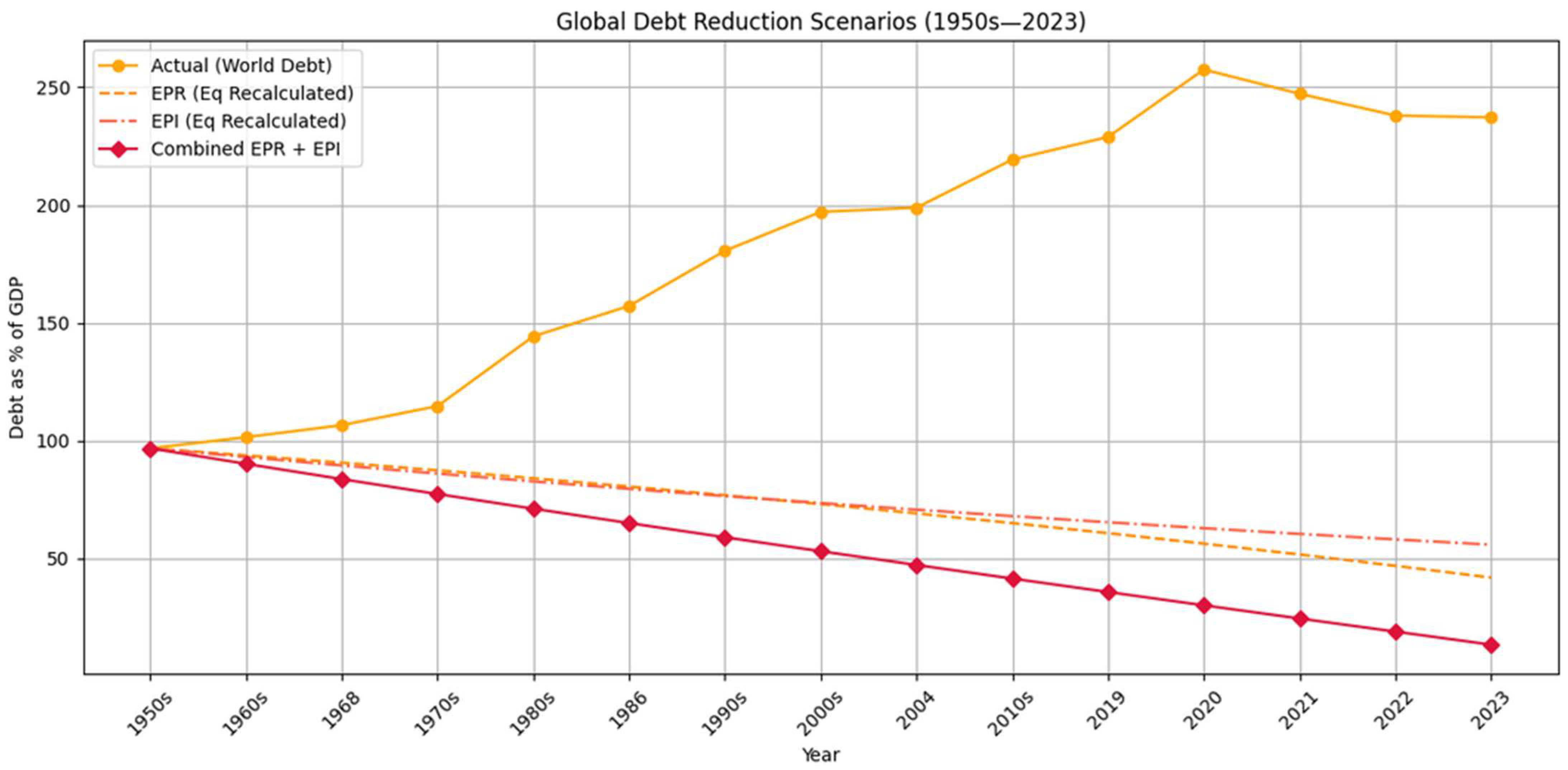

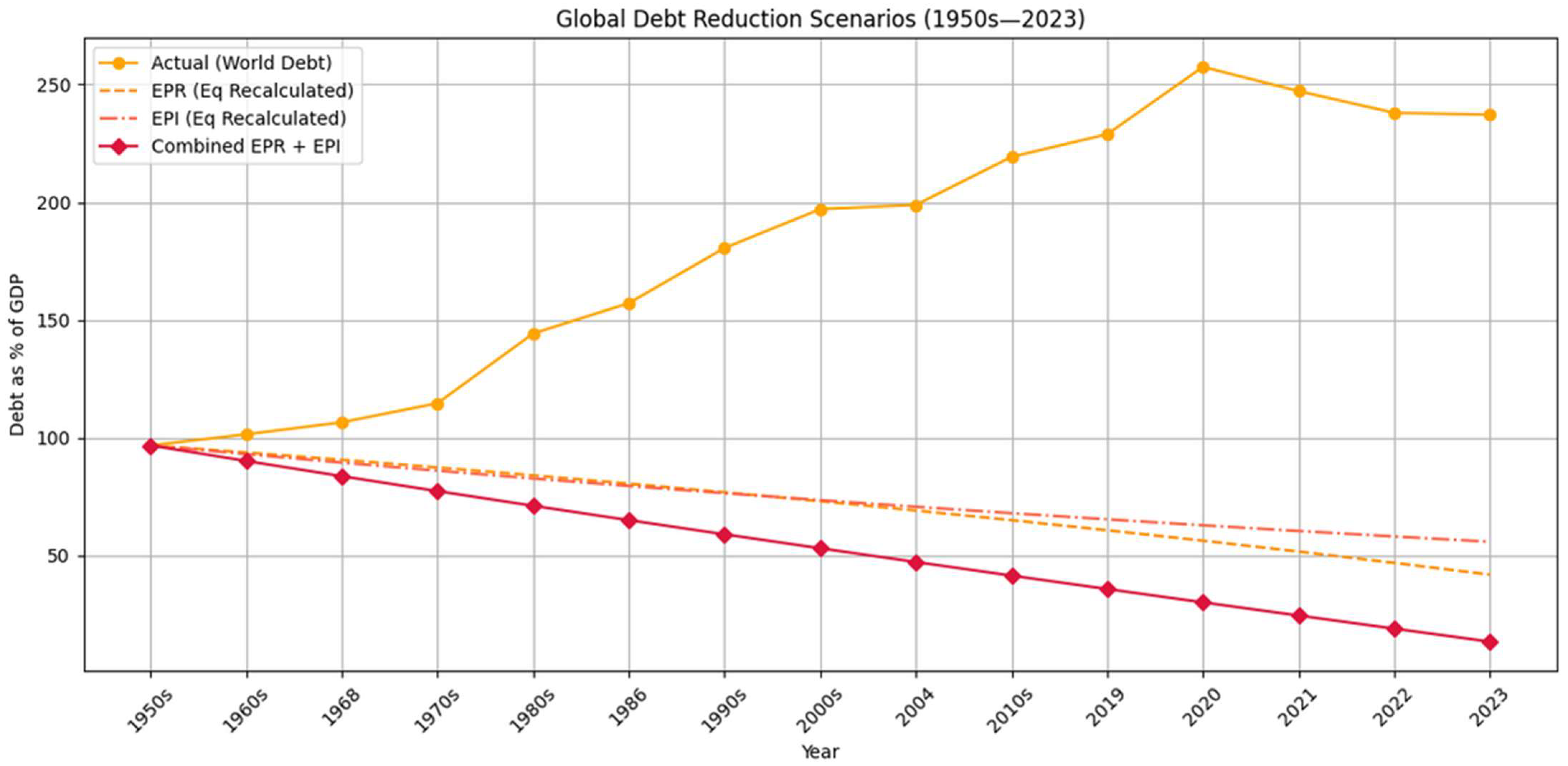

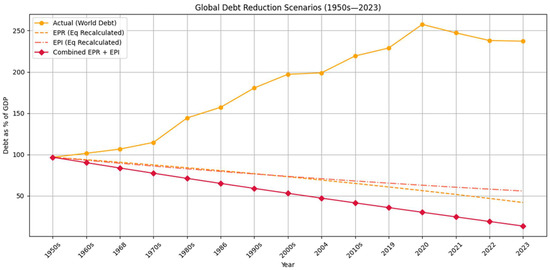

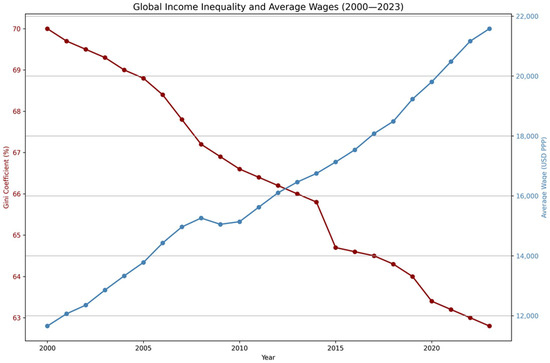

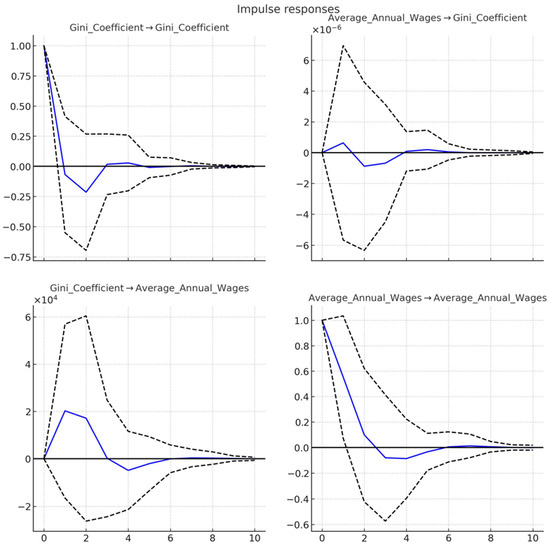

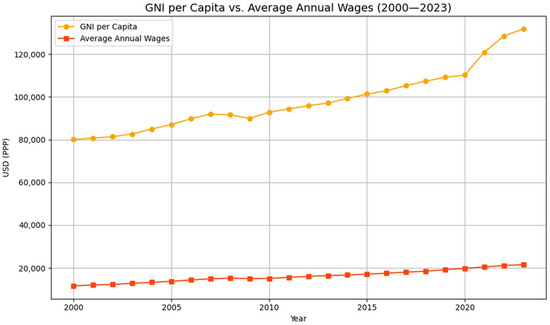

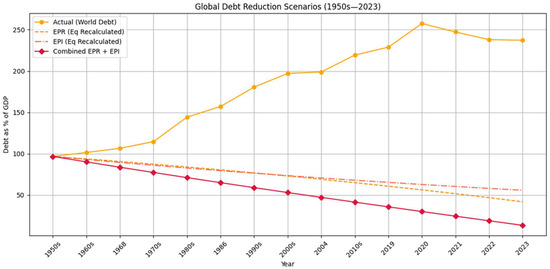

The simulation environment is developed in Python 3.10.12, MATLAB R2023b, and R version 4.3.2. Figure 3 presents the methodological framework, Figure 4 the methodological application on world data, and Figure 5 the methodology based on world data and estimations of debt decline Each variable is computed through iterative processes, where adjustments are made to ensure theoretical consistency and convergence of indicators. The Q.E. method allows for adjustment of parameters until the model meets expected outcomes under the framework of Economocracy.

Figure 3.

Methodological Framework (Author’s scheme, Appendix B and Appendix C).

Figure 4.

Methodology based on world data (Author’s scheme, Appendix D and Appendix E).

Figure 5.

Methodology based on world data and estimations of debt decline (Author’s scheme, Appendix F).

The key variables measured and simulated include the following:

- Gini coefficient: indicator of income inequality.

- Unemployment rate: reflects labor market performance.

- Average wage level: proxy for overall productivity and standard of living.

- AI job displacement (%): represents the risk of automation.

- Debt-to-GDP ratio: used to assess system sustainability.

- Redistributive mechanisms (EPR, EPI): policy tools evaluated for their macroeconomic impact.

The framework of Economocracy introduces mechanisms like EPR and EPI to address the income loss associated with automation. By reallocating resources and providing capital for skill development, Economocracy empowers individuals in a rapidly changing job landscape (Almusharraf, 2025; Borry & Getha-Taylor, 2018; Dodel & Mesch, 2020; Howcroft & Taylor, 2022; Qi, 2023; Safarov et al., 2024; Senker, 1979). Economocracy is the economic system that has been developed by Constantinos Challoumis: The current concept is a new way of managing and governing economies. It aims at dealing with current problems in economy and society, such as public debt or social inequity, through new theories and practices in economics. In this paper, Economocracy will be analyzed, and its principles will be compared to those governing capitalism and socialism, as well as its possibilities and challenges for implementation. The mathematics behind the Cycle of Money theory are

is the velocity of financial liquidity, is the velocity of escaped savings, and is the cycle of money. The is the index of the cycle of money, is the national income or GDP, and is the bank deposits of the country. This index is intended to measure the monetary dynamism of a national economy by quantifying the interaction between two key macroeconomic components: bank deposits and gross domestic product (). Moreover, represents the actual monetary output or productive value attributed to the available money supply, represents autonomous spending or initial monetary injection into the economy (e.g., public spending, investment stimuli), and m denotes the total available money, including both productive and non-productive monetary elements. The rationale is that the volume of bank deposits reflects the liquidity available within the financial system, while GDP reflects the total economic output. Their product approximates the extent to which financial resources are actively engaged in productive economic activity (Challoumis, 2022a, 2024a, 2024d, 2024e). In addition, symbolizes the general index of [General Index of the Cycle of Money (GICM)] of the country, is the index of of the country, and is the global index of . Concluding, is the general global index of and is obtained as a global constant. is the savings, is the investments, and is the exports. Then, represents the savings oriented to banks out of the country’s economy, represents the investments oriented to banks out of the country’s economy, and are the imports. The relationship is about the money cycle and proves that surpluses will always be equal to deficits at the international level, . Therefore, because the money issued by banks is less than they expect to receive due to interest, it is impossible to return it, creating public debts. Therefore, only with unproductive money can the structural problem of capitalism be corrected by replacing it with Economocracy (Challoumis, 2024g).

At the heart of the cycle of money, , lies the distinction between enforcement savings, , and escape savings, , a conceptual dichotomy that functions as a diagnostic lens for evaluating economic efficiency. Enforcement savings, those that remain within the local banking system are depicted as the essential fuel for a healthy self-organizing economy. They support a circular flow of capital that promotes investment in both large-scale productive activities and specialized sectors without crowding out small businesses. This signals the theory’s recognition of diversified economic participation as key to resilience and inclusivity. In contrast, escape savings, which are diverted outside the local economy (e.g., into offshore accounts or speculative markets), are viewed as a drain on the cycle’s vitality. Their effect is to truncate the velocity of money, reducing redistribution and impairing economic continuity. This mirrors concerns in Keynesian and post-Keynesian frameworks about liquidity preference and hoarding, but the Cycle of Money adds a spatial and regulatory layer, focused on local reinvestment as a normative benchmark. The theory thus links macro-outcomes (growth, resilience, equality) to micro-level financial behavior (where and how money is saved and reinvested). When enforcement savings outpace escape savings, the economy reaches its optimal operational capacity, underscoring a type of endogenous efficiency. This notion ties directly into the broader paradigm of Economocracy, where money’s democratic redistribution and reuse is not merely idealistic but structurally embedded. Regulatory tools, such as progressive taxation (especially on firms displacing local businesses) and strategic subsidies, are framed not only as corrective instruments but as cycle-enhancing mechanisms. The theory presents tax policy as not just a fiscal lever but a functional component of macroeconomic architecture. Likewise, low corporate taxes are endorsed conditionally, only when they incentivize internal reinvestment rather than extraction. The centrality of the banking system as a “receiver” repositions banks from neutral intermediaries to active agents in economic structure formation. Their capacity to anchor money locally, rather than facilitating its escape, is a defining factor in systemic health.

Based on the results of the general index of the Cycle of Money:

The computation of the general index of the Cycle of Money, based on global macroeconomic data and expressed with precision to nine decimal places, yields a striking average value of 0.5 (last column of Table 2).

Table 2.

General index of the Cycle of Money (averaged from 1980 to 2020) (Challoumis, 2024h).

This figure is not coincidental; it mathematically illustrates that, under the current capitalist structure, the final cent of surplus in one country mirrors the deficit in another. This systemic zero-sum behavior confirms the fundamental theoretical assertion of the Cycle of Money: that without an equitable redistribution mechanism, one nation’s accumulation inherently depends on another’s imbalance. Such a condition exposes a deep-rooted structural flaw in global capitalism, where the circulation of money does not self-correct but instead reinforces asymmetries.

Moreover, the model shows that the volume of money in circulation remains persistently insufficient, a deficiency amplified by the requirement of interest-based repayment, which structurally demands more money than is available. This monetary scarcity fuels debt cycles and stagnation. Economocracy addresses both these defects by introducing rule-based EPIs and EPRs, thus ensuring balanced flow, debt prevention, and a reformed fiscal structure grounded in democratic legitimacy and sustainability. A value of 0.5 for the GICM reflects a critical equilibrium threshold in the Cycle of Money theory developed by Constantinos Challoumis.

Interpretation of GICM = 0.5:

Balanced Circulation vs. Escape: A GICM value of 0.5 means that 50% of the injected money continues circulating within the economic cycle, while the other 50% escapes through savings, tax leakages, or external transfers.

Neutral Efficiency Point: This level represents a neutral point of economic efficiency:

Below 0.5: money leaks dominate, indicating weak reinvestment or weak redistribution.

Above 0.5: circulation is more effective, reflecting stronger economic activity, reinvestment, and better redistribution.

Implication for Policy:

When GICM = 0.5, further policy actions (e.g., EPRs or EPIs) become critical to shift the system toward more productive socially sustainable circulation. It is the minimum threshold to maintain economic sustainability without systemic degradation.

A critical finding of this study is the identification of the value 0.5 in the general index of the Cycle of Money (GICM) as a structural threshold of systemic equilibrium. When the GICM equals 0.5, it signifies that precisely half of the injected or available monetary resources continue to circulate within the domestic economy, while the remaining half leak out through channels such as savings, taxation, or international transfers. This point marks a state of balance where monetary flows neither accelerate nor collapse, representing a neutral dynamic in the economic cycle.