Abstract

This paper applies a multi-level social network analysis to examine Aragón’s innovation ecosystem, focusing on a decade of competitive public projects (2014–2023) aligned with the region’s Smart Specialisation Strategy (S3) 2021–2027. By mapping and weighting the participation of regional entities across regional, national, and European calls, the study uncovers how all types of local actors organise themselves around key specialisation areas. Moreover, a comparative benchmark is introduced by analysing more than 33,000 Horizon 2020 and Horizon Europe initiatives without Aragonese partners, revealing how to fill structural gaps and enrich the regional ecosystem through international collaboration. Results show strong funding concentration in four fields—Energy, Health, Agri-Food, and Advanced Technologies—while other historically strategic areas like Hydrogen and Water remain underrepresented. Although leading institutions (UNIZAR, CIRCE, ITA, AITIIP) play central roles in connecting academia and industry, direct collaboration among them is limited, pointing to missed synergies. Expanding previous SNA-based assessments, this study introduces a diagnostic tool to guide policy, proposing targeted actions such as challenge-driven calls, dedicated support programs, and cross-border consortia with top EU partners. Applied to two contrasting specialisation areas, the method offers sector-specific recommendations, helping policymakers align Aragón’s innovation capabilities with EU priorities and strengthen its position in both established and emerging domains.

1. Introduction

In recent years, smart specialisation strategies (S3) have become key tools for promoting regional competitiveness, sustainability, and inclusiveness in Europe (European Commission, Joint Research Centre, 2021; European Committee of the Regions et al., 2023). Instead of simply funding isolated innovation projects, S3 encourages regions to identify and build on their unique strengths through collaborative governance, knowledge sharing, and ongoing entrepreneurial discovery (Asheim, 2019; Gheorghiu et al., 2016). This holistic approach views regional innovation systems as complex, adaptive networks shaped by policy structures, social capital, and place-based strategies that influence how ideas emerge, spread, and generate sustainable advantage (Barbero et al., 2022; Mascarenhas et al., 2021).

Despite this conceptual evolution, questions remain about how effectively S3 strategies capture and steer these underlying collaboration dynamics in practice. A growing body of literature highlights the importance of moving beyond funding and governance indicators to better understand the relational patterns within innovation ecosystems (Balland et al., 2019; Tolias, 2019; Wibisono, 2022). This paper addresses that gap by proposing multi-level social network analysis (SNA) to diagnose the structure and dynamics of Aragón’s innovation ecosystem.

We apply this framework to Aragón, a region that illustrates both the strengths and limitations of S3 strategies. Despite rising R&D investment and strong GDP per capita, Aragón faces persistent challenges in technology transfer, fragmented R&D capacity, and weak collaboration among research centres. The S3 Aragón 2021–2027 strategy prioritises digitalisation, sustainability, and service innovation linked to industry, alongside improved governance and monitoring (Aragón Government, 2024). However, major gaps remain: nearly 60% of local organisations report no access to public R&D funding, research institutions remain poorly coordinated, and large firms tend to engage universities and technology centres through limited, bilateral collaborations rather than broad partnerships.

Moving from an Aragón perspective to that of other European regions, a critical gap in S3 implementation lies in the lack of detailed, empirical insight into how regional innovation systems operate in practice. While existing evaluations often focus on funding outputs, strategic planning documents, or stakeholder consultation processes, they tend to explore collaboration patterns only indirectly or in a fragmented manner. As highlighted by Tolias (2019), there is a pressing need to deepen our understanding of how innovation actors interact, particularly in terms of knowledge flows and structural positioning within networks. This mismatch between S3’s conceptual goals (dynamic, place-based, participatory innovation) and the limited tools available to monitor, diagnose and adapt these strategies effectively creates a fundamental gap in tailoring interventions that respond to the real-world challenges of regional innovation networks.

Building on earlier work (Calvo-Gallardo et al., 2021, 2022; Rodríguez Ochoa et al., 2023, 2025), which applied one-mode network analysis to examine R&D project collaborations within Aragón’s RIS3 (2014–2020) context, the present study expands this scope by adopting a multi-domain, comparative framework based on Aragón’s S3 (2021–2027) key areas. The prior research revealed patterns of institutional centrality and identified bottlenecks in regional knowledge diffusion but was limited to addressing the differences between projects funded at different geographical levels. Here, we broaden the analysis by: (i) mapping and weighting participation in competitive public projects from 2014 to 2023 across regional, national, and European levels, using funding as a proxy for collaboration intensity; (ii) classifying these projects according to Aragón’s S3 priority domains to assess whether actors are concentrated or fragmented across areas; and (iii) benchmarking Aragón’s network structures against Horizon 2020 and Horizon Europe projects that exclude Aragonese partners, identifying external models of connectivity that could help fill local gaps. This approach provides policymakers with an evidence-based view of the region’s collaborative architecture, enabling more targeted and adaptive interventions aligned with S3 goals.

The remainder of this study is organized as follows: Section 2 analyses the theoretical frameworks of the paper’s contributions. Section 3 describes the data collection and SNA-based methodology, specifying how projects are classified and weighted. Section 4 presents the findings from our participation, cohesion, and centrality analyses, highlighting their implications for innovation bottlenecks across key specialisation areas. Section 5 discusses how these empirical results inform theoretical and policy debates on regional innovation strategies, with special attention to bridging institutional gaps. Finally, Section 6 concludes by synthesising the study’s contributions to both scholarly literature and practice, outlining limitations and suggesting avenues for future research.

2. Literature Review and Conceptual Framework

2.1. Innovation Through Knowledge Flows and Interactive Learning: Regional Innovation Systems and Smart Specialisation Strategies

Innovation a systemic process, not an individual one. It emerges from dynamic interactions among diverse stakeholders, rather than isolated R&D projects (Edquist, 1997; B. A. Lundvall, 1992; Nelson & Rosenberg, 1993). Rooted in the systems of innovation tradition, this view stresses that innovation—especially in knowledge-intensive settings—requires collaboration, as no single actor holds all the necessary expertise. Both smart specialisation strategies (S3) and regional innovation systems (RIS) follow this logic, treating innovation as the outcome of coordinated activity across institutions, not just business-level performance.

Knowledge is distributed and socially embedded. It resides not in isolated labs, but in the networks, norms, and routines that shape how information is shared (Asheim & Gertler, 2005; Freeman, 1995). Access to this knowledge depends on institutional frameworks and proximity, which enable collaboration to bridge gaps in technical and organisational expertise. RIS theory highlights how geographic and institutional closeness fosters learning, while S3 builds on this by urging regions to map and connect their embedded knowledge assets.

Interactive learning lies at the core of innovation. It evolves through formal and informal, trust-based exchanges among businesses, universities, governments, and intermediaries (Jensen et al., 2007; B.-Å. Lundvall & Johnson, 1994). This learning is cumulative and context dependent. While face-to-face interaction accelerates tacit knowledge exchange, cognitive and relational proximity can substitute for physical distance (Breschi & Lissoni, 2001). Regions, in this sense, become arenas for dense knowledge interaction—making place a key factor in both RIS and S3 frameworks.

Introduced in 1997 (Cooke et al., 1997), the RIS approach conceptualizes regions as networks of businesses, universities, intermediaries, and governance structures that support innovation. A well-functioning RIS fosters collaboration, knowledge exchange, and shared access to skilled labour and support systems (Asheim & Gertler, 2005; Pinto et al., 2024).Yet many regions face systemic challenges, causing them to struggle to build cohesive systems.

Common barriers include coordination failures (Rossoni et al., 2024), institutional fragmentation, especially in large metropolitan areas where numerous organizations exist but their interactions remain siloed (Tödtling & Trippl, 2005), and ‘organizational thinness’ in peripheral regions with scarcity of innovation actors (Isaksen et al., 2022; Isaksen & Trippl, 2016). These conditions highlight that a “one size fits all” innovation policy is inadequate and, accordingly, innovation policy must adapt to specific contexts.

Smart specialisation emerged as a policy response to these challenges. Building on RIS principles, S3 was introduced in the 2014–2020 EU programming period as a condition for cohesion funding (McCann & Ortega-Argilés, 2015). It required regions to create research and innovation strategies for smart specialisation (RIS3) aligned with their unique strengths (Foray, 2014, 2016; Joint Research Centre (European Commission) et al., 2021). Rather than spreading resources thin, S3 encourages regions to focus investments on priority domains with high innovation potential.

The entrepreneurial discovery process (EDP) is a defining feature of S3. It brings together businesses, academia, and government to jointly identify promising niches (Gheorghiu et al., 2016; Marinelli & Perianez, 2017). This iterative process echoes RIS principles by grounding strategic choices in local knowledge (Szerb et al., 2020). S3 is also place-based: it recognises that top-down policies often miss local nuances (Demblans et al., 2020). By analysing economic structure and institutional capacity, S3 helps regions concentrate resources, build critical mass, and align investments with real strengths (Suedekum, 2025). Collaborative governance, in turn, reduces fragmentation (Kroll, 2017).

In summary, S3 does not replace RIS; it operationalises it. S3 transforms RIS concepts into policy action, giving regions a practical framework to mobilise assets and address systemic weaknesses (Bevilacqua et al., 2015; Rossoni et al., 2024). It offers a focused, participatory approach to strengthening regional innovation systems through strategy, collaboration, and place-based investment.

2.2. From Theory to Practice: Challenges in S3 Implementation

The smart specialisation strategy was conceived as a place-based, bottom-up approach to innovation policy, but putting this into practice has proven challenging (Capello & Kroll, 2016). Early experiences showed that the entrepreneurial discovery process (EDP) must be continuous and iterative (Marinelli & Perianez, 2017), yet many regions struggle to sustain this engagement. Translating S3’s dynamic, collaborative principles into real governance often clashes with institutional inertia and practical constraints. As recent literature notes, this gap between theory and implementation continues to limit the strategy’s full potential (Esparza-Masana, 2022; Foray, 2017; Laranja et al., 2022; Molica et al., 2025; Polido et al., 2019; Reid & Maroulis, 2017).

A key barrier is weak collaboration among the quadruple helix actors—industry, government, academia, and civil society. These ties often remain fragmented, leading stakeholders to operate in silos that undermine trust and limit meaningful interaction. Limited stakeholder engagement beyond S3’s initial design phase compounds the problem. While sustained participation is essential for effective discovery, many regions rely on narrow or symbolic consultation.

Inadequate monitoring mechanisms adds to the challenge. S3, as a policy-learning experiment, needs robust feedback systems to track strategic progress and assess the impact of funded projects. Misalignment between S3 priorities and available funding instruments further disrupts implementation. If R&D programs or investment schemes do not support identified priorities, strategies can stall. Institutional inertia also plays a role—networked governance demands new practices from public agencies, but entrenched bureaucracies often resist these changes.

Tackling these obstacles is crucial to making S3 work in practice. Here, social network analysis (SNA) offers valuable insights. It allows policymakers to map how actors interact within a regional innovation system and to identify hidden patterns, gaps, and bottlenecks (Calvo-Gallardo et al., 2022; Fernandez de Arroyabe et al., 2021; Rodríguez Ochoa et al., 2025). For instance, it can reveal isolated institutions or overcentralized “gatekeeper” nodes that hinder collaboration.

SNA is not just analytical; it is a diagnostic and policy-oriented tool. By exposing weak links and structural imbalances, it helps design targeted interventions, connecting disconnected actors, strengthening inter-organizational ties, or diversifying the governance base. Rather than replacing the EDP, SNA complements it by tracking the network’s health and inclusiveness over time. It turns the abstract idea of innovation networks into actionable data, supporting more adaptive, evidence-based S3 implementation

This approach aligns with recent calls for more sustainable, inclusive, and adaptive S3 (European Committee of the Regions et al., 2023), and contributes to the emerging “S3 2.0” agenda, which stresses challenge-oriented, systemic transformation through improved governance and policy alignment (Foray, 2023). Likewise, the OECD (OECD, 2023) emphasises stronger coordination and monitoring tools to support regions in industrial transition. In this context, SNA offers a practical method to diagnose structural gaps and support more responsive, evidence-based S3 implementation.

In this context, Aragón is well suited to examine these challenges. As a “moderate innovator” in the EU’s 2023 Regional Innovation Scoreboard (Hobza et al., 2023), it shares traits with many other European regions: a strong industrial base, active rural sectors, and a diverse institutional landscape (Aragón Government, 2025) These characteristics make it a representative case for studying the barriers and opportunities in S3 implementation.

2.3. The Case of Aragon: Innovation Ecosystem and Strategic Priorities

Aragón offers a timely and illustrative case of a regional innovation ecosystem under a modern smart specialisation strategy. According to the Spanish National Statistics Institute, the region’s R&D spending rose to 1.16% of GDP in 2023—its highest level since 2003—surpassing previous peaks in 2008–2010. While this marks significant progress, it remains below the EU average (2.2%) and the 3% target. Employment in R&D also reached a record 13.2%, closely aligned with the national figure of 13.3%, and up from 12.6% in 2010.

Aragón combines a solid economic base with favourable demographics. With 1.35 million residents (2.8% of Spain’s population), the region contributes 3.1% to national GDP, with a GDP per capita of EUR 31,051. Its S3 Aragón 2021–2027 strategy focuses on digitalisation, sustainability, and industry-linked services, identifying key domains such as Energy, Advanced Technologies, Agri-Food, and Health and Wellbeing. It adopts a more collaborative governance model aligned with the UN Sustainable Development Goals and introduces improved monitoring to support adaptive policy (Aragón Government, 2024).

However, implementation challenges persist. The region’s industrial share of gross value added dropped from 22.4% in 2000 to 17.8% in 2019, while services rose from 58.3% to 66%. Many companies struggle to find funding aligned with their technological needs, and collaboration between large companies and R&D centres remains limited. The innovation ecosystem includes many scientific and technical actors, but this diversity has not translated into a coherent, coordinated R&D offering.

Fragmentation is evident in the low number of collaborative regional projects and the absence of tools to effectively connect companies, researchers, and technology providers. Nearly 60% of organisations report not receiving public R&D support, especially in rural areas, revealing weak outreach and gaps in technology transfer. These issues call for more targeted, coordinated interventions to unlock the region’s innovation potential.

Aragón’s context reflects the broader landscape of many mid-sized European regions. As a “Moderate Innovator” in the EU Regional Innovation Scoreboard (Hobza et al., 2023), it blends a strong industrial base with extensive rural areas and an emerging R&D system. At the same time, it brings unique assets. It leads in renewable energy, which now accounts for over 80% of electricity generation (Red Eléctrica, 2024), and its rising R&D investment signals growing political and institutional commitment. The region also engages actively in the S3 Community of Practice and related EU networks, using peer learning to refine its approach (European Commission, 2025).

This combination of shared challenges and distinctive momentum makes Aragón a valuable case study. Its experience offers relevant lessons for designing and implementing smart specialisation strategies in comparable regions across Europe.

2.4. Research Questions

Recent literature on RIS3 and S3 has provided a range of qualitative and quantitative insights into the dynamics of innovation at a regional level (Balland et al., 2019; Calvo-Gallardo et al., 2022). However, several critical gaps remain. First, few studies provide multi-level, long-term benchmarks of competitive public project networks. Most focus on static snapshots rather than the evolution of innovation ecosystems across regional, national, and European scales. Second, although SNA is gaining traction, it is rarely applied in RIS contexts with an eye toward feedback loops for policy adaptation. Finally, few analyses link empirical network metrics to specific policy interventions, leaving a disconnect between theory and actionable strategies.

This study addresses these gaps by applying SNA to public R&D project networks in Aragón. Focusing on projects funded through regional, national, and European calls from 2014 to 2023, and classified by S3 2021–2027 specialisation areas, the research generates multi-level benchmarks and actionable insights to inform regional policy. The following research questions guide the analysis:

- RQ1: How do the features of competitive public project networks from 2014 to 2023 within the S3 2021–2027 specialisation areas reveal the structure and dynamics of Aragón’s innovation ecosystem?

This question maps Aragón’s innovation network over a decade, addressing the first research gap. By analysing participation, cohesion and centrality metrics, the study reveals how stakeholders interact—highlighting well-connected clusters, isolated nodes, and structural vulnerabilities. These findings offer a systemic view of local strengths and weaknesses and assess whether current strategies effectively mobilise the region’s capacities.

- RQ2: What roles do key entities play in knowledge transfer within these specialisation areas, and how do their centrality positions influence the dynamism of Aragón’s regional innovation ecosystem?

While prior work often neglects the influence of individual actors, this question examines how central entities shape innovation dynamics. Using degree, betweenness, closeness, and eigenvector centrality measures, we identify which actors act as bridges and knowledge hubs. These insights link structural network data to knowledge flows and support more targeted, evidence-based policy interventions.

- RQ3: How can the analysis of the last decade innovation networks involving non-Aragonese partners enhance Aragón’s innovation policies and strengthen its position in a targeted specialisation area?

A novel aspect of this work, compared to our earlier study (Rodríguez Ochoa et al., 2025), is the detailed analysis of participation metrics by both specialisation area and type of entity for projects funded under H2020 and Horizon Europe (EU Framework Program calls) during 2014–2023, specifically excluding Aragonese partners. These projects account for 78% of the region’s total innovation funding.

By benchmarking Aragón’s networks against European examples, we highlight opportunities to enhance local practices through transnational collaboration. This analysis explores how cross-border partnerships contribute to innovation and offers clear, transferable lessons to improve regional policy and strategic alignment.

3. Materials and Methods

3.1. Data

The present study examines the innovation networks established in the Aragón region over the past decade, categorising them according to different specialisation areas. To achieve this, our analysis builds upon the dataset presented in our previous work (Rodríguez Ochoa et al., 2025), which encompasses all competitive public projects at regional, national, and European levels that involved at least one partner from the Aragón region during the period 2014–2023.

In this study, we further refined the dataset by labelling each project according to the specialisation areas defined in the Aragón Smart Specialisation Strategy 2021–2027 (Aragón Government, 2024). The strategy document was also examined in detail to incorporate its identified bottlenecks into our analysis.

Additionally, to establish a benchmark for the Aragonese innovation ecosystem, our current research extends the previous approach by incorporating data from all projects funded under the Horizon 2020 and Horizon Europe programs (Framework Program projects) during the same period (2014–2023), excluding those projects that involved Aragonese partners. This comparative analysis facilitates a broader understanding of regional performance relative to the European context.

3.1.1. Data Sources, Collection and Preparation

All funding programs examined in this study are based on competitive public calls, in which multiple independent entities submit proposals to secure financing, with selection decisions made according to the merits of their projects and alignment with predefined objectives. This competitive process is distinct from nominative funding, where projects are directly financed without a competitive evaluation—often earmarked for specific entities or initiatives without the need for proposal submission and review. Based on this framework, the primary data sources for this study are shown in Figure 1.

Figure 1.

Project data sources considered in the analysis.

All the calls considered in the study are specified in our previous research study (Rodríguez Ochoa et al., 2025). Moreover, Appendix A includes additional information on the different databases consulted and the reasoning behind choosing these datasets.

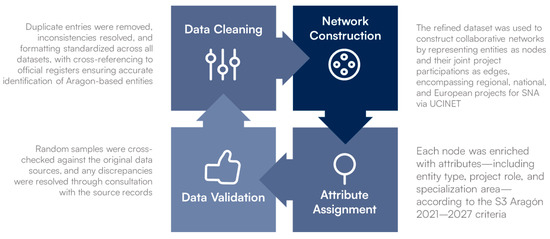

To ensure the accuracy and relevance of the data to Aragón’s innovation ecosystem, several rigorous processing steps were taken, as shown in Figure 2:

Figure 2.

Data treatment process.

These systematic steps ensured that the data prepared for analysis is both precise and relevant, thereby allowing our evaluation of Aragón’s innovation ecosystem and the provision of policy recommendations to address the bottlenecks identified in the S3 2021–2027 and improve the positioning of the region at European level in targeted specialisation areas.

3.1.2. Entities and Projects Attributes

In order to classify the participating entities based on their inherent characteristics and primary activities, we have defined six distinct categories:

- Public Sector (PUB): This category comprises governmental authorities at the national, regional, and local levels, along with energy agencies.

- Higher Education Institutions (HES): This category mainly consists of universities that are actively engaged in both teaching and research.

- Research Organizations (REC): This group includes two main types: publicly funded national research centres and predominantly private, non-profit research and technology organizations.

- Private Companies: This category is further divided into:

- ○

- Large Private Companies (PRC): Enterprises that exceed the criteria for small and medium-sized companies.

- ○

- Micro, Small, and Medium-sized Enterprises (PRC-SME): Businesses classified as micro, small, or medium according to the standards set by EU Recommendation 2003/361 (European Commission, 2003).

- Others (OTH): This group encompasses sector-specific associations and may also include certain research institutes organised as associations.

With respect to the roles of entities within projects, each consortium is managed by a coordinator, while the other members are considered participants. This classification does not distinguish between full partners, who sign the grant agreement, and third parties that have a legal or financial link to a beneficiary, as the number of such third parties is negligible and will not be analysed separately in this study.

In a novel extension to our previous research, each entity participation within the network has been assigned to one of the specialisation areas appearing in Figure 3 (as stated in the Aragón S3 2021–2027) to delineate the thematic focus of the entities involved:

Figure 3.

Specialisation areas considered in the study.

The inclusion of Biodiversity, Basic Science, and Governance and Business Development ensures comprehensive coverage of all projects while preserving thematic coherence. Notably, each project is categorised under a single, most-representative area. This single-categorisation approach simplifies the analysis by maintaining focus on the dominant thematic element—for instance, assigning AI developments within the water sector to the AI category underlines the technological emphasis, which is consistent with the objectives of thematic network analysis.

Furthermore, acknowledging that partners contribute to projects in varying ways—ranging from receiving significant funding to participating solely in an advisory capacity without financial remuneration—each project participation was assigned a monetary value. Specifically, this value corresponds to the funding granted by the funding authority, the budget allocated when acting as a subcontractor, or a nominal amount of EUR 1 when no financial compensation is provided. This approach enables the weighting of inter-entity links within the networks according to the expected contribution of each partner to the project.

3.2. Methodology

Social network analysis is a widely used approach to examine innovation ecosystems, but prior evaluations often focused narrowly on European Framework Program projects, neglecting multi-level networks and failing to weight collaborative ties by funding (Abreu & Nunes, 2020; Calvo-Gallardo et al., 2021, 2022; Fernandez de Arroyabe et al., 2021; Morisson et al., 2020; Rodríguez Ochoa et al., 2023). This is problematic, given that evidence links stronger network connectivity to improved innovation outcomes and less fragmentation, underscoring the need for a more comprehensive network perspective.

To address these gaps, the present study employs SNA, using UCINET 6 software (Borgatti et al., 2002), to analyses Aragón’s innovation ecosystem, targeting its first two research questions on network structure and actor interactions. The methodology constructs a two-mode network linking diverse entities (e.g., businesses, universities, research centres) to the portfolio of regional, national, and European innovation projects they participate in, with each entity–project tie weighted by the amount of funding involved.

This bipartite network is then projected into a one-mode collaboration network among entities, where the weight of each inter-entity link reflects the total funding those entities jointly secured in shared projects, indicating the strength of their collaboration. This choice reflects the availability and consistency of funding data across regional, national, and European levels. However, we acknowledge that funding levels may not always correlate directly with the depth or quality of collaboration. For example, a participant may receive substantial funding for tasks that require limited coordination with other partners, while another may play a central integrative role in a smaller project. Although imperfect, the funding-based weighting provides a useful approximation of involvement, especially when applied consistently across network layers. We mitigate this limitation by focusing not solely on tie strength, but also on network-level patterns of participation, centrality, and cohesion across different funding sources and policy scales.

Finally, each node (entity) is enriched with attributes such as organisation type, geographic location, smart specialisation domain, and project role (coordinator or partner), allowing analysis of network patterns across different categories of actors.

Using this enriched network representation, the study assesses overall network cohesion through global metrics and computes node-level centrality measures to identify influential actors and potential structural gaps (Borgatti et al., 2023; Wasserman & Faust, 1994).

Cohesion metrics provide insight into the overall interconnectedness of the network—a critical factor for enabling knowledge exchange and leveraging specialized research capabilities within the regional innovation ecosystem. The following metrics were evaluated:

- Average Degree: This is computed as the mean number of direct connections per node, serving as an indicator of the network’s overall activity.

- H-Index: This metric identifies the maximum number of nodes that each have at least that number of connections, offering a robust measure of network cohesion while mitigating the impact of outliers.

- Density: Calculated by dividing the total observed connections (or sum of weighted ties) by the maximum possible connections, density provides a measure of how tightly interlinked the network is.

- Connectedness: This indicator assesses the extent of both direct and indirect linkages among nodes, typically expressed as the average number of steps required to connect any two nodes. Higher connectedness is generally associated with more efficient knowledge sharing.

- Closure: This metric measures the tendency of nodes to form complete triads—if node A is connected to node B and node B is connected to node C, closure is achieved when node A is also directly connected to node C.

- Diameter: Representing the longest of all the shortest paths between any two connected nodes, the diameter signifies the overall spatial extent of the network.

- Average Tie Strength Between Groups: This is determined by calculating the mean of weighted connections between nodes with different attributes, providing insights into the strength of inter-group linkages.

On the other hand, centrality metrics offer a more detailed understanding of the influence and connectivity of individual entities within the network. These measures are crucial for identifying key players and potential bottlenecks, thus informing decisions on resource allocation and stakeholder engagement. The centrality metrics considered comprise:

- Degree: In a weighted network, this is the sum of all tie values associated with a node, indicating the immediate likelihood of that node receiving information or resources.

- Closeness: Calculated as the average of the shortest path lengths from a node to all other nodes, closeness reflects how centrally located a node is and its potential to quickly interact with other entities.

- Eigenvector: This metric assesses a node’s prominence by assigning scores based on the influence of its neighbouring nodes, meaning that nodes connected to highly influential neighbours attain higher eigenvector values.

- Betweenness: This measures how frequently a node appears on the shortest paths between pairs of other nodes, indicating its role as a bridge or broker in facilitating information flows across the network.

Together, these metrics offer a structured framework for evaluating both the global structure and the individual roles within the network, thereby providing a deeper understanding of how collaborative projects and key entities drive the regional innovation ecosystem.

4. Analysis and Results

Following the previous methodology, this section systematically dissects the innovation ecosystem through three analytical lenses. First, the participation analysis quantifies the engagement across projects by assessing the number of projects, unique participants, and funding allocations in each specialisation area, offering insights into regional dynamics and their comparison with EU benchmarks not considering Aragonese partners. Next, the cohesion properties analysis examines the structural integrity of the networks, using metrics such as average degree, density, or average tie strength to reveal how tightly entities are connected and the overall network integration. Finally, the centrality properties analysis evaluates the strategic importance of individual actors by applying measures like degree, closeness, eigenvector, and betweenness centrality, thereby identifying key hubs and bridging nodes. Together, these three degrees of analysis provide a comprehensive understanding of the collaborative patterns and structural dynamics shaping the region’s innovation landscape.

To structure the results and provide analytical clarity, each of the three research questions is addressed by a specific layer of the analysis. The participation, cohesion, and centrality properties of Aragón’s innovation networks—examined at regional, national, and European levels—respond directly to RQ1, by identifying who participates, how collaborations form, and how actors are positioned. RQ2 is addressed through a closer analysis of the collaboration profiles of key regional entities, highlighting how these actors are embedded across S3 domains. Finally, RQ3 is tackled by benchmarking Aragón’s network structures against European consortia that do not include Aragonese partners, identifying external models of connectivity that may inform future regional policy interventions.

Furthermore, to provide a representative and detailed analysis, we selected two specialisation areas: Advanced Technologies and Security and Defence. The former includes projects related to information and communication technologies, industrial digitalisation, robotics, and materials research, and it represents a consolidated, mature field. In contrast, Security and Defence is examined as an emerging field. Analysing these two areas offers critical insights into both the established and evolving dimensions of Aragón’s smart specialisation strategy.

4.1. Participation Analysis

Prior to analysing the different specialisation areas of the Aragonese ecosystem and its EU Framework Programme projects benchmark, it is useful to show the main participation figures from both networks. Thus, Table 1 shows the main figures from the Aragonese ecosystem networks addressing different geographic scope levels, as gathered in a previous study (Rodríguez Ochoa et al., 2025).

Table 1.

Data from the projects analysed during the period 2014–2023.

Moreover, in order to compare this ecosystem with a benchmark, Table 2 shows the figures of the projects funded by the Horizon 2020 and Horizon Europe programs, without considering those projects with Aragonese partners, during the same period (2014–2023).

Table 2.

H2020 and HE projects data during the period 2014–2023.

The Aragonese innovation ecosystem comprises 2464 projects, engaging 8233 unique participants in a total of 18,125 participations, securing a total funding of EUR 5.03 billion. The EU Framework Programme projects (excluding those with Aragonese partners) during the same period includes 33,933 projects, involving 5741 unique participants with 119,438 participations, receiving a total funding of EUR 57.36 billion.

Although the total number of analysed projects in the EU Framework Programme is more than 14 times higher than in Aragón, and the funding received by EU projects is nearly 12 times greater than that of the entire Aragonese innovation ecosystem, it is particularly striking that the number of unique participants in the Aragonese innovation ecosystem (8233) is higher than the one of the EU Framework Programme projects (5741) over the same period.

Following analysis of the general participation data, Table 3 shows the main participation figures by specialisation area.

Table 3.

Aragonese ecosystem 2014–2023 data by specialisation area.

The Energy and Green Fuels specialisation area emerges as the most prominent network within the Aragonese innovation ecosystem, representing 20% of all projects and accounting for over 21% of total funding. This is followed by the Health and Wellbeing sector, which secures nearly 19% of total funding, reinforcing its significance within the region’s research and innovation landscape.

Notably, a small number of specialisation areas dominate the funding distribution, with Energy, Health, Agri-Food, and Advanced Technologies collectively receiving over 65% of the ecosystem’s total funding. In contrast, Hydrogen, Artificial Intelligence, Security and Defence, and Water collectively account for only 10% of both the number of projects and total funding allocation.

Table 4 shows the classification by specialisation area of the projects from the EU Framework Program funded during the same period, as a comparison reference.

Table 4.

EU Framework Program non-Aragonese projects 2014–2023 data by specialisation area.

Reflecting broader European trends, Health and Wellbeing and Energy and Green Fuels dominate Aragón’s innovation ecosystem, each receiving around 40% of total funding—mirroring their weight at the EU level.

By contrast, Basic Science (notably particle physics) and Governance and Business Development are more prominent across Europe, driven by the EU’s strategic emphasis on commercializing research outcomes.

Advanced Technologies, Agri-Food, and Circular Economy represent about 10% of EU funding but exceed 20% in Aragón, indicating a stronger regional focus. Security and Defence, along with Water, show similar funding levels in both contexts, suggesting aligned policy agendas.

Notably, Hydrogen receives four times more proportional funding in Aragón than across Europe (4% vs. 1%). This highlights Aragón’s strategic bet on hydrogen, underpinned by dedicated infrastructure and innovation investments.

4.1.1. Key Entities’ Collaboration Analysis

To assess the collaborative dynamics of the Aragonese innovation ecosystem, this section analyses internal collaborations among four key Aragonese institutions, as identified in a previous research study (Rodríguez Ochoa et al., 2025), as well as their partnerships with major non-Aragonese entities participating in the ecosystem. Prior to analysing the results found, it is important to begin with a short description of these four key entities:

UNIZAR (University of Zaragoza, HES)—This is the leading higher education institution in Aragón and a key player in the regional innovation ecosystem. It plays a significant role in research and development, securing substantial public funding for projects at the regional, national, and European levels. UNIZAR acts as a major hub for knowledge generation, technology transfer, and collaboration with both public and private entities.

CIRCE (Research Centre for Energy Resources and Consumption, REC)—This is a private technology centre specialising in energy, digitalization and sustainability. It has a strong presence in European research programs and serves as a key bridge between academia and industry, supporting innovation in the energy transition and decarbonisation efforts.

ITA (Aragón Institute of Technology, REC)—This is a public research institute focused on applied technological development and industrial innovation. It provides support to businesses through R&D projects, technology transfer, and advanced engineering solutions, playing a strategic role in boosting Aragón’s industrial competitiveness and digital transformation.

AITIIP (AITIIP Foundation, REC)—This is a private technology centre specializing in advanced manufacturing, materials science, and circular economy solutions in the plastics sector. It supports industrial innovation by developing cutting-edge technologies in robotics, 3D printing, and sustainable materials, collaborating closely with companies in Aragón and across Europe.

Building on this information, the following tables provide a detailed overview of two key aspects of the Aragonese innovation ecosystem. Table 5 illustrates the intensity of collaboration among the region’s key institutions, highlighting the extent to which they engage in joint research and innovation initiatives. Table 6 shows the main external partners contributing to the ecosystem, assessing their levels of integration with Aragón’s leading research and innovation actors. This analysis offers valuable insights into both the internal dynamics of regional cooperation and the broader network of external collaborations that shape the region’s innovation landscape.

Table 5.

Number of common projects between the Aragonese innovation ecosystem key entities.

Table 6.

Collaborations between the non-Aragonese entities of the ecosystem and the key entities.

As Table 5 shows, the key players within Aragón’s innovation ecosystem engage in limited collaboration among themselves. However, among the few joint initiatives that do exist, private research centres have the highest number of projects in common with the four key entities, with CIRCE involved in 11 shared projects and AITIIP in eight. Notably, five of these projects involve direct collaboration between CIRCE and AITIIP. In relative terms, nearly one-fourth of the projects in which AITIIP participates are carried out in partnership with the other three key entities, highlighting this organisation’s greater dependence on these ties for its research activities.

Conversely, public innovation institutions appear less inclined to collaborate with the other key players. A possible explanation for this trend is the existence of specific regional funding programs that promote direct partnerships between public research organizations and private companies. These targeted calls may reduce the need for public entities to engage in knowledge exchange with other R&D agents, as they already have dedicated mechanisms for fostering innovation through industry collaborations.

On the other hand, Table 6 highlights that the principal non-Aragonese participants in the ecosystem are predominantly European research centres and universities. Notably, seven of these entities are based in Spain, with the Agencia Estatal Consejo Superior de Investigaciones Científicas (CSIC) emerging as the most integrated external partner, participating in 89 projects. Following CSIC, Fundación Tecnalia Research & Innovation and Universitat Politecnica de Valencia have significant involvement, engaging in 56 and 43 projects, respectively.

Beyond Spanish institutions, several prominent research centres stand out for their collaborations with Aragonese entities. Fraunhofer from Germany has participated in 79 projects, primarily collaborating with UNIZAR and ITA. The Greek Research Centre CERTH has engaged in 58 projects, mainly in partnership with CIRCE. Additionally, the French National Centre for Scientific Research (CNRS) and the Italian National Research Council (CNR) have been frequent collaborators with UNIZAR, participating in 52 and 45 projects, respectively. The French Alternative Energies and Atomic Energy Commission (CEA) has also been notably active, collaborating mainly with UNIZAR and CIRCE across 42 projects.

Among the top 20 collaborators, RINA Consulting S.p.A. from Italy is the sole corporate entity, participating in 40 projects, with a notable 38 collaborations involving CIRCE.

Within the Aragonese institutions, UNIZAR distinguishes itself by engaging in 161 collaborative projects with major non-Aragonese participants. CIRCE follows with 103 such collaborations. ITA, while less involved than UNIZAR and CIRCE, has still participated in 65 projects with all of the top 20 non-Aragonese entities. In contrast, AITIIP focuses on more specialised partnerships within its area of expertise, accounting for 22 collaborations with these leading external participants.

4.1.2. Analysis by Entity Type

Table 7 and Table 8 illustrate the distribution of funding and participations among different types of entities within the Aragonese innovation ecosystem, while Table 9 and Table 10 provide a comparative benchmark from the European Union Framework Program projects (Horizon 2020 and Horizon Europe) spanning the period 2014–2023, excluding those projects with Aragonese entities. The comparison offers critical insights into the alignment of the Aragonese ecosystem with broader European trends, highlighting structural strengths and potential gaps in collaboration patterns.

Table 7.

Funding distribution by entity type in the Aragonese ecosystem.

Table 8.

Participation distribution by entity type in the Aragonese ecosystem.

Table 9.

Funding distribution by entity type in the EU Framework Program projects.

Table 10.

Participation distribution by entity type in the EU Framework Program projects.

The distribution of funding across entity types in the Aragonese ecosystem (Table 7) reveals distinct patterns based on specialisation areas. Research organizations (REC) emerge as the most prominent funding recipients across nearly all domains, receiving on average 27.67% of total funding. This trend aligns with their role as key enablers of innovation, particularly in research-intensive areas such as Basic Science (33.30%), Biodiversity (27.97%), and Climate Change (33.84%). Higher education institutions (HES) also secure substantial funding (20.17% overall), with their strongest presence in Basic Science (43.39%), Biodiversity (48.81%), and Artificial Intelligence (29.01%).

In contrast, private companies (PRC) and SMEs (PRC-SME) exhibit higher participation in technology-driven sectors, with notable funding shares in Aerospace (55.83% PRC, 12.80% PRC-SME), Hydrogen (47.39% PRC, 21.47% PRC-SME), and Sustainable Mobility (29.72% PRC, 19.32% PRC-SME). These figures suggest a concentration of industrial innovation in high-tech and applied research fields, particularly those with strong market applications.

Public sector entities (PUB) display a more limited role, accounting for only 6.93% of total funding. Their involvement is slightly higher in governance-related fields, such as Water (24.77%), Cultural and Creative Industries (18.81%), and Health and Wellbeing (19.50%), likely reflecting public policy priorities and regulatory-driven research agendas.

Examining participation patterns (Table 8) reinforces these observations, demonstrating the degree to which different entity types engage in collaborative project networks. The research and higher education sectors again dominate, with HES (18.68%) and REC (20.55%) showing strong engagement across all domains. Notably, HES participation peaks in Basic Science (39.90%), Artificial Intelligence (22.10%), and Health and Wellbeing (28.57%), suggesting these areas benefit from strong academic involvement.

Private sector engagement follows a distinct pattern, with PRC (17.09%) and PRC-SME (23.53%) demonstrating a broader footprint in Advanced Technologies (ICT and Industry) (18.26% PRC, 32.16% PRC-SME), Hydrogen (27.02% PRC, 23.33% PRC-SME), and Security and Defence (19.17% PRC, 26.32% PRC-SME). These figures highlight the relevance of SMEs in the Aragonese ecosystem, positioning themselves as the entity type with most participation, even if, regarding funding, large companies and research centres and universities allocate greater amounts.

The comparison with the EU Framework Program (Table 9 and Table 10) provides further insight. In the broader European landscape, HES and REC exhibit stronger dominance, both in participation (50.84% HES and 27.93% REC) and funding allocation (51.93% HES and 31.70% REC). This highlights a greater reliance on academic and research institutions at the European level, where private sector participation in high-risk research remains lower. Conversely, PRC entities receive relatively higher funding in the Aragonese ecosystem (21.42% PRC versus 8.86% PRC in EU projects), indicating that industry-led innovation plays a more prominent role at the regional level.

Another takeaway from this analysis is the higher funding allocation of the Aragonese public sector and intermediary organizations (OTH) compared to EU benchmarks. Public institutions at the EU level secure an average of 2.53% of funding, compared to 6.93% in Aragón, suggesting a stronger regulatory and governance role at the regional level. Similarly, intermediary organisations (OTH) exhibit three times more involvement regionally (6.46%) than at the European scale (2.37%). The significant number of sectoral clusters in the Aragón region, coupled with their active participation in specific national funding calls essential for financial sustainability, may account for these figures. For instance, in 2023, the Ministry of Industry and Tourism allocated EUR 10.6 million to support 59 projects from Aragonese business associations through the Program for Supporting Innovative Business Clusters. This made Aragón the second-highest recipient of such funds among Spanish regions (El Periódico, 2023).

4.1.3. Advanced Technologies Analysis

Table 11, Table 12 and Table 13 show the top 10 entities with the highest amounts of funding achieved, participation in projects and coordinated initiatives, respectively in the Aragonese ecosystem and the specialisation area of Advanced Technologies, while Table 14, Table 15 and Table 16 show the same information for the benchmark from the European Union Framework Program.

Table 11.

Top 10 entities by funding achievement in Advanced Technologies within the Aragonese ecosystem.

Table 12.

Top 10 entities by number of projects in Advanced Technologies within the Aragonese ecosystem.

Table 13.

Top 10 entities by number of coordination actions in Advanced Technologies within the Aragonese ecosystem.

Table 14.

Top 10 entities by funding achievement in Advanced Technologies within the EU Framework Program projects.

Table 15.

Top 10 entities by number of projects in Advanced Technologies within the EU Framework Program projects.

Table 16.

Top 10 entities by number of coordination actions in Advanced Technologies within the EU Framework Program projects.

ITA emerges as the leading entity in Aragón in terms of funding secured, receiving EUR 22.3M, followed closely by the UNIZAR (EUR 19.6M) and BSH Electrodomésticos España (EUR 18.9M). These figures highlight the strong presence of both research institutions (REC) and higher education establishments (HES) in attracting project financing, with the private sector also playing a prominent role. Other notable recipients include AITIIP (EUR 10.5M) and CIRCE (EUR 7.3M), reinforcing the strategic position of private research centres in securing competitive project funding.

In terms of the number of participations, ITA again leads with 154 projects, followed by UNIZAR (106 projects). AITIIP is the most active private technology centre, with 36 project participations, while clusters and sector associations such as CAAR (automotive cluster, 25 projects) and ALIA (logistics cluster, 22 projects) demonstrate the role of intermediary organizations (OTH) in fostering industrial collaboration.

Coordination actions provide a measure of leadership within collaborative projects. As shown in Table 13, OTH organisations dominate coordination efforts, with sector clusters taking the top three positions, due to their role as promoters in Spanish national calls for innovative companies’ clusters. The presence large companies among the top coordinators highlights how industry-led initiatives play an integral role in project leadership. Interestingly, ITA (eight coordination actions) ranks lower in coordination than in funding and participation, suggesting a preference for participation over project leadership.

As shown in Table 14, at the European level, the dominance of major research and technology institutions is evident. Fraunhofer (EUR 147.1M, Germany), Interuniversity Microelectronics Centre (IMEC, EUR 116.6M, Belgium), and CEA (EUR 110.9M, France) lead in total funding received. Notably, Spanish representation is seen in Barcelona Supercomputing Center (EUR 35.1M) and Tecnalia (EUR 29.7M), highlighting Spain’s competitive position in supercomputing and applied research.

When compared to the top Aragonese recipients, it is evident that regional actors operate on a significantly smaller financial scale. ITA, Aragón’s highest-funded entity (EUR 22.3M), would rank outside the top 10 at the European level, demonstrating the funding gap between regional and EU-wide research networks.

Table 15 shows that Fraunhofer again leads in project participation (199 projects), followed by CEA (113 projects) and CNRS (113 projects). IMEC (95 projects) and Teknologian Tutkimuskeskus VTT (69 projects, Finland) further exemplify the role of major European research institutes in shaping technological advancement.

By comparison, the highest-ranked Aragonese entity, ITA (154 projects), would be third on the European list, demonstrating strong regional engagement despite funding disparities. UNIZAR (106 projects) also shows significant activity, reinforcing its role in Aragón’s innovation landscape.

Finally, Table 16 shows that European coordination efforts are also led by research organisations, with Fraunhofer (23 actions), CNRS (22 actions), and CEA (21 actions) demonstrating their leadership.

To summarise, a notable contrast emerges when comparing Aragon’s innovation ecosystem to the broader European Union framework. In Aragón, clusters and industry organizations predominantly lead coordination efforts, whereas at the EU level, public research institutions primarily assume project leadership roles.

4.1.4. Security and Defence Analysis

In contrast to the well-established Advanced Technologies sector, the Security and Defence domain in Aragón is currently in an emergent phase. Following the same format as the previous analysis, Table 17, Table 18 and Table 19 present the top 10 entities in Aragón in this specialisation area, ranked by funding achieved, number of projects, and coordination actions.

Table 17.

Top 10 entities by funding achievement in Security and Defence within the Aragonese ecosystem.

Table 18.

Top 10 entities by number of projects in Security and Defence within the Aragonese ecosystem.

Table 19.

Top 10 entities by number of coordination actions in Security and Defence within the Aragonese ecosystem.

The highest-funded entity in Aragon’s Security and Defence sector is INSTALAZA, a local private company (PRC) specializing in defence technologies, with a total funding of EUR 6.3 million. This stresses the role of industry-led innovation in this sector, a trend further reinforced by Equipos Móviles de Campaña ARPA (ARPA) (PRC-SME, EUR 2.45 million), another local specialized company ranked fourth after Fraunhofer (REC, EUR 4.6 million, Germany) and the French public entity Département des Hautes-Pyrénées (PUB, EUR 3.02 million, France). Among the main Aragonese key players, only UNIZAR is present, occupying the seventh position with EUR 2.14 million.

INSTALAZA also leads in project participation with eight projects, confirming its dominance in the regional ecosystem. UNIZAR (six projects) and ITA (five projects) further emphasize the role of academic and applied research centres.

Interestingly, multiple sectoral organizations (OTH) participate in two projects each, including the Agrupación Europea de Cooperación Territorial Espacio Portalet, ASAJA Alto Aragón, and Asociación Nacional de Maquinaria Agropecuaria, Forestal y de Espacios Verdes. This suggests a diverse range of actors contributing to security-related innovation, including those focused on agriculture, logistics, and environmental risk management.

INSTALAZA also emerges as the leading coordinator, heading six projects, reinforcing its strategic role in leading regional security initiatives (Table 17). Notably, various SMEs and specialised technology firms also take on leadership roles but with only a low number of projects.

Unlike Advanced Technologies specialisation area, where research institutions played a stronger coordination role, in Security and Defence, industry and public-private collaborations dominate.

Table 20, Table 21 and Table 22 present the top 10 entities in the EU Framework program Security and Defence projects based on the same three indicators.

Table 20.

Top 10 entities by funding achievement in Security and Defence within the EU Framework Program projects.

Table 21.

Top 10 entities by number of projects in Security and Defence within the EU Framework Program projects.

Table 22.

Top 10 entities by number of coordination actions in Security and Defence within the EU Framework Program projects.

At the European level, Fraunhofer (EUR 45.1M) leads security research funding, followed by CEA (EUR 36.7M) and CERTH (EUR 32.9M). The top 10 entities are dominated by research institutions and universities, which collectively secure the majority of EU funding.

By comparison, Aragonese entities receive significantly lower funding. The highest-funded Aragonese actor, INSTALAZA (EUR 6.3M), would not rank among the top 10 at the European level. This suggests regional industry-driven security innovation lacks integration into large-scale EU consortia, potentially limiting funding access and knowledge exchange.

Fraunhofer again leads in project participation (91 projects), followed by CERTH (65 projects) and CEA (64 projects). The Katholieke Universiteit Leuven (KU Leuven, HES, 57 projects, Belgium) and Netherlands Organization for Applied Scientific Research (REC, 46 projects, Netherlands) further highlight the strong role of research and applied science institutions in European security research. It is relevant to mention that two Spanish branches of a French company, ATOS Spain and ATOS IT Solutions and Services Iberia, are in the top 10, with 40 projects.

Again, Aragon’s leading entity, INSTALAZA, would rank outside the top 10 at the European level, reinforcing the need for greater integration of regional actors into EU-funded security projects.

Similarly to what happens in the Aragonese ecosystem, a large company, Engineering—Ingegneria Informatica S.p.A. (PRC, Italy, 15 coordination actions), is leading the coordination of projects. It is followed by CERTH (14 actions), KU Leuven (11 actions) and Fraunhofer (10 actions).

As can be seen, the Security and Defence specialisation area in Aragón displays a unique industry-led model, with local specialised companies playing a predominant role in project leadership and coordination. However, the relative lack of engagement with European research institutions and large-scale EU security initiatives suggests untapped potential.

4.2. Cohesion Properties

Table 23 displays the cohesion properties of the project networks classified by specialisation area, allowing for a comparative assessment of structural characteristics, thus providing insights into both the overall network connectivity and the local clustering characteristics that emerge in each area.

Table 23.

Specialisation area projects’ networks cohesion properties.

Specialisation areas vary widely in network size. Energy and Green Fuels hosts one of the largest networks with 2139 unique entities, followed by Agri-Food and Circular Economy (1820), and Advanced Technologies (1556). At the other end, Aerospace includes just 90 entities, and Security and Defence totals 213. Tie counts also differ sharply. Health and Wellbeing stands out with 43,392 ties among 1322 nodes—indicating a dense web of interactions—while Energy and Green Fuels also shows high connectivity with 27,544 ties. In smaller networks like Aerospace and Security and Defence, the number of ties is lower (682 and 718, respectively), although they may still be tightly knit due to their limited size. Below, the different metrics across specialisation areas are explained.

Average degree—the mean number of connections per node—reflects interaction intensity. Health and Wellbeing leads with 32.82, suggesting highly active collaboration. Sustainable Mobility (16.24) and Climate Change (14.59) also show strong linkages. In contrast, Cultural and Creative Industries (4.47) and Security and Defence (3.37) reflect sparser interactions.

The H-index, measuring both size and connectivity, further confirms these dynamics. Health and Wellbeing tops the list with 153, followed by Energy and Green Fuels (54), and Agri-Food and Circular Economy (53). Aerospace and Security and Defence, with H-indices of 15, show limited cohesion and reach.

Network density—the share of realized vs. possible ties—remains low in large networks like Advanced Technologies (0.0051) and Agri-Food and Circular Economy (0.0055), which is typical for large systems. Aerospace, however, displays the highest density (0.0851), consistent with tighter connections in smaller networks.

Connectedness, or how easily nodes can reach each other, varies widely. Aerospace scores 0.5363, suggesting strong overall linkage. Cultural and Creative Industries (0.0238) and Security and Defence (0.0247) show weak overall integration, hinting at isolated clusters.

Closure, which tracks tightly knit subgroups, is high in several networks. Security and Defence shows near-complete local clustering (0.9537), with similarly strong closure in Climate Change (0.9032) and Cultural and Creative Industries (0.9029). Advanced Technologies (0.6849) and Sustainable Mobility (0.6406) have moderate clustering.

Diameter—the longest shortest path between any two nodes—indicates network reach. Security and Defence (3) and Climate Change (4) offer compact paths for knowledge flow, while larger networks like Advanced Technologies and Health and Wellbeing (both 8) reflect longer communication chains.

Focusing on two priority areas, Advanced Technologies and Security and Defence reveal contrasting cohesion patterns. Advanced Technologies spans 1556 nodes and 12,284 ties, with an average degree of 7.89 and low density (0.0051), typical of large systems. Its moderate closure (0.6849), connectedness (0.2292), and high diameter (8) suggest moderate clustering but a dispersed overall structure.

In contrast, Security and Defence has fewer nodes (213) and ties (718) but much higher density (0.0159) and exceptional closure (0.9537). Its clusters are tightly knit but isolated, as shown by low connectedness (0.0247), lower average degree (3.37), and short diameter (3). While Advanced Technologies supports broader, distributed collaboration, Security and Defence reflects intense but siloed local networks.

Following the global cohesion analysis, Table 24 and Table 25 illustrate the average tie strengths between different actor types within the Advanced Technologies and Security and Defence networks. Tie strength is a proxy for the level of collaboration, with higher values indicating stronger financial or strategic connections.

Table 24.

Average tie strengths between the different entity types in the Advanced Technologies projects’ network.

Table 25.

Average tie strengths between the different entity types in the Security and Defence projects’ network.

In the Advanced Technologies network, tie strengths generally fall in the order of 108, with research entities (REC) displaying particularly robust internal collaboration—as evidenced by a REC–REC tie strength of 5.021 × 109—and strong crossties with both PUB and HES actors. In contrast, collaborations involving companies (PRC and PRC-SME) tend to be weaker, suggesting that their financial or strategic linkages are less pronounced.

Conversely, the Security and Defence network exhibits markedly higher tie strength values, predominantly in the order of 109 to 1010. In this network, the interactions among core actor types—specifically between PUB, HES and REC organizations—are particularly intense (with PUB–REC and HES–REC ties reaching approximately 1.04 × 1010 and 1.06 × 1010, respectively), indicating a very high level of collaborative integration. However, the OTH category in Security and Defence shows an anomalously low self-tie strength (6.316 × 10−2), suggesting that actors classified in this group may play a peripheral role in the network’s collaborative dynamics.

The integration of the cohesion metrics with the tie strength analyses reveals complementary insights into the collaborative dynamics of both Advanced Technologies and Security and Defence networks.

4.3. Centrality Properties

To deepen the understanding of network influence and structural positioning, this section analyses the centrality metrics of project networks classified by specialisation area. Table 26 presents the average centrality metrics for the different specialisation area networks. These measures quantify the influence and connectivity of entities within each network, providing a way to assess which fields exhibit the most centralised, highly connected, or influential actors.

Table 26.

Average centrality properties of the entities’ networks by specialisation area.

The average degree—a measure of direct ties per actor—is highest in the Health and Wellbeing network (7.525 × 1012), signalling dense interconnections. At the other end, Cultural and Creative Industries and Sectors has the lowest value (1.715 × 1011), indicating limited direct engagement among actors.

Average closeness centrality, which reflects how quickly actors can reach others in the network, is highest in Energy and Green Fuels (1.285 × 104) and Advanced Technologies (1.197 × 104). In contrast, Aerospace (4.162 × 102) and Security and Defence (8.346 × 102) show significantly lower accessibility.

For eigenvector centrality—indicating influence through connections to important nodes—Climate Change leads (2.363 × 10−2), while Agri-Food and Circular Economy trails behind (5.495 × 10−4), suggesting weaker influential linkages.

Average betweenness centrality, which captures how often actors serve as bridges, is highest in Energy and Green Fuels (735.2) and Agri-Food and Circular Economy (674.4). Security and Defence (1.127) and Cultural and Creative Industries (7.349) rank lowest, showing fewer intermediary roles.

These metrics highlight diverse structural dynamics and influence patterns across specialisation areas.

Focusing on the paper’s two priority areas, Advanced Technologies shows strong interconnectivity, with high average degree (8.864 × 1011) and closeness (1.197 × 104), confirming a broad, accessible network. Security and Defence, by comparison, has a lower average degree (5.507 × 1011) and closeness (8.346 × 102), pointing to a sparser, less accessible structure.

Notably, Security and Defence has a higher eigenvector centrality (1.394 × 10−2 vs. 3.655 × 10−3), meaning its key actors are linked to other influential nodes. However, its betweenness centrality is much lower (1.127 vs. 414.7), suggesting fewer bridging roles compared to Advanced Technologies.

In short, while Advanced Technologies benefits from distributed collaboration and strategic brokers, Security and Defence depends more on a few influential nodes. These differences offer clear policy insights for strengthening innovation and connectivity in each domain.

5. Discussion

Addressing the first research question, our analysis of participation, cohesion, and centrality metrics reveals key dynamics within Aragón’s innovation ecosystem. A few specialisation areas dominate project activity and funding. Energy and Green Fuels leads with over 20% of projects and 21% of funding, followed by Health and Wellbeing at 19%. Along with Agri-Food and Advanced Technologies, these four areas capture two-thirds of the total funding, suggesting that established networks—led by research centres, universities, and major companies—are better aligned with regional, national, and EU funding mechanisms (Foray, 2016). However, this concentration raises concerns about over-specialisation and path dependency, which could hinder adaptation as priorities or technologies shift (Isaksen & Trippl, 2016).

In contrast, emerging areas such as Hydrogen, Artificial Intelligence, Security and Defence, and Water together receive only 10% of total projects and funding. This is surprising given recent strategic emphasis and investment in Hydrogen and Water (Aragón Digital, 2025; Aragón Noticias, 2024). The low uptake points to barriers in funding access, readiness, or collaboration—echoing previously identified misalignments between S3 goals and funding instruments (Esparza-Masana, 2022).

From an RIS3 perspective, this imbalance signals coordination failures (Rossoni et al., 2024), since insufficient alignment among actors leaves many potential partnerships unexplored. Some strategic fields struggle to gain traction due to weak engagement during S3 design or limited actor alignment. These findings support the need for tailored approaches: one-size-fits-all policies fail to address structural disparities across specialisation areas.

Network cohesion metrics deepen this view. Larger networks like Health and Wellbeing and Energy and Green Fuels show many nodes and ties but low density—many connections remain untapped. Smaller domains like Aerospace show higher density and stronger local ties but risk becoming siloed, as seen in fragmented metropolitan RIS contexts (Tödtling & Trippl, 2005) High closure values across several networks also point to tight internal clusters, although they are not always well integrated externally.

Centrality analysis shows mature areas are driven by multiple influential actors—typically large research centres and businesses—while smaller domains depend on a few key players, which may restrict diversity and the discovery of new opportunities. These insights reinforce the need for specialisation-specific policy tools: some areas need better outreach; others require stronger inter-cluster bridges (Tödtling & Trippl, 2005).

In Advanced Technologies, ITA leads in funding and participation, with UNIZAR playing a central academic role. AITIIP and CIRCE bridge research and industry, while BSH represents strong private engagement. Cluster organisations often coordinate consortia but tend to act as collaborators rather than leaders, highlighting opportunities to strengthen local leadership in major initiatives.

In contrast, the Security and Defence network is industry-led. Firms like INSTALAZA and ARPA drive activity, with limited public research involvement beyond UNIZAR and ITA. Collaboration is sparse and skewed towards public entities, creating a closed network with weak SME integration. As in other regions with organisational thinness (Isaksen & Trippl, 2016), targeted policies—such as public–private consortia and SME support schemes—are needed to open access and strengthen links to larger European networks.

The analysis of the second research question shows that key institutions like UNIZAR, CIRCE, ITA, and AITIIP play central—but uneven—roles in Aragón’s innovation ecosystem. While they mobilize research, drive industrial engagement, and form collaborative networks, direct partnerships between them remain rare. For example, CIRCE and AITIIP collaborated on only five projects over the past decade, and their links to ITA and UNIZAR are even more limited. Funding models that favour public–private ties may discourage broader R&D collaboration, reinforcing silos despite a dense local innovation landscape—an issue observed in other regions (Isaksen et al., 2022). As a result, ITA and CIRCE rarely combine their applied research strengths, missing key opportunities for collaboration. This reflects the weak inter-organisational ties often noted in the literature on quadruple helix actors (Foray, 2014).

Externally, these institutions act as Aragón’s gateways to global networks. UNIZAR partners with top-tier universities and research centres like CNRS and CEA, while CIRCE links local firms to international leaders in energy and digitalisation (e.g., Fraunhofer, CERTH). ITA, although less connected abroad, has joined over 60 projects with global players. AITIIP focuses mainly on regional partnerships in advanced manufacturing and plastics, reinforcing its local anchoring.

This work builds on our earlier research (Rodríguez Ochoa et al., 2025), enriching the theoretical perspective by expanding the focus from social capital to structural dynamics within Aragón’s innovation network. Network metrics reveal strong ties in mature domains like Energy and Green Fuels, but fragmented structures in emerging ones like Security and Defence. These differences confirm that one-size-fits-all strategies fall short and that place-based policies are needed to unlock underused potential (Demblans et al., 2020; Molica et al., 2025; Suedekum, 2025).

Missed opportunities are especially evident in underrepresented areas like Water and Hydrogen, which have seen significant public investment but remain weakly positioned in competitive funding. Targeted policies could bridge these gaps by connecting regional capabilities with market opportunities (Asheim, 2019; McCann, 2023).

At the same time, our analysis highlights the evolving nature of entrepreneurial discovery in Aragón’s transition from the 2014–2020 RIS3 to the 2021–2027 framework. We also observe that, while many entities participate in multiple projects, only a few act as consistent bridges between local and European innovation spaces. This raises concerns about the inclusiveness of Aragón’s entrepreneurial discovery process (EDP), which requires broad engagement and strong external ties to remain dynamic (Gheorghiu et al., 2016; Laranja et al., 2022; Marinelli & Perianez, 2017; Szerb et al., 2020). Multi-level SNA reveals sector-specific gaps that limit discovery and suggests the need for integrative tools—like inclusive funding calls and consortium-building programs—to diversify participation and sustain learning (Karo et al., 2017; Szerb et al., 2020). Bringing in actors from outside Aragón helps local stakeholders tap frontier expertise and fresh ideas, boosting entrepreneurial discovery and keeping innovation paths adaptive and outward-looking.

These findings support the broader shift toward “S3 2.0,” which emphasizes sustainability, inclusiveness, and resilience (Buyukyazici, 2023; European Committee of the Regions et al., 2023; Foray, 2023). Well-connected areas like Energy and Green Fuels already embed environmental goals, while fragmented sectors lag behind. Metrics like high closure or uneven centrality can guide targeted action to strengthen underperforming areas (Arranz et al., 2022; Arranz & Arroyabe, 2023).

Inclusion also matters. Emerging domains like Security and Defence lack the actor density and bridging entities found in more mature sectors, echoing patterns in other developing regions (Yue et al., 2024). Broadening participation—from SMEs to civil society and local administrations—can enrich innovation processes and build agility (Torre, 2019). Collaborative calls that prioritise underrepresented actors could help bring more diverse knowledge into play.

Finally, resilience is now essential. Regions must anticipate economic or environmental shocks. Our SNA framework supports this by identifying over-dependence on single actors and enabling policy rebalancing. For instance, in Security and Defence, leadership is overly concentrated among a few firms. In contrast, in Advanced Technologies, the challenge lies in reducing central actor dominance and promoting cross-sector partnerships (Barbero et al., 2022; Janošec et al., 2024; McCann, 2023; Moujaes, 2024).

These insights align with the gaps flagged in Aragón’s 2021–2027 S3 strategy: fragmented R&D efforts, limited inter-institutional collaboration, and insufficient public support. Despite the influence of major institutions, weak internal ties (as shown in Table 5) suggests that overlapping competencies and dispersed efforts may be diluting their overall collective impact (McPhillips, 2020). This fragmentation—combined with low outreach capacity and uneven access to funding—especially affects SMEs and peripheral areas. The fact that nearly 60% of local organisations report receiving no public R&D support highlights the need for stronger intermediary networks and more accessible innovation instruments(Rossoni et al., 2024).