Economic Clues to Crime: Insights from Mongolia

Abstract

1. Introduction

2. Literature Review

Methodological Issues

3. Data and Methodology

3.1. Theoretical Basis of the Economic Model of Crime

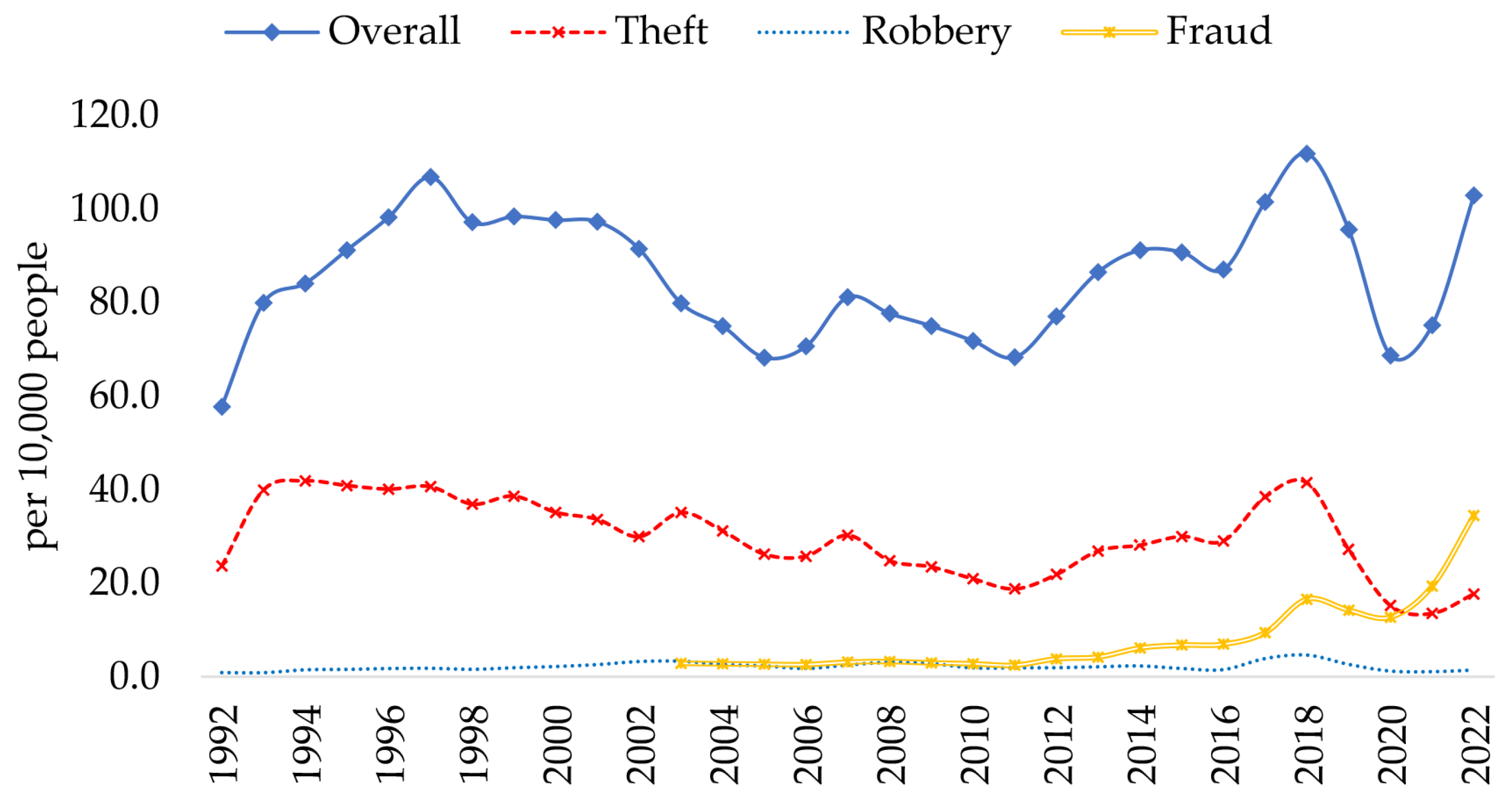

3.2. Data

3.3. Econometric Methodology for Estimating the Economic Model of Crime

3.3.1. Testing the Stationarity of Time-Series Data

3.3.2. Long-Run Relationships: Cointegration

3.3.3. Cointegration Testing

3.3.4. Error Correction Model (ECM)

4. Analysis and Results

4.1. Stationarity of Variables

4.2. Cointegration Test Results

4.3. Long-Run Equilibrium Relationships

4.4. Short-Run Dynamics and Adjustment Effects

5. Discussion and Conclusions

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Acknowledgments

Conflicts of Interest

References

- Atmadi, A., Tarigan, N. R., Negara, I. P. A. B. P. C. N., Syalaisa, N., & Ismail, M. I. A. (2024). Linear mixed model approach: The effect of poor people & unemployment rate on various types of crime in 34 provinces in Indonesia. International Journal of Applied Mathematics, Sciences, and Technology for National Defense, 2(1), 37–48. [Google Scholar] [CrossRef]

- Becker, G. S. (1968). Crime and punishment: An economic approach. Journal of Political Economy, 76(2), 169–217. [Google Scholar] [CrossRef]

- Britt, C. L. (1994). Crime and unemployment among youths in the United States, 1958–1990. American Journal of Economics and Sociology, 53(1), 99–109. [Google Scholar] [CrossRef]

- Britto, D. G. C., Pinotti, P., & Sampaio, B. (2022). The effect of job loss and unemployment insurance on crime in Brazil. Econometrica, 90(4), 1393–1423. [Google Scholar] [CrossRef]

- Buonanno, P., & Montolio, D. (2008). Identifying the socio-economic and demographic determinants of crime across Spanish provinces. International Review of Law and Economics, 28(2), 89–97. [Google Scholar] [CrossRef]

- Cameron, S. (1988). The economics of crime deterrence: A survey of theory and evidence. Kyklos, 41(2), 301–323. [Google Scholar] [CrossRef]

- Cantor, D., & Land, K. C. (1985). Unemployment and crime rates in the post-world War II United States: A theoretical and empirical analysis. American Sociological Review, 50(3), 317–332. [Google Scholar] [CrossRef]

- Coccia, M., Cohn, E. G., & Kakar, S. (2024). How immigration, level of unemployment, and income inequality affect crime in Europe. Crime, Law and Social Change, 1, 1–23. [Google Scholar] [CrossRef]

- Costantini, M., Meco, I., & Paradiso, A. (2018). Do inequality, unemployment and deterrence affect crime over the long run? Regional Studies, 52(4), 558–571. [Google Scholar] [CrossRef]

- Dhiri, S., Brand, S., Harries, R., & Price, R. (1999). Modelling and predicting property crime trends in england and wales. Home Office. [Google Scholar] [CrossRef]

- Dickey, D. A., & Fuller, W. A. (1979). Distribution of the estimators for autoregressive time series with a unit root. Journal of the American Statistical Association, 74(366a), 427–431. [Google Scholar] [CrossRef]

- Ehrlich, I. (1973). Participation in illegitimate activities: A theoretical and empirical investigation. Journal of Political Economy, 81(3), 521–565. [Google Scholar] [CrossRef]

- Engle, R. F., & Granger, C. W. J. (1987). Cointegration and error correction: Representation, estimation, and testing. Econometrica, 55(2), 251–276. [Google Scholar] [CrossRef]

- Engle, R. F., & Granger, C. W. J. (Eds.). (1991). Long-run economic relationships: Readings in cointegration. Oxford University Press. [Google Scholar]

- Engle, R. F., & Yoo, B. S. (1987). Forecasting and testing in co-integrated systems. Journal of Econometrics, 35(1), 143–159. [Google Scholar] [CrossRef]

- Fallahi, F., Pourtaghi, H., & Rodríguez, G. (2012). The unemployment rate, unemployment volatility, and crime. International Journal of Social Economics, 39(6), 440–448. [Google Scholar] [CrossRef]

- Greenberg, D. F. (2001). Time series analysis of crime rates. Journal of Quantitative Criminology, 17(4), 291–327. [Google Scholar] [CrossRef]

- Hale, C., & Sabbagh, D. (1991). Testing the relationship between unemployment and crime: A methodological comment and empirical analysis using time series data from england and wales. Journal of Research in Crime and Delinquency, 28(4), 400–417. [Google Scholar] [CrossRef]

- Han, L. (2010). Economic analyses of crime in england and wales [Doctoral dissertation, University of Birmingham]. [Google Scholar]

- Hendry, D. F. (1986). Econometric modelling with cointegrated variables: An overview. Oxford Bulletin of Economics and Statistics, 48(3), 201–212. [Google Scholar] [CrossRef]

- Janko, Z., & Popli, G. (2015). Examining the link between crime and unemployment: A time-series analysis for Canada. Applied Economics, 47(37), 4007–4019. [Google Scholar] [CrossRef]

- Jawadi, F., Mallick, S. K., Cheffou, A. I., & Augustine, A. (2019). Does unemployment matter for crime? New evidence from europe and the United States. Economic Modelling, 81, 381–397. [Google Scholar] [CrossRef]

- Johansen, S. (1988). Statistical analysis of cointegration vectors. Journal of Economic Dynamics and Control, 12(2–3), 231–254. [Google Scholar] [CrossRef]

- Johansen, S., & Juselius, K. (1990). Maximum likelihood estimation and inference on cointegration—With applications to the demand for money. Oxford Bulletin of Economics and Statistics, 52, 169–210. [Google Scholar] [CrossRef]

- Levitt, S. D. (1998). Why do increased arrest rates appear to reduce crime: Deterrence, incapacitation, or measurement error? Economic Inquiry, 36(3), 353–372. [Google Scholar] [CrossRef]

- Levitt, S. D. (2001). Alternative strategies for identifying the link between unemployment and crime. Journal of Quantitative Criminology, 17, 377–390. [Google Scholar] [CrossRef]

- Lucas, H. (2024). Crime, inflation, & unemployment in american cities: A time series analysis [Master’s thesis, Tarleton State University]. [Google Scholar]

- MacKinnon, J. G. (1991). Critical values for cointegration tests. In R. F. Engle, & C. W. J. Granger (Eds.), Long-run economic relationships: Readings in cointegration (pp. 267–276). Oxford University Press. [Google Scholar]

- MacKinnon, J. G. (1996). Numerical distribution functions for unit root and cointegration tests. Journal of Applied Econometrics, 11(6), 601–618. [Google Scholar] [CrossRef]

- Maddah, M. (2013). The effect of unemployment and income inequality on crimes: A time series analysis. International Journal of Economics Research, 4(2), 37–42. [Google Scholar]

- Mkonza, Z. B., & Zungu, L. T. (2024). Investigating the dynamic impact of socioeconomic issues on crimes: A comparison of newly democratized countries. Preprints. [Google Scholar] [CrossRef]

- Nagin, D. S. (2013). Deterrence in the twenty-first century. Crime and Justice, 42(1), 199–263. [Google Scholar] [CrossRef]

- Nordin, M., & Almén, D. (2017). Long-term unemployment and crime: Evidence from Sweden. Empirical Economics, 53(2), 367–389. [Google Scholar] [CrossRef]

- Ojo, T. J., Omojuwa, O., & Oludare, K. M. (2021). Unemployment and crime rate nexus: An empirical evidence from Nigeria. Journal of Economics and Policy Analysis, 6(2), 45–66. [Google Scholar]

- Phillips, J., & Land, K. C. (2012). The link between unemployment and crime rate fluctuations: An analysis at the county, state, and national levels. Social Science Research, 41(3), 681–694. [Google Scholar] [CrossRef] [PubMed]

- Saputra, S. A., & Widodo, W. (2023). The impact of poverty, economic inequality, and unemployment on crime rates in Central Java Province from 2000 to 2021. Journal of Economic Education, 12(1), 113–124. Available online: https://journal.unnes.ac.id/sju/index.php/jeec/article/view/74064 (accessed on 15 December 2024).

- Saridakis, G. (2004). Violent crime in the united states of America: A time-series analysis between 1960–2000. European Journal of Law and Economics, 18(3), 203–221. [Google Scholar] [CrossRef]

- Tang, C. F. (2009). The linkages among inflation, unemployment and crime rates in Malaysia. International Journal of Economics and Management, 3(1), 50–61. [Google Scholar]

- Wang, X., & Hu, S. (2021). Analysis of the relationship between unemployment and crime rate in China. In Proceedings of the 2021 international conference on social development and media communication (SDMC 2021) (Vol. 631, pp. 665–670). Atlantis Press. [Google Scholar] [CrossRef]

| Variables | Description | Source | Expected Sign |

|---|---|---|---|

| Dependent | Crime: Crime rates measured as incidents per 10,000 people | NSO | |

| Theft: Incidents of theft per 10,000 people | NSO | ||

| Robbery: Incidents of robbery per 10,000 people | NSO | ||

| Fraud: Incidents of fraud per 10,000 people | NSO | ||

| Independent | Detec: Probability of arrest measured by detection rate | GPD | (−) |

| Custo: Number of incarcerated individuals per 1000 people | GACD | (−) | |

| Unemp: Unemployment rate | NSO | (+) or (−) |

| Test Statistics at Level | Test Statistics at First Difference | |

|---|---|---|

| ln(Crime) | −2.26 | −2.93 ** |

| ln(Theft) | −2.75 | −4.54 ** |

| ln(Robbery) | −0.68 | −5.84 ** |

| ln(Fraud) | 1.34 | −2.42 * |

| ln(Detect) | −2.53 | −6.06 ** |

| Custom | −2.24 | −5.77 ** |

| Unemp | −2.59 | −6.83 ** |

| Dependent Variable | Residuals Test Statistic |

|---|---|

| ln(Crime) | −3.30 ** |

| ln(Theft) | −3.01 ** |

| ln(Robbery) | −4.15 ** |

| ln(Fraud) | −4.05 ** |

| Dependent var. | ln(Crime) | ln(Theft) | ln(Robbery) | ln(Fraud) |

|---|---|---|---|---|

| Const | 4.647 ** | 3.519 ** | 2.121 ** | 4.205 ** |

| (0.208) | (0.325) | (0.426) | (0.662) | |

| Detec | −0.002 | −0.006 | −0.017 ** | 0.0007 |

| (0.002) | (0.004) | (0.005) | (0.0067) | |

| ln(Custo) | −0.174 | −0.031 | 0.303 | −1.778 ** |

| (0.117) | (0.183) | (0.239) | (0.285) | |

| Unemp | 0.021 | 0.087 ** | −0.073 + | −0.513 * |

| (0.019) | (0.030) | (0.040) | (0.192) | |

| Unemp · D | −0.024 | −0.087 ** | 0.010 | 0.339 * |

| (0.015) | (0.023) | (0.030) | (0.133) | |

| R-squared | 0.192 | 0.430 | 0.425 | 0.841 |

| Obs. number | 31 | 31 | 31 | 20 |

| Dep. Variables | ln(Crime) | ln(Theft) | ln(Robbery) | ln(Fraud) |

|---|---|---|---|---|

| Const | 0.005 | −0.008 | 0.002 | 0.108 |

| (0.020) | [0.031] | (0.050) | (0.055) | |

| ln(Crime)t−1 | −0.453 * | |||

| (0.207) | ||||

| ln(Theft)t−1 | 0.547 * | |||

| [0.254] | ||||

| (Detec) | −0.0008 | −0.002 | −0.791 ** | 0.001 |

| (0.0019) | [0.005] | (0.238) | (0.004) | |

| ln(Custo) | −0.184 | −0.357 * | 0.100 | −0.406 |

| (0.128) | [0.169] | (0.296) | (0.285) | |

| (Unemp) | −0.001 | 0.021 | −0.391 | 0.160 |

| (0.0237) | [0.020] | (0.350) | (0.457) | |

| (Unemp) · D | −0.008 | −0.034 | 0.449 | −0.205 |

| (0.025) | [0.024] | (0.371) | (0.457) | |

| −0.484 ** | −0.487 ** | −0.584 * | −0.601 * | |

| (0.158) | [0.186] | (0.233) | (0.224) | |

| R-squared | 0.373 | 0.400 | 0.504 | 0.403 |

| Obs. number | 29 | 29 | 28 | 19 |

| Jarque-Bera test stat | 0.292 | 1.096 | 1.643 | 0.861 |

| LM test stat | 1.805 | 0.358 | 0.626 | 0.560 |

| Heteroskedasticity test stat | 1.778 | 3.093 * | 1.144 | 0.959 |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2025 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Ganbold, D.; Jamsranjav, E.; Kim, Y.-R.; Jargalsaikhan, E. Economic Clues to Crime: Insights from Mongolia. Economies 2025, 13, 160. https://doi.org/10.3390/economies13060160

Ganbold D, Jamsranjav E, Kim Y-R, Jargalsaikhan E. Economic Clues to Crime: Insights from Mongolia. Economies. 2025; 13(6):160. https://doi.org/10.3390/economies13060160

Chicago/Turabian StyleGanbold, Dagvasuren, Enkhbayar Jamsranjav, Young-Rae Kim, and Erdenechuluun Jargalsaikhan. 2025. "Economic Clues to Crime: Insights from Mongolia" Economies 13, no. 6: 160. https://doi.org/10.3390/economies13060160

APA StyleGanbold, D., Jamsranjav, E., Kim, Y.-R., & Jargalsaikhan, E. (2025). Economic Clues to Crime: Insights from Mongolia. Economies, 13(6), 160. https://doi.org/10.3390/economies13060160