Unlocking Regional Economic Growth: How Industry Sector and Mesoeconomic Determinants Influence Small Firm Scaling

Abstract

1. Introduction

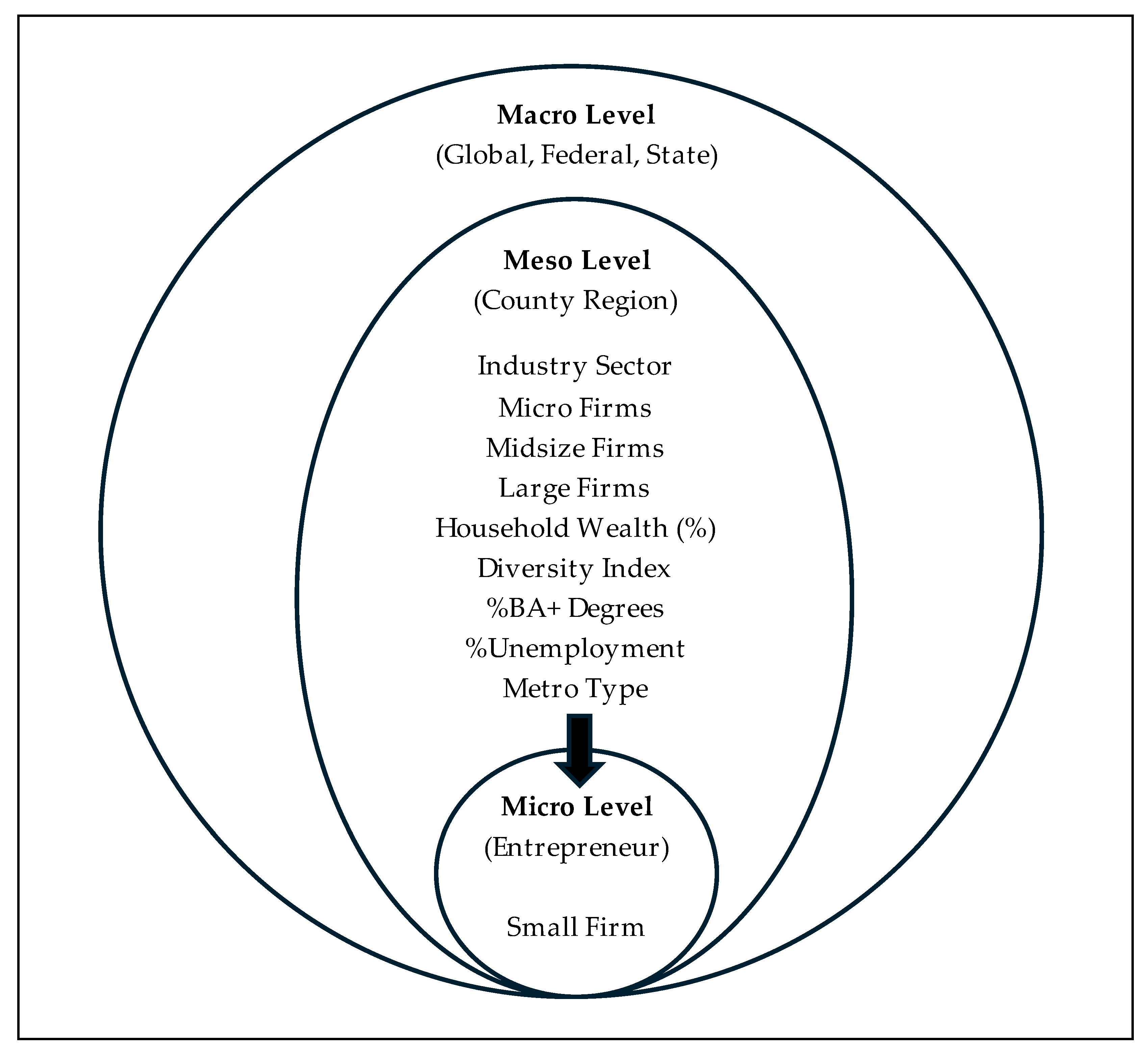

1.1. Micro-, Meso-, and Macroeconomic Perspectives on Scaling Small Firms

1.2. Guiding Research Questions

1.3. Importance of the Current Study

1.4. Background

1.4.1. Industrial Sector

1.4.2. Micro Firms

1.4.3. Midsize Firms

1.4.4. Large Firms

1.4.5. BA+ Degrees

1.4.6. Household Wealth

1.4.7. Unemployment Rate

1.4.8. Diversity Index

1.4.9. Metro Type

2. Methods

2.1. Data Sources and Variables

2.2. Research Design

β4Household Wealthi + β5Diversity Indexi + β6%BA Degreesi +

β7%Unemploymenti + β8Metro Typei + εi

3. Results

3.1. Small Firms Scalability by Sector

3.2. Small Business Scalability by Regional Context

4. Discussion

4.1. Assumptions and Limitations

4.2. Contributions to Regional Development: Policy and Practice

- Urban Regions: Policymakers should support Midsize Firms through public–private innovation clusters that foster collaboration between universities, government agencies, and businesses. While urban areas benefit from dense business networks, they may also require policies to reduce congestion costs and improve access to skilled labor.

- Suburban Regions: Policymakers should develop advanced skill-based workforce training programs that align with regional industry needs to address labor mismatches and enhance small firm scalability. As transition zones with mixed industry compositions, suburban areas may also require flexible business support services to sustain long-term economic growth.

- Rural Regions: Policymakers should prioritize infrastructure investments, particularly in broadband access, transportation networks, and targeted funding to stimulate entrepreneurial activity. However, rural areas face challenges such as low population density and limited financial resources, necessitating public investments in digital infrastructure and local entrepreneurship initiatives.

4.3. Future Research Within the Context of the Latest Studies on Scaling Firms

5. Conclusions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

References

- Abegaz, M. B., Debela, K. L., & Hundie, R. M. (2023). The effect of governance on entrepreneurship: From all income economies perspective. Journal of Innovation and Entrepreneurship, 12(1), 1–18. [Google Scholar] [CrossRef]

- Aghion, P., & Howitt, P. W. (2025). The economics of growth. MIT Press. [Google Scholar]

- Ahsan, M., Adomako, S., & Mole, K. F. (2021). Perceived institutional support and small venture performance: The mediating role of entrepreneurial persistence. International Small Business Journal, 39(1), 18–39. [Google Scholar] [CrossRef]

- Arrak, K., Kaasa, A., & Varblane, U. (2020). Regional cultural context as a determinant of entrepreneurial behaviour: The case of Germany. The Journal of Entrepreneurship, 29(1), 88–118. [Google Scholar] [CrossRef]

- Arshed, N., Rauf, R., & Bukhari, S. (2024). Empirical contribution of human capital in entrepreneurship. Global Business Review, 25(3), 683–704. [Google Scholar] [CrossRef]

- Audretsch, D. B., Belitski, M., & Theodoraki, C. (2024). Micro and macro factors of firm scaling. Technological Forecasting and Social Change, 202, 123312. [Google Scholar] [CrossRef]

- Bakhtiari, S., Breunig, R., Magnani, E., & Zhang, Y. (2020). Financial constraints and small and medium enterprises: A review. IZA Discussion Papers #12936. Institute of Labor Economics (IZA). Available online: https://hdl.handle.net/10419/215332 (accessed on 10 January 2025).

- Barnett, M. L., Gilbert, B. A., Post, C., & Robinson, J. A. (2024). Strengthening our cities: Exploring the intersection of ethics, diversity and inclusion, and social innovation in revitalizing urban environments. Journal of Business Ethics, 189(4), 647–653. [Google Scholar] [CrossRef]

- Bauman, A., & Lucy, C. (2021). Enhancing entrepreneurial education: Developing competencies for success. The International Journal of Management Education, 19(1), 100293. [Google Scholar] [CrossRef]

- Bazen, S. (2011). Econometric methods for labour economics. Oxford University Press. [Google Scholar]

- Beckmann, M., Garkisch, M., & Zeyen, A. (2021). Together we are strong? A systematic literature review on how SMEs use relation-based collaboration to operate in rural areas. Journal of Small Business & Entrepreneurship, 35(4), 515–549. [Google Scholar] [CrossRef]

- Begimkulov, E., & Darr, D. (2023). Scaling strategies and mechanisms in small and medium enterprises in the agri-food sector: A systematic literature review. Frontiers in Sustainable Food Systems, 7, 1169948. [Google Scholar] [CrossRef]

- Belitski, M., Stettler, T., Wales, W., & Martin, J. (2023). Speed and scaling: An investigation of accelerated firm growth. Journal of Management Studies, 60(3), 639–687. [Google Scholar] [CrossRef]

- Bouchouicha, R., & Vieider, F. M. (2019). Growth, entrepreneurship, and risk-tolerance: A risk-income paradox. Journal of Economic Growth, 24(3), 257–282. [Google Scholar] [CrossRef]

- Brown, P. (2024). Education, opportunity and the future of work in the fourth industrial revolution. British Journal of Sociology of Education, 45(4), 475–493. [Google Scholar] [CrossRef]

- Cainelli, G., Giannini, V., & Iacobucci, D. (2022). How local geography shapes firm geography. Entrepreneurship & Regional Development, 34(9–10), 955–976. [Google Scholar] [CrossRef]

- Cheah, J., Leong, S. Y., & Fernando, Y. (2023). Innovation strategies and organizational performance: The moderating role of company size among small-and medium-sized companies. Benchmarking: An International Journal, 30(9), 2854–2868. [Google Scholar] [CrossRef]

- Clayton, P., Feldman, M., & Montmartin, B. (2024). Entrepreneurial finance and regional ecosystem emergence. Small Business Economics, 62(4), 1493–1521. [Google Scholar] [CrossRef]

- Coviello, N., Autio, E., Nambisan, S., Patzelt, H., & Thomas, L. D. (2024). Organizational scaling, scalability, and scale-up: Definitional harmonization and a research agenda. Journal of Business Venturing, 39(5), 106419. [Google Scholar] [CrossRef]

- Crouzet, N., & Mehrotra, N. R. (2020). Small and large firms over the business cycle. American Economic Review, 110(11), 3549–3601. Available online: https://www.aeaweb.org/articles?id=10.1257/aer.20181499 (accessed on 10 January 2025). [CrossRef]

- Daniel, L. J., de Villiers Scheepers, M. J., Miles, M. P., & de Klerk, S. (2022). Understanding entrepreneurial ecosystems using complex adaptive systems theory: Getting the big picture for economic development, practice, and policy. Entrepreneurship & Regional Development, 34(9–10), 911–934. [Google Scholar] [CrossRef]

- Dopfer, K., Foster, J., & Potts, J. (2004). Micro-meso-macro. Journal of Evolutionary Economics, 14(3), 263–279. [Google Scholar] [CrossRef]

- Elsner, W., & Heinrich, T. (2011). Coordination on “meso”-levels: On the co-evolution of institutions, networks and platform size. In S. Mann (Ed.), Sectors matter! (pp. 115–163) Springer. [Google Scholar] [CrossRef]

- Fotopoulos, G. (2023). Knowledge spillovers, entrepreneurial ecosystems and the geography of high growth firms. Entrepreneurship Theory and Practice, 47(5), 1877–1914. [Google Scholar] [CrossRef]

- Fujita, M., & Mori, T. (2005). Frontiers of new economic geography. Papers in Regional Science, 84(3), 377–405. [Google Scholar] [CrossRef]

- Garcia-Martinez, L. J., Kraus, S., Breier, M., & Kallmuenzer, A. (2023). Untangling the relationship between small and medium-sized enterprises and growth: A review of extant literature. International Entrepreneurship and Management Journal, 19, 455–479. [Google Scholar] [CrossRef]

- Gartner. (2025, March 20). Small and midsize business (SMB). Available online: https://www.gartner.com/en/information-technology/glossary/smbs-small-and-midsize-businesses (accessed on 20 March 2025).

- Gupta, R. (2024). Untangling the nexus of entrepreneurship and unemployment: A bibliometric review. Journal of Global Entrepreneurship Research, 14(1), 1–15. [Google Scholar] [CrossRef]

- Hanifzadeh, F., Talebi, K., & Jafari-Sadeghi, V. (2024). Scalability of startups: The impact of entrepreneurial teams. Journal of Global Entrepreneurship Research, 14(1), 1–21. [Google Scholar] [CrossRef]

- Hartman, J. B., & Kear, M. T. (2024). Governing by entrepreneurship: Entrepreneurial ecosystems and socio-spatial difference. Competition & Change, 28(1), 209–227. [Google Scholar] [CrossRef]

- Hvolkova, L., Klement, L., Klementova, V., & Kovalova, M. (2019). Barriers hindering innovations in small and medium-sized enterprises. Journal of Competitiveness, 11(2), 51–67. [Google Scholar] [CrossRef]

- Kraus, S., McDowell, W., Ribeiro-Soriano, D. E., & Rodríguez-García, M. (2021). The role of innovation and knowledge for entrepreneurship and regional development. Entrepreneurship & Regional Development, 33(3–4), 175–184. [Google Scholar] [CrossRef]

- Krugman, P. (1991). Increasing returns and economic geography. Journal of Political Economy, 99(3), 483–499. [Google Scholar] [CrossRef]

- Lane, J. N., Leonardi, P. M., Contractor, N. S., & DeChurch, L. A. (2024). Teams in the digital workplace: Technology’s role for communication, collaboration, and performance. Small Group Research, 55(1), 139–183. [Google Scholar] [CrossRef]

- Lee, Y. S. (2017). Entrepreneurship, small businesses and economic growth in cities. Journal of Economic Geography, 17(2), 311–343. [Google Scholar] [CrossRef]

- Li, Q., Chen, H., Chen, Y., Xiao, T., & Wang, L. (2023). Digital economy, financing constraints, and corporate innovation. Pacific-Basin Finance Journal, 80, 102081. [Google Scholar] [CrossRef]

- Lucas, R. E. (1988). On the mechanics of economic development. Journal of Monetary Economics, 22(1), 3–42. [Google Scholar] [CrossRef]

- Malik, S., Alkhaldi, A., Salamzadeh, A., & Mantas, C. (2024). A systematic literature review on home-based businesses: Two decades of research. Journal of Family Business Management, 14(6), 1136–1152. [Google Scholar] [CrossRef]

- Mansikkamäki, S. (2023). Firm growth and profitability: The role of age and size in shifts between growth–profitability configurations. Journal of Business Venturing Insights, 19, e00372. [Google Scholar] [CrossRef]

- Matray, A. (2021). The local innovation spillovers of listed firms. Journal of Financial Economics, 141(2), 395–412. [Google Scholar] [CrossRef]

- Mazzoni, C. (2024). Firms, industries, markets: The micro, meso, and macro relationships in economic thought and “turning points. Palgrave Macmillan. [Google Scholar] [CrossRef]

- McGuinness, S., Pouliakas, K., & Redmond, P. (2018). Skills mismatch: Concepts, measurement and policy approaches. Journal of Economic Surveys, 32(4), 985–1015. [Google Scholar] [CrossRef]

- Munyo, I., & Veiga, L. (2024). Entrepreneurship and economic growth. Journal of the Knowledge Economy, 15(1), 319–336. [Google Scholar] [CrossRef]

- Ofem, B., Arya, B., Ferrier, W. J., & Borgatti, S. P. (2020). Entrepreneurial orientation, collaborative engagement, and performance: Evidence from rural economic development organizations. Economic Development Quarterly, 34(3), 269–282. [Google Scholar] [CrossRef]

- O’Leary, D. (2022). Unemployment and entrepreneurship across high-, middle- and low-performing European regions. Regional Studies, Regional Science, 9(1), 571–580. [Google Scholar] [CrossRef]

- Pelletier, C., & Cloutier, L. M. (2019). Conceptualizing digital transformation in SMEs: An ecosystemic perspective. Journal of Small Business and Enterprise Development, 26(6/7), 855–876. [Google Scholar] [CrossRef]

- Qian, H., & Acs, Z. J. (2023). Entrepreneurial ecosystems and economic development policy. Economic Development Quarterly, 37(1), 96–102. [Google Scholar] [CrossRef]

- Rafaqat, S., Rafaqat, S., Rafaqat, S., & Rafaqat, D. (2022). The impact of workforce diversity on organizational performance: A review. Journal of Economics and Behavioral Studies, 14(2), 39–50. [Google Scholar] [CrossRef]

- Romer, P. M. (1990). Endogenous technological change. Journal of Political Economy, 98(5), S71–S102. [Google Scholar] [CrossRef]

- Saputra, R. M., & Darmawan, H. (2023). Effects of urbanization and the growth of micro, small, and medium enterprises as supports for the economy of Indonesia in an urban context. Journal of Social Political Sciences, 4(2), 201–214. [Google Scholar] [CrossRef]

- Singh, N., Alshibani, S. M., Misra, P., Nawaz, R., & Gupta, B. (2023). Unravelling barriers in high-tech technology start-ups: Practical insights and solutions for healthcare enterprises. Journal of Enterprise Information Management, 36(6), 1708–1726. [Google Scholar] [CrossRef]

- Singh, V. (2010). MSME: ‘Nursery for entrepreneurship’: A legal perspective [Paper presentation]. National Conference—Energy Conference 2010 on “Innovation, Entrepreneurship and Business Incubation in the Universities” on 3rd and 4th April 2010 at University of Petroleum and Energy Studies, Dehradun. Available online: https://ssrn.com/abstract=2973036 (accessed on 12 February 2025).

- Solano, G., Ram, M., & Rath, J. (2023). Regulation of migrant entrepreneurship: The strained conjunction of laws, policies and practices. International Migration, 61(2), 3–8. [Google Scholar] [CrossRef]

- Sutrisno, S. (2023). The role of partnerships and business networks in the growth of MSMEs in the digital age. Technology and Society Perspectives, 1(3), 122–131. [Google Scholar] [CrossRef]

- Tippmann, E., Monaghan, S., & Reuber, R. A. (2023). Navigating the paradox of global scaling. Global Strategy Journal, 13(4), 735–773. [Google Scholar] [CrossRef]

- Tula, S. T., Ofodile, O. C., Okoye, C. C., Nifise, A. O. A., & Odeyemi, O. (2024). Entrepreneurial ecosystems in the USA: A comparative review with European models. International Journal of Management & Entrepreneurship Research, 6(2), 451–466. [Google Scholar] [CrossRef]

- U.S. Census Bureau. (2020). County business patterns 2020. Available online: https://www.census.gov/data/datasets/2020/econ/cbp/2020-cbp.html (accessed on 7 July 2024).

- U.S. Census Bureau. (2021a). CC-EST2021-ALL data file. Available online: https://www2.census.gov/programs-surveys/popest/datasets/2020-2021/counties/asrh/ (accessed on 7 July 2024).

- U.S. Census Bureau. (2021b). Annual county resident population estimates by age, sex, race, and Hispanic origin (April 1, 2020 to July 1, 2021). Available online: https://www2.census.gov/programs-surveys/popest/technical-documentation/file-layouts/2020-2021/cc-est2021-alldata.pdf (accessed on 7 July 2024).

- U.S. Census Bureau. (2021c). Measuring racial and ethnic diversity for the 2020 census. Available online: https://www.census.gov/newsroom/blogs/random-samplings/2021/08/measuring-racial-ethnic-diversity-2020-census.html (accessed on 12 August 2024).

- U.S. Census Bureau. (2022a). North American industry classification system. Available online: https://www.census.gov/naics/reference_files_tools/2022_NAICS_Manual.pdf (accessed on 12 August 2024).

- U.S. Census Bureau. (2022b). Metropolitan area standards review project. Available online: https://www.census.gov/programs-surveys/metro-micro/about/masrp.html (accessed on 12 August 2024).

- U.S. Census Bureau. (2022c). Geographic levels. Available online: https://www.census.gov/programs-surveys/economic-census/guidance-geographies/levels.html#par_textimage (accessed on 12 August 2024).

- U.S. Census Bureau. (2022d). Sampling estimation and survey inference. Available online: https://www.census.gov/topics/research/stat-research/expertise/survey-sampling.html (accessed on 28 August 2024).

- U.S. Department of Agriculture. (2020). County-level data sets. Available online: https://www.ers.usda.gov/data-products/county-level-data-sets/county-level-data-sets-download-data/ (accessed on 13 June 2024).

- Wen, Y., & Fang, L. (2024). How does innovation collaboration network structure influence regional economic resilience? Economic Development Quarterly, 38(4), 271–287. [Google Scholar] [CrossRef]

- Xin, S., & Park, T. (2024). The roles of big businesses and institutions in entrepreneurship: A cross-country panel analysis. Journal of Innovation & Knowledge, 9(1), 1–15. [Google Scholar] [CrossRef]

| Variable | Mean | SD | Min | Median | Max | |

|---|---|---|---|---|---|---|

| CBP Firm Measures * | ||||||

| Micro Firms (55.6%, n = 3,704,538) | 20.8 | 57.2 | 0 | 6.0 | 997 | |

| Scaled Firms (42.7%, n = 2,841,571) | 16.0 | 59.9 | 0 | 3.0 | 2574 | |

| LN (Scaled Firms) Dependent Variable | 1.4 | 1.5 | 0 | 1.1 | 7.9 | |

| %Scaled Firms | 33.4 | 34.1 | 0 | 29.2 | 100 | |

| Midsize Firms (1.7%, n = 109,883) | 0.6 | 4.1 | 0 | 0 | 274 | |

| Large Firms (0.044%, n = 2931) | 0.02 | 0.4 | 0 | 0 | 49 | |

| County Level Measures (n = 3094): | ||||||

| Household Wealth | 90.3 | 19.3 | 45.1 | 87.7 | 213.7 | |

| Diversity Index | 31.5 | 18.3 | 4.0 | 29.0 | 78.0 | |

| %BA+ Degrees | 22.7 | 9.7 | 1.5 | 20.2 | 79.1 | |

| %Unemployment | 6.8 | 2.3 | 1.5 | 6.6 | 22.8 | |

| Metro Type (0–8 values): | 4.0 | 2.7 | 0.0 | 3.0 | 8.0 | |

| Description | Counties | % | ||||

| 0 | Rural or less than 2500 urban population, not adjacent to a metro area | 390 | 12.6 | |||

| 1 | Rural or less than 2500 urban population, adjacent to a metro area | 214 | 6.9 | |||

| 2 | Urban population of 2500 to 19,999, not adjacent to a metro area | 431 | 13.9 | |||

| 3 | Urban population of 2500 to 19,999, adjacent to a metro area | 593 | 19.2 | |||

| 4 | Urban population of 20,000 or more, not adjacent to a metro area | 92 | 3.0 | |||

| 5 | Urban population of 20,000 or more, adjacent to a metro area | 214 | 6.9 | |||

| 6 | Counties in metro areas of fewer than 250,000 population | 351 | 11.3 | |||

| 7 | Counties in metro areas of 250,000 to 1 million population | 377 | 12.2 | |||

| 8 | Counties in metro areas of 1 million population or more | 432 | 14.0 | |||

| Total | 3094 | 100 | ||||

| NAICS | %Scaled Firms at Select Percentiles | U.S. Counties | ||||||

|---|---|---|---|---|---|---|---|---|

| Code | Description | N | 10th | 25th | Median | 75th | 90th | |

| 11 | Agriculture | 1580 | 0 | 0 | 0 | 10.7 | 51.3 | 1194 |

| 21 | Mining/Oil Gas | 1048 | 0 | 0 | 13.4 | 57.1 | 100 | 708 |

| 22 | Utilities | 1001 | 0 | 0 | 0 | 52.4 | 100 | 777 |

| 23 | Construction | 14,582 | 0 | 0 | 19.0 | 38.5 | 52.8 | 2809 |

| 31 | Fab/Textile Mfg. | 2017 | 0 | 0 | 41.0 | 67.7 | 100 | 710 |

| 32 | Wood Product Mfg. | 3327 | 0 | 0 | 56.2 | 100 | 100 | 1104 |

| 33 | Primary Metal Mfg. | 5832 | 0 | 0 | 44.4 | 75.0 | 100 | 1207 |

| 42 | Wholesale Trade | 11,617 | 0 | 0 | 36.7 | 58.3 | 100 | 1980 |

| 44 | Store Retailers | 20,754 | 0 | 30.0 | 55.6 | 75.0 | 100 | 2792 |

| 45 | General MDSE | 10,686 | 0 | 0 | 35.7 | 70.0 | 100 | 2381 |

| 48 | Transportation | 7724 | 0 | 0 | 0 | 36.7 | 55.0 | 2597 |

| 49 | WHSE/Storage | 1124 | 0 | 0 | 40.0 | 63.5 | 100 | 603 |

| 51 | Information | 4908 | 0 | 0 | 17.4 | 44.4 | 58.3 | 1833 |

| 52 | Finance/Insurance | 10,875 | 0 | 0 | 14.3 | 42.9 | 79.2 | 2735 |

| 53 | Real Estate/Rental | 8104 | 0 | 0 | 0 | 29.3 | 57.1 | 2369 |

| 54 | Prof Sci/Tech Srvs. | 13,020 | 0 | 0 | 8.9 | 31.6 | 45.8 | 2630 |

| 55 | Management | 859 | 0 | 23.1 | 51.8 | 63.0 | 100 | 859 |

| 56 | Waste Mgmt/Srvs. | 8668 | 0 | 0 | 22.2 | 42.1 | 57.1 | 2368 |

| 61 | Education Srvs. | 3039 | 0 | 0 | 35.5 | 63.9 | 100 | 1114 |

| 62 | Health/Social Srvs. | 17,192 | 0 | 26.4 | 55.0 | 81.7 | 100 | 2591 |

| 71 | Arts/Entertainment | 4468 | 0 | 0 | 0 | 45.2 | 61.9 | 1853 |

| 72 | Accommodation Srvs. | 7871 | 0 | 0 | 58.1 | 76.7 | 87.0 | 2872 |

| 81 | Non-Public Srvs. | 17,810 | 0 | 0 | 17.6 | 37.5 | 49.4 | 2989 |

| NAICS Sector | Micro Firms | Midsize Firms | Large Firms | ||||

|---|---|---|---|---|---|---|---|

| Code | Description | Estimate | SE | Estimate | SE | Estimate | SE |

| 11 | Agriculture | 0.0208 a | 0.0018 | 0.2910 a | 0.0627 | 9.9999 e | |

| 21 | Mining/Oil Gas | 0.0332 a | 0.0023 | 0.0775 c | 0.0258 | −1.8332 a | 0.3444 |

| 22 | Utilities | 0.0265 a | 0.0052 | 0.1740 a | 0.0204 | 0.3388 | 0.2547 |

| 23 | Construction | 0.0089 a | 0.0001 | 0.0393 a | 0.0041 | −0.0416 | 0.0872 |

| 31 | Fab/Textile Mfg. | 0.0112 a | 0.0011 | 0.1191 a | 0.0135 | −0.1238 | 0.1258 |

| 32 | Wood Product Mfg. | 0.0210 a | 0.0011 | 0.1151 a | 0.0076 | 9.9999 e | |

| 33 | Primary Metal Mfg. | 0.0344 a | 0.0011 | 0.0957 a | 0.0066 | −0.1058 | 0.0631 |

| 42 | Wholesale Trade | 0.0115 a | 0.0003 | 0.0743 a | 0.0061 | −0.4031 b | 0.1072 |

| 44 | Store Retailers | 0.0141 a | 0.0003 | −0.0016 | 0.0019 | −3.2530 a | 0.3631 |

| 45 | General MDSE | 0.0113 a | 0.0003 | 0.0617 a | 0.0029 | −0.3154 c | 0.1157 |

| 48 | Transportation | 0.0109 a | 0.0003 | 0.0503 a | 0.0067 | 0.1667 c | 0.0582 |

| 49 | WHSE/Storage | 0.0313 a | 0.0031 | 0.0912 a | 0.0100 | −0.3414 a | 0.0694 |

| 51 | Information | 0.0148 a | 0.0005 | 0.0484 a | 0.0061 | −0.2815 a | 0.0461 |

| 52 | Finance/Insurance | 0.0090 a | 0.0002 | 0.0526 a | 0.0046 | −0.0105 | 0.0346 |

| 53 | Real Estate/Rental | 0.0064 a | 0.0001 | 0.1126 a | 0.0084 | 9.9999 e | |

| 54 | Prof Sci/Tech Srvs. | 0.0073 a | 0.0001 | 0.0268 a | 0.0025 | −0.0630 | 0.0424 |

| 55 | Management | 0.0104 a | 0.0016 | 0.0248 a | 0.0054 | −0.0907 c | 0.0276 |

| 56 | Waste Mgmt/Srvs. | 0.0104 a | 0.0002 | 0.0287 a | 0.0021 | −0.1163 d | 0.0519 |

| 61 | Education Srvs. | 0.0152 a | 0.0005 | 0.0836 a | 0.0047 | −0.1303 a | 0.0289 |

| 62 | Health/Social Srvs. | 0.0092 a | 0.0001 | 0.0247 a | 0.0020 | −0.2145 a | 0.0102 |

| 71 | Arts/Entertainment | 0.0114 a | 0.0006 | 0.1225 a | 0.0076 | 0.0241 | 0.1570 |

| 72 | Accommodation Srvs. | 0.0118 a | 0.0003 | 0.0144 a | 0.0026 | 0.0209 | 0.0310 |

| 81 | Non-Public Svrs. | 0.0135 a | 0.0002 | −0.0186 c | 0.0068 | −0.2027 | 0.2152 |

| NAICS Sector | %BA+ Degree | HH Wealth | %Unemployment | ||||

|---|---|---|---|---|---|---|---|

| Code | Description | Estimate | SE | Estimate | SE | Estimate | SE |

| 11 | Agriculture | −0.0131 a | 0.0024 | 0.0005 | 0.0013 | 0.0221 d | 0.0095 |

| 21 | Mining/Oil Gas | −0.0165 a | 0.0037 | 0.0077 a | 0.0019 | 0.0597 a | 0.0150 |

| 22 | Utilities | 0.0037 | 0.0031 | −0.0008 | 0.0016 | 0.0336 c | 0.0130 |

| 23 | Construction | 0.0275 a | 0.0010 | −0.00002 | 0.0006 | 0.0495 a | 0.0044 |

| 31 | Fab/Textile Mfg. | 0.0162 a | 0.0030 | −0.0048 c | 0.0015 | 0.0329 d | 0.0128 |

| 32 | Wood Product Mfg. | 0.0078 b | 0.0022 | −0.0023 d | 0.0011 | 0.0169 | 0.0099 |

| 33 | Primary Metal Mfg. | 0.0035 d | 0.0017 | −0.0002 | 0.0008 | 0.0488 a | 0.0076 |

| 42 | Wholesale Trade | 0.0217 a | 0.0013 | −0.0049 a | 0.0006 | 0.0373 a | 0.0056 |

| 44 | Store Retailers | 0.0262 a | 0.0009 | −0.0022 a | 0.0005 | 0.0611 a | 0.0040 |

| 45 | General MDSE | 0.0153 a | 0.0012 | −0.0020 c | 0.0007 | 0.0502 a | 0.0056 |

| 48 | Transportation | 0.0127 a | 0.0014 | −0.0023 c | 0.0007 | 0.0336 a | 0.0056 |

| 49 | WHSE/Storage | 0.0114 c | 0.0040 | −0.0034 | 0.0019 | 0.0317 | 0.0162 |

| 51 | Information | 0.0173 a | 0.0018 | −0.0035 b | 0.0009 | 0.0134 | 0.0080 |

| 52 | Finance/Insurance | 0.0255 a | 0.0014 | −0.0024 c | 0.0007 | 0.0523 a | 0.0059 |

| 53 | Real Estate/Rental | 0.0341 a | 0.0012 | −0.0050 a | 0.0006 | 0.0817 a | 0.0052 |

| 54 | Prof Sci/Tech Srvs. | 0.0363 a | 0.0011 | −0.0042 a | 0.0006 | 0.0595 a | 0.0047 |

| 55 | Management | 0.0349 a | 0.0045 | −0.0081 b | 0.0022 | 0.0663 c | 0.0201 |

| 56 | Waste Mgmt/Srvs. | 0.0243 a | 0.0013 | −0.0040 a | 0.0007 | 0.0507 a | 0.0060 |

| 61 | Education Srvs. | 0.0237 a | 0.0024 | −0.0047 a | 0.0012 | 0.0545 a | 0.0110 |

| 62 | Health/Social Srvs. | 0.0271 a | 0.0011 | −0.0049 a | 0.0006 | 0.0675 a | 0.0047 |

| 71 | Arts/Entertainment | 0.0052 c | 0.0020 | −0.0010 | 0.0010 | 0.0298 b | 0.0090 |

| 72 | Accommodation Srvs. | 0.0118 a | 0.0020 | −0.0017 | 0.0011 | 0.0081 | 0.0084 |

| 81 | Non-Public Svrs. | 0.0222 a | 0.0010 | −0.0024 a | 0.0005 | 0.0432 a | 0.0041 |

| NAICS Sector | Diversity Index | Metro Type | Model | e(DV) | |||

|---|---|---|---|---|---|---|---|

| Code | Description | Estimate | SE | Estimate | SE | R2 | Mean |

| 11 | Agriculture | 0.0070 a | 0.0011 | −0.0029 | 0.0096 | 0.152 | 1.5 |

| 21 | Mining/Oil Gas | 0.0083 a | 0.0016 | 0.0088 | 0.0149 | 0.368 | 2.5 |

| 22 | Utilities | 0.0042 c | 0.0016 | 0.0802 a | 0.0142 | 0.313 | 2.0 |

| 23 | Construction | 0.0054 a | 0.0005 | 0.1545 a | 0.0043 | 0.547 | 4.0 |

| 31 | Fab/Textile Mfg. | 0.0062 b | 0.0016 | 0.0482 d | 0.0194 | 0.209 | 2.9 |

| 32 | Wood Product Mfg. | 0.0053 a | 0.0011 | 0.0924 a | 0.0133 | 0.282 | 3.4 |

| 33 | Primary Metal Mfg. | 0.0015 | 0.0009 | 0.1299 a | 0.0109 | 0.323 | 3.3 |

| 42 | Wholesale Trade | 0.0125 a | 0.0007 | 0.1067 a | 0.0071 | 0.376 | 4.0 |

| 44 | Store Retailers | 0.0056 a | 0.0005 | 0.1446 a | 0.0042 | 0.396 | 6.3 |

| 45 | General MDSE | 0.0081 a | 0.0006 | 0.1048 a | 0.0060 | 0.324 | 3.8 |

| 48 | Transportation | 0.0025 b | 0.0007 | 0.0954 a | 0.0060 | 0.358 | 2.5 |

| 49 | WHSE/Storage | 0.0042 | 0.0022 | 0.1476 a | 0.0295 | 0.434 | 3.8 |

| 51 | Information | 0.0068 a | 0.0009 | 0.0963 a | 0.0095 | 0.411 | 3.1 |

| 52 | Finance/Insurance | 0.0039 a | 0.0007 | 0.1005 a | 0.0061 | 0.378 | 3.7 |

| 53 | Real Estate/Rental | 0.0107 a | 0.0006 | 0.1485 a | 0.0054 | 0.581 | 2.9 |

| 54 | Prof Sci/Tech Srvs. | 0.0084 a | 0.0005 | 0.1564 a | 0.0046 | 0.601 | 3.7 |

| 55 | Management | 0.0062 d | 0.0024 | 0.2561 a | 0.0267 | 0.551 | 7.3 |

| 56 | Waste Mgmt/Srvs. | 0.0105 a | 0.0007 | 0.1303 a | 0.0067 | 0.525 | 3.8 |

| 61 | Education Srvs. | 0.0068 a | 0.0013 | 0.1651 a | 0.0147 | 0.454 | 4.3 |

| 62 | Health/Social Srvs. | 0.0043 a | 0.0005 | 0.1804 a | 0.0050 | 0.439 | 6.6 |

| 71 | Arts/Entertainment | −0.0002 | 0.0011 | 0.0955 a | 0.0097 | 0.332 | 2.7 |

| 72 | Accommodation Srvs. | 0.0052 a | 0.0010 | 0.1293 a | 0.0083 | 0.340 | 9.2 |

| 81 | Non-Public Svrs. | 0.0041 a | 0.0005 | 0.1144 a | 0.0042 | 0.495 | 3.6 |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2025 by the author. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

López, O.S. Unlocking Regional Economic Growth: How Industry Sector and Mesoeconomic Determinants Influence Small Firm Scaling. Economies 2025, 13, 138. https://doi.org/10.3390/economies13050138

López OS. Unlocking Regional Economic Growth: How Industry Sector and Mesoeconomic Determinants Influence Small Firm Scaling. Economies. 2025; 13(5):138. https://doi.org/10.3390/economies13050138

Chicago/Turabian StyleLópez, Omar S. 2025. "Unlocking Regional Economic Growth: How Industry Sector and Mesoeconomic Determinants Influence Small Firm Scaling" Economies 13, no. 5: 138. https://doi.org/10.3390/economies13050138

APA StyleLópez, O. S. (2025). Unlocking Regional Economic Growth: How Industry Sector and Mesoeconomic Determinants Influence Small Firm Scaling. Economies, 13(5), 138. https://doi.org/10.3390/economies13050138