The Economy-Wide Impact of Harnessing Human Capital Development and the Case of Ethiopia: A Dynamic Computable General Equilibrium Model Analysis

Abstract

1. Introduction

1.1. Background of the Study

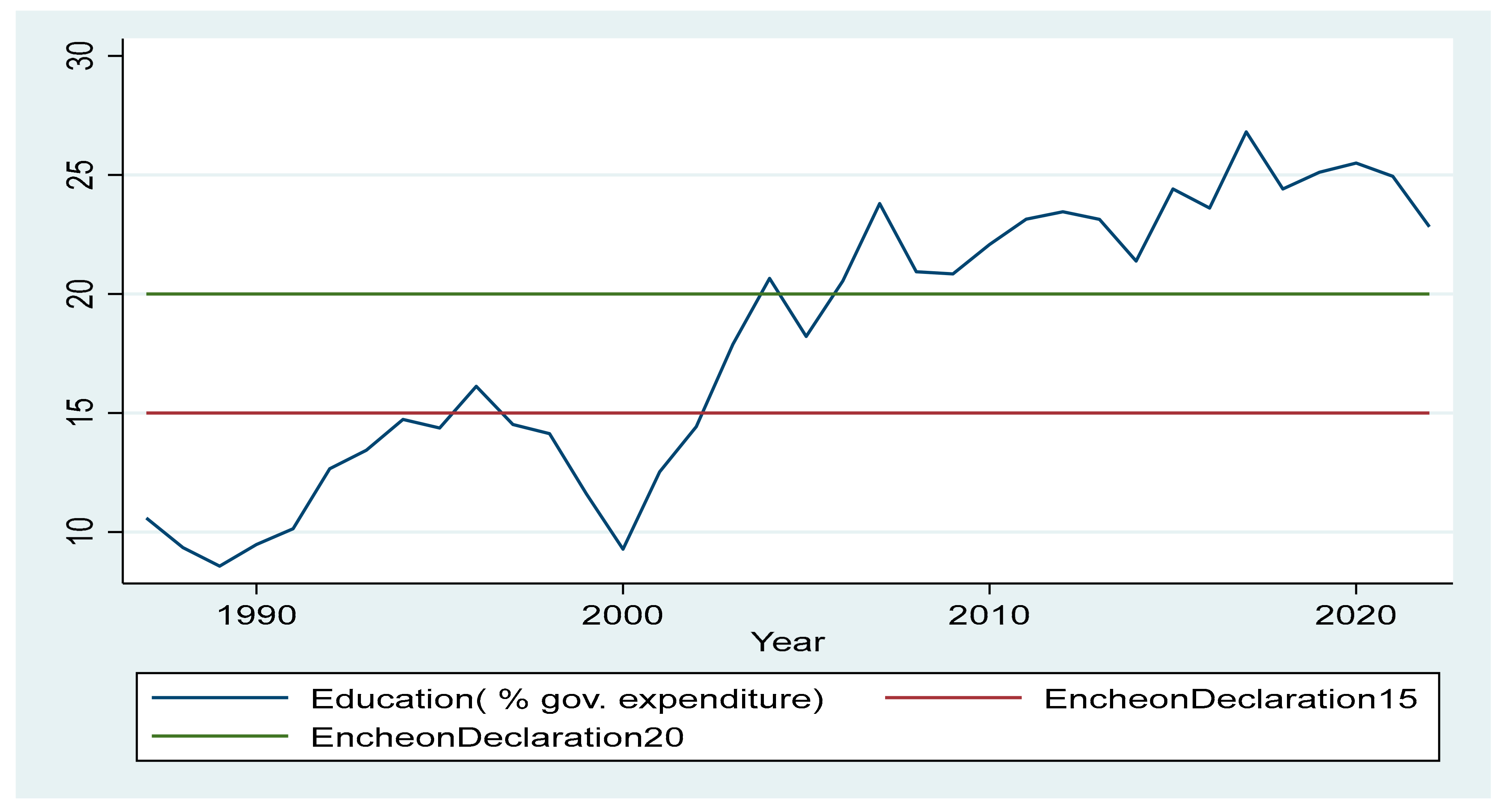

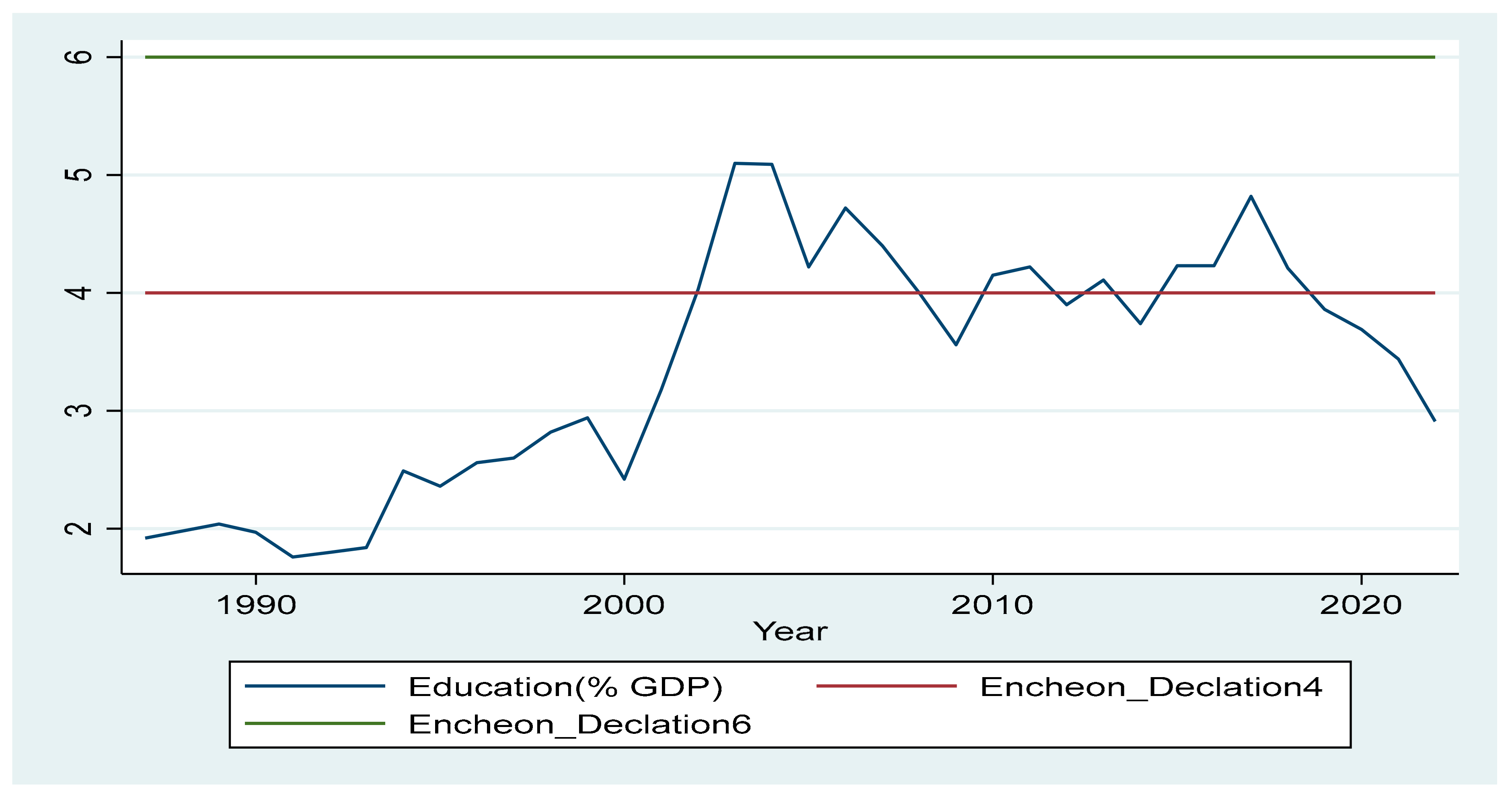

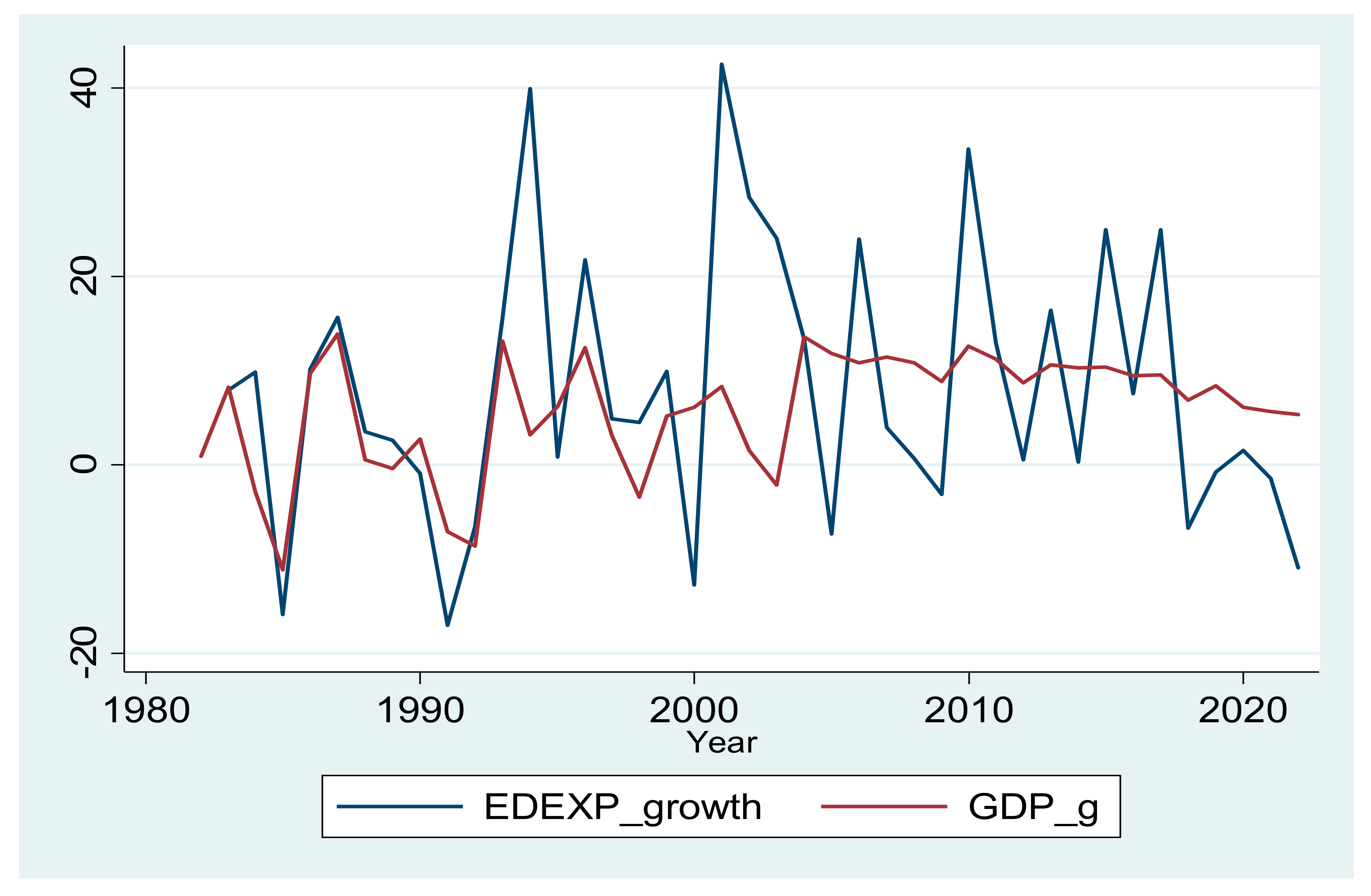

1.2. Human Capital Development in Ethiopia

1.3. Objective

- (i)

- Analyze the effect of human capital development on economic growth and on sectoral output growth.

- (ii)

- Analyze the effects of skilled and semi-skilled labor supply shock on economic growth and other macroeconomic performances.

- (iii)

- Analyze the contribution of skilled and semi-skilled labor supply shock on sectoral growth and structural transformation.

- (iv)

- Investigate the effect of skilled biased labor supply shocks on factor income, government revenue and income changes by types of households.

2. Literature Review

3. Methods and Database

3.1. Introduction

3.2. The CGE Model Description and Scenarios

3.3. The Database

4. Results and Discussions

4.1. Some Statistical Facts

4.1.1. Impact on GDP and Other Macroeconomic Variables

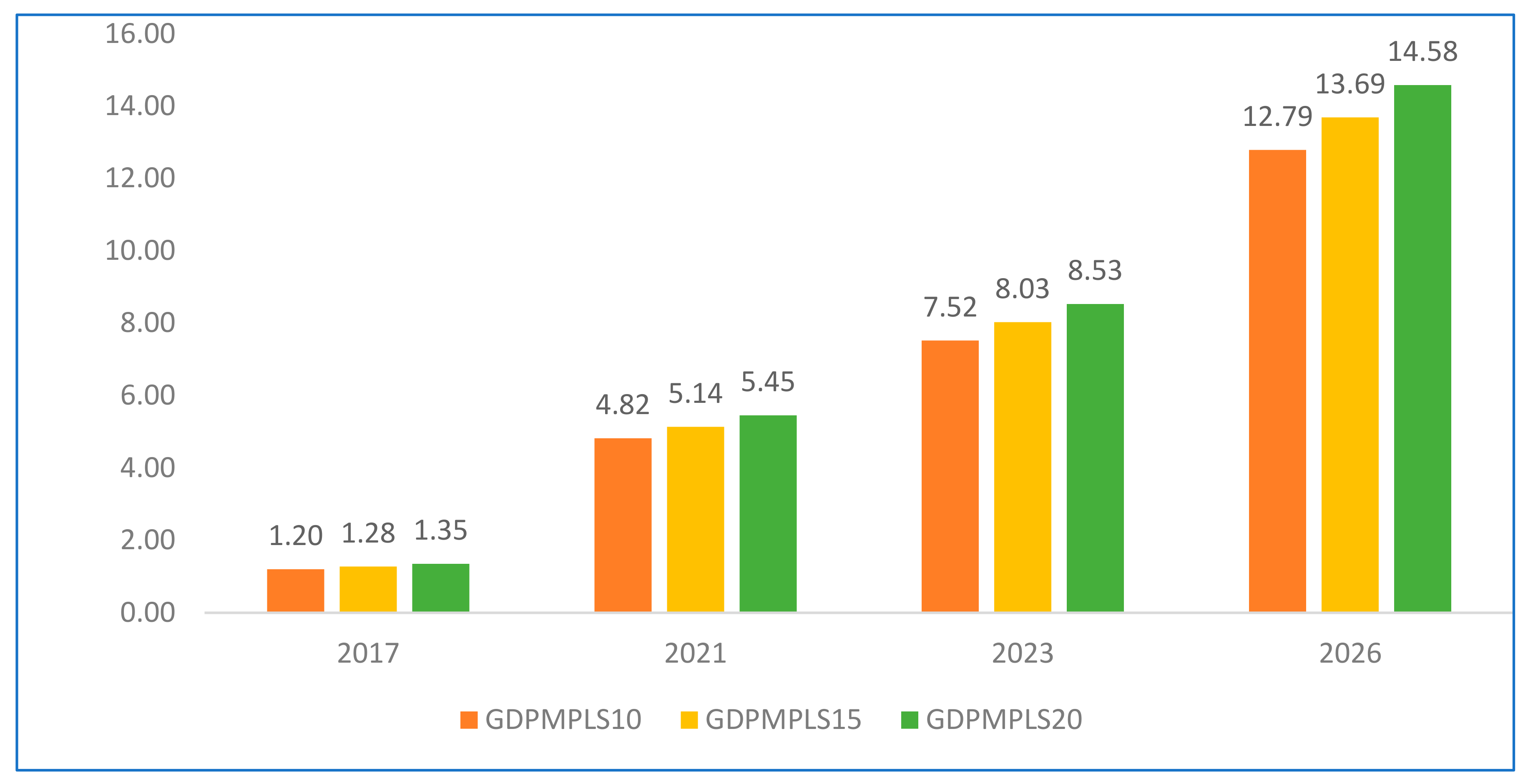

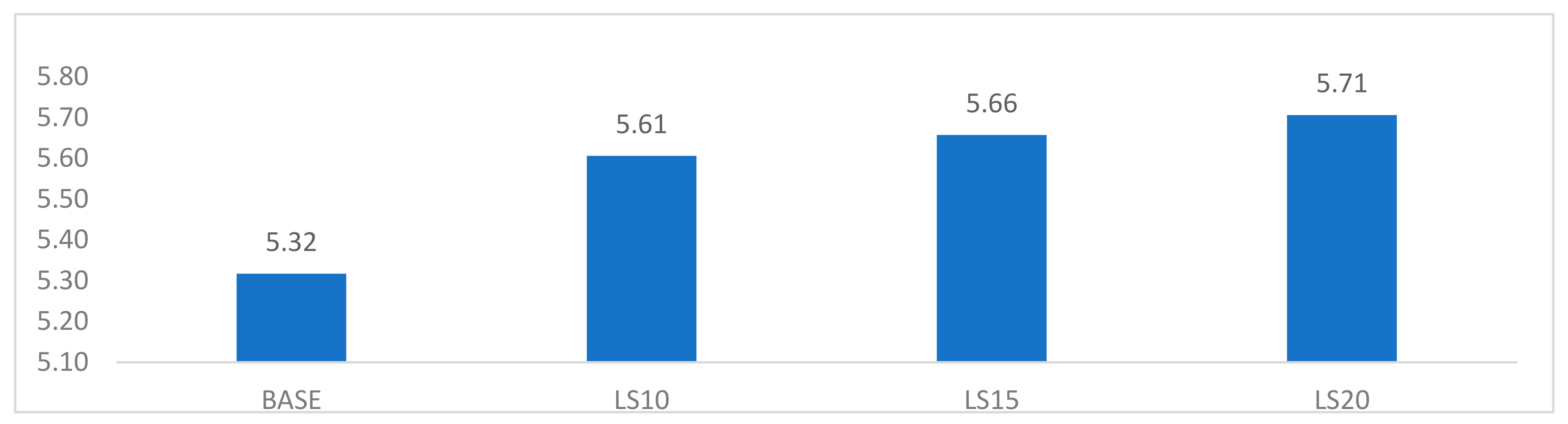

- The impact of an increase in the supply of skilled and semi-skilled labor under the LS20 simulation is greater than in the medium growth scenario (LS15) and other scenarios. This suggests that a higher proportion of skilled and semi-skilled workers will lead to a greater increase in aggregate productivity compared to a scenario with a low proportion of skilled and semi-skilled workers.

- The expansion of skilled and semi-skilled labor supply will have limited economic effects in the earlier periods, as it takes time for productivity improvements to have a widespread impact on the economy. This is because the productivity of skilled and semi-skilled labor affects the economy after a few years of workers’ engagement, which is consistent with the learning-by-doing growth hypothesis of endogenous growth theory.

4.1.2. Impact on Sectoral Output

4.1.3. Factor Income Effect

4.1.4. Impact on the Income of Government and Poor Households

5. Conclusions and Recommendations

- Invest in education and training to enhance the supply of skilled and semi-skilled labor, thus facilitating economic diversification beyond agriculture.

- Design educational programs that equip graduates with skills that are currently in demand in the labor market. This will improve employability and reduce skill mismatches.

- Regularly monitor education and employment policies to evaluate their effectiveness in aligning with the economy’s requirements, making adjustments as necessary.

- Expand financial inclusion to entrepreneurs and small businesses, enabling their growth and job creation, particularly in non-agricultural sectors where governments can collect increased tax revenues.

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

Appendix A

The CGE Model Specification

| Symbol Sets | Explanation | Symbol | Explanation |

|---|---|---|---|

| Activities | Regionally imported commodities | ||

| Activities with a Leontief function at the top of the technology nest | Non-regionally imported commodities | ||

| Commodities | Transaction service commodities | ||

| Commodities with domestic sales of domestic output | Commodities with domestic production | ||

| Commodities not in CD | Factors | ||

| Exported commodities | Institutions (domestic and rest of world) | ||

| Commodities not in CE | Domestic institutions | ||

| Aggregate imported commodities | Domestic non-government institutions | ||

| Commodities not in CM | Households | ||

| Parameters | |||

| Weight of commodity c in the CPI | Import price (foreign currency) | ||

| Weight of commodity c in the producer price index | Import price by region (foreign currency) | ||

| Quantity of c as intermediate input per unit of activity a | Quantity of stock change | ||

| Quantity of commodity c as trade input per unit of c’ produced and sold domestically | Base-year quantity of government demand | ||

| Quantity of commodity c as trade input per exported unit of c’ | Base-year quantity of private investment demand | ||

| Quantity of commodity c as trade input per exported unit of c’ from region r | Share for domestic institution i in income of factor f | ||

| Quantity of commodity c as trade input per imported unit of c′ | Share of net income of i′ to i (i′ ∈ INSDNG′; i ∈ INSDNG) | ||

| Quantity of commodity c as trade input per imported unit of c’ from region r | Tax rate for activity a | ||

| Quantity of aggregate intermediate input per activity unit | Exogenous direct tax rate for domestic institution i | ||

| Quantity of aggregate intermediate input per activity unit | 0–1 parameter with 1 for institutions with potentially flexed direct tax rates | ||

| Base savings rate for domestic institution i | Import tariff rate | ||

| 0–1 parameter with 1 for institutions with potentially flexed direct tax rates | Regional import tariff | ||

| Export price (foreign currency) | Rate of sales tax | ||

| Export price by region (foreign currency) | Transfer from factor f to institution i | ||

| Greek Symbols | |||

| Efficiency parameter in the CES activity function | CET function share parameter | ||

| Efficiency parameter in the CES value-added function | CES value-added function share parameter for factor f in activity a | ||

| Shift parameter for domestic commodity aggregation function | Subsistence consumption of marketed commodity c for household h | ||

| Armington function shift parameter | Yield of output c per unit of activity a | ||

| CET function shift parameter | CES production function exponent | ||

| Shift parameter in the CES regional import function | CES value-added function exponent | ||

| Shift parameter in the CES regional export function | Domestic commodity aggregation function exponent | ||

| Capital sectoral mobility factor | Armington function exponent | ||

| Marginal share of consumption spending on marketed commodity c for household h | CET function exponent | ||

| CES activity function share parameter | Regional imports aggregation function exponent | ||

| Share parameter for domestic commodity aggregation function | Regional exports aggregation function exponent | ||

| Armington function share parameter | Sector share of new capital | ||

| Capital depreciation rate | |||

| Exogenous Variables | |||

| Consumer price index | Savings rate scaling factor (=0 for base) | ||

| Change in domestic institution tax share (=0 for base; exogenous variable) | Quantity supplied of factor | ||

| Foreign savings (FCU) | Direct tax scaling factor (=0 for base; exogenous variable) | ||

| Government consumption adjustment factor | Wage distortion factor for factor f in activity a | ||

| Investment adjustment factor | |||

| Endogenous Variables | |||

| Average capital rental rate in time t | Quantity demanded of factor f from activity a | ||

| Change in domestic institution savings rates (=0 for base; exogenous variable) | Government consumption demand for commodity | ||

| Producer price index for domestically marketed output | Quantity consumed of commodity c by household h | ||

| Government expenditures | Quantity of household home consumption of commodity c from activity a for household h | ||

| Consumption spending for household | Quantity of aggregate intermediate input | ||

| Exchange rate (LCU per unit of FCU) | Quantity of commodity c as intermediate input to activity a | ||

| Government consumption share in nominal absorption | Quantity of investment demand for commodity | ||

| Government savings | Quantity of imports of commodity c | ||

| Investment share in nominal absorption | Quantity of imports of commodity c by region r | ||

| Endogenous Variables Continued | |||

| Marginal propensity to save for domestic non-government institution (exogenous variable) | Quantity of exports of commodity c to region r | ||

| Activity price (unit gross revenue) | Quantity of goods supplied to domestic market (composite supply) | ||

| Demand price for commodity produced and sold domestically | Quantity of commodity demanded as trade input | ||

| Supply price for commodity produced and sold domestically | Quantity of (aggregate) value-added | ||

| Export price (domestic currency) | Aggregated quantity of domestic output of commodity | ||

| Export price by region (domestic currency) | Quantity of output of commodity c from activity a | ||

| Aggregate intermediate input price for activity a | Real average factor price | ||

| Unit price of capital in time t | Total nominal absorption | ||

| Import price (domestic currency) | Direct tax rate for institution i (i ∈ INSDNG) | ||

| Import price by region (domestic currency) | Transfers from institution i′ to i (both in the set INSDNG) | ||

| Composite commodity price | Average price of factor | ||

| Value-added price (factor income per unit of activity) | Income of factor f | ||

| Aggregate producer price for commodity | Government revenue | ||

| Producer price of commodity c for activity a | Income of domestic non-government institution | ||

| Quantity (level) of activity | Income to domestic institution i from factor f | ||

| Quantity sold domestically of domestic output | Quantity of new capital by activity a for time t | ||

| Quantity of exports | |||

| 1 | Marginal product of capital (or labour) approaches infinity as capital (or labour) goes to 0 and approaches 0 as capital (or labour) goes to infinity. |

| 2 | An input is essential if a strictly positive amount is needed to produce a positive amount of output. |

| 3 | Detailed description of the models and their workings are presented in the Appendix A. |

| 4 | That is, in this scenario, skilled and semi-skilled labour supply is increased by 2.97% (2.7 + 2.7 × 0.1) and in the second scenario, skilled and semi-skilled labour increases by 3.105% and in the last scenario ther rate of increase of skilled and semi-skilled labour is 3.24%. The rate of increase of uneducated labour is adjusted in such a way that the total labour supply grows by 2.7%. |

| 5 | Uneducated are those with no formal education; primary education refers to those with some formal education but have not completed high school; secondary education refers to those who completed high school but not college; and tertiary education refers to those that completed college education. |

References

- Acemoglu, D. (2009). Introduction to modern economic growth. Princeton University Press. [Google Scholar]

- Acemoglu, D., Laibson, D., & John, A. L. (2019). Economics global edition. Pearson Education Limited. [Google Scholar]

- Aghion, P., Antonin, C., & Bunel, S. (2021). Skill-biased technical change and economic growth. Journal of Economic Growth, 26(3), 275–310. [Google Scholar]

- Ararat, L. O. (2009). The impact of human capital on economic growth: A case study in post-Soviet Ukraine, 1989–2009. Palgrave Macmillan. [Google Scholar]

- Bahar, D., Choudhury, P., & Rapoport, H. (2020). Migration, innovation, and growth (World Bank Policy Research Working Paper No. 9287). World Bank Group. [Google Scholar]

- Diao, X., Thurlow, J., & Benin, S. (2012). Strategies and priorities for African agriculture: Economy-wide perspectives from country studies. International Food Policy Research Institute. [Google Scholar]

- Domar, E. (1946). Capital expansion, rate of growth, and employment. Econometrica, 14, 137–147. [Google Scholar] [CrossRef]

- Dorosh, P., Robinson, S., & Ahmed, H. (2011). Economic implications of foreign exchange rationing in Ethiopia. Ethiopian Journal of Economics, 18, 132. [Google Scholar]

- Federal Ministry of Education. (2021). Education Sector development programme VI (ESDP VI) 2013–2017 E.C. 2020/21–2024/25 G.C. Federal Democratic Republic of Ethiopia. [Google Scholar]

- Harrod, R. F. (1939). An Essay in Dynamic Theory. The Economic Journal, 49, 14–33. [Google Scholar] [CrossRef]

- International Food Policy Research Institute (IFPRI). (2011). Social accounting matrix for Ethiopia, 2011. IFPRI. [Google Scholar]

- Klarin, T. (2018). The concept of sustainable development: From its beginning to the contemporary issues. Zagreb International Review of Economics and Business, 21(1), 67–94. [Google Scholar] [CrossRef]

- Krishnan, P., & Shaorshadez, I. (2013). Technical and vocational education and training in Ethiopia (Working Paper for the International Growth Centre–Ethiopia Country Programme). International Growth Centre (IGC). [Google Scholar]

- Lofgren, H., Harris, R. L., Robinson, S., Marcelle, T., & El-Said, M. (2002). A standard computable general equilibrium (CGE) model in GAMS. International Food Policy Research Institiute. [Google Scholar]

- Manioudis, M., & Meramveliotakis, G. (2022). Broad strokes towards a grand theory in the analysis of sustainable development: A return to the classical political economy. New Political Economy, 27(5), 866–878. [Google Scholar] [CrossRef]

- Mankiw, N. G., Romer, D., & Weil, D. N. (1992). A contribution to the empirics of economic growth. Quarterly Journal of Economics, 107, 407–437. [Google Scholar] [CrossRef]

- Mengistu, A., Bekele, F., & Gedefe, K. (2018). Domestic resource mobilization in Ethiopia: Trends, causes, and prospects (Unpublished PSI Report). PSI.

- Ministry of Finance. (2021–2022). Public expenditure data. Ministry of Finance. [Google Scholar]

- National Bank of Ethiopia. (2021). Annual report 2020/21. National Bank of Ethiopia. Available online: https://nbe.gov.et/wp-content/uploads/2024/04/2020-21-Annual-Report-for-Publication.pdf (accessed on 11 December 2024).

- Philippe, A., & Peter, H. (2009). The economics of growth. The MIT Press. [Google Scholar]

- Policy Studies Institute-European Union (PSI-EU). (2016). Social accounting matrix. PSI-EU. [Google Scholar]

- Pritchett, L. (2001). Where has all the education gone? The World Bank Economic Review, 15, 367–391. [Google Scholar] [CrossRef]

- Reimers, M., & Klasen, S. (2013). Revisiting the role of education for agricultural productivity. American Journal of Agricultural Economics, 95(1), 131–152. [Google Scholar] [CrossRef]

- Robert, J. B., & Xavier, S.-i.-M. (2004). Economic growth. The MIT Press. [Google Scholar]

- Romer, D. (2019). Advanced macroeconomics (5th ed.). University of California. [Google Scholar]

- Romer, P. M. (1990). Endogenous technological change: The problem of development. The Journal of Political Economy, 98, 71–101. [Google Scholar] [CrossRef]

- Savvides, A., & Stengos, T. (2009). Human capital and economic growth. Stanford University Press. [Google Scholar]

- Schmidt, E., & Woldeyes, F. (2019). Rural youth and employment in Ethiopia, youth and jobs in rural Africa (pp. 109–136). Oxford University Press. Available online: https://academic.oup.com/book/37379/chapter/331369233 (accessed on 13 January 2025).

- Thurlow, J. (2008). A recursive dynamic CGE model and microsimulation poverty module for South Africa. International Food Policy Research Institute. [Google Scholar]

- UNESCO. (2015). 2030—Incheon declaration and framework for action. Available online: https://unesdoc.unesco.org/ark:/48223/pf0000245656/Pdf/245656eng.pdf.multi (accessed on 24 December 2024).

- United Nations. (2022). Statistical yearbook (2022 ed.). United Nations Department of Economic and Social Affairs, Statistics Division. Available online: https://desapublications.un.org/publications/statistical-yearbook-2022-edition (accessed on 24 December 2024).

- Worku, M. Y. (2025). Access-equity tensions in education: Examining Ethiopia’s educational reforms through a distributive social justice lens. Social Sciences & Humanities Open, 11, 101443. [Google Scholar]

| Particulars | 2014/15 | 2015/16 | 2016/17 | 2017/18 | 2018/19 | 2019/20 | 2020/21 |

|---|---|---|---|---|---|---|---|

| Primary schools | 33,373 | 34,867 | 35,887 | 36,437 | 37,039 | 37,742 | 35,980 |

| Secondary schools | 2830 | 3156 | 3380 | 3589 | 3739 | 3687 | 3481 |

| No. of universities | 33 | 37 | 37 | 49 | 50 | 55 | 56 |

| School enrolment | |||||||

| Primary (million) | 18.7 | 20 | 20.8 | 20.7 | 20.04 | 20.4 | 18.4 |

| Secondary (million) | 2.11 | 2.42 | 2.56 | 2.67 | 2.82 | 3.47 | 3.54 |

| TVET (thousands) | 265.75 | 304.14 | 302.08 | 292.38 | 317.73 | 386.81 | 283.97 |

| Factors of Production | Share of Income |

|---|---|

| Lab—No Education | 36.47 |

| Lab—Primary Education | 7.09 |

| Lab—Secondary Education | 7.37 |

| Lab—Tertiary Education | 5.70 |

| Capital Land Rural | 11.88 |

| Capital Livestock Rural | 4.07 |

| Non-Agricultural Capital | 26.45 |

| Factors of Production | Share of Income |

|---|---|

| Lab—No Education | 34.05 |

| Lab—Primary Education | 7.37 |

| Lab—Secondary Education | 3.29 |

| Lab—Tertiary Education | 8.46 |

| Capital Land Rural | 7.32 |

| Capital Livestock Rural | 2.75 |

| Non-Agricultural Capital | 36.76 |

| A | C | F | ENT | H | GOV | TAX | S-I | ROW | TOTAL | |

|---|---|---|---|---|---|---|---|---|---|---|

| A | 2103.2 | 213.6 | 2316.8 | |||||||

| C | 907.3 | 883.8 | 148.8 | 588.7 | 122.4 | 2651.0 | ||||

| F | 1409.5 | 3.8 | 1413.2 | |||||||

| ENT | 542.4 | 8.0 | 0.5 | 550.8 | ||||||

| H | 868.2 | 388.5 | 11.0 | 132.3 | 1400.1 | |||||

| GOV | 19.9 | 7.6 | 192.7 | 27.2 | 247.3 | |||||

| TAX | 121.4 | 42.0 | 29.2 | 192.7 | ||||||

| S-I | 99.2 | 259.1 | 75.5 | 154.8 | 588.7 | |||||

| ROW | 426.4 | 2.7 | 1.2 | 6.8 | 3.9 | 441.0 | ||||

| TOTAL | 2316.8 | 2651.0 | 1413.2 | 550.8 | 1400.1 | 247.3 | 192.7 | 588.7 | 441.0 |

| Employment | Sector | 2005 | 2010 | 2015 | 2021 |

|---|---|---|---|---|---|

| % Male and Female | Agriculture | 78.1 | 73.6 | 68.3 | 63.7 |

| Industry | 7.3 | 7.9 | 8.9 | 10.1 | |

| Services | 14.5 | 18.4 | 22.8 | 26.2 | |

| % Male | Agriculture | 82.1 | 78.7 | 74.6 | 70.7 |

| Industry | 3.0 | 7.1 | 9.3 | 12.1 | |

| Services | 12.0 | 14.2 | 16.0 | 17.2 | |

| % Female | Agriculture | 73.4 | 67.7 | 60.9 | 55.3 |

| Industry | 9.1 | 8.9 | 8.2 | 2.4 | |

| Services | 17.5 | 23.4 | 30.9 | 36.6 |

| Variable | Base | LS10 | LS15 | LS20 |

|---|---|---|---|---|

| GDP at market price | 4.91 | 5.61 | 5.65 | 5.70 |

| Absorption | 4.3 | 4.92 | 4.96 | 5.01 |

| Private consumption | 4.82 | 4.36 | 4.39 | 4.42 |

| Gross fixed investment | 4.23 | 6.79 | 6.86 | 6.92 |

| Exports | 10.02 | 12.16 | 12.25 | 12.33 |

| Imports | 4.23 | 5.33 | 5.38 | 5.43 |

| Net Indirect TAX | 3.50 | 3.62 | 3.65 | 3.68 |

| Percentage % from BAU scenario | ||||

| GDP at market price | 0.70 | 0.74 | 0.79 | |

| Absorption | 0.62 | 0.66 | 0.71 | |

| Private consumption | −0.46 | −0.43 | −0.40 | |

| Gross fixed investment | 2.56 | 2.63 | 2.69 | |

| Exports | 2.14 | 2.23 | 2.31 | |

| Imports | 1.10 | 1.15 | 1.20 | |

| Net Indirect TAX | 0.12 | 0.15 | 0.18 | |

| Sector | BAU | LS10 | LS15 | LS20 | % Change from BAU | ||

|---|---|---|---|---|---|---|---|

| LS10 | LS15 | LS20 | |||||

| Agriculture | 5.42 | 5.51 | 5.54 | 5.58 | 0.09 | 0.13 | 0.16 |

| Industry | 4.94 | 6.47 | 6.51 | 6.55 | 1.53 | 1.57 | 1.61 |

| Services | 4.54 | 5.47 | 5.52 | 5.58 | 0.93 | 0.99 | 1.04 |

| Total VAD FC | 5.02 | 5.76 | 5.81 | 5.86 | 0.74 | 0.79 | 0.84 |

| Annual Compounded Average % Changes from INITIAL | ||||

|---|---|---|---|---|

| Labour Type | BASE | LS10 | LS15 | LS20 |

| lab-n | 4.53 | 4.26 | 4.31 | 4.36 |

| lab-p | 5.47 | 4.29 | 4.30 | 4.30 |

| lab-s | 5.47 | 4.98 | 4.97 | 4.97 |

| lab-t | 1.35 | 3.91 | 3.83 | 3.75 |

| Capital Land Rural | 6.17 | 6.8 | 6.86 | 6.92 |

| Capital Livst Rural | 5.61 | 5.72 | 5.78 | 5.83 |

| Non-Agg-capital | 4.86 | 2.88 | 2.94 | 3.00 |

| Annual Compound % Changes from INITIAL | |||||

|---|---|---|---|---|---|

| Household Type | INITIAL | BASE | LS10 | LS15 | LS20 |

| Rural poor | 164.83 | 4.81 | 4.47 | 4.52 | 4.57 |

| Rural middle class | 529.38 | 4.67 | 4.25 | 4.30 | 4.34 |

| Rural rich | 162.03 | 4.44 | 4.04 | 4.07 | 4.10 |

| Urban poor | 19.96 | 4.00 | 3.36 | 3.40 | 3.43 |

| Urban middle income | 179.50 | 4.28 | 3.50 | 3.54 | 3.57 |

| Urban rich | 303.14 | 4.00 | 3.64 | 3.65 | 3.66 |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2025 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Yeshineh, A.K.; Bekele Woldeyes, F. The Economy-Wide Impact of Harnessing Human Capital Development and the Case of Ethiopia: A Dynamic Computable General Equilibrium Model Analysis. Economies 2025, 13, 137. https://doi.org/10.3390/economies13050137

Yeshineh AK, Bekele Woldeyes F. The Economy-Wide Impact of Harnessing Human Capital Development and the Case of Ethiopia: A Dynamic Computable General Equilibrium Model Analysis. Economies. 2025; 13(5):137. https://doi.org/10.3390/economies13050137

Chicago/Turabian StyleYeshineh, Alekaw Kebede, and Firew Bekele Woldeyes. 2025. "The Economy-Wide Impact of Harnessing Human Capital Development and the Case of Ethiopia: A Dynamic Computable General Equilibrium Model Analysis" Economies 13, no. 5: 137. https://doi.org/10.3390/economies13050137

APA StyleYeshineh, A. K., & Bekele Woldeyes, F. (2025). The Economy-Wide Impact of Harnessing Human Capital Development and the Case of Ethiopia: A Dynamic Computable General Equilibrium Model Analysis. Economies, 13(5), 137. https://doi.org/10.3390/economies13050137