1. Introduction

Climate change is now one of the most pressing challenges to sustainable global development. Its impacts extend beyond the environmental sphere to profoundly affect productive systems, food security, and the economic stability of nations.

Climate change is now among the most pressing challenges to sustainable global development. Its repercussions extend beyond the environmental sphere to profoundly affect productive systems, food security, and the economic stability of nations (

Masson-Delmotte et al., 2021;

Lal et al., 2012). Aware of these risks, the United Nations has placed the fight against global warming at the heart of the 2030 Agenda through Sustainable Development Goal 13, which calls for strengthened resilience to climate-related hazards.

Climate projections confirm the region’s acute vulnerability. By the end of the 21st century, the annual mean temperature could increase at a rate exceeding the global average, while precipitation is projected to decline by 4% to 27%, intensifying drought episodes (

Gumus et al., 2024;

Masson-Delmotte et al., 2018;

Woodward et al., 2014). This vulnerability is driven by an arid climate, limited water availability, and a heavy reliance on predominantly rainfed agriculture (

Abdelfattah, 2021;

Masson-Delmotte et al., 2021;

OECD/FAO, 2023). Per capita renewable water resources are among the lowest in the world: In Morocco, approximately 87% of available water is used for agriculture, while in Egypt, 81% of the Nile’s freshwater is devoted to irrigation (

Boudhar et al., 2017;

Abdelfattah, 2021). This dependence on water makes agricultural production particularly sensitive to climate variability.

Economically, agriculture remains a cornerstone of the MENA region. It contributes between 10% and 15% of GDP, employs nearly one quarter of the labor force, and constitutes the principal source of rural income (

World Bank, 2023a). In countries such as Morocco, Egypt, and Sudan, its share at times exceeds 20% of total value added (

FAO, 2024). However, water scarcity, heightened exposure to climate shocks, and agricultural price volatility undermine the sector’s sustainability. As

de Waal et al. (

2023) note, chronic water constraints depress productivity and jeopardize food security, while projections by

OECD/FAO and OECD (

2024) highlight that variability in agricultural markets and prices strongly conditions sectoral incomes. Moreover, a one-degree Celsius increase in mean temperature can reduce agricultural productivity by 10% to 17%, depending on the crop (

Gumus et al., 2024). Yet agricultural performance is not shaped by climate alone; input prices, investment, and global demand also play decisive roles (

FAO, 2022). In an increasingly open economy, these fluctuations can amplify the effects of climate disruptions on agricultural performance.

Despite a substantial body of work, applied studies on the MENA region remain fragmented.

Nugroho et al. (

2022) and

Rahimi et al. (

2023) examine the economic determinants of agricultural value added (credit, human capital, trade openness) without integrating climatic variables, while others (

Govind, 2022;

Hejazi et al., 2023;

Elkhalfi et al., 2025) explore the climate and agriculture nexus through the lenses of food security and sustainability. Although informative, these approaches do not provide a joint analysis of climatic and productive variables in relation to agricultural performance.

This study fills that gap by assessing, within a production function-inspired framework, the combined effects of temperature, precipitation, and production factors (capital, labor, arable land) on agricultural value added across 21 MENA countries between 1990 and 2024. In this framework, the Cobb–Douglas production function plays a theoretical role that guides variable selection and expected signs (positive effects of capital, labor, and land), while the empirical approach relies on panel models. Agricultural value-added serves as the central indicator of productive performance, as it captures the sector’s net economic contribution. Our strategy does not aim to identify a structural production function in the strict sense; rather, it constitutes a reduced-form estimation inspired by the Cobb–Douglas framework, allowing us to quantify the association between productive inputs, climatic conditions, and agricultural performance in the MENA region.

In this context, the article addresses the following research question: To what extent do climatic variations, temperature and precipitation affect agricultural value added in MENA countries? The objective is to identify and quantify the effects of climate change on agricultural performance, while highlighting the role of productive resources in shaping that performance.

To address this question, we employ a fixed effects panel data model covering the period 1990–2024. The model includes three categories of variables: (1) climatic (temperature and precipitation), (2) productive (capital and labor), and (3) structural (arable land area). Unlike prior studies, our comprehensive and integrated approach captures the interactions between climate change and economic structures within a systemic perspective, one that can yield relevant guidance for adaptation and resilience policies in the MENA region.

The next section provides a literature review.

Section 3 sets out the research methodology, while

Section 4 presents the empirical results.

Section 5 is devoted to robustness tests, and

Section 6 discusses the findings. Finally,

Section 7 concludes the article.

2. Literature Review

The literature linking climate change to agricultural value added has expanded considerably over recent decades. Existing studies mobilize both climatic variables (temperature, precipitation) and adaptation factors (agricultural capital, labor, technology) to explain fluctuations in output. However, findings remain fragmented across methodological approaches and geographic contexts.

At the global level,

Fischer et al. (

2005) and

Warsame et al. (

2021) analyzed the effects of climate change on agricultural productivity using simulation models that incorporate rising temperatures and irregular precipitation. Their results show that climate shocks lead to a significant decline in productivity, particularly in tropical regions, thereby affecting agricultural value added and food markets. Nevertheless, these globally scoped studies remain generic and weakly contextualized, with limited consideration of regional specificities or internal productive factors such as capital and labor.

At a more local scale,

Emediegwu et al. (

2022) and

Lukali et al. (

2021) examined the influence of meteorological variables on millet yields in specific areas, showing that local climatic conditions have a significant impact on harvests. These studies confirm the importance of spatial variability, but they remain microeconomic and non-generalizable, and they do not assess the agricultural sector’s macroeconomic performance.

From a broader economic perspective,

Ahmed et al. (

2009) and

Kalkuhl and Wenz (

2020) examined the effect of climate on gross regional product (GRP) across several countries, revealing a pronounced impact of climate on productivity in tropical and vulnerable areas. However, their approach is confined to the overall economy and does not isolate the agricultural sector, which makes sector-specific interpretation of the results difficult.

Other authors, such as (

Soumaïla Mouleye et al., 2019), have broadened the analysis to the effects of climate change on poverty and inequality in Sub-Saharan Africa. While socially pertinent, this approach remains removed from the productive dynamics of the agricultural sector.

From a yield-oriented perspective,

Pol and Binyamin (

2014) and

Tao and Zhang (

2011) show non-linear relationships between maize and soybean yields and climatic variables, underscoring that the effects of warming vary by crop. These findings confirm the complexity of the climate–agriculture nexus, yet they overlook the sector’s structural economic interactions.

In the same vein,

Moore et al. (

2017) and

Xiong et al. (

2007) employed agro-climatic simulation models to quantify the future impacts of climate change on major global crops. Their findings confirm the anticipated decline in yields across tropical and arid zones, particularly under severe warming scenarios. However, these studies are essentially prospective and biophysical, with limited consideration of economic variables or structural differences between countries.

In Europe,

Olesen and Bindi (

2002) and

Van Passel et al. (

2017) employed the Ricardian approach to examine the effect of climate on agricultural land values. They show that, despite adaptation capacities, economic losses remain significant under pronounced warming. However, this land value-centered approach does not measure the productive performance of the agricultural sector.

Erda et al. (

2005) compared statistical and process-based approaches to measure the effects of climate change on agricultural yields, highlighting the importance of CO

2 and temperature. However, their analysis remains limited to the biophysical dimension of yields and does not incorporate economic variables.

In India,

Kumar and Viswanathan (

2019) and

Pickson et al. (

2020) showed that climate change reduces farm income, while emphasizing the role of information networks and collective learning in disseminating adaptation strategies. Although pertinent, these analyses are confined to a national and microeconomic framework, without an aggregated assessment of climatic effects at the regional scale.

More historically,

S. Barrios et al. (

2008) showed that rainfall variability accounts for a substantial share of the agricultural lag in Sub-Saharan Africa. While these studies provide a strong empirical foundation, they do not account for recent structural developments or the sector’s productive dimension.

Studies by

Auffhammer and Schlenker (

2014) and

Burke and Hsiang (

2015) confirm that agricultural output is highly dependent on climatic conditions, while

Ben Zaied and Zouabi (

2015) observe a decline in olive production in Tunisia as temperature rises. These analyses underscore the sector’s vulnerability, but they are often limited to specific crops or to global approaches that do not account for interactions among productive factors.

Dasgupta and Mattei (

2013),

Dell et al. (

2012),

Blanc (

2012) and

Kalkuhl and Wenz (

2020) also show that rising temperatures lead to output losses and reduced economic growth, particularly in low-income countries. These studies link climate to economic performance, but without an explicit production framework, which limits the scope of their conclusions for the agricultural sector.

More microeconomic approaches, such as those of

Ouedraogo (

2012) and

R. O. Mendelsohn (

2009) rely on the Ricardian method to evaluate the impact of climate on farm income. These studies confirm the sector’s vulnerability, but their spatial and temporal scope remains limited and does not incorporate structural effects related to capital and labor.

At the macroeconomic level,

Fankhauser and Tol (

2005) highlighted the link between climate change, savings, and capital accumulation, emphasizing the role of the latter in future growth. While illuminating, their approach remains economy-wide rather than sector-specific and does not account for the particularities of agricultural capital.

More recent studies, such as

Waqas et al. (

2025) on Thailand, underscore the high vulnerability of farming operations to extreme climatic events and the need for more targeted adaptation policies. However, these contributions remain largely qualitative and are not readily transferable at the regional level.

From an environmental standpoint,

El-Beltagy and Madkour (

2012) emphasize land degradation and biodiversity loss in arid zones, while

Correia et al. (

2024) show that drought episodes and rising temperatures generate substantial economic losses, notably in Angola. These analyses aptly characterize the environmental crisis but do not provide an econometric measure of its impact on agricultural performance.

Belloumi (

2014) examined the impact of climate change on agricultural production in Eastern and Southern Africa using a panel data model covering 1961–2011. The results show that precipitation exerts a positive and significant effect on agricultural output, whereas an increase in annual mean temperature leads to a notable decline in productivity. While this study confirms the structural vulnerability of African agriculture to warming, it remains limited by the absence of productive variables, such as capital and labor, and by a restricted temporal scope that does not capture the recent intensification of climate shocks.

Asafu-Adjaye (

2014) highlighted Africa’s particular vulnerability to the effects of climate change, noting that despite its low contribution to global emissions, the continent will bear some of the most severe impacts on economic growth and welfare. Drawing on economic modeling, the author shows that rising temperatures and dependence on rainfed agriculture expose African economies, especially in Southern and Sub-Saharan Africa, to substantial losses. However, this analysis is essentially qualitative and forward-looking; it is focused on adaptation policies without empirically quantifying climatic effects on agricultural performance. Agricultural performance, understood as an economy’s capacity to generate sustainable value added in the sector, arises from the interplay of several essential productive factors: capital, labor, and arable land. Often underemphasized in climate-centered approaches, these variables nonetheless constitute the structural pillars of agricultural productivity and the sector’s competitiveness.

According to

Vander Donckt et al. (

2021), measuring agricultural investment is critical for assessing its contribution to sectoral growth. The literature shows that the accumulation of physical capital, reflected in the expansion of the agricultural capital stock, is one of the main drivers of long-run real growth in agricultural GDP. This line of work highlights the fundamental role of productive capital in generating value added, emphasizing the importance of investments in infrastructure, equipment, and modern technologies as levers for sustained improvements in agricultural productivity. While pertinent, this analysis remains confined to the capital dimension and does not account for interactions with other productive factors or with climatic conditions.

In their study,

Mert and Eştürk (

2023) examined the determinants of agricultural value added in Poland and Turkey, using GDP per capita, gross fixed capital formation, and the share of agricultural land as explanatory variables. The results indicate that in Poland, agricultural area and GDP per capita positively influence the sector’s value added, whereas in Turkey, the coefficients for arable land and fixed capital are negative and significant, reflecting inefficiency in the allocation of productive resources.

From a global perspective,

Sansika et al. (

2023) show that economic globalization has a positive and significant impact on agricultural value added, based on a representative sample of 101 countries observed over 2000–2021. This relationship is explained primarily by the roles of foreign direct investment, exchange rates, and agricultural employment, which act as channels of integration and drivers of sectoral dynamism. The authors conclude that the availability and productivity of agricultural labor are essential determinants of the sector’s performance and competitiveness at the international level. In line with this analysis,

Kasap (

2025) shows—based on a study of the E7 countries (Brazil, China, India, Indonesia, Mexico, Russia, and Turkey)—that the share of arable land and agricultural employment exerts a positive and significant influence on the sector’s value added. The author also highlights that certain public expenditures, when not directed toward strengthening productivity, can produce adverse effects. These results confirm the complementary roles of labor and land resources in value creation, while suggesting that rational land management and a skilled agricultural workforce are essential levers for sustainable growth and economic stability in the agricultural sector.

A thorough review of the existing literature reveals a substantial body of work on the effects of climate change and productive factors on agricultural performance. Nevertheless, this research is often fragmented and centered on biophysical or broad macroeconomic approaches, without a genuine articulation between the climatic and structural dimensions of production. Moreover, the MENA region, characterized by a heavy reliance on rainfed agriculture and a heightened vulnerability to climate shocks, remains relatively underexplored in the empirical literature.

This study adopts an integrative perspective by combining climatic variables (temperature and precipitation) and productive factors (capital, labor, and arable land) within a unified econometric framework. The aim is to measure their joint effect on agricultural value added and to deepen understanding of the mechanisms of structural resilience in the sector across MENA countries.

H1. An increase in the annual mean temperature exerts a negative effect on agricultural value added.

H2. A moderate and stable increase in precipitation has a positive effect on agricultural value added.

H3. Agricultural investment, measured by gross fixed capital formation, has a significant positive effect on agricultural value added.

H4. Higher agricultural employment is associated with an increase in agricultural value added.

H5. The availability of arable land positively influences agricultural value added.

3. Methodology

Our study follows a rigorous empirical approach, relying on an econometric panel data model to evaluate the impact of climate change on agricultural value added in MENA countries. Before presenting the model specification, we outline the procedures for data collection, harmonization, and processing, which are indispensable steps to ensure the robustness, traceability, and credibility of the empirical results.

3.1. Data

Our sample covers 21 MENA countries over 1990–2024, depending on series availability. First, the economic variables, agricultural value added (VAAG), capital measured by gross fixed capital formation (GFCF), agricultural employment, and arable land, are collected from FAOSTAT and the World Development Indicators (World Bank). Second, the climatic variables—annual mean temperature (°C) and annual precipitation (mm)—are collected from Climate-Data.org. Third, monetary aggregates are converted into constant 2015 USD; VAAG and K are used in terms of logarithms to estimate elasticities; and temperature corresponds to the average of the twelve months, while precipitation is the annual total.

The panel is unbalanced. We apply limited interpolation (≤2 consecutive years) when a country series is otherwise continuous; beyond that, values remain missing. Outliers are screened in levels (Z-score and IQR); manifest errors are excluded, while plausible shocks are retained.

Based on this information and prior work, the variables used to explain agricultural value added in MENA countries are summarized in

Table 1. First, agricultural capital (GFCF), measured in constant 2015 USD, captures the investment effort and is an expected driver of value creation in agriculture (positive effect), consistent with production frameworks and empirical findings (

Vander Donckt et al., 2021).

Second, agricultural labor, captured by the share of agricultural employment in total employment, indicates labor availability; its expected effect on agricultural value added is positive (

Sansika et al., 2023).

Third, annual mean temperature (°C) reflects thermal constraints; higher levels, beyond physiological thresholds, reduce yields and weigh on value added (

Auffhammer & Schlenker, 2014;

S. Barrios et al., 2008;

Blanc, 2012;

Chen et al., 2016;

R. O. Mendelsohn, 2009;

R. Mendelsohn et al., 1994). Fourth, annual precipitation (mm/year) measures water availability; in the MENA region’s arid and semi-arid context, sufficient and regular rainfall sustains soil moisture and yields, thereby positively affecting agricultural value added (

Belloumi, 2014). Finally, arable land (% of total area) approximates the productive land base and conditions the capacity for crop expansion and intensification, which positively impacts agricultural value added (

Bayraç & Dogan, 2016).

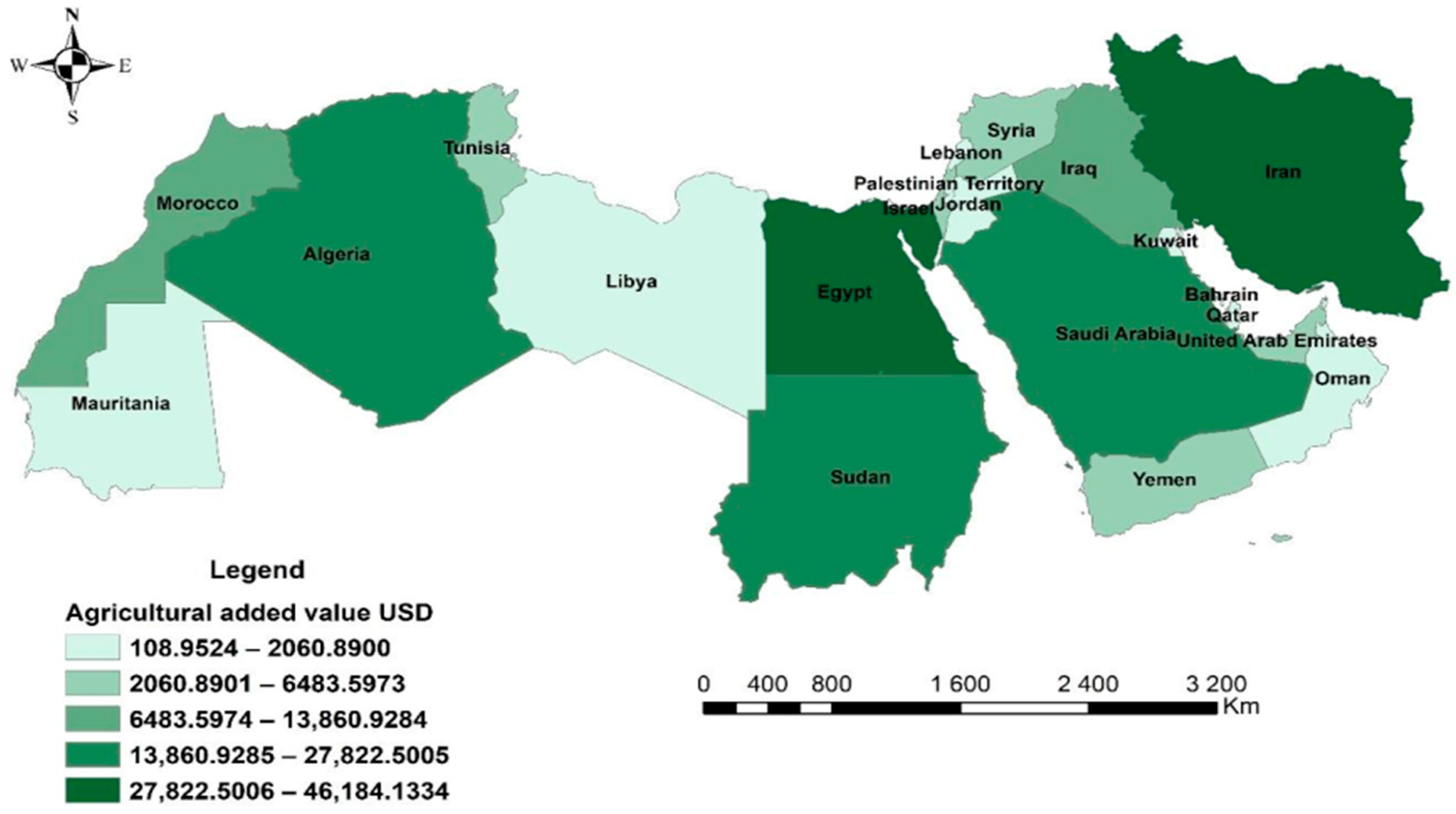

3.1.1. Agricultural Value in the MENA Region (1990–2024)

Figure 1 illustrates the spatial distribution of agricultural value added (USD) across MENA countries (Maghreb–Middle East) between 1990 and 2024, highlighting regional agricultural disparities that are closely linked to natural resources (water and soils) and agricultural policies. The countries with the highest agricultural contributions are Egypt and Iran, which display values exceeding USD 27,822.5005, reflecting the importance of agriculture in their economies and their cultivated area. In contrast, the Gulf countries (Qatar, Bahrain, the United Arab Emirates, Kuwait), as well as Mauritania and Libya, show low values, indicative of limited arable land. Morocco, Algeria, and Saudi Arabia occupy an intermediate position, reflecting a significant agricultural sector that remains constrained by climatic and water limitations.

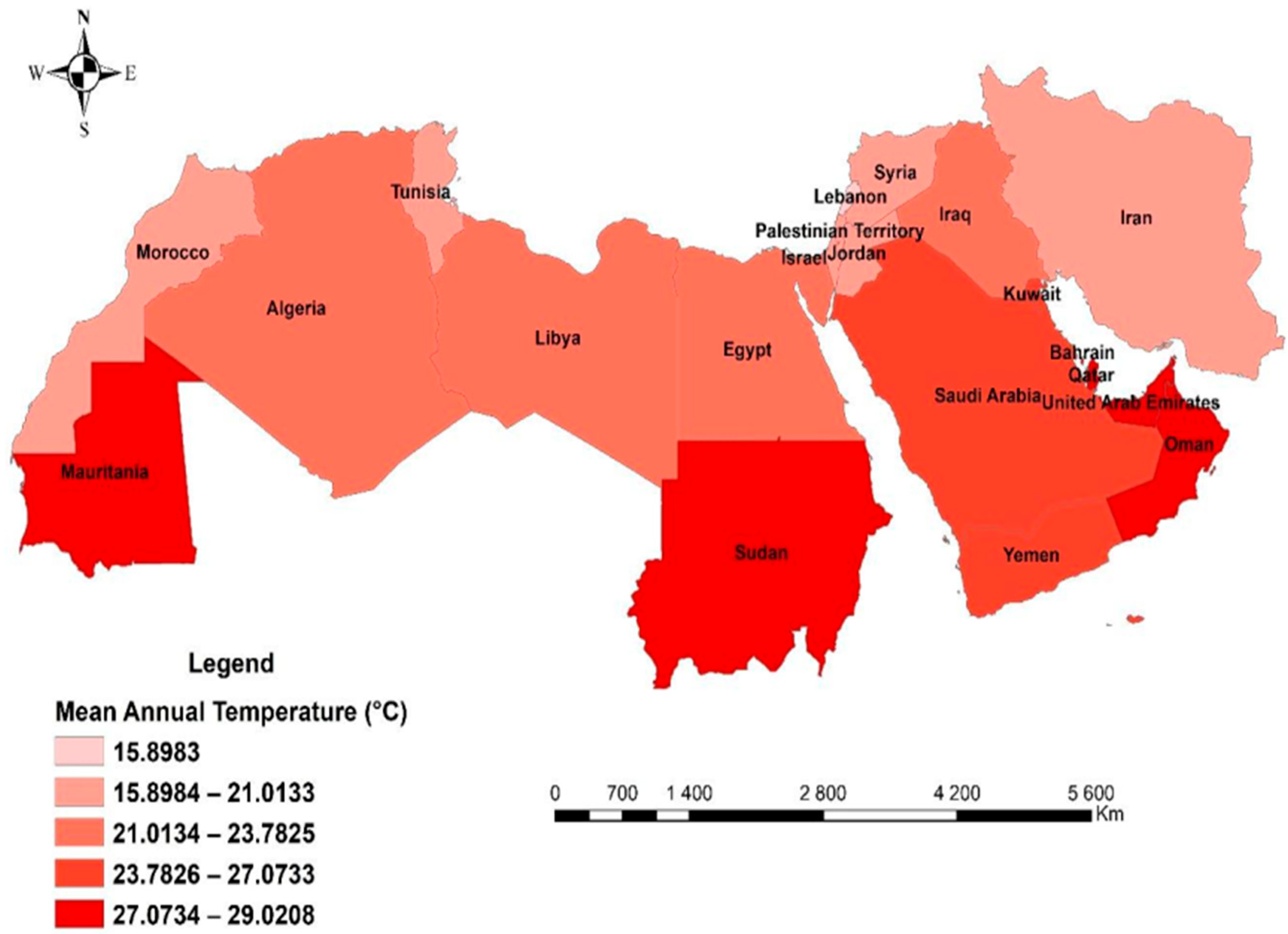

3.1.2. Annual Mean Temperature in the MENA Region (1990–2024)

This map depicts the distribution of annual mean temperatures (°C) across the MENA region over 2013–2024. As shown in

Figure 2, the highest values (>27 °C) are observed in Mauritania, Sudan, Qatar, and Oman, and are indicative of hot to arid climates. The cooler zones (<21 °C) are located in Tunisia, Morocco, Lebanon, Syria, Palestine, Israel, Jordan, and Iran, with these areas benefiting from a milder Mediterranean climate. Most Gulf countries and North African areas register temperatures between 23 and 27 °C, which intensify evaporation and heighten pressure on water resources. The map underscores the decisive role of the region’s hot, dry climate in shaping water availability and agricultural practices.

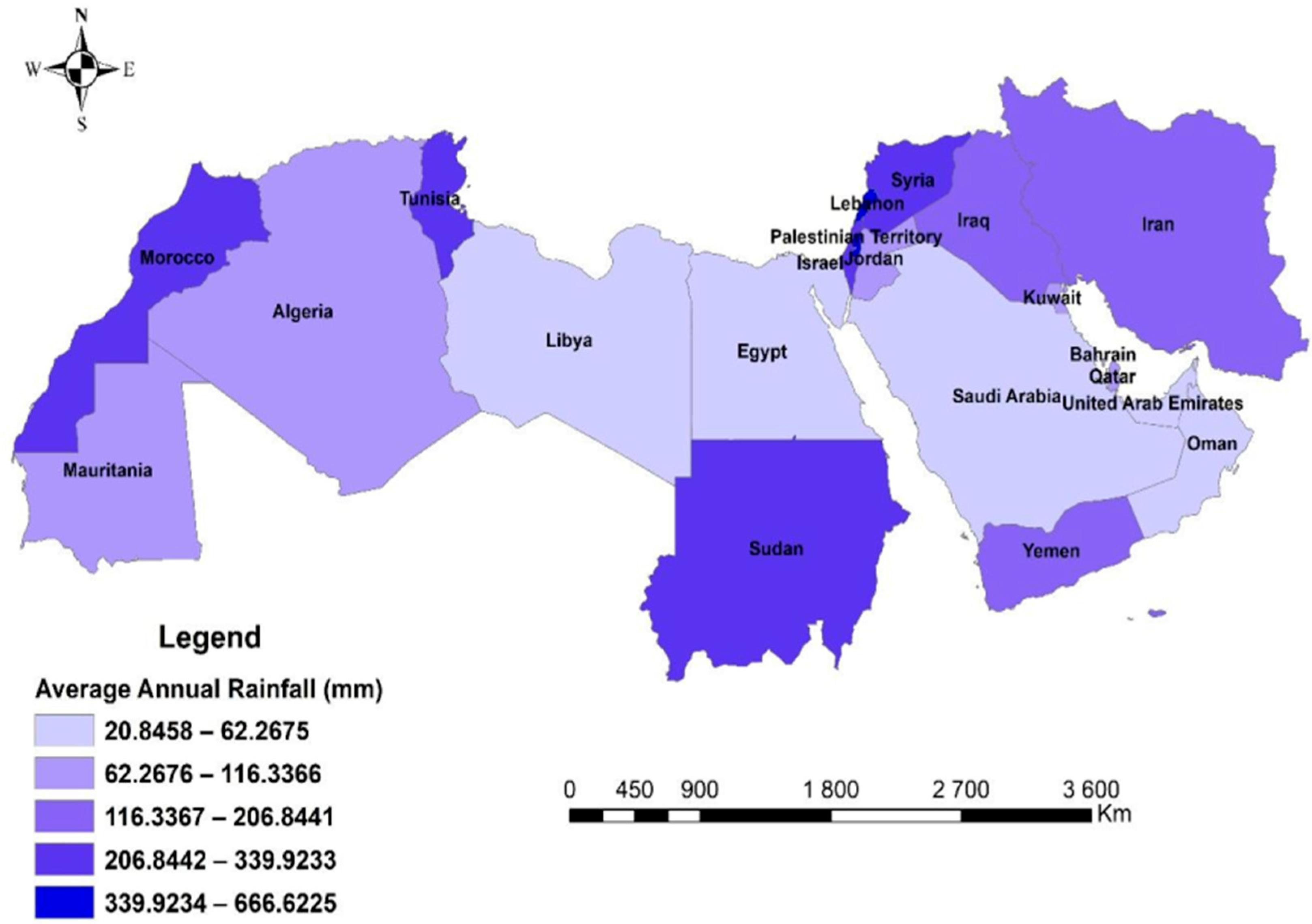

3.1.3. Annual Precipitation in the MENA Region (1990–2024)

This map shows the spatial variability of rainfall (mm) across the MENA region over 2013–2024. As illustrated in

Figure 3, the wettest zones (>206.8442 mm/year) are found in the Maghreb (Morocco and Tunisia) and the Middle East (Lebanon, Syria, Palestine, and Israel). In contrast, arid areas (<62.2676 mm/year) include the Arabian Peninsula (Saudi Arabia, the United Arab Emirates, Oman, Qatar), as well as Libya and Egypt. Sudan and Yemen exhibit relatively higher rainfall than their neighbors, resulting in locally supported rainfed agriculture. Overall, precipitation is highly heterogeneous and constitutes a decisive factor for water availability and agricultural development.

3.2. Empirical Model Specifications

The analysis of the impact of climate change on agriculture has been the subject of several empirical studies. Over the last three decades, the empirical literature on this subject has been dominated by different assessment approaches: the Ricardian (

R. Mendelsohn et al., 1994) and the production function approach (

Deschênes & Greenstone, 2007). In this research context, it is interesting to note that the study in question, which examines the impact of climatic variables on agriculture, uses a similar method. Panel data regression applied to the production approach is chosen to analyze longitudinal data on MENA countries, from 1990 to 2024. Justified by data availability, the choice of this method, as well as the Ricardian approach, is not adapted to these countries, as this approach is based on land values for which data is not available for developing countries (

R. Mendelsohn et al., 1994). For the empirical testing of the theoretical relationship between climate change and agricultural value added in the case of MENA countries, we have a choice between two econometric models, namely the fixed effects model and the random effects model. The first model captures unobserved individual characteristics that are constant over time and change between individuals. The second model assumes that individual effects are realizations of a random variable. The canonical form of the fixed effects model is written as follows:

where

: Represents the vector of K endogenous variables for individual i at time t.

: Model constant.

Individual fixed effects.

Temporal fixed effects.

Vector of explanatory variables.

: Error term.

The random effects model is written in the following form:

To estimate the model in this case, we will use Fisher’s test to check the presence of country-specific fixed effects, and the Breusch–Pagan test to check for the presence of random effects. The results of these two tests, presented in

Table 2, show the presence of both specific and random effects in our panel. To choose between the fixed effects model and the random effects model, we will use the (Hausman, 1978) test. The results of this test, as shown in

Table 3, lead to the rejection of the null hypothesis at the 5% significance level, and we therefore retain the fixed effects model.

In our study, the econometric model examining the impact of climatic variables on agricultural value added in MENA countries is written in the following simple form:

where

: Agricultural value added in country i at time t.

: The model constant.

Fixed effects for each country.

Temporal effects for each country.

: Amount invested in the agricultural sector by country i at time t.

: The employment rate in the agricultural sector in country i at time t.

: Average annual temperature in country i at time t.

: Average annual rainfall in country i at time t.

: Arable rate in country i at time t.

The error term.

: Coefficients of the model to be estimated.

3.3. Descriptive Statistics for Variables

Table 4 summarizes the panel’s descriptive statistics. On average, agricultural value added (VAAG) accounts for 10.5% of GDP in the MENA region, with substantial cross-country heterogeneity (3.5–22%). Agricultural capital (K) averages (3–3.5%) of GDP (0.8–7.5%), while the share of employment in agriculture (L) is 25% on average (5–50%). Regarding climate, the maximum temperature (TM) is around 22 °C (10–32 °C) and annual precipitation (PR) is about 220 mm/year (50–900 mm). Finally, the proportion of arable land (TA) averages 18–19%, with considerable dispersion (0.2–35%).

3.4. Correlation Matrix

The correlation matrix in

Table 5 enables us to assess the relationship between agricultural value added (VAAG) and its explanatory variables in the MENA region. Agricultural value added is positively correlated with rainfall (0.673). Similarly, the proportion of arable land (0.386) and the agricultural employment rate (0.324) are positively correlated with agricultural value added. However, average temperature is negatively correlated with agricultural value added (−0.107). Capital invested in agriculture shows a weak (0.112) but significant correlation with agricultural value added. Furthermore, correlations between explanatory variables are low overall, reducing the risk of multicollinearity and enabling robust econometric modeling.

3.5. Stationarity Results

In econometric analysis, it is necessary to verify the stationarity of the series, because the time dimension is large in our data. To make sure we do not obtain misleading estimates that mess up our results, we need to have a stationary time series. We usually use tests from

Levin et al. (

2002),

Im et al. (

2003), and

Maddala and Wu (

1999). These tests are based on the assumption of independence between individuals in the panel and share the same null hypothesis in each series containing a unit root, while the alternative hypothesis suggests that the series are stationary. In our study, we used the test developed by

Im et al. (

2003). The choice of this test is justified by the fact that our study meets the constraints imposed by this test, namely a heterogeneous sample of countries and a time dimension greater than the individual dimension. The results of the test are presented in

Table 6 below. We observe that all variables are stationary at the 5% significance level after the first differentiation, with the exception of the arable land variable, which was already stationary integrated of order (0).

4. Results

This study analyzes the impact of climate change on agricultural value added (VAAG), a key indicator of sectoral performance in MENA countries. The results of the stationarity tests shown in

Table 6 indicate that the series used are stationary. We can therefore estimate a multiple linear regression model to empirically assess the relationship between climatic variables and (VAAG) in the sample under study. The estimation results reported in

Table 7 show a good model fit: the Fisher statistic is highly significant (

p-value < 5%), and the adjusted R

2 reaches 0.940. The intercept and the coefficients for employment (L), temperature (TM), precipitation (PR), and arable land (TA) are significant at the 5% level. In contrast, capital (K) is not significant (

p = 0.196).

One advantage of panel data is the ability to control for unobserved variables. In our data, country-specific characteristics that are not directly observable may influence agricultural value added. If this influence is stable for each country across years, it reflects individual fixed effects; if it is common to all units but stable over time, it reflects time fixed effects. Otherwise, one may consider random effects incorporated into the error component.

To estimate the fixed effects model for each MENA country, we include country indicator (dummy) variables within a standard linear regression framework. The results, presented in

Table 8, indicate a satisfactory overall fit (R

2 = 0.829). The coefficient on invested capital is not significantly different from zero, whereas the other explanatory variables are significant. Individual effects are significant for most countries, with the exception of Israel, Lebanon, Djibouti, and Syria. Unobserved characteristics contribute to reducing agricultural value added in these countries (except in Djibouti, where the effect is positive). For the majority of other countries, unobserved characteristics increase agricultural value added, with the exception of Tunisia, where they have a reducing effect. The largest average gaps are observed for Morocco, Algeria, Mauritania, Kuwait, Iraq, and Jordan.

Although both specifications appear satisfactory, the residual diagnostic tests reported in

Table 9 reject the null of no AR (1) autocorrelation (Wooldridge,

F = 14.62;

p < 0.001) and the null of homoskedasticity (Breusch–Pagan, χ

2 = 41.85;

p = 0.001), indicating autocorrelated and heteroskedastic errors.

In a second step, Fisher’s test of specific (individual) effects reported in

Table 10 rejects the null hypothesis that individual effects are zero (

F = 7.4821; ddl = 20, 713;

p = 0.003), revealing structural differences across countries.

Consistent with the Hausman test results in

Table 3, our preferred specification is a fixed effects model. The residual diagnostics (

Table 9) reject both the absence of AR (1) autocorrelation and homoskedasticity, which weakens OLS inference. Consequently, our main inference relies on a fixed effects model with cluster-robust standard errors by country. As an efficiency check, we also estimate a feasible GLS for panels with heteroskedasticity and AR (1) correlation [panels (hetero) and corr(ar1)].

According to

Table 11, the model is estimated based on 735 observations (panel: countries, years). Global tests indicate strong joint significance of the regressors: For the fixed effects model, the Fisher statistic F = 21.53 is significant at the 1% level; for GLS, the Wald statistic = 23.2 is likewise significant at the 1% level. The within-country explanatory power is sustained, with

(within) = 0.748, while the GLS Pseudo-

(GLS) is similar (0.750), confirming the model’s good overall fit.

Consistent with the Hausman test, the country fixed effects specification is retained, with year fixed effects included to net out common shocks. In light of the heteroskedasticity and AR (1) diagnostics, the main inference relies on cluster-robust standard errors at the country level (G = 21). As an efficiency check, a GLS estimation [panels(hetero), corr(ar1)] is reported; it yields coefficients with the same signs and of comparable magnitude, with slightly smaller robust standard errors, thereby strengthening the robustness of the conclusions.

From the table, capital (K), agricultural employment (L), annual mean temperature (TM), annual precipitation (PR), and arable land (TA) are significant at the 1% and 5% levels in both models.

In terms of interpretation, the results highlight a positive and significant relationship between investment in the agricultural sector and agricultural value added (VAAG), confirming the role of capital in improving sectoral performance. This finding is consistent with the prior hypothesis that higher investment translates into greater VAAG. Regarding agricultural labor, it exerts a positive and significant effect on VAAG. This result also confirms the anticipated hypothesis as follows: Increases in agricultural employment are associated with higher agricultural value added, underscoring the decisive role of labor in production.

Regarding the climatic variables, the results are twofold. First, annual mean temperature has a negative and significant effect on agricultural value added (VAAG): Thermal increases penalize performance, confirming the hypothesis of an adverse temperature impact on VAAG. Second, annual mean precipitation exerts a positive and significant effect, underscoring the importance of water availability for agricultural production. Finally, arable land (TA) shows a positive and significant effect, confirming the hypothesis that the availability and effective use of the land base positively influence agricultural value added.

5. Robustness Test

We first estimated a static panel model with fixed effects to account for country-specific unobserved heterogeneity. However, the potential presence of endogeneity limits the causal interpretation of the coefficients (

Arellano & Bond, 1991). To strengthen the robustness of the estimation and address this bias, we subsequently adopt a dynamic specification using System GMM.

The determinants of agricultural value added are dynamic and strongly dependent on past observations; accordingly, the System GMM estimator provides more consistent results. This approach also corrects the coefficient bias induced by static panel estimation. Consequently, the fixed effects model was re-estimated using a System GMM estimator. The System GMM results are reported in

Table 12.

System GMM estimates indicate that capital and labor exert positive and statistically significant effects on agricultural value added. Regarding climatic determinants, annual mean temperature has a negative and significant effect, whereas precipitation and the availability of arable land have positive and significant effects. Moreover, the System GMM estimation reproduces the signs and relative magnitudes of the coefficients obtained under the fixed effects model, attesting to the robustness of the results and their stability with respect to the choice of estimation strategy.

6. Discussion

In the MENA context characterized by structural aridity, chronic water scarcity, high interannual variability in precipitation, and increasingly frequent episodes of extreme heat, our results illuminate the mechanisms that support (or undermine) agricultural value added. On the one hand, traditional inputs, capital and agricultural labor, contribute positively and are statistically significant in terms of value creation, confirming that strengthening production factors (investment, equipment, skills) remains a central lever in a region where natural constraints weigh on productivity. On the climatic side, a higher annual mean temperature is associated with a significant decline in agricultural value added, underscoring the vulnerability of cropping systems to heat stress. In contrast, a moderate and relatively stable increase in precipitation is accompanied by a significant rise in value added, highlighting the dependence of rainfed agriculture on water availability in a structurally arid, water-limited environment. Finally, the availability of arable land exerts a positive and significant effect, confirming the central role of the land base, whose extent and quality can be diminished by urban pressure, soil degradation, and advancing desertification, in the formation of agricultural value added.

These results are highly consistent with the existing literature. The negative impact of temperature on agricultural value added (VAAG) corroborates studies such as (

Dell et al., 2012) in a global context, which also show that higher temperatures reduce economic growth in poorer countries by compressing agricultural and industrial activity and undermining political stability. Similarly, in Eastern and Southern Africa,

Belloumi (

2014) and

S. Barrios et al. (

2008) find that increases in annual mean temperature have a negative effect on agricultural performance, whereas annual precipitation exerts a positive and significant effect. These findings are also in line with

Chen et al. (

2016) regarding China, who report a negative temperature effect and a positive precipitation effect on yields. Finally, the significance of capital and labor is a classic result, confirmed by numerous studies on agricultural production functions, including

Van Passel et al. (

2017),

Ouedraogo (

2012),

R. O. Mendelsohn (

2009) and

Deschênes and Greenstone (

2007).

To better contextualize our results, we retain five case studies on Morocco, Egypt, Tunisia, Yemen, and Jordan, that represent a diverse range of climatic vulnerabilities, dependence on the agricultural sector, and water constraints. At the regional scale, MENA suffers from acute water scarcity—the highest global value—with 83% of its population already living under extremely high-water stress (withdrawals exceeding 80% of renewable resources) (wri.org). This structural constraint amplifies the negative sensitivity to heat and the dependence on rainfall highlighted by our estimates.

Morocco. Agriculture accounts for roughly 12% of GDP and employs close to 30% of the total labor force, indicating substantial macro-social exposure to climate shocks. Production remains predominantly rainfed: Only about 20% of arable land is equipped for irrigation, yet irrigated areas generate roughly half of agricultural value added. From a water perspective, Morocco is among the most constrained countries; renewable water availability is about 620 m

3 per capita per year, which is well below the 1000 m

3 scarcity threshold, and agriculture accounts for roughly 80% of total withdrawals (

Verner et al., 2018). This profile explains why increases in temperature weigh heavily on agricultural value added, whereas regular rainfall delivers appreciable gains, in line with our estimated coefficients.

Egypt. Agriculture is almost entirely irrigated (95% of cultivated land), which mitigates direct dependence on local rainfall. Nevertheless, water availability remains contingent on Nile inflows, which are linked to upstream precipitation. In this context, one would expect a weaker sensitivity of agricultural value added to local rainfall, while temperature retains a negative impact via increased evapotranspiration and salinity risks (

Abdelfattah, 2021). This configuration is consistent with our results: The area has a potentially more moderate precipitation effect than in rainfed systems, alongside a persistent negative effect of heat.

Tunisia. Agriculture accounts for roughly 9.33% of GDP and 12.85% of total employment (

World Bank, 2023a), sustaining a non-negligible sectoral dependence and facilitating the transmission of climate shocks to economic activity. In water terms, renewable availability has fallen to around 400 m

3 per capita per year (2023), well below the scarcity threshold, while agriculture draws about 77.4% of total water withdrawals. Production remains predominantly rainfed; roughly 0.43–0.45 million hectares are irrigated out of 4.2 million hectares cultivated, which is about 10% of the area, hence the strong sensitivity to rainfall regimes. This configuration is fully consistent with our estimates; temperature exerts a negative effect (heat stress, evapotranspiration), moderate and regular rainfall translates into gains in agricultural value added (positive precipitation effect), and leveraging the land base (arable land) contributes positively to value creation.

Jordan. An extremely water-deficient country, with renewable resources of roughly 161 m

3 per capita per year, far below the extreme-scarcity threshold. In this context, temperature has a particularly detrimental effect, while any improvement in water availability (rainfall, storage) yields proportionally large gains (

Ministry of Water and Irrigation, 2023). This is consistent with our estimates, which show a positive coefficient associated with precipitation.

Yemen. The country combines a high relative dependence on agriculture with extreme water scarcity. On the employment side, agriculture accounts for 28–29% of total employment (

World Bank, 2023b), above the global average, thereby amplifying the transmission of climate shocks to real activity. In terms of land structure, arable land covers only about 2.2% of the territory, underscoring the scarcity of the productive base. On the topic of water, Yemen is among the world’s most water-poor countries; renewable water availability is well below 100 m

3 per capita per year (approximately 74–80 m

3/person/year) (wri.org). These constraints are consistent with our estimates, as follows: (i) Temperature exerts a pronounced negative effect (heat stress and evapotranspiration on a severely constrained water stock); (ii) any improvement in water availability, via rainfall or storage, and water management, translates into proportionally large gains, hence the positive precipitation effect; and (iii) the scarcity of arable land has a central role in its effective utilization.

From a practical standpoint, this study yields several concrete policy recommendations. First, MENA countries should accelerate investment in efficient, context-appropriate irrigation (e.g., controlled drip systems) to mitigate the adverse effects of high temperatures and stabilize yields. Second, policies should prioritize managing rainfall variability through decentralized water storage, rainwater harvesting, and aquifer recharge, in order to increase water productivity and secure supply during critical periods. Third, climate governance must be strengthened via coherent institutional frameworks, the introduction of targeted subsidies, and improved access to agricultural credit to support the adoption of resource-efficient equipment and climate-smart practices, which is consistent with the positive role of capital, labor, and the land base. Finally, more active regional cooperation in water-resource management, data and expertise sharing, indicator harmonization, and coordinated responses, constitutes a strategic lever for confronting common climate shocks and sustainably supporting agricultural value added in the MENA region.

7. Conclusions

The results of our econometric analyses provide a clear answer to our research question regarding the impact of climate change on agricultural value added in the MENA region. Empirically, we first estimated a fixed effects model (country and year). Diagnostic tests (within-country AR (1) autocorrelation and heteroskedasticity) then motivated the use of cluster-robust standard errors at the country level. Finally, to address potential endogeneity and verify the stability of the coefficients, we employed a dynamic System GMM estimator; the Hansen test together with the AR (1)/AR (2) tests confirmed the validity of the instruments and the robustness of the inference.

The estimates reveal clear regularities. First, an increase in the annual mean temperature is associated with a significant decline in agricultural value added, underscoring the vulnerability of production systems to heat stress. Second, moderate and regular rainfall is positively correlated with performance, reflecting the dependence of rainfed systems on water availability in arid contexts. Third, traditional inputs, such as capital and agricultural labor, exhibit positive and statistically significant effects, which is consistent with production theory: Investment (gross fixed capital formation) and labor mobilization support value creation. Finally, the availability of arable land also has a positive effect, confirming the central role of the land base in the formation of agricultural value added. Taken together, these results confirm our working hypotheses and their robustness regarding the adverse effects of heat, the favorable (moderate intensity) effect of precipitation, and the decisive contribution of production factors and land.

Given MENA-specific features, aridity, pressure on water resources, and the still substantial weight of agriculture in employment, this empirical reading provides a unified interpretive framework: Heat penalizes value added; rainfall supports performance when irrigation is limited; and productive resources (capital, labor, land) remain as structuring levers.

Several limitations must nonetheless be emphasized. First, the predominance of fixed effects may constrain the external validity of the results to other institutional and technological contexts. Second, the absence of country-specific heterogeneous slopes limits the analysis of differentiated sensitivities (irrigation, aridity, crop structure). Finally, certain relevant dimensions, such as adaptation investments, technological adoption, water infrastructure, and soil quality, could not be incorporated uniformly due to the lack of comparable data.

These elements open several avenues for future research: Deepening the dynamics with enriched specifications (non-linear effects of temperature and precipitation, interactions with irrigation or aridity); introducing country-specific slopes (climate × endowment interactions) to capture intra-regional heterogeneity; and widening the explanatory scope by incorporating adaptation indicators as well as measures of land quality and use. Such extensions would sharpen causal diagnosis and more precisely illuminate the levers of resilience for agricultural value added within the MENA region.