4.3. ARDL Estimations

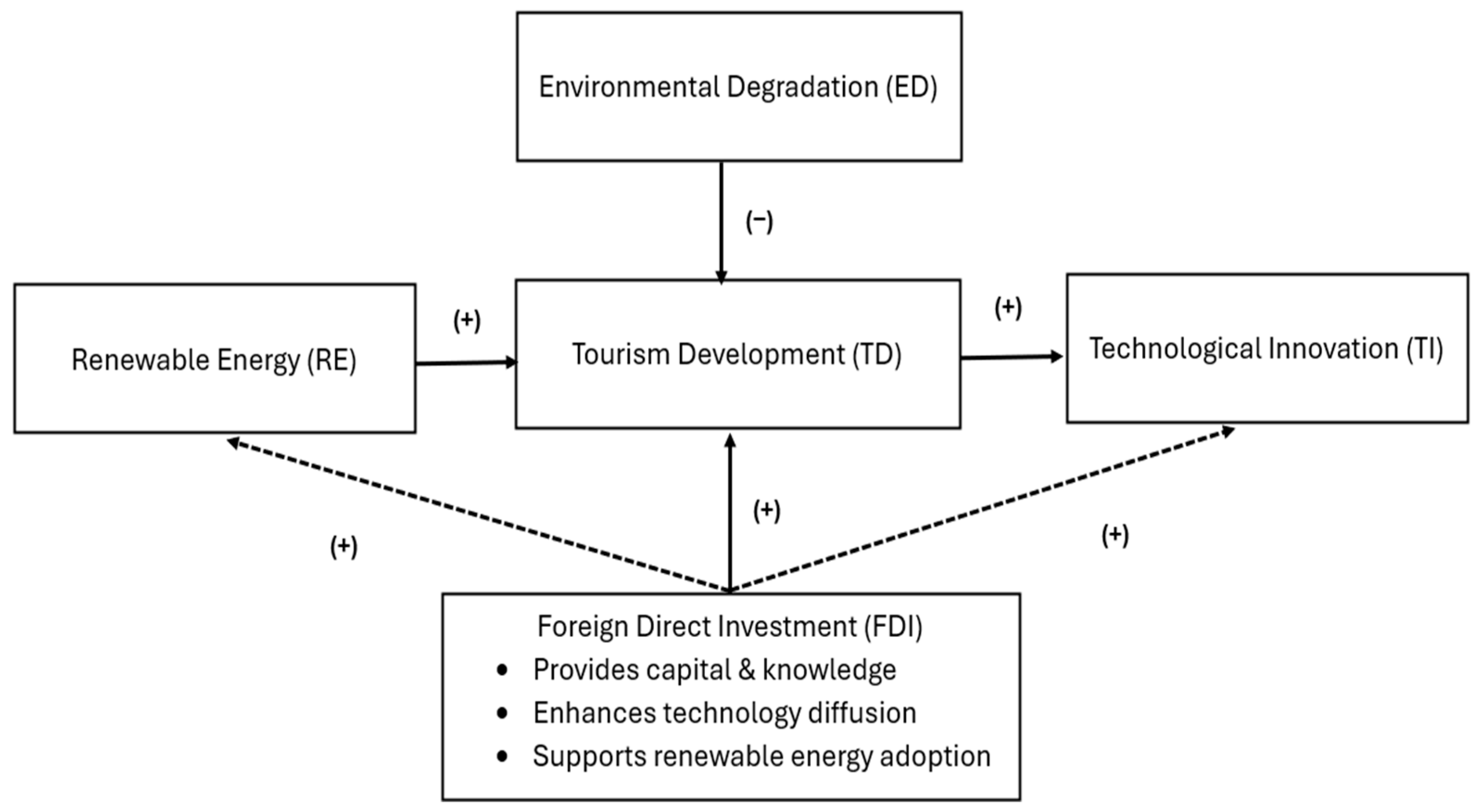

Table 5 indicates that ARDL estimates give a vivid difference between long-run equilibrium and short-run adjustment, and the log-log form enables the direct reading of the elasticities. Environmental degradation (ED) lowers tourism development (TD) in the long term: the elasticity of

lnED = −0.725 (

p = 0.078), which implies that a 1% increase in ED would be linked to a 0.73% decrease in TD; the impact is negative and statistically significant. Economically, this is an indicator of reduced quality of destinations and increased costs of operations, both of which deter competitiveness and discourage repeat visits in the long term. Moreover, the use of renewable energy (RE) is in favor of tourism:

lnRE = 0.276 (

p = 0.023), which means that a 1-percentage point gain in the use of renewable energy is likely to lead to a 0.28-percentage point gain in tourism, with the effect being moderate and statistically significant. This is economically indicative of reduced volatility of the cost of energy as well as enhanced destination credibility, as renewables reduce the input of fossil fuels over time. Moreover, the impact of technological innovation (TI) on the development of tourism is strongly positive:

lnTI = 0.301 (

p = 0.004); thus, an increase in TI by 1 percent increases TD by about 0.30%. In economic terms, this connection corresponds to efficiency gains and service differentiation, which enhance destination quality and the satisfaction of visitors. Likewise, foreign direct investment (FDI) has the most significant long-run impact:

lnFDI = 2.162 (

p = 0.008), indicating that a 1% increase in FDI is associated with a 2.16% rise in TD; therefore, the elasticity is large and highly significant. This outcome captures FDI’s role in transferring technology, capital, and managerial standards that strengthen destination competitiveness.

In contrast, the short-run equation shows weaker and mostly borderline effects, which is typical when adjustment is gradual. The contemporaneous change in environmental degradation (ΔED) is negative but not statistically significant (−3.47; p = 0.274); therefore, immediate environmental shocks do not measurably impact tourism development (TD) on the initial level. Meanwhile, the change in renewable energy usage (ΔRE) is negative and only weakly significant (−3.316; p = 0.064), whereas the changes in technological innovation (ΔTI = 0.582; p = 0.096) and foreign direct investment (ΔFDI = 0.227; p = 0.074) are slight, positive, and borderline at the 10% level. Crucially, the error-correction term is negative and highly significant (ECTt−1 = −0.219; p < 0.001); accordingly, about 21.9% of any disequilibrium is corrected each period, and the implied half-life of a shock is roughly 2.8 periods. Moreover, the negative and highly significant error-correction term provides internal confirmation of cointegration among the variables, which is entirely consistent with the earlier bounds test. In the Autoregressive Distributed Lag (ARDL) framework, such a coefficient indicates that deviations from equilibrium are corrected over time and, importantly, it also implies the presence of long-run Granger causality running from the explanatory variables to tourism development (TD). Thus, short-run fluctuations tend to fade, and the system steadily returns to its long-run path. Moreover, the model fit is strong (R2 = 0.925; adjusted R2 = 0.782), and the joint F-test confirms overall significance (p = 0.002). Consequently, the long-run coefficients carry the central message, while the significant correction speed ensures convergence.

Interpreting the contrast between long-run and short-run estimates is instructive. First, environmental degradation (ED) matters in the long run but not in the short run. Conceptually, destination quality, ecosystem services, and health risk perceptions diffuse slowly through markets; therefore, the damage from pollution or habitat loss tends to accumulate and then manifest in reputation, repeat visitation, and product variety. In the short term, however, tourism operators and visitors can temporarily offset localized degradation through pricing, marketing, or substitution across sites and seasons; hence, the immediate effect of ΔED is statistically weak. In this context, international research indicates that pollution can reduce destination appeal over time (

Zhang et al., 2020;

Su & Lee, 2022). Our results confirm this, as environmental degradation is insignificant in the short term but detrimental to tourism development in the long term.

Second, renewable energy usage (RE) positively impacts tourism development (TD) in the long run, although it exhibits a slight, negative, and only borderline effect in the short run. This asymmetry is plausible. Scaling renewables in the short run could be associated with construction activities, grid enhancement, tariff changes, and knowledge by doing; as a result, the operating expenses and short-term disturbances can affect tourism businesses. Nevertheless, over time, the use of cleaner energy would decrease the amount of pollutants in the air, improve air quality at the destination, and increase the environmental credibility of the destination. Therefore, it enhances tourism brands and minimizes energy volatility in terms of cost for hotels, transportation and attractions. These channels are supported by comparative studies in various countries and have connected renewable energy and green innovation to enhancing the environmental quality and, consequently, to tourism competitiveness reporting lasting gains as the energy transition matures (

Khanal et al., 2022;

Y. Guo & Chai, 2025).

Third, the long-run gains from technological innovation (TI) and foreign direct investment (FDI) are sizeable and robust, whereas their short-run effects are muted. This pattern is typical of capacity-building variables. Innovation in tourism diffuses through energy efficiency, digital services, smart mobility, and environmental management; thus, its payoff amplifies with adoption and scale, albeit not instantaneously. Over the past few years, the TNTO has advanced the digitalization of the sector by expanding broadband coverage in tourist areas, strengthening the national portal DiscoverTunisia, and simplifying administrative procedures for tourism facilities. It has also promoted start-up initiatives for digital tourism content and explored the introduction of a multi-service electronic card for visitors. These measures align with regional priorities that emphasize digital tools and smart-destination systems as levers of competitiveness and sustainability (

Blue Plan/UNEP-MAP, 2022;

TNTO, 2024).

Similarly, FDI often finances quality upgrades, new products, and international linkages that take time to complete and to market; therefore, the short-term effect can be small while the long-run elasticity is large. Cross-country analyses consistently document that FDI supports tourism growth over longer horizons, especially when paired with stable institutions and infrastructure (

Antwi, 2022).

Combined, the evidence suggests a logical agenda to policy and practice. In the long run, reducing environmental degradation (ED), promoting renewable energy (RE), and technological innovation (TI) will enhance tourism development (TD). Meanwhile, foreign direct investment (FDI) has the potential to enhance such gains through capital deepening and knowledge transfer. In the short run, the adjustment costs may manifest themselves, especially in the process of energy transitions; however, as the error-correction speed is very large, the costs are temporary and the sector will return to long-run equilibrium. As a result, managers and policymakers should focus on the long-term management of pollution, the predictable use of renewable energy, and environments that encourage innovation through investment, the mitigation of rollout tensions, such as staging construction, stabilizing tariffs, and providing specific assistance to small- and medium-sized tourism enterprises. The experiences of various countries point to the same conclusion: destinations that contribute to improving environmental quality and energy systems have the opportunity to secure demand and increase resilience in the long run.

The results for Tunisia resonate with regional and international evidence, though notable distinctions emerge. The negative long-run effect of environmental degradation on tourism development agrees with findings for Egypt and Morocco, where pollution and coastal stress deter international arrivals (

Ren et al., 2019;

Kwakwa, 2024). Likewise, the positive roles of renewable energy and technological innovation correspond to evidence from some MENA countries, which shows that clean energy adoption and eco-innovation enhance destination competitiveness and environmental resilience (

Abdullayev et al., 2023;

Amer et al., 2024). Nevertheless, the elasticities estimated for Tunisia are somewhat larger. This likely reflects its smaller market size, accelerated energy transition momentum, and the sector’s heightened sensitivity to improvements in environmental and technological conditions. In contrast, the strong effect of FDI exceeds that reported for broader North African nations (

Adeola et al., 2020;

Soumaré, 2015), suggesting that institutional stability and proximity to European markets attract higher-quality, tourism-oriented investment. These comparative nuances underscore Tunisia’s distinctive position in the region and clarify why structural transition dynamics shape the sustainability of its tourism sector.

After interpreting our empirical findings, we examine the robustness of our ARDL model.

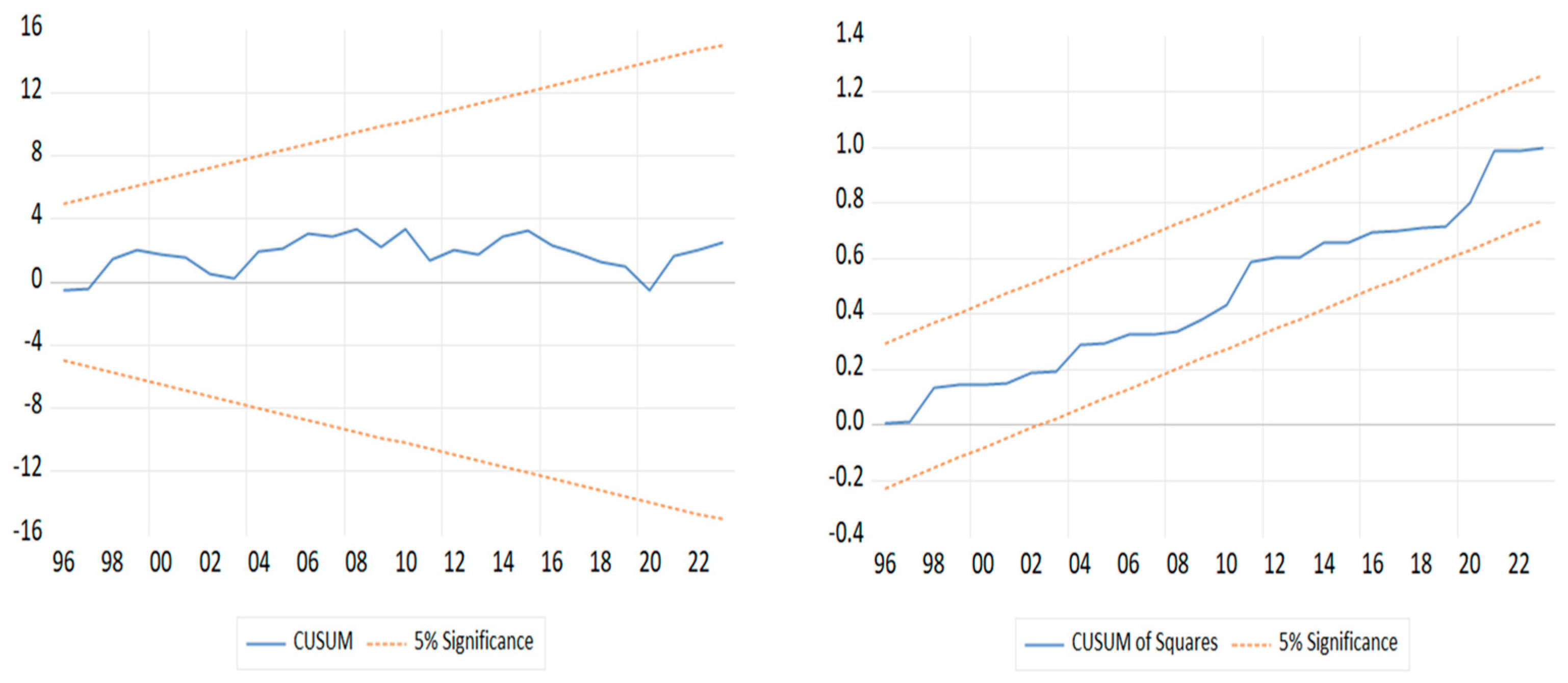

Table 6 reports the outcomes of the conducted tests, with diagnostic checks covering heteroskedasticity, serial correlation, and residual normality. In the same regard,

Figure 2 examines the stability properties of the estimated coefficients over time.

The diagnostic results in

Table 6 provide strong support for the adequacy of the ARDL specification. The Breusch–Godfrey LM statistic (

p = 0.762) confirms the absence of serial correlation, which suggests that the chosen lag structure is appropriate and that dynamic effects are well captured. Likewise, the Breusch–Pagan–Godfrey test (

p = 0.459) indicates no heteroskedasticity, meaning that the variance of the residuals is stable and the estimated standard errors remain valid. In addition, the Jarque–Bera statistic (

p = 0.719) shows that the residual series exhibits normality, which enhances the reliability of inference in a small-sample setting. Both CUSUM and CUSUM of Squares in

Figure 2. stay within the 5% significance bands; therefore, we do not reject parameter constancy. Hence, no structural break is detected in either the mean dynamics or the error variance. Consequently, the Autoregressive Distributed Lag (ARDL) model is stable, and inference is reliable. Moreover, this stability supports the credibility of the long-run elasticities and the short-run adjustment captured by the error correction term and, thus, strengthens the interpretation of equilibrium relationships and convergence speed. Thus, our estimated model provides a consistent framework for evaluating the role of environmental degradation, renewable energy usage, technological innovation, and foreign direct investment in shaping the development tourism in Tunisia.

To reinforce the long-run evidence from the ARDL model, we re-estimate the cointegrating relation by applying Fully Modified Ordinary Least Squares (FMOLS). FMOLS is designed to address endogeneity and serial correlation, thereby reducing small-sample bias and yielding efficient long-run coefficients.

As shown in

Table 7, the estimates provided by FMOLS and the ARDL approach convey the same long-run narrative. Environmental degradation (ED) is negative and marginal in both models (ARDL: −0.725; FMOLS: −0.633). Renewable energy (RE) has a positive and significant impact of 5% in both cases, with near-identical elasticities (0.276 and 0.298). Likewise, technological innovation (TI) is positive and highly significant in both; moreover, the FMOLS elasticity (0.427) modestly exceeds the ARDL value (0.301) yet remains within an overlapping range. Foreign direct investment (FDI) is strongly positive in both models (ARDL: 2.162; FMOLS: 2.766) and significant, albeit with wider uncertainty under FMOLS; the ranking of effects is preserved. Consequently, signs are identical and magnitudes are close across all regressors; accordingly, the FMOLS re-estimation corroborates the ARDL long-run coefficients and, thus, confirms the robustness of our elasticities. Consequently, the concordance across estimators confirms the robustness of our long-run elasticities for Tunisia’s tourism development.

The convergent ARDL and FMOLS results have clear policy value for Tunisia. Tourism development rises with green energy, technological innovation, and foreign direct investment, yet it falls with environmental degradation; therefore, growth in a sector crucial for jobs and foreign currency must be green. Accordingly, it is necessary to tighten pollution control and enforcement, and pair this with time-bound support for firm-level efficiency, rooftop solar, and storage. Moreover, we suggest phasing grid upgrades and keeping tariffs predictable to ease short-run frictions from the energy transition. Likewise, promoting innovation through targeted R&D credits, digitalization programs, and credible green certification is recommended. In parallel, it is necessary to attract foreign direct investment that meets environmental standards and prioritizes clean energy, circular practices, and higher-value products. Finally, we recommend investing in coastal protection, heritage upkeep, and urban cleanliness and publishing joint energy–environment–tourism indicators; as a result, reputation will improve, risks fall, and the long-run gains identified by both estimators can be realized.

To complement the cointegration evidence and clarify directional linkages, we implemented pairwise Granger causality tests among tourism development (TD) and its determinants—environmental degradation (ED), renewable energy (RE), technological innovation (TI), and foreign direct investment (FDI). In this setting, the variable X is said to Granger-cause the variable Y if the past of variable X improves the prediction of variable Y beyond the information in variable Y’s own past (

Granger, 1969;

Engle & Granger, 1987). These tests provide a stationary representation with standard lag-length selection and a dynamic check on the direction of influence, which is consistent with the ARDL-ECM framework. Because cointegration implies at least one-way causality, these results identify whether the long-run associations documented above are accompanied by short-run predictive causality, thereby informing policy sequencing model robustness.

The link between the variables reveals the presence of Granger causality, as determined by the F-statistic.

Table 8 reports the pairwise Granger-causality outcomes and the corresponding direction of influence, where unidirectional causality from the left variable to the right is denoted by (→), the reverse by (←), bidirectional causality by (↔) when both variables cause each other, and no detected causality by (≠). The results corroborate the RADL-ECM evidence. Specifically, environmental degradation Granger-causes tourism development (ED → TD), while the reverse direction is not supported. This finding implies that changes in environmental conditions precede and help to explain subsequent movements in tourism activity. Combined with the long-run negative elasticity, this confirms that environmental deterioration tends to lead, and ultimately contribute, to declines in tourism performance rather than merely coincide with them. Likewise, renewable energy and technological innovation both Granger-cause tourism development (RE → TD; TI → TD), whereas feedback from tourism to these factors remains weak or insignificant.

Conversely, foreign direct investment and tourism development exhibit bidirectional causality (FDI ↔ TD), suggesting a feedback loop in which external capital fosters expansion and quality improvements, and stronger tourism activity, in turn, attracts further inflows. These findings align closely with the long-run elasticities, reinforcing the interpretation that Tunisia’s tourism dynamics are primarily driven by environmental and technological conditions, with FDI actings as a mutually reinforcing channel.