Economic Growth, Urbanization, and Transport Emissions: An Investigation of Elasticity-Based Decoupling Metrics in the Gulf

Abstract

1. Introduction

- To what extent are transport-related CO2 emissions in GCC countries driven by economic growth and urbanization during 2012–2022?

- Do patterns of elasticity differ across countries, and can these differences be interpreted as evidence of relative or absolute decoupling?

- How does the exclusion of the COVID-19 pandemic year affect the stability and direction of these elasticities?

- What policy insights can be derived from the observed relationships for achieving low-carbon transport systems in the GCC?

2. Literature Review

2.1. Global Transport-Emissions Trends and Context

2.2. Decoupling: Concepts, Metrics, and Global Evidence

2.3. Urbanization, Urban Form, and Transport CO2

2.4. Evidence from the GCC

3. Methods

3.1. Study Design and Scope

3.2. Data Sources and Construction

3.3. Long-Run Elasticity Model

3.4. Estimation Procedure

3.5. Short-Run Elasticities

- εYoY > 1 (emissions grow faster than GDP/urban);

- 0< εYoY ≤ 1 (relative decoupling);

- εYoY < 0 (absolute decoupling).

4. Results and Discussions

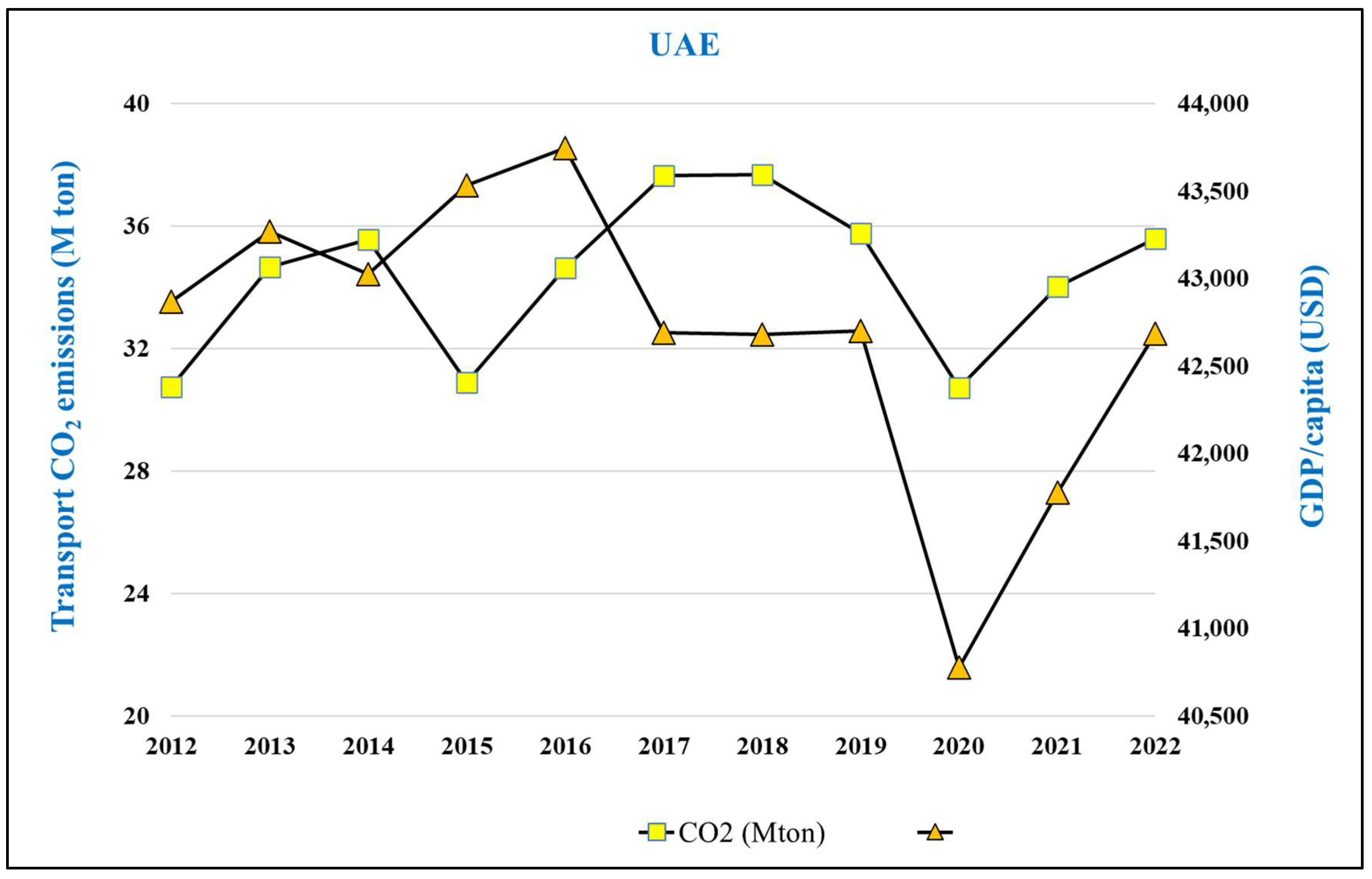

4.1. Historical Trend of Transport CO2 Emissions and GDP/Capita

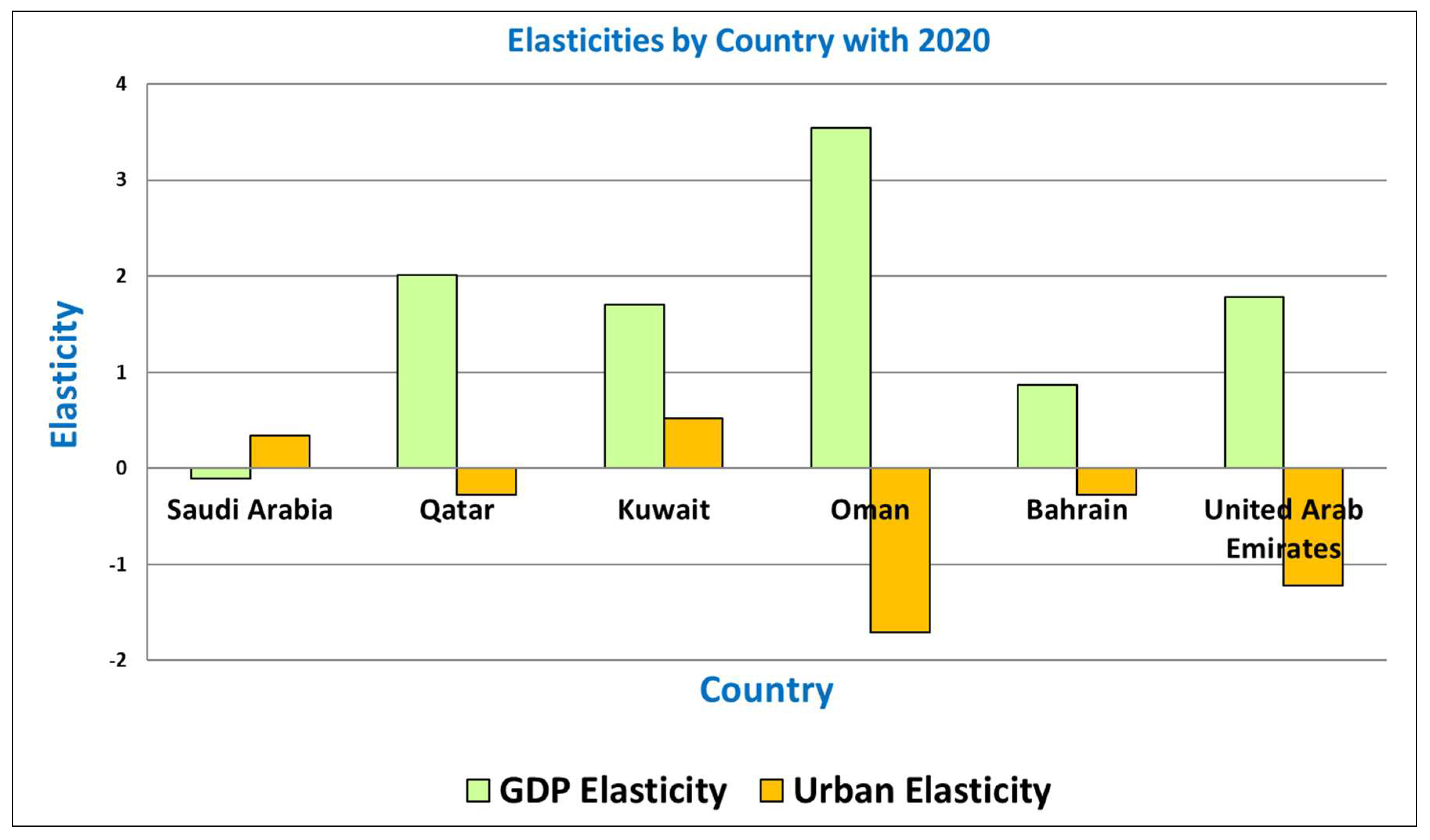

4.2. GCC Transport-CO2-Emission Elasticities

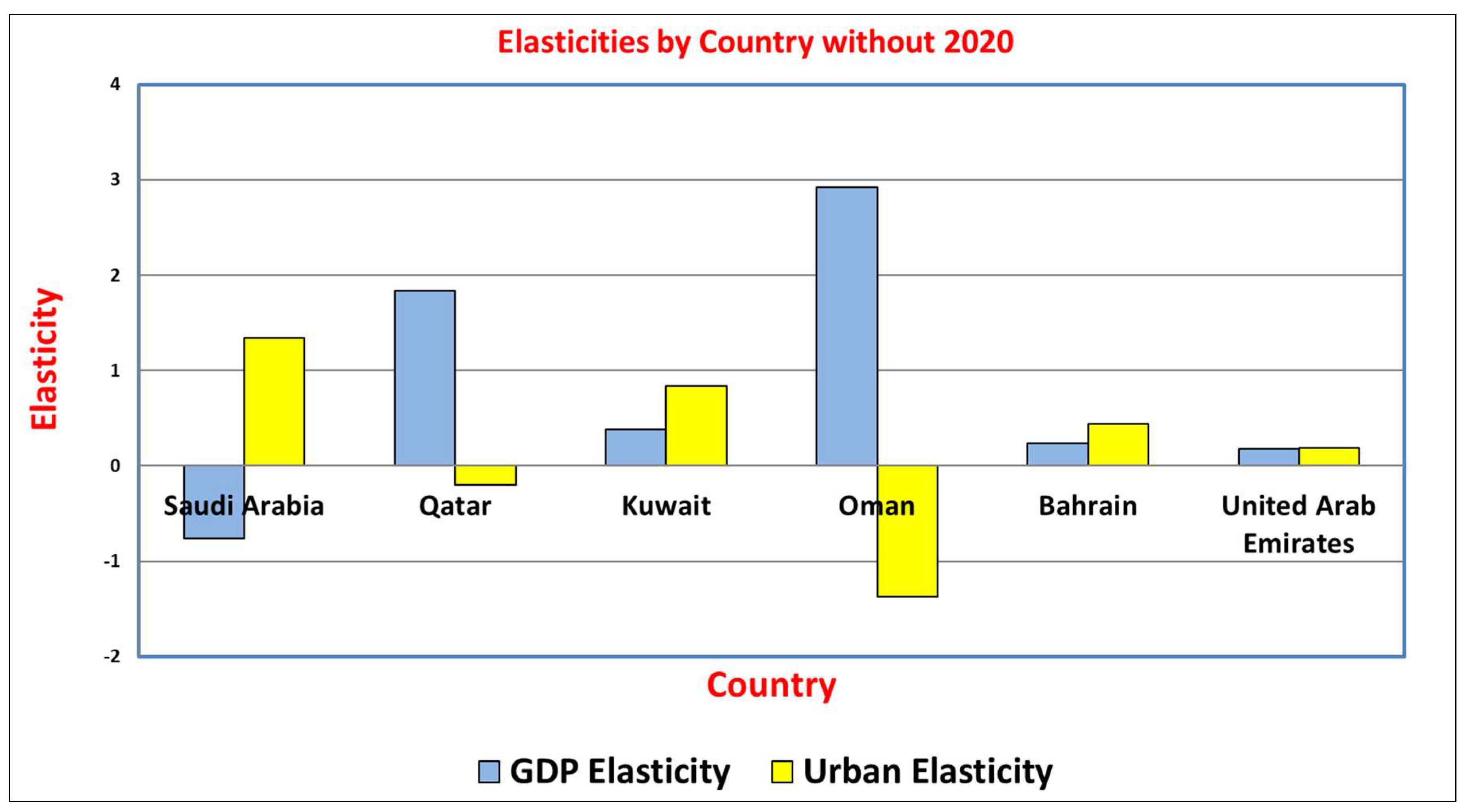

4.3. GCC Transport-CO2 Elasticities Emission Excluding 2020

5. Conclusions and Policy Implications

5.1. Key Findings

5.2. Policy Implications

5.3. Limitations and Future Work

Author Contributions

Funding

Data Availability Statement

Conflicts of Interest

Appendix A

| Country | Year | Transport_co2_Mt | gdp_const_2015_usd | urban_pop_total | urban_pop_pct | pop_total | co2_per_capita_tonnes | co2_per_usd_kg | ln_co2 | ln_gdp | ln_urban_pop | Growth_co2_pct | Growth_gdp_pct | Growth_urban_pct | yoy_elasticity_vs_gdp | yoy_elasticity_vs_urban |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Saudi Arabia | 2012 | 126.81 | 618,711,129,254 | 21,594,544 | 82.52 | 26,168,861 | 4.85 | 0.20 | 4.84 | 27.15 | 16.89 | |||||

| Saudi Arabia | 2013 | 128.90 | 636,936,502,413 | 22,856,101 | 82.74 | 27,624,004 | 4.67 | 0.20 | 4.86 | 27.18 | 16.94 | 1.64 | 2.90 | 5.68 | 0.56 | 0.29 |

| Saudi Arabia | 2014 | 136.72 | 662,570,908,160 | 23,485,373 | 82.96 | 28,309,273 | 4.83 | 0.21 | 4.92 | 27.22 | 16.97 | 5.89 | 3.95 | 2.72 | 1.49 | 2.17 |

| Saudi Arabia | 2015 | 146.94 | 693,414,400,000 | 24,801,267 | 83.18 | 29,816,382 | 4.93 | 0.21 | 4.99 | 27.26 | 17.03 | 7.21 | 4.55 | 5.45 | 1.58 | 1.32 |

| Saudi Arabia | 2016 | 146.45 | 705,230,699,063 | 25,816,111 | 83.40 | 30,954,198 | 4.73 | 0.21 | 4.99 | 27.28 | 17.07 | −0.33 | 1.69 | 4.01 | −0.20 | −0.08 |

| Saudi Arabia | 2017 | 142.91 | 713,567,089,639 | 25,903,884 | 83.62 | 30,977,355 | 4.61 | 0.20 | 4.96 | 27.29 | 17.07 | −2.45 | 1.18 | 0.34 | −2.08 | −7.21 |

| Saudi Arabia | 2018 | 136.10 | 736,593,549,190 | 25,317,770 | 83.84 | 30,196,281 | 4.51 | 0.18 | 4.91 | 27.33 | 17.05 | −4.88 | 3.18 | −2.29 | −1.54 | 2.13 |

| Saudi Arabia | 2019 | 136.43 | 748,758,860,046 | 25,273,133 | 84.07 | 30,063,799 | 4.54 | 0.18 | 4.92 | 27.34 | 17.05 | 0.24 | 1.64 | −0.18 | 0.15 | −1.36 |

| Saudi Arabia | 2020 | 122.32 | 720,270,347,023 | 26,594,664 | 84.29 | 31,552,510 | 3.88 | 0.17 | 4.81 | 27.30 | 17.10 | −10.92 | −3.88 | 5.10 | 2.81 | −2.14 |

| Saudi Arabia | 2021 | 128.22 | 767,229,070,839 | 26,015,266 | 84.51 | 30,784,383 | 4.17 | 0.17 | 4.85 | 27.37 | 17.07 | 4.71 | 6.32 | −2.20 | 0.75 | −2.14 |

| Saudi Arabia | 2022 | 137.77 | 859,301,066,621 | 27,261,746 | 84.73 | 32,175,224 | 4.28 | 0.16 | 4.93 | 27.48 | 17.12 | |||||

| Qatar | 2012 | 9.30 | 138,866,156,528 | 1,699,995 | 98.70 | 1,722,438 | 5.40 | 0.07 | 2.23 | 25.66 | 14.35 | |||||

| Qatar | 2013 | 10.19 | 146,581,616,624 | 1,893,141 | 98.79 | 1,916,426 | 5.32 | 0.07 | 2.32 | 25.71 | 14.45 | 9.10 | 5.41 | 10.76 | 1.68 | 0.85 |

| Qatar | 2014 | 12.27 | 154,400,753,941 | 2,127,387 | 98.87 | 2,151,745 | 5.70 | 0.08 | 2.51 | 25.76 | 14.57 | 18.56 | 5.20 | 11.67 | 3.57 | 1.59 |

| Qatar | 2015 | 12.79 | 161,739,955,577 | 2,319,822 | 98.95 | 2,344,557 | 5.46 | 0.08 | 2.55 | 25.81 | 14.66 | 4.20 | 4.64 | 8.66 | 0.90 | 0.48 |

| Qatar | 2016 | 13.18 | 166,695,978,169 | 2,452,713 | 99.02 | 2,477,113 | 5.32 | 0.08 | 2.58 | 25.84 | 14.71 | 2.99 | 3.02 | 5.57 | 0.99 | 0.54 |

| Qatar | 2017 | 13.45 | 164,199,531,362 | 2,522,348 | 99.08 | 2,545,820 | 5.28 | 0.08 | 2.60 | 25.82 | 14.74 | 2.04 | −1.51 | 2.80 | −1.35 | 0.73 |

| Qatar | 2018 | 11.76 | 166,227,185,730 | 2,558,411 | 99.14 | 2,580,734 | 4.56 | 0.07 | 2.46 | 25.84 | 14.75 | −13.44 | 1.23 | 1.42 | −10.95 | −9.47 |

| Qatar | 2019 | 12.33 | 167,371,229,300 | 2,617,231 | 99.19 | 2,638,657 | 4.67 | 0.07 | 2.51 | 25.84 | 14.78 | 4.74 | 0.69 | 2.27 | 6.91 | 2.09 |

| Qatar | 2020 | 11.45 | 161,416,823,769 | 2,772,773 | 99.24 | 2,794,148 | 4.10 | 0.07 | 2.44 | 25.81 | 14.84 | −7.39 | −3.62 | 5.77 | 2.04 | −1.28 |

| Qatar | 2021 | 12.18 | 164,042,828,071 | 2,486,825 | 99.28 | 2,504,910 | 4.86 | 0.07 | 2.50 | 25.82 | 14.73 | 6.18 | 1.61 | −10.88 | 3.83 | −0.57 |

| Qatar | 2022 | 11.58 | 170,908,036,354 | 2,639,210 | 99.32 | 2,657,333 | 4.36 | 0.07 | 2.45 | 25.86 | 14.79 | |||||

| Kuwait | 2012 | 12.85 | 112,054,550,828 | 3,337,109 | 100.00 | 3,337,109 | 3.85 | 0.11 | 2.55 | 25.44 | 15.02 | |||||

| Kuwait | 2013 | 13.15 | 113,342,579,056 | 3,507,844 | 100.00 | 3,507,844 | 3.75 | 0.12 | 2.58 | 25.45 | 15.07 | 2.35 | 1.14 | 4.99 | 2.06 | 0.47 |

| Kuwait | 2014 | 13.62 | 113,910,328,740 | 3,665,876 | 100.00 | 3,665,876 | 3.71 | 0.12 | 2.61 | 25.46 | 15.11 | 3.48 | 0.50 | 4.41 | 6.97 | 0.79 |

| Kuwait | 2015 | 14.05 | 114,585,555,831 | 3,834,574 | 100.00 | 3,834,574 | 3.66 | 0.12 | 2.64 | 25.46 | 15.16 | 3.14 | 0.59 | 4.50 | 5.31 | 0.70 |

| Kuwait | 2016 | 14.50 | 117,938,416,139 | 4,004,096 | 100.00 | 4,004,096 | 3.62 | 0.12 | 2.67 | 25.49 | 15.20 | 3.15 | 2.88 | 4.33 | 1.09 | 0.73 |

| Kuwait | 2017 | 15.08 | 112,380,895,320 | 4,154,812 | 100.00 | 4,154,812 | 3.63 | 0.13 | 2.71 | 25.45 | 15.24 | 3.90 | −4.83 | 3.69 | −0.81 | 1.06 |

| Kuwait | 2018 | 15.89 | 115,463,874,741 | 4,323,515 | 100.00 | 4,323,515 | 3.68 | 0.14 | 2.77 | 25.47 | 15.28 | 5.25 | 2.71 | 3.98 | 1.94 | 1.32 |

| Kuwait | 2019 | 16.31 | 118,077,765,457 | 4,442,316 | 100.00 | 4,442,316 | 3.67 | 0.14 | 2.79 | 25.49 | 15.31 | 2.58 | 2.24 | 2.71 | 1.15 | 0.95 |

| Kuwait | 2020 | 13.21 | 112,389,026,890 | 4,400,267 | 100.00 | 4,400,267 | 3.00 | 0.12 | 2.58 | 25.45 | 15.30 | −21.06 | −4.94 | −0.95 | 4.26 | 22.14 |

| Kuwait | 2021 | 15.80 | 114,268,887,222 | 4,360,865 | 100.00 | 4,360,865 | 3.62 | 0.14 | 2.76 | 25.46 | 15.29 | 17.89 | 1.66 | −0.90 | 10.79 | −19.89 |

| Kuwait | 2022 | 17.24 | 121,991,940,847 | 4,589,643 | 100.00 | 4,589,643 | 3.76 | 0.14 | 2.85 | 25.53 | 15.34 | |||||

| Oman | 2012 | 10.84 | 70,318,260,490 | 2,751,277 | 77.56 | 3,547,106 | 3.06 | 0.15 | 2.38 | 24.98 | 14.83 | |||||

| Oman | 2013 | 11.95 | 73,994,291,063 | 3,024,267 | 78.88 | 3,833,913 | 3.12 | 0.16 | 2.48 | 25.03 | 14.92 | 9.72 | 5.10 | 9.46 | 1.91 | 1.03 |

| Oman | 2014 | 12.54 | 74,950,483,987 | 3,207,755 | 80.15 | 4,002,439 | 3.13 | 0.17 | 2.53 | 25.04 | 14.98 | 4.83 | 1.28 | 5.89 | 3.76 | 0.82 |

| Oman | 2015 | 13.21 | 78,710,793,238 | 3,404,412 | 81.35 | 4,184,895 | 3.16 | 0.17 | 2.58 | 25.09 | 15.04 | 5.23 | 4.90 | 5.95 | 1.07 | 0.88 |

| Oman | 2016 | 12.41 | 82,682,873,556 | 3,622,474 | 82.50 | 4,390,877 | 2.83 | 0.15 | 2.52 | 25.14 | 15.10 | −6.24 | 4.92 | 6.21 | −1.27 | −1.00 |

| Oman | 2017 | 12.30 | 82,934,277,089 | 3,791,448 | 83.56 | 4,537,396 | 2.71 | 0.15 | 2.51 | 25.14 | 15.15 | −0.87 | 0.30 | 4.56 | −2.88 | −0.19 |

| Oman | 2018 | 12.14 | 84,001,727,416 | 3,886,999 | 84.54 | 4,597,877 | 2.64 | 0.14 | 2.50 | 25.15 | 15.17 | −1.37 | 1.28 | 2.49 | −1.07 | −0.55 |

| Oman | 2019 | 12.09 | 83,053,651,985 | 3,922,894 | 85.44 | 4,591,241 | 2.63 | 0.15 | 2.49 | 25.14 | 15.18 | −0.38 | −1.14 | 0.92 | 0.33 | −0.41 |

| Oman | 2020 | 10.05 | 80,246,670,661 | 3,901,830 | 86.28 | 4,522,497 | 2.22 | 0.13 | 2.31 | 25.11 | 15.18 | −18.46 | −3.44 | −0.54 | 5.37 | 34.29 |

| Oman | 2021 | 10.41 | 82,318,780,120 | 3,917,349 | 87.04 | 4,500,424 | 2.31 | 0.13 | 2.34 | 25.13 | 15.18 | 3.45 | 2.55 | 0.40 | 1.35 | 8.70 |

| Oman | 2022 | 13.30 | 88,892,516,940 | 4,150,773 | 87.75 | 4,730,226 | 2.81 | 0.15 | 2.59 | 25.21 | 15.24 | |||||

| Bahrain | 2012 | 3.16 | 28,888,050,242 | 1,073,101 | 88.76 | 1,208,964 | 2.61 | 0.11 | 1.15 | 24.09 | 13.89 | |||||

| Bahrain | 2013 | 3.28 | 30,416,985,616 | 1,113,272 | 88.84 | 1,253,191 | 2.61 | 0.11 | 1.19 | 24.14 | 13.92 | 3.57 | 5.16 | 3.68 | 0.69 | 0.97 |

| Bahrain | 2014 | 3.37 | 31,727,610,008 | 1,168,843 | 88.92 | 1,314,562 | 2.57 | 0.11 | 1.22 | 24.18 | 13.97 | 2.95 | 4.22 | 4.87 | 0.70 | 0.61 |

| Bahrain | 2015 | 3.52 | 32,523,297,872 | 1,219,573 | 89.00 | 1,370,322 | 2.57 | 0.11 | 1.26 | 24.21 | 14.01 | 4.29 | 2.48 | 4.25 | 1.73 | 1.01 |

| Bahrain | 2016 | 3.60 | 33,764,059,499 | 1,268,397 | 89.09 | 1,423,726 | 2.53 | 0.11 | 1.28 | 24.24 | 14.05 | 2.16 | 3.74 | 3.93 | 0.58 | 0.55 |

| Bahrain | 2017 | 3.71 | 35,436,675,411 | 1,338,785 | 89.19 | 1,501,116 | 2.47 | 0.10 | 1.31 | 24.29 | 14.11 | 3.04 | 4.84 | 5.40 | 0.63 | 0.56 |

| Bahrain | 2018 | 3.82 | 36,164,044,588 | 1,342,065 | 89.29 | 1,503,091 | 2.54 | 0.11 | 1.34 | 24.31 | 14.11 | 3.03 | 2.03 | 0.24 | 1.49 | 12.37 |

| Bahrain | 2019 | 3.74 | 36,906,448,211 | 1,326,389 | 89.39 | 1,483,756 | 2.52 | 0.10 | 1.32 | 24.33 | 14.10 | −2.22 | 2.03 | −1.17 | −1.09 | 1.89 |

| Bahrain | 2020 | 3.29 | 34,724,774,104 | 1,317,711 | 89.51 | 1,472,204 | 2.24 | 0.09 | 1.19 | 24.27 | 14.09 | −12.70 | −6.09 | −0.66 | 2.08 | 19.35 |

| Bahrain | 2021 | 3.50 | 36,235,315,986 | 1,348,242 | 89.62 | 1,504,365 | 2.33 | 0.10 | 1.25 | 24.31 | 14.11 | 6.12 | 4.26 | 2.29 | 1.44 | 2.67 |

| Bahrain | 2022 | 3.80 | 38,474,716,945 | 1,368,305 | 89.74 | 1,524,693 | 2.49 | 0.10 | 1.33 | 24.37 | 14.13 | |||||

| United Arab Emirates | 2012 | 30.76 | 316,857,313,566 | 6,264,178 | 84.75 | 7,391,448 | 4.16 | 0.10 | 3.43 | 26.48 | 15.65 | |||||

| United Arab Emirates | 2013 | 34.67 | 332,876,224,084 | 6,544,154 | 85.07 | 7,693,031 | 4.51 | 0.10 | 3.55 | 26.53 | 15.69 | 11.97 | 4.93 | 4.37 | 2.43 | 2.74 |

| United Arab Emirates | 2014 | 35.58 | 346,742,821,790 | 6,880,747 | 85.38 | 8,059,440 | 4.41 | 0.10 | 3.57 | 26.57 | 15.74 | 2.58 | 4.08 | 5.02 | 0.63 | 0.51 |

| United Arab Emirates | 2015 | 30.88 | 370,275,469,571 | 7,286,777 | 85.67 | 8,505,237 | 3.63 | 0.08 | 3.43 | 26.64 | 15.80 | −14.16 | 6.57 | 5.73 | −2.16 | −2.47 |

| United Arab Emirates | 2016 | 34.63 | 390,868,305,597 | 7,681,054 | 85.97 | 8,935,095 | 3.88 | 0.09 | 3.54 | 26.69 | 15.85 | 11.46 | 5.41 | 5.27 | 2.12 | 2.17 |

| United Arab Emirates | 2017 | 37.66 | 393,741,456,224 | 7,954,847 | 86.25 | 9,223,225 | 4.08 | 0.10 | 3.63 | 26.70 | 15.89 | 8.39 | 0.73 | 3.50 | 11.46 | 2.40 |

| United Arab Emirates | 2018 | 37.67 | 398,914,879,875 | 8,086,953 | 86.52 | 9,346,701 | 4.03 | 0.09 | 3.63 | 26.71 | 15.91 | 0.02 | 1.31 | 1.65 | 0.02 | 0.01 |

| United Arab Emirates | 2019 | 35.78 | 403,336,245,504 | 8,197,902 | 86.79 | 9,445,785 | 3.79 | 0.09 | 3.58 | 26.72 | 15.92 | −5.15 | 1.10 | 1.36 | −4.67 | −3.78 |

| United Arab Emirates | 2020 | 30.71 | 383,342,656,333 | 8,183,416 | 87.05 | 9,401,038 | 3.27 | 0.08 | 3.42 | 26.67 | 15.92 | −15.28 | −5.08 | −0.18 | 3.00 | 86.38 |

| United Arab Emirates | 2021 | 34.02 | 400,036,290,964 | 8,359,012 | 87.30 | 9,575,152 | 3.55 | 0.09 | 3.53 | 26.71 | 15.94 | 10.24 | 4.26 | 2.12 | 2.40 | 4.82 |

| United Arab Emirates | 2022 | 35.59 | 430,077,804,445 | 8,819,937 | 87.54 | 10,074,977 | 3.53 | 0.08 | 3.57 | 26.79 | 15.99 | 4.50 | 7.24 | 5.37 | 0.62 | 0.84 |

Appendix B. STATA Analysis Excluding 2020

References

- Akimoto, K. (2023). Assessment of road transportation measures for global net-zero emissions considering comprehensive energy systems. IATSS Research, 47(2), 196–203. [Google Scholar] [CrossRef]

- Akinyemi, T. O., & Ramonu, O. J. (2019). Mitigation of CO2 emissions in transportation and industrial processes using renewable energy technologies: A review. European Journal of Engineering and Technology Research, 4(5), 58–66. [Google Scholar] [CrossRef]

- Aldegheishem, A. (2024). The impact of air transportation, trade openness, and economic growth on CO2 emissions in Saudi Arabia. Frontiers in Environmental Science, 12, 1366054. [Google Scholar] [CrossRef]

- Al-Thani, M. (2023). Traffic accident predictive model for better resources in Qatar. Hamad bin Khalifa University. [Google Scholar]

- Amer, E. A. A. A., Xiuwu, Z., Meyad, E. M. A., Alareqi, M. M., Bather, S. M. H., & Abdelwahed, A. (2025). Urbanization, growth, and carbon footprints: A GCC perspective on sustainable development. Sustainable Futures, 9, 100631. [Google Scholar] [CrossRef]

- Binsuwadan, J. (2024). Transport sector emissions and environmental sustainability: Empirical evidence from GCC economies. Sustainability, 16(23), 10760. [Google Scholar] [CrossRef]

- Charabi, Y., Al Nasiri, N., Al Awadhi, T., Choudri, B. S., & Al Bimani, A. (2020). GHG emissions from the transport sector in Oman: Trends and potential decarbonization pathways. Energy Strategy Reviews, 32, 100548. [Google Scholar] [CrossRef]

- Chiranjivi, D. M., Suresh, M. K., & Siddartha, M. M. (2024). Navigating the present and future dynamics of electric vehicle fast charging and its impact on grid. CVR Journal of Science and Technology, 26(1), 68–75. [Google Scholar] [CrossRef]

- Dachkovskyi, V. (2021). Methods of evaluation of efficiency of logistic operations. Social Development and Security, 11(1), 179–196. [Google Scholar] [CrossRef]

- Dong, B., Xu, Y., & Fan, X. (2020). How to achieve a win-win situation between economic growth and carbon emission reduction: Empirical evidence from the perspective of industrial structure upgrading. Environmental Science and Pollution Research, 27(35), 43829–43844. [Google Scholar] [CrossRef]

- Fan, J., Meng, X., Tian, J., Xing, C., Wang, C., & Wood, J. (2023). A review of transportation carbon emissions research using bibliometric analyses. Journal of Traffic and Transportation Engineering (English Edition), 10(5), 878–899. [Google Scholar] [CrossRef]

- Foster, V., Dim, J. U., Vollmer, S., & Zhang, F. (2023). Understanding the challenge of decoupling transport-related CO2 emissions from economic growth in developing countries. World Development Sustainability, 3, 100111. [Google Scholar] [CrossRef]

- Hamdi, H., & Sbia, R. (2013). Dynamic relationships between oil revenues, government spending and economic growth in an oil-dependent economy. Economic Modelling, 35, 118–125. [Google Scholar] [CrossRef]

- Harrington, W., & Krupnick, A. (2012). Improving fuel economy in heavy-duty vehicles (SSRN Scholarly Paper No. 2038842). Social Science Research Network. [CrossRef][Green Version]

- Hassabou, A., Melhim, S. H., & Isaifan, R. J. (2025). Techno-economic analysis and assessment of an innovative solar hybrid photovoltaic thermal collector for transient net zero emissions. Sustainability, 17(18), 8304. [Google Scholar] [CrossRef]

- IEA. (2023). CO2 emissions in 2022. IEA. [Google Scholar]

- International Energy Agency. (2025). Energy statistics data browser—Data tools. Available online: https://www.iea.org/data-and-statistics/data-tools/energy-statistics-data-browser (accessed on 29 August 2025).

- IPCC. (2020). Transport. Available online: https://www.ipcc.ch/report/ar6/wg3/chapter/chapter-10/?utm_source=chatgpt.com (accessed on 29 August 2025).

- Kaššaj, M., & Peráček, T. (2024). Synergies and potential of industry 4.0 and automated vehicles in smart city infrastructure. Applied Sciences, 14(9), 3575. [Google Scholar] [CrossRef]

- Koimur, İ., Kangogo, L. K., & Nyaoga, R. (2014). Assessment of commuter preferences of 14-seater public service vehicles versus alternative modes of public service transport in Nairobi city. Journal of Business Economics and Finance, 3(1), 115–132. [Google Scholar]

- Luqman, M., Rayner, P. J., & Gurney, K. R. (2023). On the impact of urbanisation on CO2 emissions. Npj Urban Sustainability, 3(1), 6. [Google Scholar] [CrossRef]

- Magazzino, C. (2016). The relationship between real GDP, CO2 emissions, and energy use in the GCC countries: A time series approach. Cogent Economics & Finance, 4(1), 1152729. [Google Scholar] [CrossRef]

- Marzouk, O. A. (2017, November 13–14). Benchmarking the trends of urbanization in the gulf cooperation council: Outlook to 2050. 1st National Symposium on Emerging Trends in Engineering and Management (NSETEM’2017) (pp. 1–9), Muscat, Oman. [Google Scholar]

- Melhim, S. H., & Isaifan, R. J. (2025). The energy-economy nexus of advanced air pollution control technologies: Pathways to sustainable development. Energies, 18(9), 2378. [Google Scholar] [CrossRef]

- Moshashai, D., Leber, A. M., & Savage, J. D. (2020). Saudi Arabia plans for its economic future: Vision 2030, the national transformation plan and saudi fiscal reform. British Journal of Middle Eastern Studies, 47(3), 381–401. [Google Scholar] [CrossRef]

- Qadir, S. A., Ali, A., Islam, M. T., & Shahid, M. (2024, November 24–27). Evolution in the GCC: Assessing the progress and prospects of electric vehicle policies. 2024 IEEE Sustainable Power and Energy Conference (iSPEC) (pp. 291–296), Kuching, Malaysia. [Google Scholar] [CrossRef]

- Ramadan, E. (2015). Sustainable urbanization in the arabian gulf region: Problems and challenges. Arts and Social Sciences Journal, 6(2), 1000109. [Google Scholar] [CrossRef]

- Sinha, K. C. (2003). Sustainability and urban public transportation. Journal of Transportation Engineering, 129(4), 331–341. [Google Scholar] [CrossRef]

- Szczepański, E., Żochowska, R., Izdebski, M., & Jacyna, M. (2025). Decision-making problems in urban transport decarbonization strategies: Challenges, tools, and methods. Energies, 18(15), 3970. [Google Scholar] [CrossRef]

- Tapio, P. (2005). Towards a theory of decoupling: Degrees of decoupling in the EU and the case of road traffic in Finland between 1970 and 2001. Transport Policy, 12(2), 137–151. [Google Scholar] [CrossRef]

- The Official Portal of the UAE Government. (2023). Deregulation of fuel prices. Available online: https://u.ae/en/information-and-services/environment-and-energy/water-and-energy/energy-and-fuel-prices/deregulation-of-fuel-prices?utm_source=chatgpt.com (accessed on 29 August 2025).

- The Peninsula Newspaper. (2016, April 26). Qatar to link petrol and diesel prices to global market from May 1. Available online: https://thepeninsulaqatar.com/article/26/04/2016/Qatar-to-link-petrol-and-diesel-prices-to-global-market-from-May-1 (accessed on 29 August 2025).

- Wolbertus, R., & Van den Hoed, R. (2019). Electric vehicle fast charging needs in cities and along corridors. World Electric Vehicle Journal, 10(2), 45. [Google Scholar] [CrossRef]

- World Bank Group. (2025). World development indicators databank. Available online: https://databank.worldbank.org/reports.aspx?source=2&country=WLD (accessed on 29 August 2025).

- Yahia, O., Chohan, A. H., Arar, M., & Awad, J. (2025). Toward sustainable urban mobility: A systematic review of transit-oriented development for the appraisal of dubai metro stations. Smart Cities, 8(1), 21. [Google Scholar] [CrossRef]

| Elasticity Value | Indication |

|---|---|

| Elasticity < 0 | absolute decoupling |

| 0 < Elasticity < 1 | relative decoupling |

| Elasticity ≈ 1 | proportional growth |

| Elasticity > 1 | emissions-intensive growth |

| Parameter | Defined as |

|---|---|

| Per capita transport CO2 emissions | ton/person |

| CO2 per unit of GDP | kg/USD |

| natural logarithms of CO2, GDP, and urban population | lnCO2t, lnGDPt, and lnUrbant |

| log growth rates for CO2, GDP, and urban population | gtCO2 = lnCO2t − lnCO2t−1 gtGDP = lnGDPt − lnGDPt−1 gtU = lnUrbant − lnUrbant−1 |

| year-over-year (YoY) elasticities | εYoYt,GDP εYoYt,U |

| Country | GDP Elasticity | Urban Elasticity | R2 |

|---|---|---|---|

| Saudi Arabia | −0.111042367 | 0.33889488 | 0.066819333 |

| Qatar | 2.011017076 | −0.280226546 | 0.652021181 |

| Kuwait | 1.69962538 | 0.517150104 | 0.783009837 |

| Oman | 3.542883461 | −1.70766139 | 0.593345905 |

| Bahrain | 0.872468534 | −0.272083259 | 0.708211162 |

| UAE | 1.783062335 | −1.217766397 | 0.338916252 |

| Country | Elasticity Pattern | Key Policy Focus |

|---|---|---|

| Saudi Arabia | Near-zero GDP elasticity, positive urban elasticity, very low R2 | Sector-specific measures (aviation, freight), fuel-price and infrastructure reforms, targeted urban planning to curb car dependency |

| Qatar | Very high GDP elasticity (>2), slightly negative urban elasticity, strong fit | Manage growth pressure via CO2/fuel economy standards, EV uptake, bus electrification, consolidate urban efficiency gains |

| Kuwait | High GDP elasticity (~1.7), positive urban elasticity, highest R2 (~0.78) | Address car-dependent urban growth with transit-oriented development, parking and road-space management, EV charging corridors |

| Oman | Extremely high GDP elasticity (~3.5), strongly negative urban elasticity, moderate fit | Reinforce efficient corridors, land-use coordination, and monitor for multicollinearity; adopt strong vehicle efficiency and freight programs |

| Bahrain | Near-unit GDP elasticity (~0.87), slightly negative urban elasticity, strong fit | Consolidate compact geography gains with quality transit, access management, and cross-border traffic coordination |

| United Arab Emirates | High GDP elasticity (~1.8), negative urban elasticity, modest R2 (~0.34) | Focus on omitted drivers (aviation, logistics), expand EV and heavy-duty vehicle programs, land-use/transit integration |

| Country | GDP Elasticity | Urban Elasticity | R2 |

|---|---|---|---|

| Saudi Arabia | −0.75980478 | 1.339145507 | 0.593198515 |

| Qatar | 1.833242992 | −0.20003415 | 0.649368063 |

| Kuwait | 0.382566179 | 0.833685353 | 0.978564084 |

| Oman | 2.922226829 | −1.368374502 | 0.389752948 |

| Bahrain | 0.236429795 | 0.438801313 | 0.864890571 |

| UAE | 0.174749085 | 0.190413686 | 0.299598215 |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2025 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Melhim, S.H.; Isaifan, R.J. Economic Growth, Urbanization, and Transport Emissions: An Investigation of Elasticity-Based Decoupling Metrics in the Gulf. Economies 2025, 13, 323. https://doi.org/10.3390/economies13110323

Melhim SH, Isaifan RJ. Economic Growth, Urbanization, and Transport Emissions: An Investigation of Elasticity-Based Decoupling Metrics in the Gulf. Economies. 2025; 13(11):323. https://doi.org/10.3390/economies13110323

Chicago/Turabian StyleMelhim, Sadiq H., and Rima J. Isaifan. 2025. "Economic Growth, Urbanization, and Transport Emissions: An Investigation of Elasticity-Based Decoupling Metrics in the Gulf" Economies 13, no. 11: 323. https://doi.org/10.3390/economies13110323

APA StyleMelhim, S. H., & Isaifan, R. J. (2025). Economic Growth, Urbanization, and Transport Emissions: An Investigation of Elasticity-Based Decoupling Metrics in the Gulf. Economies, 13(11), 323. https://doi.org/10.3390/economies13110323