Abstract

This study investigates the relationship between green trade, economic complexity, and green indicators in Asian countries using a Poisson Pseudo Maximum Likelihood (PPML) fixed effects model. This study uses panel data from 33 countries in the Asia region, focusing on the national level of each country from 2010 to 2023. The analysis explores how economic sophistication and environmental indicators influence the capacity of economies to engage in sustainable trade. The findings reveal that economic complexity significantly enhances green trade, underscoring the role of knowledge-intensive production structures in fostering environmentally friendly export performance. Among the green indicators, green economic opportunities demonstrate a positive and significant effect on green trade, which indicates that economies allocating greater financial resources to renewable energy and sustainable infrastructure are better positioned to expand their participation in eco-friendly markets. This signals strong trade readiness and market-driven incentives. Conversely, green innovation shows a negative and significant effect, indicating that innovation is not yet translating into export competitiveness, is still costly, and is in an early phase. Moreover, economic complexity and renewable energy show positive and significant effects, reflecting that higher complexity enables the adoption of green technologies, the embedding of sustainability in value chains, and the export of high-value green products. These results suggest that green economic opportunities and regional dynamics play a complementary role in shaping outcomes, with proximity to innovation hubs amplifying the capacity for sustainable trade. The study contributes to the literature by linking economic complexity with green trade in the Asian context, offering evidence-based recommendations to enhance sustainability-driven growth.

1. Introduction

The growing urgency of addressing climate change has reshaped global trade patterns, with green trade emerging as a pivotal component in achieving sustainable economic growth (Zhong, 2023). Green trade emphasizes the exchange of environmentally friendly goods and services, which not only support ecological preservation but also foster long-term competitiveness in the global market (Qi, 2024). As countries increasingly integrate environmental concerns into their trade strategies, green trade is being recognized as a crucial pathway to align economic development with global sustainability agendas, particularly the Sustainable Development Goals (SDGs) and the Paris Agreement commitments (Azimi et al., 2025).

In this context, Asia plays a particularly significant role given its rapid economic expansion, large manufacturing base, and diverse environmental challenges. Several Asian countries have demonstrated progress in adopting green trade policies, such as investments in renewable energy technologies, environmentally friendly manufacturing, and stricter environmental standards in export-oriented industries (Ahmad, 2025). Nevertheless, the region continues to face structural challenges, including dependence on carbon-intensive production, uneven technological adoption, and varying institutional capacities among countries (Idris & Rahman Razak, 2025). This duality makes Asia a unique laboratory for understanding the interplay between trade, sustainability, and economic transformation (Hanafy et al., 2025).

The intersection between green trade and economic complexity provides an important dimension to this discourse (Abid & Gafsi, 2025). Economic complexity, which reflects a country’s productive capabilities and knowledge embedded in its exports, has been shown to drive innovation and long-term economic development (Emenika et al., 2025; Yu & Qayyum, 2021). When aligned with green trade, economic complexity can accelerate the transition toward sustainable industries by fostering diversification into environmentally friendly sectors (Lee et al., 2023). Countries with higher economic sophistication are more likely to adapt to and benefit from the global shift toward green trade, highlighting the relevance of analyzing their interdependence (S. Zhang et al., 2024; Caldarola et al., 2024).

Equally important is the link between green trade and green indicators such as green investment, green innovation, and green economic opportunities. Green investment serves as a catalyst for developing sustainable infrastructure and industries that underpin green trade (Kwilinsky et al., 2025). Green innovation, on the other hand, enhances the ability of firms and countries to develop cleaner production processes and environmentally friendly products, thereby reinforcing competitiveness in the global green economy (Hermundsdottir & Aspelund, 2021). Furthermore, green economic opportunities, manifested in the creation of new jobs, industries, and markets, reflect the socio-economic benefits of embracing green trade (Nyangchak, 2022), ensuring that sustainability is not merely an environmental concern but also a driver of inclusive growth (Yeboah et al., 2024).

Despite these opportunities, significant variations remain in how Asian countries capitalize on these green indicators. Some nations have advanced rapidly through supportive policies, technological capabilities, and financial resources, while others lag due to limited investment, weak institutional frameworks, and dependence on traditional carbon-intensive sectors. This divergence underscores the need for a comprehensive analysis that situates green trade within the broader framework of economic complexity and green indicators to capture the multidimensional drivers of sustainable development.

Based on these considerations, the purpose of this study is to examine the relationship between green trade, economic complexity, and green indicators in Asian countries using the PPML fixed effects model. This approach allows for an in-depth assessment of how structural economic factors, trade patterns, and sustainability-related investments interact to influence the trajectory of green trade in the region. By focusing on Asia, the study aims to provide insights into how emerging and advanced economies alike can optimize green trade strategies to accelerate sustainable growth.

The novelty of this research lies in integrating the concepts of green trade, economic complexity, and green indicators into a single empirical framework. While previous studies have largely examined these elements in isolation, this study bridges the gaps by highlighting their interconnectedness within the Asian context. This holistic approach provides new insights into how complexity and sustainability indicators jointly shape trade outcomes, offering a more nuanced understanding than existing literature.

The research gap addressed by this study concerns the limited empirical evidence on the nexus between green trade, economic complexity, and green indicators, particularly in the Asian region. Although the literature has acknowledged the growing relevance of green trade, few studies have systematically explored how structural economic capabilities and sustainability indicators interact to drive its development. By filling this gap, the study contributes to advancing both theoretical understanding and practical policy recommendations for fostering sustainable trade in Asia.

2. Literature Review

In recent years, the discourse on sustainable development has increasingly emphasized the role of trade in advancing environmental objectives. Scholars have sought to analyze how green trade can serve not only as a mechanism for reducing environmental degradation but also as a driver of long-term competitiveness and inclusive growth. Within this context, economic complexity and green indicators such as investment, innovation, and economic opportunities have been recognized as crucial components that interact with green trade to shape sustainable development pathways. This section reviews the existing body of literature on green trade, economic complexity, and green indicators, as well as empirical studies linking these dimensions.

Green trade has been broadly defined as the production, exchange, and consumption of goods and services that minimize environmental harm and contribute to sustainable development (Mahajan et al., 2023; Ramizo et al., 2025). Several studies argue that green trade plays a dual role: it helps countries reduce carbon emissions while simultaneously opening new opportunities for industrial upgrading and international competitiveness. Scholars such as L. Zhang et al. (2025) and Zehri (2025) highlighted that green trade, particularly in sectors such as renewable energy and low-carbon technologies, fosters innovation and enhances export competitiveness (L. Zhang et al., 2025; Zehri, 2025). Moreover, evidence suggests that countries integrating environmental standards into their trade policies tend to achieve not only ecological benefits (Berikhanovna et al., 2023) but also improved market access in a world increasingly sensitive to sustainability standards (Kabiru Maji et al., 2023).

Within the Asian context, green trade has gained momentum, yet disparities persist across countries. While some economies, such as in Asia, have made significant advancements in renewable energy exports and green technology development, others remain dependent on carbon-intensive industries (Chukwuma-Onwe et al., 2024; Jin et al., 2023). Studies emphasize that policy frameworks, technological capabilities, and institutional support play a pivotal role in determining how effectively a country can transition toward green trade. These variations underscore the importance of analyzing the structural and policy-driven determinants of green trade in Asia.

Parallel to this, the concept of economic complexity has been extensively examined as a determinant of long-term economic growth and diversification. Economic complexity measures the amount of productive knowledge embedded in a country’s economy, reflected in the diversity and sophistication of its export basket (Valverde-Carbonell, 2025). Higher economic complexity is associated with greater adaptability to global economic changes and an enhanced ability to specialize in high-value industries (Balland et al., 2022). Research suggests that countries with higher complexity are better positioned to integrate into global green trade networks, as their knowledge and technological capabilities facilitate the adoption of environmentally friendly production processes and innovation (Breitenbach et al., 2021).

The role of green indicators has also received substantial attention in the literature. Green investment is widely recognized as a catalyst for building sustainable infrastructure and facilitating the adoption of cleaner technologies (Ullah et al., 2025; Chen & Ma, 2021). Similarly, green innovation, often measured through patents, R&D expenditure, and technological advancements (Voica et al., 2015), directly contributes to developing eco-friendly products and production processes that enhance competitiveness in international trade (Cheng et al., 2025; Wang & Ahmad, 2024). Furthermore, green economic opportunities, encompassing new employment sectors, business models, and inclusive growth initiatives, have been highlighted as essential for ensuring that the transition to green economies yields broad social benefits rather than exacerbating inequalities (Telukdarie et al., 2024). The green economy can serve as a key solution to address sustainable economic growth (Idris et al., 2025).

Several empirical studies have explored the relationship between green trade and economic complexity. Gyamfi et al. (2023) demonstrated how complexity drives structural transformation, which can be leveraged for greener economic trajectories (Gyamfi et al., 2023). More recent works, such as Lin et al. (2024), argue that higher economic complexity enhances countries’ capacity to diversify exports toward environmentally sustainable goods (Lin et al., 2024). Scholars have noted that economies with high complexity indices tend to be frontrunners in green trade, while those with lower complexity levels face barriers in integrating into green value chains (Agrawal et al., 2024).

Similarly, the nexus between green trade and green indicators has been widely discussed (Stojkoski et al., 2016). Studies on green investment highlight that greater financial allocation toward sustainable sectors positively correlates with the growth of green exports (Falcone, 2020; Pang et al., 2022). Research on green innovation shows that countries with strong innovation ecosystems are more competitive in global green markets, particularly in renewable energy technologies and eco-friendly manufacturing (Minh Ha et al., 2023; Zhou, 2025). Meanwhile, analyses of green economic opportunities emphasize that trade liberalization in green goods contributes to job creation and inclusive development, though the distribution of benefits remains uneven across countries and sectors (Xu et al., 2025).

Despite these insights, gaps remain in the literature. Much of the existing research has focused on the relationship between green trade and either economic complexity or individual green indicators, with relatively limited attention to their combined effects, particularly in Asia. Furthermore, while studies have provided evidence from developed economies, empirical investigations into the dynamic interplay between green trade, complexity, and green indicators in emerging Asian economies remain scarce.

The literature establishes the relevance of green trade, economic complexity, and green indicators as critical elements of sustainable development, yet it reveals fragmented approaches to their analysis. The need to integrate these dimensions into a single empirical framework is clear, particularly for Asia, where structural disparities and diverse policy responses provide a rich context for study. This research seeks to fill this gap by examining how economic complexity and green indicators collectively influence green trade in Asian countries, thereby contributing to a more holistic understanding of the drivers of sustainable trade.

3. Methodology

This study uses panel data from 33 Countries in Asia Region, focusing on national-level data from each country from 2010 to 2023 to explore the impact of economic complexity and green indicators on green Trade. The data sources include from gg index-simtool organization, the Observatory of Economic complexity (oec.world) and World Development Indicators/WDI from the World Bank. Panel data was selected due to its capacity to offer enhanced information, increased variability, reduced collinearity across variables, augmented degrees of freedom, and superior efficiency in parameter estimation (Fajar et al., 2024). The specific variables and their sources are detailed in Table 1.

Table 1.

Variable used.

This study employs the Poisson Pseudo Maximum Likelihood (PPML) estimator to examine the impact of explanatory variables on the dependent variable in a panel data framework. The PPML approach is widely used in empirical research since it can handle heteroskedasticity and the presence of zero values in the dependent variable, making it superior to traditional log-linear models that are biased under these circumstances (Westerlund & Wilhelmsson, 2011). Moreover, by incorporating fixed effects, the estimation controls for unobserved heterogeneity across entities and over time, thereby improving the robustness of the results (Pfaffermayr, 2020). The general specification of the PPML model can be written as follows.

where is the dependent variable for unit i at time t, represents the entity fixed effects, captures the time fixed effects, denotes the vector of independent variables, and is the error term.

This study employs the Poisson Pseudo Maximum Likelihood (PPML) estimator with fixed effects to analyze the determinants of green trade (GTR) across countries. The PPML method is widely applied in empirical trade and environmental economics research, as it effectively addresses issues of heteroskedasticity and the presence of zero values in the dependent variable, while also providing consistent parameter estimates under general conditions. Based on Table 1, the general form of the PPML fixed effect model can be expressed as follows.

4. Results

4.1. Descriptive Statistics

The descriptive statistics provide an overview of the distributional properties of the variables employed in Table 2. Overall, most variables exhibit mild to moderate positive skewness, which indicates the presence of long right tails in their distributions. This pattern is particularly evident in renewable energy, energy intensity, carbon intensity, green innovation, green investment, and economic complexity. In contrast, green trade and green economic opportunities show relatively symmetric distributions with slight negative skewness. In terms of dispersion, substantial variation can be observed across indicators. For instance, Renewable Energy, Carbon Intensity, and GDP Per Capita demonstrate high variability relative to their means, reflecting wide disparities among countries. On the other hand, Green Trade and Green Economic Opportunities appear to be more concentrated, suggesting less heterogeneity across the sample. Furthermore, the range of Economic complexity, which includes both negative and positive values, reflects the diversity of economic sophistication levels across Asian economies.

Table 2.

Descriptive statistics of the variables.

In addition, the kurtosis measures reveal that most variables are light-tailed and close to a normal distribution, except for GDP Per Capita, which exhibits a heavy-tailed distribution. This finding highlights the significant disparity in income levels across Asian countries, where a few economies report exceptionally high Per Capita income compared to the majority. It is also worth noting that the reported maximum and minimum values of Green Trade and GDP Per Capita appear to be inverted, which likely indicates a data entry issue that requires correction. Overall, the descriptive statistics suggest the presence of skewness, heterogeneity, and extreme values, supporting the appropriateness of employing the PPML estimator with fixed effects to address distributional irregularities and ensure robust inference.

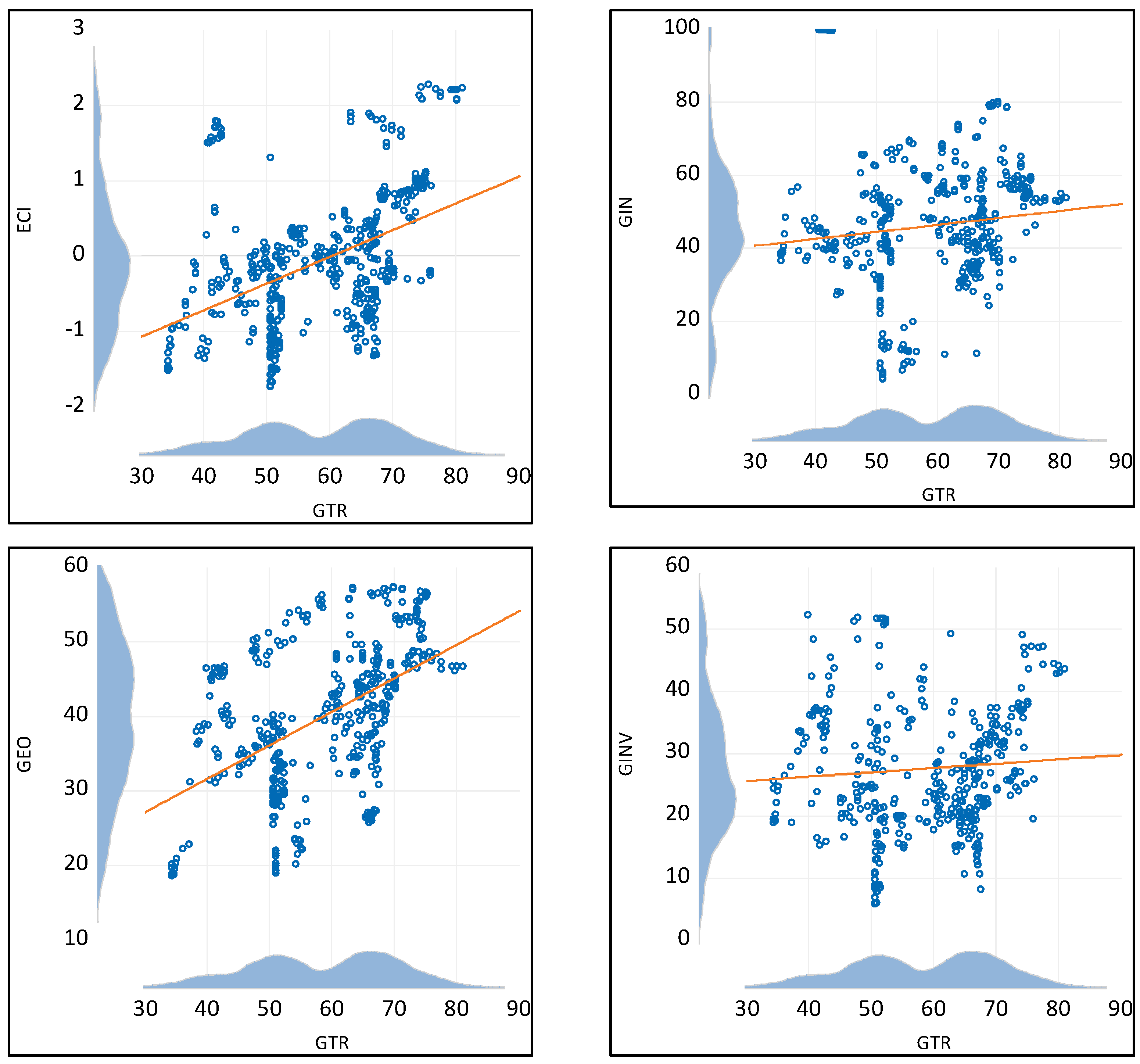

Figure 1 presents the scatter plots between the dependent variable, green trade, and the four independent variables: Economic complexity index, green investment, green economic opportunities, and green innovation. Overall, the plots suggest a positive relationship between Green Trade and all independent variables, although the strength of association appears to vary across indicators. Economic complexity and Green Economic Opportunities demonstrate clearer upward trends with relatively tighter point distributions, indicating stronger linear associations with green trade. In contrast, the relationship of Green Investment and Green Innovations with Green Trade is comparatively weaker, as reflected in the more dispersed data points and flatter fitted lines.

Figure 1.

Scatter plot towards dependent variable and independent variables.

The kernel density distributions along both axes highlight the heterogeneity of the data across countries. For example, Green Trade values cluster between 40 and 70, while Economic complexity spreads widely across negative and positive values, reflecting variations in productive sophistication. Similarly, Green investment and Green innovation exhibit concentrations around mid-range values, whereas Green economic opportunities display a broader spread. These patterns confirm the presence of cross-country heterogeneity in Asia, which justifies the application of panel regression techniques to control for unobserved differences and to better capture the underlying relationships between green trade and the explanatory variables.

Table 3 presents the correlation matrix between green trade and the explanatory variables. The results show that Green Trade has positive correlations with most independent variables, with the strongest association observed with green economic opportunities and economic complexity index. A moderate positive correlation is also found between Green Trade and GDP Per Capita, while the relationship with green investment, energy intensity, and green innovation appears relatively weak. In contrast, renewable energy exhibits a negative correlation with Green trade, suggesting an inverse linear relationship in the raw data.

Table 3.

Matrix Correlation.

The correlation coefficients also highlight strong interrelationships among some explanatory variables. For instance, Economic complexity is highly correlated with GDP Per Capita and green investment, while Green economic opportunities is strongly associated with both Green invesment and GDP Per Capita. In addition, carbon intensity and energy intensity show a strong positive correlation, reflecting their close conceptual and empirical linkages. Conversely, renewable energy displays negative correlations with most other variables, particularly with GDP Per Capita and Economic complexity. These findings indicate the potential for multicollinearity among several predictors, which will be controlled in the subsequent regression analysis using the PPML fixed effects estimator.

4.2. Estimates of the PPML: Regional Groups

Table 4 presents the estimation results of the PPML fixed effects model by regional groups in Asia. The analysis covers five subregions, namely South-Eastern Asia, Southern Asia, Western Asia, Eastern Asia, and Central Asia, allowing for a comparative understanding of the determinants of green trade across different geographical contexts. This approach is particularly relevant given the economic, institutional, and structural heterogeneity of Asian countries, which may shape how economic complexity, green-related indicators, and control variables influence trade patterns. By examining each subregion separately, the results provide more nuanced insights into the regional dynamics of green trade rather than relying solely on aggregate findings.

Table 4.

Estimates of green trade using PPML fixed effects by regions.

The estimation results for South-Eastern Asia indicate that only a limited set of variables show meaningful associations with green trade. Green economic opportunities emerge as a relevant factor, suggesting that countries in this region benefit when market opportunities linked to green development expand. Renewable energy also appears positively linked with trade performance, while carbon intensity plays a strong role, reflecting the region’s structural reliance on emission-intensive activities even as green trade increases. Other variables remain weak or insignificant, indicating that green trade in South-Eastern Asia is influenced by selective rather than broad-based factors.

For Southern Asia, the estimates show stronger and more consistent patterns across multiple indicators. Green economic opportunities are positively associated with trade, underscoring the importance of institutional and market conditions that enable environmentally sustainable commerce. However, green investment and innovation display negative coefficients, which may reflect structural challenges in channeling investments effectively toward enhancing trade competitiveness. Energy intensity, in contrast, is positively linked, while renewable energy shows a weakly negative association, highlighting the complex dynamics between traditional and renewable energy sources in shaping trade outcomes in this region.

The Western Asia results point to more modest connections between green trade and the explanatory variables. Economic complexity, green opportunities, and renewable energy demonstrate only weak associations. Green investment has a small positive effect, while GDP Per Capita shows a negative relationship, suggesting that rising income levels in some Western Asian countries may not directly translate into green trade expansion. This outcome indicates that trade performance in the region may be more strongly influenced by other structural or geopolitical factors not captured in the model.

In Eastern Asia, the results demonstrate a more differentiated picture. Economic complexity shows a significant negative association with green trade, which may indicate that rising complexity in production systems is not necessarily aligned with environmentally sustainable trade in this context. Renewable energy, on the other hand, is positively related, and carbon intensity also exerts a positive effect, signaling the coexistence of clean and emission-intensive activities in shaping trade dynamics. GDP Per Capita is also positively linked to green trade, suggesting that higher income levels may provide stronger demand and policy support for environmentally oriented commerce in this region.

Central Asia presents a distinct profile compared to the other groups. Economic complexity is strongly and positively associated with green trade, indicating that greater sophistication in production capacity enhances the region’s potential in this domain. Green innovation also plays a meaningful role, highlighting the value of technological advancement. By contrast, energy intensity and renewable energy both display negative coefficients, suggesting that higher consumption levels and reliance on renewable sources have not yet translated into stronger trade outcomes. The results also show a negative effect of income, which may reflect uneven development patterns in the region.

Across the regional estimates, renewable energy, carbon intensity, and green economic opportunities emerge as the most recurrent factors, though with varying directions of association. The heterogeneity of results highlights the importance of regional context in shaping the determinants of green trade. While some regions benefit from economic sophistication and innovation, others are more affected by structural energy patterns and institutional conditions. The regional-level estimations reveal that there is no single determinant of green trade that holds uniformly across Asia. Instead, the findings demonstrate strong regional variation in the drivers of environmentally oriented trade, underscoring the need for region-specific strategies rather than a one-size-fits-all approach.

4.3. Estimates of the PPML: Income Groups

Table 5 reports the estimation results of the PPML fixed effects model classified by income groups, namely low-income, lower-middle-income, upper-middle-income, and high-income nations. This classification provides a more refined perspective on the determinants of green trade, since economic structure, institutional capacity, and resource allocation differ significantly across income categories. Examining countries through this lens highlights not only the direct effects of economic complexity and green-related indicators, but also the extent to which income levels condition the capacity of economies to leverage green trade opportunities.

Table 5.

Estimates of green trade using PPML fixed effects by income.

In low-income countries, the results reveal a strong and positive influence of economic complexity on green trade, suggesting that even small advancements in production sophistication can significantly enhance trade performance. Green economic opportunities are also positively related, implying that institutional and market improvements directly support the integration of these countries into green-oriented trade. By contrast, green investment and green innovation display negative associations, pointing to inefficiencies in transforming investments into tangible trade outcomes. Renewable energy and energy intensity contribute positively, indicating that cleaner energy adoption is already supportive of trade in these economies, while carbon intensity and income Per Capita show a negative effect, reflecting structural challenges that limit the translation of income growth into broader trade expansion.

For lower-middle-income nations, the pattern is more nuanced. Economic complexity shows no significant influence, while green economic opportunities emerge as the strongest driver of green trade. This indicates that, for these economies, institutional readiness and favorable market conditions matter more than structural sophistication. Renewable energy also shows a positive and significant relationship, highlighting the role of energy transition in supporting trade. However, other factors such as green investment and innovation remain weak or insignificant, and income Per Capita has no meaningful effect. These results suggest that green trade in this group is primarily shaped by institutional opportunities and renewable energy adoption.

The results for upper-middle-income countries present a mixed outcome. Economic complexity appears to have little relevance, while both green economic opportunities and renewable energy remain positive contributors, albeit at a lower magnitude than in lower-income groups. Interestingly, green investment shows a negative relationship, which may reflect inefficiencies or misallocation in channeling resources toward sectors that directly enhance green trade. Carbon intensity displays a strong negative effect, signaling that pollution-related activities are detrimental to trade competitiveness in these economies. Income Per Capita also has a negative impact, which may indicate diminishing marginal effects of income growth on green trade once a certain development threshold is reached.

In high-income nations, the relationships differ substantially from the other groups. Green investment demonstrates a positive and significant effect, highlighting that advanced economies are better able to channel investments into productive and trade-enhancing activities. Renewable energy, however, shows no significant impact, possibly reflecting that most high-income countries have already achieved a stable renewable energy share, reducing its marginal effect on trade. Economic complexity and green economic opportunities do not show strong associations, suggesting that structural and institutional factors have reached a saturation point. Interestingly, income Per Capita is negatively associated with green trade, reflecting that further increases in income may not directly translate into higher trade performance, possibly due to shifts toward service-oriented economies.

Across all income categories, renewable energy and green economic opportunities appear consistently as relevant contributors to green trade, though the strength of their associations varies. In contrast, green investment and green innovation show divergent effects: negative in lower-income contexts but positive or insignificant in higher-income groups. Similarly, the role of economic complexity shifts from highly relevant in low-income countries to relatively unimportant in wealthier economies. This suggests that the drivers of green trade evolve as economies progress, with different sets of factors becoming more or less influential depending on the stage of development.

The results also highlight that income Per Capita exerts a negative or insignificant effect across most income groups, indicating that income growth alone is not a sufficient driver of green trade. Instead, targeted policies that strengthen institutional opportunities, promote renewable energy adoption, and effectively direct green investments appear more critical.

In conclusion, the PPML estimates by income groups emphasize that the determinants of green trade vary systematically across different stages of economic development. While low-income nations rely heavily on economic complexity and institutional opportunities, higher-income countries benefit more from effective investment strategies. These findings underscore the heterogeneity of green trade drivers and suggest that policy approaches must be carefully tailored to the specific income context of each group.

4.4. Estimates of the PPML: All Groups

Before turning to the interpretation of the main findings, it is important to note that the Poisson Pseudo Maximum Likelihood (PPML) approach with fixed effects was applied to estimate the impact of various explanatory variables on green trade across all groups. This method is particularly useful in addressing heteroskedasticity and the presence of zero trade flows, thereby providing robust estimates. Table 6 presents the estimation results for the pooled dataset, offering a comprehensive view of the general relationships among the selected variables and green trade performance.

Table 6.

Estimates of green trade using PPML fixed effects for all groups.

The results show that economic complexity has a positive and significant effect on green trade. This suggests that countries with more diversified and sophisticated production structures are more capable of engaging in environmentally friendly trade. A higher ECI implies that these economies possess the technological knowledge and productive capabilities necessary to support the transition toward greener exports.

Green economic opportunities are also found to play a significant positive role. This indicates that countries with stronger enabling environments for green activity, such as supportive regulation, credible market incentives, access to green finance, and relevant human capital, are better able to expand green trade. These opportunities reduce non-tariff and coordination frictions, foster firm entry and product upgrading in green sectors, and strengthen market linkages to global value chains, thereby facilitating participation in environmentally sustainable trade flows.

On the other hand, the results reveal that green innovation has a significantly negative effect on green trade. This unexpected outcome may suggest inefficiencies in the allocation or management of green innovations, where innovation spillovers may not be market-ready, leading to temporary trade-offs in trade performance. It also indicates that a “technology implementation gap”, where innovative capacities are not yet aligned with global green market demand.

Meanwhile, renewable energy demonstrates a positive and significant influence on green trade. This finding highlights the critical role of renewable energy adoption in driving the growth of environmentally friendly trade. Economies that invest in renewable energy sources are better positioned to meet global demand for greener products, thereby enhancing their trade competitiveness. Other variables, such as green investment, carbon intensity, energy intensity, and GDP Per Capita, do not show statistically significant effects in this model. This suggests that while these factors may be relevant in shaping broader economic or environmental outcomes, their direct influence on green trade is not strongly evident across all groups in the sample.

The results suggest that structural capabilities (economic complexity), the enabling environment for green activity (green economic opportunities), and renewable energy adoption are the principal drivers of green trade in the pooled sample. By contrast, green innovation is negatively associated, pointing to potential inefficiencies or timing frictions, and broader controls such as carbon intensity, energy intensity, and income Per Capita do not display robust direct effects, implying their influence is more indirect or long-term.

5. Discussion

The empirical findings of this study highlight that structural capabilities and renewable energy adoption emerge as the strongest determinants of green trade performance across countries. This result is consistent with previous research by Lin et al. (2024) and Gyamfi et al. (2023), who found that countries with higher economic complexity are better equipped to diversify exports toward environmentally sustainable goods. The statistical significance of economic complexity and renewable energy consumption underscores the importance of long-term structural and technological development in shaping sustainable trade outcomes. As argued by Breitenbach et al. (2021), economies with advanced productive knowledge and innovation capacity tend to integrate more effectively into global green trade networks. Hence, this study reinforces the idea that technological sophistication and structural transformation—rather than merely economic scale—constitute the foundation of competitiveness in green trade.

Countries with more sophisticated production systems and greater integration of renewable energy sources are better positioned to compete in green trade, both by diversifying their export base and by reducing reliance on carbon-intensive production processes. This aligns with the findings of L. Zhang et al. (2025) and Zehri (2025), who demonstrated that renewable energy and low-carbon technologies enhance export competitiveness and stimulate industrial upgrading. Similarly, Mahajan et al. (2023) emphasized that green trade serves a dual function: reducing environmental degradation while fostering new opportunities for economic growth and innovation. The results of the present study confirm that green trade expansion in Asia is closely linked to technological readiness and the structural complexity of production systems.

Green economic opportunities are also found to play a meaningful role in supporting green trade. This finding resonates with Dogaru (2021) and Telukdarie et al. (2024), who underscored that a supportive ecosystem—including regulation, market incentives, access to finance, and human capital—enables countries to benefit from the green transition. An enabling environment reduces non-tariff and coordination frictions, accelerates the diffusion of clean technologies and know-how through supply chain linkages, and strengthens firms’ capacity to upgrade products and processes. Accordingly, participation in green trade is not only a function of structural capabilities but also of the policy and market ecosystem in which firms operate. This supports the view of Chukwuma-Onwe et al. (2024) and Berikhanovna et al. (2023) that policy frameworks and institutional readiness play pivotal roles in determining how effectively a country transitions toward sustainable trade.

Interestingly, the results indicate that Green Investment, Carbon Intensity, Energy Intensity, and GDP Per Capita do not exhibit significant direct effects on green trade across the sample. This finding diverges from studies such as Falcone (2020) and Pang et al. (2022), which reported a positive link between green investment and green export performance. The divergence may be explained by differences in the absorptive capacity of domestic industries, as suggested by Voica et al. (2015), implying that green investment alone is insufficient to drive trade outcomes unless accompanied by structural and institutional mechanisms that translate capital inflows into productivity and export competitiveness. Similarly, the weak effect of carbon and energy intensity reduction may reflect the time-lagged nature of environmental improvements, which, as noted by Chen and Ma (2021), often require longer periods to materialize in trade performance as firms adapt to new production standards.

The non-significance of energy intensity further points to structural rigidities within many Asian economies. High energy intensity may reflect entrenched industrial configurations that rely heavily on fossil fuels, but the transition toward more energy-efficient systems requires substantial time and policy support. This observation echoes Jin et al. (2023), who found that fossil-fuel-dependent economies in Asia face persistent challenges in decoupling economic growth from energy consumption. As such, improvements in energy efficiency might only demonstrate a delayed effect on green trade once industries have undergone technological and institutional restructuring.

Moreover, GDP Per Capita, while often associated with economic diversification and trade sophistication, does not appear to drive green trade directly in this model. This aligns partially with the findings of Agrawal et al. (2024), who noted that income level alone is not a reliable predictor of green trade leadership; rather, it is the technological and institutional capacity for green innovation that determines a country’s competitiveness. In some cases, middle-income countries with active renewable energy and innovation policies outperform higher-income economies that rely on traditional trade structures. This reinforces the argument of Stojkoski et al. (2016) and Balland et al. (2022) that development pathways rooted in knowledge accumulation and complexity yield more sustainable trade outcomes than mere economic affluence.

Taken together, the findings emphasize that green trade dynamics are shaped more by structural and technological transformation than by traditional measures of economic wealth or aggregate investment. Renewable energy adoption and economic complexity are actionable levers that can be strengthened through targeted policy interventions, while carbon and energy intensity reductions, along with green investment flows, require complementary institutional mechanisms to translate into trade benefits. These results complement the conclusions of Minh Ha et al. (2023) and Zhou (2025), who highlighted that the competitiveness of green industries depends on innovation ecosystems and institutional efficiency rather than isolated financial inputs.

Finally, the spatial dimension of the findings underscores the role of regional cooperation. Countries embedded in regions with strong commitments to renewable energy and green trade practices are more likely to experience positive spillovers, demonstrating that green trade is not only a domestic challenge but also a collective regional project. This conclusion supports Kabiru Maji et al. (2023), who argued that harmonized environmental standards and cross-border collaboration amplify the benefits of sustainable trade integration. Accordingly, regional platforms for knowledge sharing, coordinated infrastructure development, and unified green standards can serve as catalysts for enhancing Asia’s collective capacity to compete in the evolving landscape of global green trade.

6. Conclusions

This study explores the relationship between green trade, economic complexity, and selected green indicators in Asian countries using the PPML Fixed Effects model. The results confirm that economic complexity is a significant driver of green trade, highlighting the importance of knowledge-intensive production and the diversification of export structures. In contrast, variables such as green investment, carbon intensity, energy intensity, and income Per Capita do not show statistically significant impacts, suggesting that while these factors matter in broader sustainability frameworks, their direct influence on green trade is less evident across the sample. Furthermore, opportunities arising from green economics, including renewable energy development and eco-innovation, reinforce the importance of integrating sustainability within economic development strategies.

The findings indicate that advancing green trade in Asia requires not only structural improvements in production capabilities but also policy coherence that links economic complexity with sustainability objectives. Green trade is not solely determined by national-level strategies but is also embedded within regional dynamics, where technological spillovers and cooperation among neighboring countries can strengthen sustainable trade participation. This underscores the role of Asia’s collective transition towards greener economies as a catalyst for long-term competitiveness in global markets.

To enhance the role of green trade in Asia, several policy implications arise from the findings. Governments should prioritize policies that strengthen economic complexity by fostering innovation, research, and high-value industries. Investments in human capital development and advanced technological capacity are critical for enabling economies to diversify their exports toward environmentally sustainable products. Strengthening domestic capabilities in renewable energy and eco-friendly industries will allow countries to leverage complexity as a pathway to green competitiveness.

While green investment, carbon intensity, and energy intensity were not statistically significant in this model, they should not be overlooked. Policymakers must improve the quality and direction of green investment to ensure that capital allocation effectively reduces environmental burdens. Similarly, managing carbon intensity and energy efficiency requires stricter regulatory frameworks, incentives for clean technologies, and greater regional cooperation to reduce reliance on fossil fuels. Such measures can create a supportive environment for green trade to thrive, even if their immediate statistical effect is limited.

Regional cooperation must be strengthened to capture the benefits of green spillovers. Many Asian countries can benefit from cross-border initiatives, such as renewable energy grid interconnections, technology-sharing platforms, and joint research on eco-innovation. This regional approach ensures that green trade development does not occur in isolation but rather as part of a wider ecosystem that enhances competitiveness and resilience across the continent.

Governments should integrate green trade policies into broader economic planning by aligning trade strategies with sustainability agendas such as the Sustainable Development Goals (SDGs) and national low-carbon pathways. This requires coherent regulatory frameworks that connect environmental priorities with industrial and trade policies. By creating synergies between economic complexity and green growth, Asian countries can position themselves as global leaders in sustainable trade, while simultaneously safeguarding long-term economic resilience.

This study is not without limitations. The analysis relies on available panel data, which may not fully capture the heterogeneity of green trade dynamics across different Asian countries, especially those with limited statistical capacity. The indicators used, economic complexity, green investment, carbon intensity, energy intensity, and income Per Capita, may not encompass the full spectrum of green trade determinants, such as institutional quality, environmental policy enforcement, or cultural factors influencing consumption patterns. Additionally, the PPML Fixed Effects model, while robust for handling heteroskedasticity and zero trade flows, does not account for potential dynamic feedback effects or nonlinear interactions among variables. Future research could expand the dataset, include additional green and institutional indicators, and explore advanced econometric approaches such as dynamic panel models or spatial econometrics to better capture regional interdependencies.

Author Contributions

Conceptualization, I.T.A.R., A.H.P., H.H. and N.D.S.S.; methodology, I.T.A.R. and A.I.; software, A.I.; validation, I.T.A.R., A.H.P., H.H. and N.D.S.S.; formal analysis, I.T.A.R.; investigation, I.T.A.R.; resources, I.T.A.R.; data curation, I.T.A.R. and A.I.; writing—original draft preparation, I.T.A.R.; writing—review and editing, I.T.A.R.; visualization, I.T.A.R.; supervision, I.T.A.R.; project administration, I.T.A.R.; funding acquisition, I.T.A.R., A.H.P. and N.D.S.S. All authors have read and agreed to the published version of the manuscript.

Funding

This research is usually funded by Hasanuddin University through a reward system, where the funding formalities will be given after publication.

Institutional Review Board Statement

Not applicable.

Informed Consent Statement

Not applicable.

Data Availability Statement

The data employed in this study were obtained from several reputable international databases to ensure consistency and reliability. Specifically, data related to green growth indicators were extracted from GGIndex-Simtool (ggindex-simtool.ggg), while information on trade structure and economic complexity was sourced from OEC.World. In addition, a series of macroeconomic indicators, such as GDP Per Capita, population, and other relevant control variables, were retrieved from the World Bank Open Data. These combined sources provide comprehensive coverage for conducting robust empirical analysis across countries in the study sample.

Conflicts of Interest

The authors declare no conflicts of interest.

Abbreviations

The following abbreviations are used in this manuscript:

| PPML | Poisson Pseudo Maximum Likelihood |

| GDP | Gross Domestic Product |

References

- Abid, I., & Gafsi, N. (2025). Economic complexity, environmental sustainability, and technological integration in Saudi Arabia: Analyzing long-term trends. International Journal of Energy Economics and Policy, 15(3), 669–683. [Google Scholar] [CrossRef]

- Agrawal, R., Agrawal, S., Samadhiya, A., Kumal, A., Luthra, S., & Jain, V. (2024). Adoption of green finance and green innovation for achieving circularity: An exploratory review and future directions. Geoscience Frontiers, 15(4), 101669. [Google Scholar] [CrossRef]

- Ahmad, S. (2025). Pathways to environmental sustainability in developing Asia: Insights from environmental policy, green innovation and energy structure. Reviews, 216, 115646. [Google Scholar] [CrossRef]

- Azimi, M. N., Raham, M. M., & Maraseni, T. (2025). Green trade, governance, finance, and energy efficiency: Shaping environmental landscape in global powerhouses. Journal of Environmental Management, 385, 125674. [Google Scholar] [CrossRef]

- Balland, P.-A., Broekel, T., Diodato, D., Giuliani, E., Hausmann, R., O’Clery, N., & Rigby, D. (2022). The new paradigm of economic complexity. Resources Policy, 51(3), 104450. [Google Scholar] [CrossRef] [PubMed]

- Berikhanovna, C. M., Bauirzhanovna, B. A., Kudaibergenovna, N. G., Gulbagda, B., & Serikovna, Y. G. (2023). The influence of green credit policy on green innovation and transformation and upgradation as a function of corporate diversification: The case of Kazakhstan. Economies, 11(8), 210. [Google Scholar] [CrossRef]

- Breitenbach, M., Chisadza, C., & Clance, M. (2021). The economic complexity index (ECI) and output volatility: High vs. low income countries. Journal of International Trade and Economic Development, 31(4), 566–580. [Google Scholar] [CrossRef]

- Caldarola, B., Mazzili, D., Napolitano, L., Patelli, A., & Sbardella, A. (2024). Economic complexity and the sustainability transition: A review of data, methods, and literature. Journal of Physics: Complexity, 5(2), 022001. [Google Scholar] [CrossRef]

- Chen, Y., & Ma, Y. (2021). Does green investment improve energy firm performance? Energy Policy, 153, 112252. [Google Scholar] [CrossRef]

- Cheng, Q., Lin, A.-P., & Yang, M. (2025). Green innovation and firms’ financial and environmental performance: The roles of pollution prevention versus control. Journal of Accounting and Economics, 79(1), 101706. [Google Scholar] [CrossRef]

- Chukwuma-Onwe, J., Ridzuan, A. R., Uche, E., Ray, S., Ridwan, M., & Razi, U. (2024). Greening Japan: Harnessing energy efficiency and waste reduction for environmental progress. Sustainable Futures, 8, 100302. [Google Scholar] [CrossRef]

- Dogaru, L. (2021). Green economy and green growth—Opportunities for sustainable development. Proceedings, 63(1), 70. [Google Scholar] [CrossRef]

- Emenika, O. J., Agu, C., Onah, B. U., & Urama, C. E. (2025). Economic complexity and sectoral performance in Africa: The role of economic governance institutions. Sustainable Development, 33(3), 4557–4576. [Google Scholar] [CrossRef]

- Fajar, M. Z. N., Quality, M. J. R., & Al Farohi, M. F. (2024). The impact of financial development on carbon emissions: An ASEAN perspective. Journal of Central Banking Law and Institutions, 3(3), 409–448. [Google Scholar] [CrossRef]

- Falcone, P. M. (2020). Environmental regulation and green investments: The role of green finance. International Journal of Green Economics, 14(2), 159–173. [Google Scholar] [CrossRef]

- Gyamfi, B. A., Agozie, D. Q., Musah, M., Onifade, S. T., & Prusty, S. (2023). The synergistic roles of green openness and economic complexity in environmental sustainability of Europe’s largest economy: Implications for technology-intensive and environmentally friendly products. Environmental Impact Assessment Review, 102, 107220. [Google Scholar] [CrossRef]

- Hanafy, S. A., Abouelenein, M. F., Roushdy, N., Ibrahiem, D. M., Addai, G., Sethi, N., Esily, R. R., & Samah, R. (2025). Key factors in environmental quality: Green finance, energy and trade. Energy Strategy Reviews, 60, 101800. [Google Scholar] [CrossRef]

- Hermundsdottir, F., & Aspelund, A. (2021). Sustainability innovations and firm competitiveness: A review. Journal of Cleaner Production, 280(Pt 1), 124715. [Google Scholar] [CrossRef]

- Idris, A., & Rahman Razak, A. (2025). Energy transition, green growth and emission on economic growth using spline approach: Evidence from Asia-Pasific countries. Economics—Innovative And Economics Research Journal, 13(2), 139–159. [Google Scholar] [CrossRef]

- Idris, A., Tajibu, M. J., Paddu, A. H., & Fatmawati, F. (2025). Evaluating implementation of green economy in Indonesia: Evidence from K-medoids cluster. In Proceedings of the 9th international conference on accounting, management, and economics 2024 (ICAME 2024) (pp. 429–447). Atlantis Press. [Google Scholar] [CrossRef]

- Jin, C., Luo, S., & Sun, K. (2023). Energy resources trade and investments for green growth: The case of countries in the Asia-Pacific economic cooperation. Resources Policy, 82, 103535. [Google Scholar] [CrossRef]

- Kabiru Maji, I., Saari, M. Y., & Bello, U. A. (2023). Institutional quality, green trade and carbon emissions in sub-Saharan Africa. Cleaner Energy Systems, 6, 100086. [Google Scholar] [CrossRef]

- Kwilinsky, A., Lyulyov, O., & Pimonenko, T. (2025). The role of green finance in attaining environmental sustainability within a country’s ESG performance. Journal of Innovation & Knowledge, 10(2), 100674. [Google Scholar] [CrossRef]

- Lee, C.-C., Olasehinde-Williams, G., & Gyamfi, B. A. (2023). The synergistic effect of green trade and economic complexity on sustainable environment: A new perspective on the economic and ecological components of sustainable development. Sustainable Development, 31(2), 975–989. [Google Scholar] [CrossRef]

- Lin, S., Zhou, Z., Hu, X., Chen, S., & Huang, J. (2024). How can urban economic complexity promote green economic growth in China? The perspective of green technology innovation and industrial structure upgrading. Journal of Cleaner Production, 450, 141807. [Google Scholar] [CrossRef]

- Mahajan, N., Kaur, N., Singh, V., Gupta, A., & Garg, N. (2023). Green trade: Transition towards a sustainable economy. IOP Conference Series: Earth and Environmental Science, 1279(1), 102023. [Google Scholar] [CrossRef]

- Minh Ha, N., Anh Pham, N., & Minh Tam, N. (2023). Impact of green innovation on environmental performance and financial performance. Environment Development and Sustainability, 26(7), 17083–17104. [Google Scholar] [CrossRef]

- Nyangchak, N. (2022). Emerging green industry toward net-zero economy: A systematic review. Journal of Cleaner Production, 378, 134622. [Google Scholar] [CrossRef]

- Pang, D., Li, K., Wang, G., & Ajaz, T. (2022). The asymmetric effect of green investment, natural resources, and growth on financial inclusion in China. Resources Policy, 78, 102885. [Google Scholar] [CrossRef]

- Pfaffermayr, M. (2020). Constrained Poisson pseudo maximum likelihood estimation of structural gravity models. International Economics, 161, 188–198. [Google Scholar] [CrossRef]

- Qi, J. (2024). Greening economic sectors through trade liberalization and efficient governance. Humanities & Social Sciences Communications, 11, 1690. [Google Scholar] [CrossRef]

- Ramizo, D. M., Cabalu, H., Harris, M., & Inchauspe, J. (2025). The environmental impact of green trade and circular trade: Does urbanization matter? Cleaner Production Letters, 8, 100086. [Google Scholar] [CrossRef]

- Stojkoski, V., Utkovski, Z., & Kocarev, L. (2016). The impact of services on economic complexity: Service sophistication as route for economic growth. PLoS ONE, 11(8), e0161633. [Google Scholar] [CrossRef] [PubMed]

- Telukdarie, A., Katsumbe, T., Mahure, H., & Murulane, K. (2024). Exploring the green economy—A systems thinking modelling approach. Journal of Cleaner Production, 436, 140611. [Google Scholar] [CrossRef]

- Ullah, U., Shaheen, W. A., Abdalkrim, G. M., Shafi, N., Breaz, T. O., Jaboob, M., Sani, A., & Malik, A. (2025). Past and present of energy: The role of green finance, technological innovation, and financial risk in sustainability indicators. Environment and Sustainability Indicators, 28, 100936. [Google Scholar] [CrossRef]

- Valverde-Carbonell, J. (2025). Rethinking the literature on economic complexity indexes. Economic Analysis and Policy, 87, 123–145. [Google Scholar] [CrossRef]

- Voica, M. C., Panait, M., & Radulescu, I. (2015). Green investments—Between necessity, fiscal constraints and profit. Procedia Economics and Finance, 22, 720–729. [Google Scholar] [CrossRef]

- Wang, Y. Z., & Ahmad, S. (2024). Green process innovation, green product innovation, leverage, and corporate financial performance; evidence from system GMM. Heliyon, 10(4), e25819. [Google Scholar] [CrossRef]

- Westerlund, J., & Wilhelmsson, F. (2011). Estimating the gravity model without gravity using panel data. Applied Economics, 43(6), 641–649. [Google Scholar] [CrossRef]

- Xu, A., Dai, Y., Hu, Z., & Qiu, K. (2025). Can green finance policy promote inclusive green growth?—Based on the quasi-natural experiment of China’s green finance reform and innovation pilot zone. International Review of Economics & Finance, 100, 104090. [Google Scholar] [CrossRef]

- Yeboah, S. D., Gatsi, J. G., Appiah, M. O., & Fumey, M. P. (2024). Examining the drivers of inclusive growth: A study of economic performance, environmental sustainability, and life expectancy in BRICS economies. Research in Globalization, 9, 100267. [Google Scholar] [CrossRef]

- Yu, Y., & Qayyum, M. (2021). Impacts of financial openness on economic complexity: Cross-country evidence. International Journal of Financial & Economics, 28(2), 1514–1526. [Google Scholar] [CrossRef]

- Zehri, C. (2025). Renewable energy and industrial innovation: Catalysts for economic and trade growth. Russian Journal of Economics, 11(1), 93–122. [Google Scholar] [CrossRef]

- Zhang, L., Xie, L., Mu, X., & Hu, G. (2025). Trade and the sustainable energy transition: Exploring the impact of trade on total factor renewable energy efficiency. Sustainability, 17(4), 1566. [Google Scholar] [CrossRef]

- Zhang, S., Xu, G., Shu, Y., Zhu, J., & Cheng, W. (2024). Comparing developed and emerging nations’ Economic development with environmental footprint for low-carbon competitiveness. Heliyon, 10(14), e34039. [Google Scholar] [CrossRef]

- Zhong, T. (2023). Sustainable international trade: Achieving a balance between economic growth and environmental responsibility. Frontiers in Business Economics and Management, 12(2), 7–10. [Google Scholar] [CrossRef]

- Zhou, C. (2025). Green innovation: A key strategy for enterprises and countries to gain a competitive edge in the global market. Technology Analysis and Strategic Management, 37(11), 2189–2204. [Google Scholar] [CrossRef]

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2025 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).