Ripples of Global Fear: Transmission of Investor Sentiment and Financial Stress to GCC Sectoral Stock Volatility

Abstract

1. Introduction

2. Literature Review and Economic Rationality

2.1. The Spillover of Shock Propagation Towards the GCC Sectoral Stock Conditional Volatility from Global Financial Stress Indicators (FSI)1

2.2. The Spillover of Shock Propagation Towards the GCC Sectoral Stock Conditional Volatility from Bitcoin Investors’ Fear and Greed Sentiment Indices (BSI)2

2.3. The Spillover of Shock Transmission Towards the GCC Sectoral Stock Conditional Volatility from U.S. and European Financial Market Uncertainty (U.S. CBOE VIX and Euro VSTOXX-50)

3. Data and Methodology

3.1. Data

3.2. Methodology3

3.2.1. The “Time” Domain Connectivity Approach Based upon the TVP-VAR Method by Antonakakis et al. (2020)

3.2.2. The “Frequency” Domain TVP-VAR Approach by Chatziantoniou et al. (2023)

4. Results

4.1. Descriptive Statistics

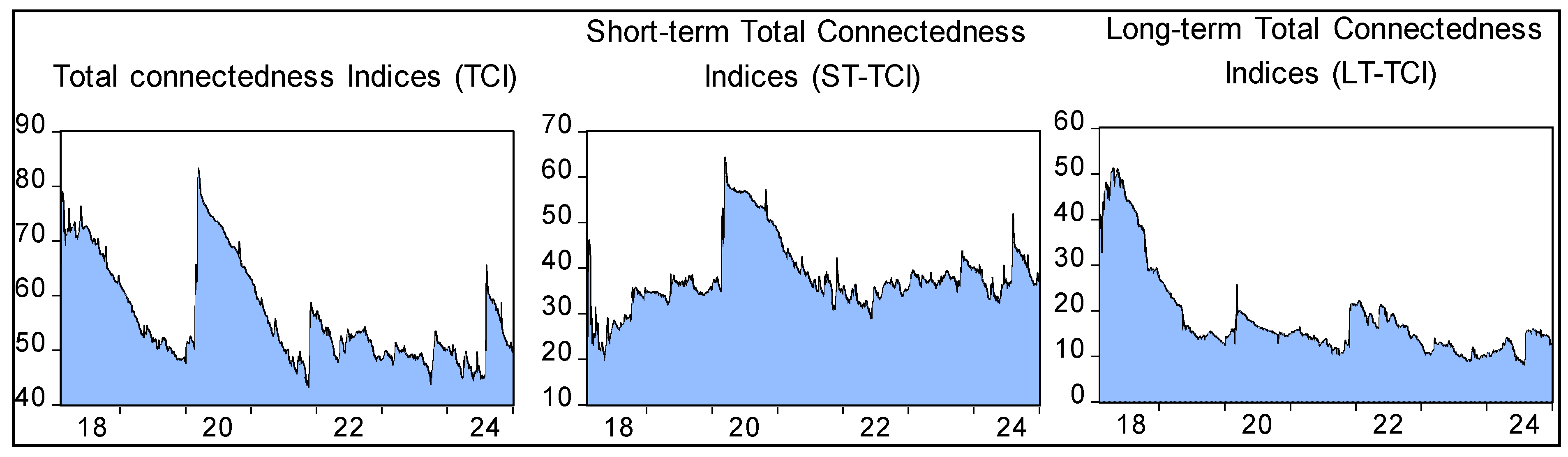

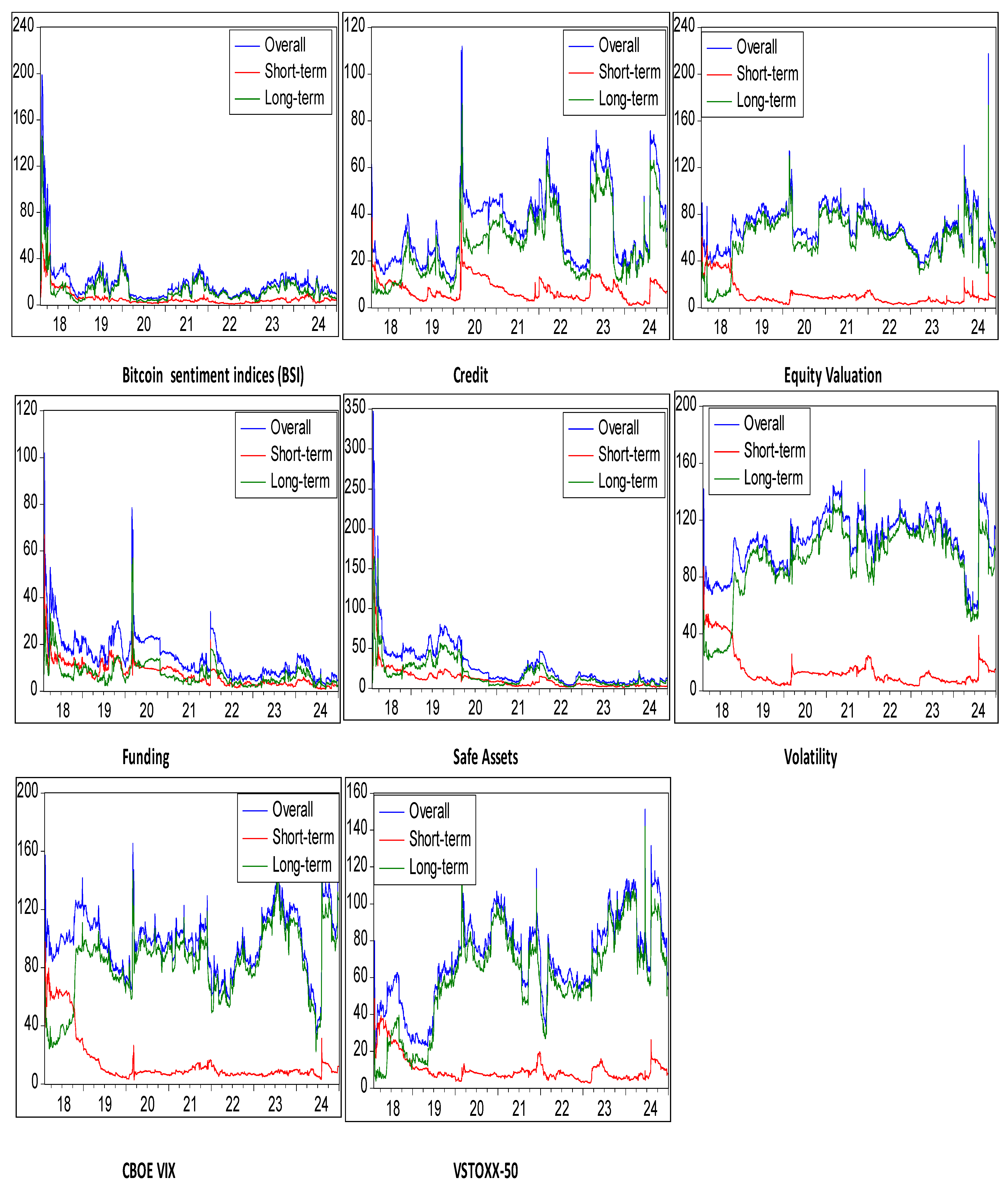

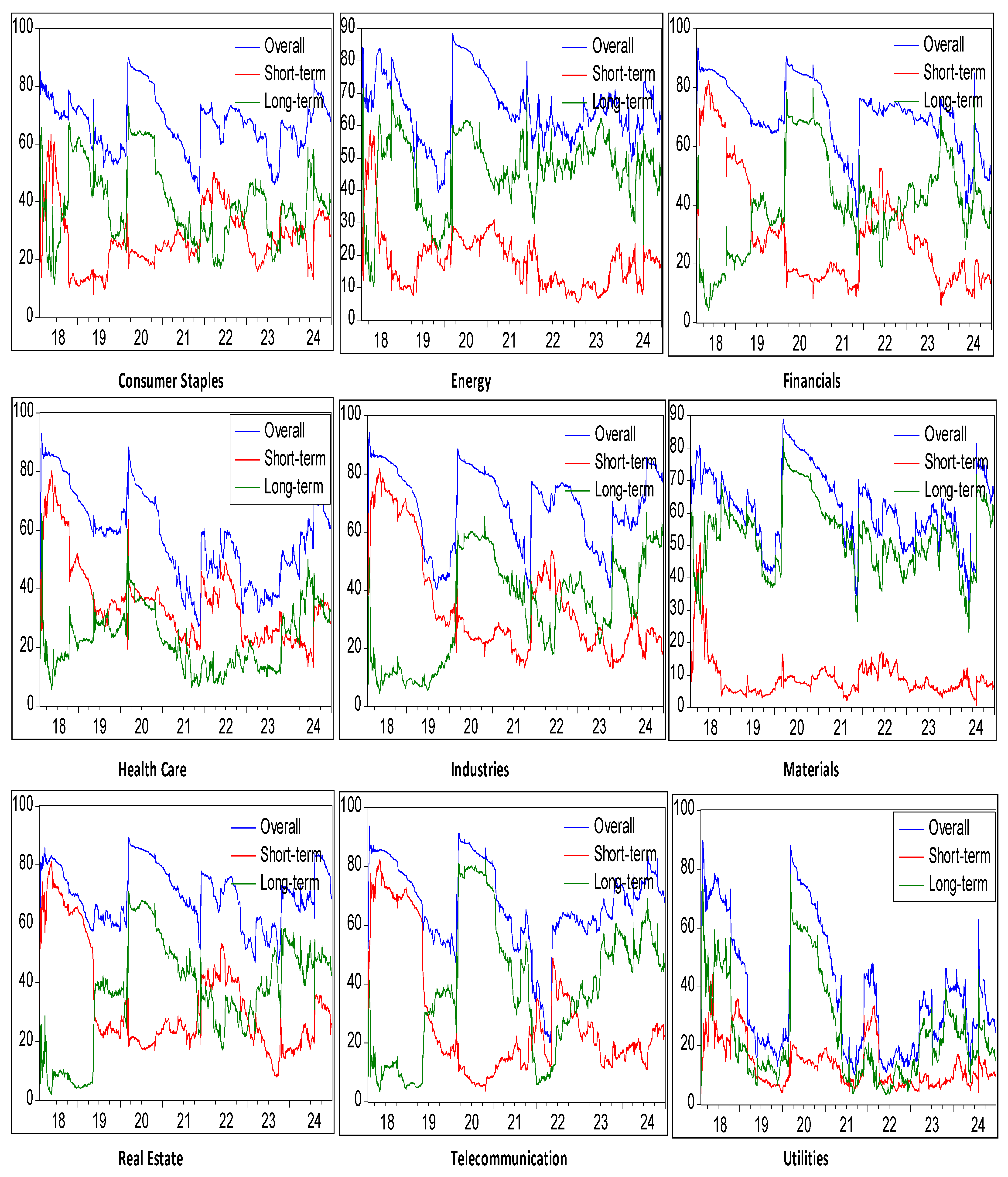

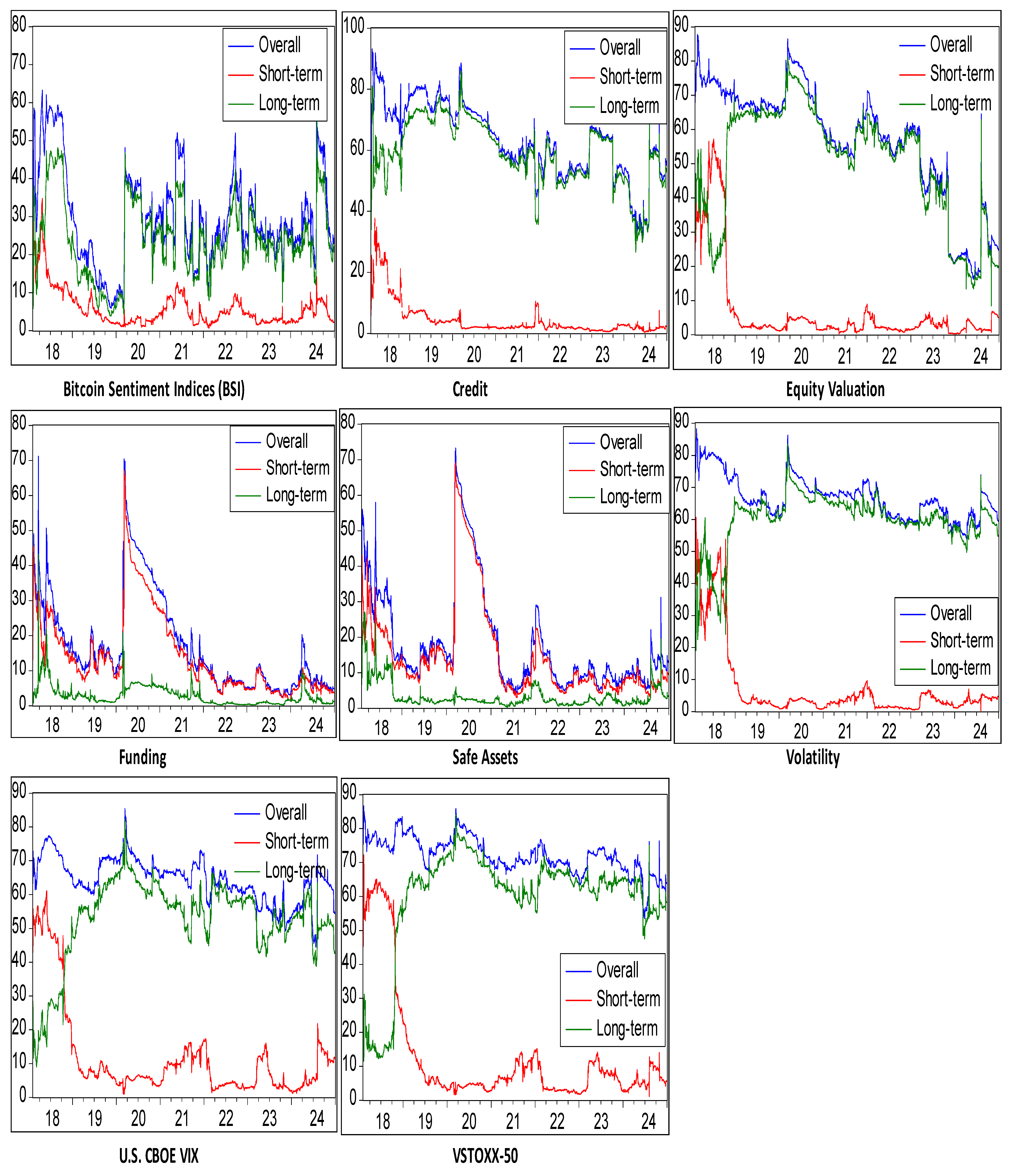

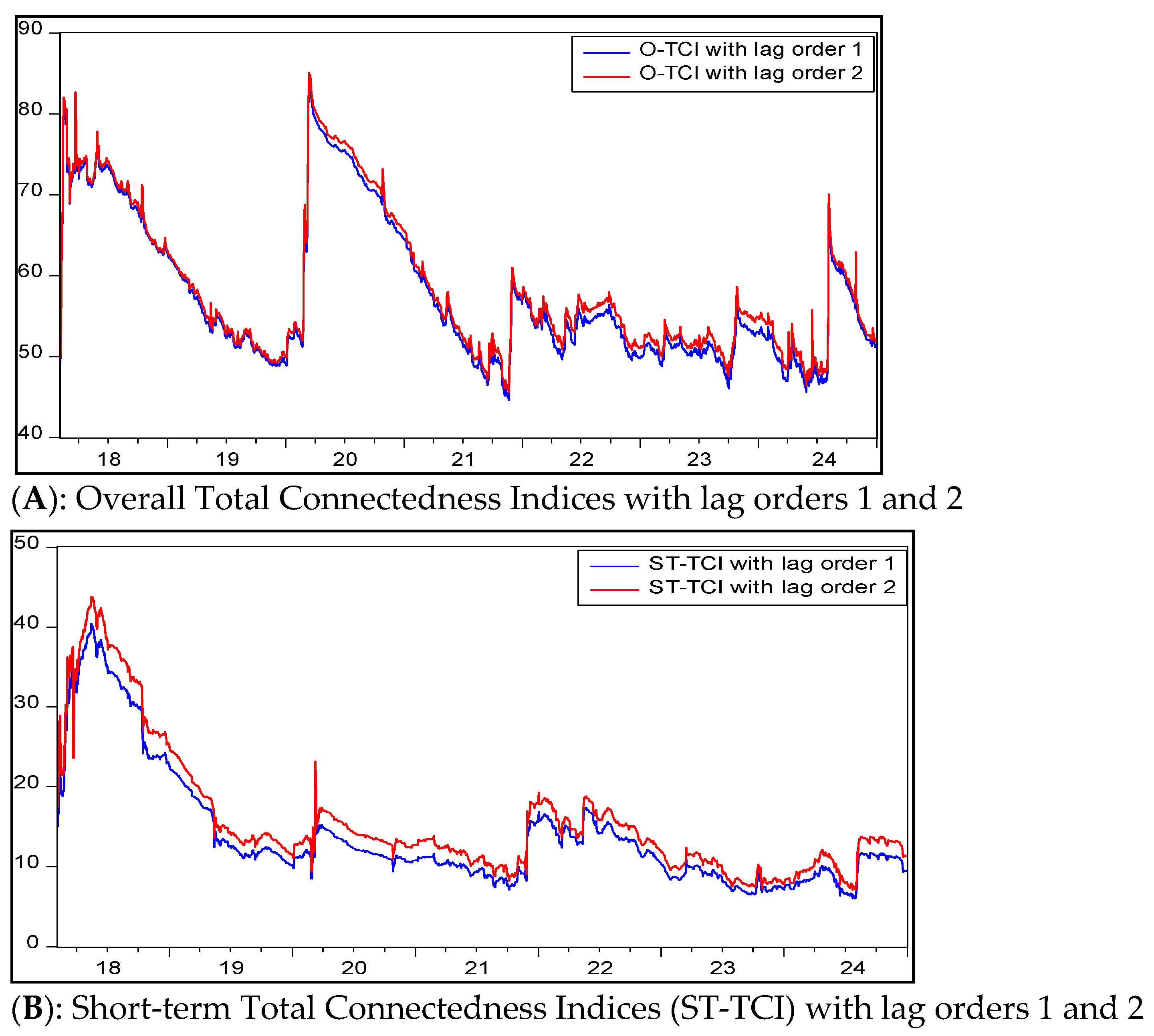

4.2. The “Time” and “Frequency” Domain Shock Spillovers from Uncertainty Factors Towards the Equity Market Conditional Volatility

4.2.1. Shock Transmission from Disaggregated Financial Stress Indicators (FSI)

4.2.2. Shock Transmission from U.S. VIX and European VSTOXX-50

4.2.3. Shock Transmission from Bitcoin Investors’ Fear and Greed Sentiment Indices (BSI)

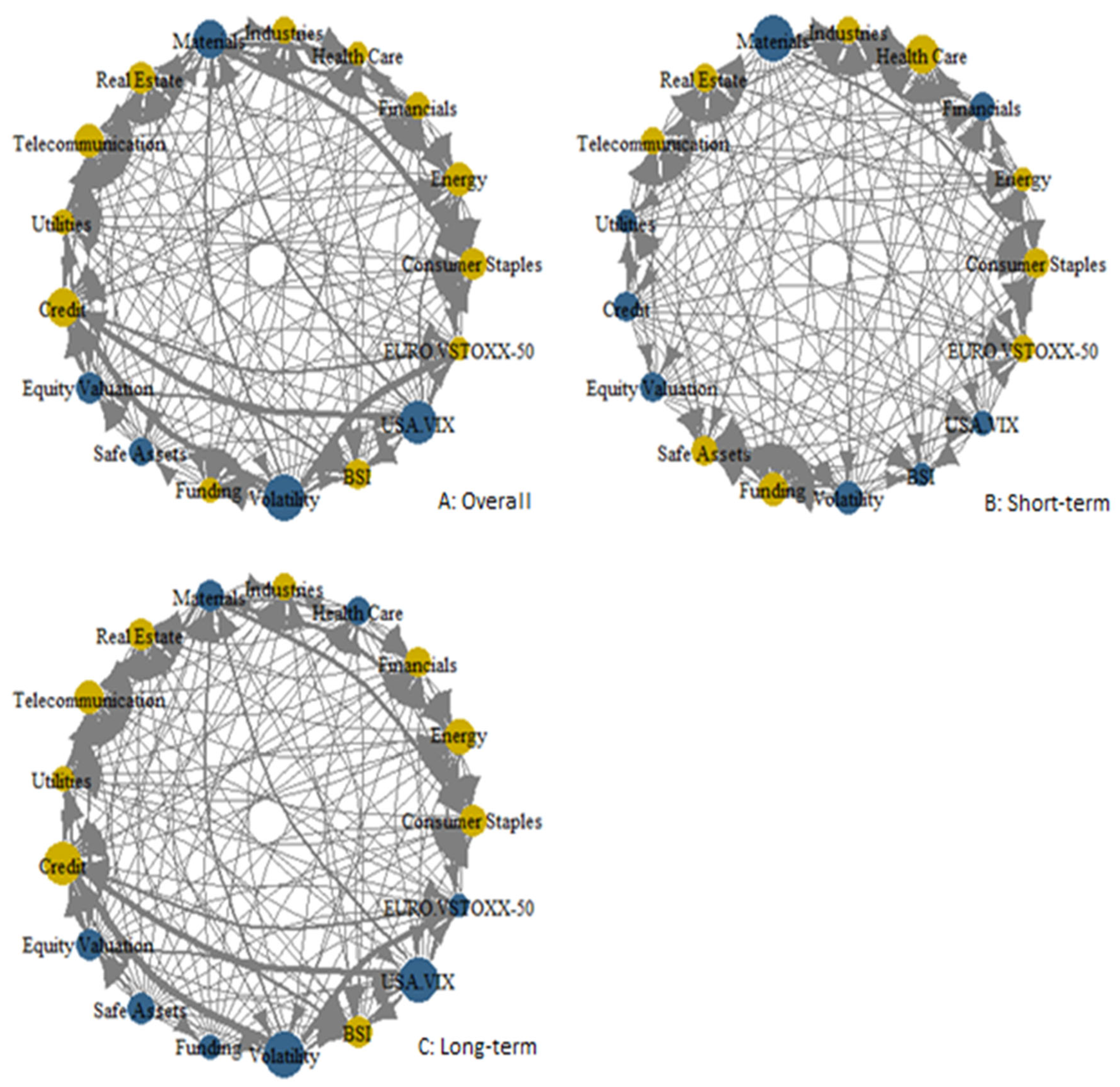

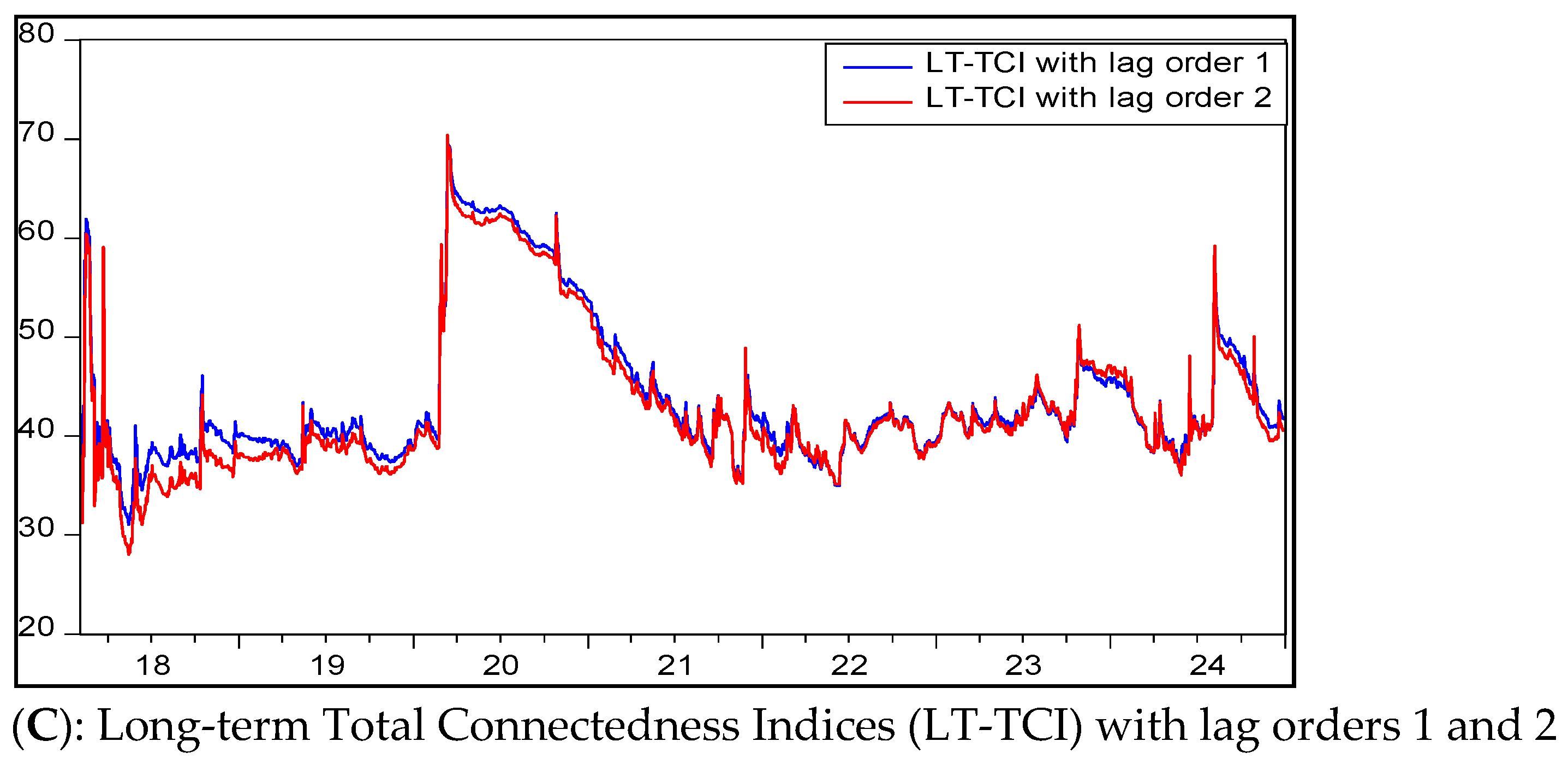

5. Robustness and Sensitivity Analysis

6. Discussion with Theoretical Rationality and Practical Implications

6.1. Shock Transmission from BSI

6.2. Shock Transmission from VIX and VSTOXX-50

6.3. Shock Transmission from Disgaregted Financial Stress Indicators (FSI)

7. Conclusions with Policy Guidelines, Research Limitation and Future Research Directions

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

| 1 | This research employs the U.S. Department of Treasury’s disaggregated global Financial Stress Indicators (FSI), which encompass measures such as “equity market valuation”, “volatility” trends, “funding” constraints, disruption in “credit” activities, and the transition of investors towards the “safe-haven” assets. Existing studies also shed light on the importance of these financial stress indicators in the forecasting frameworks. For instance, Elsayed and Yarovaya (2019) examined whether the aggregated value of the FSI are influenced during the Arab spring. On the contrary, C. Liang et al. (2023) also stated that aggregated value of the FSI outperforms other uncertainty indicators like geopolitical uncertainty and U.S. economic uncertainty in explaining the fluctuations within the equity market returns. |

| 2 | The Bitcoin Sentiment Index (BSI) reflects the overall attitude of cryptocurrency investors by merging various market indicators into a single composite score ranging from 0 to 100. The scores above 75 signifies extreme greed due to increase in buying behavior of Bitcoins amid upward shift in prices. Whereas, a score below 25 reflects the extreme fear due to the higher selling activity amid bearish bitcoin market conditions. |

| 3 | In this study, the notion of “shock transmission” and “spillover mechanism” is understood to represent a predictive and variance-decomposition-based connectivity framework that assesses the degree to which changes in the forecast error variance of one series are impacted by innovations in another, in different time and frequency domains. The directional spillover mechanisms or shock diffusion channels by which disturbances from the VIX, VSTOXX-50, BSI, and FSI spread into the GCC sectoral volatility framework are highlighted in this view rather than making explicit claims about causal relationships. Shahbaz et al. (2024) evaluated the transmission of shocks from climate-related uncertainty to industrial metal markets using the time-varying parameter VAR (TVP-VAR) framework in accordance with this methodological basis. |

References

- Adams, Z., & Glück, T. (2015). Financialization in commodity markets: A passing trend or the new normal? Journal of Banking & Finance, 60, 93–111. [Google Scholar] [CrossRef]

- Ahmed, S. I., & Randewich, N. (2020, August 18). Say goodbye to the shortest bear market in S&P 500 history. Reuters. Available online: https://www.reuters.com/article/business/say-goodbye-to-the-shortest-bear-market-in-sp-500-history-idUSKCN25E2R8/ (accessed on 1 January 2025).

- Ahmed, W. M. A. (2021a). How do Islamic equity markets respond to good and bad volatility of cryptocurrencies? The case of Bitcoin. Pacific-Basin Finance Journal, 70, 101667. [Google Scholar] [CrossRef]

- Ahmed, W. M. A. (2021b). Stock market reactions to upside and downside volatility of Bitcoin: A quantile analysis. The North American Journal of Economics and Finance, 57, 101379. [Google Scholar] [CrossRef]

- Äijö, J. (2008). Implied volatility term structure linkages between VDAX, VSMI and VSTOXX volatility indices. Global Finance Journal, 18(3), 290–302. [Google Scholar] [CrossRef]

- Akhtaruzzaman, M., Boubaker, S., Lucey, B. M., & Sensoy, A. (2021a). Is gold a hedge or a safe-haven asset in the COVID–19 crisis? Economic Modelling, 102, 105588. [Google Scholar] [CrossRef]

- Akhtaruzzaman, M., Boubaker, S., & Sensoy, A. (2021b). Financial contagion during COVID–19 crisis. Finance Research Letters, 38, 101604. [Google Scholar] [CrossRef]

- Al-Fayoumi, N., Bouri, E., & Abuzayed, B. (2023). Decomposed oil price shocks and GCC stock market sector returns and volatility. Energy Economics, 126, 106930. [Google Scholar] [CrossRef]

- Ali, S., Naveed, M., Hanif, H., & Gubareva, M. (2024). The resilience of Shariah-compliant investments: Probing the static and dynamic connectedness between gold-backed cryptocurrencies and GCC equity markets. International Review of Financial Analysis, 91, 103045. [Google Scholar] [CrossRef]

- Aliani, K., Al-kayed, L., & Boujlil, R. (2022). COVID-19 effect on Islamic vs. conventional banks’ stock prices: Case of GCC countries. The Journal of Economic Asymmetries, 26, e00263. [Google Scholar] [CrossRef]

- Alotaibi, A. R., & Mishra, A. V. (2015). Global and regional volatility spillovers to GCC stock markets. Economic Modelling, 45, 38–49. [Google Scholar] [CrossRef]

- Altman, E. I., Hu, X., & Yu, J. (2022). Has the Evergrande debt crisis rattled Chinese capital markets? A series of event studies and their implications. Finance Research Letters, 50, 103247. [Google Scholar] [CrossRef]

- Antonakakis, N., Chatziantoniou, I., & Gabauer, D. (2020). Refined measures of dynamic connectedness based on Time-Varying Parameter Vector autoregressions. Journal of Risk and Financial Management, 13(4), 84. [Google Scholar] [CrossRef]

- Apergis, N., Mustafa, G., & Malik, S. (2023). The role of the COVID-19 pandemic in US market volatility: Evidence from the VIX index. The Quarterly Review of Economics and Finance, 89, 27–35. [Google Scholar] [CrossRef]

- Apostolakis, G. N., Floros, C., Gkillas, K., & Wohar, M. (2021a). Financial stress, economic policy uncertainty, and oil price uncertainty. Energy Economics, 104, 105686. [Google Scholar] [CrossRef]

- Apostolakis, G. N., Floros, C., Gkillas, K., & Wohar, M. (2021b). Political uncertainty, COVID-19 pandemic and stock market volatility transmission. Journal of International Financial Markets, Institutions and Money, 74, 101383. [Google Scholar] [CrossRef]

- Baele, L. (2005). Volatility spillover effects in European equity markets. Journal of Financial and Quantitative Analysis, 40(2), 373–401. [Google Scholar] [CrossRef]

- Bakas, D., & Triantafyllou, A. (2020). Commodity price volatility and the economic uncertainty of pandemics. Economics Letters, 193, 109283. [Google Scholar] [CrossRef]

- Balcilar, M., Elsayed, A. H., & Hammoudeh, S. (2023). Financial connectedness and risk transmission among MENA countries: Evidence from connectedness network and clustering analysis1. Journal of International Financial Markets, Institutions and Money, 82, 101656. [Google Scholar] [CrossRef]

- Balcilar, M., Gabauer, D., & Umar, Z. (2021). Crude Oil futures contracts and commodity markets: New evidence from a TVP-VAR extended joint connectedness approach. Resources Policy, 73, 102219. [Google Scholar] [CrossRef]

- Balli, F., Hasan, M., Ozer-Balli, H., & Gregory-Allen, R. (2021). Why do US uncertainties drive stock market spillovers? International evidence. International Review of Economics & Finance, 76, 288–301. [Google Scholar] [CrossRef]

- Bandyopadhyay, S. (2024, February 19). UAE crypto investors realised estimated gains of $200 million in 2023. Khaleej Times. Available online: https://www.khaleejtimes.com/business/cryptocurrency/uae-crypto-investors-realised-estimated-gains-of-200-million-in-2023 (accessed on 14 August 2025).

- Baruník, J., & Křehlík, T. (2018). Measuring the frequency dynamics of financial connectedness and systemic risk. Journal of Financial Econometrics, 16(2), 271–296. [Google Scholar] [CrossRef]

- Bazán-Palomino, W. (2023). The increased interest in Bitcoin and the immediate and long-term impact of Bitcoin volatility on global stock markets. Economic Analysis and Policy, 80, 1080–1095. [Google Scholar] [CrossRef]

- Bekaert, G., Harvey, C. R., & Lundblad, C. (2005). Does financial liberalization spur growth? Journal of Financial Economics, 77(1), 3–55. [Google Scholar] [CrossRef]

- BenSaïda, A. (2019). Good and bad volatility spillovers: An asymmetric connectedness. Journal of Financial Markets, 43, 78–95. [Google Scholar] [CrossRef]

- Bitget Research. (2024). UAE leads crypto adoption in the Middle East with 72% of local users investing in Bitcoin. Zawya. Available online: https://www.zawya.com/en/press-release/research-and-studies/uae-leads-crypto-adoption-in-the-middle-east-with-72-of-local-users-investing-in-bitcoin-bitget-research-l9tbl2l5 (accessed on 1 January 2025).

- Boubaker, S., Goodell, J. W., Pandey, D. K., & Kumari, V. (2022). Heterogeneous impacts of wars on global equity markets: Evidence from the invasion of Ukraine. Finance Research Letters, 48, 102934. [Google Scholar] [CrossRef]

- Bouri, E., Hammoud, R., & Kassm, C. A. (2023). The effect of oil implied volatility and geopolitical risk on GCC stock sectors under various market conditions. Energy Economics, 120, 106617. [Google Scholar] [CrossRef]

- Bouteska, A., Mefteh-Wali, S., & Dang, T. (2022). Predictive power of investor sentiment for Bitcoin returns: Evidence from COVID-19 pandemic. Technological Forecasting and Social Change, 184, 121999. [Google Scholar] [CrossRef]

- Browne, R. (2021, May 13). Why Elon Musk is worried about Bitcoin’s environmental impact. CNBC. Available online: https://www.cnbc.com/2021/05/13/why-elon-musk-is-worried-about-bitcoin-environmental-impact.html (accessed on 17 August 2025).

- Browne, R., & Sigalos, M. (2024, July 5). Mt. Gox begins repaying Bitcoin to creditors a decade on from collapse. CNBC. Available online: https://www.cnbc.com/2024/07/05/mt-gox-begins-repaying-bitcoin-to-creditors-a-decade-on-from-collapse.html (accessed on 17 August 2025).

- Brunnermeier, M. K., & Pedersen, L. H. (2009). Market liquidity and funding liquidity. The Review of Financial Studies, 22(6), 2201–2238. [Google Scholar] [CrossRef]

- Caldara, D., Iacoviello, M., Molligo, P., Prestipino, A., & Raffo, A. (2020). The economic effects of trade policy uncertainty. Journal of Monetary Economics, 109, 38–59. [Google Scholar] [CrossRef]

- Cavallaro, E., & Cutrini, E. (2019). Distance and beyond: What drives financial flows to emerging economies? Economic Modelling, 81, 533–550. [Google Scholar] [CrossRef]

- Chan, J. Y.-L., Phoong, S. W., Phoong, S. Y., Cheng, W. K., & Chen, Y.-L. (2023). The bitcoin halving cycle volatility dynamics and safe haven-hedge properties: A MSGARCH approach. Mathematics, 11(3), 698. [Google Scholar] [CrossRef]

- Chatziantoniou, I., & Gabauer, D. (2021). EMU risk-synchronisation and financial fragility through the prism of dynamic connectedness. The Quarterly Review of Economics and Finance, 79, 1–14. [Google Scholar] [CrossRef]

- Chatziantoniou, I., Gabauer, D., & Gupta, R. (2023). Integration and risk transmission in the market for crude oil: New evidence from a time-varying parameter frequency connectedness approach. Resources Policy, 84, 103729. [Google Scholar] [CrossRef]

- Chau, F., & Deesomsak, R. (2014). Does linkage fuel the fire? The transmission of financial stress across the markets. International Review of Financial Analysis, 36, 57–70. [Google Scholar] [CrossRef]

- Chen, B., & Sun, Y. (2022). The impact of VIX on China’s financial market: A new perspective based on high-dimensional and time-varying methods. The North American Journal of Economics and Finance, 63, 101831. [Google Scholar] [CrossRef]

- Chen, B., & Sun, Y. (2024). Financial market connectedness between the U.S. and China: A new perspective based on non-linear causality networks. Journal of International Financial Markets, Institutions and Money, 90, 101886. [Google Scholar] [CrossRef]

- Chen, L., Verousis, T., Wang, K., & Zhou, Z. (2023). Financial stress and commodity price volatility. Energy Economics, 125, 106874. [Google Scholar] [CrossRef]

- Chen, X., Yao, Y., Wang, L., & Huang, S. (2024). How EPU, VIX, and GPR interact with the dynamic connectedness among commodity and financial markets: Evidence from wavelet analysis. The North American Journal of Economics and Finance, 74, 102217. [Google Scholar] [CrossRef]

- Cheng, T., Liu, F., Liu, J., & Yao, W. (2024). Tail connectedness: Measuring the volatility connectedness network of equity markets during crises. Pacific-Basin Finance Journal, 87, 102497. [Google Scholar] [CrossRef]

- Cipollini, A., & Mikaliunaite, I. (2020). Macro-uncertainty and financial stress spillovers in the Eurozone. Economic Modelling, 89, 546–558. [Google Scholar] [CrossRef]

- Dang, T. H.-N., Nguyen, C. P., Lee, G. S., Nguyen, B. Q., & Le, T. T. (2023). Measuring the energy-related uncertainty index. Energy Economics, 124, 106817. [Google Scholar] [CrossRef]

- Dankwah, B., Abakah, E. J. A., Agbloyor, E. K., & Lee, C.-C. (2025). Dynamic connections between Africa’s emerging equity markets and global financial assets. Emerging Markets Review, 68, 101337. [Google Scholar] [CrossRef]

- Dickey, D. A., & Fuller, W. A. (1981). Likelihood Ratio Statistics for Autoregressive Time Series with a Unit Root. Econometrica, 49(4), 1057–1072. [Google Scholar] [CrossRef]

- Diebold, F. X., & Yilmaz, K. (2012). Better to give than to receive: Predictive directional measurement of volatility spillovers. International Journal of Forecasting, 28(1), 57–66. [Google Scholar] [CrossRef]

- Diniz-Maganini, N., Diniz, E. H., & Rasheed, A. A. (2021). Bitcoin’s price efficiency and safe haven properties during the COVID-19 pandemic: A comparison. Research in International Business and Finance, 58, 101472. [Google Scholar] [CrossRef] [PubMed]

- Dutta, A. (2018). Oil and energy sector stock markets: An analysis of implied volatility indexes. Journal of Multinational Financial Management, 44, 61–68. [Google Scholar] [CrossRef]

- Elsayed, A. H., Gozgor, G., & Lau, C. K. M. (2022). Risk transmissions between bitcoin and traditional financial assets during the COVID-19 era: The role of global uncertainties. International Review of Financial Analysis, 81, 102069. [Google Scholar] [CrossRef]

- Elsayed, A. H., & Yarovaya, L. (2019). Financial stress dynamics in the MENA region: Evidence from the Arab Spring. Journal of International Financial Markets, Institutions and Money, 62, 20–34. [Google Scholar] [CrossRef]

- Endri, E., Fauzi, F., & Effendi, M. S. (2024). Integration of the Indonesian stock market with eight major trading partners’ stock markets. Economies, 12(12), 350. [Google Scholar] [CrossRef]

- Espinoza, R., Fayad, G., & Prasad, A. (2013). The macroeconomics of the Arab States of the Gulf. Oxford University Press. Available online: https://www.elibrary.imf.org/display/book/9780199683796/9780199683796.xml (accessed on 1 January 2025).

- European Commission. (2022). Joint communication to the European Parliament and the Council: A strategic partnership with the Gulf (2022). European External Action Service. Available online: https://www.eeas.europa.eu/sites/default/files/documents/Joint%20Communication%20to%20the%20European%20Parliament%20and%20the%20Council%20-%20A%20Strategic%20Partnership%20with%20the%20Gulf.pdf (accessed on 10 August 2025).

- European Commission. (2025). EU trade relations with the Gulf region—Facts, figures and latest developments. Directorate-General for Trade. Available online: https://policy.trade.ec.europa.eu/eu-trade-relationships-country-and-region/countries-and-regions/gulf-region_en (accessed on 10 August 2025).

- European Union External Action Service. (2021). Gulf Cooperation Council (GCC) and the EU. Available online: https://www.eeas.europa.eu/eeas/gulf-cooperation-council-gcc-and-eu_en (accessed on 10 August 2025).

- Fink, F., & Schüler, Y. S. (2015). The transmission of US systemic financial stress: Evidence for emerging market economies. Journal of International Money and Finance, 55, 6–26. [Google Scholar] [CrossRef]

- Gaies, B., Nakhli, M. S., Sahut, J.-M., & Schweizer, D. (2023). Interactions between investors’ fear and greed sentiment and Bitcoin prices. The North American Journal of Economics and Finance, 67, 101924. [Google Scholar] [CrossRef]

- Gilchrist, S., Yankov, V., & Zakrajšek, E. (2009). Credit market shocks and economic fluctuations: Evidence from corporate bond and stock markets. Journal of Monetary Economics, 56(4), 471–493. [Google Scholar] [CrossRef]

- Gorman, M., & Hughen, W. K. (2024). Does bitcoin still enhance an investment portfolio in a post Covid-19 world? Finance Research Letters, 62, 105170. [Google Scholar] [CrossRef]

- Guiso, L., Sapienza, P., & Zingales, L. (2018). Time varying risk aversion. Journal of Financial Economics, 128(3), 403–421. [Google Scholar] [CrossRef]

- Güler, D. (2023). The impact of investor sentiment on bitcoin returns and conditional volatilities during the era of COVID-19. Journal of Behavioral Finance, 24(3), 276–289. [Google Scholar] [CrossRef]

- Gulf Insider. (2024, March 19). UAE investors gain $204M from crypto investments in 2023. Gulf Insider. Available online: https://www.gulf-insider.com/uae-investors-gain-204m-from-crypto-investments-in-2023 (accessed on 1 January 2025).

- Guo, L., & Zhong, L.-X. (2025). Risk spillover and hedging effects between stock markets and cryptocurrency markets depending upon network analysis. The North American Journal of Economics and Finance, 80, 102524. [Google Scholar] [CrossRef]

- Haddad, H. B., Mezghani, I., & Al Dohaiman, M. (2020). Common shocks, common transmission mechanisms and time-varying connectedness among Dow Jones Islamic stock market indices and global risk factors. Economic Systems, 44(2), 100760. [Google Scholar] [CrossRef]

- Harvey, A., Ruiz, E., & Sentana, E. (1992). Unobserved component time series models with ARCH disturbances. Journal of Econometrics, 52(1–2), 129–157. [Google Scholar] [CrossRef]

- Hasan, M. B., Mahi, M., Hassan, M. K., & Bhuiyan, A. B. (2021). Impact of COVID-19 pandemic on stock markets: Conventional vs. Islamic indices using wavelet-based multi-timescales analysis. The North American Journal of Economics and Finance, 58, 101504. [Google Scholar] [CrossRef]

- He, X., Mishra, S., Aman, A., Shahbaz, M., Razzaq, A., & Sharif, A. (2021). The linkage between clean energy stocks and the fluctuations in oil price and financial stress in the US and Europe? Evidence from QARDL approach. Resources Policy, 72, 102021. [Google Scholar] [CrossRef]

- Hippler, W. J., & Hassan, M. K. (2015). The impact of macroeconomic and financial stress on the U.S. financial sector. Journal of Financial Stability, 21, 61–80. [Google Scholar] [CrossRef]

- Hoque, M. E., Billah, M., Kapar, B., & Naeem, M. A. (2024). Quantifying the volatility spillover dynamics between financial stress and US financial sectors: Evidence from QVAR connectedness. International Review of Financial Analysis, 95, 103434. [Google Scholar] [CrossRef]

- Ilesanmi, K. D., & Tewari, D. D. (2020). Financial stress index and economic activity in South Africa: New evidence. Economies, 8(4), 110. [Google Scholar] [CrossRef]

- IMARC Group. (2024). GCC cryptocurrency market size, share, growth and forecast 2025–2033. IMARC Group. Available online: https://www.imarcgroup.com/gcc-cryptocurrency-market (accessed on 1 January 2025).

- Iqbal, N., Naeem, M. A., & Suleman, M. T. (2022). Quantifying the asymmetric spillovers in sustainable investments. Journal of International Financial Markets, Institutions and Money, 77, 101480. [Google Scholar] [CrossRef]

- Jia, B., Shen, D., & Zhang, W. (2024). Bitcoin market reactions to large price swings of international stock markets. International Review of Economics & Finance, 90, 72–88. [Google Scholar] [CrossRef]

- Jolly, J. (2020, November 30). Bitcoin price hits all-time high of almost $20,000. The Guardian. Available online: https://www.theguardian.com/technology/2020/nov/30/bitcoin-price-hits-all-time-high-of-almost-20000#:~:text=The%20price%20of%20bitcoin%20has,CoinDesk%2C%20a%20bitcoin%20price%20index (accessed on 1 January 2025).

- Kannan, M. P., & Köhler-Geib, F. (2009). The uncertainty channel of contagion. International Monetary Fund. [Google Scholar]

- Kapar, B., Billah, S. M., Rana, F., & Balli, F. (2024). An investigation of the frequency dynamics of spillovers and connectedness among GCC sectoral indices. International Review of Economics & Finance, 89, 1442–1467. [Google Scholar] [CrossRef]

- Kasal, S. (2023). What are the effects of financial stress on economic activity and government debt? An empirical examination in an emerging economy. Borsa Istanbul Review, 23(1), 254–267. [Google Scholar] [CrossRef]

- Khalfaoui, R., Ben Jabeur, S., & Dogan, B. (2022). The spillover effects and connectedness among green commodities, Bitcoins, and US stock markets: Evidence from the quantile VAR network. Journal of Environmental Management, 306, 114493. [Google Scholar] [CrossRef] [PubMed]

- Khalfaoui, R., Hammoudeh, S., & Rehman, M. Z. (2023). Spillovers and connectedness among BRICS stock markets, cryptocurrencies, and uncertainty: Evidence from the quantile vector autoregression network. Emerging Markets Review, 54, 101002. [Google Scholar] [CrossRef]

- Kirci Altinkeski, B., Dibooglu, S., Cevik, E. I., Kilic, Y., & Bugan, M. F. (2024). Quantile connectedness between VIX and global stock markets. Borsa Istanbul Review, 24, 71–79. [Google Scholar] [CrossRef]

- Kirimhan, D., Payne, J. E., & AlKhazali, O. (2024). Herd behavior in U.S. bank stocks. Finance Research Letters, 67, 105930. [Google Scholar] [CrossRef]

- Kodres, L. E., & Pritsker, M. (2002). A rational expectations model of financial contagion. The Journal of Finance, 57(2), 769–799. [Google Scholar] [CrossRef]

- Koop, G., & Korobilis, D. (2014). A new index of financial conditions. European Economic Review, 71, 101–116. [Google Scholar] [CrossRef]

- Koop, G., Pesaran, M. H., & Potter, S. M. (1996). Impulse response analysis in nonlinear multivariate models. Journal of Econometrics, 74(1), 119–147. [Google Scholar] [CrossRef]

- Lane, P. R. (2024, March 11). The 2021–2022 inflation surges and monetary policy in the euro area [Blog post]. European Central Bank (ECB). Available online: https://www.ecb.europa.eu/press/blog/date/2024/html/ecb.blog240311~968c707650.en.html (accessed on 1 January 2025).

- Lang, C., Hu, Y., Corbet, S., & Hou, Y. (2024). Tail risk connectedness in G7 stock markets: Understanding the impact of COVID-19 and related variants. Journal of Behavioral and Experimental Finance, 41, 100889. [Google Scholar] [CrossRef]

- Le, T.-L., Abakah, E. J. A., & Tiwari, A. K. (2021). Time and frequency domain connectedness and spill-over among fintech, green bonds and cryptocurrencies in the age of the fourth industrial revolution. Technological Forecasting and Social Change, 162, 120382. [Google Scholar] [CrossRef]

- Li, D., Zhang, F., & Li, X. (2022). Can U.S. trade policy uncertainty help in predicting stock market excess return? Finance Research Letters, 49, 103136. [Google Scholar] [CrossRef]

- Li, S. (2022). Spillovers between bitcoin and meme stocks. Finance Research Letters, 50, 103218. [Google Scholar] [CrossRef]

- Liang, C., Luo, Q., Li, Y., & Duc Toan Huyn, L. (2023). Global financial stress index and long-term volatility forecast for international stock markets. Journal of International Financial Markets, Institutions and Money, 88, 101825. [Google Scholar] [CrossRef]

- Liu, P., & Yuan, Y. (2024). Is Bitcoin a hedge or safe-haven asset during the period of turmoil? Evidence from the currency, bond and stock markets. International Review of Financial Analysis, 96, 103663. [Google Scholar] [CrossRef]

- Liu, Y., & Wang, K. (2024). Asymmetric impacts of coal prices, fintech, and financial stress on clean energy stocks. Resources Policy, 92, 104954. [Google Scholar] [CrossRef]

- Longstaff, F. A. (2010). The subprime credit crisis and contagion in financial markets. Journal of Financial Economics, 97(3), 436–450. [Google Scholar] [CrossRef]

- Ma, R. R., Xiong, T., & Bao, Y. (2021). The Russia-Saudi Arabia oil price war during the COVID-19 pandemic. Energy Economics, 102, 105517. [Google Scholar] [CrossRef]

- Macfarlane, E. K. (2020). Strengthening sanctions: Solutions to curtail the evasion of international economic sanctions through the use of cryptocurrency. Michigan Journal of International Law, 42, 199. [Google Scholar] [CrossRef]

- Mensi, W., Ur Rehman, M., Maitra, D., Hamed Al-Yahyaee, K., & Sensoy, A. (2020). Does bitcoin co-move and share risk with Sukuk and world and regional Islamic stock markets? Evidence using a time-frequency approach. Research in International Business and Finance, 53, 101230. [Google Scholar] [CrossRef]

- Mercik, A., Słoński, T., & Karaś, M. (2024). Understanding crypto-asset exposure: An investigation of its impact on performance and stock sensitivity among listed companies. International Review of Financial Analysis, 92, 103070. [Google Scholar] [CrossRef]

- Mining Grid. (2024, September 30). UAE crypto inflows top $34 billion, highlighting strong market growth. FF News. Available online: https://ffnews.com/newsarticle/cryptocurrency/uae-crypto-inflows-growth-2025 (accessed on 1 January 2025).

- Mokni, K., Bouteska, A., & Nakhli, M. S. (2022). Investor sentiment and Bitcoin relationship: A quantile-based analysis. The North American Journal of Economics and Finance, 60, 101657. [Google Scholar] [CrossRef]

- Musholombo, B. (2023). Cryptocurrencies and stock market fluctuations. Economics Letters, 233, 111427. [Google Scholar] [CrossRef]

- Naeem, M. A., Chatziantoniou, I., Gabauer, D., & Karim, S. (2024). Measuring the G20 stock market return transmission mechanism: Evidence from the R2 connectedness approach. International Review of Financial Analysis, 91, 102986. [Google Scholar] [CrossRef]

- Nguyen, K. Q. (2022). The correlation between the stock market and Bitcoin during COVID-19 and other uncertainty periods. Finance Research Letters, 46, 102284. [Google Scholar] [CrossRef]

- Pascoe, L. (2019). Digital currency exchanges, ICOs and insolvency: The story so far. Insolvency and Restructuring International, 13, 5. [Google Scholar]

- Pavabutr, P., & Yan, H. (2007). The impact of foreign portfolio flows on emerging market volatility: Evidence from Thailand. Australian Journal of Management, 32(2), 345–368. [Google Scholar] [CrossRef]

- Pesaran, H. H., & Shin, Y. (1998). Generalized impulse response analysis in linear multivariate models. Economics Letters, 58(1), 17–29. [Google Scholar] [CrossRef]

- Phillips, P. C. B., & Perron, P. (1988). Testing for a unit root in time series regression. Biometrika, 75(2), 335–346. [Google Scholar] [CrossRef]

- Rahman, M. L., Amin, A., & Al Mamun, M. A. (2021). The COVID-19 outbreak and stock market reactions: Evidence from Australia. Finance Research Letters, 38, 101832. [Google Scholar] [CrossRef]

- Raouf, H., & Ahmed, H. (2022). Risk governance and financial stability: A comparative study of conventional and Islamic banks in the GCC. Global Finance Journal, 52, 100599. [Google Scholar] [CrossRef]

- Rösch, C. G., & Kaserer, C. (2013). Market liquidity in the financial crisis: The role of liquidity commonality and flight-to-quality. Journal of Banking & Finance, 37(7), 2284–2302. [Google Scholar] [CrossRef]

- Santacreu, A. M. (2020, October 22). The economic effects of the 2018 U.S. trade policy: A state-level analysis. Federal Reserve Bank of St. Louis. Available online: https://research.stlouisfed.org/publications/review/2020/10/22/the-economic-effects-of-the-2018-u-s-trade-policy-a-state-level-analysis (accessed on 1 January 2025).

- Sarwar, G. (2023). Market risks that change US-European equity correlations. Journal of International Financial Markets, Institutions and Money, 83, 101731. [Google Scholar] [CrossRef]

- Schiantarelli, F., Brancati, E., Brianti, M., & Balduzzi, P. (2020, October 27). Populism, political risk and the economy: What we can learn from the Italian experience. VoxEU, CEPR. Available online: https://cepr.org/voxeu/columns/populism-political-risk-and-economy-what-we-can-learn-italian-experience (accessed on 1 January 2025).

- Shahbaz, M., Sheikh, U. A., Tabash, M. I., & Jiao, Z. (2024). Shock transmission between climate policy uncertainty, financial stress indicators, oil price uncertainty and industrial metal volatility: Identifying moderators, hedgers and shock transmitters. Energy Economics, 136, 107732. [Google Scholar] [CrossRef]

- Shen, Y.-Y., Jiang, Z.-Q., Ma, J.-C., Wang, G.-J., & Zhou, W.-X. (2022). Sector connectedness in the Chinese stock markets. Empirical Economics, 62(2), 825–852. [Google Scholar] [CrossRef]

- Shi, Y., & Wang, L. (2023). Comparing the impact of Chinese and U.S. economic policy uncertainty on the volatility of major global stock markets. Global Finance Journal, 57, 100860. [Google Scholar] [CrossRef]

- Singh, A., & Singh, M. (2016). Investigating impact of financial stress on FII flows in Indian equity market. Cogent Business & Management, 3(1), 1190263. [Google Scholar] [CrossRef]

- Smales, L. A. (2020). Examining the relationship between policy uncertainty and market uncertainty across the G7. International Review of Financial Analysis, 71, 101540. [Google Scholar] [CrossRef]

- Smales, L. A. (2022). Spreading the fear: The central role of CBOE VIX in global stock market uncertainty. Global Finance Journal, 51, 100679. [Google Scholar] [CrossRef]

- Soltani, H., & Abbes, M. B. (2025). Regime-specific spillover effects between financial stress, GCC stock markets, brent crude oil, and the gold market. Journal of the Knowledge Economy, 16(2), 8840–8866. [Google Scholar] [CrossRef]

- Stiassny, A. (1996). A spectral decomposition for structural VAR models. Empirical Economics, 21(4), 535–555. [Google Scholar] [CrossRef]

- Tedeschi, M., Foglia, M., Bouri, E., & Dai, P.-F. (2024). How does climate policy uncertainty affect financial markets? Evidence from Europe. Economics Letters, 234, 111443. [Google Scholar] [CrossRef]

- The Economist. (2018, October 27). The European Commission rejects Italy’s budget. The Economist. Available online: https://www.economist.com/europe/2018/10/27/the-european-commission-rejects-italys-budget (accessed on 1 January 2025).

- The Economist. (2022, December 5). Political instability in Italy has always affected reform. The Economist. Available online: https://www.economist.com/special-report/2022/12/05/political-instability-in-italy-has-always-affected-reform (accessed on 1 January 2025).

- The National. (2024, March 16). UAE cryptocurrency investors realised gains worth $204m in 2023. The National News. Available online: https://www.thenationalnews.com/business/money/2024/03/16/uae-cryptocurrency-investors-realised-gains-worth-204m-in-2023 (accessed on 1 January 2025).

- Tissaoui, K., & Zaghdoudi, T. (2021). Dynamic connectedness between the U.S. financial market and Euro-Asian financial markets: Testing transmission of uncertainty through spatial regressions models. The Quarterly Review of Economics and Finance, 81, 481–492. [Google Scholar] [CrossRef]

- Tronzano, M. (2020). Safe-haven assets, financial crises, and macroeconomic variables: Evidence from the last two decades (2000–2018). Journal of Risk and Financial Management, 13(3), 40. [Google Scholar] [CrossRef]

- Voronkova, S. (2004). Equity market integration in Central European emerging markets: A cointegration analysis with shifting regimes. International Review of Financial Analysis, 13(5), 633–647. [Google Scholar] [CrossRef]

- World Bank Group. (2018, September 17). Argentina: Escaping crises, sustaining growth, sharing prosperity (Systematic Country Diagnostic). World Bank. Available online: https://documents1.worldbank.org/curated/en/696121537806645724/pdf/Argentina-Systematic-Country-Diagnostic-09172018.pdf (accessed on 1 January 2025).

- Wu, X., He, Q., & Xie, H. (2023). Forecasting VIX with time-varying risk aversion. International Review of Economics & Finance, 88, 458–475. [Google Scholar] [CrossRef]

- Xu, L., & Kinkyo, T. (2023). Hedging effectiveness of bitcoin and gold: Evidence from G7 stock markets. Journal of International Financial Markets, Institutions and Money, 85, 101764. [Google Scholar] [CrossRef]

- Xu, Y., Liang, C., & Wang, J. (2023). Financial stress and returns predictability: Fresh evidence from China. Pacific-Basin Finance Journal, 78, 101980. [Google Scholar] [CrossRef]

- Yadav, M. P., Rao, A., Abedin, M. Z., Tabassum, S., & Lucey, B. (2023). The domino effect: Analyzing the impact of Silicon Valley Bank’s fall on top equity indices around the world. Finance Research Letters, 55, 103952. [Google Scholar] [CrossRef]

- Yarovaya, L., Elsayed, A. H., & Hammoudeh, S. (2021). Determinants of spillovers between Islamic and conventional financial markets: Exploring the safe haven assets during the COVID-19 pandemic. Finance Research Letters, 43, 101979. [Google Scholar] [CrossRef]

- Yıldırım-Karaman, S. (2018). Uncertainty in financial markets and business cycles. Economic Modelling, 68, 329–339. [Google Scholar] [CrossRef]

- Younis, I., Naeem, M. A., Shah, W. U., & Tang, X. (2025). Inter- and intra-connectedness between energy, gold, Bitcoin, and Gulf cooperation council stock markets: New evidence from various financial crises. Research in International Business and Finance, 73, 102548. [Google Scholar] [CrossRef]

- Yousaf, I., Beljid, M., Chaibi, A., & Ajlouni, A. A. L. (2022). Do volatility spillover and hedging among GCC stock markets and global factors vary from normal to turbulent periods? Evidence from the global financial crisis and COVID-19 pandemic crisis. Pacific-Basin Finance Journal, 73, 101764. [Google Scholar] [CrossRef]

- Zhang, Q., Zhang, Z., & Luo, J. (2024). Asymmetric and high-order risk transmission across VIX and Chinese futures markets. International Review of Financial Analysis, 93, 103114. [Google Scholar] [CrossRef]

- Zhang, Y., & Mao, J. (2022). COVID-19′s impact on the spillover effect across the Chinese and U.S. stock markets. Finance Research Letters, 47, 102684. [Google Scholar] [CrossRef]

- Zhang, Y.-J., Chevallier, J., & Guesmi, K. (2017). “De-financialization” of commodities? Evidence from stock, crude oil and natural gas markets. Energy Economics, 68, 228–239. [Google Scholar] [CrossRef]

- Zhao, J., & Zhang, T. (2023). Exploring the time-varying dependence between Bitcoin and the global stock market: Evidence from a TVP-VAR approach. Finance Research Letters, 58, 104342. [Google Scholar] [CrossRef]

- Zupan, V. (2021, April 12). GCC countries leading the way in cryptocurrency regulation. Arab News. Available online: https://www.arabnews.com/node/2055281 (accessed on 14 August 2025).

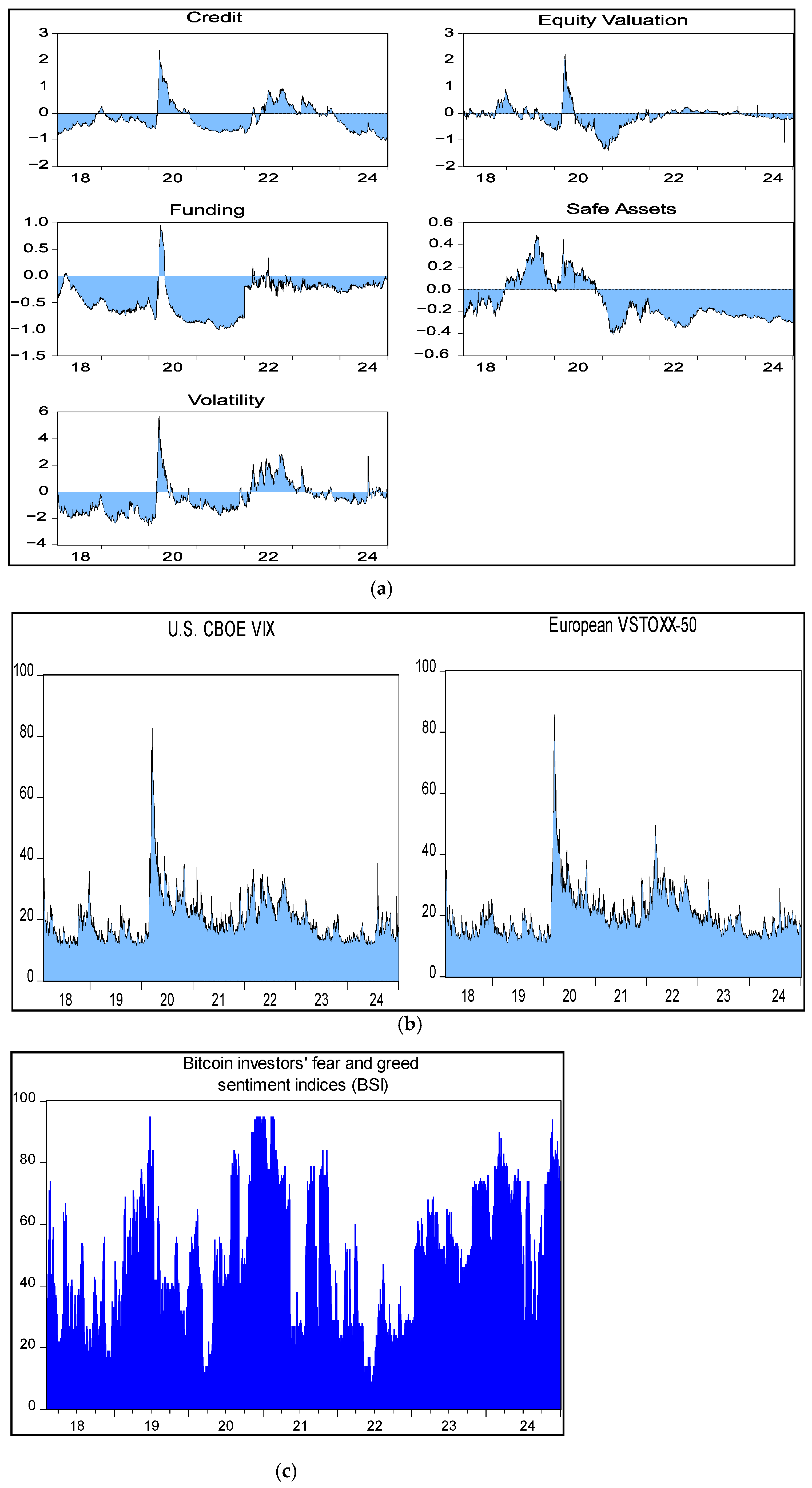

| (a) | |||||||||

|---|---|---|---|---|---|---|---|---|---|

| Credit | Equity Valuation | Funding | Safe Assets | Volatility | CBOE VIX | Euro VSTOXX-50 | BSI | ||

| Mean | −0.198 | −0.121 | 0.000 | 0.000 | −0.519 | 19.888 | 20.243 | 46.878 | |

| Median | −0.302 | −0.089 | 0.000 | 0.000 | −0.686 | 18.060 | 18.345 | 46.000 | |

| Maximum | 2.377 | 2.239 | 0.590 | 0.117 | 5.704 | 82.690 | 85.620 | 95.000 | |

| Minimum | −1.019 | −1.389 | −0.372 | −0.125 | −2.597 | 10.850 | 10.690 | 5.000 | |

| Std. Dev. | 0.506 | 0.403 | 0.038 | 0.015 | 1.183 | 7.616 | 7.822 | 21.978 | |

| Skewness | 1.214 | 0.311 | 1.598 | −0.240 | 1.196 | 2.584 | 2.753 | 0.212 | |

| Kurtosis | 5.111 | 7.863 | 44.638 | 14.218 | 5.201 | 15.032 | 16.216 | 1.994 | |

| Jarque-Bera | 933.034 | 2167.396 | 157,246.000 | 11,366.830 | 952.817 | 15,462.170 | 18,482.310 | 107.374 | |

| Probability | 0.000 | 0.000 | 0.000 | 0.000 | 0.000 | 0.000 | 0.000 | 0.000 | |

| Sum | −429.528 | −262.750 | 0.355 | 0.051 | −1122.045 | 43,038.210 | 43,806.720 | 101,444.000 | |

| Sum Sq. Dev. | 553.959 | 350.759 | 3.194 | 0.474 | 3024.781 | 125,460.000 | 132,347.400 | 1,044,800.000 | |

| Observations | 2164.000 | 2164.000 | 2164.000 | 2164.000 | 2164.000 | 2164.000 | 2164.000 | 2164.000 | |

| Unit root test (at level) | |||||||||

| ADF | −6.48 *** | −4.55 *** | −51.71 *** | −48.11 *** | −6.86 *** | −6.88 *** | −4.968 *** | −5.745 *** | |

| PP | −6.86 *** | −5.41 *** | −51.21 *** | −47.96 *** | −6.87 *** | −6.91 *** | −4.071 *** | −6.837 *** | |

| Note: This table presents the descriptive statistics of the global uncertainty factors including the global financial stress indicators (such as “Credit”, “Equity Valuation”, “Funding”, “Safe Assets”, and “Volatilities”), alongside measures of the US equity market uncertainty (US-CBOE-VIX index), the US financial market tail risk (US-CBOE SKEW index for the S&P-500), European financial market volatility (VSTOXX-50), and the sentiment analysis related to fear and greed among bitcoin investors (Bitcoin sentiment indices). The final rows of the table delineate the stationary properties of the incorporated variables by using the ADF and PP test by Dickey and Fuller (1981) and Phillips and Perron (1988). *** reflects the rejection of null hypothesis of non-stationarity at 1% level of significance. | |||||||||

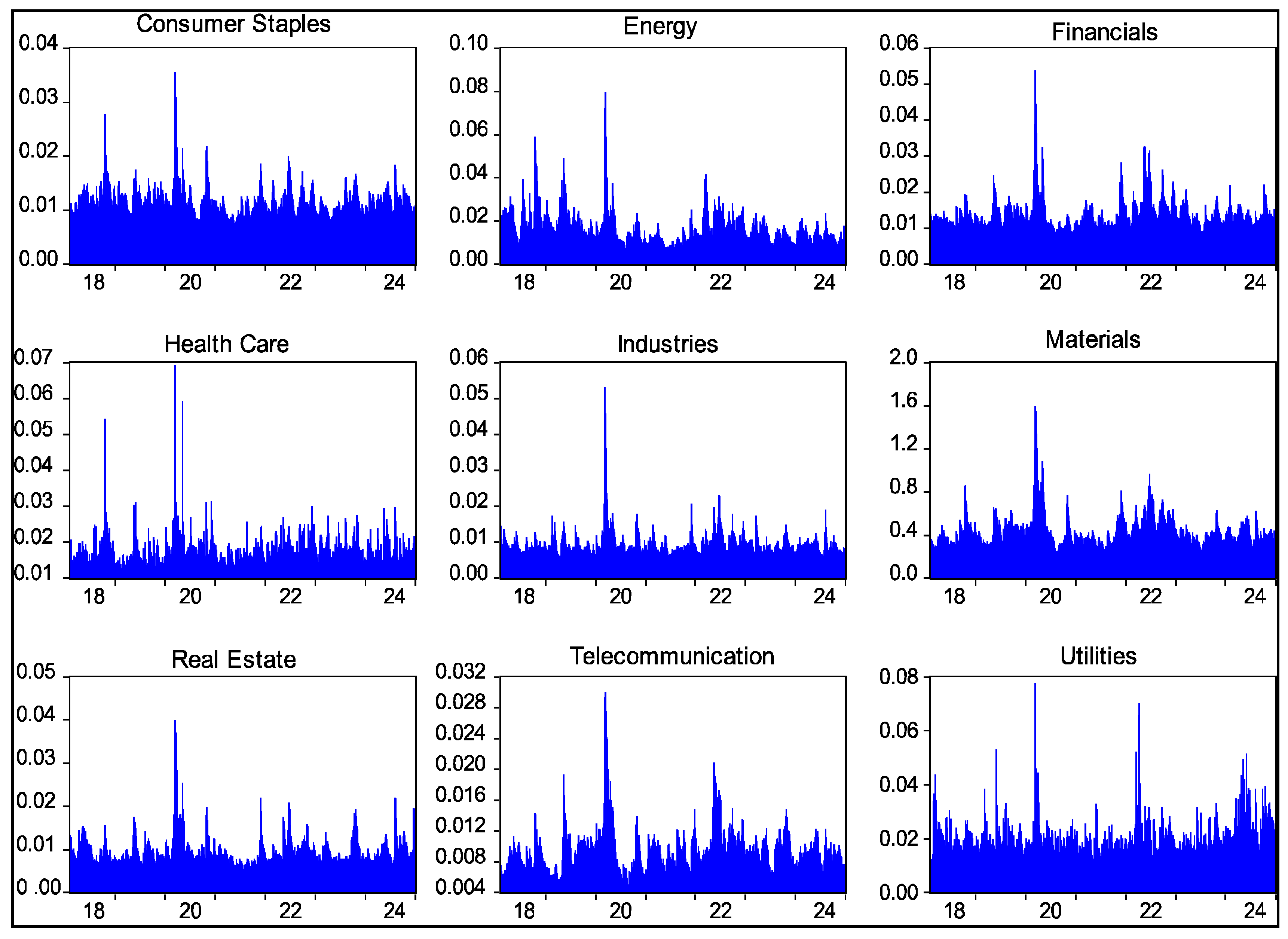

| (b) | |||||||||

| CS | ENE | FIN | HC | IND | MAT | RE | TEL | UTI | |

| Mean | 0.0114 | 0.0161 | 0.0135 | 0.0167 | 0.0092 | 0.4312 | 0.0093 | 0.0092 | 0.0196 |

| Median | 0.0109 | 0.0143 | 0.0125 | 0.0160 | 0.0085 | 0.3980 | 0.0085 | 0.0089 | 0.0181 |

| Maximum | 0.0356 | 0.0795 | 0.0537 | 0.0692 | 0.0532 | 1.6000 | 0.0399 | 0.0300 | 0.0776 |

| Minimum | 0.0071 | 0.0064 | 0.0076 | 0.0105 | 0.0057 | 0.0065 | 0.0051 | 0.0047 | 0.0037 |

| Std. Dev. | 0.0027 | 0.0074 | 0.0041 | 0.0041 | 0.0032 | 0.1447 | 0.0034 | 0.0027 | 0.0065 |

| Skewness | 2.8064 | 2.6519 | 3.3043 | 4.1312 | 4.8603 | 2.8650 | 3.4818 | 2.4437 | 2.6451 |

| Kurtosis | 18.6607 | 15.8383 | 21.9662 | 38.5118 | 45.4772 | 17.8200 | 23.1748 | 14.2838 | 15.7127 |

| Jarque-Bera | 24,954.72 | 17,397.81 | 36,372.47 | 119,863.60 | 171,208.30 | 22,764.09 | 41,072.10 | 13,634.16 | 17,095.55 |

| Probability | 0.0000 | 0.0000 | 0.0000 | 0.0000 | 0.0000 | 0.0000 | 0.0000 | 0.0000 | 0.0000 |

| Sum | 24.7295 | 34.8245 | 29.2290 | 36.2366 | 19.9611 | 933.1497 | 20.1993 | 19.9142 | 42.3532 |

| Sum Sq. Dev. | 0.0154 | 0.1185 | 0.0369 | 0.0355 | 0.0218 | 45.3108 | 0.0244 | 0.0163 | 0.0908 |

| Observations | 2164.00 | 2164.00 | 2164.00 | 2164.00 | 2164.00 | 2164.00 | 2164.00 | 2164.00 | 2164.00 |

| Unit root test (at level) | |||||||||

| ADF | −9.827 *** | −6.767 *** | −11.836 *** | −10.19 *** | −13.10 *** | −7.208 *** | −7.927 *** | −6.49 *** | −11.287 *** |

| PP | −9.901 *** | −6.625 *** | −12.398 *** | −11.25 *** | −12.80 *** | −9.29 *** | −8.87 *** | −5.80 *** | −12.387 *** |

| Note: The Table presents descriptive statistics of Sharia-compliant sectoral stock volatilities within GCC region, estimated using a EGARCH (1,1) model with student’s t copula approach, across various sectoral stocks such as Industrials (IND), Health Care (HC), Real Estate (RE), Consumer Staples (CS), Financials (FIN), Energy (ENE), Telecommunication (TEL), Utilities (UTI) and Materials (MAT). The final rows of the table delineate the stationary properties of the incorporated variables by using the ADF and PP test by (Dickey & Fuller, 1981) and (Phillips & Perron, 1988). *** reflects the rejection of null hypothesis of non-stationarity at 1% level of significance. | |||||||||

| CS | ENE | FIN | HC | IND | MAT | RE | TEL | UTI | Credit | Equity Valuation | Safe Assets | Funding | Volatility | BSI | VIX | VSTOXX-50 | FROM | |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| CS | 32.81 | 5.07 | 7.2 | 8.32 | 8.15 | 14.26 | 7.28 | 4.41 | 2.37 | 1.03 | 1.37 | 1.26 | 0.51 | 1.27 | 1.41 | 1.69 | 1.58 | 67.19 |

| ENE | 4.65 | 35.04 | 5.32 | 7.41 | 4.67 | 12.71 | 5.61 | 3.08 | 2.43 | 2.9 | 3 | 0.91 | 0.92 | 2.96 | 1.7 | 3.41 | 3.28 | 64.96 |

| FIN | 5.75 | 5.04 | 29.41 | 6.4 | 9.26 | 12.15 | 6.1 | 6.85 | 2.03 | 0.92 | 2.41 | 0.89 | 0.61 | 3.96 | 1.47 | 3.98 | 2.78 | 70.59 |

| HC | 7.99 | 4.85 | 6.74 | 42.24 | 6.83 | 10.52 | 4.74 | 3.72 | 2.88 | 0.43 | 1.55 | 1 | 1.04 | 1.37 | 1.18 | 1.86 | 1.05 | 57.76 |

| IND | 7.18 | 4.14 | 10.37 | 6.22 | 31.35 | 8.97 | 8.09 | 5.63 | 2.83 | 0.99 | 1.77 | 0.87 | 0.51 | 3.28 | 1.28 | 3.64 | 2.88 | 68.65 |

| MAT | 6.71 | 5.52 | 6.54 | 7.53 | 5.28 | 38.12 | 4.72 | 3.48 | 2.27 | 1.55 | 2.73 | 0.65 | 0.79 | 4.75 | 1.45 | 4.88 | 3.03 | 61.88 |

| RE | 6.37 | 6.14 | 7.18 | 4.63 | 8.55 | 8.97 | 30.07 | 7.22 | 3.35 | 1.74 | 3.18 | 1.26 | 0.56 | 3.23 | 1.14 | 3.55 | 2.86 | 69.93 |

| TEL | 4.58 | 4.39 | 8.68 | 4.83 | 6.57 | 10.35 | 7.64 | 33.13 | 3.01 | 1.25 | 4.2 | 1.22 | 0.54 | 2.64 | 1.56 | 3.11 | 2.32 | 66.87 |

| UTI | 2.7 | 3.47 | 3.09 | 3.31 | 3.89 | 5.39 | 4.3 | 3.6 | 61.92 | 0.69 | 0.68 | 1.61 | 0.99 | 1.14 | 1.24 | 1.17 | 0.8 | 38.08 |

| Credit | 0.98 | 1.72 | 0.95 | 0.75 | 1 | 1.83 | 1.08 | 0.89 | 3.48 | 36.55 | 10.64 | 5.56 | 1.03 | 13.89 | 0.8 | 9.53 | 9.32 | 63.45 |

| Equity Valuation | 0.7 | 1.11 | 1.3 | 1.15 | 1.2 | 1.52 | 1.15 | 1.62 | 1.12 | 5.12 | 43.17 | 3.33 | 1.14 | 15.01 | 1.33 | 12.77 | 7.27 | 56.83 |

| Safe Assets | 0.91 | 0.77 | 0.75 | 0.69 | 0.56 | 1.29 | 0.68 | 0.79 | 0.8 | 1.45 | 1.37 | 81.74 | 3.92 | 1.26 | 0.8 | 1.16 | 1.08 | 18.26 |

| Funding | 0.37 | 1.03 | 0.58 | 1.56 | 0.66 | 1.28 | 0.66 | 0.49 | 1.14 | 1.07 | 0.75 | 3.89 | 82.89 | 1.26 | 0.62 | 0.91 | 0.84 | 17.11 |

| Volatility | 0.43 | 0.81 | 1.4 | 1.16 | 1.64 | 1.29 | 0.78 | 1.22 | 1.91 | 5.84 | 11.65 | 1.51 | 0.52 | 33.07 | 0.9 | 21.56 | 14.32 | 66.93 |

| BSI | 1.11 | 1.07 | 1.5 | 0.93 | 1.39 | 2.28 | 0.84 | 1.53 | 1.4 | 1.12 | 4 | 1.31 | 0.58 | 3.43 | 70.32 | 3.96 | 3.24 | 29.68 |

| VIX | 0.42 | 0.79 | 1.84 | 1.57 | 2.04 | 1.94 | 0.88 | 1.42 | 1.22 | 2.97 | 9.78 | 1.58 | 0.51 | 23.17 | 0.91 | 35.49 | 13.46 | 64.51 |

| VSTOXX-50 | 0.45 | 0.95 | 1.43 | 1.11 | 1.67 | 1.25 | 0.81 | 1.16 | 1.02 | 5.42 | 9.83 | 1.88 | 0.57 | 22.79 | 1.23 | 20.58 | 27.87 | 72.13 |

| TO | 51.32 | 46.85 | 64.86 | 57.57 | 63.36 | 95.99 | 55.37 | 47.12 | 33.24 | 34.48 | 68.9 | 28.75 | 14.75 | 105.42 | 19 | 97.76 | 70.1 | 954.83 |

| Inc.Own | 84.13 | 81.89 | 94.27 | 99.81 | 94.71 | 134.11 | 85.44 | 80.24 | 95.16 | 71.04 | 112.07 | 110.49 | 97.64 | 138.49 | 89.32 | 133.24 | 97.96 | cTCI/TCI |

| Net | −15.87 | −18.11 | −5.73 | −0.19 | −5.29 | 34.11 | −14.56 | −19.76 | −4.84 | −28.96 | 12.07 | 10.49 | −2.36 | 38.49 | −10.68 | 33.24 | −2.04 | 59.68/56.17 |

| Panel A: Short-Term | CS | ENE | FIN | HC | IND | MAT | RE | TEL | UTI | Credit | Equity Valuation | Safe Assets | Funding | Volatility | BSI | VIX | VSTOXX-50 | FROM |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| CS | 23.61 | 1.73 | 3.74 | 3.83 | 4.78 | 2.87 | 4.42 | 2.4 | 0.94 | 0.37 | 0.21 | 0.67 | 0.2 | 0.23 | 0.37 | 0.43 | 0.42 | 27.6 |

| ENE | 1.41 | 17.11 | 1.75 | 2.71 | 1.66 | 2.54 | 3.09 | 1.18 | 1.25 | 0.38 | 0.23 | 0.36 | 0.32 | 0.35 | 0.52 | 0.54 | 0.51 | 18.78 |

| FIN | 2.98 | 1.73 | 21.68 | 3.13 | 6.05 | 2.47 | 3.71 | 4.82 | 1.17 | 0.21 | 0.36 | 0.53 | 0.3 | 0.52 | 0.45 | 0.96 | 0.73 | 30.12 |

| HC | 5.65 | 2.6 | 4.59 | 33.48 | 4.93 | 5.61 | 3.44 | 2.54 | 1.28 | 0.27 | 0.42 | 0.6 | 0.66 | 0.63 | 0.32 | 1.04 | 0.62 | 35.21 |

| IND | 4.29 | 1.74 | 7.43 | 3.61 | 25.02 | 2.47 | 5.23 | 4.08 | 1.68 | 0.26 | 0.42 | 0.52 | 0.23 | 0.7 | 0.47 | 1.16 | 0.94 | 35.23 |

| MAT | 0.92 | 0.96 | 0.91 | 1.12 | 0.83 | 5.3 | 0.67 | 0.51 | 0.63 | 0.16 | 0.39 | 0.1 | 0.12 | 0.51 | 0.19 | 0.73 | 0.35 | 9.09 |

| RE | 3.69 | 3.38 | 4.76 | 2.5 | 5.64 | 2.07 | 22.96 | 5.18 | 1.97 | 0.3 | 0.58 | 0.82 | 0.28 | 0.59 | 0.3 | 0.77 | 0.51 | 33.34 |

| TEL | 2.02 | 1.3 | 5.74 | 2.24 | 4.28 | 1.57 | 4.6 | 26.18 | 1.59 | 0.3 | 0.75 | 0.76 | 0.25 | 0.85 | 0.43 | 1.28 | 0.72 | 28.67 |

| UTI | 0.82 | 1.01 | 1.2 | 1.12 | 1.51 | 1.78 | 1.67 | 1.53 | 23.13 | 0.26 | 0.21 | 0.35 | 0.3 | 0.57 | 0.31 | 0.62 | 0.29 | 13.57 |

| Credit | 0.1 | 0.07 | 0.1 | 0.1 | 0.12 | 0.32 | 0.12 | 0.12 | 0.64 | 0.55 | 0.47 | 0.89 | 0.22 | 0.3 | 0.13 | 0.52 | 0.18 | 4.41 |

| Equity Valuation | 0.11 | 0.18 | 0.4 | 0.41 | 0.36 | 0.66 | 0.29 | 0.43 | 0.25 | 0.33 | 2.92 | 0.54 | 0.17 | 1.1 | 0.25 | 1 | 0.44 | 6.92 |

| Safe Assets | 0.76 | 0.67 | 0.64 | 0.56 | 0.46 | 0.93 | 0.59 | 0.68 | 0.6 | 1.21 | 1.03 | 74.85 | 3.56 | 1.01 | 0.49 | 0.84 | 0.92 | 14.95 |

| Funding | 0.26 | 0.98 | 0.46 | 1.48 | 0.55 | 1.1 | 0.57 | 0.41 | 0.74 | 0.98 | 0.5 | 3.48 | 76.33 | 1.1 | 0.43 | 0.62 | 0.57 | 14.23 |

| Volatility | 0.08 | 0.1 | 0.28 | 0.26 | 0.23 | 0.71 | 0.12 | 0.18 | 0.17 | 0.57 | 1.31 | 0.35 | 0.16 | 1.85 | 0.18 | 1.59 | 0.86 | 7.14 |

| BSI | 0.18 | 0.18 | 0.4 | 0.19 | 0.32 | 0.24 | 0.19 | 0.31 | 0.25 | 0.22 | 0.46 | 0.27 | 0.15 | 0.63 | 15.91 | 0.86 | 0.9 | 5.72 |

| USA.VIX | 0.15 | 0.14 | 0.74 | 0.56 | 0.68 | 0.97 | 0.2 | 0.52 | 0.24 | 0.55 | 1.87 | 0.48 | 0.12 | 3.15 | 0.26 | 6.15 | 1.24 | 11.88 |

| EURO.VSTOXX-50 | 0.14 | 0.23 | 0.85 | 0.53 | 0.82 | 0.61 | 0.2 | 0.71 | 0.38 | 1.29 | 1.56 | 0.46 | 0.19 | 2.06 | 0.67 | 2.04 | 6.66 | 12.75 |

| TO | 23.55 | 17 | 33.98 | 24.33 | 33.22 | 26.92 | 29.12 | 25.59 | 13.78 | 7.66 | 10.76 | 11.18 | 7.23 | 14.32 | 5.77 | 15.01 | 10.19 | 309.61 |

| Inc.Own | 47.16 | 34.11 | 55.66 | 57.81 | 58.24 | 32.22 | 52.07 | 51.78 | 36.91 | 8.21 | 13.68 | 86.03 | 83.57 | 16.17 | 21.68 | 21.15 | 16.85 | cTCI/TCI |

| Net | −4.05 | −1.78 | 3.86 | −10.88 | −2.01 | 17.83 | −4.22 | −3.08 | 0.22 | 3.25 | 3.84 | −3.77 | −7 | 7.18 | 0.05 | 3.13 | −2.56 | 19.35/18.21 |

| Panel B: Long-term | ||||||||||||||||||

| CS | 9.2 | 3.34 | 3.46 | 4.49 | 3.37 | 11.39 | 2.86 | 2.02 | 1.43 | 0.66 | 1.16 | 0.59 | 0.32 | 1.04 | 1.04 | 1.26 | 1.16 | 39.59 |

| ENE | 3.24 | 17.93 | 3.58 | 4.7 | 3.01 | 10.17 | 2.52 | 1.9 | 1.18 | 2.52 | 2.77 | 0.56 | 0.6 | 2.61 | 1.18 | 2.87 | 2.77 | 46.18 |

| FIN | 2.77 | 3.31 | 7.73 | 3.27 | 3.21 | 9.67 | 2.38 | 2.03 | 0.86 | 0.71 | 2.05 | 0.36 | 0.31 | 3.44 | 1.02 | 3.02 | 2.05 | 40.47 |

| HC | 2.34 | 2.25 | 2.15 | 8.75 | 1.9 | 4.9 | 1.29 | 1.18 | 1.59 | 0.16 | 1.14 | 0.4 | 0.39 | 0.73 | 0.86 | 0.82 | 0.43 | 22.55 |

| IND | 2.89 | 2.4 | 2.94 | 2.62 | 6.34 | 6.5 | 2.86 | 1.55 | 1.15 | 0.73 | 1.35 | 0.36 | 0.28 | 2.58 | 0.81 | 2.48 | 1.94 | 33.42 |

| MAT | 5.79 | 4.56 | 5.63 | 6.41 | 4.45 | 32.82 | 4.05 | 2.97 | 1.64 | 1.39 | 2.34 | 0.55 | 0.68 | 4.24 | 1.26 | 4.15 | 2.68 | 52.79 |

| RE | 2.69 | 2.75 | 2.42 | 2.13 | 2.92 | 6.89 | 7.12 | 2.04 | 1.38 | 1.44 | 2.6 | 0.44 | 0.28 | 2.64 | 0.83 | 2.78 | 2.35 | 36.59 |

| TEL | 2.56 | 3.1 | 2.94 | 2.59 | 2.29 | 8.79 | 3.04 | 6.94 | 1.42 | 0.95 | 3.44 | 0.45 | 0.29 | 1.79 | 1.13 | 1.83 | 1.6 | 38.2 |

| UTI | 1.88 | 2.46 | 1.89 | 2.19 | 2.38 | 3.61 | 2.63 | 2.07 | 38.79 | 0.44 | 0.48 | 1.25 | 0.69 | 0.56 | 0.93 | 0.55 | 0.51 | 24.52 |

| Credit | 0.88 | 1.64 | 0.85 | 0.65 | 0.88 | 1.52 | 0.96 | 0.78 | 2.84 | 36.01 | 10.17 | 4.67 | 0.81 | 13.59 | 0.66 | 9.01 | 9.13 | 59.04 |

| Equity Valuation | 0.59 | 0.92 | 0.9 | 0.74 | 0.84 | 0.87 | 0.86 | 1.19 | 0.87 | 4.79 | 40.24 | 2.79 | 0.97 | 13.91 | 1.08 | 11.77 | 6.83 | 49.91 |

| Safe Assets | 0.14 | 0.1 | 0.11 | 0.14 | 0.1 | 0.36 | 0.09 | 0.12 | 0.2 | 0.24 | 0.34 | 6.89 | 0.36 | 0.25 | 0.31 | 0.32 | 0.16 | 3.31 |

| Funding | 0.11 | 0.05 | 0.12 | 0.07 | 0.11 | 0.18 | 0.1 | 0.08 | 0.39 | 0.09 | 0.26 | 0.41 | 6.55 | 0.16 | 0.19 | 0.28 | 0.27 | 2.88 |

| Volatility | 0.35 | 0.7 | 1.13 | 0.9 | 1.41 | 0.58 | 0.66 | 1.04 | 1.74 | 5.27 | 10.34 | 1.16 | 0.36 | 31.22 | 0.72 | 19.97 | 13.46 | 59.79 |

| BSI | 0.93 | 0.89 | 1.1 | 0.74 | 1.07 | 2.04 | 0.66 | 1.22 | 1.15 | 0.9 | 3.54 | 1.04 | 0.44 | 2.8 | 54.41 | 3.1 | 2.34 | 23.96 |

| USA.VIX | 0.27 | 0.65 | 1.1 | 1.01 | 1.37 | 0.97 | 0.68 | 0.9 | 0.97 | 2.42 | 7.91 | 1.11 | 0.39 | 20.02 | 0.65 | 29.34 | 12.22 | 52.63 |

| EURO.VSTOXX-50 | 0.31 | 0.72 | 0.57 | 0.58 | 0.85 | 0.63 | 0.61 | 0.45 | 0.64 | 4.13 | 8.27 | 1.43 | 0.38 | 20.73 | 0.56 | 18.53 | 21.21 | 59.39 |

| TO | 27.77 | 29.84 | 30.88 | 33.24 | 30.14 | 69.08 | 26.25 | 21.52 | 19.46 | 26.83 | 58.14 | 17.57 | 7.52 | 91.1 | 13.23 | 82.75 | 59.91 | 645.22 |

| Inc.Own | 36.96 | 47.77 | 38.61 | 41.99 | 36.47 | 101.9 | 33.37 | 28.47 | 58.25 | 62.83 | 98.39 | 24.46 | 14.07 | 122.32 | 67.64 | 112.09 | 81.11 | cTCI/TCI |

| Net | −11.82 | −16.33 | −9.59 | 10.69 | −3.28 | 16.28 | −10.34 | −16.68 | −5.06 | −32.21 | 8.23 | 14.26 | 4.64 | 31.31 | −10.73 | 30.12 | 0.52 | 40.33/37.95 |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2025 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Tabash, M.I.; Issa, S.S.; Mansour, M.; Hannoon, A.; Gherghina, Ş.C. Ripples of Global Fear: Transmission of Investor Sentiment and Financial Stress to GCC Sectoral Stock Volatility. Economies 2025, 13, 313. https://doi.org/10.3390/economies13110313

Tabash MI, Issa SS, Mansour M, Hannoon A, Gherghina ŞC. Ripples of Global Fear: Transmission of Investor Sentiment and Financial Stress to GCC Sectoral Stock Volatility. Economies. 2025; 13(11):313. https://doi.org/10.3390/economies13110313

Chicago/Turabian StyleTabash, Mosab I., Suzan Sameer Issa, Marwan Mansour, Azzam Hannoon, and Ştefan Cristian Gherghina. 2025. "Ripples of Global Fear: Transmission of Investor Sentiment and Financial Stress to GCC Sectoral Stock Volatility" Economies 13, no. 11: 313. https://doi.org/10.3390/economies13110313

APA StyleTabash, M. I., Issa, S. S., Mansour, M., Hannoon, A., & Gherghina, Ş. C. (2025). Ripples of Global Fear: Transmission of Investor Sentiment and Financial Stress to GCC Sectoral Stock Volatility. Economies, 13(11), 313. https://doi.org/10.3390/economies13110313