4.3.1. Calibration of the Deterministic Model

We carried out the calibration process of the deterministic dynamic system by using the procedure explained in

Section 4.2 above. It begins by assuming a set of arbitrary initial values for the parameters of the Dynamic System (29). The initial values established for the coefficients maintained the expected signs, as described in

Section 3.1.

Table 2 below highlights these values in its second column.

We remember that it is used the scale transformation of the variables involving values of much higher levels, in the case of real GDP, real public sector net debt, actual tax revenues, real seigniorage income, and real government expenditures, becoming them of the order of magnitude relative to a unit, similar to the others variables, which are index number with base one. This transformation was achieved by dividing all series values by the initial value of real GDP from January 1998, which facilitated the model calibration process. In the convergence process, the mean squared deviations of the System (29) equations, given by Equation (36), were, respectively, for Equations (1) to (5), were , , , , and ; errors estimated taking all 10042-time points discretized by the fourth order Runge–Kutta method. It can be observed that the fourth system equation, corresponding to the exchange rate variable, which exhibits a more considerable amplitude variation, presents a more significant mean error, as expected.

Table 2 above highlights in the first column the parameter symbols, in the second column the assumed initial parameter values in the calibration process, and in the third column the values of the parameters adjusted for the dynamic model system after reaching the precision specified by the error tolerance of

. Finally,

Table 2 above shows the descriptions of the parameters in the fourth column.

Therefore, we will analyze the consistency of the short-term interest index coefficient in the first dynamic equation of System (29), having the product variation as the dependent variable. The calibration result for the real SELIC interest index coefficient (

) is as expected. It showed a negative relationship between the real interest rate and Brazilian GDP, with a coefficient of

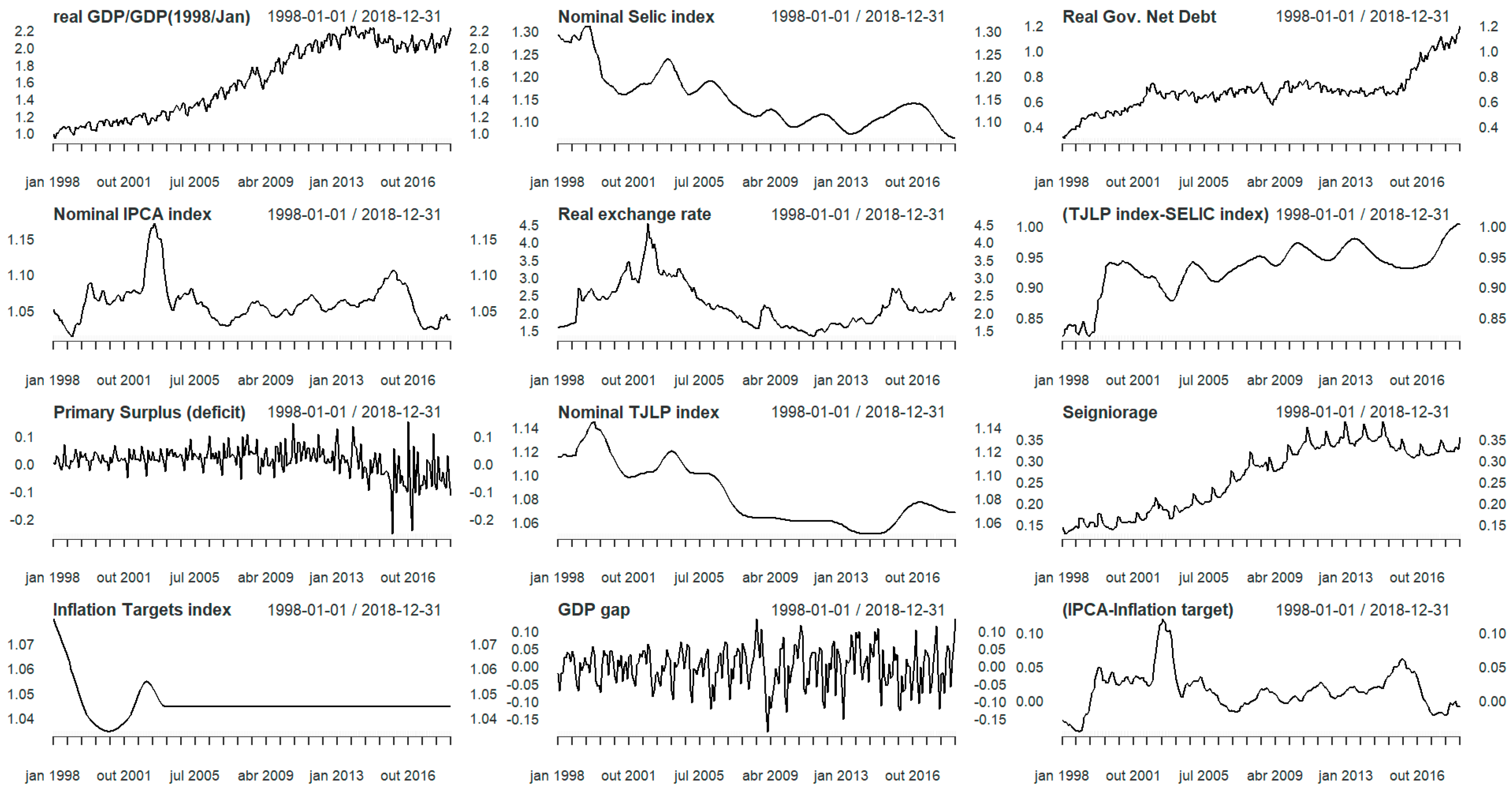

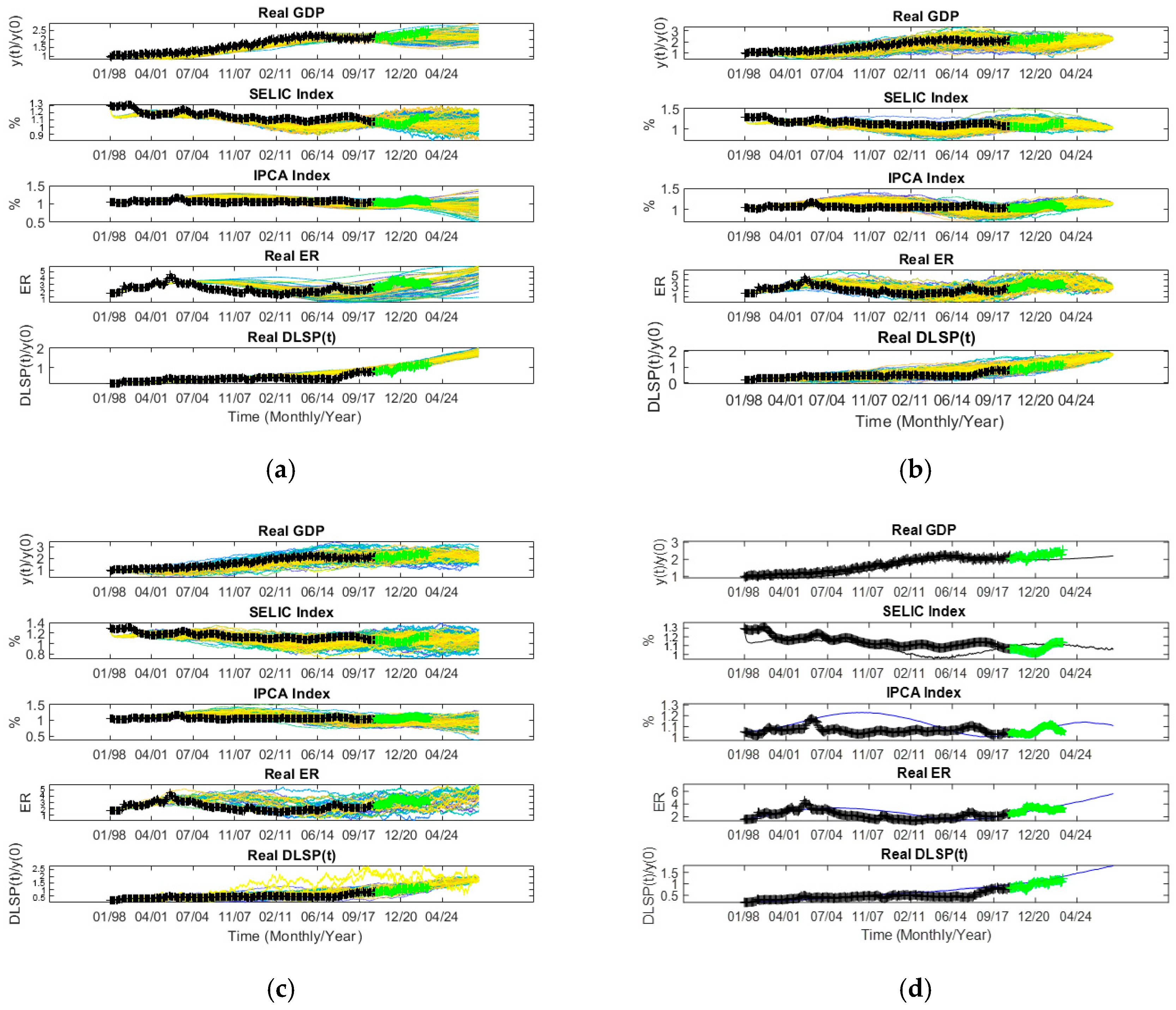

. Comparing the first and second graphics in the first line at the top of

Figure 1 below, we can observe that GNP has an increasing trend, and the nominal SELIC index (also the actual SELIC index) has a decreasing trend. These graphic behaviors confirm the consistency of the negative signal estimated for the coefficient

.

The value of the coefficient of the real exchange rate (

) in the first equation of the System (29) positively impacts GDP variation in the order of

. This result is consistent with expectations for developing economies (EMEs), as explained in detail at the end of

Section 3.1.5 and in

Goda and Priewe (

2020). Comparing the first graphic in the first line with the second graphic in the second line of

Figure 1 below, we observe that GNP has an increasing trend, and the actual exchange rate exhibits oscillations, but, on average, the real exchange rate maintained a long-run depreciation level throughout the entire period. This relationship between these two graphics emphasizes the consistency of the positive signal estimated for the coefficient

.

Some economists believe that the real exchange rate is the most critical macroeconomic price among all variables because it influences all the others (including the inflation rate) since Imports, exports, the investment rate, the savings rate, and inflation depend on the real exchange rate (

Bresser-Pereira et al., 2014, p. 3). There is a clear relationship between the trend of the real exchange rate and long-term economic growth. This phenomenon is captured by the Harrod-Balassa-Samuelson effect (as explained in

Section 3.1.5), in which an overvaluation of developing countries’ exchange rates for prolonged periods tends to depress their long-term economic growth rates (

Dollar & Kraay, 2003;

Gala, 2008).

Understanding economic growth requires focusing on what causes the initial stirrings and identifying the interacting phenomena that drive it. The effect of growth on PNP expansion is the mean rate of sustained growth of the Brazilian economy, which is proportional to the GNP slope trend during the analyzed period, as observed in the top line of the first graphic in

Figure 1 above. The coefficient

captures, in the correct sense, this positive effect of the impact of GDP on itself in a proportion of

. The growth order of this effect will be analyzed later, estimating the PND growth rate in itself.

Fama (

1981) indicates a negative correlation between inflation and stock returns. From this perspective, when the stock market registers advances during times of low interest rates, asset prices increase, and so does inflation. Consequently, the Central Bank of Brazil takes decisive measures to reduce inflationary pressures, acting based on its expected inflation rate. An increase in expected inflation also sustains an interest rate increase. This increase likely changes the trade-off between interest rates and stock prices, leading to inflation and interest rates moving in the same direction simultaneously. Regardless of the trade-off between stock value and interest rates, this relationship can shift significantly in response to a substantial change in inflation expectations. Therefore, we observe that the expected inflation index drives the change process in the inflation index (IPCA) and the nominal interest index (SELIC) in the same direction.

This process implies that the changes in IPCA and the nominal SELIC occur through a previous shift in inflation expectation (

). Hence, we conclude that for

, this variable impacts positively on

, tightening the economy, and for

, this variable impacts negatively on

, releasing the economic process. This behavior was accurately captured by the coefficient

, with a value of

. We can observe the evolution of the variable

over the analyzed period in the right graphic on the last line and the nominal SELIC index in the second graphic on the first line, both shown in

Figure 1. As observed in the graphics, the variable

maintains a positive trend, interrupted by oscillations, and the nominal SELIC index decreases systematically along a trend. Thus, we noticed that the oscillation of the variable

imposes oscillation on the nominal interest index; however, the decreasing trend in the nominal SELIC index variable is due to another factor.

There is a negative bi-causality relationship between the exchange rate and interest rates, such that when the exchange rate appreciates, the interest rate decreases, and vice versa. In general, the economy can be in either a boom state (positive gap), characterized by appreciated exchange rates, or a recession (negative gap), characterized by depreciated exchange rates. These facts are because the exchange rate appreciates when the economy evolves into a boom (and the interest rate decreases). However, the exchange rate depreciates when the economy goes into recession (and the interest rate increases).

From the arguments presented above, we conjecture that

(the coefficient of the GDP gap) in the second equation has to be negative, as captured by the model’s dynamics, with a value of

. We observe in the middle graphic on the last line of

Figure 1, in which the signal of the GNP gap variable fluctuates constantly, shifting from negative to positive throughout the analyzed period. Nevertheless, as shown in the second graphic on the first line of

Figure 1, the nominal SELIC index oscillates over a trend that decays during the analyzed period. This behavior was captured by

, despite the constant oscillations of the GDP gap.

We will analyze the behavior of the controllable parameter

in the second equation of System (29), specifically the coefficient of the differential between the SELIC index and the nominal long-term interest index (

). To understand the consistency of the

sign, we need to determine the behavior of the TJLP index, as it complies with the criteria established in law. According to this law, the BACEN (Brazilian Central Bank) sets the TJLP index equal to the inflation target accumulated for the twelve months following the first month of the rate’s validity, plus a risk premium

5.

The TJLP serves as the basis for calculating the essential cost of financing from the National Bank for Social Development (BNDES) to be granted to companies that generate employment through investments in gross fixed capital formation. Generally, the SELIC interest rate is relatively high compared to international interest rates. It is a short-term interest instrument designed to control inflation and attract foreign capital into the country or to prevent capital flight, as it serves as an index for bonds issued by the National Treasury. However, the TJLP is an interest rate subsidized by the public sector used in the long-term loans taken from the BNDES by companies selected to develop industrial and job creation projects.

The TJLP evolves as a function of the predictability of change in the expected target inflation. The TJLP index should increase if the inflation target rises, meaning that the TJLP acts in the same direction as the SELIC rate, albeit with less intensity due to a risk premium, as it is partly subsidized.

The index

is always positive, as can be seen by comparing the second graph in the first line with the second graph in the third line, both in

Figure 1. Then, a decrease in the target inflation forecast induces a shrinkage in TJLP, with a consequent increase in the variable

. An increase in the variable

, as a function of a decrease in

, must cause a reduction in SELIC, which implies that its coefficient

(in the second equation of the System (29)) must be negative for causes a negative variation in the nominal SELIC index (

), the correct sign expected. Otherwise, if at any moment the expected inflation increases, it induces an increase in the TJLP index, accompanied by a decrease in the variable

. Then, a decreasing variation in the variable

due to an increase in the

variable must cause an increase in the SELIC interest index, which demands a negative value for

. Thus, the coefficient

of the variable

presented a negative value equal to

. In summary, the coefficient

accurately captured the behavior of these variables.

The third equation of the system (29) has the inflation differential per unit of time as its dependent variable, and the real exchange rate, the output gap, and the difference between inflation and the inflation target are used as explanatory variables. Therefore, we will establish arguments that explain the consistency of the impacts of these variables’ coefficients on inflation variation.

Firstly, as stressed earlier, a positive output gap (in the boom) is associated with a positive variation in the nominal interest rate (SELIC increase), resulting in a consequent decrease in the inflation index (IPCA). A negative output gap (during the recession) is associated with a decrease in the nominal interest rate (as indicated by the SELIC index), resulting in a positive impact on the inflation index (as measured by the IPCA). Therefore, the output gap coefficient (

) has to negatively affect the inflation variation, which was correctly estimated, in the order of

. The estimative consistency of

may be verified, comparing the IPCA index graph, the first in the second line, and the GDP gap graph, the middle graph on the last line, both in

Figure 1. From these graphics, it is evident that a positive variation in the IPCA index is associated with a negative variation in the GDP, indicating a negative impact relationship.

We now analyze the consistency of the sign of the coefficient of the real exchange rate variable on the inflation variation,

. As explained in

Section 3.1.2, the link between productivity and the real exchange rate establishes the impact of the real exchange rate on inflation. The theoretical importance of the real exchange rate for the conduct of monetary policy under an Inflation-targeting regime is highlighted by

Aizenman et al. (

2011), based on the version by

Ball (

1999) and

Aghion et al. (

2009). These authors concluded that real exchange rate depreciation reduces productivity in developing countries, attributing this to financial channels that shrink working earnings, consequently diminishing inflation. The adverse effects of exchange rate volatility on productivity are more pronounced in the financial markets of developing countries than in those of developed countries. These negative effects are significant for practically all EMEs and developing countries. However, productivity gains cause an increase in relative prices, contributing to the appreciation of the real exchange rate. In other words, the higher the productivity of an economy, the more appreciated its real exchange rate will be, with a consequent positive impact on inflation. This relationship between the real exchange rate and inflation is established by the Balassa-Samuelson effect (

Samuelson, 1964;

Balassa, 1964). The logic of this process is that higher productivity causes higher wages in the tradable goods sector of an EME which will also lead to higher wages in the non-tradable sector (services). This concomitant price increase in economies experiencing more significant growth (developing economies) will result in more intense inflation rate increases than the corresponding effects in developed economies, which are subject to slower growth. Therefore, it can be understood that the appreciation of the currency in developing economies induces high productivity, accompanied by a substantial increase in inflation, which in turn has a negative impact on

, as the positive inflationary impact due to the appreciation of the currency predominates over the negative effect of increased productivity on inflation. Thus, this implies a negative value for

, which was approximately

, confirming the expectation.

In the following, we will analyze the behavior of the controllable coefficient of the variable on the inflation variation. As argued earlier, the changes in the expected inflation index induce changes in the same direction as the nominal interest (SELIC). Firstly, we consider . A positive change in causes a decrease in the variable , which implies a positive change in SELIC, with consequent decrease in inflation variation. Otherwise, if a negative change occurs in , consequently growing the variable , which implies a negative change in the SELIC rate and a positive inflation rate variation due to the shrinkage in SELIC Differently, we assume now that . Then, a precedent shrinkage change in the implies a decrease in the negative amplitude of . Then, this positive variation is linked to a positive inflation variation, as a negative shift in the SELIC rate occurred. However, if a positive change in occurs, increasing the negative modulus of variable induces a positive shift in the SELIC rate. Hence, the negative variation in is associated with a negative inflation variation.

In summary, we conclude that if the variation of the variable

is positive (negative), it is associated with a negative (positive) impact on the nominal SELIC interest index; and, as a consequence, a positive (negative) result in the inflation index. This behavior was correctly captured by

, resulting in an inflation variation of approximately

. This fact can be confirmed by examining the IPCA index in the first graphic, on the second line, and the

in the last graphic, on the last line, both in

Figure 1. Both variables evolve similarly and are positive. This behavior characterizes a positive impact relationship.

The fourth equation of System (29) has the exchange rate variation as its dependent variable and the real interest rate and the exchange rate as its independent variables.

Firstly, we analyze the impact of the relationship between the real interest rate and exchange rate variation. As detailed in

Section 3.1.4, according to the traditional view, an increase in the interest rate leads to an appreciation of the exchange rate (

Dornbusch, 1976). On the other hand, the nontraditional perspective posits a positive relationship between interest rates and exchange rates (

Furman & Stiglitz, 1998). In conclusion, as presented in

Section 3.1.4, the traditional view prevails in developed economies, while the nontraditional view is characteristic of developing economies, mainly because they are often in unstable situations.

In the dynamic model calibration, the coefficient of the real interest index variable with respect to the real exchange rate variation showed a positive correlation. Therefore, an increase in the real interest rate index causes a depreciation in the exchange rate, which was of the order of

. Some studies on the Brazilian Economy confirm this impact direction, as their findings have consistently shown a positive relationship between the interest index and the exchange rate, as noted by

Blanchard (

2004), among others.

In the fourth equation of the System, we have that the real exchange impacts itself. This relationship was explained in detail in

Section 3.1.4, in which it was characterized that in a floating exchange rate system in developing economies, exchange rate fluctuations can significantly impact the price level through changes in aggregate demand and supply. In aggregate supply, the depreciation of the national currency can have a direct and positive impact on the price level through imported goods that national consumers purchase. The indirect influence of exchange rate depreciation on a country’s price level can be observed in the prices of capital goods (intermediate goods) imported by manufacturers as inputs, as explained in

Aghion et al. (

2009). The real exchange rate depreciation reduces productivity in developing countries, leading to a consequent increase in inflation, which directly impacts the exchange depreciation. Thus, for developing economies, obtaining

is entirely acceptable.

Therefore, we have that the real exchange rate positively impacts the variation in the real exchange index via the coefficient

, with a value of

. The positive sign of the coefficient

allows us to conclude that a depreciation of the real exchange rate induces a process of exchange rate depreciation, which can be stopped only by the induction of new perspectives in the economy or by a process of intervention by the central bank, which sometimes proves to be efficient only in the very short term. The induction of new perspectives in the economy that alter the process of evolution of the real exchange rate must occur only through changes in economic structure relating to actual wages, aggregate investment, external and internal savings, and productivity (

Gala, 2008).

The fifth equation of the system (29) has as its dependent variable the debt-to-GDP differential per unit of time () and as explanatory variables the real debt-to-GDP level (), the real primary-to-GDP balances (), and the real seigniorage-to-GDP (). Therefore, we will establish arguments that explain the consistency of the impacts of these variables’ coefficients on inflation variation.

Regarding the impact of b(t) on debt variation, the difference between the real interest rate and the real GDP growth rate, , plays a crucial role in the debt structure. If , will become unstable because it positively impacts the . In another way, if , it negatively impacts ), driving towards stability.

The intensity of the impact of the amount of debt on the debt itself is a function of the intensity of the real interest rate (r(t)) and the economy’s growth rate (

), as demonstrated in

Section 3.1.1. This effect is captured in the system model (29) by the coefficient

, which can be positive or negative, depending on the value of the (

).

is positive, it impacts debt growth; if

is negative, it affects the decline in debt and promotes stability. In the case of this study, the

value found was

. This positive coefficient value indicates that debt causes indebtedness due to the excessive amount of interest paid, leading to an unstable process.

The other variables independent of the fifth equation of the System (29), W(t) and S(t), are important in solving the economic debt (

Croce, 2002). The primary difficulty in determining the solvency of the debt-to-GDP ratio lies in the fact that all relevant variables involved in this process are endogenous, including interest rates, primary balances, and seigniorage revenues. In this context, feedback from fiscal measures that generate primary balances can, in turn, affect revenues, expenses, interest rates, the behavior of private savings and government investment, and the capacity to consolidate primary balances and Seigniorage.

The government uses Seigniorage (

) to balance the budget. In this case, the budget deficit will impact the current or future increase in the money supply, with a consequent rise in the inflation rate. Therefore, financial resources raised through Seigniorage are generally limited. As

Sargent and Wallace (

1981) note, if the primary balance (

) falls into deficit, seigniorage revenues must be increased to accommodate the government’s budget constraint. The idea is that seigniorage revenue complements revenue from primary deficits. Then, the public debt will only stop growing when exogenous measures are adopted in the fiscal area so that the primary deficit is zero. These measures are of an accounting nature, as they aim to generate a primary surplus that, given a certain seigniorage supposedly under the control of the Central Bank, without incurring interest expenses and assuming exogenous growth in GDP, will enable the payment of interest on public debt.

Seigniorage is defined as the result of a monetary expansion carried out by the Central Bank, which equals the product of this expansion and real monetary balances (

Rovelli, 1994;

Hochreiter et al., 1996). Thus, as a monopolist in issuing paper money, the Central Bank can acquire goods and services that generate significant resources. In another way, Seigniorage can be defined as a revenue called inflationary tax (

Mankiw, 1987;

Hochreiter et al., 1996), which is nothing more than the compulsory transfer of income through negative real interest, paid by the monetary base, in favor of the Central Bank and against the rest of the entities that make up the economy that maintains a monetary base among their assets. In short, the Seigniorage results from mitigating the welfare effects and inflation.

Conclusively, the necessary condition for debt solvency requires only one condition: positive values for the augmented primary surplus (primary balance added to the Seigniorage). Therefore, the public debt stock is an asset with a present value equal to the augmented surplus, in which the Seigniorage is recorded as active revenue in primary balances to obtain positive operating surpluses. At the same time, Seigniorage is also accounted for as a liability, a debt security, which, at some point, must be paid off, but without any tax burden (

Cukierman et al., 1992).

Regarding the impact of the primary surplus variable added to seigniorage revenue, as indicated by the efficient , it must necessarily be positive, considering that this term is accompanied by a negative sign in System (29). As the primary balances are positive (surplus), it has a negative impact on the debt. In this study, the calibrated coefficient was , confirming the equation’s expectation. Finally, the coefficient of the seigniorage variable, , accounted as a debt liability, in contrast to its use as an active revenue integrated into the primary balances, must be negative, considering that this term is accompanied by the negative sign in System (29), whose component must positively integrate the debt. Thus, was correctly estimated in the order of .

4.3.2. Calibration of the Stochastic Model

We will analyze the stochastic dynamic model described by Systema (32), which introduces stochastic innovations. The non-controllable parameters’ impacts of the dynamic model are subject to exogenous political or economic effects, which can alter the direction and the intensity of the impact relations in the macroeconomic and monetary variables of the economy. These exogenous political and economic effects adjust the non-controllable parameters, thereby influencing the economic performance for better or worse and making the economic process more efficient or less efficient. These changes in behavior (losses or gains) are called bifurcations. We also analyzed the additive effects of stochastic innovations from domestic or IEs (or political) imposed on the macroeconomic or monetary variables.

In this study, we implement the Monte Carlo realizations to generate the stochastic effects over the non-controllable coefficients. In the Monte Carlo method, we need to specify the distribution characteristics, but we must also validate the realizations to be used in the analysis. Thus, we use the Monte Carlo method to generate the realizations, a finite sequence of arbitrary numbers whose randomness must be statistically tested. Therefore, we perform empirical statistical tests to ensure the consistency of the realizations. In our case, they were (i) the means of the realizations have to be close to the coefficient value; (ii) the distribution has to be symmetric, with a specific standard deviation (e.g., no heteroskedastic); and (iii) there must be no covariance among the realizations for any lag integers k. We proved all these conditions for all the generated realizations, classifying them as white noise.

We imposed the stochastic disturbances on the non-controllable parameters, generated through a normal probability distribution, around each calibrated value of each non-controllable parameter. For this, we assumed a given variance, the largest possible for which the stochastic achievements of the dynamic economic model converged to a stable solution.

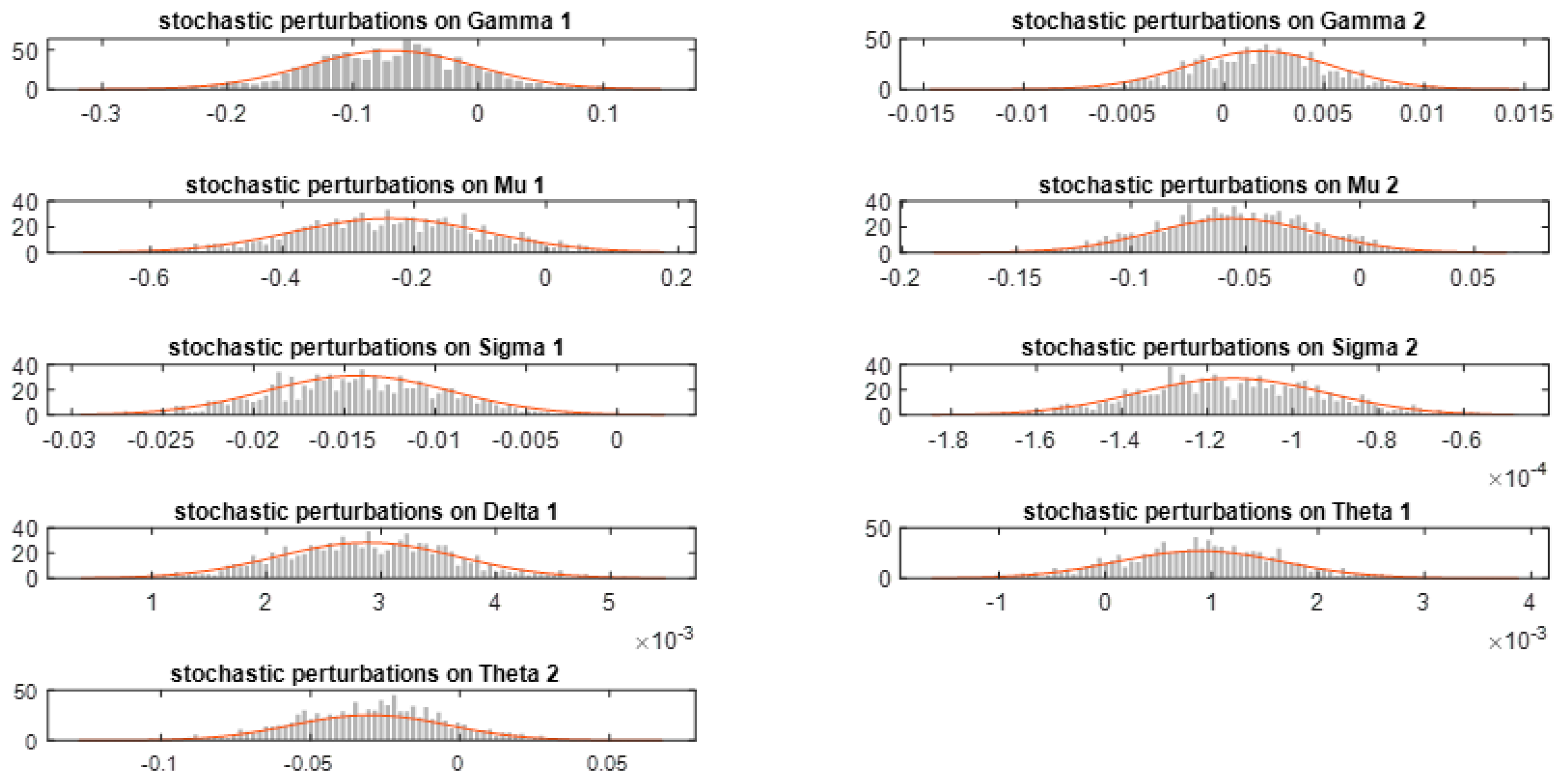

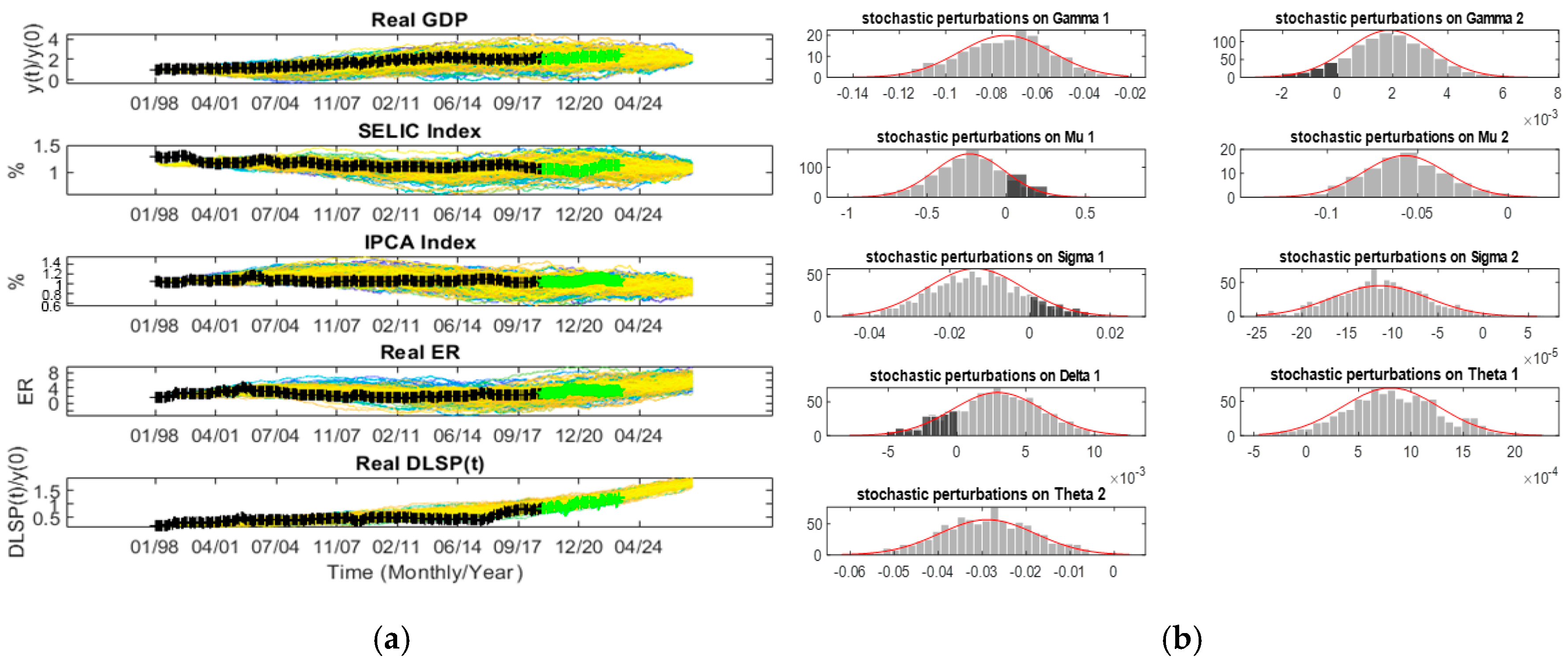

Figure 2 below shows the histograms of the stochastic shocks imposed on the calibrated coefficients of the Dynamic System (29). In each histogram of

Figure 2, an overlaid red line is observed, representing the corresponding normal distribution, with an average equal to the calibrated coefficient value and a standard deviation similar to that of the spreading interval of the stochastic disturbances, highlighted in the legend of

Figure 2, for each non-controllable coefficient, specified in each equation of the System (29).

Concerning the stochastic effects introduced additively, we generated them as a one-dimensional random walk, evolving over the entire forecast period, estimated through a computational subroutine, elaborated in the Matlab platform.

We generated one-dimensional random walks (1-D) to represent the stochastic disturbances described by the term

for all five dependent variables of the dynamic model of the System (31) by using a binomial distribution procedure as described by

Feller (

1968, p. 164), and by

Grimmett and Stirzaker (

2001, p. 202). The binomial distribution values generated are added to the corresponding variable by replacing the term

.

From a trial number established by , and assuming a probability to taking the right step (positive), we generate the successes by a binomial distribution choice. Then, considering that is the probability in j trials of taking a step to the left (negative), we have as the success number. In that task, we generate the random number sequence from the binomial distribution with , and ; as a function of the result, the sequence was generated.

The probability density function of a binomial distribution is

where the symbol

represents a factorial. In a binomial distribution, the mean number of steps

to the right and the mean number of steps

to the left are, respectively,

and

, and the standard deviation mean is the root-square of the variance, defined as

.

Therefore, we now consider the distances

distribution traveled after a given step number, defined as

To formally define the one-dimensional random walk, we take the independent random variables , estimated by (38). Then, setting , and estimating , with . The series is the simple random walk on , whose series gives the net distance walked. The expectation of is zero as the trial number N increases.

Finally, since the mean of increases as increases (), we normalized the series by its maximum module to adjust the series number in a standard amplitude. In the following, we multiply it by a proportional factor ranging between the endogenous variable mean amplitude and the mean amplitude of the random walk.

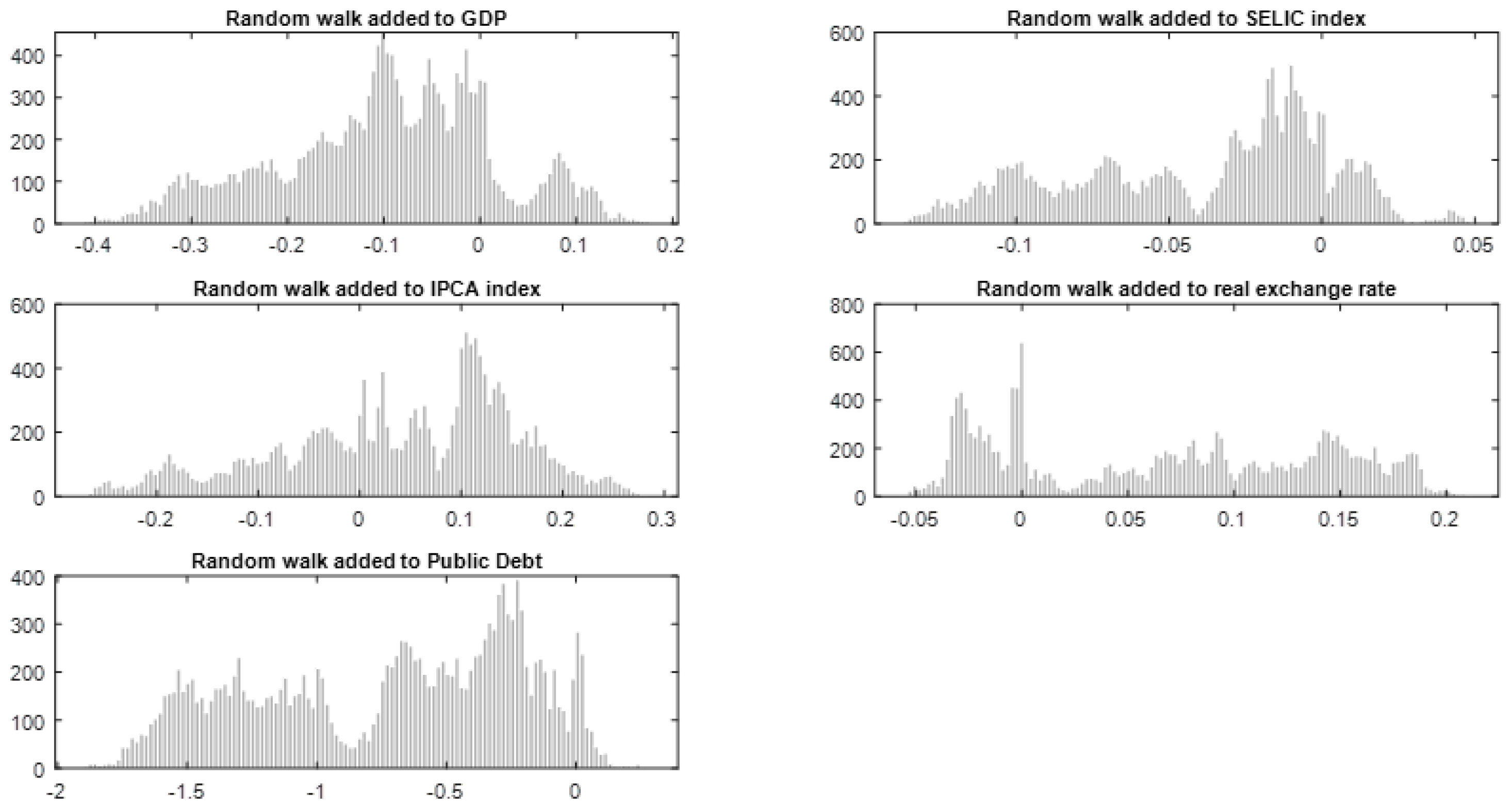

Figure 3 below shows the histograms of stochastic shocks to be added to the Model’s endogenous variables. The histograms represent the stochastic shocks for one interaction for all integration time, characterizing a one-dimensional random walk (1D) generated by binomially distributed jumps and following a

dispersion variance. The histograms in this figure are associated with endogenous variables in the following sequence: GDP (Ground Domestic Product), SELIC (short-term Interest rate), IPCA (Consumer Price Index), ER (actual exchange), and real DLSP (Net Public Debt). The shock bands added for these variables involve the respective ranges of stochastic variability formed by their minimum and maximum values, as shown in the

Figure 3 legend, with zero means.

4.3.5. Comparison of Deterministic Model Forecasts with Stochastic Model Mean Forecasts and Backtest Data

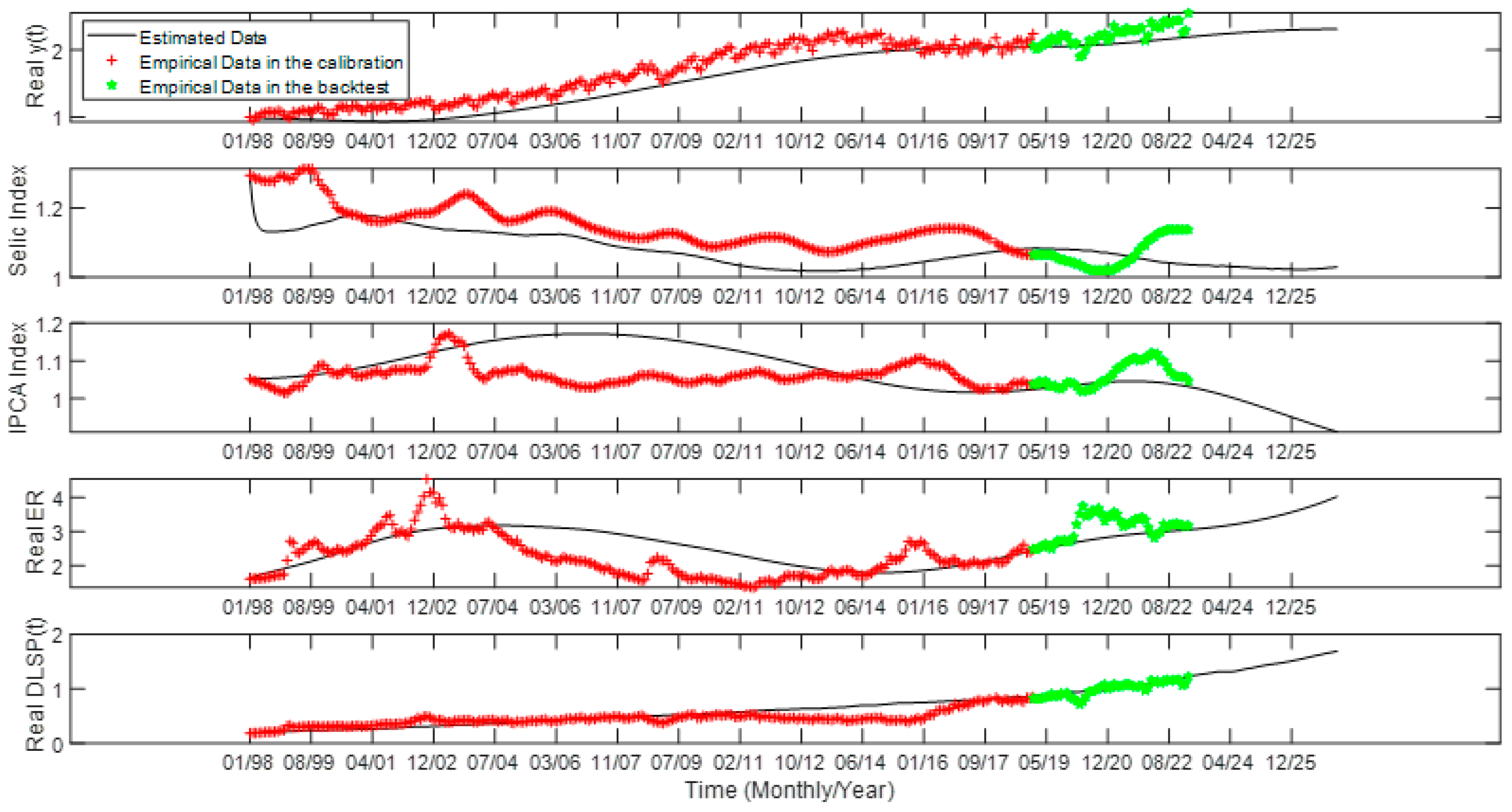

To analyze the forecast behavior of the determinist (DM) and stochastic (EM) models, we structure the mean curves’ forecast data for DM and the EM models in annual forecast data to compare them with the yearly data used as backtests. For annual data, we obtained the forecast curves estimated by the DM and EM models, for the variables real GDP, nominal SELIC index, nominal IPCA index, the real exchange rate (ER), and real DLSP from 2018 to 2026. We observe, in

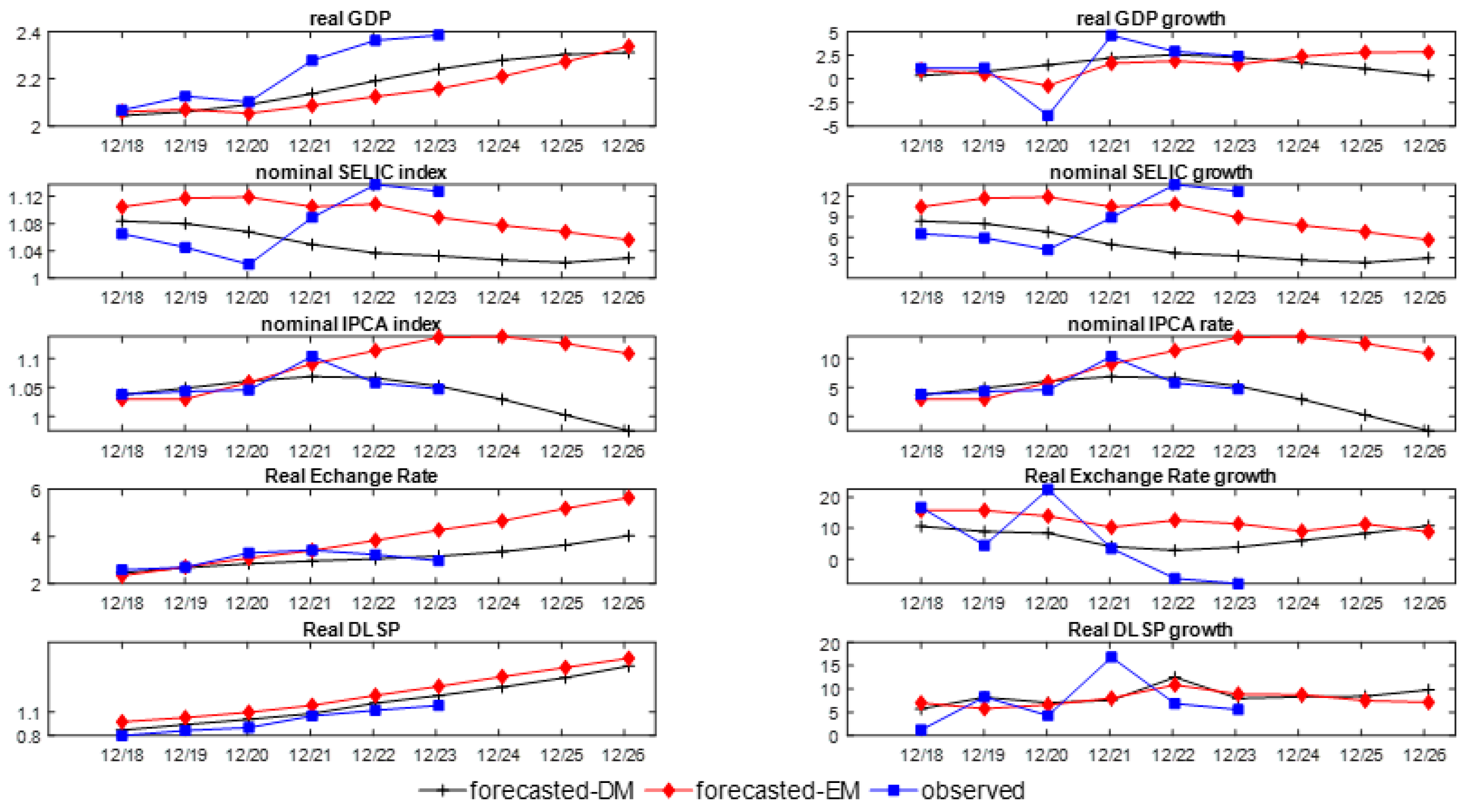

Figure 6, their evolution processes from 2018 to 2026.

In

Figure 6, the endogenous variable levels curves are represented by the graphs in its left column, in which the backtest data are represented by a blue line overlaid by square markers, the forecasts estimated by the DM are characterized by a black line overlaid by cross markers, and the estimates calculated by the EM model are represented by a red line overlaid by diamond markers (see legend at the bottom of

Figure 6).

In

Figure 6, the endogenous variable growth curves are represented by the graphs in the right column. We also presented the forecasted growth rate curves for 2018 to 2026 of the endogenous variables specified in the preceding paragraph, expressed as percentages, and compared them with the backtest data for 2018 to 2023. The legend at the bottom of

Figure 6 specifies the growth rates’ curves, similar to those used for the variable level.

First, we consider analyzing the variables at the level. In the left graphs of the first line, we observe the real GDP forecasts for both models, DM and EM, which maintain increasing trajectories similar to the evolution of empirical data from 2018 to 2020; however, the trajectories’ evolutions forecasted by DM and EM models present more significant discrepancy relative to backtest for the period from 2021 to 2023 but developing increasing processes overall forecast period, from 2019 to 2026, whose trajectories evolve closely over the forecast period, being the estimated levels of ME model lower than that one of the DM. Still, the evolution of the DM and EM forecasts maintains a similar slope to the backtest data.

We constate in the graphs of percentual rates, on the first figure on the right side of

Figure 6, that the forecasted PND growth was accurately estimated for both models, DM and EM, in average terms, except for the years 2020 and 2021, the period under intense impact of the COVID-19 crisis, not only in Brazil but in all world (the numerical forecasts and empirical data are cataloged in

Table A2, in

Appendix A). For example, the Brazilian economy grew by 1.14% in 2019, declined by 4.1% in 2020, and expanded by 4.6% in 2021. These growth rates were atypical for the characteristics of the Brazilian economy’s macroeconomic structure, as introduced in the DM and EM models. DM forecasts are feasible during an economic stability period, a situation the Brazilian economy has not experienced since 2015. Despite that, the GPD growth rates forecasted by the DM were satisfactory for 2018 to 2023, approaching the average of the backtest points, as seen in

Table A2,

Appendix B. From 2019 to 2022, the DM forecasts stress increasing growths for the Brazilian economy (as the following values: 0.782; 1.473; 2.196; 2.562) and from 2024 to 2026, the DM forecasts emphasized decreasing growths for the Brazilian economy (as the following values: 2.271; 1.696; 1.098; 0.349). By contrast, the EM model is stochastic, and it can be feasible for forecasting during periods of economic instability in scenarios characterized by stochastic innovations interposed by international or domestic political and/or economic disturbances. Therefore, their forecast similarly captures the strong effects of COVID-19 in 2020, as demonstrated by the backtest points. After 2022, the EM model captures a consistent growth in the GDP, evolving from 2022 to 2026, gradually from 1.645 to 2.831, as shown in

Table A2,

Appendix B.

The Brazilian economy lacks consistent foundations for its growth. Industrial production stagnated due to a lack of specific technological development and investment policies. It survives due to expansionist policies caused by incentive programs that increase the economy’s liquidity. A continuous increase in labor income is a stimulus to consumption caused by programs that expand social benefits, such as the release of extraordinary withdrawals of FGTS resources by workers and the anticipation of the 13th salary for retirees and pensioners. In that scenario, the GDP growth of the Brazilian economy from 2023 to 2026 is expected to be within the forecast range, as predicted by the dynamic models applied in this study: the MD and EM forecasts.

In the graphs on the left, in the second line of

Figure 6, the forecast curves for the SELIC index evolve in a decreasing trend for both forecasts, that one estimated by the deterministic model (DM) and of the one of the stochastic model (EM), throughout the entire forecast period, except for the last DM forecasted year, from 2018 to 2026. The DM forecast is close to the evolution of the sample data used as backtests from 2018 to 2020 but at a level higher than the sample curve of backtest data. From 2020, the SELIC indices used as backtests increased considerably, resulting in actions to contain the inflation increasing due to the rise of the COVID-19 crisis, inverting then the relation of the forecast curve evolution and the backtest data progression, as shown in the left graphs, on the second line of

Figure 6. The EM forecasts evolved in a way entirely similar to those forecasted of the DM; however, at a level considerably higher than the DM forecasts, approaching the backtest points evolution imposed from 2022. This evolution process can also be observed in the graphs of the SELIC growth rate on the right, in the second line of

Figure 6. Both SELIC level and SELIC growth are detailed numerically in

Table A2,

Appendix A, in which the difference between the values of the interest rates predicted by the DM and ME model and the corresponding backtest samples for the period 2018 to 2020 were, in average terms, respectively, of 2.20% and 5.85%. Already, these differences between the interest rates predicted by the DM and ME models for 2021 to 2023 were, respectively, in average terms, −7.85% and −1.70%. These differences indicate a downward trend in empirical SELIC indices for 2018 to 2020, more pronounced than those suggested by the forecast. In short, the forecasts of DM and EM models followed a systematical decrease through the forecast period (from 2019 to 2026).

In the Brazilian economy, interest rates decreased considerably from 2017 onwards, reaching a level never seen before in Brazil of 2%, even during the midst of the COVID-19 pandemic crisis. Given this context, the interest rate forecast rates by both models (DM and EM), linked with a state of stable economy, indicated a less pronounced decline than those practiced by governments until 2021. In Brazil, the impact of the COVID-19 pandemic on the economic process was intense and lasting, with a substantial effect on the production chain and labor market, and inducing a drastic increase in inflationary levels. From 2020 onwards, interest rates rose considerably (from 8.9% in 2021 to 12.75% in 2023) to contain the inflationary process and reorganize the production chain and the job market. Then, what was observed from the graphs of the nominal SELIC index level and its interest rate growth (

Figure 6) was that the applied rates were lower than forecasted before 2020 and higher than estimated after 2020 by the DM and EM models. In short, the predictions established by the model evolved for all variables, always in the direction of the evolution of the samples, in such a way that the deterministic model (DM) forecasted a need to apply from 2018 to 2023 interest rates, on mean, of 5.83%, lower than that used of 8.65%. The stochastic model (EM) forecasted an average interest rate of 10.73%, higher than the average of 8.65% in the backtest data. In that context, the forecasts were consistent.

Regarding the forecasts for the evolution of the nominal inflation index (IPCA) (as for the inflation rate), we observe in the graphs of the first and second figures in the third line of

Figure 6 and in

Table A2,

Appendix B, that the DM model forecasts, for both level and growth rate, were relatively consistent with the evolution of the sample data used as backtests, except for the year 2021, where inflation reached a very high level of 10.38%, already at the end of the intensive disruptive effects of COVID-19; caused by this epidemic and, essentially, due to the high prices of oil and its derivatives worldwide. We also observe that the forecast evolution process occurs in the direction of a deflation process, similar to the backtest indication.

We also stress in the graphs of the first and second sketches in the third line of

Figure 6 and in

Table A2,

Appendix B, the evolutions of the nominal IPCA index levels and their growth rates predicted by the model EM, compared with the backtest values. The forecasted evolution process for the IPCA variable using the EM model aligns with the data points used as backtests from 2018 to 2021, capturing the solid inflationary impact that occurred in 2021 (10.4%). However, from that point onwards, inflation empirically established by backtest data decreases, and a process of decline begins. In contrast, the forecasts set by the EM model maintain the inflation growth forecast and reach its maximum in 2023 (inflation of the order of 13.6% against 4.8% established by the backtests), evolving with a slight inflationary decrease, such that in 2026, the end of the forecast period, the forecast inflation was 10.85%.

As emphasized, the MD model estimations align satisfactorily with the backtests (except in 2021, during the COVID-19 crisis peak), following the decreasing trajectory evolution, as indicated by the empirically established inflation in the backtest data. Unlike the EM model estimation behavior, the deterministic model (MD) indicates a stable forecast evolution.

The discrepancy between the EM model forecasts and backtests after 2021 suggests that they consistently captured the instabilities caused by COVID-19 and the oil price crises from 2021 onwards. This behavior demonstrates the presence of an inflationary process intrinsic to the macroeconomic model in the face of stochastic perturbations, which, if it does not maintain the interest rate (SELIC) higher over the forecast period, can return with force, as suggested by the SELIC forecasts from the EM model, analyzed previously.

We can also stress in the graphs on the right and left sketches, in the fourth line of

Figure 6, the real exchange index and the real exchange rate forecasted (ER) by the DM and EM models from 2019 to 2026, and the backtest data. In those graphs on the right sketch, in the fourth line of

Figure 6, we observe that the real ER index forecast curve obtained by the DM shows a depreciation process in the same direction as the evolution of the empirical data sample used as backtests in the sub-period from 2018 to approximately July/2023; however, at slightly lower levels, without accompanying the depreciation effects of the COVID-19 shocks, with a peak in 2021. From there, the backtest’s evolution takes an appreciative direction while the real ER index forecast curve continues its depreciation process

8.

As for the graph of the evolution of the forecast established for real exchange index (ER) by the EM model (see graphs on the sketch on the left, in the fourth line of

Figure 6), we observe that the predicted evolution processes for these variables coincide with data points used as backtests from 2018 to 2021, capturing the effect of the solid inflationary impact on the exchange index that occurred in 2021. From 2021 onwards, the real exchange index evolves along a path of depreciation, at levels significantly higher than those established by backtests until 2023 and well above the values predicted by the DM. In that process, we observe that the exchange rate forecasts by the EM model absorb the effects of inflation volatility expected by this model at levels much higher than those estimated by the DM.

In the fourth line of

Figure 6, the graphs on the right sketch show the evolutions of the exchange rates’ growth, in percentage terms, for the forecasts and backtests. On average, the estimates for exchange rate growth using the DM between 2018 and 2021 proved satisfactory, except for 2020, which was at the center of the COVID-19 pandemic’s shocks. Nevertheless, from 2021, the backtest sample showed a decrease in the exchange rate (appreciation variation), while the exchange rate forecast by the DM showed an increase in the exchange rate (depreciation variation), with a slightly accentuated slope trend.

In the figure on the left, in the fourth line of

Figure 6, we can also observe the behavior of the exchange rate growth forecast obtained by the EM model. This forecasting process evolves in a manner very similar to the evolution of the exchange rate forecast using the DM; however, at higher levels—that is, predicting a real exchange index more depreciated than those indicated by the DM—in almost the entire forecast period (from 2018 to 2026). Still, they become closer in the period from 2024 to 2026.

In the last line of

Figure 6, we observe the evolution of the forecasts of real Brazilian public debt levels, normalized by the initial GDP value of January 1998 (DLSP), and compare them with the evolution of the levels of the DLSP samples used as backtests. In those graphs, we observed that the real DLSP forecasted by both DM and EM models evolves at entirely satisfactory approach levels relative to the empirical samples used as backtests. This proximity is observed across all coincidence ranges of forecast and backtest data (from 2018 to 2023), during which the public debt exhibits an upward trend. After 2023 up to 2026, the evolutions of the forecasts of DLSP for both DM and EM models maintain a growth trend with the same growth slope, similar to the backtest sample.

4.3.6. Stochastic Bifurcation Analysis

The economic reality of developing countries is much more complex than that simulated by a set of deterministic equations, such as System (29), as it is often an economic process subject to external and internal economic and political shocks. Given this context, we propose a stochastic dynamic system, System (31), to analyze the economy’s capacity to absorb shocks due to stochastic innovations. As noted in Section Forecast Analysis of the Macrodynamic Model Under Stochastic Bifurcation, in

Figure 5, the resolution of this stochastic system generates a set of bifurcating solutions, all characterizing some possible stable solution for the economic process that may occur at some point in its course.

Therefore, in this context, we must estimate the ranges of oscillations of the model’s endogenous variables due both to the stochastic innovations imposed on the model’s uncontrollable coefficients and due to the stochastic innovations absolved by the model, added directly to the endogenous variables, respectively, through the terms h(x(t)) and v(t) of System (31). In that procedure, we will obtain the oscillation ranges of the endogenous variables.

Table 4 below shows the mean disturbances imposed on the random walk added to the endogenous variables, the calibrated noncontrollable parameters, stressed in

Table 2 legend earlier, and the minimum and maximum values of the stochastic distributions applied on the noncontrollable coefficients, emphasized in

Figure 2 legend, and the stochastic disturbances added to the endogenous variables, stressed in

Figure 3 legend. The intervals of stochastic distributions shown in

Table 4 are the maximum supported for the Monte Carlo converged solutions.

The calibrated parameters and the stochastic disturbances range introduced to the noncontrollable parameters, represented by their minimum and maximum parameters, characterize the mean tendency and the shock dispersion amplitudes, respectively. These dispensing intervals emphasize the acceptable variabilities of the uncontrollable parameters in the convergence of the Monte Carlo realizations introduced in the simulations, in which each parameter within that range generates one stable bifurcation solution. The calibrated parameter

characterizes the mean impact of the real interest rate on the GDP equation in the Dynamic System (32), its minimum is the order of

, and its maximum is the order of

. Thus, we estimated the variability range for this coefficient as

We observe in the Relation (39) that the ranges of variation amplitudes for lower and up values acceptable for have to be in the following interval around the : . This is the acceptable variability range for ; therefore, considering the correct economic point of view, to obtain consistent solutions, we need to impose negative values for within the intervals specified above. Thus, we neglect the possible interval of positive values, , which generates a stable bifurcation solution, but this has a positive effect on real interest rates and GDP, which contradicts economic theory.

Therefore, we conjecture here that the variability of , either below or above its calibrated value, is similar the situations to which we keep equal to the calibrated value, making the actual interest rate decrease or increase in the expected change proportion of , respectively, in the ranges ]; i.e., ; neglecting the band of positive oscillations of .

For example, we calculate the average actual interest index for the empirical data period (from January 1998 to December 2018), which is (). With this data, we can now estimate the upper and low limits of stochastic variability caused by . A positive variability on (i.e., a decrease in negative module γ1) causes a diminishing in the interest rate variability. Then, if trends to zero, the decrease in the average of the real interest index, taking the mean of the positive change in , between and upper limit is (, what produces variability in the mean real interest rate, of up to (). Likewise, taking the average increase in negative module , changing from −0.0738184 up to the lower limit, , i.e., () we have a mean change in the real interest rate of (), which may also possible, which allow stable bifurcation solutions.

Therefore, in the example above, a variability in , ranging in , is similar to a mean variability in the real interest index () of , within the context of the identifications established by the estimates of Monte Carlo’s achievements.

We organized

Table 5, shown below. In that table, we present in its first column the variability range estimated for all uncontrollable parameters calibrated. From there, we can analyze the variability intensity that they can accept to generate stable bifurcation solutions in a similar way to Equation (38) for

. In

Table 5, we also show the probability intervals of the negative and positive variabilities related to all uncontrollable parameters generated by the stochastic disturbances estimated on the calibrated coefficients, i.e.,

,

,

,

,

,

,

,

, and

.

When imposing stochastic shocks on the coefficients of noncontrollable impacts and finding the bifurcated solutions (stable), defining the shock bands that yield the signs indicated by macroeconomic theory is convenient. Despite all stochastic noncontrollable coefficients adjusted by the procedure described in

Section 4.3.2, allowing solutions to be stable and generating the convergence for the endogenous variables estimates, it is convenient to use only the one that satisfies the macroeconomic concepts. Thus, proceeding similarly to the example of the forecast, it was possible to induce the variabilities range of the uncontrollable coefficients, choose the feasible coefficients with macroeconomic theory, and associate them with the consistent variabilities for the independent variables, as designed by the macroeconomic concepts. Therefore,

Table 5, in columns two to four, shows the variability band amplitudes for all uncontrollable coefficients, discriminated by positive and negative ranges. This table gives the range estimates of the coefficients’ variabilities in percentages of estimated stochastic disturbances below and above the corresponding calibration coefficients. Remember that these bands of the coefficients’ variabilities characterize the bands of the perturbations accepted in converging the stable bifurcated solutions. Most of the uncontrolled coefficients presented stabilities for feasible solutions, according to economic theory, in extensive bands within the expected signal for the coefficients, as

Table 5 shows. Nevertheless, as can also be seen in this table, we have identified perturbation bands accepted in the bifurcated convergence solutions that differ from the expected signal for the coefficients; however, these bands are quite contracted. In synthesis, as the macroeconomic theory suggests, we will select only the solutions that attain the correct signs.

According to the macroeconomic theory, we consider the stochastic noncontrollable parameters included in the feasible stochastic band obtained in the perturbation process, based on the extensive argumentation stressed in Section Calibration of the Stochastic Dynamic Model Under Stochastic Bifurcation, and neglecting all uncontrollable parameters, all ranges that do not satisfy the macroeconomics argumentations presented in

Section 3.1 and

Section 4.3.1.

For the parameter

, we expect a negative sign. Thus, we constrain the last

Table 5 column that, in the process of generating the stable bifurcations simulation, accepted only

negative values. As can be observed, in the last

Table 5 column, 100% of the stable bifurcation solutions found are in the negative range. At the same time, the parameter

can be

. As explained in

Section 3.1.5, it can be positive for developed economies but negative for developing economies (EMEs). Then, in that case, as in the last

Table 5 column, 78.6% of the stable bifurcation solutions found were with negative stochastic coefficients, and only 21.4% were with positive coefficients. As we used Brazilian economy data, an EME, it is natural that its macroeconomic structure is more compatible with the behavior of other EMEs while also accepting the functional structure of a developed economy (details in

Section 3.1.5).

The parameter

is the output gap impact on the short-run nominal interest rate. Therefore, from the arguments presented in

Section 3.1.3, the more probable sign for

is negative. As shown in the last

Table 5 column, 79.5% of the stable bifurcation solutions found were with negative stochastic coefficients, and only 20.4% were with positive coefficients. Thus, we discard the positive band of

identified in

Table 5. The coefficient

captures the effect of the differential between inflation and the inflation target on the short-run nominal interest rate. In the last

Table 5 column, 100% of the stable bifurcation solutions found were with

negative stochastic coefficients, entirely consistent with the correct view.

The parameter

can be as

, an uncontrolled impact parameter of the output gap on the inflation variation, which probably can be negative for economies in development (EMEs), as explained in

Section 3.1.2. In the last

Table 5 column, 83.6% of the stable bifurcation solutions found were with negative stochastic coefficients, and only 16.4% were with positive coefficients. Thus, we discard the positive band of

identified in

Table 5. While

can also be

, an uncontrolled impact parameter of the exchange rate effect on the inflation variation, which can be negative for economies for EMEs, also explained in

Section 3.1.2. In the last

Table 5 column, 100% of the stable bifurcation solutions found were with

negative stochastic coefficients, entirely consistent with the correct view.

The parameter

positively impacts the real Exchange rate on itself, as explained in

Section 3.1.4. All the stochastic coefficients generated had an oscillating range around the respective uncontrollable parameter; in a way, as in the last

Table 5 column, 71.3% of the stable bifurcation solutions found were with positive stochastic coefficients (correct sign waited, and only 28.7% were with negatives coefficients. Therefore, we discard the negative band of

identified in

Table 5.

The parameter

directly affects the real public sector net debt. This uncontrollable parameter can either positively or negatively affect real public debt (DLSP), as its effect is influenced by domestic and international interest rates, inflation, both domestic and global and the economy’s growth rate, as explained in

Section 3.1.1. According to the last

Table 5 column, the more probable sign for

is positive, as about 83.6% of the stable bifurcation solutions found had positive stochastic coefficients, and only 16.4% had negative coefficients. However, in that case, we use all stochastic bands of

simulated, including both the positive and negative ranges, since both are possible.

Finally, the parameter

impacts real seigniorage income on the real public sector net debt. As explained in detail in

Section 3.1.1, its sign depends on how it is accounted for, which may vary from country to country. Its sign must be negative in the context of the Brazilian economy. According to the last

Table 5 column, the more probable sign for

is positive, involving 100% of the stable bifurcation solutions found, inducing us to use all range stochastic curves calibration.

Figure 7a presents the two hundred Mont-Carlo realizations predicted for all endogenous variables, with the use of simultaneously additional shocks, in the form of random walk, in the endogenous variables and shocks in the parameters of noncontrollable impacts, maintaining just the selected ranges of perturbations feasible, discriminated by the procedure explains in the above paragraphs.

Figure 7a indicates that the estimated curves simulate a wide range of curve evolutions that can cover all possible forecast processes for all endogenous variables.

It is observed in the histograms in

Figure 7b that all bands of stochastic disturbances for the noncontrollable parameters followed the consistent variability intervals, as shown in

Table 5. To guarantee random generations based on a normal distribution, some of the range of stochastic disturbances of some parameters overlapped small non-feasible bands (bands marked as black) according to the abovementioned criteria. However, for the case of the inconsistent stochastic coefficients, as explained above, they were not used in the estimates of the bifurcated solutions presented in

Figure 7a, whose calculations were eliminated by programming flags.

From the estimations shown in

Figure 7a, we will determine all annual growth rates forecasting for the endogenous variables.

Table 6 below stresses the interval values of the variabilities for all endogenous variables, characterized by their minimum, maximum, and mean. In that table, the minimum and maximum represent the extremist values of the distribution range and the average values (the most probable value of each distribution).

The variabilities in the endogenous variables depend significantly on the positive and negative oscillations on the stochastic innovations, both on parameters and the random walks added to the endogenous variables. These stochastic innovations interfere with the economic process over time, which can cause virtuous or contractionary cycles and can change any perspective determined by the economy’s structure. Generally, these random innovations allow us to simulate an effect set due to crises in the world economy, such as, for example, COVID-19, which lasted from 2020 to 2023, the Russia-Ukraine war, which began in 2022 and continues to this day, as well as economic and/or political crises in the domestic economy. These crises exacerbate the economy’s instability and divert it from its natural process, as determined by its structure. These real-world effects may be simulated by the stochastic innovations introduced in the model and estimated by their behavior. However, we must identify the types of shocks and their intensities in the economic process to calibrate the dynamic model to establish forecasts consistent with the real economy.

Firstly, we emphasize that our primary goal in applying this dynamic stochastic model is to determine the stability conditions of the model when facing introduced stochastic innovations, both in the uncontrolled coefficients and in the addition of a random walk to the endogenous variables. Regardless of the type of stochastic innovation introduced to the model structure, it has specific effects on parameters and macroeconomic variables, which are then propagated to all other endogenous model variables. Therefore, precisely, due to this dynamic, the more important thing to do is to estimate the chocks’ ranges for which the model maintains its stability consistently with the macroeconomic theory, i.e., determine the intervals for the uncontrolled parameters and the random walk amplitudes, in which the model structure may be possible of forecasts.

We now analyze the forecasted growths for the Brazilian economy (GDP) that had a satisfactory confluence, in mean terms, with the backtests’ growth rates, except for those subjected to the intensive effect of COVID-19 (2020 and 2021). In mean terms, the GDP growth rates’ forecasts converge to the realized backtest data for 2019, 2022, and 2023, stressing a consistent evolution process over the forecast period (from 2019 to 2026), with growth rates oscillating in the forecast period in the range 1.86% to 3.30%, with a mean relatively higher than of that emphasized by the backtests, respectively, 2.55% and 1.53% per year. These forecasted results are similar to those presented by the Brazilian economy in recent years.

Relative to the nominal interest rate index (SELIC), a variable established by government agents with a base in expected inflation, the predictions evolved relatively out of alignment with the backtest data, essentially from 2020 to 2023. However, as argued previously, interest rate implementation policies in Brazil have been inappropriate since 2016, when the SELIC reached a very high level. Since 2017 (following a very high level reached by SELIC in 2016), Bacen implemented an expansionist policy to mitigate the effects of the lack of control in the productive sector of the economy due to the political crisis in the country; however, this process was conducted without harmony between the macroeconomic variables of the economic process.

The implemented expansionary monetary policies aimed at resuming economic growth, thereby sustaining an unsustainable credit and consumption expansion cycle. The interest rates decreased considerably from 2017 onwards, reaching a level never seen before in Brazil of 2%, even during the midst of the COVID-19 pandemic crisis. In this context, where economic policies aimed solely at increasing production in an expansionist process, there was an intense mismatch in the Brazilian economic process that intensified during the COVID-19 pandemic, with substantial effects on the production chain and the job market, inducing a drastic increase in inflationary levels. Starting in 2020, to contain this disjointed process, the government raised interest rates considerably (8.9% in 2021, 13.85% in 2022, and 11.75% as expected in 2023) to contain the inflationary process and reorganize the production chain and the labor market. The disjointed evolution of the SELIC context is illustrated by the fluctuations in the backtest data of growth rates from 2019 to 2023, which exhibit significant increases and decreases. However, the forecast SELIC growth rates evolve in a nearly constant manner, with a mean growth rate that is very similar to the backtest growth rates (the forecasted mean is 1.246% per year, and the backtest growth rate is 1.25% per year). The forecast results suggest that the political process governing interest rates in the Brazilian economy could be better managed, with less impact on all macroeconomic variables and fewer consequences for the country’s social and industrial processes.

This disjointed context imposed on the nominal SELIC index affects the integrated macroeconomic variables similarly, such as the IPCA index, the exchange rate (ET), the GDP growth rate, and even the public debt (DLSP), which depends heavily on the interest rates established and the exchange rate. Given this context,

Table 6 shows that the forecasts for all mean of these endogenous variables evolve gradually, with almost constant growth rates with behaviors similar to the forecasted SELIC growth rates. The observed growth rates, used as backtest data, exhibit behavioral disjointed growth rates, similar to those observed regarding the SELIC growth rates, which are wholly disconnected from a process of gradual evolution.

Relative to the inflation growth rate (IPCA rate), their forecasted growth rate evolves approximately constantly, increasing to generate a mean growth rate of 2.30% per year. In contrast, the growth rates of the data backtest periods are 0.20% per year, significantly less than those forecast by the model. In the same way, the forecasted exchange growth rates also evolve similarly to the SELIC growth rates, at an almost constant rate, which has a mean depreciation rate equal to 2.29% per year, while the backtest data, in the period from 2019 to 2023, cause a depreciation of 6.43% per year. These results align with macroeconomic theory, as the Fisher effect suggests that countries’ currencies with relatively high nominal interest rates tend to depreciate, reflecting expected inflation rates and the risk premium for investors in the country. This effect links exchange rate volatility to variations in interest rates and inflation. Therefore, we can infer a relationship between exchange rate depreciation and the increase in nominal interest and inflation rates, as observed in the forecast results and the backtest data. Following the same logic as the other variables analyzed above, the public debt growth rates (DLSP) predicted for the period from 2019 to 2026 evolve with gradual growth rates, with an average rate of 3.75% per year, while the growth referring to backtest data (from 2019 to 2023), as well as for the other variables, evolves in a disjointed manner, with an average growth rate of 8.36% per year.

Finally, even in times of crisis, the imposition of interest policies with strict and inflexible values can have a negative impact on the entire economic structure, as observed through the analysis presented here. Our forecasts with the dynamic model indicated an interest rate increase since 2019, as seen in

Table 6. With these results estimated by the model, we can conjecture that gradually evolving interest policies are a way to solve the negative impacts on the economic process, specifically in the social and industrial aspects. In conclusion, we observe in

Table 6 that all growth rates of the endogenous variables used as backtesting (from 2019 to 2023) are included, respectively, in their forecasted intervals, for which the model demonstrated to be stables, facing all kinds of stochastic innovations. Therefore, the dynamic model implemented here demonstrated robustness in all aspects, determining all stable situations under which the dynamic model structure may prevail.