1. Introduction

Most countries seek to join economic blocs to achieve several goals, the first of which are commercial goals to achieve access to international markets with the aim of maximizing the value of exports. The dynamic effects of this may extend to increasing investment and production internally and achieving benefits from economies of scale on one hand. By joining economic blocs, countries also aim to enhance the import environment to achieve efficient foreign trade operations, which is reflected in the level of well-being with regard to the import of final goods, the prices of which are supposed to decrease due to reducing or eliminating tariffs within the framework of the economic bloc or fostering the process of importing intermediate inputs for domestic production.

Export orientation is considered the best policy to confront structural imbalances in the trade balance. Among the measures taken by Egypt to increase exports is joining many bilateral and multilateral trade agreements. This trend increased with Egypt’s accession to the World Trade Organization (WTO) in 1995. The most important agreements are common market for eastern and southern Africa (COMESA), the greater Arab free trade area (GAFTA), the European Partnership Agreement (EU), Mercosur, and the Agadir Agreement. It should be noted that most of these agreements did not succeed in achieving a boom in Egyptian exports in a way that would enable them to reduce the trade balance deficit, according to most studies that evaluated the effects of trade agreements, whether on the performance of Egyptian exports, the position of the merchandise trade balance, or the value of the domestic currency (Egyptian pound) over time.

Among the factors affecting the benefits of any country joining an economic bloc, regardless of its level of liberalization, is the formulation of the country’s customs policy, whether at the level of customs tariffs or customs procedures, which affect the cost of cross-border trade. This raises several questions about the distinction between customs policy and customs tariff policy, as customs tariff policy varies according to the level of integration, so the primary goal of customs policy planning is to maximize the benefit from joining economic blocs.

Customs policies have been linked to the development of international trade. Historically, customs duties were primary revenue sources for governments. However, with the rise of globalization and regional trade agreements, the focus of customs policies has shifted towards trade facilitation and economic integration. Regional trade agreements (RTAs), such as the European Union (EU), the North American Free Trade Agreement (NAFTA), and the Association of Southeast Asian Nations (ASEAN), have significantly influenced customs policies in their respective regions (

Baldwin 2006).

The research problem is that despite the multiple economic blocs and regional trade agreements that Egypt has joined, especially after its accession to the World Trade Organization in 1995, they have not achieved the results expected of them in terms of impact on the balance of merchandise trade or on the performance of exports, noting that all of these blocs did not reach the stage of the customs union, and therefore, it did not reach the stage of the common market (even if the bloc is called a common market), which makes the level of integration of the economic blocs that Egypt joined either preferential trade agreements (PTAs) or free trade areas (FTAs) and, thus, this research aims to analyze the relationship between customs policy and the economic blocs in Egypt, with the aim of preparing a proposed framework for designing customs policy that maximizes the benefit of Egypt’s joining any new bloc, especially with Egypt’s joining to the BRICS bloc. So, this research investigates how customs policies can be designed and implemented to maximize the benefits of RTAs, focusing on trade facilitation, cost reduction, and improved economic integration.

Based on the foregoing, the research will be divided into eight sections, after the introduction, the theoretical background and the literature review, which consist of four sub-sections, then the third section of the analysis of the trade performance in the economic blocs to which Egypt is a member, the fourth section is the methodology of the study, the fifth section is results and findings of the study, the sixth is discussion followed by the conclusion of the study, the eighth section is a proposed strategy for developing the customs policy to achieve the most benefits from economic blocs, and finally, the limitations of the study and trends for future researches.

2. Theoretical Background and Literature Review

Many applied studies and international economic organizations have focused on the impact of customs policy on the performance of international trade. The World Bank’s Doing Business reports emphasize the importance of efficient customs procedures in promoting trade (

World Bank 2020a).

The country’s customs policy controls a number of procedures that affect international trade flows, as the customs policy is responsible for aligning customs procedures and regulations with the rest of the world to facilitate trade flows. Also, the harmonized customs procedures can improve trade efficiency and reduce non-tariff barriers (NTBs) (

Grainger 2011). Electronic data interchange (EDI) and automated customs systems have been crucial to the process of modernizing customs processes, as the improved technology has a positive impact on reducing customs clearance times (

Hollensen 2014).

Regarding the trade flows,

Eurostat (

2020) found that intra-EU trade volumes increased after the implementation of harmonized customs procedures. Also,

World Bank (

2020a) found that the reduction in customs clearance times within the EU has been significant. The average time for customs clearance decreased from 2.4 days in 2005 to 1.2 days in 2019. Also, harmonized customs procedures have led to a reduction in both tariff and non-tariff barriers. The average tariff rates within the EU decreased from 3.6% in 2005 to 2.1% in 2019 (

WTO 2020).

Regions that have adopted advanced customs technologies, such as ASEAN, report improved efficiency and transparency in customs operations. The ASEAN Single Window initiative, which allows for electronic submission of customs documentation, has significantly reduced clearance times and enhanced trade facilitation, which has resulted in significant efficiency gains. Data from the ASEAN Secretariat indicates that the average customs clearance time decreased by 40% following the implementation of the ASEAN Single Window (

ASEAN 2019).

Several studies have examined the impact of customs policies on trade.

Freund and Rocha (

2011) found that improvements in customs procedures significantly enhance trade flows in Sub-Saharan Africa. Similarly,

Wilson et al. (

2003) highlighted the positive effect of trade facilitation measures on global trade. Studies focusing on RTAs, such as (

Baier and Bergstrand 2007), emphasize the importance of reducing trade barriers to maximize the benefits of RTAs.

This chapter consists of four main parts. The first is the evolution of economic blocs and economic integration, then the distinguishment between customs policy and tariff policy, the third part is the role of unified customs tariff in economic blocs, and finally, the recent trends of New Regionalism.

2.1. Economic Blocs and Economic Integration

Countries seek to achieve accelerated rates of economic development so that the role of international trade appears to stimulate domestic production, investment, and employment by increasing exports as one of the expected results of trade liberalization. Therefore, most countries aim to engage in economic blocs to achieve maximum possible economic benefits. Despite the differences and diversity of motives for joining economic blocs, the economic motives mentioned above remain among the most important factors in explaining the growth of economic blocs, while not neglecting the role of political factors in their formation (

Shiells 1995).

Although the WTO has adopted the basic principle of national treatment and non-discrimination, it has approved an important exception through Article 24 of GATT, allowing member states to join RTAs or economic blocs that enable them to gradually liberalize or integrate customs tariffs among their members while maintaining a different tariff towards countries outside the bloc, even if they are members of the WTO (

Krishna 2012).

According to (

Balassa 1976), economic integration goes through several stages, the lowest degree of which begins with trade integration, which means the liberalization of restrictions on cross-border flows of goods between members of the bloc. This is achieved either in PTA or in FTA and reaches the highest degree in the Customs Union (CU). The second level includes the integration of factors of production, which means the complete liberalization of the movement of factors of production between the member states of the bloc, which is achieved in the common market stage. The highest stage of integration is known as policy integration, which involves coordinating the economic policies of the bloc’s member states, and finally, complete economic integration, which includes monetary unity, and considering the bloc as one country, noting that the state of complete integration was not achieved except in the European model.

The customs union is considered the highest degree of trade integration, as the starting point in the integration stages is the preferential trade agreements, which include the gradual reduction of customs tariffs in accordance with the schedules of mutual obligations between member states with the aim of increasing international trade flows. The next stage is the free trade area stage, which includes the abolition of customs tariffs between member states, although some countries have the right, in accordance with the provisions of the GATT agreement, to retain the customs tariff for some products that represent a certain sensitivity to the state’s economy. The customs union includes, in addition to the complete abolition of customs tariffs between member states, the existence of a unified tariff for the union towards other countries.

The European model is considered the most prominent in the economic integration experience because it is the only one that has reached the peak of the stages of economic integration. North America also witnessed the NAFTA agreement, and South America witnessed the Mercosur bloc. As for the continent of Africa, it witnessed many blocs, perhaps the most prominent of which is the COMESA, and African blocs are witnessing an attempt at continental integration within the framework of the African Continental Free Trade area (AFCFTA), which is an agreement for the African continental free trade area, in addition to many agreements such as GAFTA, the Gulf Cooperation Council (GCC), and the ASEAN Agreement.

According to the database of the Committee on Regional Trade Agreements of the WTO, which refers to any economic bloc at different stages starting from the preferential trade agreement and ending with complete economic integration with the term regional trade agreements, the number of RTAs registered with the WTO reached 362 agreements in December 2023 and has been active since 1948. Below is a simplified analysis of the most important features of the evolution of regional trade agreements.

The number of RTAs reached 29 between the 1950s and the launch of the WTO in 1995.

The period (1995–2000) witnessed the launch of 47 new RTAs.

The period (2000–2023) witnessed the launch of 286 new RTAs, which means that approximately 80% of RTAs were established during that period.

The number of RTAs that reached the customs union stage was only 12, which represents only 3% of the total RTAs, and only one RTA, the European Union, reached the stage of full integration.

2.2. Customs Policy and Tariff Policy

Customs policy is considered part of economic policy and is a set of procedures and arrangements affecting the country’s foreign trade sector. Traditionally, customs policy is seen as synonymous with tariff policy, which means using customs taxes to influence a country’s foreign trade flows. Customs taxes are usually used to protect local industries by increasing the cost of imported products, in addition to their main role as a source of government revenue (

Shebl and Jabbar 2023).

Considering the commitments imposed by the WTO regarding the gradual reduction in customs tariffs with the aim of liberalizing international trade, there has been a role for the new protectionist policy through non-tariff barriers (NTBs), which countries can use to restrict imports.

Although non-tariff barriers include many procedures that are not subject to customs jurisdiction, customs clearance procedures also include many hidden restrictions, such as customs valuation and inspections. Accordingly, customs tariff policy has become part of the comprehensive customs policy, which includes all procedures related to the customs clearance process, from the point of entry of goods into the port until its customs release.

NTBs are a set of procedures related to the customs release of goods other than customs tariffs, which have an economic impact on trade flows due to the increase in costs associated with the trade process. Most of these measures are often interpreted as aimed at protecting health, safety, and the environment in importing countries. However, practical reality indicates its use for protectionist purposes by increasing the degree of complexity of trade procedures associated with these barriers (

UNCTAD 2022).

Despite the impact of customs policy on international trade flows, its role as a fiscal policy tool cannot be overlooked, especially in developing countries, as it has a direct impact on customs revenues as a component of the country’s public revenues.

The features of customs policy have changed over time, as targeting the gradual liberalization of customs tariffs is no longer the cornerstone of customs policies for many reasons, such as:

A reasonable reduction in customs tariff schedules for each country at the global level has been achieved.

The importance of logistics costs and their role in explaining international trade flows is increasing.

Increased reliance on new protectionist policy tools as a means of overcoming countries’ obligations of trade liberalization to the World Trade Organization.

The importance of international competitiveness in attracting FDI and the impact of complex customs procedures on international foreign investment flows are increasing.

Together, these reasons have led to an increase in the relative importance of trade facilitation programs (TFPs) in customs policymaking, which has led to a change in the relative weights of policy targets towards more focus on reducing the customs clearance time at the expense of neglecting to reduce customs tariff rates (

Morini et al. 2021).

The importance of customs policy emerges when discussing international economic blocs because customs administrations are practically responsible for implementing preferential trade agreements, as well as free zones and customs unions, noting that the first and second types represent most of the regional agreements at the international level, and the role of customs administrations is not only collecting taxes and other fees but also includes customs valuation, inspection, and all procedures related to the crossing of trade across borders (

Zielinski 2017).

The WTO’s trade facilitation program (TFP) focused on customs and border crossing procedures with regard to documents, requirements, the method of processing documents, the physical movement of shipments, and electronic facilities, as they have a direct impact on the cost of trade. The World Customs Organization (WCO) also focuses on improving the effectiveness and efficiency of the customs administrations of its member states by creating the necessary tools to reconcile, standardize, unify, and simplify customs systems in different countries (

Salman 2002).

Based on the foregoing, the importance of procedural and practical aspects should not be overlooked in explaining the success of regional blocs in terms of customs clearance mechanisms other than customs tariffs. As customs tariffs may be completely removed, the cost of cross-border trade is an impediment to trade. Recent trends in interpreting global value chains (GVCs) also indicate that trade facilitation has become one of the most important infrastructure pillars necessary to attract FDI by reducing the costs associated with cross-border trade (

Takpara et al. 2023).

The World Bank has provided an annual report since 2003 on the performance of business (Doing Business), which is an index that ranks countries in the world in terms of the ease and institutionality of doing business. It consists of several sub-indices, including the cross-border trade index, which includes all costs associated with the import and export processes other than tariffs. Customs duties, freight costs, and insurance once again indicate a change in the relative weights of customs policy targets in favor of the customs clearance time index at the expense of the customs tariff index. Egypt came in position (114) out of 190 countries according to the 2020 report on the Doing Business Index. It is worth noting that the Trading Cross Borders sub-index came in at 170, which indicates its role in lowering the overall ranking of Egypt’s Doing Business Index, as it is the worst-ranked sub-index (

World Bank 2020b).

2.3. Unified Customs Tariff and Economic Blocs

The first stages of economic integration, whether preferential trade agreements (PTAs) or free trade areas (FTAs), include reducing or eliminating tariff restrictions on trade between member states. Thus, each member state in the bloc maintains a separate national customs tariff policy towards countries outside the bloc. Therefore, joining the bloc in this case requires a change in the customs tariff policy towards countries within the bloc by reducing or canceling the customs tariff only.

The Customs Union (CU) includes a change not only in the structure of the customs tariff within the bloc but also requires the existence of a unified customs tariff policy for countries outside the Customs Union. This matter may extend to coordination regarding the unification of customs clearance systems. Therefore, it can be said that the customs union is the first stage of economic integration that witnesses the coordination of customs policy among the member states of the union and that customs revenues might be shared through a mechanism agreed upon within the framework of the union agreement (

Zielinski 2017).

Although regional trade agreements (RTAs) have increased significantly in the 21st century, customs unions represent only a small percentage, not exceeding 3.3% of the total agreements, as the WTO has registered 12 customs unions as of December 2023. Perhaps one of the most important reasons for the difficulty of transforming free zones into customs unions lies in unifying the external customs tariffs of the union countries towards the world, which is faced with political considerations for the members of the bloc that differ from each other, and because of the difficulty of agreeing on the mechanism for sharing the customs revenues of the customs union (

Clausing 2000).

Many applied and empirical studies also confirm that the negotiation process plays a pivotal role in establishing customs unions, which is considered the main barrier to crossing the free trade zone towards deeper stages of economic integration (

Alimbekov et al. 2017).

Wang (

2014) found that effective customs administration can contribute to the success of the East Asian Customs Union by performing a set of functions, in addition to collecting customs taxes on a unified basis. Among the most important of these functions is the role of the customs policy of the countries of the Union in combating the smuggling of goods across borders, facilitating cross-border trade operations, encouraging change in the tax systems of the union members to unify the trade-related tax treatment, and paving the way for coordinating the national policies of the union countries.

Kormych (

2018) indicates that the success of regional agreements in general, including customs unions, does not depend only on the abolition of tariff restrictions between the countries of the bloc; rather, it requires the need to focus on simplifying and standardizing the procedures related to the crossing of trade across borders, as well as unifying technical requirements and developing mechanisms for the flow of information and documents related to trade.

2.4. Recent Trends in New Regionalism

The concept of regionalism was linked to the concept of regional integration according to the writings of (

Viner 1950;

Balassa 1962), as it represents successive integration stages starting with the preferential trade area until reaching complete economic unity, based on geographical contiguity, which the reality indicates that economic blocs have emerged without the geographical contiguity condition. This means that the bloc is available to join whenever the conditions specified by the agreement are met, which is known as New Regionalism (

Frankel and Wei 1998).

Although the phenomenon of establishing regional economic blocs is not recent, the recent trends in New Regionalism have a set of characteristics that differ from Traditional Regionalism (

Esteradeordal et al. 2001), including:

Regional blocs have become multi-faceted and do not target only economic goals.

The new regional blocs focus on non-commercial economic goals such as areas of investment, scientific and technological cooperation, international finance, and environmental issues.

New Regionalism focuses on FDI.

New Regionalism arrangements seek to increase integration into the global economy and not isolate themselves into a specific geographical region.

The concept of New Regionalism is a dynamic concept that goes beyond commercial goals to include political goals such as the case of the European Union, ASEAN countries, Mercosur, and finally, the BRICS bloc, which began politically and has not yet reached preferential trade arrangements. It also includes complementary initiatives at the economic level in addition to preferential trade agreements. New Regionalism also includes the establishment of institutions to manage and facilitate regional integration, such as investment funds and financing programs, the establishment of dispute settlement mechanisms, facilitation of FDI flows, and coordination of the bloc’s members’ macro policies (

Abdel-Lawi 2015).

One of the characteristics of New Regionalism is that it is built on economic and technological foundations and not on ideological and geographical foundations. For example, the BRICS bloc is considered a model that describes most of the features of New Regionalism, which is characterized as a multi-objective process as it seeks to achieve multiple political and economic goals. It is not limited to commercial objectives only, as in addition to commercial issues, it also focuses on FDI flows and international financing, scientific and technical cooperation, and cooperation in the fields of health and climate change issues. The New Regionalism arrangements are characterized by the geographical overlap of its members, as member states in the bloc combine membership in more than one bloc at the same time (

Wheeler 2008).

BRICS is considered an embodiment of the fundamental differences between Traditional Regionalism and New Regionalism, as New Regionalism focuses on the convergence of interests of bloc countries as a basis for its formation, regardless of geographical proximity, while Traditional Regionalism focuses on geographical proximity or ideological convergence as a basis for achieving integration, such as the two cases of the union. The European Union and the Greater Arab Free Trade Area, regardless of the difference in the level of results reached in both examples (

Burfisher et al. 2004).

It is worth noting that the BRICS bloc has unique characteristics. In terms of geographical presence, we found that BRICS includes members who are geographically distant. Although there is relative geographical proximity among China, India, and Russia, this matter is very different in Brazil and South Africa. The difference between the BRICS members was not only geographical. Rather, the political systems, as well as local economic structures and the background of the local economic systems, differed. Despite this, these countries represent emerging countries that hope to reshape their global economic systems.

Regarding the spread of regional blocs that fall under the concept of New Regionalism, the number of agreements that include preferential arrangements regarding both goods and services has reached 194 agreements according to the WTO’s database of regional agreements, which represents about 54% of the total regional agreements. The phenomenon of geographical dispersion of blocs within the framework of New Regionalism can be clearly observed in many blocs, such as Egypt’s agreement with Mercosur, the FTA agreement between the USA and Singapore, the South Korea–Chile agreement, the China–New Zealand agreement, the Jordan–Singapore agreement, and the FTA between the USA and Australia.

The IORA Union, which refers to the Union of Countries overlooking the Indian Ocean, began with Indian leadership since its establishment in 1997 and now includes 23 countries in Asia and Africa. The matter has even been extended to include membership in France, Australia, and South Africa so that the agreement falls within the concept of New Regionalism. The spread of New Regionalism based on geographically distant blocs, or whose formation depends on non-geographical foundations, has contributed to the emergence of the term geo-economic fragmentation (

Aiyar et al. 2023).

3. Egypt and International Economic Blocs

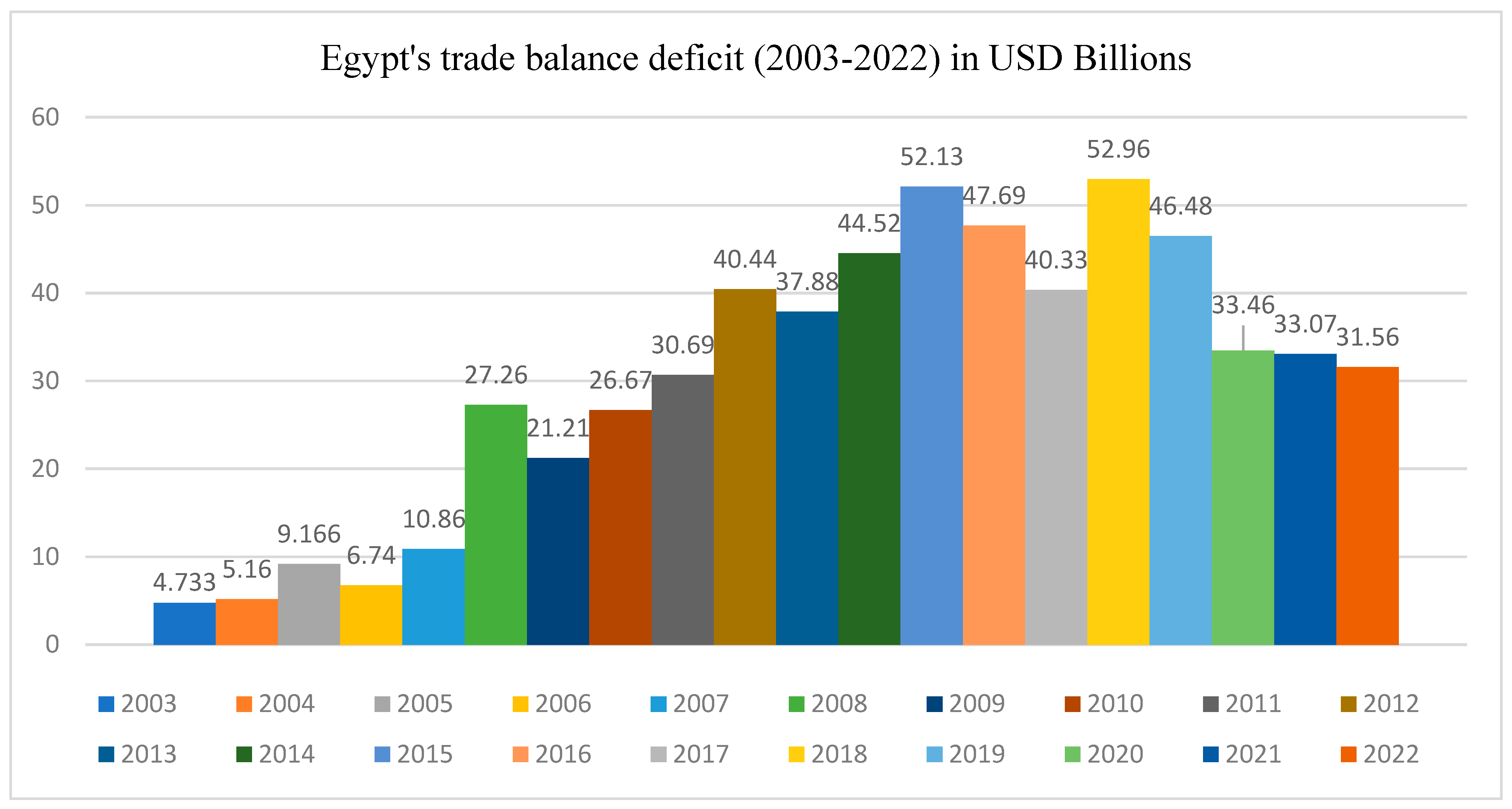

The Egyptian economy suffers from a chronic and structural deficit in trade balance due to the increase in Egyptian imports at rates greater than the increase in exports. It is clear from

Figure 1 that during the period (2003–2022), the deficit increased over time.

It is worth noting that dealing with the structural deficit in Egypt’s trade balance by reducing imports may conflict, in the Egyptian case, with the development strategy, given that Egyptian imports contain a large proportion of capital and intermediate imports necessary for domestic production, in addition to the inevitable imports, represented by food imports, which are difficult to achieve self-sufficiency, especially with the water poverty that Egypt suffers from, such as grains, oils, meat, and Egyptian imports, including mineral fuel and its derivatives (the most important of which is diesel). Therefore, treating the structural deficit in the trade balance by reducing imports is inconsistent with achieving economic prosperity, especially since the volume of Egyptian imports is not considered exceptional compared to the development of the volume of economic activity as well as the population.

Therefore, the structural problem lies in the sources of financing for imports through foreign exchange. Historically, USD sources other than those linked to exports have been used to cover the deficit, such as service exports and short-term and long-term capital flows, which is nothing more than a temporary mechanism that does not rise to the rank of radical solutions. It is concluded from the above that the optimal treatment for the structural imbalance in the trade balance depends on a national strategy to increase exports. Since the problem of market access to foreign markets is one of the important determinants of the export strategy, there is a need to discuss the role of preferential trade agreements (PTAs) and regional trade agreements (RTAs) as incentives to increase the ability of the country’s domestic products to penetrate foreign markets, especially since regional economic blocs have become one of the features of the global economic system.

There are many motives for countries to join trade agreements, and the theoretical background of these motives goes back to the classical theory of trade, as free trade achieves mutual gains for all parties, and practical experiences indicate that some countries achieve static gains in the form of improving the process of allocating economic resources, while dynamic gains appear as a result of entering into regional agreements by stimulating investment resulting from the growth of exports resulting from the reduction or elimination of customs barriers through trade agreements. For countries that are relatively small, the main motivation for joining trade agreements is to achieve a greater degree of access to foreign markets by mitigating or eliminating customs barriers (

Kumar 2017).

To maximize Egyptian exports, the Egyptian trade policy after joining the World Trade Organization (WTO) in 1995 tended to involve more in trade agreements with the aim of facilitating the access of Egyptian products to global markets. The agreements varied between bilateral agreements with many countries, such as Syria, Morocco, Turkey, and Jordan, as well as among multilateral agreements. At the Arab level, Egypt participates in the Great Arab Free Trade Agreement (GAFTA), and on the African level, Egypt is a member of the Common Market for Eastern and Southern Africa (COMESA). On the level of European and Euro-Mediterranean relations, Egypt is a member of the Egyptian–European Partnership Agreement (EU), as well as the Agadir Agreement, and other 9 agreements.

Table 1 shows the current trade agreements to which Egypt has joined, and it can be concluded that all trade agreements have not gone beyond the stage of the free trade zone. Even if the COMESA agreement is called a common market, it expresses the goal that the bloc aims to achieve.

Despite the multiplicity of agreements and the passage of more than 20 years since they came into force, the Egyptian trade balance has not witnessed an improvement that can be attributed to an export boom. Regardless of the reasons for this, the feasibility of joining new trade agreements should be evaluated, and the export and import sectors should be diagnosed. Based on historical data on trade with the member states in those agreements, as well as reviewing the applied tariff tables, these aim at extracting the most important recommendations for policymakers in the field of determining mutual obligations between the member states of any new trade agreement. By observing the absolute and relative values of Egyptian exports to a group of regional blocs to which Egypt joined, considering the year 2022 and the base year 2005, with regard to the GAFTA, COMESA, European Union, and Turkey agreements, and considering the year 2015 as the base year for Mercosur due to Egypt’s accession to it in 2018, we note the following values (

Table 2).

Considering the most important export sectors for the year 2022 as a percentage of total Egyptian exports, as well as the contribution of the selected sectors to total exports for each agreement, eight sectors were relied upon to represent the primary sectors, without specifying the sectors that include low-value-added industries, such as grain preparations, food preparations, and metal-based industries. Despite the low degree of value added in these industries as exports, they represent an industrial value added, even if their relative weight to total exports is low (

Table 3).

It can be concluded that as long as export sectors are concentrated in primary sectors, which are characterized by low added value, they are not often burdened with high customs tariff restrictions in international markets, which makes cost–benefit analysis results not in favor of regional trade agreements in the case of primary sector exports.

To confirm this, it is possible to analyze the BRICS markets as it is the most recent bloc that Egypt has joined, especially since no preferential trade agreement has yet been formed. Among the five BRICS countries, India accounted for 58% of the total Egyptian exports to the BRICS during the period (2003–2022). It would be appropriate to identify the highest products exported from Egypt to India in terms of value and obtain the actual customs tariffs applied for each product separately in order to avoid falling into bias errors resulting from average tariffs.

Applying 2021 data as an example, it becomes clear that Egypt’s exports to India this year are estimated at about USD 2.327 billion, 52% of Egypt’s exports to BRICS, which amounted to about USD 4.49 billion for the same year. By reviewing the sectoral distribution of Egyptian exports to India, sector No. (27) of mineral fuels and mineral oils represents about USD 1.759 billion, representing about 75% of Egyptian exports to India, which imposes an average tariff applied to the whole sector of about 9.9%, but by reviewing mineral fuel and mineral oil sector sub-items, it turns out that Egyptian exports are limited to two items from this sector: (270,900 crude oil) and (271,111 natural gas), and the customs tariff applied to the two items was (0%, 2.5%), respectively, which means that relying on the average tariff imposed on the entire sector may lead to misleading results (

Trade Map 2024).

Therefore, the customs tariffs applied by India on Egyptian exports are relatively low, as the average tariff imposed on the entire sector includes sub-products that are not included in Egyptian exports to India, which explains the difference between the average tariff calculated on the export sector as a whole and the actual tariff applied to exported sub-items, indicating a low possibility of a positive impact of the BRICS preferential trade agreement, if established, on Egyptian exports with respect to existing export products. However, the possibility of a preferential trade agreement’s impact on other export sectors stimulated by tariff reductions cannot be ignored if it is implemented.

4. Methodolgy

The model of the study aims to analyze the impact of customs policy procedures, such as (customs clearance time, tariff barriers, non-tariff barriers, RTAs, and digital adoption) on Egypt’s foreign trade with economic blocs’ partners from (2001–2023); the chosen blocs are (AFTCTA, BRICS, COMESA, Mercosur, EU, Turkey, and United Kingdom). Based on data availability, the model takes the following form:

where:

Trade Balanceit: is the dependent variable representing the trade balance between Egypt and RTA partners at time (t).

Customs Clearanceit: represents the customs clearance score for Egypt at time (t).

Tariff Barriersit: represents the tariff barriers between Egypt and RTA partners at time (t).

NTBit: represents the non-tariff barriers between Egypt and its RTA partners at time (t).

RTAit: is a dummy variable that equals 1 if Egypt is a member of an RTA at time (t), and 0 if not.

Digital Adoptionit: represents the government technology adoption in Egypt at time (t).

a: is the intercept.

(B1, B2, B3, B4, B5) are the coefficients to be estimated.

eit is the error term.

These variables were selected based on the positive effects they have shown on trade volumes between member states of RTAs, which was covered in the historical background, as efficient customs clearance processes, lower tariff barriers, and the reduction of non-tariff barriers (NTBs) are crucial for maximizing the benefits of regional trade agreements (

Portugal-Perez and Wilson 2012;

Baier and Bergstrand 2007;

Cadot et al. 2012). Additionally, the adoption of digital technologies in customs procedures further enhances trade efficiency and effectiveness (

Hummels and Schaur 2013). Moreover, the alignment of customs policies with regional trade agreements (RTAs) is essential to fully realize the potential of such agreements (

Medvedev 2010).

The model’s data will be collected from the following sources as shown in

Table 4.

The model uses panel data to account for both cross-sectional and time-series variations, as it allows for more comprehensive insights and controls for unobserved heterogeneity. The following estimations and tests will be conducted using EViews 12 Software:

Diagnostic Tests: Conduct diagnostic tests for heteroscedasticity, autocorrelation, and multicollinearity to ensure the validity of the model.

Hausman Test: Conduct the Hausman test to determine whether the fixed effects or random effects model is more appropriate for the data.

The following is variables descriptive analysis as shown in

Table 5.

5. Results and Findings

First, a diagnostic test was conducted to assure the validity of the model, and the results are as follows:

Serial Correlation: The Wooldridge test for autocorrelation in panel data is conducted, indicating no significant autocorrelation (p > 0.05).

Heteroskedasticity: The Breusch–Pagan test indicates the presence of heteroskedasticity (p < 0.05). Robust standard errors are used to address this issue.

Multicollinearity: The Variance Inflation Factor (VIF) test shows no significant multicollinearity among the independent variables (VIF < 10).

Second, the Hausman test was conducted to determine whether the fixed effects model or random effects model is more appropriate for this analysis, and the results of the Hausman test are presented in

Table 6.

The Hausman test indicates that the fixed effects model is more suitable for analysis. And to ensure the robustness of the results, alternative specifications and estimation techniques are employed. The Generalized Method of Moments (GMM) is used to address potential endogeneity issues. The GMM results are presented in

Table 7.

The results indicate that enhancing customs clearance process, improving the digital adoption of the government, and involving new RTAs could enhance Egypt’s trade balance, noting that the relationship between trade balance and tariff and non-tariff barriers should be considered, as increasing tariffs could lead to a decrease in the imports, which will be reflected in improving the situation of trade balance, and this is not what RTAs are based on, as RTAs depend on decreasing trade barriers between the agreement’s members to achieve mutual benefits. These results confirm the important role of customs policy in influencing international trade, as customs policy must be formulated in a way that improves the country’s benefits from economic blocs and RTAs.

The robustness checks conducted in this study, including alternative model specifications and the use of the Generalized Method of Moments (GMM) to address potential endogeneity, reinforce the reliability of the findings. The consistency of the results across different models suggests that the relationships identified are robust and reflect genuine economic dynamics rather than being artifacts of the specific model used.

6. Discussion

The analysis of the role of customs policy in maximizing the benefits of regional trade agreements (RTAs) provides several key insights into the dynamics of international trade within the context of economic blocs. The empirical findings reveal the significant impact of various aspects of customs policy on trade volume, shedding light on how policy measures can be tailored to enhance trade benefits for countries such as Egypt involved in RTAs. The findings suggest that improving the speed and reliability of customs procedures can significantly boost trade (

Djankov et al. 2010). Efficient customs clearance reduces delays and costs associated with cross-border transactions (

World Bank 2019). The positive relationship between tariff barriers and trade balance aligns with economic theory, which posits that higher tariffs discourage trade by increasing the cost of imported goods, leading to a decrease in the imports that enhances the trade balance (

Anderson and van Wincoop 2004). Also, non-tariff barriers lead to a similar impact on the trade balance (

Cadot and Malouche 2012).

This approach contradicts the primary goal of trade agreements and economic blocs, which should consider the economic structure of developing countries when drafting the terms of new RTAs or economic blocs. It is crucial to ensure that these RTAs do not turn developing countries into mere markets for the products of industrialized and developed member countries without offering any tangible benefits to the developing countries involved in the RTAs (

Baldwin 2011). The positive relationship between technology adoption and the trade balance is a critical insight. As digital technologies become more integrated into global trade, their role in facilitating smoother, faster, and more efficient customs processes cannot be overstated (

Freund and Weinhold 2002).

These insights suggest the need for increased investment in customs infrastructure, alongside a gradual and selective reduction in tariff and non-tariff barriers (

UNCTAD 2012). Additionally, advanced technology should be adopted to enhance customs policy through collaboration with developed countries (

OECD 2005).

It is necessary to consider a set of other variables, such as corruption, global economic conditions, and political stability domestically and regionally when addressing any aspect related to international trade, as they influence international trade transactions, especially in a region like the Middle East, of which Egypt is a part (

Rodrik 1998;

Kaufmann et al. 2009).

7. Conclusions

This study has demonstrated the significant role of customs policy in maximizing the benefits of economic blocs in Egypt using panel data from (2001–2023). The empirical findings suggest that by improving customs clearance procedures, reducing tariff and non-tariff barriers (assuring that this will not only lead to an increase in imports without an improvement in exports), and adopting modern technologies in customs procedures, Egypt can enhance trade volume within economic blocs and RTAs. These findings provide valuable insights for policymakers aiming to promote regional trade and economic integration.

Proposed Strategy for Developing Customs Policy within the Framework of International Economic Blocs

Based on the previous analysis, the requirements for maximizing the benefit of joining economic blocs can be summarized in the following four main axes:

Planning a customs tariff policy to maximize the trade creation and diversion effects of economic blocs.

Fully activating trade facilitation programs and liberalizing customs policy procedures.

A national strategy for maximizing added value for export-oriented industries.

Adopting regional agreements supporting the accumulation of origin (short-term).

The following is a brief explanation of each axis:

- A.

Planning customs tariff policy to maximize the trade creation and trade diversion effects of economic blocs.

In light of the modest results of Egypt’s accession to regional economic blocs on the performance of both Egyptian exports and the balance of merchandise trade, despite the multiplicity of these agreements and the results of the analysis of the expected effects of Egypt’s accession to the BRICS if a preferential trade agreement is launched, and in application to existing export sectors on the product level, it could be concluded that it is not expected that Egypt’s accession to BRICS through a preferential trade agreement will contribute to improving the Egyptian trade balance in terms of increasing exports (

Ramadan 2024).

Accordingly, the study recommends the necessity of evaluating the schedules of mutual obligations on a partial basis (every product separately) so that trade agreements do not contribute to facilitating more imports, without having an impact on the performance of exports, by aiming to negotiate the removal of tariff restrictions for export sectors that allow them to create a competitive advantage in targeted export markets (trade creation effect).

- B.

Fully activating trade facilitation programs and liberalizing customs policy procedures.

Customs administrations are responsible for implementing preferential trade agreements, as well as free zones and customs unions, and their role is not limited only to collecting taxes; rather, the role extends to important procedures, such as customs evaluation, and all procedures related to the crossing of trade across borders, which increases the importance of procedural aspects in explaining the success of regional blocs from the perspective of customs release mechanisms other than the customs tariff. As the customs tariff may be completely removed, the cost of cross-border trade remains an impediment to trade due to other logistical costs.

Customs valuation procedures could be relied upon as evidence to show the extent of the impact of customs policy measures other than tariffs on international trade flows, as (

Ramadan 2023) indicated that customs revenues due to regional trade agreements are much less than they should be according to the value of imports and the existing tariff rate; accordingly, there is no significant impact of changing the customs valuation method or consuming much time in the valuation process on customs revenues as long as there are customs exemptions.

Therefore, considering the large volume of Egyptian imports from preferential trade agreements, the application of the Article VII agreement on customs valuation methods did not result in an increase in customs revenues but rather led to the emergence of value disputes between importers and the customs administration, as most importers suffer from the overvaluation of their imports by the customs administration. Thus, paying floors in favor of shipping companies and ports, increasing dollar bleeding, price distortion, overvaluing customs duties, and inflationary effects on most imported goods without achieving anything positive, noting that a large percentage of Egyptian imports are exempt from customs duties due to regional trade agreements.

Therefore, it can be recommended to accept the value of the deal and not exaggerate the customs valuation process to avoid these disputes, and the negative effects mentioned above. In general, the study recommends, in this regard, the necessity of activating trade facilitation programs to improve the cross-border trade index in Egypt, which encourages attracting foreign direct investment. This is especially true in the exports sectors.

- C.

A national strategy for maximizing added value for export-oriented industries (long-term).

The main objective of developing countries, including Egypt, in joining regional blocs is to maximize exports by increasing access to foreign markets. The necessary condition for achieving this objective is the presence of export sectors that provide domestic added value with a high degree of competitiveness. Considering this, the study recommends adopting a national strategy to encourage export-oriented industrial sectors as an alternative to traditional primary sectors before joining new preferential trade agreements.

- D.

Adopting regional agreements supporting the accumulation of origin (short-term).

There is no doubt that all efforts related to maximizing the benefits of joining economic blocs become worthless in the absence of exportable products in the first place since preparing and implementing a national strategy to qualify industrial sectors that achieve high added value and competitiveness requires a long time. The study suggests focusing on acquiring the Egyptian origin of exported products through the integration of the processes of FDI re-exports.

Given that Egypt enjoys a unique geographical location and has membership in many regional economic blocs, emphasis should be placed on agreements that enhance the use of the accumulation of origin. This is a short-term alternative that enables Egypt to export products with Egyptian added value, especially because Egypt possesses the required infrastructure in terms of developed ports, whether on the Mediterranean or the Red Sea.

Given that the BRICS bloc is the most recent bloc that Egypt has joined, and that it is considered a multidimensional bloc whose institutions have not yet been completed, especially in the field of trade liberalization, policymakers must focus on negotiations regarding capital flows to stimulate FDI inflows, especially in the presence of the Suez Canal economic zone, which already includes the Chinese TEDA zone. South African investments in the automobile industry can also be targeted. It is possible for the Suez Canal Special Economic Zone to work as a hub to achieve a cumulative origin among BRICS member states.

8. Limitations and Future Studies

Even though this study provided an extensive analysis of the economic blocs and the impact of trade and customs policy on Egypt’s trade performance in light of the regional and international trade agreements and blocs to which Egypt is a member and proposing a strategy to develop customs policy to enhance the benefits from economic blocs, the scarcity of statistical data on tariffs and customs procedures in Egypt for a reasonable period of time was a major obstacle to the study in using an econometric model to support the findings.

The exclusion of variables such as global economic conditions, political instability, and corruption from the analysis is a limitation that should be addressed in future studies. These factors are interrelated and can significantly influence the effectiveness of customs policies. For a more comprehensive understanding of how Egypt can maximize the benefits of its membership in economic blocs, future research should seek to incorporate these variables, perhaps through a combination of qualitative analysis and quantitative modeling, to better capture the complexity of international trade dynamics. Therefore, the study suggests that future research focus on collecting an appropriate data set and focusing on microeconomic analysis on a sector level or product level, and also to expand the analysis to include a larger geographical area.