Abstract

The relationship between energy consumption and economic development is one of the primary indicators for elaborating energy policies. Different countries are at different stages of economic development and have different levels of energy consumption. Since independence, Kazakhstan’s economic development has gone through three stages: the unstable stage (1992–2000), the stage of rapid development (2001–2013), and the stage of stable development (2014–present). Kazakhstan’s economy is shifting from an industry-led economy to a service-led economy, thus, the relationship between energy consumption and economic growth also changes. By analyzing the data on energy consumption and GDP during 1992–2023, it was found that a 1% growth of GDP caused a 0.3972% growth of energy consumption in Kazakhstan on average. Due to the long period of economic influence on energy consumption, Kazakhstan could realize the adjustment of the energy consumption structure without affecting economic development by eliminating fossil energy subsidies, reducing taxes on projects for the development of renewable energy, and increasing energy-saving facilities.

1. Introduction

Energy, as the driving force of the national economy and social development, is applied in all areas of the national economy, and changes in its consumption are related to economic and social development. Energy security plays a significant role in a country’s economy, and analyzing the energy structure is a directional guide to predicting the country’s economic outlook and future industry development.

Whether a country’s economic development necessarily leads to an increase in energy consumption is a hypothesis that is still debated by scholars around the world. The pioneering work of Kraft J. and Kraft A. applied annual data of the United States from 1947–1974 and concluded that economic growth will drive energy consumption (Kraft and Kraft 1978). However, Akarca A. and Long T. disputed this conclusion because their study found that factors such as world wars and oil embargos can affect and even change structural relations (Akarca 1980). The relationship between energy consumption and the economy at different periods in the country is worth discussing.

As is well known, energy consumption is mainly related to industrialization, urbanization, and transportation. In recent years, many countries have put forward specific plans to save energy and reduce carbon emissions in view of the above sectors. The implementation of energy policies in different countries may impede economic growth and cause social problems, such as low incomes or rising unemployment (Lee 2006). Therefore, it is necessary to analyze the relationship between economic development and energy consumption, to understand the reasons for changes at different stages of development, and to develop mechanisms to reduce risks.

As a large Central Asian country with a population of 20 million and a land area of 2.7 million square kilometers, Kazakhstan not only maintains a good momentum of economic development but also plays an important role in international energy trade. Kazakhstan is an OPEC+ country and maintains stable trade relations with other countries in the field of oil and gas trade, striving to ensure the stability of the international energy environment.

Since the independence of Kazakhstan in 1991, the quality of life in the country has gradually improved along with the development of the national economy, and the energy demand in Kazakhstan is growing. During the past 30 years, from 1992 to 2023, Kazakhstan’s gross domestic product (GDP) rose from $24.92 billion in 1992 to $259.7 billion, with an average annual growth rate of 7.8% (World Bank 2023). Domestic energy consumption in Kazakhstan is increasing in accordance with economic growth. According to the Statistical Review of World Energy 2024, the primary energy consumption in Kazakhstan increased from 2.64 exajoules in 2012 to 2.98 exajoules in 2023, which is the largest share in Central Asia (Energy Institute 2024).

As in most oil-production countries in the world, Kazakhstan’s economic development and energy consumption are closely linked to fossil energy sources. The gross value added to the oil and gas industry in 2022 accounted for 19.5% of Kazakhstan’s total GDP value, including oil and gas exploration, transportation, and exports. In the current structure of energy consumption in Kazakhstan, coal, as the main raw material for power generation, accounts for 46% of the total consumption. Oil and gas are more sustainable energy sources to meet domestic needs and improve the living standards of people, accounting for 25% of the structure, respectively. On the one hand, the energy-dominated economy has exposed Kazakhstan to a set of macroeconomic challenges, including falling international oil prices and geopolitical conflicts. On the other hand, Kazakhstan faces the risk of energy shortages in the domestic market (Kazenergy 2023). Kazakhstan uses profits from oil and gas exports to subsidize domestic fossil energy use (electricity, heating, transportation). A cheap energy supply triggers the conflict between domestic energy overdependence and energy exports (Gomez et al. 2014).

Renewable energy sources, such as hydro, solar, and wind power, are also developing rapidly in Kazakhstan. Despite the huge potential for the development of renewable energy in Kazakhstan, the actual use of renewable energy remains low (only 4% of total energy consumption). Kazakhstan plans to increase the share of renewable energy to 15% of Kazakhstan’s energy sector by 2030 and to 50% by 2050 (Ministry of Energy of the Republic of Kazakhstan 2018). The development of renewable energy is considered a strategy for achieving energy transition and further increasing oil and gas exports (Kaliakparova et al. 2020).

In general, Kazakhstan’s economy has maintained stable growth, and primary energy consumption has been increasing, with coal and oil accounting for more than half of total energy consumption. The energy consumption elasticity coefficient in Kazakhstan has been fluctuating without a clear pattern of change. Kazakhstan is improving the quality of energy consumption by promoting the commercialization of the natural gas industry and continuing to attract investment to accelerate the development of renewable energy projects (Laldjebaev et al. 2021).

The energy consumption elasticity coefficient is the ratio of the growth rate of energy consumption to the growth rate of the national economy, reflecting the degree of dependence of economic growth on energy consumption (Sun et al. 2023). This coefficient is an international economic indicator that can measure energy consumption and economic development and judge the energy structure transition. In the present study, in order to examine the relationships between energy consumption and GDP, we referred to the fixed base analysis and co-integration method used by Liu. W in his study of China’s energy consumption structure (Liu et al. 2016).

Due to the correlation between energy consumption and economic development, it is important to consider the impact on the national economy when reforming the energy structure. The objective of this paper is to analyze the economic development and energy consumption of Kazakhstan in different periods by calculating the energy consumption elasticity coefficient of Kazakhstan. Considering that the traditional method of calculating the energy consumption elasticity coefficient ignores the continuity between economic development and energy consumption, this paper adopts a series of econometric models to analyze the relationship between energy consumption and economic growth and to predict the impact of future energy consumption on the economy of Kazakhstan.

The structure of this paper is organized as follows: Section 2 summarizes a brief review of the related literature and presents the novelty of this paper. Section 3 provides the main research methodology and data resources. Section 4 conducts the empirical analysis, and Section 5 draws the conclusion based on the previous analysis.

2. Literature Review

The relationship between energy consumption (EC) and economic growth has been a hot topic in the field of energy economics research. Scholars from all over the world have completed corresponding research and analysis on energy consumption and economic development in different countries and regions. Due to the different situations of national development, there are still many disagreements and controversies in the research on the relationship between energy consumption and economic development.

2.1. The Relationship between EC and GDP in the Same Country

The study of the relationship between energy consumption and GDP over different periods of time in the same country may lead to similar or completely different conclusions due to differences in the scope of the data selected, the impact factors, and the research methodology. In addition to the studies of Kraft J. and Kraft A., and Akarca A. and Long T. above, Yu E. and Hwang B. indicated that there was no causal relationship between GNP and energy consumption in the United States in the period of 1947–1979 (Yu and Hwang 1984). Stern D. conducted the Granger test for the causal effect of gross energy use on GDP in the United States over the period 1947–1990, he found that a measure of final energy use adjusted for changing fuel composition does Granger cause GDP (Stern 1993).

Lise W. and Montfort K. indicated that there is a causality relationship between energy consumption and the GDP of Turkey based on the data from 1970–2003 (Lise and Montfort 2007). Pata U.K. and Terzi H. analyzed the dynamic causality relationship of energy consumption and economic growth based on annual time series data from 1976 to 2013 in Turkey. They confirmed that there are unidirectional links between energy consumption to the Turkish economy (Pata and Terzi 2017).

2.2. The Relationship between EC and GDP in Different Countries

The relationship between energy consumption and GDP differs from country to country due to different levels of economic development, population size, industrial structure, and energy policies. Kalyoncu H. and Gursoy F. used Granger causality tests to examine the relationship between energy consumption and economic growth in Georgia, Azerbaijan, and Armenia over the period 1995–2009. They found that there is no cointegration between energy consumption and economic growth in Georgia and Azerbaijan, and there is unidirectional causality from GDP to energy consumption for Armenia. However, the specific reasons for the different results were not analyzed in their research (Kalyoncu et al. 2013). The study of Mahalik M. and Mallick H. shows that population has a significant positive effect on energy consumption in India, while economic growth has a negative effect (Mahalik and Mallick 2014). In the study of Majed A. based on the Granger causality test, he indicated that there is a unidirectional and bidirectional causal relationship between economic growth and energy consumption in high-energy consumption countries (China, India, Japan, the United States, and Saudi Arabia) during the period of 1968–2016 (Majed 2019). Han Z. and Wei Y. et al. found that although there is a bidirectional causality between energy consumption and GDP in China during the period 1978–2002, there is no long-run cointegration. (Han et al. 2004). For more literature reviews on energy consumption and GDP in different countries, please refer to the following articles (Oh and Lee 2004; Zamani 2007; Wang and Liu 2007; Wang and Dong 2009; Xiong et al. 2015; Liu et al. 2016; Sun et al. 2023).

In recent years, more and more scholars have investigated the impact of different energy policies on economic growth in different countries. Lee C. analyzed the relationship between energy consumption and income in 11 major industrialized countries based on the Granger non-causality test. He found that the adoption of energy-saving measures in some countries may hinder economic growth (Lee 2006). Fareed Z. and Pata U.K. selected the top ten renewable energy-consuming countries and analyzed the impact of renewable and non-renewable energy consumption on economic growth over the period 1970–2019. They indicated that renewable energy helps stimulate economic growth, but energy conservation policies may hurt the economic growth of some countries (Fareed and Pata 2022). Currently, similar studies have focused on the world’s major energy-consuming and developed countries, and have not covered oil and gas exporting countries.

2.3. The Energy Economy in Central Asian

The following scholars have conducted research on the relationship between energy consumption and economic growth, including Kazakhstan and other Central Asian (CA) countries. Pirani S. introduced the prospects for oil and gas production, the domestic market, and the export of Central Asia (Pirani 2019). Djumabaev O. and Oyama T. analyzed the economic and energy-related data of Central Asian countries during the period 1990–2014 based on regression model analysis, they found that energy production growth would have a positive impact on GDP growth in Kazakhstan (Djumabaev and Oyama 2018). Taguchi H. and Asomiddin A. examined the energy-use inefficiency in CA countries by using the energy-environmental Kuznets curve. The reason for the lower efficiency of energy use in Kazakhstan, Uzbekistan, and Turkmenistan than in other Asian countries is inadequate energy policy governance (Taguchi and Asomiddin 2022).

Gomez A. et al. introduced the main problems in the energy system of Kazakhstan, which caused the high energy intensity. Their study mentioned that the main reasons for Kazakhstan’s high energy consumption are the obsolescence of industrial power generation and excessive energy demand in the household and service sectors. However, their study ignored the case for renewable energy to improve energy consumption (Gomez et al. 2014). Kaliakparova G. et al. analyzed the potential of renewable energy sources and the efficiency of energy systems in Central Asia and concluded that Kazakhstan considers renewable energy as a way to increase oil and gas exports (Kaliakparova et al. 2020). Mudarissov B. and Lee Y. investigated the causal relationship between energy use and economic growth in Kazakhstan during 1990–2008 using Granger causality testing. They found that energy consumption does not have any effect on the economic growth of Kazakhstan in the long run (Mudarissov and Lee 2014). The above studies lack a comprehensive analysis of energy consumption and economic growth in Kazakhstan and the potential impact of energy policies on the economy.

In this paper, the causal relationship between energy consumption and economic growth in Kazakhstan in 1992–2023 will be analyzed based on the method of calculating the energy consumption elasticity coefficient of the econometric model and then observing the dynamics of the energy consumption elasticity coefficient in Kazakhstan. Considering that over this period Kazakhstan has experienced financial crises, energy crises, global pandemics, and geopolitical conflicts, this research focuses on the macroeconomic impact on energy consumption and makes more comprehensive recommendations for further development.

3. Methodology and Data Resources

This paper examines the current fitting and long-term estimation of energy consumption elasticity coefficient using analytical methods such as nonparametric estimation models, cointegration, and error correction models.

3.1. Traditional Method of Calculating the Energy Consumption Elasticity Coefficient

The energy consumption elasticity coefficient, as an economic indicator, is commonly used to measure the percentage change in energy consumption that realizes a 1% change in a country’s GDP, from which the correlation between the amount of economic growth and the amount of growth in energy consumption is derived. In order to reduce the volatility of the data, this paper adopts the fixed-base energy consumption elasticity coefficient by selecting the data of the starting year as the base data and calculating the growth rate of GDP and the growth rate of energy consumption at the same period, which is expressed by the following formula (Liu et al. 2016):

where

- E0 is the energy consumption in the base year.

- G0 is the GDP in the base year.

- ∆E is the increase in energy consumption.

- ∆G is the increase in GDP.

- Et is the country’s energy consumption in year t.

- Gt is the country’s real GDP in year t.

Energy consumption elasticity coefficients calculated by using the traditional method are typically more volatile because this method ignores the impact of the international environment on the economy and energy market.

3.2. Current Fitting of Energy Consumption and GDP

Nonparametric estimation is a statistical method that allows for the obtaining of a functional form of the fitted data without any theoretical guidance. The category of nonparametric regression includes various methods and estimators, such as Nadaraya-Watson kernel regression (Watson 1964), the kernel estimator (Gasser and Muller 1979), locally weighted scatterplot smoothing (LOWESS) (Cleveland 1979), and local polynomial smooth (Fan and Gijbels 1992). Nonparametric smoothers contribute to finding a curve best fit without assuming the data must fit some distribution shape. Usually, multiple smoothers are used to analyze a set of data to improve the fit.

The kernel density should be estimated when choosing the kernel function. Suppose (x1, x2 … xn) is a distributed sample drawn from distribution f. The kernel density estimation of f is defined as:

The kernel function needs to satisfy the following conditions:

The selection of the optimal kernel function in the kernel estimation process needs to minimize the integrated mean squared error (IMSE).

The bandwidth selection applied bandwidth selection method (Silverman 1986):

After determining the kernel function and the bandwidth, the nonparametric estimation method was used to analyze a unary linear regression model:

The linear regression model was conducted to estimate the regression function along with the derivative of the regression function.

3.3. Long-Term Estimation of Energy Consumption and GDP

The stationary test of time series is completed by augmented Dickey–Fuller (ADF) testing for the stationary of the variables and their difference series. If there is the same order of integration in the two variables, then the cointegration regression can be conducted.

The regression equation can be established on the following equation:

If the residual series are stationary, it can be determined that there is a cointegration relationship between the two variables in the regression Equation (7).

The error correction model (ECM) is used for model testing and significance testing to obtain the regression coefficient β1, which is the long-term energy consumption elasticity coefficient.

3.4. Data Resources

Data on energy consumption in Kazakhstan for the period 1992–2023 are taken from the Energy Outlook for Asia and the Pacific published by the Asian Development Bank (ADB), the Statistical Review of World Energy 2022 published by British Petroleum, and the Statistical Review of World Energy 2024 published by Energy Institution, etc. GDP data for Kazakhstan is derived from data published by the World Bank and the Bureau of National Statistics of the Republic of Kazakhstan. Specific data access is detailed in Table 1.

Table 1.

The data resources about energy consumption and GDP.

All data were retrieved from official reports of government and international organizations. No missing data were identified during the data collection. In order to eliminate the effect of heteroskedasticity in the calculation of the elasticity coefficient, the energy consumption (EC) and GDP series were taken logarithms LEC and LGDP separately.

4. Analysis

Based on the economic development and energy consumption of Kazakhstan in different periods of time, it is possible to roughly divide the development of Kazakhstan in 1992–2023 into three stages and analyze the relationship between energy consumption and economic development in each of these three stages using the traditional method of calculating the energy consumption elasticity coefficient.

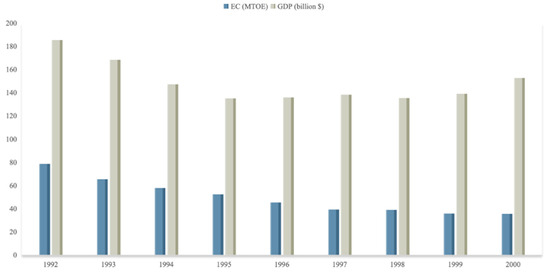

The first stage was from 1992 to 2000, in which Kazakhstan’s national economic activities had not fully recovered since the country’s independence, while economic development was affected by the Asian financial crisis. At the same time, the country’s energy consumption was decreasing. Figure 1 describes the energy consumption and GDP of Kazakhstan from 1992 to 2000.

Figure 1.

The energy consumption and GDP of Kazakhstan from 1992 to 2000 (Source—compiled by authors according to the data of World Bank).

As can be seen in Figure 1, during this period Kazakhstan’s energy consumption decreased from 78.81 million tons of oil equivalent (MTOE) to 35.65 MTOE. Both GDP and energy consumption showed a declining trend. Like most former Soviet Union countries, Kazakhstan experienced serious economic setbacks in the early stages of economic transition. According to the data of the Ministry of National Economy of Kazakhstan, Kazakhstan’s gross domestic product declined by about 22 percent between 1992 and 1995, and inflation surged into triple digits. Then Kazakhstan’s economy continued to decline as a result of the Asian financial crises in 1997 and the Russian crisis in 1998. The negative impact of the economic downturn was reflected simultaneously in population, the construction of infrastructure, and employment. The population of Kazakhstan decreased from 16.44 million in 1992 to 14.88 million in 2000, with the urban population accounting for 55% of the total. The construction of residential, educational, and healthcare facilities decreased rapidly. As a result of the reforms from the planned to the market economy, the unemployment rate in Kazakhstan increased from 0.4% in 1992 to 12.8% in 2000, which led to a decline in the standard of living of the population. The GDP value (G0) and energy consumption (E0) data of 1992 are chosen as the base data to calculate the energy consumption elasticity coefficient (e). The results obtained are shown in Table 2.

Table 2.

The energy consumption elasticity coefficient of Kazakhstan from 1993 to 2000.

The energy consumption elasticity coefficient for Kazakhstan at this stage fluctuated between 1.24 and 3.11, with an average value of 1.88. The results indicate that economic inflation, decreasing population size, and slower urbanization were the main factors leading to a decrease in energy consumption in this period. The economic structure of Kazakhstan at this stage was dominated by energy-intensive industries and agriculture, especially mining, smelting, and oil production. The decline in both the GDP value and total energy consumption illustrates the excessive consumption of energy by the economy of Kazakhstan.

In the previous stage, Kazakhstan gradually proceeded with the privatization of state-owned enterprises and the establishment of a free-market economy by actively pursuing a series of economic reforms. Previous policy and legislative reforms had created conditions for the oil sector to attract foreign investment. With the recovery of international oil prices after the 2000s, the economy of Kazakhstan began to return to growth. The growth in oil production and exports had brought significant foreign exchange earnings for the development of Kazakhstan’s economy. The trend toward globalization of the world economy and the rapid development of emerging economies have boosted Kazakhstan’s primary export commodities.

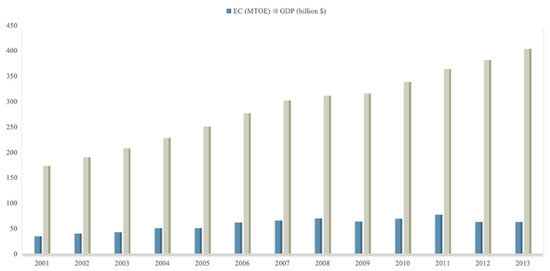

In the second stage (2001–2013) Kazakhstan realized rapid economic growth, including a GDP growth rate of 10.7% in 2006, making it one of the world’s ten fastest-growing economies. At the same time, the total population of Kazakhstan increased from 14.86 million in 2001 to 17.04 million in 2013, with a 9.71 million urban population. The unemployment rate decreased to 5.8%. The foreign trade turnover of Kazakhstan increased from 13.85 billion US dollars in 2000 to 131.4 billion US dollars in 2013 (National Bank of Kazakhstan 2015). The development of international trade has led to a significant increase in the capacity of the construction and transportation industries. In 2010, the transportation of goods by all types of transport accounted for 2439 million tons and passenger transportation for 13.18 billion people. Affordable natural resources provided energy security for Kazakhstan’s economic development. The oil production in Kazakhstan rose from 0.7 million barrels per day in 2000 to more than 1.7 million per day in 2013. Kazakhstan is among the world’s top 10 coal-rich countries, the coal production in Kazakhstan increased from 75 million tons in 2000 to 119.6 million tons in 2013. Figure 2 illustrates the energy consumption and GDP of Kazakhstan from 2001 to 2013.

Figure 2.

The energy consumption and GDP of Kazakhstan from 2001 to 2013 (Source—compiled by authors according to the data of World Bank).

Figure 2 shows that after 2001, Kazakhstan’s GDP began to grow exponentially. Energy consumption in Kazakhstan had also returned to an upward trend in comparison with the previous stage. Industrialization, urbanization, and the development of transportation during this period were the main factors in the increase in energy consumption in Kazakhstan. The energy consumption elasticity coefficient of this stage is shown in Table 3.

Table 3.

The energy consumption elasticity coefficient of Kazakhstan from 2001 to 2013.

During this period, Kazakhstan’s economy began to grow, and production and industry gradually recovered and developed. On the one hand, the benefits from the oil and gas sector were used more for national fund reserves and allocated for domestic investment in such industries as commodities, manufacturing, and services. On the other hand, cheap natural resources have caused an overdependence on fossil energy sources in Kazakhstan’s energy structure. In Kazakhstan, over 85% of all electricity is produced by thermal power plants (TPP), with more than 70% of TPPs using coal (Energy Charter Secretariat 2013). In addition, most of these power plants in Kazakhstan were built during the Soviet Union period, and the efficiency of these facilities has decreased (Dyussembekova et al. 2019). As a result, at this stage in the structure of energy consumption in Kazakhstan, coal accounted for more than 60 percent of total energy consumption. Despite the adoption of the Law on Supporting the Use of Renewable Energy Sources in Kazakhstan in 2009, consumption of renewable energy sources (hydropower) accounted for only 3.6% of total energy consumption in Kazakhstan (Energy Charter Secretariat 2013).

After 2014, the world economy experienced an energy crisis, global epidemics, and geopolitical conflicts, which inevitably affected the economy of Kazakhstan. In the third stage (2014–2023), the turbulence in the world economy has led to a slowdown in Kazakhstan’s economic growth. The Russian-Ukrainian conflict in 2022 posed the risks of international sanctions for Kazakhstan in international trade. Due to its close economic and political ties with Russia, Kazakhstan is dependent on Russia’s infrastructure for its oil and gas exports. A series of geopolitical conflicts have made European and Asian countries pay more attention to energy security, creating opportunities for Kazakhstan’s energy exports. The year 2023 marked the tenth year of China’s ‘One Belt and One Road’ (OBOR) Initiative, and Kazakhstan, as a member of OBOR, had achieved economic benefits in trade with China. According to the foreign trade turnover of Kazakhstan in 2023, China is the second exporter and first importer for Kazakhstan (Bureau of National Statistics of the Republic of Kazakhstan 2024). During this decade, the population of Kazakhstan grew to 20 million the urban population to 11.37 million, and the unemployment rate remained at about 4.85%.

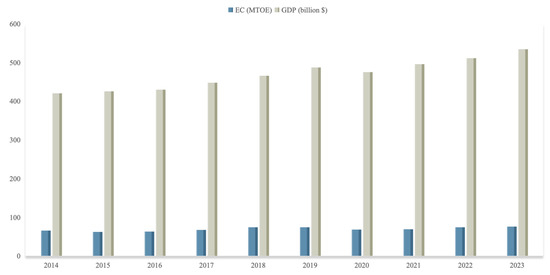

Figure 3 shows the energy consumption and GDP of Kazakhstan from 2014 to 2023.

Figure 3.

The energy consumption and GDP of Kazakhstan from 2014 to 2023 (Source—compiled by authors according to the data of World Bank).

It can be seen from Figure 3 that Kazakhstan’s GDP growth was negative for the first time in 2020 as a result of the global pandemic, but the country’s economic development recovered rapidly with the opening up of multilateral trade. At the present stage, Kazakhstan is focusing more on the development of high-quality and diversified industries, for example, the development of wholesale and retail trade, construction, and transportation industries. According to the Bureau of National Statistics of the Republic of Kazakhstan, in the structure of Kazakhstan’s GDP for 2023, services accounted for the largest share of GDP (56%), manufacturing accounted for 36.3%, and tax revenue for 7.7% (Bureau of National Statistics of the Republic of Kazakhstan 2024).

At the current stage, people’s living standards are rising in line with economic growth, and energy consumption is mainly used to meet people’s needs for electricity, transport, and heating. The electricity generation in Kazakhstan consists of coal (56%), natural gas (28%), and renewable energy (13%). Domestic subsidization of the price of natural gas is the main reason for the growth in its use in Kazakhstan (Kazenergy 2023). In 2020, Kazakhstan announced a goal to increase the share of renewable energy to 15% of Kazakhstan’s energy sector by 2030 and to achieve carbon neutrality by 2060. Kazakhstan is currently the fastest-growing country in Central Asia for developing renewable energy, and the government provides more economic and policy conditions for supporting renewable energy projects.

The energy consumption elasticity coefficient of this stage is presented in Table 4.

Table 4.

The energy consumption elasticity coefficient of Kazakhstan from 2014 to 2023.

The dynamics of the energy consumption elasticity coefficient gradually stabilized in this period (Table 4), reflecting the energy efficiency improvement across all economic sectors. The energy consumption elasticity coefficient at this stage reflects the process of energy transition in Kazakhstan without affecting economic development.

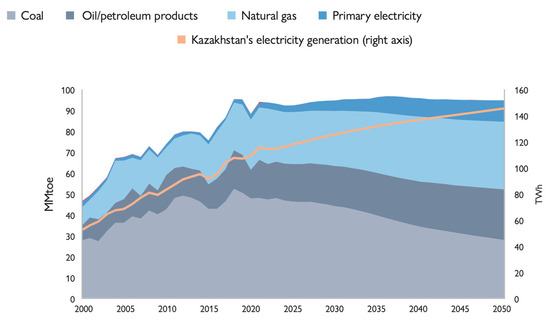

Over the past 30 years of development, oil and gas exports have been an important factor in promoting economic development in Kazakhstan. As a net exporter of primary energy, Kazakhstan uses cheap coal to secure its domestic energy consumption and exports oil and gas for economic gain and to subsidize domestic energy use. According to the Statistical Review of World Energy, the share of coal in Kazakhstan’s primary energy consumption structure was reduced from 57% in 2015 to 46% in 2023, natural gas consumption was increased from 18.6% to 25%, and renewable energy was increased from 3.4% to 4.2% (Energy Institute 2023). Figure 4 demonstrates Kazakhstan’s primary energy consumption by fuel from 2000 to 2050.

Figure 4.

Outlook for Kazakhstan’s primary energy consumption by fuel to 2050 (Source—S&P Global Commodity Insights).

In the long term, energy exports will continue to play an important role in Kazakhstan’s economic development, but slowly declining energy production and growing domestic energy consumption will eventually create a serious conflict. Although the government has enacted a number of policies to support renewable energy projects, the country’s energy transition continues to face the risk of economic losses and growing unemployment.

From the above analysis, the results of Kazakhstan’s energy consumption elasticity coefficient, calculated by the traditional method, help us obtain a general overview of Kazakhstan’s economic development and energy consumption over the past 30 years. The energy consumption elasticity coefficient calculated by the traditional method fluctuates greatly, and it is difficult to find the rule of variation. The following is the analysis of the relationship between energy consumption and economic development in Kazakhstan using the methodology based on an econometric model.

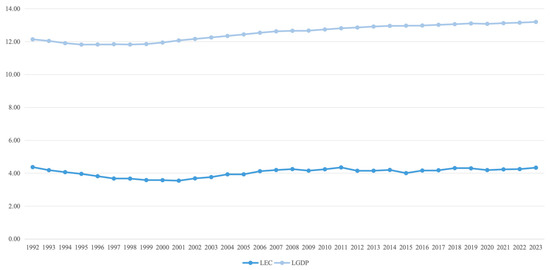

Firstly, the regression analysis was conducted on the logarithm of energy consumption (LEC) and the logarithm of GDP (LGDP) in Kazakhstan. Figure 5 demonstrates the timing diagram of LEC and LGDP.

Figure 5.

Timing diagram of the logarithm of energy consumption and GDP (Source—compiled by authors).

The ordinary least squares (OLS) regression analysis of the variables yielded the following results (Table 5).

Table 5.

The results of regression estimates.

Based on the above analysis in Table 5, the regression model is defined as:

The results of the regression analysis show that when Kazakhstan’s GDP grows by 1%, domestic energy consumption grows by 0.4068% on average. In addition, there is autocorrelation in the time series data, but the regression model does not fit well with the result of R2.

The augmented Dickey-Fuller Unit Root (ADF) test for the energy consumption series and the GDP series was conducted by EViews 13.0 (Table 6). The results indicate that the ADF statistics of the variables LEC and LGDP are both greater than the critical value at the 10% significance level, and therefore the original hypothesis cannot be rejected that both LEC and LGDP are non-stationary series.

Table 6.

The results of ADF test for variables LEC and LGDP.

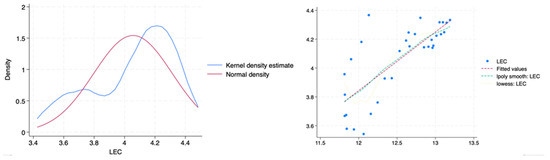

Based on the above analysis, the regression model needs to be fitted by the nonparametric estimation method. The selection of the optimal kernel function for kernel density estimation is performed by Stata 18 software to conclude that the optimal kernel function for nonparametric estimation is the quadratic (Epanechnikov) kernel (Figure 6), bandwidth (h = 0.27).

Figure 6.

Kernel density estimate and nonparametric regression.

EViews 13.0 was used to estimate the regression model of Equations (5) and (6), the results are shown in Table 7.

Table 7.

The results of nonparametric estimation.

From Table 7, it can be seen that the fitted values of LEC, m(LGDP), are very close to the original values of LEC with a serial correlation of 0.9218. The results of the ADF test on the estimation values of LEC and LGDP show that both values are less than the critical value at the 10% significance level and, therefore, the original hypothesis can be rejected since both ∆LEC and ∆LGDP are stationary series (Table 8).

Table 8.

The results of ADF test for variables ∆LEC and ∆LGDP.

Based on the above analysis, the following OLS regression Equation (9) can be obtained from Table 9.

Table 9.

The results obtained for regression estimates.

Based on the above analysis, the regression model is defined as:

Compared to Equation (8), the regression Equation (9) has a better fit. Equation (6) indicates that in the period of 1992–2023, the 1% economic growth caused a 0.3972% growth in energy consumption in Kazakhstan on average. The ADF test on the residual series of regression Equation (9) found that the ADF statistic of the residual series is less than the critical value at the 5% significance level, thus the residual series is smooth. The error correction model (ECM) for GDP and energy consumption was conducted using EViews 13.0, and the following OLS regression Equations (10) and (11) was generated from the result of Table 10.

Table 10.

The results of error correction model.

The error correction factor of −0.0394 indicates a rate of error correction of 0.0394, i.e., an adjustment period of 25 years.

There are usually many factors affecting energy consumption, including the level of economic development, energy prices, industrial structure, energy consumption structure, national energy policies, and energy-saving policies. The conclusion that can be drawn from the above analysis is that the development of the economy in Kazakhstan promotes the growth of energy consumption, but the period of this effect is long-term.

5. Conclusions

The development experience of many countries demonstrates that there is a strong correlation between energy consumption and economic growth. Usually, rapid economic growth will lead to growth in energy consumption. This trend is related to domestic energy demand, industrial development, and the rising living standards of the population.

Kazakhstan’s economy has achieved annual growth since 2000, following economic restructuring and the Asian financial crisis. According to the report of the Asian Development Bank, Kazakhstan’s GDP growth rates in 2024 and 2025 are projected at 3.8% and 5.3%, respectively, which are affected by these potential risks, including negative spillovers from the Russia-Ukraine conflict, slower-than-expected growth in the economies of trading partners, and stagnant oil production (ADB 2024). Currently, Kazakhstan’s GDP structure consists mainly of services, mining, and goods production. Oil and gas exports are still one of the main factors in Kazakhstan’s economic development.

The analysis in this paper presents that economic growth in Kazakhstan has a positive correlation with energy consumption, i.e., economic growth promotes domestic energy consumption in Kazakhstan. However, this impact is not significant due to the long-term period. Although the structure of energy consumption in Kazakhstan is dominated by coal, the changes in energy consumption in recent years have shown that the proportion of renewable energy has gradually increased. The following policy recommendations can be drawn from the analysis:

- (1)

- Overall, Kazakhstan’s economic focus is gradually shifting from industry to services. The share of services in the GDP structure currently exceeds 50 percent. At the same time, Kazakhstan’s economy remains highly dependent on oil and gas exports. Subsidizing domestic fossil energy consumption with profits from oil and gas reduces awareness of energy conservation in all sectors, especially in households and services. In order to improve the efficiency of energy use, the government should promote the commercialization of energy and gradually change the highly energy-consuming mode of economic development.

- (2)

- The government could raise national awareness of energy conservation and the use of renewable energy through propaganda and education. Prepare for the future energy transition by actively training people to obtain renewable energy technologies, thereby reducing the risk of low income and unemployment.

- (3)

- Kazakhstan could stimulate the development of renewable energy projects based on oil and gas projects. Energy companies should be required to maximize the use of renewable energy sources for electricity supply or to invest in local renewable energy power plant projects during oil field development.

Therefore, the government could consider supporting renewable energy projects and implementing energy-saving policies, which would ensure that economic growth will not be affected, and the goal of low-carbon development can be achieved. In the long term, Kazakhstan’s economic growth will lead to sustainable growth in energy consumption. Further research could consider to deeper analysis of the economic benefits of developing renewable energy and the impact of the energy transition on Kazakhstan’s economy.

Author Contributions

Conceptualization, J.J.; methodology, J.J.; software, X.Z. and B.D.; formal analysis, X.Z.; data curation, A.T.M.; writing—original draft preparation, X.Z.; writing—review and editing, A.V.K. All authors have read and agreed to the published version of the manuscript.

Funding

This research received no funding.

Institutional Review Board Statement

Not applicable.

Informed Consent Statement

Not applicable.

Data Availability Statement

No new data was created or analyzed in this study. Data sharing is not applicable to this article.

Conflicts of Interest

The authors declare no conflict of interest.

References

- Akarca, Ali. 1980. Relationship between energy and GNP: A reexamination. Journal of Energy Finance Development 5: 326–31. [Google Scholar]

- Asian Development Bank. 2024. ADB Forecasts Kazakhstan’s Economy to Grow 3.8% in 2024, 5.3% in 2025. Available online: https://www.adb.org/news/adb-forecasts-kazakhstan-economy-grow-3-8-2024-5-3-2025 (accessed on 11 April 2024).

- Bureau of National Statistics of the Republic of Kazakhstan. 2024. GDP by Production Method (January–December 2023). Available online: https://stat.gov.kz/ru/industries/economy/national-accounts/publications/117664/ (accessed on 15 February 2024).

- Cleveland, William. 1979. Robust Locally Weighted Regression and Smoothing Scatterplots. Journal of the American Statistical Association 74: 829–36. [Google Scholar]

- Djumabaev, Olimjon, and Tatsuo Oyama. 2018. Investigating Economic Growth, Trade Issues and Future Energy Strategies for Central Asian Countries. American Journal of Operations Research 8: 486–519. [Google Scholar]

- Dyussembekova, Gulsara, Gulmira Bayandina, Dilnara Zakirova, Rysty Sartova, and Marzhan Kalmenova. 2019. The Electric Energy Sector of Kazakhstan: State and Vision for the Country Taking into Account the International Trends. International Journal of Energy Economics and Policy 9: 179–86. [Google Scholar]

- Energy Charter Secretariat. 2013. Investment Climate and Market Structure Review in the Energy Sector of Kazakhstan. Available online: https://www.energycharter.org/fileadmin/DocumentsMedia/ICMS/ICMS-Kazakhstan_2013_en.pdf (accessed on 16 September 2013).

- Energy Institute. 2023. Statistical Review of World Energy 2023. Available online: https://www.energy-transition-institute.com/article/-/insights/statistical-review-of-world-energy-2023 (accessed on 26 June 2023).

- Energy Institute. 2024. Statistical Review of World Energy 2024. Available online: https://www.energyinst.org/statistical-review (accessed on 20 June 2024).

- Fan, Jianqing, and Irene Gijbels. 1992. Variable Bandwidth and Local Linear Regression Smoothers. The Annals of Statistics 20: 2008–36. [Google Scholar]

- Fareed, Zeeshan, and Ugur Pata. 2022. Renewable, non-renewable energy consumption and income in top ten renewable energy-consuming countries: Advanced Fourier based panel data approaches. Renewable Energy 194: 805–21. [Google Scholar]

- Gasser, Theo, and Hans Muller. 1979. Kernel Estimation of Regression Functions. In Smoothing Techniques for Curve Estimation. Berlin/Heidelberg: Springer, pp. 23–68. [Google Scholar]

- Gomez, Antonio, Cesar Dopazo, and Norberto Fueyo. 2014. The causes of the high energy intensity of the Kazakh economy: A characterization of its energy system. Energy 71: 556–68. [Google Scholar]

- Han, Zhiyong, Yiming Wei, Jianling Jiao, Ying Fan, and Jiutian Zhang. 2004. On the cointegration and causality between Chinese GDP and energy consumption. Systems Engineering 22: 17–21. [Google Scholar]

- Kaliakparova, Gulnar, Yelena Gridneva, Sara Assanova, Sandugash Sauranbay, and Abdizhapar Saparbayev. 2020. International economic cooperation of Central Asian countries on energy efficiency and use of renewable energy sources. International Journal of Energy Economics and Policy 10: 539–45. [Google Scholar]

- Kalyoncu, Huseyin, Faruk Gursoy, and Hasan Gocen. 2013. Causality Relationship between GDP and Energy Consumption in Georgia, Azerbaijan and Armenia. International Journal of Energy Economics and Policy 3: 111–17. [Google Scholar]

- Kazenergy. 2023. The National Energy Report KAZENERGY 2023. Available online: https://www.kazenergy.com/upload/document/energy-report/NationalReport23_en.pdf (accessed on 8 November 2023).

- Kraft, John, and Arthur Kraft. 1978. On the relationship between energy and GNP. The Journal of Energy and Development 3: 401–3. [Google Scholar]

- Laldjebaev, Murodbek, Ruslan Isaev, and Almaz Saukhimov. 2021. Renewable energy in Central Asia: An overview of potentials, deployment, outlook, and barriers. Energy Reports 7: 3125–36. [Google Scholar]

- Lee, Chien-Chiang. 2006. The causality relationship between energy consumption and GDP in G-11 countries revisited. Energy Policy 34: 1086–93. [Google Scholar]

- Lise, Wistze, and Kees Van Montfort. 2007. Energy consumption and GDP in Turkey: Is there a co-integration relationship? Energy Economics 29: 1166–78. [Google Scholar]

- Liu, Weidong, Weizhou Zhong, and Qing Shi. 2016. Forecast of China’s total energy consumption in 2020 based on method of fixed base energy consumption elasticity coefficient. Resources Science 38: 658–64. [Google Scholar]

- Mahalik, Mantu, and Hrushikesh Mallick. 2014. Energy consumption, economic growth and financial development: Exploring the empirical linkages for India. The Journal of Developing Areas 48: 139–59. [Google Scholar]

- Majed, Almozaini. 2019. The causality relationship between economic growth and energy consumption in the world’s top energy consumers. International Journal of Energy Economics and Policy 9: 40–53. [Google Scholar]

- Ministry of Energy of the Republic of Kazakhstan. 2018. Law on Support for the Use of Renewable Energy Sources. Available online: https://www.gov.kz/memleket/entities/energo/documents/details/18314?lang=ru&ysclid=lwxeonfjta421027888 (accessed on 28 December 2018).

- Mudarissov, Bauyrzhan Akimzhanovich, and Youah Lee. 2014. The relationship between energy consumption and economic growth in Kazakhstan. Geosystem Engineering 17: 63–68. [Google Scholar]

- National Bank of Kazakhstan. 2015. Kazakhstan: Balance of Payments and External Debt. Available online: https://nationalbank.kz/file/download/9368 (accessed on 28 May 2015).

- Oh, Wankeun, and Kihoon Lee. 2004. Causal relationship between energy consumption and GDP revisited: The case of Korea 1970–1999. Energy Economics 26: 51–59. [Google Scholar]

- Pata, Ugur, and Harnu Terzi. 2017. A multivariate causality analysis between energy consumption and growth: The case of Turkey. Energy Sources, Part B: Economics, Planning, and Policy 12: 765–71. [Google Scholar]

- Pirani, Simon. 2019. Central Asian Gas: Prospects for the 2020s. Oxford: The Oxford Institute for Energy Studies, pp. 1–48. [Google Scholar]

- Silverman, Bernard. 1986. Density Estimation for Statistics and Data Analysis. London: Chapman & Hall. [Google Scholar]

- Stern, David I. 1993. Energy and economic growth in the USA: A multivariate approach. Energy Economics 15: 137–50. [Google Scholar]

- Sun, Wenjuan, Shengjun Zhang, and Xiujie Men. 2023. Analysis of China’s energy consumption based on energy consumption elasticity coefficient. International Petroleum Economics 31: 11–17. [Google Scholar]

- Taguchi, Hiroyuki, and Aktamov Asomiddin. 2022. Energy-Use Inefficiency and Policy Governance in Central Asian Countries. Energies 15: 1299. [Google Scholar]

- Wang, Shouchun, and Xiucheng Dong. 2009. Causal relationship between energy consumption and GDP in China—An analysis based on structural changes and technology progress. Reformation & Strategy 25: 46–49. [Google Scholar]

- Wang, Xiuhui, and Yong Liu. 2007. China’s Energy Consumption and Economic Growth: A Study based on the Cointegration Analysis and Granger Causality Test. Resources Science 29: 57–62. [Google Scholar]

- Watson, Geoffrey. 1964. Smooth Regression Analysis. Sankhya: The Indian Journal of Statistics, Series A 26: 359–72. [Google Scholar]

- World Bank. 2023. Kazakhstan Economic Update—Spring 2023. Available online: https://www.worldbank.org/en/country/kazakhstan/publication/economic-update-spring-2023 (accessed on 19 April 2023).

- Xiong, Chuanhe, Degang Yang, Jinwei Huo, and Yannan Zhao. 2015. The relationship between energy consumption and economic growth and the development strategy of a low-carbon economy in Kazakhstan. Journal of Arid Land 7: 705–15. [Google Scholar]

- Yu, Eden S.H., and Been-Kwei Hwang. 1984. The relationship between energy and GNP: Further results. Energy Economics 6: 186–90. [Google Scholar]

- Zamani, Mehrzad. 2007. Energy consumption and economic activities in Iran. Energy Economics 29: 1135–40. [Google Scholar]

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2024 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).