Abstract

This article discusses the issues of cluster policy formation in the Republic of Kazakhstan on the basis of studying the experience of leading countries. The research aim is to find new effective tools and institutions for the development of the cluster structuring of the agro-industrial complex economy of Kazakhstan. Cluster policy in the field of supporting regional clusters starts with the identification of already existing clusters in the region, because by viewing the regional economy through the prism of various local industries and innovative enterprises, regional authorities can identify measures of effective impact and support for their clusters. This research examines the possibilities of using clusters and cluster policy as one of the most important components of the policy for the development and support of small and medium-sized enterprises in Kazakhstan’s agro-industrial complex. The research methodology includes qualitative and quantitative data analysis methods, comparative analysis, and mathematical processing (the Pearson correlation coefficient), as well as the modeling of possible development scenarios. The obtained results show that there are significant opportunities for a wider involvement of small and medium-sized enterprises in the formation of cluster structures of the agro-industrial sector through joint efforts by the government and regional centers in the conditions of innovative development of the country’s economy.

1. Introduction

A large-scale process of modernization of the country’s agriculture, especially in the context of growing global demand for agricultural products, is one of the main objectives of economic policy in the field of the agro-industrial complex of the Republic of Kazakhstan. It is an endeavor to improve all aspects of agricultural development in order to achieve higher productivity, economic sustainability and social development. One of the rational solutions in this direction is the use of the cluster approach.

The problem of choosing the most effective structured cluster approach to the development of the high-tech agro-industrial sector of the economy has always been one of the relevant topics of both academic research and its practical implementation (Gabriel and Bitsch 2023).

Currently existing economic risks for the development of the agricultural sector in Kazakhstan not only persist, but are also growing, reducing the sustainability of growth and opportunities for accelerated import substitution and product competitiveness (Huseynov et al. 2023).

The accumulated international experience shows that the increase in competitiveness in the agro-industrial complex and in the economic development of regions is quite possible as a result of the development and implementation of regional policy focused on the creation of clusters. Successful clusters in the fields of small and medium-sized businesses, large industrial production, innovation, and the agricultural sector are well known. Consequently, there is considerable experience in the implementation of cluster policies, which is manifested in different countries through clearly defined policy strategies or in the form of policy initiatives such as regional strategies or measures supporting local production systems. Around the world, the interaction of different industries within clusters has contributed to job growth, investment inflow, and technological progress.

Key clusters as a form of competitive economic relations emerged in the early second half of the twentieth century. Examples of such clusters can be found in the following countries: France—the sphere of food production, perfumes, and cosmetics; Germany—chemical, machine-building, and automotive industries (e.g., North Rhine-Westphalia); Sweden—biotechnology cluster; Singapore—chemical cluster; the United States (Arizona)—food cluster; Spain—aerospace cluster; Italy—telecommunications clusters, etc. It is also worth noting that the cluster approach is used in marine technology in Norway, the forestry sector in Finland, biotechnology in the UK, programming in Ireland, the footwear industry in Italy, and the chemical sector in Belgium. In addition, eight regional clusters are active in Austria (Pessoa 2013).

The experience of leading countries in this area confirms that when applying the cluster approach in agricultural sectors, positive economic results are very successfully achieved. In the United States (California), a wine cluster is successfully functioning; in Denmark, a dairy cluster is developing; in France, there is a cluster of wine and cognac producers; in Switzerland, a cheese cluster is successfully operating; and Canada has a successful cluster in the grain industry. The applied cluster models based on the activation of resources and technological potential of territories have noticeably strengthened the competitiveness of agricultural industries (Yanovskaya and Saginova 2020). This, in turn, has had a positive impact on the macroeconomic indicators of economic development in many countries of the world.

There is an extensive amount of research on clusters in the scientific literature. Definitions of cluster vary and have their own history of development. The main concepts of cluster theory were formulated in the works of Austrian-American economist, political scientist, and sociologist J. Shumpeter (Shumpeter 1982). The very concept of “cluster” was first introduced by American economist and Harvard Business School professor M. Porter in the 1980s (Porter 1998). According to his definition, a “cluster” is a group of companies and related organizations geographically adjacent in a certain area. They are characterized by common activities and complement each other (Sutor et al. 2019).

The modern economic literature defines the concept of a cluster as an industrial production complex realized on the basis of the geographical association of main manufacturers, general suppliers, and final consumers, having technological connections and acting as a competitive alternative to the sectoral approach.

At the same time, a cluster is characterized by mutual competition between its active participants, partnership cooperation between them, the active development of unique competencies at the regional level, and the concentration of organizations and enterprises within a certain regional territory.

Examining various approaches to defining a cluster, R.R. Tokhchukov identified two fundamental aspects in clusters in 2012 (Yuldashev 2012). Firstly, companies within a cluster must be connected to each other in a certain way, and these connections can have both a horizontal and a vertical character. Secondly, clusters are geographically homogeneous and close groups of corporate enterprises.

After analyzing the theoretical aspects and practical importance of clusters based on the experience of leading countries, one can conclude that it is advisable to introduce an additional characteristic aspect into the general terminology of the concept of “cluster”, namely, that this process should involve not only companies from certain industries (and related areas), but also government agencies and scientific institutions. In our opinion, this component looks particularly appropriate and significant in determining the essence of an entrepreneurial agro-cluster. Such an agro-cluster can be considered as an association of organizations of different spheres of activity within a single reproduction cycle, covering all stages from the production of agricultural products to the sale of finished products, and including all stages of production, aiming to achieve a successful end result.

An agro-industrial cluster can be defined as an association on a territorial and industrial basis that includes partnerships between enterprises in the agro-industrial sector, financial institutions, authorities, and scientific organizations. This integration makes it possible to make the best use of economic resources and significantly increase the competitiveness of both the industry itself and the economies of the regions and the country as a whole (Kaplinsky et al. 2001).

Having studied the experience of developing national industrial complexes both abroad and domestically, it can be concluded that there is a need and potential for applying the cluster approach in the development of the agro-industrial complex (Stoper and Walker 1989).

When structuring an agro-industrial cluster, it is necessary, first of all, to rely on the basic principles of economic theory (including the ideas of such authors as M. Porter, A. Marshall, and I. Schumpeter). These principles confirm that specialized industries tend to concentrate in certain territories and create clusters—a set of companies from related sectors that mutually compete and, at the same time, cooperate with each other. This interaction helps to increase the competitive advantages of each participant.

Secondly, an agro-industrial cluster should be considered as a highly complex and open network system in which economic entities are located in a certain territory (country, region, or area) and interact with each other in terms of technological and economic aspects.

Moreover, a cluster can be considered as an innovative element of the country’s economy. For example, I. Schumpeter identified five key types of innovation that he associated with the development of clusters (Shumpeter 1982):

- New products or services are changes to the product or service itself, such as introducing new technologies, improving product characteristics, or creating a completely new product.

- New production methods are changes related to how a product or service is produced. New methods may include the introduction of more efficient technologies, the optimization of production processes, and automation.

- Opening new markets is innovation that refers to expanding markets or finding new market opportunities for products or services.

- Opening new sources of raw materials or semi-finished products represents innovations associated with providing access to new sources of raw materials or semi-finished products, which can lead to lower production costs or the creation of new products.

- The establishment of new organizational structures means innovations related to the organizational aspects of production and management, such as the introduction of new forms of organizing the work of companies, cooperation between firms, or the creation of new institutional structures.

Schumpeter believed that these types of innovations contribute to economic development by creating new markets, increasing production efficiency, and stimulating competition among clusters.

The relevance of this article lies in the fact that cluster structuring is becoming a key tool for improving the efficiency and competitiveness of the agro-industrial complex of Kazakhstan. In the context of a constantly changing global economic situation and growing competition in the markets, the introduction of cluster approaches can help increase productivity, improve product quality, reduce costs, and stimulate innovation in the agricultural sector.

This article aims to identify the main problems faced by Kazakhstan’s agricultural sector economy in the context of cluster structuring and to offer practical recommendations for their solution. An attempt was made to analyze the existing theory of clustering, study the experience of other countries, adapt the best practices to local conditions, and develop specific strategies and support measures for the development of clusters in the agricultural sector.

2. Methodology

The study of cluster structures in the agro-industrial complex is a complicated and multifaceted task that requires a systematic approach and the use of different methodologies that may vary depending on specific conditions and tasks. However, a combination of methods for studying and analyzing cluster structures will allow researchers to conduct a comprehensive analysis and create effective strategies for the development of cluster structures in the agro-industrial complex.

The theoretical and methodological basis of the research was formed by the works of leading agricultural economists and researchers focusing on the problems of improving the efficiency of agricultural production. The research process was based on an integrated approach to the subject under study. Statistical methods of collection, processing, and analysis of economic information, as well as mathematical methods of modeling were used in this work.

A number of researchers believe that the formation of any cluster requires the presence of economic, resource, and organizational factors (Zaushicina and Suvorova 2014).

On this basis, it should be noted that the success of cluster structure creation can be presented as an additive function of a number of the above-mentioned conditions and factors:

where U is an additive indicator of cluster formation success, and Fn is a condition or a factor necessary to build a cluster structure in a certain territory and at a certain time.

Based on the results of the analysis of literary sources, expert interviews, and statistical analysis, a generalized overview of the problems and prospects for the development of cluster structuring in the economy of Kazakhstan’s agricultural sector was synthesized. This synthesis provided a basis for the elaboration of recommendations and strategies for further development of this important sector.

Cluster structure depends on many factors that interact with each other to form specific characteristic features of a given cluster. Here are some of the major factors that influence cluster structure (Humphrey and Schmitz 2000):

- Production factors. These include resources such as raw materials, technology, infrastructure, and land. Production factors determine which activities are included in the cluster and how they are interconnected.

- Innovation and research. The presence of research organizations and innovation infrastructure contributes to cluster development through the creation of new products, technologies, and production methods (Markusen 1996).

- Labor resources. The presence of qualified specialists in a certain field can determine the direction of a cluster’s activity as well as its competitiveness.

- Market demand. Market demand for certain goods or services can stimulate the development of a cluster in the relevant area.

- Educational and scientific institutions. The presence of universities, research institutes, and educational centers can contribute to staff education and training for a cluster.

- Financing. Access to investment and financing can determine a cluster’s ability to innovate and expand.

- Government support. Political and economic support from the government can significantly influence cluster development.

- Infrastructure. The availability of well-developed transportation, communication, and energy infrastructure facilitates cluster functioning.

- Networks and connections. Connections between cluster members and other organizations can facilitate the exchange of knowledge and resources.

- Cultural and social factors. Cultural characteristics and social values can influence the specifics of cluster activities.

These factors may vary depending on a specific cluster and region. The interaction and combination of these factors determine the unique structure and dynamics of each cluster.

In order to compare agricultural sectors, it is necessary to carry out a comparative analysis by year (starting from 2021) and regions of Kazakhstan using economic analysis, which plays an important role in this process. It will allow comparing the obtained data with data from other regions, revealing the relative position of a certain region on the basis of this indicator.

It is necessary to collect primary and secondary information on existing clusters in the agro-industrial complex of Kazakhstan, their structure, main participants, financial indicators, and other characteristics.

The collected data were analyzed using statistical methods such as correlation analysis, statistical analysis, and cluster analysis to identify the main factors influencing the development of clusters in the agricultural sector. The cause-and-effect analysis method was used to determine the reasons for the growth or decline of agricultural production in the periods under review.

In order to identify the relationships among various variables and determine their impact on the development of clusters in the agricultural sector of Kazakhstan, a correlation analysis was carried out among various economic indicators, such as the level of production efficiency, the volume of investment, the unemployment rate, and others.

In order to analyze the performance of enterprises in the agricultural cluster, it is necessary to calculate Pearson’s linear correlation coefficient for variables related to the establishment of an agricultural cluster.

Qualitative and quantitative analysis were employed to collect data on all variables deemed crucial to the establishment of an agricultural cluster. These included indicators such as the number of cluster members, the amount of investment, technical indicators such as production capacity or the level of technological equipment, and other important factors. Subsequently, mean values were calculated for each variable, which was followed by the calculation of mean deviations.

Subsequently, the deviations of one variable were multiplied by those of the other variable, and the resulting products were added together. For each variable, the sum of squared deviations was calculated.

The Pearson linear correlation coefficient was calculated for two variables X and Y using the formula:

where r is the Pearson correlation coefficient, and X and Y are the mean values of variables X and Y.

The next step was the interpretation of the results.

The value of the Pearson correlation coefficient, r, ranges from −1 to 1. A value close to 1 indicates a strong positive correlation between the variables, while a value close to −1 indicates a strong negative correlation, and a value close to 0 indicates no linear relationship between the variables.

The calculation of the Pearson correlation coefficient makes it possible to determine how closely the variables are related to each other, which can be useful for creating a strategy for the establishment of an agricultural cluster.

Based on the analysis results, recommendations were developed to improve the policy of cluster development in the agriculture and industry of Kazakhstan. Ways to solve the identified problems and use promising development areas were also proposed.

This methodological approach makes it possible to systematize information on the problems and prospects of cluster structurization in the economy of Kazakhstan’s agricultural sector, as well as to develop practical recommendations to improve this process.

3. Results

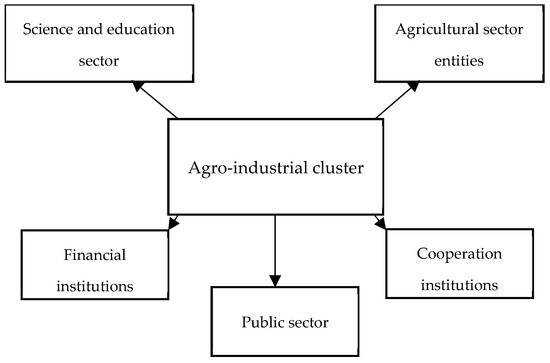

The agro-industrial cluster is a complex and open network system in which economic entities are located in a certain geographical area (country, region, or area) and interact with each other in terms of technological and economic aspects. Thus, the structure of an agricultural cluster can be presented in Figure 1.

Figure 1.

Structure of an agro-industrial cluster. Source: compiled by the authors.

The structure of an agricultural cluster may vary depending on its objectives, size, activities, and location. According to existing research, an agricultural cluster includes the following key elements (Enright 1992):

- Participants

- Agricultural enterprises and farmers: main producers of agricultural products within the cluster;

- Manufacturers of food products: enterprises engaged in the processing of agricultural products;

- Research and educational institutions: institutions engaged in research and educational programs for agricultural cluster participants.

- Coordinating body

- Governing body or coordinating committee: the group responsible for planning, coordinating, and managing the activities of the agricultural cluster.

- Infrastructure

- Production facilities: land, warehouses, mills, processing plants, and other facilities necessary for the production and processing of agricultural products;

- Logistics infrastructure: vehicles, warehouses, and storage and transportation systems that ensure the efficient distribution of products.

- Technological and information base

- Modern technologies: introduction of innovative methods of agriculture, mechanization, and automation of production processes;

- Information systems: use of information technologies for the monitoring, management, and exchange of data within the agricultural cluster.

- Financial support

- Investors and financial institutions: organizations providing financing for the development and functioning of the agricultural cluster;

- Government programs and subsidies: government support, including subsidies, tax benefits, and other support measures.

- Marketing and sales

- Marketing and promotion department: a group involved in the promotion and sale of agricultural cluster products;

- Sales channels: identification and management of products distribution channels in the market.

- Management and maintenance

- Administrative staff: staff involved in organizational and administrative tasks;

- Maintenance personnel: technical personnel engaged in equipment maintenance and repair.

- Education and training

- Education and training centers: places for training farmers, specialists, and other participants in the agricultural cluster.

- Environmental and social responsibility

- Environmental sustainability department: a group dedicated to environmental protection and sustainability issues;

- Social responsibility programs: initiatives aimed at improving social conditions for participants and society as a whole.

The overall success of an agricultural cluster depends on the effective interaction of all these elements. It is important for an agricultural cluster to contribute to the sustainable and integrated development of agriculture, while ensuring food security and stimulating economic growth in the region (Dunning 1981).

The development mechanism of an agro-industrial cluster should be understood as the use of legal, administrative, economic, organizational, and information tools in order to influence the creation and strengthening of stable and mutually beneficial ties between companies engaged in production and service activities in the agro-industrial sector, as well as scientific, educational, and financial institutions, market infrastructure, authorities, and end consumers, ensuring their stable and efficient functioning and sustainable development (Rugman and Verbeke 2002).

The functioning of an agro-industrial cluster occurs through the cooperation of many organizations (cluster members), which can be classified into five key groups, as illustrated in Figure 2.

Figure 2.

Subjects of the agro-industrial cluster. Source: compiled by the authors.

There is a tendency in Kazakhstan to form associations that are built on vertical integration using a cluster approach to production organization. An example of such associations are companies specializing in grain products: Mankent-1 production cooperative in Mankent village, South Kazakhstan region; Arystan-PK LLP in Sarykol village, Kostanay region; Abai LLP in Golubovka village, Pavlodar region; K. Marx LLP in Ozernoye village, Kostanay region; and Ryazhskoye LLP in Uzunkol village, Kostanay region.

Several dozens of large grain companies, which have formed powerful agro-industrial–trading–financial groups, currently operate in the grain market of the republic. Their entry into this market began with the aim of ensuring stable supplies of raw materials from agricultural enterprises. Subsequently, they expanded their activities by investing in grain production. One of the ways of expansion was to conclude contracts with agricultural producers for the supply of fuel and lubricants, machinery, fertilizers, etc., in exchange for crops, as well as to transfer the management of agricultural enterprises to grain companies.

The first option involved transferring the property of under-resourced enterprises to grain companies to pay off debts. The second approach, which involved the transfer of control, included investments by grain companies in agricultural production secured by land and property. This led to the creation of shared ownership through a gradual buyout of agricultural enterprises by grain companies. Moreover, these companies acquired assets of financially unstable enterprises during their restructuring and liquidation.

Kazakhstan’s grain companies currently operating on the market have a number of advantages. First of all, by diversifying their production, they reduce risks associated with variable weather conditions and potential crop losses. Secondly, by exploiting economies of scale, they achieve the effect of reducing average production costs. Thirdly, the availability of collateral allows them to obtain loans. Fourthly, significant financial resources at the disposal of many such companies allow them to create their own infrastructure units.

From a long-term perspective, tasks related to the development of processing industries and the manufacturing of production means are of particular relevance in the agro-industrial complex of Kazakhstan. The analysis of interactions in the agricultural sector has revealed that further development of processing faces obstacles such as unstable supplies, high costs, and an uneven quality of raw materials. To overcome these challenges, significant investments are required in the development of the agricultural sector, including the restoration of old and the creation of new breeding and seed farms, the introduction of modern agricultural technologies, and the creation of the necessary infrastructure and other activities.

Thus, in the current situation, the most promising and cost-effective projects are those aimed at establishing a vertically integrated value-added chain, starting from the production of raw materials and ending with their deep processing.

The following sectors can be included in the priority group:

- Production and processing of meat and leather raw materials;

- Production and processing of milk;

- Production and processing of wool;

- Production and processing of fruit, berry, and vegetable products;

- Production and processing of cotton;

- Production of agricultural machinery.

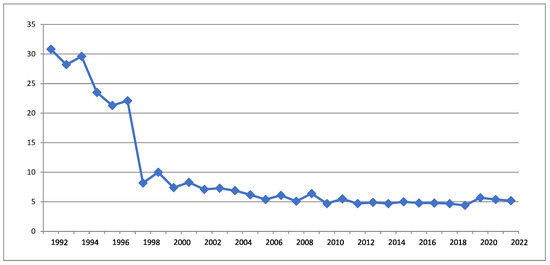

When analyzing the current state of the agro-industrial sector in Kazakhstan, attention should be paid to the share that agricultural production occupies in the overall structure of the country’s GDP. Methods of economic analysis and statistical research were used to construct a graph depicting the share of agriculture in the country’s GDP. The basis for constructing such a graph were statistical data on the country’s GDP and the contribution of various sectors of the economy, including agriculture. These data were obtained from national statistical offices, international organizations (World Bank and IMF), and specialized agricultural organizations. The collected data were processed and systematized, which included calculating the share of agriculture in the total GDP. Next, based on these data, time series were constructed, which made it possible to analyze the dynamics of changes in the share of agriculture in the GDP for a certain period.

This issue is particularly important because of the steady long-term decline in the share of agriculture in Kazakhstan’s GDP over the past three decades. As can be seen from Figure 3, the share of agriculture was 30.8% in 1992, but it decreased to just 5.2% in 2022, a difference of 25.6%. This decline can be explained by the insufficient effectiveness of government support. To change this trend, it is necessary to move from the traditional approach in agro-industrial complex development to a more effective cluster approach, which is successfully used all over the world. Figure 3 shows the dynamics of the share of agriculture in the country’s GDP by year.

Figure 3.

The share of agriculture in the structure of Kazakhstan’s GDP, %. Source: compiled by the authors.

A statistical analysis of the gross output of livestock and crop production was carried out. For this purpose, two time periods were selected—2021 and 2022—in order to cover the dynamics of their changes in the regions of Kazakhstan. Twenty regions of the country were taken as objects of analysis. Table 1 and Table 2 show statistics by region for 2021 and 2022, as well as year-by-year growth.

Table 1.

Gross livestock output data from 2021 to 2022.

Table 2.

Gross output of crop production from 2021 to 2022.

Based on the results of descriptive statistics and visualization, one can see general trends and compare product volumes in the two categories.

Gross livestock production increased by 0.8%. This is due to an increase in production volumes by industry: “dairy cattle” grew by 1.6%, “horses and other equine animals” by 3.2%, and “poultry” by 3.7%.

In agricultural enterprises, gross livestock production decreased by 1.7%; for individual entrepreneurs and farms or agricultural enterprises, it increased by 4.5%, and for households by 0.4%. The maximum share in the total volume of gross livestock production in the period under review falls on Turkestan (11%), Almaty (10.3%), Akmola (8.8%), and Abay (7.7%) regions; growth is also observed in Mangystau (10.4%) and East Kazakhstan (6.8%).

After analyzing the data from Table 1, a conclusion can be made that the increase in the share of livestock products caused by the increase in production volumes in dairy cattle indicates the possibility of creating dairy and meat clusters in the territories of Turkestan, Mangystau, East Kazakhstan, Almaty, Akmola, and Abay.

The method of cause-and-effect analysis revealed an increase in agricultural production in the period under review (increased by 15.1% compared to the previous year) due to an increase in the production of grains and legumes by 38.2% and oilseeds by 24.6%.

Crop production increased by 35.1% for agricultural enterprises, by 11.8% for individual entrepreneurs and farms, and by 3.1% for households.

The largest share of gross crop production traditionally falls on North Kazakhstan (15.7% in 2022), Kostanay (14%), Akmola (13.3%), and Turkestan (11.2%) regions; a significant increase is also observed in West Kazakhstan (31.8%) and Zhambyl regions (12.6%).

By analyzing statistical data obtained during economic and mathematical calculations and collecting statistical data by year and region according to Table 2, a conclusion can be made that the increase in the share of crop production indicates the possibility of creating cotton and grain clusters in the territories of North Kazakhstan, Kostanay, Akmola, Turkestan, Zhambyl, and West Kazakhstan.

In order to create agricultural clusters and assess their effectiveness, various economic indicators are used, which were identified during the analysis of the current market structure and the proposed structure of participants that make up the agricultural cluster, and are presented in Table 3.

Table 3.

Key economic indicators that can be used to create agricultural clusters.

These indicators help analyze the economic efficiency of agricultural clusters, identify problems, and determine areas for improving the operation of the system. When assessing the effectiveness of a cluster, it is important to take into account not only economic, but also social and environmental aspects to ensure sustainable development.

By using qualitative analysis, it can be revealed that the most important factor in the modern competitiveness of clusters is the high level of development of the related institutions and industries system. On the one hand, it is the result of market relations and effective competition, and on the other hand, as for the formation of the national innovation system and the inflow of qualified personnel, it is an unconditional merit of the state policy. At the same time, one can observe an interesting situation when the effective development of high value-added production and active innovations take place in sectors where there is a lack of natural resources.

In many developed countries of the world, the lack of their own energy resources created a demand for energy-efficient technologies, the lack of natural resources (for export-oriented production) stimulated the deepening of raw material processing, while entrepreneurial efforts and competent industrial policy ensured the correct choice of promising market niches and investment priorities (Rogalsky and Shokurov 2020).

One of the main methods for achieving economic growth in the Republic of Kazakhstan is balanced regional development, which should reduce the development gap between regions. The experience of economically developed countries shows that policies related to regional development can achieve the following:

- Reduce the pressure of poverty and neglect in depressed and less developed areas of the country;

- Lead to the mitigation of economic contradictions that exist in large cities because of excessive urbanization and the concentration of financial and human resources that arise as a result of their outflow from rural areas.

Thus, it can be concluded that the usefulness of cluster policies can be evaluated according to their ability to achieve the above two objectives.

Territorial clusters in Kazakhstan were developed in accordance with the methodological framework defined by the Kazakhstan Institute for Industrial Development (KIDI), now Qazindustry (Kazakhstan Center for Industry and Export), with the support of the World Bank. The methodology took into account quantitative and qualitative information about existing clusters in which companies expressed their willingness to cooperate. The methodology included a number of aspects for potential assessment, including value chain development, the existence of enabling conditions (infrastructure development and the availability of financial resources), expected socio-economic impact, and prospects for cluster development.

Kazakhstan is currently placing significant emphasis on the advancement of clusters within the agricultural sector. The state’s cluster development policy is designed to create a conducive environment for the growth of clusters, including the facilitation of production and infrastructure projects, the provision of organizational support, and the advancement of the scientific and educational potential. Based on the findings of the conducted research, the following essential conditions for the establishment and implementation of agricultural clusters within the branches of the agricultural sector of the Republic of Kazakhstan can be identified:

- Intensifying government support of the agricultural sector in the field of cluster formation. In this regard, the following documents have been adopted in the republic:

- Concept for the Formation of Promising National Clusters of the Republic of Kazakhstan until 2020;

- Law of the Republic of Kazakhstan “On Grain”;

- Law of the Republic of Kazakhstan “On Cotton Industry Development” dated 21 July 2007 (with amendments and additions as of 24 May 2018);

- Code of the Republic of Kazakhstan “On Taxes and Other Obligatory Payments to the Budget” (Tax Code) (with amendments and additions as of 21 July 2018), etc.;

- Program for Sustainable Development of Livestock Farming in Kazakhstan for 2021–2025.

- Creating favorable conditions for the formation of production chains of sectoral regional clusters for the production, processing, and sale of grain and cotton. In this regard, it is necessary to improve the production and marketing infrastructure of clusters in these industries.

- It is necessary to attract investments for the development of agricultural clusters. Investments can be directed to improve the infrastructure (for example, roads, irrigation systems, and storage facilities for agricultural products) in the areas where agricultural clusters are located. This may improve production efficiency and reduce costs. Investing in modern technologies and innovations might help to increase yields, reduce crop losses, optimize resource use, and improve the quality and competitiveness of products. Table 4 presents fixed capital investment in agriculture, forestry, and fisheries.

Table 4. Investment in fixed assets in agriculture, forestry, and fisheries by region.

Table 4. Investment in fixed assets in agriculture, forestry, and fisheries by region.

The conducted statistical analysis shows that the largest share of investments falls on Akmola, Kostanay, Pavlodar, and North Kazakhstan regions. In terms of industries in these regions, investments predominate in the cultivation of one- and two-year crops, as well as in livestock farming. The share of investments in Pavlodar region amounted to 22.2% of the total investments.

However, investments in education and training are also needed to help develop skills and knowledge among agricultural workers and to help attract young professionals. It is also important to focus on agricultural research and development to promote new production methods, crop breeding, plant protection, and other innovations that can improve the efficiency and sustainability of agricultural clusters.

These investments can come from both public and private sources and play an important role in ensuring the sustainable development of agriculture and the regional economy.

The following areas of development were identified for agricultural clusters in Kazakhstan: grain, meat, and dairy clusters (Pavlodar region); a vegetable cluster (South Kazakhstan region); and a cotton cluster (Turkestan region). These regions have already established the fundamental elements of cluster development, which can be considered small agro-formations, for instance, Pavlodar region, and specifically Irtysh, Uspensky, and Aktogay districts. Each district has developed a specific branch of the agricultural industry.

Irtysh district in Pavlodar region, which focuses on the development of the grain cluster, can be used as an example. The district is a leader with a cultivated area of almost 309 thousand hectares. This year, the district is increasing grain production by expanding the sown area by another 37.6 thousand hectares. The district is known for its vast land resources suitable for the cultivation of various types of grain crops such as wheat, barley, oats, and others. The grain cluster unites enterprises specializing in the production and processing of grain, as well as research institutions, educational institutions, and other interested structures. The district is developing processing infrastructure, which includes the construction of mills, bakeries, and other grain processing enterprises. The core of the cluster, namely, agricultural producers in this area, are Urazbaev farm, Abay LLP, Talapker farm, and Zamandas farm. They own sown areas, receiving sites, and processing enterprises. The purpose of their activities is grain growing and processing to final products (bakery products and flour). There is also an elevator—Irtysh elevator—located in Irtyshsk village.

Another example is Abai LLP, the largest agricultural holding in the region located in the village of Golubovka, 100 km from the regional center Irtyshsk and 300 km from the city of Pavlodar. The company is headed by Nikolay Aleksandrovich Miller. This company is a record holder among grain production companies of the region. The sown area exceeds 70,000 hectares. The technical capabilities of Abai LLP make it possible to cultivate and sow up to 4000 hectares of wheat per day. In addition, there are receiving points—warehouses, processing enterprises, mills, and logistics centers that deliver up to 3.5 thousand tons of grain, and a receiving site for processed grain. Grain delivery is carried out through a logistics system: transportation to a grain receiving site for processing, cleaning, and drying. Thanks to the drying facilities, 1800 tons of grain can be brought to the desired condition every day. In addition to agricultural production, the farm is also engaged in livestock breeding: there are more than 800 heads of highly productive livestock: Simmental and white-headed cows; sheep and horse breeding are also developed well. Raw materials and waste grain products can serve as a feed base for the development of meat and dairy clusters on the territory of this farm.

However, there are currently no certain research institutions in the area, but as for personnel education, the Irtysh Agricultural and Technological College is located on the territory of the village, and its graduates are employed by these enterprises. The employment rate of the college graduates at these agricultural enterprises is 75%. According to statistics, the productivity of personnel with higher education is two times higher than the productivity of personnel without it. Therefore, it is necessary to motivate college graduates to obtain higher education, which can be funded by employers with agreements to work at these enterprises (at the moment, only about 5% were trained at the expense of the employers), as well as to develop dual training (which accounts for about 20% in the district) and organize on-site courses for retraining or advanced training.

The financial service element is represented by targeted loans from commercial banks located in Pavlodar and their branches in Irtysh district. The most relevant programs are preferential lending programs (at 2.5%) for the agricultural complex development. In 2022, Irtysh-Agro issued 446.0 million tenge. In total, 131 farms received subsidies for the development of crop production in the amount of 610.7 million tenge.

It can be concluded that Irtysh district has all the necessary conditions and prerequisites for the development of grain clusters now and meat and dairy clusters in the future. One of the major problems today is the lack of interconnection between some of the parts of future clusters. The development of clusters and support from government initiatives, including public investment, would help to increase total grain production, introduce modern technologies, including smart agriculture, automation, and other innovations, improve grain quality (through selection, quality control, and compliance with standards), organize marketing campaigns (brand building and participation in sales in local and global markets), and provide support for research in the field of grain farming, as well as in education and training. Based on the study of Irtysh district of Pavlodar region, a conclusion can be made that special attention should be paid to the development and investment in education, as well as the development of research institutions.

Grain cluster development can also include efforts to farm sustainably, minimize negative impacts on the environment, and conserve natural resources.

A key issue is coordination between government agencies, the business community, research institutions, and other stakeholders to create an enabling environment for grain cluster development in the country.

More active participation of farm owners is needed in the field of cooperation with legislative aspects, including the signing of agreements on the interaction between cluster units.

It should be noted that the economy of the agro-industrial complex is complexly structured and, as a rule, in the process of interactions within the sphere, various kinds of problems and challenges arise that require solutions for the effective implementation of cluster policy in the near future.

First of all, there can be a lack of funding. The creation and development of clusters requires investment in infrastructure, technology, and personnel training. A lack of funding may make it difficult to implement cluster projects.

Secondly, there is insufficient participation of small and medium-sized enterprises due to legal barriers. Certain legislative and regulatory aspects may have a negative impact on the development of clusters, such as difficulties with licensing or taxation.

Thirdly, insufficiently developed infrastructure in some regions can limit the development of clusters, complicating logistics and access to resources. Also, in some cases, the development of clusters may be concentrated in certain regions, which leads to uneven development of the agricultural sector economy.

The final problem is a low level of awareness and education. Some participants may have a limited knowledge of the concept of clustering and the benefits of this approach.

These problems can slow down the development of cluster structuring in the agricultural sector economy. However, with proper planning, cooperation between various participants, and support from the government, these obstacles can be overcome, and clusters can become an effective mechanism for the development of the agro-industrial complex.

Personal subsidiary farms may interact with agricultural clusters in the context of the development of agriculture and rural areas. There are about 1.6 million of them in Kazakhstan at the moment. There is a law on personal subsidiary farms which regulates the activities of these farms through the development of directions for socio-economic state policy.

Personal subsidiary farms often produce volumes of agricultural products for their own consumption. However, they can also become suppliers of raw materials for agricultural clusters. For example, they may supply fresh vegetables, fruit, or milk for processing within a cluster. Personal subsidiary farms can become part of these chains by providing initial raw materials or services such as tillage services or organic fertilizers. The existence of a cluster as a research and communication center is necessary to connect personal farm owners. Agricultural clusters also contribute to the development of infrastructure in rural areas, including roads, warehouses, and irrigation systems. This can also be beneficial for private subsidiary farms by improving the accessibility of markets and supplies.

In general, cooperation between private subsidiary farms and agricultural clusters can contribute to the sustainable development of rural areas, increase incomes, and improve the quality of life for rural residents.

The prospects for the development of cluster structuring in the economy of the agro-industrial complex are extensive and promising, especially in the context of modern challenges and changing economic dynamics. These prospects are presented in Table 5.

Table 5.

Prospects for the development of agro-industrial complex clusters.

These prospects emphasize the importance of further development of cluster structuring in the economics of the agricultural sector to achieve the sustainable and innovative development of this important industry.

In terms of investments, much attention should be paid to investing in education to train personnel to work in agricultural clusters. Investing in educational programs specializing in agriculture, agribusiness, agroengineering, and related fields will allow the training of qualified specialists who will be able to work effectively in various segments of the agricultural sector. As a result, the presence of qualified specialists and innovative developments may attract investors’ attention, contributing to the inflow of capital into agricultural clusters.

So, investment in education is a key factor in the creation and development of agricultural clusters. Support for educational programs, research, and the professional training of specialists contributes to improving the efficiency of agriculture, stimulates innovative development, and promotes the sustainable growth of the regional economy.

In order to calculate the Pearson correlation coefficient using the example of an agricultural manufacturing enterprise, let us assume that there are two variables: the volume of investment in technical equipment (in millions of tenge) and the volume of agricultural products (in tons). The goal is to determine whether there is a relationship between the volume of investment and the volume of production. To do this, the following steps will be taken:

- Data collection:

Table 6 presents data on the amount of investment and production volume over the past five years.

Table 6.

Data on the amount of investment and the volume of production over the past five years.

- 2.

- Let us calculate mean values for each variable:

- The mean investment amount ()

- The mean production amount () =

- 3.

- The calculation of the deviation from the mean for each variable is shown in Table 7.

Table 7. Calculation of deviation from the average for each variable.

Table 7. Calculation of deviation from the average for each variable. - 4.

- Let us multiply the deviations of one variable by the deviations of another variable and present the data in Table 8.

Table 8. Multiplication of the deviations of one variable by the deviations of another variable.

Table 8. Multiplication of the deviations of one variable by the deviations of another variable. - 5.

- Let us add up all the obtained products:2500.0 + 900.0 + 0.0 + 900.0 + 2500.0 = 6800.0

- 6.

- Let us calculate the sum of squared deviations for each variable:

- Sum of squared deviations for investment

- Sum of squared deviations for production

- 7.

- Let us calculate the linear correlation coefficient using the Pearson correlation coefficient formula

- 8.

- Interpretation of results:

The value of the Pearson correlation coefficient r is close to 1, which indicates a strong positive correlation between the amount of investment in technical equipment and the volume of agricultural production at an agricultural enterprise.

Thus, this research shows that an increase in investment in technical equipment at an agricultural enterprise is accompanied by an increase in the volume of agricultural production.

4. Discussion and Conclusions

Based on the qualitative and quantitative (statistical) research methods used in this research, the results can be summarized in the following way.

In a general context, performing such tasks requires the use of clustering, which is aimed at identifying compact groups of objects with similar characteristics. The clustering process belongs to the field of classification problems, where the goal is to divide the processed set of objects into structural classes.

Thus, international and domestic experience show that agricultural and agro-logistics clusters are gaining importance as a key component in the development of strategies and programs aimed at increasing competitiveness and deepening integration in various segments of the agro-industrial complex. This applies to both the national and regional (including cross-border) levels, as well as to the sphere of integration associations. It is especially relevant if such associations have strong production and technological links at all stages of the agro-industrial complex and pursue a coordinated agricultural strategy.

The stage of introducing joint agricultural and logistics clusters has the potential to become a driving force for improving competitiveness not only in the agricultural sector, but also in various related and auxiliary production and service sectors, and also requires the development of the logistics sector.

In the context of the modern global economy, the low ratings of transport and agricultural logistics companies in Kazakhstan have a strong negative impact on their participation in global trade turnover and commodity competitiveness. These ratings also influence their role in the organization of international economic relations in general, as well as the development of the system of international transport corridors and the use of their potential for transit transportation.

In light of these decisions, it is necessary to accelerate the process of developing and implementing a strategy for the integrated development of agricultural and logistics clusters. This is especially relevant given the small share of agriculture in the economy of Kazakhstan and the need to increase it.

Having conducted a qualitative and quantitative analysis of the agro-industrial complex development, namely, the essence, structure, and functions of agricultural clusters, it can be argued that they are essentially a source of innovative development. At the same time, the success of their activity is determined by the developed strategy and institutions that form the institutional environment for the innovative development of the agro-industrial complex.

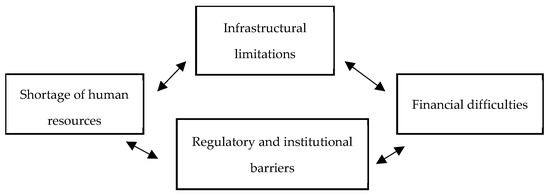

Despite this, agro-industrial clustering involves a number of problems and obstacles that can hinder its development. Some existing problems are presented in Figure 4.

Figure 4.

Problems of agricultural cluster development. Source: compiled by the authors.

- Infrastructural limitations

The lack of production infrastructure is a significant obstacle to the effective functioning of agricultural clusters. The level of wear and tear on technological equipment of agricultural enterprises is currently over 50%.

- 2.

- Financial difficulties

A lack of financial resources and difficulties with access to credit limit the development opportunities of small and medium-sized enterprises within clusters.

For example, a farm in South Kazakhstan region faced the need to modernize its equipment to increase yields and expand the range of products. The owner of the farm applied to several banks for a loan, but faced a number of problems: the banks required collateral in the form of real estate or land, the value of which had to exceed the loan amount. The farm did not have sufficient assets to provide such collateral. In the banks that were ready to grant a loan, interest rates ranged from 15% to 20% per annum, which was too high for the farm given its current profitability. Having failed to obtain the necessary financial resources, the farm had to abandon its modernization plans. This led to a decrease in the competitiveness of the enterprise, a stagnation of production capacities and, ultimately, a decrease in income and profitability.

- 3.

- Shortage of human resources

A low level of staff training, the outflow of workers from rural areas, and a lack of qualified specialists in agriculture and related industries hinder the development of clusters. Kazakhstan’s agriculture currently has a negative turnover of personnel, and the trend is getting worse: from 12.3% in 2010 to 22.0% in 2023.

- 4.

- Regulatory and institutional barriers

An imperfect legal framework and administrative barriers, a low degree of coordination between government agencies, and insufficient support from government programs hinder the formation and development of agricultural clusters. The existing Program for the Development of the Agro-Industrial Complex in the Republic of Kazakhstan could not solve the problems and thus was not fully implemented.

Based on the problems described above and the analysis that was carried out, the following solutions are proposed:

- In order to solve the problem of infrastructural constraints, it is necessary to invest in the technical equipment of the agricultural enterprise. This is evidenced by the calculated correlation coefficient, which shows that an increase in investment in technical equipment contributes to an increase in agricultural production.

- Financial support is needed in the form of preferential loans and grants for the modernization of production and the introduction of new technologies, as well as the creation of specialized financial instruments and funds to support small and medium-sized enterprises in agricultural clusters.

- The regional development of clusters can contribute to the creation of new jobs, increase employment, improve the quality of life of the population in rural areas, and ensure food security through the production of competitive products. The improvement of the quality of education and training is related to the development and implementation of educational programs for training qualified specialists in agriculture and related industries. Cooperation with universities and research centers may help to create competence centers and innovation hubs.

- It is necessary to improve the legal framework for the creation and functioning of agricultural clusters, provide tax benefits, and introduce favorable conditions for the lease and purchase of land plots for cluster participants. To ensure the successful development of the agricultural sector in Kazakhstan, it is necessary to develop a National Program for the Development of the Agricultural Sector of Kazakhstan, taking into account past mistakes and modern challenges. It is also proposed to develop a Law on Improving the Policy of the Agricultural Sector of the Republic of Kazakhstan. The law will be aimed at creating a legal framework for the development of the agricultural sector, increasing its competitiveness, ensuring food security and the sustainable development of rural areas, including the development of their infrastructure, solving the problems of preferential lending and subsidies, and improving the standard of living of the rural population.

The analysis made it possible to identify problems in the development of the agricultural sector, including the formation of clusters. Solving these problems may lead to the sustainable development of agriculture, increasing the efficiency of small and medium-sized enterprises within the agricultural cluster.

The analysis of the calculated indicators (the share of agriculture in GDP, and growth rates by year using statistical analysis (economic analysis)) made it possible to study in depth the ongoing economic processes in the formation and development of clusters. The development of the agricultural sector based on clustering will increase the production of competitive products and ensure food security in the region.

The introduction of a cluster approach can be an important step towards the sustainable development of the agro-industrial complex of Kazakhstan and its integration into the global economy. Solving these problems and overcoming obstacles can only be achieved through active cooperation between the state, agro-industrial producers, and other market participants through the use of incentive mechanisms.

Author Contributions

Conceptualization, A.T. and G.S.; methodology, M.K.; formal analysis, M.K.; investigation, S.S.; resources, T.T.; writing—original draft, A.T.; writing—review and editing, G.S. All authors have read and agreed to the published version of the manuscript.

Funding

This research received no external funding.

Informed Consent Statement

Not applicable.

Data Availability Statement

The data used are open-source. Neither classified nor trade secret data were used. The data are available at https://stat.gov.kz/ (accessed on 31 December 2023), and https://www.wipo.int/ipstats/ru/statistics/country_profile/ (accessed on 31 December 2023).

Conflicts of Interest

The authors declare no conflicts of interest.

References

- Dunning, John H. 1981. International Production and the Multinational Enterprise. London: L. George Allen & Unwin, p. 440. [Google Scholar]

- Enright, Michael. 1992. Why Clusters are the Way to Win the Game? World Link 5: 24–25. [Google Scholar]

- Gabriel, Andreas, and Vera Bitsch. 2023. Everywhere the same? Competitiveness of two regional vegetable production clusters in Southern Germany. International Food and Agribusiness Management Review 1: 139–57. [Google Scholar] [CrossRef]

- Humphrey, John, and Hubert Schmitz. 2000. Governance and Upgrading: Linking Industrial Cluster and Global Value Chain Pesearch. IDS Working Paper № 120. Brighton: IDS, p. 37. [Google Scholar]

- Huseynov, Rashad, Naila Aliyeva, and Valery Bezpalov. 2023. Cluster analysis as a tool for improving the performance of agricultural enterprises in the agro-industrial sector. Environment, Development and Sustainability 1: 4119–32. [Google Scholar] [CrossRef]

- Kaplinsky, Raphael, Mike Morris, and Jeff Readman. 2001. The Globalization of Product Markets Immerising Growth: Lesson from the South African Furniture Industry. IDS Working Paper. Brighton: IDS, p. 34. [Google Scholar]

- Markusen, Ann. 1996. Sticky Places in Slippery Spaces: A Typology of Industrial Districts. Economic Geography 72: 293–313. [Google Scholar] [CrossRef]

- Pessoa, Argentino. 2013. Competitiveness, clusters and policy at the regional level: Rhetoric vs. practice in designing policy for depressed regions. Regional Science Inquiry Journal 5: 101–16. [Google Scholar]

- Porter, Michael. 1998. Clusters and the New Economics of Competitions. Harward Business Review 76: 77–90. [Google Scholar]

- Rogalsky, A., and A. Shokurov. 2020. Assessment of Energy and Mineral Resource Endowments in Central Asia. Geneva: UNECE, p. 247. [Google Scholar]

- Rugman, Alan, and Alan Verbeke. 2002. Multinational Enterprises and Clusters: An Organizing Framework. Templeton College Working Paper. Berlin/Heidelberg: Springer, p. 24. [Google Scholar]

- Shumpeter, Joseph. 1982. Teoriya Ekonomicheskogo Razvitiya. Moskva: Progress, p. 401. 456p. [Google Scholar]

- Stoper, Michael, and Richard Walker. 1989. The capital imperative. In Territory, Technology and Industrial Growth. New York: Basil Blackwell, p. 292. [Google Scholar]

- Sutor, P., A. Reiger, and A. Keisel. 2019. Agricultural Markets 2019—Vegetables. Publication series of the Bavarian State Institute for Agriculture (LfL). Freising Weihenstephan and Schwäbisch Gmünd, Freising, Germany 15: 139–43. [Google Scholar]

- Yanovskaya, O. A., and S. A. Saginova. 2020. Prodovol’stvennaya Bezopasnost’ Kazahstana v Usloviyah Integracii: Problemy i Perspektivy. Monografiya Karaganda: TOO «Tengri Ltd.», p. 210. [Google Scholar]

- Yuldashev, G. 2012. Management of competitiveness of agricultural clusters. International Scientific Review of Modern Science and Education, 26–33. Available online: https://cyberleninka.ru/article/n/upravlenie-konkurentosposobnostyu-agroklasterov/viewer (accessed on 24 April 2024).

- Zaushicina, L., and L. Suvorova. 2014. Razvitie territorial’no-proizvodstvennyh klasterov kak osnova aktivizacii innovacionnyh processov v Kirovskoj oblasti. Nauchnoe Obozrenie Science Review 6: 255–60. [Google Scholar]

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2024 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).