Impact of Firm-Specific and Macroeconomic Determinants on Environmental Expenditures: Empirical Evidence from Manufacturing Firms

Abstract

1. Introduction

- What are the determinants of environmental expenditures in Indian manufacturing firms?

- Do country-level governance and economic development moderate the association between firm-specific and environmental expenditures of Indian manufacturing firms?

- What is the impact of the COVID-19 pandemic on environmental expenditures?

2. Literature Review and Hypothesis Development

2.1. Firm-Specific and Environmental Expenditures

2.2. Macroeconomic Determinants, Country-Level Governance, and Environmental Expenditures

2.3. COVID-19 Pandemic and Firms’ Environmental Expenditures

3. Research Methodology

3.1. Sample and Data

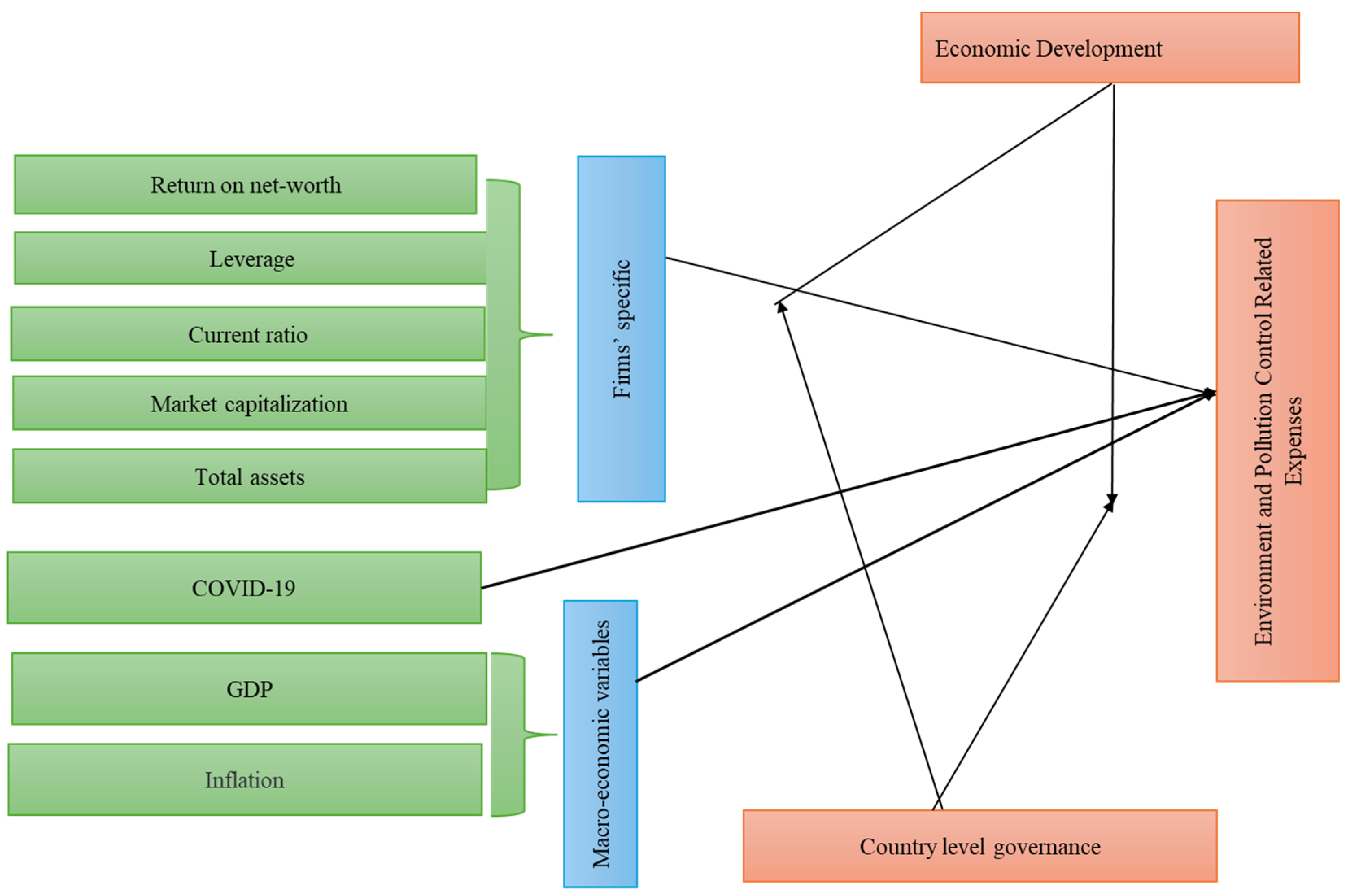

3.2. Research Framework and Variable Definition

3.3. Model Specifications

4. Data Analysis and Discussion

4.1. Descriptive Statistics

4.2. Correlation Analysis

4.3. Regression Analysis

4.4. Robust Analysis

5. Conclusions

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

References

- Abaidoo, Rexford, and Elvis Kwame Agyapong. 2021. Corporate performance volatility: A micro-level perspective. Journal of Money and Business 1: 42–63. [Google Scholar] [CrossRef]

- Abdu, Musa, and Adamu Jibir. 2018. Determinants of firms’ innovation in Nigeria. Kasetsart Journal of Social Sciences 39: 448–56. [Google Scholar] [CrossRef]

- Apple. 2020. Apple Commits to be 100 Per Cent Carbon Neutral for Its Supply Chain and Products by 2030. Apple Newsroom. Available online: https://www.apple.com/uk/newsroom/2020/07/apple-commits-tobe-100-percent-carbon-neutral-for-its-supply-chain-and-products-by-2030/ (accessed on 10 June 2022).

- Arjomandi, Amir, Hassan F. Gholipour, Reza Tajaddini, and Charles Harvie. 2023. Environmental expenditure, policy stringency and green economic growth: Evidence from OECD countries. Applied Economics 55: 869–84. [Google Scholar] [CrossRef]

- Bajaj, Yukti, Smita Kashiramka, and Shveta Singh. 2018. Dynamics of capital structure: Evidence from Indian manufacturing firms. Journal for Global Business Advancement 11: 667–86. [Google Scholar] [CrossRef]

- Baltagi, Badi H., Espen Bratberg, and Tor Helge Holmås. 2005. A panel data study of physicians’ labor supply: The case of Norway. Health Economics 14: 1035–45. [Google Scholar] [CrossRef]

- Barbosa, Natália, Ana Paula Faria, and Vasco Eiriz. 2014. Industry-and firm-specific factors of innovation novelty. Industrial and Corporate Change 23: 865–902. [Google Scholar] [CrossRef]

- Basoglu, Aykut, and Umut Uzar. 2019. An empirical evaluation about the effects of environmental expenditures on environmental quality in coordinated market economies. Environmental Science and Pollution Research 26: 23108–18. [Google Scholar] [CrossRef]

- Beiner, Stefan, Wolfgang Drobetz, Markus M. Schmid, and Heinz Zimmermann. 2006. An integrated framework of corporate governance and firm valuation. European Financial Management 12: 249–83. [Google Scholar] [CrossRef]

- Belderbos, René, Martin Carree, and Boris Lokshin. 2004. Cooperative R&D and firm performance. Research Policy 33: 1477–92. [Google Scholar]

- Bianco, Gino B. 2020. Climate change adaptation, coffee, and corporate social responsibility: Challenges and opportunities. International Journal of Corporate Social Responsibility 5: 3. [Google Scholar] [CrossRef]

- Broadstock, David C., Yan Shu, and Bing Xu. 2011. The heterogeneous impact of macroeconomic conditions on firms’ earnings forecast. Paper presented at Macao International Symposium on Accounting and Finance, Macau, China, November 21–24. [Google Scholar]

- Brodeur, Abel, David Gray, Anik Islam, and Suraiya Bhuiyan. 2021. A literature review of the economics of COVID-19. Journal of Economic Surveys 35: 1007–44. [Google Scholar] [CrossRef]

- Bui, Linda T. M., and Samuel Kapon. 2012. The impact of voluntary programs on polluting behavior: Evidence from pollution prevention programs and toxic releases. Journal of Environmental Economics and Management 64: 31–44. [Google Scholar] [CrossRef]

- Caraka, Rezzy Eko, Youngjo Lee, Robert Kurniawan, Riki Herliansyah, Prana Ugiana Gio, Puspita Anggraini Kaban, Bahrul Ilmi Nasution, Rung-Ching Chen, Toni Toharudin, and Bens Pardamean. 2020. Impact of COVID-19 large scale restriction on environment and economy in Indonesia. Global Journal of Environmental Science and Management 6: 65–84. [Google Scholar]

- CDP, CDSB, GRI, and SASB. 2020. Reporting on Enterprise Value Illustrated with a Prototype Climate-Related Financial Disclosure Standard. Available online: http://www.entegreraporlamatr.org/tr/mailing/25122020/images/Reporting-on-enterprise-value_climate-prototype_Dec20.pdf (accessed on 1 June 2022).

- CFA Institute. 2019. ESG Integration in Europe, the Middle East, and Africa: Markets, Practices, and Data. Available online: https://www.unpri.org/download?ac=6036 (accessed on 1 June 2022).

- Chatzoglou, Prodromos, Dimitrios Chatzoudes, Lazaros Sarigiannidis, and Georgios Theriou. 2018. The role of firm-specific factors in the strategy-performance relationship: Revisiting the resource-based view of the firm and the VRIO framework. Management Research Review 41: 46–73. [Google Scholar] [CrossRef]

- Chen, Wei-Ru, and Kent D. Miller. 2007. Situational and institutional determinants of firms’ R&D search intensity. Strategic Management Journal 28: 369–81. [Google Scholar]

- Cheng, Shulei, Kexin Wang, Fanxin Meng, Gengyuan Liu, and Jiafu An. 2024. The unanticipated role of fiscal environmental expenditure in accelerating household carbon emissions: Evidence from China. Energy Policy 185: 113962. [Google Scholar] [CrossRef]

- Chinazzi, Matteo, Jessica T. Davis, Marco Ajelli, Corrado Gioannini, Maria Litvinova, Stefano Merler, Ana Pastore y Piontti, Kunpeng Mu, Luca Rossi, Kaiyuan Sun, and et al. 2020. The effect of travel restrictions on the spread of the 2019 novel coronavirus (COVID-19) outbreak. Science 368: 395–400. [Google Scholar] [CrossRef]

- Chong, Zhaohui, Chenglin Qin, and Xinyue Ye. 2017. Environmental regulation and industrial structure change in China: Integrating spatial and social network analysis. Sustainability 9: 1465. [Google Scholar] [CrossRef]

- Cohen, A. 2020. Jeff Bezos Commits $10 Billion to New Bezos Earth Fund. Forbes. Available online: https://www.forbes.com/sites/arielcohen/2020/02/24/jeff-bezos-commits-10-billion-to-new-bezos-earth-fund/ (accessed on 1 June 2022).

- Costa-Campi, Maria Teresa, José García-Quevedo, and Ester Martínez-Ros. 2017. What are the determinants of investment in environmental R&D? Energy Policy 104: 455–65. [Google Scholar]

- Darnall, Nicole, Irene Henriques, and Perry Sadorsky. 2010. Adopting proactive environmental strategy: The influence of stakeholders and firm size. Journal of Management Studies 47: 1072–94. [Google Scholar] [CrossRef]

- Dechezleprêtre, Antoine, and Misato Sato. 2017. The impacts of environmental regulations on competitiveness. Review of Environmental Economics and Policy 11: 2. [Google Scholar] [CrossRef]

- Ding, Huiping, Qilan Zhao, Zhirong An, and Ou Tang. 2016. Collaborative mechanism of a sustainable supply chain with environmental constraints and carbon caps. International Journal of Production Economics 181: 191–207. [Google Scholar] [CrossRef]

- Dube, Cynthia Nokubonga, Gift Muresherwa, and Washington Makuzva. 2023. Domestic Leisure Tourism: Lessons Learnt from Township Business Operators During the COVID-19 Pandemic Era. In COVID-19, Tourist Destinations and Prospects for Recovery: Volume Three: A South African and Zimbabwean Perspective. Cham: Springer International Publishing, pp. 183–200. [Google Scholar]

- Egbunike, Chinedu Francis, and Chinedu Uchenna Okerekeoti. 2018. Macroeconomic factors, firm characteristics and financial performance: A study of selected quoted manufacturing firms in Nigeria. Asian Journal of Accounting Research 3: 142–68. [Google Scholar] [CrossRef]

- Eiadat, Yousef, Aidan Kelly, Frank Roche, and Hussein Eyadat. 2008. Green and competitive? An empirical test of the mediating role of environmental innovation strategy. Journal of World Business 43: 131–145. [Google Scholar] [CrossRef]

- El Khoury, Rim, Nohade Nasrallah, and Bahaaeddin Alareeni. 2023. ESG and financial performance of banks in the MENAT region: Concavity–convexity patterns. Journal of Sustainable Finance & Investment 13: 406–30. [Google Scholar]

- Farhan, Najib H. S., Faozi A. Almaqtari, Ebrahim Mohammed Al-Matari, Nabil Ahmed M. Senan, Waleed M. Alahdal, and Saddam A. Hazaea. 2021. Working Capital Management Policies in Indian Listed Firms: A State-Wise Analysis. Sustainability 13: 4516. [Google Scholar] [CrossRef]

- Farhan, Najib H. S., Faozi A. Almaqtari, Saddam A. Hazaea, and Waleed M. Al-Ahdal. 2023. The moderating effect of liquidity on the relationship between sustainability and firms’ specifics: Empirical evidence from indian manufacturing sector. Heliyon 9: e15439. [Google Scholar] [CrossRef]

- Fassas, Athanasios, Sotirios Bellos, and George Kladakis. 2021. Corporate liquidity, supply chain and cost issues awareness within the COVID-19 context: Evidence from us management reports’ textual analysis. Corporate Governance: The International Journal of Business in Society 21: 1155–71. [Google Scholar] [CrossRef]

- Gatenholm, Gabriella, and Árni Halldórsson. 2023. Responding to discontinuities in product-based service supply chains in the COVID-19 pandemic: Towards transilience. European Management Journal 41: 425–36. [Google Scholar] [CrossRef]

- Govind, S. J. Krishna, and Bhawana Jain. 2018. Characteristics of Corporate Wilful Default. Paper presented at 2018 International Conference on Advances in Computing, Communications and Informatics (ICACCI), Bangalore, India, September 19–22; Piscataway: IEEE, pp. 1975–80. [Google Scholar]

- Gupta, Neeraj, and Jitendra Mahakud. 2020. CEO characteristics and bank performance: Evidence from India. Managerial Auditing Journal 35: 1057–93. [Google Scholar] [CrossRef]

- Haller, Stefanie A., and Liam Murphy. 2012. Corporate Expenditure on Environmental Protection. Environmental and Resource Economics 51: 277–296. [Google Scholar] [CrossRef]

- Haque, Faizul. 2017. Does the rolodex matter? The effects of board characteristics and sustainable compensation policy on carbon performance of UK firms. The British Accounting Review 49: 347–64. [Google Scholar] [CrossRef]

- Hart, Stuart L. 2005. Capitalism at the Crossroads: The Unlimited Business Opportunities in Solving the World’s Most Difficult Problems. London: Pearson Education. [Google Scholar]

- He, Lingyun, Meng Wu, Deqing Wang, and Zhangqi Zhong. 2018. A study of the influence of regional environmental expenditure on air quality in China: The effectiveness of environmental policy. Environmental Science and Pollution Research 25: 7454–68. [Google Scholar]

- He, Zheng-Xia, Shi-Chun Xu, Wen-Xing Shen, Ru-Yin Long, and Hong Chen. 2016. Factors that influence corporate environmental behavior: Empirical analysis based on panel data in China. Journal of Cleaner Production 133: 531–43. [Google Scholar] [CrossRef]

- Hellerstein, Joseph M. 2008. Quantitative data cleaning for large databases. United Nations Economic Commission for Europe (UNECE) 25: 1–42. [Google Scholar]

- Hill, Catherine, Christianne Corbett, and Andresse St Rose. 2010. Why So Few? Women in Science, Technology, Engineering, and Mathematics. Washington, DC: American Association of University Women. [Google Scholar]

- Holm, Ulf, and D. Deo Sharma. 2006. Subsidiary marketing knowledge and strategic development of the multinational corporation. Journal of International Management 12: 47–66. [Google Scholar] [CrossRef]

- Jin, Shumo, Juanru Wang, and Peiyu Zhu. 2024. Environmental scanning, resource orchestration, and disruptive innovation. R&D Management. [Google Scholar] [CrossRef]

- Jin, Zhenji, and Jian Xu. 2019. Impact of Environmental Investment on Financial Performance: Evidence from Chinese listed Companies. Polish Journal of Environmental Studies 29: 2235–45. [Google Scholar] [CrossRef]

- Kassinis, George, and Nikos Vafeas. 2006. Stakeholder pressures and environmental performance. Academy of Management Journal 49: 145–59. [Google Scholar] [CrossRef]

- Kedward, Katie, Josh Ryan-Collins, and Hugues Chenet. 2022. Biodiversity loss and climate change interactions: Financial stability implications for central banks and financial supervisors. Climate Policy 23: 763–81. [Google Scholar] [CrossRef]

- Khan, Syed Abdul Rehman, Zhang Yu, and Khalid Farooq. 2023. Green capabilities, green purchasing, and triple bottom line performance: Leading toward environmental sustainability. Business Strategy and the Environment 32: 2022–34. [Google Scholar] [CrossRef]

- Kieschnick, RRobert, Mark LaPlante, and Rabih Moussawi. 2006. Corporate working capital management: Determinants and consequences. International Journal of Managerial Finance 3: 164–77. [Google Scholar]

- Kim, Tae Hyung, and Bowon Kim. 2018. Firm’s environmental expenditure, R&D intensity, and profitability. Sustainability 10: 2071. [Google Scholar]

- Kyereboah-Coleman, Anthony. 2007. The impact of capital structure on the performance of microfinance institutions. The Journal of Risk Finance 8: 56–71. [Google Scholar] [CrossRef]

- Le Gallo, Julie, and Youba Ndiaye. 2021. Environmental expenditure interactions among OECD countries, 1995–2017. Economic Modelling 94: 244–55. [Google Scholar] [CrossRef]

- Lee, In Hyeock, and Alan M. Rugman. 2012. Firm-specific advantages, inward FDI origins, and performance of multinational enterprises. Journal of International Management 18: 132–46. [Google Scholar] [CrossRef]

- Lee, Sze Wing Amy, Marcus Rodrigs, Thurai Murugan Nathan, Abdur Rashid, and Abdullah Al-Mamun. 2023. The relationship between the quality of sustainability reporting and corporate financial performance: A cross-sectional and longitudinal study. Australasian Accounting, Business and Finance Journal 17: 38–60. [Google Scholar] [CrossRef]

- Li, Boyu, Lishan Li, and Tianlei Pi. 2022. Is the R&D Expenditure of Listed Companies Green? Evidence from China’s A-Share Market. International Journal of Environmental Research and Public Health 19: 11969. [Google Scholar] [PubMed]

- Li, Jinchang, Ganghui Lian, and Aiting Xu. 2023. How do ESG affect the spillover of green innovation among peer firms? Mechanism discussion and performance study. Journal of Business Research 158: 113648. [Google Scholar] [CrossRef]

- Li, Kaifeng, Bobo Xia, Yun Chen, Ning Ding, and Jie Wang. 2021. Environmental uncertainty, fnancing constraints and corporate investment: Evidence from China. Pacific-Basin Finance Journal 70: 101665. [Google Scholar] [CrossRef]

- Li, Yiwei, Mengfeng Gong, Xiu-Ye Zhang, and Lenny Koh. 2018. The impact of environmental, social, and governance disclosure on firm value: The role of CEO power. The British Accounting Review 50: 60–75. [Google Scholar] [CrossRef]

- Linder, Marcus. 2016. Determinants of economic performance of environmental technology-based offers: A cross-sectional study of small Swedish firms. International Journal of Innovation and Sustainable Development 10: 237–59. [Google Scholar] [CrossRef]

- Lu, Jane W., and Paul W. Beamish. 2004. International diversification and firm performance: The S-curve hypothesis. Academy of Management Journal 47: 598–609. [Google Scholar] [CrossRef]

- Luo, Zhi, Huanhuan Yang, and Yinuo Zhang. 2024. Foreign shareholding and corporate environmental expenditure: Evidence from China. Journal of Economic Surveys. [Google Scholar] [CrossRef]

- Maditinos, Dimitrios, Dimitrios Chatzoudes, Charalampos Tsairidis, and Georgios Theriou. 2011. The impact of intellectual capital on firms’ market value and financial performance. Journal of Intellectual Capital 12: 132–51. [Google Scholar] [CrossRef]

- Madlani, Minu, Jagruti Darji, Antara Sonawane, Sheetal Mody, and Om Prakash Agrawal. 2021. Effects of Economic Growth Rate on Financial Performance of Indian Companies. Turkish Online Journal of Qualitative Inquiry 12: 4566. [Google Scholar]

- Meng, X. H., S. X. Zeng, X. M. Xie, and G. Y. Qi. 2016. The impact of product market competition on corporate environmental responsibility. Asia Pacific Journal of Management 33: 267–91. [Google Scholar] [CrossRef]

- Murovec, Nika, Renata Slabe Erker, and Igor Prodan. 2012. Determinants of environmental investments: Testing the structural model. Journal of Cleaner Production 37: 265–77. [Google Scholar] [CrossRef]

- Narula, Sapna A., Muneer A. Magray, and Anupriya Desore. 2017. A sustainable livelihood framework to implement CSR project in coal mining sector. Journal of Sustainable Mining 16: 83–93. [Google Scholar] [CrossRef]

- Narula, Sapna A., Muneer Ahmad Magry, and Ashima Mathur. 2019. Business-community engagement: A case of mining company in India. Business Strategy & Development 2: 315–31. [Google Scholar]

- Nawaiseh, Mohammad Ebrahim. 2015. Do firm size and financial performance affect corporate social responsibility disclosure: Employees’ and environmental dimensions? American Journal of Applied Sciences 12: 967. [Google Scholar] [CrossRef]

- Orsato, Renato J. 2006. Competitive environmental strategies: When does it pay to be green? California Management Review 48: 127. [Google Scholar] [CrossRef]

- Osiichuk, Dmytro, Mirosław Wasilewski, and Serhiy Zabolotnyy. 2021. The impact of independent supervisory boards on transformations in the energy sector: Results of an international longitudinal study. Energies 14: 5293. [Google Scholar] [CrossRef]

- Patil, K. R. 2022. Application of Oxygenated DEE and Ethanol on the Performance and Emission Characteristics of Diesel-Fuelled CI Engine in the Context of Variable Injection Timing. International Journal of Vehicle Structures & Systems (IJVSS) 14. [Google Scholar] [CrossRef]

- Poddar, Anushree, Sapna A. Narula, and Muneer Ahmad Magry. 2022. State of the Art of Corporate Social Responsibility Practices and Sustainable Development Goals in India During the COVID 19 Pandemic. In Emerging Economic Models for Sustainable Businesses: A Practical Approach. Singapore: Springer, pp. 155–73. [Google Scholar]

- Priya, S. Shanmuga, Erdem Cuce, and Kumarasamy Sudhakar. 2021. A perspective of COVID 19 impact on global economy, energy and environment. International Journal of Sustainable Engineering 14: 1290–305. [Google Scholar] [CrossRef]

- Rolnick, David, Priya L. Donti, Lynn H. Kaack, Kelly Kochanski, Alexandre Lacoste, Kris Sankaran, Andrew Slavin Ross, Nikola Milojevic-Dupont, Natasha Jaques, Anna Waldman-Brown, and et al. 2022. Tackling climate change with machine learning. ACM Computing Surveys 55: 1–96. [Google Scholar] [CrossRef]

- Roodman, David. 2006. How to do xtabond2: An introduction to difference and system GMM in Stata. The Stata Journal: Promoting Communications on Statistics and Stata 9: 86–136. [Google Scholar] [CrossRef]

- Rugman, Alan M., Jing Li, and Chang Hoon Oh. 2009. Are supply chains global or regional? International Marketing Review 26: 384–95. [Google Scholar] [CrossRef]

- Rugman, Alan, and Nessara Sukpanich. 2006. Firm-specific advantages intra-regional sales and performance of multinational enterprises. The International Trade Journal 20: 355–82. [Google Scholar] [CrossRef]

- Sáenz, Rogelio, and Corey Sparks. 2020. The inequities of job loss and recovery amid the COVID-19 pandemic. The Carsey School of Public Policy at the Scholars’ Repository 412. [Google Scholar] [CrossRef]

- Safitri, Vera Apridina, Lindriana Sari, and Rindu Rika Gamayuni. 2020. Research and Development (R&D), Environmental Investments, to Eco-Efficiency, and Firm Value. The Indonesian Journal of Accounting Research 22. [Google Scholar] [CrossRef]

- Saini, Neha, Monica Singhania, Morshadul Hasan, Miklesh Prasad Yadav, and Mohammad Zoynul Abedin. 2022. Non-financial disclosures and sustainable development: A scientometric analysis. Journal of Cleaner Production 381: 135173. [Google Scholar] [CrossRef]

- Samantara, Rabinarayan, and Shivangi Dhawan. 2020. Corporate social responsibility in India: Issues and challenges. IIMS Journal of Management Science 11: 91–103. [Google Scholar] [CrossRef]

- Samsinar, Kamsi Nor, and Radin Badaruddin Radin Firdaus. 2019. Is there a link between environmental expenditure, innovation, and revenue in Malaysian manufacturing industry? Kasetsart Journal of Social Sciences 40: 136–41. [Google Scholar]

- Singh, Nitish, Jieqiong Ma, and Jie Yang. 2016. Optimizing environmental expenditures for maximizing economic performance. Management Decision 54: 2544–61. [Google Scholar] [CrossRef]

- Singh, Prakash, and Charanjit Kaur. 2021. Factors determining financial constraint of SMEs: A study of unorganized manufacturing enterprises in India. Journal of Small Business & Entrepreneurship 33: 269–287. [Google Scholar]

- Sinha, Abhishek Kumar, Aswini Kumar Mishra, Manogna Rl, and Rohit Prabhudesai. 2021. Examining the determinants of small firms’ performance in India. International Journal of Productivity and Performance Management 71: 2496–533. [Google Scholar] [CrossRef]

- Smith, Carter S., Morgan E. Rudd, Rachel K. Gittman, Emily C. Melvin, Virginia S. Patterson, Julianna J. Renzi, Emory H. Wellman, and Brian R. Silliman. 2020. Coming to terms with living shorelines: A scoping review of novel restoration strategies for shoreline protection. Frontiers in Marine Science 7: 434. [Google Scholar] [CrossRef]

- Sun, Jerry, and Steven F. Cahan. 2012. The economic determinants of compensation committee quality. Managerial Finance 38: 188–205. [Google Scholar] [CrossRef]

- Sun, Rui, and Ganna Zou. 2021. Political connection, CEO gender, and firm performance. Journal of Corporate Finance 71: 101918. [Google Scholar] [CrossRef]

- Van Hoang, Thi Hong, Wojciech Przychodzen, Justyna Przychodzen, and Elysé A. Segbotangni. 2021. Environmental transparency and performance: Does the corporate governance matter? Environmental and Sustainability Indicators 10: 100123. [Google Scholar] [CrossRef]

- Wanday, Julia, and Samer Ajour El Zein. 2022. Higher expected returns for investors in the energy sector in Europe using an ESG strategy. Frontiers in Environmental Science 10: 1031827. [Google Scholar] [CrossRef]

- Wang, Feng, Zhihua Cheng, Christine Keung, and Ann Reisner. 2015. Impact of manager characteristics on corporate environmental behavior at heavy-polluting firms in Shaanxi, China. Journal of Cleaner Production 108: 707–15. [Google Scholar] [CrossRef]

- Wang, Pengju. 2018. Analysis of the Efficiency of Public Environmental Expenditure Based on Data Envelopment Analysis (DEA)-Tobit Model: Evidence from Central China. Nature Environment & Pollution Technology 17: 43–48. [Google Scholar]

- Wang, Wei, Xue-Zhou Zhao, Feng-Wen Chen, Chia-Huei Wu, Sangbing Tsai, and Jiangtao Wang. 2019. The effect of corporate social responsibility and public attention on innovation performance: Evidence from high-polluting industries. International Journal of Environmental Research and Public Health 16: 3939. [Google Scholar] [CrossRef] [PubMed]

- Wang, Wei-Kang, Wen-Min Lu, and Shun-Wen Wang. 2014. The impact of environmental expenditures on performance in the US chemical industry. Journal of Cleaner Production 64: 447–56. [Google Scholar] [CrossRef]

- World Bank Group. 2015. Kenya Economic Update. Available online: https://documents1.worldbank.org/curated/en/758021467995351269/pdf/100229-NWP-P151666-PUBLIC-Box393225B-WB-KEU-Issue-12-FINAL.pdf (accessed on 15 June 2015).

- Xiao, Wenli, Cheryl Gaimon, Ravi Subramanian, and Markus Biehl. 2019. Investment in environmental process improvement. Production and Operations Management 28: 407. [Google Scholar] [CrossRef]

- Yang, Cunyi, Conghao Zhu, and Khaldoon Albitar. 2024. ESG ratings and green innovation: AU-shaped journey towards sustainable development. Business Strategy and the Environment. [Google Scholar] [CrossRef]

- Zainudin, Rozaimah, Nurul Shahnaz Ahmad Mahdzan, and Ee Shan Leong. 2018. Firm-specific internal determinants of profitability performance: An exploratory study of selected life insurance firms in Asia. Journal of Asia Business Studies 12: 533–50. [Google Scholar] [CrossRef]

- Zhang, Dengjun, and Yingkai Fang. 2022. Are environmentally friendly firms more vulnerable during the COVID-19 pandemic? Journal of Cleaner Production 355: 131781. [Google Scholar] [CrossRef]

| Authors’ Names | Title of the Study | Variables Used for Analysis | Study Outcome | Study Geographical Location |

|---|---|---|---|---|

| (Kim and Kim 2018) | Firm’s environmental expenditures, R&D intensity, and profitability | Return on assets, R&D, profitability, environmental expenditures | The findings indicate a detrimental correlation between a company’s environmental spending and its profitability, which is influenced by the company’s research and development (R&D) capacity as measured by its R&D intensity. | United States of America |

| (Samsinar and Firdaus 2019) | Is there a link between environmental expenditures, innovation, and revenue in Malaysian manufacturing industry? | Environmental expenditures and innovation | The findings unequivocally demonstrate that both environmental spending and innovation had a definite impact on the earnings of companies in various manufacturing industries. The findings also demonstrate the presence of a reciprocal correlation between innovation and environmental expenditures. | Malaysia |

| (He et al. 2018) | A study of the influence of regional environmental expenditures on air quality in China: the effectiveness of environmental policy | Environmental expenditures and fuel tax policy | The study found a persistent equilibrium connection between environmental expenditures and the air quality index. The findings not only provide clarification on the impact of environmental expenditures on air quality, but also offer an objective assessment of the success of China’s environmental policies to some degree. | China |

| (Luo et al. 2024) | Foreign shareholding and corporate environmental expenditures: evidence from China | Foreign investments and environmental expenditures | The results suggest that pre-IPO foreign investments have a substantial and beneficial impact, whereas post-IPO foreign investments have little to no influence. | China |

| (Wang 2018) | Analysis of the efficiency of public environmental expenditures based on data envelopment analysis | Fiscal spending environmental protection | The results indicate that the fiscal expenditures on environmental protection in the five provinces is characterized by technical inefficiency, with the exception of Hubei Province in Central China. Furthermore, there are significant variations among provinces in terms of the point at which scale return occurs. | China |

| (Wang et al. 2014) | The impact of environmental expenditures on performance in the U.S. chemical industry | Environmental expenditures and financial performance | The findings of this study offer significant evidence of a correlation between environmental expenses and financial performance. The results indicate that companies that allocate resources towards environmental expenditures demonstrate higher levels of efficiency and production. | United States of America |

| (Le Gallo and Ndiaye 2021) | Environmental expenditure interactions among OECD countries, 1995–2017 | Strategic interactions, environmental expenditures, economic and political control variables | The findings indicate a notable presence of substantial positive spatial correlation in environmental spending, implying that OECD nations take into account the actions of their neighboring countries when making decisions regarding environmental expenditures. | OECD countries |

| (Cheng et al. 2024) | The unanticipated role of fiscal environmental expenditures in accelerating household carbon emissions: evidence from China | Fiscal environmental expenditures and environmental governance | The findings indicate that FEE had a substantial impact on household carbon emissions via diminishing satisfaction with environmental governance. Furthermore, factors such as public service satisfaction, household income, energy intensity, and geography play a crucial role in mitigating the situation. | China |

| (Arjomandi et al. 2023) | Environmental expenditures, policy stringency and green economic growth: evidence from OECD countries | Environmental policy stringency, environmental GDP and productivity | The findings indicate that government spending on environmental protection has a major positive impact on the national economy in the short run. The analysis demonstrates that implementing stricter environmental policies and increasing environmental expenditures can have a decelerating effect on long-term ‘green’ GDP and productivity growth. However, the impact of regulatory stringencies is relatively less pronounced. | OECD countries |

| (Basoglu and Uzar 2019) | An empirical evaluation about the effects of environmental expenditures on environmental quality in coordinated market economies | Total public expenditure increase, ecological deficit, environmental expenditures | The research has revealed a co-integration link between variables. Panel ARDL research has revealed that total public expenditures contribute to the ecological deficit, whereas environmental expenditures help reduce it. The impacts of public expenditures on the environment are multiple. The size effect has a detrimental influence on environmental quality, while the composition effect, which shifts spending towards environmental initiatives, has a beneficial effect. | Europe |

| Industry Name | Number of Firms | Number of Observations—Whole Samples | Number of Observations—Sub-Sample (2015–2021) | The Relative Importance of the Sample |

|---|---|---|---|---|

| Food and Agro-Based Product | 6 | 66 | 42 | 8.57% |

| Textiles | 7 | 77 | 49 | 10% |

| Chemical and Chemical Products | 37 | 407 | 259 | 52.8% |

| Consumer Goods | 4 | 44 | 28 | 5.7% |

| Construction Materials | 7 | 77 | 49 | 10% |

| Others | 9 | 99 | 63 | 12.8% |

| Total | 70 | 770 | 490 | 100% |

| Variable | Measurements | Symbol | Definition | Expected Sign |

|---|---|---|---|---|

| Dependent variable | Environment- and Pollution Control-Related Expenses | ENVEXP | It refers to all expenses that are spent in order to control or reduce pollution caused during the manufacturing process. These expenses can be for effluent disposal and environmental development. | |

| Independent variables | Return on Net Worth | RONW | The profit-earning capacity of the company on the shareholders’ invested amount. | + |

| Leverage | LEV | The ratio of total debt to equity. | - | |

| Current Ratio | CR | The ratio of current assets to current liabilities. | + | |

| Market Capitalization | MCAP | It is the share price multiplied by the number of shares outstanding. | + | |

| Firms’ Size | TA | It is the logarithm of total assets. | + | |

| Gross Domestic Product | GDP | Gross domestic product is a monetary measure of the market value of all the final goods and services produced in a specific time by countries. | + | |

| Inflation | INF | The rate of increase in prices over a given time. | ||

| Moderating variable | Country-Level Governance—Rule of Law | RL | Rule of law captures perceptions of the extent to which agents have confidence in and abide by the rules of society. Rank indicates the country’s rank among all countries covered by the aggregate indicator, with 0 corresponding to the lowest rank and 100 to the highest rank. Percentile ranks were adjusted to correct for changes over time in the composition of the countries covered by the Worldwide Governance Indicators (WGI). | + |

| Economic Development- GDP | GDP | Gross domestic product is a monetary measure of the market value of all the final goods and services produced in a specific time by countries. | + | |

| Dummy variable | COVID-19 | COVID-19 | The years from 2020 to 2021 are coded 1, and 0 otherwise. | - |

| Whole Sample | Sub-Sample (2015–2021) | |||||||

|---|---|---|---|---|---|---|---|---|

| N | Mean | Median | Std. Deviation | N | Mean | Median | Std. Deviation | |

| ENVEXP | 770 | 35.185 | 9.000 | 57.198 | 490 | 41.292 | 12.050 | 61.959 |

| RONW | 770 | 8.877 | 10.785 | 19.138 | 490 | 8.756 | 10.535 | 18.326 |

| LEVE | 770 | 1.466 | 0.640 | 2.238 | 490 | 1.257 | 0.510 | 2.126 |

| CR | 770 | 1.535 | 1.250 | 1.001 | 490 | 1.607 | 1.315 | 1.042 |

| MCAP | 770 | 32,988.778 | 1376.205 | 75,784.707 | 490 | 37,074.524 | 2289.865 | 80,553.948 |

| TA | 770 | 22,231.608 | 3000.700 | 44,873.455 | 490 | 24,962.481 | 3366.250 | 47,690.034 |

| GDP | 770 | 5.397 | 6.533 | 4.210 | 490 | 4.826 | 6.795 | 5.101 |

| INF | 770 | 5.283 | 3.969 | 2.556 | 490 | 3.533 | 3.566 | 0.666 |

| RL | 770 | 53.823 | 53.365 | 1.148 | 490 | 54.258 | 54.327 | 1.163 |

| Correlation Matrix—Whole Sample | |||||||||

|---|---|---|---|---|---|---|---|---|---|

| ENVEXP | RONW | LEV | CR | MCAP | TA | GDP | INF | RL | |

| ENVEXP | 1 | ||||||||

| RONW | 0.185 ** | 1 | |||||||

| LEV | −0.158 ** | −0.609 ** | 1 | ||||||

| CR | 0.010 | 0.121 ** | −0.315 ** | 1 | |||||

| MCAP | 0.638 ** | 0.138 ** | −0.162 ** | 0.125 ** | 1 | ||||

| TA | 0.559 ** | 0.118 ** | −0.137 ** | 0.085 * | 0.852 ** | 1 | |||

| GDP | −0.104 ** | −0.002 | 0.103 ** | −0.093 * | −0.038 | −0.054 | 1 | ||

| INF | −0.123 ** | 0.036 | 0.081 * | −0.074 * | −0.057 | −0.071 * | 0.054 | 1 | |

| RL | 0.030 | 0.002 | −0.007 | 0.005 | 0.035 | 0.018 | 0.062 | −0.451 ** | 1 |

| Variance Inflation Factor (VIF) | 1.638 | 1.804 | 1.135 | 3.708 | 3.670 | 1.032 | 1.298 | 1.273 | |

| Correlation Matrix—Sub-Sample from 2015 to 2021 | |||||||||

| ENVEXP | 1 | ||||||||

| RONW | 0.219 ** | 1 | |||||||

| LEV | −0.164 ** | −0.604 ** | 1 | ||||||

| CR | −0.010 | 0.171 ** | −0.357 ** | 1 | |||||

| MCAP | 0.700 ** | 0.157 ** | −0.148 ** | 0.107 * | 1 | ||||

| TA | 0.565 ** | 0.125 ** | −0.122 ** | 0.057 | 0.866 ** | 1 | |||

| GDP | −0.092 * | −0.026 | 0.113 * | −0.092 * | −0.032 | −0.047 | 1 | ||

| INF | 0.091 * | 0.047 | −0.139 ** | 0.103 * | 0.040 | 0.047 | −0.732 ** | 1 | |

| RL | −0.053 | −0.035 | 0.095 * | −0.059 | −0.004 | −0.028 | 0.121 ** | −0.371 ** | 1 |

| Variance Inflation Factor (VIF) | 1.599 | 1.792 | 1.166 | 4.089 | 4.035 | 2.288 | 2.614 | 1.236 | |

| (1) | (2) | (3) | |

|---|---|---|---|

| Variable | Direct Effect | Moderating Effect—RL | Moderating Effect—GDP |

| RONW | −0.130 * | 0.0503 | 0.0154 |

| (0.0720) | (3.100) | (3.091) | |

| LEV | −1.005 | −2.527 | −2.991 |

| (0.780) | (26.06) | (25.91) | |

| CR | −0.801 | 28.30 | 28.67 |

| (1.587) | (43.45) | (43.37) | |

| MCAP | 0.000221 *** | −0.000276 | −0.000275 |

| (2.78 × 10−5) | (0.000585) | (0.000584) | |

| TA | 4.670 *** | 5.418 | 5.207 |

| (1.285) | (31.68) | (31.64) | |

| GDP | −1.343 | −11.62 | −4.033 *** |

| (0.986) | (42.24) | (1.436) | |

| INF | −1.344 *** | −90.94 ** | −87.17 *** |

| (0.415) | (39.41) | (33.31) | |

| RL | 0.510 | −6.032 | −4.891 |

| (0.966) | (7.472) | (3.924) | |

| COVID-19 | 10.85 *** | −0.439 | 0.0148 |

| (3.582) | (6.072) | (5.515) | |

| RONW*RL | −0.00321 | ||

| (0.0578) | |||

| LEV*RL | 0.0316 | ||

| (0.485) | |||

| CR*RL | −0.552 | ||

| (0.808) | |||

| MCAP*RL | 9.42 × 10−6 | ||

| (1.08 × 10−5) | |||

| TA*RL | −0.0163 | ||

| (0.589) | |||

| GDP*RL | 0.139 | ||

| (0.774) | |||

| INF*RL | 1.666 ** | ||

| (0.733) | |||

| RONW*GDP | −0.00255 | ||

| (0.0576) | |||

| LEV*GDP | 0.0401 | ||

| (0.483) | |||

| CR*GDP | −0.558 | ||

| (0.806) | |||

| TA*GDP | −0.0133 | ||

| (0.588) | |||

| MCAP*GDP | 9.41 × 10−6 | ||

| (1.08 × 10−5) | |||

| INF*GDP | 1.595 *** | ||

| (0.619) | |||

| Constant | −1.344 | 373.2 | 311.4 |

| (51.06) | (406.5) | (215.8) | |

| R-square | 0.457 | 0.462 | 0.462 |

| Chi-square | 230.979 | 248.028 | 248.259 |

| p-value | 0.000 | 0.000 | 0.000 |

| Hausman (chi-square) | 6.303 | 7.964 | 6.329 |

| Breusch–Pagan LM (chi-square) | 1456.94 *** | 1451.35 *** | 1449.78 *** |

| Observations | 770 | 770 | 770 |

| Number of companies | 70 | 70 | 70 |

| (1) | (2) | (3) | |

|---|---|---|---|

| Variable | Direct Effect | Moderating Effect—RL | Moderating Effect—GDP |

| RONW | −0.213 ** | 4.524 | 0.0939 |

| (0.0858) | (3.136) | (0.306) | |

| LEV | 0.374 | 45.91 * | 1.483 |

| (0.913) | (25.18) | (2.759) | |

| CR | −0.980 | 3.408 | −5.858 |

| (1.730) | (39.32) | (3.882) | |

| MCAP | 3.67 × 10−5 | 0.000825 | 0.000383 *** |

| (5.50 × 10−5) | (0.000515) | (6.05 × 10−5) | |

| TA | 4.417 ** | 75.09 ** | 12.18 *** |

| (1.728) | (30.32) | (3.133) | |

| GDP | −4.756 ** | 346.3 *** | −3.241 |

| (2.002) | (96.97) | (5.441) | |

| INF | 0.597 | −157.6 | −7.578 |

| (2.110) | (104.7) | (11.88) | |

| RL | −0.224 | 42.35 *** | −0.279 |

| (0.833) | (14.21) | (1.635) | |

| COVID-19 | −2.169 | −28.72 *** | 0.0324 |

| (6.197) | (9.164) | (12.59) | |

| RONW*RL | −0.0875 | ||

| (0.0577) | |||

| LEV*RL | −0.840 * | ||

| (0.464) | |||

| CR*RL | −0.0925 | ||

| (0.725) | |||

| MCAP*RL | −1.48 × 10−5 | ||

| (9.45 × 10−6) | |||

| TA*RL | −1.326 ** | ||

| (0.556) | |||

| GDP*RL | −6.799 *** | ||

| (1.870) | |||

| INF*RL | 2.392 | ||

| (1.907) | |||

| RONW*GDP | −0.0385 | ||

| (0.0448) | |||

| LEV*GDP | −0.227 | ||

| (0.385) | |||

| CR*GDP | 0.558 | ||

| (0.577) | |||

| MCAP*GDP | −1.67 × 10−5 ** | ||

| (7.27 × 10−6) | |||

| TA*GDP | −0.993 ** | ||

| (0.428) | |||

| INF*GDP | 0.825 | ||

| (1.976) | |||

| Constant | 64.62 | −2.008 *** | 55.22 |

| (53.87) | (724.5) | (77.55) | |

| Observations | 490 | 490 | 490 |

| R-squared | 0.172 | 0.239 | 0.563 |

| p-value | 0.000 | 0.000 | 0.000 |

| Hausman (chi-square) | 48.33 *** | 68.25 *** | 3.15 |

| Breusch–Pagan LM (chi-square) | 797.37 *** | 802.09 *** | 783.54 *** |

| Number of companies | 70 | 70 | 70 |

| (1) | (2) | (3) | |

|---|---|---|---|

| Variable | Direct Effect | Moderating Effect—RL | Moderating Effect—GDP |

| L. ENVEXP | 0.794 *** | 0.827 *** | 0.776 *** |

| (0.00511) | (0.00983) | (0.00680) | |

| RONW | −0.0126 | 4.943 *** | 2.230 *** |

| (0.00794) | (1.023) | (0.367) | |

| LEV | −0.620 ** | 21.09 *** | 13.86 *** |

| (0.247) | (5.899) | (3.413) | |

| CR | −1.070 ** | 18.79 ** | 58.84 *** |

| (0.458) | (7.799) | (13.70) | |

| MCAP | 0.000108 *** | −0.000140 | −0.000288 *** |

| (4.69 × 10−6) | (0.000107) | (8.74 × 10−5) | |

| TA | 2.612 *** | 5.451 | 10.04 ** |

| (0.234) | (6.130) | (4.516) | |

| GDP | −1.820 *** | −36.43 ** | −2.746 *** |

| (0.179) | (17.08) | (0.186) | |

| INF | −0.837 *** | −38.94 ** | −15.89 *** |

| (0.0889) | (16.32) | (5.019) | |

| RL | −0.236 * | −4.858 | 1.570 * |

| (0.142) | (3.195) | (0.821) | |

| COVID-19 | −3.805 *** | −3.678 *** | −5.441 *** |

| (0.572) | (1.197) | (0.539) | |

| RONW*RL | −0.0911 *** | ||

| (0.0191) | |||

| LEV*RL | −0.391 *** | ||

| (0.110) | |||

| CR*RL | −0.376 ** | ||

| (0.144) | |||

| MCAP*RL | 4.30 × 10−6 ** | ||

| (1.90 × 10−6) | |||

| TA*RL | −0.0532 | ||

| (0.115) | |||

| GDP*RL | 0.652 ** | ||

| (0.326) | |||

| INF*RL | 0.728 ** | ||

| (0.313) | |||

| RONW*GDP | −0.0425 *** | ||

| (0.00699) | |||

| LEV*GDP | −0.264 *** | ||

| (0.0634) | |||

| CR*GDP | −1.191 *** | ||

| (0.261) | |||

| TA*GDP | −0.115 | ||

| (0.0862) | |||

| MCAP*GDP | 7.37 × 10−6 *** | ||

| (1.64 × 10−6) | |||

| INF*GDP | 0.278 *** | ||

| (0.0944) | |||

| Constant | 26.06 *** | 265.7 | −61.54 |

| (7.498) | (166.4) | (44.06) | |

| AR (1) p-value | 0.14 | 0.133 | 0.125 |

| AR (2) p-value | 0.337 | 0.332 | 0.326 |

| Hansen J-statistics | 44.60 | 38.66 | 52.45 |

| Hansen J-statistics (p-value) | 0.446 | 0.44 | 0.342 |

| No. of groups | 70 | 70 | 70 |

| No. of instruments | 55 | 56 | 66 |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2024 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Bagadeem, S.; Siddiqui, A.; Narula, S.A.; Farhan, N.H.S.; Magry, M.A. Impact of Firm-Specific and Macroeconomic Determinants on Environmental Expenditures: Empirical Evidence from Manufacturing Firms. Economies 2024, 12, 159. https://doi.org/10.3390/economies12070159

Bagadeem S, Siddiqui A, Narula SA, Farhan NHS, Magry MA. Impact of Firm-Specific and Macroeconomic Determinants on Environmental Expenditures: Empirical Evidence from Manufacturing Firms. Economies. 2024; 12(7):159. https://doi.org/10.3390/economies12070159

Chicago/Turabian StyleBagadeem, Salim, Ayesha Siddiqui, Sapna Arora Narula, Najib H. S. Farhan, and Muneer Ahmad Magry. 2024. "Impact of Firm-Specific and Macroeconomic Determinants on Environmental Expenditures: Empirical Evidence from Manufacturing Firms" Economies 12, no. 7: 159. https://doi.org/10.3390/economies12070159

APA StyleBagadeem, S., Siddiqui, A., Narula, S. A., Farhan, N. H. S., & Magry, M. A. (2024). Impact of Firm-Specific and Macroeconomic Determinants on Environmental Expenditures: Empirical Evidence from Manufacturing Firms. Economies, 12(7), 159. https://doi.org/10.3390/economies12070159