An Assessment of the Effectiveness and Scale of Tax Expenditures to Support Investments and Priority Sectors in G20 Countries

Abstract

1. Introduction

2. Methodology

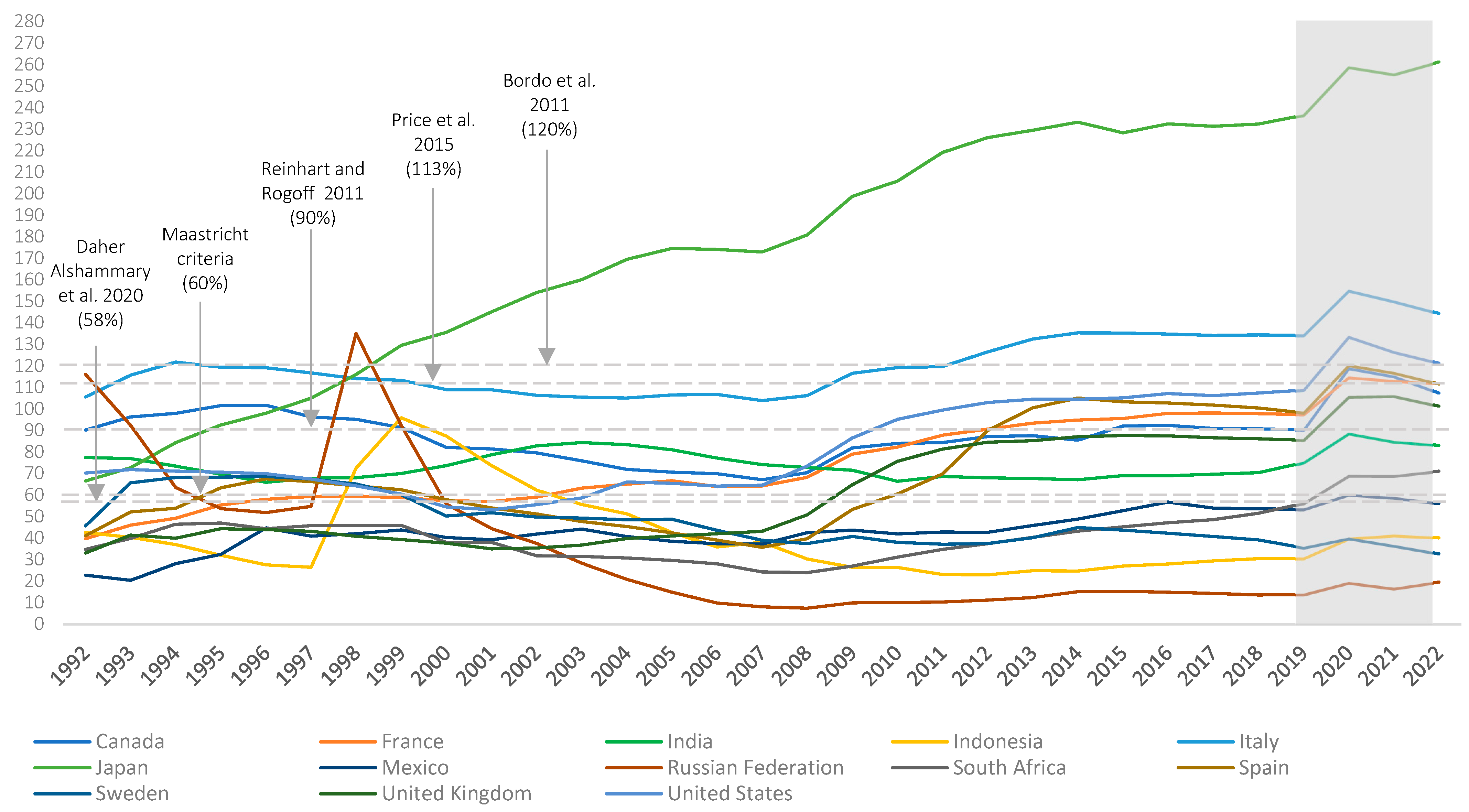

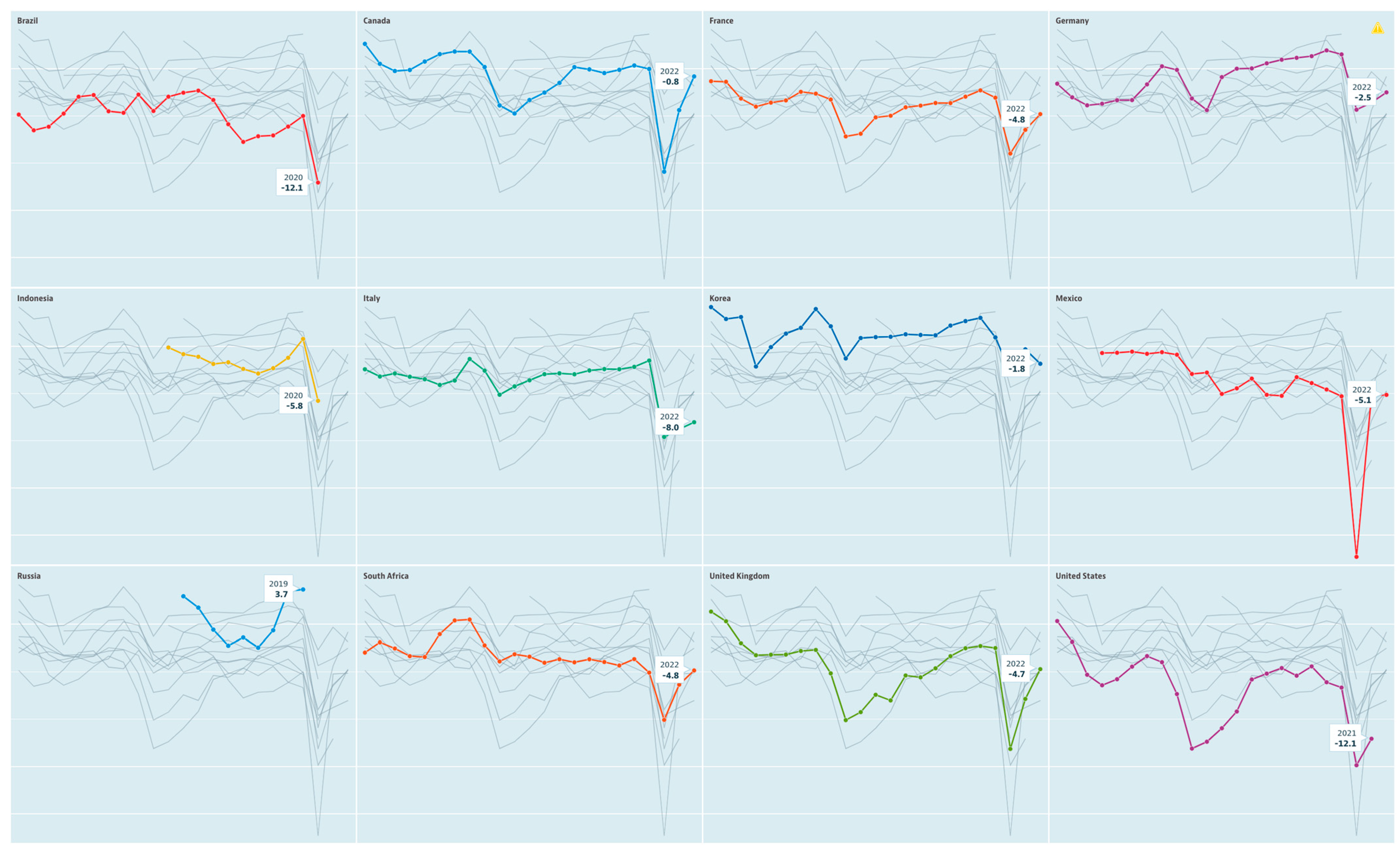

2.1. Data

2.2. Methods

3. Results

3.1. Support for Priority Sectors of the Economy

3.2. Support for Investment Activities

4. Discussion

5. Conclusions

Author Contributions

Funding

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

References

- Alesina, Alberto, Carlo Favero, and Francesco Giavazzi. 2015. The Output Effect of Fiscal Consolidation Plans. Journal of International Economics 96: S19–S42. [Google Scholar] [CrossRef]

- Alesina, Alberto, Omar Barbiero, Carlo Favero, Francesco Giavazzi, and Matteo Paradisi. 2017. The Effects of Fiscal Consolidations: Theory and Evidence. Cambridge: Harvard University Working Paper. [Google Scholar]

- Bankowski, Krzysztof, Othman Bouabdallah, Cristina Checherita-Westphal, Maximilian Freier, Pascal Jacquinot, and Philip Muggenthaler. 2023. Fiscal policy and High Inflaation. ECB Economic Bulletin, Issue 2. Available online: https://www.ecb.europa.eu/press/economic-bulletin/articles/2023/html/ecb.ebart202302_01~2bd46eff8f.en.html (accessed on 21 February 2024).

- Barradale, Greg. 2022. Is the Fiscal «Black Hole» Real? We Asked Economists. The Big Issue Limited. November 18. Available online: https://www.bigissue.com/news/politics/is-the-fiscal-black-hole-real-we-asked-economists/ (accessed on 21 February 2024).

- Barrios, Salvador, Francesco Figari, Luca Gandullia, and Sara Riscado. 2016. The Fiscal and Equity Impact of Tax Expenditures in the EU. JRC Working Papers on Taxation and Structural Reforms. № 1/2016. Seville: European Commission, Joint Research Centre. [Google Scholar]

- Barroy, Helene, Susan Sparkes, and Elina Dale. 2016. Assessing Fiscal Space for Health Expansion in low- and Middle-Income Countries: A Review of the Evidence. In Health Financing Working Paper № 3. World Health Organization: 33p, Available online: https://iris.who.int/bitstream/handle/10665/251904/WHO-HIS-HGF-HFWorkingPaper-16.3-eng.pdf?sequence=1 (accessed on 21 February 2024).

- Beer, Sebastian, Dora Benedek, Brian Erard, and Jan Loepric. 2022. How to Estimate Tax Expenses. p. 20. Available online: https://www.imf.org/en/Publications/Fiscal-Affairs-Department-How-To-Notes/Issues/2022/11/How-to-Evaluate-Tax-Expenditures-525166 (accessed on 30 November 2023).

- Bogacheva, Olga, and Tatyana Fokina. 2017. Management of tax expenditures in OECD countries. Mirovayaekonomika i Mezhdunarodnye Otnosheniya 61: 26–36. (In Russian). [Google Scholar] [CrossRef][Green Version]

- Bordo, Michael D., Agnieszka Markiewicz, and Lars Jonung. 2011. A Fiscal Union for the Euro: Some Lessons from History. NBER Working Paper No. 17380. Cambridge. September. Available online: https://www.nber.org/system/files/working_papers/w17380/w17380.pdf (accessed on 21 February 2024).

- Bosworth, B. P. 1984. Tax Incentives and Economic Growth. Wash: Brookings Institutions. [Google Scholar]

- Buzdalina, Olga B., and Nikita O. Bondarenko. 2020. Analysis of the concept of tax expenditures of the budget and its implementation in the Russian Federation. Finansovaya zhizn 2020: 113–16. (In Russian). [Google Scholar]

- Congressional Budget Office: Oφициaльный caйт. 2004. Available online: https://www.cbo.gov/ (accessed on 21 February 2024).

- Daher Alshammary, Mohammed, Zulkefly Abdul Karim, Norlin Khalid, and Riayati Ahmad. 2020. Debt-Growth Nexus in the MENA Region: Evidence from a Panel Threshold Analysis. Economies 8: 102. [Google Scholar] [CrossRef]

- Dantas, Manuela, Kenneth J. Merkley, and Felipe B. G. Silva. 2023. Government Guarantees and Banks’ Income Smoothing. Journal of Financial Services Research 63: 123–73. [Google Scholar] [CrossRef]

- ECLAC. 2022. Fiscal Panorama of Latin America and the Caribbean, Economic Commission for Latin America and the Caribbean, Santiago. Available online: https://www.cepal.org/en/publications/48015-fiscal-panorama-latin-america-and-caribbean2022-fiscal-policy-challenges (accessed on 21 February 2024).

- Economic Governance Review: Council Adopts Reform of Fiscal Rules. 2024. Council Agrees on Reform of Fiscal Rules. European Council. Available online: https://www.consilium.europa.eu/en/press/press-releases/2024/04/29/economic-governance-review-council-adopts-reform-of-fiscal-rules/ (accessed on 29 April 2024).

- Economic Governance Review: Council Agrees on Reform of Fiscal Rules. European Council. 2023. Available online: https://www.consilium.europa.eu/en/press/press-releases/2023/12/21/economic-governance-review-council-agrees-on-reform-of-fiscal-rules/ (accessed on 21 December 2023).

- European Commission, Directorate-General for Taxation, and Customs Union. 2021. Taxation in Support of Green Transition: An Overview and Assessment of Existing Tax Practices to Reduce Greenhouse Gas Emissions: Good Practice Fiches. Publications Office. Available online: https://data.europa.eu/doi/10.2778/063153 (accessed on 21 February 2024).

- Executive Summary to the 2023 Financial Report of the U.S. Government. 2023. Available online: https://fiscal.treasury.gov/files/reports-statements/financial-report/2023/executive-summary-2023.pdf (accessed on 21 February 2024).

- Freire-Gonzalez, Jaume. 2018. Environmental taxation and the double dividend hypothesis in the CGE Modeling literature: A critical review. Journal of Policy Modeling 40: 194–223. [Google Scholar] [CrossRef]

- Galbraith, J. 1981. Economics, Peace and Laughter. New York: New American Library. 382p. [Google Scholar]

- Guido, Maia, Marco G. P. Garcia, and Pedro Maia. 2022. Fiscal Space in an Era of central Bank Activism, Texto Para discussão. Rio de Janeiro: Departamento de Economia, Pontifícia Universidade Católica do Rio de Janeiro (PUC-Rio). [Google Scholar]

- Heady, Christopher, and Mario Mansour. 2019. Tax Expenditure Reporting and Its Use in Fiscal Management: A Guide for Developing Economies. №. 2019/002. Washington, DC: International Monetary Fund, p. 19. [Google Scholar]

- Heller, P. 2005. Understanding Fiscal Space. IMF Policy Discussion Paper № PDP/05/4. Washington, DC: International Monetary Fund, pp. 1–19. [Google Scholar]

- Kakaulina, Maria O., and Dmitry R. Gorlov. 2022. Assessment of the Impact of Tax Incentives on Investment Activity in Special Economic Zones of the Russian Federation. Journal of Applied Economic Research 21: 282–324. [Google Scholar] [CrossRef]

- Kose, Ayhan, Sergio Kurlat, Franziska Ohnsorge, and Naotaka Sugawara. 2022. A Cross-Country Database of Fiscal Space. Journal of International Money and Finance 128: 102682. [Google Scholar] [CrossRef]

- Laan, Tara, and Ronald Steenblik. 2023. Challenges and Opportunities for the Reform of Fossil Fuel Tax Expenditures in Developing and Emerging Economies. CEP Discussion Note. Available online: https://www.cepweb.org/wp-content/uploads/2023/07/Laan-and-Steenblik-2023-Fossil-Fuel-TEs-Reform_pdf_DN.pdf (accessed on 21 February 2024).

- Lieuw-Kie-Song, Maikel, Kate Philip, Mito Tsukamoto, and Marc van Imschoot. 2011. Towards the Right to Work: Innovations in Public Employment Programmes (IPEP). Employment Working Paper № 69. Geneva: ILO. International Labour Organization, p. 65. [Google Scholar]

- Nerlich, Carolin, and Wolf H. Reuter. 2016. Fiscal Rules, Fiscal Space, and the Procyclicality of Fiscal Policy. Finanz Archiv. Public Finance Analysis 72: 421–52. Available online: http://www.jstor.org/stable/44861227 (accessed on 21 February 2024). [CrossRef]

- OECD. 2023. Investment (GFCF) (Indicator). Available online: https://data.oecd.org/gdp/investment-gfcf.htm (accessed on 21 February 2024).

- Panskov, V. G. 2020. A New Approach to Tax Regulation of the Russian Economy. Stage: Economic Theory, Analysis, Practice 1: 24–46. [Google Scholar]

- Pigou, Arthur C. 1920. The Economics of Welfare. London: Macmillan & Co., p. 976. [Google Scholar]

- Price, Robert, Thai-Thanh Dang, and Jarmila Botev. 2015. Adjusting Fiscal Balances for the Business Cycle: New Tax and Expenditure Elasticity Estimates for OECD Countries, OECD Economics Department Working Papers, 1275. Paris: OECD Publishing. [Google Scholar] [CrossRef]

- Redonda, Agustin, and Tom Neubig. 2018. Assessing Tax Expenditure Reporting in G20 and OECD Economies. CEP Discussion Note 2018/3. Available online: https://www.cepweb.org/wp-content/uploads/2018/11/Redonda-and-Neubig-2018.-Assessing-Tax-Expenditure-Reporting.pdf (accessed on 21 February 2024).

- Reinhart, Carmen, and Kenneth Rogoff. 2011. Growth in a time Debt. American Economic Review: Papers & Proceedings 100: 573–78. Available online: https://www.nber.org/papers/w15639 (accessed on 21 February 2024).

- Report on Federal Tax Expenditures—Concepts, Estimates and Evaluations. 2022. Government of Canada. Available online: https://www.canada.ca/en/department-finance/services/publications/federal-tax-expenditures/2022.html (accessed on 21 February 2024).

- Revenue Statistics in Latin America and the Caribbean. 2023. Paris: OECD Publishing. [CrossRef]

- Sachinta, Fernando. 2019. Environmental Efficiency of Carbon Taxes: A Comparative Study of the Nordic Countries. In The First International Conference on Carbon Pricing. World Bank Working Paper Series; Washington, DC: World Bank, pp. 313–32. [Google Scholar]

- Schratzenstaller, Margit, and Angela Köppl. 2021. Taxation in Support of Green Transition. An Overview and Assessment of Existing Tax Practices to Reduce Greenhouse Gas Emissions. WIFO Studies. № 66820. Available online: https://ideas.repec.org/b/wfo/wstudy/66820.html (accessed on 21 February 2024).

- Silva, Felipe Bastos Gurgel. 2021. Fiscal Deficits, Bank Credit Risk, and Loan-Loss Provisions. Journal of Financial and Quantitative Analysis 56: 1537–89. [Google Scholar] [CrossRef]

- Smoke, Paul, David Gomez-Alvarez, Andres Felipe Munoz, and Axel Radics. 2022. The Role of Subnational Governments in the COVID-19 Pandemic Response: Are There Opportunities for Intergovernmental Fiscal Reform in the PostPandemicWorld? Washington, DC: Inter-American Development Bank. [Google Scholar] [CrossRef]

- Smoke, Paul, Mehmet S. Tosun, and Serdar Yilmaz. 2023. Subnational Government Responses to the COVID-19 Pandemic: Expectations, Realities and Lessons for the Future. Public Administration and Development 43: 97–105. [Google Scholar] [CrossRef]

- Sokolovska, Alla, and Tetiana Zatonatska. 2022. Debatable Aspects of the Concept of Tax Expenditures. Ekonomika 101: 109–24. [Google Scholar] [CrossRef]

- Solomon, David M. 2019. Voice of Small Business in America: 2019 Insights Report. [Элeктpoнный pecypc]. Available online: https://www.goldmansachs.com/citizenship/10000-smallbusinesses/US/2019-insights-report/report.pdf/ (accessed on 21 February 2024).

- Steshenko, Julia A., and Anna V. Tikhonova. 2018. Tikhonova. An Integral Approach to Evaluating the Effectiveness of Tax Incentives. Journal of Tax Reform 4: 157–73. [Google Scholar] [CrossRef]

- The Global Risks Report. 2024. 19th Edition. World Economic Forum. Available online: https://www3.weforum.org/docs/WEF_The_Global_Risks_Report_2024.pdf (accessed on 21 February 2024).

- Treaty on European Union (Maastricht, 7 February 1992). Available online: https://www.cvce.eu/content/publication/2002/4/9/2c2f2b85-14bb-4488-9ded-13f3cd04de05/publishable_en.pdf (accessed on 21 February 2024).

- Tyurina, Yulia, Svetlana Frumina, Svetlana Demidova, Aidan Kairbekuly, and Maria Kakaulina. 2023. Estimation of Tax Expenditures Stimulating the Energy Sector Development and the Use of Alternative Energy Sources in OECD Countries. Energies 16: 2652. [Google Scholar] [CrossRef]

- World Economic Outlook. 2023. IMF. Available online: https://www.imf.org/en/Publications/WEO/Issues/2023/04/11/world-economic-outlook-april-2023 (accessed on 24 December 2023).

| Year | Canada | France | Germany | India | Indonesia | Italy | Mexico | Russia | S.Korea |

|---|---|---|---|---|---|---|---|---|---|

| Policy Objective: Develop a priority economic sector or activity, % of total tax expenditure | |||||||||

| 2016 | – | 31.43 | 21.56 | 8.79 | 21.96 | 0.75 | 3.60 | 19.19 | 29.90 |

| 2017 | – | 32.69 | 21.74 | 8.80 | 22.60 | 1.59 | 4.49 | 17.68 | 31.17 |

| 2018 | – | 30.75 | 21.33 | 8.44 | 23.70 | 2.22 | 4.06 | 26.93 | 27.62 |

| 2019 | – | 31.55 | 21.31 | 6.71 | 23.87 | 2.50 | 3.29 | 29.70 | 26.27 |

| 2020 | – | 34.86 | 19.75 | 4.66 | 24.43 | 2.38 | 1.96 | 31.44 | 25.51 |

| 2021 | – | 35.04 | 21.42 | 4.13 | 23.08 | 6.24 | 1.88 | 32.73 | 24.47 |

| Rank (2021) | – | 1 | 5 | 7 | 4 | 6 | 8 | 2 | 3 |

| Policy Objective: Develop a priority economic sector or activity, % of GDP | |||||||||

| 2016 | – | 1.17 | 0.13 | 0.30 | 0.34 | 0.08 | 0.12 | 2.34 | 0.62 |

| 2017 | – | 1.30 | 0.13 | 0.29 | 0.38 | 0.05 | 0.17 | 2.99 | 0.65 |

| 2018 | – | 1.26 | 0.13 | 0.26 | 0.42 | 0.07 | 0.15 | 3.69 | 0.62 |

| 2019 | – | 1.26 | 0.13 | 0.26 | 0.42 | 0.09 | 0.13 | 4.01 | 0.70 |

| 2020 | – | 1.36 | 0.11 | 0.25 | 0.38 | 0.09 | 0.08 | 3.83 | 0.66 |

| 2021 | – | 1.23 | 0.14 | 0.19 | 0.41 | 0.17 | 0.08 | 4.56 | 0.64 |

| Rank (2021) | – | 2 | 7 | 5 | 4 | 6 | 8 | 1 | 3 |

| Sector | Canada | France | Germany | India | Indonesia | Italy | Mexico | Russia | S.Korea | Argentina | S.Africa |

|---|---|---|---|---|---|---|---|---|---|---|---|

| agricultural | √ | √ | √ (until 2019) | √ | √ | √ | √ | ||||

| energy | √ (except 2016, 2018) | √ (until 2019) | √ (2017) | √ | √ | ||||||

| defense | √ | √ | |||||||||

| extractive | √ | √ (2020, 2021) | √ | √ | |||||||

| housing/real estate | √ | √ | √ | √ (2021) | √ | √ | |||||

| transportation | √ | √ | √ (until 2019) | √ | √ | √ | √ (without 2021) | ||||

| export | √ (until 2019) | √ | |||||||||

| knowledge-intensive | √ (2021) | √ (until 2019) | √ (2016) | √ | √ | √ | √ | ||||

| manufacturing | √ | √ | √ | √ | √ (without 2021) | ||||||

| tourism | √ | √ | √ (until 2019) | √ (except 2017) | √ | √ | |||||

| ICT | √ | √ | √ | √ | |||||||

| SMEs | √ | √ | √ | √ (2016) | √ (2016–2018) | √ (2019–2021) | √ | √ (except 2016) | |||

| financial | √ | √ (until 2019) | √ | √ | |||||||

| multiple | √ | √ | |||||||||

| other | √ | √ | √ (except 2016) |

| Year | Canada | France | Germany | India | Indonesia | Italy | Mexico | Russia | S.Korea |

|---|---|---|---|---|---|---|---|---|---|

| Policy Objective: Attract/Promote investment, % of total tax expenditure | |||||||||

| 2016 | 6.32 | 0.42 | 0.04 | 10.02 | 23.28 | 0.89 | 0.15 | 0.01 | 3.11 |

| 2017 | 6.71 | 0.42 | 0.42 | 12.00 | 9.23 | 1.37 | 0.12 | 0.01 | 2.71 |

| 2018 | 7.75 | 0.44 | 0.61 | 10.50 | 10.33 | 1.92 | 0.30 | 0.02 | 4.03 |

| 2019 | 10.16 | 0.47 | 0.12 | 7.11 | 9.37 | 2.71 | 0.04 | 0.52 | 2.12 |

| 2020 | 8.89 | 0.47 | 0.20 | 3.52 | 12.14 | 1.69 | 0.04 | 1.28 | 1.37 |

| 2021 | 7.53 | 0.53 | 0.31 | 1.91 | 10.65 | 1.26 | 0.05 | 1.19 | 0.18 |

| Rank (2021) | 2 | 7 | 8 | 3 | 1 | 4 | 9 | 5 | 6 |

| Policy Objective: Attract/Promote investment, % of GDP | |||||||||

| 2016 | 0.39 | 0.016 | 0.0004 | 0.34 | 0.36 | 0.08 | 0.005 | 0.001 | 0.06 |

| 2017 | 0.43 | 0.017 | 0.004 | 0.40 | 0.16 | 0.03 | 0.005 | 0.002 | 0.06 |

| 2018 | 0.50 | 0.018 | 0.005 | 0.32 | 0.18 | 0.04 | 0.011 | 0.002 | 0.09 |

| 2019 | 0.57 | 0.019 | 0.001 | 0.28 | 0.16 | 0.07 | 0.002 | 0.003 | 0.06 |

| 2020 | 0.52 | 0.019 | 0.002 | – | 0.19 | 0.04 | 0.002 | 0.005 | 0.04 |

| 2021 | 0.60 | 0.02 | 0.003 | 0.09 | 0.19 | 0.01 | 0.002 | 0.005 | 0.0001 |

| Rank (2021) | 1 | 5 | 8 | – | 2 | 4 | 7 | 6 | 3 |

| The level of tax expenditures associated with the activation of investments (b) | VH | ||||||

| H | Canada (no/−) | ||||||

| AA | |||||||

| A | Indonesia (−/−) | ||||||

| L | |||||||

| VL | India (−/−) Italy (+/−) Mexico (−/+) | Germany (+/+) | S.Korea (−/−) | France (+/+) Russia (+/−) | |||

| VL/n | L | A | AA | H | VH | ||

| The level of tax expenditures related to the support of priority sectors of the economy (a) | |||||||

| Country | Tax Expenditures Associated with Increased Investment | Tax Expenditures Associated with Supporting Priority Sectors | Number of Indicators | Integrated Indicator | |||

|---|---|---|---|---|---|---|---|

| % of GDP | % Tax Revenue | % of GDP | % Tax Revenue | Position in Ranking | |||

| Canada | 0.599 | 7.53 | - | - | 2 | 4.371 | 1 |

| France | 0.019 | 0.53 | 1.23 | 35.04 | 4 | 0.899 | 4 |

| Germany | 0.003 | 0.31 | 0.14 | 21.42 | 4 | 0.362 | 7 |

| Indonesia | 0.19 | 10.65 | 0.41 | 23.08 | 4 | 1.901 | 2 |

| Italy | 0.01 | 1.26 | 0.17 | 6.24 | 4 | 0.274 | 8 |

| Mexico | 0.002 | 0.05 | 0.08 | 1.88 | 4 | 0.056 | 9 |

| India | 0.086 | 1.91 | 0.19 | 4.13 | 4 | 0.500 | 6 |

| Russia | 0.005 | 1.19 | 4.56 | 32.73 | 4 | 1.794 | 3 |

| Korea | 0.0001 | 0.18 | 0.64 | 24.47 | 4 | 0.518 | 5 |

| Average | 0.102011 | 2.6233 | 0.9275 | 18.6238 | – | – | |

| Country | Coefficient | 2017 | 2018 | 2019 | 2020 | 2021 |

|---|---|---|---|---|---|---|

| France | Cp | 0.90 | 1.04 | 1.00 | 0.96 | 1.09 |

| Germany | Cp | 1.00 | 1.04 | 1.00 | 1.10 | 0.14 |

| Indonesia | Cp | 0.90 | 0.94 | 1.11 | 1.27 | 2.41 |

| Italy | Cp | 1.61 | 1.07 | 0.99 | 1.38 | 0.91 |

| Mexico | Cp | 0.69 | 1.11 | 1.22 | 1.82 | 1.08 |

| Russia | Cp | 0.77 | 0.78 | 0.92 | 1.21 | 0.98 |

| S.Korea | Cp | 0.95 | 1.08 | 0.93 | 1.09 | 1.08 |

| India | Cp | 1.22 | 1.44 | 1.26 | 1.38 | 1.56 |

| Country | Coefficient | 2017 | 2018 | 2019 | 2020 | 2021 |

|---|---|---|---|---|---|---|

| Canada | Ci | 0.90 | 0.85 | 0.85 | 1.12 | 1.13 |

| France | Ci | 0.96 | 0.92 | 0.98 | 0.96 | 1.10 |

| Germany | Ci | 0.09 | 0.69 | 5.21 | 0.60 | 0.60 |

| Indonesia | Ci | 2.27 | 0.83 | 1.09 | 0.84 | 1.05 |

| Italy | Ci | 2.56 | 0.76 | 0.58 | 1.02 | 0.54 |

| Mexico | Ci | 0.97 | 0.39 | 6.15 | 0.82 | 1.03 |

| Russia | Ci | 0.59 | 0.75 | 0.54 | 0.62 | 1.07 |

| S.Korea | Ci | 1.18 | 0.59 | 1.56 | 1.56 | 7.94 |

| India | Ci | 0.92 | 1.40 | 1.15 | 1.35 | 2.18 |

| Average | Median | Min | Max | Std Deviation | |

|---|---|---|---|---|---|

| gfcf | 8359 | 8399 | 1022 | 23,451 | 5599 |

| te | 1739 | 935.7 | 51.81 | 8689 | 1894 |

| tei | 15.48 | 0.0000 | 0.0000 | 313.4 | 48.85 |

| tes | 66.04 | 0.0000 | 0.0000 | 876.1 | 177.9 |

| gfcf | te | tei | tes | |

|---|---|---|---|---|

| 1.0000 | 0.5492 | 0.1429 | 0.1435 | gfcf |

| 1.0000 | 0.2829 | 0.4864 | te | |

| 1.0000 | 0.1582 | tei | ||

| 1.0000 | tes |

| Coefficient | St. Error | t-Statistics | p-Value | ||

|---|---|---|---|---|---|

| const | 8.33215 | 0.0557630 | 149.4 | <0.0001 | *** |

| te | 0.000250023 | 2.35529 × 10−5 | 10.62 | <0.0001 | *** |

| tei | 0.000808895 | 0.000325002 | 2.489 | 0.0193 | ** |

| tes | −0.000339308 | 0.000406762 | −0.8342 | 0.4115 | |

| Average of the dependent variable | 8.756954 | St. deviation | 0.801426 | ||

| RSS | 71.94954 | St. model error | 0.662357 | ||

| R2 | 0.329213 | Fixed R2 | 0.316943 | ||

| F(3, 27) | 59.61001 | p-value (F) | 4.92 × 10−12 | ||

| Log. of likelihood | −167.1498 | Crit. Akaike | 342.2995 | ||

| Crit. Schwartz | 354.7954 | Crit. Hannan–Quinn | 347.3709 | ||

| Parameter rho | −0.210712 | Stat. Durbin–Watson | 2.060618 | ||

| Coefficient | St. Error | t-Statistics | p-Value | ||

|---|---|---|---|---|---|

| const | 8.33752 | 0.0343991 | 242.4 | <0.0001 | *** |

| te | 0.000241298 | 2.37686 × 10−5 | 10.15 | <0.0001 | *** |

| tei | 0.00166860 | 0.000370412 | 4.505 | 0.0001 | *** |

| tes | −0.000392481 | 0.000426215 | −0.9209 | 0.3653 | |

| Average of the dependent variable | 8.756954 | St. deviation | 0.801426 | ||

| RSS | 66.72194 | St. model error | 0.697869 | ||

| LSDV R2 | 0.377950 | B пpeдeлax R2 | 0.327437 | ||

| Log. of likelihood | −160.8135 | Crit. Akaike | 383.6271 | ||

| Crit. Schwartz | 480.4700 | Crit. Hannan–Quinn | 422.9307 | ||

| Parameter rho | −0.318450 | Stat. Durbin–Watson | 2.197827 | ||

| Coefficient | St. Error | t-Statistics | p-Value | ||

|---|---|---|---|---|---|

| const | 8.34466 | 0.0413684 | 201.7 | <0.0001 | *** |

| te | 0.000237139 | 2.37941 × 10−5 | 9.966 | <0.0001 | *** |

| Average of the dependent variable | 8.756954 | St. deviation | 0.801426 | ||

| RSS | 68.14367 | St. model error | 0.700173 | ||

| LSDV R2 | 0.364695 | Within the range of R2 | 0.313106 | ||

| Log. of likelihood | −162.5846 | Crit. Akaike | 383.1693 | ||

| Crit. Schwartz | 473.7642 | Crit. Hannan–Quinn | 419.9371 | ||

| Parameter rho | −0.327367 | Stat. Durbin–Watson | 2.234643 | ||

| Coefficient | St. Error | t-Statistics | p-Value | ||

|---|---|---|---|---|---|

| const | 8.48325 | 0.0751348 | 112.9 | <0.0001 | *** |

| te | 0.000229033 | 2.53244 × 10−5 | 9.044 | <0.0001 | *** |

| Average of the dependent variable | 483.7831 | St. deviation | 1.707149 | ||

| RSS | 0.330087 | St. model error | 0.326051 | ||

| LSDV R2 | 81.79336 | Within the range of R2 | 3.86 × 10−16 | ||

| Crit. Schwartz | −327.2262 | Crit. Akaike | 658.4524 | ||

| Parameter rho | 664.7003 | Crit. Hannan–Quinn | 660.9881 | ||

| Indicator | Argentina | Australia | Austria | Bulgaria | Canada | Chile | Colombia |

|---|---|---|---|---|---|---|---|

| R-squared | 0.885278 | 0.608558 | 0.637064 | 0.567065 | 0.696165 | 0.135214 | 0.516238 |

| Adjusted R-sq. | 0.856598 | 0.510698 | 0.546330 | 0.458831 | 0.620206 | −0.080982 | 0.395297 |

| Standard error | 0.111449 | 0.049349 | 0.070065 | 0.148787 | 0.058479 | 0.134802 | 0.109992 |

| Number of obs. | 6 | 6 | 6 | 6 | 6 | 6 | 6 |

| Indicator | Estonia | Finland | France | Germany | Hungary | Iceland | Italy |

| R-squared | 0.135864 | 0.939014 | 0.420436 | 0.785434 | 0.511913 | 0.523958 | 0.192468 |

| Adjusted R-sq. | −0.080170 | 0.923768 | 0.275546 | 0.731792 | 0.389891 | 0.404948 | −0.009415 |

| Standard error | 0.226028 | 0.023792 | 0.077034 | 0.061036 | 0.198347 | 0.082051 | 0.108353 |

| Number of obs. | 6 | 6 | 6 | 6 | 6 | 6 | 6 |

| Indicator | Latvia | Lithuania | Luxembourg | Mexico | The Netherlands | New Zealand | Norway |

| R-squared | 0.342324 | 0.171153 | 0.721062 | 0.078506 | 0.814588 | 0.409853 | 0.246217 |

| Adjusted R-sq. | 0.177905 | −0.036058 | 0.651327 | −0.151867 | 0.768235 | 0.262316 | 0.057771 |

| Standard error | 0.178487 | 0.177205 | 0.040985 | 0.126064 | 0.048234 | 0.082520 | 0.062309 |

| Number of obs. | 6 | 6 | 6 | 6 | 6 | 6 | 6 |

| Indicator | Portugal | Romania | South Korea | Slovakia | Spain | Sweden | United States |

| R-squared | 0.757858 | 0.977943 | 0.519492 | 0.171859 | 0.336953 | 0.004441 | 0.583334 |

| Adjusted R-sq. | 0.697322 | 0.972428 | 0.399365 | −0.035176 | 0.171192 | −0.244449 | 0.479168 |

| Standard error | 0.087328 | 0.030977 | 0.061190 | 0.097887 | 0.085705 | 0.083899 | 0.055934 |

| Number of obs. | 6 | 6 | 6 | 6 | 6 | 6 | 6 |

| Country | Coefficient | Standard Error | t-Statistics | p-Value | Significance | |

|---|---|---|---|---|---|---|

| Australia | const | 8.75821 | 0.285356 | 30.69 | 6.71 × 10−6 | *** |

| te | 0.000149736 | 6.00452 × 10−5 | 2.494 | 0.0672 | * | |

| Argentina | const | 6.34173 | 0.215248 | 29.46 | 7.90 × 10−6 | *** |

| te | 0.00350493 | 0.000630859 | 5.556 | 0.0051 | *** | |

| Austria | const | 8.69573 | 0.283821 | 30.64 | 6.76 × 10−6 | *** |

| te | 0.000519011 | 0.000195871 | 2.650 | 0.0570 | * | |

| Bulgaria | const | 7.21542 | 0.165856 | 43.50 | 1.67 × 10−6 | *** |

| te | 0.00528621 | 0.00230945 | 2.289 | 0.0840 | * | |

| Canada | const | 8.79333 | 0.159292 | 55.20 | 6.45 × 10−7 | *** |

| te | 0.000152120 | 5.02481 × 10−5 | 3.027 | 0.0389 | ** | |

| Chile | const | 7.88381 | 0.333976 | 23.61 | 1.91 × 10−5 | *** |

| te | 0.000615669 | 0.000778504 | 0.7908 | 0.4733 | ||

| Estonia | const | 9.07690 | 0.426378 | 21.29 | 2.88 × 10−5 | *** |

| te | −0.00131827 | 0.00166232 | −0.7930 | 0.4721 | ||

| Finland | const | 8.28186 | 0.139024 | 59.57 | 4.76 × 10−7 | *** |

| te | 0.000186376 | 2.37486 × 10−5 | 7.848 | 0.0014 | *** | |

| France | const | 8.18173 | 0.577354 | 14.17 | 0.0001 | *** |

| te | 0.000626945 | 0.000368044 | 1.703 | 0.1637 | ||

| Germany | const | 7.56599 | 0.432793 | 17.48 | 6.29 × 10−5 | *** |

| te | 0.00406680 | 0.00106279 | 3.827 | 0.0187 | ** | |

| Hungary | const | 6.23939 | 1.02347 | 6.096 | 0.0037 | *** |

| te | 0.00569872 | 0.00278226 | 2.048 | 0.1099 | ||

| Island | const | 9.38218 | 0.100218 | 93.62 | 7.81 × 10−8 | *** |

| te | 0.000104729 | 4.99125 × 10−5 | 2.098 | 0.1039 | ||

| Italy | const | 8.80428 | 0.0943402 | 93.32 | 7.90 × 10−8 | *** |

| te | −5.35904 × 10−5 | 5.48854 × 10−5 | −0.9764 | 0.3842 | ||

| Latvia | const | 7.21186 | 0.745516 | 9.674 | 0.0006 | *** |

| te | 0.000714845 | 0.000495415 | 1.443 | 0.2225 | ||

| Lithuania | const | 7.34227 | 0.256453 | 28.63 | 8.86 × 10−6 | *** |

| te | 0.000612376 | 0.000673802 | 0.9088 | 0.4148 | ||

| Luxemburg | const | 9.35798 | 0.180104 | 51.96 | 8.21 × 10−7 | *** |

| te | 0.000316459 | 9.84134 × 10−5 | 3.216 | 0.0324 | ** | |

| Mexico | const | 7.31017 | 0.519686 | 14.07 | 0.0001 | *** |

| te | 0.000864349 | 0.00148065 | 0.5838 | 0.5907 | ||

| The Netherlands | const | 8.40225 | 0.215094 | 39.06 | 2.57 × 10−6 | *** |

| te | 0.000118818 | 2.83435 × 10−5 | 4.192 | 0.0138 | ** | |

| New Zealand | const | 8.56021 | 0.407335 | 21.02 | 3.03 × 10−5 | *** |

| te | 0.00119751 | 0.000718480 | 1.667 | 0.1709 | ||

| Norway | const | 9.69271 | 0.259810 | 37.31 | 3.08 × 10−6 | *** |

| te | 8.69389 × 10−5 | 7.60586 × 10−5 | 1.143 | 0.3168 | ||

| Portugal | const | 7.39456 | 0.261475 | 28.28 | 9.30 × 10−6 | *** |

| te | 0.000740410 | 0.000209259 | 3.538 | 0.0241 | ** | |

| Romania | const | 6.97160 | 0.0771550 | 90.36 | 8.99 × 10−8 | *** |

| te | 0.00182146 | 0.000136776 | 13.32 | 0.0002 | *** | |

| Korea | const | 8.84327 | 0.184598 | 47.91 | 1.14 × 10−6 | *** |

| te | 0.000489842 | 0.000235552 | 2.080 | 0.1061 | ||

| Slovakia | const | 8.14813 | 0.237416 | 34.32 | 4.30 × 10−6 | *** |

| te | 0.000682200 | 0.000748768 | 0.9111 | 0.4138 | ||

| Spain | const | 7.89664 | 0.534530 | 14.77 | 0.0001 | *** |

| te | 0.000868254 | 0.000608981 | 1.426 | 0.2271 | ||

| Sweden | const | 9.62318 | 0.685151 | 14.05 | 0.0001 | *** |

| te | −3.84401 × 10−5 | 0.000287769 | −0.1336 | 0.9002 | ||

| United States | const | 10.3516 | 0.363701 | 28.46 | 9.07 × 10−6 | *** |

| te | −0.000189533 | 8.00921 × 10−5 | −2.366 | 0.0771 | * |

| Country | Integral Assessment of the Scale of Application of Tax Expenditures to Stimulate Investment and Support Priority Sectors of the Economy | Assessment of the Effectiveness of Tax Expenditures to Support Priority Sectors of the Economy | Assessment of the Effectiveness of Tax Expenditures to Stimulate Investment | |

|---|---|---|---|---|

| Rank | Meaning | Cp (2021) | Ci (2021) | |

| Canada | 1 | 4.371 (investments only) | – | 1.13 |

| Indonesia | 2 | 1.901 | 2.41 | 1.05 |

| Russia | 3 | 1.794 | 0.98 | 1.07 |

| France | 4 | 0.899 | 1.09 | 1.10 |

| S.Korea | 5 | 0.518 | 1.08 | 7.94 |

| India | 6 | 0.500 | 1.56 | 2.18 |

| Germany | 7 | 0.362 | 0.14 | 0.60 |

| Italy | 8 | 0.274 | 0.91 | 0.54 |

| Mexico | 9 | 0.056 | 1.08 | 1.03 |

| Country | The Impact of Tax Expenditures on Investment Accumulation | Country | The Impact of Tax Expenditures on Investment Accumulation | Country | The Impact of Tax Expenditures on Investment Accumulation | |||

|---|---|---|---|---|---|---|---|---|

| R (te) | p-Value | R (te) | p-Value | R (te) | p-Value | |||

| Australia | 0.510698 | 0.0389 ** | Germany | 0.731792 | 0.0187 ** | New Zealand | 0.262316 | 0.1709 |

| Argentina | 0.856598 | 0.0051 *** | Hungary | 0.389891 | 0.1099 | Norway | 0.057771 | 0.3168 |

| Austria | 0.546330 | 0.0570 * | Island | 0.404948 | 0.1039 | Portugal | 0.697322 | 0.0241 ** |

| Bulgaria | 0.458831 | 0.0840 * | Italy | −0.009415 | 0.3842 | Romania | 0.972428 | 0.0002 *** |

| Canada | 0.620206 | 0.0389 ** | Latvia | 0.177905 | 0.2225 | Korea | 0.399365 | 0.1061 |

| Chile | −0.080982 | 0.4733 | Lithuania | −0.036058 | 0.4148 | Slovakia | −0.035176 | 0.4138 |

| Estonia | −0.080170 | 0.4721 | Luxemburg | 0.651327 | 0.0324 ** | Spain | 0.171192 | 0.2271 |

| Finland | 0.923768 | 0.0014 *** | Mexico | −0.151867 | 0.5907 | Sweden | −0.244449 | 0.9002 |

| France | 0.275546 | 0.1637 | The Netherlands | 0.768235 | 0.0138 ** | United States | 0.479168 | 0.0771 * |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2024 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Demidova, S.; Tyurina, Y.; Kulachinskaya, A.; Buzdalina, O.; Ilin, I.V.; Razletovskaia, V.; Misbakhova, C.A. An Assessment of the Effectiveness and Scale of Tax Expenditures to Support Investments and Priority Sectors in G20 Countries. Economies 2024, 12, 147. https://doi.org/10.3390/economies12060147

Demidova S, Tyurina Y, Kulachinskaya A, Buzdalina O, Ilin IV, Razletovskaia V, Misbakhova CA. An Assessment of the Effectiveness and Scale of Tax Expenditures to Support Investments and Priority Sectors in G20 Countries. Economies. 2024; 12(6):147. https://doi.org/10.3390/economies12060147

Chicago/Turabian StyleDemidova, Svetlana, Yuliya Tyurina, Anastasia Kulachinskaya, Olga Buzdalina, Igor V. Ilin, Victoriya Razletovskaia, and Chulpan A. Misbakhova. 2024. "An Assessment of the Effectiveness and Scale of Tax Expenditures to Support Investments and Priority Sectors in G20 Countries" Economies 12, no. 6: 147. https://doi.org/10.3390/economies12060147

APA StyleDemidova, S., Tyurina, Y., Kulachinskaya, A., Buzdalina, O., Ilin, I. V., Razletovskaia, V., & Misbakhova, C. A. (2024). An Assessment of the Effectiveness and Scale of Tax Expenditures to Support Investments and Priority Sectors in G20 Countries. Economies, 12(6), 147. https://doi.org/10.3390/economies12060147