1. Introduction

Advancing sustainable development goals, mitigating greenhouse gas emissions and fulfilling future energy demands have become a top concern worldwide, necessitating substantial financial commitments (

Liu et al. 2021;

Boston et al. 2021). As part of sustainable development goals, providing sustainable energy is a principal objective for many countries (

Michaelowa et al. 2021). There is, however, the need to improve current financing levels and economic contributions to promoting sustainable energy (

Clark et al. 2017). It is argued by

Chan et al. (

2019) that the Sustainable Development Goals and the Paris Climate Change Agreement need help to access enough funds. The Sustainable Development Goals and the Paris Agreement provide a roadmap for effective climate action (

Chong 2018). However, they do not clearly define responsibilities or drive states to fulfill extraterritorial obligations. This issue is of considerable importance because the consumption of renewable energy sources in the sectoral economy depends on adequate financing. In this regard, many countries use different initiatives to increase funding for sustainable development goals and renewable energy projects. One of the initiatives that many developed countries mostly use to promote the transition to clean energy is through private investment mobilization. However, this initiative faces more significant constraints in developing countries.

Apart from the issue of private investment mobilization, there are also many constraint hindering the expansion of renewable energy expansion across developing countries. These constraints include the implementation of domestic policies about renewable energy, the accessibility of global public funding and the broader commercial landscape (

Chen et al. 2021). Although the global expansion of renewable energy faces significant challenges, there are numerous economic sectors that heavily rely on the services provided by renewable energy sources. Many studies conducted across the globe show that a substantial amount of renewable energy consumption is attributed to different economic sectors, such as the banking sector, transportation, residential buildings and commercial services (

Amuakwa-Mensah and Näsström 2022;

Le et al. 2020;

Doytch and Narayan 2021;

Iskandarova et al. 2021;

Maji and Adamu 2021). More specifically, some studies highlight the association between real GDP per capita and the utilization of renewable energy (

Simionescu et al. 2020;

Altunkaya and Özcan 2020;

Iskandarova et al. 2021).

Within the specific context of Ethiopia, renewable energy sources, including solar, hydro, wind and geothermal, possess considerable capacity to stimulate economic expansion (

Njoh 2021). Despite this potential, statistics reveal that 95 percent of total energy consumption in Ethiopia is derived from renewable sources. However, insights from a study conducted by

Hailu and Kumsa (

2021) underscore a significant challenge: a large part of Ethiopia’s population resides in areas with limited energy sources. This is a result of the proportion of the population that lives in urban and rural areas. The energy distribution in Ethiopian rural areas is still very limited, as the expansion of renewable energy in rural areas is more costly compared to that in urban areas. To support this argument, the study by

Fu et al. (

2024) suggests that deploying renewable energy constructions in rural compared to urban areas has different economic costs and benefits. This is mainly related to passive distribution networks that may no longer meet modern agricultural electrification and cleanliness requirements in rural areas, and this would necessitate urgent distributed energy planning in rural areas that could lead to high economic costs compared to urban areas. This has resulted in a distinctive scenario for the people of Ethiopia (

Girma 2016).

Although Ethiopia has taken a leading role in climate policy among low-income nations, its progress in rural development remains challenged, as highlighted by

Paul and Weinthal’s (

2019) analysis. More specifically, renewable energy consumption has slowly decreased in recent years, and these potential energy sources have faced barriers to broader adoption. These challenges include a complex and restrictive financing scheme by the Renewable Energy Fund (REF) (

Kotu 2012), the lack of a subsidy policy (

Hailu and Kumsa 2021), insufficient institutional cooperation among stakeholders (

Tiruye et al. 2021) and limited public awareness about renewable energy technologies (

Hameer and Ejigu 2020). Hence, addressing these obstacles is important (

Belay Kassa 2019) because renewable energy expansion can diminish carbon emissions and stimulate sustainable economic expansion in Ethiopia (

Adinew 2020).

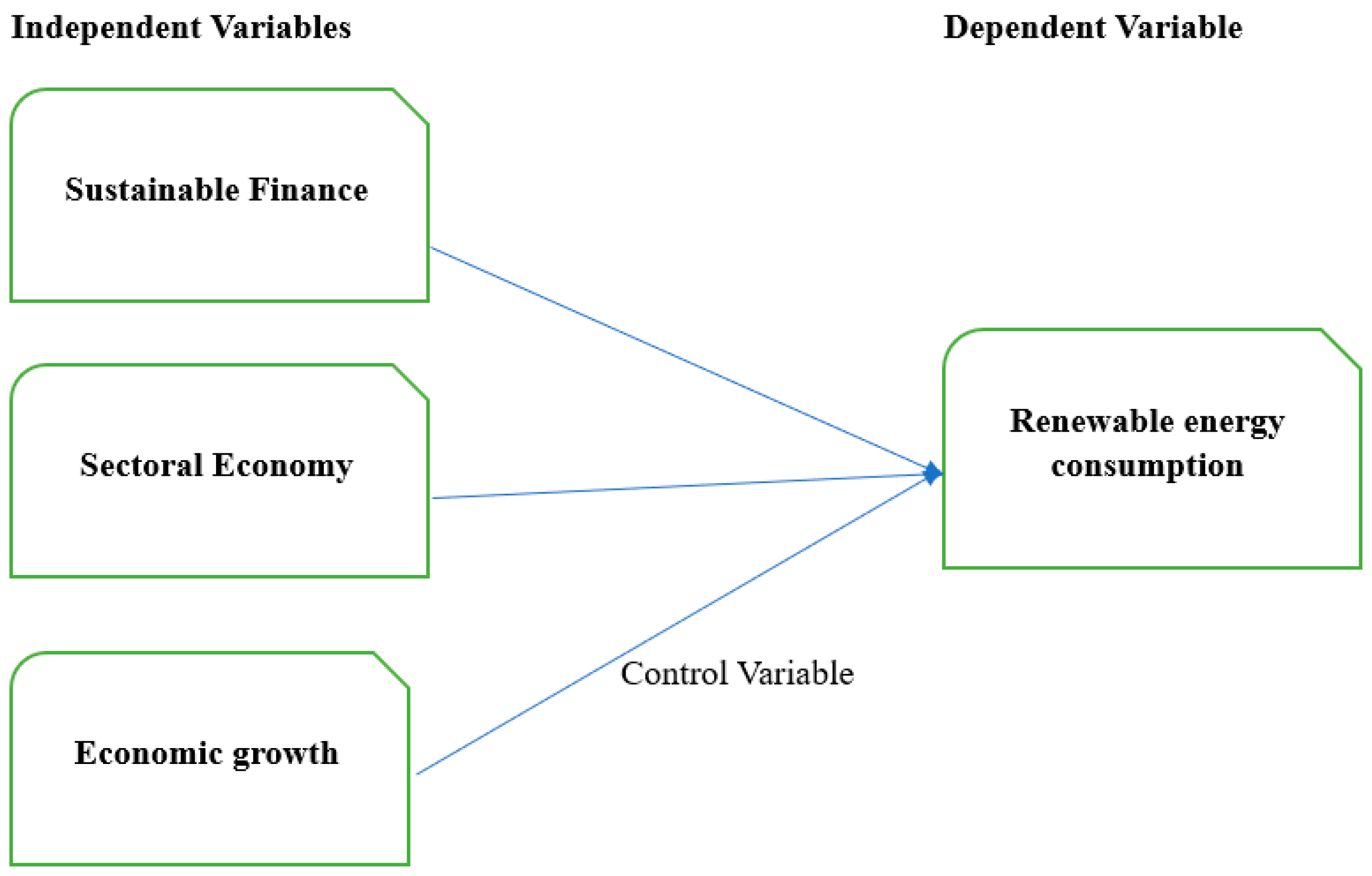

Despite numerous studies conducted to explore the challenges and potential of expanding renewable energy in Ethiopia, there has still been a significant reduction in renewable energy consumption. This reduction could be attributed to either an increase in demand or a decrease in supply. Therefore, further studies are needed to understand the factors behind the decline in renewable energy consumption. In doing so, the study at hand primarily focuses on the quantitative aspects of the economy, specifically examining the level of financial support provided for the expansion of renewable energy technologies that deliberately increase supply. Therefore, this study is motivated by the need to understand the sectoral economic factors contributing to the decline in Ethiopia’s renewable energy consumption and to explore the impact of international financial resources on renewable energy development in the country. Hence, this study investigates the effect of sustainable finance and the sectoral economy on Ethiopia’s renewable energy consumption. This study uses a benchmark from the United Nations Industrial Development Organization’s economic sector categorization system.

The industries used in this study as part of the sectoral economy are manufacturing, agriculture, construction, hunting, forestry, transportation, fishing, mining, utilities, wholesale and retail commerce, dining establishments, lodging, storage and communication. All economic sectors are measured by their value added to the economy as a proportion of the GDP. Additionally, the target variable of this study, sustainable finance, is measured by the annual international financial flows funded for supporting clean energy research and development. The dependent variable of this study, renewable energy consumption share, is calculated as the quantity of renewable energy utilized in the total energy supply for each year. Apart from the sectoral economic contribution, the research includes aggregate data on economic growth as a control variable. Based on this information, this study examines the relationship between each variable.

This study is novel in several ways. Initially, it fills a significant gap in the literature by exploring the relationship between sustainable finance, the sectoral economy and Ethiopia’s renewable energy consumption. Previous studies have not examined this relationship or provided empirical evidence. Additionally, this study uses a benchmark from the United Nations Industrial Development Organization’s sector categorization system to analyze various sectors’ contributions to Ethiopia’s economic decline in renewable energy consumption. Second, this study contributes to the existing knowledge on renewable energy utilization in Ethiopia by providing novel findings in these areas.

3. Methodology and Materials Used

This study examines the effect of Ethiopia’s sectoral economy on the percentage of renewable energy consumption using both aggregate and disaggregate time series data. Ethiopia is chosen as a case study due to its abundant renewable energy resources, with most of its energy derived from renewable sources. This selection aims to offer empirical evidence for countries relying on renewable energy sources.

This study uses an explanatory research design and a quantitative research approach to investigate the relationship between dependent and independent variables. Explanatory research design is used to understand the relationship between variables, making it a suitable choice for this investigation. To enable this research, the economic sectors are divided into six categories based on commonalities, using the categorization method supplied by the United Nations Industrial Development Organization. This categorization is based on similar characters to simplify the research process. This classification aims to facilitate the study by grouping sectors with similar characteristics. This division is undertaken to facilitate this study by grouping sectors based on their common attributes. This particular categorization allows for a comprehensive examination of how each sector contributes to and influences Ethiopia’s overall consumption of renewable energy.

Table 1 shows the sectoral economy used in this study.

Based on the categorization above, this research examines how the sectoral economy affects the proportion of renewable energy use. At the same time, it also attempts to look into the relationship between foreign finance flow supporting clean energy research and development and renewable energy production and renewable energy consumption. This research is entirely based on secondary data gathered from the United Nations Statistics Division (UNSD) (Energy Statistics Database) and the United Nations Industrial Development Organization (UNIDO) for sectoral economic statistics spanning the period of 2000–2022. This period is selected based on data available for both renewable energy and sustainable finance.

3.1. Variables and Measurements Used

This study aims to investigate how financing and the sectoral economy affect the consumption of renewable energy share in Ethiopia. As a result, the following functional estimation is used to develop the model. All independent variables are measured as the annual value added to the economy as a percentage of GDP.

RE = f (GDP, FI, IS, MIS, CS, MAS, TS, SS).

RE = Renewable energy consumption share (measured as the percentage of renewable energy consumption from each year’s total energy supply).

GDP = Gross domestic product (the economy’s annual growth rate at the aggregate level).

FI = Financial assistance to support renewable energy investment (measured by annual international financial flows supporting clean energy research at the aggregate level).

AS (agricultural sector), MIS (mining sector), CS (construction sector), MAS (manufacturing sector), TS (trade sector), and SS (service sector). All are measured by their value added to the economy as a percentage of GDP.

The above functional form can be written in the econometric form as follows.

Here, β0 is the intercept. β1–β8 are coefficients of the independent variables, and c represents the error term of the study (variables that are not included in this study).

3.2. Model Specification

The first step in choosing the best research model is determining whether the variables are stationary over time. This can be performed through different methods, but this study employs a unit root test to identify the variable’s stationarity. This procedure entails assessing the variables’ characteristics over time to see if they have a stable mean and variance. The unit root test can assess whether the variables are stationary, which is essential for proper analysis and dependable results. As a consequence, the primary purpose of this first step is to investigate the variables’ stationarity using the unit root test.

Table 2 shows the stationarity test results. The hypotheses guiding these tests are as follows: H0 posits the presence of a unit root in the variables, and the decision criterion involves rejecting H0 if the

p-value (PV) is less than 0.05. On the other hand, H1 suggests the absence of a unit root in the variables.

As depicted in the provided table,

Table 2 reveals the outcomes of the stationarity test conducted on the variables. These results indicate that the variables exhibit a consistent variance and mean over time. However, they display different levels of integration. Specifically, certain variables such as gross domestic product, financial assistance, the agricultural sector and the service sector are stationary at the level, indicating a stable pattern without significant fluctuations. On the other hand, variables like renewable energy, the mining sector, the construction sector, the manufacturing sector and the trade sectors exhibit stationarity at the first difference, implying that their values undergo consistent changes over time. Considering the overall stationarity result, it can be inferred that the variables possess different degrees of integration, characterized as I(0) and I(1). This signifies that some variables maintain a constant level, whereas others experience first-order integration, necessitating an autoregressive distributed lag (ARDL) model for analysis.

3.3. Discussion of Model Used

The autoregressive distributed lag (ARDL) model is the econometric technique used by this study’s researchers. The rationale for utilizing the ARDL model stems from the nature of the series under investigation, which exhibits a combination of integration orders, namely I(0) and I(1). The ARDL model allows researchers to adequately capture the dynamics of the variables under study.

The ARDL model estimates to test for cointegration among the variables.

The formulation of the error correction model aims to illustrate the short-term associations among the variables.

The bounds-testing approach is applied (

Pesaran and Taylor 1999), which is used to examine potential cointegration among variables. The results suggest cointegration, prompting an exploration of the short- and long-term relationship. The results of test statistics for the ARDL bounds test are presented below.

As indicated in

Table 3, the ARDL bounds testing results suggest that the variables exhibit a long-term relationship, prompting further examination of their short-term dynamics. The F-statistics result indicates a value exceeding the threshold for I(0) and I(1), indicating a long-term relationship between the variables. This finding underscores the importance of exploring the short-term dynamics to understand the relationship between these variables fully.

3.4. Lag Selection Criteria

This study’s results indicate that the model needs a maximum lag order of one. This conclusion is consistent across all lag length selection criteria, reinforcing the validity of the result. Consequently, this study uses a single lag order when running the model. The following

Table 4 of the study shows lag selection criteria used in the study.

4. Econometric Analysis and Discussion

Before conducting an econometric analysis, it is imperative to understand the data within the group thoroughly.

It is clear from

Table 5’s descriptive statistics that the dependent variable, renewable energy, has a mean value of 92.71 percent. This suggests that renewable energy was consumed at about 92.7 percent during the period (2000 to 2021). In addition, the highest documented consumption rate occurred in 2000 at 95.5%, whereas the lowest was reported in 2021 at 89.5 percent. The significant difference between the highest and lowest scores highlights Ethiopia’s dramatic decline in its use of renewable energy. This shows that the country’s adoption and consumption of renewable energy sources have seen noticeable fluctuation.

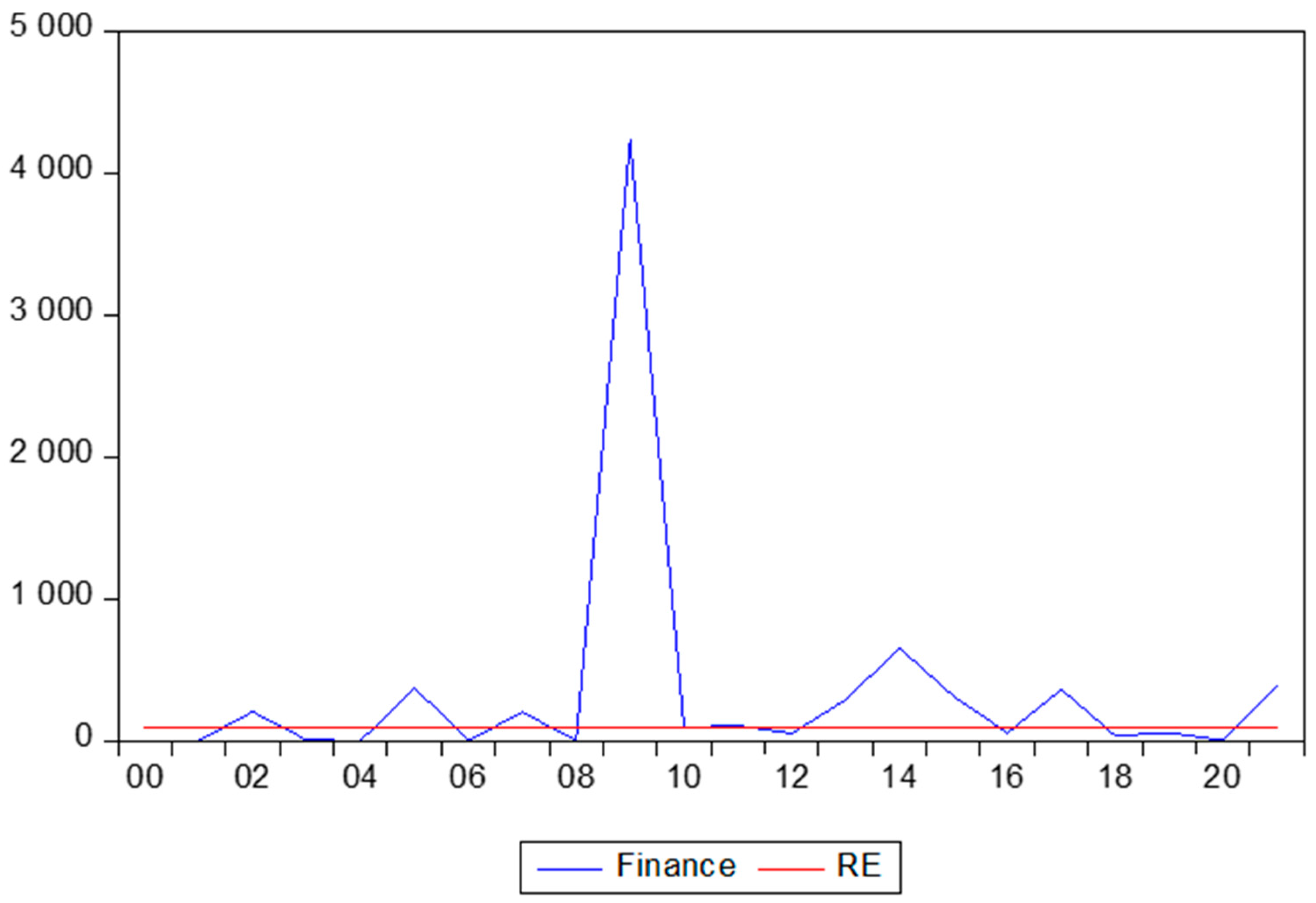

This study’s independent variable, which focuses on financial aid given to stimulate renewable energy investment, has a mean value calculated to be USD 339.2 million. This shows that, on average, throughout the study period, about USD 339.2 million in financial aid was granted for investments in renewable energy. Notably, the most minor investment was just USD 0.33 million (in 2008), whereas the most significant investment totalled a massive USD 4237.38 million (in 2009). This wide range between the maximum and minimum values illustrates the significant disparity in the magnitude of financial support dedicated to renewable energy projects. There are varying levels of commitment and investment in promoting and fostering the development of renewable energy sources, with some instances demonstrating substantial financial backing, whereas others reflect relatively limited support. These data also show a clear relationship between the renewable energy consumption trend and the financing level.

Figure 2 illustrates the exact association between the two factors.

The blue line in

Figure 2 illustrates the pattern of funding support to encourage renewable energy investments in Ethiopia. The line exhibits many ups and downs, showing a wide range in the distribution of financial aid for promoting renewable energy projects. These fluctuations imply considerable differences in how financial resources are allocated to support renewable energy investments. Furthermore, it is clear that, over time, both the funding assistance and the renewable energy consumption rate have been declining. This decrease in financial aid is consistent with the declining renewable energy consumption trend. This finding is compelling evidence that the amount of financial assistance offered to encourage renewable energy investment significantly impacts the rate at which renewable energy is consumed. The relationship between these two variables shows that decreased financial support may factor in the drop in renewable energy consumption.

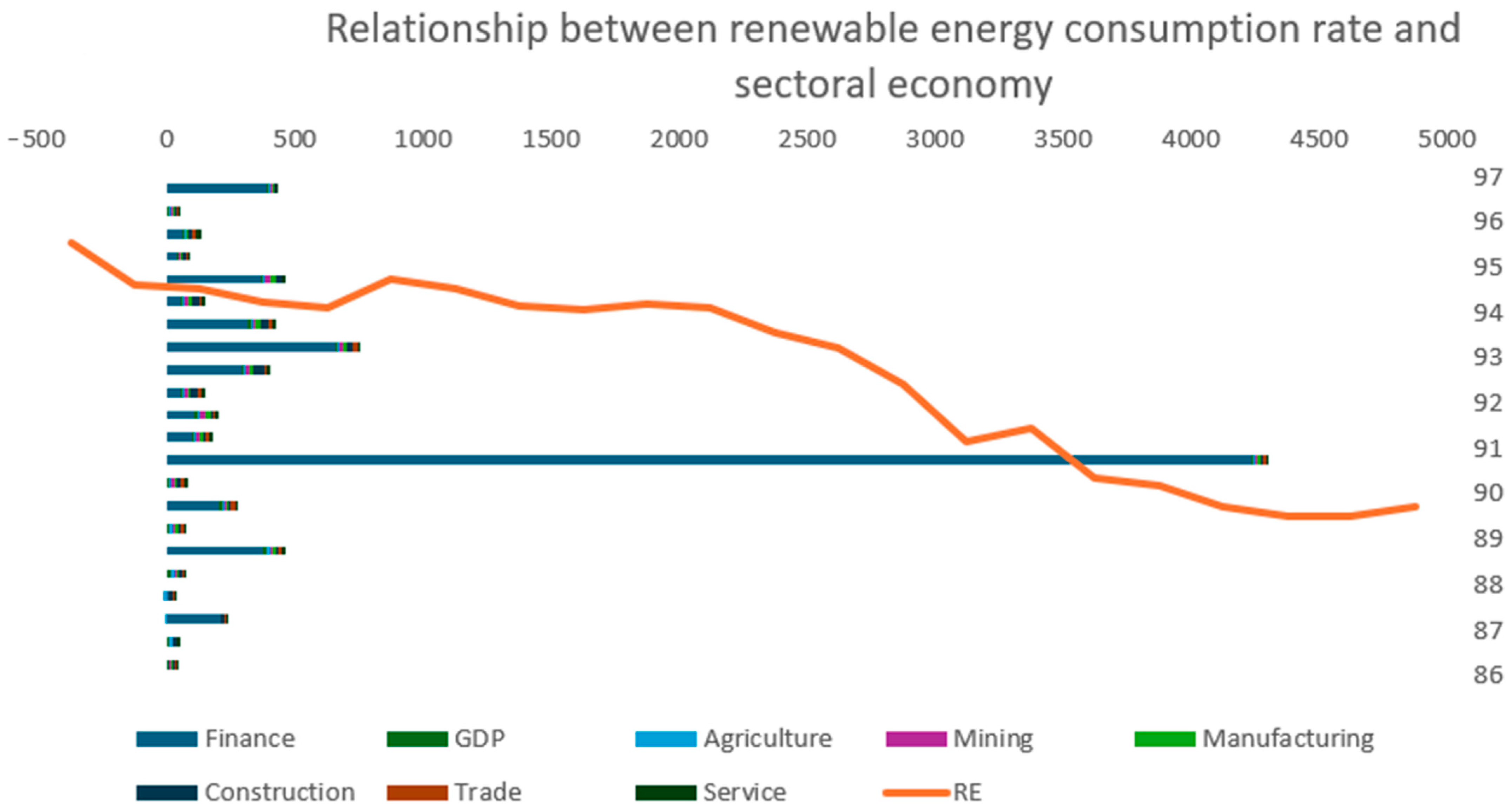

Figure 3 shows how the contribution of each sector to the economy and the renewable energy consumption rate are related. The results show that sectoral economic contributions display various values during the study period. Notably, shifts in sectoral contributions are seen to cause changes in the trend of renewable energy use across time. This finding suggests that sectoral contributions to the economy influence Ethiopia’s patterns and trends of renewable energy consumption. The variations in sectoral contributions may impact the degree of demand for renewable energy and how well it is incorporated into various economic sectors. The dynamic character of these sectoral contributions raises the possibility that changes in economic sectors and their relative importance impact the trajectory of the national consumption of renewable energy. This demonstrates the relationship between sectoral advancements and Ethiopia’s adoption of renewable energy sources. The details for independent variables can be seen above in

Table 5.

As shown below in

Table 6, the regression analysis findings support the hypothesis that the variable of financial aid has a considerable and favorable influence on how rapidly renewable energy is used. This suggests a significant and positive impact on the consumption patterns observed over the long term when financial resources are committed to promoting renewable energy efforts. In other words, the results imply that foreign financial aid is crucial for boosting the use of renewable energy sources over a long period. These findings emphasize the value of offering financial assistance to promote investments in renewable energy.

This study’s findings suggest that continued financial assistance is crucial in promoting the development of the renewable energy sector. Such support can speed up the execution of renewable energy projects, promote R&D initiatives and stimulate innovation in clean energy technologies. The results also imply that financial support for renewable energy projects may be obtained via international cooperation and collaboration, with significant advantages.

The findings also indicate that the manufacturing sector has a long-term, beneficial and considerable influence on the rate of renewable energy use within the sectoral economy. The results, for instance, suggest a 1.4-unit increase in renewable energy consumption for every unit increase in the manufacturing sector’s value contributed to the overall economy. This suggests that the manufacturing industry dramatically influences renewable energy sources. The results further emphasize how the industrial sector has a big role in the uptake and use of renewable energy. One of the possible justifications for the positive relationship is due to the country’s current economic and renewable energy status. According to statistics from the National Bank of Ethiopia (2022), the manufacturing sector contributes less to the economy than other sectors. In recent years, the firm has grown modestly despite significant growth in the use of renewable energy. Among Ethiopia’s many renewable energy resources are hydropower, wind and solar. The proximity of these resources to manufacturing hubs may make renewable energy a convenient and logical choice for powering industrial processes. The growth of the industrial sector offers the potential for hastening the adoption of renewable energy technology and smoothing the transition to a low-carbon economy.

Conversely, Ethiopia’s mining industry significantly and negatively affects renewable energy consumption. This study findings shed light on the negative consequences that mining operations have on the commitment and use of renewable energy sources. This study’s results specifically show a decrease in renewable energy consumption of about 1.835720 units for every unit rise in the mining sector’s value generated by the economy. Renewable energy consumption decreases as the mining sector grows and makes more remarkable economic contributions to the country. One possible justification for this result is the issue of resource competition. The mining sector is resource-intensive and often competes for the same natural resources needed for renewable energy projects. Furthermore, the mining industry may be pretty energy-demanding, needing a lot of power and fuel for extraction and processing. As a result, the mining industry’s energy use may overwhelm renewable energy potential, making it harder to convert to cleaner energy sources.

Furthermore, it was discovered that Ethiopia’s service sector negatively affects the utilization of renewable energy. The research discovered that, for every unit rise in the value that the service sector adds to the economy, there is a corresponding decline in the usage of renewable energy of around 0.921179 units. This research emphasizes the possible conflicts between adopting renewable energy sources and the growth of the service sector, which is often linked to increased urbanization and commercial activity. There is a noticeable and quantitative reduction in the consumption of sustainable energy resources as the service sector grows and contributes more considerably to the nation’s economic output. One of the possible arguments for a negative relationship is the energy intensity of the service sector. The service industry, which includes banking, finance, hotels and retail firms, may be less energy-intensive than other sectors, such as manufacturing or heavy industries. Because energy use in the service sector is often more minor, there may be less urgency or motivation to transition to renewable energy sources. The following

Table 7 of the study shows short-term relationship between variables.

The short-term regression analysis shows a distinct and notable relationship between financial support and the use of renewable energy. This study’s findings imply that increasing financial aid for renewable energy investments results in a favorable and significant increase in renewable energy consumption rates. Specifically, for every extra unit of financial aid supplied to encourage renewable energy efforts, the consumption rate of renewable energy is expected to rise by 0.002. This finding suggests that augmented provision of financial assistance will stimulate more significant investment in renewable energy projects, substantially expanding the country’s renewable energy capacity. Increased investment will enhance accessibility to renewable energy sources, fostering a higher consumption rate. In other words, more significant financial resources mean increased investment in renewable energy, leading to a more significant proportion of renewable energy generation within the country. Consequently, this surge in investment contributes to greater utilization of renewable energy and a subsequent increase in its consumption rate.

Surprisingly, examining both short-term and long-term correlations between independent and dependent variables yields comparable patterns in terms of direction and significance. This consistency demonstrates the robustness and reliability of the findings. This study reveals that certain variables, namely financial assistance and the manufacturing sector, positively and significantly impact Ethiopia’s renewable energy consumption rate. This favorable association applies to both the short-term and long-term consequences. Conversely, the service and mining sectors negatively influence renewable energy consumption rates in the short and long term. These data imply that these industries hurt renewable energy use. Furthermore, this research found that characteristics such as the agricultural, construction and commerce sectors have no substantial effect on renewable energy usage in the short or long term. These variables are deemed insignificant in terms of their impact on renewable energy consumption.

Another interesting conclusion from the research is the impact of economic growth, as assessed by the yearly growth rate of GDP. The results reveal that this variable does not significantly affect Ethiopia’s renewable energy consumption level. Economic growth, as captured by the GDP growth rate, is not a determining factor in shaping the country’s consumption rate of renewable energy.

Overall, these findings shed light on the factors that influence or impede Ethiopian renewable energy consumption, emphasizing the importance of financial assistance and the manufacturing sector while indicating limited impact from the service, mining, agricultural, construction and trade sectors, as well as economic growth as measured by GDP growth rate.