Abstract

The main goal of this contribution is to assess the development of the economic condition of the Slovak Republic in the context of the impacts of the COVID-19 pandemic. The situation regarding the development of and changes in the economic condition of Slovakia is compared with that in selected EU countries, considering the effects of previous global crises, with a focus on the impacts on small and medium-sized enterprises. The economies of European countries are mentioned to illustrate the ideas of the presented paper, with an emphasis on the economic dimension of the COVID-19 pandemic and its subsequent impact on the Slovak Republic. This research is conducted through basic analytical tools and an analysis of the development of macroeconomic indicators, and by addressing the issue through data from a globally available database. The results in this paper serve as proposals and recommendations for the mitigation of negative economic impacts.

1. Introduction

The COVID-19 pandemic has profoundly affected society, influencing human life and causing a global economic crisis. The influence of the COVID-19 pandemic on the economies of individual countries has been significant. The situation brought quarantines, limitations to travel, lockdowns, and limitations on production and business, as well as other direct and indirect influences, threatening economic growth not only in Europe but worldwide, bringing serious economic damage. In terms of scale and impact, the COVID-19 pandemic has had a more severe impact on the economy than the global financial crisis (Choi 2020). The fall in global GDP ranged from 1.3% to 5.8% (Aktar et al. 2021). Researchers predict that the recovery will be slow (De Backer et al. 2021).

In many countries, the stay-at-home lockdown initiated during the COVID-19 pandemic has highlighted the difficulty of combining remote work and family life. The stay-at-home lockdown forced people to relegate their whole lives to their homes. Suddenly, the home became the center of all activities, even those that had previously taken place in the city, which was practically emptied. Its impacts thus encompassed education, work, and leisure (Rosa-Jiménez and Jaime-Segura 2022).

According to Liu et al. (2022), quantifying the shock to the economy from the COVID-19 pandemic is difficult. According to the authors, this is a shock easily associated with financial markets as a type of currency shock and it has an impact on the real economy. For this reason, the authors carried out a study that focused on the use of electricity in various sectors of the economy. They proposed a new method of comparing electricity consumption in selected COVID-19 years, based on which they derived a measure of the real shock to some important economic sectors. The ratio between these influences revealed the need for a balance between stocks and differences in the economy. The authors found that while production and consumption were affected, services were more vulnerable to the shock of the COVID-19 pandemic.

Economic imbalance means damage to and a decline from economic balance. When such damage is not considerable, or only short-term, in the conditions of market economy compensation, mechanisms start to act to eliminate the unbalanced state. In this case, the imbalance cannot be evaluated positively and, in certain cases, it can be a stimulus for economic growth. However, when the damage to the economic balance has a permanent and more considerable character, it then has structural consequences, bringing negative factors such as damage to social stability, unemployment, inflation, a deficit in the state budget, a deficit in payment balances, etc. (Ondrijová and Korečko 2018; Šíbl 2002).

A study by Wang and Liu (2022) involved a thorough investigation of the relationship between COVID-19 and daily stock price changes. They used several types of COVID-19 patients as indicators to investigate whether stock prices were significantly affected by the impact of COVID-19. The authors were mainly interested in the psychological and industrial impacts of COVID-19 on the financial market. Their study empirically estimated the marginal impact of the COVID-19 pandemic on fluctuations in stock market returns. The authors confirmed their claim that the COVID-19 pandemic caused panic in the stock market, which not only reduced stock prices but also increased the volatility of daily returns. Regarding the stimulus of the shock, they identified the cumulative level of the pandemic variables as well as their incremental differences as the causes. As the results showed, the terms for these differences eventually dominated the marginal effect, which confirmed the weakening impulse of the shock.

The topic of the economic impacts of the COVID-19 pandemic is widely discussed in any country around the world. Finding optimal anti-pandemic solutions while minimizing the losses sustained to human life, to provide the optimal economic balance in individual countries, is very demanding.

The goal of this paper is therefore to conduct an analysis of the economic condition of Slovakia through the evaluation of its macroeconomic indicators, with an emphasis on its development in 2020, together with the beginning of the global health crisis. The importance of such research is underlined by indicators that report the state of the economic boom in national and regional economies. The indicators, recording the influence of the COVID-19 pandemic on the economy, are reflected in the worsening of the GDP, the measure of inflation, the measure of unemployment, the volume of indebtedness, and the value of worldwide business (Šíbl 2002). The indicators are specified according to their negative economic influences in Slovakia and compared with chosen EU countries. Following our findings, this paper provides several measurements and recommendations to mitigate the economic impact of the COVID-19 pandemic.

Through this analysis, using methods of objective reality searching, this paper evaluates the mutual relationships between the macroeconomic indexes, as well as their determination and importance, through comparing the COVID-19 pandemic and previous financial and economic crises.

2. The Present State of Problem Solving

Currently, economists emphasize the importance of individual behavior in reducing the risk of infection. In this area, Droste and Stock (2021) found a significant difference in the relationship between economic activities and viral prevalence, as well as in the relationship between transmissibility and economic activity. According to the latest estimates, the global economy is expected to have contracted by 5.2 percent and global trade is expected to have declined by 13 to 32 percent in 2020 due to the COVID-19 pandemic. This has wreaked havoc on the world economy, and governments should take multiple measures to promote economic and financial support for residents (Singh et al. 2020). The pandemic affected less developed economies particularly strongly (Zhang et al. 2020).

Estrada et al. (2021) investigated the occurrence of the epidemic and its effects on financial market activities, introducing the concept of stagpression—a new economic phenomenon that reflects the behavior of capital markets related to the impact of COVID-19. In Adams and AboElsoud (2021), the focus was on predicting China’s economic growth due to the pandemic, compared to a previous economic “shock”, the 2008 financial crisis, which had a large and significant impact on GDP growth. Chen (2020) conducted similar research. The impact of COVID-19 on the American economy was investigated by Barlow and Vodenska (2021), where they found a disruption in the production capacities of individual industries. Li and Kapri (2021) examined the economic factors affected by COVID-19 infections, finding differences due to countries’ inherent economic factors, showing that countries that relied heavily on the service sector and international trade suffered from COVID-19 the most.

Khan et al. (2021) attempted to understand the severity of the pandemic, the responses of the governments of the region, and the impacts on services, manufacturing, trade, the supply chain, and especially small businesses, and it disrupted all economic indicators. Wei et al. (2021) investigated the impact of the COVID-19 pandemic on the global economy, socio-economics, and sustainability, as well as social welfare during the pandemic, such as employment, finding that the social economy was affected by the pandemic, causing huge losses in employment, welfare, and social capital. Tejedor-Estupinan (2020) evaluated the impact of the COVID-19 pandemic on the social and economic sphere in Latin America, compared to previous pandemic situations in history. The Indian economy probably faced a loss of around 10–31% of its GDP (Kanitkar 2020). Zhang et al. (2021) described the global impact of the COVID-19 pandemic on the economic situation in 36 different countries, finding that the economic sentiment fluctuated considerably and even became pessimistic. Research by Pinilla et al. (2021) pointed to the economic and social crisis in Spain due to uncertainty about the pandemic and the socio-economic effects on people’s lives. Using data from France, Malliet et al. (2020) showed that COVID-19 had a strong short-term impact on the GDP, unemployment, and investment.

From the point of view of the statistical data of the COVID-19 pandemic, the following developments can be observed. The Crisis Committee of the World Health Organization (WHO) declared, on Thursday, 30 January 2020, a state of global health emergency in connection with the disease caused by the new coronavirus spreading from China. After announcing the global health status, the WHO declared this situation a pandemic. In the context of the WHO (2020), a global health emergency refers to situations or diseases that may spread to other countries; this type of condition requires coordinated international cooperation. The WHO expected further outbreaks of the disease caused by the new coronavirus outside of China. In China, an active investigation of this novel coronavirus began in December 2019. COVID-19 gradually spread to all Chinese provinces and dozens of other countries on all continents. The disease paralyzed much of the world. The number of cases of COVID-19 caused by the new coronavirus began to reach the hundreds, with thousands of victims worldwide. In fact, one of the greatest challenges caused by COVID-19 and the resulting overload on the health system was, and continues to be, a shortage of intensive care unit beds. Although pandemic mitigation strategies had different goals, they mainly sought to ease the burden on health systems by purchasing so-called hospital sleep for recovery, while keeping the number of new patients at a manageable level given the limited capacity of healthcare systems.

Table 1 provides a review of the number of affected individuals, deaths, and recovered individuals in the most affected countries and continents in March 2021, one year since the first occurrence of COVID-19.

Table 1.

Data on COVID-19 development in selected countries.

3. Methodology

The economies of European countries were selected to fulfill the goals of the presented paper, with an emphasis on the economic dimension of the COVID-19 pandemic and its subsequent impact on the Slovak Republic. We chose the time interval of 2008 to 2020, on the basis of which we sought to highlight the changes in the performance of the SR economy in 2020 as a result of the COVID-19 pandemic, but also to compare it with the global economic crisis. The global economic crisis that occurred between 2008 and 2009 required key impacts of anti-pandemic measures in the business sector.

The main goal of the contribution was to present an economic assessment of the Slovak Republic in the context of the COVID-19 pandemic. This goal was fulfilled by identifying the economic dimension and impact of the COVID-19 pandemic in the Slovak Republic, the impact of anti-pandemic measures with a focus on small and medium-sized businesses, and the evaluation of the development of the macroeconomic indicator of GDP COVID-19.

For the purposes of analyzing the development of macroeconomic indicators and solving the problem, we used statistical data obtained from the Statistical Office of the Slovak Republic and Eurostat EC (Eurostat 2021). The presented numerical tables and figures that show trends over time are an important statistical means of expressing the results of statistical processing.

Specialized institutions or organizational units provide information to create an image of the business environments of companies (Jenčová 2020) and perform an analysis of the national economy. Statistics are part of the decision-making process. Seeing things in progress is an important aspect of human behavior. Time series analysis is the fulfillment of this concept; therefore, we performed an elementary data analysis (Table 2) on the quarterly time series of the GDP in millions EUR at constant prices for the period of 2008 to 2020.

Table 2.

Results of the statistical values from time series.

We calculated the basic statistics and elementary characteristics of the time series analysis. From the calculated values, we can state that 52 values were analyzed, i.e., 52 quarters. The lowest volume of GDP in one quarter was EUR 14,998.60 mil. and it was noted in the first quarter of 2009. The highest volume of GDP was EUR 24,513.30 mil. In the fourth quarter of 2019. In the following Table 3, we present an overview of the GDP for the last 5 years in billions EUR.

Table 3.

GDP development in bill. EUR in 2016–2020.

In the period from 2008 to 2020, with an average of EUR 19,544.24 mil. for one quarter, the average value was EUR 19,104.75 mil. The standard deviation of values was EUR 2511.10 mil. In 2020, the nominal volume of the generated GDP reached EUR 91,104.8 mil.

4. Results

4.1. Period 1—Economic Development before Pandemic from 2008

The business environment in Slovaika in 2008 was characterized by preparation for the installment of the Euro currency and start of the first reflections of the global economic crisis in the business sector. Among the expected advantages of the Euro installment were

- Decreasing transaction costs in the international business environment;

- Price transparency and prediction in relation to foreign partners.

The installment of EUR enabled stabilization as well as the inflow of foreign investments. In 2009, the Slovak economy had been influenced in terms of aggregate performance by the impacts of the world financial and economic crisis, mainly through the decrease in external demand and the slowing down of the world economy and partially also by the direct losses from investments in the financial markets. In 2012, GDP growth helped the foreign demand and investments, but the domestic consumption showed stagnation. However, the weaknesses of the Slovak business environment are characterized by the following:

- -

- the very long enforceability of the law;

- -

- dynamic and changing legislation without an effective system for the evaluation of the impacts on the business environment;

- -

- the existing administrative burden on businessmen;

- -

- the less developed capital market and less effective public sector;

- -

- the insufficient offer of services from e-government, pertaining to high levies with impacts on the job market;

- -

- practices of clientelism and corruption,

- -

- increases in the prices of production inputs, such as energy and raw materials, which increase the costs of the enterprises;

- -

- threats to competitiveness;

- -

- a lack of sources for young and starting businesses;

- -

- a lack of dialogue with the Slovak government and SME representatives about actual problems.

All mentioned weaknesses were also typical in the business environment in other EU states, as mentioned by Chapčáková et al. (2013).

The global financial crisis in 2008–2009 resulted in unwillingness to bear debts, as well as hesitation during the crisis to release the state expenses. During the COVID-19 pandemic in 2020, we witnessed a different situation; therefore, similarity to the previous crisis does not exist.

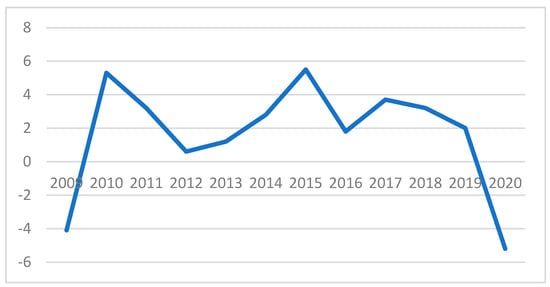

The long-term trend of GDP development from 2008 to 2020 is illustrated in Figure 1. In the analyzed period, there was recorded growth in the GDP until 2019. In 2020, there was recorded a significant change due to the influence of the COVID-19 pandemic.

Figure 1.

GDP development in Slovakia in 2009–2020 (average annual change in %). Source: (Statistical Office of the Slovak Republic 2021).

The worsening of the economy was visible in 2020, when the negative influence of the external environment was stressed by stopping a large part of the domestic economy due to the influence of the emergency and the closure of the chosen operations. At the same time, it can be stated that the Slovak economy managed the previous year during the COVID-19 crisis better than in 2009. The following tables and figures (Table 4, Table 5 and Table 6, Figure 2 and Figure 3) illustrate the development of the key macroeconomic indexes: the GDP, the measure of unemployment, the measure of inflation, the total imports and exports, and the balance of foreign trade from 2016 to 2020.

Table 4.

GDP index in Slovakia in 2016–2020.

Table 5.

Unemployment rate development in 2016–2020.

Table 6.

Inflation rate development in Slovakia in 2016–2020 (%).

Figure 2.

GDP development in Slovakia in current and constant prices in 2016–2020 in %. Source: own processing according to data from (Statistical Office of the Slovak Republic 2021).

Figure 3.

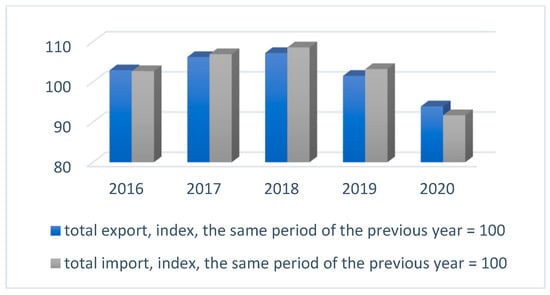

Development of foreign trade balance in bill. EUR in %. Source: (Eurostat 2021).

Data from the Statistical Office of Slovakia represent the GDP development with an increasing tendency from 2016 to 2019 and, as mentioned above, a considerable change occurred in the pandemic year of 2020. With the constant prices, the GDP decreased by 5.2% against 2019, while, compared with the financial crisis in 2009, the decrease was yet deeper, mainly by 5.5%. Figure 2 illustrates the GDP development in 2016–2020.

The second analyzed index is the unemployment rate. The percentage of the unemployment rate represents the number of unemployed active inhabitants in the economy. In Slovakia, there are two means of determining the number of unemployed and the unemployment rate. The first results from the number of individuals registered at the Office of Labour, Social Affairs and Family in Slovakia. The second method results from the periodically repeated sampling of households, which represents the methodology of the Office of Labour, Social Affairs and Family. According to the data from the Statistical Office in Slovakia, in 2019, a historically low unemployment rate was recorded at the level of 5.8% and, finally, the discussion of a stronger employee labor market began. However, due to the COVID-19 pandemic, the unemployment rate in 2020 increased again to 6.7%. Table 5 provides information about its development during the previous five years.

After studying the report of the Statistical Office of the Slovak Republic, the year-on-year inflation rate averaged at 1.5%. Falling food prices, which were the lowest in the last two years, significantly contributed to the decline in inflation. The development of the year-on-year inflation rate in the years 2016–2020 is also graphically presented in Table 6, which clearly shows its decline, especially in 2019.

Our fourth analyzed indicator comprised the volume of total exports of goods, which decreased by 6.1%, the total imports of goods, which decreased by 8.3%, and the balance of foreign trade, which was active in the amount of EUR 1212.4 mil. and was almost three times higher than at the end of 2019. We relied on credible sources from the Statistical Office of the Slovak Republic, presented in Figure 3, illustrating the balance of foreign trade from 3.4% in 2016 with a consequent decrease to 2.7% in 2020.

From the point of view of the main economic groupings, 1.3% more Slovak goods went to EU countries in the last quarter of 2020 than in 2019, and exports to the EU made up more than three quarters of Slovakia’s total exports. Among the most important trading partners, exports to Germany increased the most, by 6.9%, followed by those to France, by 2.6%, and to Poland, by 7.8%, according to the Statistical Office of the Slovak Republic (2021). Exports to the United States of America, which is also one of the main Slovak customers, also increased by more than two thirds.

Imports from EU countries increased by 5.4% for total imports of 67.2% and from OECD countries by 0.2% for total imports from the Slovak Republic of 65.2%. Imports from Germany increased the most, by almost a quarter, i.e., 23.8%, France by 5.3%, and Spain by 1.8%. Exports to OECD countries increased by 4.3%, which represented 87.2% of the total Slovak exports (OECD 2020).

We enriched the analytical part of the first period before the pandemic with data on the GDPs of the V4 countries and the EU for an international comparison; they were taken from the database of Eurostat and the Statistical Office of the Slovak Republic. Table 7 shows the GDP indicators in constant prices for all V4 countries in the years 2016–2020. The table shows that the GDP trend in all V4 countries and the EU as a whole had an increasing trend since 2016. In all countries, there was a change in the development of the GDP, mainly due to its decline, especially in the first half of the pandemic year 2020.

Table 7.

GDP indexes, the same period of previous year = 100, constant prices, methodology ESA 2010, seasonable non-adapted data—2016–2020.

Cheap labor and Eurozone membership have transformed Slovakia into a center for car manufacturing, but this became a disadvantage as the closed borders weakened the global demand for cars and disrupted cross-border supply chains. In the Czech Republic, in connection with the coronavirus crisis, there was discussion of money from helicopters, which was one of the proposed solutions to cope with the economic downturn. According to Pučelík (2020), this would have simply meat that the central bank dispensed money and distributed it directly to households, which could then possibly reduce taxes and thus support consumption. This means of supplying money to the economy could also have offered an alternative to quantitative easing programs, where the central bank supplied money to the economy indirectly. Poland maintained its best values during the pandemic (Table 8).

Table 8.

Industrial production, indexes, 20,158 = 100; industries together; data adjusted by number of working days—2016–2020.

The calculation of the industrial production index is based on the change in the volume of the selected products and industrial services; the base period is the average month of 2015. The indicators compared to the same period of the previous year are derived from the monthly base index. In 2020, compared to 2019, industrial production in the Slovak Republic decreased by 9.1%. Production in most industries in all V4 countries fell below the previous year’s level.

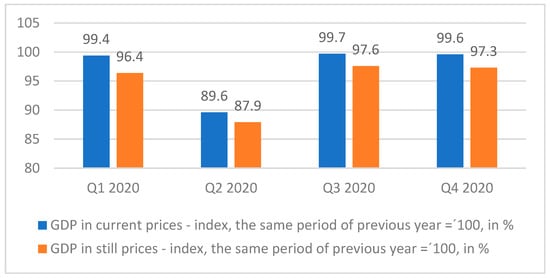

4.2. Period 2—Economic Development during the Pandemic in 2020

The assumptions of the National Bank of the Slovak Republic that the Slovak economy would reach a significant decline in the second quarter have finally been confirmed (Table 9). While, during the first wave of the pandemic, in the spring of 2020, several Slovak corporate sectors were at a loss, the second wave, in the autumn of 2020, affected only services and trade more significantly. The reason was the new quarantine measures, which paralyzed the business of hotels and restaurants in particular. The numbers that came from the industry were still relatively good. The carmakers, the driving force of the Slovak economy, for example, had reason to rejoice. Experts talked about the strong interest in cars abroad. During October 2020, registrations of new vehicles in the US and China, which are among Slovakia’s main customers, increased. In 2020, compared to the same period in the previous year, the GDP fell by 2.9% at the current prices and by 5.2% at the constant prices.

Table 9.

Economic development of Slovakia in 2020.

While the first wave of the COVID-19 pandemic caused historical declines in the key indicators in the second quarter, developments at the end of the year were already influenced by the second wave. This regrettable situation was caused by a number of negative effects on the economy. One of these was an increase in regional disproportions between the regions of the country (Mustafin et al. 2019). In the fourth quarter of 2020, the economy deteriorated by about 2.5%, as in the third quarter. The result was much better than in the spring of 2020, when the economy fell by more than 12%. In the fourth quarter of 2020, the GDP of the Slovak Republic decreased by 2.7% year-on-year at constant prices, not seasonally adjusted. The economic downturn in the fourth quarter was thus the second mildest in 2020; it was much milder than in the spring of 2020, when the state of health emergency was declared in the Slovak Republic as well. We present the economic development of 2020 graphically in Figure 4.

Figure 4.

Quarterly development of GDP in Slovakia in 2020—index. Source: own processing according to data from (Statistical Office of the Slovak Republic 2021).

There were empty hotels and restaurants that served food only through the window or by delivery on the one hand. On the other hand, there were industries that emerged from the red but also stronger interest in Slovak products abroad. Through this, the economic downturn did not significantly accelerate at the end of 2020. The economy was able to start up again and softened the pace of decline at the end of the year, so that the decline was the second smallest in the whole of 2020. The decisive part of the result was the foreign demand, which was restored to the extent that it reached year-on-year growth of 1.8%. For the entire year of 2020, the Slovak economy fell by 5.2%, which was less than in the crisis year of 2009. The overview of economic development in 2020 also shows that the blockade in the spring of 2020 had a greater negative impact on the economic condition of the Slovak Republic than the pandemic itself.

Based on the results of the statistical report on development trends in the Slovak economy, the year 2019 was extremely favorable in the tourism industry, but the development in 2020 displayed the opposite pattern due to the pandemic and related restrictions. In 2020, compared to 2019, sales in restaurants decreased by 10.6%. In the course of 2020, year-on-year sales decreased twice, in the second and fourth quarters, while the decrease always exceeded 20%. After the summer season, which partially mitigated the effects of the pandemic, the performance of tourism decreased again in the fourth quarter of 2020. Measures taken by the government of the Slovak Republic to eliminate the transmission of the virus during the second wave of the pandemic brought a decrease in indicators in passenger transport, freight, and public transport. Total sales in transport and storage in 2020 decreased by 8% year-on-year, mainly due to a decrease in warehousing and auxiliary activities in transport, land transport, and pipeline transport. On the other hand, sales in postal and courier services increased, which managed to maintain their growth throughout 2020.

The economy at the end of 2020 was affected by exports and the decrease in the decline of the selected industries. The growth of the added value in several sectors and especially in the industry in the last months of the year worsened the unfavorable trend of the first half of the year. In 2020, unemployment increased by 15% year-on-year. The unemployment rate increased by 0.9 percentage points to 6.7%. Despite the problems in the business environment, the average monthly salary maintained its growth and reached EUR 1133; in 2019, according to the Statistical Office of the Slovak Republic, it was EUR 1092. A low wage level does not stimulate a person to engage in activity, intensive work, or self-improvement (Mustafin and Ignateva 2016). The government’s regulations contributed to mitigating the impacts, especially the introduction of the so-called Kurzarbeit. Nineteen monitored industries felt the impact of the crisis, in the form of the number of employees in up to 13 industries. Services, accommodation, and catering, as well as transport and storage, recorded the largest decreases.

The impact of the pandemic in 2020 was significantly reflected in the development of prices. The trend of slowing inflation did not change, even in the fourth quarter. In the fourth quarter of 2020, the average inflation rate decreased by 1.4% to 1.5%. Core inflation was at 1.5%, while food prices fell by 3.6% to 2%. Regulated prices also fell slightly by 0.2% to 3.5%. The level of net inflation was without changes in indirect taxes; it decreased by 0.7% and reached 1.3%. The average inflation rate in 2020 was 1.9%, lower by 0.8%.

4.3. Key Impacts of Anti-Pandemic Measures on SMEs in EU and Slovakia

The level of development of small and medium entrepreneurship directly determines the degree of development of the country’s economy as a whole (Khafizov and Mustafin 2017). Unfortunately, in 2020, small entrepreneurs and sole traders paid severely due to the pandemic crisis. In almost all industries, their number decreased, with the most in accommodation and food services, by 8.2%, and in trade, by 7%. The reasons could be found mainly in the strict anti-pandemic measures, which mandated the closure of non-food establishments. The industry was still relatively good compared to the services. The services were reluctant, mainly due to the pandemic measures.

After studying the Eurostat data, a monthly survey by the European Commission showed that the economic sentiment in 19 countries sharing the Euro fell sharply, especially in April 2020, to 67.1 points, and then in November, to 88.7, points from 91.9 in October. The ESI economic sentiment indicator is a composite indicator designed to monitor GDP growth. The data are seasonally adjusted and are generated by the European Commission’s Directorate-General for Economic and Financial Affairs. The ESI is a weighted average of the balances of answers to selected questions addressed to companies, where their weight in percentage is as follows: industry 40%, services 30%, consumers 20%, retail 5%, and construction 5% (Table 10).

Table 10.

Values of ESI index in EU and Slovakia, 2019–2020.

For comparison, the economic sentiment of the Slovak Republic fell sharply for the first time in April 2020, to 59.9 points, which was the period of the first wave of the COVID-19 pandemic. Then, it fell for the second time in seven months, in November 2020, to 87 points, when the continent was hit by the second wave of COVID-19, which negatively impacted all sectors, especially those most affected by the restrictions, such as services and retail. After a partial recovery in sentiment between May and September 2020 and a broad lateral movement in October, the decline was the first, as the sentiment fell sharply during the first wave of COVID-19. The decline in sentiment was supported by a decline in confidence in retail, services, and consumers.

EU sentiment in industry and construction, which was largely spared, declined only slightly. In all cases, the outlook for the future business has deteriorated. The sentiment in services, the largest sector of the European economy, which produces about two thirds of the GDP, declined the most in the second quarter of 2020. The sentiment in industry fell the most in April 2020. After studying the Eurostat data, the inflation expectations in industry fell the most in 2020, but they have grown among consumers. Both values have been below average since 2000.

5. Discussion

The Slovak government reimbursed 80% of the cost of work to companies that were closed in 2020. However, this was not enough for some entrepreneurs. Other employers complained about unclear conditions when applying for contributions. Applicants for government aid also pointed to another problem, which concerned the self-employed, who had no income and did not pay taxes. In 2020, many entrepreneurs went bankrupt, especially in the field of gastronomy, and they were not to blame for this situation; it was based on the decisions of the Slovak government. The government aid was woefully slow and inadequate. Several factors can change the outlook of the economy, and the further waves of the pandemic remain unexamined, but they may also have affected the Slovak and global economy. In addition, more serious problems may also occur in the financial sector, which could affect the willingness or ability of banks to finance consumer loans, mortgages, or business plans. The revival of the crisis could also be undermined by potential trade wars between the world’s major economies (Krastev 2020).

Politically divergent countries, such as Taiwan, South Korea, Hong Kong, and Singapore, learned from the 2002–2003 SARS epidemic of voluntary obedience rather than repressive enforcement (Chen 2020). As the Bulgarian political scientist Krastev (2020) stated in his publication, this capacity is only very indirectly related to the GDP of a specific country or the nature of its political regime. Thus, the quality of the bureaucracy depends on the size of the budget or even the amount of healthcare spending. Further developments in the economy will depend mainly on the epidemic situation and on whether the governments of individual countries decide to proceed with a hard lockdown (Estrada et al. 2021).

One of the most important areas that was affected by the COVID-19 crisis was the labor market. We recorded the largest declines in the tourism, gastronomy, and hotel sectors, but also in administration, auxiliary work, and customer support. The major topic was and continues to be the home office, which not only employers but also employees had to become familiar with. All this led to the need to develop centers of digital technologies by creating economic clusters (Seliverstova et al. 2018). Based on the final figures of the Statistical Office of the Slovak Republic and their evaluation through the performed analyses, we can conclude that, in 2020, while the first estimates spoke of a double-digit drop in GDP, in the end, the figure was only slightly over 5%. We were particularly attracted to the industry that was more resistant to the restrictive measures. A negative outcome was the decline in investments by companies and the state, which fell by more than 15% at the end of the year. However, after the initial decline in the first half of 2020, the economy managed to start up again, and, at the end of the year, the rate of decline in the Slovak Republic was moderated (Statistical Office of the Slovak Republic 2021).

From the point of view of small and medium-sized enterprises, which are the key drivers of economic growth, innovation, employment, and social integration, based on the data of the Statistical Office of the Slovak Republic, in the period of the financial and economic crisis from 2008 to 2010, the share of small enterprises decreased from 5.5% to 2.1%. Since 2012, the share of small businesses in the total number of business entities in the Slovak Republic has been in the range of 2.3% to 2.6%. For other size categories of enterprises, the development was stable, without significant fluctuations. The year 2019 was the culmination of a successful period for the Slovak Republic since the end of the global financial and economic crisis. During this period, the national economy was characterized by a constant growth trend, to which small and medium-sized enterprises contributed significantly. In 2019, small and medium-sized enterprises in the Slovak Republic made up 99.9% of the total number of active business entities according to the legal standard and size category. This was the most dynamic growth in the number since 2007. It means that in the share of all business entities, small and medium-sized enterprises are the largest contributors to the added value in the Slovak Republic. The failure of small and medium-sized enterprises due to the pandemic therefore has had a large impact on the national economy.

6. Conclusions

The current topic of the COVID-19 pandemic offers the potential for further development, as the pandemic has opened up several questions that still need to be answered, whether from a scientific research point of view or at the political level. In the future, it is also necessary to consider whether the economic growth will be sustainable in the long run and whether it is the best criterion for the consumer-based, cosmopolitan society of the 21st century, which is characterized by three words: produce, consume, and discard. On this basis, we wish to point out that efforts to increase economic growth are, at the same time, leading to the irrational use of natural resources, especially energy resources, and thus their depletion will accelerate. As we already know, the company has no alternative yet. The given topic is very important due to the necessary reassessment of the criteria in achieving the optimal economic balance of the Slovak Republic from a long-term perspective, through such criteria that could ensure sustainable development. There is a need to revitalize tax and fiscal policy, pensions, health, public administration, social cohesion, security, labor, and, above all, environmental policy. This means that we humans must also be more responsible towards the environment and the climate, and the Slovak government must implement the necessary key reforms as soon as possible through a recovery plan.

Author Contributions

Conceptualization, A.T. and J.G.; methodology, J.G.; software, J.G.; validation, K.Č.; formal analysis, A.T. and J.G.; investigation, M.R.; resources, M.R.; data curation, K.Č.; writing—original draft preparation, A.T.; writing—review and editing, J.G.; visualization, M.R.; supervision, K.Č.; project administration, M.R.; funding acquisition, M.R. All authors have read and agreed to the published version of the manuscript.

Funding

This research was funded by the grant project KEGA 024PU-4/2023.

Informed Consent Statement

Informed consent was obtained from all subjects involved in the study.

Data Availability Statement

The data presented in this study are available on request from the corresponding author. The data are not publicly available due to privacy and ethical restrictions.

Conflicts of Interest

The authors declare no conflicts of interest.

References

- Adams, John, and Mostafa AboElsoud. 2021. Guest editorial. Journal of Chinese Economic and Foreign Trade Studies 14: 1–2. [Google Scholar] [CrossRef]

- Aktar, Most Asikha, Md Mahmudul Alam, and Abul Quasem Al-Amin. 2021. Global economic crisis, energy use, CO2 emissions, and policy roadmap amid COVID-19. Sustainable Production and Consumption 26: 770–81. [Google Scholar] [CrossRef] [PubMed]

- Barlow, Jonathan, and Irena Vodenska. 2021. Socio-Economic Impact of the Covid-19 Pandemic in the US. Entropy 23: 673. [Google Scholar] [CrossRef] [PubMed]

- Chapčáková, Alexandra, Jaroslava Hečková, and Emília Huttmanová. 2013. Business of Small and Medium Enterprises. Košice: EQUILIBRIA, Ltd. ISBN 978-80-8143-076-3. (In Slovak) [Google Scholar]

- Chen, Zhiqi. 2020. Symposium on the Economic Impact of the COVID-19 Pandemic: An Introduction. Frontiers of Economics in China 15: 475–77. [Google Scholar] [CrossRef]

- Choi, Sun Yong. 2020. Industry volatility and economic uncertainty due to the COVID-19 pandemic: Evidence from wavelet coherence analysis. Finance Research Letters 37: 101783. [Google Scholar] [CrossRef] [PubMed]

- De Backer, Bruno, Hans Dewachter, and Leonardo Iania. 2021. Macrofinancial information on the post-COVID-19 economic recovery: Will it be VU or L-shaped? Finance Research Letters 43: 101978. [Google Scholar] [CrossRef] [PubMed]

- Destatis. 2020. Staatsfinanzen 2020 im Minus: Defizit von 139.6 Milliarden Euro. Available online: https://www.destatis.de/EN/Press/2021/02/PE21_082_81.html (accessed on 2 February 2021).

- Droste, Michael, and James H. Stock. 2021. Adapting to the COVID-19 Pandemic. AEA Papers and Proceedings 111: 351–55. [Google Scholar] [CrossRef]

- Estrada, Mario, Ruiz Arturo, Evangelos Koutronas, and Minsoo Lee. 2021. Stagpression: The Economic and Financial Impact of the Covid-19 Pandemic. Contemporary Economics 15: 19–33. [Google Scholar] [CrossRef]

- Eurostat. 2021. European Statistical Recovery Dashboard. Available online: https://ec.europa.eu/eurostat/cache/recovery-dashboard/ (accessed on 3 March 2021).

- Jenčová, Sylvia. 2020. Financial and Economic Analysis of Business Subjects. Prešov: Bookman, s. r. o. ISBN 978-80-8165-394-0. (In Slovak) [Google Scholar]

- Kanitkar, Tejal. 2020. The COVID-19 lockdown in India: Impacts on the economy and the power sector. Global Transitions 2: 150–56. [Google Scholar] [CrossRef]

- Khafizov, Marat D., and Askar Nailevich Mustafin. 2017. Development of small and medium entrepreneurship: Evidence from Russia. International Journal of Economic Perspectives 11: 1529–34. [Google Scholar]

- Khan, Muhammad Azhar, Hakeem Abbas Naqvi, Moeen Ghulam, and Nadeem Iqbal. 2021. Economic and financial impact of the COVID-19 pandemic in South Asia. Environmental Science and Pollution Research 29: 15703–12. [Google Scholar] [CrossRef] [PubMed]

- Krastev, Ivan. 2020. Europe and Pandemic: How the Coronavirus Would Change Us? Žilina: Absynt, s. r. o. ISBN 978-80-8203-183-9. (In Slovak) [Google Scholar]

- Li, Yupeng, and Kul Prasad Kapri. 2021. Impact of Economic Factors and Policy Interventions on the COVID-19 Pandemic. Sustainability 13: 12874. [Google Scholar] [CrossRef]

- Liu, Lu, Junbing Huang, and Hong Li. 2022. Estimating the real shock to the economy from COVID-19: The example of electricity use in China. Technological and Economic Development of Economy 28: 1221–41. [Google Scholar] [CrossRef]

- Malliet, Paul, Frédéric Reynès, Gissela Landa, Meriem Hamdi-Cherif, and Aurélien Saussay. 2020. Assessing short-term and long-term economic and environmental effects of the COVID-19 crisis in France. Environmental and Resource Economics 76: 867–83. [Google Scholar] [CrossRef]

- Ministry of Health of the Slovak Republic. 2021. Mortality Number. Available online: https://covid-19.nczisk.sk/sk (accessed on 3 March 2021).

- Mustafin, Askar Nailevich, Alexander Evgenyevich Shlyakhtin, and Rastislav Kotulič. 2019. Role of public management in elimination regional disparities. Polish Journal of Management Studies 19: 260–70. [Google Scholar] [CrossRef]

- Mustafin, Askar Nailevich, and Oksana A. Ignateva. 2016. Formation of the human capital assessment quality model at the present stage of development of innovative economy. Academy of Strategic Management Journal 15: 27–37. [Google Scholar]

- OECD. 2020. Coronavirus. Available online: https://oecd.github.io/OECD-covid-action-map/ (accessed on 21 November 2021).

- Ondrijová, Ivana, and Jaroslav Korečko. 2018. Attitudes of entrepreneurs to the financial administration in Slovakia. In Marketing Identity: Digital Mirrors—Part I. Trnava: Fakulta masmediálnej komnikácie. (In Slovak) [Google Scholar]

- Pinilla, Jaime, Patricia Barber, Laura Vallejo-Torres, Silvia Rodriguez-Mireles, Beatriz G. Lopez-Valcarcel, and Luis Serra-Majem. 2021. The Economic Impact of the SARS-COV-2 (COVID-19) Pandemic in Spain. International Journal of Environmental Research and Public Health 18: 4708. [Google Scholar] [CrossRef]

- Pučelík, Karel. 2020. Will We Receive Money from the Helicopter? Available online: https://www.investujeme.cz/clanky/dockame-se-penez-z-helikoptery/ (accessed on 21 November 2021). (In Czech).

- Rosa-Jiménez, Carlos, and Cristina Jaime-Segura. 2022. Living Space Needs of Small Housing in the Post-Pandemic Era: Malaga as a case study. Journal of Contemporary Urban Affairs 6: 51–58. [Google Scholar] [CrossRef]

- Seliverstova, Natalia S., Askar N. Mustafin, and Eva Benková. 2018. Analysis of the factors affecting the choice of information systems by economic subjects of Russian Federation. Journal of Social Sciences Research 2018: 46–51. [Google Scholar] [CrossRef]

- Singh, Gian, Dharampal, and Jyoti. 2020. Economic Impact of COVID-19 Pandemic: Who are the Big Sufferers? Indian Journal of Economics and Development 16: 320–26. [Google Scholar] [CrossRef]

- Statistical Office of the Slovak Republic. 2021. National Account. Key Indexes. Available online: https://slovak.statistics.sk/wps/portal/ext/themes/macroeconomic/accounts/indicators (accessed on 3 March 2021).

- Šíbl, Drahoslav. 2002. Big Economic Encyclopedy. Bratislava: SPRINT. ISBN 80-89085-04-0. (In Slovak) [Google Scholar]

- Tejedor-Estupinan, Joan Miguel. 2020. The Social and Economic Impacts of the COVID-19 Pandemic in Latin America. Revista Finanzas y Politica Economica 12: 335–40. [Google Scholar] [CrossRef]

- Wang, Qian, and Lihon Liu. 2022. Pandemic or Panic? A Firm-Level Study on the Psychological and Industrial Impacts of COVID-19 on the Chinese Stock Market. Financial Innovation 8: 36. [Google Scholar] [CrossRef] [PubMed]

- Wei, Xiaoding, Lei Li, and Fangshu Zhang. 2021. The impact of the COVID-19 pandemic on socio-economic and sustainability. Environmental Science and Pollution Research 28: 68251–60. [Google Scholar] [CrossRef] [PubMed]

- WHO. 2020. Bulletin of the World Health Organization. Available online: https://www.who.int/publications/journals/bulletin (accessed on 2 December 2021).

- Zhang, Hongyu, Yiqin Ding, and Jia Li. 2021. Impact of the COVID-19 Pandemic on Economic Sentiment: A Cross-Country Study. Emerging Markets, Finance and Trades 57: 1603–12. [Google Scholar] [CrossRef]

- Zhang, Yumei, Xinshen Diao, Kevin Z. Chen, Sherman Robinson, and Shenggen Fan. 2020. Impact of COVID-19 on China’s macroeconomy and agri-food system—An economy-wide multiplier model analysis. China Agricultural Economic Review 12: 387–407. [Google Scholar] [CrossRef]

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2024 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).