Strategic Learning Alliances and Cooperation: A Game Theory Perspective on Organizational Collaboration

Abstract

1. Introduction

- What net payoffs do stakeholders derive from their collaborative efforts in alliances?

- What factors contribute to the success of international organizations in realizing the benefits of strategic learning alliances?

- What cooperative strategies are most effective in fostering successful learning alliances?

2. Literature Review

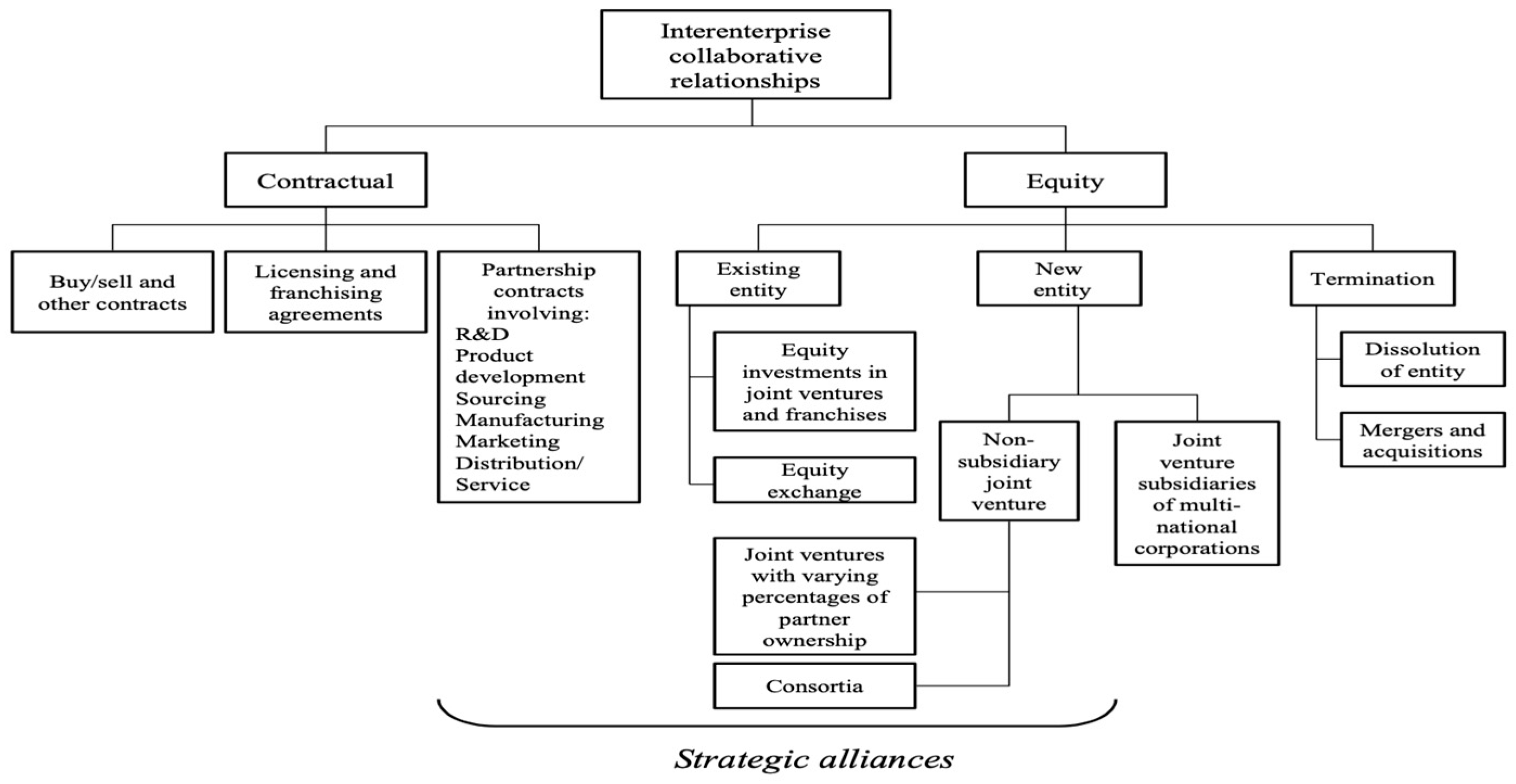

2.1. Strategic Alliances

- Short-term strategies can undermine long-term cooperation: Strategies focused on immediate gains, such as defection in one-shot prisoner’s dilemma games, can damage trust and destabilize alliances.

- Joint and reputation benefits are crucial for sustainable alliances: Cooperative strategies that emphasize shared and reputation-based benefits, as seen in games 1, foster long-term collaboration.

- Sophisticated cooperative strategies build trust: Approaches like “Firm-but-Fair”, supported by communication, are more effective than retaliatory strategies like Tit-for-Tat. These strategies foster collaboration and strengthen trust within alliances.

2.2. Game Theory

- (a)

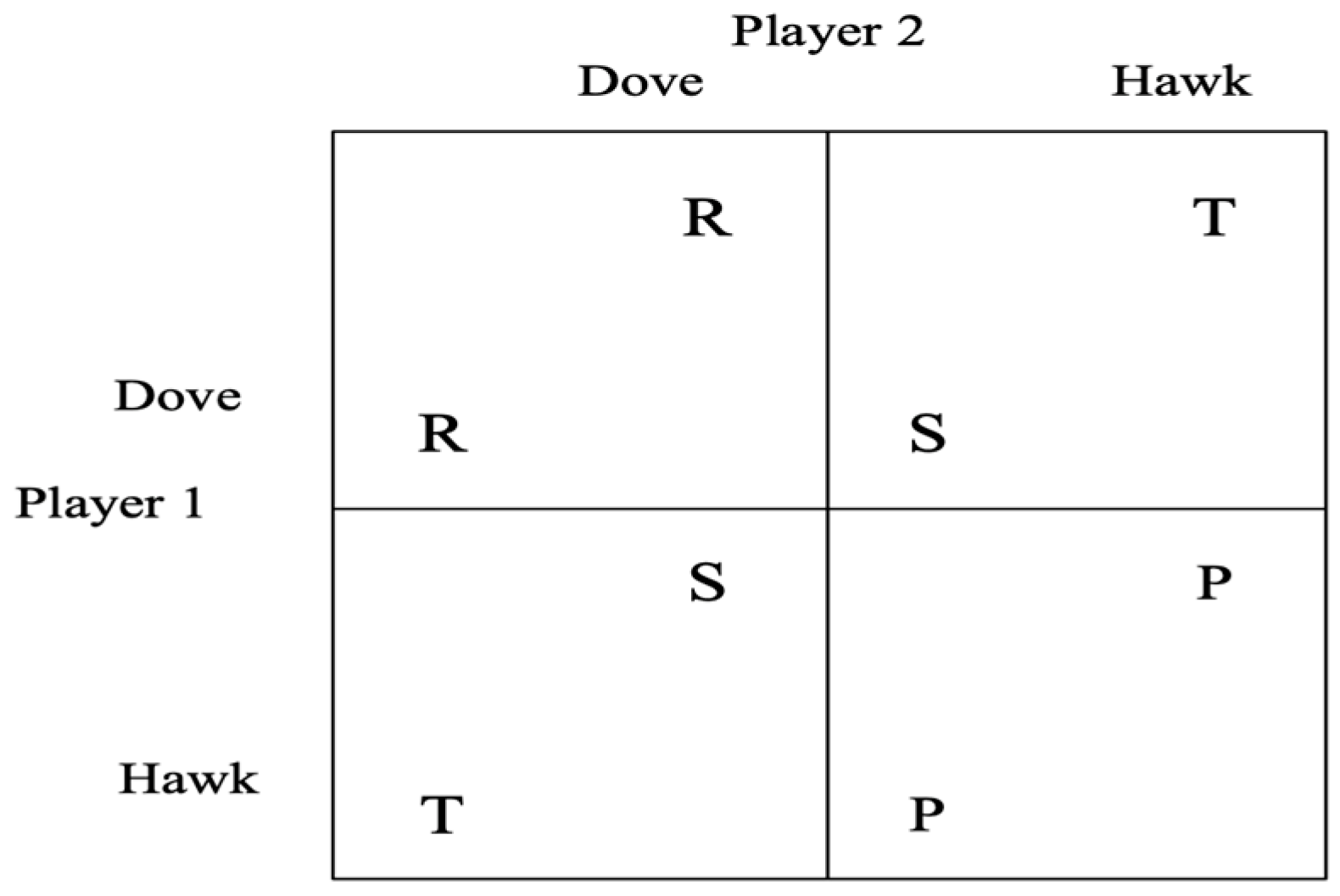

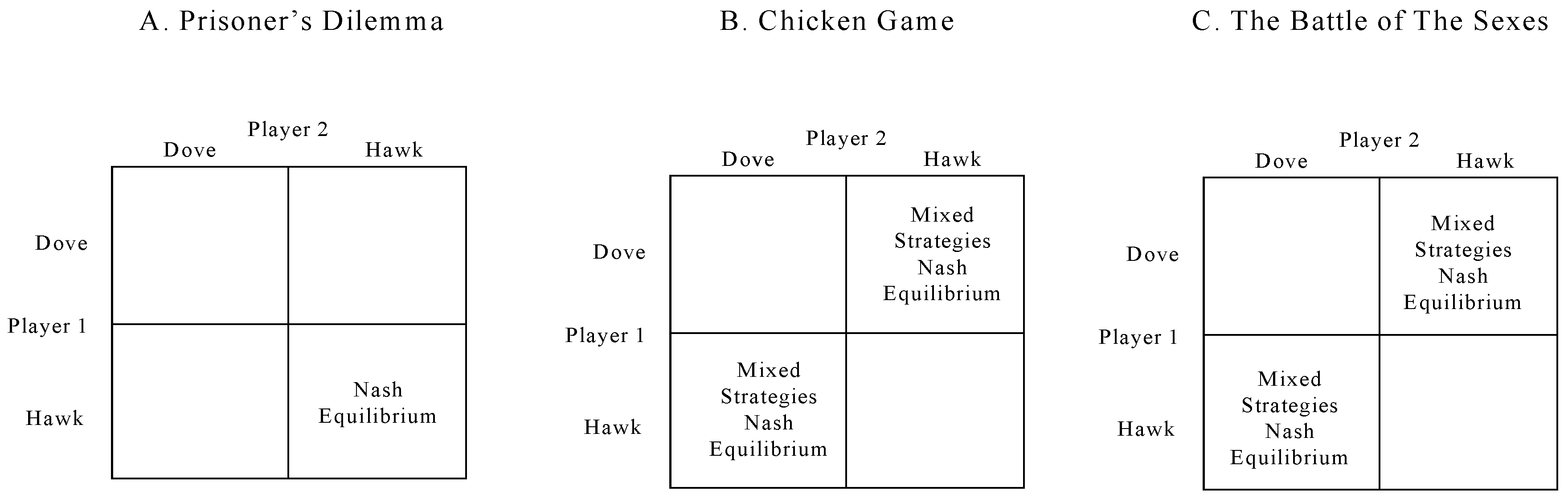

- The Prisoner’s Dilemma: This well-known scenario illustrates a situation where two participants must choose between cooperating or acting in their own self-interest by defecting. While the optimal choice for each individual is to defect, resulting in a suboptimal outcome for both, cooperation would actually lead to a more favorable result for both parties. This results in a suboptimal outcome for both, highlighting the challenges of strategic decision-making in alliances. The game represents Games 2 scenario in game theory, illustrating the conflict between individual rationality and collective benefit.

- (b)

- Chicken Game: The Chicken Game derives from a contest where two drivers head toward each other, with the first to swerve being labeled the “chicken”. If neither swerve, both lose, and if both swerve, the result is mutual avoidance. This game, classified as a Games 3, highlights the risks associated with aggressive competitive strategies in alliances. Strategic decisions in such contexts depend heavily on the willingness of each party to compromise.

- (c)

- Dominant Cooperative Strategy Games: In these games, cooperative behavior is the most advantageous outcome for all players. The payoff structure incentivizes cooperation, making it the dominant strategy. Such games are classified as Games 1, where alliances succeed through mutual collaboration and trust-building.

- (d)

- The Gender Dynamics Debate: This coordination game, classified as Game 4, features two players attempting to align their actions, even though they have different preferences. The challenge lies in balancing individual desires with the need for mutual coordination. Strategies like commitment or hierarchical decision-making can help overcome this coordination dilemma and lead to optimal outcomes.

- (e)

- The Cost/Benefit Structure of a ‘One-Shot Game’: In one-shot games, players’ perceptions of payoffs play a crucial role in shaping their decisions. Rapoport and Chammah (1965) explored the distribution of payoffs in two-player positive-sum games, underscoring the significance of players’ perceptions in driving game outcomes.

3. Research Methodology

3.1. Simulation

- Model A: An ergodic search method was utilized to explore all possible configurations of payoff perceptions from the perspective of Player 1, a member of the coalition. Initially, 24 payoff combinations were generated. By considering all permutations of positive and negative payoffs, this number expanded to 120 potential outcomes. A comprehensive search was then conducted to pinpoint games that met the predefined criteria of the model.

- Model B: This model built on the outcomes of Model A by introducing logical constraints to refine the search parameters. These constraints were designed to exclude combinations that were logically inconsistent with the results of the first model. This refinement process narrowed the focus to more feasible game scenarios, enabling a more targeted analysis.

- Model C: Stochastic Landscape Simulation in Computing: This approach was chosen for several critical reasons, such as the limited availability of empirical data, the necessity to analyze extensive datasets, and the objective of evaluating random variations in coalition benefits and costs in comparison to the outcomes predicted by the a priori models. The randomly selected values in this simulation were assigned to the cost and benefit variables (as outlined in Table 1), and various payoff matrices (A, B, C, and D) were calculated for 1200 cases. The analysis of this dataset allowed for the identification and examination of diverse categories of games based on the delivery of outcomes.

3.2. Research Model

- As noted by Matthews (1999, 2002), within an alliance, two entities, referred to as stakeholders x and y, engage in a partnership that generates two types of payoffs: potential payoffs and realized payoffs. The potential payoffs are denoted by , and the sum of these potential payoffs for all members of the alliance is calculated using the formula:

- The potential payoffs in an alliance are determined by deducting the costs (βij) from the benefits (αij). This relationship is expressed by the following equationaxy = (αij − βij).

- The realization of payoffs is contingent upon the degree of cooperation between partners x and y, who are identified as agents or stakeholders. Payoffs remain in their potential state until they are activated by the stakeholders. The cooperative variables are denoted as Θx and Θy; which represents the level of collaboration between the two stakeholders. The decision-making process is binary, involving an all-or-nothing approach (Θ ∈ 0, 1) and the realizing payoffs requires both identifying the potential payoffs and taking steps to activating them.

- Thus, the model suggests that the realized payoffs from an alliance depend on balancing potential benefits and costs, along with the level of cooperation between partners.Or, briefly,aij ~ ΘxΘySactual = ΣxΣy axy. ΘxΘy

- Matthews (1999) examines coalitions through the framework of cooperative games and introduces a model for understanding cooperation. He describes several key variables involved in alliances:

- Transfer benefits (r) are those transferred from one agent (i) to another agent (j), while transfer costs (c) are the expenses incurred by the agent making the transfer, thus, if Θx = 1 then rxy ≥ 0 and cxy ≤ 0.

- Joint benefits (b) represent the net outcomes that all agents receive from collaborating, thus, bxy ≥ 0 if and only if both Θx ≥ 0 and Θy ≥ 0.

- Reputation benefits refer to the net advantages (d) gained by individuals simply through their association with the coalition, thus, dxy ≥ 0 if Θx ≥ 0 or Θy ≥ 0 or both.

- Exit costs (h) represent the costs of leaving the coalition, thus, hx ≤ 0 and hy ≤ 0 if Θx = 0 or Θy = 0.

- The actual payoff is summarized as follows:Sactual = ΣxΣy (rxy + bxy + dxy – cxy + hxy) ΘxΘy

S(player)x = d − c if Θx = 1 and Θy = 0

S(player)x = r + d if Θy = 1 and Θx = 0

S(player)x = h otherwise

- The benefits and costs arising from the coalition are distributed randomly, with values between zero and one. However, exit costs are unique, ranging from negative-one to one (indicating that exit costs may be either positive or negative, leading to distinct games 2 and 3).The random distribution of benefits and costs in the simulation model was employed to capture a broad spectrum of potential scenarios that coalition members might encounter in strategic alliances. This approach enables an exploration of player behavior across diverse payoff structures without predefining specific conditions, thereby reflecting the uncertainty and variability often present in real-world alliances.To analyze player behavior under these varying conditions, the model evaluates each scenario by calculating payoffs based on different combinations of cooperative and competitive strategies. By doing so, it identifies patterns in decision-making and determines the conditions under which cooperation becomes a dominant strategy or when defection is more likely. The model allows for an examination of how players adapt their strategies in response to different benefit–cost distributions, thereby providing insights into strategic behavior across a range of alliance dynamics.

- Alliances seek to explore different combinations of potential outcomes, which are influenced by how each participant values the benefits and costs associated with the alliance. Equations (1) through (7) offer a comprehensive visual representation of the research model.Transfer benefits r ∈ (0, 1)

Transfer costs c ∈ (0, 1)

Joint benefits b ∈ (0, 1)

Reputation benefits d ∈ (0, 1)

Exit costs h ∈ (−1, 1)

- Model A Rational Possibilities I

- Game 1: When A > C and B > D, joint benefits surpass transfer costs, making cooperation the optimal strategy. The Nash equilibrium in this scenario is (1, 1).

- Game 2: If A < C, B < D, and D ≥ 0, then the shared benefits are insufficient to cover the costs of transfers, with these costs outweighing reputation benefits. This situation presents two possible games:

- (a)

- A one-time (prisoner’s dilemma) game where the Nash equilibrium is (0, 0).

- (b)

- A repeated interaction game where the Nash equilibrium shifts to (1, 1).

- Game 3: If A < C and B < D, and D < 0, the game takes on characteristics of a “chicken” scenario, presenting three Nash equilibria: (0, 1), (1, 0), and a mixed-strategy equilibrium.

- Model B Rational Possibilities II

4. Findings

4.1. Simulation

4.2. New Games Taxonomy

- Model 3—Random Landscape

- Representation of Cooperative Scenarios: In strategic alliances, partners often aim to maximize joint benefits while sharing resources and risks. To reflect this, the model includes intervals that favor positive payoffs for both parties, simulating scenarios where trust and alignment lead to high mutual benefits. These intervals capture alliance settings where cooperation is incentivized, allowing us to analyze how alliances perform under optimal collaborative conditions.

- Competitive and Mixed-Motive Scenarios: Recognizing that not all alliances are purely cooperative, some intervals are set to capture competitive or mixed-motive dynamics. These ranges simulate situations where organizations may face conflicts of interest or where individual incentives diverge from collective goals. For instance, payoff intervals that include lower or negative values represent potential risks or costs each partner might incur, allowing the model to reflect scenarios similar to the prisoner’s dilemma, where individual gains can undermine collective benefits.

- Exploration of Alliance Evolution: The chosen intervals are designed with the understanding that alliances often evolve over time, influenced by feedback, learning, and changing external conditions. Although the Random Landscape Model in its current form uses static intervals, these ranges provide a foundation for future research that might incorporate dynamic or adaptive payoff structures to reflect shifting alliance contexts more accurately.

5. Analysis and Discussion

5.1. Strategic Alliances and Games New Classification

- i.

- Games 1

- Game 1.1 is a fully cooperative scenario where “A” serves as both the Pareto optimal outcome and the Nash equilibrium. In this game, cooperation emerges as the most favorable strategy for all participants.

- Games 1.2 and 1.3 also have “A” as the Pareto optimum, but each game type includes two Nash equilibria.

- ii.

- Games 2

- iii.

- Games 3

- iv.

- Games 4

- Game 4.1 represents the classic "hawk-dove" scenario. The inclusion of a negative payoff, D, leads to the existence of multiple equilibria, akin to the strategic dynamics observed in the Chicken game. In this context, each player chooses the hawk strategy with a probability influenced by the payoff structure, striking a balance between the potential rewards of victory and the associated costs of conflict.

- Game 4.2, in contrast, feature a positive “D” making them resemble the “Battle of the Sexes” game. In these games, each player prefers to participate in an activity they like with their partner, such as Player 1 going to a football game (play 0, 1) or Player 2 attending a theater performance (play 1, 0). However, if neither option is possible, they would each prefer to go alone to their favorite activity (play 0, 0) (Table 5).

5.2. New Taxonomy and Strategic Alliances

- Game 1.1 games present the most favorable conditions for alliance formation, as cooperation is the dominant strategy. These situations typically lead to successful alliances, as both parties are incentivized to collaborate. In contrast, Game 1.2 and Game 1.3 games require effective communication to ensure that both partners adopt cooperative behavior, as the possibility of defection exists without adequate coordination.

- In games 2, partners are more likely to avoid forming an alliance, as the payoff structure is less attractive. Potential partners would be better off seeking alternative coalitions that offer more favorable payoff combinations. However, if an alliance is deemed necessary or desirable, factors such as repetition, reputation benefits, and the difference between payoffs (A and D) will significantly influence its success.

- Game 3 and Game 4.1 games are highly competitive, making long-term coalition formation unlikely. In these scenarios, prospective partners may seek to avoid cooperation unless they have a critical need that can only be met through the alliance. In such cases, the success of cooperation will largely depend on the magnitude of payoff D and the associated conflict costs.

- Game 4.2 games represent unique situations where partners may prioritize participation in a coalition over actual cooperation and individual payoffs. In these instances, partners are more likely to adopt asymmetric strategies, such as (0, 1) and (1, 0), or pursue a mixed-strategy Nash equilibrium, rather than striving for mutual cooperation (1, 1).

5.3. Comparison: Priori Model vs. Random Landscape

- (a)

- Difference Between Classified Games and Total Cases

- (b)

- Discrepancy in Game Distribution Between a priori and Random Landscape Models.

6. Empirical Results

7. Conclusions

Author Contributions

Funding

Data Availability Statement

Conflicts of Interest

References

- Bidault, Francis, and Thomas Cummings. 1996. Alliances Can Bring Hidden Benefits. Financial Times, March 15, p. 11. [Google Scholar]

- Child, John, and David Faulkner. 1998. Strategies of Cooperation: Managing Alliances, Networks and Joint Ventures. Oxford: Oxford University Press. [Google Scholar]

- Contractor, Farok, and Peter Lorange. 1988. Competition vs. Cooperation: A Benefit/Cost Framework for Choosing Between Fully-Owned Investments and Cooperative Relationships. In Management International Review. London: Routledge, pp. 203–16. [Google Scholar]

- Day, George S. 1995. Advantageous Alliances. Journal of the Academy of Marketing Science 23: 297–300. [Google Scholar] [CrossRef]

- Dixit, Avinash, and Barry Nalebuff. 1991. Thinking Strategically: The Competitive Edge in Business, Politics, and Everyday Life. New York: W.W. Norton and Company. [Google Scholar]

- Dodge, David, and Mobashir Salahuddin. 1998. Strategic alliances. Business and Economic Review 44: 18–20. [Google Scholar]

- Faems, Dries, Maddy Janssens, and Inge Neyens. 2012. Alliance Portfolios and Innovation Performance: Connecting Structural and Managerial Perspectives. Group & Organization Management 37: 241–68. [Google Scholar]

- Gulati, Ranjay, Nitin Nohria, and Akbar Zaheer. 2000. Strategic Networks. Strategic Management Journal 21: 203–15. [Google Scholar] [CrossRef]

- Gulati, Ranjay. 1998. Alliances and Networks. Strategic Management Journal 19: 293–317. [Google Scholar] [CrossRef]

- Haberberg, Adrian, and Alison Rieple. 2001. The Strategic Management of Organizations. Upper Saddle River: Financial Times Prentice Hall. [Google Scholar]

- Hamel, Gary. 1991. Competition for Competence and Inter-Partner Learning Within International Strategic Alliances. Strategic Management Journal 12: 83–103. [Google Scholar] [CrossRef]

- Harbison, John, and Peter Pekar. 1998. Smart Alliances: A Practical Guide to Repeatable Success. San Francisco: Jossey-Bass Publishers. [Google Scholar]

- Harsanyi, John. 1966. A General Theory of Rational Behaviour in Game Situations. Econometrica 34: 613–34. [Google Scholar] [CrossRef]

- Hoogeboom, Marcella, and Celeste Wilderom. 2019. A Complex Adaptive Systems Approach to Real-Life Team Interaction Patterns, Task Context, Information Sharing, and Effectiveness. Group & Organization Management 45: 3–42. [Google Scholar]

- Inkpen, A. C. 1998. Learning and Knowledge Acquisition through International Strategic Alliances. The Academy of Management Executive 12: 69–80. [Google Scholar] [CrossRef]

- Jarillo, Jarlos. 1993. Strategic Networks: Creating the Borderless Organization. Oxford: Butterworth-Heinemann Ltd. [Google Scholar]

- Lorange, Peter, and Johan Roos. 1992. Strategic Alliances: Formation, Implementation and Evolution. Oxford: Blackwell Publishers. [Google Scholar]

- Majdalawieh, Munir, Farhi Marir, and Tlemsani Issam. 2017. Developing Adaptive Islamic Law Business Processes Models for Islamic Finance and Banking by Text Mining the Holy Qur’an and Hadith. Paper presented at the 3rd IEEE International Conference on Big Data Intelligence and Computing, Orlando, FL, USA, November 6–10; pp. 1278–83. [Google Scholar] [CrossRef]

- Matthews, Robin. 1999. A New Model of Strategy Applied to the Russian Situation. London: Kingston University Press. [Google Scholar]

- Matthews, Robin. 2002. Strategy Complex Adaptive Systems and Games: An Evolutionary Approach. London: Kingston University Press. [Google Scholar]

- Mintzberg, Henry, Ahlstrand Bruce, and Lampel Josef. 1998. Strategy Safary. Upper Saddle River: Financial Times Prentice Hall. [Google Scholar]

- Mockler, Robert J. 2000. Multinational Strategic Alliances. New York: John Wiley & Sons. [Google Scholar]

- Mohamed Hashim, Mohamed Ashmel, Mason-Jones Rachel, Ndrecaj Vera, Tlemsani Issam, and Matthews Robin. 2024. Higher Education via the lens of Industry 5.0: Strategy and Perspective. Social Sciences & Humanities Open 9: 100828. [Google Scholar] [CrossRef]

- Mohamed Hashim, Mohamed Ashmel, Tlemsani Issam, and Matthews Robin. 2021. Higher education strategy in digital transformation. Education and Information Technology 27: 3171–95. [Google Scholar] [CrossRef] [PubMed]

- Mohamed Hashim, Mohamed Ashmel, Tlemsani Issam, and Matthews Robin. 2022a. A sustainable University: Digital Transformation and Beyond. Education and Information Technology 27: 8961–96. [Google Scholar] [CrossRef] [PubMed]

- Mohamed Hashim, Mohamed Ashmel, Tlemsani Issam, Matthews Robin, Mason-Jones Rachel, and Ndrecaj Vera. 2022b. Emergent Strategy in Higher Education: Postmodern Digital and the Future? Administrative Sciences 12: 196. [Google Scholar] [CrossRef]

- Nalebuff, Barry, and Adam Brandenburger. 1996. Co-Opetition: 1. A Revolutionary Mindset that Combines Competition and Cooperation. 2. The Game Theory Strategy That’s Changing the Game of Business. Redfern: Currency. [Google Scholar]

- Nevaer, Louis, and Steven A. Deck. 1990. Strategic Corporate Alliances: A Study of the Present. A Model for the Future. Bloomington: Quorum Books. [Google Scholar]

- Olk, Paul, and Marta Elvira. 2001. Friends and Strategic Agents: The Role of Friendship and Discretion in Negotiating Strategic Alliances. Group & Organization Management 26: 124–64. [Google Scholar]

- Parkhe, Arvind. 2017. Strategic Alliance Structuring: A Game Theoretic and Transaction Cost Examination of Interfirm Cooperation. Academy of Management Journal 36: 794–829. [Google Scholar] [CrossRef]

- Porter, Michael, and Michael Fuller. 1986. Coalitions and Global Strategy. In Competition in Global Industries. Edited by Michael Porter. Boston: Harvard Business School Press, pp. 315–44. [Google Scholar]

- Rapoport, Arotol, and Albert Chammah. 1965. Prisoners’ Dilemma. Ann Arbor: University of Michigan Press. [Google Scholar]

- Rule, Eric, and Shawn Keown. 1998. Competencies of high-performing strategic alliances. Strategy & Leadership 26: 36–37. [Google Scholar]

- Stafford, Edwin. 1994. Using Cooperative Strategies to Make Alliances Work. Long Range Planning 27: 64–74. [Google Scholar] [CrossRef]

- Tlemsani, Issam. 2010. Co-Evolution and Reconcilability of Islam and The West: The Context of Global Banking. Journal of Education, Business and Society: Contemporary Middle Eastern Issues 3: 262–76. [Google Scholar] [CrossRef]

- Tlemsani, Issam. 2020. Stock Returns Indicator: Case of Tadawul. International Journal of Monetary Economics and Finance 13: 1–15. [Google Scholar] [CrossRef]

- Tlemsani, Issam. 2022. Conventional vs Islamic debt-equity portfolio swaps. International Journal of Managerial and Financial Accounting 14: 20–34. [Google Scholar] [CrossRef]

- Tlemsani, Issam, and Robin Matthews. 2021. Games Theory and Strategic Alliances: Applications to British Russian Partnership. Higher Education, Skills and Work-based Learning 12: 689–704. [Google Scholar] [CrossRef]

- Tlemsani, Issam, Matthews Robin, and Mohamed Ashmel Mohamed Hashim. 2023a. Cross-Border Alliances and Strategic Games. Journal of Work Applied Management 15: 292–313. [Google Scholar] [CrossRef]

- Tlemsani, Issam, Mohamed Ashmel Mohamed Hashim, and Robin Matthews. 2023b. Portfolio replication: Islamic vs. conventional. Journal of Islamic Accounting and Business Research 14: 1–20. [Google Scholar] [CrossRef]

- Tlemsani, Issam, Mohamed Ashmel Mohamed Hashim, and Matthews Robin. 2024. The impact of IFRS adoption on Saudi Arabia. Journal of Islamic Accounting and Business Research 15: 519–33. [Google Scholar] [CrossRef]

- Varadarajan, Rajan, and Margaret Cunningham. 1995. Strategic Alliances: A Synthesis of Conceptual Foundations. Journal of the Academy of Marketing Science 23: 282–96. [Google Scholar] [CrossRef]

- Vega-Redondo. 1996. Evolution’, Games and Economic Behaviour. Oxford: Oxford University Press. [Google Scholar]

| Benefit/Cost | Description | Range |

|---|---|---|

| Benefits of transfer | Agent X’s benefit as part of a coalition with Agent Y | r ∈ (0, 1) |

| Transfer costs | Expenses incurred by agent x for making a transfer | c ∈ (0, 1) |

| Benefits of Joint | The payoffs agents receive through collaborative efforts | b∈ (0, 1) |

| Reputation benefits | Net gained by coalition members from their association | d ∈ (0, 1) |

| Exit costs | Penalties or costs associated with leaving the coalition | h ∈ (−1, 1) |

| Compared Payoffs | Compared Benefits and Costs | ||||||

|---|---|---|---|---|---|---|---|

| A | B | A–B | = (r + b + d − c) − (d − c) = r + b > 0 | A > B | Possible | A < B | Impossible |

| A | C | A–C | = (r + b + d − c) − (d − c) = b − c > or < 0 | A > C | Possible | A < C | Possible |

| A | D | A–D | = (r + b + d − c) − h > or < 0 | A > D | Possible | A < D | Possible |

| B | C | B–C | = (d − c) − (r + d) = −r – c = −(r + c) < 0 | B > C | Impossible | B < C | Possible |

| B | D | B–D | = (d − c) − h > or < 0 | B > D | Possible | B < D | Possible |

| C | D | C–D | = (r + d) − h > or < 0 | C > D | Possible | C < D | Possible |

| Games | Payoff Ordering | Costs and Benefits Structure |

|---|---|---|

| Game 2.1 | C > A > D > B, D >= 0 | r + d > r + b + d − c > h > d − c, h >= 0 |

| Game 2.2 | C > D > A > B, D >= 0 | r + d > h > r + b + d − c > d − c, h >= 0 |

| Games | Payoff Ordering | Costs and Benefits Structure |

|---|---|---|

| Game 3.1 | C > A > D > B, D < 0 | r + d > r + b + d − c > h > d − c, h < 0 |

| Game 3.2 | C > D > A > B, D < 0 | r + d > h > r + b + d − c > d − c, h < 0 |

| Games | Payoff Ordering | Costs and Benefits Structure |

|---|---|---|

| Game 4.1 | C > A > B > D, D < 0 | r + d > r + b + d − c > d − c > h, h < 0 |

| Game 4.2 | C > A > B > D, D >= 0 | r + d > h > r + b + d − c > d − c > h, h >= 0 |

| A Priori (Restricted) | ||||||||||||||

| Game1 | Game2 | Game3 | Game4 | Total | ||||||||||

| 1.1 | 1.2 | 1.3 | 1 | 2.1 | 2.2 | 2 | 3.1 | 3.2 | 3 | 4.1 | 4.2 | 4 | ||

| # of games | 3 | 3 | 2 | 8 | 2 | 3 | 5 | 2 | 1 | 3 | 3 | 1 | 4 | 20 |

| % of games # | 15 | 15 | 10 | 40 | 10 | 15 | 25 | 10 | 5 | 15 | 15 | 5 | 20 | 100 |

| Random Landscape | ||||||||||||||

| Game 1 | Game 2 | Game 3 | Game 4 | Total | ||||||||||

| 1.1 | 1.2 | 1.3 | 1 | 2.1 | 2.2 | 2 | 3.1 | 3.2 | 3 | 4.1 | 4.2 | 4 | ||

| # of games | 292 | 180 | 30 | 502 | 147 | 55 | 202 | 59 | 2 | 61 | 170 | 20 | 188 | 955 |

| % of games # | 29.2 | 18 | 3 | 50.2 | 14.7 | 5.5 | 20.2 | 5.9 | 0.2 | 6.1 | 17 | 2.0 | 18.8 | 95.5 |

| Total number of cases 1200 | ||||||||||||||

| Benefit and Cost Variables and Cooperation Outcomes | Intervals (for Benefit and Cost Variables) and Formulas for Cooperation Outcomes | Expected Values |

|---|---|---|

| Transfer benefits (r) | (0, 1) | 0.5 |

| Transfer costs (c) | (0, 1) | 0.5 |

| Joint benefits (b) | (0, 1) | 0.5 |

| Reputation benefits (j) | (0, 1) | 0.5 |

| Exit costs (h)—for all h | (−1, 1) | 0 |

| Exit costs (h)—for positive h | (0, 1) | 0.5 |

| Exit costs (h)—for negative h | (−1, 0) | −0.5 |

| A | A = r + b + d − c | 1 |

| B | B = d − c | 0 |

| C | C = r + d | 1 |

| D—for all h | D = h | 0 |

| D—for positive h | D = h | 0.5 |

| D—for negative h | D = h | −0.5 |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2024 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Tlemsani, I.; Matthews, R.; Mohamed Hashim, M.A. Strategic Learning Alliances and Cooperation: A Game Theory Perspective on Organizational Collaboration. Economies 2024, 12, 335. https://doi.org/10.3390/economies12120335

Tlemsani I, Matthews R, Mohamed Hashim MA. Strategic Learning Alliances and Cooperation: A Game Theory Perspective on Organizational Collaboration. Economies. 2024; 12(12):335. https://doi.org/10.3390/economies12120335

Chicago/Turabian StyleTlemsani, Issam, Robin Matthews, and Mohamed Ashmel Mohamed Hashim. 2024. "Strategic Learning Alliances and Cooperation: A Game Theory Perspective on Organizational Collaboration" Economies 12, no. 12: 335. https://doi.org/10.3390/economies12120335

APA StyleTlemsani, I., Matthews, R., & Mohamed Hashim, M. A. (2024). Strategic Learning Alliances and Cooperation: A Game Theory Perspective on Organizational Collaboration. Economies, 12(12), 335. https://doi.org/10.3390/economies12120335