Abstract

Corruption and informality are issues which have attracted a great amount of empirical research, since they are variables that can affect economic development in various and complex ways, with direct and indirect effects on economic growth. In this context, the objective of this investigation is to assess the impacts of corruption and informality on economic growth and productivity in countries from Latin America and the OECD (Organisation for Economic Co-operation and Development). To achieve this, a 3SLS-GMM estimation is proposed to manage the endogeneity of the variables in the system of equations. Subsequently, a simulation analysis is conducted to quantify the impacts of increases in corruption and informality on growth and productivity, as well as the influence of human capital in counteracting these impacts. The main findings of the research are as follows: (i) corruption decreases economic growth and productivity in both groups of countries; (ii) informality negatively affects economic growth and productivity; (iii) increases in corruption and informality reduce economic growth and productivity; and (iv) human capital has a positive impact on economic growth and reduces the negative impacts of corruption and informality.

JEL Classification:

F43; O17; O40; J24

1. Introduction

In recent decades, the determinants of economic growth have garnered special interest. Various growth models have been proposed, highlighting the importance of investment, human capital, and innovation capacity (Solow 1956; Romer 1986; Lucas 1988). However, the process underlying economic growth is mainly associated with the fundamental structures within which the economy operates, namely, institutions (Acemoglu and Robinson 2012). One primary factor is corruption, which exists in diverse forms and at different levels, spanning from minor bribery practices to high-level schemes. Its detrimental effects are undeniable—it undermines trust in institutions, distorts resource allocation, discourages investment, and erodes economic efficiency (Mauro 1995).

Likewise, the repercussions of informality are of a considerable magnitude, as they reduce fiscal revenues and negatively impact economic growth (Loayza 1996). In this context, human capital emerges to explain changes in economic growth. In this regard, Becker (2009) argues that several countries have experienced continuous growth in their per capita income, possibly due to the expansion of technical knowledge acquired through human capital.

In this respect, it is important to highlight that an educated and skilled workforce plays a fundamental role in creating a more dynamic and corruption-resistant business environment. Investment in education and professional training strengthens individuals’ capacity to demand greater transparency and accountability from governmental institutions. In view of this, currently, corruption (weak institutions) and informality stand as two major hurdles to the economic growth of emerging and developing economies (Ngouhouo et al. 2022).

Traditionally, the effects of corruption and informality on economic growth are primarily explored through their effects on investment, spending efficiency, and fiscal revenues. Mauro (1995) presents evidence that corruption harms growth by decreasing investment. Additionally, Rose-Ackerman (1997) argues that corruption reduces efficiency in the allocation of public resources. Concerning informality, Schneider and Enste (2000) argue that informality hampers growth by limiting government spending and public service quality. Moreover, both corruption and informality evade regulations and taxes, reducing fiscal revenues and slowing growth in the affected countries (Hoinaru et al. 2020).

Hence, it is imperative to deepen the study of the impacts of corruption and informality on economic growth in Latin American countries, as well as to analyze their impacts through their effects on productivity. Likewise, informality is widespread in Latin American economies. In accordance with the World Bank (2021), 35% of the region’s GDP is made up of the informal sector, and as for total employment, 70% of it is made up of informal employment.

In this context, the present analysis seeks to find evidence for the effects of corruption and informality on economic growth through productivity. To achieve this, a group of 46 countries is considered, with the sample consisting of 11 Latin American countries and 39 OECD member countries. Thus, the novelty of this research is that it is one of the first studies to conduct empirical research on the direct and indirect effects of both corruption and informality on economic growth through the productivity channel, comparing countries from Latin America and the OECD. The reason we chose this case study is because a comparison between countries from Latin America and the OECD allows us to identify different patterns in groups of countries with different levels of development and different levels of corruption and informality.

Despite the fact that OECD countries can have relatively low levels of corruption or informality, it is relevant to analyze the total effect that increases in corruption and informality can have in these countries, because, precisely in countries with a high institutional quality, deterioration in aspects associated with it—such as corruption and informality—represents a notorious change in the dynamics of these economies and can affect economic growth in a substantial way, as verified in the studies by Aidt et al. (2008), Nogueira and Madaleno (2021), and Urbina and Rodríguez (2022).

The methodology selected was 3SLS-GMM, which was applied to a system of equations involving the following interacting variables of interest: growth, corruption, informality, and productivity, along with other control variables. With these inputs, the model identified the direct and indirect effects of the variables of interest on economic growth.

The remainder of the document covers background, the research objectives, the research hypotheses, a literature review, the theoretical framework, a methodological proposal, the model results, and our conclusions and recommendations.

2. Literature Review

Recently, the empirical study of the consequences of corruption and informality has sparked significant interest, primarily due to the three following factors: (i) the increasing availability of data on corruption and informality; (ii) new research methodologies; and (iii) corruption and informality issues attracting increasing international concern.

In terms of studies on the effects of corruption on economic growth, Mauro (1995) employs Ordinary Least Squares (OLS) and Two-Stage Least Squares (2SLS) models for a sample of 67 countries from 1960 to 1985. He finds that corruption has a negative effect on growth, primarily by decreasing investment. In turn, Cieślik and Goczek (2018) study the impact of corruption on economic growth using an endogenous growth model, which predicts a negative effect on investment volume and, consequently, on economic growth. Their study contrasts theoretical predictions with empirical data from 142 countries spanning 1994–2014. Applying GMM and System GMM techniques, they find that lower corruption levels positively correlate with real per capita GDP growth and increased investment rates.

Regarding the impact of informality on economic growth, Loayza (1996) examines the impact of informality on economic growth by comparing his endogenous growth model with data from 14 Latin American economies from 1980 to 1992 and concludes that an expansion of the informal sector negatively impacts economic growth, with this effect being attributed to reduced access to public services and increased inefficiency in resource utilization among productive activities.

Similarly, Baklouti and Boujelbene (2019) develop a dynamic simultaneous equations model linking economic growth with the informal economy, contrasting its implications using GMM models. In this study, using data from 2005 to 2015 for 50 countries, the authors discover that, regarding MENA countries, there is a unidirectional link between economic growth and the informal economy. In relation to OCDE countries, this relationship is bidirectional. They conclude that the informal economy impedes economic growth in both groups, with a stronger effect observed in higher-income OECD countries.

In addition, Mo (2001) quantitatively estimates corruption’s impact on economic growth through its primary transmission channels. Using OLS estimators on a sample of 46 countries from 1970 to 1985, he finds that a 1% increase in the corruption level decreases the growth rate by 0.72%. This author highlights that corruption reduces growth mainly by diminishing the productivity of economic activities, notably through a 0.25% decrease in the human capital index for every 1% increase in the corruption level.

Salinas-Jiménez and Salinas-Jiménez (2007) examine the impact of corruption on economic growth in OECD countries from a productivity standpoint. Using a frontier approach, they analyze how corruption influences the efficiency levels across 22 OECD countries from 1980 to 2000. Their study reveals that corruption diminishes the growth rate of TFP by limiting countries’ technological frontiers. They conclude that economies with lower corruption levels generally experience higher average economic growth rates.

On the other hand, Elgin and Birinci (2016) analyze the impact of the informal sector on long-term economic growth using data from 161 countries spanning the period from 1950 to 2010. Through OLS, fixed effects, instrumental variables, and dynamic panel models with GMM, they discover an inverted “U” relationship between the size of the informal sector and per capita GDP growth. Additionally, they find that TFP growth correlates positively with the informal sector.

In terms of studies analyzing the combined effects of corruption and informality, Baklouti and Boujelbene (2019) examine how corruption’s impact on economic growth varies with the size of the informal economy. Using OLS, fixed effects, and System GMM models on a sample of 34 OECD countries from 1995 to 2014, they find that corruption and informality both reduce economic growth rates. They emphasize that the informal economy’s magnitude exacerbates corruption’s negative impact on growth. They conclude that addressing either corruption or informality through policy measures could mitigate the adverse effects of both.

Nguyen and Luong (2020) explore the interactions among corruption, the informal economy, and economic growth. Using GMM on data from 17 Asian countries from 2000 to 2015, they find that corruption positively impacts economic growth, while an informal economy has a detrimental effect. These results support the “grease the wheels” hypothesis, suggesting corruption can foster growth in highly regulated, bureaucratic contexts. They also present evidence of the “Asian paradox”, where some of the Asian countries exhibit high growth rates alongside significant corruption levels (Rock and Bonnett 2004).

Using Bayesian econometrics, Urbina and Rodríguez (2022) study the effects of corruption on economic growth, human development, and the natural resources sector in Latin American and Nordic countries. They identify the varied impacts of corruption shocks on economic growth across Latin America, while demonstrating that all Nordic countries experienced decreased growth in response to corruption shocks. This shows that shocks in corruption can have a relevant impact, even in countries where the level of corruption is low. This is confirmed by Nogueira and Madaleno (2021), who find that corruption damages Nordic economies.

In turn, Trabelsi (2024) considers panel data from 65 countries and finds that corruption can have a positive impact on growth, but after certain threshold, increases in corruption can reduce economic growth. In their study on the BRICS countries (Brazil, Russia, India, China, and South Africa), Kesar et al. (2024) find that controlling corruption has a positive impact on economic growth.

On the other hand, given that, in many cases, in order to reduce corruption, the causes of corrupt behavior must be reduced, it is relevant to consider studies on the reasons or motivations behind such corrupt acts. For instance, Nordin et al. (2013) show that behavioral factors like “desire” and “intentions” are relevant for explaining corruption actions in the construction industry. Similarly, Othman et al. (2014), by the means of interviews with public officials, find that, among the reasons why people are corrupt, there exist aspects such as power, opportunity, and moral laxity. However, it must also be considered that, especially in countries were corruption is very extensive, individuals can be virtually compelled to engage corrupt behaviors, since, without corruption, they could not achieve their legitimate goals. In this vein, Enste and Heldman (2018) note that entrepreneurs can consider corruption to be like an extra tax in contexts were corruption increases the costs of conducting business.

Therefore, several empirical studies have been performed on the impacts of corruption and informality on economic growth. However, there is a research gap with respect to the direct and indirect impacts of both variables on economic growth considering the productivity channel and comparing countries from Latin America and the OECD. Some studies have considered certain aspects in this regard, but not all these aspects. Given this, we contribute to the literature by presenting empirical evidence on the effects on corruption and informality on economic growth through productivity in countries from Latin America and the OECD. In addition, the comparison between both groups of countries is relevant, since it allows for identifying different patterns in groups of countries with different levels of development.

3. Theoretical Framework

Institutional factors play a fundamental role in economic growth. Therefore, contemporary growth models have focused on studying two of the most important foundations of growth as follows: corruption and informality. Therefore, in this section, we review a range of theoretical models developed in recent years, with the aim of integrating these models, which employ various approaches, in order to generate a comprehensive theoretical framework for our research.

First, there is Loayza’s (1996) endogenous growth model, which is divided into the formal and informal sectors. It posits that formal agents pay an income tax, with this revenue being used for the provision of public services, . Moreover, informal agents pay a proportional fraction of their income in the form of penalties, which cannot be used to pay for public services. The informal sector, , is depicted as follows:

where represents the production of the informal sector and represents the total production of the economy. Furthermore, one of the model’s assumptions is that public services are funded solely by taxes on formal production, as per the following rule:

where represents the fraction of tax revenue available for the provision of public services, is the tax rate, is the production of the formal sector, is the quality of government institutions, and is the enforcement strength, which refers to the ability to detect and penalize informal activities.

Additionally, the relationship between public services and total output is given by the following equation:

Thus, given the equilibrium values of the informal sector, , the value of the exogenous productivity parameter, , and the elasticity, , of production with respect to , the next expression shows the link between the net rate of return on the economy’s capital, , and the other mentioned variables:

The expression in the first bracket corresponds to the case of an economy without an informal sector. In this case, the rate of return initially increases and then decreases as the tax rate rises, because, while decreases as taxes rise, can increase the rate of return at a slower rate, up to a point where is maximized. In contrast, in the second bracket of the equation, it is observed that the informal sector has an unfavorable effect on the rate of return on capital, which suggests its impact on growth.

Additionally, as Loayza (1996) posits, the rate of return, , is independent of capital accumulation, is the constant rate of time preference, and is the constant intertemporal elasticity of substitution. Therefore, the first-order and transversality conditions imply the following constant growth rate of consumption:

Finally, from the equations of the net rate of return on the economy’s capital and the consumption growth rate, we derive the following equation for the economic growth rate, :

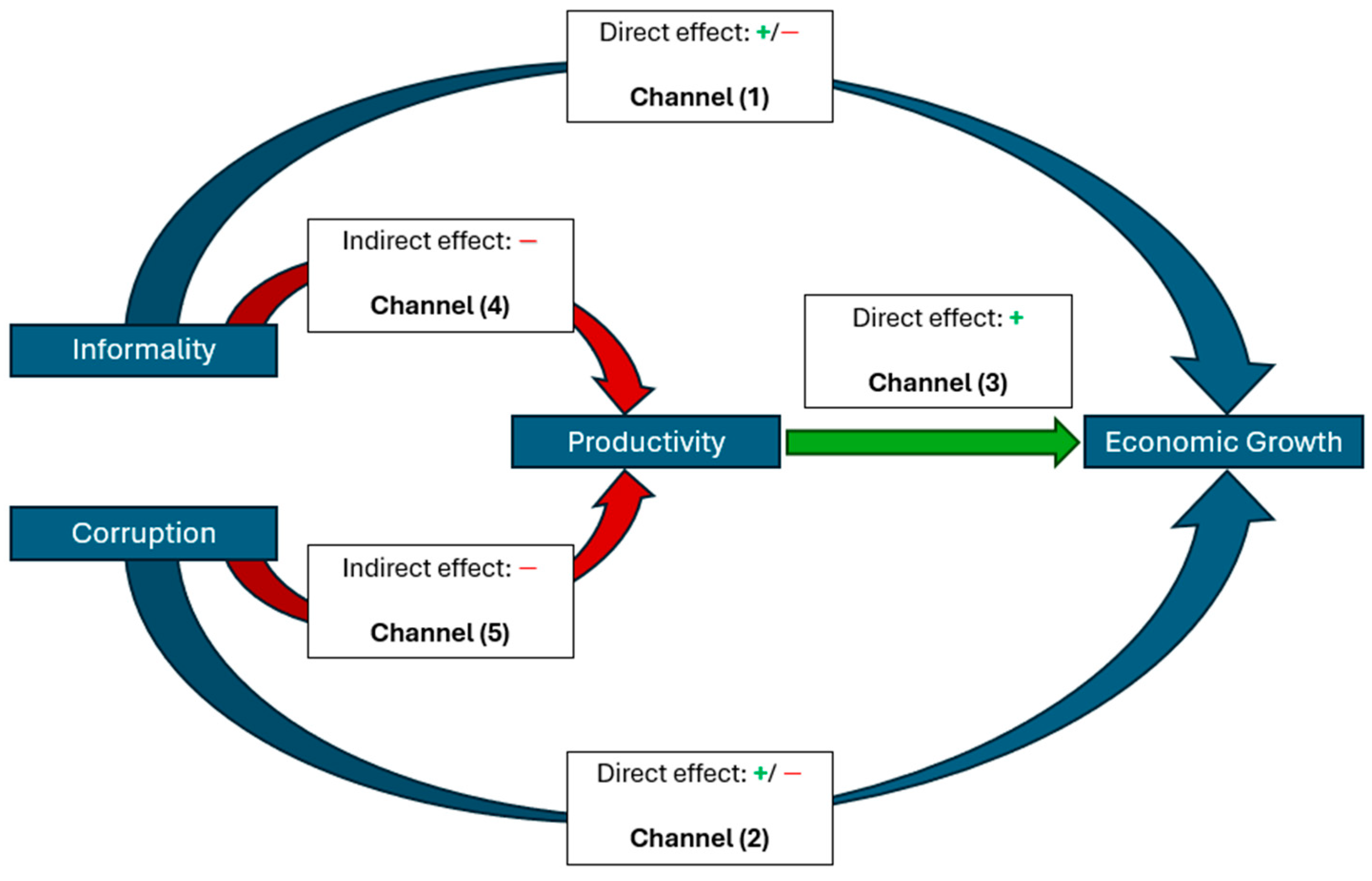

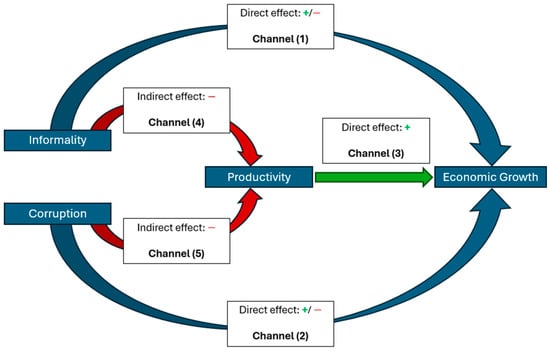

This equation presents interesting relationships between economic growth, corruption, informality, and productivity. First, it is evident that the size of the informal sector, , would have a direct, unfavorable effect on the economic growth rate, (channel 1 in Figure 1). Moreover, the magnitude of this effect would depend on other factors such as institutional quality, enforcement strength, productivity, tax rate, and available tax revenues. Subsequently, it can be observed that, as the quality of government institutions, , improves, the growth rate increases, because a greater portion of tax revenues is allocated to fund public services.

Figure 1.

Causal diagram. Note: Adapted from Mauro (1995), Loayza (1996), Rivera-Batiz (2002), and Masatlioglu and Rigolini (2008). The figure focuses on key relationships between corruption, informality, productivity, and economic growth, as outlined later in the system of equations shown later. While productivity is highlighted for its central role in economic growth, other important factors are controlled for in the econometric model.

Secondly, this research proposes that corruption has a direct impact on economic growth by the means of the investment transmission channel (channel 2 in Figure 1). In this regard, Mauro (1995) explains that GDP growth relies on the proportion of investment in the economy, which, in turn, depends on corruption. Thus, the following equation shows the effect of corruption on the growth rate:

where represents economic growth, denotes corruption, and is the proportion of investment in the economy.

In this regard, there are two approaches to determining the impact of corruption on investment. On one hand, the “sand in the wheels” theory explains that corruption reduces investment, and there is a negative link between corruption and economic growth because of its distortion in the allocation of public resources. On the contrary, the “grease the wheels” theory proposes that corruption can stimulate investment. According to Leys (1965), in the face of excessive and inefficient bureaucracy, corruption can expedite business creation.

Thirdly, in Loayza’s (1996) model, it is shown that productivity, , has a direct positive effect on the economic growth rate (channel 3 in Figure 1). In this regard, Solow (1956) posits that economic growth depends primarily on capital accumulation, population growth, technological progress, and TFP. Thus, in the Solow–Swan model, the growth in output not explained by capital accumulation is termed the Solow residual, which measures the increase in TFP.

Fourthly, regarding the indirect effects of informality and corruption on economic growth, these can be seen through their impacts on productivity. Concerning the relationship between informality and productivity (see channel 4 in Figure 1), the negative effect of informality can be explained by integrating the insights from two models. In this context, the model by Masatlioglu and Rigolini (2008) presents the expressions for the formal and informal sectors’ production:

where is the number of workers in the formal sector, is the proportion of capital allocated to the formal sector, and is the elasticity of output with respect to the number of workers in the formal sector. Similarly, and represent the productivity of the formal and informal sectors, respectively. Also, the following expression is presented:

The above expression implies that the productivity of the formal sector is higher than that of the informal sector. Through this expression, it can be observed that the model by Masatlioglu and Rigolini (2008) can be related to the model by Leyva and Urrutia (2020), because the latter specifies that the calculation of TFP involves weighting the productivity of both the formal and informal sectors, as shown in the following expression:

where is the GDP, the first parenthesis refers to the TFP, where is the exogenous component of the TFP, and and are the productivities of the technology used by formal and self-employed workers, respectively. Additionally, is the proportion of informal employment and represents the elasticity of substitution between inputs produced in the formal and informal sectors, like , which is the elasticity of output with respect to capital. is the capital used in production, and is aggregate employment.

It is important to mention that, to obtain the proportion of informal employment, it is considered that denotes aggregate employment in the formal and informal sectors, hence . So, the connection between the model by Masatlioglu and Rigolini (2008) and the model by Leyva and Urrutia (2020) exists because and can be considered as equivalent to and . Therefore, considering that the calculation of the TFP involves weighting formal and informal productivity, and that formal productivity is greater than informal productivity, the negative effect of informality on productivity can be observed. One explanation for this result is that there is lower productivity in the informal sector—compared to the formal sector—resulting in a lower weighted productivity, which, in turn, causes a lower TFP.

In turn, informality significantly widens the productivity gap among firms, with formal enterprises demonstrating a notably higher productivity (Perry 2007). Thus, informality adversely affects productivity through multiple mechanisms.

Firstly, informality hinders productivity by limiting access to financing, as many informal businesses lack access to banking services (La Porta and Shleifer 2014). Moreover, these companies face challenges in securing funds from capital markets (Kaufmann and Kaliberda 1996), leading them to operate on smaller scales and substitute physical capital with low-skilled labor due to high capital costs (Eilat and Zinnes 2002; Amaral and Quintin 2006) Additionally, informal firms engage in tax evasion and operate at reduced scales to avoid detection (Mitra 2013). Secondly, informality reduces productivity due to a lack of human capital, as higher-educated workers tend to self-select into the formal sector (Albrecht et al. 2009).

On the other hand, concerning the link between corruption and productivity (channel 5 in Figure 1), the negative effect of corruption can be explained through the model specified by Rivera-Batiz (2002). This model first explains the calculation of the growth rate of capital goods, ; it mentions that represents capital goods, denotes new capital goods, and it is also assumed that the technology sector manufactures new goods using human capital. Therefore, illustrates the quantity of human capital used in the technology sector, and is an external parameter reflecting the productivity of human capital in generating new capital goods, as shown in the following expression.

This expression indicates that the skilled labor used by the technology sector is positively associated with creating new capital goods. It is important to note that this growth rate of goods produced from human capital is closely linked to productivity growth, due to the positive link between the stock of human capital and productivity (Engelbrecht 1997).

In this context, in examining the relationship between productivity and human capital, refers to productivity. The following equation illustrates how corruption adversely affects productivity:

where corruption negatively impacts productivity through , which refers to the bribe tax applied to the profits earned by manufacturers of new goods in the country, maximizing the economic welfare of corrupt officials. Additionally, accounts for the total endowment of human capital available in the economy, is the interest rate, and α denotes the intensity of physical capital goods, while and are exogenous parameters ranging between zero and one.

From this equation, it is assumed that is a parameter that is positive to guarantee a steady-state equilibrium, like , which denotes the intensity of capital goods in production.

In this context, the impact of corruption on productivity becomes apparent through the influence of on . It is noteworthy that the damaging impact of corruption on productivity can be attributed to the two following primary factors: the misallocation of resources and a lack of innovation.

First, corruption negatively impacts productivity by leading to inefficient resource allocation. The level of production achievable may be constrained by the incentive structure hereditary from the institutional framework, whereby firms may lack sufficient motivation to adopt accessible sources or technology efficiently (Olson et al. 2000). In this sense, the adverse effect stems from the weak control of corruption within institutions, which alters firms’ incentives and thereby distorts resource allocation. As a result, resources are not utilized efficiently, leading to lower productivity.

It is also relevant to mention that distortions in resource utilization occur in both the private and public sectors. Taymaz (2009) argues that inefficient resource allocation results from distortions in public decision making or private investment project selection, prioritizing sizable secondary payments over feasible projects. Corruption distorts incentives for both private enterprises and the public sector, aiming for substantial secondary gains from projects. This compromises resource allocation and reduces productivity.

Secondly, an adverse effect of corruption on productivity can be observed via the lack of innovation it fosters, as corruption limits opportunities for leveraging technology developed by other economies (Aidt et al. 2008). Similarly, Taymaz (2009) explains that corruption complicates the process of patenting inventions, hindering innovation and reducing productivity.

Based on a review of the theoretical framework, this study proposes the following hypotheses: (i) corruption is expected to negatively impact economic growth both directly (via channel 2) and indirectly (through the interaction of channels 3 and 5) and (ii) informality is expected to negatively affect economic growth both directly (via channel 1) and indirectly (through the interaction of channels 4 and 5). Moreover, a third hypothesis is proposed to analyze the differential effects of corruption and informality across different groups of countries, as follows: (iii) corruption and informality are expected to have a greater impact on OECD countries’ growth, while human capital is anticipated to play role in mitigating the negative effects of corruption and informality.

4. Methodology

This section presents the methodological proposal of this research. A sample of 46 countries from Latin America and the OECD is used to create a balanced panel database covering annual frequencies for the period 2001–2018, selected based on data availability1. The variables used in the model are presented below.

The corruption perception index published annually by Transparency International since 1995 is used. This index ranges from 0 to 100, where larger values indicate greater levels of transparency, and lower values express greater levels of corruption. For the purposes of this research, it was chosen to invert this scale so that higher values represent higher levels of corruption. This index is widely used in empirical studies on corruption and economic growth, including Treisman (2007), who highlights its robustness and reliability for cross-country comparisons in the study of corruption’s effects on economic outcomes.

Regarding informality, the proportion of the informal sector as a percentage of GDP is considered2, sourced from the World Bank database. This measure is particularly adequate compared to other informality indicators, since we want to examine the impact of the informal sector’s production size on the growth rate of total economic production. This indicator is based on the MIMIC (Multiple Indicators, Multiple Causes) model employed by the World Bank, which provides a reliable estimate of the informal economy’s size. Studies such as that by Elgin and Schneider (2016) have compared the MIMIC model to the Dynamic General Equilibrium (DGE) approach. Their findings show that, while both methods yield similar results regarding the size and trend of the shadow economy, the MIMIC model is somewhat more sensitive to cyclical fluctuations.

In order to capture productivity, the total factor productivity index provided by the Penn World Table is used. This indicator represents the size of production that is not a result of the quantity of inputs utilized in production, and its calculation is based on ratios of the total income functions of the economy that consider initial endowments and the level of technology of each country (Feenstra et al. 2015). This measure indicates the levels of total factor productivity at the current purchasing power parity (PPP) indices relative to U.S. prices. In this sense, the productivity of the United States is 1, with more productive countries demonstrating a productivity greater than 1 and less productive countries demonstrating a productivity lower than 1.

To capture economic growth, the GDP per capita at purchasing power parity (PPP) is considered, collected from the World Bank, with values based on constant 2017 prices expressed in U.S. dollars. This measure adjusts for price level differences across countries, providing a more accurate comparison of economic performance than nominal GDP. Furthermore, GDP per capita is used to adjust for population growth in the analysis.

All main variables are presented in Table 1.

Table 1.

Description of the main variables in the model.

In terms of control variables, human capital is included, captured through the proxy of average years of schooling. This variable is one component of the World Bank’s Human Development Index and indicates the average number of years of schooling for adults aged 25 and older. Its inclusion in the model is due to the link between human capital and economic growth in various theoretical models (Barro 2001).

Moreover, the physical capital variable is incorporated into the model to control for capital stock; this is because the sample consists of countries with a high degree of heterogeneity in physical capital, aiming to isolate the effect of capital productivity. The data were obtained from the Penn World Table and are based on constant 2017 prices expressed in millions of U.S. dollars.

This investigation also incorporates the Export Concentration Index as a control variable, which functions as a proxy for exports. This variable was extracted from The World Integrated Trade Solution database of the World Bank and measures the degree of export market concentration by country of origin.

Finally, inflation is chosen as a control variable. This variable consists of the percentage changes in the Consumer Price Index and was extracted from the World Bank database.

All control variables are presented in Table 2.

Table 2.

Control variables.

A descriptive analysis of the variables is presented in Table 3, which provides an overview of the main statistical measures.

Table 3.

Variable descriptive analysis.

In regard to the dependent variables, economic growth shows an average positive value, while productivity experiences an average negative growth. Despite this, the variation is similar for both economic growth and productivity. Concerning the explanatory variables, a clear contrast emerges between corruption and informality. Informality tends to decrease in recent years, whereas corruption appears to be increasing. Additionally, corruption is more volatile than informality.

The correlation matrix in Table 4 indicates that productivity has a significant positive association with economic growth, aligning with economic growth theory. Conversely, both corruption and informality are negatively associated with economic growth and productivity, with informality showing a more significant correlation than corruption. Regarding the control variables, physical capital and exports show more significant correlations with both economic growth and productivity. This stronger relationship between physical capital, exports, and economic growth may be attributed to the roles that investment and exports play in the aggregate demand equation of GDP. In addition, the correlation matrix reveals that there are no strong correlations among the independent variables, as most exhibit either moderate or weak correlations with each other.

Table 4.

Correlation matrix.

Econometric Model

Based on the considerations presented in the previous sections of this document, we consider a system of equations whose structure is given by:

where denotes the countries, denotes the periods, and y represent the intercepts for the different equations. Furthermore, is the GDP growth, is the adjusted Corruption Perception Index, is the proportion of the informal economy using the MIMIC methodology, is the total factor productivity, is human capital, corresponds to fixed capital, represents the annual inflation rate, and is the proxy variable for exports. Both and represent the interaction variables between corruption, informality, and human capital. Finally, and are the error terms.

The proposed econometric model is estimated using the 3SLS-GMM method with individual effects. This econometric method is used to estimate systems of simultaneous equations involving multiple interdependent equations, and it is chosen for this study due to its ability to handle endogeneity. The 3SLS-GMM method consists of three stages that will be detailed below. In the first stage, the Two-Stage Least Squares (2SLS) Estimation Method is used to obtain initial estimates of the regression coefficients in each equation of the system; 2SLS is appropriate here because it addresses potential endogeneity issues by using instrumental variables. To address endogeneity and ensure the robustness of our estimates, we employ a range of lagged values for our key variables, including both the main and control variables. Multiple combinations of these lags are tested to determine the most appropriate specification.

In the second stage, predicted residuals from the 2SLS equations are calculated. Finally, in the third stage, the Generalized Method of Moments (GMM) is applied to estimate the final model parameters, using the residuals obtained in the previous stage. GMM is particularly useful in this context because it provides efficient estimates, even in the presence of heteroskedasticity and autocorrelation.

The importance of using a simultaneous equations model lies in its ability to provide a detailed analysis of the indirect effects that corruption and informality may have on economic growth. The Total Factor Productivity (TFP) variable is included in the equation where economic growth is the dependent variable to assess the extent to which productivity serves as a channel through which corruption and informality impact economic growth. In this regard, various empirical studies, such as those by Dhrifi (2015) and Nosier and El-Karamani (2018), have explored how different variables can indirectly influence economic growth through intermediary variables.

Additionally, the following assumptions are made to use the model: the independence of errors, linear relationships between variables, and an absence of measurement errors. Furthermore, the J-Hansen test is employed to detect model overidentification when using a heteroskedastic weight matrix (Roodman 2009). The J-Hansen test evaluates the validity of the instruments by testing if the model is correctly specified and if the instruments used are appropriate. A high p-value suggests that the instruments are valid and the model specification is adequate. The estimation and analysis are performed by the means of the software Stata 2023 (Stata 2023). Additional results can be found in the Supplementary Materials File S1.

5. Results

For the estimation of the 3SLS-GMM model, it is important to perform the Hansen test to assess the validity of the instruments. According to Hall (2005), this test is useful for assessing whether a model is correctly specified, and it has become the accepted method for model specification within the GMM framework. In this regard, Baum (2006) argues that Hansen’s J statistic is the most commonly used diagnostic in GMM estimation for evaluating a model’s suitability. Table 5 shows that the Hansen test presents a p-value of 0.9598; therefore, it is accepted that the instruments used in the model are correct and the coefficients obtained are unbiased.

Table 5.

3SLS-GMM regression.

The results provide evidence supporting the first research hypothesis that corruption has direct and indirect negative effects on economic growth. Concerning the explicit impact of corruption on economic growth, there is evidence that a percentage increase in corruption has a negative and significant effect of 0.11, with this result aligning with the “sand in the wheels” hypothesis. In this regard, Pellegrini (2011) argues that the adverse impact of corruption stems from the uncertainty it introduces into investment returns, as it generates additional costs in bribery payments.

Likewise, it is evidenced that a percentage increase in corruption negatively and significantly affects productivity, as it is observed that a percentage increase in corruption decreases productivity by 0.17%. Therefore, the obtained result aligns with studies conducted by authors such as Salinas-Jiménez and Salinas-Jiménez (2011) and Kéïta and Laurila (2021). Furthermore, the adverse impact of corruption is explained by the deterioration it causes in innovation, as the security of intellectual property rights are challenged (Taymaz 2009).

In turn, the second research hypothesis that informality has direct and indirect negative effects on economic growth can be accepted. It is observed that a percentage increase in informality has a negative and significant effect of 0.70%, which aligns with various empirical studies conducted by authors such as Loayza (1996), Hoinaru et al. (2020), Nguyen and Luong (2020), and Younas et al. (2022). In this regard, Loayza (1996) explains that the negative effect of informality on economic growth is due to its reduction in the availability of public services in the economy.

Similarly, it is shown that a percentage increase in informality negatively and significantly affects productivity, which aligns with findings by various authors such as Williams and Bezeredi (2018), Amin and Okou (2020), Beltrán (2020), and Goel et al. (2022). The results indicate that a percentage increase in informality decreases productivity by 1.23%. This effect arises because informal firms lack access to banking services and operate on a small scale (La Porta and Shleifer 2014).

On the other hand, a percentage increase in productivity has a positive and significant effect of 0.53% on economic growth. This positive impact has been observed in various empirical studies, such as those conducted by Asheghian (2004), Yalçınkaya et al. (2017), Abidin et al. (2020), and Kallal et al. (2021). In this sense, Abidin et al. (2020) explain that the positive impact of productivity is due to its measure of efficiency in input utilization; thus, higher levels of human and physical capital can lead to increased production, as they are used more efficiently.

Therefore, it can be evidenced that productivity plays a fundamental role in economic growth. In the context of a 3SLS-GMM model with two equations, the importance of the positive impact of productivity lies in enabling an investigation of the indirect effects of variables that affect productivity and, consequently, economic growth.

The indirect effects of corruption and informality are obtained from multiplying the coefficient of the respective variable in the productivity equation by the coefficient of productivity in the economic growth equation (0.53). Given this, we find that a percentage increase in corruption has an indirect and negative effect on economic growth, with a reduction of 0.09%, while a percentage increase in informality has an indirect and negative effect on economic growth, with a decrease of 0.65%. Therefore, it is noted that economic growth is reduced by 0.20% because of corruption, while informality decreases economic growth in by 1.36%.

Furthermore, a reciprocal effect of corruption and informality with human capital is included in the productivity equation, which shows a positive and significant coefficient in both cases. This demonstrates that human capital can mitigate the detrimental effects of corruption and informality on economic growth. In this case, the total effects of corruption and informality on economic growth are obtained from multiplying the coefficient of the interaction between human capital and the respective variable by 0.53 (the coefficient of productivity in the economic growth equation) and adding the result to the previous total effects of decreasing economic growth due to corruption and informality (−0.20% and −1.36%, respectively). Thus, with a percentage increase in human capital, the magnitude of the negative effect caused by a percentage increase in corruption can be reduced to −0.17% and the impact of informality can be reduced to −1.17%. Consequently, it would be necessary to increase human capital by 6.05%3 to neutralize the total negative effects of a 1% increase in corruption and by 7.19%4 to neutralize the total negative impacts of informality on economic growth.

The negative impact of human capital on corruption aligns with the empirical studies of Ali and Isse (2002), Serra (2006), Rehman and Naveed (2007), and Evrensel (2010). In this regard, Gani (2017) explains that a community with better education is more prone to effectively scrutinize public spending and is better equipped to judge any form of political corruption. Likewise, access to education provides individuals with the necessary skills to secure gainful employment, reducing the dependency on corrupt activities (Uslaner and Rothstein 2016); hence, better education diminishes the inclination to engage in corrupt practices.

The negative impact of human capital on informality corresponds to the empirical studies of Berrittella (2015), Berdiev et al. (2018), Kelmanson et al. (2019), and Gharleghi and Jahanshahi (2020). In this regard, Loayza (2018) argues that increased education leads to the development of technical skills, which, in turn, contribute to greater labor productivity.

Furthermore, the productivity equation shows that a percentage increase in human capital has a positive and significant effect of 0.96% on productivity; this positive result has also been observed in studies conducted by Kim and Park (2018), Männasoo et al. (2018), and Habib et al. (2019). Consequently, human capital has an indirect and positive impact of 0.51%5 on economic growth. In this regard, Habib et al. (2019) explains that the positive impact of human capital on productivity arises from the acquisition of learning and new skills by workers, which leads to an increased exploitation of technologies.

In the case of exports, it is shown that this variable has a beneficial impact on productivity, a result also found in studies conducted by Miller and Upadhyay (2000), Mengistae and Pattillo (2004), and Saleem et al. (2019). However, a non-significant effect is obtained in this model, like in the study carried out by Mengistae and Pattillo (2004). This result can be explained because exporting firms may increase their productivity levels by accessing diverse knowledge that is not available in their domestic market (Pietrucha and Żelazny 2020).

In addition, it is important to consider that the impact of corruption and informality on economic growth has boundary condition. While these factors can negatively impact growth, their influence is bounded, meaning that, even in the presence of widespread corruption or informality, economic growth is not entirely nullified. There remains a baseline level of growth driven by the inherent dynamics of the economy. Also, other factors—such as human capital, innovation, capital accumulation, etc.—continue to drive growth.

Regarding the control variables in the economic growth equation, it is observed that a percentage expansion in human capital has a positive and significant impact of 0.80% on economic growth, which aligns with studies conducted by Teixeira and Queirós (2016), Zhu and Li (2017), and Amna Intisar et al. (2020). In this sense, Teixeira and Queirós (2016) explain that better education enables entrepreneurs to acquire skills that facilitate the generation of new ideas and the establishment of new businesses. Therefore, it follows that an expansion in human capital causes an increase in research and development (R&D), consequently enhancing economic growth.

Moreover, a percentage increase in physical capital has a positive and significant impact of 0.22% on economic growth, which aligns with the findings of Bhattacharjee (2016), Solarin and Yuen (2016), and Risso and Sánchez (2019). In this regard, Martins (2019) argues that higher investments in physical capital enhance a country’s competitiveness and stimulate economic growth.

Regarding inflation, it is observed that it has a negative and significant effect of 0.23% on economic growth, as observed in the studies by Barro (1995), Rakshit and Bardhan (2019), and Yang (2019). The negative impact of inflation on economic growth stems from its inhibiting effect on savings and its stimulation of borrowing, which causes an increase in nominal interest rates and, therefore, discourages investment.

Simulation Analysis for Latin America and the OECD

The results obtained from the 3SLS-GMM model and the sample of countries considered can be further explored through a simulation analysis, providing an approximation of the effects that variations in the standard deviation of corruption and informality have on economic growth in Latin America and OECD countries, which are shown in Table 6.

Table 6.

Effects of corruption in Latin American and OECD countries.

It can be observed that corruption affects OECD countries to a greater extent than Latin American countries. This result can be explained by the fact that an increase of one standard deviation in corruption in an OCDE country causes a reduction in growth by 3.18%, while in the latter, an increase of one standard deviation causes a reduction in economic growth by 0.91%. These findings are consistent with the results of Aidt et al. (2008), who explain that societies surpassing a certain threshold of institutional quality experience an amplifying effect of corruption on economic growth.

The results shown can be explained by the effect of corruption on economic growth being more detrimental in countries with higher-quality institutions. Moreover, this is attributed to the misinterpretation of the allocation of public investment that corruption generates in countries that allocate their resources more appropriately.

The results in Table 7 show that informality affects OECD countries to a greater extent than Latin American countries. It is observed that, in OECD countries, an increase of one standard deviation in informality decreases economic growth by 1.94%, whereas in Latin American countries, an increase of one standard deviation in informality reduces economic growth by 1.52%. These findings are consistent with the investigation of Hoinaru et al. (2020), who discovered that informality has a greater detrimental impact on countries with a high income than on lower-income countries.

Table 7.

Effects of informality in Latin American and OECD countries.

These results can be ascribed to the notable relevance of informal enterprises in Latin American countries, despite operating at low scales to conceal their activities. It is possible that, in this region, the interaction of informal enterprises with the formal sector generates synergies to a larger extent than in OECD countries. Formal enterprises could reduce costs by subcontracting to informal enterprises, thereby creating employment for informal workers and contributing to poverty reduction among the population in Latin American countries.

Although informality has a detrimental impact on economic growth, synergies from the interaction between the informal and formal sectors in Latin American countries allow for cost reduction in the formal sector, thus directly increasing formal sector incomes. Therefore, the informal sector, by having a positive impact on formal sector incomes, reduces its negative effect associated with tax evasion. In this sense, the informal sector ultimately negatively impacts tax revenue in Latin America to a lesser extent than would be possible without the interaction between the informal and formal sectors; consequently, public spending that generates economic growth is affected in a reduced manner in this region.

With respect to the effects of human capital through its interaction variable with corruption (Corruption HC) and through its interaction variable with informality (Informality HC), it is shown in Table 8 that an increase of one standard deviation in human capital has a positive effect on economic growth, thereby reducing the detrimental effects of corruption and informality. Furthermore, it is observed that increases in human capital have a greater impact in Latin American countries compared to OECD countries, mitigating, to a greater extent, the effects of corruption and informality.

Table 8.

Effects of human capital increases on reducing corruption in Latin American and OECD countries.

Therefore, it is observed that, through the effect of its interaction with corruption, an increase of one standard deviation in human capital increases economic growth by 0.29% in the Latin American region, whereas in OECD countries, an increase of one standard deviation in human capital generates a 0.23%6 increase in economic growth. Thus, it is evidenced that human capital mitigates the negative effect of corruption, with the reduction being greater in Latin American countries.

Refarding Latin America, it is shown that an increase in human capital by approximately three standard deviations would be necessary to achieve a positive effect close to 0.89% and to neutralize the negative effect of 0.91% caused by an increase of one standard deviation in corruption. In turn, in OECD countries, a significantly larger increase of more than three standard deviations would be required to neutralize the negative effect of 3.18% resulting from a one standard deviation rise in corruption.

Given this, we know that if citizens are provided with good skills through education and obtain decent jobs, this could reduce population inequality and enhance their well-being; consequently, this would decrease the probability of individuals considering participating in corrupt activities. Therefore, the greater impact of human capital in Latin America compared to in OECD countries may be attributed to its broader scope in reducing corruption, by also addressing the high levels of inequality present in Latin American countries. This is in line with Balestra and Tonkin (2018), who explain that income inequality in Latin American is significantly greater than in OECD countries.

Additionally, it is observed that, through the effect of its interaction with informality, as shown in Table 9, an increase one standard deviation in human capital increases economic growth by 1.66% in the Latin American region, while in OECD countries, an increase of one standard deviation in human capital generates a 1.28%7 increase in economic growth.

Table 9.

Effects of human capital increases on reducing informality in Latin American and OECD countries.

In the case of Latin America, it is observed that increasing human capital by one standard deviation results in a positive effect of 1.66%, countering the negative effect of 1.51% caused by a one standard deviation rise in informality; while for OECD countries, a two standard deviation rise in human capital would be required to achieve a positive effect of 2.45%, neutralizing the negative effect of 1.94% resulting from a one standard deviation rise in informality. Consequently, the third research hypothesis is accepted, as corruption and informality have greater impacts on OECD countries, whereas human capital has a stronger effect in mitigating the impacts of corruption and informality in Latin American countries.

In this context, Berrittella (2015) explains that education raises wage rates and reinforces the formation of values related to the emphasis on paying taxes, therefore increasing the opportunity costs of participating in informal activities. This notion relates to the fact that the level of education is significantly lower in the Latin American region; therefore, learning about the importance of taxes would be highly relevant to increase the level of fiscal morality and influence tax compliance in this region. Additionally, Ruzek (2015) argues that, in low- and middle-income countries, businesses operate in the informal sector out of economic necessity. Thus, it is observed that human capital has highly significant effects through its interaction with corruption and informality in Latin American countries and in countries belonging to the OECD.

6. Conclusions

This research aimed to analyze the effects of corruption and informality on economic growth and productivity, therefore, a 3SLS-GMM estimation approach was used, capturing both the direct and indirect effects of corruption and informality. Additionally, the analysis was deepened by incorporating a simulation study to explore the potential variations in economic growth in response to these changes. The conclusions drawn from this study are presented below.

Regarding the first research hypothesis, a negative impact of corruption on economic growth is evidenced. It is found that a rise of one percentage point in the corruption growth rate directly decreases the economic growth rate by 0.11%. Additionally, corruption harms productivity, as a rise of one percentage point in the corruption growth rate reduces the productivity growth rate by 0.17%. Thus, evidence supporting the “sand in the wheels” hypothesis is found. Furthermore, it is evidenced that a rise of one percentage point in the corruption growth rate diminishes economic growth by 0.09% via its detrimental effect on productivity growth.

The second research hypothesis is also confirmed. It is evidenced that informality reduces economic growth and productivity. Moreover, a rise of one percentage point in the informality growth rate reduces economic growth by 0.65% through its indirect effect via productivity.

The results of the simulation analysis provide insights into the third hypothesis. It is found that, in OECD countries, an increase of one standard deviation in corruption is associated with a contraction in the economic growth rate by 3.18%, whereas in Latin American countries, a similar expansion in corruption translates to a contraction in economic growth by 0.91%. Furthermore, it is observed that a rise of one standard deviation in informality results in a contraction in economic growth of 1.94% in OECD countries, while in Latin American countries, a similar expansion in informality is associated with a contraction in economic growth of 1.52%. Additionally, it is found that a rise of one standard deviation in human capital has a beneficial impact on economic growth and mitigates the negative impacts of corruption and informality.

Given the results of this research, it is recommended that the governments of emerging countries maintain a long-term commitment to policies addressing the issues of corruption and informality. In addition, institutions in these countries should be strengthened, so that structural reforms in public administration that advocate for transparency, meritocracy, and ethics should be promoted to discourage acts of corruption, particularly in Latin America, as it is one of the regions most affected by corruption in the concession processes for infrastructure works and public services. The simplification of administrative processes and a comprehensive reform of the tax system in the most affected countries are also recommended in order to reduce informality, since agents have more incentives to engage in informal activities when administrative processes are very complex and taxes are too high.

In terms of the limitations of this study, we use data on corruption and informality that are based on estimations or perceptions, which can be questioned. For instance, some authors criticize the use of corruption indexes. Nevertheless, there are also responses to these critiques that defend the usefulness of corruption indexes, despite their limitations (Castro et al. 2022). In turn, we have issues with data availability, since the data on informality are available with gaps of some years.

As suggestions for future research, it would be valuable to extend this analysis to other regions such as African, Asian, or Nordic countries, including comparisons between results for different groups of countries. In addition, the methodology presented in this paper can also be applied to evaluate the effects of other institutional variables such economic freedom, democracy, or political stability on economic growth through productivity.

Supplementary Materials

The following supporting information can be downloaded at: https://www.mdpi.com/article/10.3390/economies12100268/s1.

Author Contributions

Conceptualization, P.B. and L.V.; methodology, P.B., L.V. and J.L.N.; software, P.B. and L.V.; validation, J.L.N. and D.A.U.; formal analysis, P.B. and L.V.; investigation, P.B. and L.V.; data curation, P.B. and L.V.; writing—original draft preparation, P.B. and L.V.; writing—review and editing, P.B., L.V., J.L.N. and D.A.U.; visualization, P.B., L.V. and D.A.U.; supervision, J.L.N. All authors have read and agreed to the published version of the manuscript.

Funding

This research received no external funding.

Institutional Review Board Statement

Not applicable.

Informed Consent Statement

Not applicable.

Data Availability Statement

The data presented in this study are available on request from the corresponding authors.

Conflicts of Interest

Authors Pedro Bermúdez and Luis Verástegui were employed by the companies Ernst & Young Ltd. and TP Invest S.R.L., respectively. The remaining authors declare that the research was conducted in the absence of any commercial or financial relationships that could be construed as a potential conflict of interest.

Notes

| 1 | Australia, Austria, Belgium, Bolivia, Brazil, Canada, Chile, Colombia, Costa Rica, Czech Republic, Denmark, Ecuador, Estonia, France, Germany, Greece, Guatemala, Honduras, Hungary, Iceland, Ireland, Israel, Italy, Japan, Latvia, Lithuania, Luxembourg, Mexico, Netherlands, New Zealand, Nicaragua, Norway, Panama, Paraguay, Peru, Poland, Portugal, Slovakia, Slovenia, South Korea, Spain, Sweden, Switzerland, Turkey, United Kingdom, and Uruguay. |

| 2 | The estimation of the size of the informal economy is employed because it offers a broader scope compared to other methods, as it considers multiple indicator and causal variables (Tedds and Giles 2002). |

| 3 | This is due to the following equation: 0.033X − 0.202 = 0, where X represents the percentage increases in human capital needed to offset the impact of a percentage increase in corruption on economic growth. |

| 4 | This is due to the following equation: 0.189X − 1.356 = 0, where X represents the percentage increases in human capital needed to offset the impact of a percentage increase in informality on economic growth. |

| 5 | The indirect effect of human capital results from multiplying 0.96 (human capital in productivity equation) by 0.53 (productivity in economic growth equation). |

| 6 | To assess the impacts of human capital associated with corruption, the average and standard deviation of human capital were calculated for both groups of countries with the following equation: (Average + 1 × sd(HC)) × ME. Here, sd(HC) represents the standard deviation of human capital and the average is derived from the human capital variable, while ME denotes the coefficient of interaction between human capital and corruption in the regression. |

| 7 | To assess the impacts of human capital associated with informality, the average and standard deviation of human capital were calculated for both groups of countries with the following equation: (Average + 1 × sd(HC)) × ME. Here, sd(HC) represents the standard deviation of human capital and the average is derived from the human capital variable, while ME denotes the coefficient of interaction between human capital and informality in the regression. |

References

- Abidin, Zainol, Ishak Yussof, and Karim Zulkefly. 2020. Total Factor Productivity Shock and Economic Growth in Selected ASEAN+ 3 Countries: A New Evidence Using a Panel VAR. International Journal of Business and Society 21: 1366–83. [Google Scholar] [CrossRef]

- Acemoglu, Daron, and James Robinson. 2012. Why Nations Fail: The Origins of Power, Prosperity and Poverty. New York: Crown Publishers. [Google Scholar]

- Aidt, Toke, Dutta Jayasari, and Vania Sena. 2008. Governance regimes, corruption and growth: Theory and evidence. Journal of Comparative Economics 36: 195–220. [Google Scholar] [CrossRef]

- Albrecht, James, Lucas Navarro, and Susan Vroman. 2009. The effects of labour market policies in an economy with an informal sector. The Economic Journal 119: 1105–29. [Google Scholar] [CrossRef]

- Ali, Abdiweli, and Hoden Said Isse. 2002. Determinants of Economic Corruption: A Cross-Country Comparison. Cato Journal 22: 449–466. [Google Scholar]

- Amaral, Pedro S., and Erwan Quintin. 2006. A competitive model of the informal sector. Journal of Monetary Economics 53: 1541–53. [Google Scholar] [CrossRef]

- Amin, Mohammad, and Cedric Okou. 2020. Casting a shadow: Productivity of formal firms and informality. Review of Development Economics 24: 1610–30. [Google Scholar] [CrossRef]

- Amna Intisar, Rabail, Muhammad Yaseen, Rakhshanda Kousar, Muhammad Usman, and Muhammad Makhdum. 2020. Impact of trade openness and human capital on economic growth: A comparative investigation of Asian countries. Sustainability 12: 2930. [Google Scholar] [CrossRef]

- Asheghian, Parviz. 2004. Determinants of economic growth in the United States: The role of foreign direct investment. The International Trade Journal 18: 63–83. [Google Scholar] [CrossRef]

- Baklouti, Nedra, and Younes Boujelbene. 2019. Shadow economy, corruption, and economic growth: An empirical analysis. The Review of Black Political Economy 47: 276–94. [Google Scholar] [CrossRef]

- Balestra, Carlotta, and Richard Tonkin. 2018. Inequalities in Household Wealth across OECD Countries: Evidence from the OECD Wealth Distribution Database OECD Statistics Working Papers. Paris: OECD Publishing. [Google Scholar] [CrossRef]

- Barro, Robert J. 1995. Inflation and Economic Growth. Cambridge, MA: National Bureau of Economic Research. [Google Scholar] [CrossRef]

- Barro, Robert J. 2001. Human capital and growth. The American Economic Review 91: 12–17. [Google Scholar] [CrossRef]

- Baum, Christopher F. 2006. An Introduction to Modern Econometrics Using Stata. College Station: Stata Press. [Google Scholar]

- Becker, Gary S. 2009. Human Capital: A Theoretical and Empirical Analysis with Special Reference to Education. Chicago: The University of Chicago Press. [Google Scholar]

- Beltrán, Arlette. 2020. Informal sector competition and firm productivity. Applied Economics Letters 27: 1243–46. [Google Scholar] [CrossRef]

- Berdiev, Aziz, James Saunoris, and Friedrich Schneider. 2018. Give me liberty, or I will produce underground: Effects of economic freedom on the shadow economy. Southern Economic Journal 85: 537–62. [Google Scholar] [CrossRef]

- Berrittella, Maria. 2015. The effect of public education expenditure on shadow economy: A cross-country analysis. International Economic Journal 29: 527–46. [Google Scholar] [CrossRef]

- Bhattacharjee, Jayanti. 2016. Do institutions affect economic growth? an empirical analysis of selected South Asian countries. Asian Journal of Comparative Politics 2: 243–60. [Google Scholar] [CrossRef]

- Castro, Sebastian, Nicole Bonilla, Fernando Unda, and Fabrizio Morán. 2022. ¿Sabemos medir la corrupción? Desafíos: Economía Y Empresa 1: 83–99. [Google Scholar] [CrossRef]

- Cieślik, Andrzej, and Lukasz Goczek. 2018. Corruption, privatization and economic growth in post-communist countries. Europe-Asia Studies 70: 1303–25. [Google Scholar] [CrossRef]

- Dhrifi, Abdelhafidh. 2015. Foreign direct investment, technological innovation and economic growth: Empirical evidence using simultaneous equations model. International Review of Economics 62: 381–400. [Google Scholar] [CrossRef]

- Eilat, Yair, and Clifford Zinnes. 2002. The shadow economy in transition countries: Friend or foe? A policy perspective. World Development 30: 1233–54. [Google Scholar] [CrossRef]

- Elgin, Ceyhun, and Friedrich Schneider. 2016. Shadow economies around the world: What do we really know? European Journal of Political Economy 45: 45–70. [Google Scholar] [CrossRef]

- Elgin, Ceyhun, and Serdar Birinci. 2016. Growth and informality: A comprehensive panel data analysis. Journal of Applied Economics 19: 271–92. [Google Scholar] [CrossRef]

- Engelbrecht, Hans-Jürgen. 1997. International R&D spillovers, human capital and productivity in OECD economies: An empirical investigation. European Economic Review 41: 1479–88. [Google Scholar] [CrossRef]

- Enste, Dominik, and Christina Heldman. 2018. The consequences of corruption. In Handbook on the Geographies of Corruption. Edited by Barney Warf. Cheltenham: Edward Elgar, pp. 106–19. [Google Scholar] [CrossRef]

- Evrensel, Ayşe Y. 2010. Corruption, growth, and growth volatility. International Review of Economics & Finance 19: 501–14. [Google Scholar] [CrossRef]

- Feenstra, Robert C., Robert Inklaar, and Marcel Timmer. 2015. The next generation of the Penn World Table. American Economic Review 105: 3150–82. [Google Scholar] [CrossRef]

- Gani, Azamt. 2017. The Empirical Determinants of Corruption in Developing Countries. Perspectives on Global Development and Technology 16: 392–409. [Google Scholar] [CrossRef]

- Gharleghi, Behrooz, and Asghar Jahanshahi. 2020. The shadow economy and sustainable development: The role of financial development. Journal of Public Affairs 20: e2099. [Google Scholar] [CrossRef]

- Goel, Rajeev, Ummad Mazhar, and Rati Ram. 2022. Informal competition and firm performance: Impacts on input—versus output performance. Managerial and Decision Economics 43: 418–30. [Google Scholar] [CrossRef]

- Habib, Misbah, Jawad Abbas, and Rahat Noman. 2019. Are human capital, intellectual property rights, and research and development expenditures really important for total factor productivity? an empirical analysis. International Journal of Social Economics 46: 756–74. [Google Scholar] [CrossRef]

- Hall, Alastair R. 2005. Generalized Method of Moments. Oxford: Oxford University Press. [Google Scholar]

- Hoinaru, Răzvan, Daniel Buda, Sorin Borlea, Viorela Văidean, and Monica Achim. 2020. The impact of corruption and shadow economy on the economic and sustainable development. Do they “sand the wheels” or “grease the wheels”? Sustainability 12: 481. [Google Scholar] [CrossRef]

- Kallal, Rahim, Abir Haddaji, and Zied Ftiti. 2021. ICT diffusion and economic growth: Evidence from the sectorial analysis of a periphery country. Technological Forecasting and Social Change 162: 120403. [Google Scholar] [CrossRef]

- Kaufmann, Daniel, and Aleksander Kaliberda. 1996. Integrating the Unofficial Economy into the Dynamics of Post-Socialist Economies: A Framework of Analyses and Evidence. Washington, DC: The World Bank. Available online: https://documents1.worldbank.org/curated/en/145671468771609920/pdf/multi0page.pdf (accessed on 20 December 2023).

- Kéïta, Kouramoudou, and Hannu Laurila. 2021. Corruption and tax burden: What is the joint effect on total factor productivity? Economies 9: 26. [Google Scholar] [CrossRef]

- Kelmanson, Ben, Koralai Kirabaeva, Leandro Medina, Borislava Mircheva, and Jason Weiss. 2019. Explaining the Shadow Economy in Europe: Size, Causes and Policy Options. Washington, DC: International Monetary Fund. Available online: https://www.imf.org/en/Publications/WP/Issues/2019/12/13/Explaining-the-Shadow-Economy-in-Europe-Size-Causes-and-Policy-Options-48821 (accessed on 20 December 2023).

- Kesar, Ashmit, Pabitra Kumar Jena, Bandi Kamaiah, Festus Victor Bekun, and Tania Dehury. 2024. Towards the quest to reduce corruption in BRICS nations: Is there a synergy between corruption and economic growth? Journal of the Knowledge Economy. [Google Scholar] [CrossRef]

- Kim, Jungsuk, and Jungsoo Park. 2018. The role of total factor productivity growth in middle-income countries. Emerging Markets Finance and Trade 54: 1264–84. [Google Scholar] [CrossRef]

- La Porta, Rafael, and Andrei Shleifer. 2014. Informality and development. Journal of Economic Perspectives 28: 109–26. [Google Scholar] [CrossRef]

- Leys, Colin. 1965. What is the problem about corruption? The Journal of Modern African Studies 3: 215–30. [Google Scholar] [CrossRef]

- Leyva, Gustavo, and Carlos Urrutia. 2020. Informality, labor regulation, and the business cycle. Journal of International Economics 126: 103340. [Google Scholar] [CrossRef]

- Loayza, Norman. 1996. The economics of the informal sector: A simple model and some empirical evidence from Latin America. Carnegie-Rochester Conference Series on Public Policy 45: 129–62. [Google Scholar] [CrossRef]

- Loayza, Norman. 2018. Informality: Why Is It so Widespread and How Can It Be Reduced? Washington, DC: World Bank Group. Available online: https://documents.worldbank.org/en/publication/documents-reports/documentdetail/130391545228882358/informality-why-is-it-so-widespread-and-how-can-it-be-reduced (accessed on 20 December 2023).

- Lucas, Robert. 1988. On the mechanics of economic development. Journal of Monetary Economics 22: 3–42. [Google Scholar] [CrossRef]

- Männasoo, Kadri, Heili Hein, and Raul Ruubel. 2018. The contributions of human capital, R&D spending and convergence to total factor productivity growth. Regional Studies 52: 1598–611. [Google Scholar] [CrossRef]

- Martins, Pedro. 2019. Structural Change Rediscovered: The Role of Human and Physical Capital. Washington, DC: The World Bank. Available online: https://documents.worldbank.org/en/publication/documents-reports/documentdetail/266031563538168642/structural-change-rediscovered-the-role-of-human-and-physical-capital (accessed on 20 December 2023).

- Masatlioglu, Yusufcan, and Jamele Rigolini. 2008. Informality traps. The B E Journal of Economic Analysis & Policy 8: 2055. [Google Scholar] [CrossRef]

- Mauro, Paolo. 1995. Corruption and growth. The Quarterly Journal of Economics 110: 681–712. [Google Scholar] [CrossRef]

- Mengistae, Taye, and Catherine Pattillo. 2004. Export orientation and productivity in Sub-Saharan Africa. IMF Staff Papers 51. Available online: http://www.imf.org/External/Pubs/FT/staffp/2004/02/pdf/mengista.pdf (accessed on 20 December 2023). [CrossRef]

- Miller, Stephen, and Mukti Upadhyay. 2000. The Effects of openness, trade orientation and human capital on total factor productivity. Journal of Development Economics 63: 399–423. [Google Scholar] [CrossRef]

- Mitra, Shalini. 2013. Informality, financial development and macroeconomic volatility. Economics Letters 120: 454–57. [Google Scholar] [CrossRef]

- Mo, Pak. 2001. Corruption and economic growth. Journal of Comparative Economics 29: 66–79. [Google Scholar] [CrossRef]

- Ngouhouo, Ibrahim, Loudi Njoya, and Simplice Asongu. 2022. Corruption, Economic Growth and the Informal Sector: Empirical Evidence from Developing Countries. Kiel: Econstor. Available online: https://www.econstor.eu/bitstream/10419/262068/1/1789936144.pdf (accessed on 20 December 2023).

- Nguyen, Thi Anh Nhu, and Thi Thuy Huong Luong. 2020. Corruption, shadow economy and economic growth: Evidence from emerging and developing Asian economies. Montenegrin Journal of Economics 16: 85–94. [Google Scholar] [CrossRef]

- Nogueira, Manuel Carlos, and Mara Madaleno. 2021. Is the aurora borealis an inspiration to the performance of Nordic economic sustainability? Sustainability 13: 9961. [Google Scholar] [CrossRef]

- Nordin, Rumaizah Mohd, Roshana Takim, and Abdul Hadi Nawawi. 2013. Behavioural factors of corruption in the construction industry. Procedia-Social and Behavioral Sciences 105: 64–74. [Google Scholar] [CrossRef]

- Nosier, Shereen, and Aya El-Karamani. 2018. The indirect effect of democracy on economic growth in the MENA region (1990–2015). Economies 6: 61. [Google Scholar] [CrossRef]

- Olson, Mancur, Naveen Sarna, and Anand Swamy. 2000. Governance and growth: A simple hypothesis explaining cross-country differences in productivity growth. Public Choice 102: 341–64. [Google Scholar] [CrossRef]

- Othman, Zaleha, Rohami Shafie, and Fathilatul Zakimi Abdul Hamid. 2014. Corruption—Why do they do it? Procedia—Social and Behavioral Sciences 164: 248–257. [Google Scholar] [CrossRef]

- Pellegrini, Lorenzo. 2011. Corruption, Development and the Environment. Dordrecht: Springer. [Google Scholar]

- Perry, Guillermo. 2007. Informality: Exit and Exclusion. Washington, DC: World Bank Publications. [Google Scholar]

- Pietrucha, Jacek, and Rafał Żelazny. 2020. TFP spillover effects via trade and FDI channels. Taylor & Francis Journals 33: 2509–2525. [Google Scholar] [CrossRef]

- Rakshit, Bijoy, and Samaresh Bardhan. 2019. Does bank competition promote economic growth? empirical evidence from selected South Asian countries. South Asian Journal of Business Studies 8: 201–23. [Google Scholar] [CrossRef]

- Rehman, Hafeez, and Amjad Naveed. 2007. Determinants of Corruption and its Relation to GDP: (A Panel study). Journal of Political Studies 12: 27–59. Available online: https://jps.pu.edu.pk/6/article/view/149 (accessed on 20 December 2023).

- Risso, Wiston, and Edgar J. Sánchez. 2019. On the impact of innovation and inequality in economic growth. Economics of Innovation and New Technology 28: 64–81. [Google Scholar] [CrossRef]

- Rivera-Batiz, Francisco. 2002. Democracy, governance, and economic growth: Theory and evidence. Review of Development Economics 6: 225–47. [Google Scholar] [CrossRef]

- Rock, Michael, and Heidi Bonnett. 2004. The comparative politics of corruption: Accounting for the East Asian paradox in empirical studies of corruption, growth and investment. World Development 32: 999–1017. [Google Scholar] [CrossRef]

- Romer, Paul. 1986. Increasing returns and long-run growth. Journal of Political Economy 94: 1002–37. [Google Scholar] [CrossRef]

- Roodman, David. 2009. How to do Xtabond2: An Introduction to Difference and System GMM in Stata. The Stata Journal 9: 86–136. [Google Scholar] [CrossRef]

- Rose-Ackerman, Susan. 1997. Corruption and the Global Economy. Washington, DC: Peterson Institute for International Economics. Available online: https://www.piie.com/bookstore/corruption-and-global-economy (accessed on 20 December 2023).

- Ruzek, William. 2015. The informal economy as a catalyst for sustainability. Sustainability 7: 23–34. [Google Scholar] [CrossRef]

- Saleem, Hummera, Malik Shahzad, Muhammad Khan, and Bashir Ahmad Khilji. 2019. Innovation, total factor productivity and economic growth in Pakistan: A policy perspective. Economic Structures 8: 7. [Google Scholar] [CrossRef]

- Salinas-Jiménez, María, and Javier Salinas-Jiménez. 2007. Corruption, efficiency and productivity in OECD countries. Journal of Policy Modeling 29: 903–15. [Google Scholar] [CrossRef]

- Salinas-Jiménez, María, and Javier Salinas-Jiménez. 2011. Corruption and total factor productivity: Level or growth effects? Portuguese Economic Journal 10: 109–28. [Google Scholar] [CrossRef]

- Schneider, Friedrich, and Dominik Enste. 2000. Shadow economies: Size, causes, and consequences. Journal of Economic Literature 38: 77–114. [Google Scholar] [CrossRef]

- Serra, Danila. 2006. Empirical determinants of corruption: A sensitivity analysis. Public Choice 126: 225–256. [Google Scholar] [CrossRef]

- Solarin, Sakiru, and Yen Yuen. 2016. A global analysis of the impact of research output on economic growth. Scientometrics 108: 855–74. [Google Scholar] [CrossRef]

- Solow, Robert. 1956. A contribution to the theory of economic growth. The Quarterly Journal of Economics 70: 65–94. [Google Scholar] [CrossRef]

- Stata. 2023. Stata Base Reference Manual. Release 18. College Station: Stata Press Publication. Available online: https://www.stata-press.com/manuals/base-reference-manual/ (accessed on 20 December 2023).

- Taymaz, Erol. 2009. Informality and Productivity: Productivity Differentials between Formal and Informal Firms in Turkey. Ankara: East Technical University. Available online: https://www.researchgate.net/publication/254429010_Informality_and_Productivity_Productivity_Differentials_between_Formal_and_Informal_Firms_in_Turkey (accessed on 20 December 2023).

- Tedds, Lindsay, and David Giles. 2002. Taxes and the Canadian Underground Economy. Toronto: Canadian Tax Foundation. [Google Scholar]

- Teixeira, Aurora, and Anabela Queirós. 2016. Economic growth, human capital and structural change: A dynamic panel data analysis. Research Policy 45: 1636–48. [Google Scholar] [CrossRef]