Using Short Time Series of Monofractal Synthetic Fluctuations to Estimate the Foreign Exchange Rate: The Case of the US Dollar and the Chilean Peso (USD–CLP)

Abstract

1. Introduction

- Is it possible to use RK4 to estimate the exchange rate between the US dollar and the Chilean peso (USD–CLP) with only a few percentage points of error using a short time series?

- Is it possible to characterize daily fluctuations in the exchange rate (USD–CLP) as monofractal fluctuations?

- Is it possible to use short monofractal fluctuations to estimate the exchange rate (USD–CLP) with only a few percentage points of error?

- Different studies have been conducted to estimate the exchange rate between foreign currencies: USD–EUR, USD–IDR, and USD–AUD, to name a few. However, this is the first attempt to study short time series for the exchange rate between the US dollar and the Chilean peso (USD–CLP), one of the main economies in Latin America.

- Methods that analyze the exchange rate between foreign currencies are typically focused on estimating future values based on historical records, with little attention paid to existing fluctuations. In this regard, we demonstrate that it is possible to characterize fluctuations in short records using the Hurst exponent (H) and detrended fluctuation analysis (DFA).

- We show that it is possible to use a synthetic time series of fluctuations (with the H parameter defined), the nonlinear Schrödinger equation, and the fourth-order Runge–Kutta method to estimate the exchange rate between the US dollar and the Chilean peso (USD–CLP) with only a few percentage points of error.

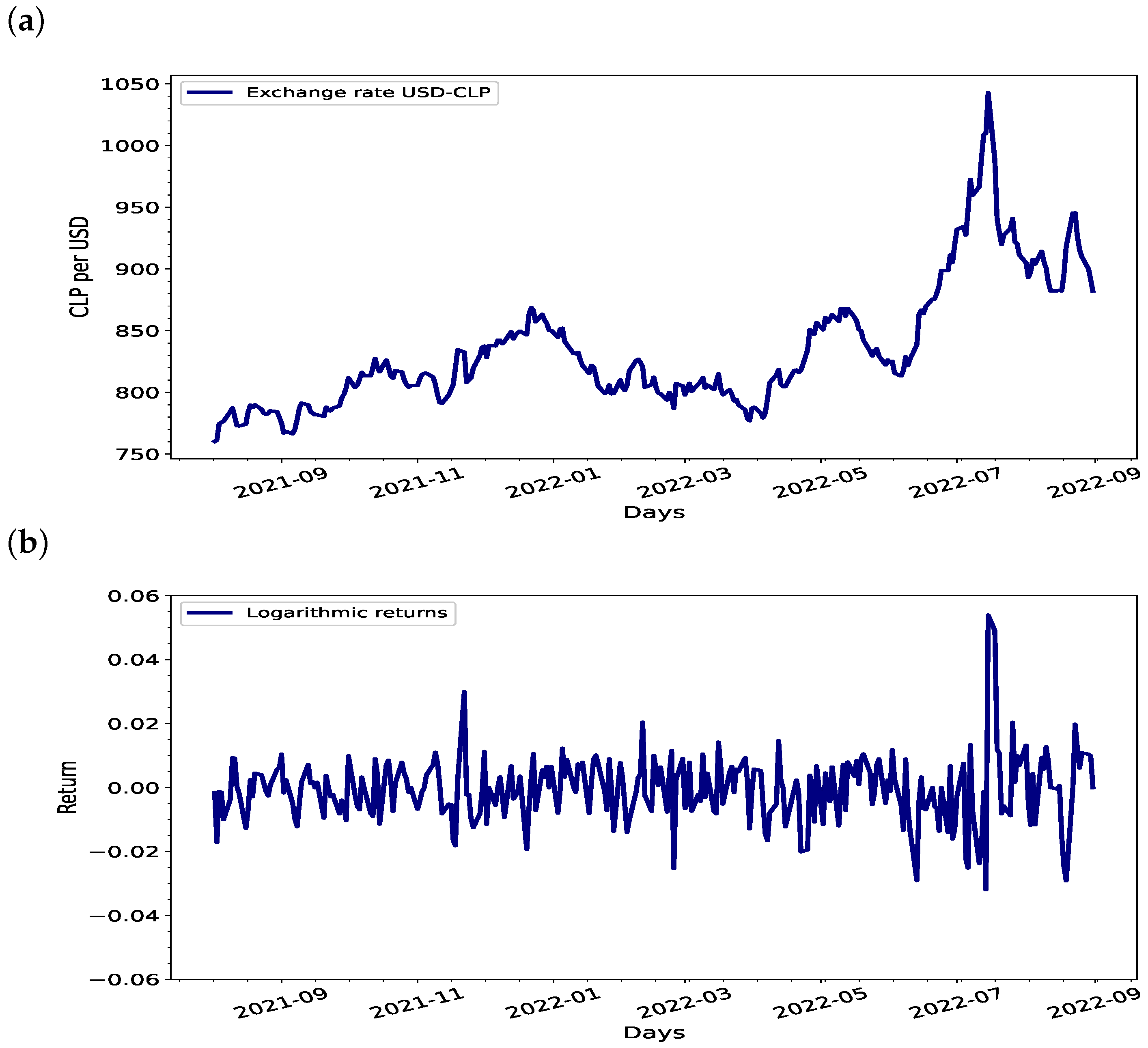

2. The Exchange Rate between the US Dollar and the Chilean Peso (USD–CLP)

Chile between the Social Outbreak and COVID-19

3. Materials and Methods

3.1. Nonlinear Schrödiger Equation (NLSE)

Nonlinear Schrödiger and Black–Scholes Equations

3.2. Runge–Kutta Numerical Method

3.3. Monofractal Fluctuations

3.4. Detrended Fluctuation Analysis (DFA)

- For a time serie of finite length N, where only a tiny proportion of are equal to zero, the new time series , where , …, N, is computed as follows:

- The new series is divided into segments of size s. Repeating the procedure from the beginning to the end, segments are obtained.

- For all segments and all sizes s, the variance from the local trend of order n, , is computed as follows:

- For all segments of a given size s, the average over 2-order fluctuations are computed as follows:

- For a range of sizes, ,The H index, called Hurst exponent, is the output of the DFA algorithm.

3.5. Data Source

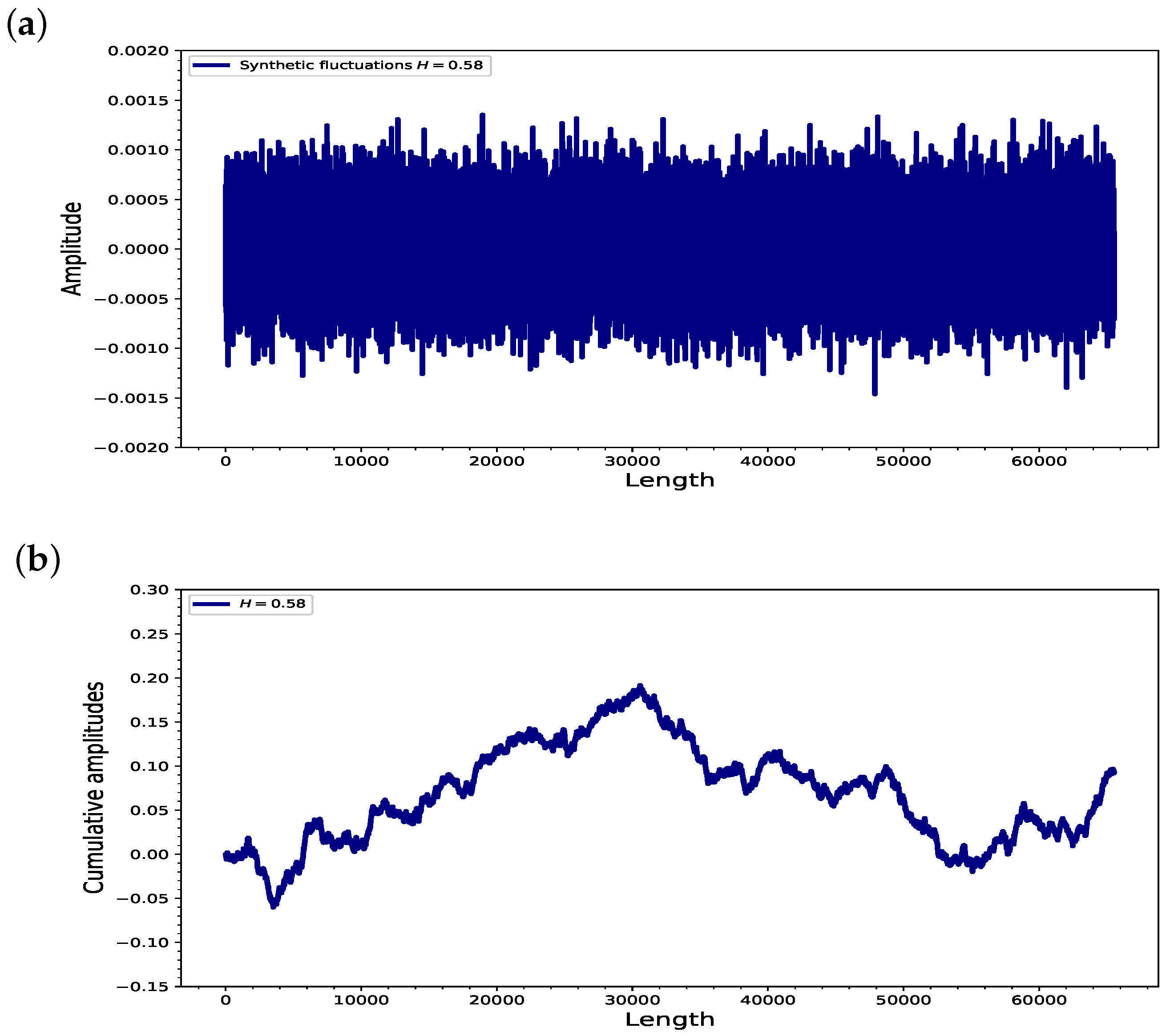

3.6. Computer-Generated Exchange Rate Fluctuation Currency

4. Results and Discussion

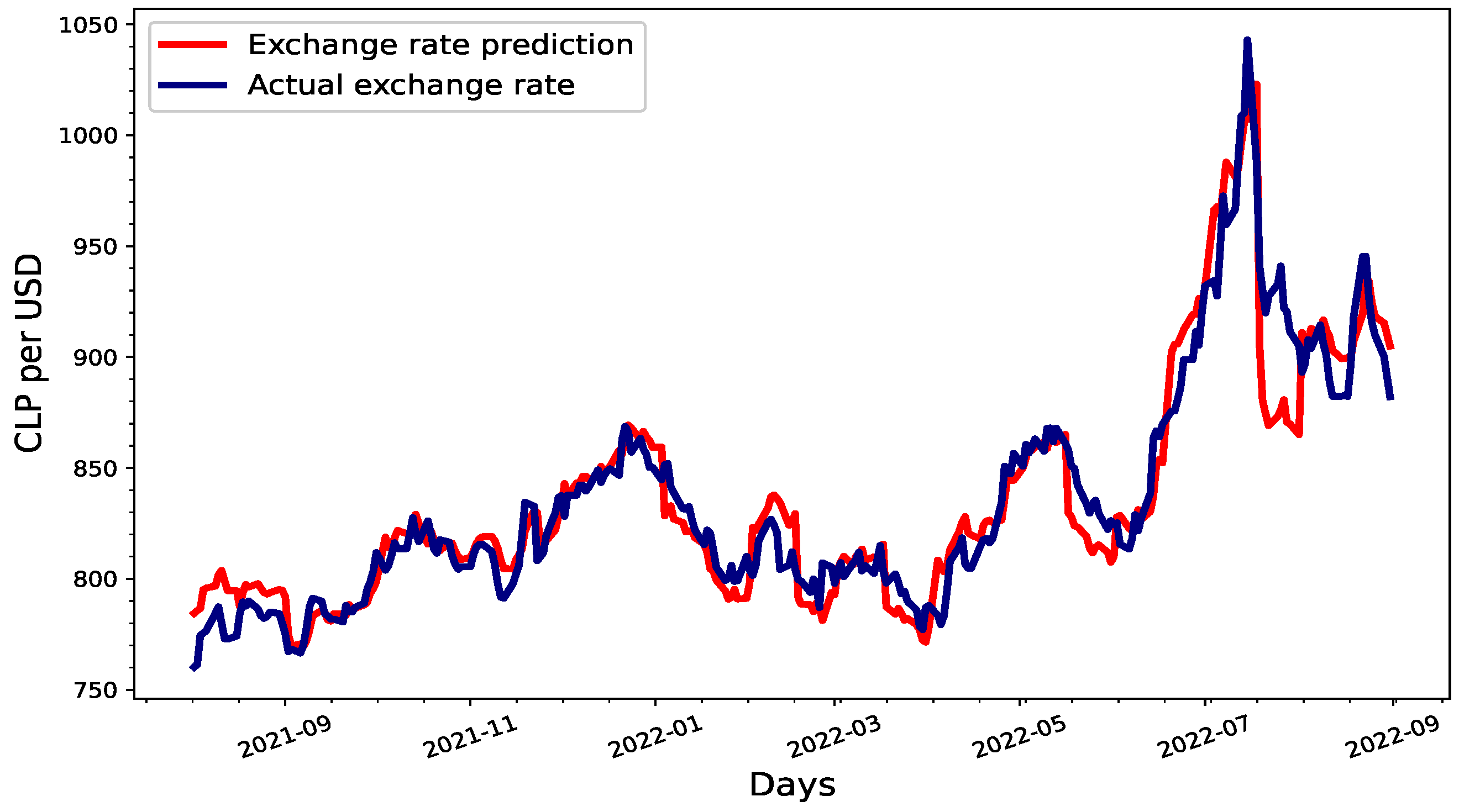

4.1. Estimating USD–CLP by the Fourth-Order Runge–Kutta Method

4.2. Characterization of Exchange Rate Fluctuations USD–CLP

4.3. Exchange Rate USD–CLP by Synthetic Fluctuation

4.4. Policy Recommendations and Limitations

5. Conclusions

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Acknowledgments

Conflicts of Interest

References

- Abry, Patrice, and Fabrice Sellan. 1996. The wavelet-based synthesis for fractional brownian motion proposed by f. sellan and y. meyer: Remarks and fast implementation. Applied and Computational Harmonic Analysis 3: 377–83. [Google Scholar] [CrossRef]

- Afuecheta, Emmanuel, Idika E Okorie, Saralees Nadarajah, and Geraldine E Nzeribe. 2022. Forecasting value at risk and expected shortfall of foreign exchange rate volatility of major african currencies via garch and dynamic conditional correlation analysis. Computational Economics 63: 271–304. [Google Scholar] [CrossRef] [PubMed]

- Araújo, Noelia. 2020. Repercusión económica mundial de la pandemia del COVID-19. análisis de sectores más afectados. Quipukamayoc 28: 85–93. [Google Scholar] [CrossRef]

- Aslam, Faheem, Paulo Ferreira, Haider Ali, Arifa, and Márcia Oliveira. 2023. Islamic vs. conventional equity markets: A multifractal cross-correlation analysis with economic policy uncertainty. Economies 11: 16. [Google Scholar] [CrossRef]

- Atria, Jorge, Nicolás Grau, Vicente Inostroza Sánchez, Alfredo Joignant, Aldo Madariaga, and Claudia Sanhueza. 2020. La política económica frente al COVID-19 en chile y el mundo: Una invitación a ampliar las fronteras de lo posible. Available online: www.ciperchile.cl/2020/05/24/la-politica-economica-frente-al-covid-19-en-chile-y-el-mundo-una-invitacion-a-ampliar-las-fronteras-de-lo-posible/ (accessed on 20 January 2024).

- Banco Central de Chile. 2022. August 20. Available online: www.bcentral.cl/web/banco-central (accessed on 20 January 2024).

- Banco de Crédito e Inversiones. 2022. July 2. Available online: www.bci.cl/inversiones/bci-estudios (accessed on 25 January 2024).

- Bardet, Jean-Marc. 2002. Statistical study of the wavelet analysis of fractional brownian motion. IEEE Transactions on Information Theory 48: 991–99. [Google Scholar] [CrossRef]

- Bernstein, Michael A. 1989. The Great Depression Delayed Recovery and Economic Change in America, 1929–1939. Princeton: Princeton University. [Google Scholar]

- Braei, Mohammad, and Wagner Sebastiana. 2020. Anomaly detection in univariate time-series: A survey on the state-of-the-art. arXiv arXiv:2004.00433. [Google Scholar]

- Cazenave, Thierry. 1989. An Introduction to Nonlinear Schrödinger Equations. Rio de Janeiro State: Universidade Federal do Rio de Janeiro, Centro de Ciências Matemáticas e da Natureza, vol. 22. [Google Scholar]

- Chaudhari, Harshal, and Martin Crane. 2020. Cross-correlation dynamics and community structures of cryptocurrencies. Journal of Computational Science 44: 101130. [Google Scholar] [CrossRef]

- Chen, An-Sing, and Mark T. Leung. 2004. Regression neural network for error correction in foreign exchange forecasting and trading. Computers & Operations Research 31: 1049–68. [Google Scholar]

- Claro, Sebastian, and Claudio Soto. 2013. Exchange rate policy and exchange rate interventions: The chilean experience. BIS Paper 73g: 1–13. [Google Scholar]

- Curto-Risso, Pedro L., Alejandro Medina, Antonio Calvo Hernández, Lev Guzman-Vargas, and Fernando Angulo-Brown. 2010. Monofractal and multifractal analysis of simulated heat release fluctuations in a spark ignition heat engine. Physica A: Statistical Mechanics and Its Applications 389: 5662–70. [Google Scholar] [CrossRef]

- Deng, Jianguang, and Panida Jirutitijaroen. 2010. Short-term load forecasting using time series analysis: A case study for Singapore. Paper presented at the IEEE Conference on Cybernetics and Intelligent Systems, Singapore, June 28–30; pp. 231–36. [Google Scholar]

- Dicle, Mehmet, and John Levendis. 2010. Day-of-the-week effect revisited: International evidence. Journal of Economics and Finance 38: 407–37. [Google Scholar] [CrossRef]

- Fama, Eugene F. 1970. Efficient capital markets: A review of theory and empirical work. The Journal of Finance 25: 383–417. [Google Scholar] [CrossRef]

- Ferreira, Paulo. 2018. Long-range dependencies of eastern european stock markets: A dynamic detrended analysis. Physica A: Statistical Mechanics and Its Applications 505: 454–70. [Google Scholar] [CrossRef]

- Ferreira, Paulo. 2020. Dynamic long-range dependences in the swiss stock market. Empirical Economics 58: 1541–73. [Google Scholar] [CrossRef]

- Ferreira, Paulo, Andreia Dionísio, Everaldo Freitas Guedes, and Gilney Figueira Zebende. 2018. A sliding windows approach to analyse the evolution of bank shares in the european union. Physica A: Statistical Mechanics and Its Applications 490: 1355–67. [Google Scholar] [CrossRef]

- Gajbhiye, Sarita, Chandrashekhar Meshram, Rasoul Mirabbasi, and S. K. Sharma. 2016. Trend Analysis of Rainfall Time Series for Sindh River Basin in India. Berlin/Heidelberg: Springer, vol. 125, pp. 593–608. [Google Scholar]

- Galeshchuk, Svitlana. 2016. Neural networks performance in exchange rate prediction. Neurocomputing 172: 446–52. [Google Scholar] [CrossRef]

- Gencay, Ramazan. 1999. Linear, non-linear and essential foreign exchange rate prediction with simple technical trading rules. Journal of International Economics 47: 91–107. [Google Scholar] [CrossRef]

- Guptha, Sivakiran, and R. Rao. 2019. Analysis of stock market efficiency in emerging markets: Evidence from brics. Romanian Economic Journal 22: 60–77. [Google Scholar] [CrossRef]

- Hersugondo, Hersugondo, Imam Ghozali, Eka Handriani, Trimono Trimono, and Imang Dapit Pamungkas. 2022. Price index modeling and risk prediction of sharia stocks in indonesia. Economies 10: 17. [Google Scholar] [CrossRef]

- Hu, Kun, Plamen Ch Ivanov, Zhi Chen, Pedro Carpena, and H. Eugene Stanley. 2001. Effect of trends on detrended fluctuation analysis. Physical Review E 64: 011114. [Google Scholar] [CrossRef]

- Huang, Zheng-Wen, Chun-Qiong Liu, Kai Shi, and Bin Zhang. 2010. Monofractal and multifractal scaling analysis of ph time series from dongting lake inlet and outlet. Fractals 18: 309–17. [Google Scholar] [CrossRef]

- Jensen, Michael C. 1972. Capital markets: Theory and evidence. The Bell Journal of Economics and Management Science 3: 357–398. [Google Scholar] [CrossRef]

- Jiang, Zhi-Qiang, Wen-Jie Xie, Wei-Xing Zhou, and Didier Sornetted. 2018. Multifractal analysis of financial markets. Research Center for Econophysics, East China University of Science and Technology 82: 1–145. [Google Scholar] [CrossRef] [PubMed]

- Jones, Steven L., and Jeffry M. Netter. 2008. Efficient capital markets. The Concise Encyclopedia of Economic 15: 87–98. [Google Scholar]

- Kamruzzaman, Joarder, Ruhul A. Sarker, and Iftekhar Ahmad. 2003. Svm based models for predicting foreign currency exchange rates. Paper presented at the third IEEE International Conference on Data Mining, Melbourne, FL, USA, November 19–22; New York: IEEE, pp. 557–60. [Google Scholar]

- Kanapickienė, Rasa, Greta Keliuotytė-Staniulėnienė, Deimantė Vasiliauskaitė, Renatas Špicas, Airidas Neifaltas, and Mantas Valukonis. 2023. Macroeconomic factors of consumer loan credit risk in central and eastern european countries. Economies 11: 102. [Google Scholar] [CrossRef]

- Kantelhardt, Jan W. 2008. Fractal and multifractal time series. arXiv arXiv:0804.0747. [Google Scholar]

- Kantelhardt, Jan W., Stephan A. Zschiegner, Eva Koscielny-Bunde, Shlomo Havlin, Armin Bunde, and H. Eugene Stanley. 2002. Multifractal detrended fluctuation analysis of nonstationary time series. Physica A: Statistical Mechanics and Its Applications 316: 87–114. [Google Scholar] [CrossRef]

- Kartono, Agus, Marina Febriyanti, and Setyanto Tri Wahyudi. 2020. Predicting foreign currency exchange rates using the numerical solution of the incompressible navier–stokes equations. Physica A: Statistical Mechanics and Its Applications 560: 125191. [Google Scholar] [CrossRef]

- Kartono, Agus, Siti Solekha, and Tony Sumaryada. 2021. Foreign currency exchange rate prediction using non-linear schrödinger equations with economic fundamental parameters. Chaos, Solitons & Fractals 152: 111320. [Google Scholar]

- Kristoufek, Ladislav. 2012. Fractal markets hypothesis and the global financial crisis: Scaling, investment horizons and liquidity. Advances in Complex Systems 15: 1250065. [Google Scholar] [CrossRef]

- Lee, Hsiu-Yun, and Show-Lin Chen. 2006. Why use markov-switching models in exchange rate prediction? Economic Modelling 23: 662–68. [Google Scholar] [CrossRef]

- Leung, Mark T., An-Sing Chen, and Hazem Daouk. 2000. Forecasting exchange rates using general regression neural networks. Computers & Operations Research 27: 1093–10. [Google Scholar]

- Look AHEAD Research Group, and Rena R. Wing. 2010. Long-term effects of a lifestyle intervention on weight and cardiovascular risk factors in individuals with type 2 diabetes mellitus: Four-year results of the Look AHEAD trial. American Medical Association 170: 1566–575. [Google Scholar]

- Lopes, Renaud, and Nacim Betrouni. 2009. Fractal and multifractal analysis: A review. Medical Image Analysis 13: 634–49. [Google Scholar] [CrossRef] [PubMed]

- López, Juan Luis, and Jesús Guillermo Contreras. 2013. Performance of multifractal detrended fluctuation analysis on short time series. Physical Review E 87: 022918. [Google Scholar] [CrossRef]

- López, Juan Luis, and L. Veleva. 2022. 2d-dfa as a tool for non-destructive characterisation of copper surface exposed to substitute ocean water. Physica A: Statistical Mechanics and Its Applications 586: 126490. [Google Scholar] [CrossRef]

- López, Juan Luis, S. Hernández, A. Urrutia, X. A. López-Cortés, H. Araya, and L. Morales-Salinas. 2021. Effect of missing data on short time series and their application in the characterization of surface temperature by detrended fluctuation analysis. Computers & Geosciences 153: 104794. [Google Scholar] [CrossRef]

- Mandelbrot, Benoit B., and James R. Wallis. 1969. Robustness of the rescaled range R/S in the measurement of noncyclic long run statistical dependence. Water Resources Research 5: 967–88. [Google Scholar] [CrossRef]

- Morales, Raffaello, Tiziana Di Matteo, Ruggero Gramatica, and Tomaso Aste. 2012. Dynamical generalized hurst exponent as a tool to monitor unstable periods in financial time series. Physica A: Statistical Mechanics and Its Applications 391: 3180–89. [Google Scholar] [CrossRef]

- Pastén, Denisse, Víctor Muñoz, Armando Cisternas, José Rogan, and Juan Alejandro Valdivia. 2011. Monofractal and multifractal analysis of the spatial distribution of earthquakes in the central zone of chile. Physical Review E 84: 066123. [Google Scholar] [CrossRef]

- Peng, Chung-Kang, Sergey V. Buldyrev, Shlomo Havlin, M. Simons, H. Eugene Stanley, and Ary L. Goldberger. 1994. Mosaic organization of DNA nucleotides. Physical Review E 49: 1685–89. [Google Scholar] [CrossRef] [PubMed]

- Peters, Edgar E. 1994. Fractal Market Analysis: Applying Chaos Theory to Investment and Economics. Hoboken: John Wiley & Sons, vol. 24. [Google Scholar]

- Quintino, Derick, José Telo da Gama, and Paulo Ferreira. 2021. Cross-correlations in meat prices in brazil: A non-linear approach using different time scales. Economies 9: 133. [Google Scholar] [CrossRef]

- Rodríguez Nava, Abigail, and Francisco Venegas Martínez. 2010. Efectos del tipo de cambio sobre el déficit público: Modelos de simulación monte carlo. Contaduría y Administración 232: 11–40. [Google Scholar] [CrossRef]

- Rossi, Barbara. 2013. Exchange rate predictability. Journal of Economic Literature 51: 1063–19. [Google Scholar] [CrossRef]

- Saâdaoui, Foued. 2023. Skewed multifractal scaling of stock markets during the COVID-19 pandemic. Chaos, Solitons & Fractals 170: 113372. [Google Scholar]

- Shi, Kai, Chun-Qiong Liu, and Nan-Shan Ai. 2009. Monofractal and multifractal approaches in investigating temporal variation of air pollution indexes. Fractals 17: 513–21. [Google Scholar] [CrossRef]

- Shi, Wenbin, Pengjian Shang, Jing Wang, and Aijing Lin. 2014. Multiscale multifractal detrended cross-correlation analysis of financial time series. Physica A: Statistical Mechanics and Its Applications 403: 35–44. [Google Scholar] [CrossRef]

- Soleymani, Fazlollah, and Andrey Itkin. 2019. Pricing foreign exchange options under stochastic volatility and interest rates using an rbf–fd method. Journal of Computational Science 37: 101028. [Google Scholar] [CrossRef]

- Taborda, Alejandra R., Diego Alejandro Murillo, Carolina L Moreno, Paula Andrea R Taborda, Marcela Fuquen, Paula Andrea Díaz, and Darío Londoño. 2022. Análisis de impacto presupuestal de la vacunación contra COVID-19 en américa latina. Revista Panamericana de Salud Pública 46: e5. [Google Scholar] [CrossRef]

- Tan, Delin, and Zheng Chen. 2012. On a general formula of fourth order runge-kutta method. Journal of Mathematical Science & Mathematics Education 7: 1–10. [Google Scholar]

- Tripathi, Bhaskar, and Rakesh Kumar Sharma. 2022. Modeling bitcoin prices using signal processing methods, bayesian optimization, and deep neural networks. Computational Economics 62: 1919–45. [Google Scholar] [CrossRef] [PubMed]

- Vázquez, Sergio Mendoza, Berenice Posada Ramírez, and Jorge Luis Camas Anzueto. 2014. Solución numérica de la ecuación no lineal de schrödinger. Available online: http://somi.ccadet.unam.mx/somi29/memoriassomi29/PDFS/optica/89-EOSOMI-70-89.pdf (accessed on 10 January 2024).

- Vera Moreno, Manuel. 2014. Efectos del potencial sobre la ecuación no lineal de schrödinger. Available online: https://idus.us.es/bitstream/handle/11441/115321/TFG%20DGFyM%20Vera%20Moreno%2C%20Manuel.pdf?sequence=1&isAllowed=y (accessed on 10 January 2024).

- Vukovic, Ognjen. 2015. On the interconnectedness of schrodinger and black-scholes equation. Journal of Applied Mathematics and Physics 3: 1108. [Google Scholar] [CrossRef]

- Wang, Jian, and Wei Shao. 2021. Multifractal analysis with detrending weighted average algorithm of historical volatility. Fractals 29: 2150193. [Google Scholar] [CrossRef]

- Wang, Lei, Provash Kumer Sarker, and Elie Bouri. 2023. Short-and long-term interactions between bitcoin and economic variables: Evidence from the us. Computational Economics 61: 1305–30. [Google Scholar] [CrossRef]

- Wu, Yue, Pengjian Shang, and Yilong Li. 2018. Modified Generalized Multiscale Sample Entropy and Surrogate Data Analysis for Financial Time Series. Berlin/Heidelberg: Springer, vol. 92, pp. 1335–350. [Google Scholar]

- Xu, Yidong, Chunxiang Qian, Lei Pan, Bingbing Wang, and Chi Lou. 2012. Comparing monofractal and multifractal analysis of corrosion damage evolution in reinforcing bars. PLoS ONE 7: e29956. [Google Scholar] [CrossRef]

- Xu, Zhaoyi, Yuqing Zeng, Yangrong Xue, and Shenggang Yang. 2021. Early warning of chinese yuan’s exchange rate fluctuation and value at risk measure using neural network joint optimization algorithm. Computational Economics 60: 1293–315. [Google Scholar] [CrossRef]

- Yan, Zhenya. 2003. Generalized method and its application in the higher-order nonlinear schrodinger equation in nonlinear optical fibres. Chaos, Solitons & Fractals 16: 759–66. [Google Scholar]

- Zapata Garrido, Luis Alberto, and Hugo Fabián Díaz Mojica. 2008. Predicción del tipo de cambio peso-dólar utilizando redes neuronales artificiales (rna). Pensamiento & Gestión 24: 29–42. [Google Scholar]

| Economic Indicators | NLSE Parameters |

|---|---|

| The exchange rate movement | Wave function () |

| The exchange rate at time | Position variable (q) |

| Gross domestic product | Wave number (k) |

| The interest rate | Landau coefficient () |

| The inflation rate | Dissipation () |

| The return rate | Angular frequency () |

| Period | (%) | (%) | (%) | GDP (k) (Billion CLP) |

|---|---|---|---|---|

| August 2021 | 0.0283 | 0.4 | 0.75 | 49,073 |

| September 2021 | 0.0303 | 1.2 | 1.50 | 49,676 |

| October 2021 | 0.0023 | 1.3 | 1.50 | 49,676 |

| November 2021 | 0.0388 | 0.5 | 2.75 | 49,676 |

| December 2021 | 0.0162 | 0.8 | 2.75 | 54,865 |

| January 2022 | −0.0472 | 1.2 | 4.00 | 54,865 |

| February 2022 | −0.0060 | 0.3 | 5.50 | 54,865 |

| March 2022 | −0.0225 | 1.9 | 5.50 | 50,278 |

| April 2022 | 0.0822 | 1.4 | 7.00 | 50,278 |

| May 2022 | −0.0354 | 1.2 | 7.00 | 50,278 |

| June 2022 | 0.1134 | 0.9 | 8.25 | 51,704 |

| July 2022 | −0.0093 | 1.4 | 9.00 | 51,704 |

| August 2022 | −0.0322 | 1.2 | 9.75 | 51,704 |

| Period | RK4 (%) | H = 0.58 (%) |

|---|---|---|

| August 2021 | 1.01 | 1.93 |

| September 2021 | 0.68 | 0.31 |

| October 2021 | 0.76 | 0.52 |

| November 2021 | 1.06 | 0.75 |

| December 2021 | 0.83 | 0.67 |

| January 2022 | 2.50 | 1.42 |

| February 2022 | 1.76 | 1.68 |

| March 2022 | 1.88 | 0.92 |

| April 2022 | 1.89 | 1.47 |

| May 2022 | 2.23 | 1.51 |

| June 2022 | 2.49 | 1.60 |

| July 2022 | 5.24 | 3.98 |

| August 2022 | 1.43 | 1.10 |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2024 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

López, J.L.; Morales-Salinas, D.; Toral-Acosta, D. Using Short Time Series of Monofractal Synthetic Fluctuations to Estimate the Foreign Exchange Rate: The Case of the US Dollar and the Chilean Peso (USD–CLP). Economies 2024, 12, 269. https://doi.org/10.3390/economies12100269

López JL, Morales-Salinas D, Toral-Acosta D. Using Short Time Series of Monofractal Synthetic Fluctuations to Estimate the Foreign Exchange Rate: The Case of the US Dollar and the Chilean Peso (USD–CLP). Economies. 2024; 12(10):269. https://doi.org/10.3390/economies12100269

Chicago/Turabian StyleLópez, Juan L., David Morales-Salinas, and Daniel Toral-Acosta. 2024. "Using Short Time Series of Monofractal Synthetic Fluctuations to Estimate the Foreign Exchange Rate: The Case of the US Dollar and the Chilean Peso (USD–CLP)" Economies 12, no. 10: 269. https://doi.org/10.3390/economies12100269

APA StyleLópez, J. L., Morales-Salinas, D., & Toral-Acosta, D. (2024). Using Short Time Series of Monofractal Synthetic Fluctuations to Estimate the Foreign Exchange Rate: The Case of the US Dollar and the Chilean Peso (USD–CLP). Economies, 12(10), 269. https://doi.org/10.3390/economies12100269