The Role of Greener Innovations in Promoting Financial Inclusion to Achieve Carbon Neutrality: An Integrative Review

Abstract

1. Introduction

2. Literature Review

3. Research Methodology

3.1. Research Questions

- RQ1: What is the research publication trend in this area?

- RQ2:What are the influential articles, authors, most productive journals, most contributing countries, and affiliations in this area?

- RQ3: What is the conceptual structure in this area?

3.2. Search Strategy

- All of the documents are in the English language;

- The time duration for the articles was from 2013 to March 2023;

- All of the documents are from peer-reviewed journals;

- All of the documents are focused on the area of green innovation and financial inclusion;

- The documents are in the short or full version (not an editorial or abstract).

3.3. Data Analysis

4. Results

4.1. Main Information

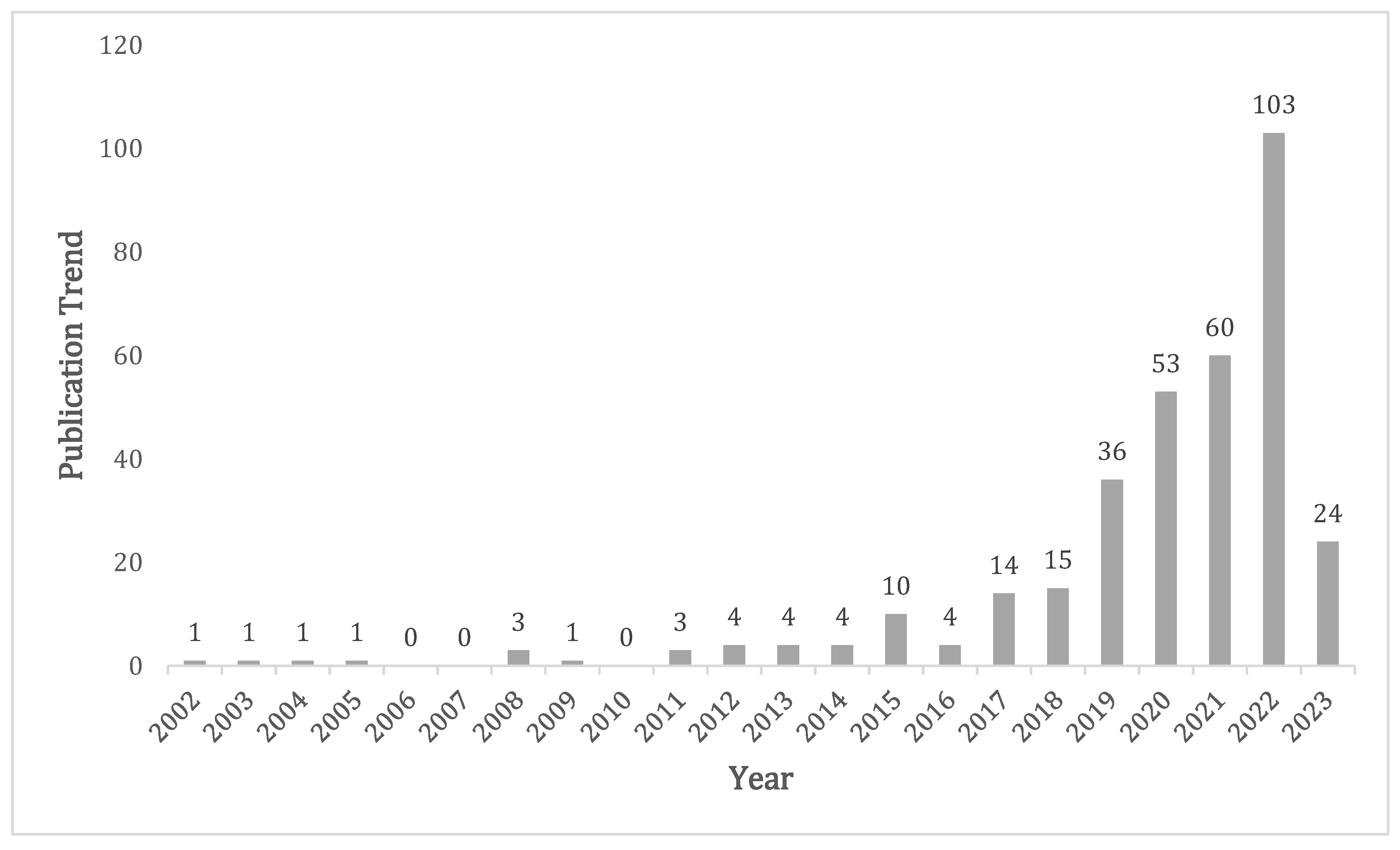

4.2. Year-Wise Publication Progress

4.3. Most Influential Articles

4.4. Most Influential Authors

4.5. Most Productive Journals

4.6. Top Contributing Countries and Affiliations

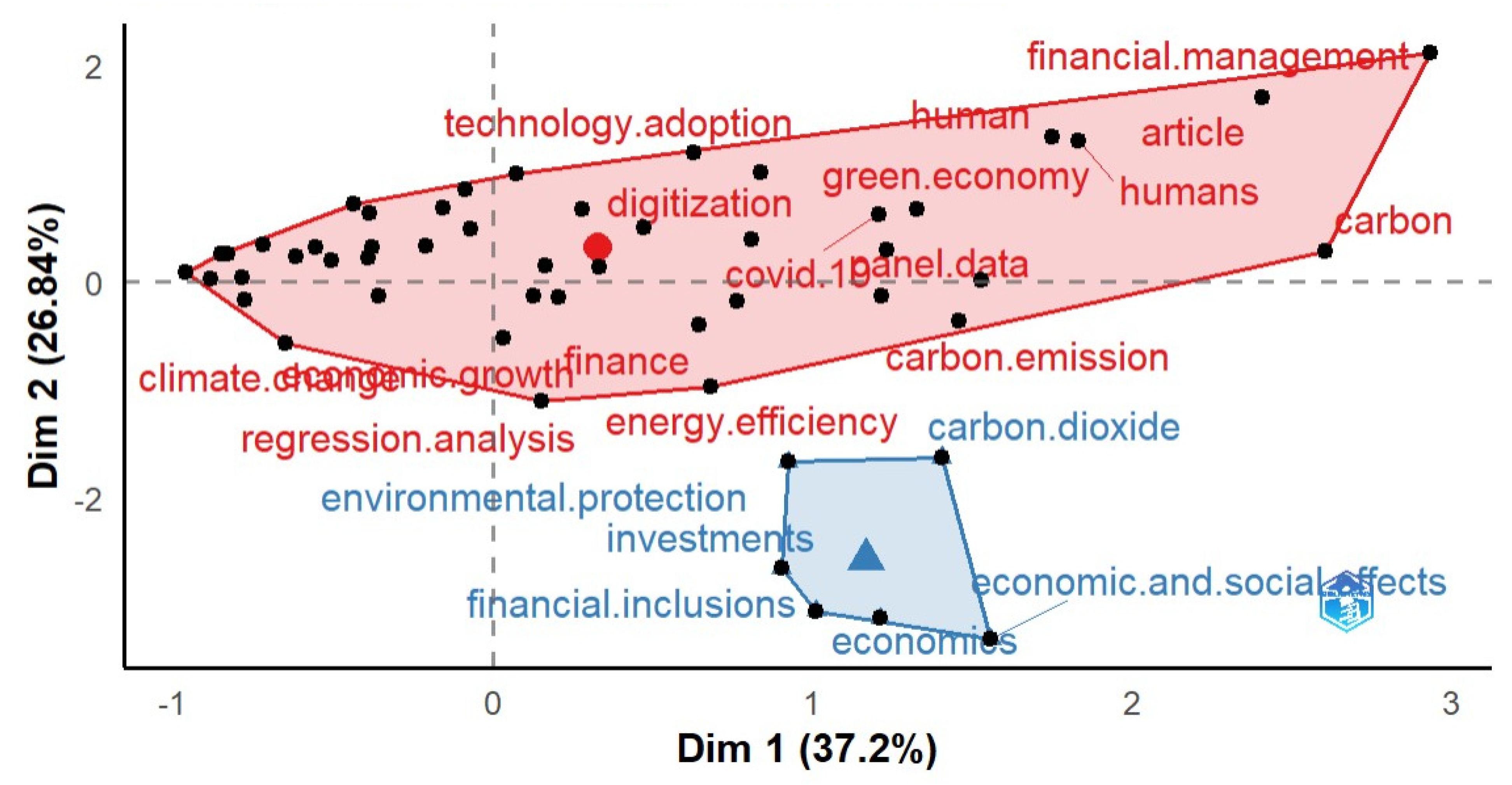

4.7. Conceptual Structure

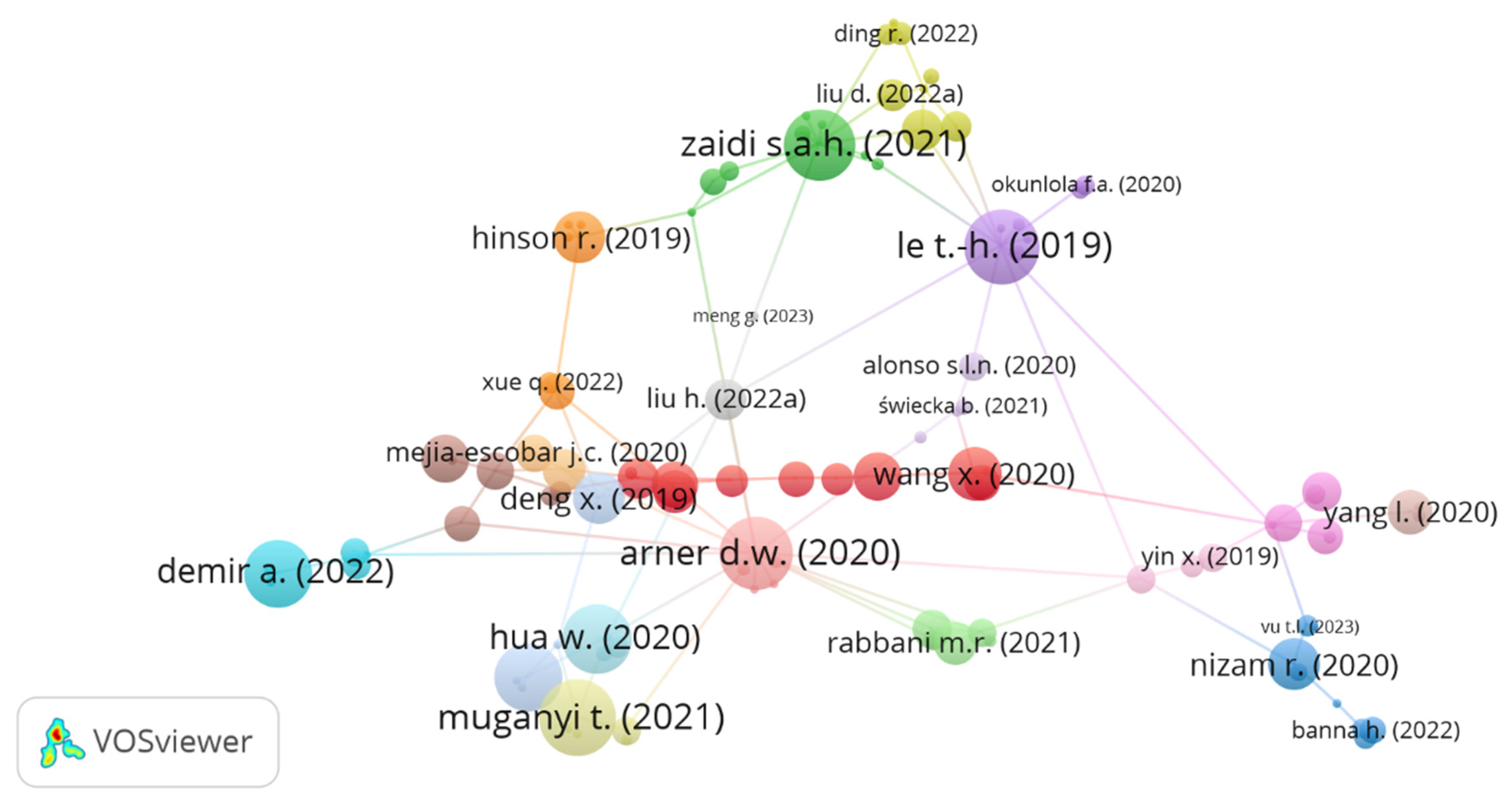

4.8. Citation Analysis

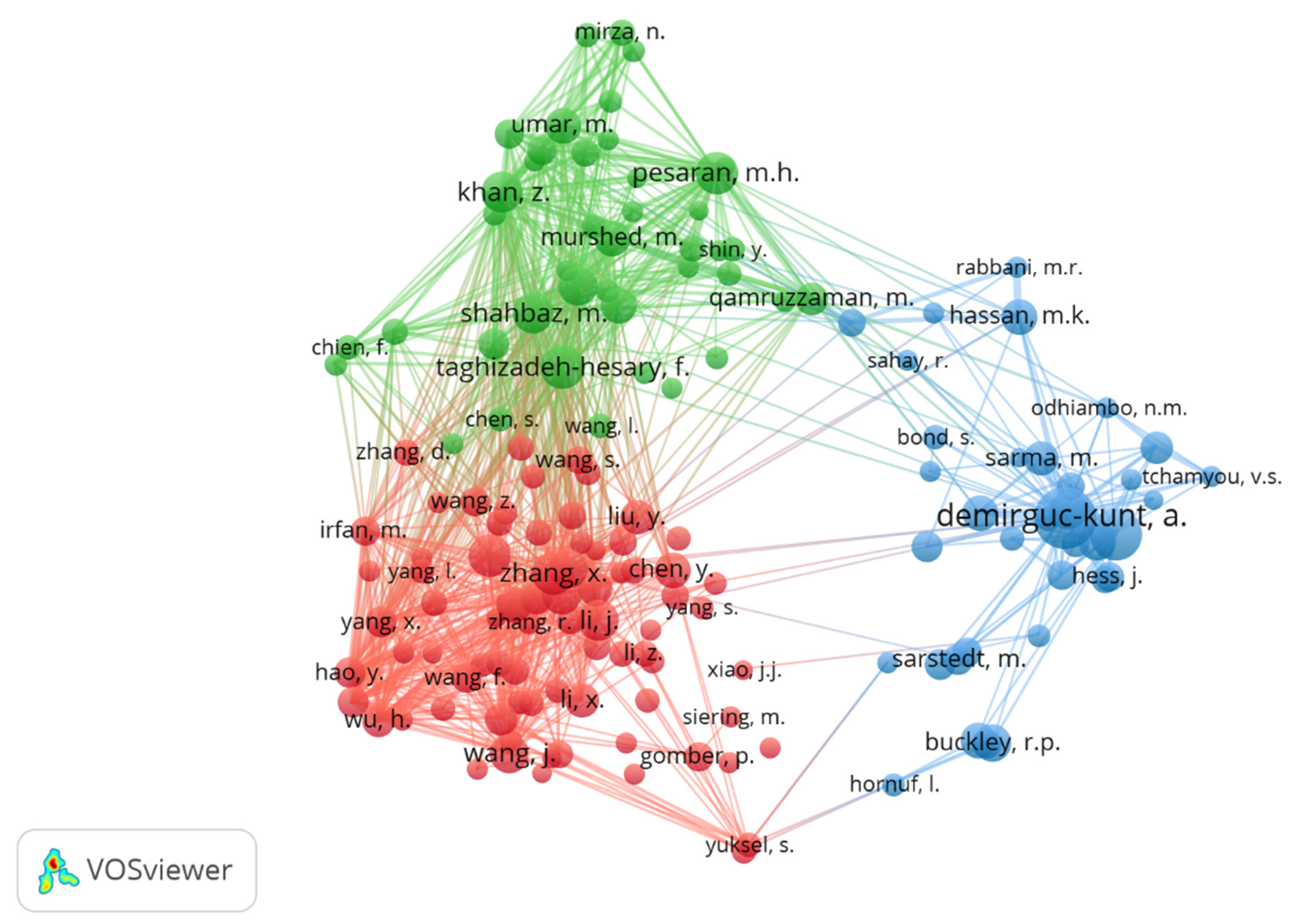

4.9. Co-Citation Analysis

4.10. Most Used Keywords

4.11. Co-Occurrence of Keywords

5. Limitations

6. Conclusions and Policy Implications

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

References

- Ahmad, Mahmood, Zahoor Ahmed, Yang Bai, Guitao Qiao, József Popp, and Judit Oláh. 2022. Financial Inclusion, Technological Innovations, and Environmental Quality: Analyzing the Role of Green Openness. Frontiers in Environmental Science 10: 851263. [Google Scholar] [CrossRef]

- Al-Okaily, Manaf, Abdul Rahman, Farah Shishan, Ahmed Al-Dmour, Rasha Alghazzawi, and Malek Alsharairi. 2021. Sustainable FinTech Innovation Orientation: A Moderated Model. Sustainability 13: 13591. [Google Scholar] [CrossRef]

- Anu, Amit Kumar Singh, Syed Ali Raza, Joanna Nakonieczny, and Umer Shahzad. 2023. Role of financial inclusion, green innovation, and energy efficiency for environmental performance? Evidence from developed and emerging economies in the lens of sustainable development. Structural Change and Economic Dynamics 64: 213–24. [Google Scholar] [CrossRef]

- Arner, Douglas W., Ross P. Buckley, Dirk Andreas Zetzsche, and Robin Veidt. 2019. Sustainability, FinTech and Financial Inclusion. European Business Organization Law Review 21: 7–35. [Google Scholar] [CrossRef]

- Bai, Xiyan, and Chan Lyu. 2023. Executive’s Environmental Protection Background and Corporate Green Innovation: Evidence from China. Sustainability 15: 4154. [Google Scholar] [CrossRef]

- Boyack, Kevin W., and Richard Klavans. 2010. Co-citation analysis, bibliographic coupling, and direct citation: Which citation approach represents the research front most accurately? Journal of the American Society for Information Science and Technology 61: 2389–404. [Google Scholar] [CrossRef]

- Cristina, Chueca Vergara, and Luis Ferruz Agudo. 2021. Fintech and Sustainability: Do They Affect Each Other? Sustainability 13: 7012. [Google Scholar] [CrossRef]

- Deng, Xiang, Zhi Huang, and Xiang Cheng. 2019. FinTech and Sustainable Development: Evidence from China based on P2P Data. Sustainability 11: 6434. [Google Scholar] [CrossRef]

- Dhayal, Karambir Singh, Arun Kumar Giri, Luca Esposito, and Shruti Agrawal. 2023. Mapping the significance of green venture capital for sustainable development: A systematic review and future research agenda. Journal of Cleaner Production 396: 136489. [Google Scholar] [CrossRef]

- Dong, Jiajia, Dou Yue, Jiang Qingzhe, and Zhao Jun. 2022. Can financial inclusion facilitate carbon neutrality in China? The role of energy efficiency. Energy 251: 123922. [Google Scholar] [CrossRef]

- Donthu, Naveen, Kumar Satish, Sureka Riya, and Joshi Rohit. 2021. Research constituents and citation analysis of the Journal of Business and Industrial Marketing (1986–2019). Journal of Business and Industrial Marketing 36: 1435–51. [Google Scholar] [CrossRef]

- Ejaz, Hasan, Hafiz Muhammad Zeeshan, Fahad Ahmad, Syed Nasir Abbas Bukhari, Naeem Anwar, Awadh Alanazi, Awadh Alanazi, Kashaf Junaid, Muhammad Atif, Khalid Omer Abdalla Abosalif, and et al. 2022. Bibliometric Analysis of Publications on the Omicron Variant from 2020 to 2022 in the Scopus Database Using R and VOSviewer. International Journal of Environmental Research and Public Health 19: 12407. [Google Scholar] [CrossRef] [PubMed]

- Ellegaard, Ole, and Johan A. Wallin. 2015. The bibliometric analysis of scholarly production: How great is the impact? Scientometrics 105: 1809–31. [Google Scholar] [CrossRef] [PubMed]

- Farooque, Muhammad, Abraham Zhang, Matthias Thürer, Ting Qu, and Donald Huisingh. 2019. Circular supply chain management: A definition and structured literature review. Journal of Cleaner Production 228: 882–900. [Google Scholar] [CrossRef]

- Feng, Jingchao, Qing Sun, and Sidra Sohail. 2022. Financial inclusion and its influence on renewable energy consumption-environmental performance: The role of ICTs in China. Environmental Science and Pollution Research 29: 52724–31. [Google Scholar] [CrossRef] [PubMed]

- Geng, Zhechen, and Guosheng He. 2021. Digital financial inclusion and sustainable employment: Evidence from countries along the belt and road. Borsa Istanbul Review 21: 307–16. [Google Scholar] [CrossRef]

- Han, Yu, Sara Wennersten, and Maggie P.Y. Lam. 2019. Working the literature harder: What can text mining and bibliometric analysis reveal? Expert Rev Proteomics 16: 871–73. [Google Scholar] [CrossRef]

- Hinson, Robert, Robert Lensink, and Annika Mueller. 2019. Transforming agribusiness in developing countries: SDGs and the role of FinTech. Current Opinion in Environmental Sustainability 41: 1–9. [Google Scholar] [CrossRef]

- IEA. 2021a. Global Energy Review 2021. Paris: IEA. Available online: https://www.iea.org/reports/global-energy-review-2021 (accessed on 22 February 2023).

- IEA. 2021b. Renewables. Paris: IEA. Available online: https://www.iea.org/reports/renewables-2021 (accessed on 22 February 2023).

- IPCC. 2018. Global Warming of 1.5 °C. An IPCC Special Report on the Impacts of Global Warming of 1.5 °C above Pre-Industrial Levels and Related Global Greenhouse Gas Emission Pathways, in the Context of Strengthening the Global Response to the Threat of Climate Change, Sustainable Development, and Efforts to Eradicate Poverty [Masson-Delmotte, V., P. Zhai, H.-O. Pörtner, D. Roberts, J. Skea, P.R. Shukla, A. Pirani, W. Moufouma-Okia, C. Péan, R. Pidcock, S. Connors, J.B.R. Matthews, Y. Chen, X. Zhou, M.I. Gomis, E. Lonnoy, T. Maycock, M. Tignor, and T. Waterfield (eds.)]. in press. Available online: https://www.ipcc.ch/site/assets/uploads/sites/2/2019/06/SR15_Full_Report_Low_Res.pdf (accessed on 26 February 2023).

- IPCC. 2023. Climate Change 2023: Synthesis Report. A Report of the Intergovernmental Panel on Climate Change. Contribution of Working Groups I, II and III to the Sixth Assessment Report of the Intergovernmental Panel on Climate Change. Edited by Core Writing Team, H. Lee and J. Romero. Geneva: IPCC, in press. Available online: https://www.ipcc.ch/report/ar6/syr/resources/how-to-cite-this-report/ (accessed on 26 February 2023).

- Le, Thai-Ha, Anh Tu Chuc, and Farhad Taghizadeh-Hesary. 2019. Financial inclusion and its impact on financial efficiency and sustainability: Empirical evidence from Asia. Borsa Istanbul Review 19: 310–22. [Google Scholar] [CrossRef]

- Le, Thai-Ha, Ha-Chi Le, and Farhad Taghizadeh-Hesary. 2020. Does financial inclusion impact CO2 emissions? Evidence from Asia. Finance Research Letters 34: 101451. [Google Scholar] [CrossRef]

- Li, He, and Juan Lu. 2023. Temperature change and industrial green innovation: Cost increasing or responsibility forcing? Journal of Environmental Management 325: 116492. [Google Scholar] [CrossRef] [PubMed]

- Liu, Hongda, Pinbo Yao, Shahid Latif, Sumaira Aslam, and Nadeem Iqbal. 2022a. Impact of Green financing, FinTech, and financial inclusion on energy efficiency. Environmental Science and Pollution Research 29: 18955–66. [Google Scholar] [CrossRef]

- Liu, Zhen, Trong Lam Vu, Thi Thu Hien Phan, Thanh Quang Ngo, Nguyen Ho Viet Anh, and Ahmad Romadhoni Surya Putra. 2022b. Financial inclusion and green economic performance for energy efficiency finance. Economic Change and Restructuring 55: 2359–89. [Google Scholar] [CrossRef]

- Matute, José, and Lars Linsen. 2022. Evaluating Data-type Heterogeneity in Interactive Visual Analyses with Parallel Axes. Computer Graphics Forum 41: 335–49. [Google Scholar] [CrossRef]

- Mehmood, Usman. 2022. Examining the role of financial inclusion towards CO2 emissions: Presenting the role of renewable energy and globalization in the context of EKC. Environmental Science and Pollution Research 29: 15946–54. [Google Scholar] [CrossRef]

- Muganyi, Tadiwanashe, Linnan Yan, and Hua-ping Sun. 2021. Green finance, fintech and environmental protection: Evidence from China. Environmental Science and Ecotechnology 7: 100107. [Google Scholar] [CrossRef]

- Nassani, Abdelmohsen A., Zahid Yousaf, Magdalena Radulescu, Daniel Balsalobre-Lorente, Hadi Hussain, and Mohamed Haffar. 2023. Green Innovation through Green and Blue Infrastructure Development: Investigation of Pollution Reduction and Green Technology in Emerging Economy. Energies 16: 1944. [Google Scholar] [CrossRef]

- Ozturk, Ilhan, and Sana Ullah. 2022. Does digital financial inclusion matter for economic growth and environmental sustainability in OBRI economies? An empirical analysis. Resources, Conservation and Recycling 185: 106489. [Google Scholar] [CrossRef]

- Paul, Justin, and Mojtaba Barari. 2022. Meta-analysis and traditional systematic literature reviews—What, why, when, where, and how? Psychology & Marketing 39: 1099–115. [Google Scholar] [CrossRef]

- Paul, Justin, Wang Marc Lim, Aron O’Cass, Andy Wei Hao, and Stefano Bresciani. 2021. Scientific procedures and rationales for systematic literature reviews (SPAR-4-SLR). International Journal of Consumer Studies 45: O1–O16. [Google Scholar] [CrossRef]

- Pizzi, Simone, Leonardo Corbo, and Andrea Caputo. 2021. Fintech and SMEs sustainable business models: Reflections and considerations for a circular economy. Journal of Cleaner Production 281: 125217. [Google Scholar] [CrossRef]

- Puschmann, Thomas, Christian Hugo Hoffmann, and Valentyn Khmarskyi. 2020. How Green FinTech Can Alleviate the Impact of Climate Change—The Case of Switzerland. Sustainability 12: 10691. [Google Scholar] [CrossRef]

- Qin, Lingui, Syed Raheem, Muntasis Murshed, Xu Miao, Zeeshan Khan, and Dervis Kirikkaleli. 2021. Does financial inclusion limit carbon dioxide emissions? Analyzing the role of globalization and renewable electricity output. Sustainable Development 29: 1138–54. [Google Scholar] [CrossRef]

- Shahbaz, Muhammad, Jiaman Li, Xiucheng Dong, and Kangyin Dong. 2022. How financial inclusion affects the collaborative reduction of pollutant and carbon emissions: The case of China. Energy Economics 107: 105847. [Google Scholar] [CrossRef]

- Stern, Nicholas, and Anna Valero. 2021. Innovation, growth and the transition to net-zero emissions. Research Policy 50: 104293. [Google Scholar] [CrossRef]

- Takalo, Salim Karimi, Hussein Sayyadi Tooranloo, and Zahra Shahabaldini Parizi. 2021. Green innovation: A systematic literature review. Journal of Cleaner Production 279: 122474. [Google Scholar] [CrossRef]

- Tsay, Ming-Yueh. 2009. Citation analysis of Ted Nelson’s works and his influence on hypertext concept. Scientometrics 79: 451–72. [Google Scholar] [CrossRef]

- United Nations Environment Programme. 2022. Emissions Gap Report 2022: The Closing Window—Climate Crisis Calls for Rapid Transformation of Societies. Nairobi. Available online: https://www.unep.org/emissions-gap-report-2022 (accessed on 13 March 2023).

- Usman, Muhammad, Muhammad Sohail Amjad Makhdum, and Rakhshanda Kousar. 2021. Does financial inclusion, renewable and non-renewable energy utilization accelerate ecological footprints and economic growth? Fresh evidence from 15 highest emitting countries. Sustainable Cities and Society 65: 102590. [Google Scholar] [CrossRef]

- Wang, Quan-Jing, Hai-Jie Wang, and Chun-Ping Chang. 2022. Environmental performance, green finance and green innovation: What’s the long-run relationships among variables? Energy Economics 110: 106004. [Google Scholar] [CrossRef]

- Xue, Long, and Xuemang Zhang. 2022. Can Digital Financial Inclusion Promote Green Innovation in Heavily Polluting Companies? International Journal of Environmental Research and Public Health 19: 7323. [Google Scholar] [CrossRef]

- Yao, Liming, Shiqi Tan, and Zhongwen Xu. 2023. Towards carbon neutrality: What has been done and what needs to be done for carbon emission reduction? Environmental Science and Pollution Research 30: 20570–89. [Google Scholar] [CrossRef] [PubMed]

- Yousaf, Zahid. 2021. Go for green: Green innovation through green dynamic capabilities: Accessing the mediating role of green practices and green value co-creation. Environmental Science and Pollution Research 28: 54863–75. [Google Scholar] [CrossRef]

- Yu, Minli, Fu-Sheng Tsai, Hui Jin, and Hejie Zhang. 2022. Digital finance and renewable energy consumption: Evidence from China. Financial Innovation 8: 58. [Google Scholar] [CrossRef]

- Zaidi, Syed Anees Haider, Muzzammi Hussain, and Qamar Uz Zaman. 2021. Dynamic linkages between financial inclusion and carbon emissions: Evidence from selected OECD countries. Resources, Environment and Sustainability 4: 100022. [Google Scholar] [CrossRef]

- Zhai, Yuming, Zhenghuan Cai, Han Lin, Ming Yuan, Ye Mao, and Mingchuan Yu. 2022. Does better environmental, social, and governance induce better corporate green innovation: The mediating role of financing constraints. Corporate Social Responsibility and Environmental Management 29: 1513–26. [Google Scholar] [CrossRef]

- Zhou, Guangyou, Jieyu Zhu, and Sumei Luo. 2022. The impact of fintech innovation on green growth in China: Mediating effect of green finance. Ecological Economics 193: 107308. [Google Scholar] [CrossRef]

| Database | Scopus |

|---|---|

| Keywords | “Financial Inclusion” OR “Fintech” OR “Green Fintech” OR “Digital Financial Inclusion” OR “Green Financial Inclusion” OR “Digital Finance” OR “Digital Payment” AND “Green Finance” OR “Green Innovation” OR “Sustainable” OR “Carbon Neutrality” OR “Renewable Energy” OR “Climate Change” OR “Energy Efficiency” OR “Sustainable Development” OR “Carbon Dioxide” |

| Timespan | 2013 to 2023 (until March) |

| Main Information about Data | |

|---|---|

| Timespan | 2013 to 2023 |

| Sources | 113 |

| Total number of publications | 290 |

| Annual growth rate % | 38.52 |

| Document average age | 1.85 |

| Average citations per doc | 10.05 |

| References | 18,655 |

| Document Information | |

| Keywords plus (ID) | 742 |

| Author’s keywords (DE) | 940 |

| Article | 272 |

| Review | 18 |

| Author information | |

| Authors | 833 |

| Authors of single-authored docs | 30 |

| Single-authored docs | 32 |

| Co-authors per doc | 3.27 |

| International co-authorships % | 29.31 |

| No. | Authors | Title | Year | Journal | TC |

|---|---|---|---|---|---|

| 1 | (Usman et al. 2021) | Do financial inclusion, renewable and non-renewable energy utilization accelerate ecological footprints and economic growth? Fresh evidence from 15 highest emitting countries | 2021 | Sustainable Cities and Society | 246 |

| 2 | (Le et al. 2020) | Does financial inclusion impact CO2 emissions? Evidence from Asia | 2020 | Finance Research Letters | 200 |

| 3 | (Muganyi et al. 2021) | Green finance, fintech and environmental protection: Evidence from China | 2021 | Environmental Science and Ecotechnology | 94 |

| 4 | (Le et al. 2019) | Financial inclusion and its impact on financial efficiency and sustainability: Empirical evidence from Asia | 2019 | Borsa Istanbul Review | 92 |

| 5 | (Zaidi et al. 2021) | Dynamic linkages between financial inclusion and carbon emissions: Evidence from selected OECD countries | 2021 | Resources, Environment and Sustainability | 90 |

| 6 | (Arner et al. 2019) | Sustainability, FinTech and Financial Inclusion | 2019 | European Business Organization Law Review | 86 |

| 7 | (Ozturk and Ullah 2022) | Does digital financial inclusion matter for economic growth and environmental sustainability in OBRI economies? An empirical analysis | 2022 | Resources, Conservation and Recycling | 70 |

| 8 | (Zhou et al. 2022) | The impact of fintech innovation on green growth in China: Mediating effect of green finance | 2022 | Ecological Economics | 72 |

| 9 | (Pizzi et al. 2021) | Fintech and SME sustainable business models: Reflections and considerations for a circular economy | 2021 | Journal of Cleaner Production | 66 |

| 10 | (Shahbaz et al. 2022) | How financial inclusion affects the collaborative reduction of pollutant and carbon emissions: The case of China | 2022 | Energy Economics | 60 |

| 11 | (Qin et al. 2021) | Does financial inclusion limit carbon dioxide emissions? Analyzing the role of globalization and renewable electricity output | 2021 | Sustainable Development | 54 |

| 12 | (Mehmood 2022) | Examining the role of financial inclusion towards CO2 emissions: presenting the role of renewable energy and globalization in the context of EKC | 2022 | Environmental Science and Pollution Research volume | 54 |

| 13 | (Hinson et al. 2019) | Transforming agribusiness in developing countries: SDGs and the role of FinTech | 2019 | Current Opinion in Environmental Sustainability | 46 |

| 14 | (Deng et al. 2019) | FinTech and sustainable development: Evidence from China based on P2P data | 2019 | Sustainability | 44 |

| 15 | (Ahmad et al. 2022) | Financial Inclusion, Technological Innovations, and Environmental Quality: Analyzing the Role of Green Openness | 2022 | Frontiers in Environmental Science | 37 |

| 16 | (Cristina and Agudo 2021) | Fintech and sustainability: Do they affect each other? | 2021 | Sustainability | 35 |

| 17 | (Liu et al. 2022a) | Impact of Green financing, FinTech, and financial inclusion on energy efficiency | 2022 | Environmental Science and Pollution Research | 30 |

| 18 | (Geng and He 2021) | Digital financial inclusion and sustainable employment: Evidence from countries along the belt and road | 2021 | Borsa Istanbul Review | 26 |

| 19 | (Puschmann et al. 2020) | How green fintech can alleviate the impact of climate change—The case of Switzerland | 2020 | Sustainability | 21 |

| 20 | (Dong et al. 2022) | Can financial inclusion facilitate carbon neutrality in China? The role of energy efficiency | 2022 | Energy | 15 |

| 21 | (Liu et al. 2022b) | Financial inclusion and green economic performance for energy efficiency finance | 2022 | Economic Change and Restructuring | 14 |

| 22 | (Yu et al. 2022) | Digital finance and renewable energy consumption: evidence from China | 2022 | Financial Innovation | 14 |

| 23 | (Al-Okaily et al. 2021) | Sustainable fintech innovation orientation: A moderated model | 2021 | Sustainability | 12 |

| 24 | (Feng et al. 2022) | Financial inclusion and its influence on renewable energy consumption-environmental performance: the role of ICTs in China | 2022 | Environmental Science and Pollution Research | 12 |

| Author | TP | TC |

|---|---|---|

| Banna H. | 4 | 27 |

| Sun H. | 4 | 27 |

| Wang Y. | 4 | 27 |

| Alam Mr. | 3 | 18 |

| Babajide AA. | 3 | 32 |

| Du M. | 3 | 04 |

| Jorge-vazquez J. | 3 | 40 |

| Li Y. | 3 | 05 |

| Liu Y. | 3 | 06 |

| Moro-visconti R. | 3 | 03 |

| Source | TP | h_index | g_index | TC | PY_start |

|---|---|---|---|---|---|

| Sustainability (Switzerland) | 85 | 20 | 27 | 962 | 2018 |

| Frontiers in Environmental Science | 21 | 4 | 7 | 70 | 2022 |

| Economic Research-ekonomskaistrazivanja | 11 | 5 | 8 | 80 | 2020 |

| Environmental Science and Pollution Research | 10 | 7 | 10 | 130 | 2022 |

| International Journal of Environmental Research and Public Health | 9 | 4 | 6 | 37 | 2021 |

| Journal of Open Innovation: Technology, Market, and Complexity | 6 | 5 | 6 | 103 | 2021 |

| Financial Innovation | 5 | 4 | 5 | 63 | 2018 |

| Journal of Islamic Monetary Economics and Finance | 5 | 3 | 5 | 38 | 2019 |

| International Journal of Economics and Business Administration | 3 | 3 | 3 | 15 | 2019 |

| Review of Development Economics | 3 | 3 | 3 | 10 | 2020 |

| Country | TC | Affiliation | TC |

|---|---|---|---|

| China | 708 | University of Kinshasa | 17 |

| United Kingdom | 297 | Covenant University | 15 |

| Spain | 147 | Shandong University of Technology | 11 |

| Pakistan | 146 | Liaoning University | 10 |

| Hong Kong | 122 | Wuhan University | 8 |

| Hungary | 119 | Beijing Technology and Business University | 7 |

| Malaysia | 82 | Catholic University of Avila | 7 |

| Japan | 81 | China University of Mining and Technology | 7 |

| South Africa | 76 | Hunan University | 7 |

| Korea | 73 | Northwest A&F University | 7 |

| Most Frequent Words | |||

|---|---|---|---|

| Words | Occurrences | Words | Occurrences |

| China | 65 | Economic growth | 20 |

| Sustainable development | 65 | Energy efficiency | 20 |

| Sustainability | 50 | Sustainable development goal | 17 |

| Economic development | 48 | Carbon emission | 15 |

| Financial system | 33 | Financial market | 14 |

| Finance | 32 | Digitization | 13 |

| Financial services | 27 | Carbon | 11 |

| Innovation | 25 | COVID-19 | 11 |

| Banking | 23 | Panel data | 11 |

| Carbon dioxide | 20 | Developing world | 10 |

| Keywords | Co-Occurrence |

|---|---|

| Financial inclusion | 101 |

| Fintech | 91 |

| Sustainable development | 85 |

| Sustainability | 72 |

| Digital finance | 66 |

| Sustainable development goals | 54 |

| Financial technology | 52 |

| Economic growth | 46 |

| Digital financial inclusion | 44 |

| Poverty | 39 |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2023 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Brahmi, M.; Esposito, L.; Parziale, A.; Dhayal, K.S.; Agrawal, S.; Giri, A.K.; Loan, N.T. The Role of Greener Innovations in Promoting Financial Inclusion to Achieve Carbon Neutrality: An Integrative Review. Economies 2023, 11, 194. https://doi.org/10.3390/economies11070194

Brahmi M, Esposito L, Parziale A, Dhayal KS, Agrawal S, Giri AK, Loan NT. The Role of Greener Innovations in Promoting Financial Inclusion to Achieve Carbon Neutrality: An Integrative Review. Economies. 2023; 11(7):194. https://doi.org/10.3390/economies11070194

Chicago/Turabian StyleBrahmi, Mohsen, Luca Esposito, Anna Parziale, Karambir Singh Dhayal, Shruti Agrawal, Arun Kumar Giri, and Nguyen Thi Loan. 2023. "The Role of Greener Innovations in Promoting Financial Inclusion to Achieve Carbon Neutrality: An Integrative Review" Economies 11, no. 7: 194. https://doi.org/10.3390/economies11070194

APA StyleBrahmi, M., Esposito, L., Parziale, A., Dhayal, K. S., Agrawal, S., Giri, A. K., & Loan, N. T. (2023). The Role of Greener Innovations in Promoting Financial Inclusion to Achieve Carbon Neutrality: An Integrative Review. Economies, 11(7), 194. https://doi.org/10.3390/economies11070194