Abstract

This paper investigates the macroeconomic determinants of global bilateral remittance flows. Unlike existing studies, which have been often hampered by the lack of comprehensive and large-enough datasets, we use data originally covering 214 countries over the 2010–2017 period. We employ a gravity-model approach to explore the role played by dyadic and country-specific covariates in explaining remittances. We find that remittance flows are robustly and strongly impacted by size effects (i.e., number of migrants in the host country and population at home), transaction costs, common social, political, and cultural ties, output growth rate, and financial development at home. We also document the existence of a robust non-linear relationship between per capita income at home and remittance flows, both in the aggregate and across income groups.

1. Introduction

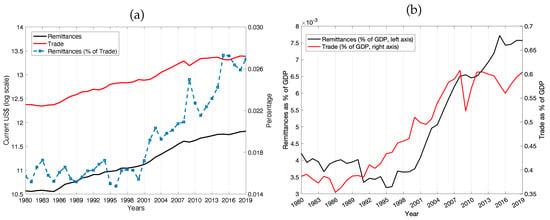

Recent years have witnessed a spectacular increase in worldwide remittance flows1. As portrayed in Figure 1, panel (a), aggregate remittance flows have been steadily growing, in nominal terms, from USD 37 to around 550 billion (current) over the 1980–2019 period, which, in real terms, is equivalent to a six-fold increase. Furthermore, global remittances grew at a higher pace than merchandise trade, as documented by an almost doubled remittance/trade ratio. In the same period, the share of remittances to world GDP increased by 80%, as compared to a 55% rise in the trade-to-GDP ratio—see panel (b)2. Such an exponential surge in global remittances can only be partly explained by the increase in the number of (official) international migrants, which between 1980 and 2019 climbed from about 102 million to 270 million3.

Figure 1.

Aggregate flows of international remittances. (a): Aggregate world remittance and trade flows (current USD). (b): Remittances and trade as a percentage of world GDP. Source: Authors’ calculation based on World Bank WDI data.

For many countries, especially low- and middle-income ones, remittance inflows have surpassed official development aid (ODA) as well as foreign direct investment (FDI), becoming their largest source of foreign exchange earnings. Overall, remittances make up a share of the country GDP ranging between 5 and 40 percent, which for some recipients is much larger than their export-to-GDP ratio4.

Therefore, it comes as no surprise that remittances may have an extremely relevant impact on home-country economies, e.g., in alleviating poverty and contributing to development (Hagen-Zanker and Siegel 2007; Yang 2011). Remittances can indeed raise consumption and/or investment and play a crucial role in income smoothing, hence acting as an automatic stabilizer. However, they may also amplify the business cycle and thus destabilize economic activity (Cooray and Mallick 2013).

Since the seminal paper by Lucas and Stark (1985), several theoretical models have been laid out to explore the determinants underlying individual migrant remittance behaviors (Rapoport and Docquier 2006). A wide spectrum of micro-motives behind the reasons why migrants remit (and how much) have been investigated, ranging between the two extremes of pure altruism and self-interest, but also including tempered forms of altruism and strategic motivations (Carling 2008). These models have been taken to the data mostly using two approaches. First, remittance determinants have been tested at the micro-level, focusing on single-country analyses and using household surveys5. Second, the macroeconomic drivers of aggregate remittances have been explored, employing panel data techniques, where the observational unit is a country and data come from balance-of-payments statistics across the years6.

Another, albeit less common, stream of literature has exploited the inherent sending–receiving nature of aggregate remittance flows, fitting panel gravity models to bilateral (origin–destination) remittance flows7. A gravity-model approach to remittances has some value added as compared to panel-based econometric models. These include the possibility (i) to take into account separately home vs. host country-specific characteristics, therefore, proxying country masses and frictions, which may limit the volume of remittances due to transaction costs; (ii) to combine a microeconomic foundation with macroeconomic data, since a gravity-like relation emerges from simple micro-founded theoretical models (McCracken et al. 2017; Rapoport and Docquier 2006; Schiopu and Siegfried 2006). This last feature is particularly important, as sign predictions coming from the theory can be tested using real-world data.

However, existing gravity-based attempts to study international remittance flows have often been hampered by the lack of comprehensive and large-enough datasets. This has resulted in insufficient coverage for either the cross-sectional dimension (e.g., countries) or for the longitudinal one (e.g., years), or both.

In this paper, we attempt to overcome this limitation by fitting a panel gravity model to the “World Bank Migration and Remittance” database (Ratha and Shaw 2007). This repository originally contains estimates for international remittance flows from 214 sending (host) countries to 214 receiving (home) countries during the years 2010–2017. Unlike existing studies, the data we employ define a balanced “squared” panel, with all country pairs featured in each year, which may improve the robustness of the coefficient estimates. Obviously, some covariate may present missing values over different years, origins, and destinations, which may result in an unbalanced sample estimate. Nevertheless, we are able to fit our gravity model to a high number of remittance flows, covering a set of host and home countries which is generally larger than those employed so far in the literature (cf., Table A5 in the Appendix D)8. At the same time, the wide cross-sectional country coverage allows one to address the question of whether the estimated covariate elasticities differ among host/home country subgroups, e.g., if the determinants of remittance flows from rich or middle-income countries to poor ones are different from those underlying remittance flows in the whole sample.

Furthermore, we contribute to the literature employing gravity models to explain the macroeconomic determinants of bilateral international remittance flows in three additional dimensions. First, unlike most of the existing papers9, we explicitly deal with the zero-flow issue (Santos Silva and Tenreyro 2006), comparing results from OLS and Poisson pseudo-maximum likelihood (PPML) estimators. Second, we flexibly employ different sets of fixed effects (FEs), playing with alternative combinations of host/home and time FEs, so as to possibly mitigate omitted-variable biases. Finally, we test for non-linearities in the relation between income at home and remittance flows, to better explore the interplay between altruistic and self-interested motives.

Regression exercises, robustly across alternative specifications, document a strong size effect on remittances, as proxied by the number of migrants in the host country and population at home. Furthermore, remittances are impacted worldwide by bilateral frictions (i.e., transaction costs, common social, political, and cultural ties). Furthermore, we find that migrants at destination remit more the larger the growth rate and financial development at home. We also detect a robust non-linear relationship between per capita income at home and remittance flows, both in the aggregate and across income groups. In the whole sample, a U-shaped relationship emerges, suggesting that migrant behaviors seem to be driven by the desire to help relatives at home to deal with poverty and adverse shocks when per capita GDP at the destination is small (i.e., an altruistic motive, cf., Lucas and Stark 1985). Conversely, the association between income at home and remittances sent from middle-income/rich nations to poor countries follows an inverted U-shaped, in line with studies focusing on private transfers in less-developed countries (Cox et al. 1998).

The rest of the paper is organized as follows. Section 2 briefly discusses some theoretical background and existing papers dealing with a gravity-model perspective to the study of remittance flow determinants. Section 3 sets out our empirical strategy. In Section 4 we describe the data and methods employed. Section 5 presents our main results and reports on robustness checks. Finally, Section 6 presents our conclusions.

2. Theoretical Background and Related Literature

Disentangling the economic motivations behind migrants’ decisions about if and how much to remit is not an easy task. Indeed remitting involves a large number of possible interacting determinants, having to do not only with the individual preferences and behavioral attitudes of the migrant, but also with economic, social, and political factors both at home and in the host country.

Since the seminal work by Lucas and Stark (1985), several theories have been proposed to fill the gap between two extreme views of migrant remittance behavior (see Yang 2011 and references therein). The first view considers remittances as driven by a purely altruistic motive, fueled by the migrant’s desire to allow relatives back home to cope with poverty and adverse shocks. The second one models remittance behavior as stemming from a self-interested individual who only cares about their return to the community they left, and, therefore, remits to increase the likelihood to inherit and/or to buy assets at home. Migrants can however decide to remit because of reasons somewhat in between those two opposite motivations (Carling 2008; Hagen-Zanker and Siegel 2007), i.e., driven by a sort of tempered altruistic behavior, wherein migration provides mutual benefits for both the migrant and the family at home. In this framework, remitting can be the consequence of a sort of implicit contractual arrangement, whose motives include loan repayment (i.e., whenever migrants borrow money from their families to cover migration-related costs), exchange (e.g., compensation for child care provided to the migrant by recipients at home), and co-insurance (e.g., when negative shocks occur at home or when the migrant loses their job in the host country). Furthermore, the decision to remit can be induced by purely strategic motives Stark and Wang (2002), e.g., if skilled migrants have an incentive to send money back home to avoid further immigration of skilled workers, which might depress wages for skilled jobs.

Trying to empirically discriminate between these competing theories is not always possible. This is because, especially at the micro-level, alternative theories often predict similar signs as to the effect of covariates in econometric models explaining remittances. In addition, poor data quality may prevent the design of an appropriate testing strategy (Rapoport and Docquier 2006). In fact, at the macro-level, the lack of high-quality data has been the major hurdle faced by researchers attempting to assess the relative importance of aggregate determinants of country remittance flows.

This is true in particular in the case of the dependent variable not being aggregate country (sent or received) remittances, but aiming at explaining bilateral international remittance flows between pairs of countries using a gravity-model approach. Such a framework is particularly appealing if the researcher aims at assessing the macroeconomic determinants of remittances. Indeed, remittance flows at the macro-level have an intrinsic sender–receiver essence. Therefore, they naturally lend themselves to a modeling setup where flows are explained using separate origin and destination characteristics, as well as features related to the dyadic interaction between host and home country, capturing the role of frictions induced by transaction costs. More importantly, a gravity specification for remittance flows emerges as the equilibrium prediction of a two-period model where migrants care about consumption and invest in a host country safe asset as well as in a home country risky asset (McCracken et al. 2017; Rapoport and Docquier 2006; Schiopu and Siegfried 2006). This allows one to derive precise implications about the expected sign of remittance macroeconomic drivers, stemming from microeconomic assumptions about altruistic vs. self-interested migrant behaviors. For example, the model predicts that, if migrants are sufficiently altruistic10, remittances to relatives in the home country should decrease the larger the income at the destination (net of that in the origin).

Existing empirical evidence stemming from gravity-model exercises about the role of macroeconomic determinants of remittances is nevertheless not conclusive (cf., Table A5 in the Appendix D). Indeed, the availability of good-quality datasets featuring, for a large set of country pairs and years, all bilateral remittance flows has always been extremely poor, hence limiting the scope of applied analyses in this field. As we show in the Appendix D (Table A5), existing works using remittance gravity models (RGMs)11 have usually focused on a limited number of sending and receiving countries (in the range of 16–89 and 7–75) observed for a short number of years, which is typically inversely related to the country sample size used in the analysis. Furthermore, the panel structure is often strongly unbalanced: the set of sending countries never coincides with that of the receiving ones, implying a rectangular dataset. This implies that one may not correctly evaluate the impact of country-specific determinants in the two-way remittance relationship between any two countries in the sample (we shall come back to this issue in Section 5.3).

Furthermore, sign predictions are indeed often contrasting and sometimes uncertain. For instance, the impact of economic conditions at home (i.e., country income, GDP growth, etc.), as well as that of transaction costs (as modeled using geographical distance and traditional gravity dyadic relations), may be biased and highly sensitive to the FE specification, the treatment of zero flows, and the presence of endogeneity. Additionally, the sample of countries included in the analysis—either as sending or receiving—greatly varies across exiting studies. Even in Ahmed et al. (2021), who employ the “World Bank Migration and Remittance” database as in the present work, only the most important migration corridors are considered12.

In addition to heterogeneity in country sample size and composition, there are further issues limiting the comparability of results (and their robustness) across existing RGM works. First, all studies but Docquier et al. (2012) apply an OLS estimator only, thus excluding ex-ante the possibility of dealing with zero-remittance flows. It is well known that, under heteroskedasticity, this may imply biased estimates of the true elasticities (Santos Silva and Tenreyro 2006). Second, existing papers employ different assumptions as to the set of sending–receiving countries and time FEs13. As discussed at length in Anderson and van Wincoop (2003), failing to properly control for cross-sectional and time-varying origin–destination heterogeneity may lead to strong unobserved-variable biases.

3. Empirical Strategy

In our exercises, we instead explicitly address both the zero-flow and cross-sectional/time-varying origin–destination heterogeneity issues. Firstly, we check the robustness of our OLS estimates against those obtained via a PPML estimator, which explicitly includes zero flows in the estimation. Secondly, we experiment with different assumptions as to FEs employed in the regressions (more on that in Section 4). More specifically, we employ both a structural specification (where only bilateral country variables are included together with origin-time and destination-time FEs) and a less stringent one, where variation in the host country is controlled by origin-time FEs, while at home we employ time-invariant destination FEs and a battery of time-varying observable characteristics.

Furthermore, in order to tackle the small sample size and composition issues, here, we use data from the “World Bank Migration and Remittance” database, originally reporting estimates for international remittance bilateral flows from 214 sending (host) countries to 214 receiving (home) countries for the years 2010–2017. As discussed in more details below, we are eventually able to retain 176 countries in our regression analyses, after removing those that never remit nor receive and for which some covariates are missing. Therefore, we still cover most remittance flows in the world in a squared panel, i.e., all incoming and outgoing (zero or positive) remittance flows are present in the dataset in each year (see Table A3 in the Appendix C and cf., the discussion in Section 5.3). Despite World Bank data not being empirically observed but coming from estimates, this is, to the best of our knowledge, the best choice if one aims at a large country coverage for a sufficiently long number of years—we shall come back to this point in Section 6. It is worth noting that our enlarged country sample size allows us to run separate gravity regressions, where sending vs. receiving countries belong to subgroups defined according to their income (i.e., high, middle and low income), and, therefore, to assess how the aggregate drivers of remittances change depending on the development levels of the home and host countries. Finally, we run a set of robustness checks to explore for potential sources of bias in our estimates.

As mentioned, we aim at reassessing in a more robust way the role of macroeconomic drivers of international remittance flows. In our RGM approach, we control for three types of covariates, net of various combinations of origin country (i), destination country (j), and year (t) FEs. The first of these is the stock of migrants in the host country, which varies across origins and destinations of remittance flows (i.e., respectively, migrant host and home countries) and time (i.e., over the triplet). In line with the existing literature (Freund and Spatafora 2008), we expect remittances to increase with the stock of migrants in the host country (“number of migrants” hereafter), due to a sheer size effect14.

The second family of covariates are time invariant and vary across pairs of countries (i.e., across the dyad). These include geographical distance, contiguity, and typical gravity-model bilateral dummies capturing ties between home and host countries (i.e., common language, and religion, as well as the existence of any former colonial relationship). Remittances are expected to decrease with distance and increase if the host and home countries share a border, as they both proxy transaction costs15. The impact of contiguity may, however, be negative if, net of geographical distance, sharing a border enhances informal remittances and discourages formal ones, as travel costs are lower and migrants find it easier to remit by unofficially transferring money across borders (Lueth and Ruiz-Arranz 2006). We also expect holding ties with the host country to boost remittances. Indeed, migrants already speaking the host country’s language or sharing the same religion may be more integrated in the new society and, hence, they may more easily get a job. Similarly, a common past of colonial relationships typically implies some degree of institutional similarity and political ties between home and host countries. This may facilitate migration towards the former colonizer and subsequent integration.

The third class of potential remittance determinants includes origin and destination country-specific factors, which vary both across countries and time (along the and/or dimensions). More specifically, we focus on covariates proxying for country economic conditions (i.e., per capita GDP and GDP growth), size effects (i.e., population), agriculture (i.e., share of rural population), education (i.e., expenditure share of education over GDP and enrollment rate), and efficiency of financial institutions (as proxied by the share of bank branches)16. Net of host country and other destination covariates, we expect remittances to increase (i) the larger the population size at home (as, net of the number of migrants at the origin, the greater will be the basin of potential recipients)17; (ii) the larger the share of home rural population and education level, as this may reflect loan repayment or exchange motives, and more generally that remittances are used for investment purposes rather than to boost consumption; cf., see Hagen-Zanker and Siegel (2007); Yang (2011)18; (iii) the more developed the financial system is at the destination, because this eases formal money transfers both at home and in the host country (Giuliano and Ruiz-Arranz 2009); and (iv) the lower the home GDP growth rate, as it may be correlated with a less dynamic economic environment at home and, therefore, may proxy for sender–receiver differences in the business cycles (Kakhkharov et al. 2017).

The impact of per capita GDP (as a proxy for income) on remittances is less straightforward. Given the host country income, we expect that, if altruistic motives dominate, then a larger income at home would decrease remittance flows. Instead, if migrants are more self-interested and care about investment, an increasing income at home should boost remittances. However, as shown in Cox et al. (1998), altruistic and self-interested motives may switch as home income increases. This means that one may possibly observe U-shaped (or inversely U-shaped) relations when investigating the impact of income on remittances. For example, migrants from poor home countries may mostly remit to help relatives back home coping with poverty and adverse shocks. On the contrary, migrants from high-income countries may start remitting pushed by tempered altruistic or even purely self-interested motivations (e.g., loan repayment, exchange, or co-insurance). Therefore, in order to explore whether this is the case in our data, we test for possible non-linearities in the (home) income–remittance relationship.

A number of other macroeconomic determinants may potentially affect international remittance flows (Carling 2008). These include, among others, climate and disasters, interest and exchange rate differentials, and poverty and fragility indicators. However, as discussed in the next section (see also in Appendix B, Table A2), their detected impact in our regression exercises was neither conclusive nor robust across alternative specifications and estimation methods, and, therefore, they were discarded from the analysis.

4. Data and Methods

We fit to the data a panel gravity model whose non-linear baseline formulation reads:

where are remittances (in levels) from i (origin/host country) to j (destination/home country) in year t; is a constant; are origin-time FEs, are destination, time-invariant FEs, and are time dummies; is a set of time-invariant, bilateral covariates; is the number of migrants, i.e., the stock of people born in country i and living in country j in year t; is a battery of destination-specific, time-dependent regressors; and are the errors.

In this baseline specification, we control for both cross-sectional and longitudinal variation across origins of the remittance flows, while focusing on time-varying observable characteristics of destination/home countries—once their unobservable cross-sectional differences are controlled for. As a consequence, country-specific variables only depend on destinations and covariates that are specific to the origin and vary over time cannot be inserted, as they would be collinear to . This means that their coefficient estimates are to be interpreted as “net of the country-origin covariates”.

To check the robustness of the bilateral-variable coefficient estimates (especially as far as is concerned), we also fit a structural gravity specification reading:

where and are, respectively, origin-time and destination-time fixed effects, and country-specific covariates are omitted (more on that in Section 5.3).

Remittance and migrant data come from the “World Bank Migration and Remittance” database (cf., Appendix A, Table A1 for descriptions and sources of all variables used in our analysis). Bilateral matrices originally report estimated remittance flows (in millions of US dollars) from 214 sending (host) countries to 214 receiving (home) countries for the years 2010–2017—we shall go back to discussing some possible issues related to using estimated rather than observed data in Section 6.19. A possible concern is related to the non-stationarity of the dependent variable. To double check that this is not the case, we ran Harris–Tzavalis (HT) panel data unit root tests on remittance flows (Harris and Tzavalis 1999), after creating a unique identifier for origin–destination flows and making the resulting panel strongly balanced by dropping some observations. The HT test is in our case more appropriate than other alternatives (see, e.g., the Levin–Lin–Chu test) as it assumes that the number of panels is large while the number of time periods is fixed and small. The results indicate that the null hypothesis of non-stationary remittance flows is rejected20.

We also employ data about migration stocks, which contain estimates of the number of people born in the destination country j and living in the host country i (i.e., the origin of the remittance flow from i to j) in the years 2010, 2013, and 2017. The estimates are based on the “Migration and Remittances Factbook” (various years) and are used here as a covariate controlling for bilateral migration-size effects at the origin. Since we do not have bilateral migration observations for all the years covered in the remittance database, we employ two alternative strategies. First, we estimate Equation (1) only for the three waves where both remittance and migration are available. In this setup, the number of migrants enters as a contemporaneous covariate for , . We label this case in our results as “Year = t”. Second, we fit our model in all the years for which we do have remittance data (), building a stepwise migrants-at-destination variable reading for , for , and for . We label this case in our results as “stepwise” (see, however, Section 5.3 for a robustness exercise where we use linearly interpolated migrant stocks). Descriptive statistics for bilateral remittances and the number of migrants in three selected years (2010, 2013, and 2017) are reported in the Appendix C, cf., Table A4.

In addition to , we account for two sources of variation. The first one () includes usual bilateral, time-invariant, standard gravity regressors such as geographical distance, contiguity, common language, common religion, and the existence of any colonial relationship in the past. We have also experimented with additional bilateral, time-invariant effects such as common ethnic language, common currency, weighted versions of geographical distance, as well as different definitions of colonial relationships; see Appendix B, Table A2 for details. However, these covariates have been excluded from all tested specifications as they turned out to be not significant in almost all of our regressions and contained too many missing values for our selected sample of 176 countries.

The second one ( in Equation (1)) controls for destination country-specific factors that may affect remittance flows and vary both longitudinally and cross-sectionally. These are: income (as proxied by per capita GDP, pcGDP henceforth), GDP growth rates, population, the share of rural population, expenditure on education (as a % of GDP), enrollment rate, and the share of bank branches21. Since, as mentioned, we are interested in exploring possible non-linearities in the relation between home income and remittances, we also insert among our covariates the square of per capita GDP.

After removing countries that did not ever remit or receive in at least one year (12 in total), and those for which our selected covariates are seldom observed (26 countries), we end up with a final sample covering 176 countries (see Table A3 in the Appendix C) for the period 2010–2017. The remittance flow panel has a squared format, i.e., all in/out (zero and positive) remittance flows are featured in the dataset in each year (more on this point in Section 5.3).

We begin fitting Equation (1) with a standard OLS estimator. This requires us to log-linearize the gravity model and, therefore, does not allow one to account for zero-remittance flows that, as Table A4 in the Appendix C suggests, is a sensible issue in our data. It is well-known that under heteroskedasticity this implies potentially biased coefficient estimates (Santos Silva and Tenreyro 2006). Therefore, we check the robustness of our OLS baseline results estimating (1) with a Poisson pseudo-maximum likelihood (PPML) estimator, using remittances in level and including their zero observations.

5. Results

5.1. Whole-Sample Regressions

Table 1 reports coefficient estimates obtained when Equation (1) is fitted to whole-sample data. We show two sets of specifications. The first set—columns (1)–(4)—includes baseline OLS and PPML estimates where empirically observed values for both the number of migrants and per capita GDP are employed. As discussed in Section 4, we also experiment with two alternative setups as far as the number of migrants covariate is concerned, according to whether only years 2010, 2013, and 2017 are considered (“Year = t”, cf., columns 1 and 2) or the “stepwise” version of is employed (columns 2 and 4).

Table 1.

Regression results. Dependent variable: bilateral remittance flows. Whole-sample estimates of gravity-model coefficients (Equation (1)). Fixed effects specification: . Columns (1–2): OLS estimates. Columns (3–4): PPML estimates. Columns (1, 3): the covariate “number of migrants” is observed only in years 2010, 2013, 2017. Columns (2, 4): The “stepwise” version of the covariate “number of migrants” is employed (see Section 4 for more details). Standard errors in round parentheses. Significance levels: * 0.05; ** 0.01; *** 0.001.

As a first general observation, both diagnostics and the signs of the estimated coefficients turn out to be very stable across our first four baseline specifications, i.e., the is always very high and we do not detect sign inconsistencies as the estimation method and the definition of the number of migrants covariate change.

Notice also that the number of observations actually fitted substantially varies across specifications. This is due to two related issues. First, the squared remittance matrix contains 176 × 175 = 30,800 observations per year, that is 246,400 observations in total, of which only 55,731 are strictly positive (cf., Appendix C, Table A4). When using the “Year = t” version for the number of migrants, there are only about 21,000 strictly positive observations notionally available with the OLS estimator. Second, the presence of missing values in the covariates (on average, about 40% of the observations), scattered across years and countries, further limits the number of observations actually available and makes the panel unbalanced. This implies that in the OLS case one can fit only about 12,500 observations in the “Year = t” case and about 33,400 observations when using the “stepwise” option. Notwithstanding missing values in the covariates, the sample size becomes much larger when we employ the PPML estimator, as all zero flows are considered. We will explicitly address the robustness of our results to the presence of missing values in the covariates in Section 5.3.

As far as the significance and magnitude of the coefficients are concerned, there appears to be a small subset of covariates that, overall, seem to impact remittances in a less robust way across specifications. For instance, colonial ties sometimes become not significant, whereas the magnitude of coefficient estimates for geographical distance, GDP growth, and common language occasionally change.

Nevertheless, the results in Table 1 suggest quite a robust and consistent pattern as to the association between macroeconomic determinants and bilateral remittances. Indeed, remittances increase the larger the pool of migrants at the origin, whether home/host countries share a language, colonial or religion tie, the larger the total population, rural population share, expenditure on education, enrollment rate, and bank branches at home. On the other hand, remittances decrease the larger the geographical distance between origin and destination and GDP growth at home, and when home and host countries share a border.

Taken together, the foregoing results imply a number of considerations as to the role played by alternative macroeconomic drivers of remittances. First, the stock of migrants at the origin appears to exert a very stable and strong size effect on remittance flows, net of the magnitude of the basin of recipients at home, controlled for by total population.

Second, the negative impact of geographical distance hints at transaction costs as being a relevant factor in explaining remittances. Note that sharing a border reduces formal flows of money towards home, which may indicate that contiguity could be an incentive to boost informal ways to remit (we shall further comment on this interpretation in Section 5.3). However, this interpretation holds only if World Bank estimates do not include informal remittances, which should not be taken for granted. Third, our exercises confirm that remittances are facilitated if the origin and destination countries hold social, cultural, and political ties, as this may further decrease transaction costs. Fourth, the positive impact of rural population share, expenditure on education, and enrollment rate suggests that, as mentioned in Section 2, remittances are employed relatively more for investment motives rather than as a way to boost consumption at home. Finally, relatively to the origin, a less dynamic but more financially developed home economy is able to attract more remittances.

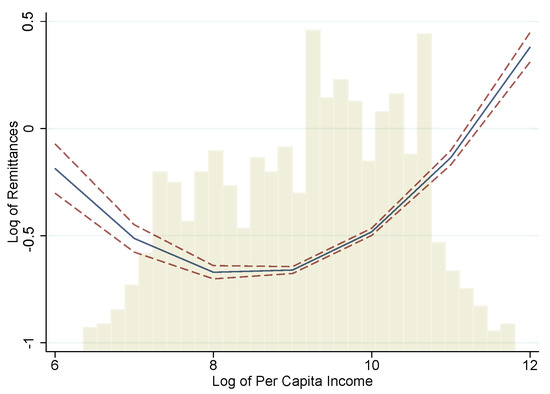

We also detect a consistent and robust non-linear impact of income (pcGDP) at destination. More precisely, as Table 1 shows, we find that the relation between home income and remittances is U-shaped, with remittance flows decreasing for low-income levels and increasing for high-income ones. The U-shaped relationship between (per capita) income and remittances observed in the whole data sample, is depicted in Figure 2. There, we plot the marginal effect of pcGDP (across its observed range) on bilateral remittance flows on a log–log scale (for the specification in Table 1, column 2) and we add in the background a histogram of the observed whole-sample distribution of pcGDP at destination.

Figure 2.

Non-linear marginal impact of (per capita) income (pcGDP) on remittances. Solid blue line: Whole sample OLS estimates from column (2), Table 1. Dashed red lines: 95% confidence bands. X-axis: log of (per capita) income (pcGDP) in the observed whole-sample range of the covariate. Y-axis: log of remittance flows. The histogram in the background depicts the whole-sample distribution of pcGDP at the destination across countries and years (bar heights are proportional to observed frequencies).

This evidence suggests that for relatively poor destination countries, altruistic motives dominate in the sending behavior of migrants (net of host income), whereas self-interest seems to be more relevant in the decision to remit as income at home—relative to that at the origin—becomes larger than a given threshold. This is in contrast with results obtained by Cox et al. (1998), who found that, in the case of private transfers in Peru, exchange motives prevail for low-income recipients and altruistic motives predominate for those with high incomes.

In order to dig further on this point—and more generally to better understand if the whole-sample results still hold when we consider subsamples of remittance flows—we now move to a more disaggregated analysis, where both the origin and destination countries are classified according to their income group.

5.2. Remittance Flows by Origin and Destination Income Group

We categorize countries in our sample into three income groups (poor, middle, and rich), using the 2020 WB income group classification based on the Atlas method22. In our exercises, countries are defined as (i) “poor” (PC) if they belong to the “low” or “lower-middle” WB income group, (ii) “middle” (MC) if they are classified as “upper-middle”, or (iii) “rich” (RC) if they belong to the “high” WB income group.

This allows us to form nine non-overlapping subsamples for our dependent variable, according to whether the origin and the destination country of remittance flows are classified as PC, MC, or RC.

We are particularly interested in focusing on two subsamples, namely, those where remittances are sent to a PC either from an RC (“rich to poor”) or an MC one (“middle to poor”). This is because of two main reasons. First, poor countries are those where remittances can impact the most in terms of alleviating poverty and promoting economic growth. Second, as discussed above, there exists literature (see, e.g., Cox et al. 1998) showing that in poor (home) countries exchange and self-interested motives prevail for low-income levels, while altruistic motives predominate when income grows. This suggests that an inverse U-shaped relationship might be observed when focusing on poor home countries, contrary to what we have found in our whole-sample estimates.

Table 2 summarizes our main outcomes. We report the OLS coefficient estimates and significance levels obtained when fitting Equation (1) to the two subsamples of interest, and comparing them with the whole-sample results from Table 1, columns (1)–(2)23.

Table 2.

Regression results by income group. Dependent variable: bilateral remittance flows. OLS estimates of gravity-model coefficients (Equation (1)) in subsamples defined according to the income group of the origin and destination remittance flow countries. Column (1): rich to poor; column (2): middle to poor; column (3): whole-sample estimates from columns (1)–(2) in Table 1. Fixed effects specification: . Number of migrants: “Year = t” means that the covariate is observed only in years 2010, 2013, 2017; “stepwise” means that the stepwise version of the covariate is employed (see Section 4). Significance levels: * 0.05; ** 0.01; *** 0.001.

To begin with, note that the sign and significance of most of the macroeconomic drivers of remittances, as identified in the whole data sample, are confirmed also when disaggregating the data by origin and destination income group. In particular, size effects exerted by migrants in the host country and home-country population continue to be strong determinants of remittances also in the “rich to poor” and “middle to poor” subsamples.

The same observation applies for GDP growth, rural population share, education-related covariates, and bank branches.

On the contrary, the impact on remittances of macroeconomic drivers associated with transaction costs and bilateral ties differs between whole-sample (column 3) and income group (columns 1–2) regressions. On the one hand, a larger geographical distance now boosts remittances from rich to poor countries. This is in line with the evidence found in de Sousa and Duval (2010) for Romania, and is in general consistent with the idea that migrants from poor countries, who travel longer distances, remit more because they cannot visit their home country very frequently—and, therefore, they cannot carry in-kind or cash with them. In addition, distance may be positively associated with remittances to poor countries due to a loan repayment motive: if family members living in distant, low-income countries partly covered the higher migration cost, such a loan may be repaid in the form of larger remittances thereafter. These interpretations are also consistent with the almost not significant effect of contiguity on remittances from high to middle income countries to poor ones, also because poor countries do not tend to share a border with richer ones (i.e., informal remitting channels become irrelevant). Nevertheless, our disaggregated regressions do not pick up any positive association between contiguity and formal remittance flows in income-disaggregated samples, as perhaps one may have expected.

Second, common ties related to religion, former colonial relationships, and (partly) language become much less important than in the aggregate while explaining remittances from middle and rich countries to poor ones. Although the interpretation of why this happens is less straightforward, the significance loss in social, cultural, and political ties as macroeconomic drivers of remittances may be in line with the idea that migrants from poor areas, hosted by richer countries, are less integrated in their societies, and, therefore, cannot sufficiently enjoy the potential transaction cost mitigation effect of common ties.

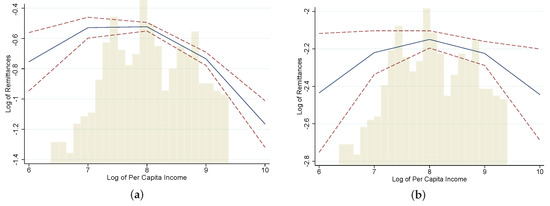

Third, and more importantly, we still find a strong and non-linear effect of per capita GDP on remittances in income group regressions. However, while whole-sample exercises suggested a U-shaped relationship, with remittances first decreasing and then increasing with income at destination, estimates in Table 2, columns (1)–(2), show that an inverse U-shaped relationship is now in place (cf., Section 5.3 for further evidence). Therefore, contrary to what happens when one takes into account all global remittance flows, when we discriminate between origin and destination income groups, investment or exchange motives seem to be behind remittances from rich and middle countries to poor ones when home per capita GDP is low. Instead, when the income of a poor destination country grows, altruistic motives seem to dominate remittance behaviors of migrants sending money from richer countries; see Figure 3. This is in line with studies focusing on private transfers in less-developed countries (Cox et al. 1998).

Figure 3.

Non-linear marginal impact of (per capita) income (pcGDP) on remittances by income group. (a) Rich to poor; (b) middle to poor. OLS estimates from columns (1)–(2), Table 2. Solid blue line: Marginal impact. Dashed red lines: 95% confidence bands. X-axis: log of (per capita) income (pcGDP) in the observed whole-sample range of the covariate. Y-axis: log of remittance flows. The histogram in the background depicts the distribution of pcGDP at destination for countries in the poor income group across the years (bar heights are proportional to observed frequencies).

5.3. Robustness Checks

The impact of macroeconomic determinants on bilateral remittance flows estimated in the previous subsections could be biased due to a number of possibly concurrent issues. In this subsection, we attempt to address some of them in order to discuss the robustness of our foregoing findings.

To begin with, our estimates employ an originally balanced sample of remittance flows in each year. As discussed above, this is one of the main contributions of the paper, as our aim was to have a country coverage over time as large as possible. However, the number of bilateral flows actually employed in the regressions is much smaller than the notional maximum. This is true not only in OLS estimates (where zero flows are automatically excluded) but also when PPML is employed. In both cases, the net reduction in the observations used in the estimation is due to the presence of missing values in the destination country covariates, which makes the sample actually employed for estimation unbalanced. We investigate whether this may be a source of bias in our results in a series of additional exercises in which we either shrink the sample of countries or we fit a structural gravity model where destination-country-specific covariates are replaced by country-time fixed effects (as it happens in all specifications for origin countries). In the first case, we select only the countries that do not have any missing values in all the covariates used in our baseline regressions. This allows us to focus on a smaller sample of 110 countries (see Appendix E, Table A6) out of the original 176 available. In the second case, we fit to both the reduced sample and to the 176-country sample a structural gravity specification (Baldwin and Taglioni 2006); see Equation (2). Table A7 in the Appendix E reports results for the case of baseline OLS estimates using the “stepwise” version of . We compare four different specifications, depending on whether the full 176-country sample or the reduced 110-country sample is employed, and whether the FEs are as in Equation (1) or as in the structural gravity model of Equation (2)24. Overall, our main results seem to be confirmed, suggesting that sample imbalance due to the presence of missing values in country covariates does not bias the main conclusions of our analysis. In particular, both the sign and magnitude of the size effect exerted by the number of migrants in the host country appears to be extremely robust in all specifications.

Our second concern is related to multicollinearity and overfitting issues. For example, population-related variables included in the baseline specification refer to the number of migrants in the host country, total population, and % of rural population at home. If these variables are strongly correlated, e.g., because the number of migrants at the origin of the remittance flows heavily depends on the population at home or its share living in rural areas, the estimated coefficients may be biased. To check for this potential source of bias, we have performed additional regressions where either the covariate “population” or the covariate “rural population share” is excluded from the list of regressors. The results are reported in the Appendix E, Table A8, columns (2)–(3), vis-à-vis the baseline correspondent estimates from Table 1 (column 1). Apart from the impact of contiguity, which becomes less relevant, all our main results robustly hold, in particular, as far as population-related regressors are concerned. Another source of multicollinearity and possible overfitting bias is related to bilateral, time-invariant variables controlling for distance, social, cultural, and political ties. These may affect remittance flows, and also migrants at the destination as well. In order to explore this potential source of bias, we have conducted two further experiments, reported in columns (9) and (10) of Table A8. In the first one (see column 9), we exclude migrants at the destination and keep bilateral variables in the regression. In the second one (see column 10), we exclude bilateral variables and keep migrants at destination in the regression. As the results in column (9) show, there is a substantial decrease in coefficient significance, although all the signs are in line with column (1). This is expected, as we are removing the only source of variation that spans the dimension . When removing bilateral, time-invariant variables, we gain in coefficient significance. Notice that the coefficient of migrants at destination is substantially reduced in magnitude and significance. Overall, however, all the correct signs are preserved and the included regressors are significant only at 5% and 1%.

Third, we investigate possible bias due to the omission of bilateral covariates controlling for technological advances, which may have contributed to reducing transaction costs. In our baseline specification, all the bilateral variables are indeed time invariant. Geographical distance alone can hardly control for technological developments that, together with an increased competition in the financial service industry, may have unevenly led to a reduction in transfer costs of remittances in particular, and of transaction costs in general (Ahmed et al. 2021; Kakhkharov et al. 2017)25. To address this issue, columns (4)–(8) in the Appendix E, Table A8, present estimation results where one adds to the baseline specification some proxies controlling for cost-reducing technological advances. To begin with, we have explored the impact that a larger diffusion of internet technologies at home—net of that in the host country, controlled for by origin FEs as usual—may have on remittance flows. We achieved this using two additional covariates, i.e., fixed broadband subscriptions (per 100 people) and the individuals using the internet (as a % of population); see the Appendix A, Table A1, for sources and definitions. The results in Table A8, Appendix E, columns (4)–(5), show that both variables enhance remittances, but the estimated effect of geographical distance, number of migrants, as well as those of other time-invariant bilateral variables, remain roughly in line with our baseline specification (see column (1)). Furthermore, we have exploited data on remittance costs from the World Bank “Remittance Prices Worldwide” database to build a bilateral, time-varying covariate defined as the average total cost of all remittance flows between any two countries as a percentage of the total transaction (for a similar perspective, see Ahmed et al. 2021). Unfortunately, a very small number of remittance costs are reported in that database, leading to a huge decrease in the estimation sample size. Nonetheless, the results in columns (6)–(8) of Table A8 hint at a picture that is quite consistent with our baseline regressions. More specifically, the average remittance cost appears to exert a weak negative (or a statistically insignificant) impact on remittance flows when inserted in the baseline specification with FEs as in Equation (1), together or without geographical distance26. Furthermore, we are still able to observe a negative (albeit weaker) effect of our contiguity covariate. In Section 5.1, this was interpreted as suggesting that sharing a border could have been an incentive to boost informal ways to remit. However, in the presence of financial development there could be a counter effect, as a more efficient financial industry could reduce remittance prices and, thus, enhance formal remittances. That counter effect was not entirely controlled for in our baseline regressions, since financial development was proxied only by bank branches at destination, whereas all bilateral covariates were time invariant. Recovering a negative effect of contiguity in this set of regressions indicates instead that sharing a border reduces formal remittances, net of the counteracting effect of financial development and technological advances. Notice that the weak impact of remittance costs is detected also when one removes time-invariant bilateral variables and replaces them with a set of paired, time-invariant FEs (Baldwin and Taglioni 2006). Indeed column (8) in Appendix E, Table A8 reports estimates when the FEs specification reads as:

where is a set of time-invariant bilateral FEs. In this case, once all time-invariant transaction costs are fully controlled for, the average remittance costs weakly and negatively affect remittance flows. More importantly, however, our main results seem to be confirmed, particularly those related to the impact of migrant networks and per capita income.

Fourth, we double check whether the coefficient estimates for the migration stock variable in its stepwise version suffer from any downward bias. We replace our stepwise assumption with a migration stock variable whose non-observed values (i.e., in years 2011, 2012, 2014, 2015, and 2016) are replaced via linear interpolation of the observed values in 2010, 2013, and 2017. We obtain a 0.897 point estimate for in the OLS case (with a standard error equal to 0.007) and a 0.846 point estimate in the PPML case (standard error equal to 0.020). This indicates that our stepwise assumption is not causing any downward bias as far as the impact of migrants at destination is concerned.

Fifth, our results may suffer from endogeneity issues, which may arise from omitted-variable biases and simultaneity, among other things. Our aim is to provide an initial robustness check against endogeneity biases, keeping, as much as possible, our analysis comparable with that performed in the existing literature studying remittances with a gravity-model approach (cf., in particular, Lueth and Ruiz-Arranz 2006; McCracken et al. 2017). Therefore, we tackle this problem with two complementary exercises; see Table A9 in the Appendix E section.27. First, we replace in Equation (1) possibly endogenous regressors, i.e., time-dependent country-specific covariates and migrants at destination, with their lagged (year ) values. The results are reported in columns (1) and (2) of Table A9, depending on the assumption about migrants at destinations. As compared to our baseline estimates in Table 1, the significance seems to be weaker overall, but all signs and point estimates appear to be fairly robust. Second, we instrument each potentially endogenous regressor with its one-year lagged value and country latitude (Bugamelli and Paterno 2009; McCracken et al. 2017) and then estimate their impact on remittances in Equation (1) with panel data two-stage least squares. All first-stage F scores (testing for relevance of the instruments) are significantly different from zero and larger than 10, as required in order not to have weak instruments.28 Furthermore, Table A9 reports outcomes from an Anderson–Rubin Wald F-test, checking for the joint significance of all endogenous regressors, and a Sargan–Hansen J test for over-identified restrictions. The results seem to confirm that the null hypothesis that all endogenous regressors are jointly equal to zero is rejected, while we cannot reject the null hypothesis that the instruments are exogenous. As to point estimates and the significance of the covariates, note that all signs and magnitudes of the coefficients are in general retained, although we can observe again a decrease in the overall significance levels.

Finally, we study whether the results about the inverse U-shaped relationship detected for the relationship between per capita GDP and remittances in the income group regressions is robust to alternative specifications. Table A10 in the Appendix E reports coefficient estimates and significance for per capita GDP and its square—for both the case of migrants at destination defined as ‘Year = t’ and ‘stepwise’. Using Equation (1), we consider PPML estimates, the strategies employed above to control for endogeneity, our reduced 110-country sample, and possible multicollinearity induced by population-related regressors. By and large, an inverse U-shaped relationship still emerges for both “rich to poor” and “middle to poor” subsamples. However, the detected non-linearities seem to be weaker in their significance, especially when controlling for endogeneity and in the reduced 110-country sample.

6. Discussion and Conclusions

In this paper, we have explored the macroeconomic determinants of bilateral remittance flows between world countries, using the “World Bank Migration and Remittance” database, which originally covers 214 sending and receiving countries over the period 2010–2017. Exploiting the inherent origin–destination nature of remittance flows, we have fitted the data using a number of gravity-model specifications, controlling for host-, home-, and time-specific fixed effects, to a subset of 176 countries.

As discussed in Section 2, using a gravity-model approach allowed us to investigate in more detail the drivers of remittance flows, separating as much as possible the host, home, and bilateral effects. Furthermore, a gravity specification can be derived by micro-founded models (McCracken et al. 2017; Rapoport and Docquier 2006; Schiopu and Siegfried 2006), which is helpful in identifying the expected signs of coefficients in terms of migrant motives.

The results from whole-sample exercises clearly indicate that size effects (controlled for by the number of migrants at the origin- and home-country population), transaction costs (distance and contiguity), and common host–home country ties, strongly influence global remittance flows. Furthermore, the important remittance-enhancing effect of rural population and education-related covariates hint at the existence of investment motives behind the migrant remittance behavior. We have also found that economic growth and financial development at home play an important role in impacting remittances.

Most of those macroeconomic determinants (e.g., size effects, education, economic growth, and financial development) are also important in explaining remittance flows from rich and middle countries to poor ones. However, when one conditions on the income group of host and home countries, interesting discrepancies emerge. First, the impact of transaction costs on remittances substantially changes: a higher origin–destination geographical distance between middle/rich country and poor ones boosts remittances, while sharing a border becomes less relevant. Second, common political, social, and cultural ties lose their importance in explaining remittance flows.

We have also documented the existence of a robust non-linear relationship between income at home and remittance flows. Globally, a U-shaped relationship emerges, suggesting that altruistic motives dominate when per capita GDP at destination is small, whereas self-interested or exchange motives become more relevant for higher levels of home income. On the contrary, remittance sent from middle/rich nations to poor countries are explained by self-interested motives for low-income levels and then by investment or exchange as income at home increases (i.e., an inverted U-shaped relationship between per capita GDP at destination and remittances emerges). This suggests that altruistic and self-interested motives non-trivially interact and may change across both host/home income groups and the level of income at home.

Our main results robustly hold vis-à-vis a number of alternative estimation strategies and specifications. First, as PPML-based exercises show, the most important findings are not influenced by the presence of zero-flow observations in the data. Second, coefficient estimates do not seem to be strongly affected by omitted-variable biases, since host-time fixed effects control for cross-country and longitudinal factors at the origin, destination-specific and time-invariant fixed effects control for unobserved cross-country heterogeneity at home, and year dummies for time trends. Third, we have employed two different specifications for the covariate controlling for the number of migrants, in order to mitigate the bias coming from the fact that migrant stocks are not observed in every year. Fourth, we do not detect strong departures from our main results when a number of possible additional sources of bias are considered. These include the effect of missing values in the covariates, multicollinearity between population-related regressors, endogeneity, and the presence of trends in technological advances, which may have led to remittance costs unevenly decreasing in time.

The main contribution of this paper was to employ a large panel of bilateral remittance flows among world countries in the attempt to overcome data limitations that, so far, have prevented existing studies from reaching robust and conclusive predictions on the impact of macroeconomic determinants on remittance flows (cf., Table A5 in the Appendix D). However, it must be noted that the wide cross-sectional coverage of the “World Bank Migration and Remittance” database comes at a cost. Indeed, bilateral remittance flows in the database are not empirically observed but come from an estimation procedure proposed in Ratha and Shaw (2007). As discussed in Mallela et al. (2020), remittance estimates may be inaccurate in terms of volume, especially for certain countries (Alvarez et al. 2015). Nevertheless, the database has been successfully employed in many existing works (see, e.g., Aggarwal et al. 2011; Arvin and Lew 2012; Azizi 2017). Furthermore, remittance flows are estimated using alternative weighting schemes and do not make use of gravity models, which may introduce biases in our analysis. In absence of better comprehensive data on bilateral remittance flows, this is still the best choice if one aims at a large country coverage for a sufficiently long number of years.

Exploring in more detail the possible biases that this type of remittance data may generate on gravity-model estimates is certainly one of our future avenues of research. The present work, however, may be extended in at least three additional ways.

First, the strategy employed in Lueth and Ruiz-Arranz (2006) and McCracken et al. (2017) to deal with potential endogeneity—and replicated here for the sake of comparison with the existing literature—may suffer from a number of limitations. For example, as discussed in Bellemare et al. (2017), the practice of using lagged explanatory variables, despite being commonly used, may lead to incorrect inference. Furthermore, using a time-invariant instrument in the first stage of an IV two-stage model without country fixed effects may lead to biased estimates and eventually lead to a violation of the assumption of instrument exogeneity. Therefore, more work trying to devise a robust strategy to deal with possible endogeneity in our specifications is certainly needed. Notice, however, that addressing endogeneity concerns in gravity-model exercises (no matter whether trade, migration, or other bilateral flows are concerned) is an area where, in general, the literature has not reached a consensus yet, although several alternative methodologies have been suggested (see, e.g., Bergstrand 2013; Cyrus 2002; Jochmans and Verardi 2022; Reed et al. 2016).

Second, the analysis of remittance flows disaggregated by income groups has only focused on remittances from middle and rich countries towards poor ones. Studying the behavior and determinants of other income-conditioned flows (e.g., those between rich or middle countries), as well as their geographical breakdown (e.g., north to south), may complement the present analysis.

Third, the presence and shape of non-linearities in per capita GDP (and other covariates) can be explored more deeply.

Finally, although the existing data only cover the period 2010–2017, the World Bank has recently started a new project (cf., knomad.org/data/remittances, accessed on 16 July 2023) with the goal of producing updated bilateral remittance data but, as of June 2023, only one additional matrix, for the year 2021, has been published. As new updates are made available, one could reproduce analyses in line with the present one employing more recent years.

Author Contributions

Both G.F. and T.R. contributed equally to this work. Conceptualization, G.F. and T.R.; Formal analysis, G.F. and T.R.; Investigation, G.F. and T.R.; Methodology, G.F. and T.R.; Writing—original draft, G.F. and T.R.; Writing—review & editing, G.F. and T.R. All authors have read and agreed to the published version of the manuscript.

Funding

This research received no external funding.

Institutional Review Board Statement

Not applicable.

Informed Consent Statement

Not applicable.

Data Availability Statement

The data employed in this work are publicly available. See Table A1 and Table A2 in the Appendices Appendix A and Appendix B for a full list of data sources.

Conflicts of Interest

The authors declare no conflict of interest.

Appendix A. Data Sources

Table A1.

Description and sources of variables used in our preferred specifications. () See Ratha and Shaw (2007).

Table A1.

Description and sources of variables used in our preferred specifications. () See Ratha and Shaw (2007).

| Variable | Description | Data Source |

|---|---|---|

| Bilateral Remittances | Yearly bilateral remittance estimates, millions of US dollars (years: 2010–2017) | World Bank Migration and Remittances Data |

| Number of Migrants | Bilateral estimates of migrant stocks (years: 2010, 2013, 2017) | World Bank Migration and Remittances Data |

| Distance | Distance between most populated cities (km) | Cepii Gravity Database (cepii.fr) |

| Contiguity | Dummy variable; 1 = country pair shares a border | Cepii Gravity Database (cepii.fr) |

| Common Language | Dummy variable; 1 = country pair shares common official or primary language | Cepii Gravity Database (cepii.fr) |

| Colonial Relationship | Dummy variable; 1 = country pair ever in colonial relationship | Cepii Gravity Database (cepii.fr) |

| Common Religion | Dummy variable; 1 = country pair shares common religion | Cepii Gravity Database (cepii.fr) |

| pcGDP | Per capita GDP, PPP (constant 2011 international dollar) | World Bank Open Data (data.worldbank.org) |

| GDP Growth | GDP growth (annual %) | World Bank Open Data (data.worldbank.org) |

| Population | Population, total | World Bank Open Data (data.worldbank.org) |

| Rural Population Share | Rural population (% of total population) | World Bank Open Data (data.worldbank.org) |

| Exp on Education (% of GDP) | Government expenditure on education, total (% of GDP) pgap_550 | World Bank Open Data (data.worldbank.org) |

| Enrollment Rate | Adjusted net enrollment rate, primary (% of primary school age children) | World Bank Open Data (data.worldbank.org) |

| Bank Branches Share | Commercial bank branches (per 100,000 adults) | World Bank Open Data (data.worldbank.org) |

| Broadband Subs | Fixed broadband subscriptions (per 100 people) | World Bank Open Data (data.worldbank.org) |

| Internet Usage | Individuals using the internet (% of population) | World Bank Open Data (data.worldbank.org) |

| Remittance Cost | Average total cost of the transaction in % | Remittance Prices Worldwide (remittanceprices.worldbank.org) |

| Precipitation Anomalies | Yearly total precipitation anomalies (z-score based on 1901–2018 obs) | Climatic Research Unit—CRU (www.cru.uea.ac.uk) |

| Temperature Anomalies | Yearly average temperatures anomalies (z-score based on 1901–2018 obs) | Climatic Research Unit—CRU (www.cru.uea.ac.uk) |

| Arable Land | Land cultivated for crops (% of total land area) | CIA World Factbook (www.cia.gov) |

| Average Elevation | Country average elevation above sea level (mt) | CIA World Factbook (www.cia.gov) |

| Coastline Length | Country total length of the boundary between the land area (including islands) and the sea (km) | CIA World Factbook (www.cia.gov) |

| Distance From The Equator | Absolute value of country latitude | CIA World Factbook (www.cia.gov) |

| Remoteness | Sum of distances between a country and all the others | Our own calculation based on Cepii Gravity Database (cepii.fr) |

Appendix B. Additional Covariates

Table A2.

Additional covariates. List of covariates used in the analysis and not included in our preferred specifications (not statistically significant in regression exercises).

Table A2.

Additional covariates. List of covariates used in the analysis and not included in our preferred specifications (not statistically significant in regression exercises).

| Variable | Description | Data Source |

|---|---|---|

| Common Ethnic Language | Dummy variable; 1 = country pair shares common language (spoken by at least 9% of the population) | Cepii Gravity Database (cepii.fr) |

| Common Colonizer | Dummy variable; 1 = country pair shares a common colonizer post 1945 | Cepii Gravity Database (cepii.fr) |

| Colonial Relation Post 1945 | Dummy variable; 1 = country pair in colonial relationship post 1945 | Cepii Gravity Database (cepii.fr) |

| Common Currency | Dummy variable; 1 = country pair share common currency | Cepii Gravity Database (cepii.fr) |

| Weighted Distance | Weighted distance (pop-wt, Km), year = 2010 | Cepii Gravity Database (cepii.fr) |

| Domestic Credit Share | Domestic credit to private sector (% of GDP) | World Bank Open Data (data.worldbank.org) |

| Poverty Gap (1.90$) | Poverty gap at USD 1.90 a day (2011 PPP) (%) | World Bank Open Data (data.worldbank.org) |

| Poverty Gap (3.20$) | Poverty gap at USD 3.20 a day (2011 PPP) (%) | World Bank Open Data (data.worldbank.org) |

| Poverty Gap (5.50$) | Poverty gap at USD 5.50 a day (2011 PPP) (%) | World Bank Open Data (data.worldbank.org) |

| Poverty Gap Share at NPL | Poverty gap at national poverty lines (%) | World Bank Open Data (data.worldbank.org) |

| Educational Attainment Share | Educational attainment, at least completed primary, population 25+ years, total (%) (cumulative) | World Bank Open Data (data.worldbank.org) |

| Displaced Persons | Internally displaced persona, total displaced by conflict and violence (number of people) | World Bank Open Data (data.worldbank.org) |

| Enrollment Rate | Adjusted net enrollment rate, primary (% of primary school age children) | World Bank Open Data (data.worldbank.org) |

| Literacy Rate | Literacy rate, adult total (% of people ages 15 and above) | World Bank Open Data (data.worldbank.org) |

| Real Exchange Rate | Real effective exchange rate index (2010 = 100) | World Bank Open Data (data.worldbank.org) |

| Real Interest Rate | Real interest rate (%) | World Bank Open Data (data.worldbank.org) |

| Natural Disasters | Total number of persons affected by natural disasters | EM-DAT (www.emdat.be) |

| Fragility | Dummy variable; 1 = country in fragile situation (conflict, violence, and instability) | World Bank Open Data (data.worldbank.org) |

Appendix C. List of Countries and Summary Statistics

Table A3.

List of countries included in the baseline regression sample (176 countries).

Table A3.

List of countries included in the baseline regression sample (176 countries).

| Country | ISO3 | Country | ISO3 | Country | ISO3 |

|---|---|---|---|---|---|

| Afghanistan | AFG | Georgia | GEO | Nicaragua | NIC |

| Albania | ALB | Germany | DEU | Niger | NER |

| Algeria | DZA | Ghana | GHA | Nigeria | NGA |

| Angola | AGO | Greece | GRC | Norway | NOR |

| Argentina | ARG | Grenada | GRD | Oman | OMN |

| Armenia | ARM | Guatemala | GTM | Pakistan | PAK |

| Australia | AUS | Guinea | GIN | Panama | PAN |

| Austria | AUT | Guinea-Bissau | GNB | Papua New Guinea | PNG |

| Azerbaijan | AZE | Guyana | GUY | Paraguay | PRY |

| Bahamas, The | BHS | Haiti | HTI | Peru | PER |

| Bahrain | BHR | Honduras | HND | Philippines | PHL |

| Bangladesh | BGD | Hungary | HUN | Poland | POL |

| Barbados | BRB | Iceland | ISL | Portugal | PRT |

| Belarus | BLR | India | IND | Qatar | QAT |

| Belgium | BEL | Indonesia | IDN | Russian Federation | RUS |

| Belize | BLZ | Iran, Islamic Rep. | IRN | Rwanda | RWA |

| Benin | BEN | Iraq | IRQ | Samoa | WSM |

| Bhutan | BTN | Ireland | IRL | Sao Tome and Principe | STP |

| Bolivia | BOL | Israel | ISR | Saudi Arabia | SAU |

| Bosnia and Herzegovina | BIH | Italy | ITA | Senegal | SEN |

| Botswana | BWA | Jamaica | JAM | Seychelles | SYC |

| Brazil | BRA | Japan | JPN | Sierra Leone | SLE |

| Brunei Darussalam | BRN | Jordan | JOR | Singapore | SGP |

| Bulgaria | BGR | Kazakhstan | KAZ | Slovak Republic | SVK |

| Burkina Faso | BFA | Kenya | KEN | Slovenia | SVN |

| Burundi | BDI | Kiribati | KIR | Solomon Islands | SLB |

| Cabo Verde | CPV | Korea, Dem. Rep. | PRK | Somalia | SOM |

| Cambodia | KHM | Korea, Rep. | KOR | South Africa | ZAF |

| Cameroon | CMR | Kuwait | KWT | Spain | ESP |

| Canada | CAN | Kyrgyz Republic | KGZ | Sri Lanka | LKA |

| Central African Republic | CAF | Lao PDR | LAO | St. Lucia | LCA |

| Chad | TCD | Latvia | LVA | St. Vincent and Grenadines | VCT |

| Chile | CHL | Lebanon | LBN | Suriname | SUR |

| China | CHN | Lesotho | LSO | Sweden | SWE |

| Colombia | COL | Liberia | LBR | Switzerland | CHE |

| Comoros | COM | Libya | LBY | Syrian Arab Republic | SYR |

| Congo, Rep. | COG | Lithuania | LTU | Tajikistan | TJK |

| Costa Rica | CRI | Luxembourg | LUX | Tanzania | TZA |

| Cote d’Ivoire | CIV | Macedonia, FYR | MKD | Thailand | THA |

| Croatia | HRV | Madagascar | MDG | Togo | TGO |

| Cuba | CUB | Malawi | MWI | Tonga | TON |

| Cyprus | CYP | Malaysia | MYS | Trinidad and Tobago | TTO |

| Czech Republic | CZE | Maldives | MDV | Tunisia | TUN |

| Denmark | DNK | Mali | MLI | Turkey | TUR |

| Djibouti | DJI | Malta | MLT | Turkmenistan | TKM |

| Dominica | DMA | Marshall Islands | MHL | Uganda | UGA |

| Dominican Republic | DOM | Mauritania | MRT | Ukraine | UKR |

| Ecuador | ECU | Mauritius | MUS | United Arab Emirates | ARE |

| Egypt, Arab Rep. | EGY | Mexico | MEX | United Kingdom | GBR |

| El Salvador | SLV | Micronesia | FSM | United States | USA |

| Equatorial Guinea | GNQ | Moldova | MDA | Uruguay | URY |

| Eritrea | ERI | Mongolia | MNG | Uzbekistan | UZB |

| Estonia | EST | Morocco | MAR | Vanuatu | VUT |

| Ethiopia | ETH | Mozambique | MOZ | Venezuela, RB | VEN |

| Fiji | FJI | Myanmar | MMR | Vietnam | VNM |

| Finland | FIN | Namibia | NAM | Yemen, Rep. | YEM |

| France | FRA | Nepal | NPL | Zambia | ZMB |

| Gabon | GAB | Netherlands | NLD | Zimbabwe | ZWE |

| Gambia, The | GMB | New Zealand | NZL |

Table A4.

Descriptive statistics. Bilateral remittances and number of migrants at the origin in selected years. 176 Countries. Whole sample: all 8 years from 2010 to 2017.

Table A4.

Descriptive statistics. Bilateral remittances and number of migrants at the origin in selected years. 176 Countries. Whole sample: all 8 years from 2010 to 2017.

| Remittances | ||||

|---|---|---|---|---|

| Year | 2010 | 2013 | 2017 | Whole Sample |

| % of Obs = 0 | 0.83 | 0.74 | 0.73 | 0.77 |

| No. of Obs > 0 | 5154 | 8043 | 8035 | 55,731 |

| Mean | 12.50 | 15.61 | 17.18 | 15.27 |

| Std Dev | 208.92 | 244.42 | 282.25 | 249.38 |

| Min | 0.00 | 0.00 | 0.00 | 0.00 |

| Max | 21,693.42 | 22,587.29 | 30,019.19 | 30,019.19 |

| Skewness | 55.27 | 47.43 | 56.01 | 53.01 |

| Kurtosis | 4451.01 | 3237.19 | 4655.12 | 4150.52 |

| Mean | 5401.53 | 6559.25 | 6869.20 | 6165.94 |

| Std Dev | 88,789.56 | 98,966.07 | 96,213.84 | 94,942.28 |

| Min | 0.00 | 0.00 | 0.00 | 0.00 |

| Max | 11,600,000.00 | 130,00,000.00 | 11,600,000.00 | 13,000,000.00 |

| Skewness | 78.22 | 75.82 | 63.50 | 75.22 |

| Kurtosis | 9159.62 | 8989.80 | 6570.46 | 8802.70 |

Appendix D. Gravity Models of International Remittance Flows: Summary of the Literature

Table A5.

Literature Review. Sample sizes, estimation, econometric issues, and predictions in existing papers fitting gravity models to international bilateral remittance flows. Notes: () unskilled workers only; () number of Western Union agents; (?) sign of the prediction uncertain.

Table A5.

Literature Review. Sample sizes, estimation, econometric issues, and predictions in existing papers fitting gravity models to international bilateral remittance flows. Notes: () unskilled workers only; () number of Western Union agents; (?) sign of the prediction uncertain.

| Paper | ||||||

|---|---|---|---|---|---|---|

| Schiopu and Siegfried (2006) | Lueth and Ruiz-Arranz (2006) | Docquier et al. (2012) | Nnyanzi (2016) | McCracken et al. (2017) | Ahmed et al. (2021) | |

| Sample sizes | ||||||

| No. sending countries | 21 | 16 | 89 | African Countries | 18 | 30 |

| No. receiving countries | 7 | 11 | 47 | 10 | 27 | 75 |

| No. of years | 6 | 25 | 4 | 21 | 10 | 7 |

| Time period | 2000–2005 | 1980–2004 | 2002–2005 | 1990–2011 | 1998–2007 | 2011–2017 |

| Estimation | ||||||

| Panel type | Unbalanced | Unbalanced | Unbalanced | Unbalanced | Balanced | Unbalanced |

| Estimation method | OLS | OLS | OLS, POISSON | OLS | OLS | OLS |

| Fixed effects employed | (j,t) | (i,j,t) | (i,j,t) | (t) | (t) | (i,j,t) |

| 0.35–0.57 | 0.69–0.72 | 0.49–0.91 | NR | 0.72–0.92 | 0.46–0.70 | |

| Econometric issues | ||||||

| Zero-flow treatment | No | No | Yes | No | No | No |

| Endogenity | No | Yes (lagged vars) | No | Yes (lagged vars) | Yes (lagged vars) | Yes (GMM) |

| Non-linearity in income | No | No | No | No | No | No |

| Rich vs. poor breakdown | No | No | Yes | No | No | No |

| Predictions | ||||||

| Number of migrants | - | + | + | + | + | |

| Distance | - | ? | - | - | ? | |

| Contiguity | - | ? | + | ? | ||

| Common language | + | + | ? | + | ? | |

| Colonial relationship | + | ? | ? | ? | ||

| Income (diff) | + | + | + | |||

| Income (home) | - | - | ||||

| Income (host) | + | + | ||||

| GDP (diff) | ? | |||||

| GDP (home) | + | ? | + | + | ||

| GDP (host) | + | + | + | ? | ||

| GDP growth (home) | ? | |||||

| GDP growth (host) | - | |||||

| Real interest rate diff | ? | + | ? | |||

| Inequality | ? | |||||

| Remittance cost | + | |||||

| Natural disasters (home) | ? | + | ||||

| Inflation (diff) | + | + | ||||

| Credit to private sector (home) | + | + | ||||

| Credit to private sector (host) | + | - | ||||

| Unemployment | ? | |||||

Appendix E. Robustness Checks

Table A6.

Countries in the Reduced Regression Sample. List of countries included in the reduced regression sample (110 countries).

Table A6.

Countries in the Reduced Regression Sample. List of countries included in the reduced regression sample (110 countries).

| Country | ISO3 | Country | ISO3 | Country | ISO3 |

|---|---|---|---|---|---|

| Albania | ALB | Guatemala | GTM | Nicaragua | NIC |

| Angola | AGO | Guinea | GIN | Niger | NER |

| Argentina | ARG | Guinea-Bissau | GNB | Norway | NOR |

| Armenia | ARM | Guyana | GUY | Oman | OMN |

| Australia | AUS | Honduras | HND | Pakistan | PAK |

| Azerbaijan | AZE | Hungary | HUN | Panama | PAN |

| Barbados | BRB | Iceland | ISL | Paraguay | PRY |

| Belarus | BLR | India | IND | Peru | PER |

| Belgium | BEL | Indonesia | IDN | Poland | POL |

| Belize | BLZ | Iran, Islamic Rep. | IRN | Portugal | PRT |

| Benin | BEN | Ireland | IRL | Qatar | QAT |

| Bolivia | BOL | Israel | ISR | Russian Federation | RUS |

| Brazil | BRA | Italy | ITA | Rwanda | RWA |

| Burkina Faso | BFA | Japan | JPN | Samoa | WSM |

| Burundi | BDI | Kazakhstan | KAZ | Sao Tome and Principe | STP |