Moderating Effect of Business Environmental Dynamism in the Innovativeness—Company Performance Relationship of Congolese Manufacturing Companies

Abstract

1. Introduction

2. Literature Review and Theoretical Framework

2.1. Innovativeness

2.2. Environmental Dynamism

2.2.1. Economic Factors

2.2.2. Government Policies

2.2.3. Arrival and Exit of Companies to and from the Industry

2.2.4. Constant Technological Changes and Adoption

2.2.5. Political and Security Stability

2.3. Moderating Effect of Environmental Dynamism

3. Methodology

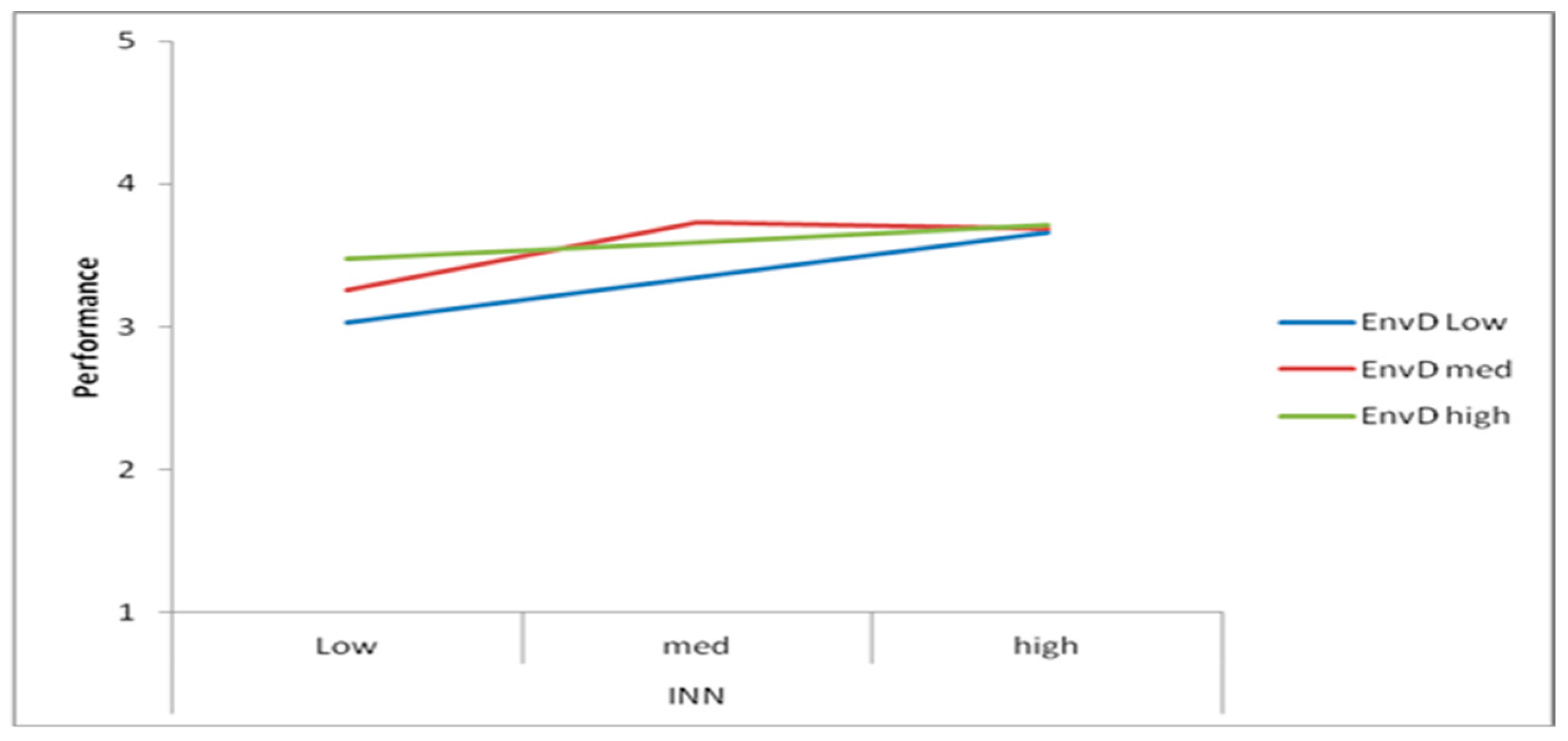

4. Results

4.1. Descriptive Statistics

4.2. Hierarchical Multiple Regression Analysis

5. Discussions and Implications

6. Conclusions, Limitations and Future Research

Author Contributions

Funding

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

Appendix A. Research Tool

| Innovativeness | 1 | 2 | 3 | 4 | 5 |

| Our company has the tendency to engage in and support new ideas, experimentation and creative processes | |||||

| Our company encourages new ideas from workers regardless of their position | |||||

| Our top management team invests sufficient financial resources on research and development | |||||

| Changes in this company’s products or service lines are quite high | |||||

| Our company emphasizes on utilising new technology | |||||

| Our employees are innovative in their way of doing things in production processes and product marketing | |||||

| Our firm encourages the staff to come up with new ideas | |||||

| Environmental Dynamism | 1 | 2 | 3 | 4 | 5 |

| In the market, customers’ choices (tastes) are unpredictable | |||||

| Actions of competitors are difficult to predict | |||||

| The technology in our industry is changing rapidly | |||||

| There is a constant arrival and exit of competitors in the market | |||||

| Performance Indicator | 1 | 2 | 3 | 4 | 5 |

| These last 4 years (2016–2019), our firm has seen its sales grow | |||||

| These last 4 years (2016–2019), our firm has seen its profits grow | |||||

| The profits gained from the business have funded the firm’s expansion | |||||

| These last 4 years (2016–2019), we have increased our market share |

References

- Adeoye, Muyiwa. 2013. The impact of business environment on entrepreneurship performance in Nigeria. Computing, Information Systems, Development Informatics & Allied Research 4: 59–64. [Google Scholar]

- Agyapong, Ahmed, Henry Mensah, and Samuel Akomea. 2021. Innovation-performance relationship: The moderating role of market dynamism. Small Enterprise Research 28: 350–72. [Google Scholar] [CrossRef]

- Alharbi, Ibrahim, Rossilah Jamil, Nik Mahmood, and Awaluddin Shaharoun. 2019. Organizational innovation: A review paper. Open Journal of Business and Management 7: 1196–206. [Google Scholar] [CrossRef]

- Atalaya, Murat, and Fulya Sarvan. 2013. The relationship between innovation and firm performance: An empirical evidence from Turkish automotive supplier industry. Procedia—Social and Behavioral Sciences 75: 226–35. [Google Scholar] [CrossRef]

- Audretsch, David, and William Baldwin. 2006. Industrial organization and the organization of industries: An American perspective. Revue de l’OFCE 97: 87–112. [Google Scholar] [CrossRef]

- Baruch, Yehuda, and Brooks Holtom. 2008. Survey response rate levels and trends in organizational research. Human Relations 61: 1139–60. [Google Scholar] [CrossRef]

- Blichfeldt, Henrik, and Rita Faullant. 2021. Performance effects of digital technology adoption and product & service innovation—A process-industry perspective. Technovation 105: 102275. [Google Scholar] [CrossRef]

- Bocken, Nancy, and Thijis Geradts. 2020. Barriers and drivers to sustainable business model innovation: Organization design and dynamic capabilities. Long Range Planning 53: 1–23. [Google Scholar] [CrossRef]

- Boutillier, Sophie, and Dimitri Uzunidis. 2014. The theory of the entrepreneur: From heroic to socialised entrepreneurship. Journal of Innovation Economics & Management 14: 9–40. [Google Scholar] [CrossRef]

- Bubenik, Peter, Juraj Capek, Miroslav Rakyta, Vladimira Binasova, and Katarina Staffenova. 2022. Impact of Strategy Change on Business Process Management. Sustainability 14: 11112. [Google Scholar] [CrossRef]

- Canh, Thi Nguyen, Nguyen Thanh Liem, Phung Anh Thu, and Nguyen Vinh Khuong. 2019. The impact of innovation on the firm performance and corporate social responsibility of Vietnamese manufacturing firms. Sustainability 11: 3666. [Google Scholar] [CrossRef]

- Carvache-Franco, Orly, Mauricio Carvache-Franco, and Wilmer Carvache-Franco. 2022. Barriers to innovations and innovative performance of companies: A study from Ecuador. Social Sciences 11: 63. [Google Scholar] [CrossRef]

- CENFRI. 2016. Making access Possible. Rapport sur le Diagnostic de l’inclusion Financière. Cape Town: CENFRI. Available online: https://cenfri.org/wp-content/uploads/2017/05/MAP-DRC_Synthesis-report_Cenfri-FinMark-Trust-UNCDF_January-2017_French_WEB.pdf (accessed on 17 February 2023).

- Chemma, Nawal. 2021. Disruptive innovation in a dynamic environment: A winning strategy? An illustration through the analysis of the yoghurt industry in Algeria. Journal of Innovation and Entrepreneurship 10: 1–19. [Google Scholar] [CrossRef]

- Chen, Jinyong, Weijia Shu, Xiaochi Wang, Muhammad Sial, Mariana Sehleanu, and Daniel Badulescu. 2022. The impact of environmental uncertainty on corporate innovation: Empirical evidence from an emerging economy. International Journal of Environmental Research and Public Health 19: 334. [Google Scholar] [CrossRef]

- Chen, Zhe. 2022. The impact of trade and financial expansion on volatility of real exchange rate. PLoS ONE 17: e0262230. [Google Scholar] [CrossRef] [PubMed]

- Chung, Henry, Russel Kingshott, Robyn MacDonald, and Martinus Putranta. 2021. Dynamism and B2B firm performance: The dark and bright contingent role of B2B relation-ships. Journal of Business Research 129: 250–59. [Google Scholar] [CrossRef]

- Covin, Jeffrey, and Dennise Slevin. 1989. Strategic management of small firms in hostile and benign environments. Strategic Management Journal 10: 75–87. [Google Scholar] [CrossRef]

- Covin, Jeffrey, and William Wales. 2012. The Measurement of entrepreneurial orientation. Entrepreneurship Theory & Practice 34: 677–702. [Google Scholar] [CrossRef]

- Crutzen, Rik, and Gjalt-Jorn Peters. 2017. Scale quality: Alpha is an inadequate estimate and factor-analytic evidence is needed first of all. Health Psychology Review 11: 242–47. [Google Scholar] [CrossRef]

- Cycyota, Cynthia, and David Harrison. 2006. What (not) to expect when surveying executives. A meta-analysis of top manager response rates and techniques over time. Organizational Research Methods 9: 133–60. [Google Scholar] [CrossRef]

- Dess, Gregory, and Donald Beard. 1984. Dimensions of Organizational Task Environments. Administrative Science Quarterly 29: 52–73. [Google Scholar] [CrossRef]

- Drnevich, Louis Paul, and Aldas Kriauciunas. 2011. Clarifying the conditions and limits of the contributions of ordinary and dynamic capabilities to relative firm performance. Strategic Management Journal 32: 254–79. [Google Scholar] [CrossRef]

- Dunyo, Samuel, and Samuel Odei. 2023. Firm-level innovations in an emerging economy: Do perceived policy instability and legal institutional conditions matter? Sustainability 15: 1570. [Google Scholar] [CrossRef]

- Estival, Jean-Pierre. 2018. L’inflation, une notion complexe et difficile à mesurer dans un monde en perpétuelle évolution. Vie & Sciences de L’entreprise 206: 160–69. [Google Scholar] [CrossRef]

- Fadlilah, Andi, Andi Ramadhany, Septa Nabella, Ita Mustika, and Maya Richmayati. 2021. The effect of green innovation on financial performance with environmental dynamism as moderating variable. Psychology and Education 58: 5228–34. [Google Scholar] [CrossRef]

- Ferreras-Méndez, José Luis, Oscar Llopis, and Joaquín Alegre. 2022. Speeding up new product development through entrepreneurial orientation in SMEs: The moderating role of ambidexterity. Industrial Marketing Management 102: 240–51. [Google Scholar] [CrossRef]

- Feyen, Erik, Jon Frost, Leonardo Gambacorta, Harish Natarajan, and Matthew Saal. 2021. Fintech and the Digital Transformation of Financial Services: Implications for Market Structure and Public Policy. BIS Papers. Basel: Bank for International Settlements, Number 117. [Google Scholar]

- Fu, Qinghua, Muhammad Sial, Muhammad Arshad, Ubaldo Comite, Phung Thu, and József Popp. 2021. The inter-relationship between innovation capability and SME performance: The moderating role of the external environment. Sustainability 13: 9132. [Google Scholar] [CrossRef]

- Garvin, David. 1987. Competing on the eight dimensions of quality. Harvard Business Review 65: 101–9. [Google Scholar]

- Gazzola, Patrizia, Enrica Pavione, Roberta Pezzetti, and Daniele Grechi. 2020. Trends in the fashion industry. The Perception of sustainability and circular economy: A gender/generation quantitative approach. Sustainability 12: 2809. [Google Scholar] [CrossRef]

- Geyer, Emily, Rebecca Miller, Stephani Kim, Joseph Tobias, Olubukola Nafiu, and Dmitry Tumin. 2020. Quality and Impact of Survey Research Among Anesthesiologists: A Systematic Review. Advances in Medical Education and Practice 11: 587–99. [Google Scholar] [CrossRef]

- Goll, Irene, and Abdul Rasheed. 2004. The moderating effect of environmental munificence and dynamism on the relationship between discretionary social responsibility and firm performance. Journal of Business Ethics 49: 41–54. [Google Scholar] [CrossRef]

- Gomes, Giancarlo, Laio Seman, Ana Berndt, and Nadia Bogoni. 2022. The role of entrepreneurial orientation, organizational learning capability and service innovation in organizational performance. Revista de Gestão 29: 39–54. [Google Scholar] [CrossRef]

- Hernández-Perlines, Felipe, Manuel Cisneros, Domingo Ribeiro-Soriano, and Helena Mogorrón-Guerrero. 2020. Innovativeness as a determinant of entrepreneurial orientation: Analysis of the hotel sector. Economic Research-Ekonomska Istrazivanja 33: 2305–21. [Google Scholar] [CrossRef]

- Herrington, Mike, and Alicia Coduras. 2019. The national entrepreneurship framework conditions in sub-Saharan Africa: A comparative study of GEM data/National Expert Surveys for South Africa, Angola, Mozambique and Madagascar. Journal of Global Entrepreneurship Research 9: 1–24. [Google Scholar] [CrossRef]

- Janicki, Hurbert, and Phanindra Wunnava. 2004. Determinants of foreign direct investment: Empirical evidence from EU accession Candidates. Applied Economics 36: 505–9. [Google Scholar] [CrossRef]

- Kallmuenzer, Andreas, and Mike Peters. 2018. Entrepreneurial behaviour, firm size and financial performance: The case of rural tourism family firms. Tourism Recreation Research 43: 2–14. [Google Scholar] [CrossRef]

- Kessler, Eric, and Alok Chakrabarti. 1996. Innovation speed: A conceptual model of context, antecedents, and outcomes. The Academy of Management Review 21: 1143–91. [Google Scholar] [CrossRef]

- Khaleel, Alaa Jawad, Samer Ali Al-shami, Izaidin Majid, and Hayder Adel. 2017. The effect of entrepreneurial orientation of small firms’ innovation. Journal of Technology Management and Technopreneurship 5: 37–49. [Google Scholar]

- Kim, Jong Hae. 2019. Multicollinearity and misleading statistical results. Korean Journal of Anesthesiology 72: 558–69. [Google Scholar] [CrossRef] [PubMed]

- Kollmann, Tobias, and Christoph Stöckmann. 2012. Filling the entrepreneurial orientation–performance gap: The mediating effects of exploratory and exploitative innovations. Entrepreneurship: Theory and Practice 38: 1001–26. [Google Scholar] [CrossRef]

- Kraus, Sascha, Coen Rigtering, Mathew Hughes, and Vincent Hosman. 2012. Entrepreneurial orientation and the business performance of SMEs: A quantitative study from the Netherlands. Review of Managerial Science 6: 161–82. [Google Scholar] [CrossRef]

- Kreiser, Patrick, Louis Marino, Donald Kuratko, and Mark Weaver. 2013. Disaggregating entrepreneurial orientation: The non-linear impact of innovativeness, proactiveness and risk-taking on SME performance. Small Business Economics 40: 273–91. [Google Scholar] [CrossRef]

- Kreitchmann, Rodrigo Schames, Francisco Abad, Vicente Ponsoda, Maria Dolores Nieto, and Daniel Morillo. 2019. Controlling for response biases in self-report scales: Forced-choice vs. Psychometric modeling of Likert items. Frontiers in Psychology 10: 1–12. [Google Scholar] [CrossRef]

- Kumar, Sanjay. 2018. Understanding different issues of unit of analysis in a business research. Journal of General Management Research 5: 70–82. [Google Scholar]

- Lechner, Christian, and Sveinn Vidar Gudmundsson. 2014. Entrepreneurial orientation, firm strategy and small firm performance. International Small Business Journal 32: 36–60. [Google Scholar] [CrossRef]

- Li, Da-yuan, and Juan Liu. 2014. Dynamic capabilities, environmental dynamism, and competitive advantage: Evidence from China. Journal of Business Research 67: 2793–99. [Google Scholar] [CrossRef]

- Liu, Hai Yue, Ying Kai Tang, Xiao Lan Chen, and Joanna Poznanska. 2017. The Determinants of Chinese Outward FDI in Countries Along “One Belt One Road”. Emerging Markets Finance and Trade 53: 1374–87. [Google Scholar] [CrossRef]

- Lumpkin, George Thomas, and Gregory Dess. 1996. Clarifying the entrepreneurial construct and linking it to performance. Academy of Management Review 21: 135–72. [Google Scholar] [CrossRef]

- Lumpkin, George Thomas, and Gregory Dess. 2001. Linking two dimensions of entrepreneurial orientation to firm performance: The moderating role of environment industry life cycle. Journal of Business Venturing 16: 429–51. [Google Scholar] [CrossRef]

- Makhmoor, Bashir, Alfalih Abdulaziz, and Pradhan Sudeepta. 2023. Managerial ties, business model innovation & SME performance: Moderating role of environmental turbulence. Journal of Innovation & Knowledge 8: 100329. [Google Scholar] [CrossRef]

- Marshall, Guillermo, and Álvaro Parra. 2019. Innovation and competition: The role of the product market. International Journal of Industrial Organization 65: 221–47. [Google Scholar] [CrossRef]

- McArthur, Angeline, and Paul Nystrom. 1991. Environmental dynamism, complexity, and munificence as moderators of strategy-performance relationships. Journal of Business Research 23: 349–61. [Google Scholar] [CrossRef]

- Meissner, Dirk, and Maxim Kotsemir. 2016. Conceptualizing the innovation process towards the ‘active innovation paradigm’ trends and outlook. Journal of Innovation and Entrepreneurship 5: 14. [Google Scholar] [CrossRef]

- Miller, Danny, and Peter Friesen. 1982. Innovation in conservative and entrepreneurial firms: Two models of strategic momentum. Strategic Management Journal 3: 1–25. [Google Scholar] [CrossRef]

- Nair, Anil, Orhun Guldiken, Stav Fainshmidt, and Amir Pezeshkan. 2015. Innovation in India: A review of past research and future directions. Asia Pacific Journal of Management 32: 925–58. [Google Scholar] [CrossRef]

- OECD. 2018. Maintaining Competitive Conditions in the Era of Digitalization. Report to G-20 Finance Ministers and Central Bank Governors. Paris: OECD. Available online: https://www.oecd.org/g20/Maintaining-competitive-conditions-in-era-of-digitalisation-OECD.pdf (accessed on 13 February 2023).

- Olanrewaju, Lawal Ibrahim, Thea Van der Westhuizen, and Olusegun Matthew Awotunde. 2019. Organisational Cultural Practices and Employee Efficiency among Selected Nigerian Commercial Banks. Journal of Economics and Behavioural Studies 11: 1–9. [Google Scholar] [CrossRef] [PubMed]

- Palazzeschi, Letizia, Ornella Bucci, and Annamaria Di Fabio. 2018. Re-thinking Innovation in Organizations in the Industry 4.0 Scenario: New Challenges in a Primary Prevention Perspective. Frontiers in Psychology 9: 30. [Google Scholar] [CrossRef]

- Petrus, Barbar. 2019. Environmental dynamism: The implications for operational and dynamic capabilities effects. Management Sciences 24: 28–36. [Google Scholar] [CrossRef]

- Ponterotto, Joseph, and Daniel Ruckdeschel. 2007. An overview of coefficient alpha and a reliability matrix for estimating adequacy of internal consistency coefficients with psychological research measures. Perceptual and Motor Skills 105: 997–1014. [Google Scholar] [CrossRef] [PubMed]

- Porter, Michael. 1981. The contributions of industrial organization to strategic management. The Academy of Management Review 6: 609–20. [Google Scholar] [CrossRef]

- Prajogo, Daniel. 2016. The strategic fit between innovation strategies and business environment in delivering business performance. International Journal of Production Economics 171: 241–49. [Google Scholar] [CrossRef]

- Ramdani, Boumediene, Ahmed Binsaif, and Elias Boukarmi. 2019. Business model innovation: A review and research agenda. New England Journal of Entrepreneurship 22: 89–108. [Google Scholar] [CrossRef]

- Rauch, Andreas, Johan Wiklund, George Thomas Lumpkin, and Michael Frese. 2009. Entrepreneurial orientation and business performance: Cumulative empirical evidence. Entrepreneurship Theory and Practice 33: 761–87. [Google Scholar] [CrossRef]

- Rezai, Bijan, Sohrab Delangizan, and Atieh Khodaei. 2020. Business environment: Designing and explaining the new environmental dynamism model in pharmacies. International Journal of Health and Life Sciences 6: e105951. [Google Scholar] [CrossRef]

- Ried, Leopold, Stephanie Eckerd, and Lutz Kaufmann. 2022. Social desirability bias in PSM surveys and behavioral experiments: Considerations for design development and data collection. Journal of Purchasing & Supply Management 28: 1–9. [Google Scholar] [CrossRef]

- Rodriguez-Pena, Antonio. 2021. Assessing the impact of corporate entrepreneurship in the financial performance of subsidiaries of Colombian business groups: Under environmental dynamism moderation. Journal of Innovation and Entrepreneurship 10: 16. [Google Scholar] [CrossRef]

- Ruba, Metalor Remo, Thea Van der Westhuizen, and Germinah Evelyn Chiloane-Tsoka. 2021. Influence of entrepreneurial orientation on organisational performance: Evidence from Congolese Higher Education Institutions. Journal of Contemporary Management 18: 243–69. [Google Scholar] [CrossRef]

- Rubera, Gaia, and Ahmet Kirca. 2012. Firm innovativeness and its performance outcomes: A meta-analytic review and theoretical integration. Journal of Marketing 76: 130–47. [Google Scholar] [CrossRef]

- Saul, Estrin, and Pelletier Adeline. 2018. Privatization in developing countries: What are the lessons of recent experience? The World Bank Research Observer 33: 65–102. [Google Scholar] [CrossRef]

- Schumpeter, Joseph. 1934. Theory of Economic Development: An Inquiry into Profits, Capital, Credit, Interest and the Business Cycle. Cambridge: Harvard University Press, vol. 6. [Google Scholar]

- Shah, Syed Hasanat, Muhammad Abdul Kamal, Hafsa Hasnat, and Li Jun Jiang. 2019. Does institutional difference affect Chinese outward foreign direct investment? Evidence from fuel and non-fuel natural resources. Journal of the Asia Pacific Economy 24: 670–89. [Google Scholar] [CrossRef]

- Shah, Syed Tanveer, Syed Mohsin Shah, and Hatem El-Gohary. 2022. Nurturing Innovative work behaviour through workplace learning among knowledge workers of small and medium businesses. Journal of the Knowledge Economy. [Google Scholar] [CrossRef]

- Singh, Daljeet Malkeet, and Norshafizah Binti Hanafi. 2020. Innovation and firm performance: Evidence from Malaysian small and medium enterprises. International Journal of Academic Research in Business and Social Sciences 10: 665–79. [Google Scholar] [CrossRef]

- Surya, Batara, Firman Menne, Hernita Sabhan, Seri Suriani, Herminawaty Abubakar, and Muhammad Idris. 2021. Economic growth, increasing productivity of SMEs, and open innovation. Journal of Open Innovation: Technology, Market, and Complexity 7: 20. [Google Scholar] [CrossRef]

- Taber, Keith. 2018. The use of Cronbach’s Alpha when developing and reporting research instruments in science education. Research in Science Education 48: 1273–96. [Google Scholar] [CrossRef]

- Taghizadeh, Seyedeh Khadijeh, Davoud Nikbin, Mirza Mohammad Alam, Syed Abidur Rahman, and Gunalan Nadarajah. 2021. Technological capabilities, open innovation and perceived operational performance in SMEs: The moderating role of environmental dynamism. Journal of Knowledge Management 25: 1486–507. [Google Scholar] [CrossRef]

- Tajeddini, Kayhan, and Stephen Mueller. 2018. Moderating effect of environmental dynamism on the relationship between a firm’s entrepreneurial orientation and financial performance. Entrepreneurship Research Journal 9: 1–13. [Google Scholar] [CrossRef]

- Tajeddini, Kayhan, Emma Martin, and Alisha Ali. 2020. Enhancing hospitality business performance: The role of entrepreneurial orientation and networking ties in a dynamic environment. International Journal of Hospitality Management 90: 102605. [Google Scholar] [CrossRef] [PubMed]

- Thai, Mai. 2015. Contingency Perspective. In Cary Cooper, Wiley Encyclopedia of Management, 3rd ed. New York: Wiley Onlinelibrary, vol. 6, pp. 1–5. [Google Scholar] [CrossRef]

- Ting, Hsiang-Feng, Hsien-Bin Wang, and Dja-Shin Wang. 2012. The moderating role of environmental dynamism on the influence of innovation strategy and firm performance. International Journal of Innovation, Management and Technology 3: 517. [Google Scholar] [CrossRef]

- Torres-Barreto, Martha Liliana, Yojan Sebastián Charry, and Mileidy Alvarez-Melgarejo. 2021. Business innovations and their key factors: Public funding, human capital, and their relationships with the industrial environment. Tendencias 22: 264–87. [Google Scholar] [CrossRef]

- UNIDO, and GTZ. 2008. Creating an Enabling Environment for Private Sector Development in Sub-Saharan Africa. Vienna: Vienna International Centre. [Google Scholar]

- Van der Westhuizen, Thea. 2019. South African Undergraduate Students’ Access to Entrepreneurial Education and Its Influence on Career Choice: Global Considerations for Developing Countries. In Global Considerations in Entrepreneurship Education and Training. Edited by Luísa Cagica Carvalho and Ana Dias Daniel. New York: IGI Global, pp. 232–52. [Google Scholar]

- Volberda, Henk, Niels van der Weerdt, Ernst Verwaal, Marten Stienstra, and Antonio Verdu. 2012. Contingency Fit, Institutional Fit, and Firm Performance: A Metafit Approach to Organization–Environment Relationships. Organization Science 23: 1040–54. [Google Scholar] [CrossRef]

- Vyas, Vijay. 2009. Innovation and New Product Development by SMEs: An Investigation of Scottish food and Drinks Industry. Unpublished Ph.D. thesis, Edinburgh Napier University, Edinburgh, UK. [Google Scholar]

- Wan, David, Ong Chin Huat, and Francis Lee. 2005. Determinants of Firm Innovation in Singapore. Technovation 25: 261–868. [Google Scholar] [CrossRef]

- World Bank. 2016. Doing Business 2016. Measuring Regulatory Quality and Efficiency. Washington, DC: World Bank. [Google Scholar]

- World Bank. 2020. Doing Business 2020. Comparing Business Regulation in 190 Economies. Washington, DC: World Bank. [Google Scholar]

- Zand, Hamed, and Babak Rezaei. 2020. Investigating the impact of process and product innovation strategies on business performance due to the mediating role of environmental dynamism using structural equations modelling. Brazilian Journal of Operations & Production Management 17: 1–15. [Google Scholar] [CrossRef]

- Zehir, Cemal, and Dilek Balak. 2018. Market dynamism and firm performance relation: The mediating effects of positive environment conditions and firm innovativeness. Emerging Markets Journal 8: 45–51. [Google Scholar] [CrossRef]

| Model | Model 1 | Model 2 | |||||

|---|---|---|---|---|---|---|---|

| Variable | β | t | β | t | |||

| Control var. | |||||||

| Location | 0.571 *** | 3.991 | 0.542 *** | 3.797 | |||

| Firm Age | −0.020 *** | −4.615 | −0.021 *** | −4.615 | |||

| Firm Size | 0.000 | 0.985 | 0.000 | 1.144 | |||

| Main effects | |||||||

| INN | 0.283 *** | 3.572 | 0.263 ** | 3.318 | |||

| ED | 0.128 † | 1.777 | 0.154 * | 2.107 | |||

| Interaction | |||||||

| INN*ED | −0.151 † | −1.315 | |||||

| Constant | 3.144 *** | 23.867 | 3.176 *** | 24.068 | |||

| Model Summary | |||||||

| R2 | 0.291 *** | 0.305 | |||||

| Adj. R2 | 0.271 *** | 0.281 | |||||

| ΔR2 | 0.291 *** | 0.014 | |||||

| ΔF | 14.064 *** | 3.372 | |||||

| F | 14.064 *** | 12.444 *** | |||||

| Durbin-Watson | 1.571 | ||||||

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2023 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Ruba, R.M.; Chiloane-Tsoka, G.E.; Van der Westhuizen, T. Moderating Effect of Business Environmental Dynamism in the Innovativeness—Company Performance Relationship of Congolese Manufacturing Companies. Economies 2023, 11, 191. https://doi.org/10.3390/economies11070191

Ruba RM, Chiloane-Tsoka GE, Van der Westhuizen T. Moderating Effect of Business Environmental Dynamism in the Innovativeness—Company Performance Relationship of Congolese Manufacturing Companies. Economies. 2023; 11(7):191. https://doi.org/10.3390/economies11070191

Chicago/Turabian StyleRuba, Remo Metalor, Germinah E. Chiloane-Tsoka, and Thea Van der Westhuizen. 2023. "Moderating Effect of Business Environmental Dynamism in the Innovativeness—Company Performance Relationship of Congolese Manufacturing Companies" Economies 11, no. 7: 191. https://doi.org/10.3390/economies11070191

APA StyleRuba, R. M., Chiloane-Tsoka, G. E., & Van der Westhuizen, T. (2023). Moderating Effect of Business Environmental Dynamism in the Innovativeness—Company Performance Relationship of Congolese Manufacturing Companies. Economies, 11(7), 191. https://doi.org/10.3390/economies11070191