Product Market Competition, Corporate Investment, and Firm Value: Scrutinizing the Role of Economic Policy Uncertainty

Abstract

1. Introduction

2. Literature Review

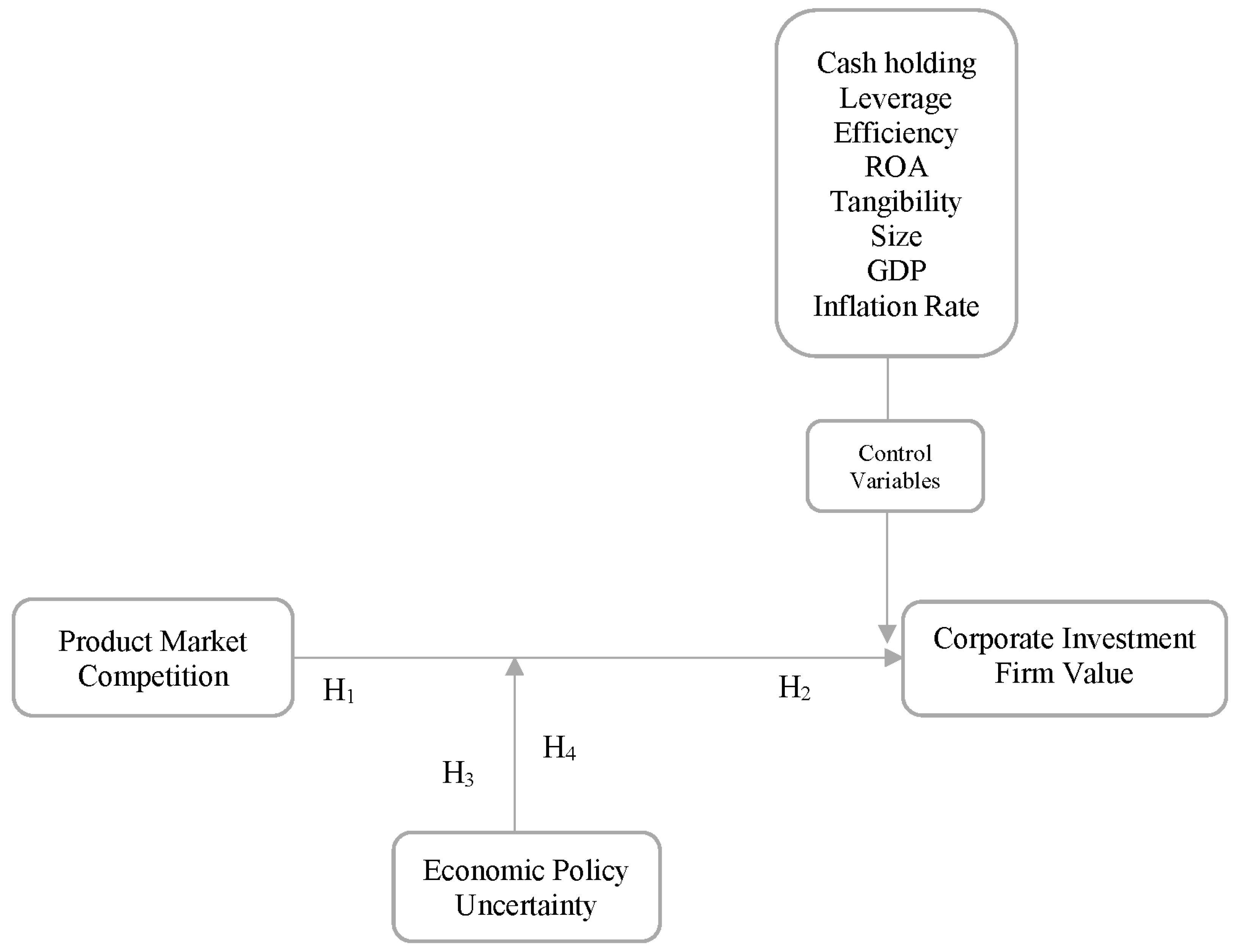

3. Sample and Methodology

3.1. Data and Variable Measurements

3.2. Model Specification and Econometric Method

4. Results and Discussion

4.1. Descriptive Statistics

4.2. Estimation of Results

4.3. Estimation of Results by Country

4.3.1. Product Market Competition, Corporate Investment, and Firm Value

4.3.2. The Interactive Effect of EPU on PMC, Corporate Investment, and Firm Value Nexus

5. Discussion of Findings

Robustness Check

6. Conclusions

7. Managerial Applications

8. Limitations and Recommendations for Further Study

Author Contributions

Funding

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

Abbreviations

| PMC | Product market competition |

| CI | Corporate investment |

| FV | Firm value |

| EPU | Economic policy uncertainty |

| CH | Cash-holding |

| LEV | Leverage |

| EFF | Efficiency ratio |

| ROA | Return on assets |

| SIZE | Firm size |

| GDP | Gross domestic product growth |

| TAN | Tangibility |

| INFL | Inflation rate |

| (GMM) | Generalized method of moments |

| (HHI) | Herfindahl–Hirschman index |

| MC | Marginal cost |

| SGA | Selling, general, and administrative expenses |

References

- Abdoh, Hussein Ali Ahmad, and Oscar Varela. 2018. Product market competition, cash flow and corporate investments. Managerial Finance 44: 207–21. [Google Scholar] [CrossRef]

- Abdoh, Hussein, and Oscar Varela. 2017. Product market competition, idiosyncratic and systematic volatility. Journal of Corporate Finance 43: 500–13. [Google Scholar] [CrossRef]

- Aghion, Philippe, Nick Bloom, Richard Blundell, Rachel Griffith, and Peter Howitt. 2005. Competition and Innovation: An Inverted-U Relationship. The Quarterly Journal of Economics 120: 701–28. [Google Scholar] [CrossRef]

- Ahsan, Tanveer, Bakr Al-Gamrh, and Sultan Sikandar Mirza. 2021. Economic policy uncertainty and sustainable financial growth: Does business strategy matter? Finance Research Letters 46: 102381. [Google Scholar] [CrossRef]

- Akdoğu, Evrim, and Peter MacKay. 2008. Investment and Competition. Journal of Financial and Quantitative Analysis 43: 299–330. [Google Scholar] [CrossRef]

- Alimov, Azizjon. 2014. Product market competition and the value of corporate cash: Evidence from trade liberalization. Journal of Corporate Finance 25: 122–39. [Google Scholar] [CrossRef]

- Alouane, Nour, Ines Kahloul, and Jocelyn Grira. 2022. The Trilogy of Ownership, Income Diversification, and Performance Nexus: Empirical Evidence from Tunisian Banks. Finance Research Letters 45: 102180. [Google Scholar] [CrossRef]

- Arellano, Manuel, and Stephen Bond. 1991. Some tests of specification for panel data: Monte Carlo evidence and an application to employment equations. The Review of Economic Studies 58: 277–97. [Google Scholar] [CrossRef]

- Babar, Md, and Ahsan Habib. 2021. Product market competition in accounting, finance, and corporate governance: A review of the literature. International Review of Financial Analysis 73: 101607. [Google Scholar] [CrossRef]

- Baker, Scott R., Nicholas Bloom, and Steven J. Davis. 2016. Measuring Economic Policy Uncertainty. The Quarterly Journal of Economics 131: 1593–636. [Google Scholar] [CrossRef]

- Bhullar, Pritpal Singh, and Dyal Bhatnagar. 2013. Theoretical framework EV vs. Stock price—A better measurement of firm value. International Journal of Commerce, Business and Management 2: 335–43. [Google Scholar]

- Boubaker, Sabri, Viet Anh Dang, and Syrine Sassi. 2018. Product Market Competition and Labor Investment Efficiency. Working Paper. Available online: http://www.fmaconferences.org/Glasgow/Papers (accessed on 23 March 2022).

- Bustamante, M. Cecilia, and Andres Donangelo. 2017. Product Market Competition and Industry Returns. The Review of Financial Studies 30: 4216–66. [Google Scholar] [CrossRef]

- Chen, Jian, Fuwei Jiang, and Guoshi Tong. 2017. Economic policy uncertainty in China and stock market expected returns. Accounting & Finance 57: 1265–86. [Google Scholar] [CrossRef]

- Chen, Liming, Ziqing Du, and Zhihao Hu. 2019. Impact of economic policy uncertainty on exchange rate volatility of China. Finance Research Letters 32: 101266. [Google Scholar] [CrossRef]

- Crepon, Bruno, Emmanuel Duguet, and Jacques Mairessec. 2006. Research, Innovation, and Productivity: An Econometric Analysis at the Firm Level. Economics of Innovation and New Technology 7: 115–58. [Google Scholar] [CrossRef]

- Datta, Sudip, Mai Iskandar-Datta, and Vivek Singh. 2013. Product market power, industry structure, and corporate earnings management. Journal of Banking & Finance 37: 3273–85. [Google Scholar] [CrossRef]

- Elzinga, Kenneth G., and David E. Mills. 2011. The Lerner Index of Monopoly Power: Origins and Uses. The American Economic Review 101: 558–64. [Google Scholar] [CrossRef]

- Fedderke, Johannes, Nonso Obikili, and Nicola Viegi. 2017. Markups and Concentration in South African Manufacturing Sectors: An Analysis with Administrative Data. South African Journal of Economics 86: 120–40. [Google Scholar] [CrossRef]

- Frésard, Laurent, and Philip Valta. 2016. How Does Corporate Investment Respond to Increased Entry Threat? The Review of Corporate Finance Studies 5: 1–35. [Google Scholar] [CrossRef]

- Giroud, Xavier, and Holger M. Mueller. 2011. Corporate Governance, Product Market Competition, and Equity Prices. The Journal of Finance 66: 563–600. [Google Scholar] [CrossRef]

- Gu, Lifeng. 2016. Product market competition, R&D investment, and stock returns. Journal of Financial Economics 119: 441–55. [Google Scholar] [CrossRef]

- He, Zelong, and Jijun Niu. 2018. The effect of economic policy uncertainty on bank valuations. Applied Economics Letters 25: 345–47. [Google Scholar] [CrossRef]

- Irvine, Paul J., and Jeffrey Pontiff. 2009. Idiosyncratic Return Volatility, Cash Flows, and Product Market Competition. The Review of Financial Studies 22: 1149–77. [Google Scholar] [CrossRef]

- Jiang, Fuxiu, Kenneth A. Kim, John R. Nofsinger, and Bing Zhu. 2015. Product market competition and corporate investment: Evidence from China. Journal of Corporate Finance 35: 196–210. [Google Scholar] [CrossRef]

- Khan, Muhammad Arif, Xuezhi Qin, and Khalil Jebran. 2019. Does uncertainty influence the leverage-investment association in Chinese firms? Research in International Business and Finance 50: 134–52. [Google Scholar] [CrossRef]

- Kim, JooMan, Insun Yang, Taeyong Yang, and Peter Koveos. 2021. The impact of R&D intensity, financial constraints, and dividend payout policy on firm value. Finance Research Letters 40: 101802. [Google Scholar] [CrossRef]

- Kripfganz, Sebastian. 2020. XTSEQREG: Stata Module to Perform Sequential Estimation of Linear Panel Data Models. Available online: https://EconPapers.repec.org/RePEc:boc:bocode:s458355 (accessed on 9 April 2021).

- Laksmana, Indrarini, and Ya-Wen Yang. 2015. Product market competition and corporate investment decisions. Review of Accounting and Finance 14: 128–48. [Google Scholar] [CrossRef]

- Lemma, Tesfaye T., Minga Negash, Mthokozisi Mlilo, and Ayalew Lulseged. 2018. Institutional ownership, product market competition, and earnings management: Some evidence from international data. Journal of Business Research 90: 151–63. [Google Scholar] [CrossRef]

- Li, Scott, Qianqiu Liu, and James Refalo. 2020. Industry classification, product market competition, and firm characteristics. Finance Research Letters 36: 101319. [Google Scholar] [CrossRef]

- Lyandres, Evgeny, and Berardino Palazzo. 2016. Cash Holdings, Competition, and Innovation. Journal of Financial and Quantitative Analysis 51: 1823–61. [Google Scholar] [CrossRef]

- Ma, Huanyu, and Dapeng Hao. 2022. Economic policy uncertainty, financial development, and financial constraints: Evidence from China. International Review of Economics & Finance 79: 368–86. [Google Scholar] [CrossRef]

- Mello, Antonio S., and Mengying Wang. 2012. Globalization, product market competition and corporate investment. Paper presented at the AFA 2013 San Diego Meetings, San Diego, CA, USA, January 4–6; pp. 1–65. [Google Scholar] [CrossRef]

- Minniti, Antonio. 2010. Product market competition, R&D composition and growth. Economic Modelling 27: 417–21. [Google Scholar] [CrossRef]

- Moradi, Mahdi, Mohammad Ali Bagherpour Velashani, and Mahdi Omidfar. 2017. Corporate governance, product market competition and firm performance: Evidence from Iran. Humanomics 33: 38–55. [Google Scholar] [CrossRef]

- Olalere, Oluwaseyi Ebenezer, and Janine Mukuddem-Petersen. 2022. Economic Policy Uncertainty and Firm Value: Is There a Link? A Panel Vector Autoregression Approach. Asia-Pacific Social Science Review 22: 106–20. [Google Scholar]

- Pastor, Lubos, and Pietro Veronesi. 2012. Uncertainty about Government Policy and Stock Prices. The Journal of Finance 67: 1219–64. [Google Scholar] [CrossRef]

- Pontuch, Peter. 2011. Product Market Concentration, Financial Constraints, and Firms’ Business Cycle Sensitivity (No. urn: Hdl: 123456789/6271). Paris: Université Paris-Dauphine. [Google Scholar]

- Roodman, David. 2009. How to do Xtabond2: An Introduction to Difference and System GMM in Stata. The Stata Journal: Promoting Communications on Statistics and Stata 9: 86–136. [Google Scholar] [CrossRef]

- Ryu, Doowon. 2019. The US–Korea free trade agreement as a shock to product market competition: Evidence from the Korean stock market. Finance Research Letters 35: 101296. [Google Scholar] [CrossRef]

- Sabherwal, Sanjiv, and Trang Thai. 2019. Product Market Competition and Corporate Cash Holdings: A Cross-Country Evidence. Paper presented at the Paris December 2019 Finance Meeting EUROFIDAI-ESSEC, Paris, France, December 19; pp. 1–60. [Google Scholar] [CrossRef]

- Schumpeter, Joseph A. 1912. The Theory of Economic Development. Cambridge, MA: Harvard University Press. [Google Scholar]

- Sheikh, Shahbaz. 2018. Corporate social responsibility, product market competition, and firm value. Journal of Economics and Business 98: 40–55. [Google Scholar] [CrossRef]

- Shin, Ilhang, and Hansol Lee. 2022. Product market competition and a firm’s R&D investment: New evidence from Korea. Investment Management and Financial Innovations 19: 287–99. [Google Scholar] [CrossRef]

- Spierdijk, Laura, and Michalis Zaouras. 2017. The Lerner index and revenue maximization. Applied Economics Letters 24: 1075–79. [Google Scholar] [CrossRef]

- Stigler, George J. 1958. The Economies of Scale. The Journal of Law and Economics 1: 54–71. [Google Scholar] [CrossRef]

- Stoughton, Neal M., Kit Pong Wong, and Long Yi. 2017. Investment Efficiency and Product Market Competition. Journal of Financial and Quantitative Analysis 52: 2611–42. [Google Scholar] [CrossRef]

- Valta, Philip. 2012. Competition and the cost of debt. Journal of Financial Economics 105: 661–82. [Google Scholar] [CrossRef]

- Van Vo, Lai, and Huong Thi Thu Le. 2017. Strategic growth option, uncertainty, and R&D investment. International Review of Financial Analysis 51: 16–24. [Google Scholar] [CrossRef]

- Wang, Yizhong, Carl R. Chen, and Ying Sophie Huang. 2014. Economic policy uncertainty and corporate investment: Evidence from China. Pacific-Basin Finance Journal 26: 227–43. [Google Scholar] [CrossRef]

- Wang, Yizhong, Yueling Wei, and Frank M. Song. 2017. Uncertainty and corporate R&D investment: Evidence from Chinese listed firms. International Review of Economics & Finance 47: 176–200. [Google Scholar] [CrossRef]

- Yung, Kenneth, and Trung Nguyen. 2020. Managerial ability, product market competition, and firm behavior. International Review of Economics & Finance 70: 102–16. [Google Scholar] [CrossRef]

| Country | Number of Firms Population | Excluded from Population | Full Sample | Number of Observations |

| Brazil | 382 | 275 | 107 | 1284 |

| Russia | 614 | 504 | 110 | 1320 |

| India | 4313 | 3595 | 718 | 8616 |

| China | 4359 | 3323 | 1036 | 12,432 |

| Total | 9668 | 7697 | 1971 | 23,652 |

| Sectors | Brazil | Russia | India | China |

| Industrials | 30 | 40 | 315 | 403 |

| Equipment and services | 17 | 13 | 35 | 51 |

| Consumer cyclicals | 15 | 10 | 107 | 128 |

| Consumer non-cyclicals | 12 | 9 | 69 | 44 |

| Materials | 10 | 13 | 93 | 110 |

| Energy | 3 | 11 | 18 | 21 |

| Utilities | 15 | 9 | 41 | 82 |

| Healthcare | 3 | 2 | 23 | 94 |

| Information technology | 2 | 3 | 17 | 103 |

| Total sample size | 107 | 110 | 718 | 1036 |

| Var | Aggregate Data | Brazil | Russia | India | China | |||||

|---|---|---|---|---|---|---|---|---|---|---|

| Mean | SD | Mean | SD | Mean | SD | Mean | SD | Mean | SD | |

| PMC | −2.956 | 24.418 | −0.3729 | 3.7135 | 0.4120 | 13.863 | −15.682 | 286.602 | −41.179 | 19.598 |

| CI | 0.3655 | 1.8608 | 0.0495 | 0.0444 | 0.0567 | 0.1382 | 1.1638 | 7.9707 | 0.0526 | 0.0528 |

| FV | 19.892 | 29.937 | 10.987 | 20.4185 | 12.879 | 59.007 | 13.515 | 17.859 | 46.907 | 358.024 |

| EPU | 7.6175 | 0.7095 | 7.6361 | 0.3948 | 7.7106 | 0.4211 | 7.0637 | 0.3456 | 7.9894 | 0.6987 |

| CH | 0.2488 | 0.2053 | 0.1223 | 0.1261 | 0.0987 | 0.1544 | 0.3621 | 0.2300 | 0.1992 | 0.1549 |

| LEV | 6.303 | 1.8128 | 0.4085 | 0.1764 | 7.3169 | 119.69 | 0.4947 | 0.2172 | 0.5514 | 0.2195 |

| EFF | 0.8134 | 5.7556 | 0.5824 | 0.5109 | 1.1049 | 1.2009 | 0.9978 | 0.7605 | 0.6785 | 7.8986 |

| ROA | 0.1154 | 0.6271 | 0.0950 | 0.0628 | 3.0730 | 36.370 | 0.1087 | 00.0860 | 0.0758 | 0.5398 |

| TAN | 1.0921 | 10.1484 | 0.3363 | 0.1660 | 3.3388 | 11.1344 | 0.2673 | 0.1993 | 0.2157 | 0.1593 |

| SIZE | 22.573 | 1.7029 | 22.4740 | 1.5682 | 22.5024 | 1.9684 | 22.858 | 1.9196 | 22.393 | 1.4861 |

| INFL | 4.5148 | 3.2709 | 5.5270 | 1.8706 | 6.9649 | 3.5184 | 7.1859 | 2.9900 | 2.2989 | 1.3733 |

| GDP | 0.6009 | 0.3739 | 0.0808 | 0.3192 | 0.0707 | 0.3387 | 0.5610 | 0.4253 | 0.7386 | 0.2003 |

| Variables | CI Model 1 | FV Model 2 | CI Model 3 | FV Model 4 |

|---|---|---|---|---|

| L.CIit−1 | 0.4841 *** (27.19) | 0.4902 *** (27.51) | ||

| L.FVit−1 | 0.3981 *** (26.00) | 0.4104 *** (26.35) | ||

| PMC | 0.0377 ** (1.98) | 0.0398 *** (3.18) | 0.0758 ** (1.99) | −0.0971 *** (−3.84) |

| CH | −0.1634 ** (−2.43) | −0.1303 ** (−3.45) | −0.6482 ** (.2740) | −0.5721 *** (−3.74) |

| LEV | −0.0012 (−0.11) | −0.0108 *** (−3.37) | −0.0527 (−0.54) | −0.0180 (−0.40) |

| EFF | 0.0964 *** (3.24) | −0.0587 *** (−4.49) | 0.3920 *** (3.29) | −0.3099 *** (−5.83) |

| ROA | −0.0664 * (−1.78) | 0.0143 (0.40) | −0.0845 (−1.24) | 0.0656 (0.88) |

| TAN | 0.0273 (0.60) | −0.0419 (−0.76) | −0.0014 (−0.15) | −0.0261 *** (−4.08) |

| SIZE | −3.7945 *** (−4.33) | −4.9016 *** (−9.85) | −0.4330 *** (−4.75) | −0.2407 *** (−5.38) |

| INFL | 0.0354 *** (2.94) | −0.0309 *** (−7.84) | 0.0346 *** (2.84) | −0.0456 *** (−6.11) |

| GDP | 0.1615 *** (4.83) | −0.1995 *** (−7.95) | 0.3519 *** (5.20) | −0.5327 *** (−10.85) |

| EPU | −0.0561 ** (−2.30) | −0.1723 *** (−12.57) | ||

| PMC*EPU | −0.0007 * (−1.86) | −0.0030 ** (−2.06) | ||

| _cons | 10.389 *** (3.81) | 17.236 *** (10.95) | 6.2124 *** (3.31) | 11.576 *** (11.85) |

| AR1 | −2.656 (0.0079) | −1.2447 (0.0011) | −11.934 (0.0000) | −11.5 (0.0012) |

| AR2 | −0.7281 (0.4665) | 1.1355 (0.2562) | 1.608 (0.1078) | 2.184 (0.2891) |

| Hansen test | 150.921 (0.1335) | 449.393 (0.1205) | 111.407 (0.3162) | 434.222 (0.5351) |

| Country effect | Yes | Yes | Yes | Yes |

| Year effect | Yes | Yes | Yes | Yes |

| F test | 1028.05 (0.0000) | 1064.90 (0.0000) | 1035.32 (0.0000) | 1169.17 (0.0000) |

| No. of instruments | 75 | 75 | 77 | 77 |

| Observations | 23,652 | 23,652 | 23,652 | 23,652 |

| Variables | Brazil | Russia | India | China | ||||

|---|---|---|---|---|---|---|---|---|

| CI | FV | CI | FV | CI | FV | CI | FV | |

| L.CIit−1 | 0.4050 *** (33.43) | 0.1839 *** (16.19) | 0.9705 *** (7.29) | 0.4720 *** (22.89) | ||||

| L.FVit−1 | 0.2242 *** (21.67) | 0.1991 *** (9.81) | 0.5085 *** (25.50) | 0.3631 *** (25.06) | ||||

| PMC | −0.1526 *** (−4.88) | 0.0682 *** (3.20) | −0.0379 ** (−2.04) | 0.0169 *** (3.00) | −0.1584 *** (−7.23) | 0.0264 *** (3.12) | 0.0254 *** (3.58) | −0.0492 *** (−3.11) |

| CH | −1.142 *** (−8.88) | −0.0945 (−0.71) | 1.1041 *** (13.56) | −0.1366 ** (−2.14) | 3.2779 *** (30.70) | 0.0382 *** (2.81) | −0.338 *** (−7.57) | −0.4807 *** (−4.33) |

| LEV | 0.8927 *** (7.35) | 0.6083 *** (4.29) | −0.0001 ** (−2.29) | −0.0003 *** (−15.23) | 0.8466 *** (5.10) | −0.0735 (−1.03) | 0.0731 (1.33) | −0.1377 (−1.02) |

| EFF | 0.0954 (1.19) | 0.1043 * (1.80) | −0.1371 *** (−5.10) | −0.0469 ** (−1.96) | 0.2681 *** (7.57) | −0.0202 (−1.43) | 0.0849 ** (2.09) | −0.2017 ** (−2.41) |

| ROA | 1.3565 *** (4.67) | −0.9829 *** (−3.45) | 0.0009 *** (3.66) | −0.0005 *** (−4.18) | −1.416 *** (−6.86 | −0.1862 ** (−1.99) | −0.1040 (−0.61) | −2.646 *** (−6.96) |

| TAN | 0.1343 *** (3.20) | 0.0559 *** (3.60) | 0.2389 *** (2.75) | −0.0419 (−0.76) | −0.0033 *** (−4.20) | 0.0088 *** (3.00) | 0.0006 *** (0.15) | 0.0289 ** (2.06) |

| SIZE | 2.470 *** (3.23) | −1.555 *** (−2.99) | −2.175 ** (−2.55) | −0.0215 ** (−2.38) | −1.171 *** (−35.79) | 0.1696 (0.46) | −0.0392 *** (−3.03) | −8.2641 *** (−16.49) |

| INFL | −0.0027 (−0.38) | −0.0372 *** (−8.99) | 0.0088 * (1.82) | −0.0025 (−1.53) | 0.1946 *** (35.80) | −0.0095 *** (−4.84) | 0.0187 *** (5.65) | −0.0940 *** (−13.77) |

| GDP | 0.1888 *** (4.75) | −0.1973 *** (−6.58) | 0.6648*** (8.05) | −0.0090 (−0.27) | −0.0285 * (−1.76) | −0.0424 *** (−3.47) | 0.0585 ** (2.30) | −0.080 (−1.52) |

| _cons | −10.578 *** (−4.42) | 6.816 *** (4.16) | 3.5153 (1.30) | 1.3191 *** (6.15) | 23.1064 *** (30.70) | 0.3503 (0.30) | 0.2188 (0.69) | 28.330 *** (17.55) |

| AR1 | −3.5231 (0.0004) | −4.5898 (0.0000) | −3.808 (0.0001) | −4.0034 (0.0001) | −1.3786 (0.0168) | −9.4448 (0.0000) | −8.8391 (0.0020) | −11.5 (0.0012) |

| AR2 | 0.3733 (0.7089) | −1.035 (0.3007) | −0.3315 (0.7402) | −0.3175 (0.7508) | −1.1318 (0.2577) | −0.8942 (0.3712) | 0.6136 (0.5395) | 2.184 (0.2891) |

| Hansen test | 67.89405 (0.3460) | 71.49039 (0.2431) | 78.4872 (0.1051) | 64.513 (0.4585) | 301.9115 (0.2245) | 200.154 (0.3418) | 84.000 (0.476) | 359.699 (0.214) |

| Country effect | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes |

| Year effect | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes |

| F test | 18,479.50 (0.0000) | 2489.13 (0.0000) | 509.20 (0.0000) | 22,051.08 (0.0000) | 551.07 (0.0000) | 987.49 (0.0000) | 825.42 (0.0000) | 1583.30 (0.0000) |

| No. of instruments | 76 | 76 | 76 | 76 | 76 | 76 | 76 | 76 |

| Observations | 1284 | 1284 | 1320 | 1320 | 8616 | 8616 | 12,432 | 12,432 |

| Variables | Brazil | Russia | India | China | ||||

|---|---|---|---|---|---|---|---|---|

| CI | FV | CI | FV | CI | FV | CI | FV | |

| L.CIit−1 | 0.3952 *** (29.26) | 0.1882 *** (17.98) | 0.9759 *** (9.69) | 0.4756 *** (22.42) | ||||

| L.FVit−1 | 0.2269 *** (23.93) | −0.0154 *** (−21.54) | 0.4694 *** (22.03) | 0.3623 *** (24.34) | ||||

| PMC | −0.1698 *** (−4.53) | 17.556 *** (2.99) | −0.0471 ** (−2.48) | 1.1922 *** (9.58) | −0.0004 * (−1.83) | 0.0263 (1.58) | 0.0931 *** (4.44) | −0.0736 *** (−4.40) |

| CH | −1.2810 *** (−10.15) | −0.0213 (−0.17) | 1.1604 *** (14.34) | −22.224 *** (−9.20) | 0.4643 *** (4.34) | 0.3568 *** (3.72) | −1.068 *** (−8.04) | −0.4323 *** (−3.96) |

| LEV | 0.9142 *** (7.25) | 0.6833 *** (4.56) | −0.0001 *** (−2.71) | −0.2420 *** (−4.43) | 0.1026 (0.62) | −0.3728 *** (−2.66) | 0.2763 * (1.72) | −0.1287 (−0.98) |

| EFF | 0.1287 (1.58) | 0.0636 (1.35) | −0.1388 *** (−5.45) | −5.2156 *** (−9.26) | 0.7390 *** (4.09) | −0.0410 (−1.38) | 0.2663 ** (2.38) | −0.2539 *** (−3.07) |

| ROA | 1.230 *** (4.27) | −0.8776 *** (−3.30) | 0.0009 *** (3.67) | 0.0079 (1.43) | −0.2556 (−1.48) | −0.4966 *** (−2.78) | −0.0377 * (−1.69) | −2.147 *** (−5.82) |

| TAN | 0.0930 *** (2.65) | 0.0497 *** (4.68) | 0.2793 *** (3.77) | −2.4701 (−0.94) | 0.0215 *** (4.68) | −0.0005 (−0.90) | 0.0208 (1.13) | 0.0573 *** (3.53) |

| SIZE | 2.463 *** (3.27) | −0.7737 (−1.53) | −1.9307 ** (−2.26) | −19.512 *** (−10.21) | −0.4165 *** (−7.71) | −1.4429 * (−1.83) | −3.146 *** (−3.34) | −5.976 *** (−11.11) |

| INFL | −0.0041 (−0.57) | −0.0339 *** (−8.62) | −0.0089 (−1.38) | −0.0487 * (−1.88) | 0.0624 *** (8.36) | −0.0117 *** (−2.83) | 0.0556 *** (5.36) | −0.0739 *** (−10.56) |

| GDP | 0.1307 *** (3.17) | −0.2328 *** (−5.73) | 0.1048 (0.62) | 4.9253 *** (7.82) | 0.1612 *** (11.20) | −0.1605 *** (−5.87) | 0.2179 *** (2.80) | −0.297 *** (−5.38) |

| EPU | −0.374 ** (−1.96) | 2.226 *** (2.96) | −3.0385 *** (−4.44) | −15.960 *** (−5.23) | 0.3305 *** (13.92) | −1.6267 *** (−6.97) | 0.2658 (1.41) | −1.4023 *** (−10.57) |

| PMC*EPU | 0.0023 ** (2.16) | −17.480 *** (−2.97) | 0.00017 *** (3.79) | −0.1320 *** (−9.15) | 0.00007 * (1.86) | 0.0179 *** (3.71) | −0.0015 * (−1.87) | 0.0051 *** (3.53) |

| _cons | −9.799 *** (−4.07) | 22.813 *** (3.82) | 9.1722 *** (3.01) | 116.382 *** (14.43) | 5.993 *** (11.15) | 9.2051 *** (3.45) | 7.1524 ** (2.50) | 24.1607 ** (14.86) |

| AR1 | −3.4659 (0.0005) | −4.5471 (0.0000) | −3.7861 (0.0002) | −2.6221 (0.0087) | −1.644 (0.0102) | −9.3072 (0.0000) | −8.8714 (0.0020) | −11.626 (0.0012) |

| AR2 | 0.3588 (0.7197) | −0.9350 (0.3497) | −0.3425 (0.7319) | −1.05 (0.2937) | −1.0565 (0.2907) | −0.9589 (0.3376) | 0.6131 (0.5398) | 1.689 (0.2912) |

| Hansen test | 68.96937 (0.3131) | 72.1426 (0.2267) | 75.699 (0.1503) | 96.18291 (0.5723) | 338.349 (0.2385) | 198.4637 (0.1372) | 90.515 (0.1620) | 349.423 (0.214) |

| Country effect | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes |

| Year effect | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes |

| F test | 19,430.87 (0.0000) | 4221.58 (0.0000) | 104.89 (0.0000) | 164.08 (0.0000) | 405.36 (0.0000) | 1022.73 (0.0000) | 825.20 (0.0000) | 1655.56 (0.0000) |

| No. of instruments | 78 | 78 | 78 | 78 | 78 | 78 | 76 | 76 |

| Observations | 1284 | 1284 | 1320 | 1320 | 8616 | 8616 | 12,432 | 12,432 |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2023 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Olalere, O.E.; Mukuddem-Petersen, J. Product Market Competition, Corporate Investment, and Firm Value: Scrutinizing the Role of Economic Policy Uncertainty. Economies 2023, 11, 167. https://doi.org/10.3390/economies11060167

Olalere OE, Mukuddem-Petersen J. Product Market Competition, Corporate Investment, and Firm Value: Scrutinizing the Role of Economic Policy Uncertainty. Economies. 2023; 11(6):167. https://doi.org/10.3390/economies11060167

Chicago/Turabian StyleOlalere, Oluwaseyi Ebenezer, and Janine Mukuddem-Petersen. 2023. "Product Market Competition, Corporate Investment, and Firm Value: Scrutinizing the Role of Economic Policy Uncertainty" Economies 11, no. 6: 167. https://doi.org/10.3390/economies11060167

APA StyleOlalere, O. E., & Mukuddem-Petersen, J. (2023). Product Market Competition, Corporate Investment, and Firm Value: Scrutinizing the Role of Economic Policy Uncertainty. Economies, 11(6), 167. https://doi.org/10.3390/economies11060167