Duration of the Membership in the World Trade Organization and Aid for Trade Flows

Abstract

1. Introduction

2. Empirical Strategy

2.1. Model Specification

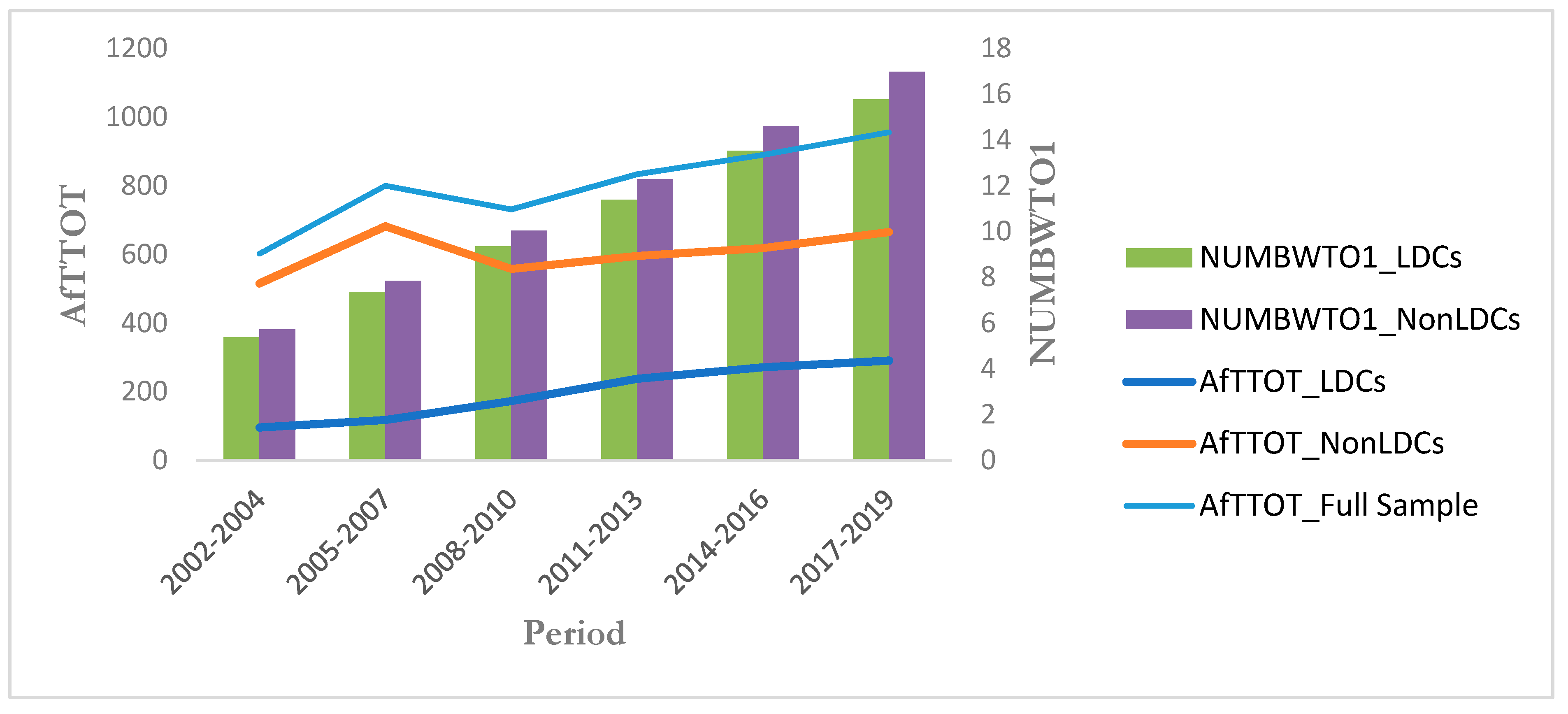

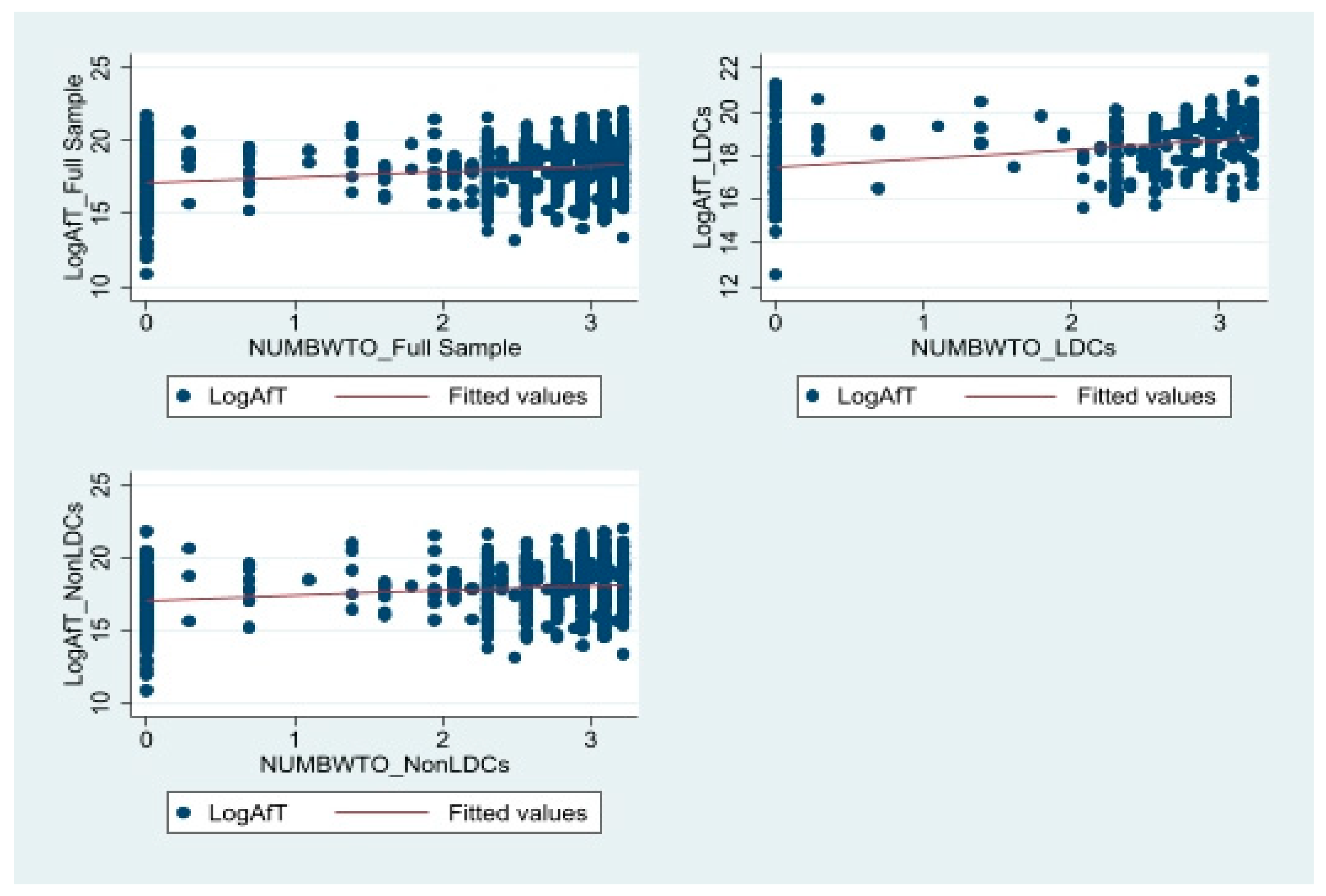

2.2. Data Analysis

2.3. Econometric Approach

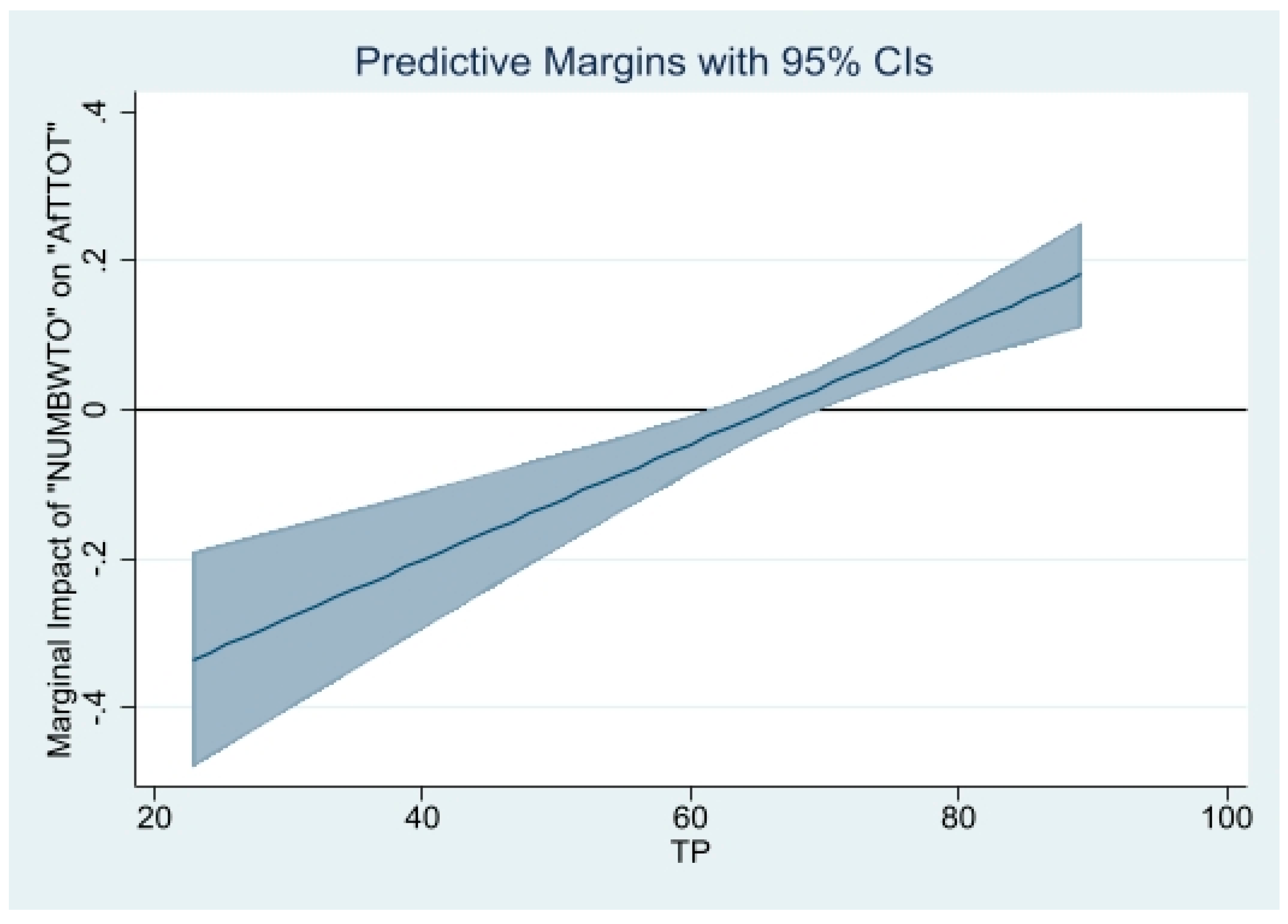

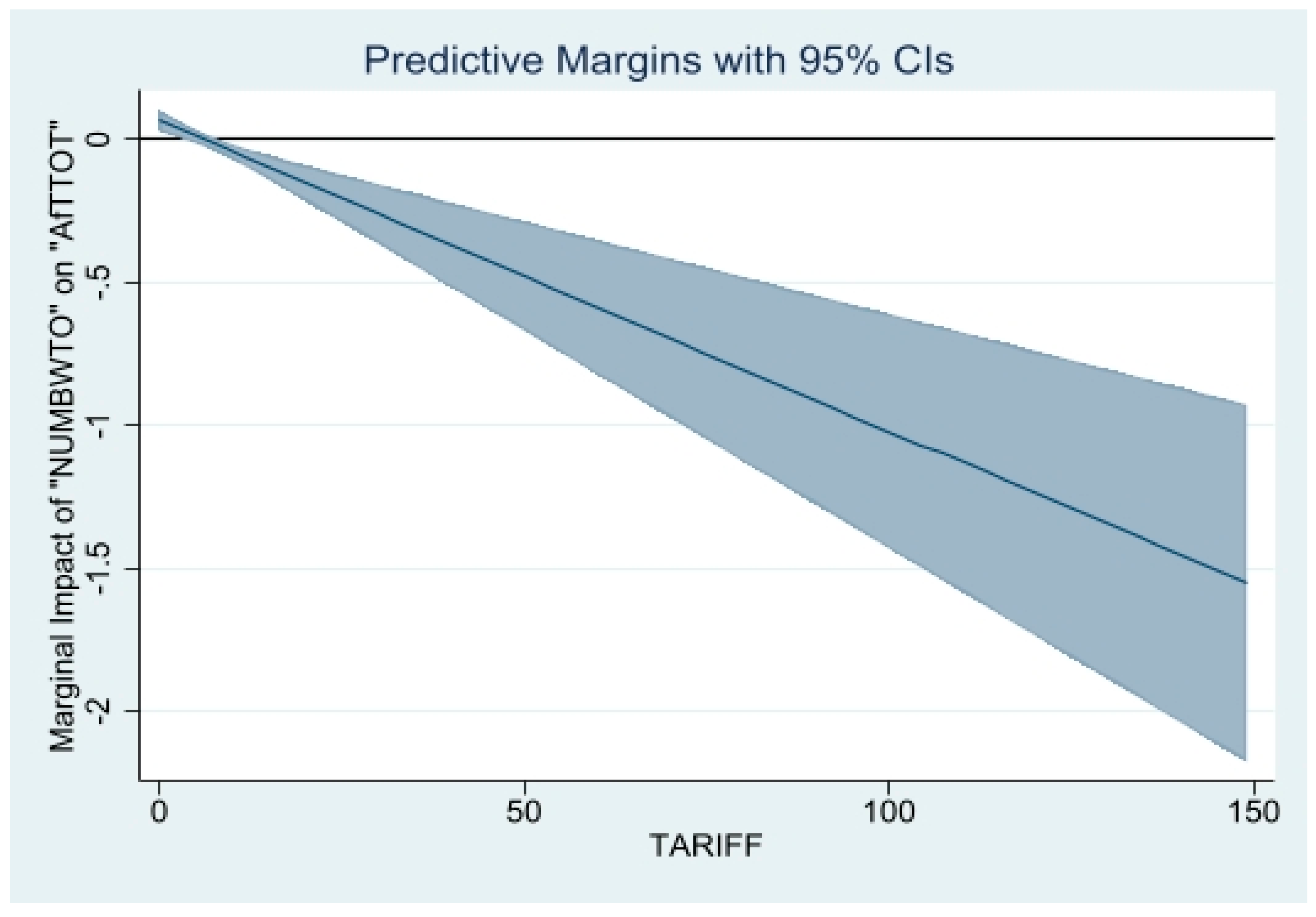

3. Empirical Results

4. Robustness Check Analysis

5. Conclusions

Funding

Informed Consent Statement

Data Availability Statement

Acknowledgments

Conflicts of Interest

Appendix A

| Variables | Definition | Source |

|---|---|---|

| AfTTOT, AfTINFRA, AfTPROD, AfTPOL | “AfTTOT” is the total real gross disbursements of total Aid for Trade. “AfTINFRA” is the real gross disbursements of Aid for Trade allocated to the buildup of economic infrastructure. “AfTPROD” is the real gross disbursements of Aid for Trade for building productive capacities. “AfTPOL” is the real gross disbursements of Aid allocated for trade policies and regulation. All four AfT variables are expressed in constant prices 2019, US Dollar. | Author’s calculation based on data extracted from the OECD statistical database on development, in particular the OECD/DAC-CRS (Organization for Economic Cooperation and Development/Donor Assistance Committee)-Credit Reporting System (CRS). Aid for Trade data cover the following three main categories (the CRS Codes are in brackets): Aid for Trade for Economic Infrastructure (“AfTINFRA”), which includes transport and storage (210), communications (220), and energy generation and supply (230); Aid for Trade for Building Productive Capacity (“AfTPROD”), which includes banking and financial services (240), business and other services (250), agriculture (311), forestry (312), fishing (313), industry (321), mineral resources and mining (322), and tourism (332); and Aid for Trade policy and regulations (“AfTPOL”), which includes trade policy and regulations and trade-related adjustment (331). |

| NUMBWTO | This is the transformed indicator of a country’s duration of membership in GATT and WTO. Let us denote “NUMB1” the duration of GATT7WTO membership for a given country. It represents the time elapsed since the country has joined either the then GATT or the WTO (for Article XII Members). This variable takes the value of “0” for years during which the country was not a GATT or WTO member. It takes the value of “1” the first year the country had joined the GATT or WTO (i.e., the year it acceded to the GATT or WTO), and is incremented by 1 for every subsequent (additional) year spent as GATT/WTO member. As the GATT entered into effect in 1948, this variable takes the value of 1 for countries that joined the GATT in 1948., and the value of 72 in 2019. For the other countries that were GATT Members before joining the WTO, the variable “NUMB1” took the value of 1 for the first year of the GATT membership, and is incremented by 1 for every additional year until 2019. For states that were not GATT Members but joined the WTO (including under WTO’s Article XII), it took the value of 1 for the first year of WTO membership, and is incremented for every additional year until 2019. As the variable “NUMB1” contains many zeros, and has a skewed distribution, it has been transformed using the following formula: NUMBWTO | Author’s computation based on data collected from the website of the WTO. The list of countries (128) that had signed GATT by 1994 is accessible online at: https://www.wto.org/english/thewto_e/gattmem_e.htm (accessed on 20 January 2020) The list of states that were GATT Members, and that joined the WTO, as well as those that joined the WTO under the WTO’s Article XII is accessible online at: (https://www.wto.org/english/thewto_e/whatis_e/tif_e/org6_e.htm (accessed 20 January 2020) |

| NonAfT | This is the measure of the development aid allocated to other sectors in the economy than the trade sector. It has been computed as the difference between the gross disbursements of total ODA and the gross disbursements of total Aid for Trade (both being expressed in constant prices 2019, US Dollar). | Author’s calculation based on data extracted from the OECD/DAC-CRS database. |

| TP | This is the indicator of trade policy, measured by the trade freedom score. The latter is a component of the Economic Freedom Index. It is a composite measure of the absence of tariff and non-tariff barriers that affect imports and exports of goods and services. The trade freedom score is graded on a scale of 0 to 100, with a rise in its value indicating lower trade barriers, i.e., higher trade liberalization, while a decrease in its value reflects rising trade protectionism. | Heritage Foundation (see Miller et al. 2021) |

| TARIFF | This is the applied tariff rate (%) (weighted mean for all products). | Author’s calculation based on data extracted from the World Development Indicators (WDI), 2021. |

| OPEN | This is the indicator of a country’s participation in international trade. It is basically the measure of trade openness proposed by Squalli and Wilson (2011). It is calculated as the ratio of the sum of a country’s exports and imports of goods and services to its GDP, adjusted by the proportion of a country’s trade level relative to the average world trade (see Squalli and Wilson 2011, p. 1758). | WDI |

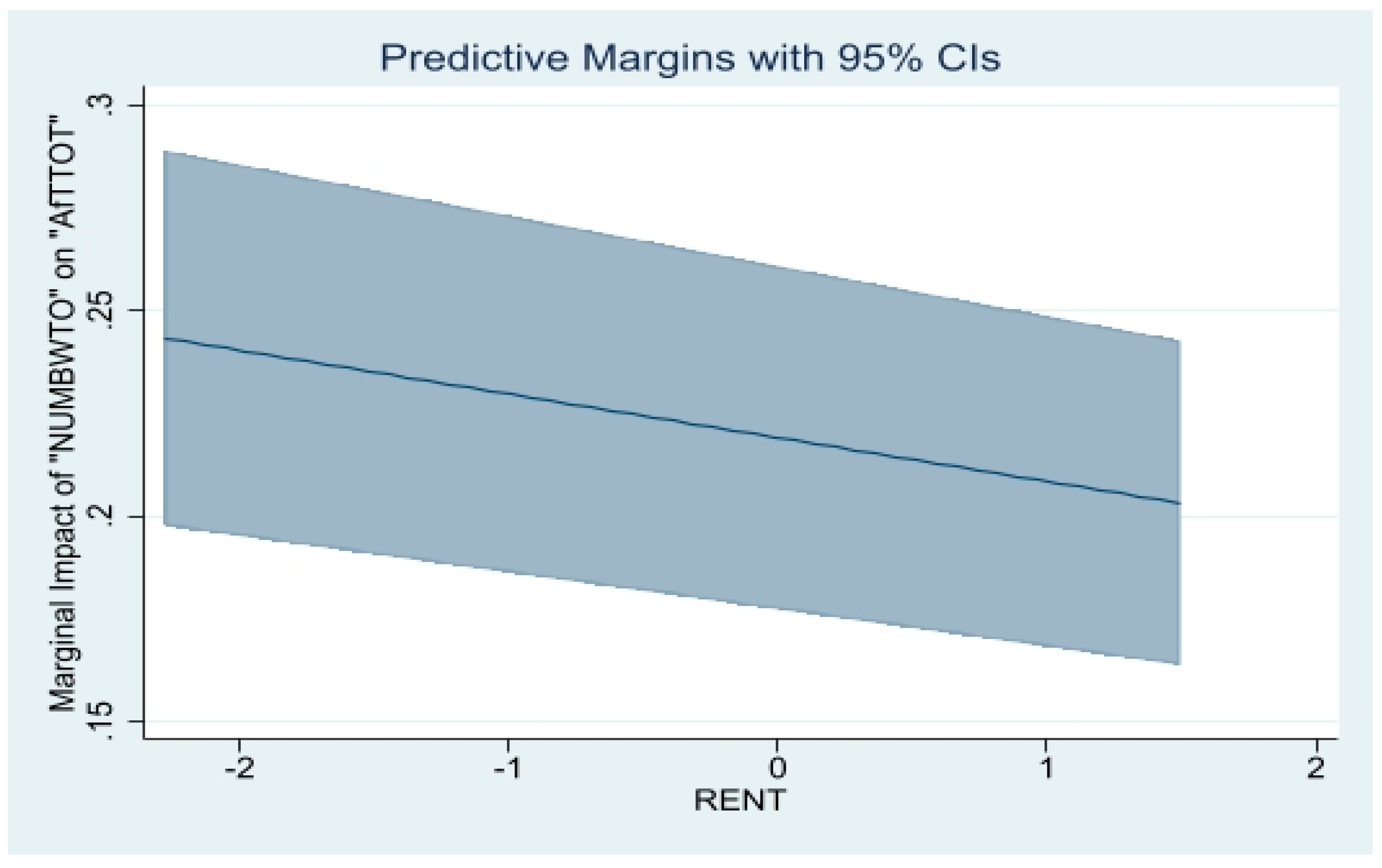

| RENT | Total natural resources rents (% of GDP) | WDI |

| GDP | Gross Domestic Product (constant 2010 US$) | WDI |

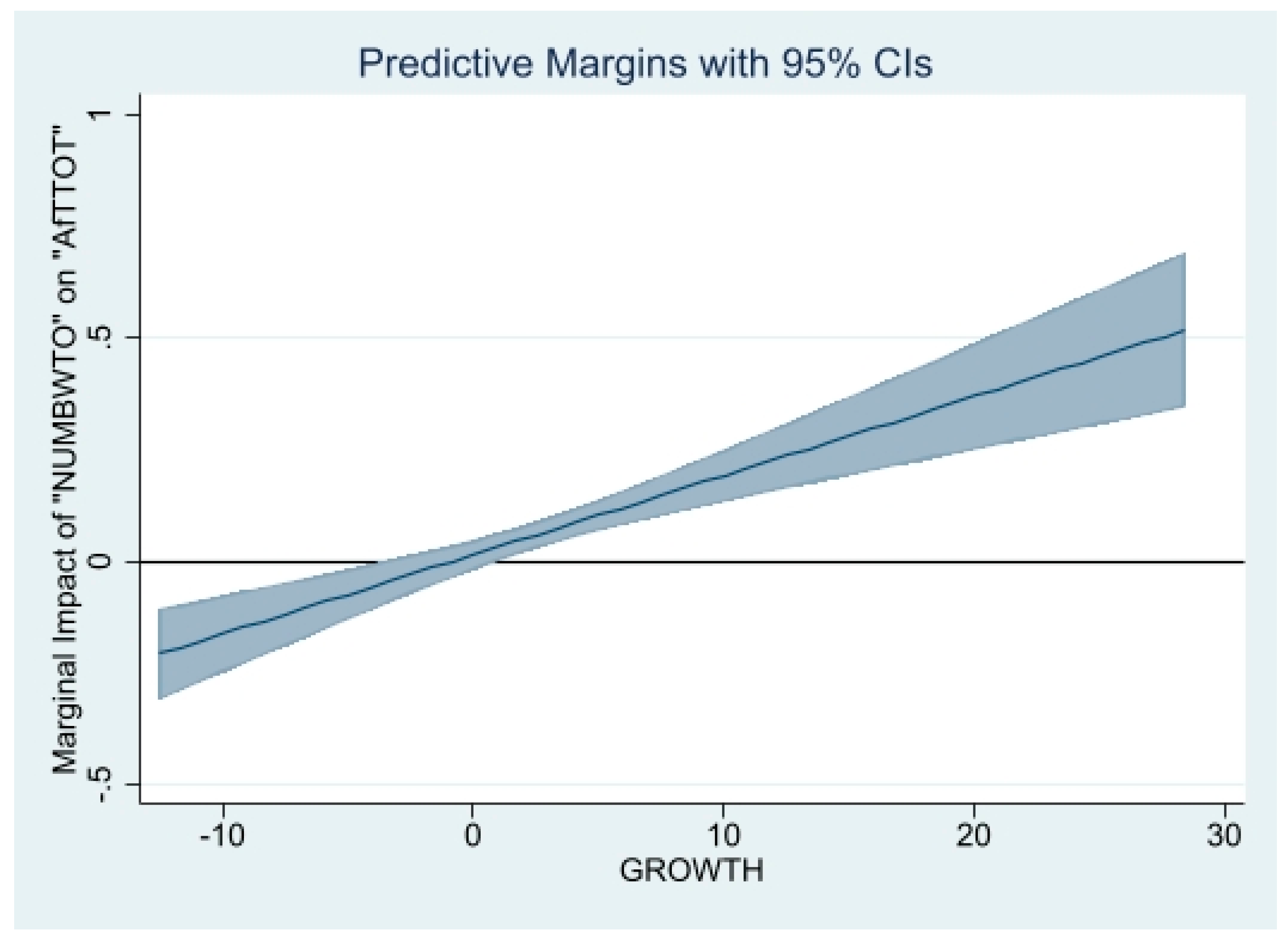

| GROWTH | Growth rate of the real GDP per capita (constant 2010 US$), annual percentage | WDI |

| POP | This is the measure of the total Population | WDI |

| Variable | Observations | Mean | Standard Deviation | Minimum | Maximum |

|---|---|---|---|---|---|

| AfTTOT | 664 | 215,000,000 | 387,000,000 | 53,334.33 | 3,670,000,000 |

| AfTINFRA | 664 | 128,000,000 | 262,000,000 | 11,374.00 | 3,170,000,000 |

| AfTPROD | 664 | 82,900,000 | 148,000,000 | 16,850.67 | 1,840,000,000 |

| AfTPOL | 652 | 3,979,265 | 9,792,189 | −29,447 | 165,000,000 |

| NUMBWTO1 | 664 | 12.32 | 8.49 | 0.00 | 24.00 |

| NUMB1 | 664 | 26.6747 | 22.87465 | 0 | 71 |

| NonAfT | 664 | 638,000,000 | 935,000,000 | 2,419,856.00 | 12,400,000,000 |

| TP | 596 | 70.38 | 10.22 | 27.40 | 89.20 |

| TARIFF | 572 | 7.72 | 7.71 | 0.47 | 149.07 |

| OPEN | 616 | 0.00 | 0.00 | 0.0000000033 | 0.0445 |

| GROWTH | 664 | 4.20 | 3.44 | −12.52 | 29.30 |

| RENT | 664 | 8.19 | 11.00 | 0.00 | 62.08 |

| GDPC | 664 | 4056.08 | 3605.41 | 211.01 | 19,230.04 |

| POP | 664 | 42,800,000 | 162,000,000 | 9944.67 | 1,390,000,000 |

| Country | Membership Duration | Country | Membership Duration | Country | Membership Duration | Country | Membership Duration |

|---|---|---|---|---|---|---|---|

| Afghanistan ** | 4 | Dominican Republic | 25 | Liberia ** | 4 | Sao Tome and Principe ** | 0 |

| Albania | 20 | Ecuador | 24 | Libya | 0 | Senegal ** | 25 |

| Algeria | 0 | Egypt, Arab Rep | 25 | Madagascar ** | 25 | Serbia | 0 |

| Angola ** | 25 | El Salvador | 25 | Malawi ** | 25 | Seychelles | 5 |

| Antigua and Barbuda | 25 | Equatorial Guinea | 0 | Malaysia | 25 | Sierra Leone ** | 25 |

| Argentina | 25 | Eritrea ** | 0 | Maldives | 25 | Solomon Islands ** | 23 |

| Armenia | 17 | Eswatini | 25 | Mali ** | 25 | South Africa | 25 |

| Azerbaijan | 0 | Ethiopia ** | 0 | Marshall Islands | 0 | South Sudan ** | 0 |

| Bangladesh ** | 25 | Fiji | 25 | Mauritania ** | 25 | Sri Lanka | 25 |

| Belarus | 0 | Gabon | 25 | Mauritius | 25 | St. Lucia | 25 |

| Belize | 25 | Gambia ** | 23 | Mexico | 25 | St. Vincent and the Grenadines | 25 |

| Benin ** | 24 | Georgia | 20 | Micronesia, Fed. Sts. | 0 | Sudan ** | 0 |

| Bhutan ** | 0 | Ghana | 25 | Moldova | 19 | Suriname | 25 |

| Bolivia | 25 | Grenada | 24 | Mongolia | 23 | Tajikistan | 7 |

| Bosnia and Herzegovina | 0 | Guatemala | 25 | Montenegro | 8 | Tanzania ** | 25 |

| Botswana | 25 | Guinea ** | 25 | Morocco | 25 | Thailand | 25 |

| Brazil | 25 | Guinea-Bissau ** | 25 | Mozambique ** | 25 | Timor-Leste ** | 0 |

| Burkina Faso ** | 25 | Guyana | 25 | Myanmar ** | 25 | Togo ** | 25 |

| Burundi ** | 25 | Haiti ** | 24 | Namibia | 25 | Tonga | 13 |

| Cabo Verde | 12 | Honduras | 25 | Nauru | 0 | Tunisia | 25 |

| Cambodia ** | 16 | India | 25 | Nepal ** | 16 | Turkey | 25 |

| Cameroon | 25 | Indonesia | 25 | Nicaragua | 25 | Turkmenistan | 0 |

| Central African Republic ** | 25 | Iran | 0 | Niger ** | 23 | Tuvalu ** | 0 |

| Chad ** | 24 | Iraq | 0 | Nigeria | 25 | Uganda ** | 25 |

| Chile | 25 | Jamaica | 25 | North Macedonia | 17 | Ukraine | 1 |

| China | 19 | Jordan | 20 | Pakistan | 25 | Uruguay | 25 |

| Colombia | 25 | Kazakhstan | 5 | Palau | 0 | Uzbekistan | 0 |

| Comoros ** | 0 | Kenya | 25 | Panama | 22 | Vanuatu ** | 8 |

| Congo, Dem. Rep ** | 25 | Kiribati ** | 0 | Papua New Guinea | 23 | Venezuela, RB | 25 |

| Congo, Rep | 25 | Kosovo | 0 | Paraguay | 25 | Vietnam | 13 |

| Costa Rica | 25 | Kyrgyz Republic | 22 | Peru | 25 | West Bank and Gaza | 0 |

| Cote d’Ivoire | 25 | Lao PDR ** | 1 | Philippines | 25 | Yemen, Rep ** | 6 |

| Cuba | 25 | Lebanon | 0 | Rwanda ** | 23 | Zambia ** | 25 |

| Dominica | 25 | Lesotho ** | 25 | Samoa | 8 | Zimbabwe | 25 |

| Article XXVI5(c) Member States | Article XII Member States | Non-Article XXVI5(c) Member States | Non-GATT/WTO States | |

|---|---|---|---|---|

| Angola | Namibia | Afghanistan | Argentina | Algeria |

| Antigua and Barbuda | Niger | Albania | Bangladesh | Azerbaijan |

| Belize | Nigeria | Armenia | Bolivia | Belarus |

| Benin | Papua New Guinea | Cabo Verde | Brazil | Bhutan |

| Botswana | Rwanda | Cambodia | Chile | Bosnia and Herzegovina |

| Burkina Faso | Senegal | China | Colombia | Comoros |

| Burundi | Sierra Leone | Ecuador | Congo, Dem. Rep. | Equatorial Guinea |

| Cameroon | Solomon Islands | Georgia | Costa Rica | Eritrea |

| Central African Republic | St. Lucia | Jordan | Cuba | Ethiopia |

| Chad | St. Vincent and the Grenadines | Kazakhstan | Dominican Republic | Iran, Islamic Rep. |

| Congo, Rep. | Suriname | Kyrgyz Republic | Egypt, Arab Rep. | Iraq |

| Cote d’Ivoire | Tanzania | Lao PDR | El Salvador | Kiribati |

| Dominica | Togo | Liberia | Guatemala | Kosovo |

| Eswatini | Uganda | Moldova | Haiti | Lebanon |

| Fiji | Zambia | Mongolia | Honduras | Libya |

| Gabon | Montenegro | India | Marshall Islands | |

| Gambia, The | Nepal | Mexico | Micronesia, Fed. Sts. | |

| Ghana | North Macedonia | Morocco | Nauru | |

| Grenada | Panama | Myanmar | Palau | |

| Guinea | Samoa | Nicaragua | Sao Tome and Principe | |

| Guinea-Bissau | Seychelles | Pakistan | Serbia | |

| Guyana | Tajikistan | Paraguay | South Sudan | |

| Indonesia | Ukraine | Peru | Sudan | |

| Jamaica | Vanuatu | Philippines | Timor-Leste | |

| Kenya | Vietnam | South Africa | Turkmenistan | |

| Lesotho | Yemen, Rep. | Sri Lanka | Tuvalu | |

| Madagascar | Thailand | Uzbekistan | ||

| Malawi | Tonga | West Bank and Gaza | ||

| Malaysia | Tunisia | |||

| Maldives | Turkey | |||

| Mali | Uruguay | |||

| Mauritania | Venezuela, RB | |||

| Mauritius | Zimbabwe | |||

| 1 | These structural impediments to developing countries’ participation in international trade include for example the lack of trade-related infrastructure and capacity (e.g., Hallaert and Munro 2009). The infrastructural deficiency concerns both hard infrastructure (such as highways, railroads, ports) and soft infrastructure such as transparency, customs efficiency, institutional reforms that would help reduce the burdensome time-consuming border procedures (e.g., Portugal-Perez and Wilson 2012). |

| 2 | The category of LDCs has been defined as such by the United Nations as the group of countries qualified as the poorest and most vulnerable to exogenous economic and environmental shocks. Information on the LDCs could be found online at: https://www.un.org/ohrlls/content/least-developed-countries (accessed on 20 February 2021). |

| 3 | Benziane et al. (2022) have provided the most recent literature survey on the subject matter. |

| 4 | Further details on the fulfilment of the transparency objective by WTO Councils and Committees are available online at: https://www.wto.org/english/tratop_e/monitor_e/monitor_e.htm (accessed on 20 February 2021). |

| 5 | Information on the WTO’s role of overseeing national trade policies is accessible online at: https://www.wto.org/english/tratop_e/tpr_e/tp_int_e.htm (accessed on 20 February 2021). |

| 6 | Koopman et al. (2020) have documented the positive effects of the membership in the WTO. |

| 7 | Basic information on the TPRM’s role concerning the WTO’s transparency objective can be found online at: https://www.wto.org/english/thewto_e/whatis_e/tif_e/agrm11_e.htm (accessed on 20 February 2021). |

| 8 | Anderson (2016) and Koopman et al. (2020) have provided literature surveys on the benefits of the WTO membership. |

| 9 | It is worth noting that Ferrantino (2010) has uncovered that the accession to the WTO exerts no significant effect on governance, and Choudhury (2019) has also obtained no significant effect of WTO membership on domestic corruption. |

| 10 | Hühne et al. (2014) have established empirically that while AfT flows increase exports by recipient countries, these resources inflows also induce a rise in the imports by recipient countries from donor countries. |

| 11 | For example, Brotto et al. (2021), Cling et al. (2009) and Tang and Wei (2009) have found that the membership in the WTO is positively associated with economic growth performance. One may, therefore, assume that an increase in the duration of WTO membership would also exert a positive effect on economic growth, although this assumption needs to be tested empirically in future research. |

| 12 | It is important to note that while the institutional and governance quality in an AfT recipient country could affect the amount of AfT flows received by a given country, we have not included such an indicator in Equation (1) not only because it is highly correlated with the indicator of economic growth. We have stated above that the membership in the WTO helps improve countries’ governance, and could, therefore, affect AfT flows through this channel. However, testing here the hypothesis concerning whether the effect of the duration of the membership in the WTO on AfT flows depends on the quality of institution and governance, goes beyond the scope of this paper. |

| 13 | Such an increase can be attributed to the AfT Initiative, which had helped mobilized greater financial resources in favour of the trade sector in developing countries immediately after the launch of this Initiative in 2005 (see Gnangnon 2019). |

| 14 | Standard errors of the coefficients obtained from the regressions based on these two estimators have been corrected using the Driscoll and Kraay (1998) technique. The latter corrects for the autocorrelation, heteroscedasticity, and any form of cross-sectional dependence in the error-term. |

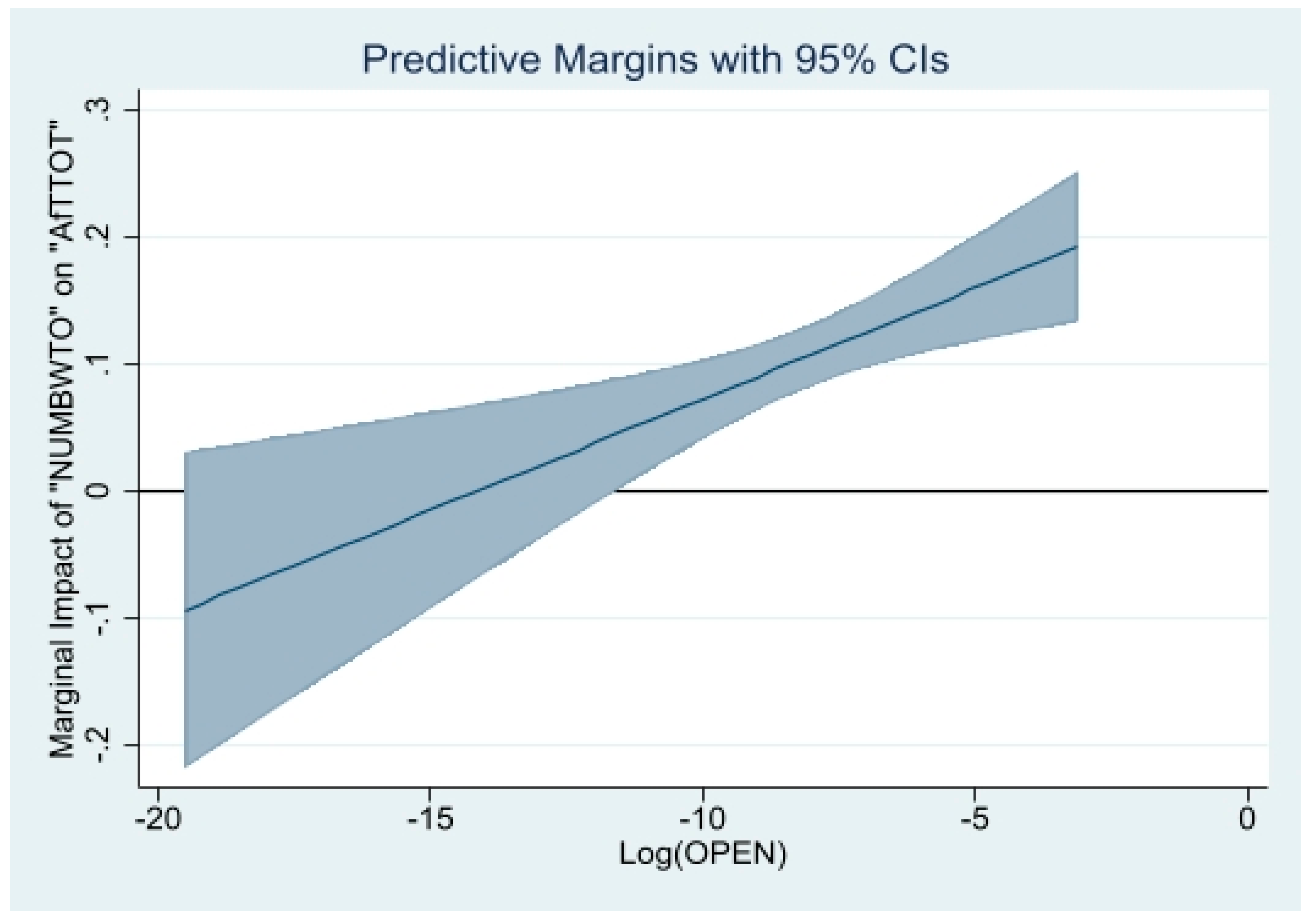

| 15 | In the full sample, the values of the variable “OPEN” range between 0.0000000033 and 0.0445—see Table A2 under Appendix A. |

| 16 | The GATT Article XXVI 5(c) reads as follows: If any of the customs territories, in respect of which a contracting party has accepted this Agreement, possesses or acquires full autonomy in the conduct of its external commercial relations and of the other matters provided for in this Agreement, such territory shall, upon sponsorship through a declaration by the responsible contracting party establishing the above-mentioned fact, be deemed to be a contracting party. GATT Article XXVI 5(c) is accessible online at: https://www.wto.org/english/res_e/publications_e/ai17_e/gatt1994_art26_gatt47.pdf (accessed on February 2021). |

| 17 | Article XII of the Marrakesh Agreement establishing the WTO provides that “Any State or separate customs territory possessing full autonomy in the conduct of its external commercial relations and of the other matters provided for in this Agreement and the Multilateral Trade Agreements may accede to this Agreement, on terms to be agreed between it and the WTO. Such accession shall apply to this Agreement and the Multilateral Trade Agreements annexed thereto” (see Article XII.1). Further information on Article XII is available online at: https://www.wto.org/english/docs_e/legal_e/04-wto.pdf (accessed on February 2021) and https://www.wto.org/english/thewto_e/acc_e/acces_e.htm (accessed on February 2021). |

References

- Aaronson, Susan Ariel, and Rodwan Abouharb. 2014. Does the WTO help member states improve governance? World Trade Review 13: 547–82. [Google Scholar] [CrossRef]

- Alonso-Borrego, César, and Manuel Arellano. 1999. Symmetrically normalized instrumental-variable estimation using panel data. Journal of Business & Economic Statistics 17: 36–49. [Google Scholar]

- Anderson, Kym. 2016. Contributions of the GATT/WTO to Global Economic Welfare: Empirical Evidence. Journal of Economic Surveys 30: 56–92. [Google Scholar] [CrossRef]

- Basu, Sudip Ranjan. 2008. Does WTO accession Affect Domestic Economic Policies and Institutions? HEI Working Paper No.: 03/2008. Geneva: The Graduate Institute of International Studies. [Google Scholar]

- Benziane, Yakoub, Siong Hook Law, Anitha Rosland, and Muhammad Daaniyall Abd Rahman. 2022. Aid for trade initiative 16 years on: Lessons learnt from the empirical literature and recommendations for future directions. Journal of International Trade Law and Policy 21: 79–104. [Google Scholar] [CrossRef]

- Blundell, Richard, and Stephen Bond. 1998. Initial Conditions and Moment Restrictions in Dynamic Panel Data Models. Journal of Econometrics 87: 115–43. [Google Scholar] [CrossRef]

- Bond, Stephen, Anke Hoeffler, and Jonathan Temple. 2001. GMM Estimation of Empirical Growth Models. CEPR Paper DP3048. London: Centre for Economic Policy Research. [Google Scholar]

- Brotto, André, Adam Jakubik, and Roberta Piermartini. 2021. WTO Accession and Growth: Tang and Wei Redux. WTO Staff Working Paper ERSD-2021-1. Geneva: World Trade Organization. [Google Scholar]

- Cao, Vinh T. H., and Lisandra Flach. 2015. The Effect of GATT/WTO on Export and Import Price Volatility. The World Economy 38: 2049–79. [Google Scholar] [CrossRef]

- Chaisse, Julien, and Mitsuo Matsushita. 2013. Maintaining the WTO’s Supremacy in the International Trade Order: A Proposal to Refine and Revise the Role of the Trade Policy Review Mechanism. Journal of International Economic Law 16: 9–36. [Google Scholar] [CrossRef]

- Chang, Pao-Li, and Myoung-Jae Lee. 2011. The WTO trade effect. Journal of International Economics 85: 53–71. [Google Scholar] [CrossRef]

- Chemutai, Vicky, and Hubert Escaith. 2017. Measuring World Trade Organization (WTO) Accession Commitments and their Economic Effects. Journal of International Commerce, Economics and Policy 8: 1750007. [Google Scholar] [CrossRef]

- Choudhury, Sanchari. 2019. WTO membership and corruption. European Journal of Political Economy 60: 101806. [Google Scholar] [CrossRef]

- Chowdhury, Abdur, Xuepeng Liu, Miao Wang, and M. C. Wong. 2021. The Role of Multilateralism of the WTO in International Trade Stability. World Trade Review 20: 668–89. [Google Scholar] [CrossRef]

- Cling, Jean-Pierre, Mohamed Ali Marouani, Mireille Razafindrakoto, Anne-Sophie Robilliard, and Francois Roubaud. 2009. The distributive impact of Vietnam’s accession to the WTO. Économie Internationale 2: 43–71. [Google Scholar] [CrossRef]

- Drabek, Zdenek, and Marc Bacchetta. 2004. Tracing the Effects of WTO Accession on Policymaking in Sovereign States: Preliminary Lessons from the Recent Experience of Transition Countries. The World Economy 27: 1083–125. [Google Scholar] [CrossRef]

- Driscoll, John C., and Aart C. Kraay. 1998. Consistent Covariance Matrix Estimation with Spatially Dependent Panel Data. Review of Economics and Statistics 80: 549–60. [Google Scholar] [CrossRef]

- Dutt, Pushan. 2020. The WTO is not passé. European Economic Review 128: 103507. [Google Scholar] [CrossRef]

- Eicher, Theo S., and Christian Henn. 2011. In search of WTO trade effects: Preferential trade agreements promote trade strongly, but unevenly. Journal of International Economics 83: 137–53. [Google Scholar] [CrossRef]

- Ferrantino, Michael J. 2010. Policy Anchors: Do Free Trade Agreements and WTO Accessions Serve as Vehicles for Developing-country Policy Reform? In Is the World Trade Organization Attractive Enough for Emerging Economies? Edited by Zdenek Drabek. Palgrave Macmillan Books. London: Palgrave Macmillan, chp. 5. pp. 139–75. [Google Scholar]

- Gamberoni, Elisa, and Richard Newfarmer. 2014. Aid for Trade: Do Those Countries that Need It, Get It? The Word Economy 37: 511–78. [Google Scholar] [CrossRef]

- Ghosh, Arunabha. 2010. Developing countries in the WTO Trade Policy Review Mechanism. World Trade Review 9: 419–55. [Google Scholar] [CrossRef]

- Gnangnon, Sèna Kimm. 2017. Multilateral Trade Liberalisation, Export Share in the International Trade Market and Aid for Trade. Journal of International Commerce, Economics and Policy 8: 1750014. [Google Scholar] [CrossRef]

- Gnangnon, Sèna Kimm. 2018. Relative Trade Preferential Margin and Aid for Trade Allocation. The International Trade Journal 32: 240–67. [Google Scholar] [CrossRef]

- Gnangnon, Sèna Kimm. 2019. Has the WTO’s Aid for Trade Initiative Delivered on Its Promise of Greater Mobilization of Development Aid in Favor of the Trade Sector in Developing Countries? International Trade Journal 33: 519–41. [Google Scholar] [CrossRef]

- Gnangnon, Sèna Kimm. 2021a. Aid for Trade flows and Poverty Reduction. Singapore Economic Review, 1–44. [Google Scholar] [CrossRef]

- Gnangnon, Sèna Kimm. 2021b. Do Donors provide higher Aid for Trade flows to Recipient-Countries that Diversify Export Products or Is It the Other Way Around? Arthaniti: Journal of Economic Theory and Practice, 09767479211036657. [Google Scholar] [CrossRef]

- Gnangnon, Sèna Kimm. 2021c. WTO Membership, the Membership Duration and the Utilization of Non-Reciprocal Trade Preferences Offered by the QUAD Countries. Kiel and Hamburg: ZBW—Leibniz Information Centre for Economics. [Google Scholar]

- Gnangnon, Sèna Kimm. 2023a. Duration of membership in the world trade organization and investment-oriented remittances inflows. The Quarterly Review of Economics and Finance 88: 258–77. [Google Scholar] [CrossRef]

- Gnangnon, Sèna Kimm. 2023b. Duration of the Membership in the GATT/WTO, Structural Economic Vulnerability and Trade Costs. Journal of Risk and Financial Management 16: 282. [Google Scholar] [CrossRef]

- Hallaert, Jean-Jacques. 2010. Increasing the Impact of Trade Expansion on Growth: Lessons from Trade Reforms for the Design of Aid for Trade. OECD Trade Policy Papers, No. 100. Paris: OECD Publishing. [Google Scholar]

- Hallaert, Jean-Jacques, and Laura Munro. 2009. Binding Constraints to Trade Expansion: Aid for Trade Objectives and Diagnostics Tools. OECD Trade Policy Papers, No. 94. Paris: OECD Publishing. [Google Scholar]

- Hühne, Philipp, Birgit Meyer, and Peter Nunnenkamp. 2014. Who Benefits from Aid for Trade? Comparing the Effects on Recipient versus Donor Exports. Journal of Development Studies 50: 1275–88. [Google Scholar] [CrossRef]

- Koopman, Robert, John Hancock, Roberta Piermartini, and Eddy Bekkers. 2020. The Value of the WTO. Journal of Policy Modeling 42: 829–49. [Google Scholar] [CrossRef]

- Kruskal, William H., and W. Allen Wallis. 1952. Use of ranks in one-criterion variance analysis. Journal of the American Statistical Association 47: 583–621. [Google Scholar] [CrossRef]

- Laird, Sam. 1999. The WTO’s Trade Policy Review Mechanism—From Through the Looking Glass. The World Economy 22: 741–64. [Google Scholar] [CrossRef]

- Larch, Mario, José Antonio Monteiro, Roberta Piermartini, and Yoto V. Yotov. 2019. On the effects of GATT/WTO membership on trade: They are positive and large after all. In WTO Staff Working Papers ERSD-2019-09. Geneva: World Trade Organization (WTO). [Google Scholar]

- Lee, Hyun-Hoon, Donghyun Park, and Meehwa Shin. 2015. Do Developing-country WTO Members Receive More Aid for Trade (AfT)? The World Economy 38: 1462–85. [Google Scholar] [CrossRef]

- Mansfield, Edward D., and Eric Reinhardt. 2008. International institutions and the volatility of international trade. International Organization 62: 621–52. [Google Scholar] [CrossRef]

- Miller, Terry, Anthony B. Kim, James M. Roberts, and Patrick Tyrrell. 2021. 2021 Index of Economic Freedom, Institute for Economic Freedom. Washington, DC: The Heritage Foundation. [Google Scholar]

- Naito, Takumi. 2016. Aid for Trade and Global Growth. Review of International Economics 24: 1178–201. [Google Scholar] [CrossRef]

- Portugal-Perez, Alberto, and John S. Wilson. 2012. Export Performance and Trade Facilitation Reform: Hard and Soft Infrastructure. World Development 40: 1295–307. [Google Scholar] [CrossRef]

- Roodman, David. 2009. A note on the theme of too many instruments. Oxford Bulletin of Economic and Statistics 71: 135–58. [Google Scholar] [CrossRef]

- Shin, Wonkyu, and Dukgeun Ahn. 2019. Trade Gains from Legal Rulings in the WTO Dispute Settlement System. World Trade Review 18: 1–31. [Google Scholar] [CrossRef]

- Squalli, Jay, and Kenneth Wilson. 2011. A New Measure of Trade Openness. The World Economy 34: 1745–70. [Google Scholar] [CrossRef]

- Subramanian, Arvind, and Shang-Jin Wei. 2007. The WTO Promotes Trade, Strongly but Unevenly. Journal of International Economics 72: 151–75. [Google Scholar] [CrossRef]

- Tadasse, Badassa, and Bichaka Fayissa. 2009. Determinants of the Allocation of US Aid for Trade. Working Paper 200901. Duluth: Department of Economics and Finance, University of Minnesota-Duluth. [Google Scholar]

- Tang, Man-Keung K., and Shang-Jin Wei. 2009. The value of making commitments externally: Evidence from WTO accessions. Journal of International Economics 78: 216–29. [Google Scholar] [CrossRef]

- Tomz, Michael, Judith L. Goldstein, and Douglas Rivers. 2007. Do We Really Know that the WTO Increases Trade? Comment. American Economic Review 97: 2005–18. [Google Scholar] [CrossRef]

- World Trade Organization (WTO). 2005. Ministerial Declaration on Doha Work Programme. Paper presented at the Sixth Session of Trade Ministers Conference, Hong Kong, China, December 13–18. [Google Scholar]

- Younas, Javed. 2008. Motivation of Bilateral Aid Allocation: Altruism or Trade Benefits. European Journal of Political Economy 24: 661–74. [Google Scholar] [CrossRef]

| POLS | FE | Two-Step System GMM | ||

|---|---|---|---|---|

| Variables | Log(AfTTOT) | Log(AfTTOT) | Log(AfTTOT) | Log(AfTTOT) |

| (1) | (2) | (3) | (4) | |

| Log(AfTTOT)t−1 | 0.668 *** | 0.212 *** | 0.541 *** | 0.537 *** |

| (0.0330) | (0.0587) | (0.0158) | (0.0180) | |

| NUMBWTO | 0.0219 ** | 0.173 ** | 0.127 *** | 0.190 *** |

| (0.0110) | (0.0675) | (0.0198) | (0.0192) | |

| NUMBWTO * LDC | −0.142 *** | |||

| (0.0402) | ||||

| LDC | 0.623 *** | |||

| (0.141) | ||||

| Log(GDPC) | 0.641 *** | 1.164 *** | 0.575 * | 1.257 *** |

| (0.223) | (0.308) | (0.336) | (0.417) | |

| [Log(GDPC)]2 | −0.0426 *** | −0.0143 | −0.0326 | −0.0682 ** |

| (0.0145) | (0.0254) | (0.0215) | (0.0265) | |

| Log(NonAfT) | 0.311 *** | 0.356 *** | 0.464 *** | 0.480 *** |

| (0.0401) | (0.0384) | (0.0391) | (0.0373) | |

| GROWTH | 0.00638 | −0.00651 | 0.0174 *** | 0.0160 *** |

| (0.0114) | (0.00847) | (0.00379) | (0.00399) | |

| RENT | −0.0117 *** | 0.0116 *** | −0.0168 *** | −0.0177 *** |

| (0.000912) | (0.00361) | (0.00148) | (0.00147) | |

| Log(POP) | 0.0155 | 1.069 *** | 0.0491 * | 0.0572 ** |

| (0.0106) | (0.143) | (0.0253) | (0.0249) | |

| Constant | −2.462 *** | −17.97 *** | ||

| (0.940) | (3.302) | |||

| Observations-Countries | 664-136 | 664-136 | 664-136 | 664-136 |

| R-squared | 0.881 | |||

| Within R-squared | 0.3740 | |||

| AR1 (p-Value) | 0.0000 | 0.0000 | ||

| AR2 (p-Value) | 0.2188 | 0.2320 | ||

| AR3 (p-Value) | 0.9394 | 0.8980 | ||

| OID (p-Value) | 0.3521 | 0.2290 | ||

| Variables | Log(AfTINFRA) | Log(AfTPROD) | Log(AfTPOL) |

|---|---|---|---|

| (1) | (2) | (3) | |

| One-period lag of the dependent variable | 0.504 *** | 0.438 *** | 0.467 *** |

| (0.0139) | (0.0156) | (0.0205) | |

| NUMBWTO | 0.143 *** | 0.0697 *** | 0.00980 |

| (0.0244) | (0.0167) | (0.0360) | |

| Log(GDPC) | 0.940 ** | 2.694 *** | 3.056 *** |

| (0.465) | (0.337) | (0.642) | |

| [Log(GDPC)]2 | −0.0563 * | −0.180 *** | −0.190 *** |

| (0.0296) | (0.0214) | (0.0418) | |

| Log(NonAfT) | 0.588 *** | 0.404 *** | 0.701 *** |

| (0.0539) | (0.0305) | (0.0759) | |

| GROWTH | 0.0363 *** | 0.0486 *** | 0.0161 |

| (0.00505) | (0.00586) | (0.0115) | |

| RENT | −0.0237 *** | −0.0103 *** | −0.0191 *** |

| (0.00231) | (0.00124) | (0.00324) | |

| Log(POP) | −0.0165 | 0.0725 *** | −0.0426 |

| (0.0338) | (0.0200) | (0.0385) | |

| Observations-Countries | 664-136 | 664-136 | 631-136 |

| AR1 (p-Value) | 0.0000 | 0.0000 | 0.0000 |

| AR2 (p-Value) | 0.0000 | 0.8677 | 0.1431 |

| AR3 (p-Value) | 0.9389 | 0.8662 | 0.5669 |

| OID (p-Value) | 0.4083 | 0.3158 | 0.1990 |

| Variables | Log(AfTTOT) | Log(AfTTOT) | Log(AfTTOT) |

|---|---|---|---|

| (1) | (2) | (3) | |

| Log(AfTTOT)t-1 | 0.541 *** | 0.579 *** | 0.544 *** |

| (0.0130) | (0.0159) | (0.00886) | |

| NUMBWTO | −0.514 *** | 0.0650 *** | 0.247 *** |

| (0.110) | (0.0191) | (0.0465) | |

| NUMBWTO * TP | 0.00779 *** | ||

| (0.00159) | |||

| NUMBWTO * TARIFF | −0.0108 *** | ||

| (0.00224) | |||

| NUMBWTO * [Log(OPEN)] | 0.0175 *** | ||

| (0.00549) | |||

| TP | −0.00391 * | ||

| (0.00236) | |||

| TARIFF | 0.0192 *** | ||

| (0.00492) | |||

| Log(OPEN) | 0.0745 *** | ||

| (0.0215) | |||

| Log(NonAfT) | 0.403 *** | 0.392 *** | 0.364 *** |

| (0.0264) | (0.0236) | (0.0183) | |

| Log(GDPC) | 3.166 *** | 1.986 *** | 0.722 *** |

| (0.315) | (0.270) | (0.267) | |

| [Log(GDPC)]2 | −0.208 *** | −0.130 *** | −0.0582 *** |

| (0.0205) | (0.0176) | (0.0173) | |

| GROWTH | 0.0141 *** | 0.0160 *** | 0.0185 *** |

| (0.00344) | (0.00360) | (0.00276) | |

| RENT | −0.0129 *** | −0.0195 *** | −0.0126 *** |

| (0.00167) | (0.00147) | (0.00123) | |

| Log(POP) | 0.0439 ** | −0.0138 | −0.0620 *** |

| (0.0208) | (0.0128) | (0.0190) | |

| Observations-Countries | 596-127 | 572-128 | 616-129 |

| AR1 (p-Value) | 0.0000 | 0.0000 | 0.0000 |

| AR2 (p-Value) | 0.7031 | 0.2937 | 0.1008 |

| AR3 (p-Value) | 0.8074 | 0.6784 | 0.4753 |

| OID (p-Value) | 0.2301 | 0.1493 | 0.3881 |

| Variables | Log(AfTTOT) | Log(AfTTOT) | Log(AfTTOT) |

|---|---|---|---|

| (1) | (2) | (3) | |

| Log(AfTTOT)t-1 | 0.525 *** | 0.575 *** | 0.577 *** |

| (0.0155) | (0.0156) | (0.0198) | |

| NUMBWTO | 0.0138 | 0.219 *** | 0.122 *** |

| (0.0175) | (0.0213) | (0.0291) | |

| NUMBWTO * GROWTH | 0.0177 *** | 0.0234 *** | |

| (0.00335) | (0.00403) | ||

| NUMBWTO * RENT | −0.0106 *** | −0.0114 *** | |

| (0.00127) | (0.00150) | ||

| Log(NonAfT) | 0.461 *** | 0.480 *** | 0.549 *** |

| (0.0412) | (0.0363) | (0.0512) | |

| Log(GDPC) | −0.103 | 0.888 ** | 0.806 |

| (0.394) | (0.411) | (0.606) | |

| [Log(GDPC)]2 | 0.00860 | −0.0557 ** | −0.0483 |

| (0.0250) | (0.0266) | (0.0387) | |

| GROWTH | 0.00105 | 0.00209 | −0.0240 *** |

| (0.00398) | (0.00463) | (0.00739) | |

| RENT | −0.0139 *** | 0.00214 | 0.00685 ** |

| (0.00147) | (0.00211) | (0.00292) | |

| Log(POP) | 0.0284 | 0.00589 | −0.0596 * |

| (0.0252) | (0.0245) | (0.0315) | |

| Observations-Countries | 664-136 | 664-136 | 664-136 |

| AR1 (p-Value) | 0.0000 | 0.0000 | 0.0000 |

| AR2 (p-Value) | 0.2041 | 0.2755 | 0.2466 |

| AR3 (p-Value) | 0.7966 | 0.8770 | 0.6686 |

| OID (p-Value) | 0.2194 | 0.4794 | 0.1734 |

| Variables | Log(AfTTOT) | Log(AfTTOT) | Log(AfTTOT) | Log(AfTTOT) | Log(AfTTOT) |

|---|---|---|---|---|---|

| (1) | (2) | (3) | (4) | (5) | |

| Log(AfTTOT)t−1 | 0.546 *** | 0.553 *** | 0.532 *** | 0.561 *** | 0.555 *** |

| (0.0165) | (0.0203) | (0.0177) | (0.0172) | (0.0173) | |

| NUMB | 0.0911 *** | 0.131 *** | 0.238 *** | 0.135 *** | 0.0781 *** |

| (0.0237) | (0.0313) | (0.0260) | (0.0195) | (0.0246) | |

| NUMB * LDC | −0.0958 ** | ||||

| (0.0387) | |||||

| LDC | 0.396 *** | ||||

| (0.148) | |||||

| NUMB * ART26 | −0.142 * | ||||

| (0.0731) | |||||

| NUMB * ART12 | 0.0134 | ||||

| (0.0545) | |||||

| NUMB * NonART26 | 0.197 *** | ||||

| (0.0725) | |||||

| ART26 | 0.0825 | ||||

| (0.270) | |||||

| ART12 | 0.235 * | ||||

| (0.140) | |||||

| NonART26 | −0.666 ** | ||||

| (0.276) | |||||

| Log(NonAfT) | 0.431 *** | 0.433 *** | 0.382 *** | 0.459 *** | 0.433 *** |

| (0.0395) | (0.0401) | (0.0411) | (0.0455) | (0.0439) | |

| GROWTH | 0.0170 *** | 0.0151 *** | 0.0134 *** | 0.00983 *** | 0.0141 *** |

| (0.00396) | (0.00428) | (0.00482) | (0.00361) | (0.00413) | |

| RENT | −0.0192 *** | −0.0188 *** | −0.0127 *** | −0.0147 *** | −0.0181 *** |

| (0.00154) | (0.00151) | (0.00174) | (0.00156) | (0.00176) | |

| Log(GDPC) | 0.957 *** | 1.180 ** | 0.127 | 0.129 | 0.750 * |

| (0.357) | (0.473) | (0.454) | (0.461) | (0.412) | |

| [Log(GDPC)]2 | −0.0600 *** | −0.0698 ** | −0.0123 | −0.00494 | −0.0475 * |

| (0.0230) | (0.0299) | (0.0295) | (0.0293) | (0.0269) | |

| Log(POP) | 0.0521 * | 0.0474 * | 0.0468 | 0.0149 | 0.0359 |

| (0.0285) | (0.0284) | (0.0365) | (0.0314) | (0.0315) | |

| Observations-Countries | 664-136 | 664-136 | 664-136 | 664-136 | 664-136 |

| Number of Instruments | 97 | 96 | 96 | 96 | 96 |

| AR1 (p-Value) | 0.0000 | 0.0000 | 0.0000 | 0.0000 | 0.0000 |

| AR2 (p-Value) | 0.2280 | 0.2347 | 0.2481 | 0.2373 | 0.2388 |

| AR3 (p-Value) | 0.9653 | 0.9255 | 0.8606 | 0.9834 | 0.9485 |

| OID (p-Value) | 0.2620 | 0.2189 | 0.2095 | 0.2650 | 0.1755 |

| Variables | Log(AfTTOT) | Log(AfTTOT) | Log(AfTTOT) |

|---|---|---|---|

| (1) | (2) | (3) | |

| Log(AfTTOT)t-1 | 0.541 *** | 0.574 *** | 0.545 *** |

| (0.0136) | (0.0174) | (0.00827) | |

| NUMB | −0.504 *** | 0.0398 * | 0.0825 ** |

| (0.0943) | (0.0205) | (0.0330) | |

| NUMB * TP | 0.00726 *** | ||

| (0.00138) | |||

| NUMB * TARIFF | −0.0116 *** | ||

| (0.00177) | |||

| NUMB * [Log(OPEN)] | 0.00636 | ||

| (0.00411) | |||

| TP | −0.00486 ** | ||

| (0.00234) | |||

| TARIFF | 0.0173 *** | ||

| (0.00443) | |||

| Log(OPEN) | 0.129 *** | ||

| (0.0234) | |||

| Log(NonAfT) | 0.407 *** | 0.404 *** | 0.367 *** |

| (0.0288) | (0.0235) | (0.0203) | |

| GROWTH | 0.00966 ** | 0.0121 *** | 0.0194 *** |

| (0.00401) | (0.00419) | (0.00295) | |

| RENT | −0.0142 *** | −0.0179 *** | −0.0157 *** |

| (0.00174) | (0.00160) | (0.00104) | |

| Log(GDPC) | 3.233 *** | 1.857 *** | 1.188 *** |

| (0.384) | (0.280) | (0.259) | |

| [Log(GDPC)]2 | −0.212 *** | −0.123 *** | −0.0905 *** |

| (0.0248) | (0.0181) | (0.0164) | |

| Log(POP) | 0.0747 *** | −0.0178 | −0.0863 *** |

| (0.0220) | (0.0124) | (0.0217) | |

| Observations-Countries | 596-127 | 572-128 | 616-129 |

| Number of Instruments | 105 | 105 | 105 |

| AR1 (p-Value) | 0.0000 | 0.0000 | 0.0000 |

| AR2 (p-Value) | 0.8188 | 0.3213 | 0.1097 |

| AR3 (p-Value) | 0.8532 | 0.6604 | 0.4203 |

| OID (p-Value) | 0.2512 | 0.1779 | 0.4717 |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2023 by the author. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Gnangnon, S.K. Duration of the Membership in the World Trade Organization and Aid for Trade Flows. Economies 2023, 11, 168. https://doi.org/10.3390/economies11060168

Gnangnon SK. Duration of the Membership in the World Trade Organization and Aid for Trade Flows. Economies. 2023; 11(6):168. https://doi.org/10.3390/economies11060168

Chicago/Turabian StyleGnangnon, Sena Kimm. 2023. "Duration of the Membership in the World Trade Organization and Aid for Trade Flows" Economies 11, no. 6: 168. https://doi.org/10.3390/economies11060168

APA StyleGnangnon, S. K. (2023). Duration of the Membership in the World Trade Organization and Aid for Trade Flows. Economies, 11(6), 168. https://doi.org/10.3390/economies11060168