Challenges in Assessing the Behaviour of Nodal Electricity Prices in Insular Electricity Markets: The Case of New Zealand

Abstract

1. Introduction

2. Nodal, Zonal, and Uniform Pricing Systems: A Short Critical Literature Survey

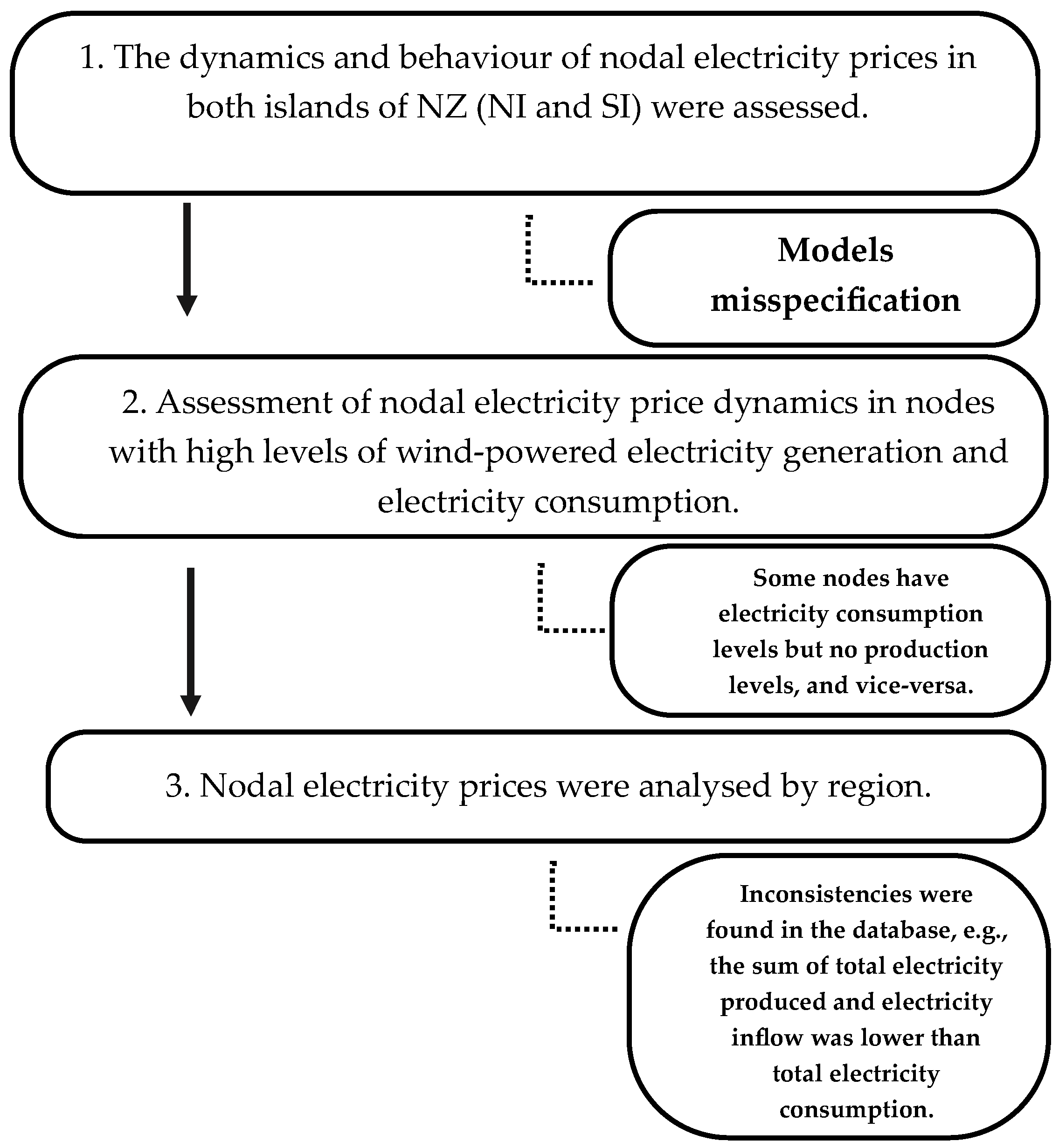

3. Challenges to Assessing the Behaviour of Electricity Prices in NZ

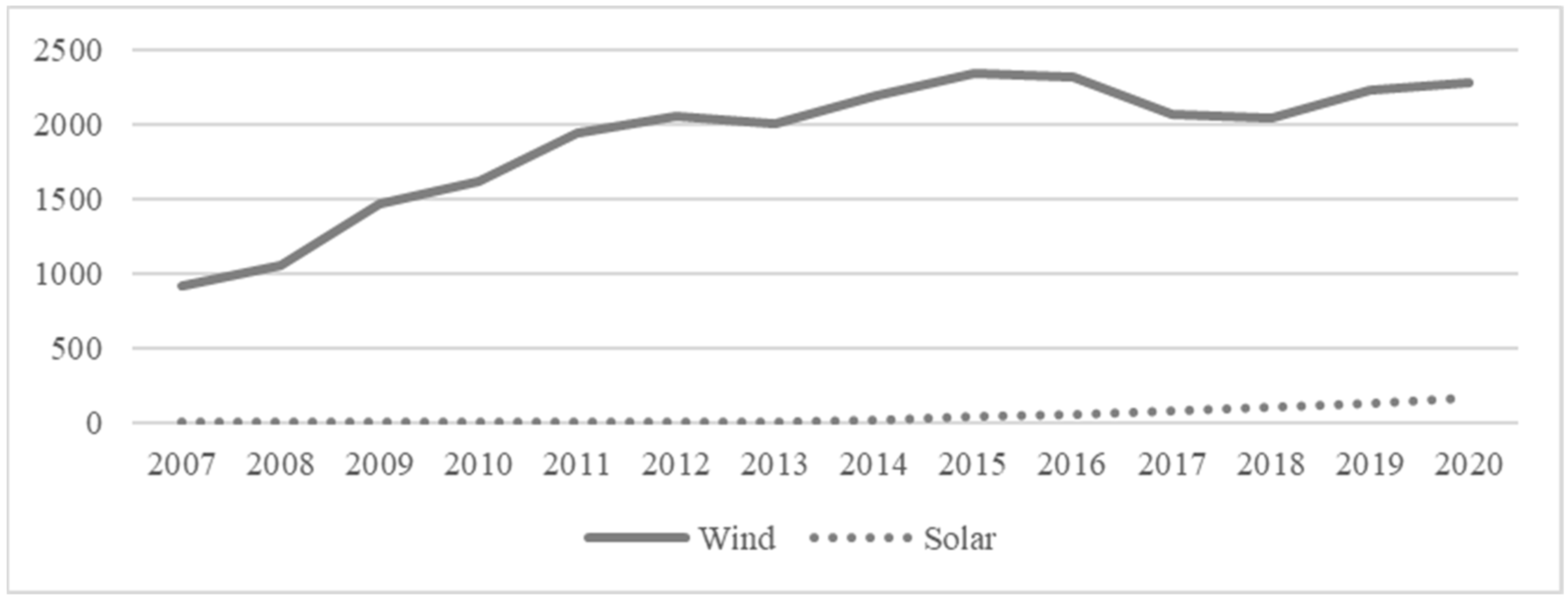

3.1. Brief Overview of the Energy Mix in NZ

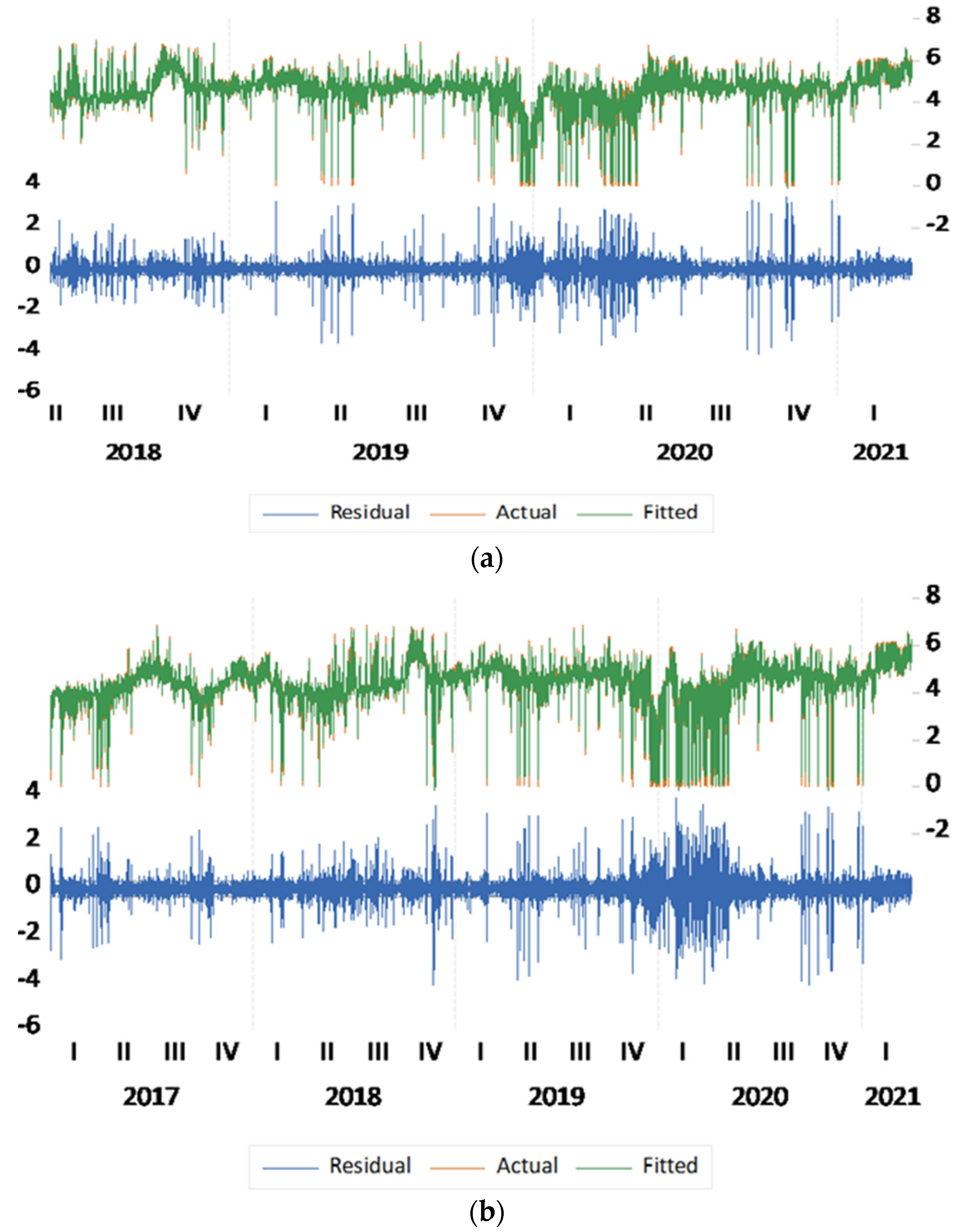

3.2. Challenges in Processing Big Data on Nodal Electricity Markets: The Suitability of Econometric Models

4. Discussion

5. Final Remarks

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

| 1 | The Python packages used to download, filter, and store data are the following: pandas, numpy, and datetime. |

| 2 | To obtain the database, each .csv file was downloaded (i.e., each day was individually downloaded), and then all days were compacted and stored in Python. |

References

- Alaywan, Ziad, Tong Wu, and Alex D. Papalexopoulos. 2004. Transitioning the California market from a zonal to a nodal framework: An operational perspective. Paper presented at 2004 IEEE PES Power Systems Conference and Exposition, New York, NY, USA, October 10–13. [Google Scholar]

- Ambrosius, Mirjam, Jonas Egerer, Veronika Grimm, and Adriaan H. van der Weijde. 2022. Risk aversion in multilevel electricity market models with different congestion pricing regimes. Energy Economics 105: 105701. [Google Scholar] [CrossRef]

- Ambrosius, Mirjam, Veronika Grimm, Thomas Kleinert, Frauke Liers, Martin Schmidt, and Gregor Zöttl. 2020. Endogenous price zones and investment incentives in electricity markets: An application of multilevel optimization with graph partitioning. Energy Economics 92: 104879. [Google Scholar] [CrossRef]

- Antonopoulos, Georgios A., Silvia Vitiello, Gianluca Fulli, and Marcelo Masera. 2020. Nodal Pricing in the European Internal Electricity Market. Luxembourg: Publications Office of the European Union, pp. 1–27. [Google Scholar] [CrossRef]

- Benhmad, François, and Jacques Percebois. 2018. Photovoltaic and wind power feed-in impact on electricity prices: The case of Germany. Energy Policy 119: 317–26. [Google Scholar] [CrossRef]

- Bollerslev, Tim. 1986. Generalized Autorregresive Conditional Hetersoskedasticity. Journal of Econometrics 31: 307–27. [Google Scholar] [CrossRef]

- Box, George E. P., and Gwilym M. Jenkins. 1976. Time Series Analysis: Forecasting and Control, Revised Edition. San Francisco: Holden Day. [Google Scholar]

- Bushnell, James, and Kevin Novan. 2018. Setting with the Sun: The Impacts of Renewable Energy on Wholesale Power Markets. National Bureau of Economic Research Working Paper Series; Cambridge: National Bureau of Economic Research. [Google Scholar] [CrossRef]

- Ciarreta, Aitor, and Ainhoa Zarraga. 2016. Modeling realized volatility on the Spanish intra-day electricity market. Energy Economics 58: 152–63. [Google Scholar] [CrossRef]

- Ciarreta, Aitor, Cristina Pizarro-irizar, and Ainhoa Zarraga. 2020. Renewable energy regulation and structural breaks: An empirical analysis of Spanish electricity price volatility. Energy Economics 88: 104749. [Google Scholar] [CrossRef]

- Cludius, Johanna, Hauke Hermann, Felix Chr Matthes, and Verena Graichen. 2014. The merit order effect of wind and photovoltaic electricity generation in Germany 2008–16 estimation and distributional implications. Energy Economics 44: 302–13. [Google Scholar] [CrossRef]

- Csereklyei, Zsuzsanna, Songze Qu, and Tihomir Ancev. 2019. The e ff ect of wind and solar power generation on wholesale electricity prices in Australia. Energy Policy 131: 358–69. [Google Scholar] [CrossRef]

- de Lagarde, Cyril Martin, and Frédéric Lantz. 2018. How renewable production depresses electricity prices: Evidence from the. Energy Policy 117: 263–77. [Google Scholar] [CrossRef]

- Erdinc, Ozan, Nikolaos G. Paterakis, and Joaõ P. S. Catalaõ. 2015. Overview of insular power systems under increasing penetration of renewable energy sources: Opportunities and challenges. Renewable and Sustainable Energy Reviews 52: 333–46. [Google Scholar] [CrossRef]

- Forrest, Sam, and Iain Macgill. 2013. Assessing the impact of wind generation on wholesale prices and generator dispatch in the Australian National Electricity Market. Energy Policy 59: 120–32. [Google Scholar] [CrossRef]

- Gürsan, Cem, and Vincent de Gooyert. 2021. The systemic impact of a transition fuel: Does natural gas help or hinder the energy transition? Renewable and Sustainable Energy Reviews 138: 110552. [Google Scholar] [CrossRef]

- Gürtler, Marc, and Thomas Paulsen. 2018. The effect of wind and solar power forecasts on day-ahead and intraday electricity prices in Germany. Energy Economics 75: 150–62. [Google Scholar] [CrossRef]

- Halkos, George E., and Eleni Christina Gkampoura. 2021. Evaluating the effect of economic crisis on energy poverty in Europe. Renewable and Sustainable Energy Reviews 144: 110981. [Google Scholar] [CrossRef]

- Heffron, Raphael J., Marc-Fabian Körner, Theresia Sumarno, Jonathan Wagner, Martin Weibelzahl, and Gilbert Fridgen. 2022. How different electricity pricing systems affect the energy trilemma: Assessing Indonesia’s electricity market transition. Energy Economics 107: 105663. [Google Scholar] [CrossRef]

- Holmberg, Pär, and Ewa Lazarczyk. 2015. Comparison of congestion management techniques: Nodal, zonal and discriminatory pricing. The Energy Journal 36: 145–66. [Google Scholar] [CrossRef]

- Iimura, Akiko, and Jeffrey S. Cross. 2018. The impact of renewable energy on household electricity prices in liberalized electricity markets: A cross-national panel data analysis. Utilities Policy 54: 96–106. [Google Scholar] [CrossRef]

- International Energy Agency. 2017. Energy Policies of IEA Countries: New Zealand 2017 Review. Paris: International Energy Agency, pp. 1–235. [Google Scholar]

- Ioannidis, Filippos, Kyriaki Kosmidou, Christos Savva, and Panayiotis Theodossiou. 2021. Electricity pricing using a periodic GARCH model with conditional skewness and kurtosis components. Energy Economics 95: 105110. [Google Scholar] [CrossRef]

- Ketterer, Janina C. 2014. The impact of wind power generation on the electricity price in Germany. Energy Economics 44: 270–80. [Google Scholar] [CrossRef]

- Lété, Quentin, Yves Smeers, and Anthony Papavasiliou. 2022. An analysis of zonal electricity pricing from a long-term perspective. Energy Economics 107: 105853. [Google Scholar] [CrossRef]

- Macedo, Daniela Pereira, António Cardoso Marques, and Olivier Damette. 2020. The impact of the integration of renewable energy sources in the electricity price formation: Is the Merit-Order Effect occurring in Portugal? Utilities Policy 66: 101080. [Google Scholar] [CrossRef]

- Macedo, Daniela Pereira, António Cardoso Marques, and Olivier Damette. 2021. The Merit-Order Effect on the Swedish bidding zone with the highest electricity flow in the Elspot market. Energy Economics 102: 105465. [Google Scholar] [CrossRef]

- Macedo, Daniela Pereira, António Cardoso Marques, and Olivier Damette. 2022. The role of electricity flows and renewable electricity production in the behaviour of electricity prices in Spain. Economic Analysis and Policy 76: 885–900. [Google Scholar] [CrossRef]

- Maciejowska, Katarzyna. 2020. Assessing the impact of renewable energy sources on the electricity price level and variability—A quantile regression approach. Energy Economics 85: 104532. [Google Scholar] [CrossRef]

- Maniatis, Georgios I., and Nikolaos T. Milonas. 2022. The impact of wind and solar power generation on the level and volatility of wholesale electricity prices in Greece. Energy Policy 170: 113243. [Google Scholar] [CrossRef]

- Marques, António, José Fuinhas, and Daniela Macedo. 2019. The impact of feed-in and capacity policies on electricity generation from renewable energy sources in Spain. Utilities Policy 56: 159–68. [Google Scholar] [CrossRef]

- Martinez-Anido, Carlo Brancucci, Greg Brinkman, and Bri-mathias Hodge. 2016. The impact of wind power on electricity prices. Renewable Energy 94: 474–87. [Google Scholar] [CrossRef]

- Mills, Andrew, Ryan Wiser, Dev Millstein, Juan Pablo Carvallo, Will Gorman, Joachim Seel, and Seongeun Jeong. 2021. The impact of wind, solar, and other factors on the decline in wholesale power prices in the United States. Applied Energy 283: 116266. [Google Scholar] [CrossRef]

- Ozturk, Ilhan. 2010. A literature survey on energy-growth nexus. Energy Policy 38: 340–49. [Google Scholar] [CrossRef]

- Papadopoulos, Agis M. 2020. Renewable energies and storage in small insular systems: Potential, perspectives and a case study. Renewable Energy 149: 103–14. [Google Scholar] [CrossRef]

- Papaioannou, George P., Christos Dikaiakos, Athanasios S. Dagoumas, Anargyros Dramountanis, and Panagiotis G. Papaioannou. 2018. Detecting the impact of fundamentals and regulatory reforms on the Greek wholesale electricity market using a SARMAX/GARCH model. Energy 142: 1083–103. [Google Scholar] [CrossRef]

- Papież, Monika, Sławomir Śmiech, and Katarzyna Frodyma. 2019. Effects of renewable energy sector development on electricity consumption—Growth nexus in the European Union. Renewable and Sustainable Energy Reviews 113: 109276. [Google Scholar] [CrossRef]

- Paul, William, Phillip Wild, John Foster, and Michael Hewson. 2017. Revitalising the wind power induced merit order effect to reduce wholesale and retail electricity prices in Australia. Energy Economics 67: 224–41. [Google Scholar] [CrossRef]

- Poletti, Stephen. 2021. Market Power in the New Zealand electricity wholesale market 2010–2016. Energy Economics 94: 105078. [Google Scholar] [CrossRef]

- Rintamäki, Tuomas, Afzal S. Siddiqui, and Ahti Salo. 2017. Does renewable energy generation decrease the volatility of electricity prices? An analysis of Denmark and Germany. Energy Economics 62: 270–82. [Google Scholar] [CrossRef]

- Sapio, Alessandro. 2019. Greener, more integrated, and less volatile? A quantile regression analysis of Italian wholesale electricity prices. Energy Policy 126: 452–69. [Google Scholar] [CrossRef]

- Sarfati, Mahir, Mohammad Reza Hesamzadeh, and Pär Holmberg. 2019. Production efficiency of nodal and zonal pricing in imperfectly competitive electricity markets. Energy Strategy Reviews 24: 193–206. [Google Scholar] [CrossRef]

- Simoglou, Christos K., Emmanouil A. Bakirtzis, Pandelis N. Biskas, and Anastasios G. Bakirtzis. 2016. Optimal operation of insular electricity grids under high RES penetration. Renewable Energy 86: 1308–16. [Google Scholar] [CrossRef]

- Souhir, Ben Amor, Boubaker Heni, and Belkacem Lotfi. 2019. Price risk and hedging strategies in Nord Pool electricity market evidence with sector indexes. Energy Economics 80: 635–55. [Google Scholar] [CrossRef]

- Tsai, Chen Hao, and Derya Eryilmaz. 2018. Effect of wind generation on ERCOT nodal prices. Energy Economics 76: 21–33. [Google Scholar] [CrossRef]

- Van den Bergh, Kenneth, Jonas Boury, and Erik Delarue. 2016. The Flow-Based Market Coupling in Central Western Europe: Concepts and definitions. The Electricity Journal 29: 24–29. [Google Scholar] [CrossRef]

- Weibelzahl, Martin. 2017. Nodal, zonal, or uniform electricity pricing: How to deal with network congestion. Frontiers in Energy 11: 210–32. [Google Scholar] [CrossRef]

- Weibelzahl, Martin, and Alexandra Märtz. 2018. On the effects of storage facilities on optimal zonal pricing in electricity markets. Energy Policy 113: 778–94. [Google Scholar] [CrossRef]

- Wen, Le, Kiti Suomalainen, Basil Sharp, Ming Yi, and Mingyue Selena Sheng. 2022. Impact of wind-hydro dynamics on electricity price: A seasonal spatial econometric analysis. Energy 238: 122076. [Google Scholar] [CrossRef]

- Wiser, Ryan, Andrew Mills, Joachim Seel, Todd Levin, and Audun Botterud. 2017. Impacts of Variable Renewable Rnergy on Bulk Power System Assets, Pricing and Costs. Berkeley: Lawrence Berkeley National Laboratory (LBNL), pp. 1–105. [Google Scholar]

- Woo, Chi-Keung, Ira Horowitz, Jack Moore, and Andres Pacheco. 2011. The impact of wind generation on the electricity spot-market price level and variance: The Texas experience. Energy Policy 39: 3939–44. [Google Scholar] [CrossRef]

- Woo, Chi-Keung, Jack Moore, Brendan Schneiderman, Tony Ho, Arne Olson, Lakshmi Alagappan, Kiran Chawla, Nate Toyama, and Jay Zarnikau. 2016. Merit-order effects of renewable energy and price divergence in California’s day-ahead and real-time electricity markets. Energy Policy 92: 299–312. [Google Scholar] [CrossRef]

- Young, David, Stephen Poletti, and Oliver Browne. 2014. Can agent-based models forecast spot prices in electricity markets? Evidence from the New Zealand electricity market. Energy Economics 45: 419–34. [Google Scholar] [CrossRef]

| Zonal Electricity Pricing Mechanism | ||||

| Authors | Period Analysed | Electricity Market | Method | Main Findings |

| Macedo et al. (2021) | Daily data from January 2016 to April 2020 | Nord Pool Electricity Market (Sweden) | Seasonally Adjusted Autoregressive Moving Average (SARMA)/Generalized Autoregressive Conditional Heteroskedasticity (GARCH) | Wind power ↓ electricity prices, and this impact is similar in magnitude in the 24 h of the day. |

| Maciejowska (2020) | Daily data from January 2015 to January 2018 | German | Quantile Regression Model | Solar and wind power ↓ electricity prices; their prominent impact occurs during peak prices. |

| Sapio (2019) | Daily data from September 2006 to July 2015 | Italian | Quantile Regression Model | Solar and wind power electricity prices; solar power is likely to price volatility, more than wind; the establishment of a new cable for electricity transmission price volatility. |

| Benhmad and Percebois (2018) | Hourly data from January 2012 to December 2015 | German | Seemingly unrelated regression | Solar PV and wind power ↓ electricity prices. The impact is likely to vary throughout the 24 h of the day. |

| Papaioannou et al. (2018) | Daily data from January 2004 to December 2014 | Greek | SARMAX/(E)GARCH | This electricity market does not exhibit asymmetries (i.e., leverage or inverse leverage effect) in volatility of electricity prices. |

| Gürtler and Paulsen (2018) | Hourly data from 2010 to 2016 | German | Fixed Effects Regression with Driscoll-Kraay estimator | Solar PV and wind power electricity prices; their impact is less prominent between 2013 and 2016, due to a in fuel prices. Reductions in forecast errors on electricity generation from wind and solar PV would decrease price volatility. |

| de Lagarde and Lantz (2018) | Hourly data from 2014 to 2016 | German | Markov Switching Model | Solar PV and wind power electricity prices in both regimes, i.e., low and high prices; this negative impact is more pronounced in regimes of high electricity prices. |

| Rintamäki et al. (2017) | Houry data from January 2010 to December 2014 (Denmark); Hourly data from January 2012 to December 2014 (Germany) | German and Danish (Nord Pool Electricity Market) | SARMA | Wind power ↓ electricity prices both in Germany and Denmark. In Denmark, price volatility is lower when wind production increases, while high in Germany; these contrasting results are related to flexible power generation capacity in each country. |

| Nodal Electricity Pricing Mechanism | ||||

| Authors | Period | Electricity Market | Method | Main Findings |

| Csereklyei et al. (2019) | 30-min and daily data from November 2010 to June 2018 | Australian | Autoregressive distributed lag regression model | Wind power and solar PV electricity prices-min estimations); increased electricity dispatched by wind power is associated with a lower magnitude of the MOE from solar PV. |

| Paul et al. (2017) | N/A | Australian | Simulation/sensitivity analysis using ANEM model | Wind power wholesale electricity prices, albeit retail electricity prices; underinvestment in interconnection capacity is the main argument for wind power not causing a further in electricity prices. Reliable capacity of interconnections is highly required in nodal pricing systems. |

| Woo et al. (2016) | Hourly data from December 2012 to April 2015 | Californian Independent System Operator | Iterated Seemingly Unrelated Regression | Real-time and day-ahead electricity prices seems to not converge mainly due to day-ahead forecast errors. |

| Forrest and Macgill (2013) | 30-min data from March 2009 to February 2011. | Australian | Tobit Model | Wind power electricity prices; larger levels of electricity produced from wind power will likely intensify the downward pressure in electricity prices and reduce the incentives for new wind power players to enter the market. |

| Uniform Electricity Pricing Mechanism | ||||

| Authors | Period | Electricity Market | Method | Main Findings |

| Macedo et al. (2022) | Daily data from May 2015 to December 2020. | Iberian (Spain) | SARMAX/GARCH | Wind power and solar PV electricity prices at most times of the day; the magnitude of these impacts varies substantially for each of the 24 h. |

| Macedo et al. (2020) | Daily data from January 2011 to September 2019. | Iberian (Portugal) | SARMAX/GARCH | Wind power and solar PV electricity prices, while increasing its volatility. A leverage effect was confirmed. |

| NI | SI | |

|---|---|---|

| Variables | Mean Equation | |

| LCONS | −0.3199 *** | 1.1861 *** |

| LWIND | −0.0965 *** | −0.0065 *** |

| LHYDRO | 0.5901 *** | −0.1928 *** |

| ω | 4.1054 *** | −3.5858 *** |

| AR(1) | 0.9753 *** | 0.9770 *** |

| SAR(24) | 0.0865 *** | 0.0883 *** |

| MA(1) | −0.4089 *** | −0.4286 *** |

| SMA(1) | 0.3422 *** | 0.3601 *** |

| Variance Equation | ||

| C | −0.0610 *** | −0.0495 ** |

| α | 1.1627 *** | 1.1764 *** |

| β | 0.3882 *** | 0.4388 *** |

| LWIND | −0.0006 | 0.0004 * |

| LCONS | 0.0162 *** | 0.0101 *** |

| LHYDRO | −0.0092 *** | −0.0027 |

| Diagnostic Tests | ||

| R2 | 0.8443 | 0.8524 |

| AIC | −0.5504 | −0.5580 |

| SIC | −0.5455 | −0.5545 |

| QLB(24) | 451.61 [0.000] | 652.89 [0.000] |

| QLB2(24) | 117.35 [0.000] | 212.18 [0.000] |

| ARCH(24) | 4.9840 [0.000] | 9.0092 [0.000] |

| Inverted AR Roots | Stationary | Stationary |

| Inverted MA Roots | Stationary | Stationary |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2023 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Macedo, D.P.; Marques, A.C.; Damette, O. Challenges in Assessing the Behaviour of Nodal Electricity Prices in Insular Electricity Markets: The Case of New Zealand. Economies 2023, 11, 159. https://doi.org/10.3390/economies11060159

Macedo DP, Marques AC, Damette O. Challenges in Assessing the Behaviour of Nodal Electricity Prices in Insular Electricity Markets: The Case of New Zealand. Economies. 2023; 11(6):159. https://doi.org/10.3390/economies11060159

Chicago/Turabian StyleMacedo, Daniela Pereira, António Cardoso Marques, and Olivier Damette. 2023. "Challenges in Assessing the Behaviour of Nodal Electricity Prices in Insular Electricity Markets: The Case of New Zealand" Economies 11, no. 6: 159. https://doi.org/10.3390/economies11060159

APA StyleMacedo, D. P., Marques, A. C., & Damette, O. (2023). Challenges in Assessing the Behaviour of Nodal Electricity Prices in Insular Electricity Markets: The Case of New Zealand. Economies, 11(6), 159. https://doi.org/10.3390/economies11060159