Abstract

Finance support and other forms of business support have been recognized as key factors in the entrepreneurial ecosystem in theoretical and empirical investigations. There is currently a knowledge gap regarding the combined impact of these two variables on the entrepreneurial ecosystem, even though much research has shown that both variables have a favorable influence on entrepreneurial ecosystems. The primary goal of this study is to determine whether the interactions between the two variables—finance support and other business support services—have an impact on the entrepreneurial ecosystem in South Africa. A second objective is to determine the main effects of these variables on the entrepreneurial ecosystem. A standardized questionnaire was used to conduct a study of 2000 SMEs in the South African province of Mpumalanga. To investigate the effects of business support services and finance on the ecosystem as measured by the test instruments, a two-way between-groups analysis of variance was carried out. Depending on their finance index, subjects were classified into three groups: low, medium, and high. There was a statistically significant main effect for finance and other business support services with F(2, 1478) = 26.109, p ≤ 0.001 and F(2, 1478) = 149.552, p ≤ 0.001 respectively. However, the effect sizes were small (partial eta squared = 0.034 and 0.168). Post hoc comparisons using the Tukey HSD test indicated that the mean scores differed for all the groups in finance support and other business support services. It was found that financial support and other business support would impact the SME ecosystem in South Africa positively if implemented separately but not if implemented interactively. The targets of financial support should be separated from other business support during policy formulation and implementation by the government.

1. Introduction & Context

In the last two decades, the relevance of small and medium enterprises (SMEs), especially in the areas of job creation and poverty alleviation, is gaining momentum in global academic discussion. A host of theoretical and empirical studies have identified finance and other business support as major determinants of the entrepreneurial ecosystem in that these two factors can make or mar the contributions and sustainability of SMEs in economic growth and development (Smorodinskaya et al. 2017; Khan and Arshad 2019; Lose 2021; and Beaudry et al. 2021). Pérez-Gomómez et al. (2018) and Al-Tit et al. (2019) highlighted the contributions of SMEs to the economic advancement of developed and developing economies, while Prokop and Stejskal (2019) attributed the success recorded by developed countries in job creation to business support from the governments at various levels. This suggests that finance and other business support, in whatever dimension, are critical in enhancing the contributions and survival of SMEs in an ecosystem. This, therefore, raises questions about the nature of the relationship between finance and other business support in relation to the entrepreneurial ecosystem. Put differently, it is useful to examine the co-movements or interactions between these two factors within an entrepreneurial ecosystem, with a focus on SMEs. As an emerging economy in Africa with a lot of benefits from investment in SME sustainability, South Africa is the target of this study.

In South Africa, finance and other business support remain issues to SMEs’ sustainability. Karymshakov et al. (2019) and Ogujiuba et al. (2021) identified finance as one major obstacle to SME sustainability in the country while business support from the government or government agencies has been proven to be inadequate for the country (Prokop and Stejskal 2019; and Mukiza 2020). Current trends in the areas of finance and other business support covered by government establishments include those from the Department of Trade and Industry (popularly called DTI) and the Small Entrepreneurship Development Agency (SEDA). The DTI funding for SMEs includes the SEDA-Technology Programme (SEDA-TP), the Agro-Processing Support Scheme (APSS), the Support Programme for Industrial Innovation (SPII), the Export Marketing and Investment Assistance Scheme (EMIAS), the Sector Specific Assistance Scheme (SSAS), and the Aquaculture Development and Enhancement Programme (ADEP). The need for a supportive entrepreneurial ecosystem stem from the challenges being faced by SMEs, especially in the areas of start-up finance and the necessary needed business support for their survival and sustainability in the country. Unemployment in South Africa is taking a new dimension such that the need for the government to provide the necessary financial and business support is becoming sacrosanct.

The need for this study emanates from the uniqueness of each entrepreneurial ecosystem. Ecosystems differ in their levels of development, the constitution of their participants or role players, and in their challenges or their competitive advantages (Mason and Brown 2014). Eggink (2021) found, by comparing the determinants of SMEs’ performance of developed and developing countries, and countries in transition, that despite certain commonalities in determinants, countries, regions, and sectors are unique, and they have unique challenges and endowments. There are also conceptual differences in the definitions of small, medium, and large enterprises, complicating comparisons, or generalizations (Obasan et al. 2016). Medium in one country may be considered small in another. These differences necessitate unique studies in different countries, regions, and sectors (Nizaeva and Coşkun 2018). Mthimkhulu and Aziakpono (2015) state that policies should not be based on findings on averages of generic studies of countries, because findings across countries can differ vastly. This may lead to distorted assumptions. Belas et al. (2017) confirms these discrepancies by finding country-level differences more prominent in explaining finance-seeking behavior than firm-level differences. Their study focused on the financial constraints of SMEs, and they provide empirical evidence from a dataset of 30 transition economies, using logistic regression. Most studies agree that the entrepreneurial ecosystem plays an important role in the performance of SMEs (Beaudry et al. 2021; Khan and Arshad 2019; Smorodinskaya et al. 2017; Carlsson 2007). Yet, there is also a viewpoint that the ecosystem does not have an influence on the innovation performance of SMEs, but that it is probably confined to high technology, developed countries, or hubs. Chandrashekar and Bala Subrahmanya (2017), for example, in their study of SMEs in Bengaluru (the highest-ranked hub of 46 technological hubs in Asia), found no direct influence of the ecosystem on the innovation of SMEs, but they argue that the performance of SMEs is enhanced by internal capabilities. These differences between countries, regions, and sectors, necessitate a study of SMEs in the South African context. It is further confirmed by Isenberg (2011) that ecosystems function under different conditions and circumstances that are unique to each ecosystem. Pita et al. (2021) further found, in their panel data study, that there is an unbalanced influence of the entrepreneurial pillars on entrepreneurial initiative, which further motivates this study’s objective to investigate the interaction of the two variables of finance support and other business support.

Theoretical Framework

There are different studies that attempt to analyze the definitions, origin, and models of the entrepreneurial ecosystem and related concepts (Javarov and Szakos 2022; Schäfer and Mayer 2019; Khattab and Al-Magli 2017; Malecki 2018). According to Beaudry et al. (2021), the concepts of ecosystem such as business ecosystem, entrepreneurial ecosystem, and innovation ecosystem have a strong link. Yet, ecosystem terminology is used differently in different studies, mostly due to the sub-disciplines or focus areas of the studies (Malecki 2018). According to Malecki (2018, p. 5), the definitions have the interaction of elements that produce “shared cultural values that support entrepreneurial activity”. Mason and Brown (2014) refer to the contribution of Alfred Marshall’s work on the role of agglomeration economies, then include the innovation system literature of the 1990s, before focusing on the entrepreneurial ecosystem approach that originated by authors such as Isenberg (2011). Many studies on entrepreneurial ecosystems give credit to Isenberg (2011) for his model of the entrepreneurship ecosystem, evaluating six domains including policy, finance, culture, supports, human capital, and markets (Javarov and Szakos 2022; Schäfer and Mayer 2019; Khattab and Al-Magli 2017).

Studies on innovation systems, more commonly used as national innovation systems, (although there are also regional and sectoral innovation systems) have become more popular since the 1980s. These studies are based on the neo-Schumpeterian views as described, for example, by Freeman (2008), Edquist (2005), Nelson (1996) and Lundvall (1992). Schumpeter is known for the importance of the role of the entrepreneur in innovation and economic growth. The neo-Schumpeterian or evolutionary economists’ views stem from Schumpeter’s (Schumpeter 1961) innovation theory in the publication “Theory of economic development”, first published in 1911. The neo-Schumpeterian view differs from Schumpeter’s theory in the sense that innovation is not only a function of the entrepreneur but that it takes place in a complex system with different components and role players, having different characteristics and complex relationships (Carlsson 2007).

In studies such as Smorodinskaya et al. (2017, p. 5245) and Beaudry et al. (2021, p. 535), innovation systems were classified as “static structures regulated by the government” in contrast to ecosystems that are “dynamic” and “self-governing”. These views were deducted from the institutional economists’ viewpoint and are based on the evolutionary economic views of the neo-Schumpeterian economists. Edquist (2005), for example, elaborates on the role of institutions, organizations, politics, academic institutions, competitors, etc., in the creation of an environment for the firms to become more competitive and, therefore, not in a regulatory way. Nelson (1996, p. 276) confirms Edquist’s view stating that “(t)here is no presumption that the system was, in some sense, consciously designed, or even that the set of institutions involved works together smoothly and coherently. Rather, the ‘systems’ concept is that of a set of institutional actors that, together, play the major role in influencing innovative performance”. Alvedalen and Boschma (2017) opine that the systemic view of entrepreneurial ecosystems leans toward innovation system concepts and indicate reasons that the innovation systems literature focuses on organizations and institutions and does not indicate the links to entrepreneurship. Yet, Eggink (2013) developed a conceptual model of an innovation system, indicating the entrepreneurial firm as the centre of the model, and elaborated on the different roles of the role players that play their respective role to enhance the performance of the entrepreneur and eventually the total performance of the system, resulting in economic growth. Buratti et al. (2022), just as for the innovation system, indicates the entrepreneur as the core of the entrepreneurial ecosystem and give Schumpeter credit for bringing entrepreneurship and innovation as the challenges to firm performance. There is a question regarding whether adding the term “eco” to “system” is not ambiguous (Smorodinskaya et al. 2017). Yet, to avoid the narrow interpretation by some authors of the term “system” as government structures and regulation, the term “ecosystem” provides more clarity on the inclusiveness of role players and interactions, linkages, and networks. Javarov and Szakos (2022) carried out a review of different ecosystem models, and these models elaborate on the different role players and their respective roles, working wittingly or unwittingly towards the entrepreneurial performance of the firms. The entrepreneurial ecosystem is also not static, but evolved over time, as is described by Javarov and Szakos (2022) and Malecki (2018).

Schäfer and Mayer (2019) stated that the more recent studies show a preference for the term “entrepreneurial ecosystem” over, as they call it, more traditional concepts such as innovation systems, due to their better focus on entrepreneurial processes. Although Mason and Brown (2014) used the term “entrepreneurial” instead of “innovation” ecosystems, their definition includes the common and crucial components of the definitions by Beaudry et al. (2021), Khan and Arshad (2019), and Smorodinskaya et al. (2017), and is thus the definition that will be used in this paper. This definition reads as follows: an entrepreneurial ecosystem is “a set of interconnected entrepreneurial actors (both potential and existing), entrepreneurial organizations (e.g., firms, venture capitalists, business angels, banks), institutions (universities, public sector agencies, financial bodies) and entrepreneurial processes … which formally and informally coalesce to connect, mediate and govern the performance within the local entrepreneurial environment” (Mason and Brown 2014).

2. Literature on the Effect of Finance & Business Support on Entrepreneurial Ecosystems

Studies, such as those by Singh and Ashraf (2020), Wald and Kansheba (2020), Cao and Shi (2020), and Stam and van de Ven (2021), provide a thorough analysis of what makes up an entrepreneurial ecosystem and its quantification. For instance, Stam and van de Ven’s study from 2021 conceived entrepreneurship as a system that creates a measurement tool for constructing an entrepreneurial ecosystem index to assess the quality of entrepreneurial ecosystems in the Netherlands. Additionally, Singh and Ashraf (2020) established the entrepreneurial ecosystem index (EEI) as a useful instrument for measuring an entrepreneurial environment in industrialized nations and discovered that there is a strong correlation between the entrepreneurship ecosystem and per capita GDP.

The need for financial support for SMEs emanates from the most common barriers to the success of SMEs, as indicated in several studies (Pita et al. 2021; Eggink 2021; Karymshakov et al. 2019; Boermans and Willebrands 2018; Islam and Hossain 2018 and Belas et al. 2017). Mason and Brown (2014) confirmed the importance of the availability of finance to the entrepreneurial ecosystem and highlighted the importance of seed and start-up funding and venture capital and indicate how these funds can also be sourced internationally. Ecosystems, therefore, function across national borders. In a systematic literature review of articles published over the period 2017–2020 on determinants of SMEs’ performance, Eggink (2021) provided further proof that the most common determinant is related to financial problems. The study revealed that more than 50% of the studies were either focused on access to or availability of finances or capital. These constraints were more prominent in the studies on developing countries than those in developed countries. The study by Eggink (2021) indicates that in terms of the constraints of SME performance, such as access to finance or credit, although common to most countries, the extent of these problems may differ vastly.

Empirical evidence of the importance to SMEs of access to finance and capital is especially prominent for developing countries. Own capital and financing are not common amongst many SMEs and funding from financial institutions is not always available due to the SMEs’ lack of collateral and credit records. The study by Boermans and Willebrands (2018) on survey data of the lending behaviour of 615 entrepreneurs in Tanzania (using OLS regression and propensity score matching techniques) found that financial constraints have a negative effect on business success (as measured by labour productivity). Lekhanya and Mason (2014), in their study on rural SMEs in South Africa, confirm that access to finance influences the performance of SMEs. Félix and dos Santos (2018) conducted a study and used static and dynamic panel data from 200 Portuguese SMEs. Their regression analysis revealed a positive relationship between, inter alia, venture capital and the firms’ success (indicated by first-five-year survival).

This lack of access to funding has detrimental effects on SMEs, causing entrepreneurs with high innovative potential not to start projects or businesses, firms not to grow to their potential, and not to improve their productivity (Boermans and Willebrands 2018; Bogliacino et al. 2009). Belas et al. (2017) opined that the lack of own funds necessitates financial support to enhance innovation activities. Financial management is further indicated as a constraint in SMEs, especially in developing countries. Financial support should preferably be accompanied by management training and support for the funding to be fruitful (Félix and dos Santos 2018). While most studies indicate financial access as the most hampering factor for SMEs, the study of Al-Tit et al. (2019) found that SMEs in Saudi Arabia indicated business support as the most critical factor for success, followed by capital availability. This study was conducted on 347 SMEs, using factor analysis. Pérez-Gomómez et al. (2018) empirically confirms the expectation that government support contributes to SMEs’ success. They include in the concept of “government assistance” both financial support (such as credit assistance, tax exemptions, or reductions), and non-financial assistance (such as managerial and technical assistance). Their study was based on 599 manufacturing SMEs in Spain, using a stochastic frontier methodology.

The type of support that the World Bank (2010) proposes includes: appropriate incentives and mechanisms; the removal of obstacles to innovative initiatives; the establishment of responsive research structures; and the fostering of a creative and receptive population through appropriate education systems. Apart from governments, support from other participants in the entrepreneurial ecosystem is needed. Prokop and Stejskal (2019) derived in their study (using the Eurostat Community Innovation Survey 2010–2012 data and a logistic regression model) the positive contribution of cooperation with clients, suppliers, universities, and other higher education institutions on the innovation activities of SMEs. In Santoro et al. (2018), Scuotto et al. (2019), and Ronen et al. (2019), the relevance on innovations was justified in affecting the SME ecosystem positively in developed countries. Scuotto et al. (2019) argued in their study that the introduction of new products and processing as innovations can affect SME performance and contributions to economic growth positively. Furthermore, Ronen et al. (2019) proved that SME ecosystems provide useful input in innovation performance. However, Wald and Kansheba (2020) showed mixed findings about the impact of the combined effects of finance and other business support on SME innovation in a study of 35 African countries. While finance and the various forms of business support identified in the study exert a weak influence on the SME ecosystem, the introduction of innovation brought positive changes in these effects.

Apart from finance support, other business support can include advice (business, legal, and financial), training, motivation, contacts, and operational support (Brinkmann and Gelfgren 2020; Ramraj 2018; Blackburn et al. 2015; Pleasence et al. 2012; Kamyabi and Devi 2011; Scott and Irwin 2009). Belhoste et al. (2019) provide proof, supplied by a study of 32 French SMEs of the importance of networks and support services in the expansion of SMEs in the international market. Empirical evidence is also provided by Urriago et al. (2014), in their study of the positive impact that science parks have on the probability of product innovation in Spain. Similar proof is provided by Squicciarini (2009) on Finnish firms, indicating that being located inside the science parks positively relates to the innovative output performance of these firms.

The study by Robson and Bennett (2000), conducted on SMEs in Britain, found that there is a significant positive relationship between the external support received by the private sector, such as lawyers, suppliers, customers, friends, and relatives, but that there is little evidence of such a relationship between government-provided advice agencies. Evidence is provided, on the other hand, by Cardoza et al. (2017) that business support by governments does contribute to productivity and growth of SMEs by means of reducing demand uncertainty and marketing costs (mostly by providing procurement contracts in these countries studied), but that there is a lack in enhancing skills, especially in expanding internationally. The importance of financing in the entrepreneurial ecosystem was underlined by Frimanslund et al. (2023). Through a thorough review of the causes, impacts, and sources of finance, the study examines the role of finance in systemic entrepreneurship and the entrepreneurial ecosystems and concludes that the function of finance depends on how ecosystems are viewed and defined. Stam (2015) added a further concept (regionalism) to the entrepreneurial–ecosystem idea. In addition to a causal model for how the ecosystem’s framework and systemic conditions affect entrepreneurial activities as ecosystem outputs and new value creation as an ecosystem result, the study presents a novel synthesis. Another level added to the EE concept was the digital entrepreneurial ecosystem (DEE). It is a concept that links producers and users of digital products through digital platforms which, according to Chu and Li (2022), merge the entrepreneurial ecosystem and the digital ecosystem. The study uses a qualitative exploratory methodology to expand on how the DEE functions for any prospective digital start-up to achieve digital entrepreneurship. The social and environmental entrepreneurial ecosystem provides solutions to social and environmental challenges such as poverty, unemployment, climate change, and pollution. Furthermore, human capital problems influence digital entrepreneurship; as a result, improving human capital traits such as digital readiness and literacy is critical (Muzanenhamo and Rankhumise 2022).

However, entrepreneurial ecosystems are expected to encourage high-growth entrepreneurship (Scheidgen 2020). According to Giddens’ structure theory, a semi-structured interview was used in this study to explore how entrepreneurs make use of the resources provided by an entrepreneurial ecosystem. It is hypothesized that EEs can differ in their levels of integration and that this characteristic has a significant impact on how entrepreneurs can access EE resources such as finance and other supports and, as a result, how specific EEs support different entrepreneur types. This hypothesis is based on the available evidence provided in the study. As a result, there are heterogeneous structures both inside and between EEs.

3. Data and Methods

3.1. Study Sample

The sample for the analysis (stratified approach) was taken from a general survey of active SMEs in the Mpumalanga province in South Africa. This article is premised on the classification of SMEs, as businesses with less than 250 persons for middle-sized and less than 50 for small-sized establishments were used. The survey instrument was not categorized to segment rural, semi-rural, and urban SMEs, but indicated areas (Nelspruit, Bushbuckridge, Malelane, Tekwane South and Hazyview) where data were collected. However, the instrument defined SMEs by services provided and legal status [See Appendix A]. Furthermore, SMEs that are not Corporation or Limited Liability were mostly rural/semi-rural in the different areas as per location.

The stratified approach was used to derive our sample [2000 SMEs]. The estimated target population is about 10,000. Thus, using a sample size calculator, margin of error of 2%, confidence level of 95%, and response rate of 20%, the sample would be 1937. Thus, we distributed 2200 questionnaires. We divided the target population into three groups (strata) and then selected samples from each stratum for the survey. For this study, we applied a two-fold structured questionnaire. The first part of the questionnaire focused on the demographics, while the second segment focused on entrepreneurial perceptions of the ecosystem and key firm and entrepreneur indicators relevant to the scope of the study. All research protocols and ethics procedures of the university were followed, including a clause on the questionnaire seeking informed consent from the participants, notifying them of their rights, the data storage process, and other safeguards. The test-retest reliability method (trustworthiness assessment of the questionnaire) and Cronbach’s alpha test (internal constancy) resulted in a value of 0.70 and 0.875, respectively, which is regarded as satisfactory. The SPSS version 25.0 was employed in analyzing the data. Table 1 below shows crosstabulations between business sector, business address and legal status.

Table 1.

Crosstabulations.

3.2. Analysis Technique [Two-Way ANOVA]

Two-way analysis of variance allows the testing of the impact of two independent variables on one dependent variable. The advantage of using a two-way ANOVA is that it allows testing for an interaction effect, that is, when the effect of one independent variable is influenced by another. It also tests for ‘main effects’, that is, the overall effect of each independent variable. There are two different two-way ANOVAs: between-groups ANOVA (when the groups are different) and repeated measures ANOVA (when the same people are tested on more than one occasion). In this research, the latter is used. Two-way means that there are two independent variables, and between-groups indicates that different people are in each of the groups. This technique allows us to look at the individual and joint effects of two independent variables on one dependent variable. One-way ANOVA cannot answer questions when two independent variables are used. The advantage of using a two-way design is that we can test the ‘main effect’ for each independent variable and explore the possibility of an ‘interaction effect’. An interaction effect occurs when the effect of one independent variable on the dependent variable depends on the level of a second independent variable. Table 2 and Table 3 below show the Two-Way ANOVA Equations and Between Subject Factors respectively.

Two-Way ANOVA with Post Hoc Tests

Hypothesis H1.

[Interaction effect] The influence of finance on ecosystem levels depends on categories of business support services.

Hypothesis H2.

[Main effect] Categories of business support services and finance differ in terms of their ecosystem scores.

Table 2.

Two-Way ANOVA Equations.

Table 2.

Two-Way ANOVA Equations.

| Sum of Squares | Degrees of Freedom | Mean Square | F Value | p Value | |

|---|---|---|---|---|---|

| A | SSA | I − 1 | SSA/DFA | MSA/MSE | p value main effect A |

| B | SSB | J − 1 | SSB/DFB | MSB/MSE | p value main effect B |

| A*B | SSAB | (I − 1) × (J − 1) | SSAB/DFAB | MSAB/MSE | p value interaction effect |

| Error | SSE | N − μ | SSE/DFE = Pooled variance | ||

| Total | SST | N − 1 | SST/DFT = Total variance |

Table 3.

Between-Subjects Factors.

Table 3.

Between-Subjects Factors.

| Value Label | N | ||

|---|---|---|---|

| Categorized Index of Finance | 1 | ≤15 [Low Index] | 760 |

| 2 | 16–45 [Medium Index] | 239 | |

| 3 | 46+ [High Index] | 487 | |

| Categorized Index of Business Support Services | 1 | ≤20 [Low Index] | 855 |

| 2 | 21–45 [Medium Index] | 194 | |

| 3 | 46+ [High Index] | 437 | |

4. Results

4.1. Two-Way ANOVA

4.1.1. Univariate Analysis of Variance

This section provides descriptive and diagnostic tests used for analysis.

Table 4 provides the mean scores, standard deviations, and N for each subgroup. The values are correct and give an indication of the impact of our independent variables.

Table 4.

Descriptive Statistics.

Levene’s Test of Equality of Error Variances: This test as shown in Table 5 provides a test of one of the assumptions’ underlying analyses of variance. The value we are most interested in is the Sig. level. This must be greater than 0.05, and therefore not significant. A significant result of 0.001 (Sig. value less than 0.05) suggests that the variance of our dependent variable across the groups is not equal. Our results suggest that we have violated the homogeneity of variances assumption. Since this is the case, we would therefore set a more stringent significance level (e.g., 0.01) for evaluating the results of our two-way ANOVA. We would consider the main effects and interaction effects significant only if the Sig. value is greater than 0.01.

Table 5.

Levene’s Test of Equality of Error Variances a,b.

Table 6, Table 7, Table 8 and Table 9 below show the Tests of Between-Subjects Effects; Multiple Comparisons [Post Hoc Tests Categorized Index of Finance]; Categorized Index of Finance; and Multiple Comparisons [Post Hoc Tests Categorized Business Support Services].

Table 6.

Tests of between-Subjects Effects.

Table 7.

Multiple Comparisons [Post Hoc Tests Categorized Index of Finance].

Table 8.

Categorized Index of Finance.

Table 9.

Multiple Comparisons [Post Hoc Tests Categorized Business Support Services].

Effect size: The effect size for the finance support and other business support service scores are provided in the column labeled partial eta squared and are 0.034 and 0.168, respectively. Using Cohen’s (1988) criterion, this can be classified as small. This effect reaches statistical significance, and the actual difference in the mean values is also high. From the descriptives table, we can see that the mean scores for the three finance groups (collapsed for business support services) appear to be of high practical significance.

The main output from two-way ANOVA is a table labeled Tests of Between-Subjects Effects. This gives several pieces of information, not necessarily in any order.

Interaction effects: We checked for the possibility of an interaction effect (that the influence of finance on ecosystem levels depends on categories of business support services). In the SPSS output, the line we need to look at is labeled CSIndF * CIBS. To find out whether the interaction is significant, we checked the Sig. column for that line. If the value is less than or equal to 0.05, then there is a significant interaction effect. In our analysis above, the interaction effect is not significant (CSIndF * CIBS: sig. = 0.140). This indicates that there is no significant difference in the effect of the finance index on the ecosystem for categories of business support services. However, even if there was a significant interaction effect, interpreting the main effects would not be simple because, to describe the influence of one of the independent variables, we need to specify the level of the other independent variable.

Main effects: We did not observe a significant interaction effect; therefore, we can safely interpret the main effects. These are the simple effects of one independent variable (e.g., the effect of business support services with all finance groups collapsed). To determine whether there is a main effect for each independent variable, we check in the column marked Sig. next to each variable. If the value is less than or equal to 0.05 (e.g., 0.03, 0.01, or 0.001), then there is a significant main effect for that independent variable. In the analysis shown above there is a significant main effect for the finance group (CSIndF: sig = “p ≤ 0.001” ), and a significant main effect for business support services (CIBS: sig = “p ≤ 0.001”). This means that categories of business support services and finance differ in terms of their ecosystem scores.

Post hoc tests are relevant only if you have more than two levels (groups) to the independent variable. These tests systematically compare each of the pairs of groups and indicate whether there is a significant difference in the means of each. In this case, we obtained a significant main effect for our independent variables; therefore, we are entitled to investigate further using the post hoc tests.

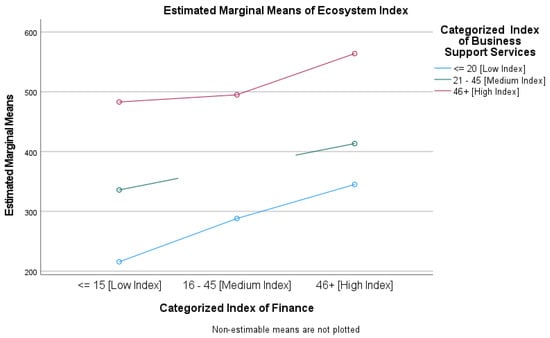

4.1.2. Multiple Comparisons

The results of the post hoc tests are provided in Table 5, labeled Multiple Comparisons. We have requested the Tukey honestly significant difference test, as this is one of the more commonly used tests. We check the column labeled Sig. for any values less than 0.05. Significant results are also indicated by a little asterisk in the column labeled Mean Difference. In the above analysis, all finance groups (1) (≤15 [Low Index]); group (2) 16–45 [Medium Index]; and group (3) 46+ [High Index] (45+) differ significantly from one another. Figure 1 below shows the estimated marginal means of index for the ecosystem for both finance and business support services.

Figure 1.

Ecosystem Index Marginal Means.

Plot: The above shows a plot of the ecosystem scores for categories of business support services, across the three finance groups. This plot is very useful for allowing a visual inspection of the relationship between the variables. This is often easier than trying to decipher a large table of numbers. Although presented last, the plots are often useful to inspect first the impact of the two independent variables. In the plot, there appears to be quite a large difference in business support services scores for all finance groups

5. Discussion

This study has two major objectives to accomplish. The first is to examine if the influence of finance on ecosystem levels depends on categories of business support services. The second objective investigates whether there is a main effect of each of the two variables and how they jointly affect the ecosystem. The null hypotheses [H1] was rejected for the alternative hypothesis, while the null hypothesis [H2] was accepted. The findings from the study revealed that despite the challenges being faced by SMEs in South Africa, financial and business support have been contributing positively to the SMEs ecosystem in recent times (p < 0.01). The effect of finance on the SME ecosystem is different from how business support affects the same the SME ecosystem even though, each of these factors affects the SME ecosystem positively. The significant and positive outcome of finance on the SME ecosystem confirms the relevance of finance in promoting the activities of SMEs in an economy. Indeed, the result indicated that the SME ecosystem is positively affected by financial support irrespective of strata in South Africa. Existing studies by Lekhanya and Mason (2014), Félix and dos Santos (2018), and Eggink (2021) are in tandem with this outcome. The government of South Africa has established various forms of innovative financial assistance for SMEs’ advancement in recent times and the benefits are becoming impactful on the ecosystem as revealed in this study.

Similarly, the findings from this study also confirmed that business support has a significant and positive effect on the SME ecosystem in South Africa. This is an indication that business support, especially in the areas of SME skill acquisition, training, incubators/accelerators, and tax evaluation services, may have resulted in the improving of the performance of the SME ecosystem. This finding comes from earlier studies by Pérez-Gomómez et al. (2018), Al-Tit et al. (2019), and Prokop and Stejskal (2019) where business support was found to affect the SME ecosystem positively. Through agencies such as the Centre for Small Business Promotion and SEDA, South Africa has been supportive in the promotion of the activities of SME operations in the last decades. As argued by Naicker and Rajaram (2019), business support is an antidote for a promising SME ecosystem and this argument holds for South Africa in view of the various business support initiatives from government and private organizations.

However, the co-movement and interactive effects of both finance support and other business support on the SME ecosystem in South Africa are not significant. In essence, the combined effects of finance and other business support on the country’s SME ecosystem are insignificant and irrelevant. This suggests that the objectives of business support differ from that of financial support and, hence, that there is a need to treat the same difference in policy implementation to avoid counter-productivity in policy execution (Magd and Gharib 2021). Extant literature in support of the finding includes Kirogo et al. (2018), Ramraj (2018), and Mukiza (2020). In Mukiza (2020), a weak and insignificant relationship was established for finance and other business support in the SME ecosystem, but the study affirmed that, with innovation, both effects became pronounced. Inadequate financial support as an element of business support in developing economies such as South Africa could negatively impact SME activities (Boermans and Willebrands 2018). While Eggink (2021) observed that finance remains one driving wheel to the success of South Africa’s developmental aspirations, the lack of its proper accessibility for SMEs is an issue that needs government attention to realise the benefits of the government’s other business support programmes (Ramraj 2018). Furthermore, unlike in developed economies, there is a mismatch in the effect of finance and other business support in emerging economies (Bone et al. 2019). The economic implication of these findings is that reductions in unemployment and poverty levels in South Africa may remain stagnant since the positive effect of finance on the SME ecosystem could be marred by overlapping business support mechanisms. In Kamyabi and Devi (2011) and Naicker and Rajaram (2019), it was established that business support such as legal services, business incubators, and accelerators, training, operational support, and tax relief, and accounting advisory services can only enhance entrepreneurial sustainability if brought nearer to the end users. Additionally, the maximum contributions of SMEs to the economic growth of a country might be far from being realised because of a conflict of objectives Magd and Gharib (2021).

Policy Implication

This study has policy implications for SME operators, the government, and policymakers and implementors. In the first place, there is evidence that improving SME financial inclusion in South Africa can enhance economic growth, poverty reduction, and employment generation such that the effectiveness of monetary and fiscal policy could also contribute to financial stability. This is evident in the significant impact of finance on the SME ecosystem in South Africa. Secondly, the study showed that the effects of finance and other business support on the SME ecosystem are mutually exclusive. An attempt to realise the benefit from one will preclude the achievement of the other. The implication of this is that the targets of financial support should be separated from business support during policy formulation and implementation by the government. The avenue for financial support to SMEs by the government should be separated from the means of information dissemination that is meant to bridge the information gap on business support. Furthermore, a high level of taxation on emerging SMEs may hinder the realisation of the expected benefits from government financial support.

In addition, the study provided empirical evidence regarding the separate and individual relevance of finance and other business support to the SME ecosystem’s innovation in South Africa. A higher percentage of the existing literature emphasised the fact that finance remains the backbone of and the sustainable ingredient for the SME ecosystem in developing economies (Félix and dos Santos 2018; Eggink 2021). According to Ogujiuba et al. (2021) the lack of adequate financial support prompted the government of South Africa to introduce agencies such as SEDA to assist would-be entrepreneurs. Our article contributes to existing findings that financial support remains an essential weapon to the survival and growth of SMEs in South Africa. Another policy implication shown in this study is that there could be policy summersault if the objectives of financial support and business support are not separated during policy formulation and implementation, especially in emerging economies such as in South Africa.

6. Conclusions

This study has been able to establish that finance and other business support affect the SME ecosystem in South Africa positively but separately. The available investigations revealed that finance and other business support affect the SME ecosystem positively, but the interactive effects of both factors have not been thoroughly investigated in the academic exercise. This is an indication that financial support and business support would impact the SME ecosystem in South Africa if implemented separately. This was supported by this study in that finance and other business support affect the SME ecosystem separately but not interactively. The outcome of the ANOVA analysis provided no evidence of the co-interaction of finance and other business support of the SME ecosystem for South Africa. By implication, the implementation of financial support and business support simultaneously might hinder the ecosystem because of objective overlapping. As an emerging economy, separating the objectives of each of these variables might be more productive than integrating them together for the country.

Similarly, to other contemporary studies on the entrepreneurial ecosystem, our study is not without limitations. Our model was contextualised over a study based on the ecosystem of the Mpumalanga province of South Africa. This is one of the nine provinces in the country and an extension of this model to the ecosystem of other provinces should be open for future research studies. Future studies should redesign the survey instrument to accommodate the diversity in South Africa.

Nonetheless, the concept of the ecosystem as espoused in the study provided a novel synthesis that forms a template that differentiated the mutually exclusive effects of finance and business support from their joint economic effects. By implication, past government policies were based on how to improve the effects of finance and business support separately without having recourse to the twin implications. Therefore, it is evident that the combined implications of finance and business support would assist policymakers in policy formulation. Secondly, the ecosystem concept as demonstrated in this study would form the basis for further studies on the co-movement of the finance and business support aspects of the entrepreneurial ecosystem.

Recommendation

- The study revealed that finance and other business support were influential to the SME ecosystem in South Africa separately but not collectively. It is suggested that policymakers in South Africa and other jurisdictions are urged to support the ecosystem for SMEs in a variety of ways, such as by offering collateral, developing, and promoting specific loans to SMEs, or granting subsidies to those that accomplish objectives, such as increasing productivity. Additionally, they might favor them in terms of taxation.

- The insignificant impact of the interaction effects of finance and other business support on the SME ecosystem requires the separation of objectives. Where objectives are mutually exclusive, the realisation of one could be detrimental to the achievement of the other. There should be a clear distinction between objective formulation and implementation by policymakers.

- For policymakers, a framework is suggested that will assist well-established businesses in assisting new SMEs to expand their market niches by incorporating them into their networks.

- It is advised that additional variables (other than financial and business support), that Eisenberg also discussed, be incorporated in the study in future studies, including entrepreneurship education at the core of high school and university curricula, for instance. Where this is to be implemented, local decision-makers’ support is necessary, as are systemic political structures, for the programme to be operational and for the subsequent fostering of the growth of local entrepreneurship ecosystems (Banha et al. 2022).

Author Contributions

Conceptualization, K.K.O.; Methodology, K.K.O.; Validation, M.E. and E.O.; Formal analysis, K.K.O.; Resources, E.O.; Writing—original draft, K.K.O. and M.E.; Writing—review & editing, M.E. and E.O. All authors have read and agreed to the published version of the manuscript.

Funding

This research was funded by University of Mpumalanga ethics grant number UMP/Ogujiuba/2/2020”, under the YED Institutional Research Theme. The APC is funded by the University of Mpumalanga, South Africa.

Institutional Review Board Statement

This study was conducted in accordance with the Declaration of Helsinki and approved by the Research Ethics Committee of UNIVERSITY OF MPUMALANGA (UMP/Ogujiuba/2/2020 on 19 January 2020) for studies involving humans.

Informed Consent Statement

Informed consent was obtained from all subjects involved in the study.

Data Availability Statement

Data is available upon request.

Conflicts of Interest

The authors declare no conflict of interest.

Appendix A

Appendix A.1. Ecosystem Survey Instrument

Appendix A.1.1. Demographic Information

- 1.

- Type of firm (Select One): Manufacturing Services

- 2.

- Number of Employees (Number):

- 3.

- Sector (Select One): [Add/Remove Sectors if necessary]

- ○

- Services

- ○

- Tourism

- ○

- Agriculture

- ○

- ICT

- ○

- Manufacturing

- ○

- Construction

- ○

- Transport

- 4.

- Address (Text):

- 5.

- Legal Status (Select One): [use locally relevant classifications]

- ○

- Corporation

- ○

- Limited Liability Company

- ○

- …

- 6.

- Year founded (Date):

- 7.

- Year of formal registration (if different) (Date):

- 8.

- Please complete the following information for each firm owner:

Age Gender % of

OwnershipHighest Level

of EducationYears of Work Experience Number of Ventures Founded Previously Founder 1 Founder 2 - 9.

- Is the top manager female? (Y/N)

Appendix A.1.2. Entrepreneurial Perceptions of the Ecosystem

- 10.

- To what degree are the following elements of Finance an obstacle to the current operations of this firm:

Finance No Obstacle Minor

ObstacleModerate

ObstacleMajor

ObstacleVery Severe Obstacle Don’t

KnowN/A Access to Debt Finance Access to Equity Finance Access to Grants - 11.

- To what degree are the following elements of Business Support Services an obstacle to the current operations of this firm:

Business Support Services No Obstacle Minor

ObstacleModerate

ObstacleMajor

ObstacleVery Severe Obstacle Don’t

KnowN/A Access to Legal Services Access to Tax Services Access to Incubators/Accelerators Access to Consultants/Advisors - 12.

- To what degree are the following elements of the Policy Environment an obstacle to the current operations of this firm:

Policy No Obstacle Minor

ObstacleModerate

ObstacleMajor

ObstacleVery Severe Obstacle Don’t

KnowN/A Business Licensing and Permits Customs and Trade Regulations Labor Regulations Tax Administration Tax Rates - 13.

- To what degree are the following elements of the Market an obstacle to the current operations of this firm:

Markets No Obstacle Minor

ObstacleModerate

ObstacleMajor

ObstacleVery Severe Obstacle Don’t

KnowN/A Access to International Markets Availability of Market Information - 14.

- To what degree are the following elements of Human Capital an obstacle to the current operations of this firm:

Human Capital No Obstacle Minor

ObstacleModerate

ObstacleMajor

ObstacleVery Severe Obstacle Don’t

KnowN/A Availability of top managers with the qualifications your business requires Availability of scientists and engineers with the qualifications your business requires Inadequately educated/trained general workforce - 15.

- To what degree are the following elements of Infrastructure an obstacle to the current operations of this firm:

Infrastructure No Obstacle Minor

ObstacleModerate

ObstacleMajor

ObstacleVery Severe Obstacle Don’t

KnowN/A Electricity Telecom/Internet Water Gas Transport - 16.

- To what degree are the following elements of the Business Environment an obstacle to the current operations of this firm:

Business Environment No Obstacle Minor

ObstacleModerate

ObstacleMajor

ObstacleVery Severe Obstacle Don’t

KnowN/A Level of support from successful business people in the region Political Instability Practices of informal sector competitors R&D collaboration between businesses and university researchers Corruption Crime, theft, and disorder Overall business environment (in region)

Appendix A.1.3. Key Firm and Entrepreneur Indicators

Finance

- 17.

- During FY (insert last FY), how much equity financing did this firm obtain from all of these outside sources?

Source Amount of Funding Sought Amount of Funding

ReceivedEquity Stake (If Applicable) Family and Friends Angel Investors Venture Capital Foundations Other Companies Government Agencies Social Impact Investors Other N/A (None) - 18.

- During FY (insert last FY), how much debt financing did this firm obtain from all of these outside sources?

Source Amount of Funding Sought Amount of Funding Received Term of Loan (Months) Interest Rate (Percentage) Banks Microfinance Institutions Other N/A (None) - 19.

- During FY (insert last FY), how much grant funding did this firm obtain from all of these outside sources?

Source Amount of Funding Sought Amount of Funding Received Grant Period (Months) Foundations Government Agencies International Aid Agencies Other N/A (None) - 20.

- How much additional capital of the following kinds are you seeking?

Type of Capital Next 12 Months (1 Year) Next 36 Months (3 Years) Equity Debt Grants N/A (None)

Markets and Sales

- 21.

- In FY (insert last FY), what was this firm’s main activity, product or service (that represented the largest proportion of annual sales)? (Detailed description)

- 22.

- What percentage of sales does the main product or activity represent? (Percentage)

- 23.

- What was this firm’s profit margin (as a percentage of total investment) for FY (insert last FY)

- (a)

- Negative ROI (Loss)

- (b)

- 0–5%

- (c)

- 6–10%

- (d)

- 11–15%

- (e)

- 16–20%

- (f)

- More than 20%

- (g)

- Unsure

- (h)

- N/A (e.g., nonprofit)

- 24.

- In FY (insert last FY), what were this firm’s total annual sales for all products and services?

- 25.

- In FY (insert last FY minus 2), three years ago, what were total annual sales for this firm?(Number)

- 26.

- In FY (insert last FY minus 4), 5 years ago, what were total annual sales for this firm?(Number)

- 27.

- In FY (insert last FY), what percentage of firm’s sales were (Percentage)

- (a)

- National sales

- (b)

- Indirect exports (sold domestically to third party that exports)

- (c)

- Direct exports

- 28.

- In which year did this firm first export directly or indirectly? (Date)

- 29.

- In FY (insert last FY), what percentage of the value of products shipped was lost due to crime or theft? (Percentage)

Human Capital

- 30.

- In FY (insert last FY), how many permanent, full-time individuals worked in this firm?

- 31.

- In FY (insert FY minus 2), three years ago, how many permanent, full-time individuals worked in this firm?

- 32.

- In FY (year of founding), how many permanent, full-time individuals worked in this firm?

- 33.

- In FY (insert last FY), how many temporary, full-time individuals worked in this firm?

- 34.

- In FY (insert FY minus 2), three years ago, how many temporary, full-time individuals worked in this firm?

- 35.

- In FY (year of founding), how many temporary, full-time individuals worked in this firm?

Infrastructure

- 36.

- Delivery of Infrastructure and Services:

Applied for Connection/Permit (Y/N) Number of Days to Receive a Connection/Approval Informal Gift/Payment Expected Or Requested (Y/N) Electricity Telecom/Internet Water Gas Construction permit

Research and Development/Innovation

- 37.

- Does your firm have any of the following? If so, please provide the number, and a brief description:

Number Brief Description Patents Copyrights Trademarks - 38.

- Has your firm introduced any new or significantly improved products or services in the past 3 years? Please provide a brief description: (open-ended)

- 39.

- Has your firm introduced any new or significantly improved processes or methods in past 3 years? Please provide a brief description: (open-ended)

Business Support Services

- 40.

- What capacity development services does your firm require?

- 41.

- Have you ever participated in a business incubation or acceleration programme?

- 42.

- If yes, which programme(s)?

- 43.

- Please state your level of satisfaction with the following services/activities provided by the incubation and acceleration programs:

Not

UsefulSlightly

UsefulModerately Useful Very

UsefulExtremely

UsefulDon’t

KnowN/A Network development Business skills development Mentorship Access to Investors/Funders Securing Direct Funding Access to like-minded entrepreneurs Awareness and Credibility - 44.

- Are you involved in this start-up to take advantage of a business opportunity or because you have no better choices for work?

- ○

- Take advantage of business opportunity

- ○

- No better choices for work

- ○

- Combination of both of the above

- ○

- Have a job but seek better opportunities

- ○

- Other (Please specify)

- ○

- Don’t Know

- 45.

- Which one of the following do you feel is the most important motive for pursuing this opportunity?

- ○

- Greater independence

- ○

- Increase personal income

- ○

- Just to maintain income

- ○

- Other (Please specify)

- ○

- Don’t Know

References

- Al-Tit, Ahmad, Anis Omri, and Jalel Euchi. 2019. Critical success factor of small and medium-sized enterprises in Saudi Arabia: Insights from sustainability perspective. Administrative Sciences 9: 32. [Google Scholar] [CrossRef]

- Alvedalen, Janna, and Ron Boschma. 2017. A critical review of entrepreneurial ecosystems research: Towards a future research agenda. European Planning Studies 25: 887–903. [Google Scholar] [CrossRef]

- Banha, Francisco, Adão Flores, and Luís Serra Coelho. 2022. NUTS III as Decision-Making Vehicles for Diffusion and Implementation of Education for Entrepreneurship Programmes in the European Union: Some Lessons from the Portuguese Case. Education Sciences 12: 436. [Google Scholar] [CrossRef]

- Beaudry, Catherine, Thierry Burger-Helmchen, and Patrick Cohendet. 2021. Editorial: Innovation policies and practices within innovation ecosystems. Industry and Innovation 28: 535–44. [Google Scholar] [CrossRef]

- Belas, Jaroslav, Ashiqur Rahman, Twyeafur Rahman, and Schonfeld Jaroslav. 2017. Financial constraints on innovative SMEs: Empirical evidence from the Visegrad countries. Inzerine Ekonomika-Engineering Economics 28: 552–63. [Google Scholar] [CrossRef]

- Belhoste, Nathalie, Rachel Bocquet, Veronique Favre-Bonté, and Frédéric Bally. 2019. How do SMEs use support services during their internationalization process: A comparative study of French traditional SMEs and INVs in Asia. International Small Business Journal 37: 804–30. [Google Scholar] [CrossRef]

- Blackburn, Robert, George Saridakis, and John Kitching. 2015. The Legal Needs of Small Businesses: An Analysis of Small Businesses’ Experience of Legal Problems, Capacity and Attitudes. London: Kingston University. [Google Scholar]

- Boermans, Martijn, and Daan Willebrands. 2018. Financial constraints matter: Empirical evidence on borrowing behaviour, microfinance and firms’ productivity. Journal of Developmental Entrepreneurship 23: 1850008-1. [Google Scholar] [CrossRef]

- Bogliacino, Francesco, Giulio Perani, Mario Pianta, and Stefano Supino. 2009. Innovation in developing countries: The evidence from innovation surveys. Paper presented at the Italian National Research Programme (FIRB) Conference, Milan, Italy, September 7–8. [Google Scholar]

- Bone, Jonathan, Juanita Gonzalez-Uribe, Christopher Haley, and Henry Lahr. 2019. The Impact of Business Accelerators and Incubators in the UK; London: Department for Business, Energy & Industrial Strategy. Available online: https://www.gov.uk/government/publications/the-impact-of-business-accelerators-and-incubators-in-the-uk (accessed on 3 January 2023).

- Brinkmann, Christoffer, and Viktoria Gelfgren. 2020. The Strategy of Using Consultants for Sustainable Business Development within SMEs. Bachelor’s thesis, Jönköping University, Jönköping, Sweden. [Google Scholar]

- Buratti, Martina, Uwe Cantner, James Cunningham, Erik Lehmann, and Matthias Menter. 2022. The dynamics of entrepreneurial ecosystems: An empirical investigation. R&D Management. [Google Scholar] [CrossRef]

- Cao, Zhe, and Xianwei Shi. 2020. A systematic literature review of entrepreneurial ecosystems in advanced and emerging economies. Small Business Economics 57: 75–110. [Google Scholar] [CrossRef]

- Cardoza, Guillermo, Gaston Fornes, Vanina Farber, Roberto Duarte, and Jaime Gutierrez. 2017. Barriers and public policies affecting the international expansion of Latin American SMEs: Evidence from Brazil, Colombia, and Peru. Journal of Business Research 69: 2030–39. [Google Scholar] [CrossRef]

- Carlsson, Bo. 2007. Innovation systems: A survey of the literature from a Schumpeterian perspective. In Elgar Companion to Neo-Schumpeterian Economics. Edited by Horst Hanusch and Andreas Pyka. Cheltenham: Edward Elgar, pp. 857–71. [Google Scholar]

- Chandrashekar, Deepak, and Mungila Hillemane Bala Subrahmanya. 2017. Absorptive capacity as a determinant of innovation in SMEs: A study of Bengaluru high-tech manufacturing cluster. Small Enterprise Research 24: 290–315. [Google Scholar] [CrossRef]

- Chu, Jiewang, and Jiaxuan Li. 2022. The Composition and Operation Mechanism of Digital Entrepreneurial Ecosystem: A Study of Hangzhou Yunqi Town as an Example. Sustainability 14: 16607. [Google Scholar] [CrossRef]

- Cohen, Jacob. 1988. Statistical Power Analysis for the Behavioral Sciences, 2nd ed. Mahwah: Lawrence Erlbaum Associates. [Google Scholar]

- Edquist, Charles. 2005. Systems of innovation: Perspectives and challenges. In The Oxford Handbook of Innovation. Edited by Jan Fagerberg and David Mowery. New York: Oxford University Press, pp. 181–208. [Google Scholar]

- Eggink, M. 2013. The Components of an Innovation System: A Conceptual Innovation System Framework. IBIMA Publishing Journal of Innovation and Business Best Practices 2013: 768378. Available online: http://www.ibimapublishing.com/journals/JIBBP/jibbp.html (accessed on 15 February 2022). [CrossRef]

- Eggink, María. 2021. Determinants of Small, Medium and Micro Enterprises’ Performance: A Structured Literature Review. Paper presented at the 5th International Conference on Business, Management and Economics, London, UK, August 27–29. [Google Scholar]

- Félix, Elisabete, and Jose dos Santos. 2018. The success factors for SMEs: Empirical evidence. Journal of Applied Economics and Business Research 8: 229–47. [Google Scholar]

- Freeman, Christopher. 2008. Systems of Innovation: Selected Essays in Evolutionary Economics. Cheltenham: Edward Elgar. [Google Scholar]

- Frimanslund, Tore, Grzegorz Kwiatkowski, and Ove Oklevik. 2023. The role of finance in the literature of entrepreneurial ecosystems. European Planning Studies 31: 372–91. [Google Scholar] [CrossRef]

- Isenberg, Daniel. 2011. The entrepreneurship ecosystem strategy as a new paradigm for economic policy: Principles for cultivating entrepreneurship. In Babson Entrepreneurship Ecosystem Project. Wellesley: Babson College. [Google Scholar]

- Islam, Shahidul, and Faruk Hossain. 2018. Constraints to small and medium-sized enterprises development in Bangladesh: Results from a cross-sectional study. The European Journal of Applied Economics 15: 58–73. [Google Scholar] [CrossRef]

- Javarov, Nasib, and Judith Szakos. 2022. Review of entrepreneurial ecosystem models. ASERC Journal of Socio-Economic Studies 5: 3–16. [Google Scholar]

- Kamyabi, Yahya, and Susela Devi. 2011. Use of professional accounting advisory services and its impact on SME performance in an emerging economy: A resource-based view. Journal of Management and Sustainability 1: 43–55. [Google Scholar] [CrossRef]

- Karymshakov, Kamalbek, Burulcha Sulaimanova, and Dastan Aseinov. 2019. Determinants of innovation activity of small and medium-sized enterprises in small post-Soviet Countries. Business and Economic Research Journal 10: 1–12. [Google Scholar] [CrossRef]

- Khan, Yasmin, and Azlin Arshad. 2019. Innovation ecosystem in the small and medium enterprises: A theoretical Perspective. Journal of Management Info 6: 51–54. [Google Scholar] [CrossRef]

- Khattab, Ishraga, and Omer Al-Magli. 2017. Towards and integrated model of entrepreneurship ecosystem. Journal of Business & Economic Policy 4: 80–92. [Google Scholar]

- Kirogo, Mercy, Andrew Nyaboga, Mwita Marwa, and Muruku Waiguchu. 2018. Influence of environmental factors on success of entrepreneurs in the trade sub-sector in Kenya. Paper presented at the Northeast Region Decision Sciences Institute 2018 Annual Conference, Providence, RI, USA, April 12–14; pp. 521–60. [Google Scholar]

- Lekhanya, Lawrence, and Roger Mason. 2014. Selected key external factors influencing the success of rural small and medium enterprises in South Africa. Journal of Enterprising Culture 22: 331–48. [Google Scholar] [CrossRef]

- Lose, Thobekani. 2021. Business incubators in South Africa: A resource-based view perspective. Academy of Entrepreneurship Journal 27: 1–12. [Google Scholar]

- Lundvall, Bengt-Ake, ed. 1992. National Systems of Innovation: Toward a Theory of Innovation and Interactive Learning. London: Printer London. [Google Scholar]

- Magd, Heshman, and Aiman Gharib. 2021. Entrepreneurship and SMEs sustainable development through business incubators: The case of Oman. Scientific Journal for Financial and Commercial Studies and Researches (SJFCSR) 2: 191–220. [Google Scholar]

- Malecki, Edward. 2018. Entrepreneurship and entrepreneurial ecosystems. Geography Compass 12: e12359. [Google Scholar] [CrossRef]

- Mason, Colin, and Ross Brown. 2014. Entrepreneurial ecosystems and growth-oriented entrepreneurship. In Background Paper for the Workshop by the OECD LEED Programme and the Dutch Ministry of Economic Affairs. The Hague: OCED. [Google Scholar]

- Mthimkhulu, Alfred, and Meshach Aziakpono. 2015. What impedes micro, small and medium firm’s growth the most in South Africa? Evidence from World Bank Enterprise Surveys. South African Journal of Business Management 46: 15–27. [Google Scholar] [CrossRef]

- Mukiza, Jonathan. 2020. Small business and entrepreneurship in Africa: The nexus of entrepreneurial Ecosystems and productive entrepreneurship. Small Enterprise Research 27: 110–24. [Google Scholar] [CrossRef]

- Muzanenhamo, Arvid, and Edward Rankhumise. 2022. Literature review on digital entrepreneurship in South Africa: A Human Capital Perspective. Entrepreneurship and Sustainability Issues 10: 464–72. [Google Scholar] [CrossRef]

- Naicker, Yergenthren, and Rajendra Rajaram. 2019. The effectiveness of tax relief initiatives on SMEs in South Africa. Acta Universitas Danubius Economica 15: 125–37. [Google Scholar]

- Nelson, Richard. 1996. The Sources of Economic Growth. London: Harvard University Press. [Google Scholar]

- Nizaeva, Mirgul, and Ali Coşkun. 2018. Determinants of the financing obstacles faces by SMEs: An empirical study of emerging economies. Journal of Economic and Social Studies 7: 81–99. [Google Scholar] [CrossRef]

- Obasan, K. A., P. B. Shobayo, and A. L. Amaghionyeodiwe. 2016. Ownership structure and the performance of small and medium enterprises in Nigeria. International Journal of Research in Social Sciences 6: 474–92. [Google Scholar]

- Ogujiuba, Kanayo, Isaac Agholor, and Ebenezer Olamide. 2021. Impact of sustainable entrepreneurship indicators on SMEs business success in South Africa. Academy of Entrepreneurship Journal 27: 1–17. [Google Scholar]

- Pérez-Gomómez, Pilar, Marta Arbelo-Pérez, and Antonio Alvarez. 2018. Profit efficiency and its determinants in small and medium-sized enterprises in Spain. Business Research Quarterly 21: 238–50. [Google Scholar] [CrossRef]

- Pita, Mariana, Joana Costa, and Antonio Moreira. 2021. Unveiling entrepreneurial ecosystems’ transformation: A GEM based portrait. Economies 9: 186. [Google Scholar] [CrossRef]

- Pleasence, Pascoe, Nigel Balmer, Robert Blackburn, and Thomas Wainwright. 2012. A Framework for Benchmarking Small Business Consumers’ Need for and Use of Legal Services. A Report to the Legal Services Board & Legal Services Consumer Panel. Cambridge: UK, PPSR. [Google Scholar]

- Prokop, Viktor, and Jan Stejskal. 2019. Determinants of innovation activities and SME absorption—Case study of Germany. In Scientific Papers of the University of Pardubice. Series D Faculty of Economics & Administration; Pardubice: University of Pardubice. [Google Scholar]

- Ramraj, Serenta. 2018. Exploring the Role of South African Business Incubators in Creating Sustainable SMMEs through Technology Transfer. Master’s Thesis, North-West University, Potchefstroom, South Africa. [Google Scholar]

- Robson, Paul, and Robert Bennett. 2000. SME growth: The relationship with business advice and external collaboration. Small Business Economics 15: 193–208. [Google Scholar] [CrossRef]

- Ronen, Harel, Schwartz Dafna, and Kaufmann Dan. 2019. Small businesses are promoting innovation! Do we know this? Small Enterprise Research 26: 18–35. [Google Scholar] [CrossRef]

- Santoro, Gabriele, Stefano Bresciani, and Armando Papa. 2018. Collaborative modes with cultural and creative industries and Innovation performance: The moderating role of heterogeneous sources of knowledge and absorptive Capacity. Technovation. [Google Scholar] [CrossRef]

- Schäfer, Susann, and Heike Mayer. 2019. Entrepreneurial ecosystems: Founding figures and research frontiers in economic geography. Zeitschrift fűr Wirtschaftsgeographie 63: 55–63. [Google Scholar] [CrossRef]

- Scheidgen, Katharina. 2020. Degrees of integration: How a fragmented entrepreneurial ecosystem promotes different types of entrepreneurs. Entrepreneurship & Regional Development, 54–79. [Google Scholar] [CrossRef]

- Schumpeter, Joseph. 1961. The Theory of Economic Development: An Inquiry into Profits, Capital, Credit, Interest and the Business Cycle. Translated by Redvers Opie. Cambridge: Harvard University Press. [Google Scholar]

- Scott, Jonathan M., and David Irwin. 2009. Discouraged advisees? The influence of gender, ethnicity, and education in the use of advice and finance by UK SMEs. Environment and Planning C: Government and Policy 27: 230–45. [Google Scholar] [CrossRef]

- Scuotto, Veronica, Manlio Giudice, Alexeis Garcia-Perez, Beatrice Orlando, and Francesco Ciampi. 2019. A spillover effect of entrepreneurial orientation on technological innovativeness: An outlook of universities and research-based spin offs. Journal of Technology Transfer, 1–23. [Google Scholar] [CrossRef]

- Singh, Ajay, and Shah Ashraf. 2020. Association of Entrepreneurship Ecosystem with Economic Growth in Selected Countries: An Empirical Exploration. Journal of Entrepreneurship, Business and Economics 8: 36–92. Available online: http://scientificia.com/index.php/JEBE/article/view/138 (accessed on 15 January 2023).

- Smorodinskaya, Nataliya, Martha Russell, Daniel Katukov, and Kaisa Still. 2017. Innovation ecosystems vs. innovation systems in terms of collaboration and co-creation of value. Paper presented at the 50th Hawaii International Conference on System Sciences, Hilton Waikoloa Village, HI, USA, January 4–7; Available online: http://hdl.handle.net/10125/41798 (accessed on 28 February 2022).

- Squicciarini, Mariagrazia. 2009. Science parks, knowledge spillovers, and firms’ innovative performance: Evidence from Finland. Economics E-Journal, 1–28. Available online: http://www.economics-ejournal.org/economics/discussionpapers/2009-32 (accessed on 28 February 2022).

- Stam, Erik. 2015. Entrepreneurial Ecosystems and Regional Policy: A Sympathetic Critique. European Planning Studies 23: 1759–69. [Google Scholar] [CrossRef]

- Stam, Erik, and Andrew van de Ven. 2021. Entrepreneurial ecosystem elements. Small Business Economics 56: 809–32. [Google Scholar] [CrossRef]

- Urriago, Angela, Andres Barge-Gil, and Evita Paraskevopoulou. 2014. The impact of science and technology parks on firms’ radical product innovation: Empirical evidence from Spain. Journal of Evolutionary Economics 24: 835–73. Available online: https://ideas.repec.org/a/spr/joevec/v24y2014i4p835-873.html (accessed on 10 December 2022). [CrossRef]

- Wald, Andreas, and Jonathan Kansheba. 2020. Entrepreneurial ecosystems: A systematic literature review and research agenda. Journal of Small Business and Enterprise Development 27: 943–64. [Google Scholar] [CrossRef]

- World Bank. 2010. Innovation Policy: A Guide for Developing Countries. Washington, DC: The World Bank. [Google Scholar]

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2023 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).