Policy Drivers of Inter-Regional Investment in China

Abstract

1. Introduction

2. Methodology

2.1. Literature Review

2.2. Data

2.3. Model

3. Results

4. Discussion

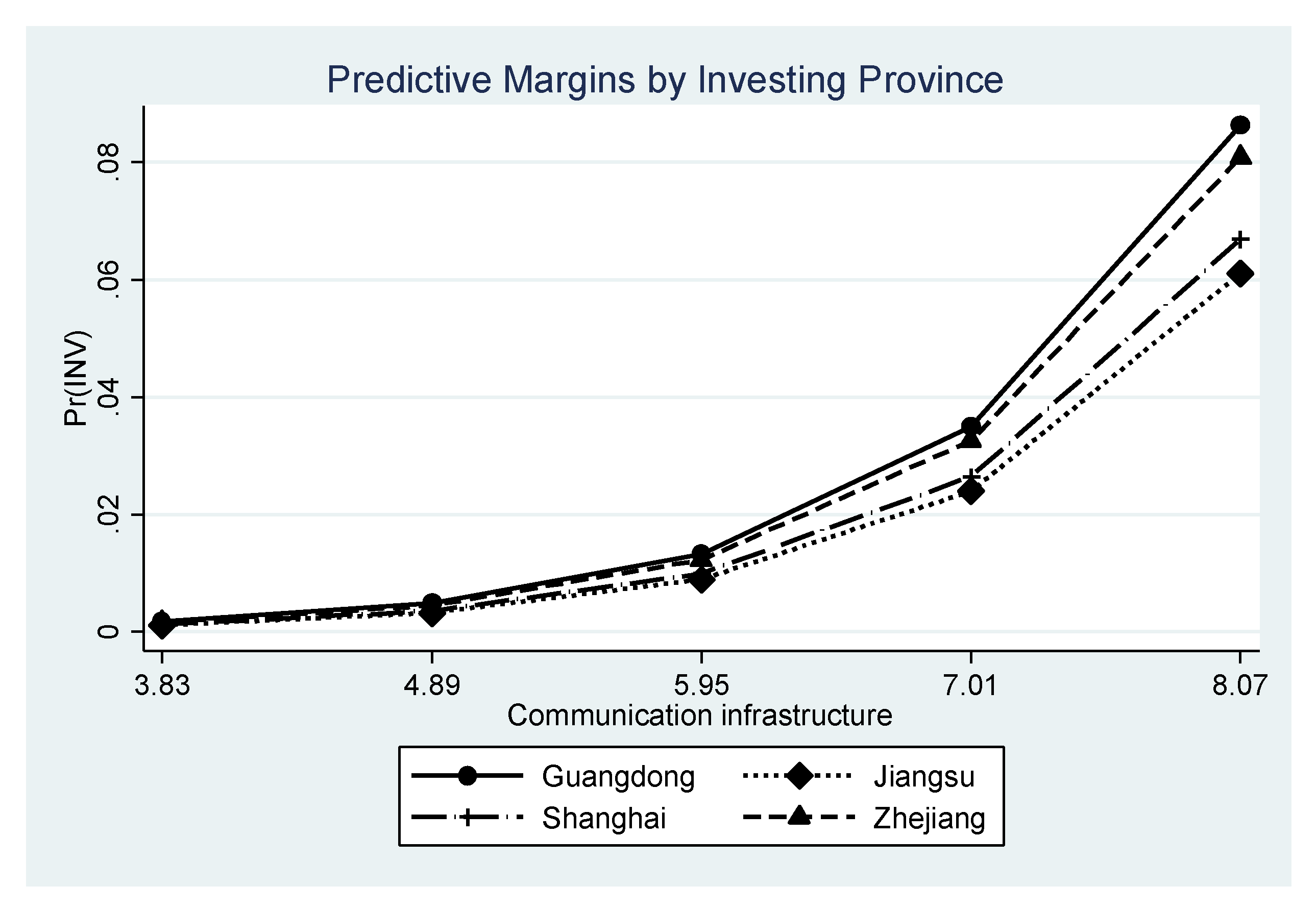

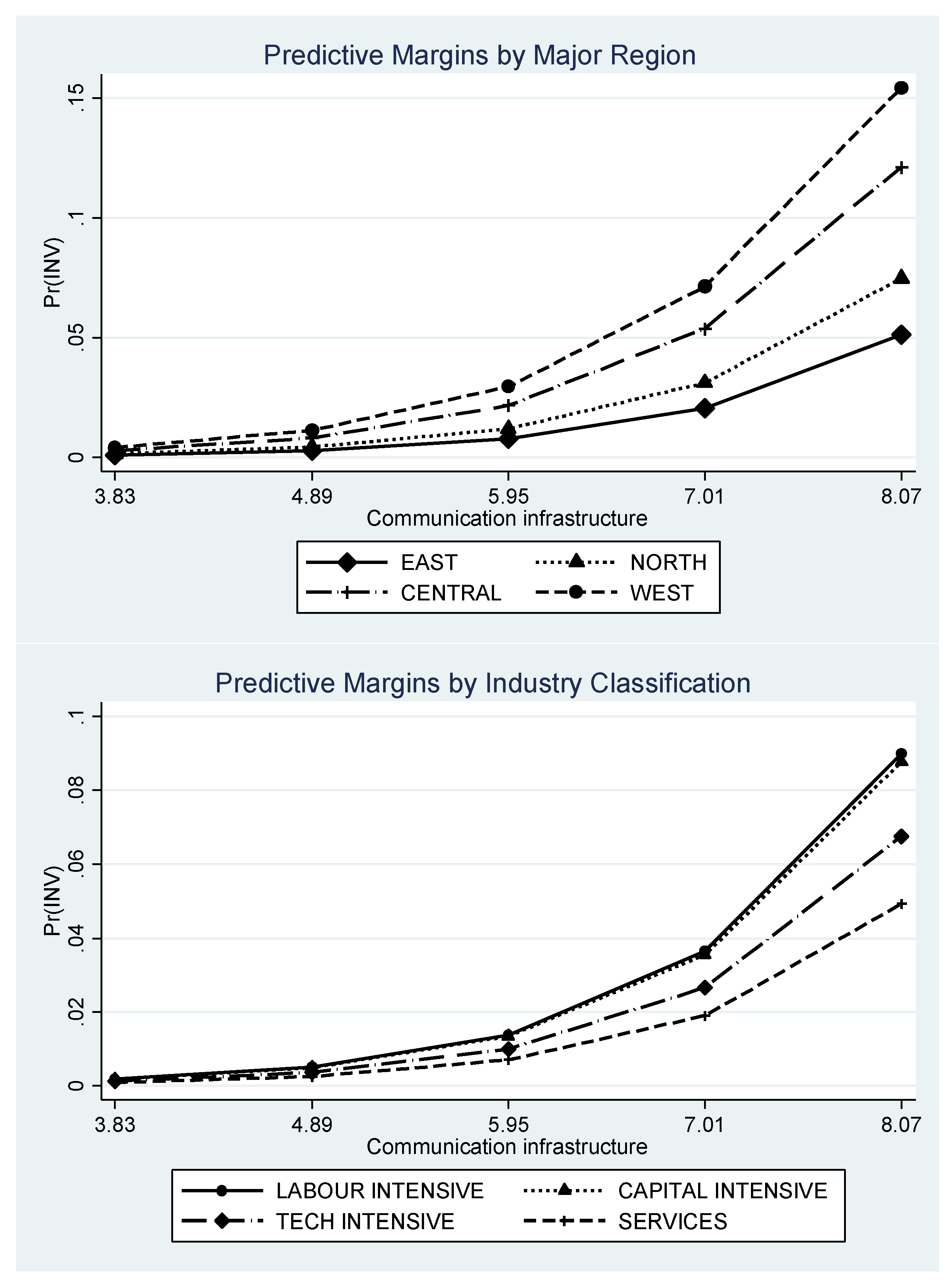

- A focus on improving communications infrastructure is likely to reap very high rewards in the form of inward investment.

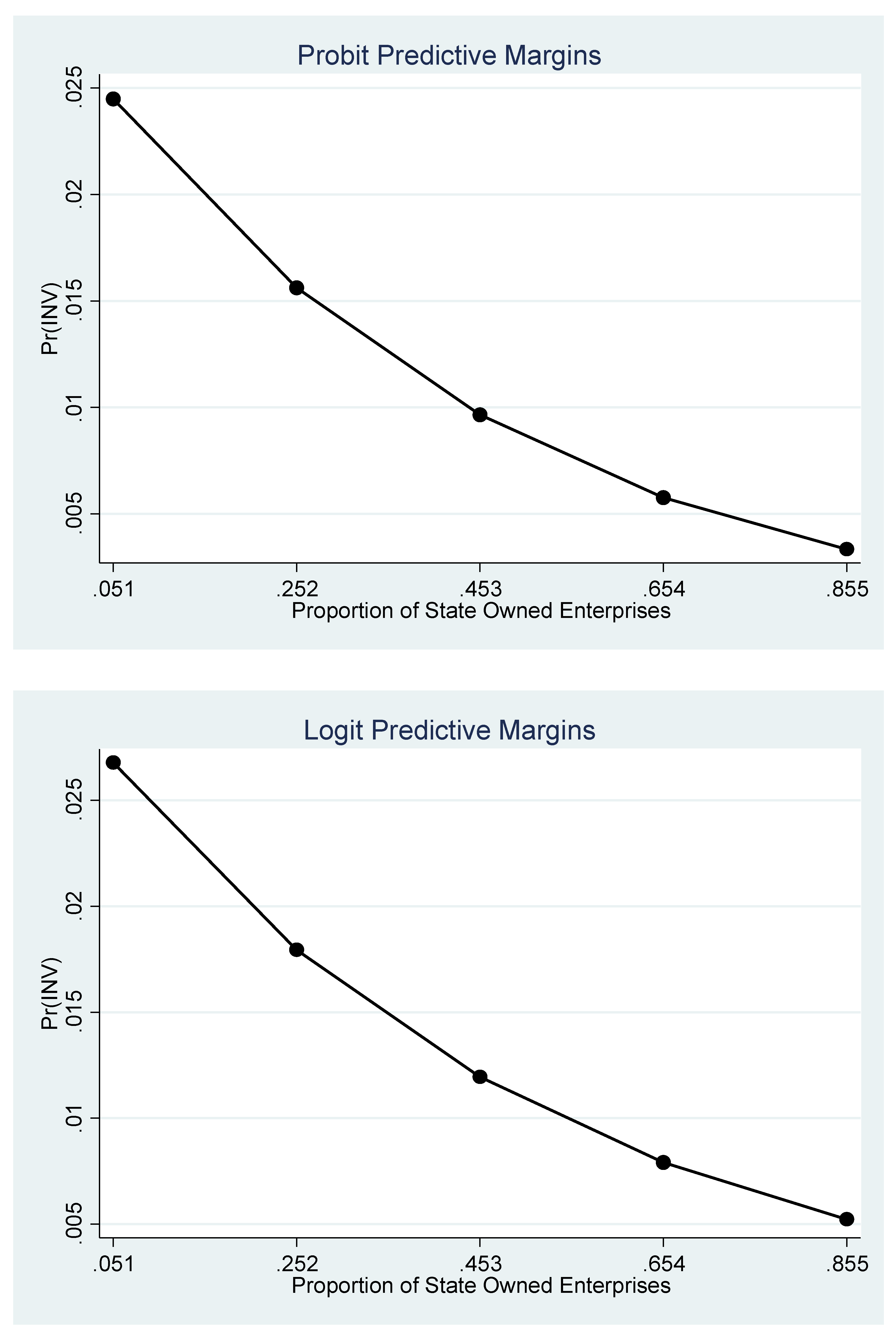

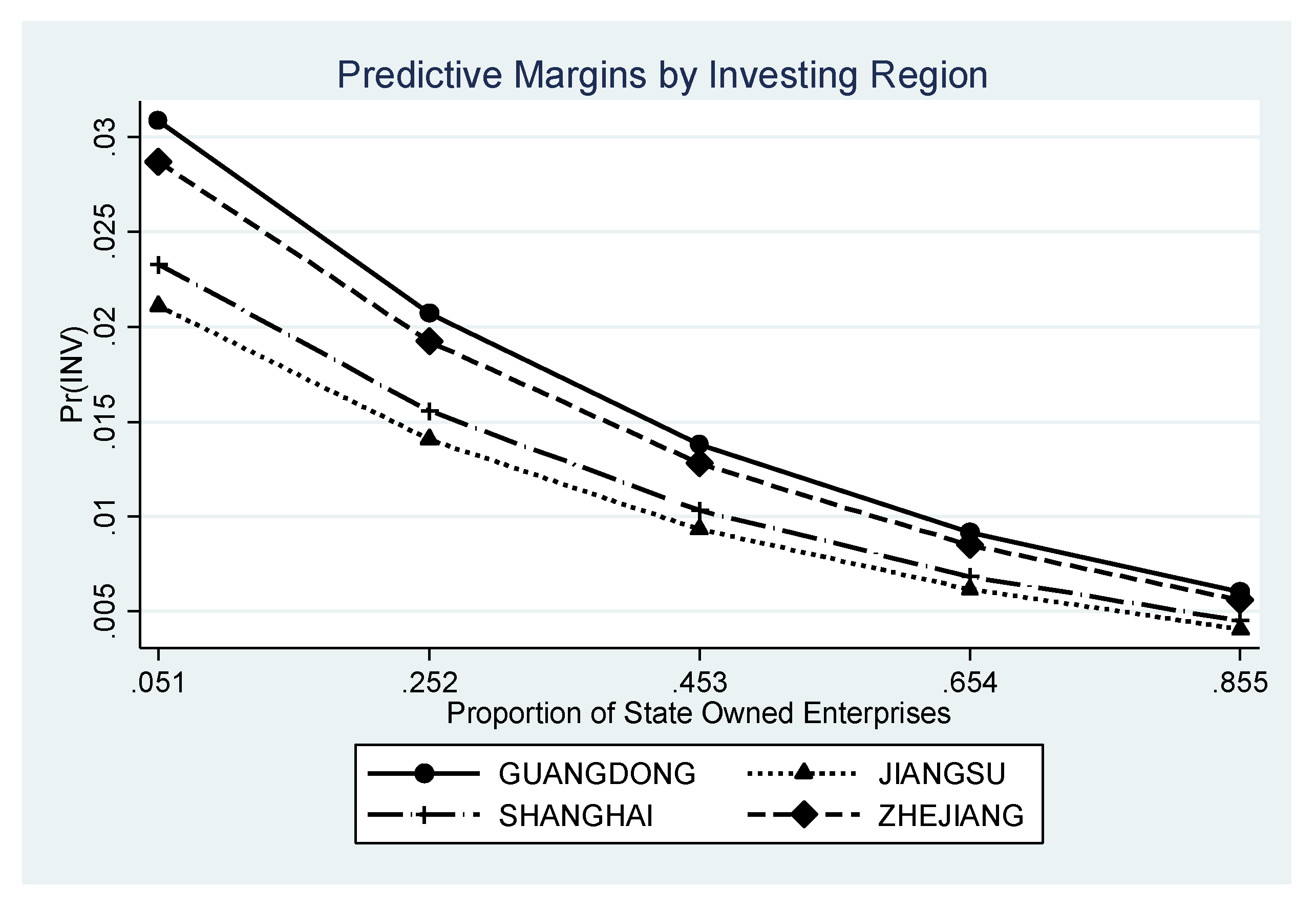

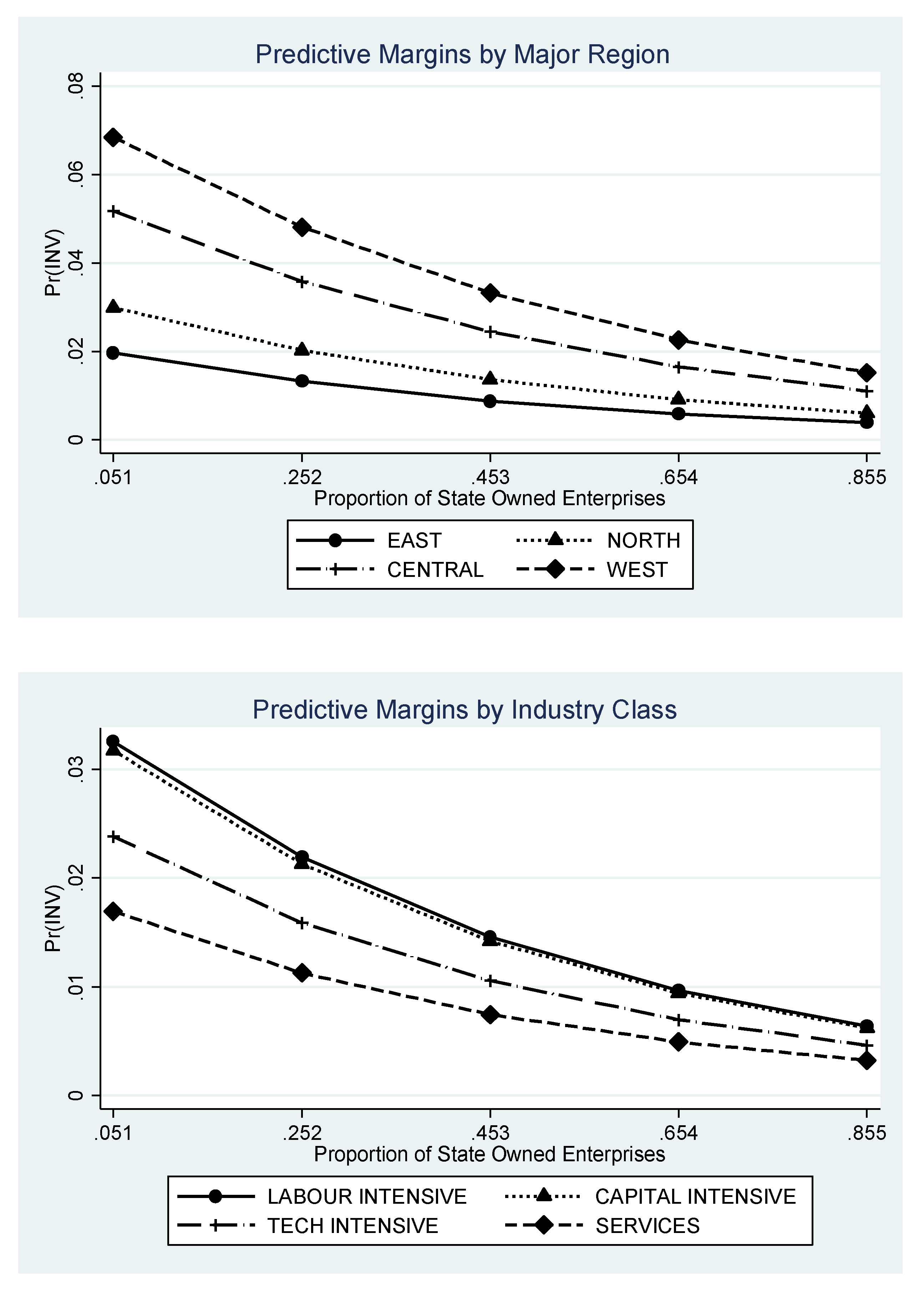

- Reducing government ownership of the means of production, particularly if the proportion of state-owned enterprises currently exceeds 45%, will also attract investment.

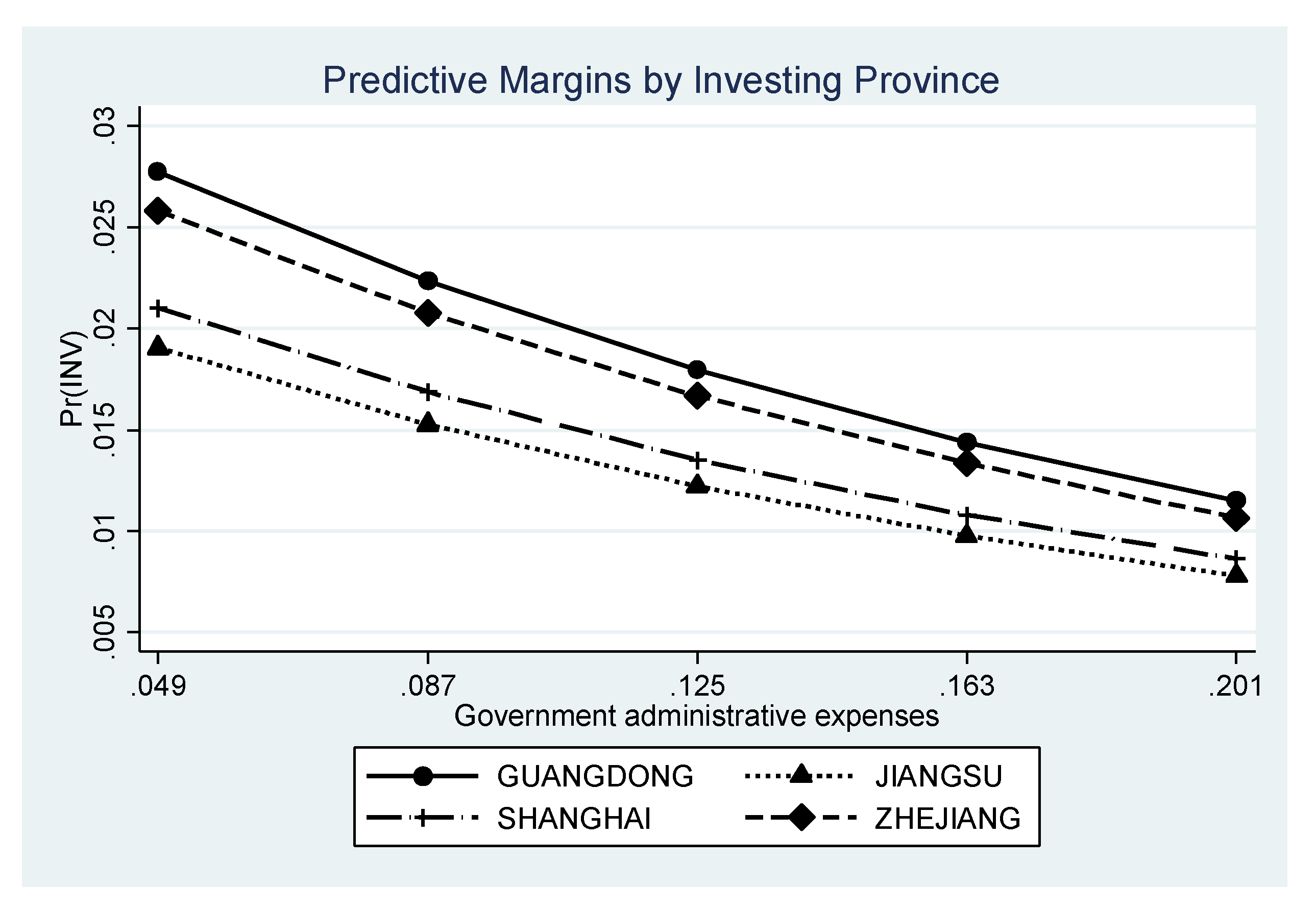

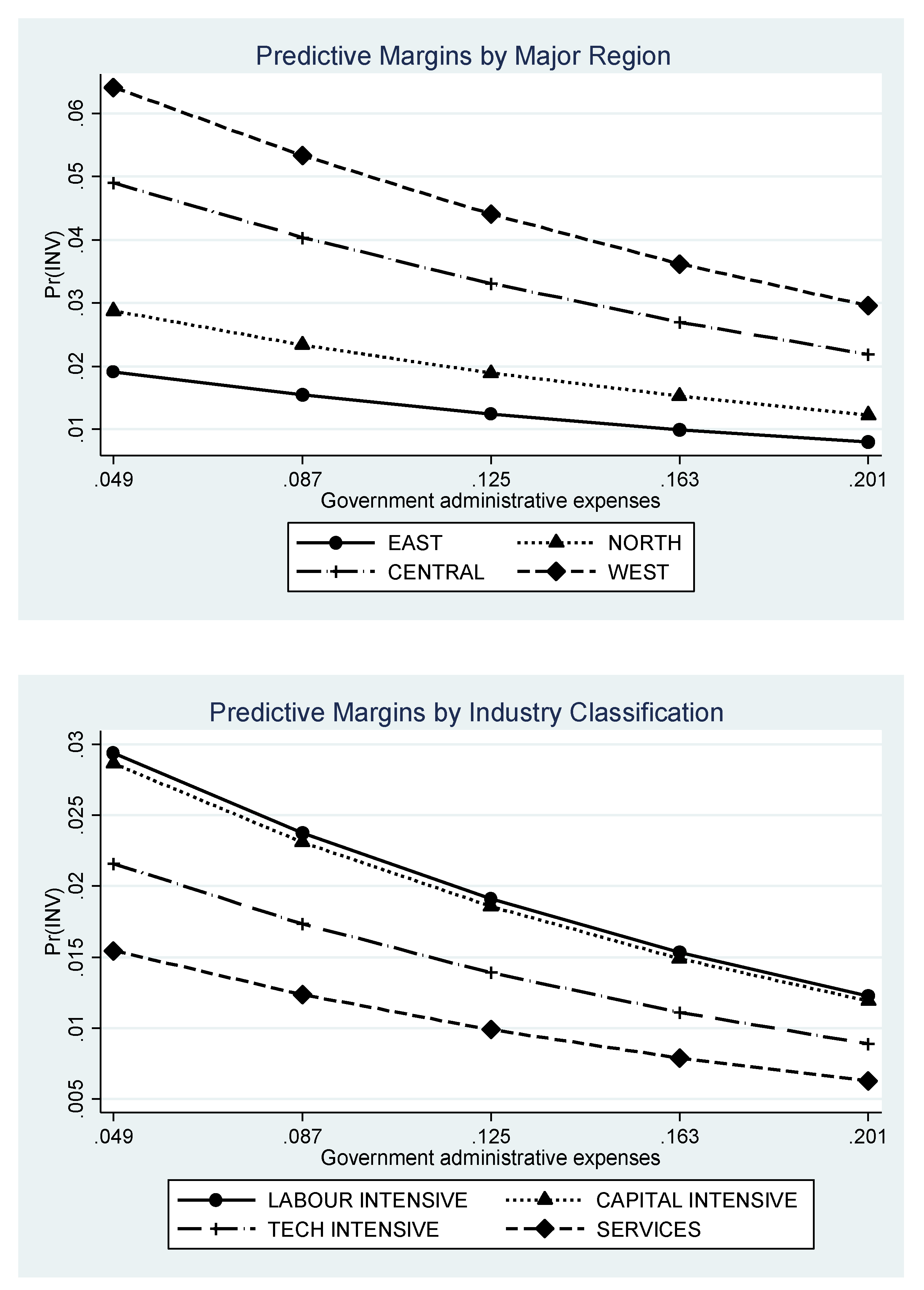

- Reducing administrative burden, such as compliance costs, will pay dividends across the entire range of observed values, so it would be worthwhile to benchmark administrative performance against best practices.

- These points apply most strongly to the Central and Eastern provincial groupings.

- Our results are in accord with some of the findings from the literature that we have reviewed above. Bjorvatn (2000) noted the importance of the provision of infrastructure. Becker and Fuest (2010) drew attention to how infrastructure provision interacts with government policy at both the national and regional levels. This point is important in the Chinese context as regional governments have a degree of autonomy over policies (Jin et al. 2005), which may lead to policy competition amongst regions cancelling out any positive effects, as noted by Head et al. (1999) in the US context. In summary, our main conclusion is that the most important contribution government can make to economic development in terms of attracting investment is to carefully consider its role. Our findings indicate that government should focus on the provision of public goods in the form of improved infrastructure while, at the same time, both reducing its role in direct ownership of productive activities and minimising the compliance costs of firms. That these findings remain relevant is underscored by the reform plans of the Third Plenum of the Chinese Communist Party in 2013, which noted “the need for markets to play a decisive role in allocating resources, as well as limiting government focus to effective regulation and preserving macroeconomic stability, rather than micromanaging economic decisions” (Dieppe et al. 2018, p. 30).

Author Contributions

Funding

Informed Consent Statement

Data Availability Statement

Acknowledgments

Conflicts of Interest

References

- Akamatsu, Kastuya. 1962. A Historical Pattern of Economic Growth in Developing Countries. The Developing Economies 1: 3–25. [Google Scholar] [CrossRef]

- Baldwin, Richard E., and Toshihiro Okubo. 2006. Heterogeneous Firms, Agglomeration and Economic Geography: Spatial Selection and Sorting. Journal of Economic Geography 6: 323–46. [Google Scholar] [CrossRef]

- Becker, Johannes, and Clemens Fuest. 2010. EU regional policy and tax competition. European Economic Review 54: 150–61. [Google Scholar] [CrossRef]

- Bjorvatn, Kjetil. 2000. Urban Infrastructure and Industrialization. Journal of Urban Economics 48: 205–18. [Google Scholar] [CrossRef]

- Brouwer, Aleid E., Ilaria Mariotti, and Jos N. van Ommeren. 2004. The Firm Relocation Decision: An Empirical Investigation. The Annals of Regional Science 38: 335–47. [Google Scholar] [CrossRef]

- Carlsen, Fredrik, Bjork Langset, and Jorn Rattso. 2005. The relationship between firm mobility and tax level; Empirical evidence of fiscal competition between local governments. Journal of Urban Economics 58: 273–88. [Google Scholar] [CrossRef]

- Chen, Chung, Lawrence Chang, and Yimin Zhang. 1995. The role of foreign direct investment in China’s post-1978 economic development. World Development 23: 691–703. [Google Scholar] [CrossRef]

- Cheng, Shaoming, and Roger R. Stough. 2006. Location decisions of Japanese new manufacturing plants in China: A discrete choice analysis. Annals of Regional Science 40: 369–87. [Google Scholar] [CrossRef]

- China Statistics Press (Various Dates). n.d. Available online: https://ceidata.cei.cn/ (accessed on 3 October 2022).

- Devereux, Michael P., and Rachel Griffith. 1998. Taxes and the location of production: Evidence from a panel of US multinationals. Journal of Public Economics 68: 335–67. [Google Scholar] [CrossRef]

- Devereux, Michael P., and Rachel Griffith. 2002. The impact of corporate taxation on the location of capital: A review. Swedish Economic Policy Review 9: 79–102. [Google Scholar] [CrossRef]

- Devereux, Micalel P., Rachel Griffith, and Helen Simpson. 2007. Firm Location Decisions, Regional Grants and Agglomeration Externalities. Journal of Public Economics 91: 413–35. [Google Scholar] [CrossRef]

- Dieppe, Alistair, Robert Gilhooly, Jenny Han, Iikka Korhonen, and David Lodge. 2018. The transition of China to sustainable growth–implications for the global economy and the euro area. ECB Occasional Paper 206. [Google Scholar] [CrossRef]

- Ethier, Wilfrid J. 1982. National and International Returns to Scale in the Modern Theory of International Trade. American Economic Review 72: 389–405. [Google Scholar]

- Fazzari, Steven, R. Glenn Hubbard, and Bruce Petersen. 1988. Financing constraints and corporate investment. Brookings Papers on Economic Activity 1988: 141–206. [Google Scholar] [CrossRef]

- Garnaut, Ross, Ligang Song, and Cai Fang. 2018. China’s 40 Years of Reform and Development: 1978–2018. Canberra: Australian National University Press. [Google Scholar]

- Global Enterprise Library (Various Dates). n.d. Available online: https://www.wind.com.cn/portal/zh/GEL/index.html (accessed on 7 October 2022).

- Guariglia, Alessandra, and Junhong Yang. 2016. A balancing act: Managing financial constraints and agency costs to minimize investment inefficiency in the Chinese market. Journal of Corporate Finance 36: 111–30. [Google Scholar] [CrossRef]

- Harris, Chauncy D. 1954. The market as a factor in the localization of production. Annals of the Association of American Geographers 44: 315–48. [Google Scholar]

- Head, C. Keith, John C. Riesa, and Deborah L. Swenson. 1999. Attracting foreign manufacturing: Investment promotion and agglomeration. Regional Science and Urban Economics 29: 197–218. [Google Scholar] [CrossRef]

- HKTDC. 2014. New Bridge and Pearl River Delta West (3): Industrial Relocation. Available online: http://hkmb.hktdc.com/en/1X0A0PKD/hkdtc-research/New-Bridge-and-Pearl-River-Delta-West-3_Industrial-Relocation (accessed on 9 September 2022).

- Holl, Adelheid. 2004. Transport Infrastructure, Agglomeration Economies, and Firm Birth: Empirical Evidence from Portugal. Journal of Regional Science 44: 693–712. [Google Scholar] [CrossRef]

- Holmes, Thomas J. 1998. The effect of state policies on the location of manufacturing: Evidence from state borders. Journal of Political Economy 106: 667–705. [Google Scholar] [CrossRef]

- Huang, Nancy, Joie Ma, and Kyle Sullivan. 2010. Economic development policies for Central and Western China. China Business Review 37: 24. [Google Scholar]

- Jin, Hehui, Yingyi Qian, and Barry R. Weingast. 2005. Regional Decentralization and Fiscal Incentives: Federalism. Chinese Style. Journal of Public Economics 89: 1719–42. [Google Scholar] [CrossRef]

- Kojima, Kyoshi. 1978. Direct Foreign Investment: A Japanese Model of Multinational Business Operations. New York: Praeger. [Google Scholar]

- Krugman, Paul. 1991. Increasing returns and economic geography. Journal of Political Economy 99: 483–99. [Google Scholar] [CrossRef]

- Krugman, Paul. 1998a. Space: The Final Frontier. Journal of Economic Perspectives 12: 161–74. [Google Scholar] [CrossRef]

- Krugman, Paul. 1998b. What’s new about the new economic geography? Oxford Review of Economic Policy 14: 7–17. [Google Scholar] [CrossRef]

- Krugman, Paul, and Anthony J. Venables. 1998. Globalization and the inequality of nations. Quarterly Journal of Economics 110: 857–80. [Google Scholar] [CrossRef]

- Lv, Ping, and Francesca Spigarelli. 2016. The determinants of location choice. Chinese foreign direct investments in the European renewable energy sector. International Journal of Emerging Markets 11: 333–56. [Google Scholar] [CrossRef]

- Martin, Phillipe, and Carol Ann Rogers. 1995. Industrial location and Public Infrastructure. Journal of International Economics 39: 333–51. [Google Scholar] [CrossRef]

- Modigliani, Franco, and Merton H. Miller. 1958. The cost of capital, corporation finance and the theory of investment. American Economic Review 48: 261–97. [Google Scholar]

- National Bureau of Statistics of China (Various Dates). n.d. Available online: http://www.stats.gov.cn/sj/zgtjnj/ (accessed on 12 July 2022).

- Owens, Raymond E., and Pierre-Daniel Sarte. 2002. Analyzing Firm Location Decisions: Is Public Intervention Justified? Journal of Public Economics 86: 223–33. [Google Scholar] [CrossRef]

- Ploberger, Christian. 2017. One Belt, One Road—China’s new grand strategy. Journal of Chinese Economic and Business Studies 15: 289–305. [Google Scholar] [CrossRef]

- Quer, Diego, Enrique Claver, and Laura Rienda. 2018. The influence of political risk, inertia and imitative behavior on the location choice of Chinese multinational enterprises. Does state ownership matter? International Journal of Emerging Markets 13: 518–35. [Google Scholar] [CrossRef]

- Shanghai Stock Exchange (Various Dates). n.d. Available online: http://www.sse.com.cn/disclosure/listedinfo/regular/ (accessed on 6 July 2022).

- Su, Yaqin, and Zhiqiang Liu. 2016. The Impact of Foreign Direct Investment and Human Capital on Economic Growth: Evidence from Chinese Cities. China Economic Review 37: 97–109. [Google Scholar] [CrossRef]

- Wagner, Joachim. 2011. Offshoring and Firm Performance: Self-Selection, Effects on Performance, or Both? Review of World Economics 147: 217–47. [Google Scholar] [CrossRef]

- Wan, Guanghua, Ming Lu, and Zhao Chen. 2007. Globalization and regional income inequality: Empirical evidence from within China. Review of Income and Wealth 53: 35–59. [Google Scholar] [CrossRef]

- Wang, Yunfei, and Hong Zhang. 2016. Globalization and Economic Development in China. In Globalization and Development Volume II: Country Experiences. Edited by Shigeru Thomas Otsubo. Oxford: Routledge. [Google Scholar]

- Western Development Strategy. 2012. Western Development: The Twelfth Five Year Plan. Available online: www.ce.cn (accessed on 30 June 2022).

- Williams, Richard. 2012. Using the margins command to estimate and interpret adjusted predictions and marginal effects. The Stata Journal 12: 308–31. [Google Scholar] [CrossRef]

- Wooldridge, Jeffrey M. 2013. Introductory Econometrics, 5th ed. Mason: South-Western. [Google Scholar]

- Yeh, E. T., and E. Wharton. 2016. Going West and Going Out: Discourses, migrants, and models in Chinese development. Eurasian Geography and Economics 57: 286–315. Available online: https://www.tandfonline.com/doi/abs/10.1080/15387216.2016.1235982 (accessed on 10 August 2022). [CrossRef]

- Zeng, Douglas Zhihua. 2011. How do special economic zones and industrial clusters drive China’s rapid development? In Policy Research Working Paper. No. WPS 5583. Washington, DC: World Bank Group. Available online: http://documents.worldbank.org/curated/en/310891468018256346/How-do-special-economic-zones-and-industrial-clusters-drive-Chinas-rapid-development (accessed on 7 October 2022).

- Zhang, Tinglin, Bindong Sun, Yinyin Cai, and Rui Wang. 2019. Government fragmentation and economic growth in China’s cities. Urban Studies 56: 1850–64. [Google Scholar] [CrossRef]

| Category | Measures |

|---|---|

| Government policies | Infrastructure provision Tax burden State-owned enterprise proportion Administrative expenses |

| Market-related factors | Labour cost Land cost Export share Market size |

| Firm-specific characteristics | Size Profitability Capital structure |

| Name | Definition |

|---|---|

| INVjikt | Dependent variable measuring industrial relocation; takes the value 1 if company j in region i invests in region k at time t; otherwise, 0. |

| Local government GOV | Each variable measured for region k at time t. |

| INT | Regional transport infrastructure, measured as regional road density in km of highway/surface area of region (km/km2). |

| INC | Regional telecommunications infrastructure, measured as the natural log of the value of post and telecommunications infrastructure (CNY billion). |

| TAX | Regional tax burden, measured as the ratio of local taxes and surcharges to the value of regional industrial output. |

| SOE | The proportion of businesses in a region that are state-owned enterprises. |

| ADM | An index that measures the administrative expenses of the regional government as a fraction of the total. |

| Market characteristics MKT | Each variable measured for region k at time t. |

| WGE | The natural log of the regional average wage as a measure of the cost of labour. |

| LND | The natural log of the price of an average commercial house, which is a proxy for the cost of land. |

| EXP | Exports from the region as a share of regional GDP. |

| LMS | A measure of local market size to capture potential demand. where GDPs is the gross domestic product of region s, GDPr is the gross domestic product of region r, drs is the distance between the two provinces, and is the intra-province distance (with arear being the province’s area). |

| Firm characteristics FRM | Each variable measured for firm j in region i at time t. |

| SZE | Firm size, measured as the natural log of total assets. |

| ROA | Return on assets, as a measure of profitability, defined as net profit/total assets. |

| CAP | Capital structure, measured as asset-to-liability ratio. |

| Categorical (Dummy) variables | |

| INVREG | Location of the investing firms. 1: Guangdong. 2: Jiangsu. 3: Shanghai. 4: Zhejiang. |

| MAJORREG | Major provincial grouping receiving investment. 1: East. 2: North. 3: Central. 4: West. |

| INDYCLASS | Major industry classifications. 1: Labour-intensive industries. 2: Capital-intensive industries. 3: Technology-intensive industries. 4: Service industries. |

| YEAR | Year of observation (2000–2010). |

| Variable | Mean | Standard Deviation | Minimum | Maximum |

|---|---|---|---|---|

| INV | 0.0588378 | N/A | 0 | 1 |

| INT | 0.6444056 | 0.4283969 | 0.0208343 | 1.900635 |

| INC | 5.951272 | 1.064577 | 2.163323 | 8.423625 |

| TAX | 0.0211205 | 0.0182539 | 0.0057701 | 0.164441 |

| SOE | 0.4538201 | 0.2017989 | 0.0920957 | 0.8910649 |

| ADM | 0.1245857 | 0.0378919 | 0.0371712 | 0.2592029 |

| WGE | 9.9753 | 0.4908811 | 8.841882 | 11.18267 |

| LND | 7.963653 | 0.5472049 | 6.855409 | 9.785942 |

| EXP | 0.1692471 | 0.2044167 | 0.0052584 | 0.9051254 |

| LMS | 5.76994 | 0.6463238 | 3.647182 | 7.136748 |

| SZE | 21.49668 | 1.061312 | 17.92033 | 26.1563 |

| ROA | 0.0495136 | 0.0608682 | 0.5237361 | 0.3897035 |

| CAP | 0.4385126 | 0.1880797 | 0.0127279 | 2.258085 |

| Variable | Model (1) | Model (2) | Model (3) |

|---|---|---|---|

| INT | 0.43660464 *** | 0.20400277 | 0.19796123 |

| INC | 0.55900919 *** | 0.49505422 *** | 0.50471382 *** |

| TAX | −4.279756 * | −2.8156894 | −2.8311528 |

| SOE | −0.80141995 *** | −1.0362848 *** | −1.0465065 *** |

| ADM | −4.801426 *** | −3.1808374 ** | −3.2037023 ** |

| WGE | −0.44269669 | −0.43134058 | |

| LND | 0.53034116 *** | 0.53366381 *** | |

| EXP | 0.37742587 | 0.38130881 | |

| LMS | 0.3588615 ** | 0.36748048 ** | |

| SZE | 0.14014136 *** | ||

| ROA | 0.32573334 | ||

| CAP | −0.02272468 | ||

| constant | −4.2348581 *** | −5.8536407 *** | −8.9992135 *** |

| Variable | Model (1) | Model (2) | Model (3) |

|---|---|---|---|

| INT | 0.82950528 *** | 0.39431354 | 0.3805061 |

| INC | 0.10590548 *** | 0.9438466 *** | 0.96150437 *** |

| TAX | −8.7166736 * | −5.709996 | −5.6842483 |

| SOE | −1.5437591 *** | −2.0739192 *** | −2.0983987 *** |

| ADM | −9.1593013 *** | −6.0791368 ** | −6.1234514 ** |

| WGE | −0.83200279 | −0.80745708 | |

| LND | 1.0419983 *** | 1.0454238 *** | |

| EXP | 0.61154122 | 0.61585561 | |

| LMS | 0.69001749 ** | 0.70958825 ** | |

| SZE | 0.26991016 *** | ||

| ROA | 0.58583844 | ||

| CAP | −0.06225517 | ||

| constant | −7.8661387 *** | −11.301255 *** | −17.354669 *** |

| Variable | IV Probit | Probit |

|---|---|---|

| INT | 0.0164266 | 0.19796123 |

| INC | 0.2269846 *** | 0.50471382 *** |

| TAX | 0.5147498 | −2.8311528 |

| SOE | −1.002299 *** | −1.0465065 *** |

| ADM | 0.2672673 | −3.2037023 ** |

| WGE | −0.5901624 * | −0.43134058 |

| LND | 0.5566808 *** | 0.53366381 *** |

| EXP | 0.3800976 | 0.38130881 |

| LMS | 0.4889643 ** | 0.36748048 ** |

| SZE | 0.1182275 *** | 0.14014136 *** |

| ROA | 0.4731584 | 0.32573334 |

| CAP | −0.2319111 | −0.02272468 |

| constant | −7.265602 ** | −8.9992135 *** |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2023 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Sang, R.; Alexander, W.R.J.; Anwar, S. Policy Drivers of Inter-Regional Investment in China. Economies 2023, 11, 150. https://doi.org/10.3390/economies11050150

Sang R, Alexander WRJ, Anwar S. Policy Drivers of Inter-Regional Investment in China. Economies. 2023; 11(5):150. https://doi.org/10.3390/economies11050150

Chicago/Turabian StyleSang, Ruicong, W. Robert J. Alexander, and Sajid Anwar. 2023. "Policy Drivers of Inter-Regional Investment in China" Economies 11, no. 5: 150. https://doi.org/10.3390/economies11050150

APA StyleSang, R., Alexander, W. R. J., & Anwar, S. (2023). Policy Drivers of Inter-Regional Investment in China. Economies, 11(5), 150. https://doi.org/10.3390/economies11050150