Dynamic Dependency between the Shariah and Traditional Stock Markets: Diversification Opportunities during the COVID-19 and Global Financial Crisis (GFC) Periods

Abstract

1. Introduction

2. Theoretical Underpinning and Related Literature Review

3. Methodology

3.1. Multivariate GARCH—DCC

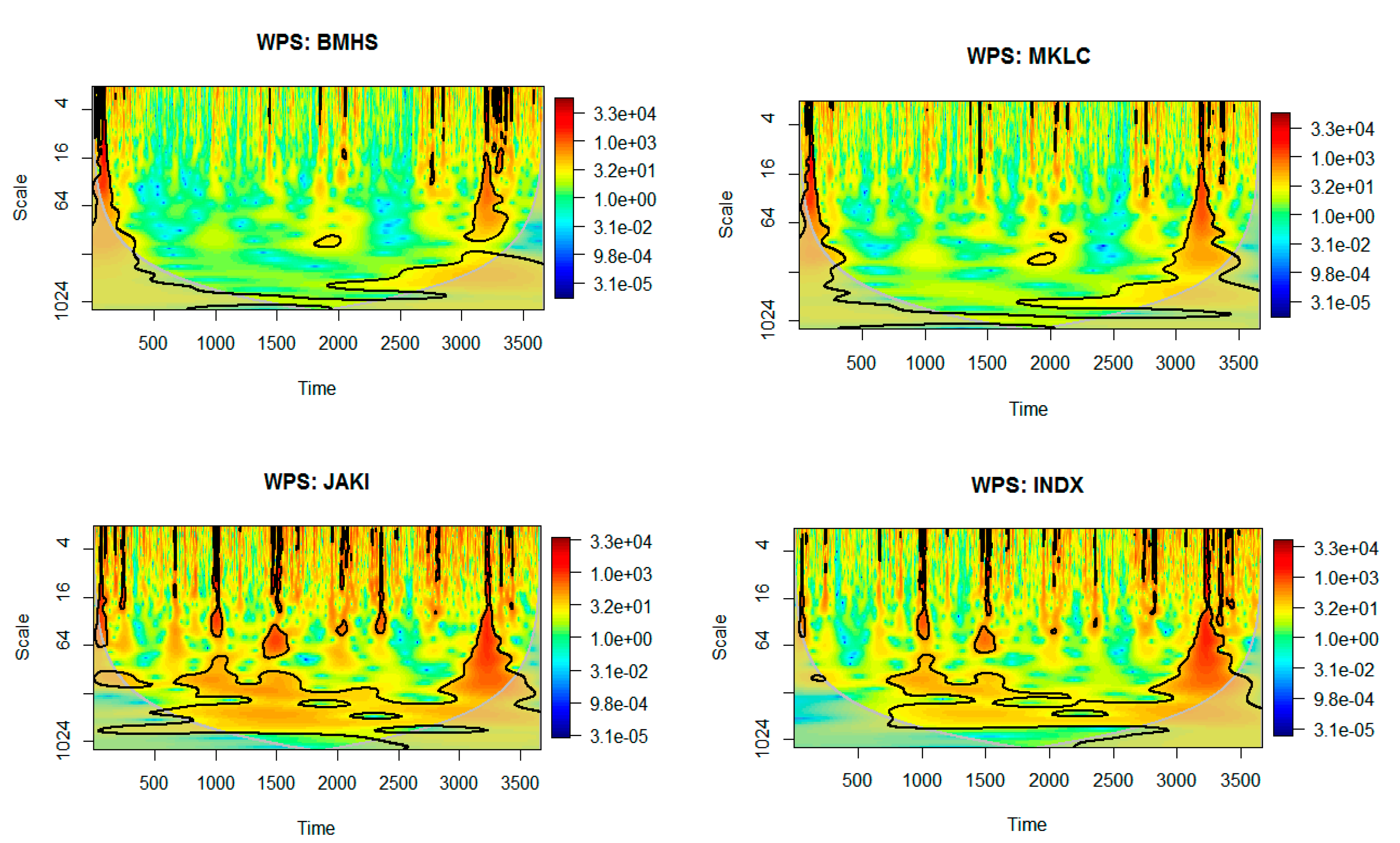

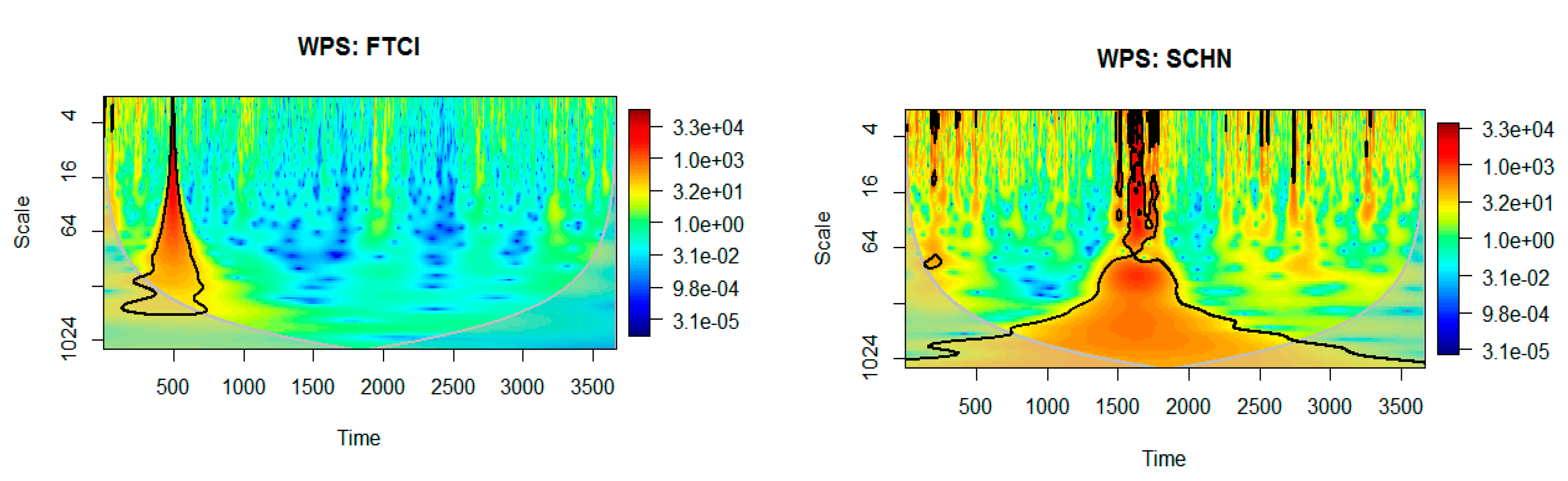

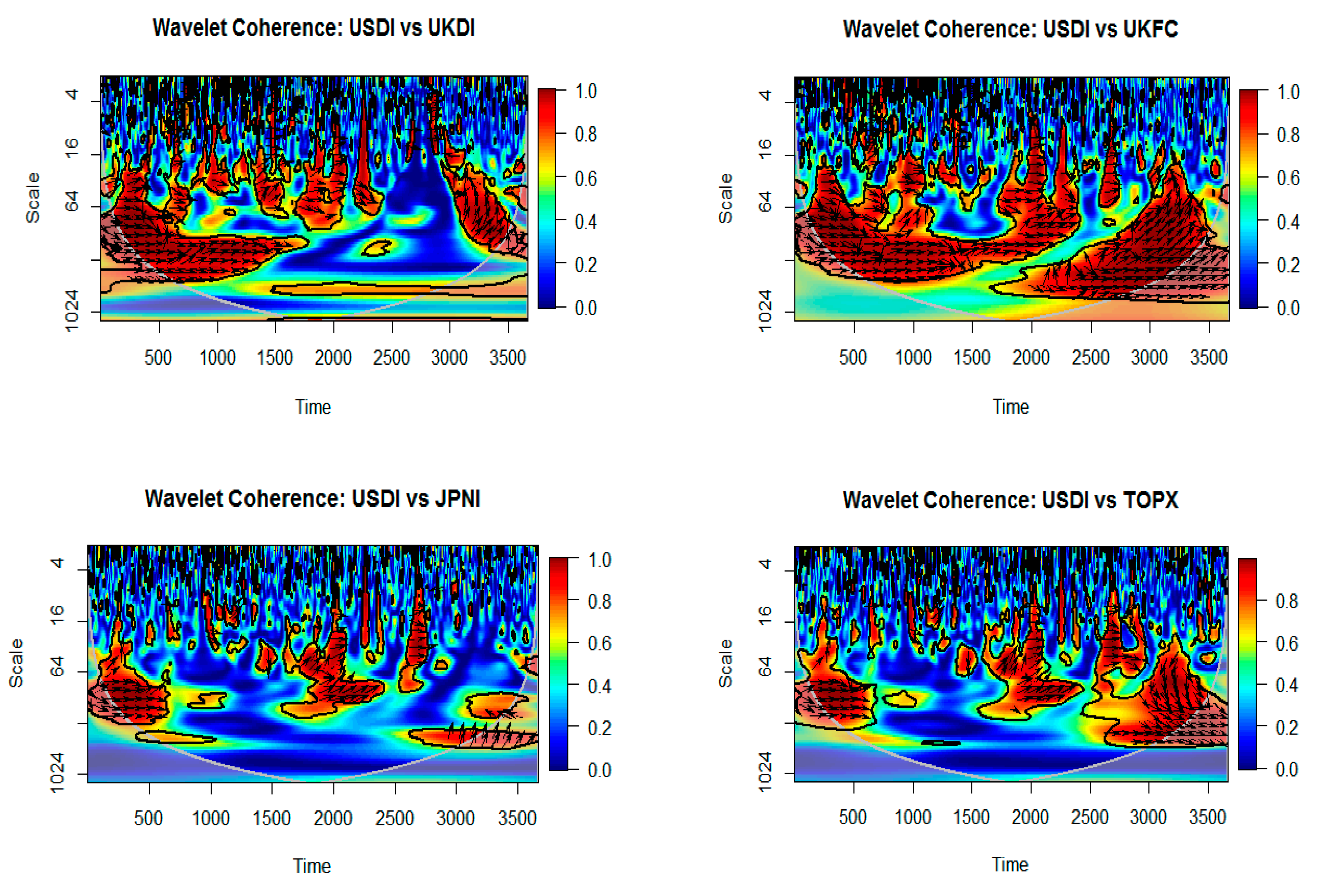

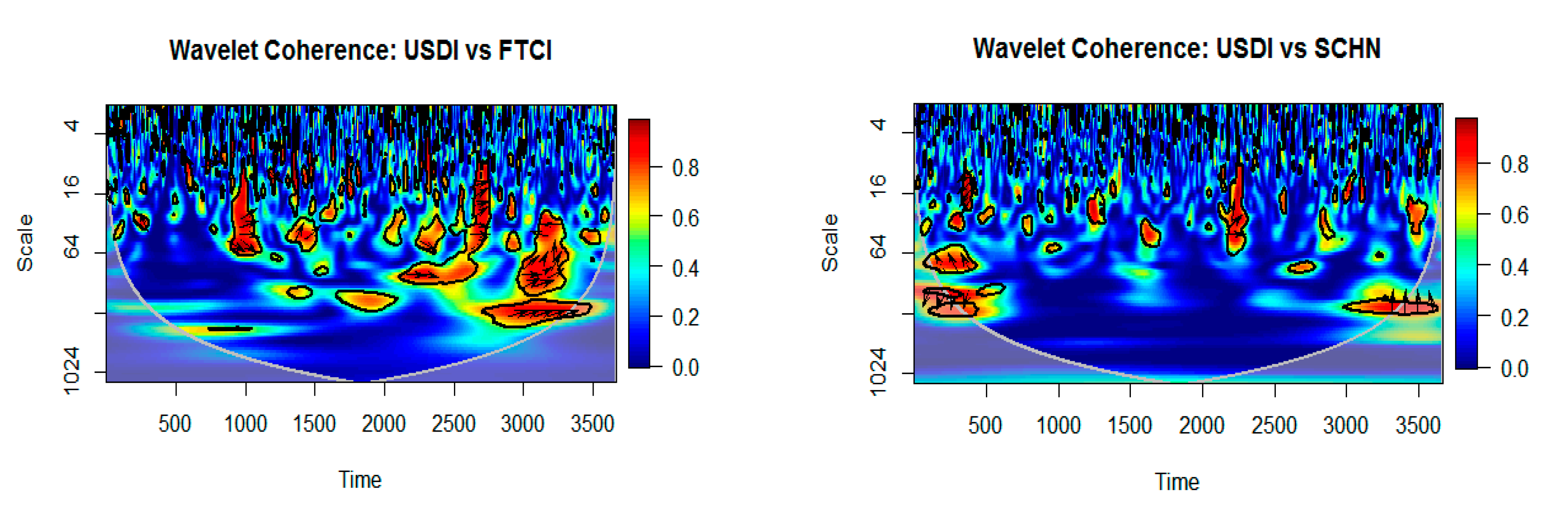

3.2. Wavelet Approach

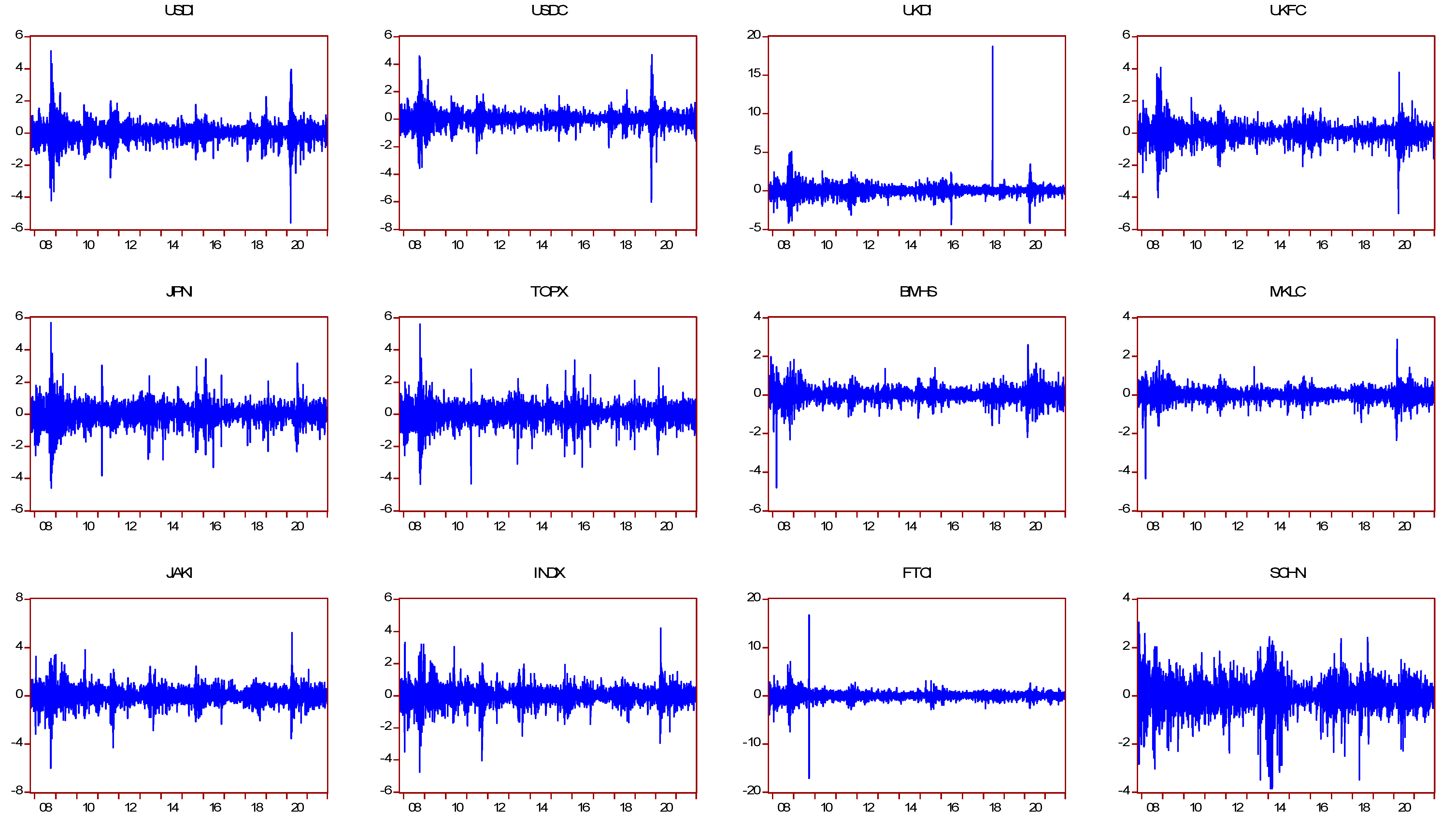

3.3. Data

4. Statistical Findings and Discussion

4.1. Descriptive Statistics

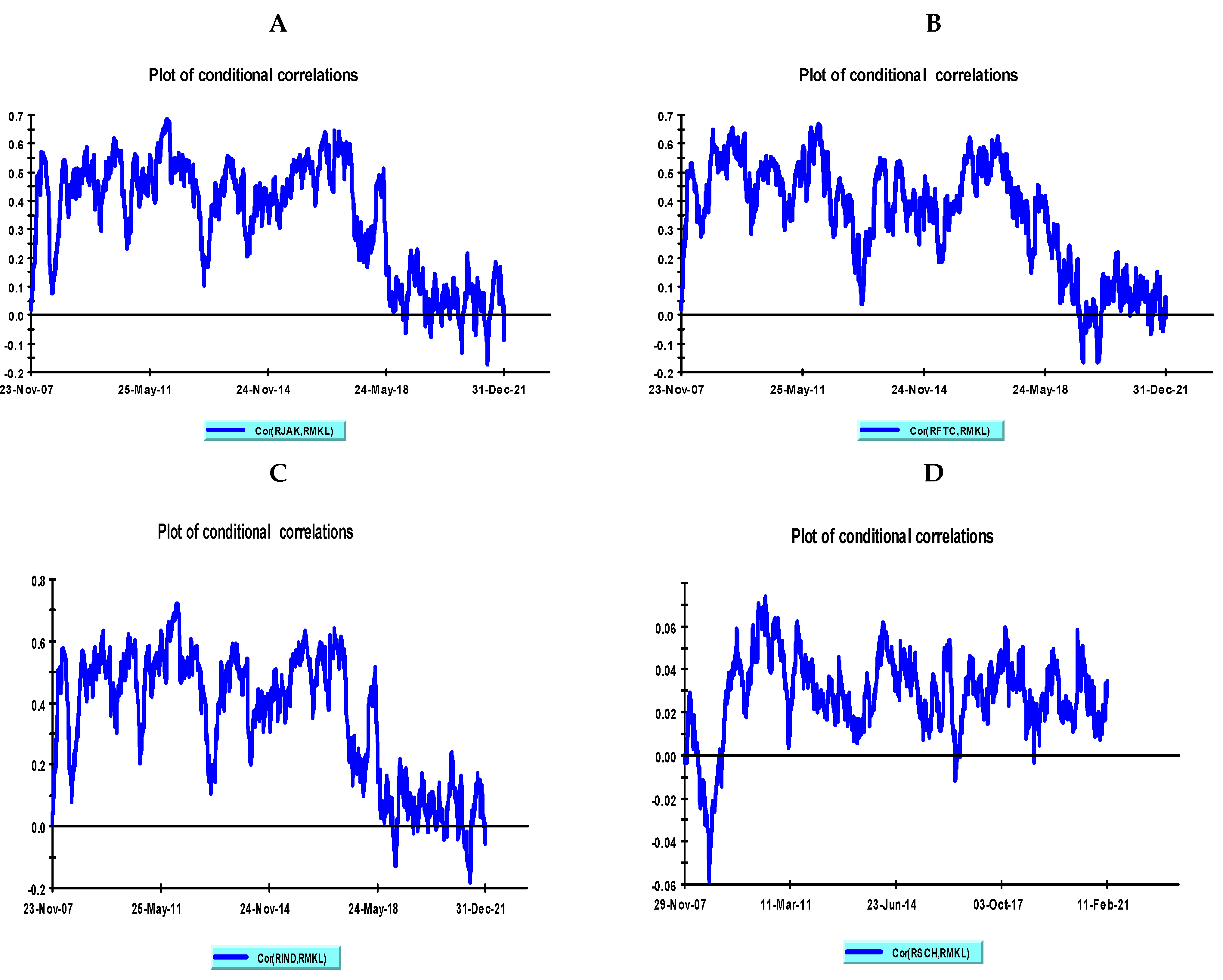

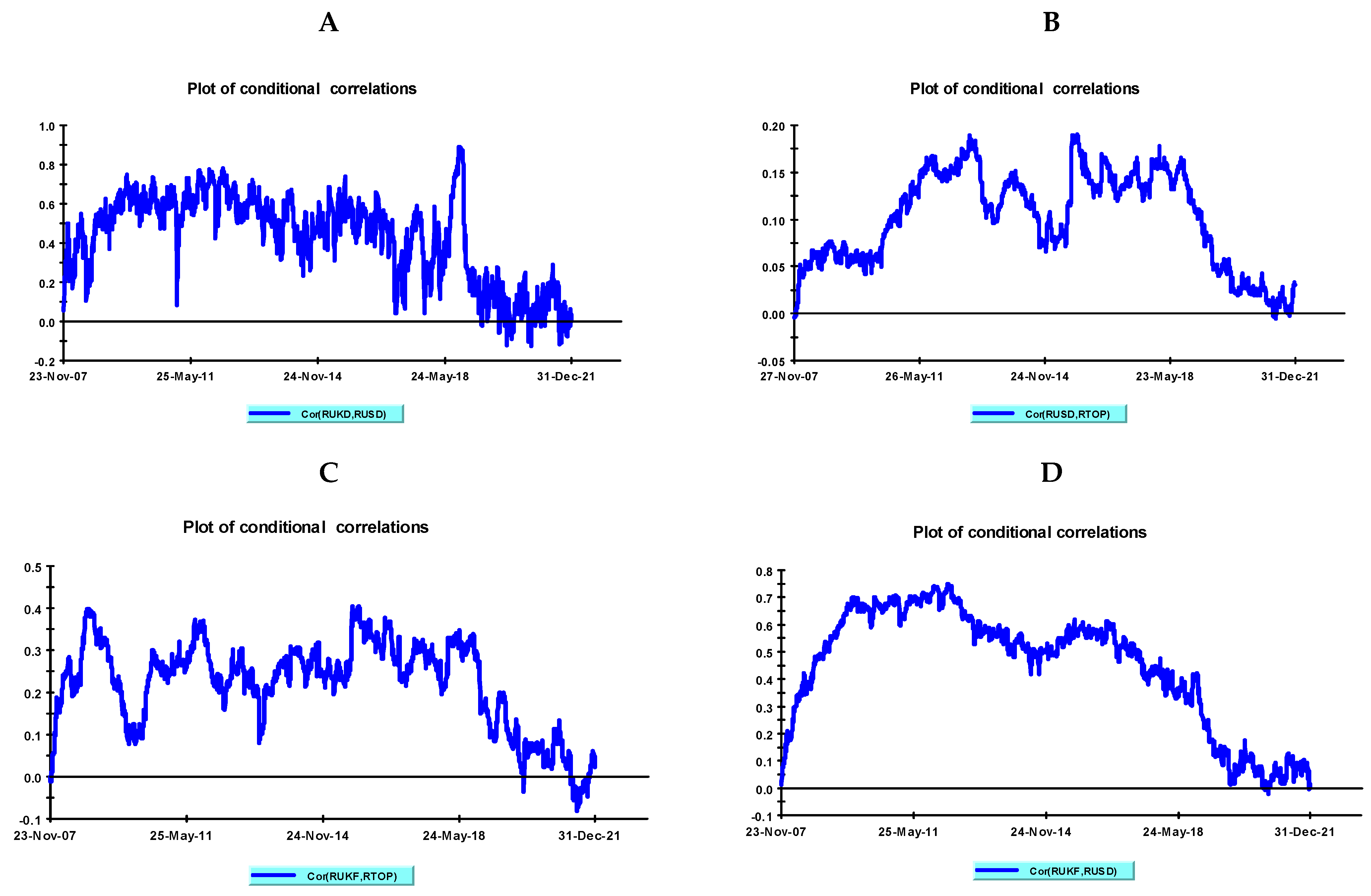

4.2. MGARCH-DCC

5. Conclusions

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Acknowledgments

Conflicts of Interest

References

- Aarif, Md Bokhtiar Hasan, Muhammad Rafiqul Islam Rafiq, and Abu N. M. Wahid. 2021. Do ‘Shariah’indices surpass conventional indices? A study on Dhaka Stock Exchange. International Journal of Islamic and Middle Eastern Finance and Management 14: 94–113. [Google Scholar] [CrossRef]

- Abbes, Mouna Boujelbene, and Yousra Trichilli. 2015. Islamic stock markets and potential diversification benefits. Borsa Istanbul Review 15: 93–105. [Google Scholar] [CrossRef]

- Ali, Fahad, Yuexiang Jiang, and Ahmet Sensoy. 2021. Downside risk in Dow Jones Islamic equity indices: Precious metals and portfolio diversification before and after the COVID-19 bear market. Research in International Business and Finance 58: 101502. [Google Scholar] [CrossRef]

- Al-Yahyaee, Khamis Hamed, Walid Mensi, Mobeen Ur Rehman, Xuan Vinh Vo, and Sang Hoon Kang. 2020. Do Islamic stocks outperform conventional stock sectors during normal and crisis periods? Extreme co-movements and portfolio management analysis. Pacific-Basin Finance Journal 62: 101385. [Google Scholar]

- Antar, Monia, and Fatma Alahouel. 2019. Co-movements and diversification opportunities among Dow Jones Islamic indexes. International Journal of Islamic and Middle Eastern Finance and Management 13: 94–115. [Google Scholar] [CrossRef]

- Asl, Mahdi Ghaemi, Giorgio Canarella, and Stephen M. Miller. 2021. Dynamic asymmetric optimal portfolio allocation between energy stocks and energy commodities: Evidence from clean energy and oil and gas companies. Resources Policy 71: 101982. [Google Scholar] [CrossRef]

- Ben Rejeb, Aymen, and Mongi Arfaoui. 2019. Do Islamic stock indexes outperform conventional stock indexes? A state space modeling approach. European Journal of Management and Business Economics 28: 301–22. [Google Scholar] [CrossRef]

- Bollerslev, Tim. 1990. Modelling the coherence in short-run nominal exchange rates: A multivariate generalized ARCH model. The Review of Economics and Statistics 72: 498–505. [Google Scholar] [CrossRef]

- Borio, Claudio. 2020. The COVID-19 economic crisis: Dangerously unique. Business Economics 55: 181–90. [Google Scholar] [CrossRef]

- Chang, Matthew C., Jui-Cheng Hung, and Chien-Chung Nieh. 2011. Reexamination of capital asset pricing model (CAPM): An application of quantile regression. African Journal of Business Management 5: 12684–90. [Google Scholar]

- Dewandaru, Ginanjar, Syed Aun R. Rizvi, Kabir Sarkar, Obiyathulla Bacha, and Mansur Masih. 2014a. How Do Macroeconomic Changes Impact Islamic and Conventional Equity Prices? Evidence from Developed and Emerging Countries. Munich Personal RePEc Archive (MPRA), Paper No 59587. Available online: https://mpra.ub.uni-muenchen.de/59587/ (accessed on 2 December 2022).

- Dewandaru, Ginanjar, Syed Aun R. Rizvi, Rumi Masih, Mansur Masih, and Syed Othman Alhabshi. 2014b. Stock market co-movements: Islamic versus conventional equity indices with multi-timescales analysis. Economic Systems 38: 553–71. [Google Scholar] [CrossRef]

- Donadelli, Michael, and Antonio Paradiso. 2014. Is there heterogeneity in financial integration dynamics? Evidence from country and industry emerging market equity indexes. Journal of International Financial Markets, Institutions and Money 32: 184–218. [Google Scholar] [CrossRef]

- Dritsaki, Chaido. 2017. An empirical evaluation in GARCH volatility modeling: Evidence from the Stockholm stock exchange. Journal of Mathematical Finance 7: 366–90. [Google Scholar] [CrossRef]

- El-Alaoui, AbdelKader Ouatik, Obiyathulla Ismath Bacha, Mansur Masih, and Mehmet Asutay. 2018. Does low leverage minimise the impact of financial shocks? New optimisation strategies using Islamic stock screening for European portfolios. Journal of International Financial Markets, Institutions and Money 57: 160–84. [Google Scholar] [CrossRef]

- Erdoğan, Seyfettin, Ayfer Gedikli, and Emrah İsmail Çevik. 2020. The effects of the covid-19 pandemic on conventional and Islamic stock markets in Turkey. Bilimname 42: 89–110. [Google Scholar] [CrossRef]

- Garcia-Jorcano, Laura, and Sonia Benito. 2020. Studying the properties of the Bitcoin as a diversifying and hedging asset through a copula analysis: Constant and time-varying. Research in International Business and Finance 54: 101300. [Google Scholar] [CrossRef]

- Hammoudeh, Shawkat, Walid Mensi, Juan Carlos Reboredo, and Duc Khuong Nguyen. 2014. Dynamic dependence of global Islamic stock index with global conventional indexes and risk factors. Pacific-Basin Finance Journal 30: 189–206. [Google Scholar] [CrossRef]

- Hasan, Md Bokhtiar, M. Kabir Hassan, Md Mamunur Rashid, and Yasser Alhenawi. 2021. Are safe haven assets really safe during the 2008 global financial crisis and COVID-19 pandemic? Global Finance Journal 50: 100668. [Google Scholar] [CrossRef]

- IFDI. 2022. Embracing Change. Available online: https://icd-ps.org/uploads/files/ICD%20Refinitiv%20ifdi-report-20221669878247_1582.pdf (accessed on 18 December 2022).

- IMF. 2020. COVID-19 Crisis Poses Threat to Financial Stability. Available online: https://www.imf.org/en/Blogs/Articles/2020/04/14/blog-gfsr-covid-19-crisis-poses-threat-to-financial-stability (accessed on 11 December 2022).

- Ismaila, Abd Ghafar, and Mohd Saharudin Shakranib. 2003. The conditional CAPM and cross-sectional evidence of return and beta for Islamic unit trusts in Malaysia. IIUM Journal of Economics and Management 11: 1–31. [Google Scholar]

- Jabeen, Munazza, and Saba Kausar. 2022. Performance comparison between Islamic and conventional stocks: Evidence from Pakistan’s equity market. ISRA International Journal of Islamic Finance 14: 59–72. [Google Scholar] [CrossRef]

- Jawadi, Fredj, Nabila Jawadi, and Wael Louhichi. 2014. Conventional and Islamic stock price performance: An empirical investigation. International Economics 137: 73–87. [Google Scholar] [CrossRef]

- Johnson, Robert, and Luc Soenen. 2003. Economic integration and stock market comovement in the Americas. Journal of Multinational Financial Management 13: 85–100. [Google Scholar] [CrossRef]

- Karamti, Chiraz, and Olfa Belhassine. 2022. COVID-19 pandemic waves and global financial markets: Evidence from wavelet coherence analysis. Finance Research Letters 45: 102136. [Google Scholar] [CrossRef] [PubMed]

- Khan, Faisal, and Sharifullah Jan. 2022. Portfolio Diversification Across Islamic Vs. Conventional Banks: The Role of Macroeconomic Fundamentals in Stock Volatility. Journal of Islamic Business and Management 12: 218–39. [Google Scholar] [CrossRef]

- Ku, Yuan-Hung Hsu. 2008. Student-t distribution based VAR-MGARCH: An application of the DCC model on international portfolio risk management. Applied Economics 40: 1685–97. [Google Scholar] [CrossRef]

- Lintner, John. 1965. Security prices, risk, and maximal gains from diversification. The Journal of Finance 20: 587–615. [Google Scholar]

- Longin, Francois, and Bruno Solnik. 2001. Extreme correlation of international equity markets. The Journal of Finance 56: 649–76. [Google Scholar] [CrossRef]

- Majdoub, Jihed, and Salim Ben Sassi. 2017. Volatility spillover and hedging effectiveness among China and emerging Asian Islamic equity indexes. Emerging Markets Review 31: 16–31. [Google Scholar] [CrossRef]

- Mantegna, Rosario N. 1999. Information and hierarchical structure in financial markets. Computer Physics Communications 121: 153–56. [Google Scholar] [CrossRef]

- Mantegna, Rosario N., and H. Eugene Stanley. 1997. Econophysics: Scaling and its breakdown in finance. Journal of Statistical Physics 89: 469–79. [Google Scholar] [CrossRef]

- Mensi, Walid, Mobeen Ur Rehman, Debasish Maitra, Khamis Hamed Al-Yahyaee, and Ahmet Sensoy. 2020. Does bitcoin co-move and share risk with Sukuk and world and regional Islamic stock markets? Evidence using a time-frequency approach. Research in International Business and Finance 53: 101230. [Google Scholar] [CrossRef]

- Mirza, Nawazish, Syed Kumail Abbas Rizvi, Irum Saba, Bushra Naqvi, and Larisa Yarovaya. 2022. The resilience of Islamic equity funds during COVID-19: Evidence from risk adjusted performance, investment styles and volatility timing. International Review of Economics & Finance 77: 276–95. [Google Scholar]

- Münnix, Michael C., Takashi Shimada, Rudi Schäfer, Francois Leyvraz, Thomas H. Seligman, Thomas Guhr, and H. Eugene Stanley. 2012. Identifying states of a financial market. Scientific Reports 2: 1–6. [Google Scholar] [CrossRef]

- Najeeb, Syed Faiq, Obiyathulla Bacha, and Mansur Masih. 2015. Does heterogeneity in investment horizons affect portfolio diversification? Some insights using M-GARCH-DCC and wavelet correlation analysis. Emerging Markets Finance and Trade 51: 188–208. [Google Scholar] [CrossRef]

- Naz, Syeda Arooj, and Saqib Gulzar. 2022. Impact of Islamic finance on economic growth: An empirical analysis of Muslim countries. The Singapore Economic Review 67: 245–65. [Google Scholar] [CrossRef]

- Nguyen, Duc Khuong, Ahmet Sensoy, Ricardo M. Sousa, and Gazi Salah Uddin. 2020. US equity and commodity futures markets: Hedging or financialization? Energy Economics 86: 104660. [Google Scholar] [CrossRef]

- Rahim, Adam Mohamed, and Mansur Masih. 2016. Portfolio diversification benefits of Islamic investors with their major trading partners: Evidence from Malaysia based on MGARCH-DCC and wavelet approaches. Economic Modelling 54: 425–38. [Google Scholar] [CrossRef]

- Rahman, Mostafizur, Md Azizul Baten, and A. Alam. 2006. An empirical testing of capital asset pricing model in Bangladesh. Journal of Applied Sciences 6: 662–67. [Google Scholar] [CrossRef]

- Rana, Md Ejaz, and Waheed Akhter. 2015. Performance of Islamic and conventional stock indices: Empirical evidence from an emerging economy. Financial Innovation 1: 1–17. [Google Scholar] [CrossRef]

- Rhaiem, N., S. Ben Ammou, and A. Ben Mabrouk. 2007. Estimation of capital asset pricing model at different time scales application to French stock market. The International Journal of Applied Economics and Finance 1: 79–87. [Google Scholar]

- Rossi, Matteo. 2016. The capital asset pricing model: A critical literature review. Global Business and Economics Review 18: 604–17. [Google Scholar] [CrossRef]

- Saiti, Buerhan, Obiyathulla I. Bacha, and Mansur Masih. 2014. The diversifica-tion benefits from Islamic investment during the financial turmoil: The case for the US-based equity investors. Borsa Istanbul Review 14: 196–211. [Google Scholar] [CrossRef]

- Shahzad, Syed Jawad Hussain, and Nader Naifar. 2022. Dependence dynamics of Islamic and conventional equity sectors: What do we learn from the decoupling hypothesis and COVID-19 pandemic? The North American Journal of Economics and Finance 59: 101635. [Google Scholar] [CrossRef]

- Shahzad, Syed Jawad Hussain, Román Ferrer, Laura Ballester, and Zaghum Umar. 2017. Risk transmission between Islamic and conventional stock markets: A return and volatility spillover analysis. International Review of Financial Analysis 52: 9–26. [Google Scholar] [CrossRef]

- Shaik, Muneer, Syed Ahsan Jamil, Iqbal Thonse Hawaldar, Mohammad Sahabuddin, Mustafa Raza Rabbani, and Mohd Atif. 2023. Impact of geo-political risk on stocks, oil, and gold returns during GFC, COVID-19, and Russian–Ukraine War. Cogent Economics & Finance 11: 2190213. [Google Scholar]

- Sharpe, William F. 1964. Capital asset prices: A theory of market equilibrium under conditions of risk. The Journal of Finance 19: 425–42. [Google Scholar]

- Suryadi, Suryadi, Endri Endri, and Mukhamad Yasid. 2021. Risk and return of islamic and conventional indices on the Indonesia Stock Exchange. The Journal of Asian Finance, Economics and Business 8: 23–30. [Google Scholar]

- Tuna, Vedat Ender, Gülfen Tuna, and Nurcan Kostak. 2021. The effect of oil market shocks on the stock markets: Time-varying asymmetric causal relationship for conventional and Islamic stock markets. Energy Reports 7: 2759–774. [Google Scholar] [CrossRef]

- Weron, Aleksander, and Rafał Weron. 2000. Fractal market hypothesis and two power-laws. Chaos, Solitons & Fractals 11: 289–96. [Google Scholar]

| Country of Origin | Shariah-Compliant Stock Indices | Ticker | Non-Shariah-Compliant Stock Indices | Ticker |

|---|---|---|---|---|

| Developed countries | ||||

| U.S. | Dow Jones Islamic Index | USDI | Dow Jones Composite Index | USDC |

| UK | Dow Jones Islamic Index | UKDI | FTSE100 Composite Index | UKFC |

| Japan | Japan FTSE Shariah index | JPNI | Tokyo Price Index (TOPIX), Japan | TOPX |

| Developing countries | ||||

| Malaysia | FTSE Bursa Malaysia Hijarah Shariah index | BMHS | FTSE Bursa Malaysia KLCI Composite Index | MKLC |

| Indonesia | Jakarta Islamic Index | JAKI | Indonesia Composite Index | INDX |

| China | FTSE Shariah Index, China | FTCI | Shanghai Composite Index | SCHN |

| Islamic Stock Markets | Conventional Stock Markets | |||||||||

|---|---|---|---|---|---|---|---|---|---|---|

| Mean | SD | Skew | Kurt | JB | Mean | SD | Skew | Kurt | JB | |

| Developed countries | ||||||||||

| U.S. | 0.0163 | 0.5485 | −0.4383 | 16.3059 | 27,198.4900 | 0.0100 | 0.5433 | −0.4776 | 18.1393 | 35,197.1500 |

| UK | 0.0100 | 0.6867 | 5.2541 | 157.5857 | 3,672,098.0000 | 0.0011 | 0.5197 | −0.3857 | 13.2120 | 16,042.2200 |

| Japan | 0.0032 | 0.6006 | −0.3215 | 11.4497 | 10,979.3600 | 0.0024 | 0.5935 | −0.3638 | 10.7932 | 9370.7250 |

| Developing countries | ||||||||||

| Malaysia | 0.0021 | 0.3457 | −0.8410 | 18.2865 | 36,175.6100 | 0.0014 | 0.3167 | −0.8869 | 18.3184 | 36,373.2500 |

| Indonesia | 0.0023 | 0.6511 | −0.4067 | 10.7598 | 9311.5310 | 0.0110 | 0.5407 | −0.5540 | 12.6270 | 14,363.500 |

| China | −0.0027 | 0.8745 | −0.3190 | 84.9092 | 1,026,277.0000 | 0.0078 | 0.5943 | −0.7787 | 8.4811 | 4966.2480 |

| Parameter | Country | Estimate | T-Ratio |

|---|---|---|---|

| Lambda 1 (λ1) | U.S. Islamic | 0.87923 | 70.5778 |

| UK Islamic | 0.93639 | 115.1142 | |

| Japan Islamic | 0.91181 | 97.7216 | |

| U.S. Conventional | 0.88181 | 71.3517 | |

| UK Conventional | 0.92103 | 101.7882 | |

| Japan Conventional | 0.91133 | 87.5851 | |

| Lambda 2 (λ2) | U.S. Islamic | 0.10869 | 10.1986 |

| UK Islamic | 0.053841 | 8.2698 | |

| Japan Islamic | 0.075973 | 10.2299 | |

| U.S. Conventional | 0.10794 | 10.0019 | |

| UK Conventional | 0.066979 | 9.2411 | |

| Japan Conventional | 0.075578 | 9.2759 | |

| Delta 1 (δ1) | 0.91279 | 120.7646 | |

| Delta 2 (δ2) | 0.033373 | 14.3188 | |

| Degree of Freedom (df) | 6.6533 | 21.6897 | |

| Maximum Log Likelihood | 63,057.5 |

| Parameter | Countries | Estimates | T-Ratio |

|---|---|---|---|

| lambda 1 (λ 1) | China Islamic | 0.89505 | 72.8431 |

| Indonesia Islamic | 0.89085 | 59.8594 | |

| Malaysia Islamic | 0.91045 | 79.0092 | |

| China Conventional | 0.93739 | 112.3559 | |

| Indonesia Conventional | 0.88501 | 54.5649 | |

| Malaysia Conventional | 0.89438 | 57.0745 | |

| Lambda 2 (λ 2) | China Islamic | 0.09694 | 8.8604 |

| Indonesia Islamic | 0.08325 | 8.0656 | |

| Malaysia Islamic | 0.07655 | 8.2102 | |

| China Conventional | 0.05757 | 7.856 | |

| Indonesia Conventional | 0.09229 | 7.6813 | |

| Malaysia Conventional | 0.08674 | 7.2524 | |

| Delta 1 (δ1) | 0.92211 | 98.38 | |

| Delta 2 (δ2) | 0.02334 | 11.7945 | |

| Degree of Freedom (df) | 6.1721 | 22.0576 | |

| Maximum Log Likelihood | 60086.8 |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2023 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Tabash, M.I.; Sahabuddin, M.; Abdulkarim, F.M.; Hamouri, B.; Tran, D.K. Dynamic Dependency between the Shariah and Traditional Stock Markets: Diversification Opportunities during the COVID-19 and Global Financial Crisis (GFC) Periods. Economies 2023, 11, 149. https://doi.org/10.3390/economies11050149

Tabash MI, Sahabuddin M, Abdulkarim FM, Hamouri B, Tran DK. Dynamic Dependency between the Shariah and Traditional Stock Markets: Diversification Opportunities during the COVID-19 and Global Financial Crisis (GFC) Periods. Economies. 2023; 11(5):149. https://doi.org/10.3390/economies11050149

Chicago/Turabian StyleTabash, Mosab I., Mohammad Sahabuddin, Fatima Muhammad Abdulkarim, Basem Hamouri, and Dang Khoa Tran. 2023. "Dynamic Dependency between the Shariah and Traditional Stock Markets: Diversification Opportunities during the COVID-19 and Global Financial Crisis (GFC) Periods" Economies 11, no. 5: 149. https://doi.org/10.3390/economies11050149

APA StyleTabash, M. I., Sahabuddin, M., Abdulkarim, F. M., Hamouri, B., & Tran, D. K. (2023). Dynamic Dependency between the Shariah and Traditional Stock Markets: Diversification Opportunities during the COVID-19 and Global Financial Crisis (GFC) Periods. Economies, 11(5), 149. https://doi.org/10.3390/economies11050149