1. Introduction

Business intelligence combines all of the news sources into something beyond the sum of their components. It does this by pulling on the operational data provided by the enterprises’ resource planning system and transforming it into meaningful intelligence that directly supports the company’s strategic goals (

Al-Mobaideen 2014). Business intelligence (BI) is universally acknowledged as the art of deriving business value from data; consequently, BI systems and communication infrastructure are required to integrate various data sources into a consistent standard framework in order to facilitate fact-checking and deep analysis across the firms. By recognizing the firm information systems, such as customer data, procurement information, employee information, production data, marketing and advertising activity data and any additional reference to crucial data (

Khan 2019;

Muntean and Cabau 2011), business intelligence tools have had the ability to make more smart judgments more efficiently (

Sharda et al. 2014). Undoubtedly, the accuracy of the data on which a firm’s decisions are based determines the quality of those judgments (

Kilani 2022). When managers consider both the internal workings of the company and the external environment in which it functions, they can make both productive and profitable decisions. This necessitates continuously seizing newly emerging opportunities, taking calculated risks and maintaining a flexible stance in response to various new requirements (

Muntean et al. 2010;

Shi and Lu 2010).

Business intelligence initiatives help decision-makers to solve business problems in order to maximize business value. The primary objective of these initiatives is to increase profitability and productivity. According to

Zeng et al. (

2012), the resolution to a business challenge typically consists of a process that also involves business intelligence, while business intelligence on its own is rarely a sufficient answer to enterprise needs. Business intelligence suppliers are preoccupied with offering appropriate solutions for administrators, business intelligence solutions that are competent at implementing balanced scorecards, corporate reports and performance dashboards (

Khatibi et al. 2020). This is related to managerial visions and a strategic planning tool that offers a global view of a company, transforming its strategy and mission into concrete and quantifiable goals (

Muntean et al. 2010;

Silahtaroğlu and Alayoğlu 2016).

With the accessibility of “big data” and blockchain technology in intelligent machines, the idea of “business intelligence” (BI) has emerged as an increasingly essential one (

Agarwal and Dhar 2014). Over the course of the past two generations, the importance of the fields of business intelligence, blockchain and big data analytics, which are closely related to one another, has grown substantially in both the academic and commercial worlds (

Chen et al. 2012;

Daneshvar Kakhki and Palvia 2016). When integrated with big data and blockchain technology, these forms of business intelligence are able to carry out operations and actions that are both timelier and more relevant than those carried out by humans. Business intelligence is utilized in both testing and production environments by IT development businesses (

Wamba-Taguimdje et al. 2020). The term “machine learning” refers to the process through which business intelligence might acquire new tools in order to investigate big data and automate decisions. The term “business intelligence” is most commonly used as an umbrella term to represent a system (

Shollo and Kautz 2010) or methods and concepts (

Sabherwal and Becerra-Fernandez 2013) that enhance decision-making by making use of reality support networks. Many concepts (such as “business intelligence”, “business analytics” and “big data”) are frequently interchangeable in research. Authors have described business intelligence in a variety of ways, including as “a process and a brand” (

Jourdan et al. 2008, p. 121), “a process, a brand and a combination of methods, or a mixture of such” (

Shollo and Kautz 2010, p. 87) or as “a good or service alone” (

Seddon et al. 2017). Several of these findings come from a study that was carried out by Accenture and General Electric. According to the study, 89 percent of businesses believe that if they do not integrate big data and blockchain, they will lose market share (

Columbus 2014).

Business intelligence (BI), blockchain technology, cloud computing services, big data and fifth-generation (5G) wireless networking are the five primary trends that are currently leading and influencing business (firm) performance. The term “big data” refers to the attempt to find techniques that can analyze the enormous volumes of information that are consistently produced. Big data uses computers to process information in order to gain insights or advantages over competitors. Big data analytics encompasses a wide variety of software programs, hardware technologies and business procedures that are all connected in some way to the phases of gathering, storing, accessing and analyzing large amounts of data (

Bayrak 2015). “Big data” refers to the enormity of a large amount of unorganized data that is collected as part of the process of developing big data analytics. This type of data can only be analyzed and comprehended by using specialized software and hardware (

Bayrak 2015). Analyzing social media data allows crucial aspects of marketing strategies to be automatically controlled using big data analytics and blockchain technology (

Tan et al. 2013). These factors include the opinions of customers toward a brand, service or organization. On the other hand, the accessibility of big data presents practitioners and academics with new hurdles, even as it opens up previously unimaginable prospects for marketing intelligence. The analysis of large amounts of data focuses primarily on overcoming three distinct sorts of difficulties: storing, managing and processing (

Kaisler et al. 2013).

Wang et al. (

2022) noticed that firm performance is impacted by the capabilities and reliability of business intelligence (BI). In addition, performance affects a company’s competitive advantage. Furthermore, BI capabilities affect BI reliability. Companies are actively contributing to the rapid development of big data technologies and are becoming more interested in the possibilities of big data. According to the Organization for Economic Cooperation and Development (OECD), big data promises to produce increased value in various business operations and it has been singled out as the next big thing in technological advancement (

Gunasekaran et al. 2017). In light of this, a recent study asserts that “big data is more than just a technological issue and for big data to be fully effective, it requires becoming an integral part of organizations” (

Braganza et al. 2017). Recent research by Ji-fan

Ren et al. (

2016) examined the link between the value proposition of big data analytics options and the performance of companies. During this process phase, blockchain technology has forced technological communication methods to forge stronger ties with firm performance (

Liu 2022). Blockchain technology, on the other hand, can boost a company’s performance by increasing the number of innovations (

Liu 2022). Companies can improve their performance by increasing their market share, expanding into new technologies, including blockchain and big data analytics (

Braganza et al. 2017;

Liu 2022), and developing higher-quality goods and services (

Braganza et al. 2017). In light of this, this study approached the concepts of performance and performance as the predicted factor of big data analytics, blockchain technology and business intelligence.

It was therefore proved that higher firm performance is influenced by advanced technologies (i.e., business intelligence, big data analytics and blockchain). It has been determined that the integrated business intelligence (BI) system is an effective and reliable tool for managing corporate capacity planning and executing supply chains. Business intelligence, with the adoption of big data analytics and blockchain, makes a substantial contribution to higher firm performance in the market. The vast majority of these systems can successfully carry out the feature in question; nevertheless, they lack the tools necessary for data analysis and reporting. It is possible to use BI tools to maintain a consistent path of innovation in information systems (

Al-Measar 2015;

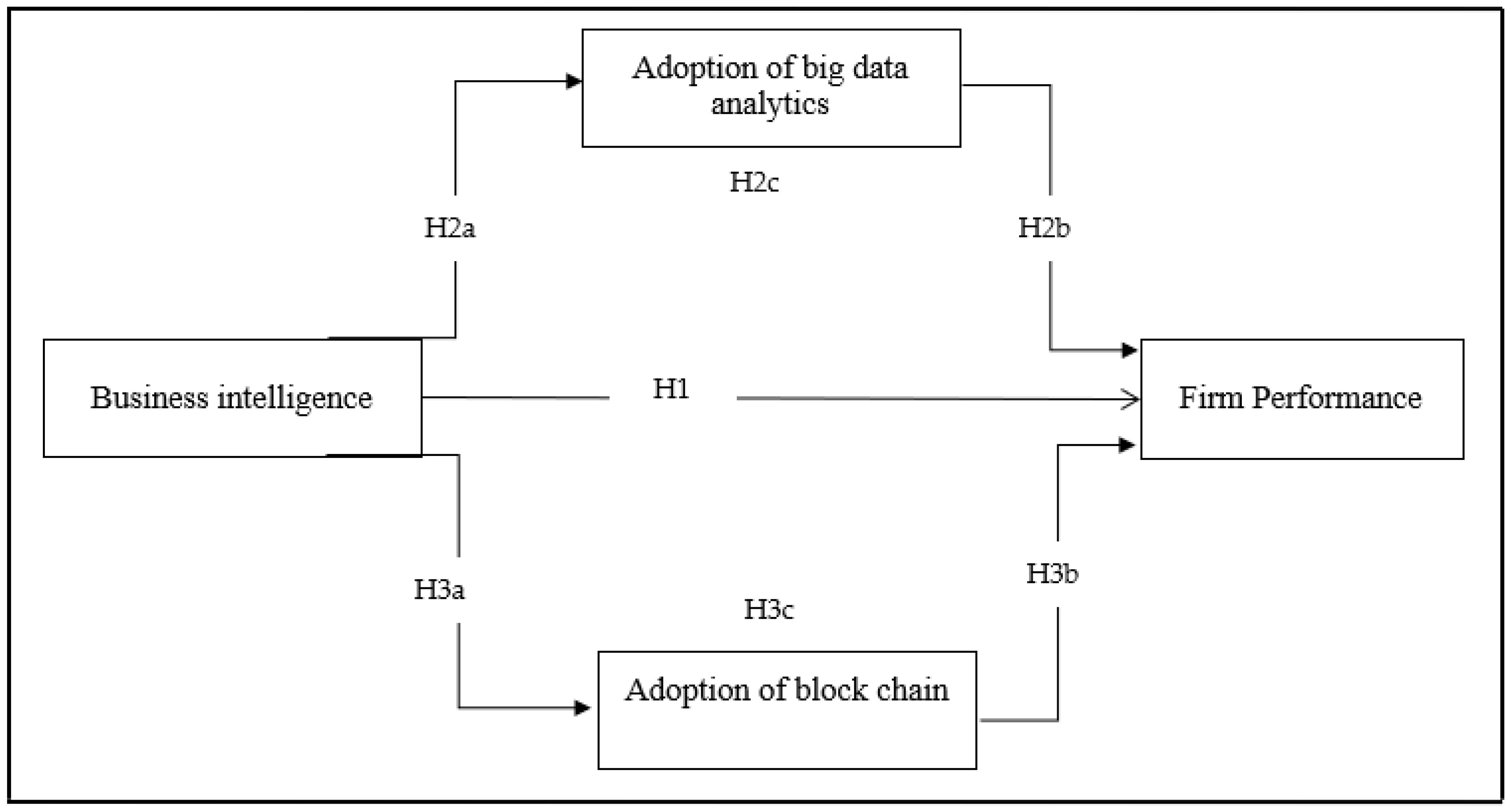

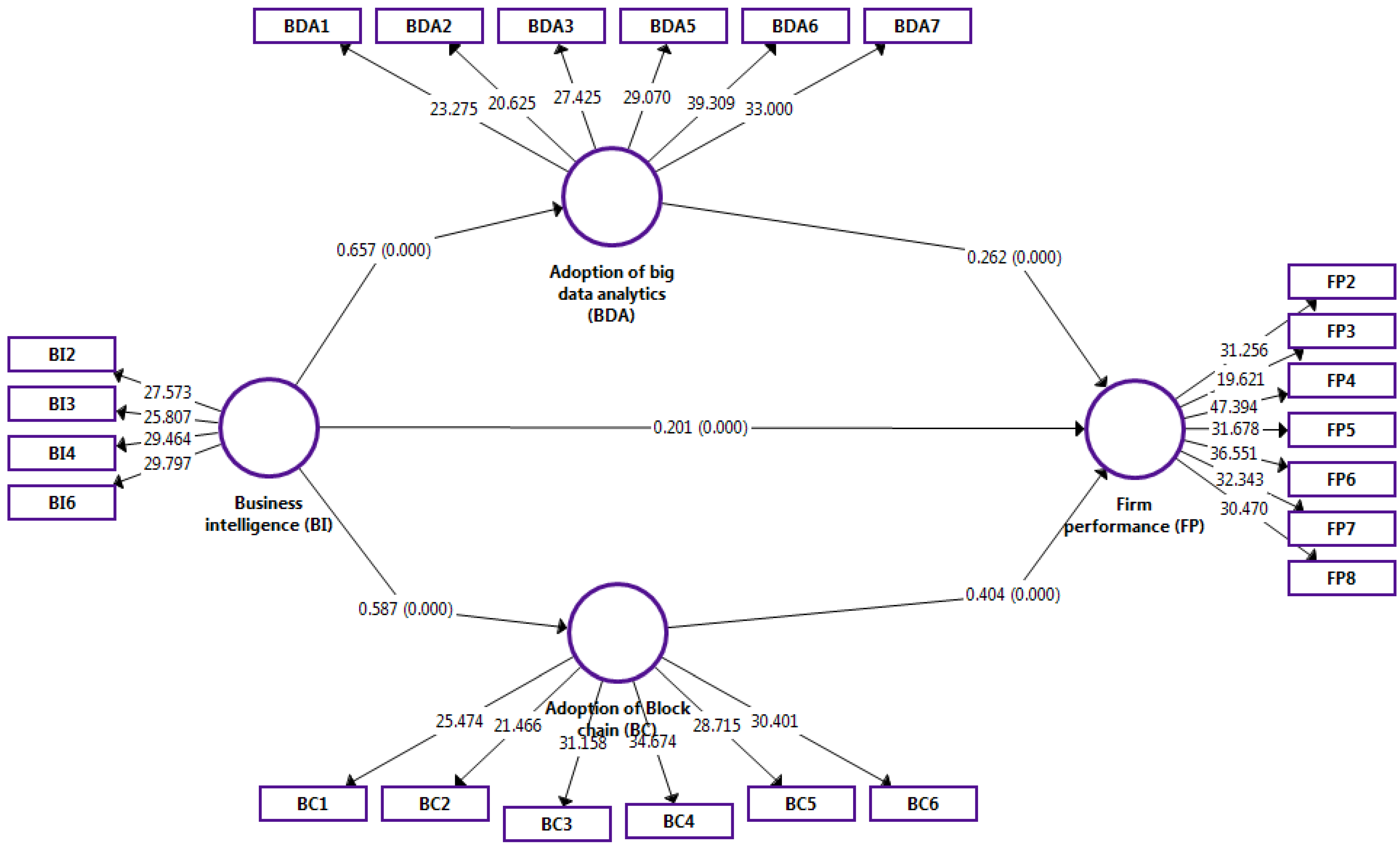

Chou 2018). As a result, this research focused on IT firms in Croatia that use business intelligence with the intention of using big data analytics and blockchain. The objectives of the study are to (1) examine the influence of business intelligence on firm performance and (2) test the mediating roles of big data analytics and blockchain between business intelligence and firm performance.

5. Discussion

This study conducted research in Croatia by targeting 12 IT firms. The study used an online survey questionnaire to collect the data from the management and employees of these IT firms. The study applied a SEM technique to analyze the relationship between business intelligence and firm performance in the presence of the adoption of big data analytics and blockchain technology. The study uploaded the survey questionnaire on social media platforms and gathered data from 387 top managerial officers. The study found the results that business intelligence directly and significantly enhanced firm performance of the Croatian IT firms. Although this conceptual model is affiliated with the mobility perspective, which is broadly used in the research on how IT affects firm performance, the treatment of the firm capacity to sense, confiscate and reshape opportunities is inconsistent throughout the IT agility literature (

Chen et al. 2012). The model makes a clear distinction between each of these aspects and, as a result, it helps to create a more accurate perception of the connection that exists between business intelligence and firm performance. It does this by elucidating the nature of the connection between business intelligence and firm performance and then providing empirical validation of that connection (

Torres et al. 2018).

Secondly, the study examined that business intelligence more strongly influenced the adoption of big data analytics than blockchain because the Croatian IT firms would recommend utilizing big data analytics in order to enhance and store big data and information (

Aydiner et al. 2019). It also proved that big data analytics is the priority of the marketers to enhance business-to-customer (B–C) relationships. Business intelligence is the capabilities of digital computer technologies to assist businesses in locating and analyzing vital data connected to their business that may be applied to a variety of different business sectors (

Aydiner et al. 2019;

Bayrak 2015). With the assistance of business intelligence, firms are able to more easily develop novel and useful corporate insights (

Barney 1991). Users of business intelligence are assisted in drawing inferences from analyzed data (

Chen et al. 2012;

Elbashir et al. 2008). Data scientists delve deep into the particulars of the data at hand, applying sophisticated statistical methods and predictive analytics in order to identify patterns and make predictions on future patterns. On the other hand, the adoption of big data analytics and blockchain significantly and directly impacted firm performance but in this case, blockchain highly enhanced firm performance.

Elbashir et al. (

2008) demonstrated that blockchain is a public, open-source, blockchain-based, decentralized computing platform with smart contract capabilities.

According to

Gunasekaran et al. (

2017), blockchain is an application for improving firm performance that is intended to serve as a foundation for the development of a wide range of industries. When evaluating the effects of blockchain adoption, new performance proposals emerge as relevant. These new measures cope with the lateral restructuring of online transactions as well as the capacity and resources of the firms. Furthermore, these new measures of firm performance are relevant. The implementation of blockchain technology has the potential to result in more efficient transaction administration. However, when the study tested the mediating roles of the adoption of big data analytics and blockchain technology, the researcher found that the adoption of big data analytics is a strong technology that has a higher potential to increase firm performance rather than the adoption of blockchain.

5.1. Managerial Implications

The results of this research have four massive implications for marketing firms and other organizations that want to get the most out of the money they invest in business intelligence and analytics. To begin, the findings of this research provide credence to the idea that business intelligence, big data analytics and blockchain can be considered a sort of capital plan that, in the long run, has an effect on a firm’s performance. This research provides empirical data that could be used as a foundation for company executives wanting to justify investments in business intelligence by establishing the causal link that connects business intelligence and firm performance. The study was conducted to provide this evidence. The big data analytics and blockchain framework provides intuitive theoretical advice that practitioners could rely on to better grasp the complicated interactions that are required to extract benefits from big-data-based business intelligence. This is possible because big data aligns well with traditional business intelligence functions within firm performance (

Işık et al. 2013). According to the results, in order for firms to fully capitalize on business intelligence resources, they will need to transform big-data-based business intelligence from a technical asset into a firm competence that is essential to achieving success in a competitive environment. Despite the fact that this is not a novel concept, the calls for businesses to implement it are often motivated by imperatives stemming from their finances, structures or cultures (

Daneshvar Kakhki and Palvia 2016;

Grover et al. 2018). Because of the work that we have done, businesses now have a new lens through which they can view the utilization of their big-data-based resources as a significant action that can enable companies to continually create and adapt in reaction to business intelligence that is constantly changing (

Gunasekaran et al. 2017;

Hindle and Vidgen 2018). Secondly, the research results highlight the significance of opportunity cost in realizing the value of business intelligence investments and recommend that the advancement of mutual understanding, policymaking and planning ought to be regarded as essential components of big data and blockchain capabilities. This is because opportunity usurpation is a key factor in realizing the benefits of big-data-based business intelligence investments. This indicates that businesses should make investments in firm policies that enable successful information and communication among various stakeholders, in addition to making technical investments in business intelligence infrastructure and employees. Although businesses are frequently advised to streamline decision-making and take proactive measures to ensure that important solutions and plans can be made in a timely manner in response to possibilities, the firms embed this recommended method in a chain of events that translates business intelligence investments into improved firm performance.

The model that the study proposed offers managers whose involvement in business intelligence, big data analytics and blockchain technology is growing (

Davenport 2014). These technologies allow them to undertake an incorporated evaluation of the impact that business intelligence, big data analytics and blockchain technology have on firm performance. It is essential to educate IT managers on the various value-generating options offered by business intelligence, big data analytics and blockchain technology solutions and the processes by which these opportunities can be translated into improvements in the company’s performance, because the changes may be profound (

Orlikowski and Scott 2015). The findings of our study indicate that business intelligence, big data analytics and blockchain technology continue to hold the promise of adding value. The implementation of blockchain technology solutions paves the way for higher firm performance, the introduction of ground-breaking new products and the potential to outperform rival businesses. Implementing solutions for business intelligence enables the firm to provide superior goods and services to its clientele, thereby winning their satisfaction. The findings on the firm performance and the explored mediation impacts will make it easier to scale up solutions for business intelligence, big data analytics and blockchain technology. According to these findings, IT managers should take customer satisfaction as a key strategic objective to ensure an improvement in their companies’ financial performance. Even so, managers ought to be mindful that some distinctions could emerge based on the particular IT objects they wish to engage in (

George et al. 2014;

Orlikowski and Scott 2015). These findings were published by (

George et al. 2014;

Mayer-Schönberger and Cukier 2013;

Orlikowski and Scott 2015).

5.2. Limitations and Future Directions

The findings of the research need to be interpreted with a number of significant limitations in mind. Despite the lack of empirical studies to support a preference for one modeling approach over another, the mediation model is compatible with other theorizing in the sense of big data analytics and blockchain. This study used a convenience sampling technique in collecting data; however, the researcher faces biases and the findings are not generalized. The study only used a survey questionnaire (i.e., quantitative method), so mixed method research should be used to explore more factors in implementing new technologies in firm performance. This is a unique research model that conceptually examines the mediations of the adoption of big data analytics and blockchain; however, the study targeted only the perceptions of the IT firms and not their practical jobs. This lends credence to its use as a basis for the selection of one modeling framework over another. As a result, the mediation technique was chosen by the study to represent the aspects of other dynamic capabilities in this work. Further consideration should be given to the possibility that detecting, seizing and converting operate in comparison, have interaction or portray first-order factors of a higher-order concept; even so, future research should expand upon the post-hoc assessment that was revealed here and further investigate the possibility that these three processes exist. Secondly, due to its non-random nature, this study used a convenient sample, which is prone to selection bias. In order to solve this problem, two strategies were utilized, including the use of different access points to enhance the features of the sample in Croatia. Thirdly, this research made use of evaluations that were based on people’s perceptions of firm performance by adopting business intelligence, big data analytics and blockchain. Such measurements include the self-reported assessments of the individuals who participated in the research, which may be prevalent in research on capacities and strategic management. Verifying the conclusions of this study would benefit from additional research in the future that investigates the data sources utilized by third parties. Fourthly, the information that was gathered places a strong emphasis on business intelligence in relation to the particular facets of the sense–seize–transform paradigm.