COVID-19 Pandemic and Stock Performance: Evidence from the Sub-Saharan African Stock Markets

Abstract

1. Introduction

2. Literature Review

2.1. Black Swan Events and Stock Market Performance

2.2. Respiratory Diseases and Stock Market Performance

2.3. COVID-19 Pandemic and Stock Market Performance

2.4. COVID-19 Pandemic and Sector Performance

3. Materials and Methods

3.1. Samples and Variables

3.2. Event Study Methodology

3.2.1. Estimation Window

Mean-Adjusted Model

3.2.2. Event Window

Abnormal Returns (AR)

Cumulative Abnormal Returns (CAR)

Test Statistic

3.3. Panel Data Regression

3.3.1. Analytical Model

3.3.2. Hausman Test

3.4. Analytical Software

4. Results

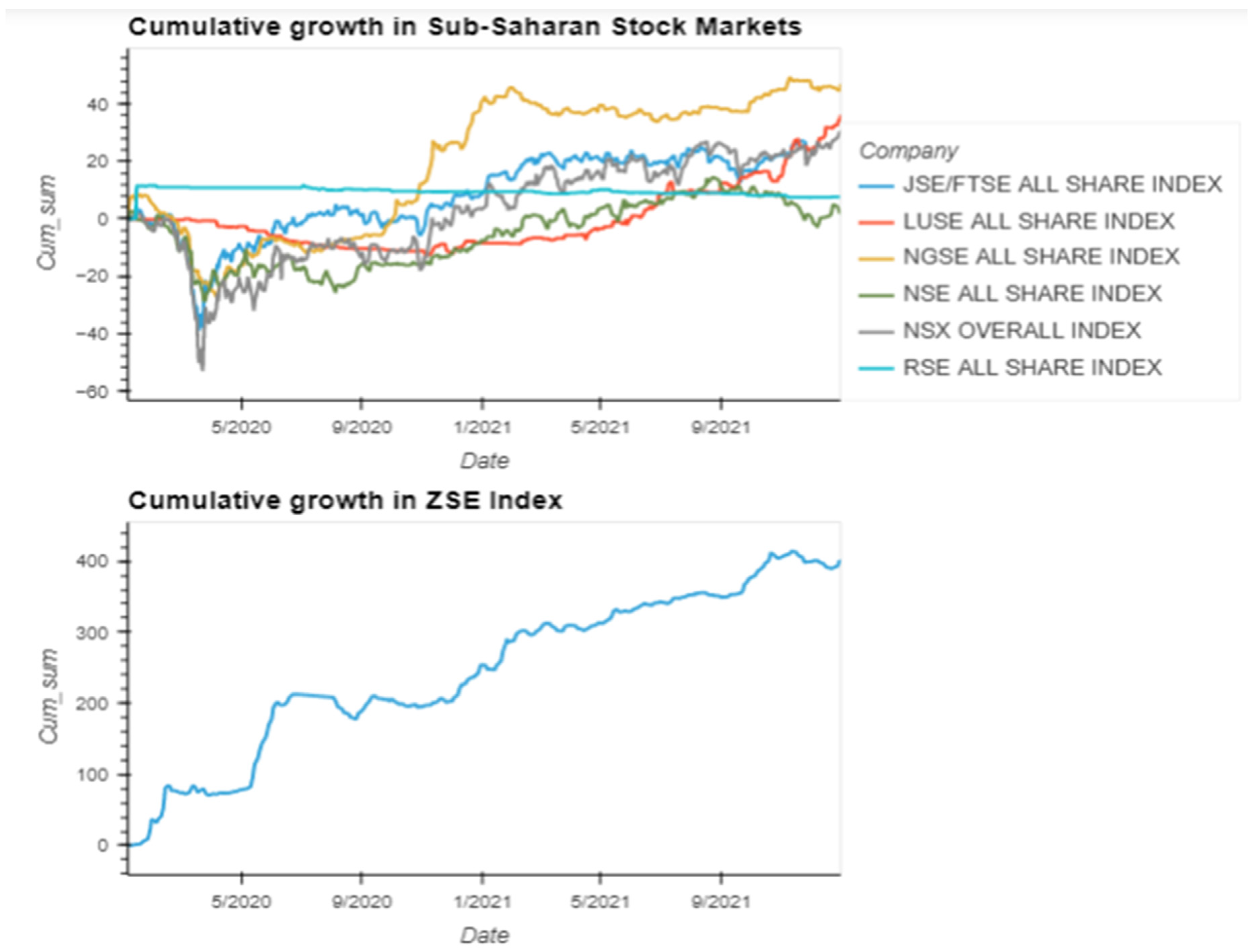

4.1. Event Analysis Results

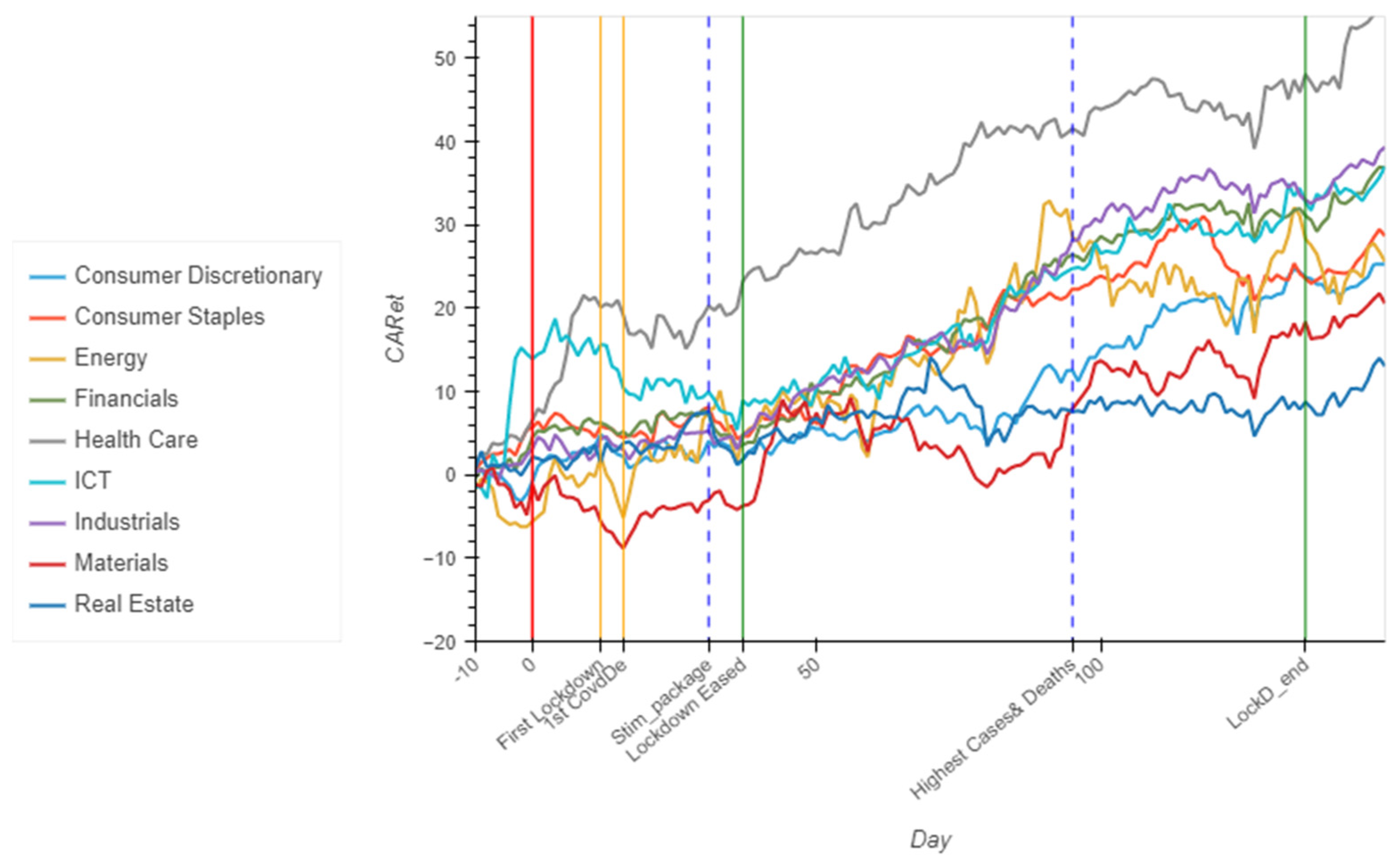

4.1.1. Johannesburg Stock Exchange

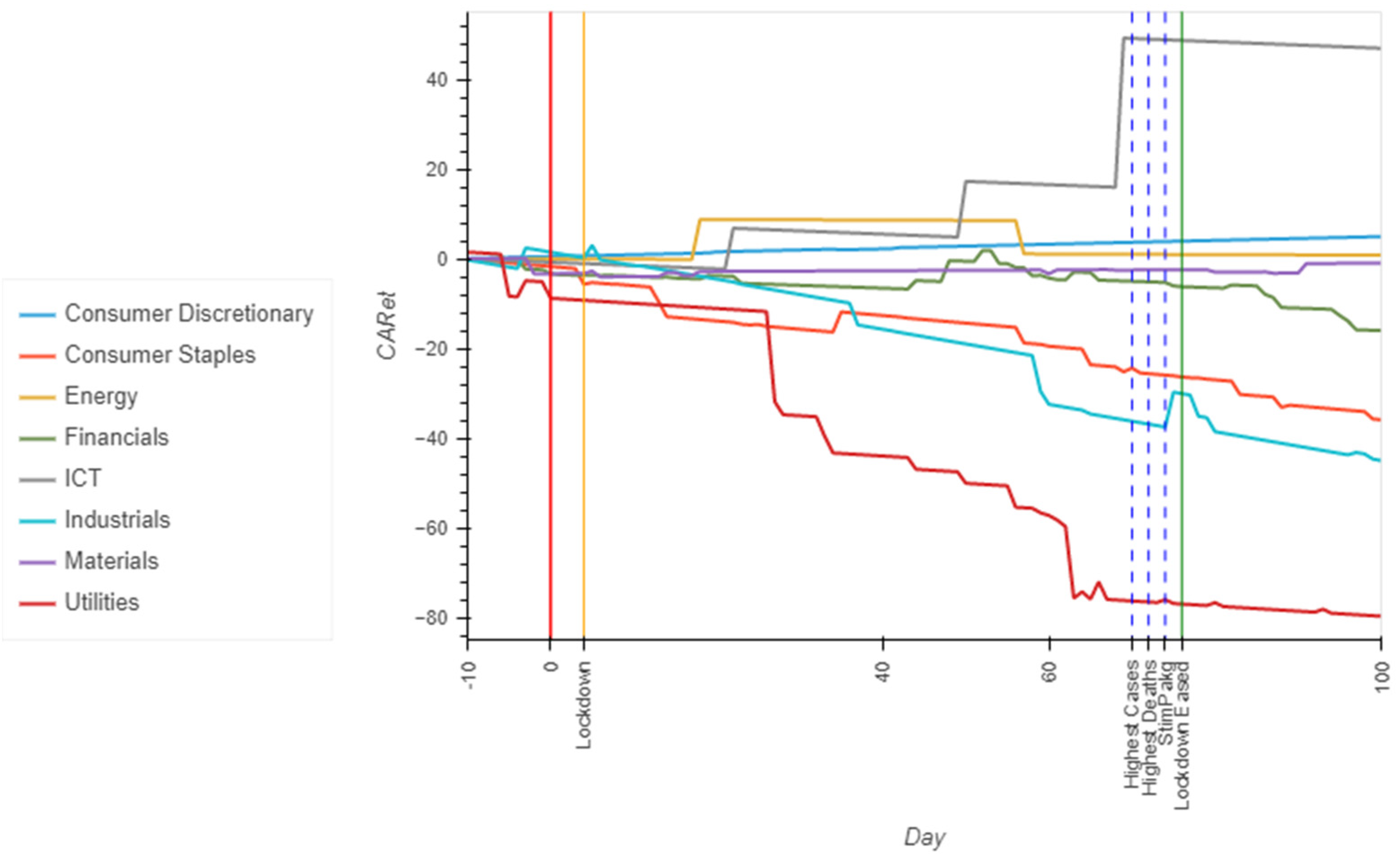

4.1.2. Zimbabwe Stock Exchange

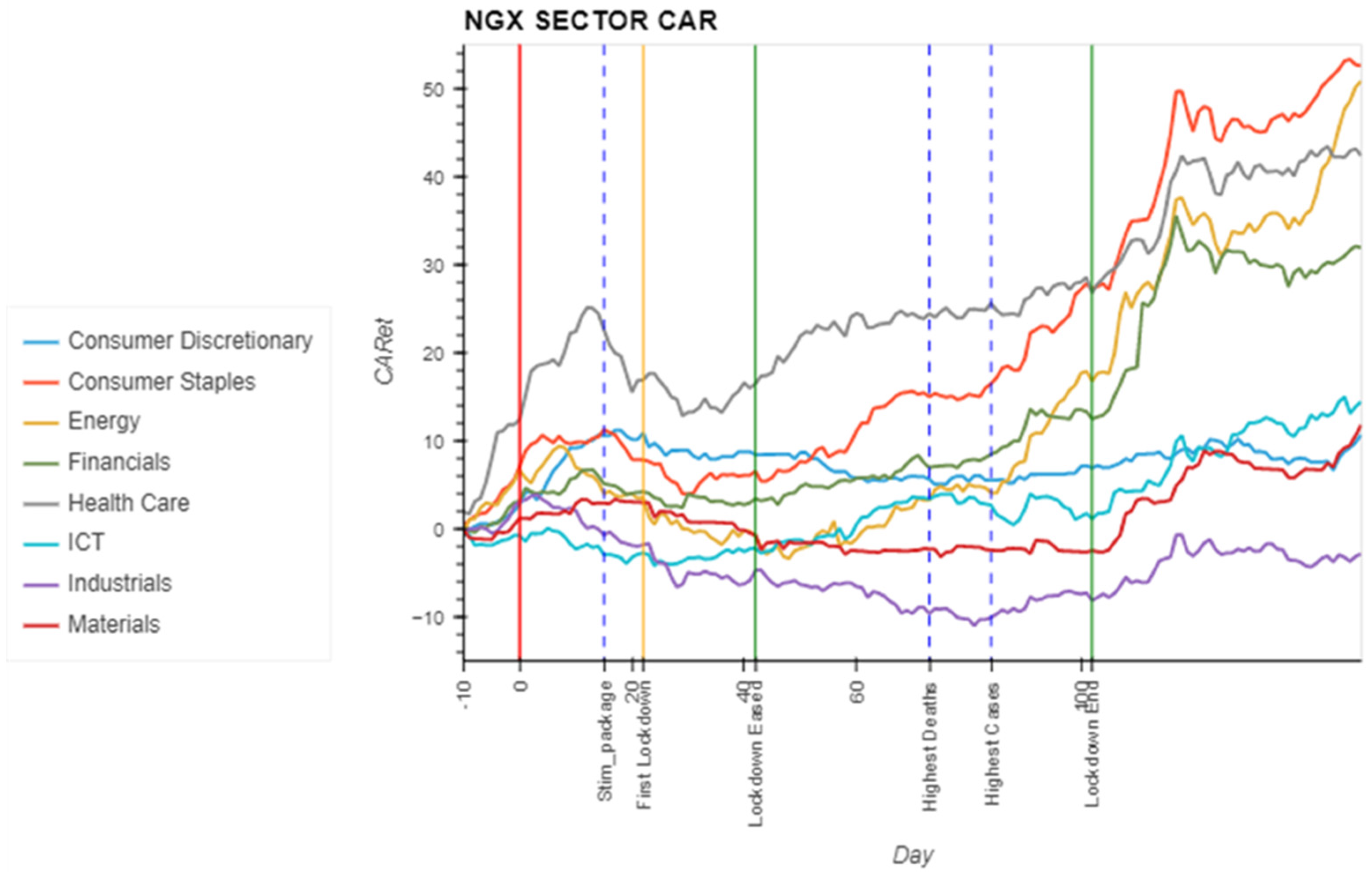

4.1.3. Nigerian Stock Exchange

4.1.4. Lusaka Stock Exchange

4.2. Panel Data Regression Results

4.2.1. Johannesburg Stock Exchange

4.2.2. Zimbabwe Stock Exchange

4.2.3. Nigerian Stock Exchange

4.2.4. Lusaka Stock Exchange

5. Discussion

6. Conclusions

Author Contributions

Funding

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

References

- Alam, Md Mahmudul, Haitian Wei, and Abu NM Wahid. 2021. COVID-19 outbreak and sectoral performance of the Australian stock market: An event study analysis. Australian Economic Papers 60: 482–95. [Google Scholar] [CrossRef]

- Amini, Shahram, Michael S. Delgado, Daniel J. Henderson, and Christopher F. Parmeter. 2012. Fixed vs random: The Hausman test four decades later. In Essays in Honor of Jerry Hausman. Bradford: Emerald Group Publishing Limited, pp. 479–513. [Google Scholar]

- Ashraf, Badar Nadeem. 2020. Economic impact of government interventions during the COVID-19 pandemic: International evidence from financial markets. Journal of Behavioral and Experimental Finance 27: 100371. [Google Scholar] [CrossRef]

- Awan, Tahir Mumtaz, Muhammad Shoaib Khan, Inzamam Ul Haq, and Sarwat Kazmi. 2021. Oil and stock markets volatility during pandemic times: A review of G7 countries. Green Financ 3: 15–27. [Google Scholar] [CrossRef]

- Baker, Scott R., Nicholas Bloom, Steven J. Davis, Kyle J. Kost, Marco C. Sammon, and Tasaneeya Viratyosin. 2020. The Unprecedented Stock Market Impact of COVID-19. Cambridge, MA: National Bureau of Economic Research. [Google Scholar]

- Bayero, Saifullahi Adam, Babangida Danladi Safiyanu, and Zaitun Sanusi Bakabe. 2021. Impact of Covid-19 on Stock Market in Sub-Saharan Africa. International Journal of Entrepreneurship and Sustainability Studies 1: 42–61. [Google Scholar] [CrossRef]

- Bekaert, Geert, Michael Ehrmann, Marcel Fratzscher, and Arnaud Mehl. 2014. The global crisis and equity market contagion. The Journal of Finance 69: 2597–649. [Google Scholar] [CrossRef]

- Bekiros, Stelios, Sabri Boubaker, Duc Khuong Nguyen, and Gazi Salah Uddin. 2017. Black swan events and safe havens: The role of gold in globally integrated emerging markets. Journal of International Money and Finance 73: 317–34. [Google Scholar] [CrossRef]

- Chaudhary, Rashmi, Priti Bakhshi, and Hemendra Gupta. 2020. Volatility in international stock markets: An empirical study during COVID-19. Journal of Risk and Financial Management 13: 208. [Google Scholar] [CrossRef]

- Chen, Mei-Ping, Chien-Chiang Lee, Yu-Hui Lin, and Wen-Yi Chen. 2018. Did the SARS epidemic weaken the integration of Asian stock markets? Evidence from smooth time-varying cointegration analysis. Economic research-Ekonomska istraživanja 31: 908–26. [Google Scholar] [CrossRef]

- Chen, Ming-Hsiang, SooCheong Shawn Jang, and Woo Gon Kim. 2007. The impact of the SARS outbreak on Taiwanese hotel stock performance: An event-study approach. International Journal of Hospitality Management 26: 200–12. [Google Scholar] [CrossRef] [PubMed]

- Choe, Yunseon, Junhui Wang, and HakJun Song. 2021. The impact of the Middle East Respiratory Syndrome coronavirus on inbound tourism in South Korea toward sustainable tourism. Journal of Sustainable Tourism 29: 1117–33. [Google Scholar] [CrossRef]

- Dang Ngoc, Hung, Van Vu Thi Thuy, and Chi Le Van. 2021. Covid 19 pandemic and Abnormal Stock Returns of listed companies in Vietnam. Cogent Business & Management 8: 1941587. [Google Scholar]

- David, Sergio A., Cláudio MC Inácio Jr, and José A. Tenreiro Machado. 2021. The recovery of global stock markets indices after impacts due to pandemics. Research in International Business and Finance 55: 101335. [Google Scholar] [CrossRef]

- Del Lo, Gaye, Théophile Basséne, and Babacar Séne. 2022. COVID-19 And the african financial markets: Less infection, less economic impact? Finance Research Letters 45: 102148. [Google Scholar] [CrossRef] [PubMed]

- Elhini, Maha, and Rasha Hammam. 2021. The impact of COVID-19 on the standard & poor 500 index sectors: A multivariate generalized autoregressive conditional heteroscedasticity model. In Journal of Chinese Economic and Foreign Trade Studies. Bradford: Emerald Publishing Limited. [Google Scholar]

- Funck, Mary, and Jose A. Gutierrez. 2018. Has Ebola infected the market: A contagious reaction to a (media) health care crisis? Journal of Business Strategies. Available online: https://ssrn.com/abstract=2786001 (accessed on 26 August 2022).

- Haiykir, Cetenak, and Özlem Öztürk Çetenak. 2022. Monetary policy application and stock market reaction during Covid-19 Pandemic: Evidence from Turkey. Ömer Halisdemir Üniversitesi İktisadi ve İdari Bilimler Fakültesi Dergisi 15: 149–64. [Google Scholar] [CrossRef]

- Harjoto, Maretno Agus, and Fabrizio Rossi. 2021. Market reaction to the COVID-19 pandemic: Evidence from emerging markets. International Journal of Emerging Markets. ahead-of-print. [Google Scholar] [CrossRef]

- Harjoto, Maretno Agus, Fabrizio Rossi, Robert Lee, and Bruno S. Sergi. 2021. How do equity markets react to COVID-19? Evidence from emerging and developed countries. Journal of Economics and Business 115: 105966. [Google Scholar] [CrossRef]

- Ichev, Riste, and Matej Marinč. 2018. Stock prices and geographic proximity of information: Evidence from the Ebola outbreak. International Review of Financial Analysis 56: 153–66. [Google Scholar] [CrossRef]

- Izzeldin, Marwan, Yaz Gülnur Muradoğlu, Vasileios Pappas, and Sheeja Sivaprasad. 2021. The impact of COVID-19 on G7 stock markets volatility: Evidence from a ST-HAR model. International Review of Financial Analysis 74: 101671. [Google Scholar] [CrossRef]

- Joo, Heesoo, Brian A. Maskery, Andre D. Berro, Lisa D. Rotz, Yeon-Kyeng Lee, and Clive M. Brown. 2019. Economic impact of the 2015 MERS outbreak on the Republic of Korea’s tourism-related industries. Health Security 17: 100–8. [Google Scholar] [CrossRef]

- Kharbanda, Varuna, and Rachna Jain. 2021. Impact of COVID on the stock market: A study of BRIC countries. International Journal of Financial Markets and Derivatives 8: 169–84. [Google Scholar] [CrossRef]

- Krivin, Dmitry, Robert Patton, Erica Rose, and David Tabak. 2003. Determination of the appropriate event window length in individual stock event studies. Available online: https://ssrn.com/abstract=466161 (accessed on 7 November 2022).

- Kumeka, Terver, Patricia Ajayi, and Oluwatosin Adeniyi. 2021. Is stock market in Sub-Saharan Africa resilient to health shocks? Journal of Financial Economic Policy 14: 562–98. [Google Scholar] [CrossRef]

- Kuruppu, Gayithri Niluka, and Anura De Zoysa. 2020. COVID-19 and panic buying: An examination of the impact of behavioural biases. Available online: https://ssrn.com/abstract=3596101 (accessed on 11 November 2022).

- Ledwani, Sanket, Suman Chakraborty, and Sandeep S. Shenoy. 2021. Spatial tale of G-7 and Brics stock markets during COVID-19: An event study. Investment Management and Financial Innovations 18: 20–36. [Google Scholar] [CrossRef] [PubMed]

- Lybeck, Eric. 2017. An Analysis of Nassim Nicholas Tableb’s The Black Swan:: The Impact of the Highly Improbable: Macat Library. Available online: https://www.taylorfrancis.com/books/mono/10.4324/9781912281206 (accessed on 11 October 2022).

- Mazur, Mieszko, Man Dang, and Miguel Vega. 2021. COVID-19 and the march 2020 stock market crash. Evidence from S&P1500. Finance research letters 38: 101690. [Google Scholar]

- Mikhaylov, Alexey, Hasan Dinçer, and Serhat Yüksel. 2023. Analysis of financial development and open innovation oriented fintech potential for emerging economies using an integrated decision-making approach of MF-X-DMA and golden cut bipolar q-ROFSs. Financial Innovation 9: 1–34. [Google Scholar] [CrossRef]

- Nafday, Avinash M. 2009. Strategies for managing the consequences of black swan events. Leadership and Management in Engineering 9: 191–97. [Google Scholar] [CrossRef]

- Narayan, Paresh Kumar, Dinh Hoang Bach Phan, and Guangqiang Liu. 2021. COVID-19 lockdowns, stimulus packages, travel bans, and stock returns. Finance Research Letters 38: 101732. [Google Scholar] [CrossRef]

- Nippani, Srinivas, and Kenneth M. Washer. 2004. SARS: A non-event for affected countries’ stock markets? Applied Financial Economics 14: 1105–10. [Google Scholar] [CrossRef]

- Olczyk, Magdalena, and Marta Ewa Kuc-Czarnecka. 2021. Determinants of COVID-19 impact on the private sector: A multi-country analysis based on survey data. Energies 14: 4155. [Google Scholar] [CrossRef]

- Phan, Dinh Hoang Bach, and Paresh Kumar Narayan. 2020. Country responses and the reaction of the stock market to COVID-19—A preliminary exposition. Emerging Markets Finance and Trade 56: 2138–50. [Google Scholar] [CrossRef]

- Ranjeeni, Kumari. 2014. Sectoral and industrial performance during a stock market crisis. Economic Systems 38: 178–93. [Google Scholar] [CrossRef]

- Sachdeva, Kanika, and P. Sivakumar. 2020. COVID-19 and Stock Market Behavior–An Event Study of BRIC Countries. Turkish Journal of Computer and Mathematics Education (TURCOMAT) 11: 741–54. [Google Scholar]

- Seetharam, Ishuwar. 2017. Environmental Disasters and Stock Market Performance. Stanford University Working paper. Stanford: Stanford University. [Google Scholar]

- Shaikh, Imlak. 2021. Impact of COVID-19 pandemic disease outbreak on the global equity markets. Economic Research-Ekonomska Istraživanja 34: 2317–36. [Google Scholar] [CrossRef]

- Shehzad, Khurram, Umer Zaman, Xiaoxing Liu, Jarosław Górecki, and Carlo Pugnetti. 2021. Examining the asymmetric impact of COVID-19 pandemic and global financial crisis on Dow Jones and oil price shock. Sustainability 13: 4688. [Google Scholar] [CrossRef]

- Singh, Gurmeet, and Muneer Shaik. 2021. The Short-Term Impact of COVID-19 on Global Stock Market Indices. Contemporary Economics 15: 1–19. [Google Scholar] [CrossRef]

- Takyi, Paul Owusu, and Isaac Bentum-Ennin. 2021. The impact of COVID-19 on stock market performance in Africa: A Bayesian structural time series approach. Journal of Economics and Business 115: 105968. [Google Scholar] [CrossRef]

- Taleb, Nassim Nicholas. 2007. The Black Swan: The Impact of the Highly Improbable. New York: Random House, vol. 2, Available online: https://innovation.cc/book-reviews/2008_13_3_14_gow_bk-rev_taleb_black-swan (accessed on 1 October 2022).

- Tastsidis Olsson, Aleksis, and Pontus Löfberg. 2014. Black Swan Investing: An empirical study in context of efficient markets. Available online: https://lup.lub.lu.se/student-papers/search/publication/46 (accessed on 11 October 2022).

- Teitler-Regev, Sharon, and Tchai Tavor. 2019. The impact of disasters and terrorism on the stock market. Jàmbá: Journal of Disaster Risk Studies 11: 1–8. [Google Scholar]

- Tetteh, Joseph Emmanuel, Anthony Amoah, Kenneth Ofori-Boateng, and George Hughes. 2022. Stock market response to COVID-19 pandemic: A comparative evidence from two emerging markets. Scientific African 17: e01300. [Google Scholar] [CrossRef]

- Topcu, Mert, and Omer Serkan Gulal. 2020. The impact of COVID-19 on emerging stock markets. Finance Research Letters 36: 101691. [Google Scholar] [CrossRef]

- Uddin, Moshfique, Anup Chowdhury, Keith Anderson, and Kausik Chaudhuri. 2021. The effect of COVID–19 pandemic on global stock market volatility: Can economic strength help to manage the uncertainty? Journal of Business Research 128: 31–44. [Google Scholar] [CrossRef]

- Woon, Wong Shou. 2004. Introduction to the event study methodology. Singapore Management University 4: 1–12. [Google Scholar]

- World Bank. 2020. Global economic prospects, June 2020. The World Bank. Available online: https://elibrary.worldbank.org/doi/abs/10.1596/978-1-4648-1553-9 (accessed on 27 December 2022).

- Xu, Libo. 2021. Stock Return and the COVID-19 pandemic: Evidence from Canada and the US. Finance Research Letters 38: 101872. [Google Scholar] [CrossRef] [PubMed]

- Yarovaya, Larisa, Roman Matkovskyy, and Akanksha Jalan. 2021. The effects of a black swan event (COVID-19) on herding behavior in cryptocurrency markets. Journal of International Financial Markets, Institutions and Money 75: 101321. [Google Scholar] [CrossRef]

- Yousfi, Mohamed, Younes Ben Zaied, Nidhaleddine Ben Cheikh, Béchir Ben Lahouel, and Houssem Bouzgarrou. 2021. Effects of the COVID-19 pandemic on the US stock market and uncertainty: A comparative assessment between the first and second waves. Technological Forecasting and Social Change 167: 120710. [Google Scholar] [CrossRef] [PubMed]

- Zhao, Linhai, Ehsan Rasoulinezhad, Tapan Sarker, and Farhad Taghizadeh-Hesary. 2022. Effects of COVID-19 on global financial markets: Evidence from qualitative research for developed and developing economies. The European Journal of Development Research 35: 1–19. [Google Scholar] [CrossRef] [PubMed]

| Variable | Description | Source |

|---|---|---|

| Stock Returns | This variable is used as a perfomance measure. The variable is calculated daily from the stock prices as the log of current stock price divided by previous day stock price. The returns for the stocks are then averaged per sector to obtain sector returns. The data is gathered per share for each stock market sampled. | Investing.com website. accesed on 23 September 2022 |

| Volumes of Trade | This variable measures the daily volumes of trade per stock. The data is gathered per share for each stock market sampled. For sector analysis, the daily change in volumes traded are averaged for all shares in each sector. | Investing.com website. accesed on 27 September 2022 |

| COVID-19 deaths | This variable measures the daily deaths from the COVID-19 pandemic. It is gathered per country. | World Health Organisation (WHO) website. accesed on 24 September 2022 |

| COVID-19 Cases | This variable measures the daily reported COVID-19 infections. It is gathered per country. | World Health Organisation (WHO) website. accesed on 24 September 2022 |

| Sector | ZSE | LSE | ||

| Significant −ve AR | Significant +ve AR | Significant −ve AR | Significant +ve AR | |

| Consumer Discretionary | Day 115–150 | -- | -- | |

| Consume Staples | Day 93–115 | Day 13–100 | ||

| Financials | -- | 96–100 | ||

| ICT | 93–118 | 69–100 | ||

| Industrial | Day 61–150 | 60–100 | ||

| Materials | Day 111–150 | Day 1–10 | ||

| Real Estate | Day 69–150 | |||

| Utilities | Day 33–100 | |||

| Sector | JSE | NGX | ||

| Significant −ve AR | Significant +ve AR | Significant −ve AR | Significant +ve AR | |

| Consumer Discretionary | -- | Day 1–51 | ||

| Consume Staples | Day 110–150 | Day 0–19, 66–150 | ||

| Energy | -- | -- | Day 5–150 | |

| Financials | Day 113–150 | Day 108–150 | ||

| Health Care | Day 6–16, 63–150 | Day 0–150 | ||

| ICT | 0–13 | --- | -- | |

| Industrial | 95–150 | -- | --- | |

| Materials | -- | -- | --- | |

| Real Estate | -- | -- | -- | |

| RandomEffects Estimation Summary | ||||||

|---|---|---|---|---|---|---|

| Dep. Variable: | CARet | R-squared: | 0.7864 | |||

| Estimator: | RandomEffects | R-squared (Between): | −0.0187 | |||

| No. Observations: | 1359 | R-squared (Within): | 0.7870 | |||

| Date: | Mon, Dec 19 2022 | R-squared (Overall): | 0.4859 | |||

| Time: | 10:23:46 | Log-likelihood | −3992.7 | |||

| Cov. Estimator: | Clustered | |||||

| F-statistic: | 1246.5 | |||||

| Entities: | 9 | p-value | 0.0000 | |||

| Avg Obs: | 151.00 | Distribution: | F(4,1354) | |||

| Min Obs: | 151.00 | |||||

| Max Obs: | 151.00 | F-statistic (robust): | 29.649 | |||

| p-value | 0.0000 | |||||

| Time periods: | 151 | Distribution: | F(4,1354) | |||

| Avg Obs: | 9.0000 | |||||

| Mix Obs: | 9.0000 | |||||

| Max Obs: | 9.0000 | |||||

| Parameter Estimates | ||||||

| Parameter | Coeff | Std. Err. | T-stat | p-value | Lower CI | Upper CI |

| const | 1.5650 | 1.4833 | 1.0551 | 0.2916 | −1.3447 | 4.4748 |

| log_cumCases | 0.8630 | 0.2756 | 3.1314 | 0.0018 | 0.3224 | 1.4036 |

| log_cumDeaths | 1.6205 | 0.2517 | 6.4380 | 0.0000 | 1.1267 | 2.1142 |

| LockDm | −6.5662 | 1.1455 | −5.7324 | 0.0000 | −8.8132 | −4.3191 |

| scVolume | −0.2433 | 0.1291 | −1.8837 | 0.0598 | −0.4966 | 0.0101 |

| Sector | Variables | JSE | NGX | ZSE | LSE | ||||

|---|---|---|---|---|---|---|---|---|---|

| Coeff | p-Value | Coeff | p-Value | Coeff | p-Value | Coeff | p-Value | ||

| Consumer Discretionary | const Cases Deaths LocDm Volm | −0.337 1.308 1.071 −10.077 −0.747 | 0.798 0.000 0.000 0.000 0.189 | 14.398 4.852 −6.168 −3.963 0.165 | 0.000 0.000 0.000 0.000 0.371 | −0.132 −0.157 −0.000 0.596 1.196 | 0.127 0.000 0.991 0.000 0.017 | 0.189 0.181 0.539 0.149 −1261.2 | 0.024 0.000 0.000 0.014 0.001 |

| Consumer Staples | const Cases Deaths LocDm Volm | 1.931 0.509 1.927 −5.607 0.304 | 0.206 0.107 0.000 0.000 0.502 | 6.586 6.436 −4.095 −29.484 0.105 | 0.000 0.000 0.000 0.000 0.730 | 0.214 0.052 −0.037 −0.160 −0.787 | 0.000 0.000 0.054 0.000 0.547 | −7.674 1.024 −6.349 −2.882 1.854 | 0.000 0.012 0.000 0.001 0.232 |

| Energy | const Cases Deaths LocDm Volm | −5.689 0.930 1.744 −2.206 −0.290 | 0.022 0.031 0.000 0.003 0.306 | 1.762 5.584 −5.221 −26.699 0.573 | 0.285 0.000 0.000 0.000 0.003 | −1.149 0.900 −1.210 3.371 −25.364 | 0.436 0.086 0.080 0.002 0.155 | ||

| Financials | const Cases Deaths LocDm Volm | 1.780 1.298 1.634 −8.615 −0.225 | 0.262 0.000 0.000 0.000 0.000 | 2.139 3.384 −2.605 −15.348 0.043 | 0.157 0.000 0.000 0.000 0.168 | −0.041 −0.082 0.001 0.236 −0.517 | 0.282 0.000 0.937 0.000 0.001 | −6.305 0.760 −1.942 0.988 −0.010 | 0.000 0.057 0.000 0.225 0.610 |

| Health Care | const Cases Deaths LocDm Volm | 2.597 2.300 1.354 −5.269 0.606 | 0.132 0.000 0.000 0.000 0.093 | 31.874 2.694 −0.925 −18.069 −0.071 | 0.000 0.000 0.242 0.000 0.719 | ||||

| ICT | const Cases Deaths LocDm Volm | 11.370 0.914 0.819 −10.412 −0.678 | 0.000 0.024 0.059 0.000 0.168 | −3.242 0.925 0.649 −7.640 0.155 | 0.007 0.015 0.172 0.000 0.340 | 0.255 0.065 −0.008 −0.342 −0.847 | 0.000 0.000 0.661 0.000 0.026 | 5.367 −3.663 14.805 1.480 −12400.5 | 0.099 0.002 0.000 0.525 0.478 |

| Industrials | const Cases Deaths LocDm Volm | −1.360 1.033 2.689 −10.417 −0.052 | 0.420 0.004 0.000 0.000 0.925 | 4.870 −0.222 −1.271 −7.979 0.122 | 0.000 0.433 0.001 0.000 0.183 | −0.143 −0.162 −0.088 0.645 0.020 | 0.132 0.000 0.028 0.000 0.866 | 6.160 −1.504 −6.985 −1.296 31.991 | 0.001 0.021 0.000 0.330 0.525 |

| Materials | const Cases Deaths LocDm Volm | −0.185 −0.820 2.855 −6.045 0.577 | 0.916 0.025 0.000 0.000 0.499 | 1.835 4.557 −5.494 −13.215 0.010 | 0.068 0.000 0.000 0.000 0.853 | −0.225 −0.143 −0.011 0.506 −0.162 | 0.018 0.000 0.791 0.000 0.776 | −3.688 −0.004 0.313 0.314 232.645 | 0.000 0.967 0.006 0.067 0.209 |

| Real Estate | const Cases Deaths LocDm Volm | 1.127 0.031 0.866 −0.042 0.258 | 0.228 0.875 0.000 0.898 0.071 | 0.053 −0.097 −0.218 0.482 −0.236 | 0.691 0.021 0.000 0.000 0.284 | ||||

| Utilities | const Cases Deaths LocDm Volm | 6.810 −4.395 −9.943 −4.710 −0.188 | 0.073 0.001 0.000 0.088 0.097 | ||||||

| RandomEffects Estimation Summary | ||||||

|---|---|---|---|---|---|---|

| Dep. Variable: | CARet | R-squared: | 0.4055 | |||

| Estimator: | RandomEffects | R-squared (Between): | 0.1111 | |||

| No. Observations: | 1057 | R-squared (Within): | 0.4075 | |||

| Date: | Tue, Nov 29 2022 | R-squared (Overall): | 0.2398 | |||

| Time: | 11:07:53 | Log-likelihood | −722.60 | |||

| Cov. Estimator: | Clustered | |||||

| F-statistic: | 179.35 | |||||

| Entities: | 7 | p-value | 0.0000 | |||

| Avg Obs: | 151.00 | Distribution: | F(4,1052) | |||

| Min Obs: | 151.00 | |||||

| Max Obs: | 151.00 | F-statistic (robust): | 5.8333 | |||

| p-value | 0.0001 | |||||

| Time periods: | 151 | Distribution: | F(4,1052) | |||

| Avg Obs: | 7.0000 | |||||

| Mix Obs: | 7.0000 | |||||

| Max Obs: | 7.0000 | |||||

| Parameter Estimates | ||||||

| Parameter | Coeff | Std. Err. | T-stat | p-value | Lower CI | Upper CI |

| const | −0.1227 | 0.0645 | −1.9025 | 0.0574 | −0.2493 | 0.0039 |

| log_cumCases | −0.0179 | 0.0549 | −0.3257 | 0.7447 | −0.1255 | 0.0898 |

| log_cumDeaths | −0.1284 | 0.0753 | −1.7054 | 0.0884 | −0.2762 | 0.0193 |

| LockDm | 0.2105 | 0.1465 | 1.4375 | 0.1509 | −0.0769 | 0.4980 |

| scVolume | −0.0202 | 0.1056 | −0.1912 | 0.8484 | −0.2273 | 0.1869 |

| RandomEffects Estimation Summary | ||||||

|---|---|---|---|---|---|---|

| Dep. Variable: | CARet | R-squared: | 0.5419 | |||

| Estimator: | RandomEffects | R-squared (Between): | −0.0052 | |||

| No. Observations: | 1208 | R-squared (Within): | 0.5425 | |||

| Date: | Tue, Nov 29 2022 | R-squared (Overall): | 0.2014 | |||

| Time: | 11:01:15 | Log-likelihood | −4103.3 | |||

| Cov. Estimator: | Clustered | |||||

| F-statistic: | 355.76 | |||||

| Entities: | 8 | p-value | 0.0000 | |||

| Avg Obs: | 151.00 | Distribution: | F(4,1203) | |||

| Min Obs: | 151.00 | |||||

| Max Obs: | 151.00 | F-statistic (robust): | 11.536 | |||

| p-value | 0.0000 | |||||

| Time periods: | 151 | Distribution: | F(4,1203) | |||

| Avg Obs: | 8.0000 | |||||

| Mix Obs: | 8.0000 | |||||

| Max Obs: | 8.0000 | |||||

| Parameter Estimates | ||||||

| Parameter | Coeff | Std. Err. | T-stat | p-value | Lower CI | Upper CI |

| const | 7.7462 | 3.6049 | 2.1488 | 0.0318 | 0.6737 | 14.819 |

| log_cumCases | 3.4648 | 0.7621 | 4.5464 | 0.0000 | 1.9696 | 4.9600 |

| log_cumDeaths | −3.0563 | 0.8051 | −3.7963 | 0.0002 | −4.6358 | −1.4768 |

| scVolume | 0.0520 | 0.0535 | 0.9729 | 0.3308 | −0.0529 | 0.1569 |

| LockDm | −15.286 | 3.0048 | −5.0871 | 0.0000 | −21.181 | −9.3905 |

| RandomEffects Estimation Summary | ||||||

|---|---|---|---|---|---|---|

| Dep. Variable: | AR | R-squared: | 0.0025 | |||

| Estimator: | RandomEffects | R-squared (Between): | −0.0013 | |||

| No. Observations: | 808 | R-squared (Within): | 0.0025 | |||

| Date: | Tue, Nov 29 2022 | R-squared (Overall): | 0.0024 | |||

| Time: | 11:21:41 | Log-likelihood | −1613.3 | |||

| Cov. Estimator: | Clustered | |||||

| F-statistic: | 0.4983 | |||||

| Entities: | 8 | P-value | 0.7370 | |||

| Avg Obs: | 101.00 | Distribution: | F(4,803) | |||

| Min Obs: | 101.00 | |||||

| Max Obs: | 101.00 | F-statistic (robust): | 1.1918 | |||

| p-value | 0.3129 | |||||

| Time periods: | 101 | Distribution: | F(4,803) | |||

| Avg Obs: | 8.0000 | |||||

| Mix Obs: | 8.0000 | |||||

| Max Obs: | 8.0000 | |||||

| Parameter Estimates | ||||||

| Parameter | Coeff | Std. Err. | T-stat | p-value | Lower CI | Upper CI |

| const | −0.1784 | 0.1033 | −1.7273 | 0.0845 | −0.3811 | 0.0243 |

| log_Cases | −0.0301 | 0.0186 | −1.6210 | 0.1054 | −0.0665 | 0.0063 |

| log_Deaths | 0.1403 | 0.1698 | 0.8259 | 0.4091 | −0.1931 | 0.4736 |

| LockDm | 0.0919 | 0.2236 | 0.4111 | 0.6811 | −0.3470 | 0.5308 |

| scVolume | 0.0014 | 0.0021 | 0.6810 | 0.4960 | −0.0027 | 0.0056 |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2023 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Ncube, M.; Sibanda, M.; Matenda, F.R. COVID-19 Pandemic and Stock Performance: Evidence from the Sub-Saharan African Stock Markets. Economies 2023, 11, 95. https://doi.org/10.3390/economies11030095

Ncube M, Sibanda M, Matenda FR. COVID-19 Pandemic and Stock Performance: Evidence from the Sub-Saharan African Stock Markets. Economies. 2023; 11(3):95. https://doi.org/10.3390/economies11030095

Chicago/Turabian StyleNcube, Mbongiseni, Mabutho Sibanda, and Frank Ranganai Matenda. 2023. "COVID-19 Pandemic and Stock Performance: Evidence from the Sub-Saharan African Stock Markets" Economies 11, no. 3: 95. https://doi.org/10.3390/economies11030095

APA StyleNcube, M., Sibanda, M., & Matenda, F. R. (2023). COVID-19 Pandemic and Stock Performance: Evidence from the Sub-Saharan African Stock Markets. Economies, 11(3), 95. https://doi.org/10.3390/economies11030095