A Comparative Analysis of the Determinants of Foreign Direct Investment: The Case of Top Ten Recipients of Foreign Direct Investment in Africa

Abstract

1. Introduction

Theoretical Framework

2. Materials and Methods

Econometric Method

3. Results and Discussion

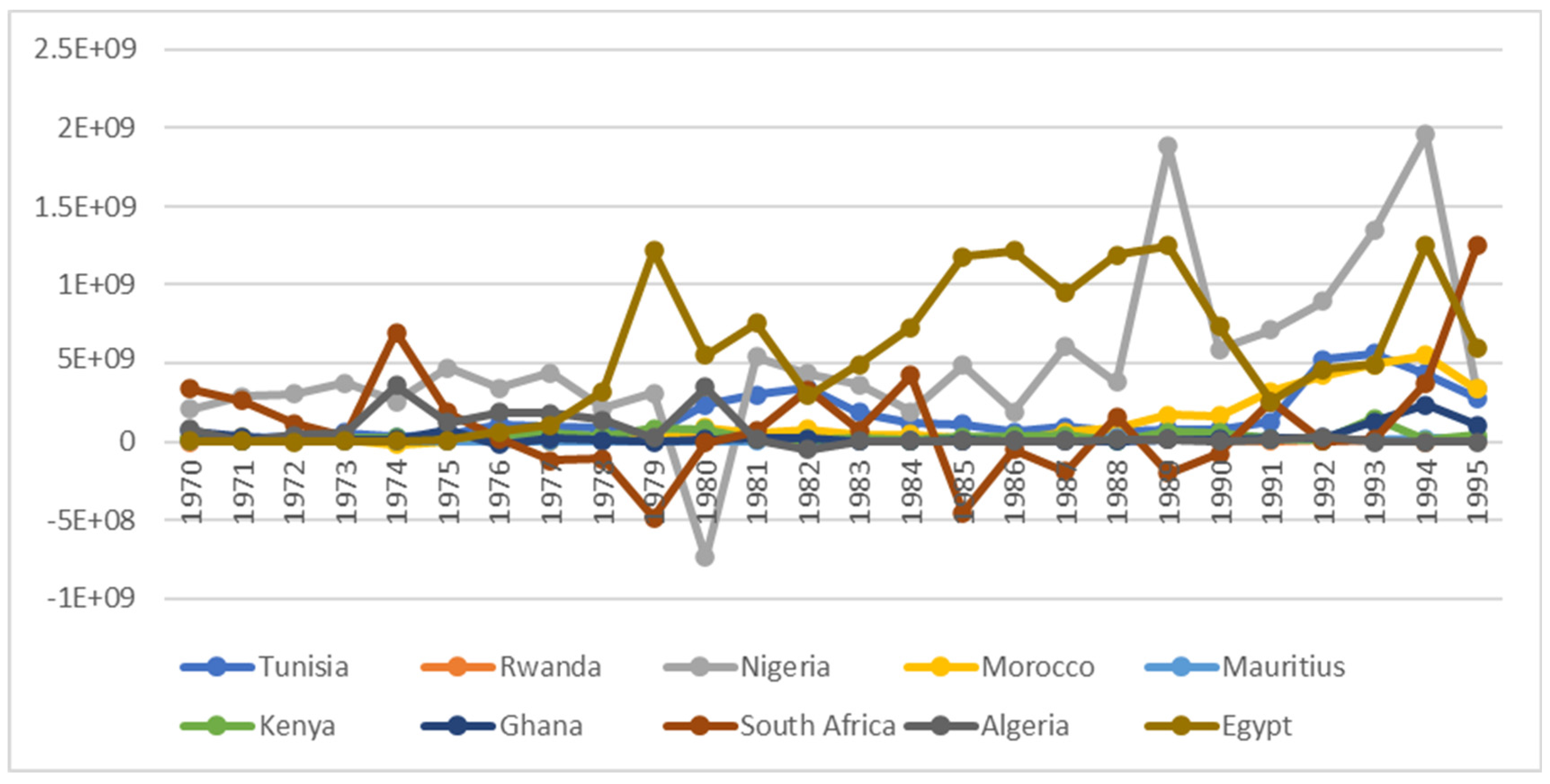

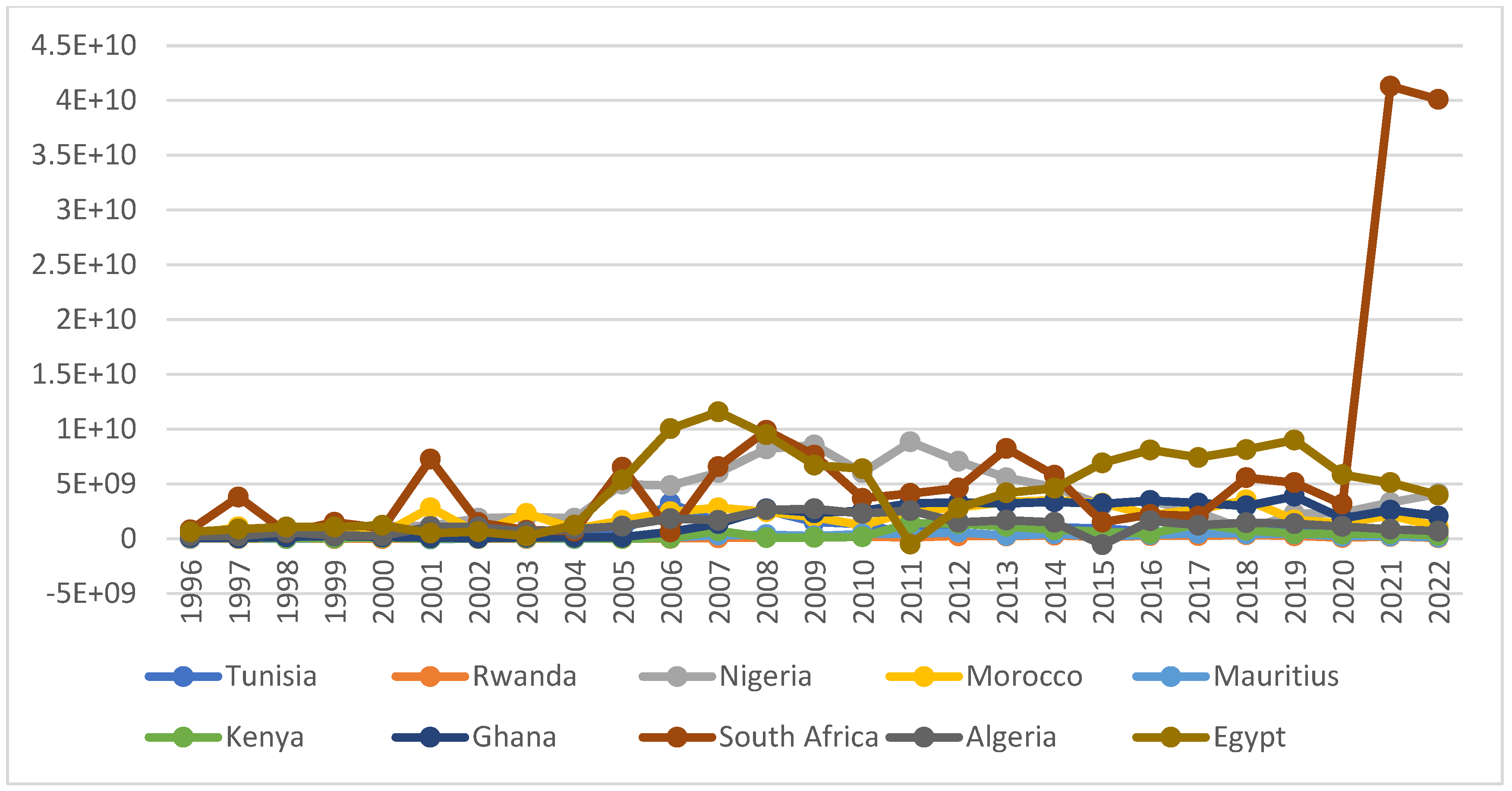

3.1. Descriptive Statistics

3.2. Stationarity Test

3.3. ARDL Bounds Test

3.4. ARDL Short-Run and Long-Run Estimates

4. Conclusions

Recommendations

- Resolving macroeconomic imbalances and fostering an environment that allows the private sector to fill in for current infrastructural gaps and spur output growth are advised for these countries’ governments.

- Governments should actively seek out and direct capital inflows into industries that genuinely boost output and employment at the national level, while minimizing inflows into the most quickly recouping investments, particularly the extractive industries, which are frequently enclave-like in nature.

- To encourage more effective government operations, it is crucial to boost institutional development above everything else. The governance quality should be improved as a strategy to remove structural barriers to the activity of the private sector, particularly the adoption of a framework of investor-friendly policies customized to the local conditions in each nation.

Author Contributions

Funding

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

References

- Abimbola, Laleye Nicaise, and Akinleye Simeon Oludiran. 2018. Major Determinants of Foreign Direct Investment in the West African Economic and Monetary Region. Iranian Economic Review 22: 121–62. [Google Scholar]

- Adebayo, Tomiwa Sunday. 2020. New Insights into export-growth nexus: Wavelet and causality approaches. Asian Journal of Economics, Business and Accounting 2: 32–44. [Google Scholar] [CrossRef]

- Adelakun, Johnson. 2011. Human Capital Development and Economic Growth in Nigeria. Journal of Economics Sustainable Development 2: 8–21. [Google Scholar]

- Adeyeye, P. O., B. O. Akinuli, and S. O. Ayodele. 2016. The Nexus between Security Expenditure and Foreign Direct Investment in Nigeria. IOSR Journal of Business and Management (IOSR-JBM) 18: 83–89. [Google Scholar]

- Ajide, Kazeem Bello, and Ridwan Lanre Ibrahim. 2022. Bayesian model averaging approach of the determinants of foreign direct investment in Africa. International Economics 172: 91–105. [Google Scholar] [CrossRef]

- Al-matari, Ebrahim Mohammed, Mahfoudh Hussein Mgamma, Nabil Ahmed M. Senan, and Adeeb Abdulwaha Alhebri. 2021. Determinants of Foreign Direct Investment in GCC Countries: An Empirical Analysis. Journal of Asian Finance, Economics and Business 8: 69–81. [Google Scholar]

- Anyanwu, John. 2011. Determinants of Foreign Direct Investment inflows to Africa, 1980–2007. Working Paper Series No. 136; Tunis: African Development Bank. [Google Scholar]

- Asiedu, Elizabeth. 2002. On the Determinants of Foreign Direct Investment to Developing Countries: Is Africa Different? World Development 30: 107–19. [Google Scholar] [CrossRef]

- Asiedu, Elizabeth. 2006. Foreign Direct Investment in Africa: Role of Government Policy, Institutions and Political Instability. World Economy 29: 63–77. [Google Scholar] [CrossRef]

- Beton, Demet, and Tomiwa Sunday Adebayo. 2020. Ongoing debate between foreign aid and economic growth in Nigeria: A wavelet analysis. Social Science Quarterly 8: 28–39. [Google Scholar]

- Busse, Matthias, and Jose Groizard. 2008. Foreign direct investment, regulations, and growth. The World Economy 31: 861–86. [Google Scholar] [CrossRef]

- Collier, Paul, Neil Gregory, and Alexandros Ragoussis. 2019. Pioneering Firms in Fragile and Conflict-Affected States: Why and How Development Finance Institutions Should Support Them. Washington, DC: World Bank. [Google Scholar]

- Djokoto, Justice, and Camillus Wongnaa. 2023. Does the level of development distinguish the impacts of foreign direct investment on the stages of human development? Sustainable Futures 5: 100111. [Google Scholar] [CrossRef]

- Dondashe, Nandipha, and Andrew Phiri. 2018. Determinants of FDI in South Africa: Do Macroeconomic Variables Matter? Munich Personal RePEc Archive, MPRA Paper No. 83636. Available online: https://mpra.ub.uni-muenchen.de/83636/ (accessed on 10 March 2021).

- Dunning, John. 1998. Location and the Multinational Enterprise: A Neglected Factor? Journal of International Business Studies 29: 45–66. [Google Scholar] [CrossRef]

- Ebire, Kolawole, Lucky Onmonya, and Ekemini Inim. 2018. Effects of the Determinants of Foreign Direct Investment in Nigeria: Error Correction Mechanism. Asian Journal of Economics and Empirical Research 5: 155–64. [Google Scholar] [CrossRef]

- Eminer, Fehiman, Tomiwa Adebayo, and Abraham Awosusi. 2020. Stock market-growth relationship in an emerging economy: Empirical finding from ardl-based bounds and causality approaches. Journal of Economics and Business 3: 903–16. [Google Scholar]

- Engle, Robert, and Clive Granger. 1987. Co-integration and error correction: Representation, estimation, and testing. Econometrica 55: 251–76. [Google Scholar] [CrossRef]

- Fon, Roger, Fragkiskos Filippaios, Carmen Stoian, and Soo Lee. 2021. Does foreign direct investment promote institutional development in Africa? International Business Review 30: 101835. [Google Scholar] [CrossRef]

- Gupta, Surbha, Surendra Yadav, and P. K. Jain. 2023. Does institutional quality matter for foreign direct investment flows? Empirical evidence from BRICS economies. International Journal of Emerging Markets. [Google Scholar] [CrossRef]

- Jadhav, Pravin. 2012. Determinants of Foreign Direct Investments in BRICS Economies: Analysis of Economic Institutional and Political Factors. Procedia-Social and Behavioral Sciences 37: 5–14. [Google Scholar] [CrossRef]

- Jadhav, Pravin, and Vijaya Katti. 2012. Institutional and Political Determinants of Foreign Direct Investment: Evidence from BRICS Economies. Poverty & Public Policy 4: 49–57. [Google Scholar]

- Jaiblai, Prince, and Vijay Shenai. 2019. The Determinants of FDI in Sub-Saharan Economies: A Study of Data from 1990–2017. International Journal of Financial Studies 7: 43. [Google Scholar] [CrossRef]

- Julio, Brandon, and Youngsuk Yook. 2016. Policy Uncertainty, Irreversibility, and Cross-Border Flows of Capital. Journal of International Economics 103: 13–26. [Google Scholar]

- Kaliappan, Shivee, Khamisb Khamis, and Normaz W. Ismail. 2015. Determinants of services FDI inflows in ASEAN countries. International Journal of Economics and Management 9: 45–69. [Google Scholar]

- Kalmaz, Demet, and Dervis Kirikkaleli. 2019. Modeling CO2 emissions in an emerging market: Empirical finding from ARDL-based bounds and wavelet coherence approaches. Environmental Science and Pollution Research 26: 5210–20. [Google Scholar] [CrossRef] [PubMed]

- Keeley, Alexandra, and Yuichi Ikeda. 2017. Determinants of foreign direct investment in wind energy in developing countries. Journal of Cleaner Production 161: 1451–58. [Google Scholar] [CrossRef]

- Kumari, Reenu, and Anil Sharma. 2017. Determinants of foreign direct investment in developing countries: A panel data study. International Journal of Emerging Markets 12: 658–82. [Google Scholar] [CrossRef]

- Larnyoh, M. T. 2021. Here Are the Top 10 African Countries with Highest FDI. Available online: https://africa.businessinsider.com/local/markets/here-are-the-top-10-african-countries-with-highest-fdi/7264vlz (accessed on 10 April 2023).

- Loungani, Prakash, and Assaf Razin. 2001. How Beneficial is Foreign Direct Investment for Developing Countries? Finance and Development 38: 1–6. [Google Scholar]

- Meressa, Hayelom. 2022. Determinants of foreign direct investment inflows to COMESA member countries: An integration of institutional and socio-economic factors. Journal of Innovation and Entrepreneurship 11: 68. [Google Scholar] [CrossRef]

- Mohammed, Badamasi. 2022. Determinants of Foreign Direct Investment in Sub-Saharan African Countries. International Journal of Business and Applied Economics 1: 1–12. [Google Scholar] [CrossRef]

- Morgan, Stephen, Jarrad Farris, and Michael Johnson. 2022. Foreign Direct Investment in Africa: Recent Trends Leading up to the African Continental Free Trade Area (AfCFTA), Number EIB-242; Washington, DC: U.S. Department of Agriculture, Economic Research Service.

- Njuguna, Angelica. 2008. Macroeconomic policies for promoting growth in Africa. Paper presented at the Ad-hoc Expert Group Meeting on Macroeconomic Policy, Productive Capacity, and Growth in Africa, Addis Ababa, Ethiopia, November 24–25; pp. 24–5. [Google Scholar]

- Njuguna, Angelica E., and Emmanuel Nnadozie. 2022. Investment Climate and Foreign Direct Investment in Africa: The Role of Ease of Doing Business. Journal of African Trade 9: 4. [Google Scholar] [CrossRef]

- Nourzad, Farrokh, David N. Greenwold, and Rui Yang. 2014. The interaction between FDI and infrastructure capital in the development process. International Advances in Economic Research 20: 203–12. [Google Scholar] [CrossRef][Green Version]

- Okara, Assi. 2023. Does foreign direct investment promote political stability? Evidence from developing economies. Economic Modelling 123: 106249. [Google Scholar] [CrossRef]

- Onyeiwu, Steve. 2004. Determinants of Foreign Direct Investment in Africa. Journal of Developing Societies 20: 89–106. [Google Scholar] [CrossRef]

- Opuala-Charles, Silva, and Ijeoma Victoria Oshilike. 2023. Impact of Ease of Doing Business on Foreign Direct Investment in Nigeria. Journal of Economics & Management Research 174: 2–9. [Google Scholar] [CrossRef]

- Pesaran, M. Hashem, Yongcheol Shin, and Richard J. Smith. 2001. Bounds testing approaches to the analysis of level relationships. Journal of Applied Econometrics 16: 289–326. [Google Scholar] [CrossRef]

- Sane, Malick. 2016. Determinants of Foreign Direct Investment Inflows to ECOWAS Member Countries: Panel Data Modelling and Estimation. Modern Economy 7: 1517–42. [Google Scholar] [CrossRef]

- Seetanah, Boopen, and Jameel Khadaroo. 2009. The role of transport infrastructure in attracting FDI in Africa. Paper presented at the African Economic Conference 2007, Addis Ababa, Ethiopia, November 15–17; pp. 357–70. [Google Scholar]

- Serven, Luis, and Andres Solimano. 1992. Private Investment and Macroeconomic Adjustment: A survey. World Bank Research Observer 7: 95–114. [Google Scholar] [CrossRef]

- Shaari, Mohd, Abdul Ridzuan, Miguel Angel, and Lilik Surgihartiand Nor Zainal. 2020. The impact of corruption on FDI: New evidence from ASEAN-5+3 countries. Paper presented at the 22nd Malaysia Finance Association Conference 2020 Malaysia Finance Association, Virtual, November 17–19. [Google Scholar]

- Suleman, Najat, Shivee Kaliappan, and Normaz Ismail. 2015. Determinants of Foreign Direct Investment: Empirical Evidence from Southern Africa Customs Union (SACU) Countries. International Journal of Economics and Management 9: 1–24. [Google Scholar]

- Tan, Man, Dengyu Yang, and Qijing Yang. 2023. Institutional quality, asset specificity, and foreign direct investment. Journal of International Money and Finance 134: 102845. [Google Scholar] [CrossRef]

- Türedi, Salih. 2018. The effect of corruption and country risk on FDI inflows: Empirical evidence from developing countries. Uluslararası İktisadi ve İdari İncelemeler Dergisi 151–72. [Google Scholar] [CrossRef]

- Vijayakumar, Narayanamurthy, Perumal Sridharan, and Kode Rao. 2010. Determinants of FDI in BRICS Countries: A Panel Analysis. International Journal of Business Science and Applied Management 5: 1–13. [Google Scholar]

- Vinesh, Sannassee Raja, Seetanah Boopendra, and Diksha Hemraze. 2014. Determinants of foreign direct investment in SADC: An empirical analysis. The Business & Management Review 4: 4. [Google Scholar]

- World Bank. 2023. Africa Overview: Development News, Research, Data. Available online: https://www.worldbank.org/en/region/afr/overview (accessed on 11 April 2023).

- World Investment Report. 2022. United Nations Conference on Trade and Development (UNCTAD) World Investment Report (WIR). New York: United Nations. ISBN 9789210015431. [Google Scholar] [CrossRef]

- Youssouf, Nvuh Njoya. 2017. Robust FDI Determinants in Sub-Saharan African Countries. Applied Economics and Finance 4: 21–30. [Google Scholar] [CrossRef]

| Country | FDI (USD Million) | GDS (USD Million) | EPC (kWh per Capita) | GDP (USD Million) | GFCF (USD Million) | CPI (%) | OEXR (N:USD) | GOV (Index) | ||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Mean | SD | Mean | SD | Mean | SD | Mean | SD | Mean | SD | Mean | SD | Mean | SD | Mean | SD | |

| Tunisia | 561.03 | 1.13 | 3863.97 | 0.69 | 839.84 | 0.57 | 26,007.14 | 0.54 | 5228.34 | 0.53 | 6.33 | 0.48 | 1.19 | 0.59 | 0.58 | 0.81 |

| Rwanda | 66.19 | 1.53 | 252.26 | 1.29 | 11.32 | 1.16 | 4188.44 | 0.75 | 731.17 | 1.23 | 7.74 | 0.84 | 364.98 | 0.82 | −1.28 | −0.81 |

| Nigeria | 2110.44 | 1.14 | 125,374.30 | 1.08 | 93.18 | 0.37 | 246,007.70 | 0.58 | 96,152.23 | 0.80 | 18.16 | 0.84 | 90.24 | 1.24 | −0.99 | −0.08 |

| Morocco | 1046.98 | 1.12 | 11,659.67 | 0.82 | 519.77 | 0.57 | 54,104.11 | 0.64 | 14,179.18 | 0.71 | 4.37 | 0.91 | 7.93 | 0.26 | −0.13 | −0.70 |

| Mauritius | 126.92 | 1.36 | 868.70 | 0.68 | 1157.89 | 0.72 | 6315.07 | 0.61 | 1311.04 | 0.56 | 7.49 | 0.93 | 21.03 | 0.54 | 0.36 | 1.28 |

| Kenya | 230.68 | 1.65 | 3249.98 | 1.16 | 131.18 | 0.26 | 39,740.95 | 0.57 | 6662.35 | 0.80 | 11.31 | 0.70 | 51.38 | 0.71 | −0.68 | −0.28 |

| Ghana | 911.91 | 1.46 | 2707.55 | 1.81 | 319.49 | 0.24 | 24,851.10 | 0.72 | 17,021.32 | 0.13 | 28.35 | 0.96 | 1.12 | 1.58 | −0.10 | −0.91 |

| South Africa | 3450.92 | 2.29 | 37,810.81 | 0.62 | 3791.80 | 0.18 | 227,549.80 | 0.35 | 35,686.40 | 0.43 | 8.73 | 0.50 | 5.66 | 0.85 | 0.78 | 0.65 |

| Algeria | 672.91 | 1.18 | 2,554,484.00 | 1.19 | 759.06 | 0.66 | 100,378.30 | 0.44 | 36,531.06 | 0.53 | 8.54 | 0.87 | 48.38 | 0.89 | −0.84 | −0.36 |

| Egypt | 2601.30 | 1.24 | 11,053.34 | 0.77 | 899.37 | 0.56 | 177,955.70 | 0.67 | 25,150.53 | 0.75 | 10.71 | 0.58 | 4.58 | 1.07 | −0.31 | −0.53 |

| Country | Panel A: ADF Unit Root Test | dmax | |||||||

|---|---|---|---|---|---|---|---|---|---|

| FDI | GDS | EPC | GDP | GFCF | CPI | OEXR | GOV | ||

| Tunisia | <0.01 ** | <0.01 ** | <0.01 * | <0.01 * | <0.01 ** | <0.01 ** | <0.01 ** | <0.01 ** | I(1) |

| Rwanda | <0.01 ** | <0.01 ** | <0.01 ** | <0.01 ** | <0.01 ** | <0.01 * | <0.01 ** | <0.01 ** | I(1) |

| Nigeria | <0.01 ** | <0.01 ** | <0.01 ** | <0.01 ** | >0.05 * | <0.01 * | <0.1 ** | >0.01 * | I(1) |

| Morocco | <0.01 ** | <0.01 * | <0.01 * | <0.01 ** | <0.01 ** | <0.01 ** | <0.01 ** | <0.01 ** | I(1) |

| Mauritius | <0.01 ** | <0.01 * | <0.01 ** | <0.01 ** | <0.01 ** | <0.01 * | <0.01 ** | <0.01 ** | I(1) |

| Kenya | >0.01 ** | >0.01 ** | >0.01 ** | >0.01 ** | >0.01 ** | >0.01 * | <0.01 ** | <0.01 ** | I(1) |

| Ghana | >0.01 ** | >0.01 ** | >0.01 * | >0.01 ** | <0.01 ** | >0.01 * | >0.01 ** | >0.01 * | I(1) |

| South Africa | >0.05 * | <0.01 ** | >0.05 * | <0.01 ** | >0.01 ** | <0.01 ** | <0.01 ** | <0.01 ** | I(1) |

| Algeria | >0.05 * | <0.01 ** | <0.01 ** | >0.01 * | <0.01 ** | >0.01 * | >0.01 ** | <0.01 ** | I(1) |

| Egypt | <0.01 ** | <0.01 ** | >0.01 * | <0.05 * | <0.01 ** | <0.01 ** | >0.01 ** | <0.01 ** | I(1) |

| Country | Panel B: DF-GLS Unit Root Test | ||||||||

| Tunisia | <0.01 ** | <0.01 * | >0.01 ** | >0.01 ** | <0.01 ** | <0.01 ** | <0.01 ** | <0.01 ** | I(1) |

| Rwanda | <0.01 ** | >0.01 * | <0.01 ** | <0.01 ** | <0.01 ** | >0.01 * | <0.01 ** | >0.01 * | I(1) |

| Nigeria | <0.01 ** | <0.01 ** | <0.01 ** | >0.01 ** | <0.05 ** | >0.01 * | <0.01 ** | >0.01 * | I(1) |

| Morocco | <0.01 ** | >0.01 ** | >0.01 ** | <0.01 ** | <0.01 ** | <0.01 ** | <0.01 ** | >0.05 * | I(1) |

| Mauritius | <0.01 ** | <0.01 ** | >0.01 ** | >0.01 ** | >0.01 ** | >0.01 * | <0.01 ** | <0.01 ** | I(1) |

| Kenya | <0.01 ** | >0.01 ** | <0.01 ** | >0.05 ** | <0.01 ** | >0.01 * | <0.01 ** | <0.01 ** | I(1) |

| Ghana | <0.01 ** | <0.01 ** | >0.01 ** | <0.01 ** | <0.01 ** | <0.01 * | >0.01 ** | >0.01 * | I(1) |

| South Africa | >0.01 * | <0.01 ** | >0.01 ** | <0.01 ** | >0.01 ** | >0.01 * | <0.01 ** | <0.01 ** | I(1) |

| Algeria | >0.01 * | <0.01 ** | <0.01 ** | <0.01 ** | <0.01 ** | >0.01 * | <0.05 ** | <0.01 ** | I(1) |

| Egypt | >0.01 ** | <0.01 ** | <0.01 ** | >0.01 ** | <0.01 ** | >0.01 ** | <0.01 ** | >0.01 * | I(1) |

| Country | F-Statistics | Signif. | Lower Bound I(0) | Upper Bound I(1) |

|---|---|---|---|---|

| Tunisia | 5.339386 | 1% | 2.96 | 4.26 |

| Rwanda | 8.736953 | 1% | 2.73 | 3.90 |

| Nigeria | 4.236122 | 1% | 2.73 | 3.90 |

| Morocco | 6.481428 | 1% | 3.31 | 4.63 |

| Mauritius | 6.929383 | 1% | 2.73 | 3.90 |

| Kenya | 6.623438 | 1% | 2.73 | 3.90 |

| Ghana | 4.370192 | 1% | 2.96 | 4.26 |

| South Africa | 5.128838 | 1% | 2.96 | 4.26 |

| Algeria | 5.864881 | 1% | 2.96 | 4.26 |

| Egypt | 9.061308 | 1% | 2.73 | 3.90 |

| Panel A Short-Run Estimates | ||||||||

| Country | GDS | EPC | GDP | GFCF | CPI | OEXR | GOV | ECM |

| Tunisia | −0.4055 (0.1994) | −0.2708 (0.6967) | 3.7376 (0.0104) * | 0.5341 (0.4133) | −0.5196 (0.0731) * | −1.2789 (0.0620) * | 1.5635 (0.0227) * | −0.8482 (0.0000) * |

| Rwanda | −0.2683 (0.1026) | 0.9160 (0.0033) * | −1.8800 (0.1398) | 2.1709 (0.0005) * | 0.3285 (0.0531) * | −2.4901 (0.0000) * | 1.9906 (0.0072) * | −0.9583 (0.0000) * |

| Nigeria | 0.8060 (0.0030) * | 1.7369 (0.0096) * | −1.6274 (0.0154) * | −0.1251 (0.7820) | 0.0760 (0.5232) | 0.4257 (0.0003) * | −0.8137 (0.5332) | −0.7158 (0.0000) * |

| Morocco | 4.0634 (0.0076) * | 2.6566 (0.5551) | −3.8926 (0.1561) | −0.1098 (0.9174) | −0.7274 (0.0689) * | −2.9599 (0.0406) * | 5.2205 (0.0507) * | −0.9980 (0.0000) * |

| Mauritius | −0.0039 (0.9912) | −5.7859 (0.0001) * | 2.1974 (0.3153) | 5.2813 (0.0001) * | 0.1233 (0.3887) | 1.9035 (0.0110) * | 2.4432 (0.0559) * | −0.9199 (0.0000) * |

| Kenya | 1.0570 (0.1280) | −9.0323 (0.0610) * | 2.3020 (0.4563) | 0.7808 (0.2733) | 0.5918 (0.1903) | −0.0959 (0.9133) | 6.8251 (0.0327) * | −0.4472 (0.0000) * |

| Ghana | 0.1170 (0.4121) | 0.4088 (0.2385) | 3.1298 (0.0004) * | −0.1505 (0.8899) | −0.0044 (0.2605) | −0.5624 (0.0012) * | 1.3029 (0.2663) | −0.5455 (0.0000) * |

| South Africa | 5.7453 (0.0152) * | −3.7756 (0.2153) | 2.5128 (0.7549) | −5.9752 (0.0326) * | −0.2925 (0.0205) * | 0.2269 (0.3234) | 5.3829 (0.1436) | −0.7213 (0.0000) * |

| Algeria | −3.1075 (0.0582) * | −20.879 (0.0007) * | 51.1164 (0.0005) * | 0.6359 (0.7746) | −0.0537 (0.9245) | 3.2924 (0.0143) * | −14.677 (0.0010) * | −0.7074 (0.0000) * |

| Egypt | −1.7598 (0.0882) | 18.3110 (0.0006) * | −16.9375 (0.0008) * | 2.0952 (0.0001) * | −0.0342 (0.2117) | 0.2884 (0.0329) * | −1.6093 (0.2327) | −0.8298 (0.0000) * |

| Panel B Long-Run Estimates | ||||||||

| Tunisia | −0.4780 (0.2013) | −0.3193 (0.6970) | 4.4065 (0.0098) * | 0.6296 (0.3976) | −0.6125 (0.0683) * | −1.5078 (0.0637) * | 1.8433 (0.0169) * | |

| Rwanda | −0.2799 (0.1212) | 0.9559 (0.0057) * | −1.9619 (0.1694) | 2.2655 (0.0009) * | 0.3428 (0.0520) * | −2.5985 (0.0000) * | 2.0772 (0.0128) * | |

| Nigeria | 1.1260 (0.0026) * | 2.4266 (0.0068) * | −2.2735 (0.0209) * | −0.1747 (0.7819) | 0.1061 (0.5210) | 0.5946 (0.0003) * | −1.1368 (0.5324) | |

| Morocco | 4.0713 (0.0067) * | 2.6618 (0.5541) | −3.9002 (0.1471) | −0.1101 (0.9174) | −0.7288 (0.0725) * | −2.9657 (0.0378) * | 5.2307 0.0478) * | |

| Mauritius | −0.0043 (0.9912) | −6.2893 (0.0000) * | 2.3886 (0.2944) | 5.7408 (0.0001) * | 0.1341 (0.3877) | 2.0691 (0.0141) * | 2.6558 (0.0671) * | |

| Kenya | 0.9214 (0.1218) | −7.8732 (0.0576) * | 2.0066 (0.4537) | 0.6806 (0.2699) | 0.5159 (0.1880) | −0.0837 (0.9132) | 5.9493 (0.0272) * | |

| Ghana | 0.2145 (0.4226) | 0.7494 (0.2279) | 5.7372 (0.0000) * | −0.2758 (0.8900) | −0.0080 (0.3015) | −1.0309 (0.0008) * | 2.3885 (0.2604) | |

| South Africa | 7.9652 (0.0502) * | −5.2345 (0.2607) | 3.4837 (0.7558) | −8.2839 (0.0781) * | −0.4055 (0.0325) * | 0.3146 (0.3332) | 7.4628 (0.1844) | |

| Algeria | −4.3926 (0.0641) * | −29.5147 (0.0024) * | 72.2562 (0.0020) * | 0.8989 (0.7719) | −0.0759 (0.9241) | 4.6540 (0.0203) * | −20.7476 (0.0059) * | |

| Egypt | −2.1207 (0.0950) * | 22.0665 (0.0013) * | −20.4113 (0.0018) * | 2.5249 (0.0000) * | −0.0412 (0.2392) | 0.3476 (0.0432) * | −1.9394 (0.2479) | |

| Linearity Test | Autocorrelation Test | Heteroscedasticity Test | |

|---|---|---|---|

| Ramsey RESET | Arch Test | Breusch–Pagan–Godfrey | |

| Tunisia | 0.103288 (0.7496) | 0.061485 (0.8052) | 2.254619 (0.1184) |

| Rwanda | 0.141208 (0.7096) | 1.915811 (0.1729) | 0.225503 (0.7994) |

| Nigeria | 2.785011(0.0734) | 0.005294 (0.9423) | 1.159702 (0.3237) |

| Morocco | 7.091459 (0.0012) | 0.159733 (0.6912) | 1.979679 (0.1570) |

| Mauritius | 0.052524 (0.7733) | 1.425341 (0.2386) | 0.57056(0.5712) |

| Kenya | 8.366309 (0.0064) | 0.000471 (0.9828) | 1.788986 (0.1821) |

| Ghana | 0.008886 (0.9254) | 0.206341 (0.6517) | 0.451776 (0.6397) |

| South Africa | 0.51077 (0.4805) | 0.396977 (0.5317) | 2.065398 (0.1457) |

| Algeria | 31.89554 (0.0000) | 2.029547 (0.1609) | 0.699147 (0.5044) |

| Egypt | 0.579195 (0.4532) | 1.054388 (0.3098) | 0.061359 (0.9406) |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2023 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Adelakun, J.; Ogujiuba, K. A Comparative Analysis of the Determinants of Foreign Direct Investment: The Case of Top Ten Recipients of Foreign Direct Investment in Africa. Economies 2023, 11, 244. https://doi.org/10.3390/economies11100244

Adelakun J, Ogujiuba K. A Comparative Analysis of the Determinants of Foreign Direct Investment: The Case of Top Ten Recipients of Foreign Direct Investment in Africa. Economies. 2023; 11(10):244. https://doi.org/10.3390/economies11100244

Chicago/Turabian StyleAdelakun, Johnson, and Kanayo Ogujiuba. 2023. "A Comparative Analysis of the Determinants of Foreign Direct Investment: The Case of Top Ten Recipients of Foreign Direct Investment in Africa" Economies 11, no. 10: 244. https://doi.org/10.3390/economies11100244

APA StyleAdelakun, J., & Ogujiuba, K. (2023). A Comparative Analysis of the Determinants of Foreign Direct Investment: The Case of Top Ten Recipients of Foreign Direct Investment in Africa. Economies, 11(10), 244. https://doi.org/10.3390/economies11100244