Abstract

The relationship between India and ASEAN has emerged as a crucial basis of their foreign policy. Both the regions signed a Free Trade Agreement in 2009, which came into effect in 2010. They are now reviewing the FTA to further enhance their economic cooperation. At this critical juncture, this study aimed to analyze the trade and export relationship between India and ASEAN and examine the extent to which the AIFTA effectively influenced it. Additionally, the study intended to determine what other factors influenced the trade and export relationship between the two regions and what future changes are needed in order to make this partnership mutually beneficial. To fulfill this objective, a gravity model was applied to a panel data from 2000–2019. A random effect model was utilized for the estimation. The empirical analysis concludes that the adoption of the AIFTA increased trade significantly; however, had no significant impact on raising exports. The study has identified rising NTMs as one of the important variables impeding realization of India’s export potential to ASEAN. This study suggests that in order to increase India’s exports and for the future of the FTA, India needs to emphasize on building stronger and extensive relationships with those countries in the ASEAN that are witnessing a higher GDP growth rate, such as Cambodia, Malaysia, the Philippines and Vietnam.

1. Introduction

Given that India and the Association of Southeast Asian Nations (ASEAN)1 have rapidly developing economies, the relationship between them has emerged as a crucial basis of their foreign policy. The rising economy of India and ASEAN countries has provided an impetus for establishing regional economic cooperation, which has emerged since the 1990′s with the ‘Look East Policy,’ of India further upgraded to the ‘Act East Policy’ in 2014. One of the primary channels that India aimed to increase its economic integration with ASEAN was through trade. With this objective, India and ASEAN signed the ASEAN India Free Trade Agreement (AIFTA) in 2009, which came into force in 20102 and agreed to progressively eliminate tariffs on 80 percent of the tariff lines, accounting for 75 percent of the trade (GOI 2020).

Since AIFTA was signed, bilateral trade between these members has been positively impacted. The region has grown into India’s fourth-largest trading partner and accounts for almost 10 percent of India’s global trade (Chapman 2018). However, though increasing, India–ASEAN trade seems to be heavily skewed towards the rise in ASEAN’s exports to India. This accelerated growth in imports has resulted in a significant rise in India’s trade deficit with the region from around US$ 8 billion in 2009–2010 to about US$ 22 billion in 2018–2019. During the same period, the share of ASEAN in India’s total trade deficit rose from about 7 percent to 12 percent (Rai 2019).

India’s incapacity to expand its export to this region has led to heavy scrutiny of the Government’s decision to sign the AIFTA. Additionally, the failure of India to achieve the desired results from FTA’s has led it to be wary about its standings in the Asia Pacific, eventually leading it to not join the Regional Comprehensive Economic Partnership (RCEP)3 in 2019. The Indian government has shown concerns that, by signing the RCEP, its domestic market would be flooded with imports, which a similar rise in exports would not meet. Such concerns from India’s side have led the trade ministers from India and ASEAN to begin negotiations on revising the scope of the AIFTA, which was agreed upon at the sixteenth ASEAN Economic Ministers–India Consultations in September 2019. Through the review of AIFTA, India is lobbying for improved market access under the current FTA (Chakraborty 2020). At this juncture, it becomes crucial to ascertain the trade and economic relationship between India and ASEAN and whether AIFTA can be an effective strategy for India to promote its trade and exports. Consequently, the prime objective of the study is to analyze the impact of AIFTA on India’s goods exports to ASEAN. To fulfill this objective, this study uses an augmented gravity model framework for panel data from 2000 to 2019. The preference of gravity model for the analysis is due to its extensive use in the literature for assessing the economic and welfare impacts of an FTA (Fukao et al. 2003; Roberts 2004; Tang 2005; Bhattacharya and Bhattacharya 2007; Baier and Bergstrand 2009; Kumar and Prabhakar 2017). In terms of theoretical contribution, this study builds on earlier research that almost solely examined the ASEAN-India trade connection study from the FTA perspective. The study’s inclusion of non-tariff measures (NTMs)4 variables is a noteworthy addition. In the contemporary global economy, NTMs have taken on a major position as trade protection instruments and are seen as a crucial element when performing FTA impact assessments (Yotov et al. 2016). By definition NTMs are policies that have a negative impact on trade as a result of their discriminatory and protectionist intent (UNCTAD 2013). Reports have shown that the reduction in countries’ tariffs is paralleled with a considerable increase in NTMs (De et al. 2019). Additionally, statistics from the Economic Research Institute of ASEAN and UNCTAD show that a rising number of NTMs is frequently seen as a key barrier to nations’ ability to gain from regional integration with ASEAN. A gravity study that omits these fundamental factors might produce inconsistent and skewed results. By using the NTM variable, the research aims to provide more conclusive evidence of the influence of AIFTA on trade and export between India and ASEAN, which was mostly absent from the earlier studies.

In terms of empirical contribution, the research addresses some of the issues with past estimates of the Gravity model analysis used to examine AIFTA. One of them being the incorporation of Multilateral Trade Resistance (MTR) term in the gravity model. One of the most important developments in the intuitive gravity model was made by Anderson and Van Wincoop (2003) who stated that trade flows between countries were not only determined by the conventional factors of economic mass and distance, but also by the ratio of ‘bilateral’ to ‘multilateral’ trade resistance. When utilizing a gravity model, Baldwin and Taglioni (2006) referred to the deletion of the MTR term as a “gold medal mistake”. Therefore, the study aims to overcome the estimation bias through the use of a more theoretically accurate gravity model (Shepherd et al. 2013; Yang and Martinez-Zarzoso 2013).

The remainder of this article is structured as follows: in the second chapter, this article discusses the literature review of a few notable studies centering mainly on India and ASEAN trade agreements. Then, it presents a brief background on India ASEAN FTA and Non-Tariff Measures in Section 3. Next, this article introduces the methodology, the variables used and their definition and the data sources in the Section 4. Then, it conducts empirical analysis by using R software and interprets the results in the Section 5. Finally, this article draws conclusion based on the major findings and describes the future implications.

2. Literature Review

The AIFTA and development of negotiations between India and the ASEAN have led to a considerable interest in this region among researchers across the world. Among the vast amount of the literature that uses the gravity model to investigate bilateral trade flows, the present section compiles a few notable studies centering mainly on India and ASEAN.

Batra (2006) analyzed India’s trade potential with a large sample size of 146 countries, including regional groupings in Asia, such as The South Asian Association for Regional Cooperation (SAARC), ASEAN and Gulf Cooperation Council (GCC), with cross-section data for the year 2000. Using OLS estimation techniques, the paper found that the gravity equation fits India’s trade structure with ASEAN and the magnitude of India’s trade potential was highest with the Asia-Pacific region.

Bhattacharyya and Mandal (2010) estimated that AIFTA would lead to a significant rise in imports for India but not an equivalent rise in exports. It also found that ASEAN exports were sensitive to a tariff imposed by India, while on the other hand, Indian exports were found to be unresponsive. The paper concluded that the reduction of tariffs would have a skewed impact favored towards ASEAN.

Veeramani and Saini (2010) conducted a sectoral analysis of India’s plantation commodities. Their results suggested that AIFTA would cause a significant increase in India’s import of plantation commodities. Unlike previous findings, the results from this study determined that the increase in imports would induce trade creation rather than trade diversion.

Singh and Sharma (2014) applied the model to understand India’s trade with the European Union (EU) and ASEAN, using panel data from 1998–2011. The main conclusions that emerged from their study was that India traded more with ASEAN countries in comparison to the EU countries, which the authors indicate is a result of India’s increasing integration with Asian countries.

Venkatesh and Bhattacharyya (2014) evaluated intra-regional and extra-regional ASEAN trade volumes from 1970–2010. The study concluded that even though India’s exports to ASEAN did increase substantially, there was no notable impact of AIFTA with respect to the intra-ASEAN trade.

Renjini et al. (2017) conducted a sectoral analysis focused on the agricultural trade potential between India and ASEAN using panel data from 1995–2014. This study finds that AIFTA has had a positive impact on the total agricultural trade between India and ASEAN. However, the study failed to point the direction of the impact, unlike Veeramani and Saini (2010), who, in their study, discussed the trade creation effect of FTA in the plantation sector.

Khurana and Nauriyal (2017), in their paper, reveals that the implementation of the AIFTA has led to pure trade diversion effects for India. An important argument the study makes is by pointing out that India’s overall total imports and exports have registered a decline since 2012. Therefore, the trade diversion effect of AIFTA cannot be entirely attributed to the agreement given the overall global economic slowdown. The paper suggests the possibility of a positive impact on India’s exports with the overall increase in world trade in later years. Furthermore, they point out that the export flows might also be low during the study period due to the agreement’s partial implementation and that as more goods come under the purview of tariff reduction, the exports may increase.

Chandran (2018) in their finding strongly reasons the possibility of more significant trade between India and ASEAN countries through FTA. The study concludes that since ASEAN had a lower initial tariff compared to India, it is likely to benefit more in the short run. Furthermore, it recommends that in order for India to utilize its trade potential with ASEAN, FTA in services and investment are vital.

Sarin (2016) in their study concluded that a reduction in trade barriers would only lead to an increase in the import volumes leading to the decline of India’s terms of trade.

A recent article published by the Reserve Bank of India (2019) dissects the impact of India’s FTAs separately for exports, imports and overall trade. Similar to Chandran (2018) findings, this paper points out that due to India’s initial tariff being much higher, its effective reduction leads to partner countries reaping higher benefits. Nevertheless, the study points out that there is some positive impact of the trade agreement, including growth in imports of capital goods and industrial supplies, which indirectly could be a factor in enhancing India’s productive capacity.

Based on the results of gravity trade models, Sharma and Kathuria (2020) showed that a trade potential existed between India and ASEAN nations. The study infers that the commercial connection between India and ASEAN in products and services would continue to be mutually beneficial, improving the efficiency of capital markets, promoting investment, and opening up new trade prospects for India and ASEAN.

Bharti and Nisa (2021) studied the effects of AIFTA on the merchandise trade of India. Contrary to the previous studies that have found some positive impact, this study concluded that AIFTA had a negative but an insignificant impact on India’s trade to this region.

Singh (2021) investigates the trade creation and diversion effect of AIFTA The article inferred that the agreement has both import and export creating affects, but the former was much more significant than the latter. Lastly, the article concludes that long-term trade deficits between India and ASEAN are more likely caused by domestic inefficiencies, rather than FTAs or tariff liberalization per se.

Gulnaz and Manglani (2022) explored the factors influencing bilateral trade flows between India and eleven ASEAN countries using a gravity model analytical approach for a period of 32 years, from 1988 to 2019). The study concludes that except for Brunei and Cambodia, where trade has already reached its maximum potential, there is a sizable amount of unrealized trade potential between India and ASEAN nations.

In sum, we can infer that the existing the literature has shown a mixed impact of AIFTA on India’s trade. This can be attributed to the fact that each of these studies brings out the time-specific factors in determining this impact. Moreover, it is important to note that while doing an empirical analysis, the results vary with the choice of variables and analysis. Given the above literature review, our study tries to fill in the literature gap regarding methodology and variable choices.

3. India ASEAN FTAs and Non-Tariff Measures

Through the AIFTA, both India and ASEAN have agreed to progressively eliminate tariffs on 80 percent of the tariff lines, accounting for 75 percent of the trade. The tariff reduction schedule under AIFTA is given in Table 1.

Table 1.

AIFTA Tariff reduction schedule.

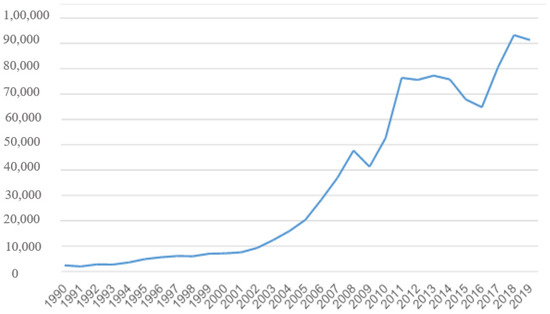

The reduction in tariffs through AIFTA and the various regional developments between these regions have led to considerable growth in trade between these two regions. Figure 1 represents India’s total trade with ASEAN from 1990 to 2019. The volume of bilateral trade between India and ASEAN has increased by approximately 47 times from USD $1954 million in 1991 to USD $91,344 million in 2019. Furthermore, there has been a sharp increase in India’s trade with the ASEAN region after the signing of the FTA. Total trade saw a 121 percent increase from USD $41,316 million in 2009 to USD $91,344.19 in 2019, thus indicating that FTA was successful in significantly increasing trade ties between these two regions.

Figure 1.

India’s Total Trade with ASEAN (1990–2019). Source: Direction of Trade Statistics, IMF (2020).

Simultaneously, India’s trade deficit in goods with ASEAN has also increased considerably. Table 2 depicts India and ASEAN’s total import, exports and trade balance from 1990 to 2019. The imports value in 2019 was USD $57,045.47 million, and exports were USD $34,301.33 million. While India’s total trade has increased by almost 19 times in the past three decades, its imports have increased at a much higher pace than their exports, leading to an ever-increasing trade deficit. In 1990, the deficit stood at USD $−864.15 million, which has increased approximately 26-fold by 2019. Except for 1991 1993 and 1994, respectively, India has always had a net trade deficit with ASEAN in the last two and half decades. Moreover, the trade deficit seems to have further exacerbated the post-signing of FTA.

Table 2.

India’s Trade Balance with ASEAN Countries (USD$ Million).

Table 3 shows the country-wise trade balance. India has a trade surplus with Cambodia, Lao PDR, Myanmar and the Philippines and a trade deficit with all the other six nations. In 2019, it had the largest trade deficit with Indonesia at USD $11,025.4 million, which makes almost 48 percent share of the total deficit, followed by Malaysia and Singapore. In 2005 (Pre-FTA period), India does seem to have fairly enjoyed a trade surplus with almost six ASEAN nations and had a reasonably low deficit value of USD $526.47 million. Post FTA, the deficit has escalated, signifying worsening terms of trade for India, even in countries where it enjoyed a trade surplus pre-FTA.

Table 3.

India’s Trade Balance with ASEAN Countries (USD$ Million).

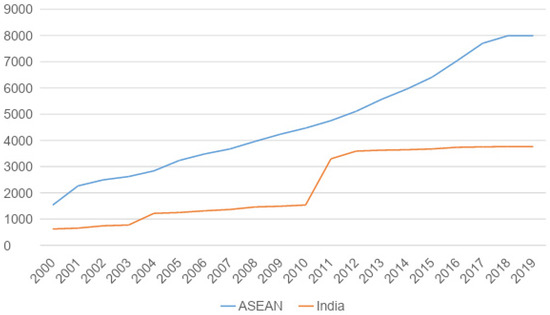

Furthermore, while tariffs between ASEAN and India have reduced through FTA’s, on the contrary, the rise in NTMs has also been phenomenal. According, to an extensive report published by the ASEAN-India Centre (AIC) at RIS in 2019 found that, despite better market access due to various trade liberalization and trade agreements between these two regions, the complexities and the applications of NTMs have consistently been (De et al. 2019). Figure 2 shows the overall increase in the total number of coded NTMs imposed by India and ASEAN on each other’s imports from 2000 to 2019. The ASEAN region imposed a total of 1533 NTMs on Indian exports in 2000, which has steadily increased to reach up to 7992 by 2019. On the other hand, in case of India, it imposed 622 NTMs in 2000, which gradually increased to 1536 in 2010. In 2011, the total NTMs imposed by India saw a sharp increase to reach 3297. Since then, there has been a slight increase to reach 3762 in 2019. Overall, the figure shows that both ASEAN and India have used NTMs as a tool to restrict market access, despite engaging in trade liberalization through FTA’s.

Figure 2.

Total number of coded NTMs imposed by India and ASEAN. Source: UNCTAD TRAINS (2020).

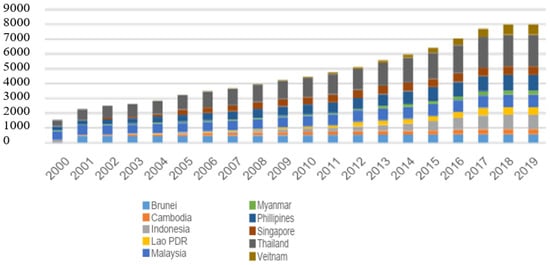

The country-wise analysis in Figure 3 shows that amongst all the ASEAN countries in 2019, Thailand had the highest number of aggregate NTMs imposed at 2121, followed by the Philippines at 1060, Indonesia at 961 and Malaysia at 857. When looking at the time series trend from 2000 to 2019, it can be noticed that nations, such as Lao PDR, Vietnam and Indonesia, have witnessed the most growth in NTMs levied on Indian exports.

Figure 3.

Country-Wise Total number of NTMs imposed by ASEAN to India. Source: UNCTAD TRAINS (2020).

4. Methodology

This study applies an augmented gravity model for the empirical analysis. The gravity model has been used in international economics as a popular methodology to measure potential trade between countries. It was inspired by the Newtonian model of gravitational forces, i.e., the force of attraction between two bodies is proportional to the product of their masses and inversely proportional to the square of the distance between their centers of gravity. In the simplest gravity model, bilateral trade flows between two countries are assumed to be proportional to the product of their economic sizes (represented by Gross Domestic Product) and inversely proportional to a measure of the distance between the countries (Bergstrand 1985).

The primary objective behind choosing the gravity model lies in its ability to isolate the effects of the FTA by controlling for the effects of other numerous trade determinants (Plummer et al. 2011). The gravity model is able to explain why trade relations between some countries are greater than others and which factors influence trade and the scale of trade flows that conventional trade theories fail to do. Furthermore, it allows more variables to be considered to explain the extent of trade as an aspect of international trade. Therefore, along with the impact of AIFTA, this study further seeks to evaluate the influence of other specific factors on India’s exports.

Over the years, the baseline gravity model has been modified, and new variables have been added to the gravity model leading to the formation of the augmented gravity model where scholars have introduced other essential variables which account for the trade cost, some of which have now become standard variables used in the gravity literature (Khurana and Nauriyal 2017). Additionally, no consensus has been found on which additional variables need to be included in the extended gravity model besides the primary GDP and distance measurements. Therefore, this study uses variables which are common in the gravity literature that have done FTA impact assessments. Lastly, as mentioned before the study incorporates MTR terms in our gravity model. Since MTR variables are unobservant, they do not correspond to any price indices data (Shepherd et al. 2013). One of the most widely used method to incorporate this MTR term is through the use of both time and country fixed effect (Sanjuan Lopez et al. 2013). The new model proxies these MTR terms using the country and year fixed effect following Rahman and Ara (2010), Irshad and Anwar (2019).

The gravity model for this study is written as:

where:

- = Log of total trade between India and ASEAN countries at time t;

- = Log of exports from India to ASEAN countries at time t;

- = Log of India’s GDP at time t;

- = Log of ASEAN countries GDP at time t;

- = Log of bilateral distance between India and ASEAN countries;

- = Dummy variable of common colony;

- = Dummy variable of common ethnology;

- = Dummy variable of AIFTA;

- (1 + ) = Log of (1 + total trade/GDP at time t)5;

- ( + ) = Log (Non-Tariff Measures imposed by ASEAN countries to India at time t + NonTariff Measures imposed by India to ASEAN countries at time t;

- + = Interaction variable of AIFTA and total sum of NTMs imposed by India and ASEAN at time t;

- ( = Log of bilateral real exchange rates between India and ASEAN countries at time t6;

- = Time fixed effect measured in terms of dummy variable that takes the value 1 when the year is t and 0 otherwise;

- = Country fixed effect measured in terms of dummy variable when the importing country is country j and 0 otherwise;

- = Well behaved error term.

4.1. Data Sources

Total trade and total export data were collected from Direction of Trade Statistics Yearbook, International Monetary Fund (IMF). The GDP and trade openness data were collected from World Development Indicators. Distance, common colony and ethnology data were collected from Centre d’Etudes Prospectives et d’Informations Internationales (Institute for Research on the International Economy). The data for the nominal exchange rate was collected from the IMF and CEIC database, while the Consumer Price Index (CPI) was collected from the World Bank.

Given that NTMs are considered as one of the core variables for a trade policy analysis (Yotov et al. 2016), this variable is an important addition to our model. Additionally, the majority of the previous studies have not utilized this variable of AIFTA. Following Vanzetti et al. (2018) and Dolabella (2020), this variable is measured as: NTMs measures applied by ASEAN countries on India at time t + NTMs measures applied by India on ASEAN countries at time t. The NTMs data were collected from the UNCTAD TRAINS database. The study also includes an interaction term of NTMs and AIFTA in both equations. Reports have shown that the reduction in countries tariff barriers has been paralleled with a considerable increase in NTMs (De et al. 2019). Given this knowledge, suppose we consider that the NTMs have a different effect in the absence and presence of AIFTA. This additional effect beyond the individual effects of just AIFTA and NTMs can be tested using an interaction term. As these variable measures the impact of NTMs for different values of the AIFTA dummy variable, this variable is expected to have a negative and significant impact on our dependent variables implying that NTMs has a stronger negative relationship to the dependent variable in the Post-FTA period. Lastly, the model is estimated using the statistical software “R” version 3.6.2.57.

4.2. Econometric Issues

Some diagnostic tests are used in both models to ensure the accuracy of the results. The first test is done to check the serial correlation between variables. Furthermore, a Variance Inflation Factor (VIF) test is done in order to test for multicollinearity (presented in Appendix A). Additionally, the Durbin–Watson (DW) test was used to detect the presence of serial correlation. All estimates were also checked for heteroscedasticity through the Breusch–Pagan (BP) test. In order to correct for the presence of any heteroscedasticity, consistent standard errors were used. When using panel data, it is also imperative to ensure that the data is stationary, which is tested using the panel unit root test. The stationary of data is important as it greatly affects how data is interpreted and projected when using time series data. The majority of time series models presume that each point is independent of one another when projecting or predicting the future. When data is stationary, it means that the statistical properties of the data do not change over time and can be used to predict the outcome efficiently. In our analysis, all the stationary tests are presented in Appendix B. Lastly, since the data was found to be stationary at the first difference, a panel cointegration test is conducted to analyze the panel series integration properties and the long-term relationships between the variables used in the analysis (Bonuedi 2013). Panel cointegration tests by Pedroni and Kao were performed to investigate the long-run correlations between the variables. Appendix B summarizes the Pedroni panel cointegration test results, which show that 7 out of 11 statistics in Model 1 and 6 out of 11 statistics in Model 2 are significant at the 1 percent level. This implies that we can reject the null hypothesis of no co-integration. The Kao panel co-integration test results are also consistent with the results of the Pedroni test for both models. Thus, both findings support the presence of a long-run co-integration relationship between the variables.

The study applies the Fixed Effect (FE) and Random Effect (RE) estimation to overcome the biases of unobservable heterogeneity in panel data. The selection of models, fixed or random, is based on the Hausman specification test. In our analysis RE model was selected over the FE based on the Hausman-test p-value of 0.07 and 0.08 for Equations (1) and (2) which suggests the acceptance of the null hypothesis. Additionally, to test whether a POLS or a RE model is better suited for this analysis, a Breusch-Pagan Lagrange multiplier (BPLM) test is also done. The LM test helps you decide between a RE regression and a POLS regression. The results of the BPLM test also indicate that the RE model is the best fit for our analysis. Lastly, Instrumental variables (IVs) estimations have also been used in the Two-Stage Least Squares (2SLS) framework to resolve the endogeneity problem.

5. Results

Table 4 presents the estimated results of Equation (1). The study has applied a stepwise regression analysis beginning with the core gravity variables, then adding different control variables to the model. Adding more important variables to our analysis is expected to overcome the issue of omitted variable bias to some extent. Column 5 shows the results of the model when all the control variables have been added.

Table 4.

Random Effect Model with Robust Standard Errors–Total Trade.

A number of interesting features are apparent from these estimates. The first is that the model fits the data relatively well, which is denoted by the adjusted R2 at 0.82, meaning that the explanatory variables account for over 82 percent variation in trade in the data. The results of the DW8 test were 1.6, suggesting that there is no issue of autocorrelation.

Taking the core gravity variables first, we see that importer and exporter GDP are both positively associated with trade, as we would expect: a 1 percent increase in India’s GDP would lead to a 0.77 percent increase and a 1 percent increase in ASEAN’s GDP, would lead to a 1.17 percent increase in total trade between the regions and this effect is statistically significant at the 1 percent level. The coefficient of distance has the theoretically consistent negative impact but is statistically insignificant. The results are similar with Singh and Sharma (2014), who found that GDP was more important than distance in explaining India’s ASEAN trade but differs from Chakravarty and Chakrabarty (2014). One possible interpretation is that all of the ASEAN countries are close to one another and, therefore, there are no significant bilateral differences in distance between these countries and India.

Of the remaining variables, the common colonizer dummy has the expected positive sign and is statistically significant at the 1percent level. Indicating that ASEAN countries who had a similar colonizer in the past with India are likely to trade 0.36 percent more than the reference group (not a common colony).The variable of trade openness also was positive and significant at 1 percent level of significance. A 1 percent increase in trade openness leads to a 2.00 percent rise in trade between these two regions.

After the interaction term is introduced in column 5, we see that the coefficient of the AIFTA also becomes positive and statistically significant at a 5 percent level of significance. One possible interpretation is that, even if AIFTA has a significant effect on trade, it may not be visible without the interaction effect. In this case, isolating the interaction effect can help the primary effect stand out more clearly. This is most common when the two effects have opposite signs and are coexisting. Due to the opposing impact is coexisting, it causes the main effect of a variable to be not explicitly observable until an interaction variable is introduced. This finding is in par with the literature that show that the reduction in countries tariff is paralleled with a considerable increase in NTMs (De et al. 2019).

Therefore, we can infer that in the presence of the interaction term, a statistically significant AIFTA variable means that we can rule out the possibility that the coefficient on AIFTA is 0 and accept the hypothesis that AIFTA would lead to more trade between these two regions than without AIFTA. Other things remaining the same, for example, in the presence of AIFTA, there would be a 0.35 percent increase in trade than in the absence of an FTA. On the other hand, the coefficient of NTMs is negative and statistically significant at a 5 percent level, thus provided that AIFTA = 0, a 1 percent increase in the sum of NTMs imposed by India and ASEAN will lead to a 0.08 percent fall in total trade. The coefficient on the interaction term is also negative and statistically significant, meaning that we can accept the hypothesis that NTMs have a stronger negative relationship to trade post-AIFTA than pre-FTA period. Specifically, on average, for every extra 1 percent increase in the sum of NTMs, in the presence of AIFTA we will see a 0.40 (0.08 + 0.32) fall in total trade, other things remaining the same.

The results for Equation (2) are shown in Table 5. Looking at the RE regression results, the model fits the data well, as the adjusted R2 is 0.86, meaning that the independent variables is able to explain 86 percent variation in export in the data. The results of the DW test were 1.7, suggesting that there is no issue of autocorrelation.

Table 5.

Random Effect Model with Robust Standard Errors–Total Exports.

Column 6 shows the final results of the regression analysis where all the control variables are included. The log of India’s GDP and ASEAN GDP is significant at a 1 percent level of significance. Thus, other things remaining the same on average, a 1 percent increase in India’s GDP would lead to a 0.58 percent increase in exports, whereas a 1 percent increase in ASEAN’s GDP would increase exports by 1.24 percent. The variable for distance also had the theoretically stipulated negative effect on export but are statistically insignificant.

Among the other control variables both common colony and common ethnology variable are insignificant. On the other hand, the variable for trade openness was found to be significant at a 1 percent level of significance, implying that other things remaining the same, on an average a 1 percent increase in importing countries’ trade openness would lead to a 2.21 percent increase in India’s exports to ASEAN.

The variable of AIFTA was positive, but not statistically significant. Through this finding we can infer that the main effect of AIFTA was positive and significant for trade, implying that it had led to an overall trade creation. On the other hand, exports did not see a comparable effect. These results are in line with earlier research by Venkatesh and Bhattacharyya (2014), Bhattacharyya and Mandal (2010) and Singh (2021). The variable for both logs of NTMs and the interaction term was significant at 1 percent level. Other things remaining the same provided AIFTA = 0, a 1 percent increase in NTMs would lead to a 0.07 percent fall in exports. On the other hand, the interaction term accounts for the variation in the effect on NTMs dependent on AIFTA dummy values (0, 1). As a result, the findings suggest that NTMs have a more prominent negative association with exports after AIFTA. In other words, India witnessed a 0.31 (0.07 + 0.24) percent drop in exports after AIFTA, an effect seen before. Lastly, the variable real exchange rate did not have any significant impact on total exports. This finding was similar to Sarin (2016) but differed from Gulnaz and Manglani (2022). One likely explanation behind the finding is that that both regions foreign currency markets are well established to offer protection against risk brought on by exchange rate volatility.

Lastly, while estimating the intuitive gravity model or its theoretical counterpart, endogeneity must be considered, especially when policy variables are included in the model. The reason for this is that policies are commonly impacted by a country’s level of integration in international markets: more open economies, for example, have an incentive to implement more liberal policies, establishing a causal relationship between policies and trade (Shepherd et al. 2013). In order to resolve the presence of potential endogeneity problems in our model, Instrumental Variables (IV’s)9 estimations are often used in the two-stage least squares (2SLS) framework for the random effect model. For a gravity regression to produce good IVs, the variables should be significantly associated with GDP and uncorrelated with the error term (Cyrus 2002). The study uses the lagged value of importer and exporter GDP along with importer and exporter country population following Parsley and Wei (1996) as IV’s.

The results of the 2SLS are present in Table 6. Column one shows the results for India’s bilateral trade with ASEAN, and column two shows India’s export to ASEAN. The coefficient values for both exporter and importer GDP are positive and highly significant at a 1 percent level of significance. There is a slight increase in the values compared to the baseline model (Table 1 and Table 2). The coefficient of the distance variable was insignificant for both models. The dummy variable for the common colony had a significant impact on total trade but insignificant for exports, whereas common ethnology was insignificant for both models. The coefficient of trade openness was significant at a 1 percent level of significance. Therefore, a 1 percent increase in trade openness leads to a 1.98 percent increase in trade and a 2.33 percent increase in exports.

Table 6.

2SLS Regression Results of the Gravity Model Estimates.

The variable for AIFTA was significant for trade but insignificant for exports. Thus indicating that AIFTA has a positive impact in increasing India’s trade with the ASEAN region. All things remaining the same, having an AIFTA in place with an average number of NTMs would result in a 0.33 percent increase in trade than without any FTA. The coefficient for NTMs and the interaction term were also significant for both the models. Holding all else constant, a one percent increase in NTMs in the absence of AIFTA would lead to a 0.11 percent fall in total trade and a 0.07 percent fall in total exports. On the other hand, provided that AIFTA = 1, a one percent increase in NTMs would lead to a fall of total trade by 0.47 percent and total exports by 0.31 percent. Lastly, the real exchange rate variable was positive, but the influence was insignificant for exports. The findings imply that during the period undertaken for the study, the depreciation of India’s real exchange rate did not substantially impact its exports.

6. Conclusions

The study attempted to examine the determinants of trade and export flows from India to ASEAN with an emphasis on the impact of AIFTA. An augmented gravity model was used on a panel data from 2000–2019 in order to fulfill the objective.

The estimated coefficients reveal that the conventional variable of importer and exporter GDP significantly impacted both total bilateral trade and exports, whereas distance was found to be insignificant. Moreover, trade and export flows from India are found to increase more that proportionally with an increase in the ASEAN countries GDP. This point reconfirms the result obtained previously by Venkatesh and Bhattacharyya (2014) but differs from the results reported by Khurana and Nauriyal (2017). The result suggests that going forward in the agreement, India needs to emphasize building stronger and extensive relationships with those countries in the ASEAN that are witnessing a higher GDP growth rate, such as Cambodia, Malaysia, the Philippines and Vietnam.

The variable of importing countries’ trade openness also offered strong evidence supporting positive significance for both models. It seems reasonable to conclude that as ASEAN countries become more liberalized, India’s trade and exports relation would benefit. Additionally, it would have a more significant impact to increase India’s exports compared to total trade. A plausible explanation of these findings is that the trade-to-GDP ratio is widely used to quantify the importance of international transactions compared to domestic transactions. Thus, as trade becomes more important in ASEAN’s GDP, various trade barriers are likely to be reduced, allowing them to pursue more free trade, enhancing India’s trade and exports with the area.

The two most significant findings of the study are: first, that AIFTA had failed to produce the desired effect on India’s export to ASEAN. This finding is consistent with a number of previous studies (Sarin 2016; Chandran 2018). Second, that NTM’s and the interaction term both have a significant and negative impact on India’s export. Moreover, the additional effect values were higher for both total trade and exports than the effect of NTMs when AIFTA=0. This finding implies that India and ASEAN have utilized NTMs to distort trade flows in the post-FTA period. Additionally, in the case of exports, the results show that NTMs are playing a much more significant role in dictating export flows between India and ASEAN compared to AIFTA.

In conclusion, the result suggests that, even though AIFTA has led to the successive reduction in tariff barriers, the same has not been achieved simultaneously in terms of NTMs. This indicates that tariffs are just one aspect of a comprehensive trade protection strategy in the case of trade and exports between India and ASEAN. At the same time, NTMs are another important protectionist instrument that works in tandem with tariffs. These results raise the likelihood that policymakers may not have paid enough attention to building a complementing ecosystem in terms of trade facilitation measures for the efficient operation of the trade regime at the time of FTA signing. Going forward in the agreement, the study suggests that a careful examination of such variables must be undertaken before concluding that FTAs are harmful to Indian businesses. This finding is highly crucial for India going forward in the FTA. With the review of AIFTA, it is essential that along with the various tariff barriers, the issues of NTMs, are discussed. With the review of FTAs and NTMs, an autonomic decision-making mechanism can be established to enhance principle-based economic judgments and minimize trading transaction costs and frictions. A future study on the extent of the impact of AIFTA and NTMs on total imports would also provide better insights into the level of success of AIFTA in terms of imports and exports.

Author Contributions

Conceptualization, P.K. and C.K.; methodology, P.K.; software, P.K.; formal analysis, P.K. and C.K.; investigation, P.K. and C.K.; resources, P.K.; data curation, P.K.; writing—original draft preparation, P.K. and C.K.; writing—review and editing, P.K. and C.K.; visualization, P.K. and C.K.; supervision, C.K. All authors have read and agreed to the published version of the manuscript.

Funding

This research received no external funding.

Informed Consent Statement

Not applicable.

Data Availability Statement

Not applicable.

Acknowledgments

This work was supported by Hankuk University of Foreign Studies Research Fund of 2020 and by the National Research Foundation of Korea Grant Funded by the Korean Government (NRF-2017S1A6A3A02079749).

Conflicts of Interest

The authors declare no conflict of interest.

Appendix A

Table A1.

Correlation coefficient matrix of Model 1.

Table A1.

Correlation coefficient matrix of Model 1.

| Ln India GDP | Ln ASEAN GDP | Ln Dist | ComEthno | ComCol | AIFTA | LnTrOpn | LogNTM | Log NTM × AIFTA | |

|---|---|---|---|---|---|---|---|---|---|

| Ln India GDP | 1 | ||||||||

| Ln ASEAN GDP | 0.36 | 1 | |||||||

| Ln Dist. | 2.21 × 10−17 | 0.32 | 1 | ||||||

| ComEthno | 6.75 × 10−19 | 0.31 | 0.42 | 1 | |||||

| ComCol | −2.1 × 10−17 | −0.05 | 0.05 | 0.10 | 1 | ||||

| AIFTA | 0.86 | 0.32 | 0 | −2.1 × 10−18 | 1.13 × 10−18 | 1 | |||

| Ln (1 + Opn) | −0.06 | 0.17 | 0.02 | 0.35 | 0.34 | −0.07 | 1 | ||

| Ln (NTM ASEAN + NTM India) | 0.85 | 0.46 | 0.03 | 0.05 | 0.01 | 0.86 | 0.04 | 1 | |

| Ln [(ASEAN NTM + India NTM) × AIFTA] | 0.88 | 0.31 | 0.001 | 0.0001 | 0.00 | 0.78 | −0.09 | 0.88 | 1 |

Table A2.

Correlation coefficient matrix of Model 2.

Table A2.

Correlation coefficient matrix of Model 2.

| Ln India GDP | Ln ASEAN GDP | Ln Dist | ComEthno | ComCol | AIFTA | LnTrOpn | Log NTM | Log NTM × AIFTA | Log Xrate | |

|---|---|---|---|---|---|---|---|---|---|---|

| Ln India GDP | 1 | |||||||||

| Ln ASEAN GDP | 0.36 | 1 | ||||||||

| Ln Dist. | −3.8 × 10−18 | 0.32 | 1 | |||||||

| ComEthno | 0 | 0.31 | 0.43 | 1 | ||||||

| ComCol | −2.2 × 10−17 | −0.06 | 0.05 | 0.10 | 1 | |||||

| AIFTA | 0.86 | 0.32 | 0 | −2.1 × 10−18 | 1.13 × 10−18 | 1 | ||||

| Ln (1 + Opn) | −0.07 | 0.17 | 0.02 | 0.35 | 0.34 | −0.07 | 1 | |||

| Ln NTM | 0.47 | 0.52 | 0.300 | 0.24 | 0.12 | 0.43 | 0.23 | 1 | ||

| Ln NTM × AIFTA | 0.85 | 0.30 | 0.021 | −0.03 | −0.06 | 0.91 | 0.0617 | 0.44 | 1 | |

| Ln (Xrate) | −0.02 | 0.09 | 0.47 | 0.34 | 0.74 | 0.01 | 0.58 | 0.43 | −0.07 | 1 |

Table A3.

The result of VIF-Model 1.

Table A3.

The result of VIF-Model 1.

| Variables | VIF | 1/VIF |

|---|---|---|

| Ln India GDP | 4.56 | 0.22 |

| Ln ASEAN GDP | 2.84 | 0.35 |

| Ln Dist. | 3.44 | 0.29 |

| Com Col | 2.16 | 0.46 |

| Com Ethno | 4.07 | 0.25 |

| AIFTA | 7.43 | 0.13 |

| Ln (1 + Opn) | 2.43 | 0.41 |

| Ln (ASEAN NTM + India NTM) | 8.82 | 0.11 |

| Ln [(ASEAN NTM + India NTM) × AIFTA] | 9.33 | 0.11 |

Table A4.

The result of VIF-Model 2.

Table A4.

The result of VIF-Model 2.

| Variables | VIF | 1/VIF |

|---|---|---|

| Ln India GDP | 4.49 | 0.22 |

| Ln ASEAN GDP | 1.68 | 0.60 |

| Ln Dist. | 2.29 | 0.44 |

| Com Col | 2.09 | 0.48 |

| Com Ethno | 1.92 | 0.52 |

| AIFTA | 7.36 | 0.14 |

| Ln (1 + Opn) | 2.36 | 0.42 |

| Ln NTM | 8.75 | 0.11 |

| Ln NTM × AIFTA | 9.28 | 0.11 |

| Ln (Xrate) | 3.78 | 0.26 |

Appendix B

Table A5.

Unit Root Test LM Pesaran and Shin W-Stat Test.

Table A5.

Unit Root Test LM Pesaran and Shin W-Stat Test.

| Variables | Level | p-Value | N | First Difference | p-Value | N |

|---|---|---|---|---|---|---|

| Ln Total Trade | −2.08 | 0.02 | 179 | −4.87 | 0.00 | 169 |

| Ln Total Export | −1.24 | 0.11 | 179 | −6.50 | 169 | |

| Ln India GDP | −1.08 | 0.14 | 179 | −5.44 | 0.00 | 169 |

| Ln ASEAN GDP | −1.14 | 0.13 | 179 | −3.17 | 0.00 | 169 |

| Ln OPN | 0.77 | 0.78 | 179 | −5.66 | 0.00 | 169 |

| Ln (NTM ASEAN + NTM India) | 0.16 | 0.56 | 175 | −8.68 | 0.00 | 165 |

| Ln ASEAN NTM | −0.96 | 0.17 | 175 | −4.14 | 0.00 | 165 |

| Ln Xrate | 1.65 | 0.95 | 179 | −1.77 | 0.04 | 169 |

Null Hypothesis: Unit Root (Individual Unit Root Process).

Table A6.

Results of Pedroni and Kao Panel Cointegration Test.

Table A6.

Results of Pedroni and Kao Panel Cointegration Test.

| Pedroni Residual Cointegration Test | Kao Residual Cointegration Test | |||||||||

|---|---|---|---|---|---|---|---|---|---|---|

| Alternative Hypothesis: Common | Alternative Hypothesis: Individual | |||||||||

| AR Coefficents (Within-Dimension) | AR Coefficients (Within-Dimension) | |||||||||

| Statistic | p-Value | Weighted Statistic | p-Value | t-Statistic | Probability | |||||

| Model 1—Trade | ||||||||||

| Panel-v statistic | 1.98 | 0.02 ** | −2.24 | 0.99 | Group rho statistic | 3.01 | 0.99 | ADF | −2.35 | 0.01 *** |

| Panel rho statistic | 1.47 | 0.93 | 2.19 | 0.99 | Group PP-statistic | −2.13 | 0.02 *** | |||

| Panel PP-statistic | −1.91 | 0.03 ** | −2.03 | 0.02 ** | Group ADF-Statistic | −3.48 | 0.000 *** | |||

| Panel ADF-Statistic | −5.63 | 0.000 *** | −2.86 | 0.00 *** | ||||||

| Model 2—Export | ||||||||||

| Panel-v statistic | −2.56 | 0.99 | −1.87 | 0.97 | Group rho statistic | 3.18 | 0.99 | |||

| Panel rho statistic | 1.30 | 0.90 | 1.88 | 0.97 | Group PP-statistic | −9.27 | 0.000 *** | ADF | −7.31 | 0.000 *** |

| Panel PP-statistic | −15.73 | 0.00 *** | −5.57 | 0.00 *** | Group ADF-Statistic | −5.64 | 0.000 *** | |||

| Panel ADF-Statistic | −8.10 | 0.00 *** | −5.49 | 0.00 *** | ||||||

Note ***, **, * denote 1%, 5%, and 10% significance levels, correspondingly.

Notes

| 1 | Formed in 1967, ASEAN is a regional intergovernmental organization in Southeast Asia comprising the ten member countries of Indonesia, Thailand, Singapore, Malaysia, Philippines, Vietnam, Brunei, Cambodia, Laos and Myanmar. |

| 2 | The AIFTA came into force on 1 January 2010 in the case of Malaysia, Singapore and Thailand; 1 June 2010 for Vietnam; 1 September 2010 for Myanmar; 1 October 2010 for Indonesia; 1 November 2010 for Brunei; 24 January 2011 for Lao PDR; 1 June 2011 for Philippines; and 29 July 2011 for Cambodia. |

| 3 | Initiated in 2012, RCEP is an attempt to achieve FTA among the 10 ASEAN member states and its’ Plus Six’ partners: Australia, China, India, Japan, New Zealand and South Korea. (Mishra 2013). For India, agreeing to the RCEP negotiations, which centers on free trade, was perceived to escalate its trade deficit (Oba 2019). |

| 4 | NTMs are limitations imposed by countries in the form of prohibitions, conditions, or special market regulations that make goods importing or exportation difficult and/or expensive. According to United Nations Conference on Trade and Development (UNCTAD), NTMs cover sanitary and phytosanitary standards (SPS), technical barriers to trade (TBT), import and export licensing, export restrictions, customs surcharges, anti-dumping and safeguard measures, among others. NTMs are considered to be more restrictive to trade than actual tariffs. As countries reduce their tariff barriers through trade negotiations, such as FTA, there has been an increasing importance of NTMs on trade. Since tariff liberalization has been insufficient in providing regional integration of many developing nations, NTMs have gained a more prominent role as trade and consumer protection tools in the current world economy (Yotov et al. 2016). |

| 5 | The constant 1 is added to the value of openness and exchange rate before doing the log transformation. Since the variables are all non- zero for both the variables therefore following Woolbridge (2012) we can assume that the percentage change interpretations for log (1 + x) can be interpreted as the same as log (x). |

| 6 | The variable of exchange rate is only included in equation 2 because in the case of total trade, which represents the sum of the import and exports, neither theoretical not empirical studies have been able to provide a definitive answer to the direction of the variable, leaving the obtained results to be ambiguous and inconclusive (Franke 1991; Sercu and Vanhulle 1992; Dellas and Zilberfarb 1993; McKenzie 1999; Baum and Caglayan 2006; Banik and Roy 2020). According to Viane and De Vries this ambiguity is because importer and exporters are on opposite sides of a trading relationship. Taglioni (2002) claims that the only consensus reached on the impact of the exchange rate on trade, if any, is that it is difficult to assess. Therefore, majority of earlier gravity model studies have looked at the impact of exchange rates on exports and imports activities separately (Arghyriou 2000; Eger 2002; Kurihura 2003; Thorpe and Zhang 2005; Kandogan 2005; Carrère 2006; Anderson et al. 2013; Boke and Doganay 2014; Kang and Dagli 2018). Thus, following the previous literature, this study also applies this variable in equation 2 where the dependent variable is total exports. |

| 7 | R software has been downloaded from: https://cran.r-project.org/mirrors.html (accessed on 21 April 2020). |

| 8 | According to a rule of thumb, if the DW test values fall in the range of 1.5 to 2.5, then it is considered that the data does not suffer from the issue of serial or autocorrelation. |

| 9 | The IV is the third variable, Z, used in regression analysis where you have endogenous variables—variables that are determined by other variables in the model. In other words, you are using it to account for unpredictable actions between variables. Using an instrument attribute helps you control for this endogeniety. |

References

- Anderson, James E., and Eric Van Wincoop. 2003. Gravity with Gravitas: A Solution to the Border Puzzle. American Economic Review 93: 170–92. [Google Scholar] [CrossRef]

- Baier, Scott L., and Jeffrey H. Bergstrand. 2009. Estimating the effects of free trade agreements on international trade flows using matching econometrics. Journal of International Economics 77: 63–76. [Google Scholar] [CrossRef]

- Baldwin, Richard, and Daria Taglioni. 2006. Gravity for Dummies and Dummies for Gravity Equations. NBER Working Paper 12516. Cambridge: NBER. [Google Scholar]

- Batra, Amita. 2006. India’s global trade potential: The gravity model approach. Global Economic Review 35: 327–61. [Google Scholar] [CrossRef]

- Bergstrand, Jeffery H. 1985. The gravity equation in international trade: Some microeconomic foundations and empirical evidence. The Review of Economics and Statistics 67: 474–81. [Google Scholar] [CrossRef]

- Bharti, Saurabh Kumar, and Syeedun Nisa. 2021. A Study of India’s Trade Flows with the ASEAN: Gravity Model Analysis. Orissa Journal of Commerce 42: 15–26. [Google Scholar] [CrossRef]

- Bhattacharya, Swapan K., and Biswa N. Bhattacharya. 2007. Gains and Losses of India-China Trade Cooperation—A Gravity Model Impact Analysis. ESIFO Working Paper No. 1970, April, Category 7: Trade Policy. Munich: Center for Economic Studies and ifo Institute (CESifo). [Google Scholar]

- Bhattacharyya, Ranajoy, and Avijit Mandal. 2010. Estimating the impact of the Indo-ASEAN free Trade Agreement on India’s Balance of Trade. Journal of Global Analysis 1: 9–25. [Google Scholar]

- Bonuedi, Isaac. 2013. Determinants of Ghana’s Bilateral trade Flows: A Gravity Model Approach. Ph.D. dissertation, Kwame Nkrumah University of Science and Technology, Kumasi, Ghana. [Google Scholar]

- Chakraborty, Subhayan. 2020. India Seeks Stronger Rules of Origin as It Urges ASEAN for FTA Review. Retrieved 2 February 2021, from Business Standard. Available online: https://www.business-standard.com/article/economy-policy/india-seeks-strongerrules-of-origin-as-it-urges-asean-for-fta-review-120083000397_1.html (accessed on 15 February 2021).

- Chakravarty, Smwarajit Lahiri, and Ranajit Chakrabarty. 2014. A gravity model approach to Indo-ASEAN trade-fluctuations and swings. Procedia-Social and Behavioral Sciences 133: 383–91. [Google Scholar] [CrossRef]

- Chandran, Dr. Sarath. 2018. Trade Impact of the India-ASEAN Free Trade Agreement (FTA): An Augmented Gravity Model Analysis. Research Journal of Economics & Business Studies 6: 36–45. [Google Scholar]

- Chapman, Terri. 2018. ASEAN and India: Five for the Next Five. Delhi: Observer Research Foundation. [Google Scholar]

- Cyrus, Teresa L. 2002. Income in the gravity model of bilateral trade: Does Endogeneity Matter? The International Trade Journal 16: 161–80. [Google Scholar] [CrossRef]

- De, Prabir, Durairaj Kumarasamy, and Komal Biswal. 2019. Non-Tariff Measures (NTMs): Evidence from ASEAN-India Trade. New Delhi: ASEAN-India Centre at Research and Information System for Developing Countries (RIS). 182p, ISBN 81-7122-145-9. [Google Scholar]

- Dolabella, Marcelo. 2020. Bilateral Effects of Non-Tariff Measures on International Trade: Volume-Based Panel Estimates. New York: United Nations Publication. [Google Scholar]

- Fukao, Kyoji, Toshihiro Okubo, and Robert M. Stern. 2003. An econometric analysis of trade diversion under NAFTA. The North American Journal of Economics and Finance 14: 3–24. [Google Scholar] [CrossRef]

- Government of India (GOI). 2020. Agreement on Trade in Goods Under the Framework Agreement on Comprehensive Economic Cooperation between The Republic of India and The Association of South East Asian Nations. Brief on India-Korea Economic and Commercial Relations. Available online: https://www.indembassyseoul.gov.in/page/india-rok-trade-and-economic-relations/#:~:text=1.,mark%20for%20the%20first%20time.&text=Korea’s%20total%20FDI%20to%20India,2020%20stands%20at%20%246.94%20billion (accessed on 15 April 2021).

- Gulnaz, Saba, and Hemlata Manglani. 2022. Does gravity work in the context of India and ASEAN bilateral trade? An application of the FGLS method. Theoretical & Applied Economics 29: 143–60. [Google Scholar]

- Irshad, Muhammad Saqib, and Sofia Anwar. 2019. The determinants of Pakistan’s bilateral trade and trade potential with world: A gravity model approach. European Online Journal of Natural and Social Sciences 8: 1–24. [Google Scholar]

- Khurana, Richa, and Dinesh Kumar Nauriyal. 2017. ASEAN-India free trade agreement: Evaluating trade creation and trade diversion effects. Journal of East-West Business 23: 283–307. [Google Scholar] [CrossRef]

- Kumar, Surender, and Prerna Prabhakar. 2017. India’s trade potential and free trade agreements: A stochastic frontier gravity approach. Global Economy Journal 17: 20160074. [Google Scholar] [CrossRef]

- Parsley, David C., and Shang-Jin Wei. 1996. Convergence to the law of one price without trade barriers or currency fluctuations. The Quarterly Journal of Economics 111: 1211–36. [Google Scholar] [CrossRef]

- Plummer, Michael G., David Cheong, and Shintaro Hamanaka. 2011. Methodology for Impact Assessment of Free Trade Agreements. Asian Development Bank. Available online: https://aric.adb.org/pdf/FTA_Impact_Assessment.pdf (accessed on 28 December 2020).

- Rahman, Mohammad Masudur, and Laila Arjuman Ara. 2010. Bangladesh trade potential: A dynamic gravity approach. Journal of International Trade Law and Policy 9: 130–47. [Google Scholar] [CrossRef]

- Rai, Durgesh K. 2019. India’s Trade with Its FTA Partners: Experiences, Challenges and Way Forward. The Economic Times. Available online: https://economictimes.indiatimes.com/blogs/et-commentary/indias-trade-with-itsfta-partners-experiences-challenges-and-way-forward/ (accessed on 5 January 2021).

- Reserve Bank of India. 2019. Foreign Trade Agreements: An Analysis*. Available online: https://rbidocs.rbi.org.in/rdocs/Bulletin/PDFs/04AR120919_028BA1821849674D13AD24B6A41n.d.6EC4.PDF (accessed on 21 March 2021).

- Renjini, V. R., Amit Kar, G. K. Jha, Pramod Kumar, R. R. Burman, and K. V. Praveen. 2017. Agricultural Trade Potential between India and ASEAN: An Application of Gravity Model. Agricultural Economics Research Review 30: 105–12. [Google Scholar] [CrossRef]

- Roberts, Benjamin. 2004. A gravity study of the proposed China-ASEAN free trade area. The International Trade Journal 18: 335–53. [Google Scholar] [CrossRef]

- Sanjuan Lopez, Ana Isabel, George Philippidis, and Helena Resano. 2013. Gravity estimation of Non-Tariff Measures (NTMs) on EU-USA agri-food trade: Implications for Further Analysis. In 16th Annual Conference on Global Economic Analysis, Shanghai, China. Global Trade Analysis Project (GTAP). West Lafayette: Purdue University. Available online: https://www.gtap.agecon.purdue.edu/resources/res_display.asp?RecordID=4197 (accessed on 1 January 2021).

- Sarin, Vishal. 2016. India-ASEAN Trade and Economic Relations. New Delhi: New Century Publications. [Google Scholar]

- Sharma, Preeti, and Girish Kathuria. 2020. Measuring Potential and Performance of Indo-ASEAN International Trade Using Gravity Model Approach. Amity Journal of Finance 5: 15–26. [Google Scholar] [CrossRef]

- Shepherd, Ben, Hrisyana Doytchinova, and Alexey Kravchenko. 2013. Gravity Model of International Trade: A User Guide. Available online: http://www.unescap.org/sites/default/files/tipub2645.pdf (accessed on 5 October 2020).

- Singh, Dr. Shikha, and Dipti Sharma. 2014. Impact of European Union and ASEAN Countries on India’s Trade Volume Using Gravitymodel: A Panel Data Approach. The Indian Economic Journal, 323–34. [Google Scholar]

- Singh, Loitongbam Bishwanjit. 2021. Impact of India-ASEAN Free Trade Agreement: An Assessment from the Trade Creation and Trade Diversion Effects. Foreign Trade Review 56: 400–14. [Google Scholar] [CrossRef]

- Tang, Donny. 2005. Effects of the regional trading arrangements on trade: Evidence from the NAFTA, ANZCER and ASEAN countries, 1989 2000. The Journal of International Trade & Economic Development 14: 241–65. [Google Scholar]

- UNCTAD. 2013. Non-Tariff Measures to Trade: Economic and Policy Issues for Developing Countries. Developing Countries in International Trade Studies. New York: United Nations Publication. [Google Scholar]

- Vanzetti, David, Christian Knebel, and Ralf Peters. 2018. Non-tariff measures and regional integrationin ASEAN. Paper presented at Twenty First Annual Conference on Global Economic Analysis, Cartagena, CO, USA, June 13–15. [Google Scholar]

- Veeramani, C., and Gordhan K. Saini. 2010. Impact of ASEAN- Commodities: A Simulation Analysis. Working Paper 2010-004. Mumbai: Indira Gandhi Institute of Development Research. [Google Scholar]

- Venkatesh, Vaishnavi, and Ranajoy Bhattacharyya. 2014. The ASEAN Free Trade Agreement: How Effective? Working Papers 1425. New Delhi: Indian Institute of Foreign Trade. [Google Scholar]

- Yang, Shanping, and Inmaculada Martinez-Zarzoso. 2013. A Panel Data Analysis of Trade Creation and Trade Diversion Effects: The Case of ASEAN-China Free Trade Area (ACFTA). Discussion Papers No. 224. Göttingen: Ibero America Institute for Economic Research. [Google Scholar]

- Yotov, Yoto V., Roberta Piermartini, and Mario Larch. 2016. An Advanced Guide to Trade Policy Analysis: The Structural Gravity Model. Geneva: World Trade Organization. [Google Scholar]

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2022 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).