Abstract

Being a form of territorial division of labor, economic specialization should be considered as a strategic management priority, contributing to a competitive territorial production structure and, consequently, regional economic growth. The article is devoted, firstly, to the development of a method for assessing the level of territorial division of labor based on a new coefficient of regional economic specialization; and secondly, to the investigation of regional specialization effects on economic growth. The purpose of the to substantiate the influence of the territory specialization factor on industrial economic growth, along with other conventional factors of regional development, using econometric methods based on an extended exogenous growth model. Premised on the data from Russian manufacturing industries and using a new coefficient of regional specialization, the authors have developed and verified an original approach to substantiate the effectiveness of regional clustering for ensuring the growth of industrial output based on an extended exogenous growth model. Approbation of the proposed assessment method and verification of research hypothesis formulated by the authors have been carried out using regional statistical data of the Russian Federation for the period from 2005 to 2019. The empirical analysis results have contributed to a place-based theoretical approach, involving both the cluster concept and the concept of “smart specialization”. The practical significance of the research is to validate clustering feasibility as a form of territorial division of labor and provide a number of principles for the regional industrial policy based thereon to accelerate territorial economic growth.

1. Introduction

The new challenges facing society in the era of globalization and major transformations necessitate the development of a well-balanced regional policy focused primarily on creating an effective production structure for the territory. Regional economic specialization should, firstly, be considered as a strategic management priority leading to the creation of a competitive structure of the economy and economic growth, and secondly, as a necessary condition for sustainable development.

The existing theoretical developments in the field of regional economic development lead to the conclusion that economic progress is randomly distributed in space, and regional conditions differ significantly. This is due, first of all, to the high specificity and diversity of regional factors that reflect the individual conditions for the development of regions. This problem is especially relevant for Russia due to its territorial size, and the socio-cultural, natural resource, and climatic diversity of the internal economic space.

Research into the issue of existing disproportions in the level and dynamics of regional economic growth goes back to An Inquiry into the Nature and Causes of the Wealth of Nations by Adam Smith (Smith 2007) first published in 1776. Since then, a number of theoretical and empirical works have been devoted to regional economic development factors. In accordance with the new economic geography concept, there are two groups of regional development factors: “first nature causes” (natural resource capital, geographical location), and the “second nature causes”, which include agglomeration and cluster effects, human capital and the institutional environment (Boschma 2005; Krugman 1991a, 1991b, 2009; Fujita et al. 2001).

The ambiguity of the research results on the economic structure in the context of ensuring economic development is demonstrated by the so-called the MAR vs. Jacobs controversy. The MAR model is an abbreviation that combines the theories of Alfred Marshall (Marshall 1890), Kenneth J. Arrow (Arrow 1962) and Paul M. Romer (Romer 1990), and proposes that spatial clustering and intra-industry knowledge spillovers, that is, regional specialization, positively affect the economic growth. In turn, the model of Jane Jacobs (Jacobs 1969) emphasizes the importance of inter-industry knowledge spillovers and thus the diversification of economic structure. These conflicting approaches have given rise to numerous empirical studies examining the relationship between economic structure and knowledge spillovers that drive innovation and growth (De Groot et al. 2016). However, despite numerous studies on the question of whether regional specialization or diversification contributes to economic growth, a clear answer has not yet been found (De Groot et al. 2016). At the same time, the views of researchers on this issue reflect diverse, and sometimes conflicting, approaches (Rothgang et al. 2017). There are studies showing the risks of overspecialization (clustering) of regions, leading to a weakening of regional economic stability and the emergence of a technological blocking effect (Uyarra and Ramlogan 2012). Among other things, it is also unclear what is meant by specialization: the absolute scale of economic activity in the region, its share in the regional economy, or its share in the country’s economy as a whole? Are the effects of specialization static, or is its impact evolutionary?

These facts actualize the need to continue the research on the problem of specialization in the context of stimulating the economic development of the territory. According to Frenken et al. (2007), a starting point for our study, the agglomeration economy is based on the tendency of economic activity to cluster (accumulation, concentration), as firms benefit from localization next to other firms. As a result, new sales markets are emerging, the functionality of enterprises’ products is growing, the interdependence of suppliers and consumers is increasing, and the pace of innovative activity of enterprises is enhanced. According to De Groot et al. (2009), industrial concentration and economic specialization contribute to the emergence of positive externalities that could affect economic development, employment, and income in a given territory. Fagerberg and Srholec (2002) have substantiated the importance of specialization for regional economic growth.

The research hypothesis is that the qualitative regional structure of the economy is a key factor for industrial economic growth along with other conventional factors presented in the economic growth literature.

In this article, we, firstly, develop a categorical apparatus, which is necessary for conducting the research. We propose the category of “level of specialization of the region” (or “regional specialization”), which is necessary in order to determine the general specialization of the territory, demonstrating the strength of manifestation of agglomeration effects in the economy of the region. This requires some kind of indicator, on the basis of which one can judge how much the whole region, and not just a single industry, is specialized and focused on some types of economic activity. To this end, we are developing a new coefficient of economic specialization of the territory based on the Herfindahl–Hirschman index, which will allow us to quantify the territorial division of labor (TDL) and study its impact on economic development.

Secondly, to study the impact of regional specialization on economic growth rates, we conduct an econometric analysis. We accept certain assumptions and limitations. In particular, the growth of manufacturing industry production is considered in the calculations, which is directly due to the logic of the study of specialization and limitations in the amount and comparability of available statistical data for the analysis. The theoretical basis of the analysis is the provisions of economic geography and regional economics; in particular, our work is based on the Mankiw–Romer–Weil (MRW) growth model (Mankiw et al. 1992).

The purpose of the study is to substantiate the influence of the territory specialization factor on industrial economic growth, along with other conventional factors of regional development, using econometric methods. The authors will develop and test an original approach using the data of the manufacturing industry of the Russian economy to substantiate the effectiveness of regional clustering in order to ensure the growth of industrial production based on an extended econometric model of exogenous economic growth (Mankiw et al. 1992) using a new coefficient of regional specialization. Testing of the proposed assessment method and verification of the research hypothesis will be carried out on the statistical data of the Russian regions in the context of 10 manufacturing industries for the period from 2005 to 2019. The practical significance of the study lies in the proposition of the fundamental principles for the regional industrial economic policy implementation.

The paper proceeds as follows. Section 2 presents an analysis of foreign and Russian literature on territorial division of labor, regional economic specializations, and clusters. Special emphasis is given to conceptual approaches that explore the relationship between regional specialization and clustering, and economic development. The conducted theoretical analysis made it possible to formulate the research hypotheses. Section 3 introduces the research methodology, including the development of a new coefficient for assessing regional specialization. It also describes the algorithms for collecting, preparing and analyzing statistical data, as well as building econometric models to test the formulated hypotheses. Section 4 presents the approbation results of the developed methods and approaches based on the manufacturing industry data from the regions of the Russian Federation, demonstrating the positive effect of specialization on the manufacturing industry growth. In Section 5, the authors discuss propositions arising from the conducted analysis. This section also highlights the key findings of the study and presents its theoretical contribution and practical significance. In Section 6, some limitations of the research and future research perspectives are proposed.

2. Literature Review and Hypothesis Development

2.1. The Triad of Categories “Territorial Division of Labor—Regional Economic Specialization Clusters”

Having omitted a definition of the territorial division of labor, Karl Marx noted that it “assigns certain industries to certain regions of the country” (Marx 1983). Baransky (1980) has specified territorial (geographical) division of labor as a spatial form of social division, when different countries (or regions) work for each other, the result of labor is transported, and there is an obligatory gap between the place of production, and the place of consumption.

In this context, Lenin’s views are of particular interest (Lenin 1971, p. 431): “Territorial division of labor, specialization of certain districts in the production of a single product, sometimes one type of product, and even a certain part of the product have indirect relationship with division of labor, emphasizing an inseparable unity of territorial division of labor, and regional specialization”.

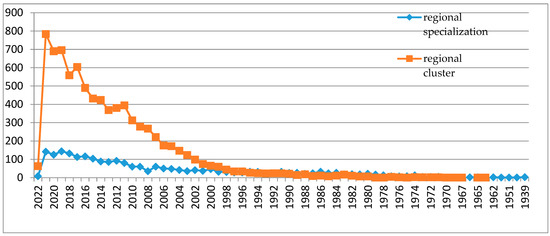

In turn, foreign authors have focused mainly on the study of clusters and cluster policy (Isaksen and Karlsen 2012; Njøs and Jakobsen 2016). For example, keyword searching for “regional specialization” and “regional cluster” has shown 2359 and 8285 results, respectively, in the Scopus database (Figure 1). However, clusters are a modern form of territorial division of labor. In our opinion, an integrated approach, linking the processes of territorial division of labor, regional economic specialization, and clusters into a single system is required. It seems important to integrate the links between the above theories in terms of identifying the relationship between regional specialization, and regional economic development.

Figure 1.

Dynamics of the number of publications that contain the terms “regional specialization” and “regional cluster” in their titles, keywords, and abstracts.

In previous studies, the authors have formulated the following definition: “Regional economic specialization is the achievement of competitive regional advantages based on the territorial division of labor due to the development of competitive industries with products mainly export-oriented and manufactured in quantities that significantly exceed local needs at relatively low labor costs, localization of economic activity due to a certain combination of socio-economic, geographical, historical, cultural, natural-climatic and other indicators” (Korostyshevskaya et al. 2021).

“Smart specialization” strategy that manifests a place-based approach to regional economic development (Barca et al. 2012) should be mentioned within the framework of our research. It allows identifying strategic areas for regional development based on the analysis of their strengths, institutional context and the potential of the regional innovation system (European Commission 2017). The major difficulty with this approach is the selection of “smart specialization” industries and substantiation of the very role of specialization within this process (Dzemydaite 2021).

It should be emphasized that being diverse and interdependent TDL forms, regional economic specializations and clusters based thereon have been increasingly used as objects of influence of regional economic policy.

In literature circles, a discussion about the positive effects of economic clustering was initiated by Michael Porter, followed by Marshall who distinguished two main areas between such positive effects. The first one is associated with realization of benefits from close proximity of enterprises, or with the so-called “agglomeration economies”. The second one is based on the MAR spillover model, according to which knowledge is transferred from one company, institution, or organization to another within the cluster due to formal and informal relationships, and the creation of “social networks” of interaction between employees. This model suggests that clusters should thereby increase the human capital of workers and become more attractive for the implementation of innovative projects. Indeed, with clustering in the economies of developed countries, clusters have become fields for innovations, patents, and technological progress along with their original value as a catalyst for regional economic development.

In the context of our research, it seems necessary to trace the development of scientific thought in terms of territorial economic development and regional specialization (clustering) linkage.

2.2. Relationship between Regional Specialization and Economic Development

Stemming from territorial division of labor, clusters are reviewed in numerous domestic and foreign studies. However, one should recognize the insufficiency of empirical research that substantiates the positive impact of specialization as a prerequisite for regional clustering and agglomeration effects on territorial economic development. Some papers demonstrate the difficulty of evaluating cluster policies due to their complexity, high dimensionality, and temporal dimension of policy effects (Rothgang et al. 2017). There was an extensive debate on the influence of specialization of regional economic structure on its economic growth and development (Kemeny and Storper 2014). These studies date back to Plato’s considerations in his Republic, where he says that the division of labor within the state leads to greater efficiency (Sandelin et al. 2001). Many arguments in favor of the existence of this relationship were expressed by David Ricardo (1817) in the theory of comparative advantages and later by Paul Krugman (2009) in the theory of comparative efficiency, being actively used in regional studies.

The works of Jacobs (1969), Marshall (1920), Arrow (1962), and Romer (1990) have played a major role in the study of economic specialization and diversification.

The concept of agglomeration economies suggests that firms benefit from close proximity to other firms by reducing transaction costs for coordination and communication. The theory substantiates the advantages of production specialization over diversification (Marshall 1890). In (Marshall 1920) it is noted that homogeneous or similar industries, despite their economic independence, have a tendency to geographical concentration. According to his theory, there is a kind of multiplier effect with close location of enterprises, since there are benefits from being located close to enterprises with similar specialization and demand for factors of production. A significant contribution to the elaboration of this assumption was made by (Hidalgo et al. 2007; Hausmann et al. 2011). Porter (2003) pays attention to the co-location of specialized types of economic activity. He determines the nature of the formation of regional specialization based on the buyer–seller relationship, or technological similarity between industries and regions. Besides, a certain type of economic activity of an individual territory is formed both by the efforts of ordinary companies, and by scientific and educational institutions, specialized government organizations, financial institutions, and consultants, which additionally reveals the institutional nature of regional specialization. He allocates the totality of related regions and industries into clusters, which he considers as a single object of development and management, using the cluster approach and methodology (Porter 2003). In later research, the cluster approach in regional specialization is viewed as integration and interconnection of industries and space (McCann and Ortega-Argilés 2013).

The problem of formation of regional specializations was studied by Krugman, the founder of the new economic geography. He notes that geographical concentration and close interaction between companies allows achieving an agglomeration effect that stimulates innovative activity and becomes an important competitive advantage in modern conditions. The processes of specialization and diversification resulting in regional inequality were studied in terms of this theory (Krugman 1980, 2009). Some authors (Scott 1988; Storper 1997) investigated the reasons for the emergence of industrial agglomerations and their positive impact on the efficiency of individual enterprises. As a result of joint activities, they manage to achieve economies of scale and collaborative localization. In turn, the region with a concentration thereof becomes more competitive in global markets. This region accumulates specialized knowledge, skills, norms, values, and common institutions.

In turn, Frenken et al. (2007) argue that it is more promising for the long-term economic growth of a region when its industrial structure includes many interconnected products (“related variety”). It contributes to economic growth by stimulating Jacobs- type of knowledge externalities. Innovative activities emerge as a result of diversification in modern regional areas of specialization (Hassink and Gong 2019). This approach has become widespread in numerous empirical studies (Asheim et al. 2011; Boschma and Frenken 2009; Boschma et al. 2016; Shediac et al. 2008; Frenken et al. 2005; Neffke et al. 2011; Boschma et al. 2015). Despite using different dependent variables (e.g., new products, industries, technologies), measures of relatedness (e.g., product relatedness, technological relatedness, skill relatedness), spatial units of analysis (countries, regions, cities, labor markets), and time periods (Boschma 2017), these studies admit relatedness to be an important factor in regional diversification. Thus, related diversification turned out to be more common in the regions, but unrelated diversification occurs less frequently.

Regional diversification is a deeply uncertain process that can be reduced by relying on existing local capacity to diversify into new activities (Frenken et al. 2007). For example, it is easier for regions to switch from motorcycles to trucks than from bananas to computers, because motorcycles and trucks require similar capabilities, while bananas and computers require diverse capabilities.

Unfortunately, this approach does not specify whether this situation is the cause, or the result of previous diversification. Therefore, it remains unclear, if one should have increased specialization in the past in order to subsequently cover a wider range of economic activities. Gunnar Myrdal (1957) put forward the thesis that specialization leads to a more complex industrial structure. Later, this thesis was developed in the core-periphery model within the framework of the new economic geography, which demonstrates an economy’s successful specialization, its expansion and diversification through economies of scale in the domestic market. In our opinion, it is important to perceive the nature of diversification when new potential activities emerge within the sectoral structure of the economy. However, specialization emphasizes that these activities are related to the regional context and experience, and to previous activities implemented in the given territory.

The processes of specialization and diversification and their impact on the economic development of the territory are closely related to the research on agglomeration effects in the economy. Frenken et al. (2007) identify four groups of benefits from agglomeration effects in economics, leading to prosperity of some regions while others lag behind.

Firstly, the new economic geography emphasizes increasing economies of scale as an advantage of agglomeration. Secondly, the source of the agglomeration effect is the localized economy. This source is related to the so-called MAR externalities originating from industry specialization (McCann and Ortega-Argilés 2013). According to Krugman, the advantages of economies from localization are as follows: economies due to specialization; labor market; knowledge spillovers. Indeed, information about innovations is more easily disseminated among agents located in the same territory, thanks to social ties that favor mutual trust and private personal contacts (Gamidullaeva et al. 2020). Hence, clusters provide many more innovative opportunities for enterprises compared to dispersed location (Tolstykh et al. 2020). Thus, George Stigler (1951) found that the creation of specialized suppliers requires a sufficiently large industry market. Thirdly, agglomeration effects arise from urban size and density, and urbanization economies are available to all local firms. There are benefits from close proximity of a variety of economic, cultural, social and political organizations and actors, which is characteristic of large cities with developed infrastructure, networks and opportunities for innovation. Finally, according to Frenken et al. (2007), the source of the agglomeration economy is Jacobs-type knowledge externalities, or cross-industry externalities (Jacobs 1969). As stated by the author, the diversity of industries is a favorable environment for creating innovation and growth. Indeed, the creation of innovative products and technologies requires cross-sectoral interaction, and knowledge, technology and cooperation exchange.

However, the researchers associate a more diversified economic structure with regional economic development. For example, according to (Jacobs 1969), the more diversified an economy is, the more are the opportunities to create a greater range of goods and services. It is close location of firms that contributes to knowledge, information and experience exchange between economic agents and collaboration of different industries, positively affecting the creation of innovative products at their intersections. A crucial aspect is the linkage between these technologies (Balland et al. 2019). Some authors consider the risk associated with technological obsolescence, and vulnerability to changes in the external environment, including the ongoing COVID-19 crisis outcomes as a key argument against specialization (Skare et al. 2021; Zhang et al. 2021). The authors speak of the drawback of diversification, being the lack of opportunities for the development of collective learning and competition, which hinders the development of new specializations in the regions (Iacobucci and Guzzini 2016; Capello and Kroll 2016).

In this article, we focus the research on the effects of sectoral structure of the economy on regional economic growth rates, namely, the effects of a localized economy and industry specialization, which greatly contributes to MAR vs. Jacobs studies.

Since each region in Russia is characterized by a unique set of factors, then any model simplifies the real situation to a certain extent. Based on the analysis of the experience of the most prosperous regions in Russia and the above literature review, the following research hypothesis has been formulated: there is a direct relationship between regional specialization and industrial economic growth rates (regions with greater specialization have higher growth rates).

3. Methodological Framework

3.1. Operationalizing Specialization

There are a number of important indicators presented in the literature for quantifying the level of regional economic specialization:

- Location quotient;

- Per capita production coefficient;

- Regional merchantability quotient.

At this stage, without going into the analysis of the above indicators, it can be seen that the location quotient is closely related to locating economic activity, and the concentration of larger scale types of production (obtaining necessary economic profits); the per capita production coefficient reflects the ability to meet the demand in the region in the best possible way; and the regional merchantability quotient reflects the possibility of solving other commercial problems. We consider the proposed indicators for quantifying the level of regional economic specialization in more detail.

The location quotient (LQ) is the ratio of a given industry share in the production structure of the region to the share of the same industry in the country:

where VR is the volume of industry production by region; VC is the volume of industry production by country; TR is the total industrial production of the region; TC is the total industrial production in the country.

The per capita production coefficient (PPC) is the ratio of the share of the regional economic sector in the corresponding structure of the country’s sector to the share of the regional population in the country:

where VR is the volume of industry production by region; VC is the volume of industry production by country; RP is the population of the region; CP is the population of the country.

The regional merchantability quotient (RMQ), often referred to as the export coefficient, is calculated as the ratio of the regional production export of the relevant industry to its production:

where PE is regional production export of the relevant industry (produced in the region, excluding transit); IO is the output of the relevant industry.

If some integral indicator is developed to combine the three coefficients, being rather difficult to interpret, it would be more qualitative than quantitative.

Despite a measurement of economic specialization in the sense of LQ indexes being broadly used, there is still a literature gap for more critical analysis of the applicability of quantitative measures for policy purposes. This point of view is supported by many authors (Dzemydaite 2021; Hassink and Gong 2019; Foray 2019). As Benner (2020) highlighted, there is a need for rigorous assessments and a critical judgment of the currently used techniques in policy formation.

The above coefficients assess the level of regional specialization in an individual industry, but none of them calculates the total level of industry territorial specialization, although there is no doubt that a region can have several specialized industries. In our opinion, the level of regional specialization, focusing on certain types of economic activity, or the development of certain industries, could be used to determine regional specialization.

We propose a method for assessing general territorial specialization based on the Herfindahl–Hirschman index (Hirschman 1964). The coefficient of territorial specialization (Spec) is calculated as the sum of the squares of each industry’s share in the total volume of regional production, resulting in the diversification level of any territorial unit economy (the level of general territorial specialization).

where is the volume of supplied products of the i-th industry in comparable prices of t year; is the gross regional product in t year; n is the number of industries.

The coefficient of regional specialization shows how much the economy of a particular region or country is diversified. Being simple to calculate, the coefficient provides the opportunity for making cross-country comparisons, for historical analysis of specialization trends, and for assessing the whole regional specialization.

As highlighted above, in order for a region to achieve a higher level of specialization in some types of economic activity, it should have at least partial demand in foreign markets. For this reason, it is the tradable industries that should be included in the analysis of economic specialization. Traded sectors are those whose products are sold internationally, and these can be both goods and services (Gervais and Jensen 2019; Francois and Hoekman 2010). However, most studies have focused on the manufacturing sector, implicitly assuming that services cannot be sold in international markets, although this is not the case. In our study, the research object is the manufacturing industry as the most indicative to demonstrate the significance of the specialization factor, and the service sector is excluded from the calculations.

3.2. Methodology and Description of Variables

The data source is the Federal State Statistics Service (Rosstat) unless otherwise noted. The data for 83 regions of Russia (some data for the Republic of Crimea and the city of Sevastopol are unavailable) for 2005–2019 have been used for calculations (Federal State Statistics Service (Rosstat) 2021). In accordance with the MRW model, the growth rate of manufacturing industry adjusted for inflation has been used as a dependent variable. Some independent variables used in similar calculations in the literature, namely, institutional conditions and technological development, have been added to the MRW model. Having selected a number of feasible indicators for each factor, the research objectives were to determine the most important regressor and explore the obtained dependencies for multicollinearity.

Table 1 shows the considered factors, their designations, the used indicators, and the expected effect thereof on regional development.

Table 1.

Variables.

The physical capital savings rate has been estimated as the ratio of the previous year’s investments to the reporting year’s gross regional product (GRP). Thus, we have evaluated the extent to which investments in capital of the past periods are revealed in the current year’s regional growth. To assess the human capital savings rate, standard educ and student indicators described in the literature review have been used. The educ indicator is the share of employed residents with tertiary education (Zemtsov and Smelov 2018). It also assesses the quality of human capital and the impact of agglomeration effects (Fujita et al. 2001) associated with concentration and diversification of economic activity in cities. The student indicator is the number of students per 100 people.

Favorable institutional conditions contribute to attracting investment, expansion of lending and the development of small and medium-sized businesses leading to an increase in the level of regional development (Audretsch and Keilbach 2010). To assess regional institutional quality, we have used the investment risk calculations of the Expert RA Rating Agency (RAEX). The total index involves such particular risks as financial, social, managerial, economic, environmental, and criminal, thus covering the whole range of possible changes in the institutional environment (Zemtsov and Smelov 2018).

Crime rate is one of key indicators of environment quality, which correlates with investment risk assessments. A high crime rate can denote poor protection both for property rights, and health and life of potential investors.

Entrepreneurial activity serves as an additional indicator of institutional quality for domestic investors (entrepreneurs). To assess the accumulated knowledge and the level of technological development, the import performance indicator for machinery, equipment, and vehicles has been used (Zemtsov and Smelov 2018).

We have assessed the effect of regional specialization on the growth of regional manufacturing industry output in the framework of the classical β-convergence model. The presence of β-convergence suggests that there is a negative relationship between the initial value level (e.g., income, carbon dioxide emissions, energy productivity) and its growth rate. The regression equation for testing β-convergence is as follows:

where is the value of Y variable in the current period t; is the value of Y variable with a T lag. A negative significant coefficient β indicates the presence of convergence. The rate of convergence (Ricardo 1817) is calculated as In our case, Y is the actual output of the manufacturing industry. We have used panel data and calculated the growth to the previous year. Therefore, T = 1 and Equation (5) takes the following form:

where i is the number of the region; t is the year.

Thus, the effect of specialization is assumed to be the same in all regions over the years, and it is represented by the coefficient γ. However, each region may have its individual effects. In addition, various effects on growth (general trends for all regions) depend on the years and are represented by the coefficient . According to our hypothesis, we expect the effect to be significant (i.e., the coefficient γ is significantly different from 0 in terms of statistics), and positive. The coefficient β is expected to be significant and negative in the presence of convergence.

Such a model is sometimes regarded as a fixed effects model, but this can hardly be completely appropriate. The fact is that there is a term on the left- and right-hand sides of the equation. Therefore, the model can be written as:

It can no longer be assessed as a fixed effects model, since there is a lag of the dependent variable on the right-hand side. Thus, it is a dynamic model, and there is an endogeneity problem. We will evaluate it using the bias corrected LSDV dynamic panel data estimator (Bruno 2005).

4. Results

Calculations of specialization coefficients for 2005–2019 have been carried out using data from ten manufacturing industries (Table 2). A yearbook Regions of Russia: Socio-Economic Indicators published by the Rosstat has served as a source of annual statistical data. An electronic collection is available at: https://www.gks.ru/bgd/regl/b19_14p/Main.htm (accessed on 1 February 2021)].

Table 2.

Classification of manufacturing industry by periods (2005–2011; 2010–2012; 2013–2016; 2017–2019).

A reference book titled Structure of the Shipped Products (Works, Services) Volume by Type of Economic Activity–Manufacturing has been used.

The MS Excel package has been applied to prepare the initial statistical data and calculate the related indicators1.

Statistical data on the real output of the overall manufacturing industries (ten industries for the Russian Federation) have been used for the analysis (Table 2). The current output for each industry has been adjusted taking into account the consumer price index. It has been revealed that the manufacturing industry classification would change four times from 2005 to 2019 due to grouping and regrouping of some categories, which allows all classifications to be brought to a single form. We have applied analytical procedures to present comparable data for the whole period from 2005 to 2019 (Table 2).

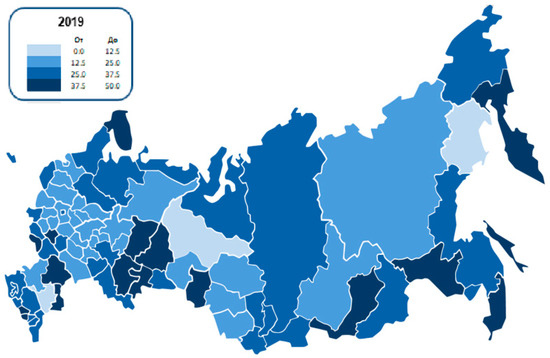

In 2019, the level of sectoral specialization of Russian regions was heterogeneous (less than 10%: 0; 10–20%: 22; 20–30%: 35; 30–40%: 9; 40–50%: 6; more than 50%: 6) (Figure 2). The specialization of the manufacturing industry in St. Petersburg, and the country’s largest industrial centers, was on the verge of 20%. The level of specialization of the largest industrial regions was above 20% (Moscow: 35.62%; Sverdlovsk region: 41.86%; Chelyabinsk region: 40.98%; the Republic of Bashkortostan: 27.62%; Tyumen region:60.21%; Perm Krai: 21.89%; Samara region: 24.62%; Krasnoyarsk Krai: 57.49%). Kamchatka Krai was the highest specialized region of Russia (93.36%), and Smolensk region the lowest one (10.97%).

Figure 2.

Regional specialization of the manufacturing industry of the constituent entities of the Russian Federation in 2019. Source: Rosstat.

To build econometric models, we have used the Software for Statistics and Data Science (Stata).

Estimation results for 83 regions of the Russian Federation for the period from 2005 to 2019 are shown in Table 3. The fixed effects model (1a) estimates are given in the first column; the second column shows the dynamic model (2) estimates; the coefficients α, β, δ are omitted for brevity.

Table 3.

Estimates of relationship between specialization and manufacturing industry growth, 2005–2019.

The estimates of both models are consistent. The coefficient β is significant and negative with the output logarithm lag, which indicates the presence of convergence. The higher regional specialization (SQ) is, the higher the output. Hence, our hypothesis has been confirmed.

5. Discussion and Conclusions

There are few cases of empirical analysis of the influence of economic specializations on the economic development of a territory as compared to numerous theoretical studies (Krugman 1991a, 1991b; Midelfart-Knarvik et al. 2000; Buigues et al. 1999, etc.).

In this article, the authors have attempted to assess the general territorial specialization, manifesting strength of agglomeration effects in the regional economy. Using the coefficient of regional specialization, econometric models that describe the impact of specialization on the economic development of a territory have been developed.

The performed analysis has allowed us to draw a number of major conclusions.

Firstly, the level of regional specialization does not specify regional development or backwardness. There are both highly specialized backward regions, and industrialized regions with a low level of specialization.

Secondly, the use of the proposed coefficient of regional specialization is efficient, primarily, when assessing the dynamics of changes in regional sectoral output, especially in estimating the effectiveness of economic policy to stimulate the territorial division of labor, including cluster policy in relation to industries.

Finally, there is a stable relationship between the level of specialization of regions, and the rate of their economic growth.

These findings generally correlate with the smart specialization approach. The core principle of “smart specialization” requires each region to focus on its strengths and manage the process of priority setting in the context of national and regional strategies.

There is a close relationship between our research findings and the cluster concept, being actively used in many countries both at the national and regional levels to ensure knowledge-based territorial growth and development. The cluster implies the geographical localization of related enterprises operating in a certain area (industry), thus providing variety of advantages, leading to accelerated growth and development of the enterprises included therein (Beaudry 2001; Baptista and Swann 1998). The relevant literature specifically addresses a cluster impact on regional innovation activity (Feldman 2000).

For example, according to (Tatarkin et al. 2013), the authors have analyzed the distribution of the most important objects of modernization and new construction in old-industrial area, using the example of Sverdlovsk region. It has been revealed that the development of cluster forms of organization and functioning of industrial enterprises was one of the most important trends in the location of new construction and modernization facilities in the machine-building complex for 2007–2012, thus emphasizing the value of territorial specialization.

Martin et al. Martin et al. (2011) have found a similar effect of specialization on firm performance (the effect on wages being slightly less). In most papers, clusters are considered as local concentrations of specific industries, rather than groups of related industries. Modern literature suggests considering employment growth at the industry level as a strength function of industry specifics and cluster strength of the related industries (Delgado et al. 2014).

In publications, clusters are considered as factors that determine differences in the level of well-being of individual areas (Beaudry and Schiffauerova 2009; Ketels 2013). The authors argue that clusters matter to regional development and growth (Hausmann and Klinger 2007; Lederman and Maloney 2012; Rothgang et al. 2021).

These facts also emphasize that specialization as a form of division of labor, with clustering to be paid much more attention in foreign literature, plays a vital role in the development of individual enterprises and, therefore, the territory as a whole.

Thus, the empirical analysis results have definitely contributed to a place-based theoretical approach, involving both the cluster concept and the concept of “smart specialization” (Lis et al. 2021; Zárate-Mirón and Moreno Serrano 2021; Dossoa et al. 2022). The research findings are consistent with the concept of related diversification within the concept of “smart specialization”. The importance of related diversification in ensuring economic growth, focusing on a regional tendency to specialize in related industries, has been analyzed by many researchers (Boschma et al. 2016).

Implications for Regional Cluster Policy

Thus, given the analysis, we provide a number of principles for the regional industrial policy.

First is the accounting principle of the specific regional context. Regional policy should coincide with certain unique natural and climatic, geographic and other conditions of a particular region. Here, the definition of priority specialization plays a key role both in prioritization of government support and, above all, determines the possibility of market synergetic effects.

There is an opportunity to identify particular “competitive advantages” of a region in national and global markets via the development of specific regional “comparative advantages”. This evolution of the regional economy from the use of “comparative advantages” to the creation of “competitive advantages” is essential for strengthening the internal economic space of the country as a whole. In this regard, the “designation” of promising sectors of specialization “topdown” from the federal level, ignoring regional competitive advantages, seems to be incorrect.

Second is the systemicity principle. It is implemented in the formation of clusters as a horizontal form of territorial division of labor. Such clusters can make a significant contribution to the economic development of regions by supporting research and innovation activities within the identified areas of specialization. Clusters formed on the basis of “comparative advantages” of the region using the bottom-up (spontaneous) principle, or on the initiative of private investors, and government structures, that is, top-down, allow to determine regional competitive advantages, to identify the real needs of enterprises located on a specific territory, and make state support as targeted as possible. Having occupied a certain niche in global markets, a region will be able to determine its place in global value chains. “Since markets are global, and labor resources are usually concentrated in space, clusters can be regarded as local “assemblage points” in global market networks” (Kutsenko et al. 2019).

6. Limitations and Future Research Agenda

The proposed coefficient of territorial specialization does not account for a high degree of heterogeneity of countries and regions, regarding such factors as the size of the country and region; population density; raw materials, industrial or technological orientation of the economy, for example. Moreover, statistical methods for classifying industries in different countries vary significantly, which reduces the attractiveness and accuracy of such calculations. Nevertheless, this problem applies to any similar coefficients and indices, outside of our research.

The developed econometric models to confirm the proposed hypothesis have certain drawbacks. In future research, the authors plan to include other factors that have not been taken into account at the moment. This will allow improving quality, reliability, and explanatory power of the developed models. In addition, it is advisable to analyze the influence of the specialization factor on the statistical data for the US states and China provinces.

Having defined “regional specializations”, we adhere to some authors (Iacobucci and Guzzini 2016) on the formation of specialization due to export-oriented production. In this regard, we are planning to set apart tradable and non-tradable sectors of the economy in our future research.

Based on the Herfindahl–Hirschman index, it is also feasible to analyze the level of industrial concentration, that is, the extent to which the industry is concentrated or scattered in a particular industry across the country. It will be possible to determine which industries either tend to localization, or to uniform dispersion. This, in turn, will relieve decision-makers from attempts to form territorial specializations based on industries that are evidently not prone to concentration.

Author Contributions

Conceptualization, formal analysis, writing—original draft preparation, collected data, data validation, supervision, funding acquisition, L.G.; writing—original draft preparation, collected data, data validation, performed the first data analysis, E.K.; collected data, data validation, performed the first data analysis, A.M.; collected data, data validation, formal analysis, O.P. All authors have read and agreed to the published version of the manuscript.

Funding

This research received no external funding.

Institutional Review Board Statement

Not applicable.

Informed Consent Statement

Not applicable.

Data Availability Statement

Not applicable.

Conflicts of Interest

The authors declare no conflict of interest.

Note

| 1 | The authors are willing to share the data set in Excel format with those who wish to replicate the results of the research. |

References

- Arrow, Kenneth J. 1962. The economic implications of learning by doing. The Review of Economics Studies 29: 155–73. [Google Scholar] [CrossRef]

- Asheim, Bjørn T., Ron Boschma, and Philip Cooke. 2011. Constructing regional advantage: Platform policies based on related variety and differentiated knowledge bases. Regional Studies 45: 893–904. [Google Scholar] [CrossRef]

- Audretsch, David B., and Max Keilbach. 2002. Entrepreneurship Capital and Economic Performance. Regional Studies 38: 949–59. [Google Scholar] [CrossRef]

- Balland, Pierre-Alexandre, Ron Boschma, Joan Crespo, and David L. Rigby. 2019. Smart specialization policy in the European Union: Relatedness, knowledge complexity and regional diversification. Regional Studies 53: 1252–68. [Google Scholar] [CrossRef] [Green Version]

- Baptista, Rui, and Peter Swann. 1998. Do firms in clusters innovate more? Research Policy 27: 525–40. [Google Scholar] [CrossRef]

- Baransky, N. N. 1980. Selected Works. Formation of Soviet Economic Geography. Moscow: Mysl. [Google Scholar]

- Barca, Fabrizio, Philip McCann, and Andrés Rodríguez-Pose. 2012. The case for regional development intervention: Place-based versus place-neutral approaches. Journal of Regional Science 52: 134–52. [Google Scholar] [CrossRef]

- Beaudry, Catherine. 2001. Entry, growth and patenting in industrial clusters: A study of the aerospace industry in the UK. International Journal of the Economics of Business 8: 405–36. [Google Scholar] [CrossRef] [Green Version]

- Beaudry, Catherine, and Andrea Schiffauerova. 2009. Who’s right, Marshall or Jacobs? The localisation versus urbanisation debate. Research Policy 38: 318–37. [Google Scholar] [CrossRef] [Green Version]

- Benner, Maximilian. 2020. Six additional questions about smart specialization: Implications for regional innovation policy 4.0. European Planning Studies 28: 1667–84. [Google Scholar] [CrossRef]

- Boschma, Ron. 2005. Proximity and Innovation: A Critical Assessment. Regional Studies 39: 61–74. [Google Scholar] [CrossRef]

- Boschma, Ron. 2017. Relatedness as driver of regional diversification: A research agenda. Regional Studies 51: 351–64. [Google Scholar] [CrossRef]

- Boschma, Ron, and Koen Frenken. 2009. Technological relatedness and regional branching. In Dynamic Geographies of Knowledge Creation and Innovation. Edited by Harald Bathelt, Maryann Feldman and Dieter F. Kogler. New York and London: Routledge Taylor & Francis Group. [Google Scholar]

- Boschma, Ron, Pierre-Alexandre Balland, and Dieter Franz Kogler. 2015. Relatedness and technological change in cities: The rise and fall of technological knowledge in U.S. metropolitan areas from 1981 to 2010. Industrial and corporate change 24: 223–50. [Google Scholar] [CrossRef]

- Boschma, Ron, Lars Coenen, Koen Frenken, and Bernhard Truffer. 2016. Towards a theory of regional diversification. Papers in Evolutionary Economic Geography 16: 17. [Google Scholar]

- Bruno, Giovanni S. F. 2005. Estimation and inference in dynamic unbalanced panel-data models with a small number of individuals. Stata Journal 5: 473–500. [Google Scholar] [CrossRef] [Green Version]

- Buigues, Pierre, Steve Davies, Pierre Defraigne, Ioannis Ganoulis, Paul Geroski, André Sapir, and Leo Sleuwaegen. 1999. Specialisation and (Geographic) Concentration of European Manufacturing. Enterprise DG Working Paper No. 1. Brussels: European Commission. [Google Scholar]

- Capello, Roberta, and Henning Kroll. 2016. From theory to practice in smart specialization strategy: Emerging limits and possible future trajectories. European Planning Studies 24: 1393–406. [Google Scholar] [CrossRef]

- De Groot, Henri, Jacques Poot, and Martijn Smit. 2009. Agglomeration Externalities, Innovation and Regional Growth: Theoretical Perspectives and Meta-analysis. In Handbook of Regional Growth and Development Theories. Cheltenham: Edward Elgar Publishing Ltd., pp. 256–81. [Google Scholar]

- De Groot, Henri, Jacques Poot, and Martijn Smit. 2016. Which agglomeration externalities matter most and why? Jornal of Economic Survey 30: 756–82. [Google Scholar] [CrossRef]

- Delgado, Mercedes, Michael E. Porter, and Scott Stern. 2014. Clusters, Convergence, and Economic Performance. Research Policy 43: 1785–99. [Google Scholar] [CrossRef] [Green Version]

- Dossoa, Mafini, Alexander Kleibrinka, and Monika Matusiaka. 2022. Smart specialisation strategies in sub-Saharan Africa: Opportunities, challenges and initial mapping for Côte d’Ivoire. African Journal of Science, Technology, Innovation and Development 14: 121–34. [Google Scholar] [CrossRef]

- Dzemydaite, Giedrė. 2021. The Impact of Economic Specialization on Regional Economic Development in the European Union: Insights for Formation of Smart Specialization Strategy. Economies 9: 76. [Google Scholar] [CrossRef]

- European Commission. 2017. Communication from the Commission to the European Parliament, the Council, the European Economic and Social Committee and the Committee of the Regions. Strengthening Innovation in Europe’s Regions: Strategies for Resilient, Inclusive and Sustainable Growth. Brussels: European Commission, Available online: https://eur-lex.europa.eu/legal-content/EN/TXT/PDF/?uri=CELEX:52017DC0376&from=en (accessed on 10 March 2022).

- Fagerberg, Jan, and Martin Srholec. 2002. Explaining Regional Economic Performance: The Role of Competitiveness, Specialization and Capabilities. Lund: Lund University. [Google Scholar]

- Federal State Statistics Service (Rosstat). 2021. Available online: https://rosstat.gov.ru/ (accessed on 14 February 2021).

- Feldman, Maryann. 2000. Location and innovation: The new economic geography of innovation, spillovers and agglomeration. In The Oxford Handbook of Economic Geography. New York and Oxford: Oxford University Press, pp. 559–79. [Google Scholar]

- Foray, Dominique. 2019. In response to ‘Six critical questions about smart spezialisation’. European Planning Studies 27: 2066–78. [Google Scholar] [CrossRef]

- Francois, Joseph, and Bernard Hoekman. 2010. Services Trade and Policy. Journal of Economic Literature 48: 642–92. [Google Scholar] [CrossRef] [Green Version]

- Frenken, Koen, Frank Oort, Thijs Verburg, and Ron Boschma. 2005. Variety and Regional Economic Growth in The Netherlands. Utrecht: Utrecht University. [Google Scholar]

- Frenken, Koen, Frank van Oort, and Thijs Nicolaas Verburg. 2007. Related variety, unrelated variety, and regional economic growth. Regional Studies 41: 685–97. [Google Scholar] [CrossRef] [Green Version]

- Fujita, Masahisa, Paul Krugman, and Anthony J. Venables. 2001. The Spatial Economy: Cities, Regions, and International Trade. Cambridge: MIT Press. [Google Scholar]

- Gamidullaeva, Leyla, Sergey Vasin, and Nicholas Wise. 2020. Increasing small- and medium-enterprise contribution to local and regional economic growth by assessing the institutional environment. Journal of Small Business and Enterprise Development 27: 259–80. [Google Scholar] [CrossRef]

- Gervais, Antoine, and Bradford Jensen. 2019. The tradability of services: Geographic concentration and trade costs. Journal of International Economics 118: 331–50. [Google Scholar] [CrossRef] [Green Version]

- Hassink, Robert, and Huiwen Gong. 2019. Six critical questions about smart specialization. European Planning Studies 27: 2049–65. [Google Scholar] [CrossRef]

- Hausmann, Ricardo, and Bailey Klinger. 2007. The Structure of the Product Space and the Evolution of Comparative Advantage. Working Paper 146. Cambridge: Center for International Development at Harvard University. [Google Scholar]

- Hausmann, Ricardo, César A. Hidalgo, Sebastián Bustos, Michele Coscia, Sarah Chung, Juan Jimenez, Alexander Simoes, and Muhammed A. Yıldırım. 2011. The Atlas of Economic Complexity. Cambridge: Puritan Press. [Google Scholar]

- Hausmann, Ricardo, Bailey Klinger, Albert-László Barabási, and Ricardo Hausmann. 2007. The product space conditions for the development of nations. Science 317: 482–87. [Google Scholar]

- Hirschman, Albert. O. 1964. The paternity of an index. American Economic Review 54: 761. [Google Scholar]

- Iacobucci, Donato, and Enrico Guzzini. 2016. Relatedness and connectivity in technological domains: Missing links in S3 design and implementation. European Planning Studies 24: 1511–26. [Google Scholar] [CrossRef]

- Isaksen, Arne, and James Karlsen. 2012. Combined and complex mode of innovation in regional cluster development–analysis of the light-weight material cluster in Raufoss. In Interactive Learning for Innovation: A Key Driver within Clusters and Innovation Systems. Edited by Bjørn T. Asheim and Mario Davide Parrilli. Basingstoke: Palgrave Macmillian, pp. 115–36. [Google Scholar]

- Jacobs, Jane. 1969. The Economy of Cities. New York: Vintage Books. [Google Scholar]

- Kemeny, Thomas, and Michael Storper. 2014. Is specialization good for regional economic development? Regional Studies 49: 1003–18. [Google Scholar] [CrossRef]

- Ketels, Christiian. 2013. Cluster Policy: A Guide to the State of the Debate. In Knowledge and Economy. Edited by Peter Meusburger, Johannes Glückler and Martina el Meskioui. Heidelberg: Springer. [Google Scholar]

- Korostyshevskaya, E. M., L. A. Gamidullaeva, and A. P. Myamlin. 2021. To the question about quantitative measurement of territorial division of labor. Models, Systems, Networks in Economics, Engineering, Nature and Society 1: 5–20. [Google Scholar] [CrossRef]

- Krugman, P. 1980. Scale Economies, Product Differentiation, and the Pattern of Trade. American Economic Review American Economic Association 70: 950–59. [Google Scholar]

- Krugman, Paul. 1991a. Geography and Trade. Cambridge: MIT Press. [Google Scholar]

- Krugman, Paul. 1991b. Increasing returns and economic geography. Journal of Political Economy 99: 483–99. [Google Scholar] [CrossRef]

- Krugman, P. 2009. The increasing returns revolution in trade and geography. American Economic Review 99: 561–71. [Google Scholar] [CrossRef] [Green Version]

- Kutsenko, Evgeniy S., Vasily L. Abashkin, and Ekaterina A. Islankina. 2019. Focusing Regional Industrial Policy via Sectorial Specialization. Voprosy Ekononiki 5: 65–89. Available online: https://publications.hse.ru/articles/289430204 (accessed on 4 December 2021).

- Lederman, Daniel, and William Maloney. 2012. Does What You Export Matter? In Search of Empirical Guidance for Industrial Policies. Washington, DC: The World Bank. [Google Scholar]

- Lenin, V. I. 1971. Collected Works. Politizdat: Moscow, vol. 3. [Google Scholar]

- Lis, Anna Maria, Arkadiusz Michał Kowalski, and Marta Mackiewicz. 2021. Smart Specialization through Cluster Policy. Evidence from Poland and Germany. In Partnerships for Regional Innovation and Development, 1st ed. London: Routledge, p. 28. [Google Scholar]

- Mankiw, N. Gregory, David Romer, and David N. Weil. 1992. A contribution to the empirics of economic growth. The Quarterly Journal of Economics 107: 407–37. [Google Scholar] [CrossRef]

- Marshall, Alfred. 1890. Principles of Economics, 1st ed. London: MacMillan & Co. [Google Scholar]

- Marshall, Alfred. 1920. Principles of Economics, 8th ed. London: MacMillan & Co. [Google Scholar]

- Martin, Philippe, Thierry Mayer, and Florian Mayneris. 2011. Public support to clusters. A firm level study of French «Local Productive Systems». Regional Science and Urban Economics 41: 108–23. [Google Scholar] [CrossRef]

- Marx, Karl. 1983. The process of capitalist production. In Capital: A Critique of Political Economy. Moscow: Politizdat, vol. 1, pp. 329, 740. [Google Scholar]

- McCann, Philip, and Raquel Ortega-Argilés. 2013. Smart Specialization, Regional Growth and Applications to European Union Cohesion Policy. Regional Studies 49: 1291–302. [Google Scholar] [CrossRef]

- Midelfart-Knarvik, Karen-Helene, Henry G. Overman, Stephen J. Redding, and Anthony J. Venables. 2000. The Location of European Industry. Economic Papers No. 142. Report Prepared for the Directorate General for Economic and Financial Affairs. Brussels: European Commission. [Google Scholar]

- Myrdal, G. 1957. Rich Lands and Poor: The Road to World Prosperity. New York: Harper & Brothers. [Google Scholar]

- Neffke, Frank, Martin Henning, and Ron Boschma. 2011. How do regions diversify over time? Industry relatedness and the development of new growth paths in regions. Economic Geography 87: 237–65. [Google Scholar] [CrossRef]

- Njøs, R., and S.-E. Jakobsen. 2016. Cluster Policy and Regional Development: Scale, Scope and Renewal. Regional Studies Regional Science 3: 146–69. [Google Scholar] [CrossRef] [Green Version]

- Porter, Michael. 2003. The economic performance of regions. Regional Studies 37: 549–78. [Google Scholar] [CrossRef]

- Ricardo, David. 1817. On the Principles of Political Economy and Taxation. London: John Murray. [Google Scholar]

- Romer, Paul M. 1990. Endogenous Technological Change. Journal of Political Economy 98: 71–102. [Google Scholar] [CrossRef] [Green Version]

- Rothgang, Michael, Uwe Cantner, Jochen Dehio, Dirk Engel, Michael Fertig, Holger Graf, S. Hinzmann, E. Linshalm, M. Ploder, A.-M. Scholz, and et al. 2017. Cluster policy: Insights from the German leading edge cluster competition. Journal of Open Innovation: Technology, Market, and Complexity 3: 18. [Google Scholar] [CrossRef] [Green Version]

- Rothgang, Michael, Bernhard Lageman, and Anne-Marie Scholz. 2021. Why are there so few hard facts about the impact of cluster policies in Germany? A critical review of evaluation studies. Review of Evolutionary Political Economy 2: 105–39. [Google Scholar] [CrossRef]

- Sandelin, Bo, Hans-Michael Trautwein, and Richard Wundrak. 2001. Det Ekonomiska Tänkandets Historia, 3rd ed. Stockholm: SNS Förlag. [Google Scholar]

- Scott, A. J. 1988. New Industrial Spaces: Flexible Production Organisation and Regional Development in North America and Western Europe. London: Pion. [Google Scholar]

- Shediac, Richard, Rabih Abouchakra, Chadi N. Moujaes, and Mazen Ramsay Najjar. 2008. Economic Diversification: The Road to Sustainable Development. New York: Booz & Company. [Google Scholar]

- Skare, Marinko, Małgorzata Porada-Rochon, and Blazevic Buric. 2021. Energy Cycles: Nature, Turning Points and Role in England Economic Growth from 1700 to 2018. Available online: https://actamont.tuke.sk/pdf/2021/n2/8skare.pdf (accessed on 1 March 2021).

- Smith, Adam. 2007. An Inquiry into the Nature and Causes of the Wealth of Nations. Hampshire: Harriman House. [Google Scholar]

- Stigler, George J. 1951. The division of labor is limited by the extent of the market. Journal of Political Economy 59: 185–93. [Google Scholar] [CrossRef]

- Storper, Michael. 1997. The Regional World: Territorial Development in a Global Economy. New York: Guilford Press. [Google Scholar]

- Tatarkin, Alexander, Irina Makarova, Alexander Petrov, and Lidiya Averina. 2013. Peculiarities of the spatial distribution of productive forces in the old-industrial area. Spatial Economics 4: 28–43. [Google Scholar] [CrossRef]

- Tolstykh, Tatyana, Leyla Gamidullaeva, and Nadezhda Shmeleva. 2020. Elaboration of a mechanism for sustainable enterprise development in innovation ecosystems. Journal of Open Innovation: Technology, Market, and Complexity 6: 95. [Google Scholar] [CrossRef]

- Uyarra, Elvira, and Ronnie Ramlogan. 2012. The Effects of Cluster Policy on Innovation. Nesta Work. Paper Series, 12/05. Available online: http://www.nesta.org.uk/sites/default/files/the_effects_of_cluster_policy_on_innovation.pdf (accessed on 17 January 2022).

- Zárate-Mirón, Viviana Elizabeth, and Rosina Moreno Serrano. 2021. The Impact of Smart Specialization Strategies on Sub-Cluster Efficiency: Simulation Exercise for the Case of Mexico. Competitiveness Review. [Google Scholar] [CrossRef]

- Zemtsov, S. P., and Y. A. Smelov. 2018. Factors of regional development in Russia: Geography, human capital and regional policies. Journal of the New Economic Association 4: 84–108. [Google Scholar] [CrossRef]

- Zhang, Haofeng, Yinduo Wang, Yang Long, Longzhi Yang, and Ling Shao. 2021. Modality independent adversarial network for generalized zero shot image classification. Neural Networks 134: 11–22. [Google Scholar] [CrossRef] [PubMed]

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2022 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).