Abstract

This study aims to determine the effect of human capital, structural capital, and consumer capital on financial performance and moderate the speed of innovation. The type of research used in the study is quantitative—data collection techniques in distributing questionnaires measured using a Likert scale. The sampling technique used was random sampling and was determined by the slovin formula. The population in this study was MSMEs in Buleleng Regency, and the samples used in this study amounted to 392 MSMEs. Data or statistical analysis techniques in the study were considered using the Structural Equation Model with WarpPLS 5.0 software modelling. The results show that the technology and commitment variables have no significant effect on the development of religious ecotourism villages. In contrast, cultural changes significantly impact the development of religious ecotourism villages. This study uses the speed of innovation as a moderating variable, the speed of innovation is one of the essential things for MSMEs to improve financial performance. The speed of innovation supports intellectual capital, which is currently focused on knowledge-driven business to create a competitive advantage.

1. Introduction

Financial performance can provide a tangible form in assessing whether a company is growing and developing well or not to determine the company’s viability. Changes in the company’s growth base from labor-based to knowledge-based lead to knowledge management that improves performance (Suseno and Pinnington 2017). Companies compete by running a knowledge-based business to use the available resources efficiently and economically.

Almost all companies now in their management develop knowledge-based business performance, which considers current assets and fixed assets as not a differentiator for competitive advantage (Nikolaou 2019). Competitive advantage in today’s companies can be seen based on the knowledge and skills possessed by employees. To attract investors, the market value becomes the dominant value higher than the book value. This causes intellectual capital to be the capital that is most considered an intangible asset but can produce quality financial performance (Osinski et al. 2017). This intangible asset is not seen in traditional financial reporting, which only measures financial assets in the short term (Zambon 2017). In large companies, intangible assets have been presented and become a measurement of reporting to stakeholders and evaluating internally. In knowledge-based business, Hashim et al. (2015) said that high-quality resources are a priority for developed countries.

These resources in the company are realized in intellectual capital; three capitals include human capital concerning the knowledge, skills, and experience each employee brings in carrying out the company’s operational activities (Kianto et al. 2017). Structural capital covers non-human resources in an organization such as databases, organizational charts, procedures, administrative processes, strategies, and everything of high value to the organization (Hejazi et al. 2016). The third capital is consumer capital by having knowledge in marketing activities and then establishing relationships with consumers and being a determinant in increasing market value (Harmeling et al. 2017). Human capital describes what an employee brings into a company so that the company’s market value increases; structural capital describes how employees are connected within the company and how and when the employee leaves the company. Consumer capital describes how the company relates to external stakeholders (Dženopoljac et al. 2016). So human capital includes professional competence, employee motivation, and ability in leadership.

In contrast, structural capital includes collaboration with internal parties, understanding of IT and management tools and optimally in corporate culture, and consumer capital refers to the relationship between partners, consumers, and suppliers. as well as investors who have an overall effect on intangible assets (Wataya and Shaw 2019). Management can define, classify, assign, report and manage intangible assets in the company. These assets are the basis for claiming rights to future benefits that affect the creation of quality market value.

Its development and growth require competitiveness to generate profits; it is stated that human capital is the most complex factor in developing competitive advantage (Ployhart et al. 2014). However, the total cost of labor in various companies is larger than the cost of maintaining production and operations. These costs are different for each company, whether related to industry, goods or services. According to (Fathi et al. 2013), market value in a company is created based on intellectual capital, namely human capital, structural capital, and consumer capitalism, where the efficiency of the measured value is on the company’s intangible and tangible assets.

Human capital is a genetic inheritance that includes education, training and experience, and business life. When companies can treat employees as well as possible, it impacts profits, and of course, this capital supports structural capital and consumer capital (Dumay et al. 2020). Structural capital in the company is the knowledge capable of fulfilling the company’s activity processes and can support a high level of intellectuality (Komnenic and Pokrajčić 2012). However, when an organization has poor procedures and systems, it cannot achieve optimal performance and its potential is not utilized optimally. (Aghamirian et al. 2015) Consumer capital becomes potential in organizations, whereas knowledge already exists in the organization in establishing relationships with consumers, suppliers, competitors and the government. The better the relationship, the more excellent the opportunity for companies to learn from consumers and suppliers (Maharani and Fuad 2020). These three capitals are indispensable in improving a company’s performance.

The current performance of MSME companies for the government can support the Indonesian economy (Hadiyati 2015), but MSME actors still feel some obstacles. The obstacles included here are both financial and non-financial. Economic barriers include the still weak MSMEs in the availability of funds, limited knowledge in managing finances, the lack of a systematic approach to MSME funding, and the lack of information obtained in seeking bank credit or operating costs that are still too high (Irjayanti and Azis 2012). Meanwhile, non-financial barriers include a lack of knowledge of the production aspects of MSMEs. They still use traditional technology, lack maximum quality control and product competitiveness, have not maximized innovation and creativity, have not been able to keep up with environmental changes, and are still weak in identifying marketing targets (Jovanovski et al. 2019). The product or service being marketed is not yet targeted at the needs or wants of the market. In addition, the problem that often occurs is that products circulating from neighbouring countries have product prices that are much cheaper with the same quality, causing heavy competitiveness for local MSMEs. Both the lack of knowledge and skills possessed by MSME actors make the financial performance of MSMEs less than optimal, where their business is not productive, inefficient or ineffective (Casalino et al. 2014). MSMEs must be able to develop their potential and build a competitive advantage. The maximum financial performance obtained by MSMEs is based on intellectual capital that can be appropriately managed and accompanied by the speed of innovation so that MSMEs can run sustainably.

The whole world has indeed felt the impact of the COVID-19 pandemic, including Indonesia where what was supposed the most was the weakening of people’s purchasing power due to workers who lost a lot of work (Affandi et al. 2020). The perpetrators of MSMEs certainly felt a reasonably significant impact, and some even went bankrupt. It is a formidable challenge for MSME actors, who were initially able to survive, and must innovate quickly (Hamdani and Wirawan 2012). The speed of innovation for MSME actors is significant to advancing their business. After the pandemic, MSMEs must rise to improve the Indonesian economy (Reardon et al. 2021). Indonesia is currently the largest market in Southeast Asia for agriculture and consumer goods; even the value of online sales transactions or e-commerce, which is growing more and more, is becoming the largest in ASEAN.

2. Methodology

2.1. Financial Performance

The stakeholder theory by R. Edward Freeman in 1984 stated that the existence of a company is strongly influenced by stakeholder support for the company (Dawkins 2014). Stakeholder power is seen as control over company resources (Miller et al. 2014). The higher the authority and attention given by the company to stakeholders, the stronger the relationship between the two parties (Lentjušenkova and Lapina 2016). Stakeholders can also influence management but must still see how stakeholder control functions over the company’s resources (Beringer et al. 2013; James 2013). The Resource-Based View theory by Wernerfelt in 1984 focuses on significant company resources and capabilities as the basis for competitiveness and operational performance (Leonidou et al. 2017; Tehseen and Sajilan 2016; Barney and Mackey 2016). To achieve a competitive advantage, companies can utilize and develop sources of company capital, one of which is intellectual capital, which means using strategic assets in the form of intangible assets (Wijaya and Suasih 2020). This means that this theory views the company as having different assets, capabilities, experience, and organizational culture to give the company a sustainable competitive advantage.

Financial performance as a series of operational activities that focus on finance within a certain period is reported in financial statements, including income statements, changes in capital, balance sheets, cash flows and notes to financial statements (Abuzayed 2012), (Przychodzen 2015). Financial performance in its measurement looks at implementation, financing and strategic decisions (Churet and Eccles 2014). Analyzing the financial performance of a company aims to find weaknesses. It can determine reliable strengths in financial performance so that they can make critical decisions for the company in the future (Revelli and Viviani 2015). Financial performance measurement by analyzing financial statements helps evaluate performance to improve it. (Teeratansirikool et al. 2013) Achievement of performance depends on the management, where every decision taken positively or negatively impacts financial performance.

2.2. Human Capital

The characteristics of human capital that are considered the most important in creating a relevant performance in organizations are education, knowledge and experience (Cherkesova et al. 2016). Teaching, learning gained, and previous experiences lead to innovative and creative discoveries to support the progress of operational activities, and implementing structural aspects helps achieve quality and success. Human capital is an investment in a company by providing education and training for its employees to improve employees’ knowledge, skills, and competencies to maximize the productivity and output of a company (Malaolu and Ogbuabor 2013; Wright et al. 2014). These resources are essential for economic productivity, and skills are enhanced through education and experience. Human capital is divided based on competencies, namely knowledge, skills, and talents possessed by employees and attitudes, namely the willingness of employees to use abilities in providing a company benefits (Iwamoto and Suzuki 2019).

Human capital is one of the intangible assets of the company where intelligence, ability, creativity and innovation, as well as the experience possessed by all employees, can support the sustainability of the company, so that human capital is declared to be the main stakeholder in the company (Nuryani et al. 2018). Human capital is part of intellectual capital where companies employ employees who prioritize mindsets rather than physical ones to deal with technological developments (Sima et al. 2020). Investment in improving employees is expected to have a positive impact both in the short and long term of the company. As a form of an intangible asset, human capital is expected to create future economic value in the company by increasing employee competence and organizational ability (Silva et al. 2019). This illustrates how the quality of a company’s workforce, the best quality, is beneficial for investors to assess efficiency and predict future profitability and company productivity (Yusuf 2013).

2.3. Structural Capital

Structural capital is a concept or system created by employees but owned within the company’s scope. In companies based on a combination of internal structures that can improve the development process, establish initiatives, and improve technology, the structural capital also increases (Ling 2013). Structural capital includes non-human resources within the company, which have databases, organizational structures, organizational culture, strategies or other high value. Structural capital functions as leverage in company growth based on rules, databases, and corporate culture (Gogan et al. 2015). Structural capital includes the things in the company to be organized and integrated; this capital becomes the supporting infrastructure for performing well (Paunović 2021). Structural capital is a unique approach to carrying out operational activities because other competitors can hardly imitate it. By investing in structural capital, companies can improve their work processes so that services and quality of production and operational activities can be more efficient and effective (Aramburu et al. 2013). Structural capital in the company can produce high quality and reduce operating costs to lead to successful operational performance (Matos et al. 2017). This capital can direct to put aside unnecessary things in the process of creating value, helping achieve employee productivity and increasing income.

2.4. Consumer Capital

Consumer capital grows based on trust, commitment, norms, and interactive relationships between companies and stakeholders (Fisher 2019). Consumer capital is a facility for exchanging knowledge, learning and cooperation so that they can find ways to solve problems. This capital allows companies to develop good relationships with partners or customers so that organizations can learn from the experiences of others (Archer-Brown and Kietzmann 2018). Without good consumer capital, a company has difficulty interacting with its partners. Consumer capital embodies how continuous communication is applied by companies in serving external parties to add market value. Consumer capital has market share characteristics, customer retention, and profits from consumers (Kirmaci 2012). Managed consumer capital is expected to overcome the worst conditions because the company can find out who its customers are. Without consumer capital, it is impossible to achieve market value and performance. Consumer capital is linked to the company’s ability to have quality relationships with its clients and form a company’s external business network, such as communicating with consumers and suppliers and having a reputation and brand (Jalali et al. 2014; Bagher Taghieh et al. 2013). Consumer capital is a relationship that companies must foster in running a business that includes consumers and suppliers. Consumer capital is a relational value between companies and other people, including consumer satisfaction, durability, reputation, suppliers, investors, government and business networks and other stakeholders (Isanzu 2015).

2.5. Speed of Innovation

Innovation in the economic aspect means introducing new goods or services that customers do not know about or unique qualities of an item, introducing new production methods, or opening new markets (Snyder et al. 2016). Innovation is the most crucial factor in MSMEs to improve operational performance (Kuncoro and Suriani 2018). These three things are significant to avoid failures such as inappropriate strategies, non-innovative product designs, and costs incurred for product innovations that are too high or unable to compete with others (Lendel and Varmus 2014). The speed of innovation is expressed as the time required by the company from the concept and process to offering the new product to the market (Wang 2012). The speed of innovation has a reason as an innovation strategy, namely the result of the speed of innovation making superior new products to affect the company’s performance (Hecker and Ganter 2013). The speed of innovation provides a sustainable competitive advantage, and intense competition and rapid technological developments make the pressure to innovate faster. A company’s speed in innovating is very much needed, especially MSMEs, where MSME actors expect their business to survive and develop (Akman and Yilmaz 2019). Innovation is the main supporting factor in a company’s success by looking at the basic innovation dimensions, including products, processes, marketing, and organization. A clear understanding of which direction to take in realizing innovation significantly assists a company in prioritizing market strategies. The speed of innovation is essential in competitive competition (Casadesus-Masanell and Zhu 2013). The ability to develop and launch innovative products quickly before being preceded by competitors is the right step for the key to the success of a company competing in the advanced technology industry. According to (Ngari and Muiruri 2014), in his research, the application of financial innovation has a significant effect on financial performance.

3. Results

The outer model is used to test the validity and reliability of a research instrument (Hair et al. 2014).

3.1. The Effect of Human Capital on Improving Financial Performance

In employees, there is human capital with the attitudes, competencies, knowledge and skills, innovation, creativity and experience needed in an organization or company to achieve a target (Campbell et al. 2012). Companies realize that when they invest in their employees, they can easily enjoy better operational performance, which indirectly leads to increased financial performance (Wang et al. 2014). (Joshi et al. 2013) states that the existence of human capital in a company provides benefits, namely the loss of the threat of opportunism, the creation of synergies, reducing uncertainty, control and protection of assets, and the ability to access and follow the latest technological developments (Bendickson and Chandler 2017).

Human capital is needed to increase capabilities and maintain a competitive advantage to support sustainable investment and a knowledge-based economy (Chatterjee 2016). This capital is one of the differentiating factors for performance between companies that can bring economic value to the company. Increasing human capital internally can be performed by providing training and development programs and providing high-level knowledge and skills in facing the job competition market (Scafarto and Dimitropoulos 2018). According to Ogunyomi and Bruning (2016), human capital refers more to education, training, and other developments in improving employees’ skills, knowledge, values, and social assets, resulting in employee satisfaction and indirectly affecting the company’s financial performance. Nimtrakoon (2015) also states that the impact of human capital efficiency consistently affects financial performance.

Hypothesis 1 (H1).

Human capital affects improving financial performance.

3.2. The Effect of Structural Capital on Improving Financial Performance

Structural capital influences financial performance. High structural capital certainly impacts efficiency in carrying out the production process and can reduce production costs. It increases company profits that affect assets (Yong et al. 2020). Good organizational management certainly impacts the creation of competitive advantage by expanding the company’s capabilities. The existence of a structure that supports employees to produce intellectual rules and corporate culture is applied to provide optimal business performance (Nejati 2016). Structural capital is a strategic intangible asset in an organization which includes: organizational culture, procedures, information systems, hardware and software, databases, patents, copyrights, etc. When the organization strongly supports structural capital by fostering a culture of innovation and organizational commitment and involving top to bottom management, it creates a performance advantage, which means structural capital creates corporate value (Felício et al. 2014). Research conducted by Babai et al. (2016) shows that structural capital shows a company’s ability to fulfil company processes and structures in supporting employee efforts to produce operational performance, especially optimal financial performance, for example, the company’s operational system, organizational culture, organizational structure or technology system. According to research conducted by Thiagarajan and Baul (2014), structural capital becomes a means of infrastructure for employees to work optimally. When employees have a high intellectual level but the company’s system is terrible, intellectual capital and financial performance are not able to be achieved optimally.

Hypothesis 2 (H2).

Structural capital affects improving financial performance.

3.3. The Effect of Consumer Capital on Improving Financial Performance

Consumer capital is stated to influence financial performance; where consumer capital gets better and more competitive, it will affect maximum sales and use capital more efficiently to improve company performance (Ranani and Bijani 2014). Increased sales on consumer capital is due to a harmonious relationship between the company and its partners, such as quality and reliable suppliers, loyal and consistently satisfied customers with the services provided by the company, as well as good relations between the company and the government and the surrounding community (Hashemnia et al. 2014). Consumer capital is also external because it consists of relationships with outside parties and a network based on company satisfaction and loyalty (Deniswara et al. 2019). This means that this capital is a company’s ability to meet consumer demand. When the organizational structure is reasonable, skilled employees providing quality services improve performance (Adnan et al. 2013). In consumer capital, the organization must determine the control and where its business is and how many chains to build for various people. Expanding the organization’s business value chain is essential and pays attention to costs, risk mitigation, managerial decisions and the exploitation of the economic scope that impacts performance (Wuttke et al. 2013). The benefits of empowering consumer capital are improving coordination, having interaction with consumers and suppliers, having the opportunity to create an idea or product differentiation and having control.

Hypothesis 3 (H3).

Consumer capital affects improving financial performance.

3.4. Speed of Innovation Moderates the Effect of Human Capital on Improving Financial Performance

When creating innovation, knowledge and skills are needed to impact the product on the relationship between customers and company competitors (Meihami 2014; Budi 2019). This indirectly indicates that the role of human capital is significant and related to increasing the productivity of MSMEs. Innovation decisions are made quickly and accurately based on environmental and external analysis. As MSME actors can speed up innovation, human capital must be accompanied by training in developing their skills; besides, they can also add insight to their business from financial and non-financial aspects (Agostini et al. 2017). With sufficiently mature knowledge and skills, and experience in building a business, the possibility of failure can be avoided and become a competitive advantage in the target market (Omotayo 2015). The performance of MSMEs can provide optimal results. Research by Wang et al. (2018) and Leitner (2018) showed that the speed and quality of innovation fully mediate the impact of human capital on financial performance.

Hypothesis 4 (H4).

Speed of Innovation moderates the effect of human capital on improving financial performance.

3.5. Speed of Innovation Moderates the Effect of Structural Capital on Improving Financial Performance

Structural capital reflects non-human resources involved in organization, such as values, business processes, and behavior patterns. This capital facilitates the creation of innovation with information retrieval, retrieval, storage, processing, and analysis using technology systems (Wang et al. 2016). It means that structural capital is used to incorporate knowledge in a company so that there are acceptable standards to avoid conflicts due to changes in the realization of innovation (Wang et al. 2014). Innovation planning and decision-making become more productive and efficient when the capital structure is effective. It makes it faster to satisfy customer needs based on new products or services developed by the company (Costa et al. 2014). The existence of structural capital makes it easy to increase acquisitions, share knowledge, and build corporate culture. In the end, it can support the speed of innovation, fulfill process facilities and collaboration in developing innovations to improve financial performance (Soo et al. 2017; Ndubisi et al. 2015; Hartono and Halim 2014; Lestari et al. 2020). The speed of innovation is successful in improving the financial performance of MSMEs. Optimization is inseparable from the system and structure built by MSME actors in their business. These efforts include: the use of sophisticated technology, keeping up with the rapidly changing environment, optimally applied organizational culture, and the ability to adapt to processes. Innovative productivity becomes added value in the world market, achieving status by producing quality goods or services.

Hypothesis 5 (H5).

Speed of Innovation moderates the effect of structural capital on improving financial performance.

3.6. Speed of Innovation Moderates the Effect of Consumer Capital on Improving Financial Performance

To achieving satisfactory innovation results, a company utilizes internal resources, science and technology, and external stakeholders’ capabilities. Consumer capital forms an atmosphere of communication and provides feedback so that it is faster to develop the innovation process (Ungerman et al. 2018). Consumer capital embodies the company’s solidarity with stakeholders, thereby creating an opportunity. Companies involve customers or suppliers, thus encouraging continuous innovation (Kianto et al. 2017). Activities in developing new products, work processes and quality, and services in the future lead to better company financial performance. The speed of innovation is very important for MSMEs in introducing and marketing new products through communication and establishing relationships with customers (Al-Ansari et al. 2013). The relationship fostered with customers, especially loyal customers, is considered to have a significant impact on responding to the introduction of innovations created by MSME actors. Here, MSME actors take a communication approach while introducing new products to customers and then allowing them to respond; if there are still some shortcomings, they can be corrected immediately (Aksoy 2017). In addition, this can build a more comprehensive network of cooperation with the government or other business partners. MSMEs can move more efficiently and effectively in procuring resources, producing, and even marketing to take advantage of business opportunities with other parties (Distanont and Khongmalai 2020). It is the right step in making decisions to innovate to provide operational and financial performance for MSMEs.

Hypothesis 6 (H6).

Speed of Innovation moderates the effect of consumer capital on improving financial performance.

The research used is a quantitative approach, and a particular population or sample was researched. The data collection technique was distributing questionnaires to measure five variables: human capital, structural capital, consumer capital, innovation speed, and financial performance. The questionnaire used a Likert scale from 1- to 5 points. Summary of sample presentation as presented in Table 1. The sampling technique used was a random sampling technique determined by the solving formula. The population was MSMEs in the Buleleng Regency, which were recorded at the Disdagprinkopumkm.go.id in 2020 with a total of 54,489 MSME actors with a margin of error of 5%, so the sample obtained was 401 MSME actors. However, only 392 samples were in this study because nine questionnaires were not returned. Data or statistical analysis techniques in the study were considered using the Structural Equation Model (SEM) with WarpPLS 5.0 software modelling. Variable measurements are summarized in the presentation of Table 2.

Table 1.

Summary of sample presentation.

Table 2.

Variables Definition.

Research Model:

- Y = γ1X + γ2M + γ3XM + ε

- Description:

- Y: Endogenous variables;

- X: Exogenous variable;

- γ: The influence coefficient of the exogenous on the endogenous latent variable;

- M: Moderating variables;

The criteria for this validity are met if the loading value is 0.5 to 0.6. Convergent validity in this study is based on Table 3 and Table 4; it is known that the combined loadings and cross-loadings have met the criteria, so the validity is fulfilled.

Table 3.

Convergent validity.

Table 4.

Convergent validity.

Table 5 shows that the AVE value of each variable from 392 respondents is greater than the correlation between latent variables in the same column. It indicates that it can accept discriminant validity. It shows that it can accept discriminant validity.

Table 5.

Discriminant validity.

From Table 5, the composite reliability value of each variable is above 0.7, and the Cronbach’s alpha value of each variable is above 0.5. It is concluded that all variables have met the reliability criteria. In addition, Table 6 shows the R-square in this study is 0.393, which means that 39.3% of the variables of increasing financial performance can be explained by the variables of human capital, structural capital, and consumer capital and the speed of innovation as moderating variables, while the remaining 60.7% are influenced by other variables. The standard method bias of the research results are worth less than 3.3, so the total collinearity value of VIFs is accepted. In the measurement of Q-square, coefficients are used as an assessment of predictive validity, which can be negative. They have a value greater than 0, and Table 6 shows that the value is more significant than 0, so it is declared valid.

Table 6.

Latent variable coefficients.

The significance level of testing this hypothesis is performed by looking at the value of the p-value. (Davcik 2014) The inner model test or structural model evaluation is a specification in determining the relationship between latent constructs and other latent constructs. Research is declared good if the structural model meets the required standards (Kock 2015). In Table 7 below, there are test items and standard test values for the inner model used to measure the model’s strength.

Table 7.

Model fit and quality indices.

Based on the results of the output in Table 7, the fit and quality indices model for all criteria are known. The values of APC, ARS, AARS, AVIF, and AFVIF to GoF have met the requirements so that the structural model can be accepted and used for analysis.

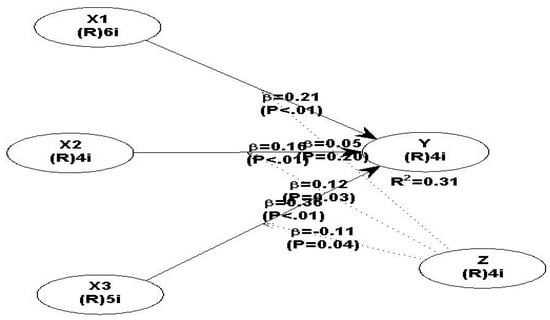

Figure 1 shows a direct relationship for the variables studied where the output results are in the form of a model and the results of the path analysis test. Table 8 output results in path coefficient values are used to determine the magnitude of the influence of direct and indirect relationships (moderation). The results of the direct influence test in this study are shown in Figure 1 and Table 7: the path coefficient value of human capital, structural capital, and consumer capital, towards improving financial performance is 0.205 (p-values < 0.001), 0.157 (p-values 0.007 < 0.05), and 0.362 (p-values < 0.001), which means that all variables have a positive and significant effect on improving financial performance; The path coefficients of the speed of innovation to moderate human capital on improving financial performance are 0.054. The p-values of >0.202 with a significance level of 0.05 stated that the speed of innovation does not moderate the effect of human capital on improving financial performance. The path coefficients of the speed of innovation moderating structural capital on improving financial performance are 0.119 and p-values of 0.031 < 0.05 significance level—the speed of innovation moderates the effect of structural capital on improving financial performance. The value of path coefficients from the speed of innovation to moderate consumer capital on improving financial performance is −0.113 and p-values of 0.038 < 0.05 significance level. It is stated that the speed of innovation is not strong enough to moderate the effect of consumer capital on improving financial performance.

Figure 1.

The analysis results of the direct and indirect effects.

Table 8.

Path coefficients.

4. Discussion

Intellectual capital, which has three components, is increasingly important for MSME actors to apply. They must follow increasingly sophisticated technological developments and difficult business competition, so MSME actors must change business patterns into knowledge-based businesses. MSMEs continue to strengthen the foundation and amount of employee talent they have to face the digital world so that the company does not experience economic downturns in the future. The use of tangible assets and intangible assets for MSME actors is expected to be more efficient in improving their business financial performance.

H1 shows that the first hypothesis is accepted. The results of this study are similar to research conducted by (Martin et al. 2013; Kim et al. 2016; Post and Byron 2015; Gambardella et al. 2013) who found that the higher the value of human capital, the higher the achievement of financial performance. Human capital is the component of intellectual capital that has the most significant role in an organization. When the company treats employees as human capital or assets, greater profits are obtained than when treated as resources. Human capital becomes a competitive and sustainable superior resource so that it becomes valuable capital, cannot be imitated and cannot be substituted. As stated by Ployhart (2012), human capital cannot be replicated because it is based on individuals. Individuals are the basis for forming organizational structures and systems that are difficult for other competitors to follow. Many companies make labor productivity a measure of the company’s financial performance to see how the company has carried out the performance results in a period (Shaw et al. 2013). Human capital is an advantage in the organization where it is extracted from the knowledge of an employee and becomes the most valuable asset (Crane and Bontis 2014).

Furthermore, the following study results indicate that H2 is accepted, where the results of this study are the same as the research of Alipour (2012) and Musibah and Alfattani (2014). Structural capital creates a work environment that helps MSME actors increase knowledge about the business they are running to improve their financial performance (Sardo et al. 2018). Structural capital includes the company’s operational systems, production processes, organizational culture, management philosophy, and everything the company owns. Managing structural capital can develop knowledge, shorten the time of a job, and have a clear strategy (Sydler et al. 2014; Surya et al. 2021) This management produces something new and can be learned so that MSME actors have progressive and increasing productivity.

The results of the study indicate that H3 is accepted. As is the case in research by Baporikar et al. (2016), who found that consumer capital is one of the sources of income components in improving financial performance, one of which can be performed by retaining old customers and attracting the attention of new customers so that it becomes an essential aspect for MSMEs. MSME actors determine and then select the selected customers and market segments to target for their business. In consumer capital, how much value is given by consumers or customers can be seen from the products issued, good relations with customers, and brand image (Callarisa et al. 2012). A product is valuable if it approaches or even exceeds what consumers perceive. This creates potential consumers, so it is also necessary to provide the best service based on existing capabilities and resources (Teece 2018); this certainly impacts company performance, especially financial performance.

Furthermore, the results of the moderation research show that H4 is rejected, which means that the speed of innovation cannot moderate the influence of human capital on improving financial performance. It is inconsistent with research conducted by Aryanto et al. (2015) and Zhou et al. (2013), who found that human capital practices are positively related to innovation ability, which positively affects innovation performance. The speed of innovation does not only rely on human capital, but companies sometimes mostly prefer to use technology (Murray et al. 2016). One of the reasons is because technology is easier to apply when compared with human capital, which must be given education and training which requires more time and costs. In addition, innovation using human capital is more for small companies than large-scale companies (McGuirk et al. 2015). Human capital utilized efficiently is a determining factor in increasing productivity, but this is not entirely the case because it sometimes triggers waste and inefficiency, significantly so when speeding up innovation without sufficient knowledge and experience (Tzabbar and Margolis 2017). This reduces the financial performance of a company.

Further research indicates that H5 is accepted, which means that the speed of innovation can moderate the effect of structural capital on improving financial performance. The results of this study follow research conducted by Bayraktaroglu et al. (2019), who found that innovation has a moderating effect on the relationship between structural capital and profitability. Structural capital is an indicator of the added value of a company, which includes the database, organizational structure, corporate culture, strategy and other matters related to the company. Structural capital becomes a liaison for resources that have more value; this is because structural capital is a means and infrastructure in supporting the performance of MSME actors, especially in creating an innovation (Chahal and Bakshi 2015; Alrowwad and Abualoush 2020). When employees have high knowledge, but they are not supported by adequate facilities in applying the speed of innovation, they are not able to improve financial performance. Structural capital plays an essential role in all activities of MSME actors, especially in realizing innovations that enhance the financial performance of their businesses (Han and Li 2015).

Following the study results, H6 is rejected, which means that the speed of innovation is not strong enough to moderate the effect of consumer capital on improving financial performance. The results of this study follow research conducted by Ratnawati (2020), who found that consumer capital does not always provide financial benefits for MSME actors. This is because customers do not all have a high level of loyalty, especially new customers (Li 2014); sometimes, these customers become a threat to SMEs, where they prefer to compare products with other competitors. Especially for the innovations created by MSME actors, sometimes having the speed of innovation can be an opportunity for other competitors to follow and even exceed the products that have been made (Mehdivand et al. 2012; Campo et al. 2014). So, here, it is related to which MSME actors can respond as quickly as possible but still follow the needs of outsiders, especially customers. So MSME actors who have the speed of innovation then take advantage of consumer capital, but it is not to the needs of outsiders; of course, this has an impact on the financial performance expected by MSME actors.

5. Conclusions

The study results, using five variables, show shown differences between the research results and the hypothesis in this study. Developments in Industry 4.0 have caused the business environment to become increasingly uncertain. It will also affect the decline in the national economy, so companies are expected to need to make quick and steady management decisions to maintain their sustainability and strengthen their position in the market supported by the government. Currently, most of the business world has adopted a knowledge-based business that emphasizes using the intellectual capital owned by the company, including human capital, structural capital, and consumer capital. Intellectual capital is also one of the important assets in the success and survival of MSMEs. For the government, micro, small, and medium enterprises are an essential part of the backbone of the Indonesian economy. To maintain the sustainability of MSMEs, a competitive advantage is needed by utilizing their intellectual capital. Intellectual capital is an intangible asset that helps create the best product and service innovations to increase the performance of MSMEs. The Resource-Based View (RBV) theory states that a competitive advantage is achieved if a company can use and maximize its resources. The RBV theory is considered appropriate to describe the company’s internal strength, which is carried out through intellectual capital, which impacts financial performance. The limitations of this study are that the variables used are only three independent variables: human, structural capital, and consumer capital, as well as the moderating variable, namely the speed of innovation, so that it still does not show a role in improving financial performance. They represent MSMEs outside the Buleleng Regency area.

Author Contributions

Conceptualization, methodology, writing—original draft, I.G.A.P.; data curation, formal analysis, supervision, F.J.; writing—review and editing, P.C.H.; resources, investigation, visualization, G.A.Y. All authors have read and agreed to the published version of the manuscript.

Funding

This research received no external funding.

Institutional Review Board Statement

Not applicable.

Informed Consent Statement

Not applicable.

Data Availability Statement

Not applicable.

Acknowledgments

Thank you for the support provided by the Institute for Research and Community Service Ganesha University of Education, and the Ministry of Research Technology, National Innovation Research Agency, Republic of Indonesia.

Conflicts of Interest

The authors declare no conflict of interest.

References

- Abuzayed, Bana. 2012. Working capital management and firms’ performance in emerging markets: The case of Jordan. International Journal of Managerial Finance 8: 155–79. [Google Scholar] [CrossRef]

- Adnan, Nur Syuhada, Amrizah Kamaluddi, and Nawal Kasim. 2013. Intellectual Capital in Religious Organisations: Malaysian Zakat Institutions Perspective. Middle-East Journal of Scientific Research 16: 368–77. [Google Scholar] [CrossRef]

- Affandi, Azhar, Akhmad Sobarna Sarwani, Heri Erlangga, Ade Onny Siagian, Agus Purwanto, Aidil Amin Effendy, and G. Juhaeri. 2020. Optimization of MSME empowerment in facing competition in the global market during the COVID-19 pandemic. Systematic Reviews in Pharmacy 11: 1506–15. [Google Scholar]

- Aghamirian, Bahman, Behrouz Dorri, and Babak Aghamirian. 2015. Customer knowledge management application in gaining organization’s competitive advantage in electronic commerce. Journal of Theoretical and Applied Electronic Commerce Research 10: 63–78. [Google Scholar] [CrossRef]

- Agostini, Lara, Anna Nosella, and Roberto Filippini. 2017. Does intellectual capital allow improving innovation performance? A quantitative analysis in the SME context. Journal of Intellectual Capital 18: 400–18. [Google Scholar] [CrossRef]

- Akman, Gülşen, and Cengiz Yilmaz. 2019. Innovative capability, innovation strategy and market orientation: An empirical analysis in Turkish software industry. In Managing Innovation: What Do We Know About Innovation Success Factors? Singapore: World Scientific Publishing, pp. 139–81. [Google Scholar]

- Aksoy, Hasan. 2017. How do innovation culture, marketing innovation and product innovation affect the market performance of small and medium-sized enterprises (SMEs). Technology in Society 51: 133–41. [Google Scholar] [CrossRef]

- Al-Ansari, Yahya, Marwan Altalib, and Muna Sardoh. 2013. Technology orientation, innovation and business performance: A study of Dubai SMEs. The International Technology Management Review 3: 1–11. [Google Scholar] [CrossRef]

- Alipour, Mohammad. 2012. The effect of intellectual capital on firm performance: An investigation of Iran insurance companies. Measuring Business Excellence 16: 53–66. [Google Scholar] [CrossRef]

- Alrowwad, Ala’aldin, and Shadi Habis Abualoush. 2020. Innovation and intellectual capital as intermediary variables among transformational leadership, transactional leadership, and organizational performance. Journal of Management Development 39: 196–222. [Google Scholar] [CrossRef]

- Aramburu, Nekane, Josune Sáenz, and Carlos Blanco. 2013. Structural capital, innovation capability, and company performance in technology-based colombian firms. Proceedings of the International Conference on Intellectual Capital, Knowledge Management & Organizational Learning 2: 20–29. [Google Scholar]

- Archer-Brown, Chris, and Jan Kietzmann. 2018. Strategic knowledge management and enterprise social media. Journal of Knowledge Management 22: 1288–309. [Google Scholar] [CrossRef]

- Aryanto, Riza, Avanti Fontana, and Adi Zakaria Afiff. 2015. Strategic human resource management, innovation capability and performance: An empirical study in Indonesia software industry. Procedia-Social and Behavioral Sciences 211: 874–79. [Google Scholar] [CrossRef]

- Babai, Fatemeh, Rogieh Niazy, Maryam Talebi, and Jamal Mohamade. 2016. Intellectual Capital Measuring and Reporting. Bull. Sociétét R. Des. Sci. Liege 85: 1063–69. [Google Scholar] [CrossRef]

- Bagher Taghieh, Mohammad, Sedigheh Taghieh, and Zahra Poorzamani. 2013. The effects of relational capital (customer) on the market value and financial performance. European Online Journal of Natural and Social Sciences 2: 207–11. [Google Scholar]

- Baporikar, Neeta, Geoffrey Nambira, and Geroldine Gomxos. 2016. Exploring factors hindering SMEs’ growth: Evidence from Nambia. Journal of Science and Technology Policy Management 7: 190–211. [Google Scholar] [CrossRef]

- Barney, Jay B., and Alison Mackey. 2016. Text and metatext in the resource-based view. Human Resource Management Journal 26: 369–78. [Google Scholar] [CrossRef]

- Bayraktaroglu, Ayse Elvan, Fethi Calisir, and Murat Baskak. 2019. Intellectual capital and firm performance: An extended VAIC model. Journal of Intellectual Capital 20: 406–25. [Google Scholar] [CrossRef]

- Bendickson, Joshua S., and Timothy D. Chandler. 2017. Operational performance: The mediator between human capital developmental programs and financial performance. Journal of Business Research 94: 162–71. [Google Scholar] [CrossRef]

- Beringer, Claus, Daniel Jonas, and Alexander Kock. 2013. Behavior of internal stakeholders in project portfolio management and its impact on success. International Journal of Project Management 31: 830–46. [Google Scholar] [CrossRef]

- Budi, Ichsan Setiyo. 2019. The Effect of Intellectual Capital and Islamic Corporate Governance on Islamic Social Reporting Disclosure with Financial Performance Mediation. The Winners 20: 95–110. [Google Scholar] [CrossRef][Green Version]

- Callarisa, Luis, Javier Sánchez García, John Cardiff, and Alexandra Roshchina. 2012. Harnessing social media platforms to measure customer-based hotel brand equity. Tourism Management Perspectives 4: 73–79. [Google Scholar] [CrossRef]

- Campbell, Benjamin A., Russell Coff, and David Kryscynski. 2012. Rethinking sustained competitive advantage from human capital. The Academy of Management Review (AMR) 37: 376–95. [Google Scholar] [CrossRef]

- Campo, Sara, Ana M. Diaz, and María J. Yagüe. 2014. Hotel innovation and performance in times of crisis. International Journal of Contemporary Hospitality Management 26: 1292–311. [Google Scholar] [CrossRef]

- Casadesus-Masanell, Ramon, and Feng Zhu. 2013. Business model innovation and competitive imitation: The case of sponsor-based business models. Strategic Management Journal 34: 464–82. [Google Scholar] [CrossRef]

- Casalino, Nunzio, Stefan Ivanov, and Toshko Nenov. 2014. Innovation’s governance and investments for enhancing competitiveness of manufacturing SMEs. Law and Economics Yearly Review Journal 3: 72–97. [Google Scholar]

- Chahal, Hardeep, and Purnima Bakshi. 2015. Examining intellectual capital and competitive advantage relationship: Role of innovation and organizational learning. International Journal of Bank Marketing 33: 376–99. [Google Scholar] [CrossRef]

- Chatterjee, Joydeep. 2016. Strategy, human capital investments, business-domain capabilities, and performance: A study in the global software services industry. Strategic Management Journal 38: 588–608. [Google Scholar] [CrossRef]

- Cherkesova, Elvira Y., Evgeniya A. Breusova, Ekaterina P. Savchishkina, and Nataliya E. Demidova. 2016. Competitiveness of the human capital as strategic resource of innovational economy functioning. Journal of Advanced Research in Law and Economic 7: 1662–67. [Google Scholar]

- Churet, Cecile, and Robert G. Eccles. 2014. Integrated reporting, quality of management, and financial performance. Journal of Applied Corporate Finance 26: 56–64. [Google Scholar] [CrossRef]

- Costa, Ricardo V., Carlos Fernández-Jardon Fernández, and Pedro Figueroa Dorrego. 2014. Critical elements for product innovation at Portuguese innovative SMEs: An intellectual capital perspective. Knowledge Management Research and Practice 12: 322–38. [Google Scholar] [CrossRef]

- Crane, Lesley, and Nick Bontis. 2014. Trouble with tacit: Developing a new perspective and approach. Journal of Knowledge Management 18: 1127–40. [Google Scholar] [CrossRef]

- Davcik, Nebojsa S. 2014. The use and misuse of structural equation modeling in management research: A review and critique. Journal of Advances in Management Research 11: 47–81. [Google Scholar] [CrossRef]

- Dawkins, Cedric E. 2014. The principle of good faith: Toward substantive stakeholder engagement. Journal of Business Ethics 121: 283–95. [Google Scholar] [CrossRef]

- Deniswara, Kevin, Ratu Marwaah Firhatil Uyuun, Ang Swat Lin Lindawati, and Willnaldo Willnaldo. 2019. Intellectual Capital Effect, Financial Performance, and Firm Value: An Empirical Evidence from Real Estate Firm, in Indonesia. The Winners 20: 49–60. [Google Scholar] [CrossRef]

- Distanont, Anyanitha, and Orapan Khongmalai. 2020. The role of innovation in creating a competitive advantage. Kasetsart Journal of Social Sciences 41: 15–21. [Google Scholar] [CrossRef]

- Dumay, John, James Guthrie, and Jim Rooney. 2020. Being critical about intellectual capital accounting in 2020: An overview. Critical Perspectives on Accounting 70: 1–9. [Google Scholar] [CrossRef]

- Dženopoljac, Vladimir, Stevo Janoševic, and Nick Bontis. 2016. Intellectual capital and financial performance in the Serbian ICT industry. Journal of Intellectual Capital 17: 373–96. [Google Scholar] [CrossRef]

- Engel, Jerome S. 2015. Global clusters of innovation: Lessons from Silicon Valley. California Management Review 57: 36–65. [Google Scholar] [CrossRef]

- Fathi, Saeed, Shekoofeh Farahmand, and Mahnaz Khorasani. 2013. Impact of Intellectual Capital on Financial Performance. International Journal of Academic Research in Economics and Management Sciences 2: 6–17. [Google Scholar]

- Felício, Jose Augusto, Eduardo Couto, and Jorge Caiado. 2014. Human capital, social capital and organizational performance. Management Decision 52: 350–64. [Google Scholar] [CrossRef]

- Fisher, Greg. 2019. Online communities and firm advantages. Academy of Management Review 44: 279–98. [Google Scholar] [CrossRef]

- Frias-Aceituno, José V., Lázaro Rodríguez-Ariza, and Isabel M. Garcia-Sánchez. 2014. Explanatory factors of integrated sustainability and financial reporting. Business Strategy and the Environment 23: 56–72. [Google Scholar] [CrossRef]

- Gambardella, Alfonso, Claudio Panico, and Giovanni Valentini. 2013. Strategic incentives to human capital. Strategic Management Journal 36: 37–52. [Google Scholar] [CrossRef]

- Gogan, Luminita Maria, Dan Cristian Duran, and Anca Draghici. 2015. Structural capital-A proposed measurement model. Procedia Economics and Finance 23: 1139–46. [Google Scholar] [CrossRef]

- Hadiyati, Ernani. 2015. Marketing and government policy on MSMEs in Indonesian: A theoretical framework and empirical study. International Journal of Business and Management 10: 128–38. [Google Scholar] [CrossRef][Green Version]

- Hair, Joe F., Jr., Marko Sarstedt, Lucas Hopkins, and Volker G. Kuppelwieser. 2014. Partial least squares structural equation modeling (PLS-SEM): An emerging tool in business research. European Business Review 26: 106–21. [Google Scholar] [CrossRef]

- Hamdani, Jahja, and Christina Wirawan. 2012. Open innovation implementation to sustain Indonesian SMEs. Procedia Economics and Finance 4: 223–33. [Google Scholar] [CrossRef]

- Han, Yuqian, and Dayuan Li. 2015. Effects of intellectual capital on innovative performance: The role of knowledge-based dynamic capability. Management Decision 53: 40–56. [Google Scholar] [CrossRef]

- Harmeling, Colleen M., Jordan W. Moffett, Mark J. Arnold, and Brad D. Carlson. 2017. Toward a theory of customer engagement marketing. Journal of the Academy of Marketing Science 45: 312–35. [Google Scholar] [CrossRef]

- Hartono, Hendry, and Erwin Halim. 2014. The impact of knowledge management and entrepreneur’s knowledge on innovation and firm performance. The Winners 15: 108–14. [Google Scholar] [CrossRef]

- Hashemnia, Shahram, Somayeh Naseri, and S. Mozdabadi. 2014. A strategic Review the Impact of Intellectual Capital Components on Organizational Performance in Sepah Bank Branches throughout Tehran Province. Journal of Educational and Management Studies 4: 46–56. [Google Scholar]

- Hashim, Maryam Jameelah, Idris Osman, and Syed Musa Alhabshi. 2015. Effect of Intellectual Capital on Organizational Performance. Procedia-Social and Behavioral Sciences 211: 207–14. [Google Scholar] [CrossRef]

- Hecker, Achim, and Alois Ganter. 2013. The influence of product market competition on technological and management innovation: Firm-level evidence from a large-scale survey. European Management Review 10: 17–33. [Google Scholar] [CrossRef]

- Hejazi, Rezvan, Mehrdad Ghanbari, and Mohammad Alipour. 2016. Intellectual, human and structural capital effects on firm performance as measured by Tobin’s Q. Knowledge and Process Management 23: 259–73. [Google Scholar] [CrossRef]

- Irjayanti, Maya, and Anton Mulyono Azis. 2012. Barrier factors and potential solutions for Indonesian SMEs. Procedia Economics and Finance 4: 3–12. [Google Scholar] [CrossRef]

- Isanzu, Janeth N. 2015. Impact of Intellectual Capital on Financial Performance of Banks in Tanzania. Journal of International Business Research and Marketing 1: 16–23. [Google Scholar] [CrossRef]

- Iwamoto, Hiroki, and Hideo Suzuki. 2019. An empirical study on the relationship of corporate financial performance and human capital concerning corporate social responsibility: Applying SEM and Bayesian SEM. Cogent Business & Management 6: 1–10. [Google Scholar] [CrossRef]

- Jalali, Alireza, Mastura Jaafar, and Thurasamy Ramayah. 2014. Entrepreneurial orientation and performance: The interaction effect of customer capital. World Journal of Entrepreneurship, Management and Sustainable Development 10: 48–68. [Google Scholar] [CrossRef]

- James, Marianne L. 2013. Sustainability and integrated reporting: Opportunities and strategies for small and midsize companies. The Entrepreneurial Executive 18: 17–27. [Google Scholar]

- Joshi, Mahesh, Daryll Cahill, Jasvinder Sidhu, and Monika Kansal. 2013. Intellectual capital and financial performance: An evaluation of the Australian financial sector. Journal of Intellectual Capital 14: 264–85. [Google Scholar] [CrossRef]

- Jovanovski, Bojan, Denitsa Seykova, Admira Boshnyaku, and Clemens Fischer. 2019. The impact of industry 4.0 on the competitiveness of SMEs. Industry 4.0 4: 250–55. [Google Scholar]

- Kianto, Aino, Josune Sáenz, and Nekane Aramburu. 2017. Knowledge-based human resource management practices, intellectual capital and innovation. Journal of Business Research 81: 11–20. [Google Scholar] [CrossRef]

- Kim, Kyoung Yong, Leanne Atwater, Pankaj C. Patel, and James W. Smither. 2016. Multisource feedback, human capital, and the financial performance of organizations. Journal of Applied Psychology 101: 1569–84. [Google Scholar] [CrossRef]

- Kim, Taegoo, Woo Gon Kim, Simon Si-Sa Park, Gyehee Lee, and Bonggu Jee. 2012. Intellectual Capital and Business Performance: What Structural Relationships Do They Have in Upper-Upscale Hotels? International Journal of Tourism Research 14: 391–408. [Google Scholar] [CrossRef]

- Kirmaci, Sevcan. 2012. Customer relationship management and customer loyalty; a survey in the sector of banking. International Journal of Business and Social Science 3: 1–10. [Google Scholar]

- Kock, Ned. 2015. WarpPLS 5.0 User Manual. Laredo: ScriptWarp Systems. [Google Scholar]

- Komnenic, Biserka, and Dragana Pokrajčić. 2012. Intellectual capital and corporate performance of MNCs in Serbia. Journal of Intellectual Capital 13: 106–19. [Google Scholar] [CrossRef]

- Kuncoro, Wuryanti, and Wa Ode Suriani. 2018. Achieving sustainable competitive advantage through product innovation and market driving. Asia Pacific Management Review 23: 186–92. [Google Scholar] [CrossRef]

- Leitner, Karl-Heinz. 2018. Intellectual capital, innovation, and performance: Empirical evidence from SMEs. In Exploiting Intellectual Property to Promote Innovation and Create Value. Singapore: World Scientific, pp. 255–82. [Google Scholar]

- Lendel, Viliam, and Michal Varmus. 2014. Evaluation of the innovative business performance. Procedia-Social and Behavioral Sciences 129: 504–11. [Google Scholar] [CrossRef][Green Version]

- Lentjušenkova, Oksana, and Inga Lapina. 2016. The transformation of the organization’s intellectual capital: From resource to capital. Journal of Intellectual Capital 17: 610–31. [Google Scholar] [CrossRef]

- Leonidou, Leonidas C., Paul Christodoulides, Lida P. Kyrgidou, and Daydanda Palihawadana. 2017. Internal drivers and performance consequences of small firm green business strategy: The moderating role of external forces. Journal of Business Ethics 140: 585–606. [Google Scholar] [CrossRef]

- Lestari, Setyani Dwi, Farah Margaretha Leon, Sri Widyastuti, Nora Andira Brabo, and Aditya Halim Perdana Kusuma Putra. 2020. Antecedents and consequences of innovation and business strategy on performance and competitive advantage of SMEs. The Journal of Asian Finance, Economics and Business 7: 365–78. [Google Scholar] [CrossRef]

- Li, Yina. 2014. Environmental innovation practices and performance: Moderating effect of resource commitment. Journal of Cleaner Production 66: 450–58. [Google Scholar] [CrossRef]

- Ling, Ya-Hui. 2013. The influence of intellectual capital on organizational performance—Knowledge management as moderator. Asia Pacific Journal of Management 30: 937–64. [Google Scholar] [CrossRef]

- Maharani, Tia, and Khoirul Fuad. 2020. The effect of human capital, structural capital, customer capital, managerial ownership, and leverage toward profitability of company. Journal of Advanced Multidisciplinary Research 1: 46–62. [Google Scholar] [CrossRef]

- Malaolu, Victor, and Jonathan Emenike Ogbuabor. 2013. Training and Manpower Development, Employee Productivity and Organizational Performance in Nigeria: An Empirical Investigation. International Journal of Advances in Management and Economics 2: 163–77. [Google Scholar]

- Martin, Bruce C., Jeffrey J. McNally, and Michael J. Kay. 2013. Examining the formation of human capital in entrepreneurship: A meta-analysis of entrepreneurship education outcomes. Journal of Business Venturing 28: 211–24. [Google Scholar] [CrossRef]

- Matos, Florinda, Valter Martins Vairinhos, Renata Paola Dameri, and Susanne Durst. 2017. Increasing smart city competitiveness and sustainability through managing structural capital. Journal of Intellectual Capital 18: 693–707. [Google Scholar] [CrossRef]

- McGuirk, Helen, Helena Lenihan, and Mark Hart. 2015. Measuring the impact of innovative human capital on small firms’ propensity to innovate. Research Policy 44: 965–76. [Google Scholar] [CrossRef]

- Mehdivand, Mohsen, Mohammad Reza Zali, Merhdad Madhoshi, and Asadollah Kordnaeij. 2012. Intellectual capital and nano-businesses performance: The moderating role of entrepreneurial orientation. European Journal of Economics, Finance and Administrative Sciences 52: 147–62. [Google Scholar]

- Meihami, Bahram, and Hussein Meihami. 2014. Knowledge Management a way to gain a competitive advantage in firms (evidence of manufacturing companies). International Letters of Social and Humanistic Sciences 3: 80–91. [Google Scholar] [CrossRef]

- Miller, Kristel, Maura McAdam, and Rodney McAdam. 2014. The changing university business model: A stakeholder perspective. R&D Management 44: 265–87. [Google Scholar]

- Murray, Alan, Armando Papa, Benedetta Cuozzo, and Giuseppe Russo. 2016. Evaluating the innovation of the Internet of Things: Empirical evidence from the intellectual capital assessment. Business Process Management Journal 22: 341–56. [Google Scholar] [CrossRef]

- Musibah, Anwar Salem, and Wan Sulaiman Bin Wan Yusoff Alfattani. 2014. The mediating effect of financial performance on the relationship between Shariah supervisory board effectiveness, intellectual capital and corporate social responsibility, of Islamic banks in Gulf Cooperation Council countries. Asian Social Science 10: 139–64. [Google Scholar] [CrossRef]

- Ndubisi, Nelson Oly, Celine Marie Capel, and Gibson C. Ndubisi. 2015. Innovation strategy and performance of international technology services ventures: The moderating effect of structural autonomy. Journal of Service Management 26: 548–64. [Google Scholar] [CrossRef]

- Nejati, Ramin. 2016. Management of intangible assets a value enhancing strategy in knowledge economy. Research Journal of Humanities and Social Sciences 7: 54–60. [Google Scholar] [CrossRef]

- Ngari, James Mark Karimi, and James Kamau Muiruri. 2014. Effects of Financial Innovations on the Financial Performance of Commercial Banks in Kenya. International Journal of Humanities and Social Science 4: 51–57. [Google Scholar]

- Nikolaou, Ioannis. 2019. A framework to explicate the relationship between CSER and financial performance: An intellectual capital-based approach and knowledge-based view of firm. Journal of the Knowledge Economy 10: 1427–46. [Google Scholar] [CrossRef]

- Nimtrakoon, Sirinuch. 2015. The relationship between intellectual capital, firms’ market value and financial performance: Empirical evidence from the ASEAN. Journal of Intellectual Capital 16: 587–618. [Google Scholar] [CrossRef]

- Nuryani, Ni Nyoman Juli, Dewa Putu Rida Satrawan, Anak Agung Ngurah Oka Suryadinatha Gorda, and Luh Kadek Budi Martini. 2018. Influence of Human Capital, Social Capital, Economic Capital towards Financial Performance & Corporate Social Responsibility. International Journal of Social Sciences and Humanities 2: 65–76. [Google Scholar] [CrossRef]

- Ogunyomi, Paul, and Nealia S. Bruning. 2016. Human resource management and organizational performance of small and medium enterprises (SMEs) in Nigeria. The International Journal of Human Resource Management 27: 612–34. [Google Scholar] [CrossRef]

- Omotayo, Funmilola Olubunmi. 2015. Knowledge Management as an important tool in Organisational Management: A Review of Literature. Library Philosophy and Practice 1: 1–23. [Google Scholar]

- Osinski, Marilei, Paulo Mauricio Selig, Florinda Matos, and Darlan José Roman. 2017. Methods of evaluation of intangible assets and intellectual capital. Journal of Intellectual Capital 18: 470–85. [Google Scholar] [CrossRef]

- Pasban, Mohammad, and Sadegheh Hosseinzadeh Nojedeh. 2016. A Review of the Role of Human Capital in the Organization. Procedia-Social and Behavioral Sciences 230: 249–53. [Google Scholar] [CrossRef]

- Paunović, Mihailo. 2021. The impact of human capital on financial performance of entrepreneurial firms in Serbia. Management: Journal of Sustainable Business and Management Solutions in Emerging Economies 26: 29–46. [Google Scholar] [CrossRef]

- Ployhart, Robert E. 2012. Personnel selection and the competitive advantage of firms. International Review of Industrial and Organizational Psychology 27: 153–95. [Google Scholar]

- Ployhart, Robert E., Anthony J. Nyberg, Greg Reilly, and Mark A. Maltarich. 2014. Human capital is dead; long live human capital resources! Journal of Management 40: 371–98. [Google Scholar] [CrossRef]

- Post, Corinne, and Kris Byron. 2015. Women on boards and firm financial performance: A meta-analysis. Academy of Management Journal 58: 1546–71. [Google Scholar] [CrossRef]

- Przychodzen, Justyna, and Wojciech Przychodzen. 2015. Relationships between eco-innovation and financial performance–evidence from publicly traded companies in Poland and Hungary. Journal of Cleaner Production 90: 253–63. [Google Scholar] [CrossRef]

- Ranani, Hossein Sharifi, and Zivar Bijani. 2014. The Impact of Intellectual Capital on the Financial Performance of Listed Companies in Tehran Stock Exchange. International Journal of Academic Research in Accounting, Finance and Management Sciences 4: 119–27. [Google Scholar] [CrossRef]

- Ratnawati, Kusuma. 2020. The influence of financial inclusion on MSMEs’ performance through financial intermediation and access to capital. The Journal of Asian Finance, Economics, and Business 7: 205–18. [Google Scholar] [CrossRef]

- Reardon, Thomas, Ben Belton, Lenis Saweda O. Liverpool-Tasie, Liang Lu, Chandra S. R. Nuthalapati, Oyinkan Tasie, and David Zilberman. 2021. E-commerce’s fast-tracking diffusion and adaptation in developing countries. Applied Economic Perspectives and Policy 43: 1243–59. [Google Scholar] [CrossRef]

- Revelli, Christophe, and Jean-Laurent Viviani. 2015. Financial performance of socially responsible investing (SRI): What have we learned? A meta-analysis. Business Ethics: A European Review 24: 158–85. [Google Scholar] [CrossRef]

- Sardo, Filipe, Zélia Serrasqueiro, and Helena Alves. 2018. On the relationship between intellectual capital and financial performance: A panel data analysis on SME hotels. International Journal of Hospitality Management 75: 67–74. [Google Scholar] [CrossRef]

- Scafarto, Vincenzo, and Panagiotis Dimitropoulos. 2018. Human capital and financial performance in professional football: The role of governance mechanisms. Corporate Governance: The International Journal of Business in Society 18: 289–316. [Google Scholar] [CrossRef]

- Shaw, Jason D., Tae-Youn Park, and Eugene Kim. 2013. A resource-based perspective on human capital losses, HRM investments, and organizational performance. Strategic Management Journal 34: 572–89. [Google Scholar] [CrossRef]

- Silva, Vander Luiz, João Luiz Kovaleski, and Regina Negri Pagani. 2019. Technology transfer and human capital in the industrial 4.0 scenario: A theoretical study. Future Studies Research Journal: Trends and Strategies 11: 102–22. [Google Scholar] [CrossRef]

- Sima, Violeta, Ileana Georgiana Gheorghe, Jonel Subić, and Dumitru Nancu. 2020. Influences of the industry 4.0 revolution on the human capital development and consumer behavior: A systematic review. Sustainability 12: 4035. [Google Scholar] [CrossRef]

- Snyder, Hannah, Lars Witell, Anders Gustafsson, Paul Fombelle, and Per Kristensson. 2016. Identifying categories of service innovation: A review and synthesis of the literature. Journal of Business Research 69: 2401–8. [Google Scholar] [CrossRef]

- Soo, Christine, Amy Wei Tian, Stephen T. T. Teo, and John Cordery. 2017. Intellectual capital-enhancing HR, absorptive capacity, and innovation. Human Resource Management 56: 431–54. [Google Scholar] [CrossRef]

- Sumedrea, Silvia. 2013. Intellectual capital and firm performance: A dynamic relationship in crisis time. Procedia Economics and Finance 6: 137–44. [Google Scholar] [CrossRef]

- Surya, Batara, Firman Menne, Hernita Sabhan, Seri Suriani, Herminawaty Abubakar, and Muhammad Idris. 2021. Economic growth, increasing productivity of SMEs, and open innovation. Journal of Open Innovation: Technology, Market, and Complexity 7: 20. [Google Scholar] [CrossRef]

- Suseno, Yuliani, and Ashly H. Pinnington. 2017. The war for talent: Human capital challenges for professional service firms. Asia Pacific Business Review 23: 205–29. [Google Scholar] [CrossRef]

- Sydler, Renato, Stefan Haefliger, and Robert Pruksa. 2014. Measuring intellectual capital with financial figures: Can we predict firm profitability? European Management Journal 32: 244–59. [Google Scholar] [CrossRef]

- Teece, David J. 2018. Business models and dynamic capabilities. Long Range Planning 51: 40–49. [Google Scholar] [CrossRef]

- Teeratansirikool, Luliya, Sununta Siengthai, Yuosre Badir, and Chotchai Charoenngam. 2013. Competitive strategies and firm performance: The mediating role of performance measurement. International Journal of Productivity and Performance Management 62: 168–84. [Google Scholar] [CrossRef]

- Tehseen, Shehnaz, and Sulaiman Sajilan. 2016. Network competence based on resource-based view and resource dependence theory. International Journal of Trade and Global Markets 9: 60–82. [Google Scholar] [CrossRef]

- Thiagarajan, Anthony, and Utpal Baul. 2014. Holistic Intellectual Capital Conceptual Offering for Empirical Research and Business Application. International Journal of Management 3: 31–50. [Google Scholar]

- Tzabbar, Daniel, and Jaclyn Margolis. 2017. Beyond the startup stage: The founding team’s human capital, new venture’s stage of life, founder–CEO duality, and breakthrough innovation. Organization Science 28: 857–72. [Google Scholar] [CrossRef]

- Ungerman, Otakar, Jaroslava Dedkova, and Katerina Gurinova. 2018. The impact of marketing innovation on the competitiveness of enterprises in the context of industry 4.0. Journal of Competitiveness 10: 132–48. [Google Scholar] [CrossRef]

- Wang, Zhining, and Nianxin Wang. 2012. Knowledge sharing, innovation and firm performance. Expert Systems with Applications 39: 8899–908. [Google Scholar] [CrossRef]

- Wang, Zhining, Nianxin Wang, and Huigang Liang. 2014. Knowledge sharing, intellectual capital and firm performance. Management Decision 52: 230–58. [Google Scholar] [CrossRef]

- Wang, Zhining, Nianxin Wang, Jinwei Cao, and Xinfeng Ye. 2016. The impact of intellectual capital—Knowledge management strategy fit on firm performance. Management Decision 54: 1861–85. [Google Scholar] [CrossRef]

- Wang, Zhining, Shaohan Cai, Huigang Liang, Nianxin Wang, and Erwei Xiang. 2018. Intellectual capital and firm performance: The mediating role of innovation speed and quality. The International Journal of Human Resource Management 32: 1222–50. [Google Scholar] [CrossRef]

- Wataya, Eiko, and Rajib Shaw. 2019. Measuring the value and the role of soft assets in smart city development. Cities 94: 106–15. [Google Scholar] [CrossRef]

- Wijaya, Putu Yudy, and Ni Nyoman Reni Suasih. 2020. The effect of knowledge management on competitive advantage and business performance: A study of silver craft SMEs. Entrepreneurial Business and Economics Review 8: 105–21. [Google Scholar] [CrossRef]

- Wright, Patrick M., Russell Coff, and Thomas P. Moliterno. 2014. Strategic human capital: Crossing the great divide. Journal of Management 40: 353–70. [Google Scholar] [CrossRef]

- Wuttke, David A., Constantin Blome, and Michael Henke. 2013. Focusing the financial flow of supply chains: An empirical investigation of financial supply chain management. International Journal of Production Economics 145: 773–89. [Google Scholar] [CrossRef]

- Yong, Jing Yi, M.-Y. Yusliza, Charbel Jose Chiappetta Jabbour, and Noor Hazlina Ahmad. 2020. Exploratory cases on the interplay between green human resource management and advanced green manufacturing in light of the Ability-Motivation-Opportunity theory. Journal of Management Development 39: 31–49. [Google Scholar] [CrossRef]

- Yusuf, Ismaila. 2013. The Relationship between Human Capital Efficiency and Financial Performance: An Empirical Investigation of Quoted Nigerian Banks. Research Journal of Finance and Accounting 4: 148–54. [Google Scholar]

- Zambon, Stefano. 2017. Intangibles and intellectual capital: An overview of the reporting issues and some measurement models. In The Economic Importance of Intangible Assets. London: Routledge, Taylor & Francis Group, pp. 153–83. [Google Scholar]

- Zhou, Yu, Ying Hong, and Jun Liu. 2013. Internal commitment or external collaboration? The impact of human resource management systems on firm innovation and performance. Human Resource Management 52: 263–88. [Google Scholar] [CrossRef]

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2022 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).