Cross-Market Correlations and Financial Contagion from Developed to Emerging Economies: A Case of COVID-19 Pandemic

Abstract

1. Introduction

2. Literature Review

3. Research Methodology

4. Results

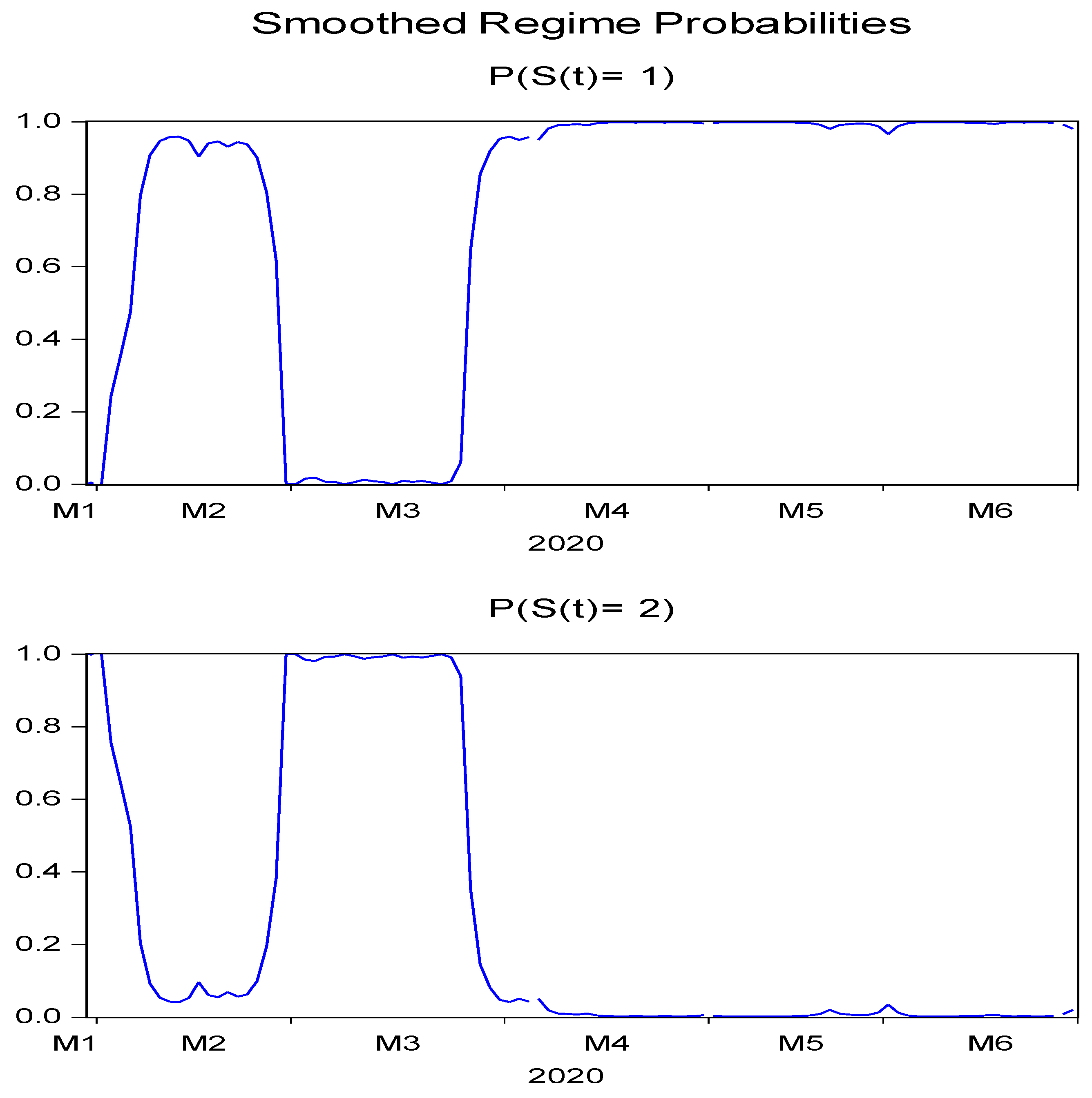

4.1. Regime Switching Model

4.2. DCC-G.A.R.C.H. Results

4.3. Test of Contagion

4.3.1. Contagion in Asia Region

4.3.2. Contagion in Africa and Middle East Region

5. Discussion

6. Conclusions and Implications

Author Contributions

Funding

Conflicts of Interest

References

- Abou-Zaid, Ahmed S. 2011. Volatility spillover effects in emerging MENA stock markets. Review of Applied Economics 7: 107–27. [Google Scholar]

- Ahmad, Wasim, Sanjay Sehgal, and N. R. Bhanumurthy. 2013. Eurozone crisis and B.R.I.I.C.K.S. stock markets: Contagion or market interdependence? Economic Modelling 33: 209–25. [Google Scholar] [CrossRef]

- Aizenman, Joshua, Yothin Jinjarak, Minsoo Lee, and Donghyun Park. 2016. Developing countries’ financial vulnerability to the eurozone crisis: An event study of equity and bond markets. Journal of Economic Policy Reform 19: 1–19. [Google Scholar] [CrossRef]

- Akhtaruzzaman, Md, Sabri Boubaker, and Ahmet Sensoy. 2021. Financial contagion during COVID-19 crisis. Finance Research Letters 38: 101604. [Google Scholar] [CrossRef]

- Aloui, Riadh, Mohamed Safouane Ben Aissa, and Duc Khuong Nguyen. 2011. Global financial crisis, extreme interdependence, and contagion effects: The role of economic structure? Journal of Banking & Finance 35: 130–40. [Google Scholar] [CrossRef]

- Al-Yahya, AbdulRahman A. I., Mohammed Asad, Abdulmoniem Sadaby, and Mohammed Sanad Alhussaini. 2020. Repeat oral dose safety study of standardized methanolic extract of Boswellia sacra oleo gum resin in rats. Saudi Journal of Biological Sciences 27: 117–23. [Google Scholar] [CrossRef]

- Arbaa, Ofer, and Eva Varon. 2019. Turkish currency crisis-Spillover effects on European banks. Borsa Istanbul Review 19: 372–78. [Google Scholar] [CrossRef]

- Baig, Taimur, and Ilan Goldfajn. 1999. Financial market contagion in the Asian crisis. I.M.F. Staff Papers 46: 167–95. [Google Scholar] [CrossRef]

- Bakry, Walid, Peter John Kavalmthara, Vivienne Saverimuttu, Yiyang Liu, and Sajan Cyril. 2022. Response of stock market volatility to COVID-19 announcements and stringency measures: A comparison of developed and emerging markets. Finance Research Letters 46: 102350. [Google Scholar] [CrossRef]

- Bello, Jaliyyah, Jiaqui Guo, and Mohammad Khaleq Newaz. 2022. Financial contagion effects of major crises in African stock markets. International Review of Financial Analysis 82: 102128. [Google Scholar] [CrossRef]

- Berg, A. 1999. The Asian Crisis: Causes, Policy Responses, and Outcomes. Working Paper No.99/138. Washington DC: IMF. [Google Scholar] [CrossRef]

- Calvo, Guillermo A., Leonardo Leiderman, and Carmen M. Reinhart. 1996. Inflows of Capital to Developing Countries in the 1990s. Journal of Economic Perspectives 10: 123–39. [Google Scholar] [CrossRef]

- Castagneto-Gissey, Giorgio, and Eugene Nivorozhkin. 2016. No contagion from Russia toward global equity markets after the 2014 international sanctions. Economic Analysis and Policy 52: 79–98. [Google Scholar] [CrossRef]

- Celık, Sibel. 2012. The more contagion effect on emerging markets: The evidence of DCC-GARCH model. Economic Modelling 29: 1946–59. [Google Scholar] [CrossRef]

- Chiang, Thomas, Bang Jeon, and Huimin Li. 2007. Dynamic correlation analysis of financial contagion: Evidence from Asian markets. Journal of International Money and Finance 26: 1206–28. [Google Scholar] [CrossRef]

- Claessens, Stijn, Rudiger Dornbusch, and Yung Chul Park. 2001. Contagion: Why crises spread and How This Can Be Stopped. In International Financial Contagion. Boston: Springer, pp. 19–41. [Google Scholar] [CrossRef]

- Conlon, Thomas, and Richard McGee. 2020. Safe haven or risky hazard? Bitcoin during the COVID-19 bear market. Finance Research Letters 35: 101607. [Google Scholar] [CrossRef]

- Conlon, Thomas, Shaen Corbet, and Richard McGee. 2020. Are Cryptocurrencies a Safe Haven for Equity Markets? An International Perspective from the COVID-19 Pandemic. May 10. Available online: http://dx.doi.org/10.2139/ssrn.3601045 (accessed on 12 January 2021).

- Corbet, Shaen, Charles Larkin, and Brian Lucey. 2020. The contagion effects of the COVID-19 pandemic: Evidence from gold and cryptocurrencies. Finance Research Letters 35: 101554. [Google Scholar] [CrossRef]

- Corbet, Shaen, Yang Hou, Yang Hu, Brian Lucey, and Les Oxley. 2021. Aye Corona! The contagion effects of being named Corona during the COVID-19 pandemic. Finance Research Letters 38: 101591. [Google Scholar] [CrossRef]

- Corsetti, Giancarlo, Marcello Pericoli, and Massimo Sbracia. 2005. ‘Some contagion, some interdependence’: More pitfalls in tests of financial contagion. Journal of International Money and Finance 24: 1177–99. [Google Scholar] [CrossRef]

- Dimitriou, Dimitrios, Dimitris Kenourgios, and Theodore Simos. 2013. Global financial crisis and emerging stock market contagion: A multivariate FIAPARCH-DCC approach. International Review of Financial Analysis 30: 46–56. [Google Scholar] [CrossRef]

- Dungey, Mardi, and Dinesh Gajurel. 2014. Equity market contagion during the global financial crisis: Evidence from the world’s eight largest economies. Economic Systems 38: 161–77. [Google Scholar] [CrossRef]

- Dungey, Mardi, Renée Fry, Brenda González-Hermosillo, and Vance L. Martin. 2005. Empirical modelling of contagion: A review of methodologies. Quantitative Finance 5: 9–24. [Google Scholar] [CrossRef]

- Engle, Robert. 2002. Dynamic conditional correlation: A simple class of multivariate generalized autoregressive conditional heteroskedasticity models. Journal of Business & Economic Statistics 20: 339–50. [Google Scholar] [CrossRef]

- Forbes, Kristin, and Roberto Rigobon. 2000. Contagion in Latin America: Definitions, Measurement, and Policy Implications. Cambridge: National Bureau of Economic Research. [Google Scholar] [CrossRef]

- Forbes, Kristin, and Roberto Rigobon. 2001. Measuring Contagion: Conceptual and Empirical Issues. In International Financial Contagion. Edited by S. Claessens and K. J. Forbes. Boston: Springer, pp. 43–66. [Google Scholar] [CrossRef]

- Forbes, Kristion J., and Roberto Rigobon. 2002. No contagion, only interdependence: Measuring stock market co- movements. Journal of Finance 57: 2223–61. [Google Scholar] [CrossRef]

- Fry-McKibbin, Renée, Cody Yu-Ling Hsiao, and Chrismin Tang. 2014. Contagion and global financial crises: Lessons from nine crisis episodes. OpenEconomies Review 25: 521–70. [Google Scholar] [CrossRef]

- Giovannetti, Giorgia, and Margherita Velucchi. 2013. A spillover analysis of shocks from US, UK and China on African financial markets. Reviewof Development Finance 3: 169–79. [Google Scholar] [CrossRef]

- Guo, Feng, Carl R. Chen, and Ying Sophie Huang. 2011. Markets contagion during financial crisis: A regime-switching approach. InternationalReview of Economics & Finance 20: 95–109. [Google Scholar] [CrossRef]

- Guo, Yanhong, Ping Li, and Aihua Li. 2021. Tail risk contagion between international financial markets during COVID-19 pandemic. International Review of Financial Analysis 73: 101649. [Google Scholar] [CrossRef]

- Hamilton, James D. 1989. A new approach to the economic analysis of nonstationary time series and the business cycle. Econometrica: Journal of the Econometric Society 57: 357–84. [Google Scholar] [CrossRef]

- He, Qing, Junyi Liu, Sizhu Wang, and Jishuang Yu. 2020. The impact of COVID-19 on stock markets. Economic and Political Studies 8: 275–88. [Google Scholar] [CrossRef]

- Huong, Le Thi Minh. 2021. The contagion between stock markets: Evidence from Vietnam and Asian emerging stocks in the context of COVID-19 Pandemic. Macroeconomics and Finance in Emerging Market Economies, 1–17. [Google Scholar] [CrossRef]

- Huynh, Toan Luu Duc, Matteo Foglia, Muhammad Ali Nasir, and Eliana Angelini. 2021. Feverish sentiment and global equity markets during the COVID-19 pandemic. Journal of Economic Behavior& Organization 188: 1088–108. [Google Scholar] [CrossRef]

- Hwang, Jae-Kwang. 2014. Spillover Effects of the 2008 Financial Crisis in Latin America Stock Markets. International Advances in EconomicResearch 20: 311–24. [Google Scholar] [CrossRef]

- Jin, Xiaoye. 2016. The impact of 2008 financial crisis on the efficiency and contagion of Asian stock markets: A Hurst exponent approach. Finance Research Letters 17: 167–75. [Google Scholar] [CrossRef]

- King, Mervyn A., and Sushil Wadhwani. 1990. Transmission of volatility between stock markets. The Review of Financial Studies 3: 5–33. [Google Scholar] [CrossRef]

- Kwapień, Jarosław, Marcin Wątorek, and Stanisław Drożdż. 2021. Cryptocurrency Market Consolidation in 2020–2021. Entropy 23: 1674. [Google Scholar] [CrossRef]

- Lane, Philip R. 2012. The European sovereign debt crisis. Journal of Economic Perspectives 26: 49–68. [Google Scholar] [CrossRef]

- Luo, Changqing, Lan Liu, and Da Wang. 2021. Multiscale financial risk contagion between international stock markets: Evidence from EMD- Copula-CoVaR analysis. The North American Journal of Economics and Finance 58: 101512. [Google Scholar] [CrossRef]

- Mckinsey. 2021. The Impact of COVID-19 on Capital Markets. Available online: https://www.mckinsey.com/business-functions/strategy-and-corporate-finance/our-insights/the-impact-of-covid-19-on-capital-markets-one-year-in (accessed on 21 June 2021).

- Miyakoshi, Tatsuyoshi. 2003. Spillovers of stock return volatility to Asian equity markets from Japan and the US. Journal of InternationalFinancial Markets, Institutions and Money 13: 383–99. [Google Scholar] [CrossRef]

- Neaime, Simon. 2012. The global financial crisis, financial linkages and correlations in returns and volatilities in emerging MENA stock markets. Emerging Markets Review 13: 268–82. [Google Scholar] [CrossRef]

- OECD Report. 2020. Available online: https://www.oecd.org/coronavirus/en/policy-responses (accessed on 12 January 2021).

- Orlowski, Lucjan T. 2012. Financial crisis and extreme market risks: Evidence from Europe. Review of Financial Economics 21: 120–30. [Google Scholar] [CrossRef]

- Sadorsky, Perry. 2012. Correlations and volatility spillovers between oil prices and the stock prices of clean energy and technology companies. Energy Economics 34: 248–55. [Google Scholar] [CrossRef]

- Samarakoon, Lalith P. 2011. Stock market interdependence, contagion, and the U.S. financial crisis: The case of emerging and frontier markets. Journal of International Financial Markets, Institutions and Money 21: 724–42. [Google Scholar] [CrossRef]

- Sharif, Arshian, Chaker Aloui, and Larisa Yarovaya. 2020. COVID-19 pandemic, oil prices, stock market, geopolitical risk and policy uncertainty nexus in the US economy: Fresh evidence from the wavelet-based approach. International Review of Financial Analysis 70: 101496. [Google Scholar] [CrossRef]

- Siddiqui, Taufeeque Ahmad, Haseen Ahmed, and Mohammad Naushad. 2020. Diffusion of COVID-19 impact across selected stock markets: A wavelet coherency analysis. Investment Management and Financial Innovations 17: 202–14. [Google Scholar] [CrossRef]

- Smeets, Dieter. 2016. Financial contagion during the European sovereign debt crisis. Journal of Economic & Financial Studies 4: 46–59. [Google Scholar] [CrossRef][Green Version]

- Syllignakis, Manolis N., and Georgios P. Kouretas. 2011. Dynamic correlation analysis of financial contagion: Evidence from the Central and Eastern European markets. International Review of Economics & Finance 20: 717–32. [Google Scholar] [CrossRef]

- Tortola, Pier Domenico. 2015. Coming full circle: The Euro crisis, integration theory and the future of the E.U. The International Spectator 50: 125–40. [Google Scholar] [CrossRef]

- Tsay, Ruey S. 2005. Analysis of Financial Time Series. Hoboken: John Wiley&Sons. [Google Scholar] [CrossRef]

- Van Royen, Anne-Sophie. 2002. Financial contagion and international portfolio flows. Financial Analysts Journal 58: 35–49. [Google Scholar] [CrossRef]

- Viale, Ariel M., David A. Bessler, and James W. Kolari. 2014. On the structure of financial contagion: Econometric tests and Mercosur evidence. Journal of Applied Economics 17: 373–400. [Google Scholar] [CrossRef]

- Wątorek, Marcin, Jarosław Kwapień, and Stanisław Drożdż. 2021. Financial return distributions: Past, present, and COVID-19. Entropy 23: 884. [Google Scholar] [CrossRef]

- Wu, Guosong, Boxian Yang, and Ningru Zhao. 2020. Herding Behavior in Chinese Stock Markets during COVID-19. Emerging Markets Finance andTrade 56: 3578–87. [Google Scholar] [CrossRef]

- Xie, Lijuan, Mei Wang, and Toan Luu Duc Huynh. 2021. Trust and the stock market reaction to lockdown and reopening announcements: A cross-country evidence. Finance Research Letters 46: 102361. [Google Scholar] [CrossRef]

- Yarovaya, Larisa, and Marco Chi Keung Lau. 2016. Stock market comovements around the Global Financial Crisis: Evidence from the UK, BRICS and MIST markets. Research in International Business and Finance 37: 605–19. [Google Scholar] [CrossRef]

- Yousaf, Imran, Shoaib Ali, Elie Bouri, and Tareq Saeed. 2021. Information transmission and hedging effectiveness for the pairs crude oil-gold and crude oil-Bitcoin during the COVID-19 outbreak. Economic Research-EkonomskaIstraživanja, 1–22. [Google Scholar] [CrossRef]

- Zainudin, Ahmad Danial, and Azhar Mohamad. 2021. Financial contagion in the futures markets amidst global geo-economic events. The Quarterly Review of Economics and Finance 81: 288–308. [Google Scholar] [CrossRef]

- Zaremba, Adam, Renatas Kizys, David Y. Aharon, and Ender Demir. 2020. Infected markets: Novel coronavirus, government interventions, and stock return volatility around the globe. Finance Research Letters 35: 101597. [Google Scholar] [CrossRef]

- Zhang, Yi, Long Zhou, Yajiao Chen, and Fang Liu. 2022. The Contagion Effect of Jump Risk across Asian Stock Markets during the Covid-19 Pandemic. The North American Journal of Economics and Finance 61: 101688. [Google Scholar] [CrossRef]

| Regimes | Variable | Coefficient | Std. Error | z-Statistic | Prob. |

|---|---|---|---|---|---|

| Regime1 | log(sigma) | −4.816 | 0.088 | −54.272 | 0.000 |

| Regime 2 | Log(sigma) | −3.669 | 0.159 | −22.974 | 0.000 |

| Common | Return(–1) | −0.062 | 0.096 | −0.649 | 0.515 |

| Transition Matrix Parameters | |||||

| Variable | Coefficient | Std. Error | z-Statistic | Prob. | |

| P11-C | 3.602 | 0.796 | 4.523 | 0.000 | |

| P21-C | −2.675 | 0.927 | −2.884 | 0.003 | |

| Constant Transition Probabilities | |||

|---|---|---|---|

| P(i,k) = P(s(t) = k|s(t − 1) = i) | |||

| (row = i/column = j) | |||

| 1 | 2 | ||

| 1 | 0.973 | 0.026 | |

| 2 | 0.064 | 0.935 | |

| Variance Equation | ||||

|---|---|---|---|---|

| CRISIS | PRE-CRISIS | |||

| Country | ||||

| U.S. | 0.361 (0.168) | 0.548 (0.002) | 0.167 (0.000) | 0.717 (0.050) |

| India | 0.231 (0.020) | 0.767 (0.000) | 0.097 (0.000) | 0.774 (0.000) |

| China | 0.007 (0.611) | 0.976 (0.000) | 0.0815 (0.260) | 0.901 (0.000) |

| Taiwan | 0.115 (0.181) | 0.737 (0.000) | 0.098 (0.368113) | 0.624 (0.000) |

| Thailand | 0.223 (0.065) | 0.760 (0.000) | 0.000 (0.786) | 0.998 (0.000) |

| Multivariate DCC | Equation | |||

| DCC(a) | 0.000 (0.999) | 0.000 (0.999) | ||

| DCC(b) | 0.919 (0.000) | 0.910 (0.000) | ||

| Variance Equation | ||||

|---|---|---|---|---|

| CRISIS | PRE-CRISIS | |||

| Country | ||||

| U.S. | 0.108 (0.000) | 0.878 (0.000) | 0.167 (0.000) | 0.733 (0.000) |

| Egypt | 0.055 (0.039) | 0.933 (0.000) | 0.000 (0.999) | 0.998 (0.000) |

| U.A.E. | 0.144 (0.182) | 0.854 (0.000) | 0.000 (0.886) | 0.996 (0.000) |

| Saudi Arabia | 0.086 (0.039) | 0.912 (0.000) | 0.000 (0.963) | 0.997 (0.000) |

| South Africa | 0.100 (0.002) | 0.891 (0.000) | 0.000 (0.999) | 0.999 (0.000) |

| Multivariate DCC equations | ||||

| DCC(a) | 0.001 (0.798) | 0.011 (0.134) | ||

| DCC(b) | 0.815 (0.001) | 0.928 (0.000) | ||

| Country | (Mean) Pre-Crisis | (Mean) Crisis | t-Test | Contagion |

|---|---|---|---|---|

| Japan–India | 0.965 | 0.529 | −78.02 | N |

| Japan–China | 0.965 | 0.529 | −78.02 | N |

| Japan–Taiwan | 0.980 | 0.681 | −82.536 | N |

| Japan–Thailand | 0.976 | 0.567 | −110.33 | N |

| U.S.–India | −0.011 | 0.196 | 73.086 | C |

| U.S.–China | −0.013 | −0.038 | −10.374 | N |

| U.S.–Taiwan | −0.017 | −0.000 | −4.6896 | N |

| U.S.–Thailand | −0.009 | 0.258 | 156.38 | C |

| U.K.–India | −0.726 | 0.576 | 38.3 | C |

| U.K.–China | −0.663 | 0.363 | 24.5 | C |

| U.K.–Taiwan | −0.710 | 0.433 | 30.988 | C |

| U.K.–Thailand | −0.701 | 0.555 | 33.337 | C |

| Country | (Mean) Pre-Crisis | (Mean) Crisis | t-Test | Contagion |

|---|---|---|---|---|

| Japan–Egypt | 0.967 | 0.415 | −77.359 | N |

| Japan–South Africa | 0.909 | 0.585 | −21.808 | N |

| Japan–Saudi Arabia | 0.844 | 0.357 | −22.151 | N |

| Japan–U.A.E. | −0.020 | 0.402 | 160.59 | C |

| U.S.–Egypt | 0.000 | 0.075 | 26.149 | C |

| U.S.–Saudi Arabia | 0.725 | 0.458 | −8.0159 | N |

| U.S.–U.A.E. | −0.013 | 0.142 | 77.80 | C |

| U.S.–South Africa | −0.005 | 0.153 | 154.5 | C |

| U.K.–Egypt | −0.721 | 0.288 | 30.108 | C |

| U.K.–U.A.E. | 0.055 | 0.436 | −40.012 | N |

| U.K.–Saudi Arabia | −0.641 | 0.416 | 24.877 | C |

| U.K.–South Africa | −0.597 | 0.776 | 28.35 | C |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2022 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Siddiqui, T.A.; Khan, M.F.; Naushad, M.; Syed, A.M. Cross-Market Correlations and Financial Contagion from Developed to Emerging Economies: A Case of COVID-19 Pandemic. Economies 2022, 10, 147. https://doi.org/10.3390/economies10060147

Siddiqui TA, Khan MF, Naushad M, Syed AM. Cross-Market Correlations and Financial Contagion from Developed to Emerging Economies: A Case of COVID-19 Pandemic. Economies. 2022; 10(6):147. https://doi.org/10.3390/economies10060147

Chicago/Turabian StyleSiddiqui, Taufeeque Ahmad, Mazia Fatima Khan, Mohammad Naushad, and Abdul Malik Syed. 2022. "Cross-Market Correlations and Financial Contagion from Developed to Emerging Economies: A Case of COVID-19 Pandemic" Economies 10, no. 6: 147. https://doi.org/10.3390/economies10060147

APA StyleSiddiqui, T. A., Khan, M. F., Naushad, M., & Syed, A. M. (2022). Cross-Market Correlations and Financial Contagion from Developed to Emerging Economies: A Case of COVID-19 Pandemic. Economies, 10(6), 147. https://doi.org/10.3390/economies10060147