Driving Technological Innovation through Intellectual Capital: Industrial Revolution in the Transportation Sector

Abstract

:1. Introduction

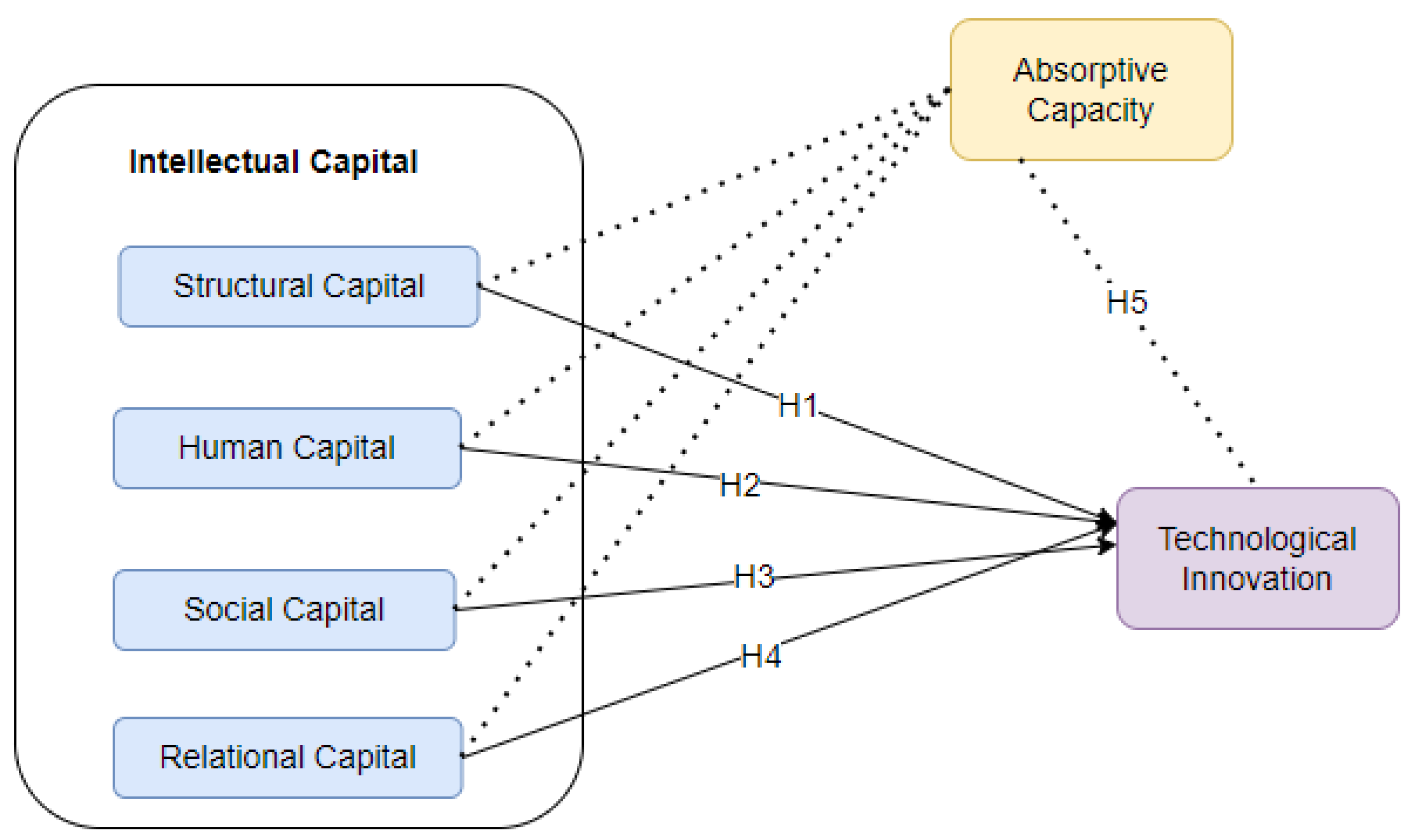

- To determine the effects of intellectual capital aspects toward the technological innovation in the transport sector in Russia;

- To evaluate the mediating role of absorptive capacity on the effects of intellectual capital on technological innovation.

- What are the effects of intellectual capital aspects toward the technological innovation in the transport sector in Russia?

- What is the mediating role of absorptive capacity on the effects of intellectual capital on technological innovation?

2. Literature Review

2.1. Technological Innovation

2.2. Effects of Intellectual Capital on Technological Innovation

2.3. Hypothesis Development

2.3.1. Structural Capital

2.3.2. Human Capital

2.3.3. Social Capital

2.3.4. Relational Capital

2.4. Intellectual Capital as a Driver of Technological Innovation

3. Methodology

3.1. Population and Sample Size

3.2. Measurement

4. Results

4.1. Descriptive Statistics

4.2. Reliability and Validity

4.3. Evaluation of Hypotheses

5. Discussion

6. Conclusions

7. Limitations and Future Study Suggestions

8. Implications

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

References

- Agostini, Lara, and Anna Nosella. 2017. Enhancing radical innovation performance through intellectual capital components. Journal of Intellectual Capital 18: 789–806. [Google Scholar] [CrossRef]

- Agostini, Lara, Anna Nosella, and Roberto Filippini. 2017. Does intellectual capital allow improving innovation performance? A quantitative analysis in the SME context. Journal of Intellectual Capital 18: 400–18. [Google Scholar] [CrossRef]

- Alrowwad, Ala’aldin, Shadi Habis Abualoush, and Ra’ed Masa’deh. 2020. Innovation and intellectual capital as intermediary variables among transformational leadership, transactional leadership, and organizational performance. Journal of Management Development 38: 196–222. [Google Scholar] [CrossRef]

- Alvino, Federico, Assunta Di Vaio, Rohail Hassan, and Rosa Palladino. 2020. Intellectual capital and sustainable development: A systematic literature review. Journal of Intellectual Capital 22: 76–94. [Google Scholar] [CrossRef]

- Andreeva, Tatiana, and Tatiana Garanina. 2016. Do all elements of intellectual capital matter for organizational performance? Evidence from Russian context. Journal of Intellectual Capital 17: 397–412. [Google Scholar] [CrossRef] [Green Version]

- Asaturova, Julia. 2019. Peculiarities of development of industry 4.0 concept in Russia. IOP Conference Series: Materials Science and Engineering 497: 1–6. [Google Scholar] [CrossRef]

- Barykin, Sergey Yevgenievich, Andrey Aleksandrovich Bochkarev, Evgeny Dobronravin, and Sergey Mikhailovich Sergeev. 2021a. The place and role of digital twin in supply chain management. Academy of Strategic Management Journal 20: 1–19. [Google Scholar]

- Barykin, Sergey Yevgenievich, Andrey Aleksandrovich Bochkarev, Sergey Mikhailovich Sergeev, Tatiana Anatolievna Baranova, Dmitriy Anatolievich Mokhorov, and Aleksandra Maksimovna Kobicheva. 2021b. A methodology of bringing perspective innovation products to market innovation products to market. Academy of Strategic Management Journal 20: 1–18. [Google Scholar]

- Barykin, Sergey Yevgenievich, Irina Vasilievna Kapustina, Olga Aleksandrovna Valebnikova, Natalia Viktorovna Valebnikova, Olga Vladimirovna Kalinina, Sergey Mikhailovich Sergeev, Marisa Camastral, Yuri Yevgenievich Putikhin, and Lydia Vitalievna Volkova. 2021c. Digital technologies for personnel management: Implications for open innovations. Academy of Strategic Management Journal 20: 1–14. [Google Scholar]

- Barykin, Sergey Yevgenievich, Irina Vasilievna Kapustina, Sergey Mikhailovich Sergeev, Olga Vladimirovna Kalinina, Viktoriia Valerievna Vilken, Elena De La Poza Plaza, Yuri Yevgenievich Putikhin, and Lydia Vitalievna Volkova. 2021d. Developing the physical distribution digital twin model within the trade network. Academy of Strategic Management Journal 20: 1–24. [Google Scholar]

- Barykin, Sergey Yevgenievich, Olga Vladimirovna Kalinina, Irina Vasilievna Kapustina, Victor Andreevich Dubolazov, Cesar Armando Nunez Esquivel, Elmira Alyarovna Nazarova, and Petr Anatolievich Sharapaev. 2021e. The sharing economy and digital logistics in retail chains: Opportunities and threats. Academy of Strategic Management Journal: Marketing Management and Strategic Planning 20: 1–14. [Google Scholar]

- Bayraktaroglu, Ayse Elvan, Fethi Calisir, and Murat Baskak. 2019. Intellectual capital and firm performance: An extended VAIC model. Journal of Intellectual Capital 20: 406–25. [Google Scholar] [CrossRef]

- Buenechea-Elberdin, Marta. 2017. Structured literature review about intellectual capital and innovation. Journal of Intellectual Capital 18: 262–85. [Google Scholar] [CrossRef] [Green Version]

- Buenechea-Elberdin, Marta, Aino Kianto, and Josune Sáenz. 2018a. Intellectual capital drivers of product and managerial innovation in high-tech and low-tech firms. R&D Management 48: 290–307. [Google Scholar] [CrossRef]

- Buenechea-Elberdin, Marta, Josune Sáenz, and Aino Kianto. 2018b. Knowledge management strategies, intellectual capital, and innovation performance: A comparison between high-and low-tech firms. Journal of Knowledge Management 22: 1757–81. [Google Scholar] [CrossRef]

- Burgelman, Robert A., Modesto A. Maidique, and Steven C. Wheelright. 1983. Strategic Management of Technology and Innovation. Irwin: McGraw Hill, pp. 293–350. [Google Scholar]

- Cabrita, Maria do Rosário Meireles Ferreira, Maria de Lurdes Ribeiro da Silva, Ana Maria Gomes Rodrigues, and María del Pilar Muñoz Dueñas. 2017. Competitiveness and disclosure of intellectual capital: An empirical research in Portuguese banks. Journal of Intellectual Capital 18: 486–505. [Google Scholar] [CrossRef]

- Caddy, Ian. 2000. Intellectual capital: Recognizing both assets and liabilities. Journal of Intellectual Capital 1: 1469–930. [Google Scholar] [CrossRef]

- Cassol, Alessandra, Cláudio Reis Gonçalo, and Roberto Lima Ruas. 2016. Redefining the relationship between intellectual capital and innovation: The mediating role of absorptive capacity. BAR-Brazilian Administration Review 13: 1–25. [Google Scholar] [CrossRef] [Green Version]

- Chaveesuk, Singha, Bilal Khalid, and Wornchanok Chaiyasoonthorn. 2022. Continuance intention to use digital payments in mitigating the spread of COVID-19 virus. International Journal of Data and Network Science 6: 527–36. [Google Scholar] [CrossRef]

- Cohen, Wesley M., and Daniel A. Levinthal. 1990. Absorptive capacity: A new perspective on learning and innovation. Administrative Science Quarterly 35: 128–52. [Google Scholar] [CrossRef]

- Dabić, Marina, Jasminka Lažnjak, David Smallbone, and Jadranka Švarc. 2018. Intellectual capital, organisational climate, innovation culture, and SME performance: Evidence from Croatia. Journal of Small Business and Enterprise Development 26: 522–44. [Google Scholar] [CrossRef]

- Diaconu, Mihaela. 2011. Technological Innovation: Concept, Process, Typology and Implications in the Economy. Theoretical and Applied Economics 18: 127–44. [Google Scholar]

- Donate, Mario J., Isidro Peña, and Jesús D. Sánchez de Pablo. 2016. HRM practices for human and social capital development: Effects on innovation capabilities. The International Journal of Human Resource Management 27: 928–53. [Google Scholar] [CrossRef]

- Dzinkowski, Ramona. 1999. Intellectual capital: What you always wanted to know but were afraid to ask. Accounting & Business 2: 22–24. [Google Scholar]

- Dzinkowski, Ramona. 2000. The measurement and management of intellectual capital: An introduction. Management Accounting 78: 32–36. [Google Scholar]

- Freeman, Christopher. 1982. The Economics of Industrial Innovation, 2nd ed. London: Frances Printer. [Google Scholar]

- Ginesti, Ginesti, Adele Caldarelli, and Annamaria Zampella. 2018. Exploring the impact of intellectual capital on company reputation and performance. Journal of Intellectual Capital 19: 915–34. [Google Scholar] [CrossRef]

- Hagemeister, Markus, and Arturo Rodríguez-Castellanos. 2010. Organisational capacity to absorb external R&D: Industrial differences in assessing intellectual capital drivers. Knowledge Management Research & Practice 8: 102–11. [Google Scholar]

- Hair, Joseph, William Black, Barry Babin, Rolph Anderson, and Ronald Tatham. 2009. Multivariate Data Analysis, 6th ed. Porto Alegre: Bookman. [Google Scholar]

- Haris, Muhammad, HongXing Yao, Gulzara Tariq, Ali Malik, and Hafiz Mustansar Javaid. 2019. Intellectual capital performance and profitability of banks: Evidence from Pakistan. Journal of Risk and Financial Management 12: 56. [Google Scholar] [CrossRef] [Green Version]

- Hormiga, Esther, Rosa M. Batista-Canino, and Agustín Sánchez-Medina. 2011. The role of intellectual capital in the success of new ventures. International Entrepreneurship and Management Journal 7: 71–92. [Google Scholar] [CrossRef]

- Hu, Li-Tze, Peter M. Bentler, and Yutaka Kano. 1992. Can test statistics in covariance structure analysis be trusted? Psychological Bulletin 112: 351. [Google Scholar] [CrossRef] [PubMed]

- Hussinki, Henri, Paavo Ritala, Mika Vanhala, and Aino Kianto. 2017. Intellectual capital, knowledge management practices and firm performance. Journal of Intellectual Capital 18: 904–22. [Google Scholar] [CrossRef]

- Iqbal, Amjad, Fawad Latif, Frederic Marimon Viadiu, Umar Farooq Sahibzada, and Saddam Hussain. 2019. From knowledge management to organizational performance: Modelling the mediating role of innovation and intellectual capital in higher education. Journal of Enterprise Information Management 32: 36–59. [Google Scholar] [CrossRef]

- Iqbal, Kanwar Muhammad Javed, Farooq Khalid, and Sergey Yevgenievich Barykin. 2021. Hybrid workplace: The future of work. In Handbook of Research on Future Opportunities for Technology Management Education. Hershey: IGI Global, pp. 28–48. [Google Scholar] [CrossRef]

- Jantunen, Ari, Kaisu Puumalainen, Sami Saarenketo, and Kalevi Kyläheiko. 2005. Entrepreneurial orientation, dynamic capabilities and international performance. Journal of International Entrepreneurship 3: 223–43. [Google Scholar] [CrossRef]

- Januškaitė, Virginija, and Lina Užienė. 2018. Intellectual capital as a factor of sustainable regional competitiveness. Sustainability 10: 4848. [Google Scholar] [CrossRef] [Green Version]

- Kalkan, Adnan, Özlem Çetinkaya Bozkurt, and Mutlu Arman. 2014. The impacts of intellectual capital, innovation and organizational strategy on firm performance. Procedia-Social and Behavioral Sciences 150: 700–7. [Google Scholar] [CrossRef] [Green Version]

- Khalid, Bilal, and Michal Kot. 2021. The impact of accounting information systems on performance management in the banking sector. IBIMA Business Review 2021: 578902. [Google Scholar] [CrossRef]

- Lane, Peter J., Balaji R. Koka, and Seemantini Pathak. 2006. The reification of absorptive capacity: A critical review and rejuvenation of the construct. Academy of Management Review 31: 833–63. [Google Scholar] [CrossRef]

- Lin, Tung-Ching, Christina Ling-hsang Chang, and Wen-Chin Tsai. 2016. The influences of knowledge loss and knowledge retention mechanisms on the absorptive capacity and performance of a MIS department. Management Decision 54: 1757–87. [Google Scholar] [CrossRef]

- MacCallum, Robert C., and Sehee Hong. 1997. Power analysis in covariance structure modeling using GFI and AGFI. Multivariate Behavioral Research 32: 193–210. [Google Scholar] [CrossRef]

- Malerba, Franco, and Luigi Orsenigo. 1997. Technological regimes and sectorial patterns of innovative activities. Industrial and Corporate Change 6: 83–117. [Google Scholar] [CrossRef]

- Malhotra, Naresh. 2012. Marketing Research: An Applied Guidance, 6th ed. Porto Alegre: Bookman. [Google Scholar]

- Malmberg, Anders. 2003. Beyond the Cluster-Local Milieu and Global Economic Connections. Edited by Jamie Peck. Londres: SAGE Publications. [Google Scholar]

- Manzaneque, Montserrat, Yolanda Ramírez, and Julio Diéguez-Soto. 2017. Intellectual capital efficiency, technological innovation and family management. Innovation 19: 167–88. [Google Scholar] [CrossRef]

- Mariano, Stefania, and Christian Walter. 2015. The construct of absorptive capacity in knowledge management and intellectual capital research: Content and text analyses. Journal of Knowledge Management 19: 372–400. [Google Scholar] [CrossRef]

- Martín-de Castro, Gregorio, Isabel Díez-Vial, and Miriam Delgado-Verde. 2019. Intellectual capital and the firm: Evolution and research trends. Journal of Intellectual Capital 20: 555–80. [Google Scholar] [CrossRef]

- Massaro, Maurizio, John C. Dumay, Andrea Garlatti, and Francesca Dal Mas. 2018. Practitioners’ views on intellectual capital and sustainability: From a performance-based to a worth-based perspective. Journal of Intellectual Capital 19: 367–86. [Google Scholar] [CrossRef]

- McNamara, Carter. 2008. Management Function of Coordination and Control: Overview of Basic Methods. London: SAGE Publication. [Google Scholar]

- Mention, Anne-Laure. 2012. Intellectual capital, innovation and performance: A systematic review of the literature. Business and Economic Research 2: 1–37. [Google Scholar] [CrossRef]

- Muangmee, Chaiyawit, Zdzisława Dacko-Pikiewicz, Nusanee Meekaewkunchorn, Nuttapon Kassakorn, and Bilal Khalid. 2021. Green entrepreneurial orientation and green innovation in Small and Medium-Sized Enterprises (SMEs). Social Sciences 10: 136. [Google Scholar] [CrossRef]

- Murovec, Nika, and Igor Prodan. 2009. Absorptive capacity, its determinants, and influence on innovation output: Cross-cultural validation of the structural model. Technovation 29: 859–72. [Google Scholar] [CrossRef]

- Nicolò, Giuseppe, Francesca Manes-Rossi, Johan Christiaens, and Natalia Aversano. 2020. Accountability through intellectual capital disclosure in Italian Universities. Journal of Management and Governanc 24: 1055–87. [Google Scholar] [CrossRef]

- Nielsen, Christian, and Henrik Dane-Nielsen. 2019. Value creation in business models is based on intellectual capital–And only intellectual capital! Journal of Business Models 7: 64–81. [Google Scholar]

- Nunnally, Jum, and Ira Bernstein. 1994. Psychometric Theory, 3rd ed. New York: MGraw-Hill. [Google Scholar]

- Obeidat, Bader Yousef, Ali Tarhini, Raed Masa’deh, and Noor Osama Aqqad. 2017. The impact of intellectual capital on innovation via the mediating role of knowledge management: A structural equation modelling approach. International Journal of Knowledge Management Studies 8: 273–98. [Google Scholar] [CrossRef]

- OECD. 2005. Oslo Manual: Guidelines for Collecting and Interpreting Innovation Data. Paris: OECD. [Google Scholar] [CrossRef]

- O’Reilly, Charles A., and Michael L. Tushman. 2004. The ambidextrous organization. Harvard Business Review 82: 74–81. [Google Scholar] [PubMed]

- Pedro, Eugenia, João Leitão, and Helena Alves. 2018. Back to the future of intellectual capital research: A systematic literature review. Management Decision 56: 2502–83. [Google Scholar] [CrossRef]

- Pérez-Luño, Ana, Shanthi Gopalakrishnan, and Ramon Valle Cabrera. 2014. Innovation and performance: Therole of environmental dynamism on the success of innovation choices. IEEE Transactionson Engineering Management 61: 499–510. [Google Scholar] [CrossRef]

- Poh, Law Teck, Adem Kilicman, and Siti Nur Iqmal Ibrahim. 2018. On intellectual capital and financial performances of banks in Malaysia. Cogent Economics and Finance 6: 1453574. [Google Scholar] [CrossRef] [Green Version]

- Ramírez, Yolanda, Montserrat Manzaneque, and Alba Maria Priego. 2017. Formulating and elaborating a model for the measurement of intellectual capital in Spanish public universities. International Review of Administrative Sciences 83: 149–76. [Google Scholar] [CrossRef]

- Rogers, Everett M. 1995. Diffusion of Innovations, 4th ed. Nueva York: Free Press. [Google Scholar]

- Rossi, Francesca Manes, Giuseppe Nicolò, and Paolo Tartaglia Polcini. 2018. New trends in intellectual capital reporting: Exploring online intellectual capital disclosure in Italian universities. Journal of Intellectual Capital 19: 814–35. [Google Scholar] [CrossRef] [Green Version]

- Santos-Rodrigues, Helena, Carlos Fernández-Jardón, and Pedro Figueroa Dorrego. 2015. Relation between intellectual capital and the product process innovation. International Journal of Knowledge-Based Development 6: 15–33. [Google Scholar] [CrossRef]

- Schumpeter, Joseph. 1934. The Theory of Economic Development. Harvard: Harvard University Press. [Google Scholar]

- Secundo, Giustina, Christle De Beer, Cornelius S. L. Schutte, and Giuseppina Passiante. 2017a. Mobilising intellectual capital to improve European universities’ competitiveness: The technology transfer offices’ role. Journal of Intellectual Capital 18: 607–24. [Google Scholar] [CrossRef]

- Secundo, Giustina, Susana Elena Perez, Žilvinas Martinaitis, and Karl Heinz Leitner. 2017b. An Intellectual Capital framework to measure universities’ third mission activities. Technological Forecasting and Social Change 123: 229–39. [Google Scholar] [CrossRef]

- Secundo, Giustina, Rosa Lombardi, and John Dumay. 2018. Intellectual capital in education. Journal of Intellectual Capital 19: 2–9. [Google Scholar] [CrossRef]

- Secundo, Giustina, Valentina Ndou, Pasquale Del Vecchio, and Gianluigi De Pascale. 2020. Sustainable development, intellectual capital and technology policies: A structured literature review and future research agenda. Technological Forecasting and Social Change 153: 119917. [Google Scholar] [CrossRef]

- Shevlin, Mark, and Jeremy Miles. 1998. Effects of sample size, model specification and factor loadings on the GFI in confirmatory factor analysis. Personality and Individual Differences 25: 85–90. [Google Scholar] [CrossRef]

- Stacchezzini, Riccardo, Cristina Florio, Alice Francesca Sproviero, and Silvano Corbella. 2019. An intellectual capital ontology in an integrated reporting context. Journal of Intellectual Capital 20: 83–99. [Google Scholar] [CrossRef]

- Subramaniam, Mohan, and Mark A. Youndt. 2005. The influence of intellectual capital on the types ofinnovative capabilities. Academy of Management Journal 48: 450–63. [Google Scholar] [CrossRef] [Green Version]

- Tabachnick, Barbara, and Linda Fidell. 2001. Using Multivariate Statistics, 4th ed. Boston: Allyn and Bacon. [Google Scholar]

- Ting, Irene Wei Kiong, and Hooi Hooi Lean. 2009. Intellectual capital performance of financial institutions in Malaysia. Journal of Intellectual Capital 10: 588–99. [Google Scholar] [CrossRef]

- Trading Economics. 2021. Russia Competitiveness Rank. Available online: https://tradingeconomics.com/russia/competitiveness-rank (accessed on 1 March 2022).

- Trequattrini, Raffaele, Rosa Lombardi, Alessandra Lardo, and Benedetta Cuozzo. 2018. The impact of entrepreneurial universities on regional growth: A local intellectual capital perspective. Journal of the Knowledge Economy 9: 199–211. [Google Scholar] [CrossRef]

- Vasin, Sergey, Leyla Gamidullaeva, Elena Shkarupeta, Alexey Finogeev, and Tatiana Vasinas. 2018. Emerging trends and opportunities for industry 4.0 development in Russia. European Research Studies Journal 21: 63–76. [Google Scholar] [CrossRef]

- Wall, William Philip. 2021. The comparison of the TQM practices and quality performance between manufacturing and service sectors. Polish Journal of Management Studies 23: 436–52. [Google Scholar] [CrossRef]

- Xu, Jian, and Binghan Wang. 2018. Intellectual capital, financial performance and companies’ sustainable growth: Evidence from the Korean manufacturing industry. Sustainability 10: 4651. [Google Scholar] [CrossRef] [Green Version]

- Xu, Jian, and Feng Liu. 2020. The impact of intellectual capital on firm performance: A modified and extended VAIC model. Journal of Competitiveness 12: 161–76. [Google Scholar] [CrossRef]

- Xu, Jian, and Jingsuo Li. 2019. The impact of intellectual capital on SMEs’ performance in China: Empirical evidence from non-high-tech vs. high-tech SMEs. Journal of Intellectual Capital 20: 488–509. [Google Scholar] [CrossRef]

- Xu, Jian, Yue Shang, Weizhen Yu, and Feng Liu. 2019. Intellectual capital, technological innovation and firm performance: Evidence from China’s manufacturing sector. Sustainability 11: 5328. [Google Scholar] [CrossRef] [Green Version]

- Xu, Xin-long, Xiao-nan Yang, Liang Zhan, Cheng Kun Liu, Ni-di Zhou, and Meimei Hu. 2017. Examining the relationship between intellectual capital and performance of listed environmental protection companies. Environmental Progress and Sustainable Energy 36: 1056–66. [Google Scholar] [CrossRef]

- Yusliza, Mohd Yusoff, Jing Yi Yong, Imran Tanveer, T. Ramayah, Juhari Noor Faezah, and Zikri Muhammad. 2020. A structural model of the impact of green intellectual capital on sustainable performance. Journal of Cleaner Production 249: 119334. [Google Scholar] [CrossRef]

- Zahra, Shaker A., and Gerard George. 2002. Absorptive capacity: A review, reconceptualization, and extension. Academy of Management Review 27: 185–203. [Google Scholar] [CrossRef]

- Zhang, Hui-Ying, and Shuang Lv. 2015. Intellectual capital and technological innovation: The mediating role of supply chain learning. International Journal of Innovation Science 7: 199–210. [Google Scholar] [CrossRef]

- Zhang, Yinan Qi, Zhiqiang Wang, Kulwant Pawar, and Xiande Zhao. 2018. How does intellectual capital affect product innovation performance? Evidence from China and India. International Journal of Operations and Production Management 38: 895–914. [Google Scholar] [CrossRef]

- Zhilenkova, Elena, Marina Budanova, Nikolay Bulkhov, and Dmitry Rodionov. 2019. Reproduction of intellectual capital in innovative-digital economy environment. In IOP Conference Series: Materials Science and Engineering. Bristol: IOP Publishing, vol. 497, p. 012065. [Google Scholar] [CrossRef]

| Variables | Frequency (n) | Percent (%) | |

|---|---|---|---|

| Age | 21–30 | 122 | 26.8 |

| 31–40 | 203 | 44.6 | |

| 41–50 | 86 | 18.9 | |

| Above 50 | 44 | 9.7 | |

| Education | High School and Below | 89 | 19.6 |

| Colleges | 170 | 37.4 | |

| Graduates | 124 | 27.3 | |

| Post-Graduate | 72 | 15.8 | |

| Work Experience | 1–2 years | 106 | 23.3 |

| 3–5 years | 96 | 21.1 | |

| 5–10 years | 124 | 27.3 | |

| Above 10 years | 129 | 28.4 |

| Constructs | Standardized Loadings | Composite Reliability | AVE | Cronbach’s α |

|---|---|---|---|---|

| Absorptive Capacity | 0.91 | 0.63 | 0.91 | |

| ABC1 | 0.823 | |||

| ABC2 | 0.813 | |||

| ABC3 | 0.806 | |||

| ABC4 | 0.787 | |||

| ABC5 | 0.729 | |||

| ABC6 | 0.784 | |||

| Human Capital | 0.88 | 0.55 | 0.88 | |

| HUC1 | 0.723 | |||

| HUC2 | 0.783 | |||

| HUC3 | 0.752 | |||

| HUC4 | 0.766 | |||

| HUC5 | 0.733 | |||

| HUC6 | 0.707 | |||

| Relational Capital | 0.88 | 0.59 | 0.88 | |

| REC1 | 0.755 | |||

| REC2 | 0.776 | |||

| REC3 | 0.799 | |||

| REC4 | 0.767 | |||

| REC5 | 0.737 | |||

| Social Capital | 0.84 | 0.67 | 0.85 | |

| SOC1 | 0.676 | |||

| SOC2 | 0.723 | |||

| SOC3 | 0.71 | |||

| SOC4 | 0.62 | |||

| SOC5 | 0.654 | |||

| SOC6 | 0.74 | |||

| Structural Capital | 0.90 | 0.61 | 0.90 | |

| STC1 | 0.779 | |||

| STC2 | 0.804 | |||

| STC3 | 0.771 | |||

| STC4 | 0.797 | |||

| STC5 | 0.732 | |||

| STC6 | 0.796 | |||

| Technological Capital | 0.89 | 0.55 | 0.90 | |

| TEC1 | 0.719 | |||

| TEC2 | 0.756 | |||

| TEC3 | 0.721 | |||

| TEC4 | 0.73 | |||

| TEC5 | 0.729 | |||

| TEC6 | 0.791 | |||

| TEC7 | 0.732 |

| Estimate | S.E. | C.R. | P | ||||||

|---|---|---|---|---|---|---|---|---|---|

| Direct Effects | |||||||||

| H1 | STC | → | TEC | 0.144 | 0.045 | 3.211 | 0.001 | ||

| H2 | HUC | → | TEC | 0.389 | 0.050 | 7.762 | *** | ||

| H3 | SOC | → | TEC | 0.387 | 0.062 | 6.197 | *** | ||

| H4 | REC | → | TEC | 0.088 | 0.027 | 3.257 | 0.001 | ||

| Indirect Effects | |||||||||

| H6 | STC | → | ABC | → | TEC | 0.085 | 0.05 | 9.869 | *** |

| HUC | → | ABC | → | TEC | 0.065 | 0.017 | 7.702 | *** | |

| SOC | → | ABC | → | TEC | 0.108 | 0.04 | 9.997 | *** | |

| REC | → | ABC | → | TEC | −0.008 | 0.057 | −1.373 | 0.170 | |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2022 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Zemlyak, S.V.; Kiyashchenko, L.T.; Ganicheva, E.V. Driving Technological Innovation through Intellectual Capital: Industrial Revolution in the Transportation Sector. Economies 2022, 10, 100. https://doi.org/10.3390/economies10050100

Zemlyak SV, Kiyashchenko LT, Ganicheva EV. Driving Technological Innovation through Intellectual Capital: Industrial Revolution in the Transportation Sector. Economies. 2022; 10(5):100. https://doi.org/10.3390/economies10050100

Chicago/Turabian StyleZemlyak, Svetlana Vasilievna, Ludmila Timofeevna Kiyashchenko, and Elena Victorovna Ganicheva. 2022. "Driving Technological Innovation through Intellectual Capital: Industrial Revolution in the Transportation Sector" Economies 10, no. 5: 100. https://doi.org/10.3390/economies10050100

APA StyleZemlyak, S. V., Kiyashchenko, L. T., & Ganicheva, E. V. (2022). Driving Technological Innovation through Intellectual Capital: Industrial Revolution in the Transportation Sector. Economies, 10(5), 100. https://doi.org/10.3390/economies10050100