Abstract

The purpose of this research is to investigate intellectual capital as a driver of technological innovation considering the industrial revolution in Russia’s transportation sector. The study was driven by the recent technological advancements in Russia’s transportation industry and the huge economic importance of the sector to the economy, showing the need to understand the progress achieved in the sector. The study was carried out using primary data collected from respondents in managerial positions in firms operating in the transportation sector. A total of 455 respondents were used, and data were collected using a structured closed-ended questionnaire. The fields of intellectual capital considered were structural, social, human, and relational capital. The model was evaluated using CFA, reliability, and validity tests, while the study hypotheses were tested using SEM. The results reveal that structural capital, social capital, human capital, and relational capital have a significant and positive influence on technological innovation in Russia’s transportation sector. Human and social capital was found to have the largest effect. The study recommends that, for firms to implement technological innovation, they should consider human capital, such as specialized knowledge, skills, expertise, experiences, and abilities embedded within organizations personnel, and social capital, such as effective communication, the laid down mechanisms of coordination and communications within the organization, human ties, trust, and relationships. They should also improve their absorptive technology capacity.

1. Introduction

The globe is at the point of a fourth industrial revolution, culminating in the full automation of most industrial operations and, consequently, improved labor productivity, economic growth, and the competitiveness of its tigers (Barykin et al. 2021a). “Industry 4.0” represents an opportunity for Russia to improve its position in the international economic environment, but the Russian government is not fully using its capacity (Vasin et al. 2018). Russia was ranked 43rd in the World Economic Forum’s Global Competitiveness Index 2017 and retained the same position in the 2019 report, owing to excellent educational quality, infrastructural development, and innovation capability, all of which are characteristics directly related to “Industry 4.0” (Trading Economics 2021).

Similar to any other type of capital, intellectual capital (IC) influences the sectors of life with which it interacts. The presence of intellectual capital in one sector of the business leads to its effects being experienced in other related sectors. Asaturova (2019) pointed out that Russia collaborates with the OECD on quantitative concerns in the framework of the OECD’s present work in innovation, science, and technology. Intellectual capital elements specific to Industry 4.0 contribute moderately to significantly to add value and the income of production and service firms in Russian regions (Vasin et al. 2018; Wall 2021). On the other hand, the authors found no substantial contributions of Industry 4.0 and digitalization, especially regarding the wage difference of Russian workers, compared to conventional human capital variables, such as educational qualifications. Although on a reduced budget, Russia is attempting to guarantee its position in the technological race. Although Russia’s smaller economy in comparison to the US and China is a drawback, Russia’s edge has always been its capacity to combine technology with the necessary operational ideas, force, and command formations and evaluate them in real-world operational scenarios (Barykin et al. 2021b).

The value of a firm staff’s skills, professional education, or other sensitive data that may offer an organization a competitive edge is its intellectual capital. According to Xu et al. (2019), intellectual capital (IC) is considered a commodity. It is defined as the aggregation of all core competencies accessible to a corporation that may be used to boost profitability, attract new clients, develop new commodities, or generally enhance the position of the business in the market—the bottom line is that it is the sum of a company’s personnel abilities, organizational processes, and other immaterial qualities (Buenechea-Elberdin et al. 2018a). Intellectual capital is a business asset, yet it is challenging to assign it a value. It is not recognized as “intellectual capital” on the financial statements but, rather, it is integrated into intellectual capital to the greatest possible extent (as a component of intangible resources and goodwill on the accounting records), which is challenging to assess (Khalid and Kot 2021; Xu and Wang 2018). Organizations invest a significant amount of resources in developing management expertise and training employees for specific business positions to increase their company’s “brain capacity”. The resources invested in building intellectual capital provide a return to the firm that is challenging to quantify but may result in many years of economic benefit. The three most common components of intellectual capital are structural capital, relational capital, and human capital. Human capital comprises all of the knowledge and experience of an organization’s workers. Social capital, on the other hand, is considered the “total of available and particular resources integrated into, accessible in, and developed from an individual’s or societal unity’s network of interactions”. Regarding this, Massaro et al. (2018) define the term “social” as “the adhesive that keeps communities together”. In response, Zhang et al. (2018) stress that social capital is the value of human ties based on trust and personal networks. Despite this, Xu et al. (2019) emphasize that knowledge exchange and efficiency in organizations may be significantly diminished without social capital innovation. Social capital consists of relationships, attitudes, and values that govern interpersonal interactions and add to a society’s economic and social growth (Buenechea-Elberdin et al. 2018a).

According to Ginesti et al. (2018), human capital involves training, life, and employment experience, which might be enhanced by providing training. Relational capital applies to all of an institution’s relationships, which involves its vendors, customers, employees, and investors, among others (Nielsen and Dane-Nielsen 2019). Structural capital caters to the organization’s fundamental belief structure, including its mission statement, business regulations, workplace culture, and organizational design critical in all organizational operations. Compared to other assets, excellent intellectual human capital creates more revenue and higher profits. Human capital and income are inextricably intertwined. An individual with a high educational degree will be able to accomplish high-value-added tasks more efficiently and rapidly (Agostini and Nosella 2017; Iqbal et al. 2021). The individual will also incorporate more fresh ideas and innovations into their profession (Barykin et al. 2021c). Better human capital results in more production per hour worked and, hence, higher productivity. Secundo et al. (2020) assert that it is analogous to extra physical capital (machines), since greater human capital likewise increases worker productivity. According to Alvino et al. (2020), human capital is also described as realizing that individuals in organizations and enterprises, similarly to equipment and money, are vital and necessary assets that assist development and progress.

Another school of thought (Caddy 2000; Dzinkowski 1999, 2000) also viewed human capital from the point of intellectual liabilities, where human capital gives rise to issues that weaken the organization and stifle growth. Some of the challenges arising from intellectual liabilities have been known to include inadequate training and development, discrimination among employees, high employee turnover, and an inexperienced top management team. The information problems arising from HC include a lack of effective information systems as well as a dearth of analysis to convert raw data into actionable information. The information problems include a lack of effective information systems as well as a dearth of analysis to convert raw data into actionable information. Configuration problems take into account the limitation of flexibility in organizational framework, dearth of intellectual property, and decisions bordering on the poor choice of the geographical location of the entity. This study, however, focused on the positive attributes of HC and how it can add value to organizations and industries. The research, adopting a survey research design, was geared toward achieving the following objectives:

- To determine the effects of intellectual capital aspects toward the technological innovation in the transport sector in Russia;

- To evaluate the mediating role of absorptive capacity on the effects of intellectual capital on technological innovation.

However, the inclusion of these aspects in the technology is influenced by its absorptive capacity. The aggregate mindsets, talents, and abilities of people help to improve organizational performance and production. Human capital is a fundamental idea that acknowledges individuals and believes that individuals should be treated as assets rather than expenses. Absorptive capacity is an organization’s capacity to recognize, absorb, change, and use external knowledge, studies, and experience. Absorptive capacity is defined by Obeidat et al. (2017) as the rate at which a corporation can acquire and apply scientific, technological, or other external knowledge. Companies that see their employees only as an item of expenditure will try to cut their workforce amid a crisis (Cabrita et al. 2017). Companies that consider their employees as valuable assets, on the other hand, will make every effort to keep their employees with them through difficult times. Obeidat et al. (2017) point out that such situations include when highly solvent firms recruit additional employees to help them expand even quicker when the economy recovers from the slump. Every investment in training and development, healthcare, and support is more than simply a cost (Agostini et al. 2017). As a result, businesses must not overlook the legitimacy of human capital in favor of tangible assets, such as equipment and money. The aim of this paper was to explore the role of intellectual capital as a driver of technological innovation in the industrial revolution taking place in Russia’s transportation sector. The study was hinged on the recent technological advancements in the transportation industry and the enormous economic significance of the sector in the development of the Russian economy. To help us understand this, the following research questions were investigated;

- What are the effects of intellectual capital aspects toward the technological innovation in the transport sector in Russia?

- What is the mediating role of absorptive capacity on the effects of intellectual capital on technological innovation?

The rest of the article is organized in the following order: The literature review explores previous studies on IC capital and how they relate to this study. The methodology highlights the adopted method of data collection from the study population, sample measures of the variables under review, including their measurement properties as well as method of data analysis. The next section presents the results, including the SEM analysis. The next section is the discussion of the findings, followed by the conclusion, limitations, future recommendations and implications of the study.

2. Literature Review

2.1. Technological Innovation

Technological innovation has been wrongly limited to concepts in the digital sphere involving computers and electronic devices (Chaveesuk et al. 2022). Similarly, technological innovation does not occur only in complex systems, processes and products. Technological innovation does not necessarily have to be complicated, but it must be novel and aim to put the technology it represents into use in the marketplace. As a result, technological innovation is a subset of the overall innovation discipline. It focuses on technology and how to successfully incorporate it into products, services, and processes. As a body of knowledge, technology can thus be viewed as a foundation for technological innovation, serving as a stepping stone to development, manufacturing, R&D, and marketing (Burgelman et al. 1983; Diaconu 2011; Freeman 1982). Different definitions exist that attempt to capture the essence of innovation; Schumpeter (1934) defined innovation based on “new combinations” of factors of production of new goods and services, marketing, processes, and firms. Malerba and Orsenigo (1997) defined innovation as the commercialization of an invention as a result of its incorporation into socio-economic practice. As a result, innovation is viewed as the result of a system that begins with the genesis of an idea and persists through its realization. According to the Oslo Manual (OECD 2005), innovation is defined as an activity that results in new or vastly improved products, services, processes, marketing methods, or business organization.

The common factor in all the definitions is the concept of something new or a significantly improved version of the old product, service or process. Technological innovation has an enormous influence on organizational populations by disrupting markets, adjusting the comparative significance of resources, putting organizational learning capabilities to the test, and changing the competitive environment (Mention 2012; Muangmee et al. 2021). Studies have identified that technologies develop over time through iterations of lengthy stretches of continuous improvements that maximize and legitimize an available system, peppered by technological divergences in which new, drastically excellent technologies supplant old, weaker ones, allowing for orders-of-magnitude greater advancements in organizational performance (Xu and Li 2019). The technological innovation may either be competence improving, associated with developing expertise and supporting incumbent perspectives, or competence-destroying, leaving entrants’ positions outdated and allowing newcomers to become technologically better rivals. The discontinuity-induced technological ferment concludes with developing a dominant model, with a unique framework that achieves supremacy in a product category, and technological progress returns to gradual gains on the dominant technology.

Januškaitė and Užienė (2018) argue that although the applicability of this technology process is debatable, it has been valuable in a broad range of sectors. As bearers’ avenues of advantage dwindle, technological innovation offers a chance for entrepreneurs to develop new companies and develop competitive positions. Technological innovation also increases the unpredictability and risk for incumbents since its results can only be roughly predicted (Manzaneque et al. 2017). The significance of an invention may not be grasped until it is too late for holders utilizing outdated know-how to engage efficiently with new rivals; betting too early on a particular breakthrough may imperil a holder’s existence if that technology does not become prevalent. Technological solutions and technical innovation may significantly impact the competitive dynamics and development of organizational populations. Performance is a metric of input and output evaluation and the extent to which the translation of input into output aids in achieving predetermined organizational objectives (Xu and Liu 2020). Most critically, many firms lack the potential to innovate. Zhilenkova et al. (2019) assert that the capacity to innovate is the talent and knowledge required to successfully absorb, master, and enhance current technologies and develop new ones. Marketing capacity and strategic planning capacity may be used to strategically assess organizational performance across various aspects using innovation (Pedro et al. 2018). Marketing capability is a company’s capacity to market and sell items based on an awareness of the customer demands, remuneration status, costs and advantages, and adoption of innovation.

2.2. Effects of Intellectual Capital on Technological Innovation

The adoption of innovation refers to any modification in goods, services, or procedures unique to the acquiring business. Secundo et al. (2018) point out that the approach is comparable to exploiting innovation based on a firm’s existing expertise and follows a structured process that picks, modifies, and executes certain qualities. The firm’s expertise is critical for innovation. Rossi et al. (2018) argue that knowledge may be found in various places, such as manuals, archives, patents, and licensing in businesses. Given the location and presence of knowledge, it is sometimes referred to as conserved knowledge or a firm’s organizational capital. Previous research has shown the significance of organizationally stored information and its use in formative and recurring activities (Bayraktaroglu et al. 2019). The effect of stored information is predicted to grow as it is networked via partnerships and interactions among the people who work with it. Groups and teams, for instance, have been discovered to deploy knowledge in businesses, and their performance may be improved by networking, information interchange, and knowledge dissemination (Buenechea-Elberdin 2017).

Several studies have linked intellectual capital with technological innovation. According to Donate et al. (2016), human capital brings diverse knowledge, ideas and skills, which, in turn, leads to product innovation. The development of human capital is a gradual process and is key to an organization’s innovation (Donate et al. 2016). On the other hand, the relational capital is considered a significant contributor to the technological innovation through enhancing the knowledge-based business environment. Its helps in adjusting and improving the business practices, in order to enhance efficiency and competitiveness (McNamara 2008). Relational capital has also been considered a critical aspect toward technological innovation through driving performance. By creating relations, the firms expand their learning network and acquires new knowledge and updated techniques. The firms improve their levels of innovation by learning from others (Barykin et al. 2021d).

Social capital also promotes the efficacy of group work and the complexity of information sharing among team members. Social capital enhances the intensity of contacts and the flow of knowledge (Iqbal et al. 2021; Martín-de Castro et al. 2019). However, numerous related studies on fundamental human capital, the impact on economic development and the effect of knowledge-based human capital on economic progress deserve special emphasis, which are primarily investigated here. Input soliciting is crucial in linking leadership and performance outcomes between duty and discursive power. Xu et al. (2017) state that although there are several studies on the significance of basic human capital and the influence on economic growth, emphasis should also be placed on the influence of human intellectual capital on innovation development.

2.3. Hypothesis Development

Numerous publications in the literature present several approaches for recognizing and categorizing the idea of intellectual capital. Nevertheless, one or more elements of intellectual capital have variable degrees of influence on organizational success. Nonetheless, it is critical for companies to thoroughly comprehend the notion of intellectual capital and investigate the components of their intellectual capital in businesses.

2.3.1. Structural Capital

Organizational structural capital (STC) encompasses all non-human knowledge storage facilities, such as databases, organizational charts, initiatives, routines, procedure guidelines, and regulations (Xu et al. 2017). As a result, Buenechea-Elberdin et al. (2018b) define structural capital as “what stays in the firm when workers go home after work.” Taking technological innovation into account, structural capital has been transformed from analog paper records and charts to digital initiatives that are deployed to organizational strategy to improve work efficiency. Kalkan et al. (2014) add that in some instances, technological innovation could lead to improved firm performance across a variety of performance metrics. Yusliza et al. (2020) argue that companies do not have distinct human capital, but that structural capital pertains to the entire company and may be copied and distributed. From the viewpoint of Nicolò et al. (2020), structural capital is information developed by an organization inextricably linked to the entity. Nevertheless, structural capital creates an environment where people may spend their human capital to generate and exploit knowledge (Secundo et al. 2017a). On this premise, Zhang and Lv (2015) note that the knowledge and institutional capital stored in the company’s database has a great capacity to promote technological innovation. Secundo et al. (2017b) further argue that structural capital is primarily concerned with an organization’s system and structure. Ramírez et al. (2017) point out that if a company lacks structural capital, it will be challenging to fully use its entire intellectual capital. A company’s strong structural capital leads to the maximum exploitation of its intellectual capital (Secundo et al. 2017a). As per the research, structural capital comprises infrastructure, data and information, processes, and regulations. Based on these arguments, the following hypothesis is developed:

Hypothesis 1 (H1).

Organization’s structural capital has a positive effect on technological innovation.

2.3.2. Human Capital

Dabić et al. (2018) describe the primary subcomponents of an organization’s human capital (HC) as the areas of expertise, depth of knowledge, and wealth of exposure of its staff. They further elucidate that human resources are the living and thinking components of intellectual capital resources. On the other hand, Poh et al. (2018) state that human capital is at the core of intellectual capital. It is concerned with employees’ knowledge, expertise, skill, capacity, and inventiveness (Hussinki et al. 2017). Alrowwad et al. (2020) argue that workers develop intellectual capital due to their expertise, attitude, and intellectual flexibility. According to Iqbal et al. (2019), employees’ human capital encompasses their skills and abilities, their knowledge in certain disciplines critical to the success of the firm, as well as their aptitudes and attitudes. Regarding the same, Trequattrini et al. (2018) assert that employee retention, motivation, and adaptability are often important considerations since a firm’s skill and experience pool develops with time with the improvement of organizational processes. A high degree of worker turnover may indicate that a company is squandering these critical components of intellectual capital. This establishes a relationship between human capital and technological innovation and how they can affect an organization’s trajectory (Andreeva and Garanina 2016; Haris et al. 2019; Ting and Lean 2009). Based on these arguments, the following hypothesis is developed:

Hypothesis 2 (H2).

An organization’s human capital has a positive effect on technological innovation.

2.3.3. Social Capital

Another significant element of intellectual capital is social capital (SC). Stacchezzini et al. (2019) define social capital as the “total of available and particular resources integrated into, accessible in, and developed from an individual’s or societal unity’s network of interactions”. Regarding this, Massaro et al. (2018) define the term “social” as “the adhesive that keeps communities together”. In response, Zhang et al. (2018) stress that social capital is the value of human ties based on trust and personal networks. Despite this, Xu et al. (2019) emphasize that knowledge exchange and efficiency in organizations may be significantly diminished without social capital innovation. Social capital consists of relationships, attitudes, and values that govern interpersonal interactions and add to a society’s economic and social growth (Buenechea-Elberdin et al. 2018b). O’Reilly and Tushman (2004) highlight the ability of two companies to adopt and apply social capital in exploration and exploitation at the same time. The purely symbolic physical co-location of businesses within clusters nurtures industry contacts and the sharing of market information (Malmberg 2003). As a result, social networks incorporating an elevated level of social capital push companies to standardize their competitive knowledge bases through technological innovation (Rogers 1995). This enhances the network’s market expertise and knowledge acquisition, which improves the potential to recognize, integrate, and utilize vital business knowledge accessible within the network by adopting technologically innovative methods (Murovec and Prodan 2009). Based on the foregoing, organizations must use the knowledge and experience of their environment’s intermediaries to observe the developments of their industries (Jantunen et al. 2005). Furthermore, Xu and Wang (2018) argue that social capital serves a critical function in the growth of intellectual capital in a company. Social capital is a significant value addition in organizations and is built on social networks, informal relationships, formal relationships, and confidence. Based on these arguments, the following hypothesis is proposed:

Hypothesis 3 (H3).

An organization’s social capital has a positive effect on technological innovation.

2.3.4. Relational Capital

Despite the notion that relational capital has emerged to gain a competitive edge in a changing global context, it has received little attention. There is evidence of reference to relational capital from various viewpoints and conceptual frameworks in the literature’s frameworks for monitoring and evaluating intellectual capital (Ginesti et al. 2018). Relational capital is mirrored in the “client viewpoint,” which examines how to generate value for the customer, match their needs, and why the customer is spending (Nielsen and Dane-Nielsen 2019). Agostini and Nosella (2017) are contemporary authors who allude to relational capital as “customer capital”, emphasizing their focus on consumer loyalty to the firm and trust in connections. In previous publications, the authors broadened the idea of relational capital to include, in addition to connections with consumers, interactions with vendors, competitors, partners, allies, and public bodies and institutions, and these interactions have been enhanced by technological innovation in communication. The latter is the case with Secundo et al. (2020), who broaden the study of organizational–customer interactions, alluding to this kind of intellectual capital as consumer and relationship capital, which have both been boosted by technological innovation.

Along these lines, other authors, such as Alvino et al. (2020), examine its ties with its rivals, suppliers, organizations, and the government in its so-called customer capital. Meanwhile, Cabrita et al. (2017) suggest categorizing according to three core dimensions: customer connections, supplier ties, and alliances. Similar to Obeidat et al. (2017) and Agostini and Nosella (2017), other authors have expanded relational capital outside interactions with consumers and other agents, including reputation and corporate image. Xu and Li (2019) characterize “market assets” as those produced from a favorable interaction between the firm and its market and the organization and its consumers. Examples are product brands, repeat purchases, distribution networks, corporate name and image, and other characteristics that provide a competitive edge. In response, Januškaitė and Užienė (2018) include interactions with customers and suppliers in addition to commercial brands and the business reputation or image in their so-called “external structure”. More recently, Xu and Liu (2020) allude to relational capital via the concept of customer capital, which alludes to the organization’s links and ties with external forces—for example, interactions with consumers and other players considering the available technological innovation that has fostered the process. These authors incorporate client and supplier connections, business image in this investment and technological innovation in basing their arguments. The following hypothesis is proposed based on these arguments:

Hypothesis 4 (H4).

An organization’s relational capital has a positive effect on technological innovation.

Absorption capacity (AC) was introduced in research from the postulations of Cohen and Levinthal (1990), which referred to an organization’s capacity to recognize, incorporate and utilize available information within its environment. Additionally, Zahra and George (2002) classified AC as “a set of organizational routines and processes by which firms acquire, assimilate, transform and exploit knowledge to produce a dynamic organizational capacity” (p. 186).

The mediating role of absorptive capacity between human capital and technological innovation is seen when the organization provides a good working environment, space, and effective database, which in turn reduce time wastage and promote the prevailing knowledge toward innovation (Subramaniam and Youndt 2005). Absorptive capacity mediates the relationship between intellectual capital and technological innovation though involving its external parties in its enhanced production of superior products and process innovation (Santos-Rodrigues et al. 2015). The absorptive capacity is considered to mediate the effects of intellectual capital on technological innovation through the adoption of enhanced ICT techniques, which are critical in the development of new products and adjusting the existing ones toward reduction in cost. It also allows firms to adjust their strategies based on the existing business situation.

Intellectual capital is identified as a critical factor in driving external knowledge assimilation (Hagemeister and Rodríguez-Castellanos 2010). Moreover, the capacity for this incorporation is dependent on previous understanding of the industry (Lane et al. 2006), which is regarded as more important than the individuals’ sum knowledge (Cohen and Levinthal 1990). According to Mariano and Walter (2015), empirical studies on AC within the domains of intellectual capital and knowledge management should be oriented toward examining and clarifying the advances of intellectual capital factors to the dynamic processes of firms. Lin et al. (2016) investigated the correlation between knowledge loss and declining AC, offering empirical evidence on the effects of knowledge loss, as well as declining performance. Based on these assumptions, the following hypothesis is tested:

Hypothesis 5 (H5).

Absorptive capacity positively mediates the relationship between intellectual capital and technological innovation.

2.4. Intellectual Capital as a Driver of Technological Innovation

All businesses must develop and utilize innovation. The term “innovation generation” pertains to creating a new product, method, or expertise for the market, while “innovation adoption” refers to adapting current knowledge from outside the company. In other words, created innovations are novel to a company and its market, but accepted innovations are novel exclusively to the company that accepts them (Manzaneque et al. 2017). Absorptive capacity is an organization’s capacity to recognize, absorb, change, and use external knowledge, studies, and experience. Absorptive capacity is defined by Obeidat et al. (2017) as the rate at which a corporation can acquire and apply scientific, technological, or other external knowledge. It assesses an organization’s capacity to learn. Some debate the degree of novelty, such as Secundo et al. (2018), differentiating between radical and gradual novelty.

In another case, Buenechea-Elberdin (2017) refers to “creative followers” who generate incremental innovation by using any radical invention as a starting point. Studies by Xu et al. (2017) and Martín-de Castro et al. (2019) have tackled the widespread misunderstanding regarding the breadth of innovation (generation versus adoption) by concentrating on the magnitude of innovation. Cassol et al. (2016) point out that the innovations combine new and adapt to current information with intellectual capital. For instance, the production and acquisition of new knowledge is required to form innovation, and the newly acquired knowledge is a direct result of human capital and social capital. Still, the acceptance of innovation is based on the duplication of already existing information. In this setting, companies that generate new knowledge may depend on intellectual capital, while the development of new knowledge is an experimental process characterized by variety, search, experimentation, unpredictability, and discovery (Mention 2012). Innovation generation and adoption provide various chances for enterprises to obtain market newness.

3. Methodology

3.1. Population and Sample Size

To investigate the study objectives and put the hypotheses identified in the previous section to the test, this study used data collected from firms operating in the Russian transportation sector. The motivation that led to choosing this sector was its importance to the Russian economy, and the role the transportation sector plays in the daily life of people and society as a whole. The sector’s technological innovations, as well as its levels of innovation, have improved and increased.

The study’s empirical analysis was conducted using a construct relationship and data from 455 respondents. These respondents consist of firms and companies specializing in transportation services in Russia. The specific interest was companies using different levels of technology to offer transportation services to their customers. The data were collected from the various categories of workers, such as general managers, marketing managers, executive officers, R&D officers, production managers, and drivers among other workers occupying important positions in the transportation industry.

The data were collected using a structured closed-ended questionnaire. The questionnaire contained two sections: the demographic section in which the data for information, such as age, education, and work experience, of the respondents were collected, and the section where data regarding the constructs of the study were collected. The questionnaire was sent to the respondents through email. The questionnaire was also hosted online on Google sheet, and the link was shared with the targeted respondents on social media.

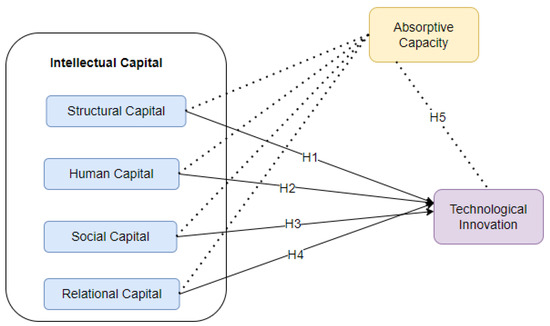

3.2. Measurement

The measurement variables contained three major variable categories—the independent variable, mediating variable, and dependent variable. The independent variables include structural capital, human capital, social capital, and relational capital. The mediating variable is an absorptive capacity, and the dependent variable is technical innovation. The four aspects of intellectual capital were adopted from Subramaniam and Youndt (2005). The items of human capital used include overall skills, expertise, and individual knowledge levels. The items of social capital include leverage knowledge among employees, customers, suppliers, and alliance partners. The organization capital was measured using the ability of the organization to store knowledge in physical repositories, such as databases, patents, and manuals. The dependent variable measurement variables were adopted from Pérez-Luño et al. (2014). From the literature review, various aspects of each construct were adopted to the questionnaire. For human capital, the aspects adopted in the questionnaire included knowledge skills and abilities exploited by individual employees. They entail education, experience, skills, and training. For relational capital, the aspects included were interrelationships and networks, individual interactions, customer and suppliers’ relationships, strategic allowance and customer knowledge. For structural capital, the aspects included in the questionnaire were system and program, research and development, intellectual property rights (IPRs). The absorptive capacity factors included were the ability of the firm to assimilate and exploit technology, as well as knowledge management. The technological innovation aspects include the ability to adopt and develop new technologies. The model adopted for the study is presented in Figure 1.

Figure 1.

Conceptual framework of the study.

The instruments and model used for the study were validated using confirmatory factor analysis (CFA), reliability analysis, and validity analysis via Amos SPSS. The data were analyzed using structural equation modeling (SEM). This technical analysis was considered suitable because it enables the simultaneous analysis of multiple variables (Hair et al. 2009; Malhotra 2012). The analysis of descriptive statistics and correlation analysis was conducted using SPSS.

4. Results

4.1. Descriptive Statistics

This section evaluated the demographic characteristics of the respondents—age, education, and work experience (Table 1). From the results, the age group with the most respondents was 31–40 years (44.6%). This was followed by those in the age range of 21–30 years (26.8%). This indicates that the sector was dominated by younger people. Regarding the educational qualification of the respondents, the highest level of education is those who have reached college level (37.4%) followed by those at the graduate level (27.3%). For work experience, the highest experience level was above 10 years (28.4%) followed by 5–10 years (27.3%), implying that the respondents have significant experience in the transportation sector.

Table 1.

Demographic information of respondents.

4.2. Reliability and Validity

The reliability and validity analysis of this study was conducted using various techniques, including Cronbach’s alpha, standardized loadings, composite reliability, and average variance extracted (AVE). These statistics are presented in Table 2. The validity of the study—both discriminant and convergent validity of the study constructs—was evaluated using confirmatory factor analysis. The recommended threshold for factor loading constructs should be more than 0.50. This threshold was satisfied because all the standardized factor loadings were above 0.5. The requirement for the average variance extracted (AVE) threshold to be above 0.50 was also fulfilled as all the values of AVE were above 0.5 (Tabachnick and Fidell 2001).

Table 2.

Reliability and validity analysis.

The internal consistency was evaluated using convergent validity and Cronbach’s alpha. The threshold for the two metrics is that composite reliability and Cronbach’s alpha should be 0.70 or more (Nunnally and Bernstein 1994). Based on the findings presented in Table 2, the CR and Cronbach’s alpha were both above 0.70, which satisfied this criterion. The satisfaction of the above four criteria confirmed that the validity and reliability of the constructs used in the study were satisfactory. The applied model was evaluated using CFA and the model fitness indexes. According to Hu et al. (1992), TLI, IFI, and GFI should be greater than 0.90, while Shevlin and Miles (1998) recommend that NFI should be above 0.90. Based on the CFA results, the recommended threshold was satisfied. MacCallum and Hong (1997) recommend that RMSEA should be <0.080, while X2/df should be <5.0, and these thresholds were satisfied.

4.3. Evaluation of Hypotheses

This section describes evaluation of the study hypotheses based on the structural equation modeling (SEM) results. The results are presented in Table 3.

Table 3.

SEM analysis.

The first hypothesis of the study evaluated the relationship between an organization’s structural capital (STC) and technological innovation (TEC). The relationship between the two variables was significant (β = 0.144, p < 0.05), which supports hypothesis 1 (H1). The relationship between human capital and technological innovation was significant and positive (β = 0.389, p < 0.05), which confirmed the second hypothesis (H2) of the study. The results also indicated a positive and significant relationship between social capital and technological innovation (β = 0.387, p < 0.05), which confirms the third hypothesis (H3). The fourth hypothesis of the study evaluated the relationship between an organization’s relational capital (REC) and technological innovation (TEC). The results indicate a positive and significant relationship between the two variables (β = 0.226, p < 0.05), which confirm the fourth hypothesis (H4) of the study. The last hypothesis was evaluating the mediating effect of absorptive capacity between the intellectual capital variables and technological innovation. This was evaluated by estimating the SEM with bootstrapping. The results indicate that the absorptive capacity significantly mediated the effect of structural capital, human capital, and social capital on technological innovation but did not significantly mediate the effect of relational capital on technological innovation. As a result, hypothesis five (H5) was partially confirmed.

5. Discussion

In our research, we developed a conceptual model to investigate how four aspects of intellectual capital (human capital, relational capital, social capital, and structural capital) influence the generation and adoption of innovation in Russia’s transportation sector. Similar studies on a related issue have been carried out in different research areas, applying different research aspects. The result that structural capital has a positive effect on technological innovation was supported by a number of studies (Kalkan et al. 2014; Nicolò et al. 2020; Secundo et al. 2017a; Zhang and Lv 2015). Structural capital was found to have a significant and positive influence on the technological innovation in transport firms. This implies that, as suggested by Zhang and Lv (2015), the knowledge and institutional capital stored in the company’s database has a great capacity to promote technological innovation. Additionally, well-equipped organizations in the sector with databases, operating processes, procedures, and better production planning could help leverage a better platform for developing continued technological innovation. The positive effect of structural capital if maximally exploited according to Secundo et al. (2017a) will lead to improving the intellectual capital of the firm.

It is also a suggestion that transport firms’ investment in non-physical capital, such as systems and procedures, could bear great benefits in terms of their technological advancement. These findings are supported by Ting and Lean (2009), Haris et al. (2019), and Andreeva and Garanina (2016), who found that structural capital significantly influences technological innovation efforts. Relational capital was found to have a significant and positive influence on technological innovation. These findings prove that the relationships maintained by a company with other different agents and competitive environments, such as those with customers, suppliers, allies, and other firms and intuitions, are important in developing important information toward its innovation (Barykin et al. 2021e). The importance of absorptive capacity comes from the fact that firms ought to have the ability to recognize, assimilate, and adopt new external innovation knowledge for their commercial purposes.

The second hypothesis also uncovered a significant and positive relationship between human capital and technological innovation. With the identification of human capital as the living and thinking components of intellectual capital by Dabić et al. (2018), HC are thus essential to technological innovation because they are the components that would execute the innovations that will advance the organization in their quest for sustainability. Applying this to the Russian transportation sector, innovations in the transportation sector will depend on the interpretation and integration of technological innovations by the human capital component of intellectual capital. Human capital according to Iqbal et al. (2019), encompasses their skills, abilities, attitude, intellectual flexibility and expertise, and this is best measured in how innovative employees are in utilizing these core attributes. Employing them in the Russian transportation sector will lead to massive transformation and development, which can only be made possible by harnessing the human capital component of intellectual capital.

Similarly, H3 also finds a positive and significant correlation between social capital and technological innovation. This is seen in examples of Pérez-Luño et al. (2014), O’Reilly and Tushman (2004). The findings of Pérez-Luño et al. (2014) suggest that technological innovation and its adoption in the transport sector in Russia are influenced by several factors. The findings of technological innovation indicate that social capital has a significant and positive influence on technological innovation. These findings are in line with that of O’Reilly and Tushman (2004), who investigated the ability of two companies to adopt and use the techniques for exploration and exploitation at the same time. From the relational perspective, it is suggested that it shows that customers and suppliers are the crucial part of an organization. Companies can generate innovative ideas from their customer’ choices, because the customers are the ultimate buyers of products and their knowledge is quite imperative for organizations (Hormiga et al. 2011).

This implies the importance of developing social capital as the basis of technological innovation. The findings of Subramaniam and Youndt (2005) indicate that incremental and radical innovations capabilities in companies are significantly and positively influenced by social capital. By confirming the hypothesis in their study, human capital was found to have a significant influence on technological innovation. This suggests that individual skills, expertise, and professional experiences could promote the harnessing of efforts toward the development and adoption of technological innovations in an organization through sharing ideas.

H4 follows the tradition of the previous three hypotheses by affirming a positive relationship of the effect of relational capital on technological innovation. This is supported by the views by Agostini and Nosella (2017) that alluded about RC being mainly concerned with the client–customer relationship and how the cordiality will enhance productivity for the firm. Relating this to the transportation sector in Russia, the ability of the relational component of the intellectual capital that is anchored on the relationship between the client and the customers, and how using technological innovations to meet customer needs. The relational nexus could be seen from the point of view of maintaining and upgrading transportation facilities with what is obtainable in developed societies, and also build on the client–customer relationship by providing more feedback and adopting digital channels to disseminate information that customers consider valuable and time saving, which Secundo et al. (2020) describe as a technology innovation booster. The findings are also supported by the postulations of Alvino et al. (2020) and Cabrita et al. (2017), who analyzed the relevance of relational capital to innovation to include the relationship with competitors, suppliers, other businesses and the government. These variables can be important sources of technological innovations which can be applied to improve the operations of the transportation sector in Russia, and, in the process, maintain cordiality between the firm and its customers.

The results of H5 show that the absorptive capacity partially mediated the effect of structural capital, human capital, and social capital on technological innovation but did not significantly mediate the effect of relational capital on technological innovation. This is supported by Subramaniam and Youndt (2005) who acknowledge that the mediating role of the absorptive capacity between human capital and technological innovation is seen when the organization provides a good working environment, space, and effective database, which, when applied to the organizational process, leads to the optimal and effective running of the firm’s business, as it reduces time wastage and promotes the prevailing knowledge toward technological innovation. The transportation sector is one that hosts a variety of individuals who need to arrive at their destinations safely and on time. Santos-Rodrigues et al. (2015) introduced the significance of building intellectual capital by seeking out external parties in the delivery of quality services and products and optimizing the innovation process to ensure satisfaction. The transportation sector no doubt can benefit immensely by applying the findings of this study into their operations and to position the transportation sector in Russia to effectively service its external and internal clients and partners toward the growth toward sustainability.

6. Conclusions

This research investigated the independent effects of four aspects of intellectual capital—human, social, relational, and structural—on technological innovation practices in the transportation sector in Russia. The study provides critical empirical evidence that firms operating in the dynamic Russian transportation industry adopt technological innovation through the application of a wide range of knowledge. The study confirms that all the considered dimensions of intellectual capital—human capital, social capital, relational capital, and structural capital—have a significant influence on transport sectors firms’ technological innovation in Russia. Among them, human capital was found to have the highest influence on technological innovation, followed by social capital. This implies that specialized knowledge, skills, expertise, experiences, and abilities are embedded within an organization’s personnel, which are its greatest assets as far as technological innovation is concerned. In addition, social capital aspects, such as effective communication, the laid down mechanisms of coordination and communications within the organization, human ties, trust, relationships, attitudes, and values that govern interpersonal interactions, are critical in fostering technological innovation. Additionally, the ability of a company to assimilate new knowledge in its organization operations—or its absorptive capacity—determines the effectiveness and speed of its technological innovation.

7. Limitations and Future Study Suggestions

Though this study was considered successful from its inception to its conclusion, some limitations can be highlighted. The first limitation is that this study was carried out on one specific sector—the transportation sector in Russia. Therefore, the generalization of the results obtained in this research should be handled with this aspect in consideration. Another limitation is that absorptive capacity had an independent positive and significant influence on technological innovation, but the study did not offer a hypothesis for this. A similar study but in different sectors should be considered in future, with comparison of the outcomes.

8. Implications

The findings of this study offer important implications that are useful in terms of the existing theoretical knowledge, management knowledge, as well as managerial practices. From the theoretical perspective, the existing literature is limited in aspects of intellectual capital. This study has attempted to expound the existing theory by adding the element of social capital to the intellectual capital discourse in developing the resultant model. Additionally, the paper adds value to the existing knowledge by evaluating an extended model with four intellectual capital factors—structural, relational, human, and social factors and their effects on the technological innovation in Russia’s transport sector with consideration of the absorptive capacity as a mediating variable. For the practical managerial implications, with a focus on the transport sector in Russia, the four aspects of intellectual capital—human, relational, structural, and social—were considered positively and significantly important as far as adoption and implementation of technological innovation is concerned.

Therefore, firms operating in the transportation industry should align these aspects of intellectual capital in a manner that they would effectively and sufficiently supplement and complement each other to facilitate the generation and adoption of technological innovation. More importantly, the firm’s absorptive capacity, implying its ability to take advantage of and leverage available capital and associated knowledge, would influence its technological adoption. In the case of Russia’s transport sector firms, they should majorly leverage on human capital aspects, such as knowledge, skills, expertise, experiences, and abilities embedded within organizations personnel as well as social capital, such as effective communication, the laid down mechanisms of coordination and communication within the organization, human ties, trust, relationships, attitudes, and values that govern interpersonal interactions within the organization.

Author Contributions

Conceptualization was done by S.V.Z.; methodology, L.T.K.; software, E.V.G. All authors have read and agreed to the published version of the manuscript.

Funding

The article has been prepared based on the results of studies supported by budgetary funds in accordance with the state order for the Financial University under the Government of the Russian Federation on the topic “Development of mechanisms for the development of innovative interaction and forms of exchange of intangible assets as factors of economic growth in conditions of economic transformation”.

Institutional Review Board Statement

Not applicable.

Informed Consent Statement

Not applicable.

Data Availability Statement

Data sharing is not applicable to this article.

Conflicts of Interest

The authors declare no conflict of interest.

References

- Agostini, Lara, and Anna Nosella. 2017. Enhancing radical innovation performance through intellectual capital components. Journal of Intellectual Capital 18: 789–806. [Google Scholar] [CrossRef]

- Agostini, Lara, Anna Nosella, and Roberto Filippini. 2017. Does intellectual capital allow improving innovation performance? A quantitative analysis in the SME context. Journal of Intellectual Capital 18: 400–18. [Google Scholar] [CrossRef]

- Alrowwad, Ala’aldin, Shadi Habis Abualoush, and Ra’ed Masa’deh. 2020. Innovation and intellectual capital as intermediary variables among transformational leadership, transactional leadership, and organizational performance. Journal of Management Development 38: 196–222. [Google Scholar] [CrossRef]

- Alvino, Federico, Assunta Di Vaio, Rohail Hassan, and Rosa Palladino. 2020. Intellectual capital and sustainable development: A systematic literature review. Journal of Intellectual Capital 22: 76–94. [Google Scholar] [CrossRef]

- Andreeva, Tatiana, and Tatiana Garanina. 2016. Do all elements of intellectual capital matter for organizational performance? Evidence from Russian context. Journal of Intellectual Capital 17: 397–412. [Google Scholar] [CrossRef] [Green Version]

- Asaturova, Julia. 2019. Peculiarities of development of industry 4.0 concept in Russia. IOP Conference Series: Materials Science and Engineering 497: 1–6. [Google Scholar] [CrossRef]

- Barykin, Sergey Yevgenievich, Andrey Aleksandrovich Bochkarev, Evgeny Dobronravin, and Sergey Mikhailovich Sergeev. 2021a. The place and role of digital twin in supply chain management. Academy of Strategic Management Journal 20: 1–19. [Google Scholar]

- Barykin, Sergey Yevgenievich, Andrey Aleksandrovich Bochkarev, Sergey Mikhailovich Sergeev, Tatiana Anatolievna Baranova, Dmitriy Anatolievich Mokhorov, and Aleksandra Maksimovna Kobicheva. 2021b. A methodology of bringing perspective innovation products to market innovation products to market. Academy of Strategic Management Journal 20: 1–18. [Google Scholar]

- Barykin, Sergey Yevgenievich, Irina Vasilievna Kapustina, Olga Aleksandrovna Valebnikova, Natalia Viktorovna Valebnikova, Olga Vladimirovna Kalinina, Sergey Mikhailovich Sergeev, Marisa Camastral, Yuri Yevgenievich Putikhin, and Lydia Vitalievna Volkova. 2021c. Digital technologies for personnel management: Implications for open innovations. Academy of Strategic Management Journal 20: 1–14. [Google Scholar]

- Barykin, Sergey Yevgenievich, Irina Vasilievna Kapustina, Sergey Mikhailovich Sergeev, Olga Vladimirovna Kalinina, Viktoriia Valerievna Vilken, Elena De La Poza Plaza, Yuri Yevgenievich Putikhin, and Lydia Vitalievna Volkova. 2021d. Developing the physical distribution digital twin model within the trade network. Academy of Strategic Management Journal 20: 1–24. [Google Scholar]

- Barykin, Sergey Yevgenievich, Olga Vladimirovna Kalinina, Irina Vasilievna Kapustina, Victor Andreevich Dubolazov, Cesar Armando Nunez Esquivel, Elmira Alyarovna Nazarova, and Petr Anatolievich Sharapaev. 2021e. The sharing economy and digital logistics in retail chains: Opportunities and threats. Academy of Strategic Management Journal: Marketing Management and Strategic Planning 20: 1–14. [Google Scholar]

- Bayraktaroglu, Ayse Elvan, Fethi Calisir, and Murat Baskak. 2019. Intellectual capital and firm performance: An extended VAIC model. Journal of Intellectual Capital 20: 406–25. [Google Scholar] [CrossRef]

- Buenechea-Elberdin, Marta. 2017. Structured literature review about intellectual capital and innovation. Journal of Intellectual Capital 18: 262–85. [Google Scholar] [CrossRef] [Green Version]

- Buenechea-Elberdin, Marta, Aino Kianto, and Josune Sáenz. 2018a. Intellectual capital drivers of product and managerial innovation in high-tech and low-tech firms. R&D Management 48: 290–307. [Google Scholar] [CrossRef]

- Buenechea-Elberdin, Marta, Josune Sáenz, and Aino Kianto. 2018b. Knowledge management strategies, intellectual capital, and innovation performance: A comparison between high-and low-tech firms. Journal of Knowledge Management 22: 1757–81. [Google Scholar] [CrossRef]

- Burgelman, Robert A., Modesto A. Maidique, and Steven C. Wheelright. 1983. Strategic Management of Technology and Innovation. Irwin: McGraw Hill, pp. 293–350. [Google Scholar]

- Cabrita, Maria do Rosário Meireles Ferreira, Maria de Lurdes Ribeiro da Silva, Ana Maria Gomes Rodrigues, and María del Pilar Muñoz Dueñas. 2017. Competitiveness and disclosure of intellectual capital: An empirical research in Portuguese banks. Journal of Intellectual Capital 18: 486–505. [Google Scholar] [CrossRef]

- Caddy, Ian. 2000. Intellectual capital: Recognizing both assets and liabilities. Journal of Intellectual Capital 1: 1469–930. [Google Scholar] [CrossRef]

- Cassol, Alessandra, Cláudio Reis Gonçalo, and Roberto Lima Ruas. 2016. Redefining the relationship between intellectual capital and innovation: The mediating role of absorptive capacity. BAR-Brazilian Administration Review 13: 1–25. [Google Scholar] [CrossRef] [Green Version]

- Chaveesuk, Singha, Bilal Khalid, and Wornchanok Chaiyasoonthorn. 2022. Continuance intention to use digital payments in mitigating the spread of COVID-19 virus. International Journal of Data and Network Science 6: 527–36. [Google Scholar] [CrossRef]

- Cohen, Wesley M., and Daniel A. Levinthal. 1990. Absorptive capacity: A new perspective on learning and innovation. Administrative Science Quarterly 35: 128–52. [Google Scholar] [CrossRef]

- Dabić, Marina, Jasminka Lažnjak, David Smallbone, and Jadranka Švarc. 2018. Intellectual capital, organisational climate, innovation culture, and SME performance: Evidence from Croatia. Journal of Small Business and Enterprise Development 26: 522–44. [Google Scholar] [CrossRef]

- Diaconu, Mihaela. 2011. Technological Innovation: Concept, Process, Typology and Implications in the Economy. Theoretical and Applied Economics 18: 127–44. [Google Scholar]

- Donate, Mario J., Isidro Peña, and Jesús D. Sánchez de Pablo. 2016. HRM practices for human and social capital development: Effects on innovation capabilities. The International Journal of Human Resource Management 27: 928–53. [Google Scholar] [CrossRef]

- Dzinkowski, Ramona. 1999. Intellectual capital: What you always wanted to know but were afraid to ask. Accounting & Business 2: 22–24. [Google Scholar]

- Dzinkowski, Ramona. 2000. The measurement and management of intellectual capital: An introduction. Management Accounting 78: 32–36. [Google Scholar]

- Freeman, Christopher. 1982. The Economics of Industrial Innovation, 2nd ed. London: Frances Printer. [Google Scholar]

- Ginesti, Ginesti, Adele Caldarelli, and Annamaria Zampella. 2018. Exploring the impact of intellectual capital on company reputation and performance. Journal of Intellectual Capital 19: 915–34. [Google Scholar] [CrossRef]

- Hagemeister, Markus, and Arturo Rodríguez-Castellanos. 2010. Organisational capacity to absorb external R&D: Industrial differences in assessing intellectual capital drivers. Knowledge Management Research & Practice 8: 102–11. [Google Scholar]

- Hair, Joseph, William Black, Barry Babin, Rolph Anderson, and Ronald Tatham. 2009. Multivariate Data Analysis, 6th ed. Porto Alegre: Bookman. [Google Scholar]

- Haris, Muhammad, HongXing Yao, Gulzara Tariq, Ali Malik, and Hafiz Mustansar Javaid. 2019. Intellectual capital performance and profitability of banks: Evidence from Pakistan. Journal of Risk and Financial Management 12: 56. [Google Scholar] [CrossRef] [Green Version]

- Hormiga, Esther, Rosa M. Batista-Canino, and Agustín Sánchez-Medina. 2011. The role of intellectual capital in the success of new ventures. International Entrepreneurship and Management Journal 7: 71–92. [Google Scholar] [CrossRef]

- Hu, Li-Tze, Peter M. Bentler, and Yutaka Kano. 1992. Can test statistics in covariance structure analysis be trusted? Psychological Bulletin 112: 351. [Google Scholar] [CrossRef] [PubMed]

- Hussinki, Henri, Paavo Ritala, Mika Vanhala, and Aino Kianto. 2017. Intellectual capital, knowledge management practices and firm performance. Journal of Intellectual Capital 18: 904–22. [Google Scholar] [CrossRef]

- Iqbal, Amjad, Fawad Latif, Frederic Marimon Viadiu, Umar Farooq Sahibzada, and Saddam Hussain. 2019. From knowledge management to organizational performance: Modelling the mediating role of innovation and intellectual capital in higher education. Journal of Enterprise Information Management 32: 36–59. [Google Scholar] [CrossRef]

- Iqbal, Kanwar Muhammad Javed, Farooq Khalid, and Sergey Yevgenievich Barykin. 2021. Hybrid workplace: The future of work. In Handbook of Research on Future Opportunities for Technology Management Education. Hershey: IGI Global, pp. 28–48. [Google Scholar] [CrossRef]

- Jantunen, Ari, Kaisu Puumalainen, Sami Saarenketo, and Kalevi Kyläheiko. 2005. Entrepreneurial orientation, dynamic capabilities and international performance. Journal of International Entrepreneurship 3: 223–43. [Google Scholar] [CrossRef]

- Januškaitė, Virginija, and Lina Užienė. 2018. Intellectual capital as a factor of sustainable regional competitiveness. Sustainability 10: 4848. [Google Scholar] [CrossRef] [Green Version]

- Kalkan, Adnan, Özlem Çetinkaya Bozkurt, and Mutlu Arman. 2014. The impacts of intellectual capital, innovation and organizational strategy on firm performance. Procedia-Social and Behavioral Sciences 150: 700–7. [Google Scholar] [CrossRef] [Green Version]

- Khalid, Bilal, and Michal Kot. 2021. The impact of accounting information systems on performance management in the banking sector. IBIMA Business Review 2021: 578902. [Google Scholar] [CrossRef]

- Lane, Peter J., Balaji R. Koka, and Seemantini Pathak. 2006. The reification of absorptive capacity: A critical review and rejuvenation of the construct. Academy of Management Review 31: 833–63. [Google Scholar] [CrossRef]

- Lin, Tung-Ching, Christina Ling-hsang Chang, and Wen-Chin Tsai. 2016. The influences of knowledge loss and knowledge retention mechanisms on the absorptive capacity and performance of a MIS department. Management Decision 54: 1757–87. [Google Scholar] [CrossRef]

- MacCallum, Robert C., and Sehee Hong. 1997. Power analysis in covariance structure modeling using GFI and AGFI. Multivariate Behavioral Research 32: 193–210. [Google Scholar] [CrossRef]

- Malerba, Franco, and Luigi Orsenigo. 1997. Technological regimes and sectorial patterns of innovative activities. Industrial and Corporate Change 6: 83–117. [Google Scholar] [CrossRef]

- Malhotra, Naresh. 2012. Marketing Research: An Applied Guidance, 6th ed. Porto Alegre: Bookman. [Google Scholar]

- Malmberg, Anders. 2003. Beyond the Cluster-Local Milieu and Global Economic Connections. Edited by Jamie Peck. Londres: SAGE Publications. [Google Scholar]

- Manzaneque, Montserrat, Yolanda Ramírez, and Julio Diéguez-Soto. 2017. Intellectual capital efficiency, technological innovation and family management. Innovation 19: 167–88. [Google Scholar] [CrossRef]

- Mariano, Stefania, and Christian Walter. 2015. The construct of absorptive capacity in knowledge management and intellectual capital research: Content and text analyses. Journal of Knowledge Management 19: 372–400. [Google Scholar] [CrossRef]

- Martín-de Castro, Gregorio, Isabel Díez-Vial, and Miriam Delgado-Verde. 2019. Intellectual capital and the firm: Evolution and research trends. Journal of Intellectual Capital 20: 555–80. [Google Scholar] [CrossRef]

- Massaro, Maurizio, John C. Dumay, Andrea Garlatti, and Francesca Dal Mas. 2018. Practitioners’ views on intellectual capital and sustainability: From a performance-based to a worth-based perspective. Journal of Intellectual Capital 19: 367–86. [Google Scholar] [CrossRef]

- McNamara, Carter. 2008. Management Function of Coordination and Control: Overview of Basic Methods. London: SAGE Publication. [Google Scholar]

- Mention, Anne-Laure. 2012. Intellectual capital, innovation and performance: A systematic review of the literature. Business and Economic Research 2: 1–37. [Google Scholar] [CrossRef]

- Muangmee, Chaiyawit, Zdzisława Dacko-Pikiewicz, Nusanee Meekaewkunchorn, Nuttapon Kassakorn, and Bilal Khalid. 2021. Green entrepreneurial orientation and green innovation in Small and Medium-Sized Enterprises (SMEs). Social Sciences 10: 136. [Google Scholar] [CrossRef]

- Murovec, Nika, and Igor Prodan. 2009. Absorptive capacity, its determinants, and influence on innovation output: Cross-cultural validation of the structural model. Technovation 29: 859–72. [Google Scholar] [CrossRef]

- Nicolò, Giuseppe, Francesca Manes-Rossi, Johan Christiaens, and Natalia Aversano. 2020. Accountability through intellectual capital disclosure in Italian Universities. Journal of Management and Governanc 24: 1055–87. [Google Scholar] [CrossRef]

- Nielsen, Christian, and Henrik Dane-Nielsen. 2019. Value creation in business models is based on intellectual capital–And only intellectual capital! Journal of Business Models 7: 64–81. [Google Scholar]

- Nunnally, Jum, and Ira Bernstein. 1994. Psychometric Theory, 3rd ed. New York: MGraw-Hill. [Google Scholar]

- Obeidat, Bader Yousef, Ali Tarhini, Raed Masa’deh, and Noor Osama Aqqad. 2017. The impact of intellectual capital on innovation via the mediating role of knowledge management: A structural equation modelling approach. International Journal of Knowledge Management Studies 8: 273–98. [Google Scholar] [CrossRef]

- OECD. 2005. Oslo Manual: Guidelines for Collecting and Interpreting Innovation Data. Paris: OECD. [Google Scholar] [CrossRef]

- O’Reilly, Charles A., and Michael L. Tushman. 2004. The ambidextrous organization. Harvard Business Review 82: 74–81. [Google Scholar] [PubMed]

- Pedro, Eugenia, João Leitão, and Helena Alves. 2018. Back to the future of intellectual capital research: A systematic literature review. Management Decision 56: 2502–83. [Google Scholar] [CrossRef]

- Pérez-Luño, Ana, Shanthi Gopalakrishnan, and Ramon Valle Cabrera. 2014. Innovation and performance: Therole of environmental dynamism on the success of innovation choices. IEEE Transactionson Engineering Management 61: 499–510. [Google Scholar] [CrossRef]

- Poh, Law Teck, Adem Kilicman, and Siti Nur Iqmal Ibrahim. 2018. On intellectual capital and financial performances of banks in Malaysia. Cogent Economics and Finance 6: 1453574. [Google Scholar] [CrossRef] [Green Version]

- Ramírez, Yolanda, Montserrat Manzaneque, and Alba Maria Priego. 2017. Formulating and elaborating a model for the measurement of intellectual capital in Spanish public universities. International Review of Administrative Sciences 83: 149–76. [Google Scholar] [CrossRef]

- Rogers, Everett M. 1995. Diffusion of Innovations, 4th ed. Nueva York: Free Press. [Google Scholar]

- Rossi, Francesca Manes, Giuseppe Nicolò, and Paolo Tartaglia Polcini. 2018. New trends in intellectual capital reporting: Exploring online intellectual capital disclosure in Italian universities. Journal of Intellectual Capital 19: 814–35. [Google Scholar] [CrossRef] [Green Version]

- Santos-Rodrigues, Helena, Carlos Fernández-Jardón, and Pedro Figueroa Dorrego. 2015. Relation between intellectual capital and the product process innovation. International Journal of Knowledge-Based Development 6: 15–33. [Google Scholar] [CrossRef]

- Schumpeter, Joseph. 1934. The Theory of Economic Development. Harvard: Harvard University Press. [Google Scholar]

- Secundo, Giustina, Christle De Beer, Cornelius S. L. Schutte, and Giuseppina Passiante. 2017a. Mobilising intellectual capital to improve European universities’ competitiveness: The technology transfer offices’ role. Journal of Intellectual Capital 18: 607–24. [Google Scholar] [CrossRef]

- Secundo, Giustina, Susana Elena Perez, Žilvinas Martinaitis, and Karl Heinz Leitner. 2017b. An Intellectual Capital framework to measure universities’ third mission activities. Technological Forecasting and Social Change 123: 229–39. [Google Scholar] [CrossRef]

- Secundo, Giustina, Rosa Lombardi, and John Dumay. 2018. Intellectual capital in education. Journal of Intellectual Capital 19: 2–9. [Google Scholar] [CrossRef]

- Secundo, Giustina, Valentina Ndou, Pasquale Del Vecchio, and Gianluigi De Pascale. 2020. Sustainable development, intellectual capital and technology policies: A structured literature review and future research agenda. Technological Forecasting and Social Change 153: 119917. [Google Scholar] [CrossRef]

- Shevlin, Mark, and Jeremy Miles. 1998. Effects of sample size, model specification and factor loadings on the GFI in confirmatory factor analysis. Personality and Individual Differences 25: 85–90. [Google Scholar] [CrossRef]

- Stacchezzini, Riccardo, Cristina Florio, Alice Francesca Sproviero, and Silvano Corbella. 2019. An intellectual capital ontology in an integrated reporting context. Journal of Intellectual Capital 20: 83–99. [Google Scholar] [CrossRef]

- Subramaniam, Mohan, and Mark A. Youndt. 2005. The influence of intellectual capital on the types ofinnovative capabilities. Academy of Management Journal 48: 450–63. [Google Scholar] [CrossRef] [Green Version]

- Tabachnick, Barbara, and Linda Fidell. 2001. Using Multivariate Statistics, 4th ed. Boston: Allyn and Bacon. [Google Scholar]

- Ting, Irene Wei Kiong, and Hooi Hooi Lean. 2009. Intellectual capital performance of financial institutions in Malaysia. Journal of Intellectual Capital 10: 588–99. [Google Scholar] [CrossRef]

- Trading Economics. 2021. Russia Competitiveness Rank. Available online: https://tradingeconomics.com/russia/competitiveness-rank (accessed on 1 March 2022).

- Trequattrini, Raffaele, Rosa Lombardi, Alessandra Lardo, and Benedetta Cuozzo. 2018. The impact of entrepreneurial universities on regional growth: A local intellectual capital perspective. Journal of the Knowledge Economy 9: 199–211. [Google Scholar] [CrossRef]

- Vasin, Sergey, Leyla Gamidullaeva, Elena Shkarupeta, Alexey Finogeev, and Tatiana Vasinas. 2018. Emerging trends and opportunities for industry 4.0 development in Russia. European Research Studies Journal 21: 63–76. [Google Scholar] [CrossRef]

- Wall, William Philip. 2021. The comparison of the TQM practices and quality performance between manufacturing and service sectors. Polish Journal of Management Studies 23: 436–52. [Google Scholar] [CrossRef]

- Xu, Jian, and Binghan Wang. 2018. Intellectual capital, financial performance and companies’ sustainable growth: Evidence from the Korean manufacturing industry. Sustainability 10: 4651. [Google Scholar] [CrossRef] [Green Version]

- Xu, Jian, and Feng Liu. 2020. The impact of intellectual capital on firm performance: A modified and extended VAIC model. Journal of Competitiveness 12: 161–76. [Google Scholar] [CrossRef]

- Xu, Jian, and Jingsuo Li. 2019. The impact of intellectual capital on SMEs’ performance in China: Empirical evidence from non-high-tech vs. high-tech SMEs. Journal of Intellectual Capital 20: 488–509. [Google Scholar] [CrossRef]

- Xu, Jian, Yue Shang, Weizhen Yu, and Feng Liu. 2019. Intellectual capital, technological innovation and firm performance: Evidence from China’s manufacturing sector. Sustainability 11: 5328. [Google Scholar] [CrossRef] [Green Version]

- Xu, Xin-long, Xiao-nan Yang, Liang Zhan, Cheng Kun Liu, Ni-di Zhou, and Meimei Hu. 2017. Examining the relationship between intellectual capital and performance of listed environmental protection companies. Environmental Progress and Sustainable Energy 36: 1056–66. [Google Scholar] [CrossRef]

- Yusliza, Mohd Yusoff, Jing Yi Yong, Imran Tanveer, T. Ramayah, Juhari Noor Faezah, and Zikri Muhammad. 2020. A structural model of the impact of green intellectual capital on sustainable performance. Journal of Cleaner Production 249: 119334. [Google Scholar] [CrossRef]

- Zahra, Shaker A., and Gerard George. 2002. Absorptive capacity: A review, reconceptualization, and extension. Academy of Management Review 27: 185–203. [Google Scholar] [CrossRef]

- Zhang, Hui-Ying, and Shuang Lv. 2015. Intellectual capital and technological innovation: The mediating role of supply chain learning. International Journal of Innovation Science 7: 199–210. [Google Scholar] [CrossRef]

- Zhang, Yinan Qi, Zhiqiang Wang, Kulwant Pawar, and Xiande Zhao. 2018. How does intellectual capital affect product innovation performance? Evidence from China and India. International Journal of Operations and Production Management 38: 895–914. [Google Scholar] [CrossRef]

- Zhilenkova, Elena, Marina Budanova, Nikolay Bulkhov, and Dmitry Rodionov. 2019. Reproduction of intellectual capital in innovative-digital economy environment. In IOP Conference Series: Materials Science and Engineering. Bristol: IOP Publishing, vol. 497, p. 012065. [Google Scholar] [CrossRef]

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2022 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).