Abstract

In recent years, a number of countries with emerging economies have proceeded to use market-oriented strategies, deregulation and reforms in order to attract more foreign investors and attract foreign direct investment (FDI) inflows. The present paper aims to empirically investigate the role of governance in attracting FDI using panel data and comparing two groups of fast-growing emerging countries, namely BRIC (Brazil, Russia, India, China) and CIVETS (Colombia, Indonesia, Vietnam, Egypt, Turkey and South Africa). The study includes a panel data analysis using the latest available secondary data ranging from 2002 to 2019. Empirical models are extended and presented. The findings suggest that FDI inflows in BRICS are attracted by rule of law, regulatory quality, political stability and absence of violence, while CIVETS absorb FDI inflows due to control of corruption, political stability, absence of violence, regulatory quality and government effectiveness. The paper contributes to the existing literature since it is the first attempt to investigate the role of governance in attracting FDI in BRIC and CIVETS economies, taking into consideration other FDI determinants. To our knowledge, it is the first paper to study and compare FDI and institutional determinants in the specific groups of emerging countries.

1. Introduction

Foreign direct investment (FDI) inflows refer to the net capital inflows invested for the acquisition of at least 10% of an enterprise’s voting stock, assuming that this enterprise operates in an economy different than the investor’s country (IMF 1993). The international capital allocation is determined by the operation of multinational enterprises (MNEs), which hold and control capitals and revenues in two or more countries (Dunning 1973; Dunning and Lundan 2008). FDIs can be implemented as greenfield (GF) investments, which refer to the creation of a subsidiary abroad from the ground up to take advantage of complementarities, or as cross-border mergers and acquisitions (M&A), which include the transfer of ownership of an existing asset (Moghadam et al. 2019; Li et al. 2021). Additionally, FDIs can be either horizontal, which are applied by MNEs that undertake the same activities in multiple countries, or vertical, which include several fragments of the production process and each stage is located in a country where it is performed at minimum cost (Dunning 1993; Pečarić et al. 2021). FDI inflows could engage in the production of finished products (manufacturing FDI), while, conversely, service FDIs are applicable to MNEs that do not produce goods (Fernandes and Paunov 2012).

The majority of emerging countries have made several reforms in order to increase their attractiveness towards MNEs and foreign investors. FDI inflows are very beneficial for the recipient country because it is empirically proven that they contribute to economic growth and regional development (Chang 2005; Wijeweera et al. 2010; Iwasaki and Suganuma 2015; Pegkas 2015), poverty alleviation (Fowowe and Shuaibu 2014; Ucal 2014; Uttama 2015), job opportunities (Tomohara and Takii 2011; Ucal 2014), positive backward spillovers (Gorodnichenko et al. 2014; Ha and Giroud 2015), etc.

Nevertheless, it is crucial for the recipient countries to improve their governance and political condition (Uttama and Peridy 2010; Alam and Shah 2013), as these significantly affect foreign investors’ decision making (Wong and Tang 2011). Additionally, it can be observed that the top recipient economies, such as China, are obligated to follow certain political strategies in order to maintain their attractiveness (Metaxas and Kechagia 2013; Lemoine 2013). Among the determinants of FDI, the present paper focuses on governance indicators, including voice and accountability (VA), political stability and absence of violence (PV), government effectiveness (GE), regulatory quality (RQ), rule of law (RL) and control of corruption (CC).

As mentioned, the contribution of the paper is twofold. Firstly, the study contributes to the existing literature by extending the scope of previous related researches on FDI, which focused solely on BRICS (e.g., Jadhav 2012; Jadhav and Katti 2012) or on specific cases of CIVETS countries (e.g., Ngô et al. 2018). Secondly, as there are limited empirical studies on FDI in CIVETS countries, the present research provides policy directions that could increase those countries’ attractiveness to MNEs.

The paper is organized as follows: In the first section, a literature review is presented in order to define the models’ theoretical framework; in the second section, the methodology and the studied variables are explained; the third section presents the empirical results of the panel data analysis; the fourth analysis includes the discussion of the results. The study concludes with a series of suggestions for future research.

2. Theoretical Framework

2.1. FDI and Predominant Theories

Several theories have previously been presented on FDI. Among them, Dunning (1981) presented the eclectic paradigm of international production and combined the theory of economic organization and the traditional theory of factor endowments. According to this theory, the propensity for MNEs to invest abroad depends on the competitive advantage compared to local firms, namely ownership, location and internalization (OLI). Similarly, Banga (2006) argued that the competitive advantage of specializing solely in certain products leads to trade between countries and highlighted the importance of exploiting scale economies, while Kindleberger (1969) suggested that FDI flows are attributed to market imperfections. Conversely, in the case of perfect competition, the absence of external economies, costless information and the absence of trade barriers, countries would be involved internationally solely via international trade.

Buckley and Casson (1976) highlighted the importance of expertise and knowledge in several activities carried out by enterprises that are related though flows of intermediate products. Nevertheless, it is difficult to organize these products and, thus, internal markets are created to achieve common control and ownership. Additionally, Caves (1971) concluded that FDIs are related to product differentiation in the home country, while Vernon (1966) argued that enterprises proceed to FDIs to avoid losing markets, and Knickerbocker (1974) observed that several companies might be influenced by a leader’s investment moves.

Finally, local enterprises have better information on the country’s economic environment compared to MNEs. Therefore, FDI flows are performed in case MNEs have a countervailing advantage and in case they sell this advantage to imperfect markets (Hymer 1976). Additionally, it is argued that corruption increases uncertainty and the MNEs decision making, leading to differentiated FDI inflows (Wei 2000). MNEs are more likely to choose to invest their capital in democratic countries to reduce the risk of nationalization (Ahlquist 2006). According to relevant theories, institutional quality is crucial for FDI inflows since inefficient institutions deter capital inflows (Asiedu 2006). The present research focuses on different dimensions of institutional quality, arguing that, according to Buchanan et al. (2012), a broad dimension of institutional quality leads to increased FDI inflows and has a negative impact on the volatility of FDI inflows. Based on the above, the research focuses on six dimensions of institutional quality to investigate their role in attracting FDI in two groups of developing countries.

2.2. Institutional Quality as an FDI Determinant in Developing and Emerging Countries

The present research focuses on governance and institutions as determinants of FDI inflows arguing that they highly affect the investment decisions of MNEs, according to Jensen (2008), as well as economic growth and total factor productivity (Coe et al. 2009). It is noted that good governance includes several political and institutional conditions that could have a negative influence on the operation of an investment company (Fails 2012) or the business climate, and governance is considered to be the most unpredictable FDI factor (Busse and Hefeker 2007). Anwar and Iwasaki (2021) conducted a meta-analysis and reached the conclusion that foreign investors choose to invest their capitals in risky markets that present modest institutional quality. Several empirical studies have focused on the impact of the recipient country’s governance on the amount of FDI inflows in different geographic regions in developed and developing countries, as presented in Table 1, as well as in different groups of developing economies (Table 2). The majority of the researches reached the conclusion that poor institutions deter FDI in the recipient developing country. The present paper includes a concise review in order to identify a literature gap.

Table 1.

Empirical findings on FDI and governance in developing countries.

Table 2.

Empirical findings on FDI and institutional quality in sub-groups of developing countries.

Therefore, Table 1 presents the summary of the empirical findings on FDI and governance in developing countries, and it is observed that previous studies focused on different time periods and applied panel data on groups of developing or developed countries and developing economies.

As presented in Table 2, previous studies on the relation between FDI and institutional quality, focused on certain sub-groups of economies, mainly focused on African and the Asian developed and developing countries. In addition, although they studied different time periods and geographic regions, they reached the common conclusion that institutional quality is a determinant of FDI inflows.

Governance is therefore studied as the main independent variable in order to investigate the role of the host economy’s political and institutional environment in attracting FDI. It can be observed that previous studies focused on different groups of developing or emerging economies and on different geographic regions. Moreover, different indicators of governance could lead to contrasting results. Nevertheless, none of the published papers have, until the present paper, studied the case of FDI and institutions in the CIVETS economies, despite the increasing research interest towards FDI in the specific group of countries (Guerra Baron 2014; Efeoglu and Christiansen 2014; Petrović-Ranđelović et al. 2020).

The comparison between BRIC and CIVETS countries has been selected under the criterion that CIVETS could be the successor of BRICS (Yi et al. 2013; Anand et al. 2019). It is estimated that, over the next decade, CIVETS countries are expected to achieve economic growth and their growth rate could beat those of G7 countries for the same period (Anand et al. 2019). Both CIVETS and BRIC are fast growing economies, they are characterized by geographic dispersion and institutional variations. Moreover, the groups of countries present diversity regarding their population, market size, financial systems and macroeconomic conditions.

2.3. Institutional Quality as an FDI Determinant in BRIC and CIVETS Countries

The countries in the BRIC and CIVETS groups attracted research interest in the present study because they are groups of emerging countries that are absorbing increasing FDI inflows. In 2020, BRICS attracted 19.7% of the world’s FDI inflows; in 2020, Brazil and Colombia were listed among the top FDI recipients in Latin America and the Caribbean, absorbing USD 24.8 billion and USD 7.7 billion, respectively. Additionally, Egypt is the largest FDI recipient in Africa, Indonesia was listed among the top 20 host economies in 2019 and 2020, while South Africa, Vietnam and Turkey attracted USD 136.7 billion, USD 15.8 billion and USD 7.9 billion, respectively (UNCTAD 2021). The studied economies have been listed among the world’s top merchandise importers in the last few decades, while Brazil and China were listed among the leading traders worldwide during 2019–2020 (WTO 2021). Both groups of countries are heterogeneous in terms of their internal market, level of productivity, population, spillovers, trade openness and dominant sectors. They include authoritarian and democratic governments, conflict and competition, as in the case of India and China. The CIVETS countries also present high heterogeneity in terms of their industrial structures, dependence on international trade, economic and political ties and market size (John et al. 2014).

FDI could help BRICS achieve the economic development of developed countries (Nistor 2015). According to Bose and Kohli (2018), BRICS countries are the most developed group among the emerging economies and, thus, garner more foreign investors. Nevertheless, there are several differences between the group of countries, as well as intragroup differences. Duan (2010) observed that Brazil, India and Russia mostly attract FDI in the tertiary sector, while China in the secondary sector. Similarly, Bose and Kohli (2018) concluded that the services sector attracts more FDI in South Africa and India, Russia and Brazil in manufacturing and services, while China attracts more FDI in manufacturing. Kishor and Singh (2015) also studied FDI in BRICS and suggested that the countries should further improve infrastructure, GDP and investment opportunities.

Among the FDI determinants, attention is paid to the governance of countries because a number of the CIVETS countries have introduced significant reforms over recent decades in order to improve their institutions, reduce protectionism and attract more foreign capital (Delaunay and Torrisi 2012; Botello et al. 2019). It is noted that the countries in this group have not made an effort to coordinate their external financial strategies and they are considered as promissory emerging countries (Guerra Baron 2014).

For example, Vietnam, in 1986, applied the “Doi Moi” policy, which attracted more MNEs in the country (Delaunay and Torrisi 2012). Similarly, Egypt introduced various regulatory reforms, such as the Infitah policy, in order to reduce their shadow economy and integrate into the global economy (Farzanegan et al. 2020). In a similar manner, Indonesia applied a liberalization strategy so as to absorb FDI and promote local enterprises’ development (Iman and Nagata 2005). A summary of the empirical findings on FDI and institutions in BRIC and CIVETS is presented in Table 3.

Table 3.

Empirical findings on FDI and institutional quality in BRIC and CIVETS.

As presented in Table 3, there are limited studies on FDI and institutional quality in BRIC and CIVETS, among which some focused on groups of countries, while others on case studies. It can be observed that the case of BRICS economies has been a subject of study by various researchers (e.g., Jadhav 2012; Jadhav and Katti 2012; Chodisetty and Reddy 2019); nevertheless, none of these studies investigated and compared FDI and governance in CIVETS, which highlights the contribution of this paper to the body of existing knowledge. Certain case studies (e.g., Tosun et al. 2014; Ngô et al. 2018; Makoni 2018) focused on members of CIVETS; nevertheless, it can be concluded that the role of governance in CIVETS as a group of countries has been undermined.

2.4. Other Potential Determinant Factors of FDI

Several explanatory variables have been studied as drivers of FDI in the specific groups of countries. Explanatory variables have been chosen based on the literature review, on the available data and on the eclectic paradigm of Dunning (1988). According to the eclectic paradigm, the host country’s market size plays a crucial role in attracting foreign investors. It is noted that the interaction between FDI and Gross Domestic Product (GDP) has been a matter of study for several researchers (e.g., Mahmoodi and Mahmoodi 2016; Shah and Ali 2016; Azam and Haseeb 2021). Mehrara et al. (2010) indicated a positive interaction between FDI and GDP in 57 developing economies during 1981–2006. However, Mahembe and Odhiambo (2016) observed that FDI inflows had a positive impact on GDP solely in the middle income countries for the period 1980–2016. Vijayakumar et al. (2010) concluded that FDI and market size are positively related in the case of the BRICS countries. In the present essay, GDP is investigated as a proxy of the host economy’s market size.

Another factor that could affect the FDI inflows into a developing economy is trade openness, which is estimated as the ratio of imports plus exports as a share of GDP. Trade liberalization and its association to FDI inflows has been a subject of study for several researchers. Seyoum et al. (2014) observed a bidirectional causal effect between FDI and trade openness in 25 developing countries during 1977–2009. These findings are in accordance with the findings of Liargovas and Skandalis (2012) in 36 developing countries during 1990–2008 and the results of Gupta and Singh (2016) in the BRICS economies over the period 1983–2013. Labes (2015) and Maryam and Mittal (2020) also concluded that trade openness was an important FDI determinant in the BRICS countries over the period 1992–2012 and the period 1994–2018, respectively.

However, Dua and Garg (2015) achieved contrasting results, arguing that in India, during 1997–2011, there was a negative influence of trade openness on FDI inflows due to tariffs on natural resources. Conversely, Vijayakumar et al. (2010) observed that in the BRICS economies the impact of trade openness in FDI inflows is insignificant. Therefore, it is interesting to study the effect of trade openness, which is used as a proxy for the exchanging countries’ trade barriers.

Exchange rate is also a potential determinant factor of FDI, as observed by Labes (2015) and Maryam and Mittal (2020). In particular, Lily et al. (2014) observed causality and a negative influence of exchange rate volatility on FDI inflows in four ASEAN (Association of Southeast Asian Nations) countries for the period 1971–2011. In accordance with the findings of Lily et al. (2014), Kiyota and Urata (2004) observed that a depreciation of the host country’s currency is related to increased FDI inflows. Conversely, exchange rate volatility discourages foreign investors. However, Upadhyaya et al. (2011) investigated the interaction between FDI inflows and exchange rate in four South Asian economies during the period 1976–2009 and reached ambiguous results. It is therefore interesting to include exchange rate in the present paper in order to examine its impact on FDI inflows in the sample countries. Moreover, official exchange rates have been studied as a traditional FDI factor, under the condition that unstable exchange rates could affect the recipient economy’s imports and exports. Official exchange rates have been proven to be a determinant of FDI factors by several researchers (Liargovas and Skandalis 2012; Kinuthia and Murshed 2014; Xaypanya et al. 2015; Akbar and Akbar 2015; Najaf and Ashraf 2016; Sane 2016). Countries with devaluated currency are expected to attract more FDI inflows considering that multinational companies will have a competitive advantage compared to local enterprises when regarding their financial resources and access to international capital markets. Additionally, Lily et al. (2014) argued that countries with devaluated currency usually receive FDI inflows. Therefore, stable official exchange rates are used as a proxy for exchange rate risk and they are expected to be positively related to FDI inflows.

Additionally, inflation is a variable that is expected to have a negative impact on FDI inflows. A negative link between FDI and inflation was observed by Xaypanya et al. (2015) in eight developing countries during 2000–2011. Similarly, Mason and Vracheva (2017) concluded that in 50 developed and developing countries during 1996–2012, inflation had a negative influence on FDI inflows, and anti-inflation policies increased the recipient countries’ attractiveness; however, according to the researchers, the attractiveness of anti-inflation measures was mostly higher for developed countries. A negative impact of inflation on FDI inflows was also observed by Siddica and Angkur (2017) in 40 developed and developing economies from 1990 to 2010 and Gupta and Singh (2016). Therefore, inflation is used as an independent variable in order to consider the host economies’ price unpredictability, macroeconomic stability and risk.

3. Estimation Methods and Data

The main research question of the study is whether poor governance discourages FDI inflows in BRIC and CIVETS countries. Furthermore, the indicators of governance that determine FDI inflows in these groups of countries are investigated. A panel data analysis is applied in the present study in order to use both time series and cross-sectional data and to reach unbiased empirical findings. Taking into consideration the data availability, panel data are suitable for modeling the complexity of several variables (Hsiao 2007). It is noted that the study focuses on BRIC economies; therefore, South Africa is studied as a member of CIVETS.

3.1. Data and Sources

The present research is based on secondary, balanced, annual panel data, collected by several databases, as presented in Table 4 and Table 5, respectively.

Table 4.

Dependent and independent variables’ definitions and sources.

Table 5.

Definitions and courses of institutional variables.

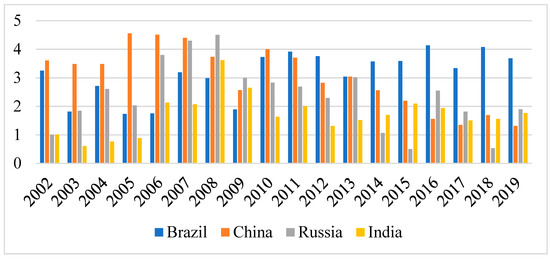

As presented in Table 4 and Table 5, secondary data are collected from the World Bank and, in particular, from the World Development Indicators and the Worldwide Governance Indicators. The dependent variable (FDI) is measured as the net FDI inflows as a percentage of GDP. GDP is measured using growth rate of GDP at market prices. However, data for VA, PV, GE, RQ, RL and control of corruption are available on annual basis from 2002 to 2019. As a result, the studied period is limited from 2002 to 2019. When regarding the studied groups of countries, it can be observed that China remains the top FDI destination among the BRIC, as presented in Figure 1. China registered a growth in net FDI inflows in 2018 but a decline in 2019, which could be attributed to reduced flows from the country’s main investors.

Figure 1.

Net FDI inflows among the BRIC (2002–2019) (%GDP).

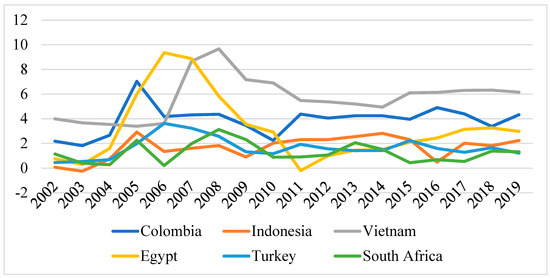

For the CIVETS countries, Turkey was the largest recipient until 2009, and Indonesia ranked first from 2009 to 2015 and from 2017 to 2019, which can be associated to increased foreign investors’ interest towards other Asian economies (Figure 2). It is argued that Indonesia is listed among the foreign investors’ top FDI destinations in the specific group of countries mostly because of its fiscal policy and low public debt (Lindblad 2015).

Figure 2.

Net FDI inflows among the CIVETS (2002–2019) (%GDP).

3.2. Model Specification

The present paper presents an extension of the model suggested by Erkekoglu and Kilicarslan (2016), which included six political variables, namely VA, PV, GE, RQ, RL and CC as proxies for governance. In addition, the model takes into consideration the models proposed by Anwar and Afza (2014), Epaphra and Massawe (2017) and Sabir et al. (2019), as well as data availability and the literature review on FDI determinants, and, thus, the initial model used in the present study is expressed as following

where FDI represents net FDI inflows (% GDP), GDP represents GDP annual growth (%), Exch represents real exchange rate, Trade represents trade openness, Infla represents inflation, and VA, PV, GE, RQ, RL and CC are proxies for institutions. The model is transformed in logarithmic form in order to mitigate the potential effects of outliers. As a result, the model is developed as

where, i represents the recipient country, t represents time and ε represents the error disturbance term.

FDIit = β0 + β1GDPit + β2Inflait + β3Exchit + β4Tradeit + β5CCit + β6Vait + β7PVit + β8RLit + β9RQit + β10GEit + εit

lnFDIit = β0 + β1lnGDPit + β2lnInflait + β3lnExchit + β4lnTradeit + β5CCit + β6Vait + β7PVit + β8RLit + β9RQit + β10GEit + εit

3.3. Methodology

The present study involves secondary data collection from reliable databases, such as the World Bank database and the Penn World Table. A correlation matrix was used in order to check for multicollinearity among the studied variables. Previous empirical studies also performed a correlation matrix, including Epaphra and Massawe (2017), Busse and Hefeker (2007), etc. Several methods have been suggested in order to correct multicollinearity, such as ignoring, which could, however, lead to statistically insignificant variables.

Nevertheless, multicollinearity could be solved by removing some of the explanatory variables in order to reach statistically significant findings (Brooks 2014). Therefore, a stepwise regression is realized in order to investigate whether some of the explanatory variables should be removed, without reducing R-squared. The next step is to perform a Hausman test so as to choose between fixed and random effects. The hypotheses of the Hausman test are:

Hypotheses 0 (H0).

Random effects is appropriate.

Hypotheses 1 (H1).

Fixed effects is appropriate.

Thus, in the case where p-value is higher than 0.05 at α = 95%, then random effects test is appropriate since the null hypothesis is not rejected. It is noted that Generalized Method of Moments (GMM) is not suitable for the sample of the research because T, which represents time period, is higher than N, which represents the number of studied countries. Finally, the final model is tested for cross-section dependence, for heteroscedasticity and for autocorrelation. It is noted that each test is performed for both groups of countries.

4. Empirical Results

The empirical analysis was performed using the statistical package Eviews 11.0. The descriptive statistics of the studied variables are presented in Table 6 and Table 7 for BRIC and CIVETS, respectively, in order to describe the main features of the data.

Table 6.

Descriptive statistics of dependent and explanatory variables for BRIC economies.

Table 7.

Descriptive statistics of dependent and explanatory variables for CIVETS economies.

In order to detect multicollinearity and to control the correlation among the variables, a correlation matrix is constructed, as presented in Appendix A (Table A1 and Table A2). It is noted that higher values in the correlation matrix, which rank from −1 to +1, are related to multicollinearity. Therefore, in the case where the correlation coefficient is equal to 1 (r = 1.0), then there is a perfect or complete correlation, which is very strong. Conversely, r = −1.0 stands for an inverse relation among the variables and r = 0 is related to no correlation. In the present study, r values are significant when r > 0.5. This value is estimated as 2/√N, where N is the number of studied economies; that is to say four BRIC and six CIVETS countries. In other words, when r ≥ 1 in BRIC and r ≥ 0.816 in CIVETS, then the correlation among the variables is significant, at α = 0.05. Additionally, the panel unit root test is used to investigate panel cointegration among the variables. The ADF-Fisher Unit Root test is applied and it is observed that the null hypothesis is not rejected and variables are non-stationary at α = 0.05, as presented in Appendix A (Table A3).

Stepwise regression is performed for both groups of countries in order to investigate whether certain variables should be excluded (Table 8). In other to avoid omitted variable bias issues, and considering the high correlation among the governance indicators, different estimations including one governance variable at a time are presented in Table A6 and Table A7 in Appendix A, as well as the estimated models for each added variable, leading to similar results as for the included variables.

Table 8.

Stepwise regression results for BRIC and CIVETS.

As presented in Table 8, in the BRIC countries the stepwise regression led to the conclusion that PV, RL, GE, CC and RQ should be included, while in the CIVETS groups it was concluded that PV, GE, CC, RQ and VA should be included. As observed in Table A6 and Table A7 in Appendix A, the regressions that include the specific variables for each group of countries present the highest R-squared and adjusted R-squared. Thus, 10 regressors are tested, using stepwise forward as the selection method and p-value forwards equal to 0.5 as the stopping criterion. As presented in Table 8, in the case of the BRIC economies, all tested regressors should be included and they are statistically significant at α = 95%, except for voice and accountability, which should be excluded. On the contrary, as for the CIVETS countries, it is observed that rule of law, inflation and trade openness are excluded. The remaining regressors are statistically significant at α = 95%, except for government Effectiveness and control of corruption.

Furthermore, the Hausman test is performed in order to choose whether to apply fixed or random effects. The results of the Hausman test are presented in Table 9. It is observed that the probability value is equal to zero. The null hypothesis of the test is that the random effects model is appropriate. However, it is observed that the probability value is less than 5%, which means that the null hypothesis is rejected and the fixed effects model is appropriate in order to produce better coefficients. The results of the fixed effects test are presented in Table 9. Additionally, OLS results are presented in Appendix A (Table A4) as well as a dynamic model using FDI lagged by one year (Table A5).

Table 9.

Fixed effects test results for BRIC and CIVETS and Hausman test results.

As observed in Table 9, Prob (F-statistic) = 0.000000 and, therefore, the models are statistically significant at α = 95%. As for the BRIC economies, a negative association is observed between FDI inflows and inflation, government effectiveness, control of corruption and real exchange rate. Similarly to the CIVETS countries, it is concluded that there is a negative relation between the dependent variable FDI and voice and accountability.

Finally, the models are tested for cross-section dependence, heteroscedasticity and autocorrelation, as presented in Table 10.

Table 10.

Results of diagnostic tests.

As observed in Table 10, there is no cross-section, heteroscedasticity and autocorrelation in both groups of countries.

5. Discussion

The present research focused on FDI inflows and governance in two groups of emerging economies, namely BRIC and CIVETS, using panel data analysis for the period 2002–2019. The comparison of the FDI determinants in the specific groups of economies led to interesting results.

Firstly, as expected, the coefficient of GDP is positive and statistically significant, which leads to the conclusion that there is a positive effect of GDP on FDI inflows in the studied groups of economies. These results are opposite to the findings of Antwi and Zhao (2013) and Kwoba and Kibati (2016) who concluded that there was a significant negative interaction between FDI and GDP. Contrary to this, Mahmoodi and Mahmoodi (2016), Mehrara et al. (2010) and Sabir et al. (2019) reached similar results to this research and observed that there is a positive association between FDI and GDP.

Additionally, a negative association is observed between FDI and the exchange rate in the BRIC, while, conversely, there is a positive impact of the exchange rate on FDI in the CIVETS. Therefore, a depreciation of the local currency is expected to have a negative influence on FDI inflows in the CIVETS. This finding is in line with the results of Zakari (2017) who concluded that there is a positive relationship between FDI and exchange rate, as well as the results of Kiyota and Urata (2004), who argued that volatility of exchange rates tends to discourage FDI inflows.

With regards to inflation, it is observed that it is negatively related to FDI inflows in the BRIC economies. These findings are in line with the results of Sabir et al. (2019), who also observed that inflation negatively affects FDI inflows in developing economies. However, Tsaurai (2018) achieved contrasting results, observing that there is a positive association between FDI inflows and inflation; nevertheless, the researcher highlighted that the variable is statistically insignificant. Based on the stepwise regression results, inflation is not a determinant FDI factor in the CIVETS economies.

Moreover, it is concluded that trade openness in the BRIC countries attracts FDI inflows. Sabir et al. (2019) also observed a positive association between FDI inflows and trade openness in developing countries, as did Kurul and Yalta (2017). Saidi et al. (2013) also observed that trade openness is positively related to FDI inflows in 20 developed and developing economies during 1998–2011. However, trade openness is not an FDI determinant for the CIVETS. Additionally, Gangi and Abdulrazak (2012) observed a negative association between FDI inflows and VA, as in the case of the CIVETS. The researchers concluded that there was a positive interaction between FDI and RL, which is also observed in the BRIC, a positive impact of RQ on FDI, which is observed in both CIVETS and BRIC, as well as a positive relation between FDI and CC, as in the case of the CIVETS countries. Contrary to the findings of the present study for both groups, the researcher argued that there is a negative association between FDI and PV. Jadhav (2012) highlighted the importance of “tariff jumping” and noted that trade restrictions and low trade openness could positively influence FDI. In addition, MNEs are more likely to choose a more open economy to locate their capital in since trade protection is often related to higher transaction costs. Differences in the institutional variables between the studied groups could be attributed to the heterogeneity and the institutional reforms applied by the countries’ governments.

Furthermore, Kurul and Yalta (2017) concluded that there was a positive association between FDI and CC, as in the CIVETS. However, contrary to the findings of the present essay for the CIVETS, the researchers concluded that FDIs are positive related to VA. Moreover, their study reached an opposite result regarding GE in the BRIC, arguing that, according to the researchers, GE and FDI inflows are positively associated. These results are also in line with the findings of Anwar and Afza (2014) for the CIVETS, who observed a positive impact of CC, PV and RQ on FDI inflows. Contrary to the findings regarding the BRIC economies, Peres et al. (2018) observed that CC and RL are positively related to FDI inflows in the developing countries.

Epaphra and Massawe (2017) also reached a similar conclusion for both groups of countries and observed that there a positive interaction between FDI and PV. The findings are also in line when regarding the CIVETS countries and the positive association between FDI and CC, as well as between FDI and RQ. However, Sabir et al. (2019) reached different findings and argued that RQ does not affect FDI inflows in the developing countries.

In conclusion, it is suggested that, in order for the host economies to benefit from FDI inflows, it is crucial to apply a stabilization program and to introduce structural reforms in order to reduce political risk, as proposed by Axarloglou and Pournarakis (2005) as well. Moreover, it is suggested that the improvement in the Asian and Latin American developing economies would ameliorate their investment climate, and thus would attract more foreign investors. Both groups of countries attract a significant amount of FDI, but they do not present economic integration, which could reinforce their security level and development. In addition, both groups have made significant efforts to improve their economic conditions and attract more inflows; however, it is crucial that they sustain their economic development to claim the greatest global inflows.

Another policy implication refers to the economic policy uncertainty (EPU) of the studied groups. On the one hand, according to Mensi et al. (2014), the BRICS stock market depends on the United States (U.S.) stock market’s uncertainty, as well as on commodity markets and global stock. Dakhlaoui and Aloui (2016) reached similar findings and observed that stock market volatility in the BRICS is affected by U.S. economic uncertainty, mainly during periods of economic instability. Additionally, Guo et al. (2018) focused on the BRIC economies and the group of seven (G7) countries to investigate the interaction between stock returns and EPU from 1985 to 2015 and concluded that EPU has a negative impact on the stock markets of China and India. On the other hand, in the aftermath of the global financial crisis and the European debt crisis, Hung (2021) concluded that there was a bidirectional relationship between BRICS stock return and EPU.

It should be highlighted that the study is, however, subjected to certain limitations. The first limitation refers to the sample of the countries. It is noticed that its is solely lower–middle and upper–middle income countries that have been selected, taking into consideration the data availability. Therefore, future studies could extend the sample of countries to include high-income countries, in other words, economies that present GNI per capita higher than USD 12,056.

Another limitation of the study refers to the fact that trade openness has been used as a variable of trade liberalization. However, certain factors, such as the structural characteristics of the host economies and the trade barriers, have not been taken into consideration. Consequently, further analyses could distinguish between liberalized and close economies to mostly focus on the trade policies applied by the recipient countries.

Finally, it is noted that due to data restrictions, only total FDI inflows are examined. Consequently, there is no discrimination between horizontal and vertical FDI, or among market-seeking, resource-seeking, efficiency-seeking and strategic asset-seeking FDI (Dunning 1993). Additionally, different entry modes of FDI have not been considered, as suggested by Lee et al. (2014), which could be a suggestion for future research. FDI inflows as a dependent variable could be replaced by the inward FDI performance index, which is defined as the ratio of a country’s share in global FDI inflows to its share in world FDI (Hintošová 2021; UNCTAD 2022). Additional variables could be included to investigate technology advantages, such as the number of patterns and the number of higher education Research and Development (R&D) personnel, as suggested by Kyrkilis and Pantelidis (2003). The human capital in the recipient countries could also be studied, as suggested by Barro and Lee (1993), as well as digital skills.

Panel data analysis is often associated with certain limitations, including data availability, measurement errors or selectivity errors. Future studies could also use time dummy variables in order to investigate the association among the variables after a social or financial event, such as the recent financial crisis. Furthermore, the developing African countries could be a subject of future research in order to compare FDI inflows in more geographic regions. It would be interesting to study whether political risk and institutional quality have contributed to the reduction in FDI inflows in Africa over the past 5 years, as observed by UNCTAD (2018). Similarly, future studies could investigate the association between FDI and governance in developed and developing countries of the regions. Sabir et al. (2019) also compared FDI inflows, FDI determinants and institutional quality between developed and developing countries, but did not limit the investigation to a certain geographic region.

Similarly, it would be interesting to investigate the role of special economic zones (SEZ), which could influence investment decisions (Makabenta 2002; Cieślik and Ryan 2005). Chaudhuri and Yabuuchi (2010) argued that well-organized SEZs could bring several benefits, including FDI inflows, and suggested that infrastructure and irrigation projects in the agricultural sector are needed. Additionally, SEZs in China resulted in higher FDI inflows during the 1980s; however, the 1991 liberalization increased further FDI inflows. Nevertheless, it is crucial to consider the number (Kang and Lee 2007; Leong 2013) and the heterogeneity of the SEZs (Kang and Lee 2007). Additionally, the role of EPU could be investigated, considering that capital flows to the BRICS are negatively affected by EPU (Çepni et al. 2020). As for the CIVETS countries, there is little documented evidence on the impact of EPU on the group’s stock market. Adam (2020) investigated the interaction between stock markets and information flow from EPU, focusing on the case of African countries, including Egypt, and concluded that significant information is transmitted to Egypt from international EPU.

Finally, it would be interesting to investigate the impact of institutional quality on the economic growth in specific countries because, according to Asongu and Odhiambo (2018), better institutions led to the growth of GDP in BRICS and MINT (Mexico, Indonesia, Nigeria, Turkey) economies. Furthermore, additional sub-indices of institutional quality could be added, such as religious tension (Busse and Hefeker 2007; Gammoudi and Cherif 2016), investment profile (Gammoudi and Cherif 2016), conflicts (Busse and Hefeker 2007) and transparency and the guarantee of civil liberties (Kurul and Yalta 2017).

6. Conclusions and Suggestions

FDI inflows are influenced by the socioeconomic and political environment of the BRIC and CIVETS economies. The present study concludes that market size, as measured by current GDP, is positively related to FDI inflows in both groups of countries. In addition, a negative association has been observed between FDI and inflation solely in the BRIC economies. As for the components of the governance indicators, it is observed that FDI is positively related to PV, RL and RQ in the BRIC countries and positively associated to CC, PV, RQ and GE in the CIVETS. In conclusion, there are policy implications that can be derived for the studied economies. Firstly, considering the positive relationship between trade openness and FDI, it is suggested that recipient countries abolish trade restrictions and barriers and strengthen anti-regulations. Secondly, the local currency should remain stable and flexible in order to prevent fluctuations in the amount of FDI inflows and to protect the host country’s commercial viability. Thirdly, it is suggested that the stability of the host economies’ public institutions should be enhanced so as to encourage foreign investors and multinational companies. Considering that among the BRIC countries, Russia and China have an authoritarian regime, it is suggested that they should focus on improving their political stability and regulatory quality in order to enhance cooperation with other countries and economic organizations. Conversely, the other countries in the group are fractious democracies and it is suggested that they further strengthen rule of law. The CIVETS countries mainly include democratic regimes; it is suggested that Colombia focuses on reducing corruption to hinder exports and development, Turkey and Egypt focus on political stability and the absence of violence, Vietnam can improve government effectiveness and rule of law and Indonesia their regulatory quality. Finally, it is crucial for South Africa to improve their political stability and absence of violence, especially considering increased violent incidents and protests, mainly after Zuma’s imprisonment, while Turkey faces a severe currency and debt crisis, which could influence several institutional variables.

Author Contributions

Conceptualization, P.K. and T.M.; methodology, P.K.; software, P.K.; validation, P.K. and T.M.; formal analysis, P.K.; investigation, P.K.; resources, P.K.; data curation, P.K.; writing—original draft preparation, P.K.; writing—review and editing, P.K. and T.M.; visualization, P.K. and T.M.; supervision, T.M.; project administration, T.M. All authors have read and agreed to the published version of the manuscript.

Funding

This research received no external funding.

Data Availability Statement

This study did not report any data.

Conflicts of Interest

The authors declare no conflict of interest.

Appendix A

Table A1.

Correlation matrix for BRIC economies.

Table A1.

Correlation matrix for BRIC economies.

| FDI | GDP | Inflation | Exchange Rate | Trade Openness | CC | GE | PV | RL | RQ | VA | |

|---|---|---|---|---|---|---|---|---|---|---|---|

| FDI | 1 | 0.306 | −0.059 | 0.457 | 0.565 | −0.286 | −0.226 | 0.274 | −0.171 | −0.256 | −0.534 |

| GDP | 0.306 | 1 | 0.140 | 0.320 | 0.369 | −0.262 | −0.148 | 0.105 | −0.132 | −0.242 | −0.351 |

| Inflation | −0.059 | 0.140 | 1 | −0.018 | −0.127 | −0.236 | −0.254 | −0.077 | −0.104 | −0.271 | −0.241 |

| Trade openness | 0.561 | 0.140 | −0.018 | 1 | 0.804 | −0.024 | −0.005 | 0.645 | −0.016 | −0.403 | −0.581 |

| Exchange rate | 0.457 | 0.369 | −0.127 | 0.804 | 1 | −0.460 | −0.222 | 0.471 | −0.387 | −0.552 | −0.465 |

| CC | 0.141 | −0.262 | −0.353 | −0.024 | −0.668 | 1 | 0.512 | 0.519 | 0.733 | 0.669 | 0.482 |

| GE | 0.521 | −0.148 | −0.551 | −0.052 | −0.108 | 0.512 | 1 | 0.3 | 0.411 | 0.125 | −0.226 |

| PV | 0.332 | 0.105 | −0.205 | 0.645 | −0.554 | 0.519 | 0.31 | 1 | 0.037 | 0.663 | −0.068 |

| RL | −0.041 | −0.132 | −0.3913 | 0.016 | −0.508 | 0.733 | 0.411 | 0.037 | 1 | 0.212 | 0.655 |

| RQ | 0.069 | 0.242 | 0.1443 | −0.404 | −0.574 | 0.669 | 0.125 | 0.663 | 0.212 | 1 | 0.324 |

| VA | −0.606 | −0.358 | 0.125 | −0.581 | −0.568 | 0.482 | −0.226 | −0.068 | 0.655 | 0.324 | 1 |

Table A2.

Correlation matrix for CIVETS economies.

Table A2.

Correlation matrix for CIVETS economies.

| FDI | GDP | Inflation | Exchange Rate | Trade Openness | CC | GE | PV | RL | RQ | VA | |

|---|---|---|---|---|---|---|---|---|---|---|---|

| FDI | 1 | 0.369 | −0.058 | 0.457 | 0.567 | −0.282 | −0.226 | 0.274 | −0.171 | −0.257 | −0.534 |

| GDP | 0.306 | 1 | 0.140 | 0.369 | 0.320 | −0.262 | 0.148 | 0.105 | −0.132 | −0.242 | −0.351 |

| Inflation | 0.059 | 0.140 | 1 | −0.127 | −0.018 | −0.216 | −0.221 | −0.021 | −0.104 | −0.373 | −0.181 |

| Exchange rate | 0.454 | 0.368 | −0.127 | 1 | 0.804 | −0.910 | −0.180 | 0.891 | −0.901 | −0.911 | −0.991 |

| Trade openness | 0.565 | 0.329 | −0.018 | 0.804 | 1 | −0.243 | −0.054 | 0.645 | −0.016 | −0.403 | −0.581 |

| CC | 0.014 | −0.262 | −0.236 | −0.279 | −0.243 | 1 | 0.848 | 0.132 | 0.711 | 0.833 | 0.642 |

| GE | 0.154 | 0.201 | −0.254 | −0.222 | −0.054 | 0.848 | 1 | 0.321 | 0.744 | 0.838 | 0.685 |

| PV | −0.022 | −0.191 | −0.077 | 0.475 | 0.645 | 0.132 | 0.321 | 1 | 0.403 | −0.018 | −0.075 |

| RL | 0.018 | 0.410 | −0.104 | −0.387 | −0.016 | 0.711 | 0.744 | 0.403 | 1 | 0.637 | 0.379 |

| RQ | 0.165 | 0.190 | −0.273 | −0.522 | −0.403 | 0.833 | 0.838 | −0.018 | 0.637 | 1 | 0.775 |

| VA | 0.08 | 0.401 | −0.241 | −0.465 | −0.581 | 0.642 | 0.685 | −0.075 | 0.379 | 0.775 | 1 |

Table A3.

Unit root test for BRIC and CIVETS economies.

Table A3.

Unit root test for BRIC and CIVETS economies.

| ADF-Fisher Unit Root Test | ||||||||

|---|---|---|---|---|---|---|---|---|

| BRIC Economies | CIVETS Economies | |||||||

| At Level | Statistic | Probability | Statistic | Probability | Statistic | Probability | Statistic | Probability |

| LnFDI | 17.914 | 0.717 | 35.971 | 0.000 | 33.069 | 0.109 | 60.252 | 0.000 |

| LnGDP | 15.206 | 0.201 | 37.382 | 0.001 | 45.691 | 0.002 | 71.436 | 0.000 |

| LnInfla | 11.754 | 0.162 | 42.917 | 0.000 | 46.820 | 0.001 | 69.398 | 0.000 |

| LnExch | 2.932 | 0.936 | 16.294 | 0.018 | 21.281 | 0.003 | 30.093 | 0.001 |

| LnTrade | 10.659 | 0.227 | 23.336 | 0.003 | 16.607 | 0.165 | 66.99 | 0.000 |

| CC | 18.911 | 0.153 | 14.807 | 0.003 | 18.056 | 0.114 | 59.113 | 0.002 |

| GE | 5.241 | 0.731 | 22.481 | 0.004 | 17.891 | 0.119 | 67.761 | 0.021 |

| PV | 10.152 | 0.254 | 32.822 | 0.000 | 17.526 | 0.13 | 65.320 | 0.000 |

| RL | 10.303 | 0.244 | 15.850 | 0.014 | 6.078 | 0.812 | 66.829 | 0.000 |

| RQ | 16.355 | 0.476 | 19.496 | 0.012 | 10.565 | 0.566 | 66.091 | 0.026 |

| VA | 7.868 | 0.699 | 15.864 | 0.007 | 5.649 | 0.832 | 57.806 | 0.039 |

Table A4.

OLS test results for BRIC and CIVETS.

Table A4.

OLS test results for BRIC and CIVETS.

| Dependent Variable: LnFDI | ||||

|---|---|---|---|---|

| BRIC | CIVETS | |||

| Variable | Coefficient | Prob. | Coefficient | Prob. |

| C | −1.1791 | 0.002 | −0.0618 | 0.002 |

| LnGDP | 0.0191 | 0.029 | 0.0482 | 0.027 |

| LnInfla | −0.7191 | 0.001 | −0.3921 | 0.638 |

| LnExch | −0.9101 | 0.023 | 0.0571 | 0.036 |

| LnTrade | 1.1891 | 0.000 | 1.1925 | 0.000 |

| CC | −0.7808 | 0.012 | 0.1573 | 0.023 |

| PV | 0.2281 | 0.038 | 0.0831 | 0.036 |

| RL | 0.6289 | 0.026 | ||

| RQ | 0.3682 | 0.381 | 0.8061 | 0.000 |

| GE | −0.7281 | 0.481 | 0.3801 | 0.361 |

| VA | −0.3791 | 0.000 | ||

| R-squared | 0.4528 | 0.5382 | ||

| Adjusted R-squared | 0.4101 | 0.4981 | ||

| Durbin–Watson stat | 1.5022 | 1.2912 | ||

| Obs. | 72 | 108 | ||

Table A5.

Test results for BRIC and CIVETS using lagged FDI.

Table A5.

Test results for BRIC and CIVETS using lagged FDI.

| Dependent Variable: LnFDI | ||||

|---|---|---|---|---|

| BRIC | CIVETS | |||

| Variable | Coefficient | Prob. | Coefficient | Prob. |

| C | −2.8012 | 0.279 | 0.1412 | 0.805 |

| LnGDP | 0.0391 | 0.026 | 0.0038 | 0.000 |

| LnInfla | −0.0321 | 0.102 | −0.0037 | 0.336 |

| LnExch | −0.0192 | 0.258 | 0.006 | 0.929 |

| LnTrade | 1.2019 | 0.067 | 0.4005 | 0.000 |

| Lagged FDI | 0.0380 | 0.000 | ||

| CC | −0.3691 | 0.027 | 0.1924 | 0.023 |

| PV | 0.1801 | 0.291 | 0.1316 | 0.001 |

| RL | 0.1791 | 0.182 | ||

| RQ | 0.3791 | 0.291 | 0.2653 | 0.781 |

| GE | −0.0902 | 0.081 | 0.3981 | 0.299 |

| VA | −0.389 | 0.065 | ||

| R-squared | 0.6381 | 0.899 | ||

| Adjusted R-squared | 0.6071 | 0.088 | ||

| F-statistic | 51.1174 | 51.444 | ||

| Prob(F-statistic) | 0.0000 | 0.000 | ||

| Durbin–Watson stat | 1.969 | 1.709 | ||

| Obs. | 68 | 102 | ||

Table A6.

Multiple regressions for BRIC.

Table A6.

Multiple regressions for BRIC.

| Model 1 | Model 2 | Model 3 | Model 4 | Model 5 | Model 6 | |||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Variable | Coeff. | Prob. | Coeff. | Prob. | Coeff. | Prob. | Coeff. | Prob. | Coeff. | Prob. | Coeff. | Prob. |

| GDP | −0.024 | 0.311 | 0.006 | 0.795 | 0.005 | 0.809 | −0.002 | 0.919 | 0.027 | 0.083 | 0.012 | 0.512 |

| Inflation | 0.035 | 0.295 | −0.030 | 0.423 | −0.037 | 0.401 | −0.028 | 0.553 | −0.037 | 0.012 | −0.039 | 0.189 |

| Real exchange rate | −0.103 | 0.000 | −0.091 | 0.000 | −0.088 | 0.000 | −0.089 | 0.000 | −0.097 | 0.000 | −0.087 | 0.021 |

| Trade openness | 0.168 | 0.020 | 0.166 | 0.000 | 0.174 | 0.001 | 0.205 | 0.004 | 0.265 | 0.002 | 0.291 | 0.001 |

| PV | 0.001 | 0.996 | 0.041 | 0.201 | 0.039 | 0.331 | 0.045 | 0.275 | 0.088 | 0.102 | 0.078 | 0.781 |

| GE | −0.158 | 0.002 | −0.162 | 0.003 | −0.181 | 0.003 | −0.201 | 0.002 | −0.261 | 0.103 | ||

| RQ | 0.072 | 0.075 | −0.012 | 0.905 | 0.076 | 0.191 | 0.079 | 0.041 | ||||

| CC | 0.045 | 0.481 | −0.107 | 0.087 | 0.096 | 0.002 | ||||||

| RL | 0.152 | 0.002 | 0.189 | 0.057 | ||||||||

| VA | 0.157 | 0.003 | ||||||||||

| R-squared | 0.410 | 0.487 | 0.488 | 0.492 | 0.547 | 0.541 | ||||||

| Adjusted R-squared | 0.366 | 0.439 | 0.432 | 0.446 | 0.481 | 0.478 | ||||||

| F-statistic | 9.197 | 10.293 | 8.715 | 8.458 | 8.321 | 8.218 | ||||||

| Prob(F-statistic) | 0.000 | 0.000 | 0.000 | 0.000 | 0.000 | 0.000 | ||||||

| Durbin–Watson stat | 1.005 | 1.102 | 1.103 | 1.189 | 1.355 | 1.378 | ||||||

| Obs. | 72 | 72 | 72 | 72 | 72 | 72 | ||||||

Model 1. FDIit = β0 + β1GDPit + β2Inflait + β3Exchit + β4Tradeit + β5Vait + εit; Model 2. FDIit = β0 + β1GDPit + β2Inflait + β3Exchit + β4Tradeit + β5PVit + β6GEit + εit; Model 3. FDIit = β0 + β1GDPit + β2Inflait + β3Exchit + β4Tradeit + β5PVit + β6GEit + β7RQit + εit; Model 4. FDIit = β0 + β1GDPit + β2Inflait + β3Exchit + β4Tradeit + β5PVit + β6GEit + β7RQit + β8CCit + εit; Model 5. FDIit = β0 + β1GDPit + β2Inflait + β3Exchit + β4Tradeit + β5PVit + β6GEit + β7RQit + β8CCit + β9RLit + εit; Model 6. FDIit = β0 + β1GDPit + β2Inflait + β3Exchit + β4Tradeit + β5PVit + β6GEit + β7RQit + β8CCit + β9RLit + β10Vait + εit.

Table A7.

Multiple regressions for CIVETS countries.

Table A7.

Multiple regressions for CIVETS countries.

| Model 1 | Model 2 | Model 3 | Model 4 | Model 5 | Model 6 | |||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Variable | Coeff. | Prob. | Coeff. | Prob. | Coeff. | Prob. | Coeff. | Prob. | Coeff. | Prob. | Coeff. | Prob. |

| GDP | 0.089 | 0.101 | 0.081 | 0.029 | 0.070 | 0.229 | 0.073 | 0.212 | 0.027 | 0.062 | 0.027 | 0.616 |

| Inflation | −0.053 | 0.171 | −0.043 | 0.065 | −0.620 | 0.058 | −0.056 | 0.349 | −0.019 | 0.071 | −0.022 | 0.695 |

| Real exchange rate | 0.014 | 0.003 | 0.015 | 0.037 | 0.010 | 0.015 | 0.012 | 0.089 | 0.026 | 0.000 | 0.024 | 0.023 |

| Trade openness | 0.237 | 0.000 | 0.248 | 0.000 | 0.361 | 0.000 | 0.361 | 0.000 | 0.075 | 0.000 | 0.075 | 0.397 |

| PV | −0.03 | 0.036 | −0.039 | 0.036 | 0.101 | 0.791 | 0.102 | 0.793 | 0.061 | 0.093 | 0.065 | 0.127 |

| GE | 0.023 | 0.12 | −0.584 | 0.000 | −0.621 | 0.000 | −0.281 | 0.005 | −0.272 | 0.083 | ||

| RQ | 0.435 | 0.000 | 0.419 | 0.000 | 0.441 | 0.000 | 0.445 | 0.000 | ||||

| CC | 0.076 | 0.516 | 0.037 | 0.076 | 0.034 | 0.743 | ||||||

| VA | −0.234 | 0.000 | 0.237 | 0.000 | ||||||||

| RL | −0.021 | 0.880 | ||||||||||

| R-squared | 0.427 | 0.431 | 0.448 | 0.454 | 0.555 | 0.551 | ||||||

| Adjusted R-squared | 0.394 | 0.412 | 0.409 | 0.416 | 0.514 | 0.509 | ||||||

| F-statistic | 9.191 | 10.881 | 11.291 | 11.913 | 13.611 | 12.307 | ||||||

| Prob(F-statistic) | 0.000 | 0.000 | 0.000 | 0.000 | 0.000 | 0.000 | ||||||

| Durbin–Watson stat | 0.692 | 0.789 | 0.835 | 0.894 | 0.961 | 0.960 | ||||||

| Obs. | 108 | 108 | 108 | 108 | 108 | 108 | ||||||

Model 1. FDIit = β0 + β1GDPit + β2Inflait + β3Exchit + β4Tradeit + β5PVit + εit; Model 2. FDIit = β0 + β1GDPit + β2Inflait + β3Exchit + β4Tradeit + β5PVit + β6GEit + εit; Model 3. FDIit = β0 + β1GDPit + β2Inflait + β3Exchit + β4Tradeit + β5PVit + β6GEit + β7RQit + εit; Model 4. FDIit = β0 + β1GDPit + β2Inflait + β3Exchit + β4Tradeit + β5PVit + β6GEit + β7RQit + β8CCit + εit; Model 5. FDIit = β0 + β1GDPit + β2Inflait + β3Exchit + β4Tradeit + β5PVit + β6GEit + β7RQit + β8CCit + β9VAt + εit; Model 6. FDIit = β0 + β1GDPit + β2Inflait + β3Exchit + β4Tradeit + β5PVit + β6GEit + β7RQit + β8CCit + β9VAt + β10RLit + εit.

References

- Adam, Anokye Mohammed. 2020. Susceptibility of Stock Market Returns to International Economic Policy: Evidence from Effective Transfer Entropy of Africa with the Implication for Open Innovation. Journal of Open Innovation: Technology, Market, and Complexity 6: 71. [Google Scholar] [CrossRef]

- Ahlquist, John. 2006. Economic policy, institutions, and capital flows: Portfolio and direct investment flows in developing countries. International Studies Quarterly 50: 681–704. [Google Scholar]

- Ajide, Kazeem Bello, and Ibrahim Dolapo Raheem. 2016. Institutions—FDI nexus in ECOWAS countries. Journal of African Studies 17: 319–41. [Google Scholar] [CrossRef]

- Akbar, Minhas, and Ahsan Akbar. 2015. An empirical analysis of foreign direct investment in Pakistan. Studies in Business and Economics 10: 5–15. [Google Scholar] [CrossRef]

- Alam, Abdullah, and Syez Zulfiqar Ali Shah. 2013. Determinants of foreign direct investment in OECD member countries. Journal of Economic Studies 40: 515–27. [Google Scholar] [CrossRef]

- Anand, Prathivadi, Flavio Comim, and Shailaja Fennell. 2019. BRICS and emerging economies: An assessment. In Handbook of BRICS and Emerging Economies. Edited by Prathivadi Anand, Shailaja Fennell and Flavio Comim. New York: Oxford University Press. [Google Scholar]

- Antwi, Samuel, and Xicang Zhao. 2013. Impact of Foreign Direct Investment and Economic Growth in Ghana: A Cointegration Analysis. International Journal of Business and Social Research 3: 64–74. [Google Scholar] [CrossRef]

- Anwar, Amar, and Ichiro Iwasaki. 2021. Institutions and FDI from BRICS countries: A meta-analytic review. Empirical Economics 4: 1–52. [Google Scholar] [CrossRef]

- Anwar, Zeshan, and Talat Afza. 2014. Impact of governance indicators on FDI inflows: Empirical evidence from Pakistan. Caspian Journal of Applied Science Research 3: 16–23. [Google Scholar]

- Asiedu, Elisabeth. 2006. Foreign direct investment in Africa: The role of natural resources, market size, government policy, institutions and political stability. World Economy 29: 63–77. [Google Scholar] [CrossRef]

- Aslan, Ünal, and Zeynep Okten. 2010. The relations between FDI and democracy: Evidence from Turkey. International Research Journal of Finance and Economics 56: 111–23. [Google Scholar]

- Asongu, Simplice, Uduak Akpan, and Salisu Isihak. 2018. Determinants of foreign direct investment in fast-growing economies: Evidence from the BRICS and MINT countries. Financial Innovation 4: 1–17. [Google Scholar] [CrossRef]

- Asongu, Simplice, and Nicholas Odhiambo. 2018. Drivers of growth in fast emerging economies: A dynamic instrumental quantile approach to real output and its rates pf growth in BRICS and MINT countries. Applied Econometrics and International Development 18: 5–22. [Google Scholar]

- Axarloglou, Kostas, and Mike Pournarakis. 2005. Capital inflows in the Balkans: Fortune or misfortune? The Journal of Economic Asymmetries 2: 21–48. [Google Scholar] [CrossRef]

- Azam, Muhammad, and Muhammad Haseeb. 2021. Determinants of foreign direct investment in BRICS-does renewable and non-renewable energy matter? Energy Strategy Reviews 35: 100638. [Google Scholar] [CrossRef]

- Banga, Rashmi. 2006. The export-diversifying impact of Japanese and US foreign direct investments in the Indian manufacturing sector. Journal of International Business Studies 37: 558–68. [Google Scholar]

- Barro, Robert J., and Jong W. Lee. 1993. International Comparisons of Educational Attainment. Journal of Monetary Economics 32: 363–94. [Google Scholar] [CrossRef]

- Bbale, John Mayanja, and John Bosco Nnyanzi. 2016. Institutions and Foreign Direct Investment: Evidence from Sub-Saharan Africa Regions. Journal of Sustainable Development 9: 11–26. [Google Scholar] [CrossRef]

- Bose, Soumali, and Bindya Kohli. 2018. Study of FDI trends and patterns in BRICS economies during the period 1990–2015. Emerging Economy Studies 4: 78–101. [Google Scholar] [CrossRef]

- Botello, Juan Carlos, Martin Davila, and Carolyn Vargas. 2019. How does Colombia attract foreign direct investment? International Journal of Business and Economic Development 6: 1–14. [Google Scholar] [CrossRef]

- Brooks, Chris. 2014. Introductory Econometrics in Finance, 3rd ed. New York: Cambridge University Press. [Google Scholar]

- Buchanan, Bonnie, Quan Le, and Meenakshi Rishi. 2012. Foreign direct investment and institutional quality: Some empirical evidence. International Review of Financial Analysis 21: 81–89. [Google Scholar] [CrossRef]

- Buckley, Peter, and Mark Casson. 1976. The Future of the Multinational Enterprise. London: The MacMillan Press. [Google Scholar]

- Busse, Matthias, and Carsten Hefeker. 2009. Political risk, institutions and foreign direct investment. European Journal of Political Economy 23: 397–415. [Google Scholar] [CrossRef]

- Caves, Richard. 1971. International Corporations: The industrial Economics of Foreign Investment. Economica 38: 1–27. [Google Scholar]

- Çepni, Oğuzhan, Selçuk Gül, Yavuz Selim Hacıhasanoğlu, and Muhammed Hasan Yılmaz. 2020. Global uncertainties and portfolio flow dynamics of the BRICS countries. Research in International Business and Finance 54: 101277. [Google Scholar] [CrossRef]

- Chang, Shu Chen. 2005. The dynamic interactions among foreign direct investment, economic growth, exports and unemployment: Evidence from Taiwan. Economic Change and Restructuring 38: 235. [Google Scholar] [CrossRef]

- Chaudhuri, Sarbajit, and Shigemi Yabuuchi. 2010. Formation of special economic zone, liberalized FDI policy and agricultural productivity. International Review of Economics & Finance 19: 779–88. [Google Scholar] [CrossRef]

- Chodisetty, Murthy, and Deepshika Reddy. 2019. Impact of institutional indicators influence on FDI flows with reference to BRICS countries. An empirical research. International Journal of Innovative Technology and Exploring Engineering 8: 798–803. [Google Scholar] [CrossRef]

- Cieślik, Andrzej, and Michael Ryan. 2005. Location Determinants of Japanese Multinationals in Poland: Do Special Economic Zones Really Matter for Investment Decisions? Journal of Economic Integration 20: 475–96. [Google Scholar] [CrossRef][Green Version]

- Cleeve, Emmanuel. 2012. Political and institutional impediments to foreign direct investment inflows to sub-Saharan Africa. Thunderbird International Business Review 54: 469–77. [Google Scholar] [CrossRef]

- Coe, David, Elhanan Helpman, and Alexander Hoffmaister. 2009. International R&D spillovers and institutions. European Economic Review 53: 723–41. [Google Scholar] [CrossRef]

- Dakhlaoui, Imen, and Chaker Aloui. 2016. The interactive relationship between the US economic policy uncertainity and BRIC stock markets. International Economics 146: 141–57. [Google Scholar] [CrossRef]

- Daude, Christian, and Ernesto Stein. 2007. The quality of institutions and foreign direct investment. Economic & Politics 19: 317–44. [Google Scholar] [CrossRef]

- Delaunay, Christian, and Richard Torrisi. 2012. FDI in Vietnam: An empirical study of an economy in transition. Journal of Emerging Knowledge on Emerging Markets, 4. [Google Scholar] [CrossRef]

- Dua, Pami, and Reetika Garg. 2015. Macroeconomic determinants of foreign direct investment: Evidence from India. Journal of Developing Areas 49: 133–55. [Google Scholar]

- Duan, Yunyun. 2010. FDI in BRICs: A sector level analysis. International Journal of Business and Management 5: 46. [Google Scholar] [CrossRef][Green Version]

- Dumludag, Devrim. 2009. An analysis of the determinants of foreign direct investment in turkey: The role of the institutional context. Journal of Business Economics and Management 10: 15–30. [Google Scholar] [CrossRef]

- Dunning, John Harry. 1973. The determinants of international production. Oxford Economic Papers 25: 289–335. [Google Scholar]

- Dunning, John Harry. 1981. International Production and the Multinational Enterprise. London: George Allen and Unwin. [Google Scholar]

- Dunning, John Harry. 1988. Explaining International Production. London: Unwin Hyman. [Google Scholar]

- Dunning, John Harry. 1993. Multinational Enterprises and the Global Economy. Wokingham: Addison-Wesley. [Google Scholar]

- Dunning, John Harry, and Sarianna Lundan. 2008. Multinational Enterprises and the Global Economy, 2nd ed. Cheltenham: Edward Elgar. [Google Scholar]

- Efeoglu, Ibrahim, and Bryan Christiansen. 2014. Turkey: A rising civets star? In Handbook of Research on Global Business Opportunities. Edited by Bryan Christiansen. Pennsylvania: IGI Global. [Google Scholar]

- Epaphra, Manamba, and John Massawe. 2017. The effect of corruption on foreign direct investment: A panel data study. Turkish Economy Review 4: 19–54. [Google Scholar]

- Eren, Mesult, and Alfredo Jimenez. 2015. Institutional quality similarity, corruption distance and inward FDI in Turkey. Journal for East European Management Studies 20: 88–101. [Google Scholar] [CrossRef]

- Erkekoglu, Hatice, and Zerrin Kilicarslan. 2016. Do political risks affect the foreign direct investment inflows to host countries. Journal of Business, Economics and Finance 5: 218–32. [Google Scholar] [CrossRef]

- Fails, Matthew. 2012. Inequality, Institutions, and the Risks to Foreign Investment. International Studies Quarterly 54: 516–29. [Google Scholar] [CrossRef]

- Farzanegan, Mohammad, Mai Hassan, and Ahmed Badreldin. 2020. Economic liberalization in Egypt: A way to reduce the shadow economy? Journal of Policy Modeling 42: 307–27. [Google Scholar] [CrossRef]

- Fernandes, Ana, and Caroline Paunov. 2012. Foreign direct investment in services and manufacturing productivity: Evidence from Chile. Journal of Development Economics 97: 305–21. [Google Scholar] [CrossRef]

- Fowowe, Babajide, and Mohammed Shuaibu. 2014. Is foreign direct investment good for the poor? New evidence from African countries. Economic Change and Restructuring 47: 321. [Google Scholar] [CrossRef]

- Gammoudi, Mouna, and Mondher Cherif. 2016. Capital account openness, political institutions and FDI in MENA region: An empirical investigation. Journal of Economic Development 41: 53–76. [Google Scholar]

- Gangi, Yagoub, and Rafid Abdulrazak. 2012. The impact of governance on FDI flows to African countries. World Journal of Entrepreneurship, Management and Sustainable Development 8: 162–69. [Google Scholar] [CrossRef]

- Gorodnichenko, Yuriy, Jan Svejnar, and Katherine Terrell. 2014. When does FDI have positive spillovers? Evidence from 17 transition market economies. Journal of Comparative Economics 42: 954–69. [Google Scholar] [CrossRef]

- Guerra Baron, Angélica. 2014. Un estudio comparado de las politicas exteriores economicas: El case de los paises CIVETS. Papel Politico 19: 179–210. [Google Scholar] [CrossRef]

- Guo, Peng, Huiming Zhu, and Wanhai You. 2018. Asymmetric dependence between economic policy uncertainty and stock market returns in G7 and BRIC: A quantile regression approach. Finance Research Letters 25: 251–58. [Google Scholar] [CrossRef]

- Gupta, Priya, and Archana Singh. 2016. Determinants of Foreign Direct Investment Inflows in BRICS Nations: A Panel Data Analysis. Emerging Economy Studies 2: 181–98. [Google Scholar] [CrossRef]

- Gwenhamo, Farayi, and Johannes Fedderke. 2013. The composition of foreign capital stocks in South Africa: The role of institutions, domestic risk and neighbourhood effects. Economic Modelling 35: 763–70. [Google Scholar] [CrossRef]

- Ha, Yoo Jung, and Axèle Giroud. 2015. Competence-creating subsidiaries and FDI technology spillovers. International Business Review 24: 605–14. [Google Scholar] [CrossRef]

- Hintošová, Aneta Bobenič. 2021. Inward FDI: Characterizations and Evaluation. Encyclopedia 1: 1026–37. [Google Scholar] [CrossRef]

- Hsiao, Cheng. 2007. Panel data analysis: Advantages and disadvantages. Test 16: 1–22. [Google Scholar] [CrossRef]

- Hung, Ngo Thai. 2021. Directional Spillover Effects Between BRICS Stock Markets and Economic Policy Uncertainty. Asia-Pacific Financial Markets 28: 429–48. [Google Scholar] [CrossRef]

- Hymer, Stephen. 1976. The International Operations of National Firms: A Study of Direct Foreign Investment. Cambridge: MIT Press. [Google Scholar]

- Iman, Mohamad, and Akiya Nagata. 2005. Liberalization policy over foreign direct investment and the promotion of local firms development in Indonesia. Technology in Society 27: 399–411. [Google Scholar] [CrossRef]

- IMF. 1993. Balance of Payments Manual: Fifth Edition (BPM5). Washington, DC: International Monetary Fund. [Google Scholar]

- Iwasaki, Ichiro, and Keiko Suganuma. 2015. Foreign direct investment and regional economic development in Russia: An econometric assessment. Economic Change and Restructuring 48: 209. [Google Scholar] [CrossRef][Green Version]

- Jadhav, Pravin. 2012. Determinants of foreign direct investment in BRICS economies: Analysis of economic, institutional and political factor. Procedia—Social and Behavioral Sciences 37: 5–15. [Google Scholar] [CrossRef]

- Jadhav, Pravin, and Vijaya Katti. 2012. Institutional and political determinants of foreign direct investment: Evidence from BRICS economies. Poverty and Public Policy 4: 49–57. [Google Scholar]

- Jensen, Nathan. 2008. Political Risk, Democratic Institutions, and Foreign Direct Investment. The Journal of Politics 70: 1040–52. [Google Scholar] [CrossRef]

- John, Elena, Laura Wallenius, and Mikael Collan. 2014. The impact of Euro Area macroeconomic announcements on CIVETS stock market. Procedia Economics and Finance 15: 27–37. [Google Scholar] [CrossRef][Green Version]

- Kang, Sung Jin, and Hong Shik Lee. 2007. The determinants of location choice of South Korean FDI in China. Japan and the World Economy 19: 441–60. [Google Scholar] [CrossRef]

- Kindleberger, Charles Poor. 1969. American Business Abroad: Six Lectures on Direct Investment. New Haven: Yale University Press. [Google Scholar]

- Kinuthia, Bethuel Kinyanjui, and Syed Mansoob Murshed. 2014. FDI determinants: Kenya and Malaysia compared. Journal of Policy Modeling 37: 388–400. [Google Scholar] [CrossRef]

- Kishor, Nawal, and Raman Preet Singh. 2015. Determinants of FDI and its impact on BRICS countries: A panel data approach. Transnational Corporations Review 7: 269–78. [Google Scholar] [CrossRef]

- Kiyota, Kozo, and Shujiro Urata. 2004. Exchange Rate, Exchange Rate Volatility and Foreign Direct Investment. The World Economy 27: 1501–36. [Google Scholar] [CrossRef]

- Knickerbocker, Frederick. 1974. Oligopolistic Reaction and Multinational Enterprise. Cambridge. Cambridge, MA: Harvard Business School Division of Research. [Google Scholar]

- Kurul, Zühal, and Yasemin Yalta. 2017. Relationship between institutional factors and FDI flows in developing countries: New evidence from dynamic panel estimation. Economies 5: 17. [Google Scholar] [CrossRef]

- Kwoba, Margaret, and Patrick Kibati. 2016. Impact of Selected Macro Economic Variables on Foreign Direct Investment in Kenya. International Journal of Economics, Finance and Management Sciences 4: 107–16. [Google Scholar] [CrossRef]

- Kyrkilis, Dimitrios, and Pantelis Pantelidis. 2003. Macroeconomic determinants of outward foreign direct investment. International Journal of Social Economics 30: 827–36. [Google Scholar] [CrossRef]

- Labes, Sebastian Andrei. 2015. FDI determinants in BRICS. CES Working Papers 7: 296–308. [Google Scholar]

- Lee, Hoon, Glen Biglaiser, and Joseph Staats. 2014. The effects of political risk on different entry modes of foreign direct investment. International Interactions 40: 683–710. [Google Scholar] [CrossRef]

- Lemoine, Françoise. 2013. From foreign trade to international investment: A new step in China’s integration with the world economy. Economic Change and Restructuring 46: 25–43. [Google Scholar] [CrossRef]

- Leong, Chee Kian. 2013. Special economic zones and growth in China and India: An empirical investigation. International Economics and Economic Policy 10: 549–67. [Google Scholar] [CrossRef]

- Li, Yameng, Ruosu Gao, and Jingyi Wang. 2021. Determinants of EMNEs’ Entry Mode Decision with Environmental Volatility Issues: A Review and Research Agenda. Journal of Risk and Financial Management 14: 500. [Google Scholar] [CrossRef]

- Liargovas, Panagiotis, and Konstantinos Skandalis. 2012. Foreign direct investment and trade openness: The case of developing economies. Social Indicators Research 102: 323–31. [Google Scholar] [CrossRef]

- Lily, Jaratin, Mori Kogid, Dullah Mulok, Lim Sang, and Rozilee Asid. 2014. Exchange Rate Movement and Foreign Direct Investment in ASEAN Economies. Economics Research International 2014: 320949. [Google Scholar] [CrossRef]

- Lindblad, Thomas. 2015. Foreign Direct Investment in Indonesia: Fifty years of discourse. Bulletin of Indonesian Economic Studies 51: 217–37. [Google Scholar] [CrossRef]

- Mahembe, Edmore, and Nicholas Odhiambo. 2016. Does foreign direct investment cause economic growth? A dynamic panel data analysis for SADC countries. International Journal of Emerging Markets 11: 316–32. [Google Scholar] [CrossRef]

- Mahmoodi, Majid, and Elahe Mahmoodi. 2016. Foreign direct investment, exports and economic growth: Evidence from two panels of developing countries. Economic Research 29: 938–49. [Google Scholar] [CrossRef]

- Makabenta, Maria Peregrina. 2002. FDI Location and Special Economic Zones in the Philippines. Review of Urban & Regional Development Studies 14: 59–77. [Google Scholar] [CrossRef]

- Makoni, Patricia. 2018. Drivers of foreign direct investment in Egypt. Acta Universitatis Danubius Œconomica 14: 474–95. [Google Scholar]

- Maryam, Javeria, and Ashok Mittal. 2020. Foreign direct investment into BRICS: An empirical analysis. Transnational Corporations Review 12: 1–9. [Google Scholar] [CrossRef]

- Mason, Ryan, and Veselina Vracheva. 2017. The impact of inflation targeting on attractive foreign direct investment. The Journal of Applied Business and Economics 19: 79–94. [Google Scholar]

- Mehrara, Mohsen, Amin Haghnejad, Jalal Dehnavi, and Fereshteh Meybodi. 2010. Foreign direct investment, exports and economic growth in the developing countries: A panel data approach. Journal of Academic Research in Economics 2: 259–80. [Google Scholar]

- Mensi, Walid, Shawkat Hammoudeh, Juan Reboredo, and Khuong Nguyen. 2014. Do gobal factors impact BRICS stock markets? A quantile regression approach. Emerging Markets Review 19: 1–17. [Google Scholar] [CrossRef]

- Metaxas, Theodore, and Polyexni Kechagia. 2013. FDI through the imitation procedure: The case of China. Applied Econometrics and International Development 13: 145–60. [Google Scholar]

- Moghadam, Alireza Tavakol, Nur Syazwani Mazlan, Lee Chin, and Saifuzzaman Ibrahim. 2019. Mergers and Acquisitions and Greenfield Foreign Direct Investment in Selected ASEAN Countries. Journal of Economic Integration 34: 746–65. [Google Scholar]

- Najaf, Khakan, and Saleh Ashraf. 2016. Impact of terrorism, gas shortage and political instability on FDI inflows in Pakistan. Scientific Journal of Pure and Applied Sciences 5: 390–97. [Google Scholar] [CrossRef]

- Naude, Wim, and Waldo Krugell. 2007. Investigating geography and institutions as determinants of foreign direct investment in Africa using panel data. Applied Economics 39: 1223–33. [Google Scholar] [CrossRef]

- Ngô, Vi Dũng, Thi Bich Đào, and Ngoc Nguyn ễ. 2018. Economic and non-economic determinants of FDI inflows in Vietnam: A sub-national analysis. Post-Communist Economies 30: 693–712. [Google Scholar] [CrossRef]

- Nistor, Paula. 2015. FDI implications on BRICS economy growth. Procedia Economics and Finance 32: 981–85. [Google Scholar] [CrossRef]

- Pečarić, Mario, Tino Kusanović, and Pavle Jakovac. 2021. The Determinants of FDI Sectoral Structure in the Central and East European EU Countries. Economies 9: 66. [Google Scholar] [CrossRef]

- Pegkas, Panagiotis. 2015. The impact of FDI on economic growth in Eurozone countries. The Journal of Economic Asymmetries 12: 124–32. [Google Scholar] [CrossRef]

- Peres, Mihaela, Waqar Ameer, and Helian Xu. 2018. The impact of institutional quality on foreign direct investment inflows: Evidence for developed and developing countries. Economic Research-Ekonomska Istraživanja 31: 626–44. [Google Scholar] [CrossRef]

- Petrović-Ranđelović, Marija, Petar Mitić, Aleksandar Zdravković, Dušan Cvetanović, and Slobodan Cvetanović. 2020. Economic growth and carbon emissions: Evidence from CIVETS countries. Applied Economics 52: 1806–15. [Google Scholar] [CrossRef]

- Qureshi, Fiza, Saba Qureshi, Xuan Vinh Vo, and Ikramuddin Junejo. 2020. Revisiting the nexus among foreign direct investment, corruption and growth in developing and developed markets. Borsa Istanbul Review 21: 80–91. [Google Scholar] [CrossRef]

- Rashid, Mamunur, Xuan Looi, and Shao Wong. 2017. Political stability and FDI in the most competitive Asia Pacific countries. Journal of Financial Economic Policy 9: 140–55. [Google Scholar] [CrossRef]

- Sabir, Samina, Anum Rafique, and Kamran Abbas. 2019. Institutions and FDI: Evidence from developed and developing countries. Financial Innovation 5: 1–20. [Google Scholar] [CrossRef]

- Saidi, Yosra, Anis Ochi, and Houria Ghadri. 2013. Governance and FDI attractiveness: Some evidence from developing and developed countries. Global Journal of Management and Business Research Finance 13: 15–24. [Google Scholar]

- Sane, Malick. 2016. Determinants of foreign direct investment inflows to ECOWAS member countries: Panel data modeling and estimation. Modern Economy 7: 1517–42. [Google Scholar] [CrossRef]

- Seyoum, Mebratu, Renshui Wu, and Jihong Lin. 2014. Foreign Direct Investment and Trade Openness in Sub-Saharan Economies: A Panel Data Granger Causality Analysis. South African Journal of Economics 82: 402–21. [Google Scholar] [CrossRef]

- Shah, Mumtaz Hussain, and Zahid Ali. 2016. What Drives Foreign Direct Investment to BRICS? Putaj Humanities & Social Sciences 23: 51–66. [Google Scholar]

- Siddica, Asiya, and Tanzim Angkur. 2017. Does institution affect the inflo of FDI? A panel analysis of developed and developing countries. International Journal of Economics and Finance 9: 214–21. [Google Scholar] [CrossRef]

- Tomohara, Akinori, and Sadayuki Takii. 2011. Does globalization benefit developing countries? Effects of FDI on local wages. Journal of Policy Modelling 33: 511–21. [Google Scholar] [CrossRef]

- Tosun, Umur, Onur Yurdakul, and Varol Iyidogan. 2014. The relationship between corruption and foreign direct investment inflows in Turkey: An empirical investigation. Transylvanian Review of Administrative Sciences 42: 247–57. [Google Scholar]

- Tsaurai, Kunofiwa. 2018. Investigating the impact of inflation on foreign direct investment in Southern Africa. Economica 14: 597–611. [Google Scholar]

- Ucal, Meltem. 2014. Panel Data Analysis of Foreign Direct Investment and Poverty from the Perspective of Developing Countries. Procedia – Social Behavioral Sciences 109: 1101–5. [Google Scholar] [CrossRef]