Efficiencies of Faith and Secular Microfinance Institutions in Regions of Asia, Africa, and Latin America: A Two-Stage Dual Efficiency Bootstrap DEA Approach

Abstract

:1. Introduction

2. Literature Review

2.1. Microfinance and Women

2.2. Religion Performance and Effectiveness

3. Research Design

3.1. Research Questions

- To determine the social and financial efficiency of 129 cluster MFIs (faith and secular) with a frontier non-parametric methodology (Simar and Wilson 2007; Seiford and Zhu 2014; Wijesiri et al. 2015). This helps to identify the microfinance status in established countries;

- To determine the effect of external variables on these efficiency variables through both cluster6 and two-model7 groups, the time series as the Tobit regression model (Wijesiri et al. 2015). This helps to explore which variable can affect the MFI performance.

3.2. Data Selection

3.3. Variable Selection

3.4. Borrowing Rate

4. Methodology

5. Results

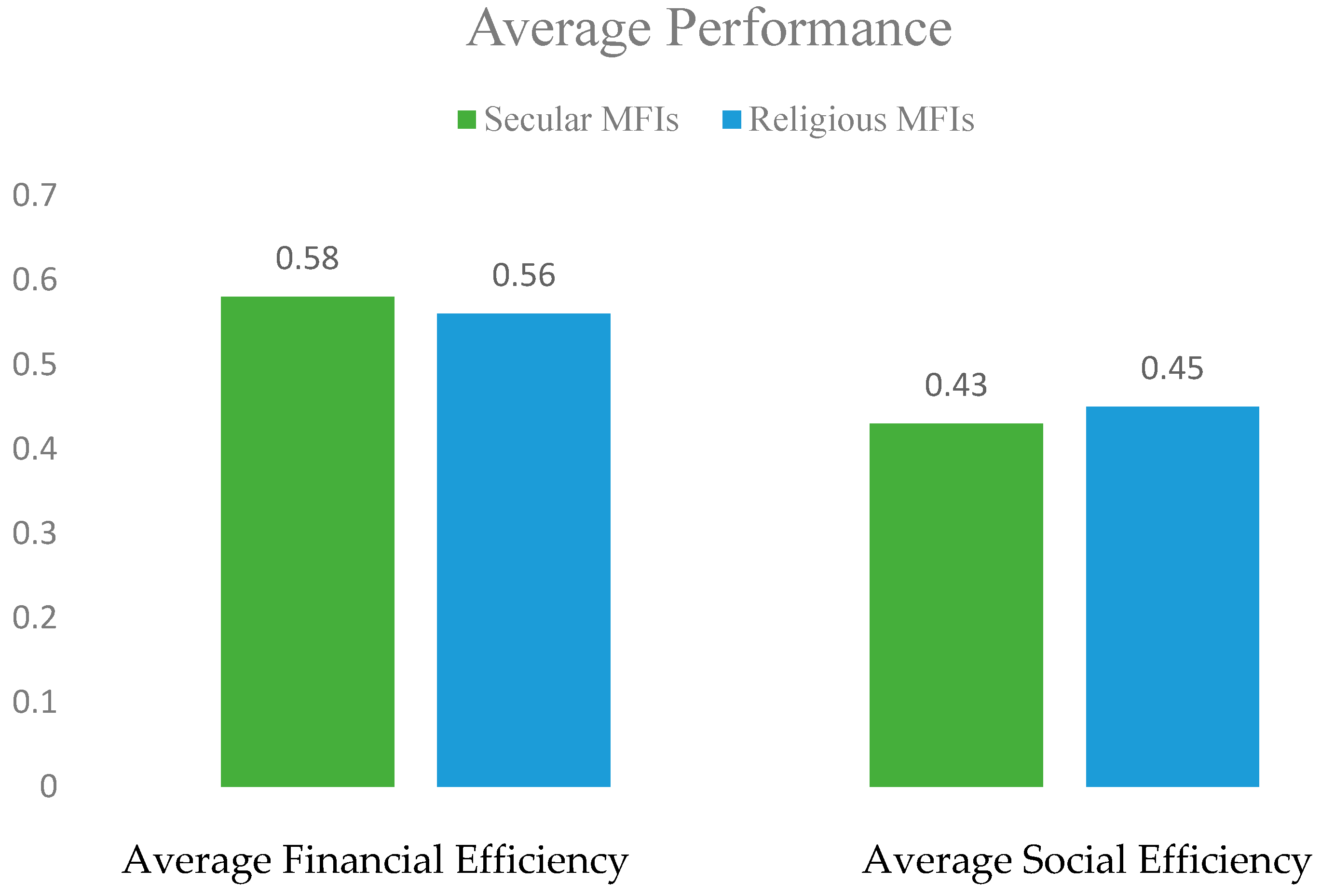

5.1. First Stage Non-Parametric Constant Rail Scale DEA Approach

5.2. Second Stage Tobit Random Effect Model Regression

6. Discussion and Conclusions

Author Contributions

Funding

Data Availability Statement

Conflicts of Interest

| 1 | NBFC—Non-bank Financial corporation. |

| 2 | NGO—Non-Government Organization. |

| 3 | ROA—Return on Assets. |

| 4 | ROE—Return on Equity. |

| 5 | Data envelopment analysis—constant return to scale. |

| 6 | All three external variables. |

| 7 | Two external variables individually. |

References

- Aggarwal, Raj, John W. Goodell, and Lauren J. Selleck. 2015. Lending to women in microfinance: Role of social trust. International Business Review 24: 55–65. [Google Scholar] [CrossRef]

- Agrawal, Pawan, and Shayan Sen. 2017. Digital economy and microfinance. The MIBM Research Journal 5: 27–35. [Google Scholar]

- Alimukhamedova, Nargiza. 2013. Contribution of microfinance to economic growth: Transmission channel and the ways to test it. Business and Economic Horizons 9: 27–43. [Google Scholar] [CrossRef]

- Amemiya, Takeshi. 1984. Tobit Models: A Survey. Journal of Econometrics 24: 3–61. [Google Scholar] [CrossRef]

- Barro, Robert J., and Rachel Mccleary. 2003. Religion and economic growth across countries. American Sociological Review 68: 760–781. [Google Scholar] [CrossRef] [Green Version]

- Belwal, Rakesh, Misrak Tamiru, and Gurmeet Singh. 2012. Microfinance and Sustained Economic Improvement: Women Small-Scale Entrepreneurs in Ethiopia. Journal of International Development 24: 84–99. [Google Scholar] [CrossRef]

- Ben Abdelkader, Ines, and Faysal Mansouri. 2019. Performance of microfinance institutions in the MENA region: A comparative analysis. International Journal of Social Economics 46: 47–65. [Google Scholar] [CrossRef]

- Charnes, Abraham, William W. Cooper, and Edwardo Rhodes. 1978. Measuring the efficiency of decision making units. Company European Journal of Operational Research 2: 429–44. [Google Scholar] [CrossRef]

- Cobb, J. Adam, Tyler Wry, and Eric Yanfei Zhao. 2016. Funding Financial Inclusion: Institutional Logics and the Contextual Contingency of Funding for Microfinance Organizations. Academy of Management Journal 59: 2103–31. [Google Scholar] [CrossRef] [Green Version]

- Daley-Harris, S. 2009. State of the Microcredit Summit Campaign Report 2009 Sam Daley-Harris. Available online: https://www.researchgate.net/publication/265114804_State_of_the_Microcredit_Summit_Campaign_Report_2009 (accessed on 11 February 2022).

- Fersi, Marwa, and Mouna Boujelbéne. 2016. The Determinants of the Performance and the Sustainability of Conventional and Islamic Microfinance Institutions. Economics World 4: 197–215. [Google Scholar] [CrossRef] [Green Version]

- Gutiérrez-Nieto, Begoña, Carlos Serrano-Cinca, and Cecilio Mar Molinero. 2009. Social efficiency in microfinance institutions. Journal of the Operational Research Society 60: 104–19. [Google Scholar] [CrossRef] [Green Version]

- Gyapong, Ernest, Daniel Gyimah, and Ammad Ahmed. 2021. Religiosity, borrower gender and loan losses in microfinance institutions: A global evidence. In Review of Quantitative Finance and Accounting. New York: Springer, vol. 57. [Google Scholar] [CrossRef]

- Hadi, Nabawiyah Abdul, and Amrizah Kamaluddin. 2015. Social Collateral, Repayment Rates, and the Creation of Capital among the Clients of Microfinance. Procedia Economics and Finance 31: 823–828. [Google Scholar] [CrossRef]

- Imam, Patrick, and Kangni Kpodar. 2016. Islamic banking: Good for growth? Economic Modelling 59: 387–401. [Google Scholar] [CrossRef]

- Kar, Ashim Kumar. 2012. Does capital and financing structure have any relevance to the performance of microfinance institutions? International Review of Applied Economics 26: 329–48. [Google Scholar] [CrossRef]

- Khan, Zahoor, and Jamalludin Sulaiman. 2015. Social and Financial Efficiency of Microfinance Institutions in Pakistan. The Pakistan Development Review 54: 389–403. [Google Scholar] [CrossRef] [Green Version]

- Lebovic, James H. 2004. Uniting for peace? Democracies and United Nations peace operations after the cold war. Journal of Conflict Resolution 48: 910–36. [Google Scholar] [CrossRef]

- Leite, Rodrigo de Oliveira, Layla Mendes, and Luiz Claudio Sacramento. 2019. To profit or not to profit? Assessing financial sustainability outcomes of microfinance institutions. International Journal of Finance & Economics, 1–13. [Google Scholar] [CrossRef]

- Li, Linyang, Niels Hermes, and Aljar Meesters. 2019. Convergence of the performance of microfinance institutions: A decomposition analysis. Economic Modelling 81: 308–24. [Google Scholar] [CrossRef]

- Liñares-Zegarra, J., and John O. S. Wilson. 2018. The size and growth of micro finance institutions. The British Accounting Review 50: 199–213. [Google Scholar] [CrossRef]

- Mansori, Shaheen, Meysam Safari, and Zarina Mizam Mohd Ismail. 2020. An analysis of the religious, social factors and income’s influence on the decision making in Islamic microfinance schemes. Journal of Islamic Accounting and Business Research 11: 361–76. [Google Scholar] [CrossRef]

- Mersland, Roy, D’Espallier Bert, and Magne Supphellen. 2013. The Effects of Religion on Development Efforts: Evidence from the Microfinance Industry and a Research Agenda. World Development 41: 145–56. [Google Scholar] [CrossRef] [Green Version]

- Mia, Md Aslam, and V. G. R Chandran Govindaraju. 2016. Measuring Financial and Social Outreach Productivity of Microfinance Institutions in Bangladesh. Social Indicators Research 127: 505–27. [Google Scholar] [CrossRef]

- Navajas, Sergio, and Luis Tejerina. 2006. Microfinance in Latin America and the Caribbean: How Large Is the Market? Available online: http://www.asbasupervision.com/en/bibl/financial-inclusion/microfinance/223-microfinance-in-latin-america-and-the-caribbean-how-large-is-the-market/file (accessed on 11 February 2022).

- Sainz-Fernandez, Isabel, Begoña Torre-Olmo, Carlos López-Gutiérrez, and Sergio Sanfilippo-Azofra. 2018. Development of the Financial Sector and Growth of Microfinance Institutions: The Moderating Effect of Economic Growth. Sustainability 10: 3930. [Google Scholar] [CrossRef] [Green Version]

- Schwarz, Susan, Alexander Newman, and Abu Zafar Shahriar. 2015. Profit orientation of microfinance institutions and provision of financial capital to business start-ups. International Small Business Journal 34: 532–52. [Google Scholar] [CrossRef]

- Seiford, Lawrence M., and Joe Zhu. 2014. Data Envelopment Analysis: History, Models, and Interpretations Chapter 1 (Issue August 2011). Available online: https://www.researchgate.net/publication/226038831_Data_Envelopment_Analysis_History_Models_and_Interpretations (accessed on 11 February 2022).

- Simar, Léopold Leopold, and Paul W. Wilson. 2007. Estimation and inference in two-stage, semi-parametric models of production processes. Journal of Econometrics 136: 31–64. [Google Scholar] [CrossRef]

- Simar, Léopold, and Paul W. Wilson. 2010. A general methodology for bootstrapping in non-parametric frontier models. Journal of Applied Statistics 27: 779–802. [Google Scholar] [CrossRef]

- Somavia, J. 2007. Why Target Women? Promoting Gender Equality and Decent Work through Microfinance in Tanzania. Available online: www.ilo.org/gender (accessed on 29 December 2021).

- Tchuigoua, Hubert Tchakoute. 2015. Capital Structure of Microfinance Institutions. Journal of Financial Services Research 43: 313–40. [Google Scholar] [CrossRef]

- Ul-Hameed, Waseem, Hisham Bin Mohammad, and Hanita Binti Kadir Shahar. 2018. Microfinance institute’s non-financial services and women-empowerment: The role of vulnerability. Management Science Letters 8: 1103–16. [Google Scholar] [CrossRef]

- Walheer, Barnabé. 2018. Aggregation of metafrontier technology gap ratios: The case of European sectors in 1995–2015. European Journal of Operational Research 269: 1013–26. [Google Scholar] [CrossRef]

- Wijesiri, Mahinda, and Michele Meoli. 2015. Journal of Retailing and Consumer Services Productivity change of micro finance institutions in Kenya: A bootstrap Malmquist approach. Journal of Retailing and Consumer Services 25: 115–21. [Google Scholar] [CrossRef]

- Wijesiri, Mahinda, Laura Viganò, and Michele Meoli. 2015. Efficiency of microfinance institutions in Sri Lanka: A two-stage double bootstrap DEA approach. Economic Modelling 47: 74–83. [Google Scholar] [CrossRef]

- Wijesiri, Mahinda, Jacob Yaron, and Michele Meoli. 2017. Journal of Multinational Financial Assessing the financial and outreach efficiency of microfinance institutions: Do age and size matter? Journal of Multinational Financial Management 40: 63–76. [Google Scholar] [CrossRef]

| Country | Institution Type | Religion Status |

|---|---|---|

| Afghanistan | NGOs | Secular |

| Azerbaijan | Credit corporative, Bank, and NBFC | Secular, Faith |

| Bolivia | Bank, and Credit corporative | Secular, Faith |

| Brazil | Bank, and Credit corporative | Secular, Faith |

| Bangladesh | NGO, Bank | Secular, Faith |

| Costa Rica | NGO, Bank, and Credit corporative | Secular, Faith |

| Colombia | Microcredit | Secular |

| Cambodia | NGO, and Bank | Secular, Faith |

| El Salvador | NGO | Secular, Faith |

| Egypt | NGO | Secular, Faith |

| Ecuador | Bank, Credit corporative, Microcredit, and NGO | Secular |

| Guatemala | Bank, NGO, Credit, NBFI corporative, and Microcredit | Secular, Faith |

| Ghana | Bank | Secular |

| India | NGO, Credit corporative, NBFI, and Bank | Secular, Faith |

| Kosovo | NGO | Secular |

| Kazakhstan | Credit corporative | Secular |

| Jordon | Bank | Secular, Faith |

| Mexico | NBFI, and Bank | Secular, Faith |

| Morocco | Bank, and Credit corporative | Secular, Faith |

| Nicaragua | NBFI, and Credit corporative | Secular, Faith |

| Peru | Bank, Credit corporative, NGO, and NBFI | Secular, Faith |

| Pakistan | NBFI, and Bank | Secular, Faith |

| Palestine | Credit corporative | Faith |

| Tanzania | Bank | Secular |

| Tajikistan | Bank, and NGOs | Secular |

| NBFI | NGO | Bank | Credit Union | Rural Bank | |

|---|---|---|---|---|---|

| Borrowings | 36 | 30 | 21 | 8 | 10 |

| Deposits/investments | 43 | 28 | 58 | 79 | 69 |

| Equity | 21 | 42 | 20 | 13 | 21 |

| Variables | Indicators | Term Definitions | Data Explanation |

|---|---|---|---|

| Input variables | Loan Officers | Dealing with authorizing loans to the clients, monitoring interest and security, responsible for outgoing credits and outstanding loans. | The database consists of 127 well-performing microfinance institutions. A total of 30 MFIs are identified as faith-based organizations and 97 MFIs are secularly operating microfinance institutions. The 30 Faith institutions are related to Catholic- and Islamic-based MFIs. These are identified by the establishment and collaborations and merging with dominating microfinance institutions. All the data are drawn from Mix.org merged with World Bank Data in the year 2019. |

| Total Assets | The absolute estimation of assets is constrained by the financial organization because of past occasions and from which future monetary advantages are relied upon to stream to the MFI. | ||

| Cost per borrower | It is the cost imposed on a borrower from loan application to the total loan repayment. | ||

| Output variables | Financial Revenue (Financial efficiency) | Revenues generated from loans, assets, other financial accumulations. | |

| Female borrowers (Social efficiency) | The percentage of women borrowers is consistently increasing periodically. The social outreach is well enough. |

| Variable | Mean | Std. Dev. |

|---|---|---|

| Total Assets (USD MM *) | 19.71 | 270.50 |

| Personal (Count) | 208 | 2190 |

| Cost per Borrower (USD) | 137 | 1065 |

| Financial Revenue (USD MM *) | 4.60 | 51.2 |

| Female borrowers (Count) | 15.709 | 681,944 |

| Correlations | Assets | Financial Revenue | Personal (s) | Female Borrower(s) | Cost per Borrower(s) |

|---|---|---|---|---|---|

| Assets | 1.00 | ||||

| Financial revenue | 0.73 | 1.00 | |||

| Personal(s) | 0.27 | 0.49 | 1.00 | ||

| Female borrower(s) | 0.22 | 0.39 | 0.64 | 1.00 | |

| Cost per borrower(s) | 0.023 | 0.024 | −0.02 | 0.64 | 1.00 |

| Country | Avg Female Borrower (%) |

|---|---|

| Afganisthan | 52 |

| Azerbaijan | 29 |

| Bolivia | 40 |

| Brazil | 46 |

| Bangladesh | 96 |

| Costa Rica | 43 |

| Colombia | 58 |

| Combodia | 68 |

| El Salvador | 70 |

| Egypt | 100 |

| Ecuador | 46 |

| Guatemale | 75 |

| Ghana | 75 |

| India | 100 |

| Kosovo | 22 |

| Kazaksthan | 64 |

| Jordon | 84 |

| Mexico | 93 |

| Morocco | 57 |

| Nicaragua | 59 |

| Peru | 43 |

| Pakistan | 95 |

| Palestine | 100 |

| Tanzania | 32 |

| Tajikistan | 34 |

| MFI (p) | Social | Financial | MFI | Social | Financial | ||||

|---|---|---|---|---|---|---|---|---|---|

| θ | θa | θ | θa | θ | θa | θ | θa | ||

| 1 | 0.45 | 0.43 | 0.86 | 0.83 | 65 | 0.72 | 0.71 | 0.90 | 0.57 |

| 2 | 0.92 | 0.67 | 0.22 | 0.62 | 66 | 0.56 | 0.50 | 0.65 | 0.32 |

| 3 | 0.93 | 0.73 | 0.36 | 0.45 | 67 | 0.38 | 0.43 | 0.69 | 0.54 |

| 4 | 0.13 | 0.14 | 0.21 | 0.30 | 68 | 0.02 | 0.02 | 0.96 | 0.86 |

| 5 | 0.01 | 0.39 | 0.19 | 0.64 | 69 | 0.02 | 0.52 | 0.34 | 0.34 |

| 6 | 0.01 | 0.47 | 0.73 | 0.57 | 70 | 0.22 | 0.51 | 0.59 | 0.33 |

| 7 | 0.00 | 0.49 | 1.00 | 0.58 | 71 | 0.36 | 0.50 | 0.43 | 0.57 |

| 8 | 1.00 | 0.45 | 0.48 | 0.44 | 72 | 0.37 | 0.73 | 0.06 | 0.45 |

| 9 | 0.80 | 0.60 | 0.51 | 0.51 | 73 | 0.89 | 0.59 | 0.67 | 0.48 |

| 10 | 0.61 | 0.44 | 0.90 | 0.37 | 74 | 1.00 | 0.61 | 1.00 | 0.44 |

| 11 | 0.31 | 0.52 | 0.22 | 0.42 | 75 | 0.98 | 0.64 | 0.56 | 0.72 |

| 12 | 0.48 | 0.33 | 0.76 | 0.75 | 76 | 0.52 | 0.53 | 0.37 | 0.67 |

| 13 | 0.48 | 0.57 | 0.67 | 0.43 | 77 | 0.08 | 0.46 | 0.79 | 0.65 |

| 14 | 0.88 | 0.21 | 0.00 | 0.37 | 78 | 0.17 | 0.54 | 0.86 | 0.41 |

| 15 | 0.02 | 0.57 | 0.05 | 0.46 | 79 | 0.88 | 0.59 | 0.17 | 0.41 |

| 16 | 0.19 | 0.27 | 0.12 | 0.14 | 80 | 0.11 | 0.62 | 0.42 | 0.41 |

| 17 | 0.00 | 0.62 | 0.00 | 0.30 | 81 | 0.87 | 0.94 | 0.19 | 0.27 |

| 18 | 0.28 | 0.61 | 0.00 | 0.60 | 82 | 0.59 | 0.42 | 0.23 | 0.50 |

| 19 | 0.58 | 0.51 | 0.94 | 0.31 | 83 | 0.76 | 0.57 | 0.07 | 0.36 |

| 20 | 1.00 | 0.86 | 0.94 | 0.43 | 84 | 0.02 | 0.59 | 0.81 | 0.49 |

| 21 | 0.83 | 0.56 | 0.75 | 0.64 | 85 | 0.54 | 0.51 | 0.63 | 0.59 |

| 22 | 0.00 | 0.45 | 0.19 | 0.59 | 86 | 0.30 | 0.51 | 0.09 | 0.55 |

| 23 | 0.94 | 0.57 | 0.20 | 0.38 | 87 | 0.00 | 0.52 | 0.89 | 0.59 |

| 24 | 1.00 | 0.84 | 0.90 | 0.71 | 88 | 0.11 | 0.43 | 1.00 | 0.55 |

| 25 | 0.01 | 0.19 | 0.21 | 0.29 | 89 | 0.46 | 0.45 | 0.56 | 0.46 |

| 26 | 0.14 | 0.07 | 0.70 | 0.53 | 90 | 0.44 | 0.58 | 0.49 | 0.47 |

| 27 | 0.62 | 0.22 | 1.00 | 0.52 | 91 | 0.29 | 0.65 | 0.83 | 0.51 |

| 28 | 1.00 | 0.21 | 1.00 | 0.62 | 92 | 0.94 | 0.64 | 0.41 | 0.27 |

| 29 | 0.01 | 0.01 | 0.26 | 0.33 | 93 | 0.70 | 0.90 | 0.10 | 0.75 |

| 30 | 0.43 | 0.14 | 0.89 | 0.61 | 94 | 0.00 | 0.18 | 0.35 | 0.57 |

| 31 | 0.77 | 0.61 | 0.42 | 0.37 | 95 | 0.00 | 0.41 | 0.50 | 0.61 |

| 32 | 0.31 | 0.48 | 0.59 | 0.50 | 96 | 0.00 | 0.41 | 0.00 | 0.37 |

| 33 | 0.49 | 0.47 | 0.08 | 0.32 | 97 | 0.79 | 0.73 | 0.99 | 0.68 |

| 34 | 0.01 | 0.29 | 0.00 | 0.16 | 98 | 1.00 | 0.87 | 1.00 | 0.87 |

| 35 | 0.00 | 0.27 | 0.31 | 0.36 | 99 | 0.93 | 0.63 | 0.69 | 0.55 |

| 36 | 0.35 | 0.51 | 0.03 | 0.50 | 100 | 0.98 | 0.63 | 0.20 | 0.47 |

| 37 | 0.22 | 0.18 | 0.55 | 0.46 | 101 | 0.85 | 0.43 | 0.71 | 0.59 |

| 38 | 0.57 | 0.62 | 0.71 | 0.61 | 102 | 0.07 | 0.49 | 0.63 | 0.57 |

| 39 | 0.69 | 0.59 | 0.93 | 0.71 | 103 | 0.62 | 0.46 | 3.63 | 0.90 |

| 40 | 0.19 | 0.11 | 0.39 | 0.31 | 104 | 0.11 | 0.57 | 0.21 | 0.44 |

| 41 | 0.41 | 0.50 | 0.87 | 0.70 | 105 | 1.00 | 0.67 | 0.04 | 0.32 |

| 42 | 0.57 | 0.53 | 1.00 | 0.58 | 106 | 0.12 | 0.20 | 0.50 | 0.44 |

| 43 | 0.27 | 0.61 | 0.69 | 0.51 | 107 | 0.26 | 0.46 | 0.63 | 0.47 |

| 44 | 0.38 | 0.40 | 0.42 | 0.52 | 108 | 0.22 | 0.17 | 0.83 | 0.68 |

| 45 | 0.80 | 0.47 | 0.99 | 0.79 | 109 | 0.73 | 0.65 | 0.36 | 0.40 |

| 46 | 0.02 | 0.49 | 0.03 | 0.30 | 110 | 0.81 | 0.44 | 0.43 | 0.56 |

| 47 | 0.33 | 0.52 | 0.01 | 0.40 | 111 | 0.38 | 0.58 | 0.45 | 0.47 |

| 48 | 0.49 | 0.63 | 0.32 | 0.53 | 112 | 0.10 | 0.49 | 0.74 | 0.46 |

| 49 | 0.13 | 0.61 | 0.47 | 0.27 | 113 | 0.28 | 0.56 | 0.68 | 0.35 |

| 50 | 0.26 | 0.36 | 0.98 | 0.56 | 114 | 0.84 | 0.48 | 0.92 | 0.48 |

| 51 | 0.59 | 0.51 | 0.98 | 0.62 | 115 | 0.62 | 0.39 | 0.76 | 0.56 |

| 52 | 0.13 | 0.53 | 0.54 | 0.54 | 116 | 0.06 | 0.36 | 0.89 | 0.60 |

| 53 | 0.61 | 0.51 | 0.50 | 0.53 | 117 | 0.21 | 0.05 | 0.70 | 0.38 |

| 54 | 0.16 | 0.46 | 0.33 | 0.46 | 118 | 0.00 | 1.00 | 0.00 | 1.00 |

| 55 | 0.05 | 0.47 | 0.38 | 0.38 | 119 | 0.91 | 0.64 | 0.3 | 0.21 |

| 56 | 0.69 | 0.23 | 0.64 | 0.44 | 120 | 0.50 | 0.40 | 0.68 | 0.64 |

| 57 | 0.14 | 0.39 | 0.88 | 0.67 | 121 | 0.00 | 0.57 | 0.00 | 0.41 |

| 58 | 0.15 | 0.59 | 0.97 | 0.43 | 122 | 0.58 | 0.61 | 0.00 | 0.19 |

| 59 | 0.10 | 0.07 | 0.33 | 0.76 | 123 | 0.80 | 0.95 | 0.73 | 0.57 |

| 60 | 0.02 | 0.29 | 0.28 | 0.57 | 124 | 0.04 | 0.11 | 0.13 | 0.34 |

| 61 | 0.32 | 0.47 | 0.57 | 0.45 | 125 | 0.55 | 0.61 | 0.80 | 0.56 |

| 62 | 0.43 | 0.25 | 0.79 | 0.31 | 126 | 0.00 | 0.36 | 0.62 | 0.70 |

| 63 | 1.00 | 0.51 | 0.89 | 0.51 | 127 | 0.01 | 0.22 | 0.10 | 0.50 |

| 64 | 0.61 | 0.54 | 0.40 | 0.56 | |||||

| Social Efficiency (θa) (127 MFIs) | Coefficient | Social Efficiency (θa) | Coefficient | Social Efficiency (θa) | Coefficient |

|---|---|---|---|---|---|

| Religion (faith) | 0.04 | Religion (faith) | −0.07 ** | Religion (faith) | −0.05 * |

| Region | 0.16 *** | Type | −0.01 | Region | 0.12 *** |

| 0.2 *** | −0.00 | 0.15 ** | |||

| −0.09 ** | 0.02 | −0.06 | |||

| Type | −0.02 | −0.04 | |||

| 0.03 | −0.05 | ||||

| −0.06 | |||||

| −0.09 ** | |||||

| −0.17 ** | |||||

| Cons | 0.63 *** | 0.51 *** | 0.57 *** |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2022 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Kolloju, A.K.; Meoli, M. Efficiencies of Faith and Secular Microfinance Institutions in Regions of Asia, Africa, and Latin America: A Two-Stage Dual Efficiency Bootstrap DEA Approach. Economies 2022, 10, 66. https://doi.org/10.3390/economies10030066

Kolloju AK, Meoli M. Efficiencies of Faith and Secular Microfinance Institutions in Regions of Asia, Africa, and Latin America: A Two-Stage Dual Efficiency Bootstrap DEA Approach. Economies. 2022; 10(3):66. https://doi.org/10.3390/economies10030066

Chicago/Turabian StyleKolloju, Adithya Kiran, and Michele Meoli. 2022. "Efficiencies of Faith and Secular Microfinance Institutions in Regions of Asia, Africa, and Latin America: A Two-Stage Dual Efficiency Bootstrap DEA Approach" Economies 10, no. 3: 66. https://doi.org/10.3390/economies10030066

APA StyleKolloju, A. K., & Meoli, M. (2022). Efficiencies of Faith and Secular Microfinance Institutions in Regions of Asia, Africa, and Latin America: A Two-Stage Dual Efficiency Bootstrap DEA Approach. Economies, 10(3), 66. https://doi.org/10.3390/economies10030066