1. Introduction

Governments in various countries, irrespective of the country’s level of economic growth, seek to initiate macroeconomic policies to achieve better economic performance to advance their level of business activities and, ultimately, ensure a better quality of life for the people. To achieve this, various approaches and interventions are applied in the process, but the outcomes are always different (

Aregbeshola 2017). According to

Bačík et al. (

2019), economic conditions and competitiveness are currently highly discussed issues that are necessary to confront within individual countries. In a period characterized by economic dynamics, economic growth, and the sustainability of economic development, most countries are concerned with the study of indicators that can help them to understand their economic situation.

The industrial complex is a significant factor in the economy of any country. However, the low level of strategic management processes in industrial enterprises and the lack of on the part of the state to make modern strategic decisions for the rapid and efficient development of abandoned production facilities for the manufacturing of goods that are able to compete and to be in demand in the European market can lead some industrial enterprises to recession and bankruptcy (

Vashchenko 2015).

The value of Russian imports in USD declined between 2013 and 2021. It was not an indication of import substitution, but weak economic development and substantial ruble depreciation. Relative to GDP, Russian imports have remained relatively stable at around 20% throughout the past two decades both in terms of USD and constant rubles. The product structure of Russia’s foreign trade has changed little during past decades. Russia’s exports are dominated by energy commodities and other raw materials. Russian imports mainly consist of investment and consumer goods and components required for their production. At the aggregate level, Russian production is not highly dependent on imported inputs. Typically, smaller economies and economies that are more deeply involved in global value chains rely more on imported inputs. Russia, a relatively large economy, participates in global value chains only in limited terms. It is heavily focused instead on commodity exports (

Simola 2022).

According to

Vertakova et al. (

2022), most regions of Russia have insignificant volumes of foreign economic activity, regardless of the state of the economic and political environment. The main volumes of foreign economic activity are concentrated in a limited number of regions. Import substitution generally refers to a policy that eliminates the importation of the commodity and allows for its production in the domestic market. The objective of this policy is to bring about structural changes within the economy. Structural changes are realized by creating gaps in the process of eliminating imports and, thus, making investments possible in the non-traditional sectors (

Bruton 1970).

Import substitution is a difficult experience for any country’s economy. Its introduction initiates change in the supply and marketing channels of many economic agents in the country. In April 2014, the Government of the Russian Federation, in response to the changed economic paradigm, implemented the State Program on Industrial Development and Improving Industrial Competitiveness. Its goal was to create a competitive, sustainable, structurally balanced industry capable of effective self-evolution with integration into the global technological environment. It also encouraged the development and application of advanced industrial technologies aimed at the formation and tapping of new markets for innovative products that would effectively ensure the economic growth and defense capacity of the country.

Import substitution policy is a set of measures aimed at stimulating the production and competitiveness of domestic goods to increase domestic demand and optimize the demand for imports. It is determined by the need to reduce the dependence of the transitive economy on economic leaders. The main objective of the policy of import substitution is to encourage national production and to develop new products to stimulate demand and import restrictions. Factors contributing to the policy of import substitution include the large capacity of the domestic market, natural resources, and the ability to provide investments in the industry due to raw materials being exported (

Chervinski 2015).

The implementation of the import substitution strategy requires a trade protection policy, which mainly includes the following (

Nassyrova et al. 2020):

Tariff protection, that is, high tariffs on imports of end-consumer goods and low tariffs or exemptions on tariffs on the means of production and intermediate goods necessary to produce final consumption goods.

Import quotas limiting the import of various types of goods to reduce imports of non-essential goods and ensuring that state-supported industrial enterprises can receive imported capital goods and intermediate products and lower their production costs.

Appreciation of the national currency to lower the cost of goods and reduce the pressure of the deficit of foreign currency, but tariffs and quotas are important safeguards in an import substitution strategy.

According to

Cherkesova et al. (

2019), import substitution is the most important element of the implementation of economic policy in Russia. The processes of spatial polarization that occurred in Russia, accompanied by several contradictory trends, led to the consideration of the problem of advanced import substitution as one of the most important tasks of federal and regional socio-economic development. Import substitution has become a key area of Russian economic policy since 2014. Despite this, various indicators for assessing this phenomenon in the Russian economy have different trends and do not allow us to make a clear conclusion about the results achieved. There is also no comprehensive assessment of the impact on economic growth (

Gotovsky 2021).

The Russian government has adopted plans for import substitution in more than 20 economic sectors. Most of these plans initially envisaged a gradual reduction in the level of foreign industrial products used in Russia and their replacement by domestic goods by up to 50–100% by 2020. Now, these plans are under review with the aim to set additional indicators to be achieved by 2024 and even 2030 (

Heidemann 2022).

Tolkachev and Teplyakov (

2019) argue that although some positive results have been achieved (e.g., in the agricultural industry and the pharmaceutical industry), there are still significant problems with the current approach. According to them, a systematic approach to import substitution should focus on stimulating the industrial base through government regulation and support, which is better than the present policy of maintaining a relatively unregulated domestic free market and relying on the import of foreign technology. They reviewed several arguments in favor and against this approach and concluded that under current economic conditions, the best way forward for the Russian economy involves the transition to a system-strategic approach to import substitution, which requires a reevaluation of macroeconomic policy and the rejection of certain liberal principles (e.g., rigid monetary policy, floating exchange rates, and abstaining from currency restrictions).

After a decade of continuous economic growth and increasing the well-being of the population, Russia and its regions are faced with serious economic and political challenges of the global crisis. As a result, the need to revise the strategy in the field of import substitution and strengthen the coordination of state and regional policy measures for the country’s sustainable economic development has become especially important. Currently, another important paradigm of development is environmental import substitution.

Balabanova et al. (

2021) argue that in these times, developed countries are also undergoing structural transformations associated with the deployment of a new environmentally oriented industrial sector. For countries that are technologically catching up, the challenge is also to critically understand the modification of this trend. Therefore, primarily, the development of environmental import substitution, integrating the resource availability of the economy and environmental imperatives and technologies for the careful use of resources and their recycling, determines the prospects for the sustainable development of the economy as a whole in the future. In addition, according to

Štefko et al. (

2021), the sustainability of the industry’s competitiveness and individual business entities depends on the successful implementation of modern technologies and the development of the intelligence industry.

In view of the above, a multi-year in-depth analysis of policy data in mainstream media was conducted at the sub-federal level. Undoubtedly, the issue of researching policy implementation is of interest as a model for assessing the effectiveness of public administration. The relationship between the results of economic agents and the effectiveness of state regional policy shows that the regional wellness of the constituent entities of the Federation is a definite goal and direction. Therefore, against the background of altered economic conditions, regional authorities have the privilege of comprehensively supporting market agents along with their early adaptation to the new economic reality. Sanctions placed on the Russian economy by foreign partners created additional opportunities for the development of the domestic software and hardware equipment market (

Seliverstova et al. 2018).

Currently, we can conduct our own independent assessment of import substitution together with analytical institutions, mass media, and other experts. Let us look at the history of Russian import substitution retrospectively.

Our focus is on the significance of state support programs. According to the conclusions of the Gaidar Institute Analytical Center, the import substitution process was active during the periods of 2014 and 2016. Then, the process ceased, and after 2018, the monitoring stopped due to a lack of visible achievements. Moreover, import substitution is implemented both in production and consumption (

Petukhova 2019). In 2018, the value of the rouble collapsed, which did not cause a symmetrical decline in imports and consumption.

It is important to note that import substitution and the refurbishment of processing facilities were launched in the late 1990s when several large national corporations were founded (Rosnano, Rosatom, United Aircraft Corporation (UAC))—and they were guaranteed government orders. The profits were supposed to be used for further recovery in the country. It is also worth noting that we do not cover the entire history of import substitution in this article. Thus, let us consider the goals of the analysis and the assessment of the results of implementing an import substitution policy.

The issue of import substitution has become especially relevant for the federal administration after the financial and economic crisis connected with foreign states’ post-2014 sanction policy towards Russia. According to

Shchebarova et al. (

2021), the economic sanctions applied to Russia since 2014 have increased the manifestation of protectionism both in relation to Russia itself and in terms of its retaliatory measures against foreign trade partners. However, these sanctions cannot be equated with the classic instruments of protectionism, but we can talk about neo-protectionism since economic sanctions are aimed at strengthening protective measures against free trade. Economic sanctions designed to reduce Russia’s influence in the economic and political spheres also have positive effects—the sanctions and counter-sanction measures led to the development of a coherent import substitution policy, which indicates that the impact of sanctions on foreign trade is weak.

On the other hand, according to

Kuznetsov et al. (

2018), the unrestrained increases in imports have had negative consequences both for Russia’s agrarian sector and its economy as a whole. The key perils of satiating the market in an uncontrolled manner with imported food are, above all, associated with declines in the profitability of domestic agricultural production, drops in economic activity, upticks in unemployment, and, consequently, a slowdown in economic growth.

According to

Vashchenko (

2015), import substitution must be an intermediate stage in the process of restructuring the country’s economy and oriented towards developing new directions in industry and modernizing producing processes, ensuring the transition to an export-oriented model of economic development. Today, countries with economies in transition are interested in import substitution policies because they face problems with a negative foreign trade balance and low competition for national goods in the international market. Therefore, import substitution is an approach that can solve all these problems.

Chernova and Kheyfets (

2018) stated that the policy of import substitution is part of the implemented industrial policy aimed at the modernization of national industries and the production of competitive products. Modernization involves the technological re-equipment of economic sectors based on a high rate of renewal of fixed assets, the growth of the innovative activity of enterprises, the implementation of new technologies and advanced management methods, the growth of labor productivity, large-scale investments, and the development of human capital.

To answer the question of whether individual industries and regions of the country adapted to the changed macroeconomic conditions when implementing the import substitution, it is necessary to analyze statistical data and, on that basis, create a model that illustrates the positive structural shifts in the economy of entities and their industries. Some scholars and politicians believe that the 2014 crisis had the least impact on the country’s economy compared to other economic shocks of the past. However, only the identification of structural shifts in the economy and analysis of the impact of the ongoing import substitution in each region will make it possible to draw a conclusion about the actual situation and the effectiveness of economic measures taken by the regional administration in the current environment.

2. Literature Review

This paper highlights the issues of import substitution in the context of attaining total macro-economic balance, market adaptation, and new levels of regional economic development as a constituent part of the national economy. In addition, we do not deny that import substitution can be considered in a narrower sense as a substitution of products and technologies, the latter of which have become inaccessible for economic and political reasons.

In the 1950s, many economists believed that import substitution—policies to restrict the importation of manufactured goods—was the best trade strategy to promote industrialization and economic growth in developing countries. By the mid-1960s, however, there was widespread disenchantment with the results of such a policy, even among its proponents. Perhaps surprisingly, early advocates of import substitution were quite cautious in their support for the policy and were also among the first to question it based on the evidence derived from the country’s experiences (

Irvin 2020).

Researching the outcome of import substitution policies is a vital issue in many experts’ works. According to

Baer (

1972), the period of import substitution has ended in all nations that were industrialized after Great Britain.

Kuznetsova and Tsedilin (

2019) investigated expert opinions and conclusions based on a comparison of imports and exports between 2014 and 2018. After the market adjusted to new conditions and a new weakened rouble exchange rate (in relation to 2014), imports in some sectors of the country increased. The authors arrived at the following conclusion: the modern epoch of production internationalization and digital transformation connects national economic success with the integrity of global value chains (GVCs), where efficient functioning becomes impossible without imports. Consequently, the declared import substitution policy may become less effective.

Berezinskaya and Vedev (

2015) defined import substitution policy as a national production driver. The potential of the policy and the direction of its implementation were the focus of their analysis. The authors concluded that the Russian economy of 2014 was too import-dependent (that is, it was too dependent on raw materials for many production sectors). The authors view the backwardness of the production chain as a threat to the efficiency of import production. After analyzing the results of our research, it is important to note that the authors’ opinion was correct; dependence on imported material, components, and technology have not been fully overcome.

A more objective view on import substitution can be seen in the study by

Aregbeshola (

2012), which illustrates the experience of Brazil and South Africa. Brazil’s import substitution policy turned out to be effective even in the presence of serious bureaucratic barriers. Its practical value was based on the division of industries into export-oriented (which were protected and supported) and those accessible for direct foreign investment. The policy enabled the country’s GDP to increase by 7%. Since then, investments have been made in infrastructure and production facilities, which have spurred economic and tax growth and made the country more investment friendly. The development of South Africa was limited for several reasons. Firstly, there was a lack of demand for goods from developing countries in the markets of developed countries because of insufficient competitive advantages. Secondly, there was a considerable dependence on the export of natural resources. At the beginning of the development of the import support policy, special government aid grants were issued, and sectors of strategic importance were defined. Politically, much attention was given to the production of final goods and intermediate consumption. Moreover, after the refurbishment of internal production facilities and the saturation of the domestic market, it became possible to export these goods.

Kiliçaslan and Temurov (

2016) assessed the effectiveness of import substitution in the context of identifying the correlations among import substitution, labor productivity, and competitiveness, using the example of manufacturing industries in South Korea and Turkey. In addition, in the work by

Aregbeshola (

2017), the effectiveness of import substitution was studied from the point of view of its impact on economic growth in the BRICS countries using econometric methods.

Ko et al. (

2014) proposed to evaluate the effectiveness of import substitution using an aggregate coefficient of import substitution, which is the sum of the weighted coefficients for the import of industries or groups of industries in which the relative size of the industry is the measure of weight.

Having considered various approaches to import substitution policy, it is worth noting that its effectiveness is, in most cases, defined by the efficiency of state institutions—as they bring financial support to competitive economic agents—and the activity of economic agents, their interest, and business initiative in the presence of considerable technological import dependence, as shown by the example of Russia.

There are only a handful of studies that attempt to measure the impact of the sanctions against the Russian Federation and their countermeasures. Strong pre-sanction economic ties between Russia and the sanctioning countries make this case particularly instructive.

Dreger et al. (

2016) evaluated the macroeconomic impact of the sanctions’ regime using a multivariate VAR model. They found that the sanctions had a limited impact and attributed the downturn in the Russian economy to the decline in oil prices in early 2015.

Crozet and Hinz (

2020) estimated the effect of the sanctions’ regime on trade, i.e., the exports of both sanctioned and sanctioning countries. They found significant “friendly fire”, where even firms that were not directly impacted by any measure nevertheless exported significantly less to Russia. They also noted that firms directly affected by the Russian embargo on food and agricultural products were able to recoup only a fraction of the lost exports in other markets via trade diversion. One study that attempted to assess the consequences of Russia’s import restrictions was

Boulanger et al. (

2016), where the authors simulated the short-run impact of the Russian food embargo on the Russian and European economies in a computable general equilibrium (CGE) exercise. According to their estimates, Russia lost EUR 3.4 billion of real income, equivalent to a 0.24% reduction in per capita utility. At the same time, the EU-28 lost EUR 128 million or 0.0025% of per capita utility. They modeled the Russian import ban as a loss in existing trade preferences, leading to a reduction in consumer utility.

3. Methodology

The methods of quantitative analysis of import substitution developed and presented in the scientific literature make it possible to assess the potential of import substitution based on both individual and complex indicators (

Chernova and Kheyfets 2018).

Ershova and Ershov (

2016) developed an integral indicator of import substitution effectiveness that helps group regions of the country into leading (high efficiency), median (average efficiency), and stagnant (low efficiency).

Borovkova and Tikhanovich (

2017) calculated the integral effectiveness indicator as the sum of partial indicators of performance (the coefficient of import dependence, the share of innovative products, the coefficient of import coverage by export, etc.) and weighting factors that characterize the degree of influence of each criterion on the final indicator. A separate group of studies consists of scientific works in which the authors used a matrix model for assessing the effectiveness of import substitution. In particular, the model, which is based on the system of national accounts using the input–output method of analysis, was implemented in the works of

Tatarkin et al. (

2017) and

Strizhkova (

2016). In assessing the effectiveness of import substitution, the balance method was also used. For example, the technique used by

Losev et al. (

2017) was based on the comparison of two sets of indicators—the volume of production and import of goods and the volume of consumption of goods on the domestic market and their export.

To identify the positive results of the import substitution policy at the level of regions and industries, the algorithm proposed by the authors was used in the current study. A panel data model with a determined effect and dummy variables was applied to analyze the effect on the outcome of regional economic policy.

Mironova (

2018) evaluated the effectiveness of import substitution in various economic sectors by studying the dynamics of absolute and relative indicators of imports and exports of the Russian Federation.

Conolly and Hanson (

2016) assessed the effectiveness of import substitution by analyzing energy prices, imports and exports, gross domestic product, as well as investment activity in the country.

Chernova and Klimuk (

2017) built their assessment of the effectiveness of import substitution on the analysis of statistical data on the share of exports and imports in Russia’s GDP in comparison with the leading countries of the world.

Ullrich (

2017) assessed the effectiveness of import substitution in Russia by analyzing the dynamics of indicators such as gross domestic product, exports, imports, the rouble exchange rate, and the cost of import substitution programs.

In the work by

Levine and Renelt (

1992), variables were presented to describe the gross regional product (GRP), including data on the investment share of the GDP (INV), the initial level of the real GDP per capita in 1960, the initial secondary school enrolment rate (SEC), and the average annual rate of population growth (GPO).

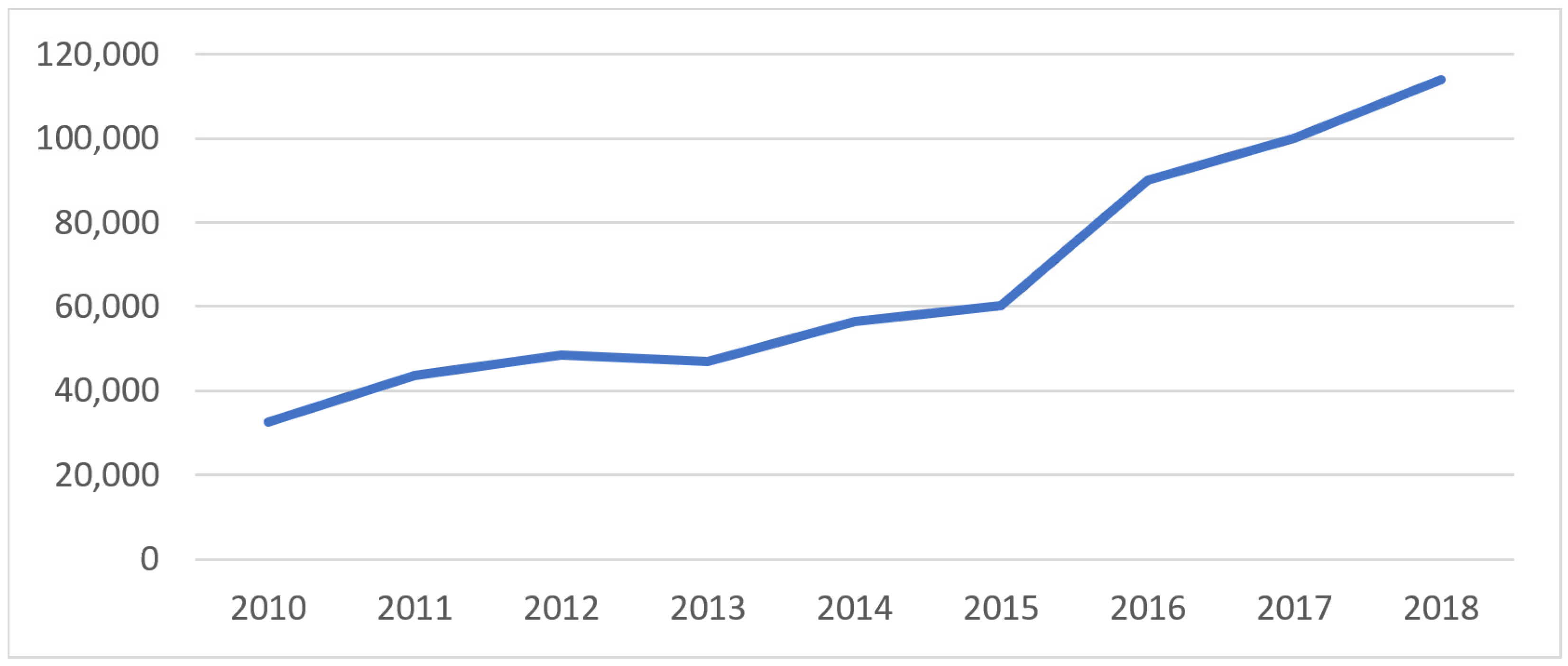

The study was based on the official statistics of the Russian Federation by sectors of the economy. The observations of 80 Russian regions during the period of 2010–2018 (except for the Republic of Crimea and Sevastopol, a city of federal significance and two autonomous territorial districts) were used in our study. To estimate the effectiveness of the import substitution policy in Russian regions and sectors, we had to refer to the data on the value of the GRP per capita, the regional structure of the value added in economic sectors, and the data of the GNP deflator. It was possible to distinguish the data on the following sectors: agriculture, fishing industry (fish farming), mining, and manufacturing, which are supported by the Federal Centre as priorities. Using the deflator data, we made the values of the added value commensurate with the data of 2010 via discounting, which is the basis of our research.

The authors believed that the choice of this indicator as an effectiveness indicator of the import substitution policy would test the hypothesis that a successful economic policy directly depends on how these sectors of the country’s economy are developing and integrating into the regional system of economic relations. Accordingly, the volume of the output and work performed and the services rendered in these industries will contribute to a systematic increase in the share of GRP per capita.

It is worth presenting the reasons for the factors considered in the current research. Firstly, we were interested in the events following 2014. The year 2010 was the starting point for the recovery of the Russian economy after the world financial crisis of 2008–2009. The choice of 2018 as the last year in our study can be explained by the limited statistical data, which are insufficient for a complete picture. Secondly, regarding the choice of Russian regions and branches, some industries are aggregated into sectors. Thirdly, there are numerous techniques for economic growth analysis. Our study tested the hypothesis that economic growth in a region can be estimated through the GRP per capita. It should also be noted that the data reflect the economic growth very accurately, as there were no visible population changes in the region. In addition, the currency rate used in this study was 65 roubles per USD 1.

The region selection algorithm is based on the classification of regions regarding the changes in the economic growth data of 2015. This means that we identified regions as having economic efficiency if they experienced end-to-end growth before and after the given year or a decline and growth in relation to 2015 in the selected sectors. On the contrary, we identified a region as economically “depressed” if it experienced a steady decline or growth during 2010–2014 and a decline after 2015. In addition, the aggregated data do not consider the role of an industry in a regional economy, so we introduced a 20% tail cut-off limit. This means that we ranked the regions by industry proportion and excluded the ones where the industry under analysis was too small-scale for our study.

Figure 1 presents a table with the proportions and cut-off levels.

Table 1 depicts the figures that illustrate samples of efficient economic policy.

It is important to note that maintaining agriculture and mining operations imposes tight restrictions on a region; it must have an ideal location, the presence of mineral resources, and other factors. The share of manufacturing in the economic structure is undoubtedly significant in itself, but ranking by significance and defining economic ties may lead to entirely new research. We used soft limits to highlight significant regions in manufacturing.

To estimate the effect of the policies held in a region and the management quality, we used a fixed-effect (FE) model for the panel data. It enabled us to dispose of time-invariant factors (e.g., the geographic location of a region and other factors not under observation). In order to analyze the phenomenon we have described, we defined the period of 2015–2018 for economically efficient regions as a dummy variable and included it in our model. From the viewpoint of descriptive statistics, there is a certain heteroscedasticity of the tails, as the regions under consideration differed considerably in their level of economic growth; thus, to estimate the coefficients of the model, we used standard errors resistant to heteroscedasticity. To get accurate estimates of the economic effect of the management policy, we added several meaningful variables to approximate the data. For example, economists frequently refer to the data on unemployment, data on labor productivity, real population incomes, investment per capita, and the volume of factors of capital production. We used the logarithm of the given factors in our model to perform regression analysis, as follows:

where y

it is the GRP per capita,

is the unemployment, labor productivity, investment per capita, capital production means, and real income, Dummy is the efficient level of regional management, and ε

it is the residuals; individual effects α

i and the slope coefficient β enter the model additively instead of interactively.

The results of the calculations and tests are presented in the following section.

4. Results and Discussion

In accordance with our methodology of selecting regions with effective state regional policy, the following results were obtained: only 29 regions out of 80 regions under observation demonstrated good effectiveness in terms of import substitution. It is worth noting that if we made the cut-off level of the industry significance higher for the region, it would reduce the number to 5 regions out of 80. In addition to the regional point of view, we can also provide an industrial point of view. The calculation results for the regions are presented in

Table 2.

These calculations can make it possible to draw conclusions about the impact of the financial and economic crisis on the Russian economy, which led to the policies. A precautionary measure for Russians in an economic downturn is an increase in savings (

Vasilova et al. 2018). It is obvious that in the current unstable economic situation, enterprises are massively reducing their workforce; however, the amount of work remains the same and falls on the shoulders of existing employees (

Rudaleva and Mustafin 2017). As we mentioned earlier, the national Russian economy has been influenced both by sanctions of foreign states and countersanctions by the Russian government.

Table 2 directly reflects the results of the impact. Firstly, because of the food embargo, Russian national agriculture, as well as the fishing industry, received additional advantages that allowed at least half of the sector to increase its production capacity. What is more, the depreciation of the national currency led to an increase in the cost of imports, which played a considerable role in the production process, but it led to a decrease in the production of another part of the sector. Secondly, the weakening of the national currency should have had a positive impact on mining and manufacturing as the most export-oriented sectors. However, here we observed the issue mentioned earlier; the increased cost of imports and the use of imported technologies have failed to realize the economic potential of these sectors.

After we divided the regions according to the criteria of the effectiveness of the economic policy, we tested our hypothesis. For this, we used a panel data model of different specifications. Our attention was also drawn to the random-effect model with dummy variables; however, the Hausman test revealed that, in our case, the first model—the fixed-effect model with dummy variables—was preferable.

According to our earlier assumption, our model contains heteroscedasticity. We can confirm this based on the modified Wald statistic for groupwise heteroscedasticity in the residuals of the fixed-effect regression model. The test results are presented in

Table 3, and the estimates of the model coefficients, the Hausman test, and the dummy weight in the regression data are presented in

Table 4 and

Table 5.

After we disproved the hypothesis of the homoscedasticity of the tails, we obtained standard errors resistant to heteroscedasticity. The model estimation results are given in

Table 4.

Analysis of the table confirmed that our model is significant in general. In addition, the regression factors “Investment per capita” and “Level of unemployment” were excluded because they resulted in insignificant estimations. Significant results were obtained regarding the real incomes of the population, which, in this time interval and model, had contrary dependence in relation to the GRP level. Nevertheless, our mission was to check the significance of the dummy variable, which showed a 1% significance with the robust standard errors.

The results of the model demonstrate that the regions defined as having effective import substitution policies presented a 3 to 17% GRP level per capita in comparison to other regions. As previously mentioned, the FE model has the advantage of excluding time-invariant variables and other characteristics beyond the scope of observation, which leads to estimation accuracy. Therefore, it is safe to say that effective economic policies lead to higher levels of economic growth.

This conclusion can be compared with the study by

Kwon (

2010), who conducted research on a sample of companies in the United States. The results indicate that import substitution offers great potential as a driver for regional economic development. Advancing an overall awareness of sustainability and regional economic stabilization has indeed increased the need for reconsideration of this strategy. Local-serving industries provide a multiplier effect as valuable as those associated with exporting industries, and the substitution of imports may induce the promotion of such local-serving industries. In particular, import substitution has been proven to be effective in certain industries, including agriculture, food, health care, and retail.

According to

Conolly and Hanson (

2016), reducing Russia’s import dependency can be seen, therefore, as achieving two ostensibly economic objectives that, in fact, have a broader political purpose. First, building new and (usually) high-technology industries will help Russia in its seemingly perpetual quest for modernization. If successful, this would result in higher incomes and better jobs for the population. Second, reducing import dependency in strategic areas would insulate Russia from the possible threat of economic sanctions and trade embargoes by geopolitical competitors.

The policy of import substitution in Russia is connected to an attempt to restore, modernize, and build the missing production elements of the national economy, that is, mainly a vertical one. However, it will be limited in terms of its “useful application”, and it will be systematically delayed, focusing mainly on price competitiveness to generate the expansion of an economy that is especially sensitive to exchange rate fluctuations in the absence of a connection with horizontal measures of certain critical technologies’ development, the formation of new knowledge areas, and recreation of the missing scientific competencies. In fact, a policy of pre-emptive import substitution is required. A policy oriented toward emerging markets is aimed at increasing the economic security of the Russian economy in the global market (

Cherkesova et al. 2018). The proposed concept of environmental import substitution in the Russian economy of a technologically catching-up type is based on the systematic formation of favorable conditions for the reproduction of industrial, intellectual, and social capital corresponding to modern technological structures, the launch of cluster mechanisms for the accelerated innovative development of the manufacturing sector, and the stimulation of domestic demand for its products (

Balabanova et al. 2021).

Due to the status of Russia in the world economy, the foreign-economic policy currently is playing an important role in the development of national security and the state’s interest in the spheres of economy considering external and internal threats. A decline in external economic conditions may result in serious consequences for the functioning and development of the country as well as for the trade and investment activities, which will further lead to a decline in export, the withdrawal of capital, a recession of industrial production, trade, and the investment sphere, and the fall of GDP and living standards. Thus, considering the current state of instability in the world economy and the growing political tension in relation to the Russian Federation, measures to increase economic security in the country should be taken. The policy of import substitution is considered to be one of the major solutions nowadays (

Makasheva et al. 2016).

The sanction standoff between Russia and the West opened up new opportunities for Russian food manufacturers. A new import substitution policy declared by the government restricted the access of the leading foreign countries to the market and unlocked a potential for internal development. Russian producers spotted new niches in the food market. There exist numerous obstacles to assimilating new market prospects: organizational (logistics, infrastructure, etc.), investment, legal, economic, etc. (

Chernova et al. 2017). According to

Nassyrova et al. (

2020), an important factor that prompted countries to implement import substitution was the weakening trade deficit which caused a shortage of foreign currency due to fluctuations in world commodity prices. Today, countries are deliberate in their import substitution strategies. Moving industrial investment in countries gives the opportunity to stimulate the production of locally produced goods, reduce imports and help domestic companies master new technologies.

Aksenova and Prikhodko (

2016) suggested increasing enterprises’ activity efficiency due to modernization actions. The modernization of industry is an essential and objective necessity caused by the desire of states to support long-term socio-economic stability, increase economic power, strengthen the international positions of the country, and ensure economic security. They concluded that there is a significant impact of industry modernization on the sustainable development of enterprises and the economy as a whole. The authors suggest that as the development model changes, and new approaches, partnerships, and relationships develop, the main tasks of industrial enterprises should be finding solutions to the problem of risk management and strengthening economic security. The prospects of industrial production development in Russia, aimed at meeting the growing domestic demand, are quite favorable with appropriate funding of scientific research in the field of new equipment.

The important role of import substitution in the economic security protection of a state and its regions, especially in times of crisis and geopolitical and economic instability, was proved in a study by

Georgievich et al. (

2015). The authors argue that the problem of import substitution is not a modern, trendy scientific stream. The issue of the displacement of imported goods by domestic ones was brought up in famous classic theories of mercantilists. They presumed that an active policy of import substitution in the industry might become the driver of regional economic development.

Golova (

2021) argues that import substitution has a two-fold task:

- (a)

to ensure the economic independence of the country,

- (b)

to upgrade its production in a timely manner, considering promising science and technology developments.

Accordingly, it is necessary to distinguish two aspects in the structure of import substitution. The first one is common import substitution aimed at reducing dependence on foreign suppliers by using production technologies available in the country and (or) copying foreign products. The second is innovative import substitution characterized by the constant monitoring of technology markets, analysis of scientific results, and development of advanced technologies; knowledge and experience gained are necessary for the timely upgrading of production facilities and creation of competitive alternative products and new technologies. Both aspects of import substitution are important for ensuring economic security; however, the innovative aspect is a priority for countries lagging in technological development (

Golova 2021).

The issue of economic modernization remains of current interest but stays unsolved, especially in the branches where the issue of import substitution is crucial: industry, agriculture, etc. The types of economic activity that can be labeled as open to import substitution are the ones with high or medium indicators of competitiveness, investment, and innovation activity. Within those types, the import substitution policy can be implemented without a threat to economic security. The analysis of the main features of import substitution, such as the levels of competitiveness, innovations, and investment by the types of economic activity, is the basis for working out a smart import substitution policy, which will carry no threat to the country’s economic security. The main types of economic activity with a high dependency on imports are metallurgical production, chemical industry, wood processing, electrical machines and equipment production, machinery and equipment production, textile manufacturing, fishery, and fish farming (

Andreeva et al. 2015).

5. Conclusions

In determining whether the regions were able to find competitive advantages in the changed economic situation, we also analyzed the data of economic activity by industry by region. In many ways, in the economic crisis of 2014, which was caused by a change in external non-economic conditions, a significant depreciation of the national currency had a negative impact on the country’s regions. For many of them, it was difficult to trace unambiguously positive or unambiguously negative structural shifts. It should be noted that the current structural changes prevented naming all economic movements in all regions, so the analysis relied on the regions with the most significant shares of production in the volume of GRP.

We summarized the overall data for the regions according to federal districts, which are administrative–territorial units of a new type within the framework of the All-Russian Classifier of Economic Regions:

The Central Federal District.

In the Belgorod region, there was a drop in food, fabrics and textiles, and footwear production but an increase in finished metal products. In the Bryansk region, we observed a decline in food, fabrics, and goods production, as well as in the production of paper. In the Vladimir region, positive structural shifts occurred in terms of the adaptation of enterprises producing food, fabric, and textiles, as well as those producing finished metal goods, but the manufacture of machinery and equipment, as well as electronic equipment declined. In the Tula region, there was a decrease in the following types of economic activity: the production of machinery and equipment, the manufacturing of motor vehicles, and the production of electronic equipment. In the Moscow region, there was an increase in the production of electronic equipment and finished metal products, accompanied by a decline in the production of machinery and equipment and food products. It is worth saying that in Moscow and the Yaroslavl region, there was an increase in the manufacture of machinery and equipment and motor vehicles.

Northwestern Federal District.

In the Kaliningrad region, there was a decline in the production of both machinery and equipment and in the production of electronic equipment. In the Pskov region, food production increased, but the production of electronic equipment declined. In the city of St. Petersburg, there was a significant drop in food production and the production of machinery and equipment.

North Caucasian Federal District.

In the Karachay-Cherkess Republic and the Republic of North Ossetia-Alania, there was an increase in food production.

Volga (Privolzhsky) Federal District.

In the Republic of Tatarstan, the production of food, machinery and equipment, and electronic equipment declined. In the Udmurt Republic, there was a process of adaptation in the production of machinery and equipment, and electronic equipment, but the volume of food production and other industries decreased. In the Perm Krai, there was an increase in finished metal products, as well as an increase in the production of machinery and equipment. In the Ulyanovsk region, an interesting trend was noted, whereby the crisis of 2014 did not have an impact on growth in the production of machinery and equipment, and this was also true for the Nizhny Novgorod region.

Ural Federal District.

In the Chelyabinsk and the Sverdlovsk regions, there was a decline in the production of finished metal products, particularly pipes. In addition, in the Kurgan and Sverdlovsk regions, the crisis of 2014 had a positive impact on the production of machinery and equipment, as well as on the manufacture of motor vehicles.

Siberian Federal District.

In all regions of this federal district, we noticed a decline in food production. Such results may be due to the inflationary growth in prices, which led to a drop in the sales volume of goods.

Far Eastern Federal District.

In the Kamchatka Territory and the Sakhalin Region, food production increased, but similar economic activity decreased in other regions of the district.

The data obtained indicated that a number of industries suffered from the sanctions, and the implemented policy of import substitution did not restore the volume of production to the pre-crisis level.

Import substitution has been a top priority of Russia’s economic policy in recent years. Complex geopolitical conditions, Western sanctions and consequent Russian countermeasures necessitated urgent compensation for the reduced volume of imported goods through increasing domestic production. Despite a significant rise in the number of publications on the problems of import substitution policy, the issues of assessing the efficiency of the ongoing policy are yet to be studied (

Kheyfets and Chernova 2019). The economic growth of a country concerned depends on the development of its regions, especially on the development of the regions that have better results in comparison with the other ones (

Malyarets et al. 2022). Based on the findings of this study, we are confident that the food embargo imposed on the agricultural sector has empowered its volume of production. However, there are still many regions in which there are no significant indications of this phenomenon. Other sectors of the economy, such as mining and manufacturing, have not managed to fully adapt to the new conditions. Many experts and scientists have reported similar conclusions and have proved considerable technological dependence on imported technologies and components.

Regarding our hypothesis, we arrived at the following conclusion. The regions that managed to implement effective import substitution policies (after 2014) also managed to achieve higher economic growth. This hypothesis was confirmed by our model. According to this model, the effect of the import substitution policies was estimated at an average value of 10%. This means that the GRP per capita in the regions with an effective import substitution policy was 10% higher than in the regions that did not manage to react adequately to the altered economic conditions.

Given all the limitations of the model, the proposed hypothesis enabled us to identify general macroeconomic changes in the import substitution policy pursued by the regions of the country. In order to answer the question more accurately, it was necessary to consider certain types of production and sales volumes of goods by investigating the availability of similar types of production, their importance in the value creation in the country’s economy as a whole, the significance for consumer demand, and the possibility of implementing an import substitution policy without serious threats. The data on Russia’s imports suggested that a substantial share was the import of machinery and equipment, which exposed the economy to some degree of dependence. For example, the import share of machinery and equipment in total imports to Russia in 2017 amounted to 54.93%, compared to 54.20% in 2011, which reflected a certain consistency in the structure of the country’s imports, even with the implementation of government programs aimed at increasing the competitiveness of Russian industries and carried out using budget funds. It can also be concluded that a comprehensive reduction in production costs within the framework of a vertically integrated approach with a proportional drop in retail prices should solve the problem of effective consumer demand and increase the export potential of manufacturers.

The research enabled us to identify individual regions of the country where we observed positive trends in the effectiveness of import substitution. In further studies, we plan to identify the institutional conditions that led to the results observed and, if possible, to systematize this experience when making a recommendation based on the data obtained.