Public Expenses in Education and Youth Unemployment Rates—A Vector Error Correction Model Approach

Abstract

1. Introduction

- (i)

- Do total public expenditures in education and the country’s real economic growth rate affect the country’s youth unemployment rates in the short and long run?

- (ii)

- Do public expenditures in higher education and the country’s real economic growth rate affect the unemployment rates of youth graduated from tertiary education in the short and long run?

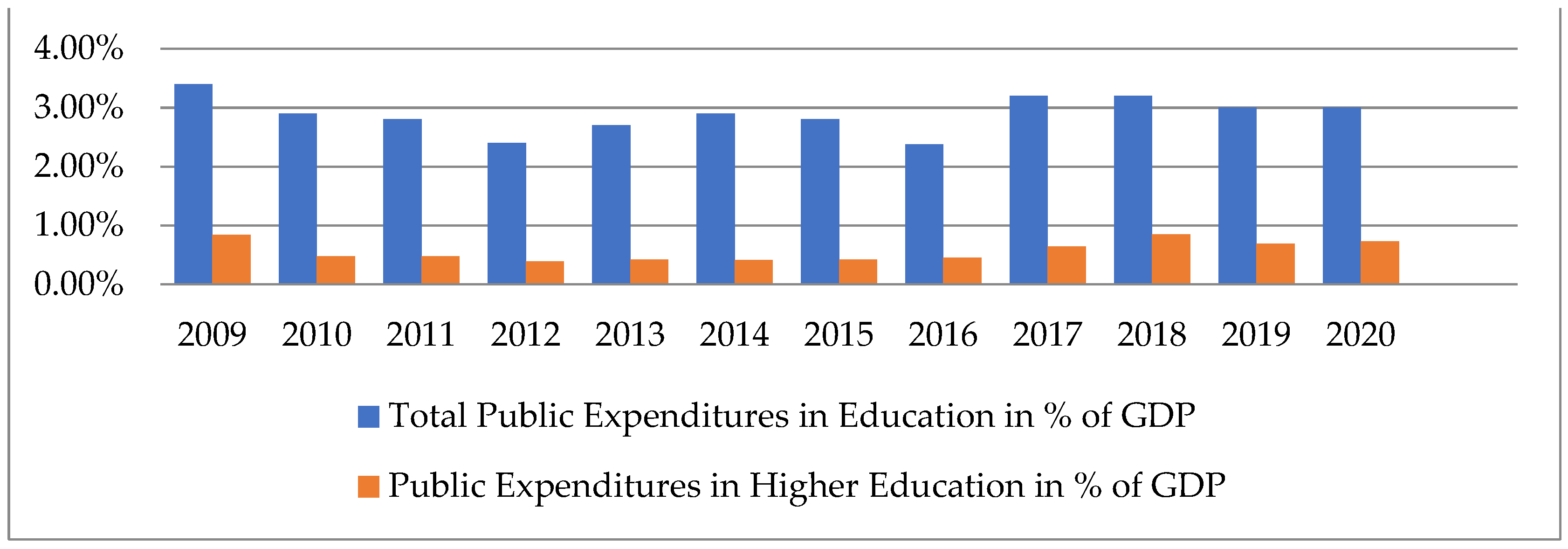

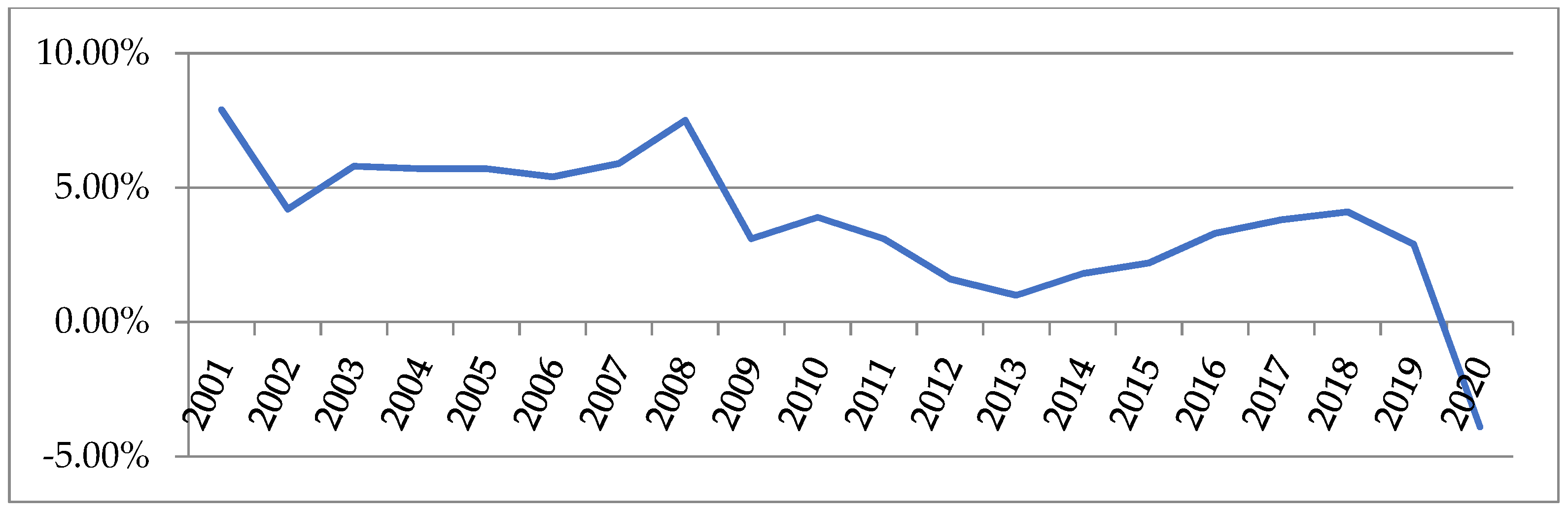

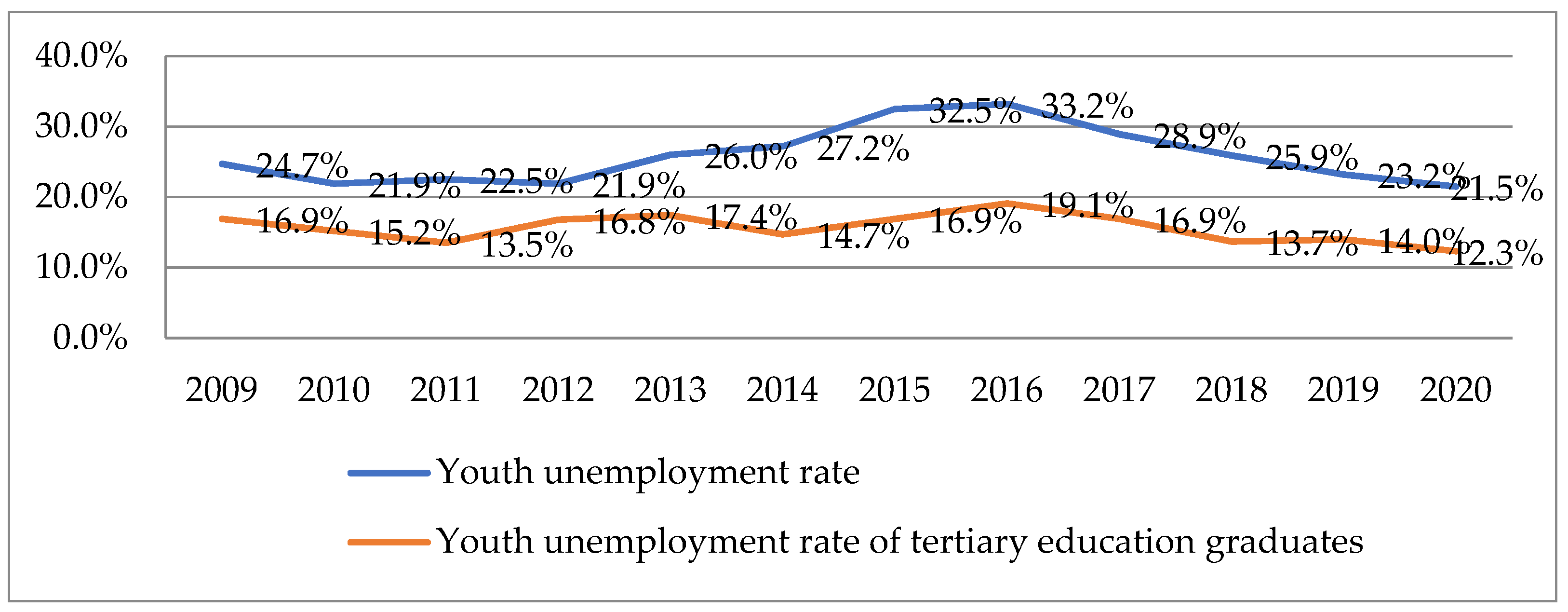

2. A Panorama of Education and Youth Unemployment Rates in Albania

3. Literature Review

“Education is a leading determinant of economic growth, employment, and earnings. Ignoring the economic dimension of education would endanger the prosperity of future generations, with widespread repercussions for poverty, social exclusion, and sustainability of social security systems.”

4. Methodology

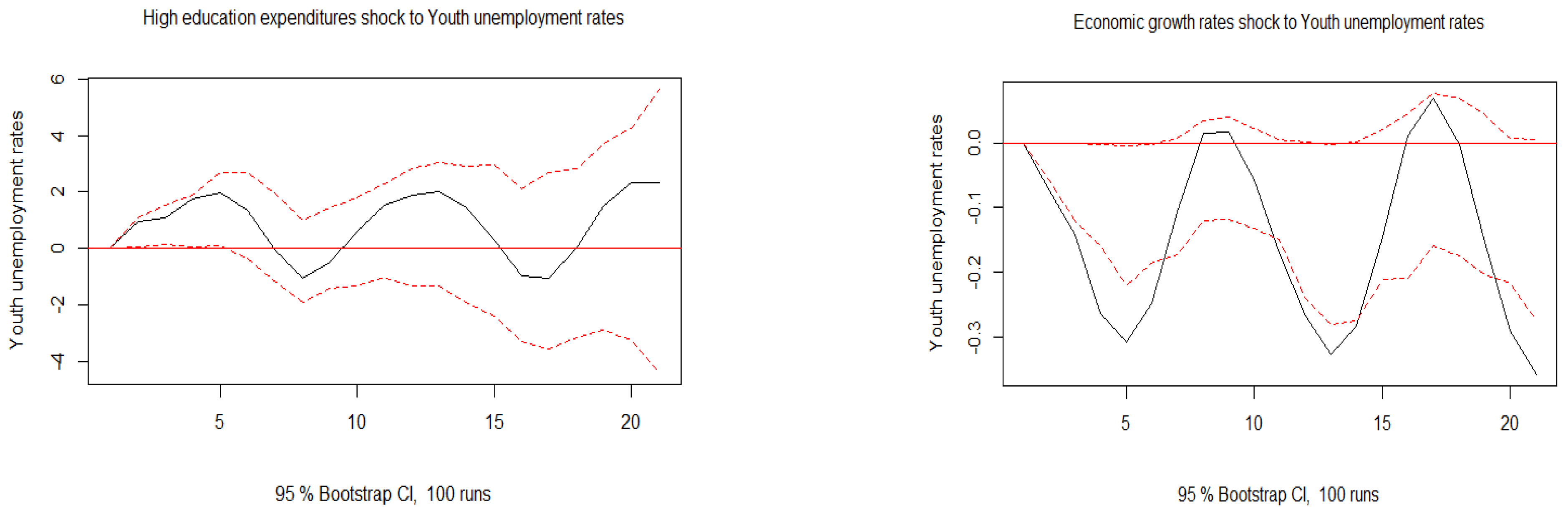

5. Empirical Results

6. Conclusions

- -

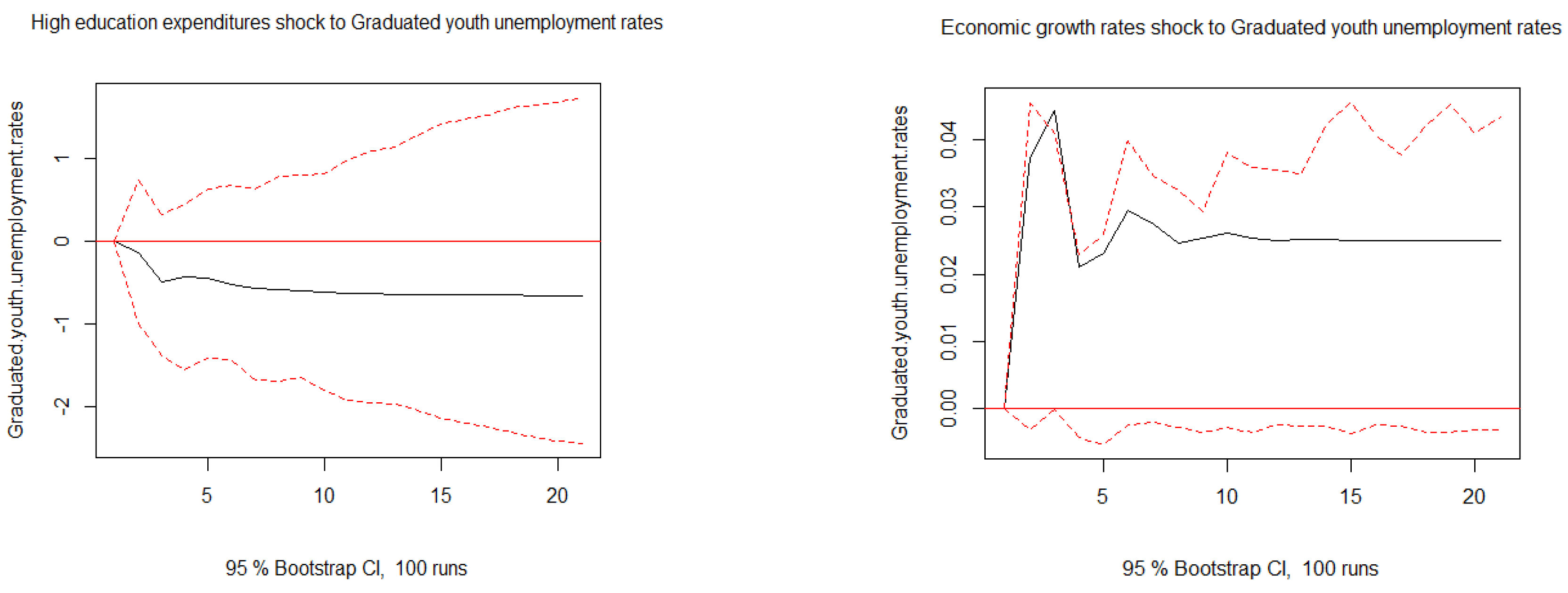

- In the long run, total public expenses in education negatively affect the youth unemployment rates. If the government increases the share of GDP to total public expenditures in education by 1%, the youth unemployment rates decrease by 10.81% in the long term. Even though economic growth is a major factor affecting the reduction in unemployment rates, the data results of Albania show that the real growth economic rates have no significant impact on minimizing the youth unemployment rate nor the graduated youth unemployment rate.

- -

- Similarly, in the long run, public expenses in higher education reveal a negative relationship to the graduated youth unemployment rate. If the government increases the share of GDP to public expenditures in tertiary education by 1%, this will have a decreasing effect on the unemployment rates of the graduated youth by 5.85%.

- -

- In the short run, the real economic growth rate shows a short-term causality to the youth unemployment rate, but not to the graduated youth unemployment rate. This suggests that in conditions of economic growth in the country, the emerging vacancies are filled with new youth employees with no graduation criteria. In the short run, total public expenses in education have no impact on the youth unemployment rate, nor public expenses in higher education on the unemployment rate of graduated youth with tertiary education.

- -

- The speed of adjustment indicating the convergence from the short-run to long-run equilibrium of the youth unemployment rate is 22% in a quarter time - period, for the total public expenses in education is 29%, and for the real economic growth rate is 15% (model I). While the speed of adjustment of the graduated youth unemployment rate and the speed of adjustment of the public expenditure in higher education is the same of 53% in a quarter time-period (Model II) showing a faster convergence.

7. Recommendations

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

Appendix A

| Variable | Coefficient in ECT | The Coefficient in ECT Where the Variable Is the Dependent Variable | Speed of Adjustment |

|---|---|---|---|

| YUR | 1 | −0.22 | −0.22 |

| TPEE | −10.81 | 0.027 | −0.29 |

| REGR | 2.19 | −0.07 | −0.15 |

| Variable | Coefficient in ECT | The Coefficient in ECT Where the Variable Is the Dependent Variable | Speed of Adjustment |

|---|---|---|---|

| GYUR | 1 | −0.53 | −0.53 |

| HEE | −5.85 | 0.09 | −0.53 |

| REGR | 0.47 | 0.11 | 0.05 |

References

- Barrel, Ray, Dawn Holland, and Iana Liadze. 2010. Accounting for UK Economic Performance 1973–2009; National Institute of Economic and Social research (NIESR) Discussion Papers. London, vol. 359, pp. 1–30. Available online: https://www.niesr.ac.uk/wp-content/uploads/2021/10/dp359_0-2.pdf (accessed on 6 August 2022).

- Barro, Robert J., and Jong-Wha Lee. 1997. Schooling Quality in a Cross Section of Countries. Economica 68: 465–88. [Google Scholar] [CrossRef]

- Barro, Robert. 2001. Human Capital and Growth. American Economic Review 91: 12–17. [Google Scholar] [CrossRef]

- Becker, Gary Stanley. 1993. Human Capital A Theoretical and Empirical Analysis with Special Reference to Education, 3rd ed. Chicago: University of Chicago Press. Available online: https://www.academia.edu/35396287/Human_Capital_a_Theoretical_and_Empirical_Analysis_with_Special_Reference_to_Education_Third_Edition (accessed on 2 June 2022).

- Castells, Manuel. 1994. The University System: Engine of Development in the New World Economy. Edited by Jamil Salmiand Adriaan M. Verspoor. Oxford: Revitalising Higher Education, pp. 14–40. [Google Scholar]

- Dickey, David A., and Wayne A. Fuller. 1979. Distribution of the estimators for autoregressive time series with a Unit Root. American Statistical Association 74: 427–31. [Google Scholar]

- Dissou, Yazid, Selma Didic, and Tatsiana Yakautsaya. 2016. Government spending on education, human capital accumulation and growth. Economic Modelling 58: 9–321. [Google Scholar] [CrossRef]

- Dumitrescu, Bogdan, Vasile Dedu, and Adrian Enciu. 2009. The Correlation between Unemployment and Real GDP Growth: A Study Case on Romania. Annals of Faculty of Economics 2: 317–22. Available online: https://econpapers.repec.org/article/orajournl/v_3a2_3ay_3a2009_3ai_3a1_3ap_3a317-322.htm (accessed on 20 April 2021).

- Engle, Robert F., and Clive. W. J Granger. 1987. Co-integration and error-correction: Representation, estimation, and testing. Econometrica 55: 251–76. [Google Scholar] [CrossRef]

- Grant, Catherine. 2017. The Contribution of Education to Economic Growth. London: UK Department for International Development, Institute of Development Studies. [Google Scholar]

- Hala, Hjazeen, Mehdi Seraj, and Hyseyin Ozdeser. 2021. The nexus between the economic growth and unemplyement in Jordan. Future Business Journal 7: 42. [Google Scholar]

- Hanushek, Eric A., and Ludger Wößmann. 2007. The Role of Education Quality in Economic Growth. World Bank Policy Research Working Paper 4122, February 26. [Google Scholar]

- Haupt, Alexander. 2012. The evolution of public spending on higher education a democracy. European Journal of Political Economy 28: 557–73. [Google Scholar] [CrossRef]

- Hussain, Tariq, Muhammad Wasif Siddiqi, and Asim Iqbal. 2010. A Coherent Relationship between Economic Growth and Unemployment: Empirical evidence from Pakistan. International Science Index 4: 956–63. [Google Scholar]

- IIASA. 2008. Economic Growth in Developing Countries: Education Proves Key. Available online: http://www.iiasa.ac.at/web/home/resources/publications/IIASAPolicyBriefs/pb03-web.pdf (accessed on 15 November 2021).

- INSTAT. 2021a. Economic Growth Rates. Tirane: INSTAT. [Google Scholar]

- INSTAT. 2021b. Labor Market Indexes. Tirane: INSTAT. [Google Scholar]

- Johansen, S, and K Juselius. 1990. Maximum likelihood estimation and inference on cointegration with application to the demand for money. Oxford Bulletin of Economics and Statistics 52: 169–210. [Google Scholar] [CrossRef]

- Kiefer, Nicholas M. 1985. Evidence on the Role of Education in Labor Turnover. Journal of Human Resources 20: 445–52. [Google Scholar] [CrossRef]

- Liew, Venus Khim-Sen. 2004. Which Lag Selection Criteria Should We Employ? Economics Bulletin 3: 1–9. Available online: https://www.researchgate.net/publication/4827253_Which_Lag_Selection_Criteria_Should_We_Employ (accessed on 20 January 2022).

- Lütkepohl, Helmut. 2005. New Introduction to Multiple Time Series Analysis. Berlin/Heidelberg: Springer, p. 63. [Google Scholar]

- Macrotrends. 2022. Available online: https://www.macrotrends.net/countries/ALB/albania/youth-unemployment-rate (accessed on 19 August 2022).

- Mehmetaj, Nevila, and Merita Zulfiu Alili. 2021. Employment of Economics Graduates: Does Gpa Matter? Interdisciplinary Description of Complex Systems 19: 210–26. [Google Scholar] [CrossRef]

- Ministry of Education, Sport and Youth. 2021a. Education Public Expenses in the Percentage of GDP. Available online: https://arsimi.gov.al/buxheti-dhe-financat/ (accessed on 15 May 2022).

- Ministry of Education, Sport and Youth. 2021b. Statistics. Available online: https://arsimi.gov.al/wp-content/uploads/2022/04/12-Raport-Moni-12_M-Janar-Dhjetor-2021_Final-28.2.2022_FN.pdf (accessed on 20 November 2021).

- Moreau, Marie-Pierre, and Carole Leathwood. 2006. Graduates’ employment and the dis-course of employability: A critical analysis. Journal of Education and Work 19: 305–24. [Google Scholar] [CrossRef]

- Nickell, Stephen. 1979. Education and lifetime patterns of unemployment. Journal of Political Economy 87: 117–31. [Google Scholar] [CrossRef]

- Nunez, Imanol, and Ilias Livanos. 2010. Higher education and unemployment in Europe: An analysis of the academic subject and national effects. Higher Education 59: 475–87. [Google Scholar] [CrossRef]

- OECD. 2000. From Initial Education to Working Life. Paris: OECD. [Google Scholar]

- OECD. 2014. Education at a Glance. Paris: OECD Publishing. [Google Scholar] [CrossRef]

- Okun, Arthur M. 1962. Potential GNP: Its Measurement and Significance. In Proceedings of Business and Economic Statistics Section. Alexandria: American Statistical Association, pp. 89–104. [Google Scholar]

- Osipian, Ararat. 2008. Role of Education in Economic Growth in the Russian Federation and Ukraine. (March 2007). Available online: https://ssrn.com/abstract=1092504 (accessed on 20 July 2022).

- Ranis, Gustav, Frances Stewart, and Alejandro Ramirez. 2000. Economic Growth and Human Development. World Development 28: 197–219. [Google Scholar] [CrossRef]

- Sachs, Jeffrey D., and Andrew M. Warner. 1995. Natural Resource Abundance and Economic Growth. NBER Working Papers 5398. Cambridge: National Bureau of Economic Research, Inc. [Google Scholar]

- Schultz, Theodore W. 1961. Investment in human capital. The American Economic Review 51: 1–17. Available online: https://www.ssc.wisc.edu/~walker/wp/wp-content/uploads/2012/04/schultz61.pdf (accessed on 2 July 2022).

- Schultz, Theodore W. 1989. Investing in people: Schooling in low-income countries. Economics of Education Review 8: 219–23. [Google Scholar] [CrossRef]

- Sims, Christopher A. 1980. Macroeconomics and Reality. Econometrica 48: 1–48. [Google Scholar] [CrossRef]

- Soylu, Özgur Bayram, Ismail Çakmak, and Fatih Okur. 2018. Economic growth and unemployment issue: Panel data analysis in Eastern European Countries. Journal of International Studies 11: 93–107. [Google Scholar] [CrossRef]

- St. Aubyn, Miguel, Alvaro Pina, Filomena Garcia, and Joana Pais. 2009. Study on the efficiency and effectiveness of public spending on tertiary education. Economic Papers 301: 1–148. Available online: https://ec.europa.eu/economy_finance/publications/-pages/publication11902_en.pdf (accessed on 2 June 2022).

- Teulings, Coen N. 2005. Comparative advantage, relative wages, and the accumulation of human capital. Journal of Political Economy 113: 425–61. [Google Scholar] [CrossRef]

- Tilak, Jandhyala B.G. 2003. Higher Education and Development. In The Handbook on Educational Research in the Asia Pacific Region. Springer International Handbooks of Education. Dordrecht: Springer, Volume 11, pp. 809–26. [Google Scholar] [CrossRef]

- Ullah, Sami. 2014. Relationship Between Unemployment and Human Capital. Journal of Resources Development and Management 3: 1–11. [Google Scholar]

- Woessmann, Ludger. 2015. The Ecobnomic Case for Education. Education Economics 24: 3–32. Available online: http://www.tandfonline.com/doi/abs/10.1080/09645292.2015.1059801?journalCode=cede20 (accessed on 5 July 2022). [CrossRef]

- World Bank. 2022. Available online: https://www.worldbank.org/en/country/albania/overview (accessed on 15 July 2022).

| Model I | Dickey–Fuller | Lag Order | p-Value |

|---|---|---|---|

| YUR | −1.1441 | 4 | 0.9099 |

| TPEE | −2.7669 | 4 | 0.2619 |

| REGR | −2.6287 | 4 | 0.3185 |

| Model II | |||

| GYUR | −1.276 | 3 | 0.8549 |

| HEE | −2.3857 | 3 | 0.4231 |

| REGR | −3.5477 | 3 | 0.05178 |

| Model I H0 Hypotheses | Trace Test Statistic | Critical Value (5%) | Max-Eigen Test Statistic | Critical Value (5%) |

|---|---|---|---|---|

| r <= 2 | 20.41 | 9.24 | 20.41 | 9.24 |

| r <= 1 | 42.56 | 19.96 | 22.15 | 15.67 |

| r = 0 | 64.71 | 34.91 | 22.15 | 22.00 |

| Model II | ||||

| r <= 2 | 3.03 | 9.24 | 3.03 | 9.24 |

| r <= 1 | 20.16 | 19.96 | 17.13 | 15.67 |

| r = 0 | 49.66 | 34.91 | 29.49 | 22.00 |

| Model I. r1 (Short Term) | 1 YUR | −10.8095 TPEE | 2.1877 REGR |

|---|---|---|---|

| YUR-1 | −0.7319 (0.1166) *** | −0.0190 (0.0130) | 0.0865 (0.0711) |

| YUR-2 | −0.6833 (0.1030) *** | −0.0108 (0.0114) | 0.1003 (0.0628) |

| YUR-3 | −0.6347 (0.0779) *** | −0.0026 (0.0087) | 0.1141 (0.0475) * |

| TPEE-1 | −1.5695 (1.4792) | −0.5468 (0.1644) ** | −0.7461 (0.9019) |

| TPEE-2 | −0.7664 (1.4279) | −0.3883 (0.1587) * | −0.7063 (0.8707) |

| TPEE-3 | 0.0368 (1.1444) | −0.2298 (0.1272). | −0.6665 (0.6978) |

| REGR-1 | 0.5529 (0.2752) * | −0.0610 (0.0306). | −0.7263 (0.1678) *** |

| REGR-2 | 0.6257 (0.2550) * | −0.0624 (0.0283) * | −0.6117 (0.1555) *** |

| REGR-3 | 0.6984 (0.1994) *** | −0.0638 (0.0222) ** | −0.4971 (0.1216) *** |

| C | 0.0004 (0.0014) | −0.0000 (0.0002) | −0.0004 (0.0009) |

| ECT | −0.2195 (0.1226). | −0.0273 (0.0136) * | −0.0727 (0.0748) |

| Model II. r1 (Short Term) | 1 GYUR | −5.8549 HEE | 0.4728 REGR |

|---|---|---|---|

| GYUR-1 | −0.5884 (0.2419) * | −0.0252 (0.0331) | 0.0320 (0.1449) |

| GYUR-2 | −0.5052 (0.2300) * | 0.0073 (0.0315) | 0.0523 (0.1378) |

| GYUR-3 | −0.4220 (0.1828) * | 0.0398 (0.0250) | 0.0725 (0.1095) |

| HEE-1 | −1.5491 (1.4915) | −0.4449 (0.2041) * | −0.2747 (0.8934) |

| HEE-2 | −1.1752 (1.4509) | −0.2273 (0.1985) | −0.4811 (0.8691) |

| HEE-3 | −0.8014 (1.1678) | −0.0097 (0.1598) | −0.6875 (0.6995) |

| REGR-1 | 0.2188 (0.2160) | −0.0514 (0.0296). | −0.7811 (0.1294) *** |

| REGR-2 | 0.2823 (0.2379) | −0.0755 (0.0326) * | −0.5677 (0.1425) *** |

| REGR-3 | 0.3458 (0.2026). | −0.0996 (0.0277) ** | −0.3544 (0.1214) ** |

| C | −0.0557 (0.1608) | −0.0154 (0.0220) | −0.1028 (0.0963) |

| ECT | −0.3284 (0.2241). | 0.0576 (0.0307) ** | 0.0117 (0.1342). |

| Model I | Chi-Squared | df | p Value | Model II | Chi-Squared | df | p Value |

|---|---|---|---|---|---|---|---|

| Portmanteau Test | 12.703 | 30 | 0.9187 | 38.362 | 30 | 0.1407 | |

| ARCH (multivariate) | 366 | 540 | 1 | 186 | 540 | 0.9776 | |

| JB-Test (multivariate) | 3.8331 | 6 | 0.6993 | 92.13 | 6 | 0.0000 | |

| Skewnesss (multivariate) | 3.2595 | 3 | 0.3533 | 9.0549 | 3 | 0.0285 | |

| Kurtosis (multivariate) | 0.57363 | 3 | 0.9024 | 83.076 | 3 | 0.0000 |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2022 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Mehmetaj, N.; Xhindi, N. Public Expenses in Education and Youth Unemployment Rates—A Vector Error Correction Model Approach. Economies 2022, 10, 293. https://doi.org/10.3390/economies10120293

Mehmetaj N, Xhindi N. Public Expenses in Education and Youth Unemployment Rates—A Vector Error Correction Model Approach. Economies. 2022; 10(12):293. https://doi.org/10.3390/economies10120293

Chicago/Turabian StyleMehmetaj, Nevila, and Nevila Xhindi. 2022. "Public Expenses in Education and Youth Unemployment Rates—A Vector Error Correction Model Approach" Economies 10, no. 12: 293. https://doi.org/10.3390/economies10120293

APA StyleMehmetaj, N., & Xhindi, N. (2022). Public Expenses in Education and Youth Unemployment Rates—A Vector Error Correction Model Approach. Economies, 10(12), 293. https://doi.org/10.3390/economies10120293