4. Results

We tested our first hypothesis, which attempts to assess the decision factors that influence consumer behavior and the amount of electronic payment for purchases with statements x1-x2-x3.

It is important, from the point of view of the topic and the first hypothesis, whether those who fill in the questionnaire receive their salary in cash, as this can greatly influence the size of the subsequent money usage fees, and convenience can also influence the way the money is spent. According to the results of descriptive statistics, respondents, despite government pressure, still receive their salary in cash (8%, i.e., 40 people), albeit in small numbers. The distribution according to background variables is shown in

Table 3, from which it can be established that there is no big difference between the proportions of each category, except for labor market status.

In addition to simpler descriptive analyses, cross-tabulation analysis and Chi-square test were also performed to explore deeper correlations. When examining the background variables, in the case of the 40 people, a significant difference occurred only in terms of education (chi-square: 16.639; DF: 3, probability: 0.001).

To make the analysis more accurate, all respondents (

n = 499) were included in the comparative study. Examining the x1 statement (“You will receive your salary in cash”) with the background variables, a significant difference appeared only in the case of education (chi-squared: 16.0588; DF: 3, probability: 0.001). The results obtained are shown in

Table 4.

Following the cross-tabulation analysis, we used the Bonferroni test to examine where there was a justified difference between the qualification categories and the choice of payment method. After running it, we obtained the result that there was a justified difference between the choice of each qualification category and the method of payment in all cases, except for the salary received in the bank account and those with secondary education without a high school diploma. Thus, education indirectly influences the choice of payment method and the nature of the job while the job determines who gets paid.

The second examined statement (x2) focused on a regularly used means of payment for managing purchases (“How do you regularly manage your purchases?”). Based. on the results, a relatively large number—68% of respondents—prefer to make their daily purchases with a debit card.

From the statistical studies (cross-tabulation analysis, Chi-square test) it can be stated that the difference confirmed during the analysis of correlations with the background variables was also shown in the case of education (chi-squared: 42.336; DF: 6, probability: 0.000). During the running of the Bonferroni test, we obtained a similar result as in the previous statement of x1; there was no significant difference between the individual qualification categories (

Table 5).

Statement x3 provides information on the factors we used to choose between payment instruments in everyday shopping situations (“In everyday shopping situations, what makes you decide between a credit card and cash?”). Respondents had to evaluate their choice of payment methods on a Likert scale, but we also provided an open-ended opportunity to express their views. In total, 44.3% of respondents said they did not make decisions based on habit, while 29.5% were influenced by everyday situations. As before, we disaggregated the analysis by age, education, labor market status, and place of residence to explore deeper correlations by the ANOVA method. In the decision to choose a means of payment, a significant difference can be seen for the location of payment and habit, as shown in

Table 6.

The results for the analysis of variance show that there is a statistically verifiable difference between the location of the payment, the decision factors of habit, and the place of residence. A Tukey test was performed to detect differences between groups, the results of which are illustrated in

Table 7.

In the current study, there is a justified difference between the village and the county seat, in terms of the location of the payment, the custom of the other town, and the county seats.

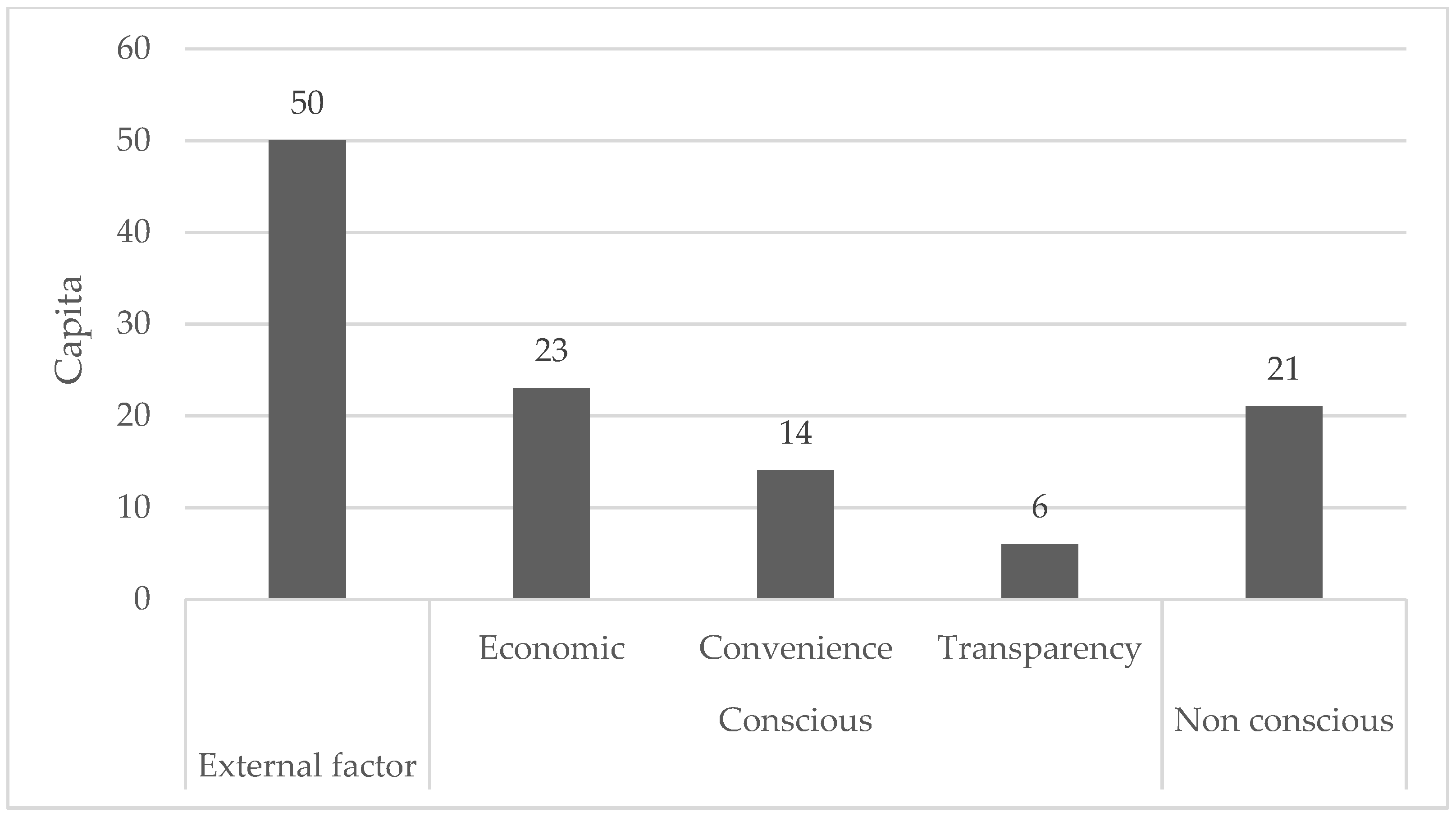

In the case of the other option (open-ended question), 117 possible answers were returned, of which 114 interpretable answers were accepted after processing, where financial awareness appears significantly (

Figure 1). The number of evaluable responses received was 114, and one person’s response could be classified into more than one category. Accordingly, at 50, an external factor determines the payment method, e.g., the supply of a given point of sale with a terminal, or how a given person obtains the income. In total, 21 make ad-hoc decisions, while 43 deliberately vote for cash or a card for economic, convenience, or transparency reasons. These categories have been defined by the authors on their own merits based on the literature.

Overall, the statistical analysis results show that in the case of x1 (chi-square: 16.0588; DF: 3, probability: 0.001) and x2 (chi-square: 42.336. DF: 6, probability: 0.000) there is a significant difference with the background variables only in the case of educational attainment. However, in the case of x3, there is a difference between the place of residence, including the village and the county seat.

Based on the above, we accepted our first hypothesis (“Decision factors can be defined that influence consumer behavior and the frequency of electronic payment for purchases”).

Thus, based on the results, consumers did not use cash and card uniformly in their various payments yet, but it may be interesting to examine what motivates them to make a choice and how conscious the outcome is.

We tested our second hypothesis with statements x4-x5-x6.

With statement x4, we aimed to examine whether respondents’ shopping habits are affected by the payment instrument they choose, which can generate overspending, jeopardizing sustainability (“Where you can pay by credit card, you spend more than you can with cash only.”).

The descriptive statistics showed that 18.24% of respondents do not know or did not observe their spending habits, of those who could tell 17.23% knew they were spending more and 64.53% said they were not spending more when paying by card.

There is no statistically significant difference with background variables, which means that statement x4 is independent of age, place of residence, education, and labor market status.

Concerning the issue, it is important to highlight that financial awareness did not occur in nearly a fifth of respondents because they did not know or did not pay attention to their spending habits. Awareness is an important part of managing our finances, the existence of which contributes to long-term sustainability.

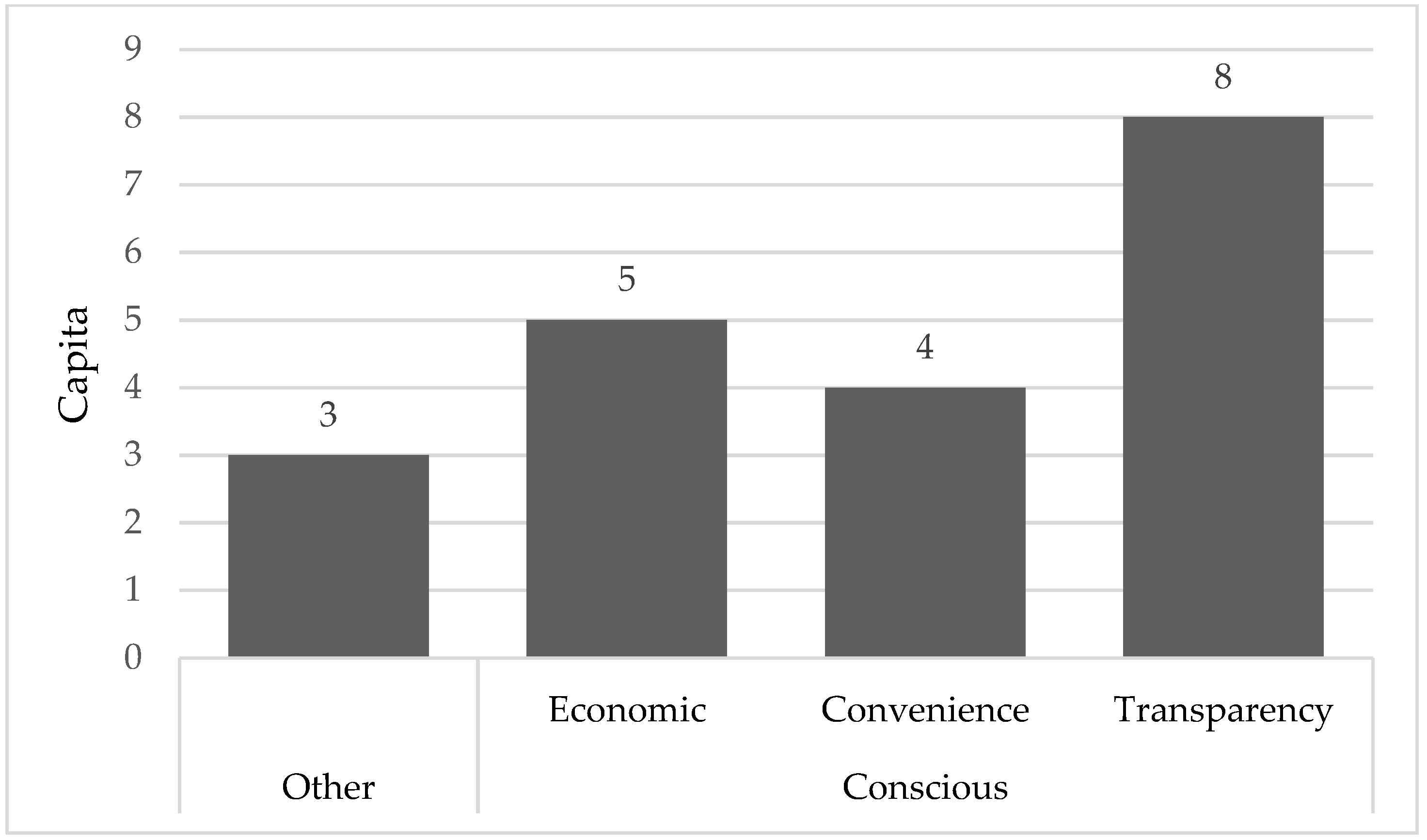

Another question of the research confirms this result, where we asked an open-ended question about the most important features and advantages of cash payment. In total, 20 of the 26 evaluable responses were returned, of which awareness was most often mentioned (

Figure 2). Several respondents have written that traceability (eight people) is an important advantage in choosing the form of payment, five have emphasized the economic aspect, and four consider the use of cash to be more convenient.

The x5 and x6 statements provide information on the attitudes of those surveyed towards security (“I feel safer keeping my money (e.g., my salary) in cash than in electronic form” and, “I think the risk of theft is lower when using a card than when using cash”, respectively).

Based on the data, it can be stated that in the case of variable x5, we found a significant difference based only on education and employment status. In the case of theft, in relation to variable x6, we did not experience a significant difference between the individual background variables, as shown in

Table 8.

In

Table 9, the segregation relationships between the x5 variable and the background variables are highlighted. Based on our research, respondents who do not have a high school diploma are different from those with a high school diploma, and those with higher education, prefer to use cash. In addition, there is a difference based on labor market status, where students differ from all other categories, i.e., students feel more secure using cash. This may be because students spend smaller sums as they mostly do not have an independent income, and for smaller amounts, only cash is available in several locations.

Based on the x4 statement, 18.24% do not know or follow their spending habits, 17.23% knew they would spend more, and 64.53% said they would not spend more on card payments. Based on the data, it can be stated that in the case of variable x5, we found a significant difference based only on education and employment status. In the case of theft and variable x6, we did not experience a significant difference between the individual background variables.

Based on the above, we rejected Hypothesis H2 (“Payment options that influence financial awareness can reduce the number of purchases.”), the degree of financial awareness does not affect the choice of payment method.

5. Conclusions

Considering the above, our article aims to compare the two most common payment methods, cash, and card payments. Based on the literature, it can be concluded that the battle between cash and electronic money is at a turning point and there is a tendency for electronic payments to slowly overcome cash.

In light of this, the assessment of consumer behavior regarding the choice of financial instruments may be extremely important shortly. On one hand, this possible separation threatens sustainable development goals in the long term, and on the other hand, financial awareness can affect the number of purchases and savings.

Based on our literature research, we assumed that there were decision factors that influenced payment habits. Age (

Éltető 2021) and educational background (

Nga et al. 2010) can be derived directly from the literature, which indirectly affects the labor market situation and place of residence. Based on the tests carried out, we have found that our results, in terms of education and labor market status, agree with the literature. In addition, the location of payment and habit as a decision-making factor demonstrably influence consumer behavior and the chosen payment method. Based on the above, we accept our first hypothesis (“Decision factors can be defined that influence consumer behavior and the frequency of electronic payment for purchases”).

By assessing decision-making factors, we intend to provide a deeper understanding of consumption habits and the spread of digitalization to inform education, which can contribute to the prevention of overconsumption. In our second hypothesis, we examined whether financial awareness reduced the number of purchases (

Helm and Subramaniam 2019). Based on the results of our research, the full transition is not yet feasible, as shown by the results of our survey. Eight percent of respondents still receive payment in cash, 8.4% still buy only in cash, and 31.7% use cash and cards alternately when shopping. Based on the results we can conclude that financial awareness is not affected by the choice of payment method, which is why we reject our second hypothesis. Although government pressure would force cashlessness (thereby explicitly whitening the economy), switching opportunities are still not available in many places (e.g., smaller beauty providers, markets, etc.).

For sustainability, the UN aims to eliminate inequalities. As financial awareness is strongly influenced by education, according to the literature and according to our research. Therefore, the lagging strata are at multiple disadvantages. In total, 17.23% of our respondents know that they spend more on card payments, and 29.5% are influenced by their habits in everyday shopping situations. This “spontaneity” in the choice of payment methods refers to a lack of awareness, including financial awareness, which increases consumption and, thus, the amount of waste, jeopardizing sustainability.

In the fight against the use of cash, the introduction of digital central bank money is expected to have a decisive influence in the near future. Based on this, the central bank maintains a special account for all actors, the use of which is expected to result in a significant reduction in cash, since digital central bank money will function as a kind of digital cash. In our study, we could not address this expected change, this direction may mean the continuation of our research.