Abstract

The return and volatility spillover effects on Asian Dragons were investigated in this study. Yahoo Finance provided the monthly statistics (from August 1997 to December 2020). This study used a generalized autoregressive conditional heteroskedasticity–autoregressive moving average (GARCH–ARMA) model. The results showed that return spillover effects were observed in unidirectional relationships, but volatility spillover effects were shown in both unidirectional and bidirectional connections. The TSEC Weighted Index (TWII) and the Hang Seng Index (HSI) were net stock market return transmitters to other markets, whereas the Straits Times Index (STI) and the Korean Composite Stock Price Indices (KOSPI) were net receivers. Simultaneously, the STI was a significant net transmitter of stock market volatility to other markets, according to research. As a result, the KOSPI has become a safe haven for portfolio investors. Portfolio managers and overseas investors who are reviewing investment and asset allocation decisions should be aware of these facts.

1. Introduction

The economies of Hong Kong, South Korea, Taiwan, and Singapore are known as the four Asian dragons. Between the middle of the 1950s and the beginning of the 1990s, those four economies witnessed fast industrialization, technical innovation, and extraordinarily rapid growth rates of approximately 7% per year (Bhatia and Gupta 2018). According to Hsieh (2011), East Asian and Southeast Asian economies maintained macroeconomic stability and sustained economic growth prior to the Asian financial crisis in 1997.

The Asian financial crisis of 1997 was the first major setback for the four Asian Dragons. A wave of speculative attacks hit the Hong Kong stock exchange. Furthermore, the large number of non-performing business loans in South Korea resulted in a massive stock market meltdown. Taiwan and Singapore, on the other hand, suffered only minimal losses. Fortunately, all four economies recovered well (Garay 2003; Khan and Woo 2009). In the global financial system, these countries began to become more prominent and competitive (Yilmaz 2010).

Because Asian stock markets are still emerging, this research focuses on those markets (Li and Giles 2015). For international portfolio investors seeking diversity, the markets of emerging countries have long been popular choices. These markets have piqued the interest of international investors. As a result, such investors prefer to put their money into emerging markets. As stated by Fu et al. (2011), emerging markets can offer higher returns and greater diversity. A recent study by Huruta et al. (2021) stated that investing strategies could be based on the spillover impact of returns and the volatility in commodities markets (oil and gold), currency rate, and stock prices.

Due to Asian economies’ enormous size and potential for diversification, foreign investors are interested not only in the stock and currency markets, but also in other classes of assets, such as bonds, commodity futures, and real estate investments. Excessive spillover between asset classes is typically a sign of market uncertainty. Foreign and international investors with multi-asset portfolios benefit from learning more about the spillover connections of major domestic financial markets (Liow et al. 2021). Investors’ portfolio diversifications and hedging strategies can be improved with a better understanding of the effects of return and volatility on domestic financial markets.

Our study is useful for local investors in Hong Kong, South Korea, Taiwan, and Singapore (the four Asian Dragons) and for the policymakers of those economies. When evaluating risk and market stability, and creating regulatory control measures, policymakers must know which markets among the four Asian Dragons are net transmitters and which are net receivers of volatility transmission.

Previous preliminary studies on the effects of return and volatility spillover were mostly focused on developed markets (Hamao et al. 1990; Karolyi 1995; Koutmos and Booth 1995; Lin et al. 1991; Nelson 1991; Poon and Taylor 1992; Susmel and Engle 1994; Theodossiou and Lee 1993). Over time, the emphasis has shifted from market return and volatility spillovers in developed markets to market return and volatility spillovers in emerging markets (Abbas et al. 2013; Chuang et al. 2007; Diebold and Yilmaz 2009; Hamao et al. 1990; Li and Giles 2015; Liu and Pan 1997; Miyakoshi 2003; Mohammadi and Tan 2015; Singh et al. 2010; Wang and Wang 2010; Wei et al. 1995). Likewise, return and volatility spillover research in regional developing markets has proliferated (Bayramoğlu and Abasiz 2017; Bozma and Başa 2018; Çelik et al. 2018; Gürsoy and Eroğlu 2016; Hung 2019b; Johansson and Ljungwall 2009; Kutlu and Karakaya 2020; Mukherjee and Mishra 2010; Roni et al. 2018; Worthington and Higgs 2004; Yilmaz 2010). However, the spillover effects of return and volatility in particular stock markets in the four Asian Dragons (Hong Kong, South Korea, Taiwan, and Singapore) during the Asian financial crisis in August 1997, the Global Financial Crisis in September 2008, and the COVID-19 outbreak in late December 2019 have been rarely examined. Despite the importance of the prominent and competitive international portfolio managers (Yilmaz 2010), few studies examined how these spillover effects were transmitted to other financial markets. The four Asian Dragons have demonstrated a path of convergence toward the markets of the most developed nations, as evidenced by their recent declines in growth rates. However, their process of catching up is undoubtedly one of the fastest and most interesting topics for study (Yash and Anmol 2018).

For many years, particularly since the Asian crisis of the late 1990s, the nature of financial market return and volatility dependency has been debated (Diebold and Yilmaz 2009; Forbes and Rigobon 2002; King et al. 1994). Because of the consequences for global integration and financial deregulation, the relationship between developing and developed economies has been of interest to financial economists (Hung 2019a). With greater global financial integration, investors and policymakers are increasingly interested in the transmission of information regarding return and volatility across equity markets (Yousaf et al. 2020).

To lessen the risk of contagion when asset volatility spreads from one market to another during a crisis, portfolio managers must change their asset allocation (Yang and Zhou 2017) and financial policymakers must alter their practices (Yousaf and Hassan 2019). This study’s major objectives were to determine how the four Asian Dragons were affected by the spillover effects of stock market returns and volatility. It was prompted by changes in stock prices in financial markets during the Asian financial crisis, the Global Financial Crisis, and the COVID-19 outbreak. As a result, portfolio managers and policymakers needed to comprehend these occurrences, which was crucial in calculating and evaluating the risk of a geographically diversified portfolio. The research added to the body of knowledge about the impacts of returns and volatility on stock market spillovers.

One significant contribution of this study is that it is likely one of the few studies to provide a thorough understanding of the spillover effects of returns and volatility within the four Asian Dragons (Hong Kong, South Korea, Taiwan, and Singapore). Our study was motivated by the possibility of predicting the spillover effects of returns and volatility, particularly the largest effects, which can be of great interest for traders, investors, and academicians alike. This study revisits earlier findings and contributes to the literature about the spillover effects of returns and volatility by a monthly time series instead of the earlier daily and annual data. Another significant aspect of this study is that it expands upon the initial objective by not only examining the relationships between various stock markets, but also the spillover effects of such relationships on stock markets.

This was article is divided into the following sections. Section 2 includes the literature review and the hypotheses that were established. Section 3 reports on the research approach. Section 4 contains the empirical findings, as well as a commentary. In the Conclusion section (Section 5), limitations and ideas for further study are mentioned.

2. Literature Review and the Development of Hypotheses

In order to create an ideal portfolio, Markowitz’s (1959b) modern portfolio theory explains the relationships between various stock markets. The idea is to diversify a portfolio’s risk by including both risky and less risky (or risk-free) assets. During a financial crisis, the top stock market exhibits increased volatility. As a result, portfolio investors must diversify their holdings by investing in emerging stock markets with a low level of integration. To find opportunities for portfolio diversification across markets and over time, portfolio managers must analyze the risk transmission between various equity markets (Yousaf et al. 2020). When creating investment portfolios, a thorough understanding of the connections between various domestic financial markets within a domestic economy is important (Diebold and Yilmaz 2012, 2014).

This section considers studies that addressed information on returns and volatility that is transmitted between stock markets in Asia and other countries. Using a multivariate generalized autoregressive conditional heteroskedasticity (GARCH) family model, Mohammadi and Tan (2015) explored the effects of daily return and volatility in the stock markets of the United States, Hong Kong, and mainland China. Their study revealed a one-way return from the United States to the other three markets, as well as a volatility spillover effect. On the other hand, there were only minor correlations between mainland China and international markets. The study’s findings could have a major impact on portfolio diversification, risk management, and international investment. Li and Giles (2015) discovered that the United States market has considerable unidirectional shock and volatility spillovers to Japan and to developing economies in Asia. Remarkably, that study found that the Chinese stock market had a higher influence on the Japanese stock market than previously thought. Miyakoshi (2003) used a bivariate exponential GARCH (EGARCH) model and showed that when it came to the spillover effects of return and volatility from developed countries to emerging markets, the Japanese stock market had a greater impact on developing stock markets in Asia than on the US stock market. Chuang et al. (2007) also presented the Japanese stock market as essential in spreading volatility to other East Asian financial markets.

Lee and Goh (2016) highlighted that the largest source of mean spillover effects was the US market. Despite the fact that the Hong Kong market’s past volatility and shock spillover effects were broader, ASEAN markets tended to react more strongly to bad news from the US market. The autoregressive GARCH (AR-GARCH) model with same-day effect was used by Singh et al. (2010) to predict volatility spillovers in North American, European, and Asian stock markets. The stock markets in Asia and Europe have a larger spatial impact. Premaratne and Balasubramanyan (2003) claimed that volatility in a smaller market might easily spread to a larger market. In contrast, Liu and Pan (1997) provided evidence that the US stock market had a stronger influence on emerging Asian stock markets than on the Japanese stock market.

Wang and Wang (2010) investigated the volatility spillovers between developing and developed stock markets using a multivariate GARCH model. According to empirical evidence, developing countries’ market openness had a major impact on the impact of current markets. Yilmaz (2010) also confirmed that, based on his analysis, the spread of volatility across markets had overtaken the spread of return spillovers. During crisis and non-crisis periods, there was a significant gap in the East Asian return and volatility spillover indices.

In terms of stock returns during and after the Global Financial Crisis, Hung (2019b) stated that the correlation between China’s market and other markets looked to be exceptional. In addition, the Chinese market’s volatility appeared to have a significant impact on other markets. Multivariate EGARCH was employed by Johansson and Ljungwall (2009) to show that Taiwan’s mean spillovers affected both China and Hong Kong. The Hong Kong market’s volatility flowed over into Taiwan, affecting the mainland China market’s instability. Despite the fact that foreign investment possibilities have been limited until recently, this implies that the mainland Chinese stock market is linked to other stock markets.

The GARCH model was used by Kutlu and Karakaya (2020) to examine the return and volatility spillovers between the Borsa Istanbul stock exchange (BIST) and the Moscow stock exchange (RTS). In the pre-crisis era, there was a return spillover from the BIST to the RTS, but neither the return nor the volatility of the RTS spilled over to the BIST. There was little evidence of return and volatility spillover between the the BIST and the RTS in the post-crisis period.

The stock markets of New York, London, and Tokyo all have mean and volatility spillover effects, according to Hamao et al. (1990). The strength of the global financial markets was highlighted by this dichotomy. However, the openness of developing stock markets has little impact on open-to-close returns. The conditional mean spillover between the New York and London markets and those in Taiwan and Hong Kong is applicable only to close-to-open returns. Hamao et al. also discovered that the average spillover effects from London and New York to Taiwan and Hong Kong were generally unidirectional. There were volatility spillover effects from New York to Tokyo and Hong Kong, as well as from Tokyo to London and New York (Wei et al. 1995).

Mukherjee and Mishra (2010) looked into stock market integration and volatility spillovers between India and its major Asian competitors. India and its Asian competitors have bidirectional and positive intra-day return spillovers. To investigate volatility transmission across Asian stock markets, Worthington and Higgs (2004) utilized a multivariate GARCH model. Based on the data, positive mean and volatility spillovers were identified. Short-run shocks and long-run volatility in Turkey’s conditional variance were influenced by short-run shocks and long-run volatility in Poland and Hungary’s financial markets, according to Bozma and Başa (2018). Volatility and return spillovers between the fragile five nations (Brazil, India, Indonesia, South Africa, and Turkey) were discovered by Gürsoy and Eroğlu (2016). They noticed that the Indian stock market’s volatility spilled over into the other four markets. Furthermore, data showed that all of those four markets had a return spillover to Indonesian stock markets. Lee (2009) looked into the effects of volatility spillovers across six Asian stock markets. That research demonstrated significant volatility spillover effects between these countries’ stock markets.

Prior to the Global Financial Crisis of 2007–2008, Roni et al. (2018) found a lower correlation between Asian developing stock markets. During the Global Financial Crisis, both the return and volatility spillover indices hit new highs. In contrast, there was no short-run causation in the Chinese and Bangladesh stock markets. Similarly, there was no correlation between the stock markets of Malaysia, the Philippines, South Korea, and Bangladesh during the pre-crisis, crisis, and post-crisis stages. The only exception was the Indian stock market, which experienced a bidirectional causality from India to Bangladesh. Diebold and Yilmaz (2009) found that return spillovers had a rapidly expanding pattern, but still no explosions, whereas volatility spillovers seemed to have no pattern, but a significant surge on the twenty major stock markets. Abbas et al. (2013) looked at the volatility spillover of the four Asian markets from the United States, Singapore, and Japan. There was no evidence that the situation was reversed. These results could be explained by international economics, trade, and investment links, as well as by recent financial market integration and policy coordination.

The value-at-risk EGARCH (VAR-EGARCH) model was used by Çelik et al. (2018) to explore cross-country volatility and return spillovers. They highlighted that Indonesia, Mexico, Nigeria, the Philippines, and Turkey had not exceeded key market indicators. The distribution of information shocks was unequal among nations and among statistically significant sections internally. Excluding the Nigerian stock exchange, all of the stock markets were more vulnerable to unfavorable information shocks. When the market received negative news, it experienced higher volatility than when the market received favorable news.

The Morgan Stanley Capital International (MSCI) Index volatility spillovers in stock markets in Brazil, Mexico, Russia, and Turkey were researched by Bayramoğlu and Abasiz (2017). Negative shocks in the MSCI Index had a bigger influence on return variance than positive shocks in the Mexican and Russian indices, according to the researchers. Baek and Oh (2016) applied a Leverage Heteroskedastic Autoregressive Realized Volatility (LHAR) model. Using the LHAR model, many decompositions of the Hang Seng Index (HSI) to the the Korean Composite Stock Price Indices (KOSPI) spillover effects into moderate negative daily spillover were demonstrated.

Our study refers to an adequate influential paper and relevant past study by Chen and Huang (2010). The earlier study by Chen and Huang (2010) examined the impacts of leverage and spillover on the returns and volatility of exchange-traded funds (ETFs) and stock indices in developed and emerging countries. They found that Hong Kong had the best return–spillover effects, followed by Singapore. However, Taiwan’s stock index return was noted to have a significant negative impact on ETF return. That study particularly highlighted the existence of bidirectional implications on the spillover effects on stock index and ETF volatilities.

Our study is different from the study of Chen and Huang (2010) in the following aspects. Chen and Huang (2010) examined the return and volatility spillover between Canada, the UK, France, Germany, Hong Kong, and Japan and three emerging markets, Singapore, Korea and Taiwan, whereas our study examines the volatility as well as return spillover between Hong Kong, South Korea, Taiwan, and Singapore (the four Asian Dragons). More specifically, our study first examines the return as well as the volatility spillovers, whereas Chen and Huang (2010) examined both stock index and ETF returns. Second, our study examines the spillovers between the four Asian Dragons, whereas Chen and Huang (2010) examined the spillover and the leverage effects on returns and volatilities of both the stock index andthe ETF. Third, our study focuses on the Asian financial crisis (August 1997), the Global Financial Crisis (September 2008), and the COVID-19 outbreak (late December 2019), whereas Chen and Huang (2010) examined the spillovers using daily data. Fourth, our study uses the GARCH–ARMA model, whereas Chen and Huang (2010) employed the GARCH–ARMA and EGARCH–ARMA models. Finally, our full data sample is monthly data from August 1997 to December 2020, whereas Chen and Huang (2010) used a sample period from 14 January 2000 to 19 June 2019. Apart from these differences, the study of Chen and Huang (2010) is very beneficial for understanding the return and volatility spillover among the stock markets of the four Asian Dragons.

Overall, there is increased interest in research that studies how the spillover effects of return and volatility affect different countries. Compared to other Asian stock markets, the economy of the four Asian Dragons has recently been more open. Given the volatility in many stock markets, we need to understand the issue of spillover effects. Portfolio investors and policymakers may not be aware of the current state and unforeseen shifts in the spillover transmission of return and volatility in the context of this study. As a result, the main goal of our study is to contribute to the empirical knowledge of these subjects.

The impact of spillovers on return and volatility may be classified into six classes based on the following (Huruta et al. 2021). First, there are bidirectional return spillover effects in stock markets. Second, stock markets exhibit bidirectional volatility spillover effects. Third, stock markets exhibit unidirectional return spillovers. Fourth, stock markets exhibit unidirectional volatility spillover effects. Fifth, there are no stock market return spillovers. Sixth, there are no stock market spillover effects on volatility. As a result, the following hypotheses were proposed:

Hypothesis 1a (H1a).

Return spillover effects are visible in the KOSPI and the HSI.

Hypothesis 1b (H1b).

Volatility spillover effects are visible in the KOSPI and the HSI.

Hypothesis 2 (H2a).

Return spillover effects are visible in the STI and the HSI.

Hypothesis 2b (H2b).

Volatility spillover effects are visible in the STI and the HSI.

Hypothesis 3a (H3a).

Return spillover effects are visible in the TWII and the HSI.

Hypothesis 3b (H3b).

Volatility spillover effects are visible in the TWII and the HSI.

Hypothesis 4a (H4a).

Return spillover effects may be seen in the STI and the KOSPI.

Hypothesis 4b (H4b).

Volatility spillover effects may be seen in the the STI and the KOSPI.

Hypothesis 5a (H5a).

Return spillover effects are visible in the TWII and the KOSPI.

Hypothesis 5b (H5b).

Volatility spillover effects are visible in the TWII and the KOSPI.

Hypothesis 6a (H6a).

Return spillover effects are visible in the TWII and the STI.

Hypothesis 6b (H6b).

Volatility spillover effects are visible in the TWII and the STI.

3. Methodology

The stock market’s monthly closing price was used in this investigation. The closing price of the stock index is utilized to guarantee that the monthly findings are accurate. Each market’s stock index is transformed into a stock index return. Returns are calculated using the logarithm of price relatives. Equation (1) expresses the logarithmic difference between the current month’s closing price yield and the prior month’s closing price yield (Robiyanto et al. 2020).

Hong Kong, Taiwan, South Korea, and Singapore, the four Asian Dragon stock markets, offered monthly data samples. This the stock markets’ information is shown in Table 1.

Table 1.

Stock markets’ information.

The Yahoo Finance website (Yahoo Finance 2021a, 2021d, 2021c, 2021b) provided monthly statistics for the four stock markets from August 1997 through December 2020. Information on the Asian financial crisis (August 1997), the Global Financial Crisis (September 2008), and the COVID-19 outbreak (late December 2019) were included in the data statistics. The six stock market pairs that were matched included the KOSPI–HSI, the STI–HSI, the TWII–HSI, the STI–KOSPI, the TWII–KOSPI, and the TWII–STI.

The ARMA-LM test, the stationarity test, and the Lagrange multiplier test were carried out in this study. Furthermore, both conditional heteroscedasticities and GARCH effects were explained using the GARCH–ARMA model. Equations (2) and (3) show the spillover effects of returns for a single nation stock index.

Huruta et al. (2021) and Chen and Huang (2010) stated that H0 (d = 0) and H1 (d ≠ 0) were evaluated using the parameter (). H0 indicates that the sequence had no return spillover impact. H1 denotes that the sequence had spillover effects on returns. However, Equations (4) and (5) show the volatility spillover effects for a single nation’s stock index.

The two hypotheses, H0 (l = 0) and H1 (l ≠ 0), were tested through the parameter (). H0 demonstrated that there were no volatility spillover effects in the series. The H1-suggested sequence, on the other hand, exhibited volatility spillover effects.

4. Findings and Discussion

The empirical results obtained through a number of steps are presented in this section. The descriptive data are shown in Table 2. The sample correlations for all equity markets are shown in Table 3. The ADF, LM, and ARCH–LM model diagnostics are provided in Table 4. Finally, in Table 5 and Table 6, the GARCH–ARMA model was used to examine the effects of return (d) and volatility (l) spillovers.

Table 2.

Descriptive statistics.

Table 3.

Correlation matrix.

Table 4.

Model diagnostics statistics in summary.

Table 5.

Spillover effects of returns.

Table 6.

Spillover effects of volatility.

Table 2 shows that the whole stock market index had a positive return. The KOSPI (SD = 7.845795) and the HSI (SD = 6.921183) had the most volatile stock markets among nations. Mostly all stock markets were negative and left-skewed, but Korean stock markets were positive and right-skewed. In terms of the kurtosis parameter, all stock market returns seemed to have a leptokurtic distribution. In addition, the J–B statistic revealed that the data followed a normal distribution. This implied that the residual’s normal distribution assumption could not be ruled out (Chen and Huang 2010). Table 3 explains the correlation matrix in more detail.

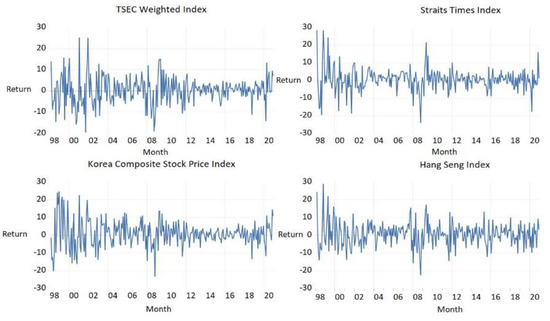

As shown in Table 3, the highest correlation (0.793989) was found between the STI and the HSI, while the lowest correlation was found between the TWII and the KOSPI (0.544596). When it comes to geographical issues, Taiwan and Hong Kong share a strong relationship (0.604508). Geographical issues may be at play in the TWII and HSI markets for close-to-open returns, according to Wei et al. (1995). During the data collection, the stock markets grew increasingly interconnected. International investors should take account the strong integration in terms of shock and volatility implications, as this would reduce the possible profits from a global portfolio (Khan 2011). In addition, the monthly return of stock markets is depicted in Figure 1.

Figure 1.

Stock market returns fluctuate on a monthly basis.

When the Asian financial crisis began in August 1997, stock markets had no higher returns than they did by the end of 1998. In the same way, the financial crisis in September 2008 and the COVID-19 pandemic in late 2019 happened in the same year. For all stock markets, the hypothesis of no unit roots is accepted (Table 4). We can use ARMA to model the data because we do not need to integrate or differentiate parameters. In addition, the Akaike Information Criterion (AIC) was used to diagnose the ARMA and GARCH models. The AIC had superior small sample properties, while the Schwarz criterion (SBC) was better with large samples. As our study performed with a small sample, a minimum AIC value was required in selected the best ARMA model. After we established the model, we proceeded and tested to ensure that it had no serial correlation. We were expecting to have an insignificant result, to accept the null hypothesis of no serial correlation. Based on the Lagrange multiplier test, all stock markets had no serial correlation. Then, we proceeded to check for ARCH effect/serially correlated variance. The Lagrange multiplier test was used to explain the ARCH effect and to reduce heteroskedasticity in the data’s volatility. We expected a significant result to reject the null hypothesis of no ARCH effects. Then, we proceeded to identify our GARCH model.

The null hypothesis of no ARCH influence across all stock markets was rejected. Further, we showed four appropriate GARCH models. Since we were already testing our GARCH model, the null hypothesis of no serial correlation in the variance was accepted. To accept the null hypothesis, we needed insignificant values for the second ARCH–LM test. Our results indicated that the ARCH–LM test had insignificant values (0.8346—HSI, 0.471—KOSPI, 0.6532—STI, and 0.5242—TWII). Table 5 and Table 6 show the use of the GARCH–ARMA model to determine whether stock market returns and volatility had any spillover effects. Studying the spillover effects on GARCH was much like exploring the VAR model with the ARCH effects. We determined if one investment instrument (stock market index) affected the other, and vice versa. Using the impact of a lagged stock market index, we considered whether the return of one stock market index influenced the return of another.

For the second (STI—HSI) and fifth (TWII—KOSPI) pairs, the lagged stock market return (d) was positive and significant at the 0.05 and 0.1 levels, respectively. The unidirectional spillover effects of the return from the lagged Hang Seng Index on the present Straits Times Index are particularly noteworthy. It was followed by the lag of the TWII on the KOSPI, indicating that returns were transmitted. The TWII and the HSI were the biggest net transmitters of returns to foreign stock markets, while the STI and the KOSPI were the biggest net receivers. As a result, H2a and H5a were supported by empirical evidence. The considerable trade volumes between the STI—HSI and TWII—KOSPI stock markets explained the spillover effect of return between the stock markets of the concerned countries. Returns from the HSI to the STI, due to the Hong Kong stock market, had a larger role in transmitting the four Asian Dragons’ returns than returns from other stock markets. These results were consistent with the previous findings of Chen and Huang (2010), who provided evidence for returns transmission by demonstrating the strong and positive influence of lagged stock index returns for Singapore and Hong Kong. As the regional financial hub, the Hong Kong stock market has a significant impact (Lee and Goh 2016). Table 3 also shows the highest correlation between the STI and the HSI. Due to minor spillover effects from the TWII to the KOSPI, investors altered their asset allocation to the Taiwan 50 ETF. Semiconductor manufacturing is a big part of its portfolio, and technology businesses have a lot of export potential (Chen and Huang 2010). These results were in contrast with the findings of Chen and Huang (2010), who reported that the presence of ETF performance in Taiwan was significantly impacted negatively by the lagged stock index return. The withdrawal of foreign investment, particularly from Taiwan’s stock markets, was partly due to speculators’ growing concerns over the nation’s economic slowdown, decline in individual consumption, and political unrest. Moreover, the lowest connection between Taiwan and South Korean stock returns supported the modest spillover effects. These findings were also in line with Chen and Huang’s earlier (Chen and Huang 2010) research, which found that the estimated coefficients of lagged ETF return for South Korea and Taiwan had a positive impact on recent stock index returns, demonstrating the existence of the spillover effect.

At 0.01 and 0.05 levels, the lagged stock markets’ residual in the conditional variance (l) equation was positive for the second (STI—HSI), third (TWII—HSI), fifth (TWII—KOSPI), and sixth (TWII—STI) pairs. Nonetheless, at 0.01 and 0.05 levels, the first (HSI—KOSPI) and fourth (STI—KOSPI) combinations showed a negative effect. Our findings were in line with those of Baek and Oh (2016), who showed that many decompositions of the HSI to the KOSPI spillover effects moderate negative daily spillover. The first pair (HSI—KOSPI), the second pair (STI—HSI), the third pair (TWII—HSI), and the fifth pair (TWII—KOSPI) demonstrated unidirectional volatility spillover effects. In contrast, the fourth pair (STI—KOSPI) and sixth pair (TWII—STI) represented bidirectional volatility spillover effects.

These findings were consistent with those of Lee (2009), who demonstrated significant volatility spillover effects between six Asian stock markets. This implies that portfolio investors can diversify risk by creating a portfolio from these stock markets. These results were also in line with the previous studies by Yousaf et al. (2020), who found the considerable trade volumes between the United States and two Latin American stock markets (Brazil and Mexico) explained the volatility linkages between the stock markets of the concerned countries. Based on those linkages, this highlighted evidence supporting volatility transmission. According to our findings, Hong Kong was identified as the largest net transmitter of volatility to other stock markets. These findings suggested that portfolio investors can obtain the maximum benefit of diversification by establishing a portfolio.

Singapore, South Korea, and Taiwan emerged as net stock market volatility transmitters to other markets. Specifically, given that the volatility spillovers to the KOSPI were quite minor during the observation, the KOSPI was a portfolio investors’ safe haven. These findings are supported by Chen and Huang (2010), who showed that the volatility of stock index returns had a negative impact on conditional variance of ETF returns in Korea, but its effect was minor. As stated by Markowitz (1952a), assets (stocks) should have a negative correlation. Instead of using a net receiver, the KOSPI used a net transmitter.

To summarize, H1b, H2b, H3b, H4a, H4b, H5b, H6a, and H6b were all accepted by the empirical data. Due to the Hu-Gang Tong stock, the empirical results pointed to a unidirectional and negative transmission of volatility from the HSI to the KOSPI. The stock enabled Hong Kong and mainland China investors to trade a wide range of shares listed on the other side of the border, through securities firms in their home markets (Baek and Oh 2016). Likewise, positive and negative volatility spillovers from the STI to the KOSPI were seen in the fourth pair. The spillovers of shock in both directions show that the STI and the KOSPI were closely linked. News of shocks on one stock exchange volatility was high, whereas on another, it was low (Khan 2011). Surprisingly, return and volatility spillover effects were equally as substantial in Singapore and Hong Kong (Premaratne and Balasubramanyan 2003). Taiwan and South Korea were second and third, respectively. Moreover, Miyakoshi (2003) and Lee (2009) found considerable volatility spillover effects within Asian nations, and our analysis supported their findings. As a result, foreign portfolio investors seeking diversification benefits may profit, over time, from investing in the four Asian Dragons stock markets.

5. Conclusions

The four Asian Dragons are the continent’s fastest-growing economies. Measuring the return and volatility transmission was carried out using the GARCH–ARMA model. The empirical evidence demonstrated that the stock markets of the four Asian Dragons exhibited competitive return and volatility spillovers. Unidirectional return transmission was implemented, in particular, on the second and fifth pairs. The TWII and the HSI were net stock market return transmitters to other markets, whereas the STI and the KOSPI were net receivers. This implied that these stock market prices play an important role in predicting prices within the majority of Asian Dragon markets. The volatility transmission was also experienced by all pairs. This implied that portfolio investors can diversify risk by creating a portfolio of all the stock markets in the four Asian Dragons. The largest net transmission of volatility to other stock markets was experienced by the HSI. However, the KOSPI’s volatility spillovers were very limited, because it was a safe haven for portfolio investors.

The results have significant policy and investment implications. For policymakers, the historical data on stock market returns and volatility transmission are important in predicting future contagion and crises. The findings are also critical for investors who want to build convincing portfolios and budgets in their selected competitive markets. By investing in the safe-haven stock market, portfolio diversification can help investors reduce risk and increase earnings. Overall, our findings provide useful information for policymakers and portfolio managers regarding optimal asset allocation, diversification, hedging, forecasting, and risk management.

Along with its strengths, our study has several limitations. Our study was limited to the impacts of stock market returns and volatility. As a result, more research is needed to compare stock markets and exchange trading funds across nations (emerging and developed countries). Furthermore, daily returns might explain the foundation of volatility variance. It is recommended that coefficients be produced to benefit investors with the conditional covariance and conditional variances via guiding methods such as DCC–GARCH or BEKK–GARCH. The GARCH–ARMA model was used in our study to analyze the effects of return on volatility within the four Asian Dragons. To study the return and volatility spillover, extensions might additionally include other models, such as copulas, and stochastic dominance.

Author Contributions

Conceptualization, A.D.H., C.-W.L., and S.-H.C.; methodology, C.D.; software, A.P.S.C.; validation, C.-W.L. and S.-H.C.; formal analysis, A.D.H.; investigation, S.-H.C.; resources, A.P.S.C.; data curation, C.D.; writing—original draft preparation, A.D.H., C.-W.L., and S.-H.C.; project administration, C.D.; funding acquisition, A.P.S.C.; writing—review and editing, A.P.S.C. and C.D. All authors have read and agreed to the published version of the manuscript.

Funding

This research was partially supported by the National Science and Technology Council, Taiwan (Grant number MOST-111-2637-H-324-001-) and by the Ministry of Education, Taiwan (Grant number 1110035928).

Institutional Review Board Statement

Not applicable.

Informed Consent Statement

Not applicable.

Data Availability Statement

Not applicable.

Conflicts of Interest

The authors declare no conflict of interest.

References

- Abbas, Qaisar, Sabeen Khan, and Syed Zulfiqar Ali Shah. 2013. Volatility Transmission in Regional Asian Stock Markets. Emerging Markets Review 16: 66–77. [Google Scholar] [CrossRef]

- Baek, Eun-Ah, and Man-Suk Oh. 2016. Volatility Spillover between the Korean KOSPI and the Hong Kong HSI Stock Markets. Communications for Statistical Applications and Methods 23: 203–13. [Google Scholar] [CrossRef]

- Bayramoğlu, Mehmet Fatih, and Tezcan Abasiz. 2017. The Analysis of Volatility Spillover Effect between Emerging Market Indices. Journal of Accounting and Finance 74: 183–200. [Google Scholar] [CrossRef]

- Bhatia, Nikhil, and Ishan Gupta. 2018. The Four Asian Dragon’s Significance in World Economic Development. International Journal of Advance Research, Ideas and Innovations in Technology 4: 377–83. [Google Scholar]

- Bozma, Gürkan, and Selim Başa. 2018. Analyzing Volatility Transmissions Between Stock Markets of Turkey, Romania, Poland, Hungary and Ukraine Using M-GARCH Model. Hacettepe University Journal of Economics and Administrative Sciences 36: 1–16. [Google Scholar] [CrossRef]

- Çelik, İsmail, Arife Özdemır Höl, and Semra Demir Gülbahar. 2018. Return and Volatility Spillover in Developing Countries: VAR-EGARCH Application to NIMPT Countries. Finans Politik & Ekonomik Yorumlar 636: 9–24. [Google Scholar]

- Chen, Jo Hui, and Chya-Yuan Huang. 2010. An Analysis of the Spillover Effects of Exchange-Traded Funds. Applied Economics 42: 1155–68. [Google Scholar] [CrossRef]

- Chuang, I-Yuan, Jin-Ray Lu, and Keshin Tswei. 2007. Interdependence of International Equity Variances: Evidence from East Asian Markets. Emerging Markets Review 8: 311–27. [Google Scholar] [CrossRef]

- Diebold, Francis X., and Kamil Yilmaz. 2009. Measuring Financial Asset Return and Volatility Spillovers, with Application to Global Equity Markets. The Economic Journal 119: 158–71. [Google Scholar] [CrossRef]

- Diebold, Francis, and Kamil Yilmaz. 2012. Better to Give than to Receive: Predictive Directional Measurement of Volatility Spillovers. International Journal of Forecasting 28: 57–66. [Google Scholar] [CrossRef]

- Diebold, Francis, and Kamil Yilmaz. 2014. On the Network Topology of Variance Decompositions: Measuring the Connectedness of Financial Firms. Journal of Econometrics 182: 119–34. [Google Scholar] [CrossRef]

- Forbes, Kristin, and Roberto Rigobon. 2002. No Contagion, Only Interdependence: Measuring Stock Market Comovements. The Journal of Finance LVII: 2223–61. [Google Scholar] [CrossRef]

- Fu, Tian Yong, Mark Jeremy Holmes, and Daniel Choi. 2011. Volatility Transmission and Asymmetric Linkages between the Stock and Foreign Exchange Markets: A Sectoral Analysis. Studies in Economics and Finance 28: 36–50. [Google Scholar] [CrossRef]

- Garay, Urbi. 2003. The Asian Financial Crisis of 1997–1998 and the Behavior of Asian Stock Markets. The University of West Georgia. Retrieved. Available online: https://www.westga.edu/~bquest/2003/asian.htm (accessed on 15 March 2022).

- Gürsoy, Öğr Gör Samet, and Ömer Eroğlu. 2016. Return and Volatility Spillovers among the Share Markets of Emerging Economies: An Analysis from 2006 to 2015 Years. Mehmet Akif Ersoy University Journal of Economics and Administrative Sciences 3: 16–33. [Google Scholar]

- Hamao, Yasushi, Ronald W. Masulis, and Victor Ng. 1990. Correlations in Price Changes and Volatility across International Stock Markets. The Review of Financial Studies 3: 281–307. [Google Scholar] [CrossRef]

- Hsieh, Wen-jen. 2011. The Global Economic Recession and Industrial Structure: Evidence from Four Asian Dragons. Tokyo: Asian Development Bank Institute, p. 315. Available online: https://papers.ssrn.com/sol3/papers.cfm?abstract_id=1949069 (accessed on 20 January 2022).

- Hung, Ngo Thai. 2019a. Dynamics of Volatility Spillover Between Stock and Foreign Exchange Market: Empirical Evidence from Central and Eastern European Countries. Economy & Finance 6: 244–65. [Google Scholar] [CrossRef]

- Hung, Ngo Thai. 2019b. Return and Volatility Spillover across Equity Markets between China and Southeast Asian Countries. Journal of Economics, Finance and Administrative Science 24: 66–81. [Google Scholar] [CrossRef]

- Huruta, Andrian Dolfriandra, Hans Hananto Andreas, Roberto Louis Forestal, Anboli Elangovan, and John Francis Diaz. 2021. Revisiting Spillover Effect: An Empirical Evidence from GARCH-ARMA Approach. Industrija 49: 67–80. [Google Scholar] [CrossRef]

- Johansson, Anders Carl, and Christer Ljungwall. 2009. Spillover Effects Among the Greater China Stock Markets. World Development 37: 839–51. [Google Scholar] [CrossRef]

- Karolyi, G. Andrew. 1995. A Multivariate GARCH Model of International Transmissions of Stock Returns and Volatility: The Case of the United States and Canada. Journal of Business & Economic Statistics 13: 11–25. [Google Scholar] [CrossRef]

- Khan, Mohd Asif. 2011. Management of Shock and Volatility Spillover Effects Across Equity Markets: A Case Study of India, Singapore and South Korea. International Journal of Management Reserach and Development (IJMRD) 1: 72–84. [Google Scholar]

- Khan, Saleheen, and Kwang Woo Park. 2009. Contagion in the Stock Markets: The Asian Financial Crisis Revisited. Journal of Asian Economics Contagion 20: 561–69. [Google Scholar] [CrossRef]

- King, Mervyn, Enrique Sentana, and Sushil Wadhwanii. 1994. Volatility and Links between National Stock Markets. Econometrica 62: 901–33. [Google Scholar] [CrossRef]

- Koutmos, Gregory, and Geoffrey Booth. 1995. Asymmetric Volatility Transmission in International Stock Markets. Journal of Lnternational Money and Finance 14: 747–62. [Google Scholar] [CrossRef]

- Kutlu, Melih, and Aykut Karakaya. 2020. Return and Volatility Spillover Effects between the Turkey and the Russia Stock Market. Journal of Economic and Administrative Sciences 2020: 1–15. [Google Scholar] [CrossRef]

- Lee, Sang Jin. 2009. Volatility Spillover Effects among Six Asian Countries. Applied Economics Letters 16: 501–8. [Google Scholar] [CrossRef]

- Lee, Stan Shun-Pinn, and Kim-Leng Goh. 2016. Regional and International Linkages of the ASEAN-5 Stock Markets: A Multivariate Garch Approach. Asian Academy of Management Journal of Accounting and Finance 12: 49–71. [Google Scholar]

- Li, Yanan, and David Giles. 2015. Modelling Volatility Spillover Effects Between Developed Stock Markets and Asian Emerging Stock Markets. International Journal of Finance & Economics 20: 155–77. [Google Scholar] [CrossRef]

- Lin, Wen-Ling, Robert Fry Engle, and Takatoshi Ito. 1991. Do Bulls and Bears Move across Borders? International Transmission of Stock Returns and Volatility as the World Burns. Review of Financial Studies 7: 507–38. [Google Scholar] [CrossRef]

- Liow, Kim Hiang, Jeongseop Song, and Xiaoxia Zhou. 2021. Volatility Connectedness and Market Dependence across Major Financial Markets in China Economy. Quantitative Finance and Economics 5: 397–420. [Google Scholar] [CrossRef]

- Liu, Ya-Chiu Angela, and Ming-Shiun Pan. 1997. Mean and Volatility Spillover Effects in the U.S. and Pacific—Basin Stock Markets. Multinational Finance Journal 1: 47–62. [Google Scholar] [CrossRef]

- Markowitz, Harry Max. 1952a. Portfolio Selection. The Journal of Finance 7: 77–91. [Google Scholar] [CrossRef]

- Markowitz, Harry Max. 1959b. Portfolio Selection: Efficient Diversification of Investments. London: Yale University Press. [Google Scholar]

- Miyakoshi, Tatsuyoshi. 2003. Spillovers of Stock Return Volatility to Asian Equity Markets from Japan and the US. Journal of International Financial Markets, Institutions and Money 13: 383–99. [Google Scholar] [CrossRef]

- Mohammadi, Hassan, and Yuting Tan. 2015. Return and Volatility Spillovers across Equity Markets in Mainland China, Hong Kong and the United States. Econometrics 3: 215–32. [Google Scholar] [CrossRef]

- Mukherjee, Kedar Nath, and Ram Kumar Mishra. 2010. Stock Market Integration and Volatility Spillover: India and Its Major Asian Counterparts. Research in International Business and Finance 24: 235–51. [Google Scholar] [CrossRef]

- Nelson, Daniel. 1991. Conditional Heteroskedasticity in Asset Returns: A New Approach. Econometrica 59: 347–70. [Google Scholar] [CrossRef]

- Poon, Ser-Huang, and Stephen John Taylor. 1992. Stock Returns and Volatility: An Empirical Study of the UK Stock Market. Journal of Banking and Finance 16: 37–59. [Google Scholar] [CrossRef]

- Premaratne, Gamini, and Lakshmi Balasubramanyan. 2003. Stock Market Volatility: Examining North America, Europe and Asia. Singapore: National University of Singapore. [Google Scholar]

- Robiyanto, Robiyanto, Bayu Adi Nugroho, Eka Handriani, and Andrian Dolfriandra Huruta. 2020. Hedge Effectiveness of Put Replication, Gold, and Oil on ASEAN-5 Equities. Financial Innovation 6: 53. [Google Scholar] [CrossRef]

- Roni, Bhowmik, Ghulam Abbas, and Shouyang Wang. 2018. Return and Volatility Spillovers Effects: Study of Asian Emerging Stock Markets. Journal of Systems Science and Information 6: 97–119. [Google Scholar] [CrossRef]

- Singh, Priyanka, Brajesh Kumar, and Ajay Pandey. 2010. Price and Volatility Spillovers across North American, European and Asian Stock Markets. International Review of Financial Analysis 19: 55–64. [Google Scholar] [CrossRef]

- Susmel, Raul, and Robert Fry Engle. 1994. Hourly Volatility Spillovers between International Equity Markets. Journal of International Money and Finance 13: 3–25. [Google Scholar] [CrossRef]

- Theodossiou, Panayiotis, and Unro Lee. 1993. Mean and Volatility Spillovers across Major National Stock Markets: Further Empirical Evidence. Journal of Financial Research XVI: 337–50. [Google Scholar] [CrossRef]

- Wang, Ping, and Peijie Wang. 2010. Price and Volatility Spillovers between the Greater China Markets and the Developed Markets of US and Japan. Global Finance Journal 21: 304–17. [Google Scholar] [CrossRef]

- Wei, John, Yu-Jane Liu, Chau-Chen Yang, and Guey-Shiang Chaung. 1995. Volatility and Price Change Spillover Effects across the Developed and Emerging Markets. Pacific-Basin Finance Journal 3: 113–36. [Google Scholar] [CrossRef]

- Worthington, Andrew, and Helen Higgs. 2004. Transmission of Equity Returns and Volatility in Asian Developed and Emerging Markets: A Multivariate GARCH Analysis. International Journal of Finance & Economics 9: 71–80. [Google Scholar] [CrossRef]

- Yahoo Finance. 2021a. Hang Seng Index. Available online: https://finance.yahoo.com/quote/%5EHSI/history?p=%5EHSI (accessed on 10 June 2021).

- Yahoo Finance. 2021b. KOSPI Composite Index. Available online: https://finance.yahoo.com/quote/%5EKS11?p=^KS11&.tsrc=fin-srch (accessed on 10 June 2021).

- Yahoo Finance. 2021c. STI Index. Available online: https://finance.yahoo.com/quote/%5ESTI?p=^STI&.tsrc=fin-srch (accessed on 10 June 2021).

- Yahoo Finance. 2021d. TSEC Weighted Index. Available online: https://finance.yahoo.com/quote/%5ETWII?p=^TWII&.tsrc=fin-srch (accessed on 10 June 2021).

- Yang, Zihui, and Yinggang Zhou. 2017. Quantitative Easing and Volatility Spillovers Across Countries and Asset Classes. Management Science 63: 333–54. [Google Scholar] [CrossRef]

- Yash, Dangayach, and Gupta Anmol. 2018. Four Asian Dragons-Evolution and Their Growth. International Journal of Advance Research and Development 3: 158–62. [Google Scholar]

- Yilmaz, Kamil. 2010. Return and Volatility Spillovers among the East Asian Equity Markets. Journal of Asian Economics 21: 304–13. [Google Scholar] [CrossRef]

- Yousaf, Imran, and Arshad Hassan. 2019. Linkages between Crude Oil and Emerging Asian Stock Markets: New Evidence from the Chinese Stock Market Crash. Finance Research Letters 31: 207–17. [Google Scholar] [CrossRef]

- Yousaf, Imran, Shoaib Ali, and Wing-Keung Wong. 2020. Return and Volatility Transmission between World-Leading and Latin American Stock Markets: Portfolio Implications. Journal of Risk and Financial Management 13: 148. [Google Scholar] [CrossRef]

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2022 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).