Abstract

The Theory demonstrates that oil price and oil volatility (OVX) are significant determinants of economic activity; however, studies seldom consider both variables in the oil–exchange rate nexus and ignore the distributional heterogeneity of the exchange rate. We investigate their joint effect and employ both the quantile regression and Markov switching models to address this. We differentiate between positive/negative shocks and control for the effect of the global financial crisis in 2008 and the COVID-19 pandemic in 2020. We observe that OVX shocks significantly impact the exchange rate for all countries whereas, oil price shocks only affect the exchange rate of oil importing countries. Rising (falling) OVX causes the local currency to depreciate (appreciate). The impact of rising or falling OVX is the same for oil importing and oil exporting countries whereas the impact of rising and falling oil price varies. The impact of oil price and OVX on exchange rate is affected by market conditions. The exchange rate responds to oil price and OVX mostly at lower quantiles (bearish markets) for all countries, which reveals investors sensitivity. In contrast, a weak to no significant response is observed at the higher quantiles (bullish market). Our results are robust in model selection (Markov switching models).

JEL Classification:

C21; F31; O55; Q40

1. Introduction

The sustaining of a stable exchange rate is well established in literature as significant to boosting economic growth (Danladi and Uba 2016; Conrad and Jagessar 2018). Therefore, continuous scholarly attention has been given to the factors that affect exchange rate returns, of which the central focus has mainly been on financial variables (stock market) (Tsagkanos and Siriopoulos 2013; Korley and Giouvris 2021), macro-economic variables (Chang and Su 2014), and governance (Fraj et al. 2018), with few studies specifically focused on oil shocks in Sub-Sahara Africa (Nusair and Olson 2019). However, a change in the price of oil is equally significant in determining the expected future fundamental movement(s) of the exchange rate (Brahmasrene et al. 2014). Further, oil price and exchange rate are both important factors that are closely linked to the economy (Ravazzolo and Rothman 2013; Evgenidis 2018; Ebenezer et al. 2022). This is because both variables are relevant for forecasting future macro-economic activities (Raymond and Rich 1997; Evgenidis 2018). Said and Giouvris (2019), looking at ten net oil importers/exporters, found that oil and foreign exchange are the most important predictive variables of the state of the economy, especially for emerging oil exporters, suggesting an over-reliance on this commodity.

Oil price shocks have been identified as a possible explanation for changes in the exchange rate (Chaudhuri and Daniel 1998). Yousefi and Wirjanto (2004) observed that an increase in oil price leads to the appreciation of the dollar. Chen and Chen (2007) have similarly shown that shocks in the oil market lead to changes in the exchange rate in G7 countries. Czech and Niftiyev (2021) used monthly data from January 2000 to May 2020 to analyse the exchange rate in Azerbaijan and Kazakhstan. Using structural VAR model, their results show that a rise in oil price shocks leads to the appreciation of the exchange rate of Azerbaijan and Kazakhstan against the USD. A similar result has been reported by Conrad and Jagessar (2018) for Trinidad and Tobago using ARDL. Conrad and Jagessar (2018), in their article, firstly argue that overvaluations and undervaluations in the exchange rate impede economic growth and secondly that fluctuations in the price of oil can have a serious impact on the real effective exchange rate (REER) especially if the country in question (such as Trinidad and Tobago) relies heavily on it. Hence, knowledge of how the oil price affects the exchange rate will help investors to diversify their portfolios to hedge risk1 and also allow policy makers to develop effective strategies to reduce oil price risk (Salisu and Mobolaji 2013). A possible strategy suggested by Zankawah and Stewart (2020) is the use of alternative sources of energy that will reduce the high dependency on oil to minimise the fluctuations in the exchange rate and promote economic growth (see Konstantakopoulou 2016 on growth and Wang et al. 2022 on the use of clean energy). Khan et al. (2021) show that oil price also affects the shipping industry and freight rates indicating the importance of oil price for trade. Along the same line, Said and Giouvris (2019) have found that Baltic Dry is more important for oil importers (Singapore, UK, Germany, Japan and France). We expect therefore, that shocks in the oil market should lead to changes in the exchange rate in developing countries in Africa as these countries depend heavily on oil for revenue. The oil market is also a primary source of foreign exchange which can generate structural difficulties in their economies (Eagle 2017). Alternatively, shocks in the oil market may affect USD reserves in these countries and consequently their exchange rates (Salisu and Mobolaji 2013).

Peersman and Van Robays (2009) argue that exchange rate changes due to oil price shocks have a derailing impact on the economy. With this effect on the economy, several studies, such as Aloui et al. (2013), have investigated the impact of oil shocks on exchange rates in developed markets. Adding to this, Conrad and Jagessar (2018) have reported that an increase in oil price results in an appreciation of the exchange rate in Trinidad and Tobago. Their findings support the theoretical argument from studies such as Golub (1983) that rising oil price leads to currency appreciation (currency depreciation) in oil exporting (importing) countries. For example, a rise in oil price worsens the trade balance of net importers since they need to buy more USD. This increases the nominal exchange rate and thereby causes depreciation of the local currency, while with net exporters, the reverse is possible due to increase in trade surpluses, improvement in current account balances hence, appreciation of the local currency (Allegret et al. 2014). However, an area of concern is Africa due to its rapid population growth. Rapid population growth leads to growth in energy demand according to the IEA (2019). The projected growth in oil demand by the IEA (2019), will be higher than China and India due to the projected population of Africa that will surpass these two countries by 2040. This article, therefore, focuses on the effect of oil shocks on exchange rates in Africa by examining the oil–exchange rate nexus for oil exporting (Angola, Nigeria) and oil importing (Cote d’Ivoire, Ghana, Mauritania) countries in Africa (see African Vault 2015) to provide a new explanation for the interdependency between the variables.

Three reasons underpin the decision to focus on these developing countries in Africa. First, Africa plays a significant role in the global oil markets. In 2019, Africa’s contribution to the world’s total oil output was 9.6% (EIA 2020). Nigeria for example, is a leading crude oil producer. Further to this, several countries in Africa, such as Ghana, Mauritania, Senegal and Kenya, are joining the growing list of downstream and upstream oil producers with new oil discoveries. Second, the oil sector is a significant contributor to their trade balance (Eagle 2017). According to Eagle (2017), positioning oil as a main source of revenue makes the economy be highly vulnerable to oil price volatility. This is confirmed by Said and Giouvris (2019), who found that oil and foreign exchange are the most important factors in predicting changes in GDP. They also indicate a two-way causality between oil and GDP for oil exporters. In Angola, for example, the 2014/15 oil price crisis depleted government revenue and threatened their fiscal policies (Bala and Chin 2018). Third, these countries are witnessing increases in foreign direct investment and rapid economic growth (AFDP 2019). Countries experiencing rapid economic growth, according to Kin and Courage (2014), are likely to be affected by oil price shocks because of an increase in the demand for oil. Finally, studies on these phenomena in Africa are limited despite its growing importance. Further assessment is needed in these countries as oil market shocks have increased risks in developing countries relative to developed countries (IEA 2004). You et al. (2017) have emphasized that the consequences of oil market shocks in developing countries are prevalent due to unstable macro-economic performance. Though the relationship between exchange rate and oil price, as well as between exchange rate and oil price uncertainty/oil price volatility2, have been examined in different studies, this study examines the joint effect of both oil price and oil price uncertainty on exchange rates.

The rationale is based on recent theory which demonstrates that changes in both oil price and oil volatility are significant determinants of economic activity (Ferderer 1996). Similarly, Kocaarslan et al. (2020) reasons that the relationship between oil shocks and economic variables should not be based solely on oil price without exploring the role of oil volatility shocks, as this may produce biased estimates. In addition, Jin and Zhu (2019) suggest that changes in oil price uncertainty should be regarded as an early warning indicator to prevent risk contagion. This is with the consideration that uncertainty in the oil market may reduce the efficiency of resource allocation by affecting and delaying important decisions on investment, such as production and consumption (Kocaarslan et al. 2020) which inevitably may depress exchange rate returns. For example, higher uncertainty in the oil market leads to a decline in the economic output growth which lowers consumption and spending. As the output growth of the economy falls, this impacts trade and may cause an adverse effect on the exchange rate (Mekki 2005).

Some studies have also demonstrated the significance of oil price uncertainty from different economic perspectives, such as aggregate output (Lee et al. 1995; Ferderer 1996), investment (Pindyck 1993) and unemployment (Kocaarslan et al. 2020). Since uncertainty in the oil market reduces wealth and investment (see Ferderer 1996), a number of studies have empirically examined the role of oil price uncertainty on exchange rate (Ghosh 2011; Muhammad et al. 2012; Salisu and Mobolaji 2013). For example, Salisu and Mobolaji (2013) have reported that an increase in oil price uncertainty causes the Nigerian Naira to depreciate relative to USD. However, oil price uncertainty, as defined in these studies, is suggested to evolve according to a generalized autoregressive conditional heteroskedasticity process (GARCH) computed from historical returns. Oil volatility generated by these models may not be accurate as historical prices are less informative and do not account for fear (Maghyereh et al. 2016).

This study takes a different approach. First, oil price uncertainty mentioned in this study is based on a newly published crude oil volatility index (OVX). Another alternative approach in prior studies is the use of VIX3 as a measure of uncertainty and risk aversion (see Basher and Sadorsky 2016; Said and Giouvris 2017a, 2017b; Peng et al. 2019; Malik and Umar 2019). Parallel to OVX is the VIX. The OVX however, is now regarded as a more suitable and direct measure of oil price uncertainty as it is based on diversified traders and investors expectation on future oil market changes (Ji and Fan 2016; Xiao et al. 2018). Only few studies have employed the OVX as a measure of oil volatility. With those, the main focus has been the impact of OVX on stock market (Liu et al. 2013; Maghyereh et al. 2016; Xiao et al. 2018).

Second, although previous studies have demonstrated the role of oil shocks on exchange rates, this study, to the best of our knowledge, is the first empirical one to document the joint impact of both oil price changes and OVX changes on exchange rates for developing countries (both importers and exporters). Breen and Hu (2021) looked at the effect of oil price and OVX on the exchange rates of developed countries: Canada, Norway and Australia. OVX appears to be a good predictor of exchange rates for Canada, Norway and Australia regardless of importer/exporter status. Therefore, we contribute to the literature providing new insights on the oil–exchange rate nexus from the perspective of the OVX (and price) for developing countries employing a bigger sample, one that could possibly allow us to offer generalized results for developing countries.

Third, while previous empirical studies which have examined the link between exchange rates and oil prices have focused mainly on developed markets, our focus is on Sub Saharan Africa (SSA). Previous studies on SSA, however, have relied on a linear specification for their variables and do not take into account that the effects of oil price on exchange rate might vary throughout the returns distribution. However, empirical evidence shows that shocks of different signs and magnitudes do have different impacts on the exchange rate (Nusair and Olson 2019). In this study therefore, we account for distributional heterogeneity of the exchange rate by employing the quantile regression (QR) model proposed by Koenker and Bassett (1978). We examine whether oil shocks affect exchange rates among bearish (lower quantile), normal (median) and bullish (higher quantile) markets. The QR model allows shocks of different signs and magnitude to have varying impacts on the dependent variable and allows for a more detailed investigation into different market conditions, namely bearish, normal and bullish markets (see Nusair and Olson 2019). As Su et al. (2016) have observed, the conditional heterogeneity of the exchange rate may have an influence on the relationship that exists between the variables. Applying this approach Nusair and Olson (2019) point out that the impact of oil prices on exchange rate depends on market circumstances (e.g., bearish or bullish markets). Our study differs from Nusair and Olson (2019) by examining the role of OVX in the oil–exchange rate nexus. Thus, accounting for such varying and distributional asymmetric effect provides a more accurate finding. The QR model has not been used for the countries under investigation. This model enables us to determine if the relationship between the variables differs throughout the distribution of the exchange rate return in developing countries. To the best of our knowledge, this is the first empirical study on the oil–exchange rate nexus to adopt this approach with respect to these countries.

In addition, we differentiate positive oil shocks from negative oil shocks. Several studies point to the fact that oil price shocks on macro-economic variables are directionally asymmetric (Akram 2004; Ahmad and Hernandez 2013; Evgenidis 2018) with the view that positive and negative shocks may have varying effects. Thus, we aim to jointly account for the asymmetric impact of oil prices and OVX changes on exchange rate return among some oil exporting (Angola, Nigeria) and oil importing countries (Cote d’Ivoire, Ghana, Mauritania) in Africa using the quantile regression model. Specifically, we compare results from the OLS model and the QR model in developing countries. Furthermore, we present a recent picture on the oil–exchange rate nexus by using a more recent sample period of 2007–2022, covering both the global financial crisis and the COVID-19 pandemic. Thus, we include a dummy variable to capture the structural change due to the financial crisis in 2008 and the COVID-19 pandemic in 2020. This is because other studies argue that the co-movement between exchange and oil prices was stronger during the financial crisis (Malik and Umar 2019) and the COVID-19 pandemic (Czech and Niftiyev 2021). Finally, we also conduct detailed sensitivity analysis of the results using an alternative technique (Markov switching model) for robustness.

To summarise, a distinguishing feature of this study from earlier work is the incorporation of oil price uncertainty in the oil–exchange rate nexus and the application of the quantile regression model (and Markov switching model for robustness). The results of this study show that the effect of oil price and OVX shocks and exchange rate is asymmetric (whether oil shocks is positive or negative) and depends upon the state of the exchange rate market (bullish, normal or bearish). For instance, falling oil price shocks have greater impact on exchange rate returns than rising oil price shocks and these effects vary throughout the distribution of the exchange rate returns in terms of magnitude and significance. The oil risk (oil price and OVX) shocks are more pronounced when the market is bearish. The evidence from OVX shocks on exchange rates is negative and significant for most countries. We find that the impact of oil prices on exchange rates is negative and significant for the oil importing countries (Cote d’Ivoire, Ghana and Mauritania) whereas we observe a weak effect for the oil exporting countries (Nigeria and Angola). Our results on the impact of OVX on exchange rate do not depend on country classification (it is independent of the status of a country as oil exporting or oil importing) as we observe that a fall in OVX causes the domestic currency to appreciate whereas a rise in OVX causes the domestic currency to depreciate. Moreover, the impact of rising and falling oil prices can vary. The results are robust to an alternative econometric technique (Markov switching models).

The rest of the study is organised as follows: Section 2 presents theory and briefly reviews literature on the relationship between oil risk and exchange rate, Section 3 explains the research methodology, which includes details of the adopted econometric model while Section 4 outlines the results of the statistical test analysis and the outcome of the econometric model. Finally, Section 5 provides the conclusion of this study.

2. Literature Review

2.1. Theoretical Background

In assessing the impact of oil prices on exchange rates, different studies have underpinned a number of theoretical models that explain a link between the two variables such as the terms of trade (Amano and Van Norden 1998) and the wealth effect (Golub 1983; Bodenstein et al. 2011). For terms of trade, studies such as that of Giulietti et al. (2015) point out that oil price tends to follow the law of one price because the price of oil is one of the main drivers of economic trade. To demonstrate this, Amano and Van Norden (1998) developed a framework to capture the effect of oil price and real exchange rate. Traditionally, a two-way transition mechanism is identified for oil exporting countries (supply side) and oil importing countries (demand side). For oil importing countries for example, Amano and Van Norden (1998) directly matched the increase in oil prices to a fall in trade balance which may in turn cause the local currency of the importing country to depreciate4. However, for an oil exporting country an increase in oil prices will increase trade balance causing the local currency of the exporting country to appreciate5. Subsequently, the intent of the latter is based on a transfer of wealth from oil importers to oil exporters6. For example, higher oil prices will lead to a change in the exchange rate of the importing country based on current account imbalances and portfolio reallocation. That is, a rise in oil prices will lead to depreciation of the currency of the importing country and an appreciation of the currency of the exporting country.

Diaz et al. (2016) argue that an increase in oil prices can have dire consequences on economic activity. Khan et al. (2021) show that oil price also affects the shipping industry and freight rates indicating the importance of oil price for trade. An argument by Soojin (2014) on oil price uncertainty shows that oil price uncertainty has an adverse effect on economic activity. In particular, some studies have demonstrated that oil price uncertainty is as important as the level of oil price in determining economic activity (Ferderer 1996; Kocaarslan et al. 2020). These authors base their argument on the theory of investment under uncertainty. Following these, we considered both oil prices and oil price uncertainty.

For example, during uncertain economic conditions, common practice/theory dictates that managers delay the making of investment decisions as the risks posed are often irreversible. Managers tend to postpone decisions on investments until the risks presented by the uncertainties are reduced. The investment delay may significantly affect macro-economic activities and thus may result in cyclical fluctuations in the economy (Bernanke 1983; Elder and Serletis 2010; Kocaarslan et al. 2020). According to Bernanke (1983), rising uncertainties may equally be misunderstood by agents as they may not be able to isolate a permanent shock from a temporary shock. This lack of clarity, therefore, may lead a temporary shock to be confused as a permanent shock. Bernanke (1983) therefore, demonstrated that it is optimal for firms to postpone irreversible investment decisions in response to an increase in oil price uncertainty. Additionally, Edelstein and Kilian (2009) found evidence that uncertainty may also affect consumer expenditure due to an increase in precautionary savings by agents in response to increased oil price uncertainty. Thus, it could be argued that delay in investment in response to rising oil price uncertainty has an adverse impact on aggregate investment and consumption in the real economy (Kocaarslan et al. 2020; Wang et al. 2017). Moreover, if incentive to investment and consumption declines this tends to impact trade and consequently may have an adverse effect on exchange rate returns (see Mekki 2005).

2.2. Empirical Evidence

2.2.1. Developed Countries

Exchange rate and oil prices provide a wealth of research because both variables have been associated with economic activities (Hamilton 1996). Several studies have established the relationship between oil prices and exchange rates, however, the bulk of research on the relationship between oil prices and exchange rate have focused on developed economies. Lizardo and Mollick (2010), for example, show that an increase in oil price leads to appreciation of the USD relative to the local currency of net oil importers such as Japan, with the depreciation of the USD relative to the local currency for net oil exporters such as Canada. Chen and Chen (2007) examined the relationship between real oil prices and exchange rates for G7 countries and found a significant relationship between real oil prices and real exchange rates. They showed that real oil prices are a significant component in explaining the exchange rate movement. Amano and Van Norden (1998), based on analyses of Germany, Japan and the US identified that real oil prices are a dominant component in determining real exchange rates in the long run. Similarly, Chaudhuri and Daniel (1998) found that changes in the oil price explain the movement in the US dollar real exchange rates. Issa et al. (2008) found that the impact of real oil prices on the Canadian dollar are negative. Cifarelli and Paladino (2010) employed multivariate GARCH to examine the relationship between oil prices and exchange rates and reported a significant negative relationship between oil volatility and the real USD exchange rate. Wu et al. (2012) found that oil prices significantly contribute to the movement in US dollar exchange rate. In another study, Volkov and Yuhn (2016) found co-movement between oil prices and exchange rates for Russia, Norway, Brazil, Mexico and Canada. Using GARCH-M the authors revealed that an increase in oil prices causes the local currencies in all the countries (oil exporting) to appreciate. However, Habib and Kalamova’s (2007) research on the long-run relationship between oil prices and exchange rates for Russia, Norway, and others, concluded that there is no long-run relationship between the variables for all countries except for Russia.

2.2.2. Developing Countries (Africa)

There are few studies on the relationship between oil prices and exchange rates that specifically focus on developing countries. For these countries, the focus has mostly been on Nigeria with differing results. For example, Turhan et al. (2013), using a vector autoregressive model to examine the dynamic link between oil prices and exchange rates in Nigeria and other emerging economies, found that there is no significant relationship between oil prices and exchange rates in Nigeria. Thus, oil prices do not help to explain the dynamics in the exchange rate. Ozsoz and Akinkunmi (2012) employed a vector error correction model to detect the determinants of real exchange rates in Nigeria from 2004 to 2010. Their model showed that an increase in oil prices leads to an appreciation of the Naira exchange rate. This relationship is expected as Nigeria is a net oil exporter. Similarly, Adeniyi et al. (2012) used the GARCH model to confirm Ozsoz and Akinkunmi’s findings. In contrast, Muhammad et al. (2012) claimed that oil price increases lead to the depreciation of the Nigerian Naira. Coleman et al. (2011), on the relationship between real exchange rate and oil prices for a number of African countries, found no statistically significant relationship between the oil market and the exchange rate market for Cote d’Ivoire. Similarly, Lv et al. (2018) found no evidence of either a long- or a short-run dynamic between oil prices and exchange rates in Angola. Eagle (2017) also found no statistically significant relationship between oil prices and exchange rates in Angola. Zankawah and Stewart (2020) examined Ghana (oil importing) using a GARCH-BEKK model, found that oil price shocks have a significant effect on the exchange rate, while an increase in oil price causes the Ghanaian Cedis to depreciate, supporting a negative relationship. The significant effect between oil price and exchange rate in Ghana was also confirmed in the findings by Mensah et al. (2016). However, Ngoma et al. (2016) observed that rising oil prices causes the Ghanaian Cedis to undergo a short-lived appreciation.

In light of the current results in these developing countries and the fact that oil price shocks are perceived as a good predictor of the exchange rate, further research is needed.

2.2.3. Asymmetric Effects of Oil Prices

Although, the studies discussed above indicate a relationship between oil price and exchange rate, results vary a lot. Meanwhile, other studies have associated the varied results on the fact that the effect of oil price shocks is directionally asymmetric concluding that positive and negative shocks may have varying effects (Hamilton 2003; Akram 2004; Ahmad and Hernandez 2013). Similarly, the linear and symmetric approaches alone are not enough to explain the relationship between the variables due to the asymmetric effect of oil price shocks (Mork 1989; Balke et al. 2002). Mork’s (1989) support for asymmetric effects of oil price has been confirmed by Kocaarslan et al. (2020), who state that identifying asymmetries enables a better understanding of the key role of oil price. However, prior literature on developing countries has ignored the likelihood of asymmetric effects of oil shocks on the exchange rate.

To account for asymmetries in oil price shocks, some studies have used oil shock indicators, such as demand and supply shocks, to characterise asymmetries in the relationship between oil prices and exchange rate. For example, Atems et al. (2015) argue that the response of exchange rate to oil prices differ greatly depending on whether the shocks are driven by supply or demand as they only observed significant effects from demand shocks. Malik and Umar (2019), using daily data from major oil exporting and oil importing countries, namely Brazil, Canada, China, India, Japan, Mexico and Russia from 1996 to 2019, found that oil price shocks driven by changes in demand have an effect on exchange rates; However, they observed no significant impact on exchange rates from supply shocks. A similar effect has been found by Chen et al. (2016), who observed no significant effect of supply shocks on the exchange rate but found that demand shocks significantly impact the exchange rate return for most OECD countries. On the contrary, Jiang and Gu (2016) have shown that oil supply shocks had a more significant effect. On the other hand, asymmetries are characterised by positive and negative oil price shocks as reflected in Hamilton (2003, 1996); Mork (1989); and Wang et al. (2013). These studies report that the magnitude of the positive oil shocks on macro-economic variables is greater than negative shocks, indicating an asymmetric effect. Asymmetric effects are also reported in the study by Engemann et al. (2014), which showed that some states only respond to negative oil price shocks.

To formalise the asymmetric relationship between oil prices and exchange rates, Akram (2004) highlighted the asymmetric effects of oil price shocks to the Norwegian exchange rate. Wu et al. (2012) also identified the asymmetric relationship between oil price and the US dollar exchange rate. Their studies further highlight how the relationship between the two variables appear to be more negative when the US dollar depreciates than when the dollar appreciates. In a study by Mensi et al. (2015), the authors used a bi-variate dynamic conditional covariance EGARCH model to show that the relationship between oil price and exchange rate is asymmetrical. Unlike the aforementioned studies on developing countries, this paper considers whether changes in oil price risk have asymmetric impact on the exchange rate return. Most empirical studies on the oil–exchange rate nexus, particularly in the developing countries under study, do not include the asymmetric effect of oil price shocks on exchange rates, which may cause the relationship to be biased (Atems et al. 2015). An exception is Iwayemi and Fowowe (2011), who found that negative oil shocks have significant predictive power on real exchange rates in Nigeria while positive oil shocks had no significant effect.

2.2.4. Justification for QR Model

Hamilton (2003) has shown that macroeconomic fundamentals are largely nonlinear and asymmetric. In the literature, various studies have been based on linear models (Chen and Chen 2007) while, others employed non-linear models (Lv et al. 2018). For example, Lv et al. (2018) used Markov switching model(s) to investigate the nonlinear impact of oil shocks on the exchange rate. However, the Markov switching model in these studies is largely governed by two regimes, a high and a low volatility state and thus fails to capture the entire distributional heterogeneity of exchange rate responses, such as when the market is bullish (low volatility), bearish (high volatility) or normal (neither bearish nor bullish) (Su et al. 2016). The QR analysis makes it possible for shocks of different magnitudes and signs to have different impacts on the exchange rate (Nusair and Olson 2019). With no consensus in empirical evidence in the relationship between oil shocks and exchange rates, some authors began to identify the basic rationale underlying the conflicting results, including the findings of Su et al. (2016). Their findings show that previous studies ignored the distributional heterogeneity of the exchange rate return (different market conditions). The authors posit that the large depreciation or appreciation of a country’s exchange rate will lead to changes in the terms of trade and current account balances which may lead to the exchange rate exhibiting distributional heterogeneity. They further suggest that both the ‘central bank intervention effect’ and the ‘export selection effect’7 provide the theoretical foundation for the distributional heterogeneity of the exchange rate return. Similarly, Nusair and Olson (2019), in a similar study, observed that the effect of oil prices on exchange rate varies throughout the distribution of the exchange rate and hence varies under different market conditions. Thus, in comparison with related literature in identifying the impact of oil shocks on exchange rates, this study employs the quantile regression (QR) model proposed by Koenker and Bassett (1978). The QR model is less sensitive to the presence of outliers, skewness and non-normal errors and so produces more robust and accurate results (Xiao et al. 2018). Although, this method has been used to determine the relationship between financial and economic variables by Lee and Zeng (2011) for G7 countries, Nusair and Al-Khasawneh (2018) for GCC countries, and Nusair and Olson (2019) for Asian countries, it has not been applied in this regard for the countries in this study.

3. Data and Methodology

3.1. Data

The sample of this study consists of U.S Dollar (USD) nominal exchange rates of five developing countries8 namely, Angola, Cote d’Ivoire, Ghana, Mauritania and Nigeria. Although we wish to add more countries, data is not available. Our choice of countries, although stemming largely from the limited number of studies in Africa, are all oil producing countries that still depend on energy importation, especially refined petroleum products. According to Eagle (2017), eighty percent of oil producing countries in Africa export crude oil and import refined petroleum products, thereby making these economies very susceptible to the fluctuations of oil prices. In addition, this group of counties includes both net oil exporting countries (Angola and Nigeria) and net oil importing countries (Cote d’Ivoire, Ghana, and Mauritania) as shown in Table 1. Therefore, there is the possibility to uncover potential differences in the impact of oil price and OVX changes on exchange rate between oil exporting countries and oil importing countries. Several researchers have pointed out that the impact of oil prices on macro-economic variables differ depending on whether a country is a net importer or a net exporter (Wang et al. 2013). The aim of the study is to ascertain the extent to which (if any) oil price changes and OVX changes affect exchanges rates in oil exporting/importing countries.

Table 1.

Classification of countries. This table reports the oil exports/imports and net oil exports for our sample countries in 2015. All data are obtained from Datastream, OPEC and Central Intelligence Agency (CIA) and the UN Environment Programme (UNEP) website. -: data not available.

The oil risk in this study is composed of the crude oil implied volatility index (OVX) and crude oil prices9. Data on oil prices and nominal exchange rate are derived from DataStream and data on crude oil implied volatility index are obtained from the Chicago Board of Exchange’s (CBOE) official website. For the oil price data, we chose the crude oil Brent because two thirds of global crude contracts are based on crude oil Brent and it is the most widely used reference (Umar et al. 2021). We express the nominal exchange rate in terms of USD per one unit of the domestic currency so that an increase (decrease) in the nominal exchange rate leads to depreciation (appreciation) of the USD.

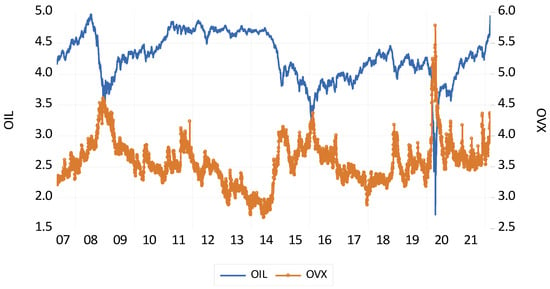

The data set considered in this study contains daily observations; this is considered more appropriate as higher frequency data are said to contain more specific and detailed information than lower frequency data (Aloui et al. 2013). Daily data have been used by other studies in examining the oil–exchange rate nexus such as You et al. (2017) and Malik and Umar (2019). The authors acknowledge that using daily data captures the dynamic interactions between oil price and exchange rate. Moreover, the oil–exchange rate nexus may be influenced by monetary policy/interest rate such as LIBOR (see Iwayemi and Fowowe 2011; Volkov and Yuhn 2016); however, we could not incorporate such factors in our model as there is no daily series available for all the selected countries10. Our sample period is between 10 May 2007 and 3 March 2022. This yielded 3871 daily observations. The start date of May 2007 is based on the crude oil implied volatility index as there are no prior data to this time. The period under study captures various financial and economic crises such as the global financial crisis (2007–2009) and the COVID-19 pandemic. Figure 1 shows the plot of the oil prices and the OVX movement over the sample period. For example, in Figure 1 we observe a fall in oil prices in 2008 and from mid-2014 to early 2016. The 2008 spike could be attributed to the global financial crisis and the later period could be attributed to the US Shale oil development shocks. In fact, a significant decline in the oil prices is from early 2020 to mid-2020 and was driven by the COVID-19 pandemic. During this period international oil prices witnessed a drastic fall by more than three times from 74USD/Barrel to 20 USD/Barrel.

Figure 1.

Trend of oil price and OVX.

In this study, we converted all price series into returns by taking the natural log difference of the price multiplied by 100.

Table 2 shows the descriptive statistics of data. In Table 2, the mean returns for exchange rate for all countries over the sample period are negative which suggest a nominal appreciation against the USD, while the oil variables show a positive mean return.

Table 2.

Descriptive Statistics. This table shows descriptive statistics for the return series respectively covering the period 14 January 2007–31 December 2019. SD is the standard deviation, J–B test is the Jarque–Bera normality test. ** means that the null hypothesis is rejected at the 5% significance level.

3.2. Methodology and Research Hypotheses

According to Hu (2006), crisis/structural breaks may impact the structure and degree of dependence between variables. Similarly, Baur (2013) states that a model without a dummy variable to capture breaks in the series implies that the dependence is fully captured by the slope variables, which may be biased. Accordingly, authors such as Beckmann et al. (2016) and Malik and Umar (2019) identified that the co-movement between exchange rates and oil shocks have intensified since the global financial crisis. The authors split their data period into pre-crisis, crisis and post-crisis, while others show that the strength of the relationship between exchange rates and oil price has significantly increased during the COVID-19 pandemic (Czech and Niftiyev 2021). Some studies have also employed dummy variables to capture the impact of the crisis on the oil–exchange rate nexus (Pershin et al. 2016; Brahmasrene et al. 2014). In this study, we follow Brahmasrene et al. (2014), who included a dummy variable to examine the impact of the 2008 financial crisis (2008 oil price shock) on the oil–exchange rate nexus. Our study differs from Brahmasrene et al. (2014) in so far as we include a structural break (dummy variable) to capture the impact of the global financial crisis in 2008 and the COVID-19 pandemic in 2020 on the dependence between exchange rates and oil risk shocks in Africa. Thus, we apply the QR analysis using dummy variables to capture the impact of the 2008 financial crisis and the COVID-19 pandemic on the co-movement between the variables. Using a dummy variable follows a number of studies, including Devpura (2021). Specifically, the aim of this study is to ascertain the extent to which (if any) oil price changes and OVX changes affect exchanges rates in oil exporting/importing countries under different economic conditions (crises) considering different econometric approaches. Our research hypotheses are as follows:

Hypothesis 1 (H1).

Oil price changes/shocks affect the exchange rate for all countries.

Hypothesis 2 (H2).

OVX changes/shocks affect the exchange rate for all countries.

To provide a first glimpse, our results show that the impact of a rising or falling OVX is the same for oil importing and oil exporting countries whereas the impact of rising and falling oil price varies/depends on market conditions (bull vs. bear market). As indicated in previous sections, we also employ Markov switching models to test for robustness. Both hypotheses remain the same.

3.3. Econometric Model

Given that the purpose of this study is to evaluate the relationship between oil risk shocks (OIL and OVX) and exchange rate under different market conditions, and that it follows the framework of Nusair and Olson (2019), the QR model proposed by Koenker and Bassett (1978) is adopted to fulfil our objective. As stated earlier this model allows the effect of the independent variables to vary across several quantiles.

The main focus is to establish if there is an asymmetric effect of oil risk shocks (OIL and OVX) on exchange rates in Africa. The asymmetric effects of oil price shocks were based on significant empirical evidence (Balke et al. 2002). To start with, a standard OLS model was specified as follows:

where, and .

denotes the nominal exchange rate return at time t denotes the oil price changes, denotes the crude oil volatility changes, is a vector of n dummy variables with = 1, if observation t belongs to the ith period and 0 otherwise, is a random error term.

Nonetheless, empirical evidence has shown that the impact of oil risk shocks on exchange rate varies throughout the distribution of exchange rate returns. To ascertain to this fact, we employed the QR model which is specified as follows:

In this section represents the dependent variable which was assumed to be linearly dependent on x, is the conditional quantile of the dependent variable, is the intercept and denotes the unobserved effects at quantile, and represents a vector of independent variables (which includes oil return, OVX changes and dummy variables), and a vector of estimated quantile regression coefficients respectively. The estimated coefficient of the quantile of the conditional distribution, based on the least absolute deviation approach, can be specified as a minimization of the weighted deviations as follows

where is the weighted absolute factor also known as check function is defined as

Alternatively, it can be represented as

In this equation, .

In addition, the sum of residuals is minimized into positives and negatives given different weights of and respectively, based on linear programming. Basically, quantile regression is based on minimizing absolute errors, further details of the estimation can be found in Koenker and Bassett (1978).

Then, to evaluate the effect of oil risk shock on exchange rate returns throughout the distribution of exchange rate returns we specified the QR model as follows:

Following Nusair and Olson (2019), we restricted our quantiles to nine (). We then divided them equally into 3 quantiles, namely lower quantile (, median quantile (and higher quantile. Lower exchange rate quantile corresponds to bearish market and represents large USD appreciation against the domestic currency. Higher exchange rate quantile corresponds to bullish market and represents large USD depreciation against the domestic currency. Meanwhile, median exchange rate quantile corresponds to normal market which means that the market is neither bearish nor bullish. In our case, for each market condition, two observations must be statistically significant to be considered as significant.

4. Results and Analysis

4.1. Stationarity and Cointegration

In Table 3, we test the stationarity and integration order of the variables, to avoid the problem of spurious regression. The study employed three different tests for robustness namely: Augmented Dickey–Fuller test11 (Dickey and Fuller 1979), Phillips and Perron (1988), and Kwiatkowski et al. (1992). The ADF and PP test failed to reject the null hypothesis in all the log level series except for OVX, suggesting evidence of unit root in the series. However, for the first difference of the log level series, both ADF and PP rejected the null hypothesis, this suggests that the first difference was stationary. The KPSS test rejected the null hypothesis in all the log level series except for OVX. However, with the first difference of the log series, the KPSS failed to reject the null hypothesis, hence the first difference of the log series was stationary. All three tests confirmed that all variables are non-stationary in their levels except OVX but stationary in their first difference. Thus, the series were integrated of order I(1), while OVX is I(0).

Table 3.

Unit root and stationary test. The table shows the unit root and stationarity test for the oil index and exchange rate series. ADF is the augmented Dickey–Fuller test, PP is the Phillips–Perron test, KPSS is the Kwiatkowski–Phillips–Schmidt–Shin test. Null hypothesis for ADF and PP; H0 = series has unit root (H0:; null hypothesis for KPSS test; H0 = series is stationary. *** indicate 1%, ** indicate 5% significance level and * indicate 10%.

Then, the bound testing approach (Pesaran et al. 2001) was used to investigate the degree of integration between the variables. The bound testing was appropriate for this study since integration order of the variables was mixed. The bounds testing approach made it possible to determine more efficient cointegrating relationship and did not require series of the same integrated orders (Sari et al. 2010), thus we could infer if there existed a long-run relationship between the variables. The result, shown in Table 4, fails to reject the null hypothesis of no-cointegration between the variables at the 5% significance level except for Angola. Thus, the results suggest that there is no long-run relationship between exchange rate, oil price and OVX for each country except for Angola12.

Table 4.

Bounds-testing cointegration estimation results. The table presents bounds-testing estimation results. This estimation is based on the null hypothesis of “no cointegration” against the alternative. We failed to reject the null hypothesis if the F-statistics obtained were lower than the critical values. The critical values for the 5% significance level I(1) is 4.94 and I(0) is 5.73 values as suggested in Pesaran et al. (2001).

4.2. Structural Breaks

Before proceeding to the QR analysis using the return series, we tested for structural breaks in the relationships within the oil–exchange rate nexus. The effects of structural breaks inherent in the data series may impact the relationship between the variables since the variables may vary due to these structural breaks (Beckmann et al. 2016). Zhu et al. (2016) have mentioned that the slope variables may be biased when dependence is impacted by structural breaks. Since the span of our study is characterised by different shocks and events such as the 2008 global financial crisis and COVID-19 pandemic, such events may suggest structural breaks in the dependence between the variables. To identify structural breaks in the co-movement between the variables, we applied the Bai and Perron (1998, 2003) multiple structural breakpoint test, allowing for a maximum of five breaks as shown in Table 5.

Table 5.

Bai–Perron multiple breakpoint tests. The table presents the estimation results of the Bai–Perron multiple structural breakpoint tests, allowing for a maximum of five breaks for the relationship between the return series of the two variables. Null hypothesis: H0 = L + 1 vs. L sequentially determined structural breaks. Bold values indicate 5% significance level.

The results from Table 5 suggest that structural breaks are only present in Cote d’Ivoire (2010, 2013), while the other countries show no evidence of structural breaks. These breaks correspond to the aftermath of the global financial crisis in 2008, and the Euro debt crisis in 2011. Moreover, the breaks did not capture the highest oil price uncertainty jump and the lowest drop in oil price that each coincide with the global financial crisis in 2008, the oil price shock in 2016 and the COVID-19 pandemic as shown in Figure 1. Following Pershin et al. (2016), we did not consider these breaks as we observed no evidence of structural breaks in most countries. However, the possible effect of financial crisis in 2008 and the COVID-19 pandemic must be considered because the oil–exchange rate nexus may change. Some authors have identified that the co-movement between exchange rate and oil shocks has intensified since the crisis (Beckmann et al. 2016; Reboredo and Rivera-Castro 2013; Czech and Niftiyev 2021). Thus, in this study, we applied the QR analysis including dummy variables in order to capture the impact of the global financial crisis in 2008 and the COVID-19 pandemic on the dependence between exchange rate and oil risk shocks in Africa. Accordingly, the dummy variable was informed by authors such as Beckmann et al. (2016); Zhu et al. (2016). In addition, Zhu et al. (2016) have posited that ignoring structural breaks between financial and economic series may render the estimation inappropriate.

4.3. Oil Price and OVX Changes on Exchange Rate

4.3.1. OLS Estimation

Net Oil Importers

We apply OLS and quantile regression models to examine the relationship between the exchange rate and oil risk factors (Oil price and OVX). In Table 6 (see column 3), the OLS results show that oil price has a positive impact on exchange rate for all countries, however only Cote d’Ivoire is significant. This implies that rising oil price causes the USD to depreciate against the domestic currency. The appreciation of the domestic currency is contrary to the ‘wealth effect’. Specifically, net importers need to pay for imported oil using USD purchased from the international currency market, hence the demand for USD goes up, depressing the domestic currency (Lizardo and Mollick 2010). The result for Cote d’Ivoire is surprising as no relationship was expected because of their strong restrictions on their respective exchange rate as they maintain a pegged exchange rate regime (Lv et al. 2018). Lv et al. (2018) posit that countries with a pegged exchange rate regime weaken or eliminate the relationship between exchange rate and oil prices shocks. Interestingly, Lv et al. (2018) found a significant impact of oil price shocks on exchange rates for Kuwait and Saudi Arabia, which also observe a pegged exchange rate. Our results for Cote d’Ivoire are, however, contrary to Coleman et al. (2011) who found no relationship between oil price shocks and exchange rate for Cote d’Ivoire. The OLS results further show that OVX changes have negative impact on the exchange rate in Ghana and Cote d’Ivoire. This result indicates that an increase in OVX leads to a decrease in the exchange rate returns thereby, causing an appreciation of the US dollar against the Ghanaian Cedis and CFA franc. This finding can be attributed to the fact that greater uncertainties in oil prices have a significant impact in the real economy (Wang et al. 2017) which in turn affects the exchange rate.

Table 6.

Estimation results for OLS and quantile model. The table shows the OLS and quantile model estimation results. We chose nine quantiles () and divided them into three regimes: low (, medium ( and high ( which correspond to bearish, normal and bullish markets, respectively. ß4 and ß5 are the coefficients of the dummy variables. Bold values indicate statistical significance at the 1%, 5% and 10% levels.

Net Oil Exporters

Our results for Angola and Nigeria (OPEC) show that neither oil price changes nor OVX changes have a significant effect on their currencies. This is contrary to theory based on the terms of trade effect and some studies such as Korhonen and Juurikkala (2009), who have reported that oil price negatively affects exchange rate for OPEC member countries. However, Angola’s result is in tandem with Eagle (2017), who found no statistically significant relationship between oil price volatility and exchange rate. For Nigeria, the result is contrary to findings of Adeniyi et al. (2012) and Olomola and Adejumo (2006) who reported a statistically inverse relationship between oil price shocks and exchange rate.

Moreover, studies argue that the co-movement between exchange and oil prices is stronger during crisis (Malik and Umar 2019; Czech and Niftiyev 2021). However, the dummy variable for structural break in Table 6 (column 3), capturing the impact of global financial crisis and the COVID-19 pandemic on the relationship between the variables, is only significant in Angola.

4.3.2. QR model Estimation

Net Oil Importers

In Table 6 (column 3), OLS regression examines only the average effects of independent variables on dependent variables based on the conditional mean of the dependent variable (Nusair and Olson 2019). Similarly, the OLS regression is valid for samples with normal distributions but less valid for samples with large amount of discrepant data (Koenker and Bassett 1978). As mentioned earlier, analysing several quantiles using the QR analysis provides more details on the relationship between the variables under different market conditions compared to the OLS (Tsai 2012). Thus, the impact of oil price and OVX changes on exchange rate returns may vary throughout the distribution of the exchange rate returns in view of different market conditions, hence we applied the QR analysis in Equation (4) as reported in Table 6 (column 4–12). In Table 6 (column 4–12) the result for Cote d’Ivoire shows that OVX changes have a significant negative effect on the exchange rate at the lower quantile, while the effect of oil prices is insignificant. This implies that an increase in OVX will cause the CFA franc to depreciate against the USD when the market is bearish. Indeed, given that Cote d’Ivoire employs a pegged exchange rate regime, one would expect that OVX changes have weak or no significant impact on exchange rate. However, this finding seems to suggest that OVX changes play a significant part in the depreciation of the currency in Cote d’Ivoire at all quantiles. This may be largely due to the forward-looking measure of the OVX changes.

The result for Ghana suggests that OVX changes have a significant negative effect on the exchange rate returns at lower quantile, while the effect of oil prices on exchange rate is not significant. This implies that, when the market is bearish, changes in OVX leads to the depreciation of the Ghanaian Cedis. Zankawah and Stewart (2020) found a statistically significant relationship between oil price and exchange rate in Ghana using monthly data from 1991–2015, which is contrary to our findings.

The results for Mauritania suggest that oil price changes positively impact the exchange rate at higher quantile (0.8,0.9) with no significant effect at the other quantiles. This suggests that oil price shocks cause the Mauritanian Ougyiya to appreciate when the market is bullish. This is the first study to investigate the impact of oil risk on exchange rates in Mauritania. Therefore, empirical work for comparative analysis for Mauritania is limited. Moreover, the appreciation of the local currency against the dollar following an increase in oil prices was unexpected. This is because empirical evidence on oil importing countries shows that rising oil prices leads to currency depreciation through the terms of trade effect (Nusair and Olson 2019). A plausible reason for Mauritania could be its small population and less dependency on oil.

In summary, for the oil importing countries we found significant responses of exchange rate to oil prices only in Mauritania. Whereas OVX changes have a negatively significant effect on exchange rate for all countries mostly at the lower quantile.

Net Oil Exporters

Focusing on Nigeria, the result shows that neither oil price nor OVX changes have a statistically significant effect on the Nigerian Naira which is contrary to theory. A plausible reason could be the adoption of a less flexible exchange rate regime in Nigeria. Lv et al. (2018) posits that exchange rate restrictions could distort the relationship between exchange rate and oil prices. An alternative explanation could be the heavy subsidised petroleum products in Nigeria. As a result, changes in oil risk shocks are not transmitted into domestic petroleum prices which may cause no corresponding variations in earnings or investments, hence no changes in the Nigerian Naira (Iwayemi and Fowowe 2011).13

Similar to Nigeria, changes in oil prices have no effect on the exchange rate in Angola. However, OVX changes are significant and lead to changes in the Angolan Kwanza. Specifically, changes in OVX have a negative effect on exchange rate returns at both lower and higher quantiles. Thus, in extreme market conditions (bearish and bullish), OVX changes cause the Angola Kwanza to depreciate. This could be due to the high dependence on oil revenue, as oil exports are the main source of foreign exchange in Angola (Hammond 2011).

The insignificant effect of oil prices on exchange rate for the two oil exporting countries is contrary to the positive effect of oil prices on exchange rate based on the ‘terms of trade effect’ and the ‘wealth effect’. Our finding is contrary to Salisu and Mobolaji (2013) and Ghosh (2011). These authors found that changes in oil prices cause the local currency to appreciate.

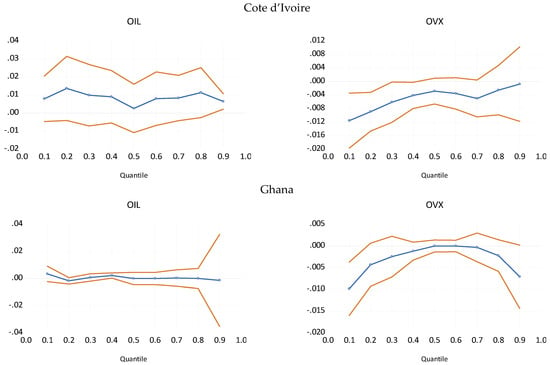

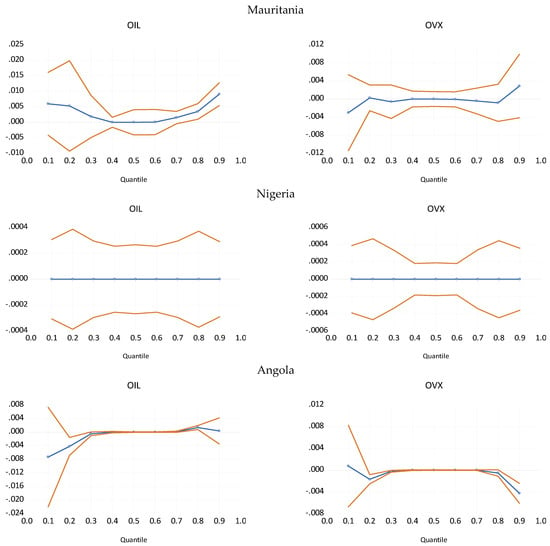

Figure 2 broadens the understanding on the relationship between the variables and shows the estimated coefficients used to capture the effect of oil risk changes on the exchange rate returns under different quantiles. Figure 2 graphically depicts the QR coefficients estimation over the conditional distribution. Moving along the conditional distribution, the QR estimates vary in magnitude, direction, and significance. The significance of the coefficients estimated for all five countries are mostly observed when exchange rates are extremely high or low with no significant effect during normal times as indicated in Table 6.

Figure 2.

Plot of coefficients across the different quantiles.

Table 7 reports the quantile slope equality test which examines if the estimated coefficients/slope parameters of oil prices and OVX changes are significantly different. The null hypothesis of this test is that the coefficients have the same slope across the various quantiles. In Table 7, we compare each slope parameter against another across the quantiles such as Q0.1 = Q0.2…, etc. and also show whether the lower quantile has equal slope with the median (Q0.1 = Q0.5), likewise the median against the higher quantile (Q0.5 = Q0.9). The results from the table suggest that the null hypothesis of slope equality is rejected across the quantiles for most currencies. This implies that the response of exchange rate changes to oil price and OVX changes at different quantiles are not constant but heterogeneous. This result further confirms the result in Table 6.

Table 7.

Quantile slope equality test. The table shows the p-values for quantile equality slope test. Bold p-value indicates the rejection of the null hypothesis of equality at the 1%, 5% and 10% significance levels. ß4 and ß5 is the coefficient of the dummy variable.

4.3.3. Asymmetric Impacts of Oil Risk Changes on Exchange Rate under Different Market Conditions

An assessment to determine if the relationship between the variables is asymmetric is presented in Table 8. This will further the understanding of the effect of oil price and OVX changes on exchange rate return. For example, various studies such as You et al. (2017) and Xiao et al. (2018) advocate for asymmetric effect of oil prices changes. Reboredo (2012) also suggests asymmetric adjustment between oil market and the exchange rate market. Thus, we allow for asymmetry in the relationship between oil risk variables and exchange rate as this is guided by extant literature on asymmetry (You et al. 2017). Notably in Table 6 (column 4–12), the response of exchange rate to changes in oil risk factors varies in magnitude and significance. To test for evidence of asymmetry in the relationship between oil risk variables and exchange rate return in Africa, we differentiate between positive/negative oil price changes and positive/negative OVX changes and examine their impact on the exchange rate returns. In this study, positive oil price changes (oil+) and positive OVX changes (OVX+) denote increase/rise in oil price and increase in oil price uncertainty while negative oil price changes (oil−) and negative OVX changes (OVX−) denote decrease/fall in oil price and oil price uncertainty respectively.

Table 8.

OLS and quantile model asymmetric estimation results. The table shows the OLS and quantile model estimation results. We chose nine quantiles ( ) and divided them into three regimes: low (, medium ( and high (, corresponding to bearish, normal and bullish markets, respectively. ß11 = ß12 and ß21 = ß22 are the null hypotheses of the Wald test. ß11 and ß12 are the coefficients of OIL+ and OIL−. ß21 and ß22 are the coefficients of OVX+ and OVX−. Bold values indicate statistical significance at the 1%, 5% and 10% levels.

Net Oil Importers

Using the quantile regression to ascertain the effect of Oil+/−, OVX+/− on the exchange rate under different market conditions, we turn to the result in Table 8 (column 4–12). The results for Cote d’Ivoire and Mauritania are similar, in that Oil+ and Oil− has a significant negative impact on the exchange rate only at lower quantile. This suggests that at lower quantiles where there is large depreciation of their local currency against the dollar, rising oil prices cause the CFA franc and Mauritanian Ougyiya to depreciate. This is consistent with “destabilizing speculative behaviour” mentioned in Nusair and Olson (2019, p. 55). While rising oil price may warrant destabilizing speculation in the foreign exchange market, falling oil price causes the CFA franc and Mauritanian Ougyiya to appreciate which may bring about stability in the foreign exchange market. The result for Ghana however, indicates that rising oil prices cause the Ghanaian Cedis to depreciate only at higher quantile when the market is bullish while falling oil price appreciates the Ghanaian currency only at a lower quantile when the market is bearish. Likewise, OVX+ and OVX− have a negative effect on the exchange rate for all net importing countries at lower quantile when the market is bearish. This implies that rising (falling) OVX changes causes the local currency to depreciate (appreciate). This finding seems to be consistent with the term of trade argument for net oil importing countries.

Net Oil Exporters

Turning to the oil exporting countries, the result for Nigeria indicates that Oil+ and Oil− have a negative effect on the exchange rate at a lower quantile when the market is bearish. This result suggests that rising (falling) oil price causes the Nigerian Naira to depreciate (appreciate) which is contrary to the wealth effect argument that rising oil price appreciates the currency. However, the result is not meaningful statistically. In contrast, Iwayemi and Fowowe (2011) show that positive oil shocks have no effect on the Naira.

Our analysis for Angola, however, shows that Oil+ has no significant effect on the exchange rate. This is quite surprising; however, a possible explanation could be found in the less diversified economic structure and heavy reliance on imports in Angola (Lariau et al. 2016). Although, Oil− has a positive effect on the Angolan Kwanza, it is not statistically meaningful. OVX+ has a negative effect on the exchange rate at lower quantile when the market is bearish. Thus, rising OVX changes cause the local currency to depreciate. This finding confirms the argument that higher oil price uncertainty tends to decrease real economic activity. For instance, Elder and Serletis (2010), mention that a rising OVX may portray uncertainty which may lead to a fall in real economic activity through different factors such as current investment and unemployment rates (Kocaarslan et al. 2020), thereby depressing corporate earnings and income and hence exchange rate returns.

For all countries under study, a similar pattern is observed. The exchange rate responds to oil price changes for oil importing countries, whereas a weak to non-significant effect is observed for the oil exporting countries, while OVX changes have negative effect on the exchange rate for all countries. Moreover, the exchange rate responds to Oil and OVX shocks mostly at the lower quantile.

The Wald test results in Table 8 show a rejection of the null hypothesis at most quantiles for all countries. This shows that oil risk has an asymmetric effect on the exchange rate in all countries. The coefficient estimates are observed to be heterogeneous throughout the distribution of exchange rate returns and its effect varies in magnitude, direction and significance. In addition, the quantile slope equality test, which examines whether the coefficients are heterogeneous across quantiles, indicates that the null hypothesis of quantile slope equality can be rejected at most quantiles for all countries, as shown in Table 9. The results, therefore, indicate that estimated coefficients are statistically heterogeneous across quantiles, providing further support to our findings.

Table 9.

Quantile slope equality test (Asymmetric model). The table shows the p-values for quantile equality slope test. Bold p-values indicate the rejection of the null hypothesis of equality at the 1%, 5% and 10% significance levels.

4.3.4. Summary of Estimation Results

Overall, exchange rate returns respond asymmetrically to changes in oil risk factors (OIL/OVX) for most countries under study. An acceptable cause for the significant sensitivity to both shocks could be the over dependence on oil and its revenue for these countries.

By separating the oil exporting from the oil importing countries, we found that oil price is a significant factor in the exchange rate of the oil importing countries over the examined oil exporting countries. Moreover, currency depreciation (appreciation) caused by rising (falling) oil prices for oil importing countries has been confirmed, whereas the oil–exchange rate relationship for the oil exporting countries has not been supported. Regardless of the status of a country as net oil exporter or importer, a rise (fall) in OVX causes the domestic currency to depreciate (appreciate). Whereas the impact of oil prices on exchange rate varies. Falling oil prices have a greater impact on the exchange rate than rising oil prices. Alternatively, a rising OVX has a greater impact on exchange rate relative to a falling OVX.

The findings of this study further indicate that there is significant response of exchange rates towards oil risk changes mostly at the lower quantile when the market is bearish. Further, at the higher quantile when the market is bullish, we observe weak-to-no significant response of exchange rate to oil risk changes. The less significant effect on exchange rate when the market is bullish can be interpreted to include two conclusions. First, during bullish market conditions, which can be interpreted as a booming economy, there is a reflection of better economic conditions which reduces the uncertainty to commit to resources and thus, leads to increase in investment (Lee and Zeng 2011). Second, several studies such as You et al. (2017), have pointed out that in a booming economy, firms and individual investors have more confidence in the economy and this tends to decrease the adverse effect from oil risk shocks. Thus, the impact of rising/falling oil risk changes on exchange rate returns in the countries in our study is stronger when the market is bearish than when the market is bullish. This result seems consistent with the “stylised fact”, investors are less sensitive when the market is bullish compared with the market when it is bearish.

4.4. Robustness Checks: Markov Regime Switching Model

Empirical evidence shows that macroeconomic variables behave in a non-linear manner (Switzer and Picard 2016), if this is the case the findings based on the quantile regression might not present the whole picture. To deal with this issue, we examined the robustness of our findings by considering an alternative method.

This is important as it allows us to confirm the results and the suitability of the model already employed. To confirm the robustness of our results, we used the Markov regime switching model. The model allowed us to examine the non-linear and asymmetric dependence between the exchange rates and oil prices in different regimes.

Further, an important result of our estimation in Section 4.3.2 is that the exchange rate responds significantly to oil prices for oil importing countries (Cote d’Ivoire, Ghana and Mauritania) whereas a weak to non-significant effect is observed for the oil exporting countries (Nigeria and Angola), while OVX changes have a negative effect on the exchange rates for all countries. Moreover, the exchange rate responds to oil price and OVX shocks mostly at the lower quantile.

In order to check for robustness of QR results, we investigated the effect of oil prices and OVX on the exchange rate using the Markov regime switching model, and thus we could infer whether the co-movement between the variables is regime specific.

With regards to oil importing countries, the model shows that Oil− has a significant negative effect on the exchange rate for Ghana and Mauritius as observed in the previous results. We further observed a non-significant effect of oil prices on exchange rate for the oil exporting countries (Angola and Nigeria) as shown in Table 10 A,B. This further confirms our earlier results that the effect of oil prices has weak to no significant effect on the exchange rate for the oil exporting countries investigated.

Table 10.

(A) Estimation results using Markov switching model (bear market). (B) Estimation results using Markov switching model (bull market). Σ refers to the standard deviation of each state. Standard errors are shown in parenthesis. The transition probabilities are reported as P11 and P22. Bold value indicates statistical significance at the 1%, 5% and 10% levels.

The results on asymmetric effect of OVX on exchange rate are quite similar to the previous results in that OVX+ and OVX− have a significant negative effect on the exchange rate for most countries. The only difference is that of Cote d’Ivoire, where positive and negative OVX do not affect the exchange rate

Moreover, the exchange rate reacts differently to oil price and OVX when the exchange rate market is bearish than when it is bullish which confirms that the relationship is dependent on market conditions as obtained in the previous results. Thus, the co-movement between exchange rate and oil price and OVX in SSA is dependent on market conditions and more prevalent when the market is bearish than when it is bullish.

In all, when compared with our QR results, the direction of relationship and significance are largely the same, confirming that the impact of oil risk shocks on exchange rate is asymmetric and depends on market conditions. We show that the dependence is negative and more pronounced when the market is bearish. Thus, we conclude that our findings are robust to the chosen model.

5. Conclusions

This study investigated the response of exchange rate to oil risk changes in oil exporting and oil importing countries in Africa. We approached the investigation differently from previous studies by, firstly, focusing on the joint impact of both oil price and oil price uncertainty changes on exchange rate. We used OVX as a measure of oil price uncertainty thereby, providing a new perspective and possibly new explanation to the oil–exchange rate nexus in developing countries in Africa. This is because the failure to account for oil price uncertainty in the oil–exchange rate nexus may produce biased estimates (see Kocaarslan et al. 2020).

Secondly, we used the quantile regression model to investigate the interactions between the variables to completely observe the relationship which will otherwise not be observed using the ordinary least squares (OLS); as OLS only provides mean dependency relationship. We further investigated the asymmetric effects of oil risk shocks on exchange rate under different market conditions. We did not use the OLS to draw any policy recommendation because the usefulness of the estimated results is limited and may be biased. We also used Markov regime switching models to test for robustness.

The results of our investigation show the following: first, there is significant evidence that oil price and OVX have asymmetric effects on the exchange rate in the countries studied. A fall in oil price has a greater impact on exchange rate than an increase in oil price. Conversely, rising OVX changes have a greater impact on exchange rate relative to falling OVX. Thus, the fall in oil price and the rise in OVX play a dominant role in influencing the exchange rate returns in the countries under study. Second, we demonstrate that these effects are heterogeneous, that is, they vary in terms of magnitude and significance throughout the distribution of the exchange rate return.

Third, the results reveal that an exchange rate responds to changes in oil price and OVX generally at the lower quantile, when the market is bearish, which verifies the ‘stylistic argument’. We may, therefore, infer that the effect of oil price and OVX on exchange rate depends on market conditions (state of the currency market). We show that a fall in oil price causes the domestic currency to appreciate. Similarly, a rise in oil price causes the domestic currency to depreciate. For the oil importing countries in this study, this finding is consistent with theory. However, for the oil exporting countries, the findings contradict the terms of trade and the wealth effect argument. The OVX–exchange rate nexus is independent of the net oil exporter/importer status whereas the oil price–exchange rate nexus depends on the net oil importer/exporter status

5.1. The ‘Big Picture’ in the Exchange Rate–Oil Nexus and Implications for the Countries Concerned

Results from this study provide significant policy implications. Specifically, a fall in the price of oil and a rise in oil price uncertainty (volatility) play a dominant role in influencing the exchange rate returns in these countries. Policymakers, therefore, need to consider both oil price and uncertainty when developing policies to reduce the excessive fluctuations in their exchange rate. These countries may take measures that reduce uncertainty and high dependency on oil in order to bring about desirable effects in their foreign exchange market. For example, oil importing countries may take measures to reduce oil consumption through increasing fossil fuel consumption taxes or promote alternative sources of energy. Meanwhile, oil exporting countries may reduce subsidies on fossil fuels in order to reduce consumption. Fossil fuel subsidies have a negative macro-economic impact (Keith et al. 2015). Omotosho (2019) has pointed out that energy subsidies reduce investment due to excessive domestic demand which limits the amount of oil available for exports, thereby decreasing foreign exchange needed for investment (especially USD) since most payments are made in USD. Thus, a reduction in consumption may reduce the effect of oil market shocks on the exchange rate.

There are strong indications from our results that the impact of oil risk shocks on exchange rates is stronger when the market is bearish than when the market is normal or bullish. Consequently, while making policy decisions, these countries should be mindful of the impact on exchange rates from oil risk shocks, especially when the market is bearish, and take extra precautions against potential spillovers as well as risk transmission between the oil market and the exchange rate market. Further, these countries need to show interest in hedging and diversification of their investments in crude oil future markets, mostly during major economic events, as these may offer a significant opportunity to reduce the impact of oil risk shocks on the currency. In addition to making investment decisions, investors should be mindful of the spillover effect when the market is bearish.

Given the continuous discovery of oil in African countries and frequent crises hitting the oil market, our findings are timely and offer further useful insight for investment decisions and risk management in these countries.

To abstract from the African countries under examination and capture the big picture, we offer a brief account of the current situation in Europe and the ongoing energy crisis (oil, natural gas, electricity). The findings of this study are not relevant only for the countries under examination here. Specifically, the euro and the GBP have dropped in value in relation to USD (the lowest in nearly 20 years), inflation is increasing at an alarming rate and industrial production is reducing.14 If energy prices (including oil price and oil price volatility) have such a pronounced effect on currencies that are used for international transactions/payments, then the situation will definitively be gloomier for the currencies examined here. A major lesson to be learned here is that policy makers must take action to dampen the effects of energy prices on currencies, whether those are used for international transactions or are less well known (as is the case with the currencies under examination here)

5.2. Limitations and Future Research

We identify two major limitations in this study, and both relate to data availability. The first is the lack of data, especially when it comes to base interest rates from the respective central banks of the countries used in our sample. The second is an overall lack of data for many countries in the wider region. Our initial intention was to use more than five countries as our sample for a much longer period, but this is just not possible. Research in this particular region is stifled by incomplete datasets. We believe that future research in the oil price–OVX–exchange rate nexus should firstly concentrate on adding more countries so that results obtained will be applicable to the whole of Africa considering the recent development and subsequent interest in the area.

Author Contributions

Conceptualization, M.K.; methodology, M.K.; formal analysis, M.K.; data curation, M.K.; writing—original draft preparation, M.K.; writing—review and editing, E.G.; supervision, E.G.; project administration, E.G.; reply to reviewers: E.G. All authors have read and agreed to the published version of the manuscript.

Funding

This research received no external funding.

Conflicts of Interest

The authors declare no conflict of interest.

Notes