Do Government Expenditures in G7 Countries Target Socioeconomics or Physical Output?

Abstract

1. Introduction

2. Literature Review

3. Methodology

4. Data

5. Results

6. Conclusions

This Study

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Acknowledgments

Conflicts of Interest

References

- Afonso, António, Alma Romero-Barrutieta, and Emma Monsalve. 2013. Public Sector Efficiency: Evidence for Latin America Public. Available online: https://ssrn.com/abstract=2365007 (accessed on 10 July 2021).

- Afonso, António, and Miguel St Aubyn. 2005. Nonparametric Approaches to Educational and health expenditures Efficiency in OECD countries. Journal of Applied Economics 8: 227–46. [Google Scholar] [CrossRef]

- Afonso, António, João Tovar Jalles, and Ana Venâncio. 2020. Government Spending Efficiency, Measurement and Applications: A Cross-Country Efficiency Dataset. REM Working Paper 0147-2020. Available online: https://ssrn.com/abstract=3734216 (accessed on 20 June 2021).

- Afonso, Antonio, Ludger Schuknecht, and Vito Tanzi. 2010a. Public Sector Efficiency: Evidence for New EU Member States and Emerging Markets. Applied Economics 42: 2147–64. [Google Scholar] [CrossRef]

- Afonso, Antonio, Ludger Schuknecht, and Vito Tanzi. 2010b. Income Distribution Determinants and Public Spending efficiency. The Journal of Economic Inequality 8: 367–89. [Google Scholar] [CrossRef]

- Afonso, António, and Mina Kazemi. 2017. Assessing public spending efficiency in 20 OECD countries. In Inequality and Finance in Macrodynamics. Cham: Springer, pp. 7–42. [Google Scholar]

- Aigner, Dennis, C. A. Knox Lovell, and Peter Schmidt. 1977. Formulation and estimation of stochastic frontier production function models. Journal of Econometrics 6: 21–37. [Google Scholar] [CrossRef]

- Aitken, Andrew. 2019. Measuring Welfare Beyond GDP. National Institute Economic Review 249: R3–R16. [Google Scholar] [CrossRef]

- Aman, Khan, and Olga I. Murova. 2015. Productive Efficiency of Public Expenditures: A Cross-state Study. State and Local Government Review 47: 170–80. [Google Scholar]

- Battese, George Edward, and Tim J. Coelli. 1993. A Stochastic Frontier Production Function Incorporating a Model for Technical Inefficiency Effects. Working Papers in Econometrics and Applied Statistics No. 69. Armidale: Department of Economics, University of New England. [Google Scholar]

- Battese, George Edward, and Tim J. Coelli. 1995. A model for technical inefficiency effects in a stochastic frontier production function for panel data. Empirical Economics 20: 325–32. [Google Scholar] [CrossRef]

- Burgess, James F. 2006. Productivity analysis in health care. In The Elgar Companion to Health Economics, 2nd ed. Cheltenham: Edward Elgar Publishing. [Google Scholar]

- Chan, Sok-Gee, Zulkufly Ramly, and Mohd Zaini Abd Karim. 2017. Government spending efficiency on economic growth: Roles of value-added tax. Global Economic Review 46: 162–88. [Google Scholar] [CrossRef]

- Coelli, Tim J. 1996. A Guide to FRONTIER Version 4.1: A Computer Program for Stochastic Frontier Production and Cost Function Estimation. CEPA Working Papers. Armidale: CEPA, vol. 7. [Google Scholar]

- De Borger, Bruno, and Kristiaan Kerstens. 1996. Cost efficiency of Belgian local governments: A comparative analysis of FDH, DEA, and econometric approaches. Regional Science and Urban Economics 26: 145–70. [Google Scholar] [CrossRef]

- Despotis, D. K. 2005. Measuring human development via data envelopment analysis: The case of Asia and the Pacific. The International Journal of Management Science 33: 385–90. [Google Scholar] [CrossRef]

- Farrel, Michael James. 1957. The Measurement of productive efficiency. Journal of the Royal Statistical Society: Series A (General) Part III 120: 253–90. [Google Scholar] [CrossRef]

- Greene, William. 2004. Distinguishing between heterogeneity and inefficiency: Stochastic frontier analysis of World Health Organization’s panel data on national health care systems. Health Economics 13: 959–80. [Google Scholar] [CrossRef] [PubMed]

- Gupta, Sanjeev, and Marijn Verhoeven. 2001. The efficiency of government expenditure—Experiences from Africa. Journal of Policy Modelling 23: 433–67. [Google Scholar] [CrossRef]

- Kelley, Allen C. 1991. The Human Development Index: “Handle with Care”. Population and Development Review 17: 315–24. [Google Scholar] [CrossRef]

- Kim, Jim Yong. 2018. The Human Capital Gap: Getting Governments to Invest in People. Foreign Affairs 97: 92–101. Available online: http://www.jstor.org/stable/44822216 (accessed on 6 April 2021).

- Kumbhakar, Subal C., and C. A. Knox Lovell. 2000. Stochastic Frontier Analysis. Cambridge: Cambridge University Press. [Google Scholar] [CrossRef]

- Lucas, Robert E., Jr. 1988. On the Mechanics of Economic. Development. Journal of Monetary Economics 22: 3–42. [Google Scholar] [CrossRef]

- Meeusen, Wim, and Julien van Den Broeck. 1977. Efficiency estimation from Cobb-Douglas production functions with composed error. International Economic Review 18: 435–44. [Google Scholar] [CrossRef]

- Murova, Olga, and Aman Khan. 2017. Public investments, productivity and economic growth: A cross-state study of selected public expenditures in the United States. International Journal of Productivity and Performance Management 66: 251–65. [Google Scholar] [CrossRef]

- Peterson, Lauri. 2014. The measurement of Non-economic Inequality in Well Being Indices. Social Indicators Research 119: 581–98. [Google Scholar] [CrossRef]

- Prasetyo, Ahmad Danu, and Zuhdi Ubaidillah. 2013. The Government Expenditure Efficiency towards the Human Development. Procedia Economics and Finance 5: 615–22. [Google Scholar] [CrossRef]

- Verhoeven, Marijn, Victoria Gunnarsson, and Stephanie Carcillo. 2007. Education and Health in G7 Countries: Achieving Better Outcomes with Less Spending. IMF Working Paper WP/07/263. Available online: https://ssrn.com/abstract=1033217 (accessed on 19 May 2021).

- Zagler, Martin, and Georg Dürnecker. 2003. Fiscal Policy and Economic Growth. Journal of Economic Survey 17: 397–418. [Google Scholar] [CrossRef]

| Country | Statistics | HDI | GDP (Billion USD) | Labor (Million) | Capital (Million USD) | Government Expenditure (Million USD) |

|---|---|---|---|---|---|---|

| Canada | Mean | 0.89758 | 1390.00 | 17.23 | 241,969.80 | 548.73 |

| Maximum | 0.92200 | 1840.00 | 19.16 | 358,648.10 | 730.04 | |

| Minimum | 0.86800 | 736.00 | 15.08 | 123,902.90 | 299.20 | |

| S.D. | 0.0166 | 387.00 | 1.19 | 77,968.65 | 155.10 | |

| France | Mean | 0.86911 | 2370.00 | 26.63 | 395,905.40 | 1279.54 |

| Maximum | 0.89100 | 2920.00 | 27.69 | 620,976.80 | 1605.02 | |

| Minimum | 0.84200 | 1360.00 | 24.56 | 223,914.90 | 684.00 | |

| S.D. | 0.01658 | 511.00 | 0.87 | 117,057.60 | 308.37 | |

| Germany | Mean | 0.91300 | 3180.00 | 38.81 | 542,697.80 | 1437.39 |

| Maximum | 0.93900 | 3950.00 | 42.09 | 896,915.40 | 1736.48 | |

| Minimum | 0.86900 | 1940.00 | 36.21 | 365,718.70 | 913.87 | |

| S.D. | 0.02145 | 653.00 | 1.82 | 164,161.80 | 265.79 | |

| Italy | Mean | 0.86384 | 1900.00 | 22.36 | 309,683.30 | 914.00 |

| Maximum | 0.88300 | 2400.00 | 23.27 | 420,231.00 | 1123.48 | |

| Minimum | 0.83000 | 1140.00 | 20.76 | 206,261.70 | 519.06 | |

| S.D. | 0.01547 | 370.00 | 0.65 | 57,068.18 | 195.94 | |

| Japan | Mean | 0.88521 | 4940.00 | 64.04 | 952,356.10 | 1818.38 |

| Maximum | 0.91500 | 6200.00 | 66.71 | 1,152,520.00 | 2465.21 | |

| Minimum | 0.85500 | 4120.00 | 62.78 | 822,928.00 | 1416.47 | |

| S.D. | 0.01899 | 570.00 | 0.91 | 105,802.90 | 311.66 | |

| UK | Mean | 0.89726 | 2530.00 | 29.92 | 305,300.60 | 1065.87 |

| Maximum | 0.92000 | 3100.00 | 32.96 | 506,140.20 | 1303.36 | |

| Minimum | 0.86700 | 1640.00 | 27.67 | 181,344.10 | 612.16 | |

| S.D. | 0.01723 | 446.00 | 1.56 | 97,517.66 | 223.04 | |

| US | Mean | 0.90468 | 14,900.00 | 147.00 | 2,361,391.00 | 5354.80 |

| Maximum | 0.92000 | 20,500.00 | 159.00 | 3,814,110.00 | 7305.98 | |

| Minimum | 0.88100 | 10,300.00 | 140.00 | 1,496,212.00 | 2951.49 | |

| S.D. | 0.01317 | 3080.00 | 5.83 | 697,329.70 | 1292.58 | |

| All | Mean | 0.8901 | 4460.00 | 49.36 | 729,900.50 | 1774.10 |

| Maximum | 0.9390 | 20,500.00 | 159.00 | 3,814,110.00 | 7305.98 | |

| Minimum | 0.8300 | 736.00 | 15.08 | 123,902.90 | 299.20 | |

| S.D. | 0.0239 | 4590.00 | 42.36 | 756,928.90 | 1603.46 |

| Dependent Variable | Ln (HDI) | ||

|---|---|---|---|

| Independent Variable | Coefficient | Standard Error | t-Ratio |

| Intercept (β0) | 4.0302 *** | 0.0481 | 83.7685 |

| Ln(L) | −0.0282 *** | 0.0079 | −3.5471 |

| Ln(K) | 0.0770 *** | 0.0087 | 8.8801 |

| Intercept (δ0) | −0.3994 *** | 0.0079 | −50.8670 |

| Ln(G) | 0.0402 *** | 0.0003 | 125.5703 |

| Sigma-squared | 0.0005 *** | 0.0001 | 9.5439 |

| Gamma | 0.9999 *** | 0.1063 | 9.4044 |

| Dependent Variable | Ln (GDP) | ||

|---|---|---|---|

| Independent Variable | Coefficient | Standard Error | t-Ratio |

| Intercept (β0) | 12.5854 *** | 0.4785 | 26.3008 |

| Ln(L) | 0.7014 *** | 0.0599 | 11.7186 |

| Ln(K) | 0.3181 *** | 0.0475 | 6.6999 |

| Intercept (δ0) | 1.2938 ** | 0.4981 | 2.5975 |

| Ln(G) | −0.1054 ** | 0.0469 | −2.2465 |

| Sigma-squared | 0.0515 *** | 0.0182 | 2.8313 |

| Gamma | 0.9624 *** | 0.0245 | 39.2460 |

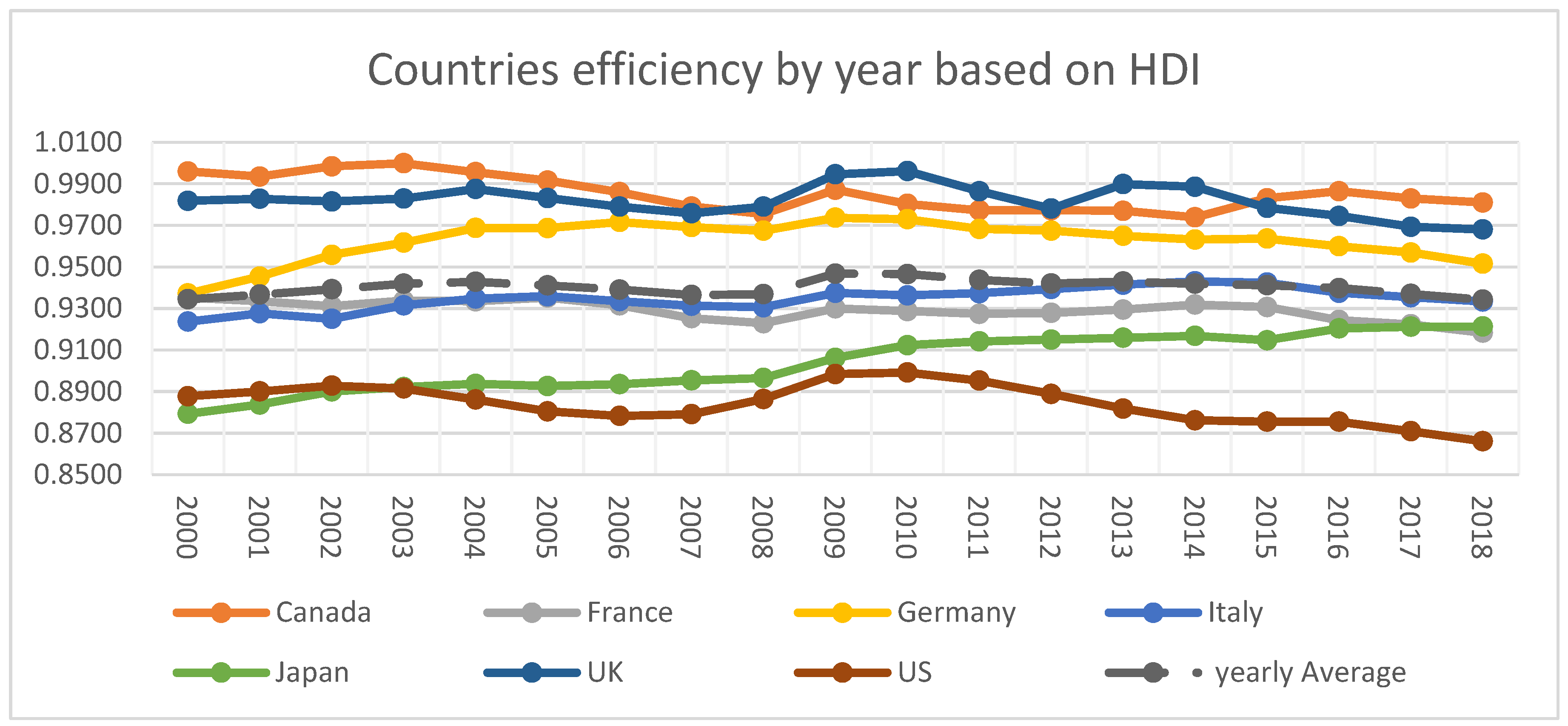

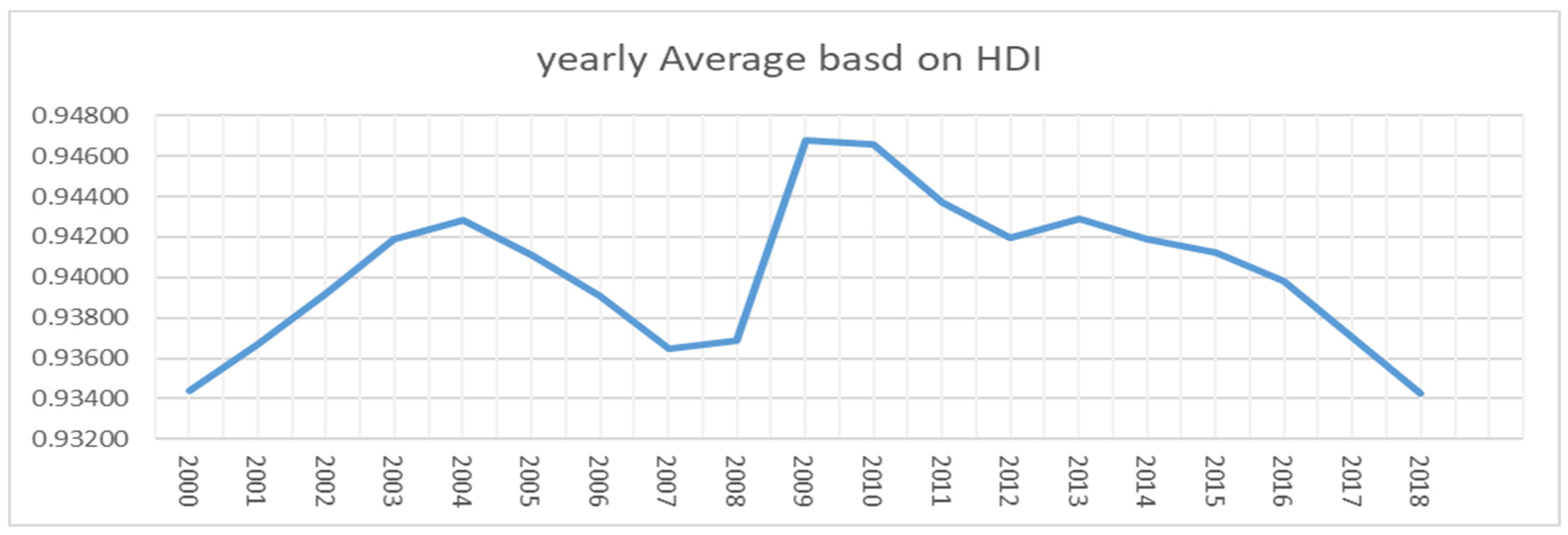

| Year | Canada | France | Germany | Italy | Japan | UK | US | Yearly Average | Rank |

|---|---|---|---|---|---|---|---|---|---|

| 2000 | 0.9959 | 0.9352 | 0.9372 | 0.9237 | 0.8793 | 0.9818 | 0.8878 | 0.9344 | 18 |

| 2001 | 0.9935 | 0.9335 | 0.9453 | 0.9277 | 0.8838 | 0.9828 | 0.8901 | 0.9367 | 16 |

| 2002 | 0.9984 | 0.9311 | 0.9558 | 0.9250 | 0.8900 | 0.9815 | 0.8928 | 0.9392 | 12 |

| 2003 | 0.9999 | 0.9337 | 0.9617 | 0.9315 | 0.8922 | 0.9829 | 0.8915 | 0.9419 | 8 |

| 2004 | 0.9956 | 0.9334 | 0.9687 | 0.9348 | 0.8937 | 0.9875 | 0.8862 | 0.9428 | 5 |

| 2005 | 0.9915 | 0.9353 | 0.9687 | 0.9359 | 0.8927 | 0.9832 | 0.8805 | 0.9411 | 10 |

| 2006 | 0.9860 | 0.9315 | 0.9716 | 0.9335 | 0.8936 | 0.9790 | 0.8783 | 0.9391 | 13 |

| 2007 | 0.9790 | 0.9253 | 0.9692 | 0.9313 | 0.8954 | 0.9758 | 0.8791 | 0.9364 | 17 |

| 2008 | 0.9755 | 0.9229 | 0.9674 | 0.9306 | 0.8965 | 0.9790 | 0.8864 | 0.9369 | 15 |

| 2009 | 0.9871 | 0.9300 | 0.9737 | 0.9375 | 0.9062 | 0.9945 | 0.8984 | 0.9468 | 1 |

| 2010 | 0.9803 | 0.9287 | 0.9730 | 0.9363 | 0.9123 | 0.9961 | 0.8992 | 0.9466 | 2 |

| 2011 | 0.9773 | 0.9274 | 0.9683 | 0.9373 | 0.9141 | 0.9864 | 0.8953 | 0.9437 | 3 |

| 2012 | 0.9773 | 0.9278 | 0.9675 | 0.9394 | 0.9150 | 0.9781 | 0.8889 | 0.9420 | 6 |

| 2013 | 0.9770 | 0.9295 | 0.9649 | 0.9415 | 0.9159 | 0.9899 | 0.8818 | 0.9429 | 4 |

| 2014 | 0.9739 | 0.9319 | 0.9631 | 0.9430 | 0.9168 | 0.9885 | 0.8762 | 0.9419 | 7 |

| 2015 | 0.9830 | 0.9307 | 0.9636 | 0.9424 | 0.9147 | 0.9784 | 0.8755 | 0.9412 | 9 |

| 2016 | 0.9864 | 0.9244 | 0.9599 | 0.9375 | 0.9204 | 0.9745 | 0.8755 | 0.9398 | 11 |

| 2017 | 0.9829 | 0.9223 | 0.9569 | 0.9354 | 0.9212 | 0.9693 | 0.8709 | 0.9370 | 14 |

| 2018 | 0.9810 | 0.9184 | 0.9515 | 0.9333 | 0.9213 | 0.9680 | 0.8661 | 0.9342 | 19 |

| Country average | 0.9853 | 0.9291 | 0.9625 | 0.9346 | 0.9039 | 0.9820 | 0.8842 | 0.9402 | - |

| Maximum | 0.9999 | 0.9353 | 0.9737 | 0.9430 | 0.9213 | 0.9961 | 0.8992 | 0.9468 | |

| Minimum | 0.9739 | 0.9184 | 0.9372 | 0.9237 | 0.8793 | 0.9680 | 0.8661 | 0.9342 | |

| Rank | 1.0000 | 5.0000 | 3.0000 | 4.0000 | 6.0000 | 2.0000 | 7.0000 | - | - |

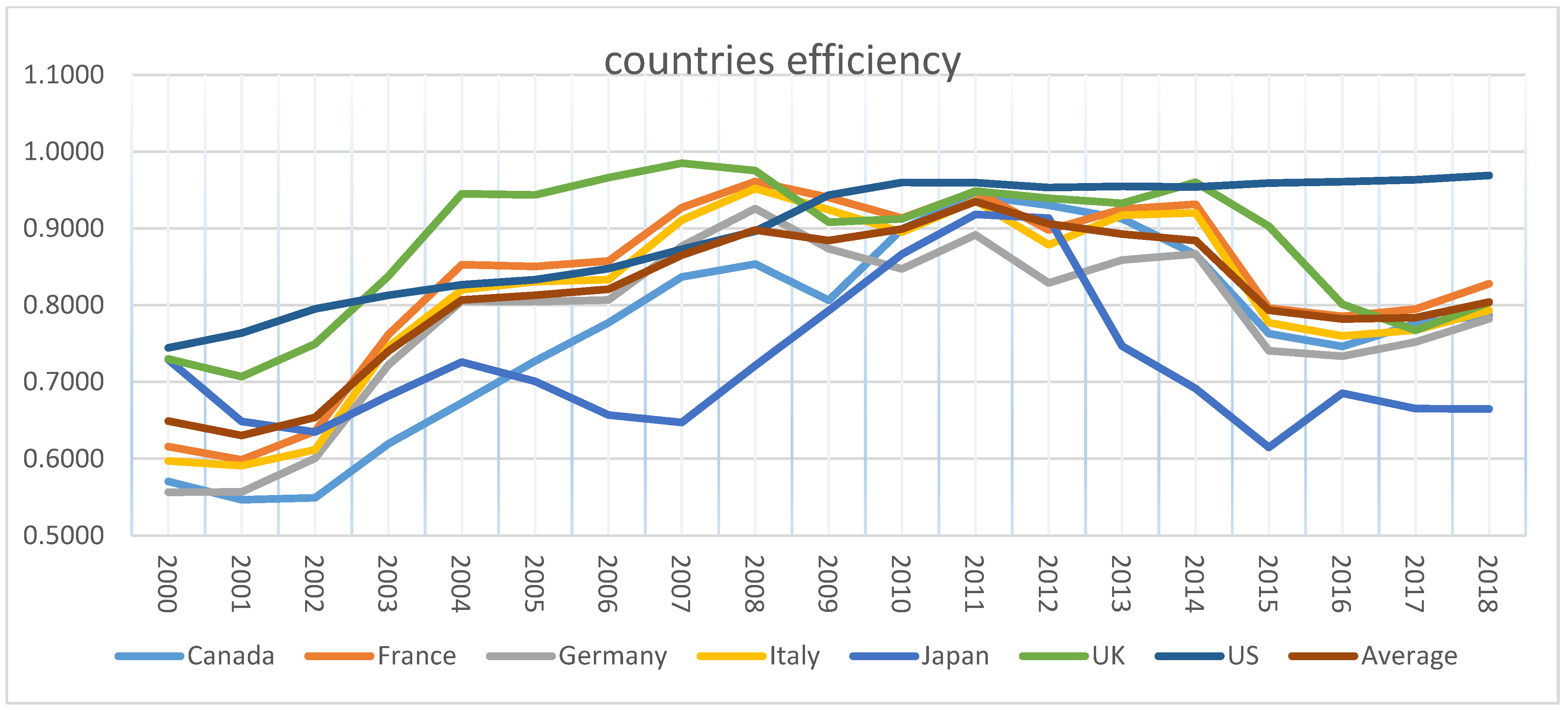

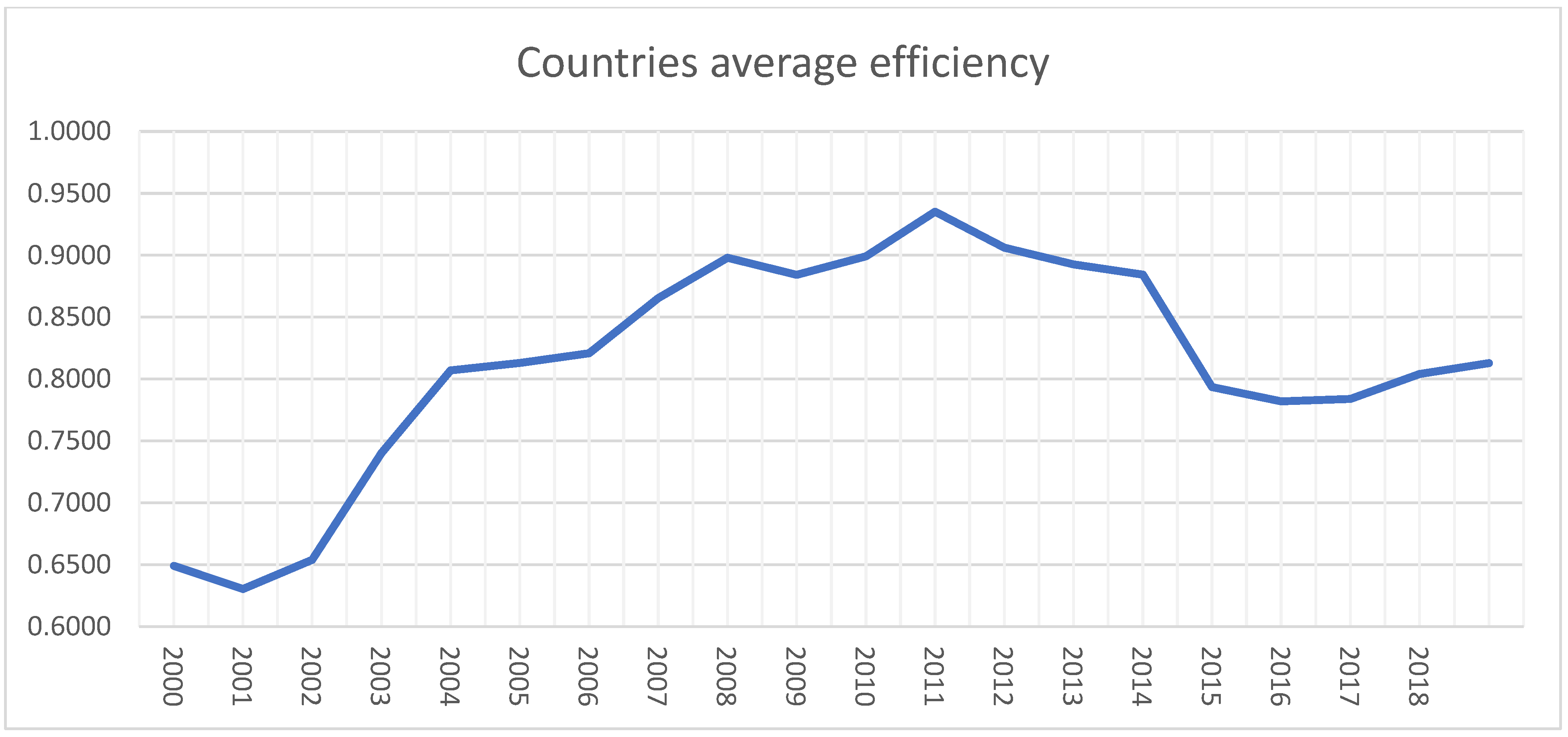

| Year | Canada | France | Germany | Italy | Japan | UK | US | Yearly Average | Rank |

|---|---|---|---|---|---|---|---|---|---|

| 2000 | 0.5703 | 0.6158 | 0.5564 | 0.5971 | 0.7289 | 0.7299 | 0.7447 | 0.6490 | 18 |

| 2001 | 0.5466 | 0.5986 | 0.5567 | 0.5912 | 0.6487 | 0.7069 | 0.7638 | 0.6304 | 19 |

| 2002 | 0.5490 | 0.6358 | 0.6005 | 0.6119 | 0.6348 | 0.7495 | 0.7952 | 0.6538 | 17 |

| 2003 | 0.6193 | 0.7618 | 0.7222 | 0.7456 | 0.6818 | 0.8379 | 0.8130 | 0.7402 | 16 |

| 2004 | 0.6726 | 0.8529 | 0.8054 | 0.8200 | 0.7260 | 0.9451 | 0.8267 | 0.8070 | 11 |

| 2005 | 0.7273 | 0.8504 | 0.8046 | 0.8309 | 0.7007 | 0.9437 | 0.8333 | 0.8130 | 10 |

| 2006 | 0.7772 | 0.8576 | 0.8069 | 0.8333 | 0.6569 | 0.9662 | 0.8478 | 0.8208 | 9 |

| 2007 | 0.8369 | 0.9272 | 0.8770 | 0.9108 | 0.6472 | 0.9853 | 0.8727 | 0.8653 | 8 |

| 2008 | 0.8536 | 0.9612 | 0.9260 | 0.9522 | 0.7213 | 0.9753 | 0.8965 | 0.8980 | 4 |

| 2009 | 0.8064 | 0.9405 | 0.8737 | 0.9243 | 0.7929 | 0.9082 | 0.9435 | 0.8842 | 7 |

| 2010 | 0.8993 | 0.9135 | 0.8473 | 0.8951 | 0.8664 | 0.9124 | 0.9598 | 0.8991 | 3 |

| 2011 | 0.9431 | 0.9486 | 0.8916 | 0.9364 | 0.9184 | 0.9487 | 0.9595 | 0.9352 | 1 |

| 2012 | 0.9303 | 0.8980 | 0.8289 | 0.8788 | 0.9135 | 0.9394 | 0.9534 | 0.9060 | 2 |

| 2013 | 0.9128 | 0.9251 | 0.8589 | 0.9173 | 0.7467 | 0.9326 | 0.9548 | 0.8926 | 5 |

| 2014 | 0.8660 | 0.9314 | 0.8667 | 0.9204 | 0.6914 | 0.9601 | 0.9541 | 0.8843 | 6 |

| 2015 | 0.7630 | 0.7962 | 0.7408 | 0.7771 | 0.6149 | 0.9027 | 0.9590 | 0.7934 | 13 |

| 2016 | 0.7463 | 0.7856 | 0.7337 | 0.7599 | 0.6853 | 0.8014 | 0.9610 | 0.7819 | 15 |

| 2017 | 0.7759 | 0.7949 | 0.7521 | 0.7676 | 0.6653 | 0.7674 | 0.9635 | 0.7838 | 14 |

| 2018 | 0.7870 | 0.8280 | 0.7822 | 0.7932 | 0.6647 | 0.8036 | 0.9691 | 0.8040 | 12 |

| Country average | 0.7675 | 0.8328 | 0.7806 | 0.8138 | 0.7214 | 0.8798 | 0.8932 | 0.8127 | - |

| Rank | 6.0000 | 3.0000 | 5.0000 | 4.0000 | 7.0000 | 2.0000 | 1.0000 | - | - |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2022 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Al-Rabbaie, A.A.R.; Al-qalawi, U.R.; Alwaked, A. Do Government Expenditures in G7 Countries Target Socioeconomics or Physical Output? Economies 2022, 10, 262. https://doi.org/10.3390/economies10100262

Al-Rabbaie AAR, Al-qalawi UR, Alwaked A. Do Government Expenditures in G7 Countries Target Socioeconomics or Physical Output? Economies. 2022; 10(10):262. https://doi.org/10.3390/economies10100262

Chicago/Turabian StyleAl-Rabbaie, Arqam Abdul Razzaq, Usama Robin Al-qalawi, and Ahmad Alwaked. 2022. "Do Government Expenditures in G7 Countries Target Socioeconomics or Physical Output?" Economies 10, no. 10: 262. https://doi.org/10.3390/economies10100262

APA StyleAl-Rabbaie, A. A. R., Al-qalawi, U. R., & Alwaked, A. (2022). Do Government Expenditures in G7 Countries Target Socioeconomics or Physical Output? Economies, 10(10), 262. https://doi.org/10.3390/economies10100262