1. Introduction

As the largest Muslim country globally, Islam teaching underlies Indonesian activities to fulfill their necessities of life and prepare for a better future, an investment. According to

Chabachib et al. (

2019),

Pamungkas et al. (

2018) and

Tandelilin (

2017), an investment is a commitment of some funds or other resources used for certain businesses at present, with the intention to obtain profits in the future. Profits gained from an investment can be cash receipts (dividends) or an increased investment value (capital gains) (

Lusyana and Sherif 2017). From the perspective of Islam, a good investment is an investment made based on Islamic law, and the activities carried out are not prohibited (haram). Investment based on Islamic law is known as Sharia investment (

Alam et al. 2017). In practice, there are two forms of Islamic investment that investors may choose: tangible assets (real assets) and financial assets. In recent years, Islamic investments in financial assets tend to be more attractive to investors in Indonesia than real investment because Sharia investment in financial assets offers many benefits that may be greater than investing in tangible assets without violating Islamic Sharia (

Toto et al. 2020).

One type of Sharia investment in financial assets is sharia shares. According to

Aldiena and Hanif al Hakim (

2019), sharia shares are shares of a company with a line of business that does not conflict with Sharia principles. In Indonesia, Islamic stock trading is centered on the Indonesia Stock Exchange (IDX) as the official capital market recognized by the Indonesian government

Rosalyn (

2018) with several advantages and the potential for greater profits than investing in tangible assets, Islamic stock investments are increasingly attracting investors in Indonesia. The capitalization value of sharia shares on the Indonesia Stock Exchange increases every year. In 2015, the total market capitalization of sharia shares on the IDX was IDR 1737.23 trillion. Each year, the average increase was 3.955% until 2020, while the market capitalization of sharia shares was IDR 2058.77 trillion (

OJK 2021). The price movements of sharia shares traded on IDX Indonesia can be seen through the sharia share price index, namely the Jakarta Islamic Index (JKII). The value of the JKII, in particular, provides investors with the performance of Islamic stocks at a specific time, such as price movements and fluctuations, and profit levels. If the JKII is following a rising trend, the prices of Islamic shares on the IDX increase, and vice versa. In addition, JKII can also be used as a benchmark for stock portfolio performance. To analyze the stock price index, one of the quantitative models used to model and predict the stock price index value is geometric Brownian motion (GBM), a developed model first introduced by Louis Bachelier in the early 1900s to predict stock prices (

Islam and Nguyen 2020). In the GBM model, the return value of the stock price index successively in a certain period is mutually independent and normally distributed. In other words, if the return data are not mutually independent and normally distributed, then this model cannot be used for prediction. According to

Estember and Maraña (

2016), there are two parameters in the GBM model called the volatility and drift parameters, which have constant values.

The consideration of the risk of loss that might occur at any time should be taken into account. Every investor needs to prepare an accurate risk management strategy to anticipate the risk of loss to prevent the investment from having a severe impact (

Richter and Wilson 2020). To do so, investors must quantify the possible value of the risk of loss (

Jacxsens et al. 2016) using a model, such as Value at Risk (VaR). VaR calculates the prediction of the maximum loss that will occur during a holding period with a level of confidence that can be determined according to the needs of investors (

Le 2020). Studies on modeling the JKII price index to predict future prices have been conducted for a few years and it is hypothesized that the current JKII price is a linear combination of the white noise process from the previous periods. Based on this hypothesis, the JKII price was modeled and predicted using the first-order moving average (MA) model. The results showed that the first order of the M.A. model is accurate for the prediction of the JKII price index with a mean square error (MSE) value of 5.267. In January 2013–February 2014, the variance of JKII prices was heteroscedastic. So, applied the Autoregressive Integrated Moving Average-Generalized Autoregressive Model was applied (ARIMA-GARCH). The conditional heteroscedasticity (ARIMA-GARCH) model predicts JKII prices for the March 2014 period. The GARCH modeling begins with ARIMA modeling. Based on the Akaike information criterion (AIC) value, the best ARIMA model was ARIMA (0,1,1) with AIC − 4.94. The modeling continued by forming the GARCH model. The GARCH (2.1) model was chosen as the best model with AIC − 5.30. The prediction results obtained had an error value of 2.1%.

Meanwhile,

Hanurowati et al. (

2016) used the vector autoregressive exogenous (VARX) model to model the JKII price. The external factors considered to affect the price of JKII are the Indonesia Composite Index (ICI) price and the global price of Brent crude oil. The selected VARX model for modeling was VARX (1,1). The residual of the VARX (1,1) model satisfied the white noise assumption and followed a normal distribution; therefore, the prediction results with the mean absolute percentage error (MAPE) for JKII prediction were very accurate, at 3.63%. During the last ten years, research into the prediction of the risk of loss of the JKII price index in Indonesia has never been carried out, however, it only focuses on certain stocks that are included in the category of sharia shops, such as the research conducted (

Faturrahman et al. 2021) on the risk of loss using the JKII price index as an observation variable. By knowing the predicted loss on the JKII price index, the estimated loss of all sharia shares that have been listed on the Jakarta Islamic Index can be identified.

Most previous studies discussed JKII price prediction and modeling based on the correlation between the current price index value and the previous one. Given this reality, this study promoted alternative price prediction and modeling of JKII using the GMB model. This model assumed that the past JKII price index return data were mutually independent and normally distributed. The prediction of the risk of loss of the JKII price index was developed using the Value at Risk (VaR) model with a Monte Carlo simulation approach to obtain an estimated loss of all sharia shares listed on the JKII. The study aimed to analyze the JKII as an Islamic stock price index listed on the Indonesia Stock Exchange. This analysis includes price index predictions and JKII risk loss predictions. So far, no studies have examined this issue. Information about future price movements and the value of the risk of loss is very important for investors and companies listed in the JKII. This information can be used as a reference for investors before deciding to invest. Furthermore, for companies, this information can be used as a reference to improve company performance.

The analysis determined the value of JKII using the GBM model and testing the prediction accuracy using MAPE. After obtaining the predictive value, the predicted value of JKII is used to measure the prediction of losses using the VaR method. The data used are the daily closing price of JKII from 1 August 2020–13 August 2021. The data were obtained through the Yahoo Finance website. The results of this price prediction and risk of loss are expected to be an accurate reference and consideration for investors who will use their funds to invest in Islamic stocks traded on the IDX.

The rest of this paper is divided into four sections: the literature review is outlined in

Section 1: Introduction,

Section 2: Methodology,

Section 3: Result, and

Section 4: Conclusions is given in the last section.

3. Results

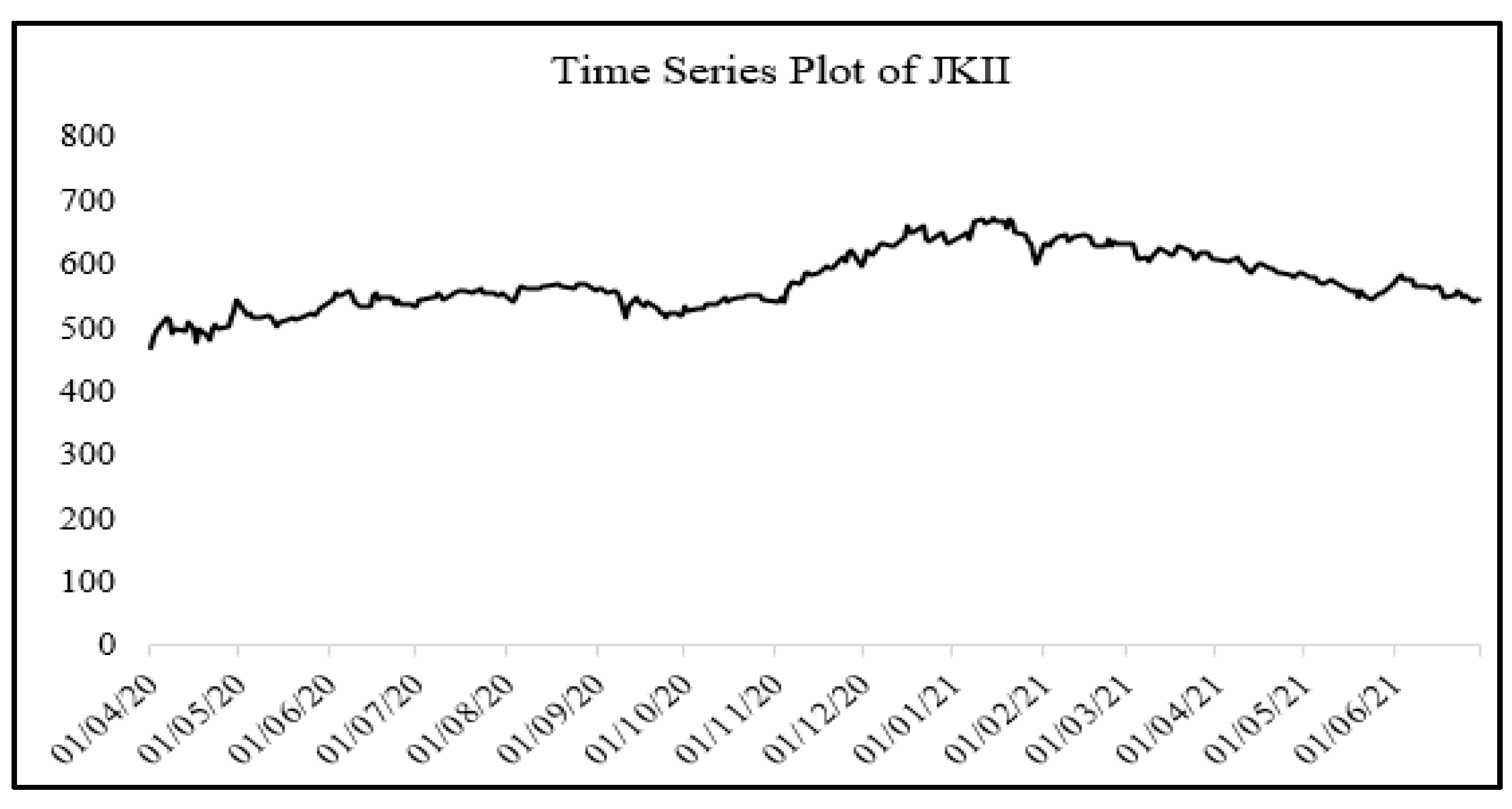

This study used 329 secondary daily data of the JKII index price downloaded from FinanceYahoo.com (accessed on 10 October 2021) from 1 August 2020 to 13 August 2021. The following is a summary of the price movement of the JKII index in that period, which is depicted through a time series plot:

Figure 1 shows the time series plot in which the movement pattern of the JKII price index is divided into three periods. First, in the period 1 August 2020–1 November 2020, the JKII price index tended to be stable at IDR 500, meaning, during that period, there was no significant decrease or increase in the movement of Islamic stock prices in Indonesia. In the period 1 November 2020–1 February 2021, the JKII price index increased from IDR 500 to IDR 650. The increase in this period was due to the economic activities of Islamic companies in Indonesia starting to bounce back after previously being constrained by the COVID-19 pandemic that hit Indonesia. After the period 1 February 2021 to 13 August 2021, the movement of the JKII price index was moderately stable, which was in the range of IDR 650–IDR 600.

According to

Aduda et al. (

2016), the information presented on the time series plot is limited only to the movement pattern of index price data. Therefore, descriptive statistical values of the JKII price index are needed to obtain more specific information about the characteristics of the JKII price index data.

Table 2 shows that the average JKII price index was IDR 570.45, with the smallest value being IDR 467.88 and the largest being IDR 671.59. The average deviation of the value of each price index to the average value was 44.5246. As this value was relatively small, the value of the JKII price index tended to be homogeneous and stable. The skewness value obtained was 0.4351 > 0, meaning that most of the data had a value less than the average, and on the frequency distribution curve, the data tended to converge on the left side. After determining the characteristics of the JKII price index, the analysis was continued to predict the price index and the value of losses. Prediction of the JKII Price Index began by dividing the data into two: in-sample and out-sample data. In-sample data serve to form model parameters, while out-sample data serve as a comparison to test the accuracy of predictions (

Henry et al. 2019). In-sample data were determined to be 299 from 1 August 2020 to 30 June 2021, and out-sample data were 30 from 1 July 2021 to 13 August 2021. After the data were divided into two segments, the next step was to calculate the return value for the in-sample data. The following is a summary of the in-sample returns in the form of a descriptive statistical table:

In the in-sample period, the average return was 0.000446, meaning that the average profit from investing in Islamic stocks was 0.446% of the funds invested. The highest profit value obtained was 4.987%, and the highest loss was 5.143% of the invested funds.

In

Section 2, it was explained that the assumption that had to be met in predicting the price of the JKII index using the GBM. model was that the return data had to follow the normal distribution. In this study, the normality test was carried out using the Kolmogorov-Smirnov Test (K-S test) and was chosen because this test is an exact test that does not depend on the test’s cumulative distribution function. The process carried out is more concise, with accurate results (

Luqman et al. 2018). The test output can be seen in the following table:

The provision to reject or accept H

0 in the normality test using the Kolmogorov–Smirnov test is based on the

p-value; if the

p-value is less than α, then it is decided that H

0 is rejected (

Hassani and Silva 2015). Based on

Table 3, the

p-value was 0.135, which was more significant than α, so the test decision was that the JKII in-sample return data followed a normal distribution. Since the JKII in-sample return data were proved to have a normal distribution, the GBM model could be used to predict the JKII price index.

In addition to normality test, it was necessary to perform a unit root test on the JKII in-sample return data. This test aims to see if the data are stationary. If the information is not stationary, the mean and variance are not constant. Thus, the data are not suitable for modeling using GBM, which requires the information to be normally distributed with constant mean and variance. The results of the unit root test using the Augmented Dickey–Fuller (ADF) test are as follows:

The parameters needed in the GBM model are the mean (

μ) and daily volatility (

σ) of the return data (

Nkemnole and Abass 2019). In addition, the volatility value used was the daily volatility because the price index to be predicted was the everyday price index. The following are the values for these two parameters:

By substituting the values of μ and σ in

Table 4 into Equation (4), the GBM model for predicting the JKII price index was as follows:

This model was used to predict the JKII price index in the out-sample period (1 July 2021–13 August 2021). The prediction results obtained are shown in

Table 5.

From the results of the ADF test, the t-statistic value obtained is −18.985 with a

p-value of 0.000. If the

p-value is less than α, then H

0 is rejected. So it can be concluded that the return data are stationary. Estimated GBM model parameters are presented in

Table 6 as follows:

Referring to

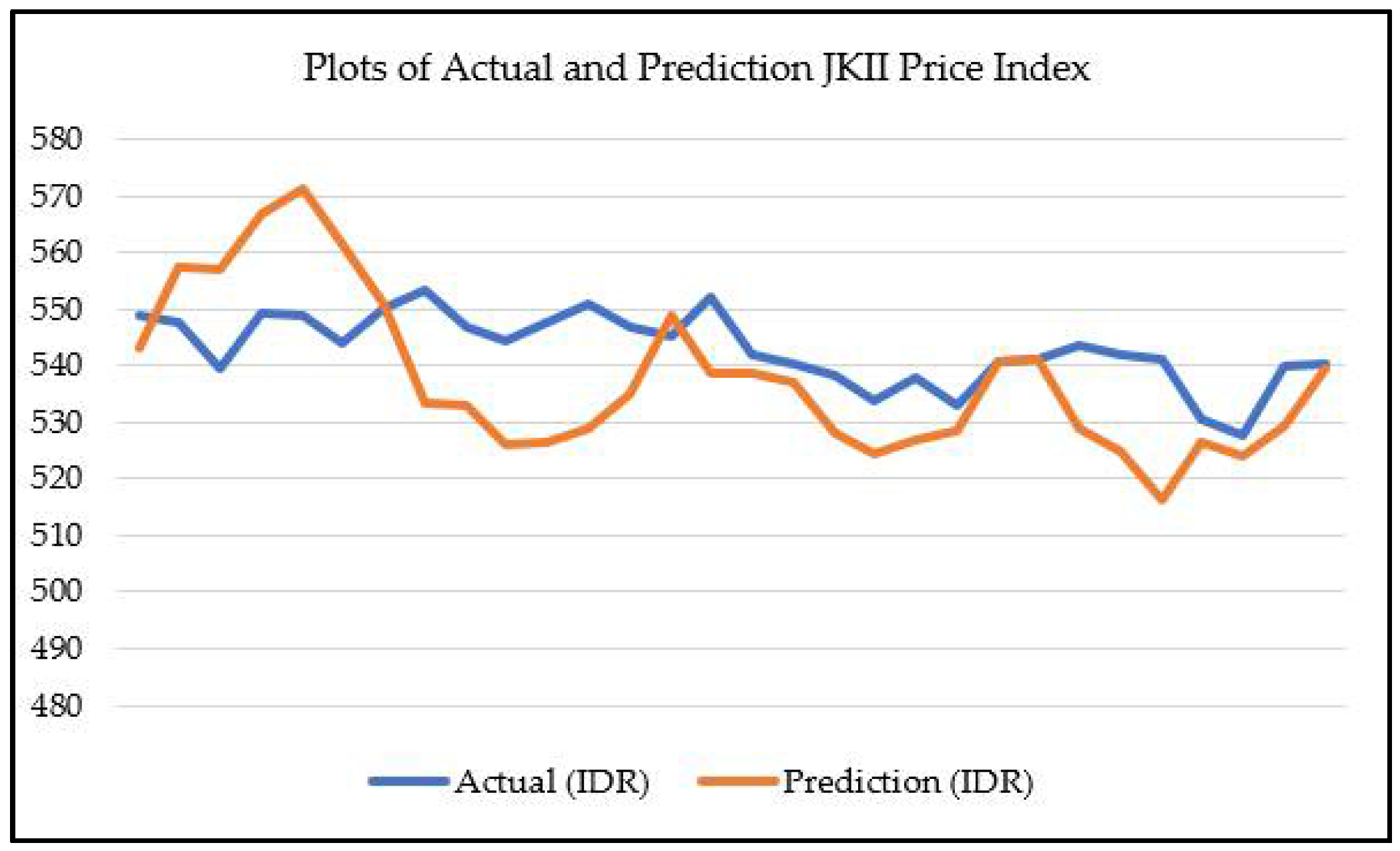

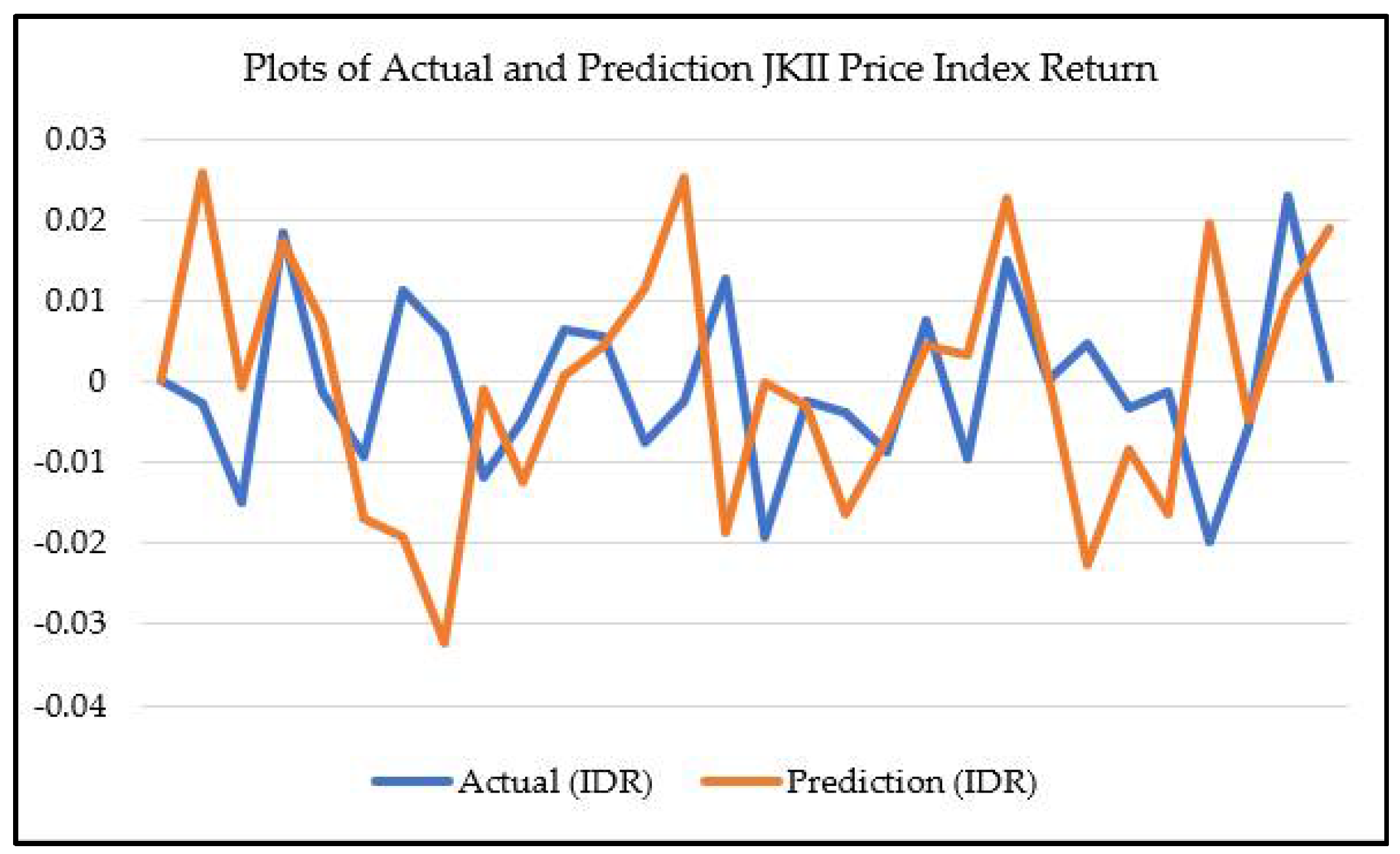

Table 7, the predicted results of the JKII index and the return had a value that was quite close to the actual value. This indicated that the GBM model was suitable to be used by investors to predict the movement of JKII and sharia stock prices in the future period. Sometimes, prediction results will be easier to understand if presented in tabular form. Therefore, here we offer the plots of the JKII price index and JKII return prediction and Plots of actual. Plots of actual and predicted JKII price in-dex from 1 July 2021–12 August 2021 are presented in

Figure 2 and Plots of actual and predicted JKII return from 1 July 2021–12 August 2021 are presented in

Figure 3:

The following is the MAPE value of the JKII price index prediction for out-sample data.

Based on the obtained MAPE value, the GBM model produced very accurate prediction results, resulting from the return value, which was usually distributed (

Ibrahim et al. 2021). Several previous studies applied the GBM. Model to predict prices, and the results showed that if the assumption of normality were met, the prediction would yield very accurate results.

Abidin and Jaffar (

2014), who used the GBM model to predict stock prices of 22 companies in Malaysia, obtained exact prediction results, with MAPE values ranging from 1.69–10.60%.

Trimono and Ispriyanti (

2017), who analyzed the share price of Ciputra Development Ltd. in 2016−2017 using the GBM model, produced a very accurate MAPE value of 1.87%. In addition, several other studies examining the application of the GMB model to analyze price movements and predictions concluded that the MAPE obtained was always accurate, at less than 10% (

Nkemnole and Abass 2019). After the GBM model was proven to have good predictive accuracy, the model was used to predict the JKII price index for the following five periods after 13 August 2021. The prediction results are presented in

Table 8 and Prediction of JKII price index for 16 August 2021–23 August 2021 is presented in

Table 9:

Based on forecasts, the JKII price index would move stably in the following five periods at a price range of IDR 550. The price stability reflected the stable returns to be received. This is a perfect situation for investors who did not like high risk in investing. In addition to the price index prediction, the risk of loss prediction was the next aim of this study. The initial period as the benchmark was 13 August 2021. Through the VaR method with the Monte Carlo simulation approach, the loss risk prediction at several confidence levels and holding periods was predicted. For each simulation to produce the VaR value, the number of random numbers generated was 1000, and the number of repetitions (

m) carried out was 500. Loss risk prediction for several holding periods and confidence levels are presented in

Table 10:

In each holding period, a possible loss of value at several levels of confidence might occur. As a negative sign on a VaR value represents a loss value (

Maruddani 2019), the interpretation of the VaR value for a 3-day holding period at a 95% confidence level was −0.0529. The meaning was that the maximum possible loss value for Islamic stocks in Indonesia for three trading periods after 13 August 2021, namely on 19 August 2021, was 0.0529 (5.29%) of the total invested funds. In other words, suppose that the invested funds were IDR 100,000,000, then the estimated maximum loss that might occur was IDR 5,290,000. Therefore, the longer the holding period and the greater the level of confidence chosen, the greater the prediction of losses will be. This finding was in line with the previous studies of

Amin et al. (

2019);

Hong et al. (

2014), which used the VaR Monte Carlo simulation model to predict losses on financial asset data.

4. Conclusions

In the JKII price index, the GBM model can be used as an alternative to predict the value of the price index in the future. Based on the results of the analysis obtained in

Section 4, by utilizing the return value of the JKII price index for the period 1 August 2020–13 August 2021, the GBM model formed to predict the JKII price index with a change in 1 day was:

The MAPE value for prediction results on out-sample data (1 July 2021–13 August 2021) is 2.03%; in other words, the prediction results are very accurate. For the period outside of the out-sample data, which was 16 August 2021, the predicted value of the JKII price index was IDR 552.26. Then, through the VaR method with the Monte Carlo simulation approach, at a 95% confidence level, the predicted maximum loss that would occur on 16 August 2021 was 3.07%.

The results of this study indicate that when the return on the JKII price index is normally distributed, then GBM model can predict the JKII price index very accurately. Theoretically, the GBM model will provide maximum predictive results for asset prices when the return data are normally distributed. VaR risk prediction results through the Monte Carlo simulation approach at a confidence level of 90–99% were in the range of 2–9% of the total invested funds. The main difference between the results of this study and other studies that discuss JKII price index prediction is that the predicted results of the price index are directly interpreted as the final result of the study. However, the results of the price index prediction in this study are used as a reference to measure the value of risk of loss, which is also an important indicator of a financial instrument.

The implication of this research is if the return on the sample data are not distributed and price prediction is conducted using the GBM model, the prediction results will be inaccurate and cannot be accounted for. This implication is indirectly at the same time a limitation of this study. GBM and the VaR Monte Carlo model rely heavily on the assumption of normality returns, so that if the return data are not normally distributed, the methods cannot be used. Suggestions for further research can be developed to model the JKII price index if the historical return data are not normally distributed. One of the models that can be used is the GBM with the Jump model.