Abstract

Rapid depletion of fossil fuel reserves forces the global energy sector to transition to sustainable energy sources. Specifically, distributed energy markets have emerged in the renewable energy sector in recent years, partly because blockchain technology is becoming a successful way to promote secure and transparent transactions. Using its decentralized structure, transparency, and even pseudonymity, blockchain is increasingly adopted worldwide for large-scale energy trading, peer-to-peer exchanges, project financing, supply chain management, and asset tracking. The research comprehensively analyzes blockchain applications across multiple fields related to energy, bibliographically evaluating their transformative potential. In addition, the study explores the architecture of various blockchain systems, assesses critical security and privacy challenges, and discusses how blockchain can enhance operational efficiency, transparency, and reliability in the energy sector. The paper’s findings provide a roadmap for future developments and the strategic adoption of blockchain technologies in the evolving energy landscape for an effective energy transition.

1. Introduction

With fossil fuel depletion on a global scale, climate change, and the necessity to ensure a sustainable, secure, and resilient energy supply, the global energy transition has become imperative. In this context, the digitalization of the energy sector is emerging as one of the main instruments of transformation, enabling the development of new forms of decentralized generation, distribution, and use. That is the case of blockchain technology, a highly disruptive digital technology currently attracting attention for its potential role in transforming the conventional communication and transaction paradigms based on trust and traceability within the energy system [1].

Blockchain is a distributed ledger technology that offers unique properties such as decentralization, immutability, transparency, and automation via smart contracts. All of these properties have made it a potentially good infrastructure for distributed energy markets, direct peer-to-peer (P2P) energy trading, Renewable Energy Certificates of origin verification, user privacy protection, and operational efficiency in smart grids and microgrids [2,3]. Moreover, its combination with new technologies such as the Internet of Things (IoT), artificial intelligence (AI), and edge computing opens new opportunities for the automation and decentralized governance of the complex energy system [4].

However, adopting blockchain applications in the energy industry still faces significant technical, regulatory, and economic challenges. These include scalability limitations, computational costs, cybersecurity vulnerabilities, interoperability of existing infrastructure, and inadequate regulatory frameworks [5,6]. Overcoming these obstacles requires a series of non-trivial steps, such as a rigorous evaluation of existing architectures, a deep understanding of emerging business models, and a critical analysis of available technological proposals [7].

This paper aims to provide a comprehensive review of the state of the art in applying blockchain technology in the energy sector, focusing on use cases such as P2P energy trading, smart grids, renewable energy management, etc. It further explores the critical privacy, security, and performance challenges and discusses the technical platforms used to develop the technology. Finally, the present constraints are critically assessed, and future research prospects are sketched to indicate the path towards responsible deployment of this technology in the shift towards a more decentralized, transparent, and sustainable energy system.

Consequently, the present paper addresses the following research questions:

- RQ1. What are the key applications of blockchain in the energy sector?

- RQ2. Which applications are most analyzed in the academic literature?

- RQ3. What are the common technical, regulatory, and operational challenges often encountered within individual application domains?

2. Literature Review Methodology

A semi-systematic literature review was carried out to analyze the academic contributions on the blockchain application in the energy market in a structured way [8]. This type of review, unlike the classical systematic review, does not aim for exhaustive coverage of all existing studies but instead seeks to provide a broad and structured overview of an emerging field that admits subcategories, allowing key patterns to be identified without the need to encompass the entirety of academic production [9]. This approach makes it possible to structure the review rigorously while simultaneously adapting it to integrate the different sections within such a broad topic as the one addressed here. Identifying potentially relevant works in each section facilitates the subsequent generation of a narrative synthesis [10], which is why this methodology has been considered the most appropriate for this type of article. In addition, this is a methodology recognized and used in various research fields [11,12,13], including the energy domain [14,15].

To strengthen the initial identification phase, elements of the scoping review were incorporated [16,17], ensuring that this approach provided broad coverage of the possible topics [18]. The search strategy for these studies combined two procedures. On the one hand, an initial exploration inspired by the scoping review methodology was conducted to broaden the field of research and guarantee inclusion in emerging areas [19,20]. For this purpose, the Web of Science database was consulted, using the broad query “blockchain AND energy”. The inclusion criteria were that the selected items had to be scientific articles (discarding other possible types of contributions), written in English, indexed in the Science Citation Index Expanded (SCIE) and Social Sciences Citation Index (SSCI), and published between 2017 and 2025.

The result of this set of restrictions identified 393 articles, which served as the basis for delimiting the main application areas most representative of blockchain technology in the energy sector, along with some additional minor regions. Specifically, the total set of articles allowed the establishment of the main areas: P2P and energy trading, smart grids, renewable energies, mobility, and carbon and environmental markets. Moreover, in the spirit of a scoping review, this mapping highlighted the need to address an additional section relating to privacy and security, which will also be covered later.

From this point, the WoS search was refined more concretely, using these thematic areas. This refined search yielded 198 articles, constituting the initial corpus for detailed analysis. In this refinement, precisely the same inclusion criteria as in the general search were maintained: scientific articles in English, published between 2017 and 2025, and indexed in SCIE and SSCI. In these 198 articles, exclusion criteria were applied, eliminating works that did not fit into the established categories, those of an exclusively technical nature, and those irrelevant due to a lack of connection with the subject of study. Consequently, 33 articles were discarded, whereas 165 remained. At the same time, the corpus was expanded by including 41 articles identified in the references and citations of the selected works, particularly highly cited studies that met the inclusion criteria. The result was 206 unique articles.

All these articles were classified according to proper categories. Two reviewers independently evaluated the thematic assignment of each work. The initial delimitation of thematic areas allowed for an unequivocal classification of most articles, with consensus required only in 26 cases assigned to more than one category. In line with Cohen’s Kappa index guidelines, minor differences in exclusion criteria were resolved by consensus [19,20]. The outcome results from the systematic application of the requirements and searches described here, with their inclusion/exclusion directives, combined with the classification performed by the two reviewers, ensuring transparency and reliability. In addition to enabling access to the main categories of application, this procedure also made it possible to identify the most representative works in each area, providing a robust foundation for the analysis presented in the following sections.

3. Applications Based on the Use of Blockchain in the Energy Market

3.1. P2P Energy Trading

3.1.1. General Fundamentals and Legal and Regulatory Aspects

The development of blockchain-based energy trading platforms requires a basic understanding of the fundamentals of this distributed technology and the mechanisms that allow consensus between nodes without centralized intermediaries. This conceptual foundation is indispensable for interpreting the logic behind the decentralization of energy markets and designing smart contracts that automate operations.

Technically, the security of blockchain-based P2P trading relies on cryptographic primitives and consensus workflows. Each transaction is digitally signed by the sender’s private key and hashed into a block, making it immutable and tamper-evident once validated by the network. Consensus protocols such as Proof of Stake, Proof of Work, or Proof of Authority, together with Practical Byzantine Fault Tolerance variants, ensure that independent nodes collectively agree on the validity of trades, thereby eliminating the need for a trusted intermediary [1,21]. This combination of signatures, hashing, and consensus guarantees transaction integrity, authenticity, and non-repudiation.

On top of this infrastructure, smart contracts embed trading logic directly into executable code deployed on-chain. In energy auctions, contracts can collect bids and offers, automatically match them according to predefined rules (e.g., double auction mechanisms), and settle payments in real time once inputs are verified [22]. Verification is typically based on IoT-enabled smart meters or trusted oracles that feed external data (such as delivered kWh or market prices) into the blockchain. By integrating these elements, smart contracts enforce delivery, automate settlement, and trigger penalties for non-compliance, providing a transparent and auditable workflow for energy trading and balancing markets [23].

In this context, immutability means that once a transaction is recorded, it cannot be altered without invalidating the entire chain. At the same time, verification ensures that only meters, or even oracle-confirmed data, are executed. Smart contracts follow the usual “if-then” logic (e.g., if a meter reading confirms delivery, then transfers tokens), which formalizes trading rules into enforceable, transparent, and tamper-proof workflows.

Some of the main principles that define blockchain technology are immutability, transparency, decentralization, and the traceability of transactions, all of which facilitate its adoption in distributed energy networks. A first approach to the topic uncovers works that provide general overviews of blockchain scenarios applied to the energy sector [2,24,25,26], including some of the related literature review [1,5]. Although some studies classify blockchain architectures and detail the various consensus algorithms [1], others focus on describing its fundamental components [2]. Li et al. [21] focus on these same components to orient them to the energy trading that concerns us here, describing how transaction records are validated by Energy Auction Gateways (EAGs), and detailing the consensus process carried out by these EAGs. Even Guerrero et al. [27] have proposed a methodology based on P2P techniques for energy trading in networks with voltage problems, line congestion, and system losses.

A category of studies on the big picture of P2P energy trading with blockchain attempts to frame the legal framework of its operation and the policy implications of its implementation. The most comprehensive review of these legal and economic challenges is by [6], in addition to [5], which focuses on the barriers to widespread adoption of decentralized energy trading. Unsurprisingly, this section points towards data protection in innovative contract architecture, including privacy and system security. There are enough papers that it is interesting to group them into a separate category.

3.1.2. Privacy and Security

The development of blockchain-based energy trading platforms requires a basic understanding of the fundamentals of this distributed technology and the mechanisms that allow consensus between nodes without the need for centralized intermediaries. This enables an essential basis for interpreting the logic behind the decentralization of energy markets and designing smart contracts that automate operations. This focuses on solutions and challenges related to participant identity protection, data confidentiality, and overall transaction security in blockchain-based energy systems. Indeed, data protection in an innovative contract architecture is a key issue [28,29], just as privacy [30] and cybersecurity of systems in the decentralized energy market are [31].

The aforementioned work by [6] had already addressed the legal challenges of data protection, along with the identification of data controllers, rectification and erasure rights, and possible anonymization techniques, linking to technical solutions such as Zero-Knowledge Proofs (ZKPs) and homomorphic encryption to comply with privacy regulations. Solutions such as those of the Decentralized Ant-Colony Optimization (DACO) algorithm can serve to balance market efficiency with information privacy, prevent identification, ensure privacy [32], and overcome proposals based on blacklisting [21]. Academic studies along these lines are extended by proposals for privacy-preserving P2P trading systems that implement the Function-Hiding Inner Product Encryption (FHIPE), thus allowing bid comparisons in the encrypted domain without revealing actual values [29]. Similarly, it has been used with homomorphic Paillier encryption and Secure MultiParty Computation (SMPC) to order bids without revealing compromised information [33].

On the issue of trust offered by participants, the original work of [9] introduced a credit-based payment scheme, where borrowers who fail to pay are blocklisted and distributed to all nodes on the blockchain, favoring trust and preventing fraud. It has also designed a network security-constrained trading verification method to ensure the security of grid operation during P2P transactions, even in privacy-preserved trading scenarios [33]. In connection with system security against False Data Injection (FDI) attacks, it has been proposed that measurement data should be protected with static nodes in a first private blockchain layer, designed to safeguard the Distributed Control System (DCS) cryptographically [31]. In addition to other related matters, this issue appears to be connected to technical aspects that part of the reviewed literature has addressed, which we have grouped in a different section regarding the ability of the network to deliver an operationally capable performance ratio.

3.1.3. Performance, Cost, and Scalability

Concerning the technical aspect of these decentralized networks, the primary challenge in implementing blockchain-based energy trading lies in ensuring optimal performance [7] and sufficient scalability to assume successive increases in the number of transactions and participants. Evaluation of transaction speed, latency, aggregate system throughput, and associated computational costs has become a fundamental axis of analysis to determine the feasibility of these large-scale solutions.

In this general framework, several of these descriptive works offer possible alternatives to reduce computational effort by addressing the interoperability challenges between various blockchain platforms [25,34,35]. Specific trials have shown how to increase transaction volume and those nodes that affect such metrics [36]. Comparisons of consensus algorithms show that performance can vary significantly depending on the protocol used, especially in latency, throughput, and fault tolerance.

In addition, in the carbon and energy trading field, where performance directly impacts market dynamics, stress tests under different conditions are essential to verify the robustness of platforms and their responsiveness [35]. As platforms face more demanding scenarios, several studies propose scalability solutions that allow optimizing resources without compromising functionality. These include second-layer approaches that reduce computational complexity and shorten block commit times, thus improving system operational efficiency [7,37]. Cost and resource consumption, in addition to those related to electricity and gas, have become critical metrics for assessing the efficiency of a system. In general, computational cost increases with the number of participants, but some algorithms exhibit more moderate growth rates, suggesting room for adaptability to high-demand conditions [28,38]. Even more complex techniques, such as FHIPE cryptographic operations, can be completed efficiently, keeping execution time low despite receiving an increasing number of pricing options, pointing to acceptable performance under real-world conditions [38].

Bidding platforms have also been the subject of specific analysis in terms of performance and scalability, especially in the processing time required to perform operations [24]. Added to this are proposals that, like the Block Alliance Consensus (BAC) algorithm, have demonstrated remarkable efficiency in average block and chain resolution time [34]. Some studies have also focused on reducing technical losses in trading platforms [39]. Finally, additional metrics such as output loss and conflict frequency in Multi-Version Concurrency Control (MVCC) and the influence of trigger intervals on latency and block throughput have been incorporated to evaluate the robustness of systems under asynchronous or delayed data conditions [22]. As highlighted in earlier work, Guerrero et al. [27] analyzed technical difficulties associated with voltage problems and the risk of system overload.

3.1.4. Market Mechanisms and Trading Models

Blockchain-based P2P energy trading systems require the design of market structures capable of articulating supply and decentralized demand, ensuring economic efficiency and operational stability. The related architecture should also integrate bilateral mechanisms, pool systems, and final market equilibria [36]. Attempting to delimit the studies of interest in the market itself and its organization, the first group of works of a rather descriptive nature of P2P energy trading platforms stands out [24,36]. Such earlier works are varied in their approaches. However, they are oriented towards the sustainability and future viability of the proposed models [21,40], or their overall economic efficiency [30,32]. Of particular interest are those works focused on demand management in P2P energy markets [22,39], many of which combine technical and financial elements to prevent certain constraints from violating physical grid requirements [27], thus connecting to the imaginative grid management literature. In this regard, Dong et al. [41] link the number of consumers to the behavior of trading strategies in scenarios with dynamic pricing.

Other works focus on analyzing closed auctions, bid matching, and payment settlement through smart contracts, providing a clear view of the operational flow between producers and consumers, and calculating clearing prices [28]. In some cases, matching prioritizes physical criteria, such as distance between participants, to reduce technical losses [39], while in others, energy tags or metadata are incorporated to improve platform decision making [40]. Some of them incorporate advanced cryptographic techniques that preserve privacy during matching, such as using encrypted heaps and price encryption, maintaining the integrity of the auctions even under system operator supervision [29]. In dynamic environments, where the supply–demand balance varies constantly, P2P systems implement schemes in which prices are automatically adjusted from periodic aggregations of consumption and production [38]. These proposals are also compared with traditional models, such as daily markets or uniform price auctions, allowing the relative efficiency of new decentralized designs versus traditional ones [25].

Even in those systems where transaction privacy is prioritized by encryption, matching strategies are not affected, thus ensuring the reliability of the market process [30]. In operational terms, the effects of different settlement windows on the number of transactions performed have been evaluated, directly impacting market efficiency [37]. Finally, models based on demand response games allow coordinators to adjust prices from aggregate bids, driving the system towards efficient Nash-like equilibria and encouraging rational participation of all agents involved [22]. As expected, some of the proposals explore the functioning of the energy market in localized and specific energy systems, called Local Energy Markets [42], such as smart homes [40], microgrids [31,36], virtual power plants, and other assimilated systems [24], mostly discussed elsewhere in the present research.

3.1.5. Implementing Energy Trading Platforms

The move from theory to practice in P2P energy trading systems includes explanations on implementing functional platforms effectively. This technical dimension encompasses both the configuration of development environments and the coding of smart contracts, the selection of programming languages and libraries, and the choice of blockchains, depending on whether they are public or not publicly accessible, or even having an access control layer, depending on various implications in terms of scalability, security, and governance [25,35]. The implementation of P2P energy trading platforms on blockchain shows a clear preference for the use of Ethereum as the base infrastructure, accompanied by the Solidity language to program smart contracts that manage the matching logic, payment settlement, and control of the consumer and consumers’ energy states [24,38,39,42]. These implementations are often supported by local environments such as GanacheUI and Remix, along with libraries such as Web3.py, which facilitate the deployment and simulation of system functions. In some cases, these tests are complemented with tools such as Metamask and Infura.io, which allow for the emulation of the interaction with public networks and brings the experiment closer to real usage scenarios [24].

Beyond the earlier points, some recent studies have introduced development frameworks such as Truffle-Geth and Web3.py within hierarchical or multilayer architectures to strengthen privacy and resilience against attacks [31]. Other proposals opt for permissive solutions, such as Hyperledger Burrow or Hyperledger Fabric, which allow the configuration of networks with validated nodes, ordering services such as Apache Kafka and CouchDB databases, suitable for environments where greater control over access and governance is required [22,32]. These studies provide concrete insights into the most widely used tools, the preferred development environments, and the technical decisions accompanying the move from conceptual models to functional prototypes.

Several concrete examples of peer-to-peer (P2P) electricity trading illustrate the transition from theory to real market implementations at different levels, ranging from household to community and wholesale markets. One of the earliest and essential pilot projects was the Brooklyn Microgrid in the United States, launched by LO3 Energy (New York, NY, USA) in 2016 to enable local P2P solar trading on Ethereum. Although the initiative attracted considerable attention, it never progressed beyond the pilot stage. The issues identified ranged from bottlenecks such as transaction costs to regulatory barriers in U.S. retail markets and scalability limitations of the blockchain infrastructure [43,44]. Nevertheless, the case remains relevant as a pioneering demonstration of blockchain-enabled community trading and an illustration of the challenges that subsequent projects must overcome.

In Australia and India, blockchain-based platforms such as uGrid, xGrid, and TraceX (developed by Powerledger) enable P2P electricity exchanges among prosumers (consumer-producers). Among these projects is the collaboration with CESC in Calcutta, where participants trade surplus solar generation via blockchain and smart contracts. In Europe, Enerchain, launched in 2017 with the involvement of more than forty energy companies, introduced a blockchain infrastructure for wholesale electricity and gas transactions. Its pilot projects demonstrated the feasibility of intraday exchanges and forward contracts without intermediaries [45]. Similar experiences exist, such as SunContract in Slovenia and Powerpeers in the Netherlands [46]. The results have shown cost savings and a certain degree of market penetration [2].

Overall, the P2P trading landscape illustrates pioneering but discontinued pilots, such as the Brooklyn Microgrid, and ongoing market-oriented platforms like Power Ledger, Enerchain, and SunContract. This contrast highlights how early bottlenecks informed the design of more recent and scalable deployments.

3.2. Smart Grids

The smart grid concept modernizes traditional electricity networks by integrating information and communication technologies (ICTs). Smart grids support bidirectional flows of electricity and information, allowing intelligent control of generation, distribution, and consumption. They also incorporate Advanced Metering Infrastructure (AMI), distributed generation, demand response mechanisms, and real-time monitoring systems to improve operational efficiency, grid reliability, and user engagement.

Within the smart grid paradigm, microgrids have emerged as local zones of interconnected loads and distributed energy resources (DERs), such as solar panels, batteries, and electric vehicles. Microgrids can provide grid-connected and island functionality, afford greater system resilience and energy independence, and power remote or underserved areas. Their autonomy, which is drawn from the primary grid during outages or peak demand times, renders them especially appealing in the face of extreme weather and growing energy insecurity.

The need for safe, open, and autonomous coordination between different players in smart and microgrids in decentralized energy systems is increasing. Distributed solutions, such as blockchain technology, are being investigated, as traditional centralized control architectures often struggle to manage the complexity and scale of modern energy networks.

The integration of blockchain technology into innovative energy systems is driven by its potential to solve several pressing challenges. First, blockchain’s decentralization naturally matches the distributed nature of smart grids and their smaller version (microgrids), where independent agents (generators or consumers) are required to manage energy flows without a central authority. Second, the trustless nature of the blockchain enables trustless interactions, allowing parties to engage in transactions with guaranteed integrity and transparency, even without prior trust relationships.

Applications of such a new concept can be found in P2P energy trading, real-time energy auditing, renewable energy certification, and automated grid operation. Further, blockchain allows energy assets to be tokenized, fractional ownership, dynamic pricing, and new financial instruments for grid participation. When combined with the IoT, blockchain can also improve data integrity and automated decision making in edge environments, paving the way for autonomous energy systems. However, blockchain integration in the energy system is in its early stages and faces multiple issues, such as scalability, interoperability, regulation, and energy consumption of the consensus mechanism.

3.2.1. Blockchain Applications in Smart Grids and Microgrids

P2P trading is one of the most investigated and deployed blockchain applications in energy systems. It allows consumers and prosumers to exchange electricity via smart contracts. This approach eliminates the need for a central utility, reduces transaction costs, and adds flexibility to the grid [3,47,48,49,50,51,52,53]. P2P platforms often employ blockchain to automate pricing, manage settlements, and maintain participant trust [3,52,54].

Another primary application is transactive energy management. Transactive energy is a system of economic and control mechanisms that balance supply and demand across the grid. Blockchain provides the infrastructure for decentralized energy markets by allowing secure bidding, clearing, and contract execution [50,55,56]. In these contexts, blockchain records demand response commitments on-chain and executes smart-contract rules automatically when consumption thresholds are met, ensuring verifiable participation and automated settlement.

Blockchain has also improved demand response programs, rewarding consumers for reducing or moving their power consumption during peak times. It has the potential to automatically check participation, calculate rewards, and initiate payouts, providing greater automation and transparency [3,57,58].

In ancillary services (e.g., frequency regulation, voltage control, and spinning reserves), blockchain has the potential to bring resources into markets historically dominated by a few large power plants. Microgrid owners can also pool these aggregations for decentralized coordination and participation in services to the primary grid [3,59,60].

Finally, blockchain supports the optimization of distributed energy storage. It enables tracking storage assets’ origin, status, and availability, facilitating shared use in community energy systems. Token-based incentive mechanisms can be designed to encourage optimal charging/recharging behavior and support local balancing [61].

These cases highlight the blockchain’s capacity to decentralize energy transactions and operational decisions. They also show the diversity of its applications across economic and technical domains within smart and microgrids.

3.2.2. Technical Enablers and Architectures

Blockchain deployment in energy systems is closely tied to supporting technologies and architectural models, facilitating secure, scalable, and interoperable integrations. This leads to a better element for scalable, safe, and interoperable blockchain applications in the energy sector. However, deploying them in real-world settings requires addressing the significant challenges outlined in the next section. This section reviews the leading technical enablers facilitating blockchain integration into smart grid and microgrid infrastructures.

Smart Contracts and Execution Platforms

At the heart of most blockchain-based energy applications are smart contracts, which automate transactions and enforce logic without intermediaries [62]. Platforms like Ethereum and Hyperledger have become popular for implementing energy-related applications due to their flexibility and developer support [3]. In P2P energy trading, smart contracts automate auction processes, execute payments upon delivery confirmation, or enforce penalties for non-compliance [57]. Demand response programs allow for programmable incentives based on predefined load reduction thresholds [63]. Smart contracts also make possible real-time grid automation, where distributed assets can automatically react to dynamic market signals and operational limits (e.g., solar panels, electric vehicles [EVs], or batteries). Their immutability and transparency ensure that agreements are executed faithfully and verifiably, building trust in decentralized energy systems [64].

Integration with IoT, AI, and Edge Computing

The effectiveness of blockchain in energy systems is significantly improved when integrated with IoT devices that provide the real-time data necessary to execute brilliant contracts and monitor energy assets [65,66]. IoT sensors and meters capture generation, consumption, and grid status data at the granular level, which the end user on the blockchain simultaneously signs off on to support transparency and auditability [67]. In addition, edge computing brings computational resources closer to the source of data generation, mitigating the latency and the bandwidth demand of real-time applications. In blockchain-enabled microgrids, edge nodes can validate transactions, host lightweight smart contracts, and participate in the local consensus [68,69]. Artificial intelligence and blockchain have also been proposed to enhance decision making and forecasting ability. For example, AI algorithms can predict energy demand or market trends, while blockchain technology can ensure the integrity and traceability of autonomous agents’ decisions [70,71,72,73]. Equigy, a joint initiative of European transmission system operators (TenneT (Arnhem, The Netherlands), Terna (Roma, Italy), Swissgrid (Aarau, Switzerland), APG (Wien, Austria)), launched in 2020, is a crowd balancing platform based on blockchain and IoT. This platform integrates distributed resources such as electric vehicles, batteries, and heat pumps into frequency control service markets. It has expanded its pilots in 2024–2025 with new aggregators in the Netherlands and Switzerland [74].

Decentralized Autonomous Organizations in Energy Systems

A new blockchain application in the energy industry involves Decentralized Autonomous Organizations (DAOs), which manage community energy systems. DAOs are a native form of blockchain governance rules encoded into smart contracts, with token holders/members deciding through transparent voting procedures. In the context of microgrids, DAOs can manage shared infrastructure (e.g., batteries, solar farms, and smart buildings [75]), distribute revenue from energy sales, or coordinate maintenance and upgrades. By decentralizing decision making, DAOs reduce administrative overhead and improve community participation. Although still experimental, DAOs represent a promising approach for self-governing energy communities, especially in rural or island settings with limited regulatory oversight [76].

Tokenization Models

Tokenization is the process of representing energy or financial value as digital tokens on a blockchain. These tokens can enable transactions, reward actions, or convey ownership of energy assets. Tokenization schemes, especially those based on blockchains, are nowadays used in smart grids, allowing for efficient, decentralized, and secure energy trading. These models use digital tokens to represent energy units, allowing agents (producers and consumers) to trade P2P electricity without a centralized entity used as an intermediary, thanks to smart contracts, automated transactions, and settlement schemes [77,78]. Advanced token protocols, such as ERC-1155, have digitalized the flexibility of heat and electrical energy, so buildings can now trade multiple types of energy in various markets as smart communities, making systems more interoperable and reducing transaction costs [56]. Some systems incorporate demurrage mechanisms, in which the value of energy tokens decreases with time, to encourage active trading and avoid token hoarding [77]. The integration of blockchain and IoT also enables real-time monitoring and incentive of energy-efficient behavior, with token rewards based on measured environmental and consumption metrics, supporting demand response and carbon reduction goals [79]. Furthermore, decentralized market-clearing algorithms and reinforcement learning-based price forecasting algorithms are being explored to optimize market operations and adapt to dynamic pricing in smart grids [77,80]. These solutions are intended to provide greater grid flexibility, reliability, and customer participation to reduce dependence on centralized control and enhance intelligent electricity networks’ economic and operational efficiency.

In the Port of Rotterdam, the Distro platform utilizes smart contracts and blockchain to operate a high-frequency microgrid energy market, reducing costs and enhancing returns for local producers. Similarly, Arensis (Dresden, Germany) and Schneider Electric (Marktheidenfeld, Germany) developed the ENTRADE IO, a blockchain-powered platform that streamlines financing and energy trading in remote microgrid environments. Distro and ENTRADE IO remained on the pilot stage, while Equigy has evolved into a TSO-backed initiative that is currently expanding in Europe. These contrasting outcomes underscore blockchain integration’s potential and scaling challenges in grid services.

3.3. Renewable Energy

3.3.1. Preliminary Musings

Although we do not refer here to the use of renewable energy as a form of powering blockchain mining [81], it is essential to note the application of this technology to the energy management of these forms of energy. As with other assimilated forms of energy, blockchain technology’s capability allows for potential advantages regarding sustainability, decentralization, and transparency. The enablement of new P2P energy markets, ensuring the traceability of these renewable energy sources, enables distributed management [82] whose interest has generated a growing literature that we summarize here. Although this is one of the most treated sectors from the point of view of the number of academic publications [83,84], we detect a distribution of the literature around two essential general points. The first concern is generalities about the use of blockchain in these markets, including some regulatory issues. The second significant section of the literature examines the difficulties and solutions that its implementation may encounter.

3.3.2. Fundamentals of Market Models

The related literature evolves from some preliminary descriptions [85], more conceptual, to recent quantitative assessments and applied studies evaluating market models, supply chains, or environmental certification mechanisms [83,86]. Among the first types of work is the contribution of [87], which collects expert opinion on the potential of blockchain for renewable energy, highlighting the institutional requirements and the advantages that can be found with decentralization, which are also collected by other authors [88]. Previously, very little work has been carried out to examine the possible compatibility of blockchain with these energies in preliminary architecture models showing data layers and incentive systems, pointing towards the system’s possible advantages in decentralization and reliability [85,87,89].

The subsequent literature already includes practical cases [62] that show how theory can be translated into real applications. It reviews cases of renewable integration with blockchain and presents integrative analyses of P2P in its management [86]. Some articles extend these holistic approaches, expanding their market analysis and including aspects such as certification, scalability, privacy, or management of these renewable energy networks [2,90]. In this category of applied studies, the issues of market organization between individuals and local power plants have been the subject of research, which has presented specific models or frameworks [91].

Among concrete applications, some work focused on virtual power plants (VPPs) and renewable energy trading, using formal algorithms and smart contracts to automate and make transparent dynamic market processes. On the one hand, Ref. [92] presents a general framework based on a mixed integer linear programming (MILP) model. This system uses a layer of smart contracts on blockchain to automate and record energy transactions in renewable energy, demonstrating an improvement in the reliability, transparency, and use of renewable energy while reducing system operating costs. Some studies have also linked the conceptual systems referred to in the beginning with the development of applied models for the concrete operation of community grids [91]. Indeed, several studies stress the need for certified regulatory and technological frameworks to guarantee the legitimacy of clean energy consumption [2,90]. Technically, renewable certificates can be tokenized as digital assets on-chain, where each token represents a verified MWh, and transfers are only validated once production data from certified meters are securely hashed into the blockchain. Interestingly, these works reflect how blockchain technology is an infrastructure on two levels. On the one hand, it can be performed by enabling an optimized technical automation platform, such as virtual power plants. However, it contributes to the verification and political governance of renewable energy consumption. Integrating these two functional levels is essential to consolidate this technology because it not only serves to model P2P energy markets but also supports regulated and certified systems.

In connection with previous studies, Ref. [93] develops a more general view of the concrete uses of blockchain in the crypto market. By analyzing the integration of these applications, their study discusses solutions to existing technological challenges and possible relevant operational scenarios. Although it is not technically specialized, as in previous work [92], it allows placing its scope within a broader comparative framework on specific applications and energy market models. Indeed, this treatment scheme of possible solutions links to another body of work that has been categorized separately. Blockchain technologies and artificial intelligence can be associated with managing decentralized energy market structures [73].

In addition to conceptual models, several blockchain-based initiatives in renewable energy markets are already operational. Greeneum (Paris, France) provides a decentralized platform for certifying and trading carbon credits and green energy certificates, integrating blockchain and AI to enhance transparency and accountability in renewable generation. WePower (St. Louis, MO, USA) demonstrated large-scale tokenization of green energy in Estonia, uploading 24 TWh of production data onto Ethereum and creating billions of energy tokens, later piloting corporate procurement solutions in Australia with retailers such as Mojo Power (The Woodlands, TX, USA). The Energy Web Foundation, through its EW Origin and EW Zero toolkits, has been adopted by major utilities and corporations, including Google (New York, NY, USA), Shell (New Orleans LA, USA), and Iberdrola (Bilbao, Spain), to standardize renewable energy certificate issuance and enable corporate clean energy sourcing across multiple jurisdictions. Finally, EFFORCE, co-founded by Steve Wozniak, applies Ethereum-based tokens to incentivize energy efficiency projects, which assess savings from efficiency financing projects with industrial clients. These examples highlight that blockchain is no longer limited to theoretical models but underpins active platforms for renewable certification, tokenized procurement, and energy efficiency financing.

In renewable energy, active initiatives such as Energy Web and EFFORCE coexist with discontinued cases like WePower, which demonstrated large-scale tokenization but failed to sustain operations. Together, they illustrate the promise and volatility of blockchain-enabled clean energy platforms.

3.3.3. Challenges in the Implementation of Blockchain in Renewable Energy

The previous literature has intensively reviewed blockchain applications in the renewable energy sector, referring to its implementation of technological, economic, and regulatory challenges. The most recent literature provides an overview of barriers and enablers, with different emphases depending on the main perspective applied. A good general summary of the advantages of this technology, along with the challenges generated by uncertainty, privacy, scalability, and energy consumption, is outlined by [90].

In economic terms, which is more focused on renewable energy, the identification of barriers based on high development costs and the lack of concrete operational targets appears to be a problem for the sustainability of this energy system [94]. The initial investment cost seems to be a relevant obstacle, along with the resistance to organizational change. Although the benefits associated with decentralization are recognized [88], the absence of dynamic policies and difficulties in designing integrated local markets are highlighted, which pose a possible regulatory barrier [73,95].

In addition to the above difficulties, there is a lack of technological standardization [96], whose technical solutions enable secure, immutable, and decentralized databases that help reduce intermediaries and speed up transactions in the renewable energy supply chain [92,97,98]. It has already explored technical applications in decentralized grid management, such as output power control and smart contracts for voltage regulators [4]. In the field of cybersecurity, [99] presents a detailed analysis of how the protection of this type of smart grid can be strengthened, agreeing with other works that point to security, privacy, and scalability [25,35,100] as elements capable of counteracting the costs pointed out [86,94].

Correspondingly, [101] addresses the issue of the efficiency and feasibility of adopting blockchain in renewable energy supply chains. Their study elaborates a consolidated framework that combines varied techniques with fuzzy programming to analyze efficiency, risk, and uncertainty. By incorporating factors such as investment cost, technological complexity, and system design elements mentioned above, they obtain a valuable tool to determine the conditions to implement blockchain technology in renewable energy contexts.

3.4. Other Applications

3.4.1. Management of Energy Certificates and Carbon Credits

Blockchain enables the creation, tracking, and trading of Renewable Energy Certificates (RECs) and carbon credits, ensuring transparency, authenticity, and efficient market operations. The use of blockchain technology here mitigates fraud, simplifies certification, and allows real-time certificate exchange [102,103,104,105]. Several European utilities are using blockchain for near real-time traceability and certification. Greenchain is the guarantees-of-origin tracking platform developed by Acciona (Madrid, Spain), which has been extended to renewable hydrogen through GreenH2chain. FlexiDAO/Energy Web is a pilot project with Iberdrola (Bilbao, Spain) that provides end-to-end traceability from generating assets to final consumption. Although the 2019 pilot was mainly demonstrated, it illustrates the company’s innovation lines in this field. Energy Web Origin, in connection with renewables, also finds a natural place here, given its role in certification.

3.4.2. Flexibility Services and Demand Response

Blockchain platforms facilitate the aggregation and verification of flexibility services, such as demand-side management and participation in demand response programs. Blockchain technology facilitates trust among stakeholders, automates incentives through smart contracts, and verifies participation records [2,106].

Real market projects also demonstrate the application of blockchain to flexibility services. As mentioned above, Equigy (TenneT (Arnhem, The Netherlands), Terna (Roma, Italy), Swissgrid (Aarau, Switzerland), APG (Wien, Austria)) operates a blockchain and IoT-based crowd-balancing platform aggregating V2G resources, batteries, and heat pumps to provide frequency control services. The consortium maintains pilots and has expanded with new aggregators in the Netherlands and Switzerland. In the United Kingdom, Electron operates exchanges and market processes, illustrating how blockchain can automate the verification and settlement of flexible services.

3.4.3. Smart Metering and Automated Billing

Blockchain improves the accuracy, trust, and automation of meter data collection and billing processes, providing tamper-proof metering, real-time consumption records, and supporting dynamic pricing schemes [107].

Although many contributions remain at the prototype stage, some operational integrations demonstrate how blockchain ensures integrity and auditability. The Estonian grid operator Elering (Tallinn, Estonia) integrated the KSI blockchain (Guardtime, Tallinn, Estonia) via API into Estfeed to guarantee the immutability of smart meter data and support agreements between market participants. In parallel, recent academic proposals explore automated billing and settlement based on smart contracts and secure metering, consolidating the technical framework for future deployments, which have not yet resulted in concrete market applications. This ensures that meter data are cryptographically sealed and cannot be altered retroactively, while smart contracts can automatically calculate invoices and trigger payments once validated readings are received.

3.4.4. Energy Communities and Local Marketplaces

Blockchain enables decentralized coordination in energy communities, allowing consumers to securely share, manage, and trade energy locally. This strengthens community empowerment, enhances local resilience, and simplifies settlements [108,109,110]. The emerging ecosystem of Decentralized Physical Infrastructure Networks (DePINs) represents an architecture that links physical resources with tokenized incentives through blockchain [111]. Devices (e.g., routers, sensors, and solar panels) provide services verified by IoT/oracles, recorded on-chain, and settled via smart contracts. This structure combines the physical infrastructure, verification, and economic layers, where tokens are issued and transferred. Unlike centralized architectures such as smart grids or DERs, which may use blockchain only for traceability or P2P transactions, DePINs reorganize the entire system under decentralized governance. The consensus typically relies on efficient protocols, such as PoS, PoA, or Proof of Coverage (PoC), that validate the actual provision of physical services. In the energy sector, efficiency and scalability benefits align with those of smart grids and DERs. However, DePIN introduces a qualitative leap by structuring the energy infrastructure as a fully decentralized network.

A concrete example is Quartierstrom in Switzerland, where 37 households operate a blockchain-based community market for solar electricity, demonstrating the feasibility of local trading and automated settlement rules. For DePIN, a hub (depinhub.io) exists as a central hub to aggregate projects, including energy.

3.4.5. Integration of Electric Mobility and Vehicle-to-Grid (V2G)

The blockchain manages the authentication, billing, and data exchange of electric vehicle charging and V2G transactions. This allows secure payment settlement, manages credit billing, and facilitates automated participation in grid services [112].

In real market settings, the Share&Charge Foundation operates the Open Charging Network, an open-source, blockchain-based e-roaming protocol on Energy Web Chain. This is a concrete example of blockchain-enabled mobility solutions.

3.4.6. Supply Chain Management for Energy Commodities

Blockchain streamlines tracking and authentication of energy commodities (e.g., oil, gas, and grid materials) through the supply chain. This ensures provenance, increases transparency, and reduces fraud in complex energy supply chains [113].

VAKT (used by BP (London, UK), Shell (New Orleans LA, USA), Equinor (Stavanger, Norway), and other firms) digitizes post-trade processes for crude oil in hydrocarbon markets, while Komgo (Geneva, Switzerland) specializes in blockchain-based trade finance. Circulor (London, UK) provides blockchain-enabled “battery passports” and mine-to-car traceability in battery materials. In 2024, Volvo (Gothenburg, Sweden) launched the first operational battery passport for one of its models, and mining companies such as BHP have used this traceability for the nickel–cobalt markets in collaboration with downstream manufacturers.

3.4.7. Investment Tokenization and Project Financing

Blockchain helps tokenize investments in renewable and infrastructure projects, broadening access to funding and enabling fractional ownership. It also improves liquidity, reduces barriers for small investors, and automates dividend distributions [114,115]. Additionally, it is used to design tokens or reputation-based incentives that encourage desired behaviors such as savings, participation, renewable energy, etc. [116].

Real market examples include The Sun Exchange, which operates an active platform for fractional ownership of solar panels in African schools and shops, with settlement on blockchain and payments in local currency. Similarly, EFFORCE tokenizes energy savings to finance industrial retrofits.

3.4.8. Wholesale Energy Market Operations

Blockchain supports automating, settling, and auditing wholesale energy trades, reducing intermediaries and operational costs. It enables real-time contract execution, transparent pricing, and simplified regulatory auditing [117].

At the wholesale level, Enerchain facilitates intraday and forward electricity and gas trading among European traders without a centralized market infrastructure. Another concrete application is Electron, which developed blockchain-based exchanges of capacity obligations in the United Kingdom, illustrating process automation and native audit trails.

3.4.9. Regulatory Compliance and Auditability

Beyond uses like certificate tracking, invoicing, or market settlement, blockchain in energy also applies to regulatory compliance, focusing on integrating legal rules. These factors have contributed to translating rules into code (for instance, for limits, tariffs, and subsidies). While overlapping with other domains, this involves real-time, tamper-proof enforcement, enabling dynamic regulatory auditability. Thus, blockchain shifts from a technical or commercial tool to a compliance infrastructure for regulated but decentralized systems, automating legal verification, reducing fraud and reporting burdens, and supporting adaptive regulatory governance [118,119]. Concrete regulatory initiatives are already experimenting with these capabilities: the World Bank piloted a platform in Chile linking distributed generation and carbon markets, extracting lessons for scaling. The Climate Warehouse program is developing digital infrastructure to safeguard the integrity of the carbon market. In the European sphere, KSI blockchain has been deployed in public infrastructures, including energy and data systems, as a basis for immutability and traceability tests required by regulators.

4. Some Considerations on Privacy and Security

Blockchain refers to a distributed ledger technology (DLT) that facilitates secure, public, and immutable records maintained without centralized authority. Fundamentally, a blockchain is a series of cryptographically linked blocks, which record transaction data. All network participants (nodes) store a copy of the ledger and employ a consensus mechanism such as Proof of Work (PoW), Proof of Stake (PoS), or Practical Byzantine Fault Tolerance (PBFT), to validate new additions. According to [120], there are three main types of blockchain networks:

- Public blockchains, which are openly accessible and operated by decentralized communities (e.g., Bitcoin, Ethereum, and Solana);

- Private blockchains, which restrict access to specific participants and are typically used within businesses (e.g., Hyperledger Fabric, Quorum, and R3 Corda);

- Consortium blockchains lie between the two and are operated by entities that trust each other (e.g., Multichain and FISCO BCOS).

Each type features different trade-offs regarding scalability, security, and governance, and their choice depends on the energy sector’s application domain. For decentralized energy systems, data security is a prerequisite for reliable and efficient processes in energy blockchain, and the need to address challenges about secure data storage, robust data management, and practical data applications has become more urgent. This system is generally facing several security threats [121], such as the following:

- Identity Management and Authentication—since centralized identity systems are not well-suited for distributed energy systems. Risks include impersonation attacks and poor key management. Blockchain offers decentralized identity (DID) models and verifiable credentials to address these weaknesses.

- Data Integrity and Tamper-Resistance—as energy data needs to be accurate and verifiable and protected against tampering. Attackers may inject false data, tamper with the logs, or even compromise the smart meters. Blockchain’s immutable ledgers and cryptographic hashes enable strong integrity guarantees.

- Secure Energy Trading—since energy trading systems are vulnerable to manipulation and fraud. Smart contract flaws, front-running, and settlement disputes are frequent issues. Blockchain enables atomic, auditable, and transparent trading protocols.

- Threat Models in Decentralized Energy Systems—where distributed energy systems suffer from Denial of Service (DoS) attacks, Sybil attacks, and replay attacks. While blockchain mitigates some risks (e.g., tampering), it also requires secure hardware and governance.

- Privacy Leakage—as granular data, can reveal sensitive behavior through detailed energy use patterns. Standard blockchain ledgers may reveal metadata even when pseudonyms are used. Techniques like ZKPs, differential privacy, and noise addition are essential to balance audibility and confidentiality.

To address these security issues, various blockchain-based solutions have been designed to combat cyber threats, keep stakeholders’ activities confidential, and ensure that all transactions and records are kept tamper-free. These solutions lay the groundwork for a more resilient, transparent, and trustworthy energy ecosystem.

4.1. Privacy-Preserving Mechanisms

Privacy-preserving mechanisms are critical for maintaining secure and confidential peer-to-peer energy trading mechanisms in a blockchain-based environment, especially in a consortium and trust-distributed (but not fully trusted) base infrastructure. These mechanisms trade off strong privacy guarantees with computational efficiency to be real-time or near real-time for energy trading, where grid operations need latencies below 1 s for settlement, pricing, or load balancing. In the following, key privacy-preserving techniques are detailed, as well as their technical underpinnings and computational trade-offs in energy trading.

4.1.1. Zero-Knowledge Proofs (ZKPs) and Noise Adding

Zero-knowledge proofs (ZKPs) enable a prover to demonstrate the validity of a statement (e.g., authentication and transaction validity) without revealing underlying private data. Zhang et al. [122] introduces a consortium blockchain-based privacy-preserving scheme for P2P energy trading, integrating three mechanisms: from a Dynamic Partitioning Algorithm to optimize privacy protection while minimizing impacts on blockchain throughput and data accuracy; from an Account Mapping (ACM) to dissociate blockchain addresses from real-world identities and thus obfuscate trading patterns of active users; and from a Virtual Token and Noise-Adding Strategy, leveraging additive Laplace noise to mask actual energy consumption while preserving statistical utility.

In the ZKP domain, protocols such as Zk-SNARKs (Zero-Knowledge Succinct Non-Interactive Argument of Knowledge) and Zk-STARKs (Zero-Knowledge Scalable Transparent Argument of Knowledge) are prominent [123,124,125]. Zk-SNARKs, exemplified by the Groth16 protocol [126], rely on pairing-based cryptography and traditionally require a trusted setup, although more recent schemes such as Halo 2 (deployed in Zcash NU5) have removed this requirement [127]. Zk-SNARK proofs are highly succinct and extremely efficient to verify (often <10 ms on-chain for large circuits), but proving time remains the bottleneck (ranging from a few seconds for small circuits to tens of seconds or minutes for larger ones, depending on hardware) [128,129].

In contrast, zk-STARKs do not require a trusted setup and rely only on collision-resistant hash functions, which makes them post-quantum secure [130]. However, STARK proofs are typically larger, and while their proving time can be competitive or even faster than SNARKs in some benchmarks, verification tends to be slower and more resource-intensive, affecting scalability in constrained environments [131].

For energy trading systems, latency requirements depend on the market layer: real-time wholesale markets typically settle every 5 min, while retail demand response and transactive energy applications may require feedback within seconds to tens of seconds. Sub-second latencies are generally reserved for grid control loops rather than pricing or settlement [132,133,134]. In this context, Zk-SNARKs can be feasible if proof generation is performed off-chain and only succinct verification occurs on-chain. In contrast, Zk-STARKs may face challenges due to proof size and verification cost.

Finally, [135] proposes a Multi-Party Electronic Contract Signing (MECS) protocol built on a consortium blockchain to achieve fair, efficient, and TTP-free participant co-signing. MECS leverages ZKPs to ensure that contract terms are validated without exposing sensitive data, relying on the immutability and auditability of the blockchain for transparency. However, the computational overhead of ZKP-based schemes, considering the order of seconds for proof generation in modest circuits, suggests hybrid approaches such as those proposed in [136] may be needed to balance privacy, scalability, and performance in high-frequency P2P trading contexts.

4.1.2. Anonymous Messaging

PriWatt, introduced in [137], is a fully decentralized P2P energy trading platform that preserves participants’ privacy through three key mechanisms:

- First, pseudonymous, transaction-specific addresses allow prosumers and consumers to generate fresh and unique blockchain and messaging key pairs for each transaction, ensuring no long-term identifier can be linked to their real identity. This approach builds upon prior work on unlikable transactions in Bitcoin and privacy-enhancing overlays such as TumbleBit [138,139].

- Second, multi-signature smart contracts, employing m-of-n multi-signature scripts (e.g., 2-of-3 among buyer, seller, and mediator) to ensure no single party, besides the mediator, can reveal transactional data, with dispute resolution maintaining anonymity.

- Third, anonymous encrypted messaging streams, inspired by Bitmessage [140], transmit all negotiation messages in encrypted form to the entire network. Every node receives every message, but only the intended recipient can decrypt it, thus concealing communication patterns.

These mechanisms incur minimal computational overhead, since modern symmetric encryption algorithms such as AES-256 can be executed in less than a millisecond per block on commodity hardware with AES-NI support [141]. Nevertheless, broadcasting encrypted messages to all nodes significantly increases network bandwidth requirements, which can limit scalability in large consortia or densely populated P2P energy markets.

4.1.3. Secure Multi-Party Computation (SMPC)

SMPC enables multiple parties (e.g., prosumers, grid operators and market makers) to jointly compute settlement, pricing, or load-balancing functions over their private inputs (consumption/generation data) without revealing them. Protocols such as Shamir’s secret-sharing-based SMPC [142] split private data into shares distributed among participants, requiring reconstruction thresholds (e.g., t-of-n) for computation.

In contrast, garbled circuit approaches [143], while more flexible for arbitrary functions, typically incur higher computational costs, with circuit evaluation times scaling at least linearly with input size [144]. Recent benchmarks of optimized SMPC frameworks (e.g., SPDZ, ABY3) report latencies in several hundred milliseconds to multiple seconds, depending on network conditions and function complexity [145,146]. This makes SMPC well suited for periodic tasks in energy markets such as daily or hourly settlement, where delays of seconds to minutes are tolerable [147], but less viable for real-time grid control, which under standards such as IEC 61850 requires latencies in the millisecond range (e.g., 1–4 ms for GOOSE and sampled values). Consequently, while SMPC enhances privacy in decentralized energy trading, its applicability is constrained to market-level rather than sub-second grid operations.

4.1.4. Homomorphic Encryption (HE)

HE allows computations on encrypted data, enabling aggregations (e.g., total load and average price) without decrypting individual inputs [148]. Partially homomorphic schemes, such as Paillier (additive), are computationally efficient, with encryption below 100 ms and decryption times below 10 ms for 2048-bit keys, which makes them suitable for real-time aggregation in energy markets [149]. Fully homomorphic encryption (FHE) schemes, including Brakerski–Gentry–Vaikuntanathan (BGV), Brakerski–Fan–Vercauteren (BFV), and Cheon–Kim–Kim–Song (CKKS), are lattice-based constructions that support arbitrary computations but incur prohibitive overheads, with simple operations that require seconds to minutes depending on circuit depth and parameters [150]. Compared to Paillier, lattice-based FHE schemes generally involve higher computational costs for encryption and decryption due to polynomial arithmetic in high dimensions, and their main bottleneck arises in homomorphic multiplications and bootstrapping. Therefore, for energy trading, Paillier-based HE is preferable for real-time tasks, while FHE may be reserved for offline analytics.

4.1.5. Ring Signatures and Mixing Services

Ring signatures, as introduced in CryptoNote and later adopted by Monero [151], enable a user to sign a transaction within an anonymity set such that the actual signer is computationally indistinguishable from the rest of the group. Their computational overhead grows linearly with the ring size, which limits scalability for large anonymity sets. In practice, ring signature generation and verification typically require tens of milliseconds (10–100 ms) for moderate ring sizes, though performance degrades as the anonymity set expands [152]. Mixing protocols, such as CoinJoin and its derivatives, improve privacy by aggregating multiple users’ transactions into a single batch before posting the settlement on-chain [153]. While such approaches effectively reduce on-chain traceability, they inherently introduce batching delays ranging from a few seconds to extended periods, depending on system load and adoption. This additional latency can be problematic in near-real-time applications such as peer-to-peer energy trading, where sub-second responsiveness is often desirable.

4.1.6. Trusted Execution Environments (TEEs)

TEEs, such as Intel SGX or ARM TrustZone, provide hardware-enforced confidentiality for off-chain execution of sensitive computations (e.g., auction algorithms, demand response optimization) [154,155]. Within these TEEs, enclaves act as isolated containers that protect code and data even in a compromised operating system. Enclaves can issue remote attestations, allowing third parties to verify the measured code and execution state and anchor the result on-chain following the attested compute pattern. In typical workloads, enclave transitions (ECALL/OCALL) and internal computation add microseconds to a few milliseconds of overhead [156], but complete remote attestation usually incurs tens to hundreds of milliseconds [157]. However, TEEs come with significant limitations. They depend on specialized hardware, which restricts portability across platforms, and are vulnerable to several classes of attacks, including side-channel. Transient execution exploits such as Foreshadow, LVI, and SGAxe. In addition, their large-scale adoption in energy systems is hampered by the heterogeneous availability of compatible hardware.

4.1.7. Differential Privacy (DP) for Aggregates

DP adds calibrated noise (e.g., Laplace and Gaussian) to aggregate statistics (e.g., neighborhood load profiles and DER contributions) to prevent inference of individual data [158]. The computation overhead of basic DP mechanisms is negligible, typically in the range of microseconds to a few milliseconds, making DP suitable for near real-time reporting in smart grid environments [159,160]. However, excessive noise can reduce data utility, requiring careful calibration of the privacy budget (ε), a parameter in differential privacy that balances privacy protection and data utility [161].

4.1.8. Attribute-Based Encryption (ABE)

ABE provides fine-grained, policy-driven access control, in which encrypted energy data can only be decrypted by users whose attributes satisfy a predefined access policy [162]. While ABE offers substantial flexibility in enforcing security rules (e.g., “hospital grid” or “municipal microgrid”), its computational overhead remains a limiting factor. Benchmarks show that encryption and decryption operations typically take more than 500 ms, depending on the number of attributes and the complexity of the access policy [163]. These delays are generally acceptable for access control in energy trading scenarios such as billing or settlement. Still, they are less suitable for high-frequency transactions in peer-to-peer markets, where key management and bilinear pairings introduce non-negligible latency.

4.1.9. Federated Learning for Demand Response Models

Federated learning enables the collaborative training of demand response models across prosumers’ devices without requiring the exchange of raw data, thereby enhancing privacy [164]. Local model updates are periodically aggregated on a central or hierarchical server, and privacy-preserving techniques such as differential privacy (DP) can be integrated into this process [165].

4.2. Identity and Access Management

Applying blockchain technology to energy trading systems has opened a new dimension for decentralized, transparent, and effective market operations. However, according to the findings from the present study, significant hurdles still exist to overcome in providing scalability, privacy, security, and robustness to emerging threats. Based on this, we indicate the challenging open issues and future research directions in this field.

4.2.1. Access Control Systems

These are cases in which a system is mainly designed to manage the system of control of accesses, such as Discretionary Access Control (DAC), Mandatory Access Control (MAC), Role-Based Access Control (RBAC), and Attribute-Based Access Control (ABAC), ensuring protection against the unauthorized use of accessible resources by enforcing fine-grained permissions across hybrid storage deployments [166,167].

4.2.2. Scalable Privacy-Preserving Protocols

This appears to be related to the fact that investigating how sharding schemes (e.g., Elastico, OmniLedger, and Pyramid) and Directed Acyclic Graphs (DAGs) architectures [168] can be combined with Zero-Knowledge Proofs or secure multi-party computation to support high-frequency energy trade without leaking sensitive transaction details is needed.

4.2.3. Formal Security Verification of Smart Contracts

This arises when several smart contracts are not formally verified. Formal methods proposed in [169] are a priority to ensure that contract logic cannot be exploited to infer private trading strategies or proprietary pricing algorithms at runtime.

4.2.4. Threat Modeling and Intrusion Detection

This is directly linked to formulating threat models covering blockchain-specific attacks (e.g., eclipse and front-running) and conventional cyber threats and researching AI-driven anomaly detection tailored to energy trading patterns, such as those proposed in [170,171].

5. Results

Using blockchain in energy systems such as smart grids and microgrids holds great promise. However, technical, regulatory, economic, and social challenges hinder its large-scale deployment. Therefore, it is essential to understand the challenges below as they are crucial for guiding future research and ensuring practical feasibility.

First, P2P energy trading platforms are the most developed in terms of concept and implementation. Different functional architectures for decentralized energy exchange through smart contracts have been proposed, including auction mechanisms, automated payment settlement, and efficient energy matching [27,28,32]. However, these solutions still show limited scalability and rely primarily on simulated scenarios or on-site pilot testing [7,24].

In smart grids and microgrids, blockchain is considered a distributed coordination tool useful for DER integration, energy flow accountability, and demand response mechanism automation [3,58]. However, its implementation requires complex interoperability with legacy infrastructures and diverse protocols, which still represents a significant barrier to widespread adoption.

Regarding blockchain technology and its applications in the renewable energy sector, the reviewed studies point out the possibility of certifying the origin of energy, greening energy markets, and increasing supply chain transparency [2,92]. Nevertheless, additional economic and regulatory barriers are observed in this area. The lack of consistent policies to promote the massive introduction of these solutions is of particular concern [86,94].

The literature has proposed advanced solutions for security and privacy, such as Zero-Knowledge Proofs (ZKPs), homomorphic encryption (HE), and secure multi-party computation (SMPC) mechanisms, to ensure confidentiality without sacrificing traceability [29,30,172,173,174,175,176,177]. However, these techniques still face computational limitations, and their practical adoption in real energy environments is still in its infancy.

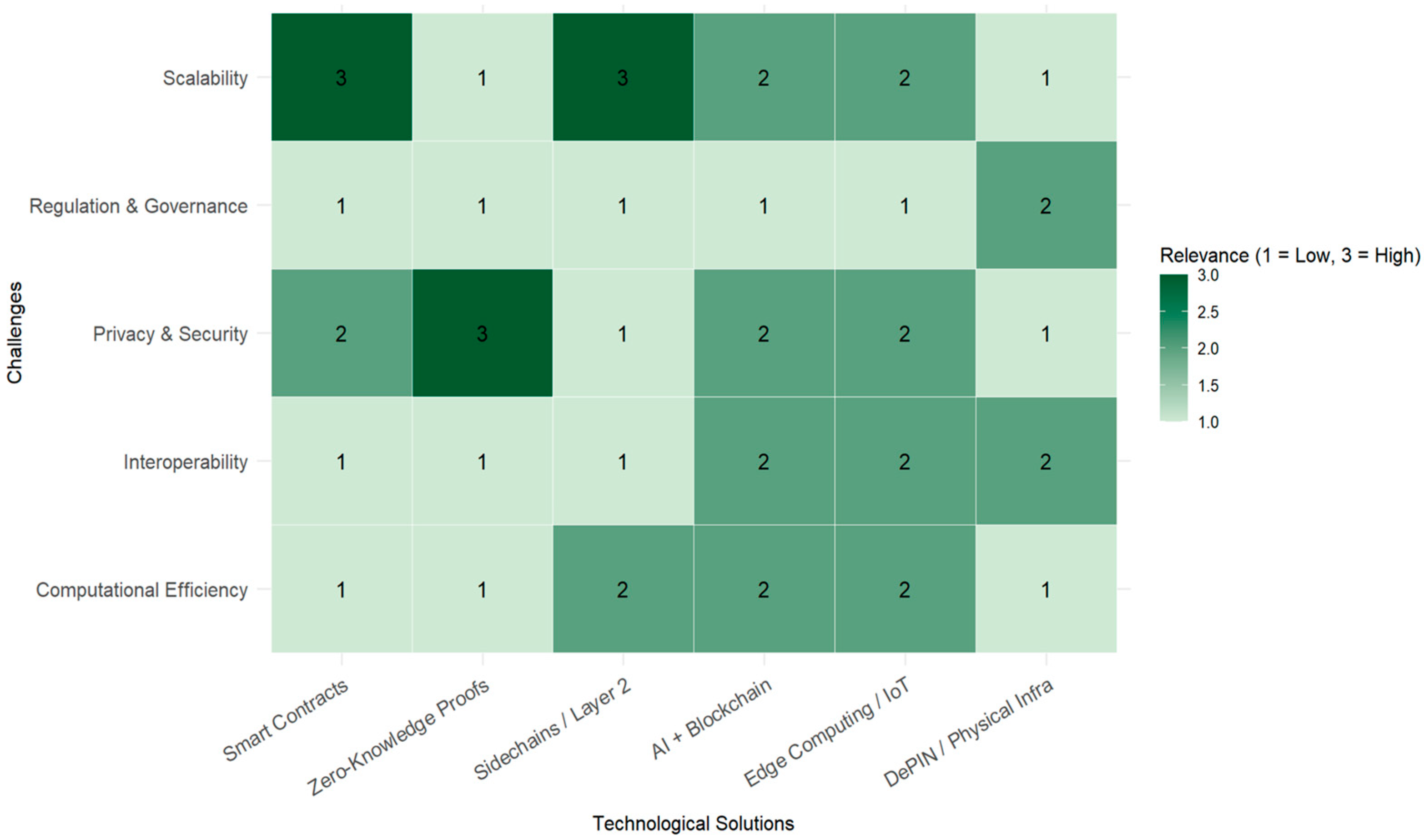

Figure 1 presents a correlation matrix between the main challenges from related literature and the blockchain-based technological solutions proposed for the energy sector. The heat map in Figure 1 is a qualitative visualization derived from thematic co-occurrence across the reviewed literature. Color intensity reflects the relative frequency with which technological solutions are proposed to address the challenges. No numeric scoring was applied. This heat map provides an integrated view of which technical approaches most frequently respond to each observed barrier, whether technical, regulatory, economic, or security-related. There is a strong link between smart contracts and the automation of energy exchange processes and alternative consensus mechanisms to address scalability limitations. Emerging technologies such as Zero-Knowledge Proofs (ZKPs) or off-chain solutions address privacy and computational efficiency challenges. This graphic representation summarizes the alignment between critical problems and lines of solution, highlighting the predominant research areas and possible gaps yet to be explored. This figure is based on the qualitative coding of the 206 articles selected through the semi-systematic review process detailed in Section 2. Each cell reflects thematic co-occurrence patterns identified during the manual classification of studies across the main technological challenges and proposed blockchain-based solutions.

Figure 1.

Mapping blockchain challenges and technological solutions in the energy sector. Source: own elaboration.

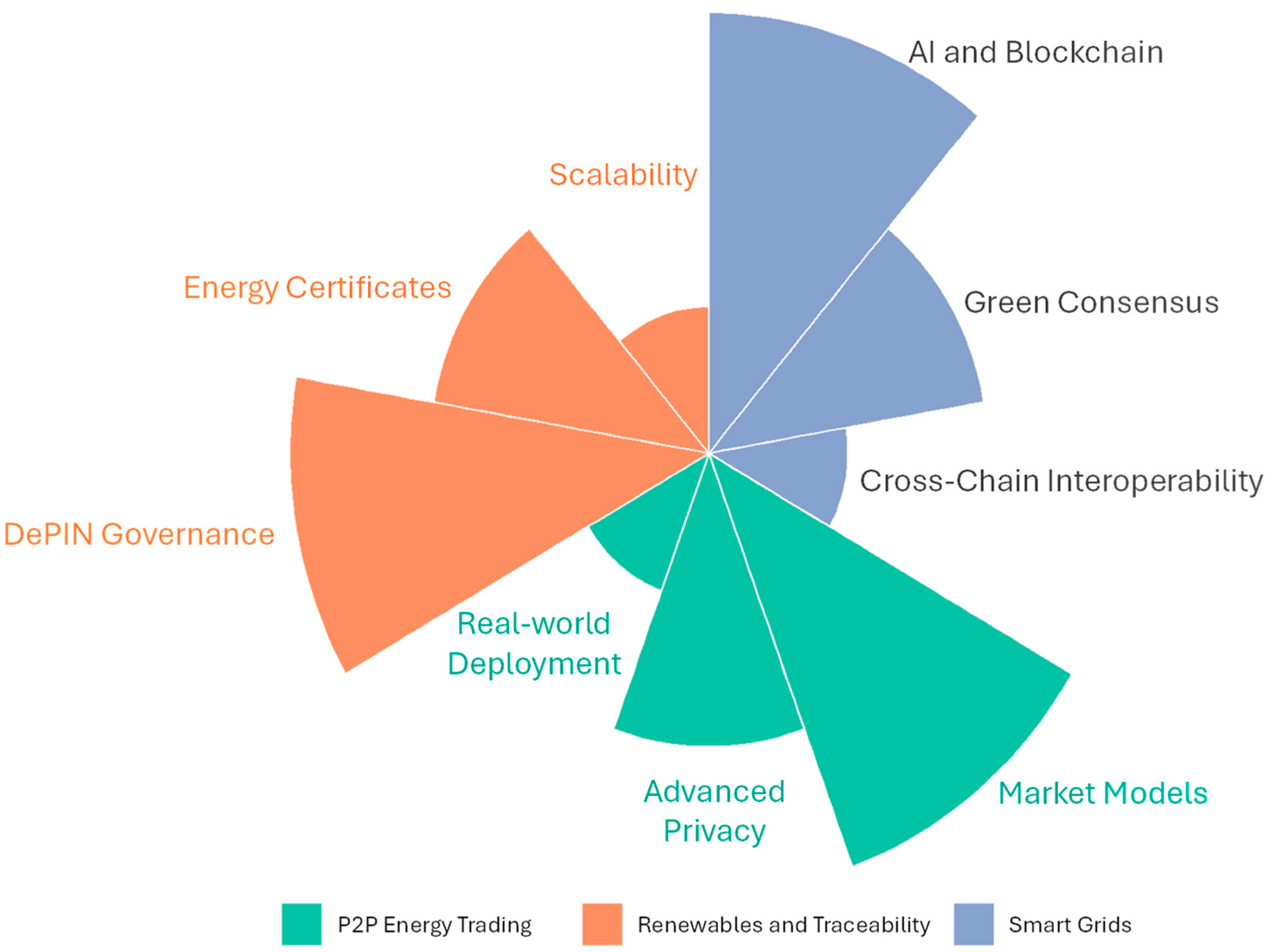

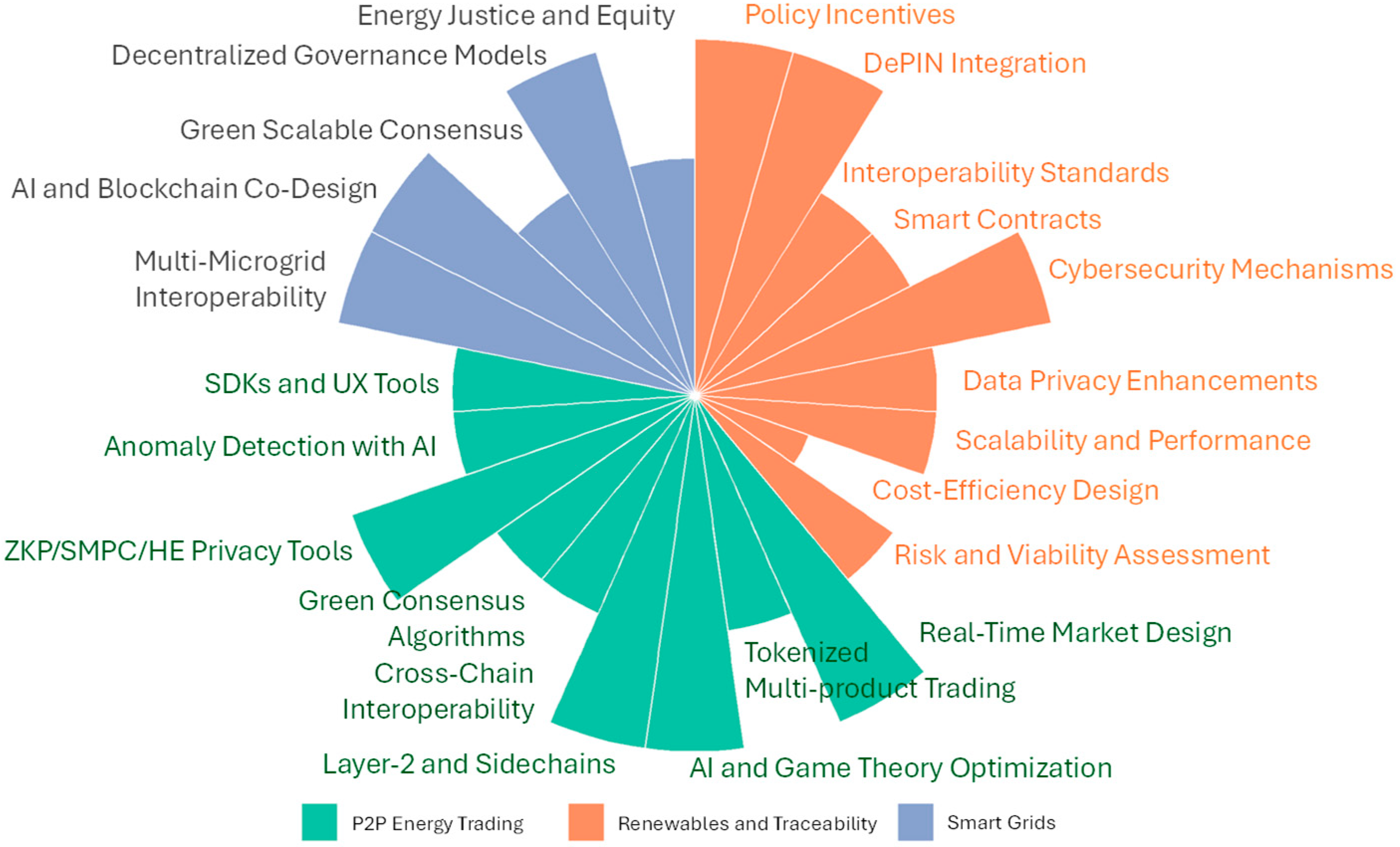

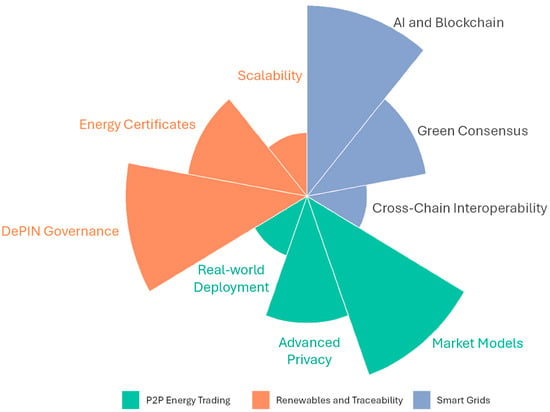

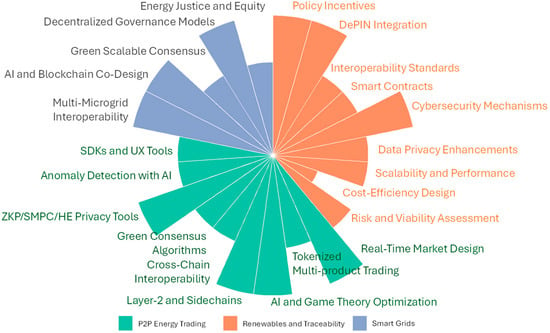

Based on this review, the following priority areas for future research that connect with the current gaps can be identified (cf. Figure 2):

Figure 2.

Research lines by application domain. Source: own elaboration.

- Development of interoperable and scalable platforms that enable the management of high transaction volumes with low computational costs and acceptable latency times [35,36].

- Co-design of blockchain solutions with artificial intelligence, aimed at improving decentralized energy systems’ operational efficiency and adaptive response [70,73].

- Decentralized governance mechanisms and dynamic regulation allow models like DAOs to be integrated into energy communities, ensuring equitable participation and system sustainability [42,76].

- Assessment of these solutions’ social and territorial impact, especially in environments with low digital infrastructure or unequal energy access.

Overall, the results reveal a growing field with a solid technological foundation but requiring performance, regulation, scalability, and integration advances to consolidate itself as a structural component of the energy transition.

An overview of the radial graph of the main lines of future research identified is given in Figure 2, which is classified under three main areas: smart grids, P2P energy trading, and traceable renewable energy. Every axis is a strategic focus from the recent literature, such as integrating artificial intelligence with blockchain, decentralized governance through physical infrastructures (DePIN), or adopting ecological consensus models. This figure shows the evolution of the research approach toward more holistic proposals, where interoperation, efficiency, and inclusion are emphasized. It also provides a visual roadmap for future academic contributions and technological developments in blockchain-based energy. The prioritization level assigned to each research line (1: low/emerging, 2: medium, 3: high) is based on qualitative coding of the 206 selected articles, as explained in Section 2. This classification was guided by three cumulative criteria: (i) recurrence of the topic across the corpus; (ii) degree of academic consensus; (iii) criticality for overcoming technological, regulatory, or social barriers.

6. Discussion

Integrating blockchain in the energy sector presents promising applications and persistent challenges. The main areas of application (smart grids, P2P trading, and renewable energy) are discussed below. The obstacles and research priorities identified in the literature are also highlighted.

6.1. Results for Smart Grids